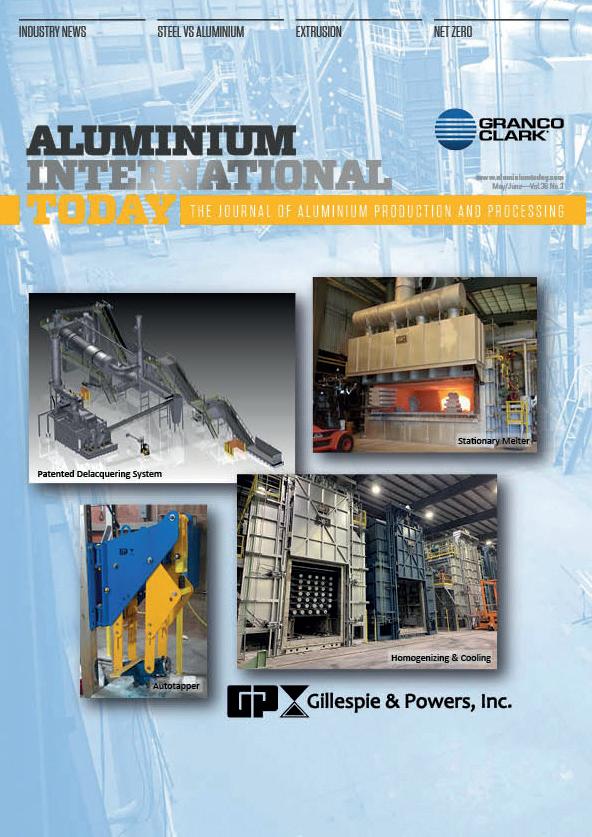

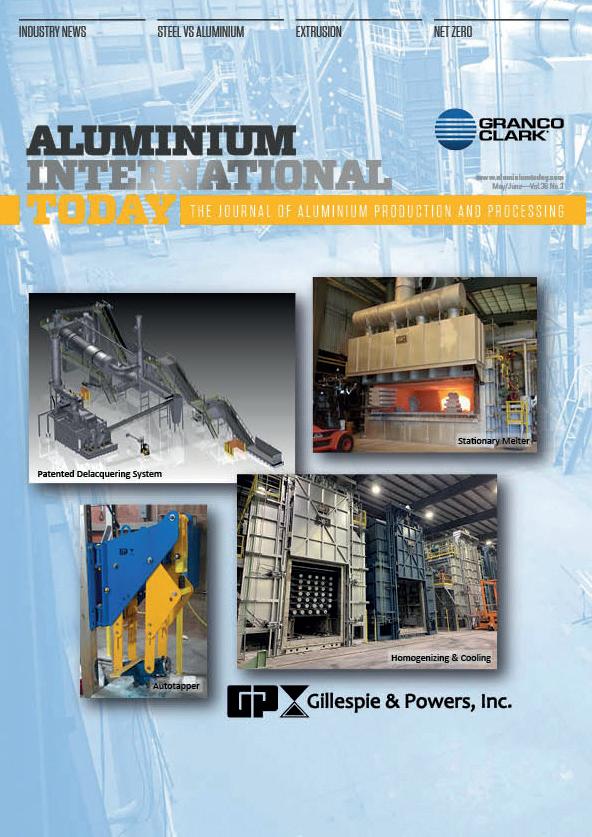

Stationary Melter Patented Delacquering System Homogenizing & Cooling Autotapper INDUSTRY NEWS STEEL VS ALUMINIUM EXTRUSION THE JOURNAL OF ALUMINIUM PRODUCTION AND PROCESSING www.aluminiumtoday.com May/June—Vol.36 No.3 ALUMINIUM INTERNATIONAL TODAY MAY/JUNE 2023 VOL.36 NO3 NET ZERO

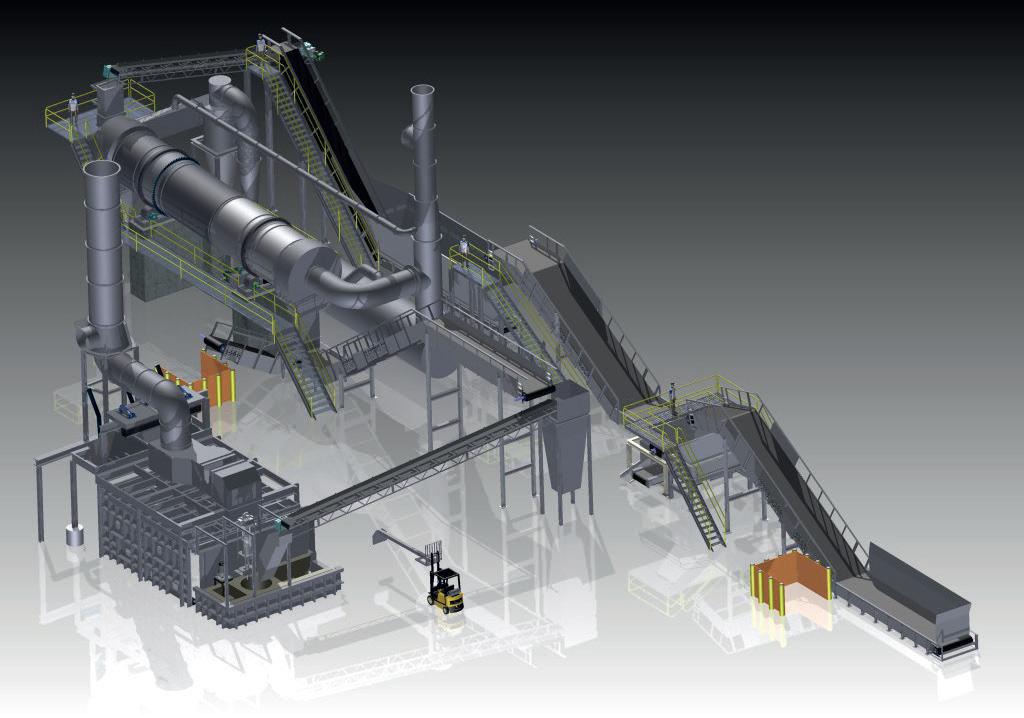

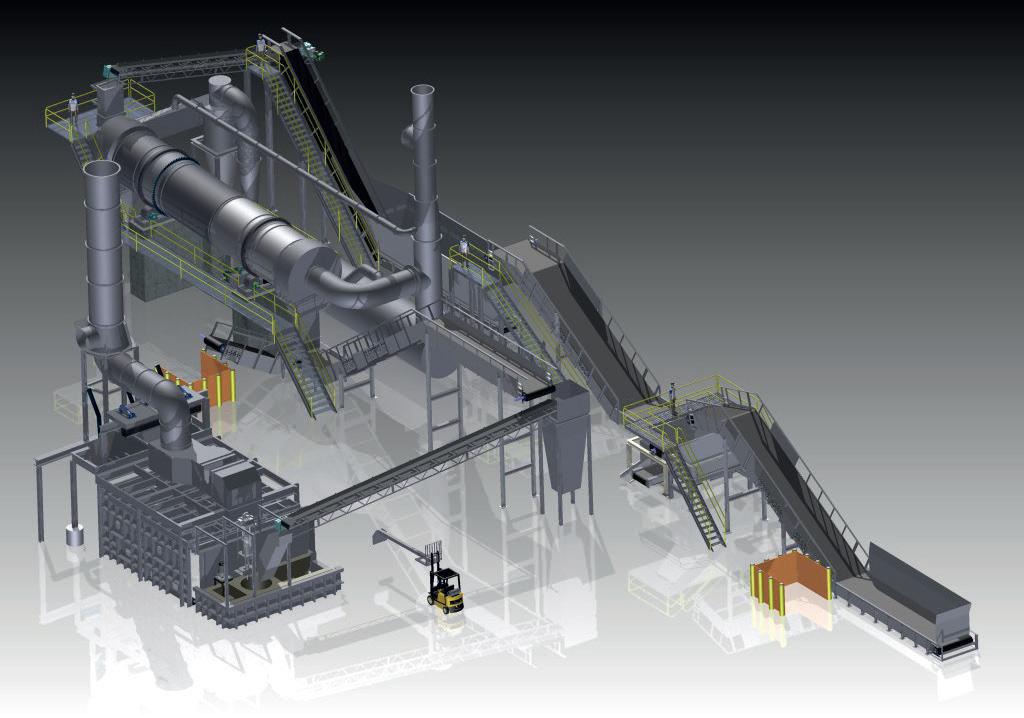

OVER YEARS EXPERIENCE IN THE ALUMINUM MELTING INDUSTRY SINGLE CHAMBER/MULTI CHAMBER FURNACES SCRAP DECOATING SYSTEMS TILTING ROTARY MELTING FURNACES SCRAP CHARGING MACHINES LAUNDER SYSTEMS CASTING/HOLDING FURNACES HOMOGENIZING OVENS COOLERS SOW PRE HEATERS REPAIR & ALTERATIONS www.gillespiepowers.com 314 423 9460 ST. LOUIS, MISSOURI, USA 800 325 7075

Sow Drying

Tilting Melter & Holder

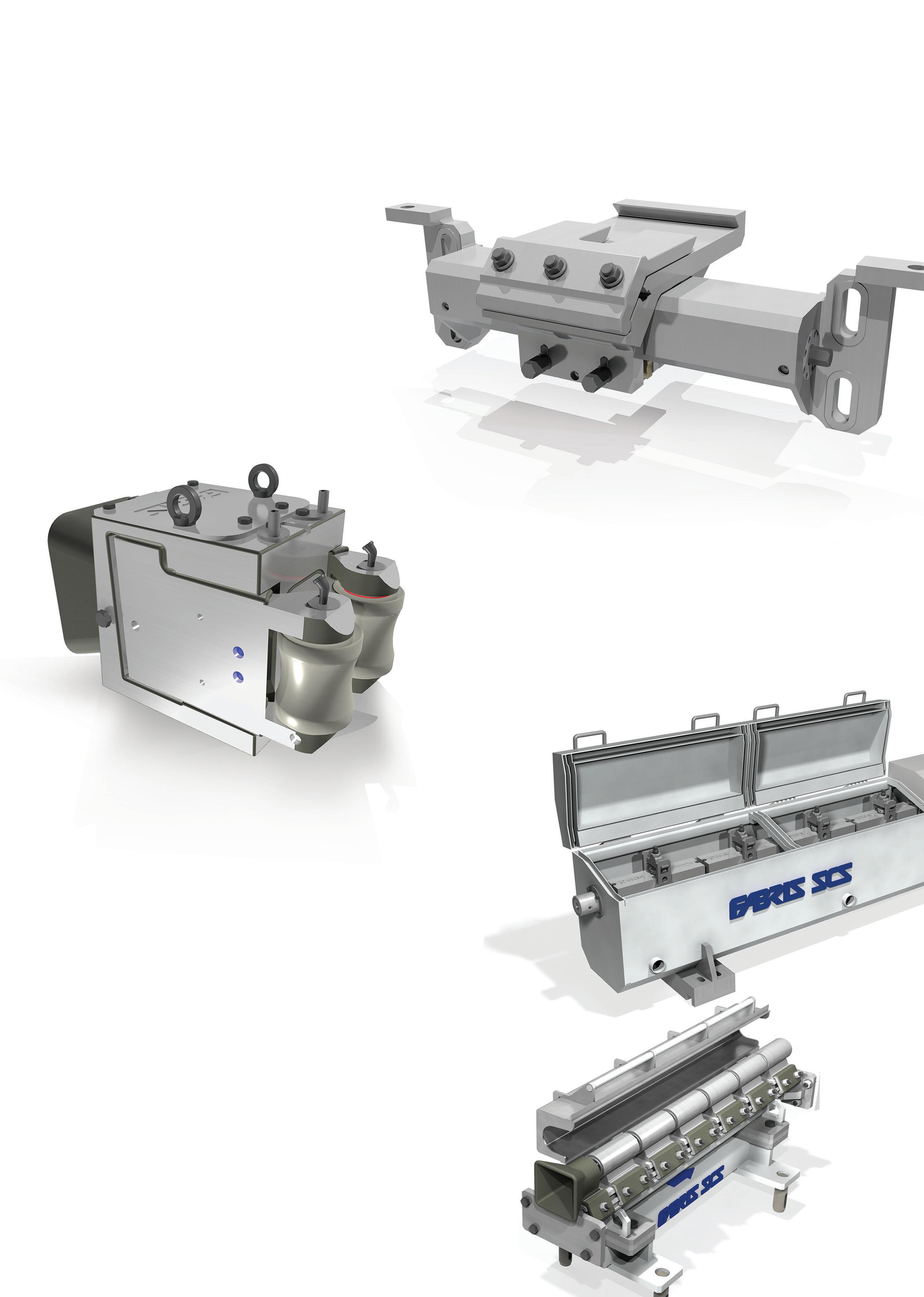

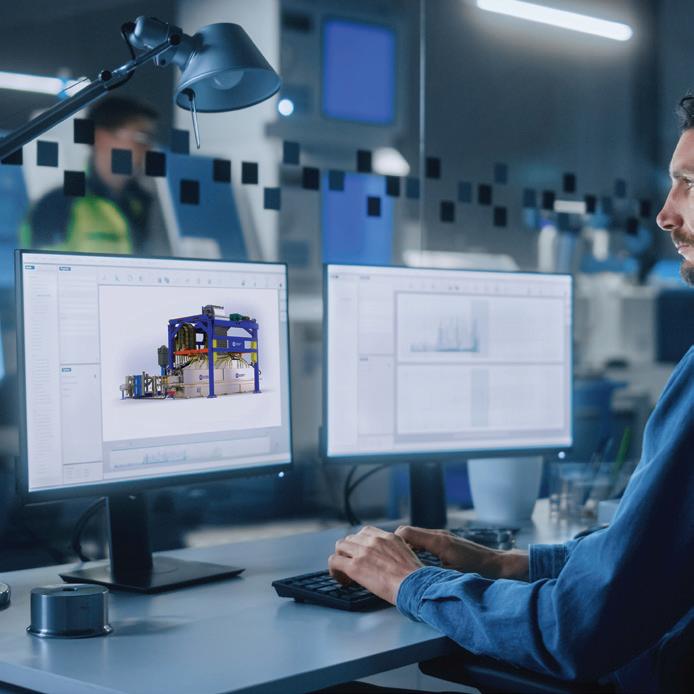

Zero Outsourced Engineering and Service

From concept to completion, all mechanical and controls engineering is completed in-house. Our trained service engineers and technicians use the most advanced tools to keep your equipment performing at peak efficiencies.

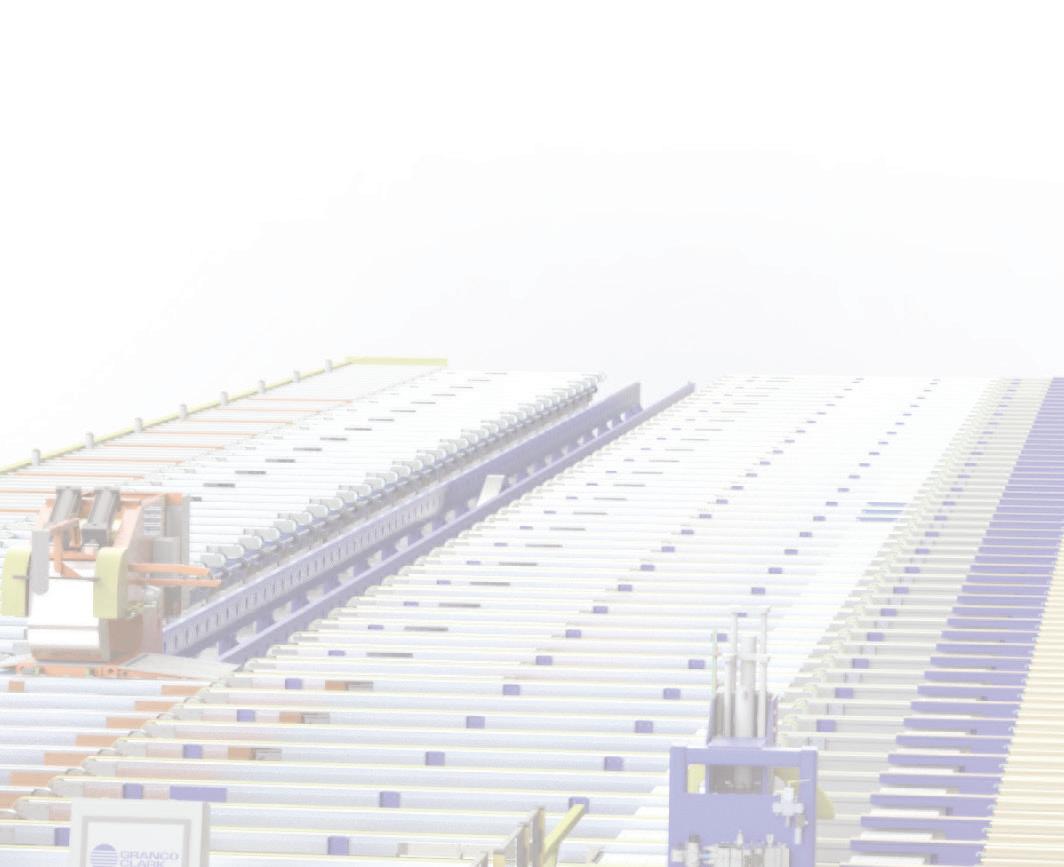

100% USA Engineered & Manufactured

All Granco Clark equipment comes from our 92,000 square foot modern Michigan facility providing the industry’s most innovative custom equipment built with the exceptional quality you come to expect from Granco Clark. Our repeat customers attest to that.

All-inclusive Turn-key System Supplier.

Granco Clark is your all-inclusive turn-key system supplier. Expect superior performance, industry knowledge, unmatched and proven solutions, onsite commissioning, support, and responsive service technicians.

100% Employee-owned Contact us to discuss your next project. +1-800-918-2600 | www.grancoclark.com We are 100% customer focused.

Employee-owned

Our industry knowledge and experience are superior and proven, with our custom-engineered equipment delivering the solutions and performance you expect from Granco Clark.

Being a full-service company means we are with you from the initial planning phase of the project through the start of production and beyond. You will have access to unmatched industry service, support and parts. Our global team of trained service technicians are available to keep your production facility always running smoothly and provide on-site service (in most cases, within 24 hours).

Engineering. Manufacturing. Global Support. Excellence is our standard.

Volume 36 No. 3 – May June 2023

Editorial

Editor: Nadine Bloxsome Tel: +44 (0) 1737 855115 nadinebloxsome@quartzltd.com

Editorial Assistant: Zahra Awan Tel: +44 (0) 1737 855038 zahraawan@quartzltd.com

Production Editor: Annie Baker

Sales

Commercial Sales Director: Nathan Jupp nathanjupp@quartzltd.com

Tel: +44 (0)1737 855027

Sales Director: Ken Clark kenclark@quartzltd.com

Tel: +44 (0)1737 855117

Advertisement Production

Production Executive: Martin Lawrence

Managing Director: Tony Crinion

CEO: Steve Diprose

Circulation/subscriptions

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034 email subscriptions@quartzltd.com

Annual subscription: UK £257, all other countries £278. For two year subscription: UK £485, all other countries £501. Airmail prices on request.

Single copies £47

ALUMINIUM INTERNATIONAL TODAY is published six times a year by Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, UK. Tel: +44 (0) 1737 855000

Fax: +44 (0) 1737 855034

Email: aluminium@quartzltd.com

Aluminium International Today (USO No; 022-344) is published bi-monthly by Quartz Business Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: send address changes to Aluminium International c/o PO Box 437, Emigsville, PA 17318-0437. Printed

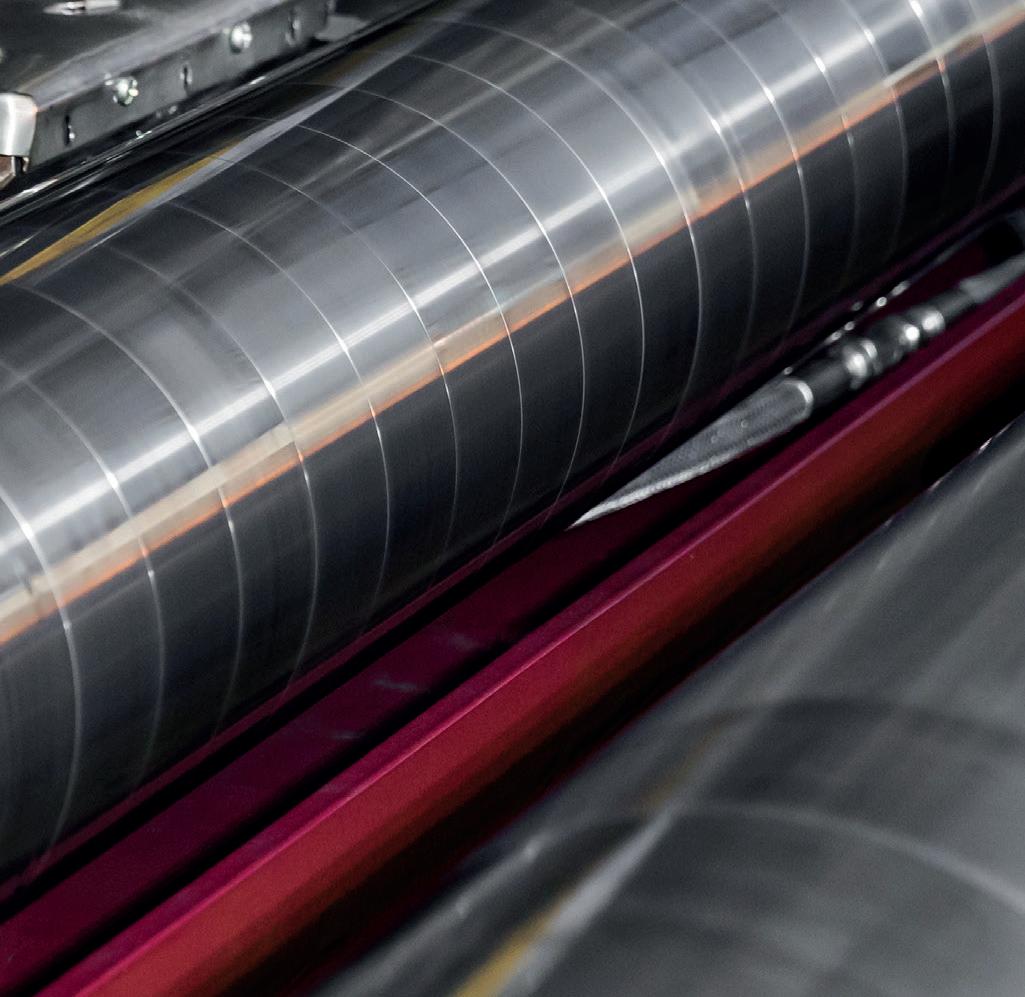

Cover picture courtesy of GILLESPIE & POWERS INC

CONTENTS 1 www.aluminiumtoday.com

International Today May/June 2023 2 LEADER 2 NEWS

Aluminium

COVER

by: Pensord, Tram Road, Pontlanfraith, Blackwood, Gwent, NP12 2YA, UK © Quartz Business Media Ltd 2023 ISSN1475-455X Supporters of Aluminium International Today SEARCH FOR ALUMINIUM INTERNATIONAL TODAY 7 36 13 25 THE ALUMINA CHRONICLES 7 Innovative and basic products made of aluminium SUSTAINABILITY 28 When sustainability becomes a duty INTERVIEW 33 Taha International SA: Waste or raw-material GREEN SILICON 36 Think global, act globalGreen Silicon Metal from Iceland AUTOMOTIVE 40 Top 3 reasons aluminium is the intelligent choice for EV/BEV automakers EXCLUSIVE 42 Steel vs Aluminium: The automotive industry EXTRUSION 13 Focus on US Extrusions 18 Ensuring extrusions meet the mark in meticulous surface quality NET ZERO 21 Circular, Inclusive, and Net Zero 25 Hydro’s HalZero technology reaches a new milestone

in the UK

FUTURE-PROOFING

With the Future Aluminium Forum just around the corner, all the attention is on the future of our sector.

As global aluminium demand is projected to increase by almost 40 per cent by 2030, the aluminium sector will need to produce an additional 33.3 Mt to meet demand growth in all industrial sectors.

This will only be possible through the inception of streamlined technologies, digital manufacturing and sustainable solutions across the supply chain... which is exactly the kind of topics that will be presented by industry experts, producers and solutions providers at the Future Aluminium Forum in Québec City between the 10th - 12th May.

However, you might be reading this issue while attending the CRU World Aluminium Conference, which will once again be held at a beautiful location in central London.

This year’s CRU event will be co-hosted by the International Aluminium Institute (IAI) and the Aluminium Stewardship Initiative (ASI). The partnership with IAI and ASI will reinforce CRU’s full supply chain focus on delegation and will introduce interesting and new content about carbon accounting methodologies, as well as allowing attendees to make valuable connections with industry peers, and build their professional network in a business social environment.

I hope to see many familiar and some new faces at these events over the coming months and look forward to the discussions around how our industry is being shaped and the plans for the future. In the meantime, I hope you enjoy this issue!

nadinebloxsome@quartzltd.com

Rio Tinto begins construction of its new billet casting center in Alma

Rio Tinto begins construction of its new billet casting center in Alma

Rio Tinto has begun construction to increase its capacity to cast low-carbon, high-value aluminium billets by 202,000 metric tonnes at its Alma, Québec smelter.

The existing casting center will be expanded to include new state-of-the-art equipment such as furnaces, acasting pit, coolers, handling, inspection, sawing and

packaging systems. Commissioning is scheduled for the first half of 2025.

The C$240 million investment will allow more of Rio Tinto’s aluminium production to be used to make billets from renewable hydroelectric power. This will allow Rio Tinto to be more agile and flexible in meeting the anticipat-

ed growing demand from North American extruders for a variety of high value-added products, primarily for the automotive and construction industries. The project is expected to generate an estimated economic impact of more than $200 million for Québec, create approximately 40 new jobs and help support existing jobs.

Alba’s Line 6 new nameplate capacity jumps to 560,000 MT

Aluminium Bahrain B.S.C. (Alba) has announced claims that it hit a new milestone in Reduction Line 6 with the recent creep which has seen its production capacity increase from 540,000 metric tonnes per annum (mtpa) to 560,000 mtpa by increasing the current from 460 kA to 478 kA.

Speaking on this achievement, Alba’s Chairman of the Board Shaikh Daij bin Salman bin Daij Al Khalifa said:

“We have gone bigger with expanding Line 6 nameplate production capacity for the better. This new milestone is important for Alba, now and in the future as we continue to strive to improve our operational productivity and efficiency while keeping Alba on track to rank as the largest smelter in the world ex-China.

I would like to applaud our teams for creeping-up safely our Line 6 assets in the last couple of months to expand its throughput all the while optimizing our fixed cost structure.

from 540,000 metric tonnes per annum (mtpa) to 560,000 mtpa by increasing the current from 460 kA to 478 kA.

Speaking on this achievement, Alba’s Chairman of the Board Shaikh Daij bin Salman bin Daij Al Khalifa said:

“We have gone bigger with expanding Line 6 nameplate production capacity for the better. This new milestone is important for Alba, now and in the future as we continue to strive to improve our operational productivity and efficiency while keeping Alba on track to rank as the largest smelter in the world ex-China.

Aluminium Bahrain B.S.C. (Alba) has announced claims that it hit a new milestone in Reduction Line 6 with the recent creep which has seen its production capacity increase

I would like to applaud our teams for creeping-up safely our Line 6 assets in the last couple of months to expand its throughput all the while optimizing our fixed cost structure.”

Hydro delivers first near-zero aluminium for construction market

Hydro have announced that the first aluminium profiles made with 100 percent recycled post-consumer aluminium have been delivered by Hydro to the Innovationsbogen project in Augsburg, Germany. The Hydro CIRCAL 100R aluminium used in this project reduces the

CO2 emissions by 527 tonnes and is enabling decarbonisation of Europe’s building industry.

Hydro, through its building system brand WICONA, has announced it has delivers aluminium made with near-zero carbon footprint to a building project in

Europe. WICONA will deliver door, window and curtain walling profiles made from 100 percent recycled post-consumer aluminum. Near-zero aluminium is defined as aluminium with a footprint of less than 0.5kg CO2e /kg aluminium throughout the value chain.

COMMENT 2

May/June 2023 TOP STORIES

Alcoa: Closure of Intalco Smelter

Alcoa have announced the closure of its Intalco aluminium smelter in Washington State, which has been fully idle since 2020.

The closure announcement begins a process to prepare the site for new economic development opportunities.

“The Intalco smelter site operated for nearly 55 years, and we’ve spent significant time evaluating options for the asset, including a

potential sale,” said Alcoa President and CEO Roy Harvey. “Our analysis, however, indicates that the facility cannot be competitive for the long-term.

“The site is an important part of our history, and we are encouraged by the prospects for potential economic development via another entity that will own and control land at the site,” Harvey said. “We will continue to engage

with our stakeholders, including community members and government officials, as we make this transition.”

Permanently closing Intalco’s 279,000 metric tons of annual capacity will bring Alcoa Corporation’s global consolidated capacity to 2.69 million metric tons, including a combined 399,000 metric tons at two other smelters in the United States.

EGA joins Australian cooperative research centre

Emirates Global Aluminium has joined HILT CRC to progress research into the decarbonisation of alumina refining.

HILT CRC (Heavy Industry Low-carbon Transition Cooperative Research Centre) is an Australian cooperative research centre bringing together industry, researchers and government to achieve technological breakthroughs in the decarbonisation of the steel, iron, alumina and cement industries. Australia is the world’s second

PACKAGING

Ball Aerosol becomes first ASI certified packaging manufacturer

largest alumina refining country and the largest alumina exporter.

Joining international research and technology providers, EGA is HILT’s first industry partner with operations entirely outside Australia. EGA’s Al Taweelah alumina refinery began production in 2019 and is the only alumina refinery in the UAE. EGA also operates aluminium smelters in Abu Dhabi and Dubai and a bauxite mine and associated export facilities in the Republic of Guinea.

Strike at Hydro Karmøy and Årdal

Following the breach in mediation between The Confederation of Norwegian Enterprise (NHO), the Confederation of the Vocational Unions (YS) and the Norwegian Labor Union (LO), employees organised in Industri Energi and FLT at Hydro Karmøy and Hydro Årdal will go on strike from Monday, April 17.

The strike will gradually affect the operations at Hydro Karmøy and Hydro Årdal. The impact on operations is regulated by a separate agreement, which states how operations are to be reduced in a responsible manner and how both parties shall contribute.

The affected members will go on strike gradually, as ramping

down production requires considerable work effort from the operators at the aluminium plants. This process will take several months.

Shipping activities will be strictly limited for both Hydro Årdal and Hydro Karmøy for the duration of the strike, which will lead to delays in deliveries.

BALL Corporation has announced that it has received the Aluminium Stewardship Initiative (ASI) certification for the Performance and Chain of Custody Standards for its Global Aerosol Packaging division.

The certification covered all nine of Ball’s manufacturing plants, aerosol packaging and slugs worldwide.

This means Ball is the first impact extruded aluminium manufacturing company that’s able to supply ASI certified aluminium aerosol cans, slugs and bottles to its customers.

Alupro calls for government action to secure an aluminium-friendly DRS

The 29 members of Alupro sent a joint letter to Thérèse Coffey MP, Secretary of State for Environment, Food and Rural Affairs, calling for immediate government action in order to ensure that a deposit return scheme (DRS) across England, Wales and Northern Ireland further enhances aluminium recycling rates without compromising the market.

Net Zero lab drives

decarbonisation of Novelis plant in Switzerland

Novelis Inc and its partners at the research and development laboratory Net Zero Lab Valais, have announced that they have successfully completed the first year of operations, launching key energy projects aimed at enabling scope 1 and 2 carbon neutral production at Novelis´ Sierre plant in Switzer-

land.

In the first year of the plant’s decarbonisation journey with the Net Zero Lab Valais, the company has approved an investment in a new electrical pusher furnace, which will allow the plant to preheat sheet ingots with renewable electricity instead of natural gas,

saving around 4,500t CO2eq per year and up to 180,000 CO2eq over the furnace’s lifetime.

In addition, the lab partners completed a project to transfer waste heat from the casting process in Novelis´ plant to the Technopôle – a nearby building complex.

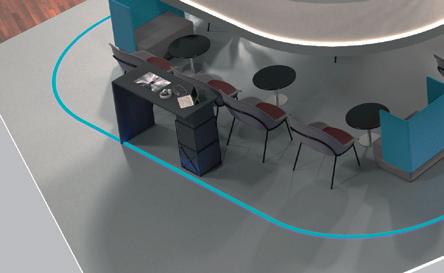

Novelis opens New Can Customer Solution Center Novelis Inc. has announced the opening of its Customer Solution Center (CSC) for the beverage packaging market in São José dos Campos, Brazil. The center will focus on advancing aluminum beverage can innovation and sustainability solutions in response to growing market demand.

The new CSC will serve as an innovation hub in a facility designed for collaboration, most notably with beverage can makers, brand owners, other industry suppliers and scientific partners.

3

NEWS Aluminium International Today

ALBA: Solar farm project

Aluminium Bahrain B.S.C. (Alba) has announced that it has secured sustainable financing loan of BD1.6 million to establish its Solar Farm Project from Bank of Bahrain & Kuwait (BBK), Bahrain’s pioneer in retail and commercial banking.

A signing ceremony was held on 12 March 2023 at Alba’s Al Dana Hall, which was attended by Alba’s Chief Executive Officer Ali Al Baqali and BBK’s Group Chief Executive Officer Dr. A. Rahman Saif in the presence of senior officials from Alba and BBK.

Commenting on this occasion, Alba’s CEO Ali Al Baqali said: “Our vision goes beyond the Aluminium we produce or the manufacturing processes we rely on. Our ambition today, being the largest

smelter in the world ex-China, is to deliver what is best to all our stakeholders: our people, communities, customers and most importantly to the Kingdom of Bahrain.

Installing the Solar Farm reflects how our climate strategy ties into our value creation story. Team-

ing up with our banking partner, BBK, we were able to finance our green project with a green loan in line with our ESG roadmap. Every small step we take collectively, will get us closer to meet Bahrain’s objectives for Net Zero Emissions by 2060.”

Alcoa expands its EcoSource™ low-carbon alumina brand

Alcoa has announced the expansion of the Company’s EcoSource™ low-carbon alumina brand to now include certain grades of non-metallurgical alumina.

First launched in 2020 for smelter-grade applications (SGA), EcoSource is the world’s first and only low-carbon alumina brand. Now, it is also being offered in non-metallurgical (NMA) grades, including hydrates and calcined materials. Hydrates are primarily used in municipal water treatment applications; calcined materials are used in the manufacturing of ceramic tiles,

glass, and flame retardants.

“We’re excited to expand our EcoSource brand to more customers as an important evolution in our product portfolio,” said Alcoa

Executive Vice President and Chief Commercial Officer Kelly Thomas. “We are offering solutions today to help our customers reduce their emissions and meet their own sustainability goals.”

EcoSource, in both SGA and NMA, is said to be sourced from Alcoa’s global refining system, which has an average carbon dioxide equivalent intensity (CO2e) that is below 0.6 tons per ton of alumina produced, which includes Scope 1 and Scope 2 emissions from bauxite mining and alumina refining.

IAI launches Aluminium Forward 2030 Coalition

The International Aluminium Institute (IAI) has announced the launch of Aluminium Forward 2030, a coalition of IAI’s 25 production members and 20 downstream and customer companies who have committed themselves to transforming the aluminium sector. The aim is to accelerate progress toward net zero emissions while working together on a roadmap that is inclusive of all the other UN Sustainable Devel-

opment Goals. This IAI initiative flows from discussions with various players in the beverage can, automotive, electrical, transport and construction markets and demonstrates the power of collab-

orative efforts to tackle one of the most complex global challenges.

Key leaders in major aluminium sectors, such as Jaguar Land Rover; Ball, Crown Holdings and Ardagh Metal Packaging; Cable producers Nexans; and aluminium technology company Gränges, among others, have already endorsed Aluminium Forward 2030. The coalition aims to protect and enhance the societal value of aluminium in all its applications.

MAY

10th - 12th

Future Aluminium Forum

The Forum will return in a live format to Québec City, a region where the aluminium industry has existed for more than a century and is now seeing rapid change and collaboration between manufacturers, processors, suppliers and OEMs. Held in Québec City, Canada www. futurealuminiumforum. com

16th - 18th

CRU: World Aluminium Conference 2023

The Conference will allow attendees to make valuable connections with industry peers and build their professional network in a business social environment. www.events.crugroup. com/aluminium

JUNE

12th - 16th

METEC

International buyers, users, experts and decision-makers from the metallurgy, thermal engineering and casting industry meet here at these four events at the same time and place.

Held in Düsseldorf, Germany www.metec-tradefair.com

SEPTEMBER

13th - 14th

UK Metals Expo

Returning in 2023, The UK Metals Expo will host the entire industry under one roof. According to Chris McDonald, Chair, UK Metals Council: “Anyone with a career in the metals industry will want to attend, any organisations providing goods or services to this industry will want to be represented.”

Held in Birmingham, UK www.metec-tradefair.com

For a full listing visit www.aluminiumtoday.com/ events

Aluminium International Today www.aluminiumtoday.com

2023 DIARY

4

May/June 2023 GREEN NEWS

#turningmetalsgreen Our mission to create a climate-neutral and digital metals industry Hall 1, booth E40/41 Experience our solutions and technologies for turning this mission into reality. We are looking forward to your visit and excited to discuss your ideas on future technologies. Get your free ticket and register as a #connect member on our website. Join our "Leading Partner Talks" on the booth or in our livestream. www.sms-group.com/metec2023

Innovative and basic products made of aluminium

By Richard McDonough*

Aluminium is one of the most adaptable metals used in today’s world. The sustainability aspects of aluminium allow manufacturers, fabricators, designers, and others to use this metal to create a wide variety of products. This edition of The Alumina Chronicles details a few examples of the versatility of aluminium in the United States (US) and beyond. (Main image)

Accurate Perforating

“We manufacture perforated aluminium,” said Jim Erhart, Marketing Manager of Accurate Perforating. “At its most basic, we put holes in metal, but in fact, it is much more. The process involves tools and dies that are fine-tuned to specific patterns set forth by the customer. When we perforate aluminium, it is primarily used in architectural applications and the noise enclosure industry. Applications include intricate facades, sunshades, cladding, infill panels, and railings.” (Image 1)

According to Mr. Erhart, the vast majority of the firm’s business – 95% –is in the US and Canada. “The balance goes to Mexico and Central America,” he stated. “Occasionally, we have sold our perforated metal internationally, but that is intermittent at best.”

Based on its total business, perforated aluminium represents approximately 15% of the total business at Accurate Perforating, Mr. Erhart stated: “Other materials that make up the rest include stainless steel, galvanised steel, carbon steel (hot rolled and cold rolled), nickel, brass, and copper. Our business is well diversified so if one material type or industry is down, one of the others is up, thus balancing out our portfolio.”

“We use aluminium in several ways,” Mr. Erhart continued. “On a weekly basis, we are purchasing multiple truckloads of aluminium coil. Each of these truckloads weighs approximately 45,000 lbs. and consists of aluminium from as light as 24 gauge to as heavy as ¼ wall. When

the aluminium arrives at our facility, it is inspected thoroughly for quality, including micing the material. After inspection, the material is sent to one of our 18 perforating presses. We then use the coils to ‘blank’ specific sheets for customers on many of our vendor-managed inventory programmes we have with our customers.

Mr. Erhart stated that “we also buy aluminium already in sheet form. These sheets are cut to length and width; [this] makes it most efficient and economical for our customers and machinery. A typical size is 48” wide by 96” long. These sheets are then sent through the perforated presses dependent on the customer’s application. Because our perforated aluminium often goes to contractors and sub-contractors, we take it a step further with metal fabrication to get the part ready. This could include bending, adding end margins for bolting into place, forming, welding, or powder-coat painting.”

As for why Accurate Perforating uses aluminium, Mr. Erhart said that “around 15 to 20 years ago, we shifted our business model. We used to sell most of

our perforated metal in large lots through distribution channels. What we found is by going exclusively that route, our margins continued to erode. We made the business decision to go after more direct business and began working with architects and sub-contractors. Because of this, we got into aluminium as it is the ideal choice for use in architectural applications.”

“In the architectural space, we sell to contractors and sub-contractors who use it in facades, signage, and more in the non-residential construction industry,” noted Mr. Erhart. “Perforated aluminium is also used for HVAC contractors, power generation, decorative fence panels, noise cancellation panels, and the automotive industry for functional and decorative use.”

Accurate Perforating shipped approximately 5,000 tonnes of perforated aluminium in 2022, according to Mr. Erhart. That usage level was lower last year as compared to the previous year.

“In 2022, our aluminium business was down a bit as compared to 2021,” stated Mr. Erhart. “2021 was unique in

THE ALUMINA CHRONICLES 7 Aluminium International Today May/June 2023

* Do you have questions about the aluminium industry? Governmental regulations? Company operations? Your questions may be used in a future news column. Contact Richard McDonough at aluminachronicles@gmail.com. © 2023 Richard McDonough

Aluminium was utilised by Accurate Perforating for railing infill panels for 2929 Weslayan in Houston, Texas. (The photograph was provided courtesy of Accurate Perforating.)

the metal industry due to supply chain woes. Because of this, we had an influx of new customers who couldn’t get perforated aluminium from their regular suppliers. This led to an increase in overall consumption of aluminium.”

Mr. Erhart explained that Accurate Perforating has always used aluminium in its production, noting that “the customer decides which substrate to use for the specific application that is required. Metal substrates typically cannot be interchanged.”

Recycling – even of the smallest pieces of aluminium – is a key component of the operating profile of Accurate Perforating.

“All our metal is recycled,” said Mr. Erhart. “Naturally, the perforating process creates scrap; the tiny shapes that are punched out of each sheet or coil are captured and then picked up by local metal recyclers.”

“Aluminium, like all metals, is great because it is infinitely recyclable,” continued Mr. Erhart. “When we think about that, we were ‘green’ before anyone was calling it that.”

Challenges outside of the aluminium industry have affected the firm. High interest rates in the second half of 2022, Mr. Erhart stated, began to impact the company’s non-residential construction usage. He stated that “this sector is our primary driver for perforated aluminium.”

“2023 will be an interesting year for aluminium,” Mr. Erhart continued. “Due to high interest rates, we expect the first half of the year to be slow for non-residential construction…If interest rates fall, we expect construction to be busier and our perforated aluminium business will pick up. But because of those uncertainties, we are predicting the aluminium side of our business to be down approximately 5%. This will be made up by other materials and industries (carbon steel, stainless steel, etc.) which we planned for at the end of 2022. We are predicting that our overall business will be up in 2023 by approximately 3%.” (Image 2)

Ball Corporation

The Ball Aluminium Cup continues to be an important product manufactured by Ball Corporation. In a news statement dated 16 March 2023, Ball Corporation released its Climate Transition Plan and 2022 Annual Combined Financial and Sustainability Report. That news statement indicated that the firm has started a second manufacturing line of this aluminium cup “…and now has the capability to produce 9-, 12-, 16-, 20- and 24-ounce cups, offering a fully recyclable cup for any event or occasion.”

These aluminium cups are helping to drive sustainability at sports and

entertainment venues across the country, according to statements issued by the firm. In addition to their use in commercial environments, individual consumers are also able to buy the cups for personal use.

“It has been inspiring to see continued excitement and growing demand for the Ball Aluminium Cup since we first introduced the product to consumers in 2019,” Dan Fisher, President and Chief Executive Officer of Ball Corporation, said in a news statement issued on 20 October 2022. “As a company, we are relentlessly focused on advancing the circular economy. We believe that the expansion

Solutions: Sustainability. The Edison Awards stated that “the Ball Aluminium Cup is an aluminium alternative to your typical, single-use disposable plastic cup. Unlike plastic though, aluminium can be recycled over and over again without losing quality or value. It is a true, sustainable alternative to existing singleuse competitors. Additionally, it delivers a significantly better drinking experience.”

(Image 3)

Kali Butterfly

Whilst a beverage cup is one of the most basic products created from aluminium,

of our innovative aluminium cup will continue to drive meaningful change toward both helping our customers reach their sustainability goals and solving the packaging waste crisis.”

“We are excited to expand the Ball Aluminium Cup portfolio and offer our venue and food service customers a full suite of sustainable beverage packaging solutions – from aluminium cans to bottles and cups,” Emily Fong Mitchell, President and General Manager of Ball Aluminium Cups noted in the same news statement. “At Ball, we’re committed to increasing access to the infinitely recyclable aluminium cup, which helps our customers meet growing consumer demand for truly sustainable products.”

In 2022, this specific product was recognised as a Gold winner by the Edison Awards in the field of Consumer

Aluminium International Today May/June 2023 THE ALUMINA CHRONICLES 8

jewelry is one of the most creative products based on aluminium. Kali Butterfly is one of the businesses actively using aluminium in design work in this field.

“Kali Butterfly specialises in handmade

Image 1. (Above) Accurate Perforating created perforated panels made of aluminium that were installed at Carleton College in Northfield, Minnesota. (The photograph was provided courtesy of Accurate Perforating.)

Image 2. (Right) Aluminium was used by Accurate Perforating for this decorative façade element at the Southeast Raleigh YMCA Elementary School in Raleigh, North Carolina. (The photograph was provided courtesy of Accurate Perforating.)

anodised aluminium jewelry as well as aluminium chainmail costume pieces for music videos, film, and stage productions,” said Vanessa Walilko, Owner and Designer of Kali Butterfly. “Our customers are

outfit last year and the scale shoulder piece he wore when he won the Royal Rumble this year.” (Image 4)

Aluminium is the key ingredient for Kali Butterfly.

“Every piece of jewelry and every costume piece is made with aluminium,” stated Ms. Walilko. “We die-press aluminium sheet for our aluminium shapes. We then turn aluminium wire into rings to connect each shape together in lightweight, colourful jewelry. Our costume pieces are made in the same way – aluminium shapes and rings woven together using the same chainmail techniques as medieval chainmail.”

“I love making jewelry that is colourful,

usage has steadily increased each year I’ve been in business.”

“We’ve always used aluminium,” she noted. “No other metal can achieve the colours that anodised aluminium can.”

Challenges in recent years have affected how this one-woman business conducted its operations.

“The ongoing Pandemic has made direct sales more difficult,” said Ms. Walilko. “I used to sell at art fairs around the nation and in Canada, but I had to change direction when COVID-19 canceled shows and made the shows that did run unsafe. That forced me to figure out more avenues online to reach customers.”

“Last year, I started selling aluminium jewelry supplies and I’ve seen that aspect of my business grow,” Ms. Walilko continued. “I anticipate that side of my business to continue growing in the future.”

She noted that “I feel very grateful that my suppliers have had minimal increases in their prices which means that I’ve been able to keep my prices stable. There have been some supply chain issues with getting the right anodised aluminium sheet, so my buying habits have changed. I typically buy more at once so I can sustain creating certain designs during periods when raw materials are unavailable.”

Sustainability is important to Ms. Walilko. She explained that the jewelry

located mostly in the US.”

“My jewelry customers are typically professional women from 25-55 years of age who are looking for jewelry that’s colourful and easy to wear,” Ms. Walilko continued. “My costume customers are all over the map. I’ve made clothes worn by the Japanese pop singer Salia when she released an album in the US. I’ve made chainmail for Pippin on Broadway and for their touring company. I’ve also made scalemail for Cody Rhodes of the WWE [World Wrestling Entertainment] twice –the scale shoulders on his WrestleMania

playful, lightweight, and also accessible to the average consumer, and aluminium is the only metal that allows me to do that,” Ms. Walilko continued. “I also love being able to make metal statement pieces in costumes that are also wearable. When I made the chainmail for Pippin on Broadway, they needed chainmail that was sturdy and lightweight to be wearable for the actors in their choreography. Aluminium, again, is the only metal that can achieve those results when customers are looking for colourful pieces.”

According to Ms. Walilko, “aluminium

created by Kali Butterfly can be – and is – recycled.

“One of the things that I love about using aluminium is that once you remove the findings (usually made from zinc or steel), the entire piece can be recycled,” stated Ms. Walilko. (Image 5)

THE ALUMINA CHRONICLES 9 Aluminium International Today May/June 2023

Image 3. (Left) The Ball Aluminium Cup is an integral part of the Climate Transition Plan of Ball Corporation. (The photograph was provided courtesy of Ball Corporation.)

Image 4 (Below) Aluminium was used to create this piece of jewelry – the “Red Queen Collar” – by Kali Butterfly. (The photograph was provided courtesy of Kali Butterfly.)

Image 5. (Below right) This aluminium piece is called “Octopus, Octopus!” According to Kali Butterfly, “Chainmail octopus [was] made by connecting over 12,000 rings by hand.”

(The photograph was provided courtesy of Kali Butterfly.)

Stillion Industries

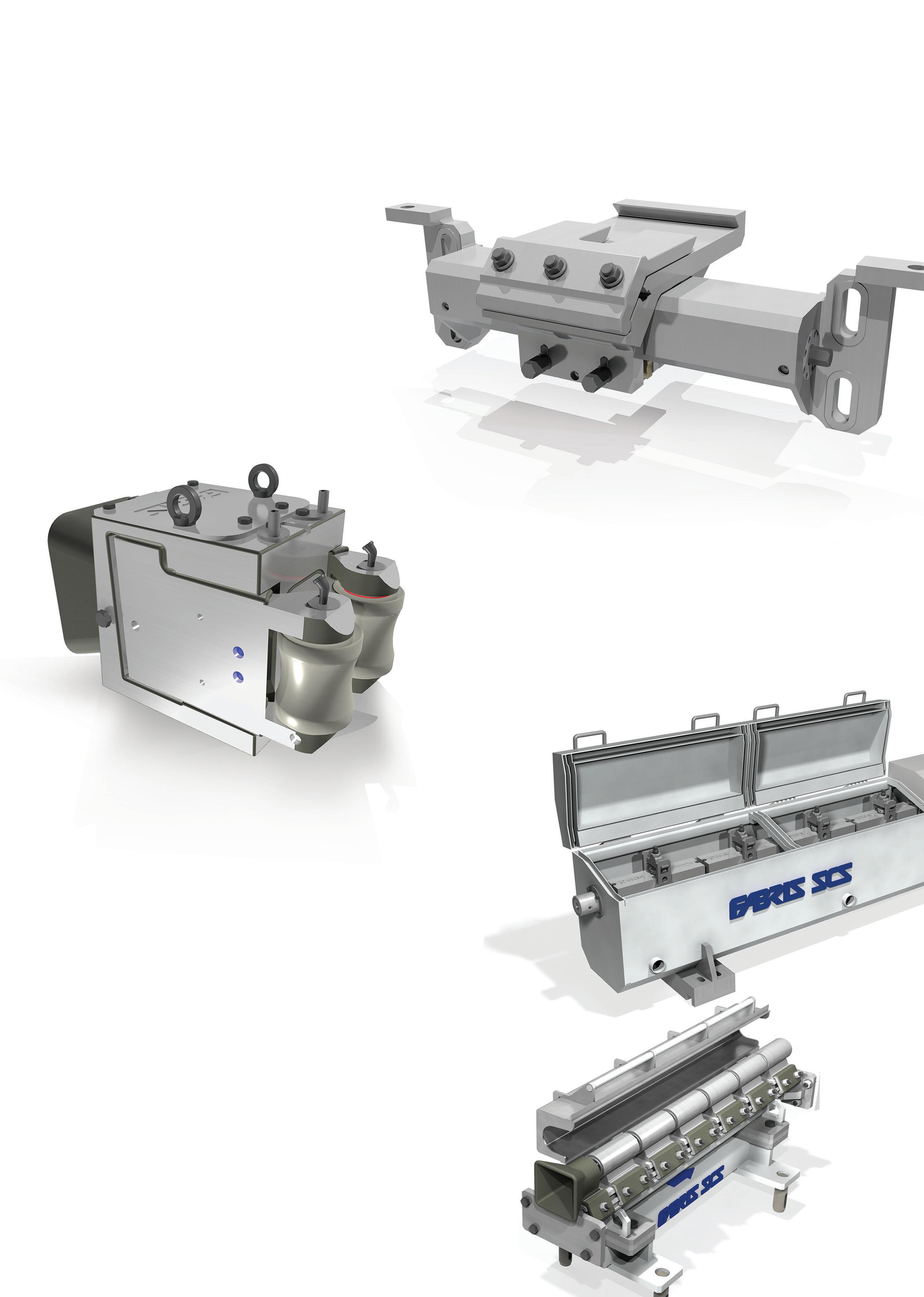

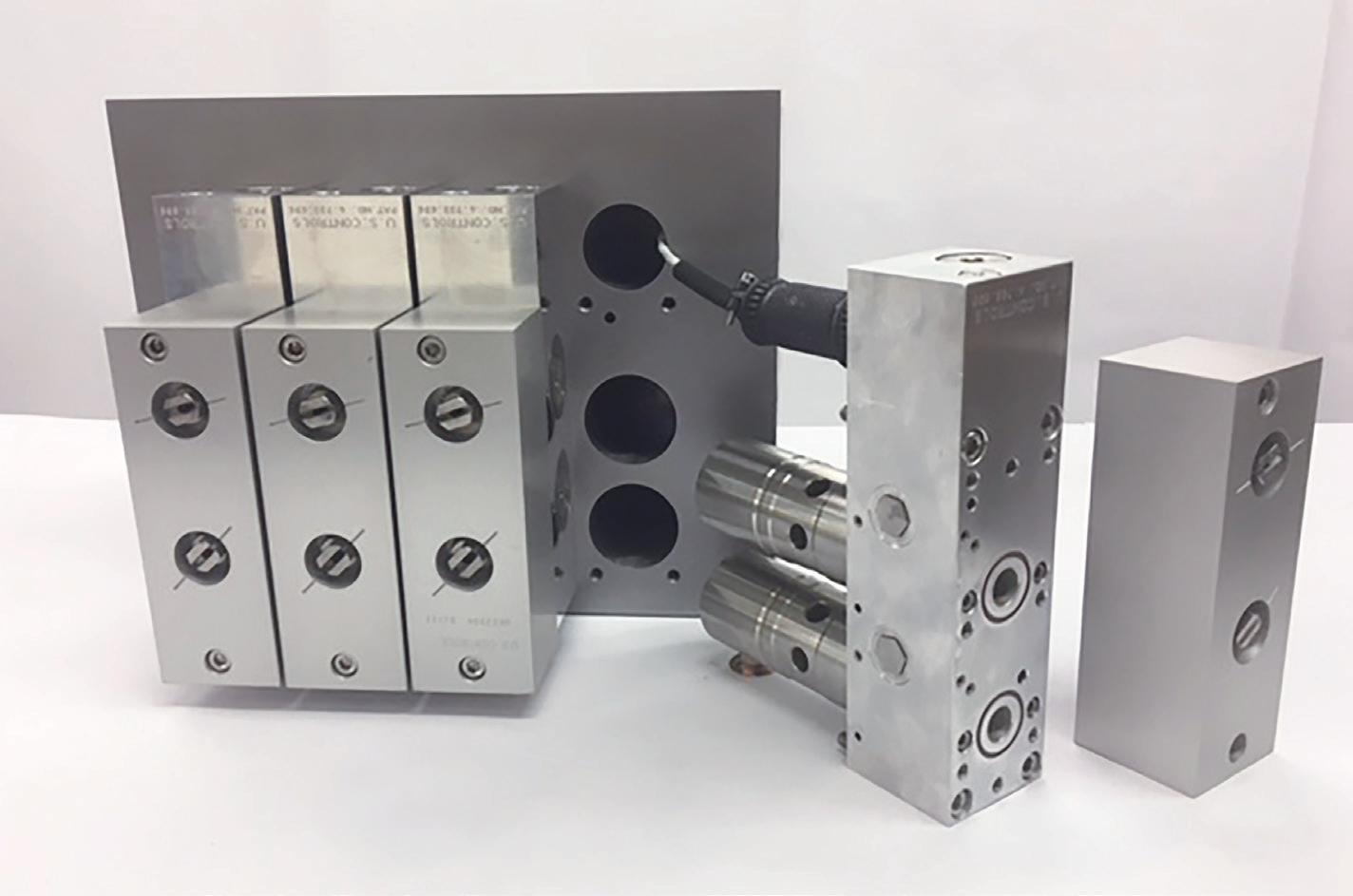

Aluminium is utilised for a number of devices critical to business operations, yet typically unseen by the average person. Such is the case for many of the products produced by Stillion Industries. The company is headquartered in Dexter, Michigan, due west of Detroit.

“As a machine shop, we use aluminium to make parts for other customers as well as for our own product line of metal disintegrators,” stated Keith Stillion, President of Stillion Industries. “Some examples of those components include the Arc-er head body, the auto feed base casting, and the cross-arm adjustment for our larger machines. We also make our graphite electrode holders out of aluminium.”

Sales are made throughout the world.

“Our customers are businesses in industries from automotive to mining,” said Mr. Stillion. “Approximately 20% of our annual machining is done with aluminium.”

He indicated that Stillion Industries uses aluminium because “…it is easy to work with and lightweight.”

Usage of aluminium at this company was about the same in 2022 as it was in

2021. Mr. Stillion stated that “our level of aluminium-related production has remained similar in past years.”

Supply chain difficulties have affected many in the aluminium industry, including Stillion Industries.

Mr. Stillion said that “we have experienced issues related to the supply

chain, specifically the closure of businesses has forced us to seek alternative suppliers.”

He indicated that the aluminium utilised in its products is able to be recycled. He also explained that sustainability efforts of the firm include sourcing all of its metals locally and recycling all scrap, also locally. (Image 6) �

SPOUTS & FLOATERS

Aluminium International Today May/June 2023 THE ALUMINA CHRONICLES 10

Image 6. Stillion Industries used aluminium to manufacture a number of products, including a cross-arm structure (left) and an auto-feed mount.

(The photographs were provided courtesy of Stillion Industries.)

More Info: ventas@rodabell.com www.rodabell.com

CROSS FEEDER

T-PLATES

THIMBLES

CASTING TOOLING GRAPHITE RING

Refratechnik hybrid castables: Also suited for low temperatures.

We have optimised the technology of Sol Gel bonded castables even further, enabling us to combine the best of two worlds for you: Faster drying and high strength already at room temperature.

Your benefits with hybrid castables: Time and energy savings during production of prefabricated components and when commissioning furnaces.

Learn more: www.refra-hybrid.com/en

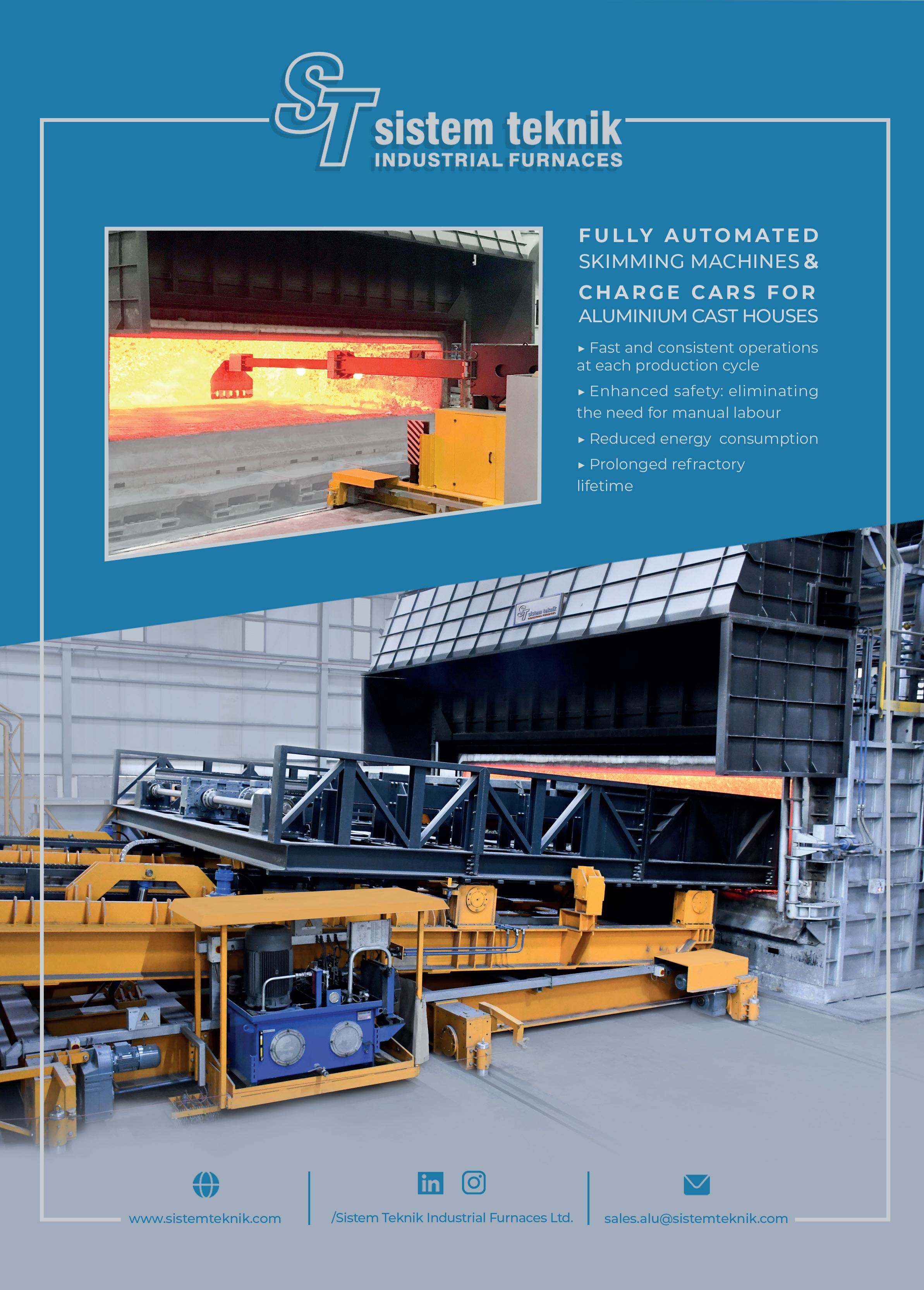

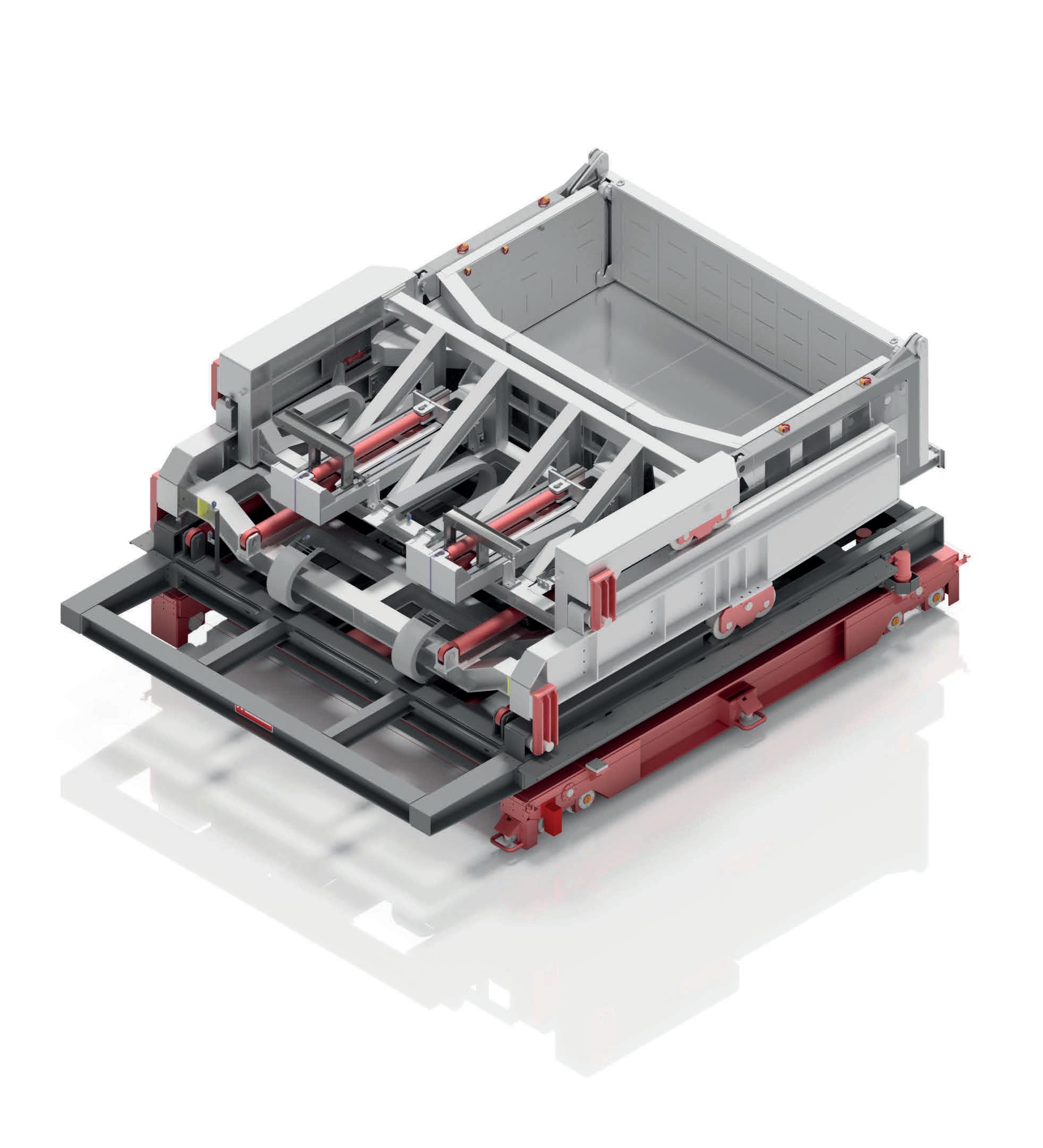

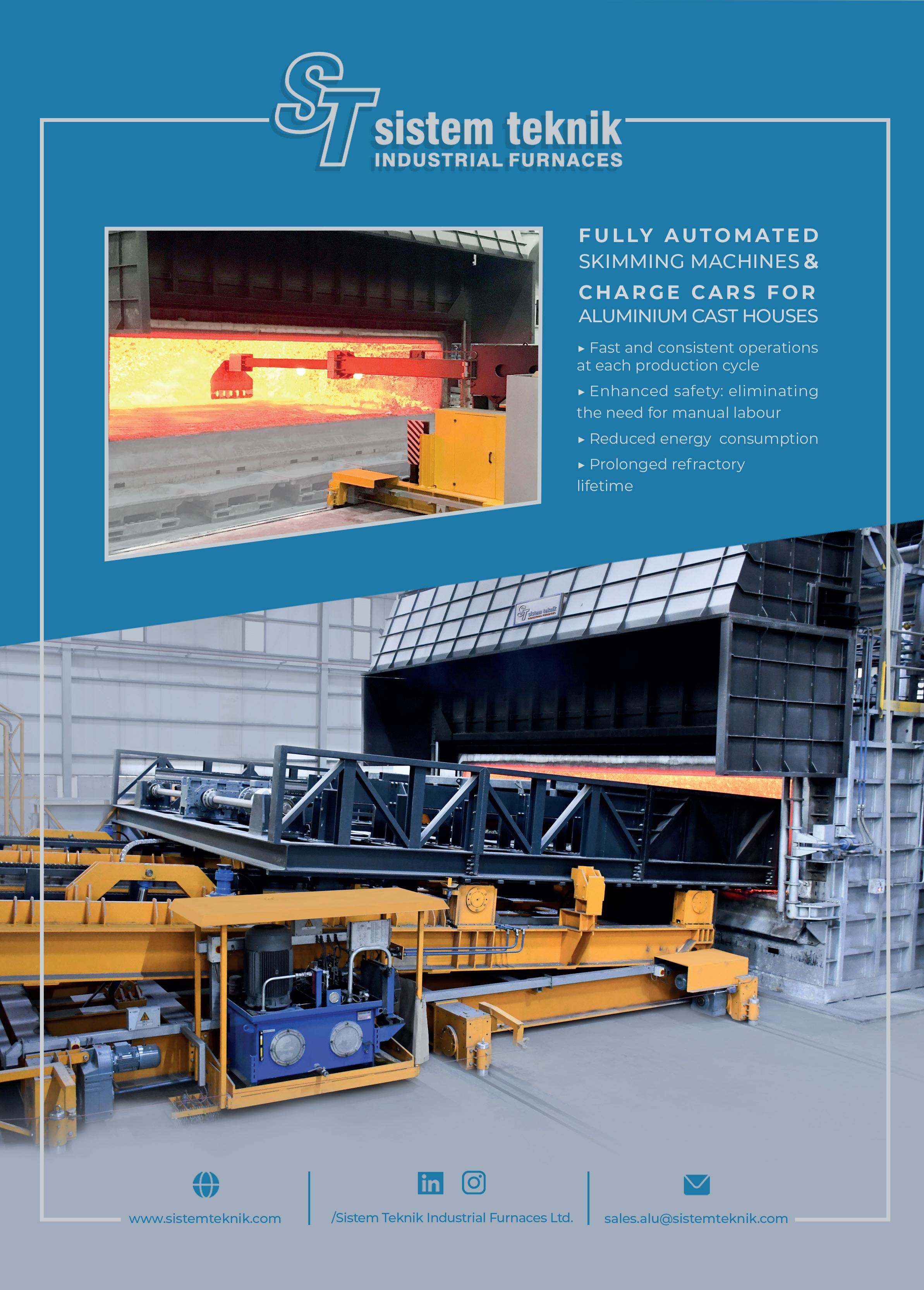

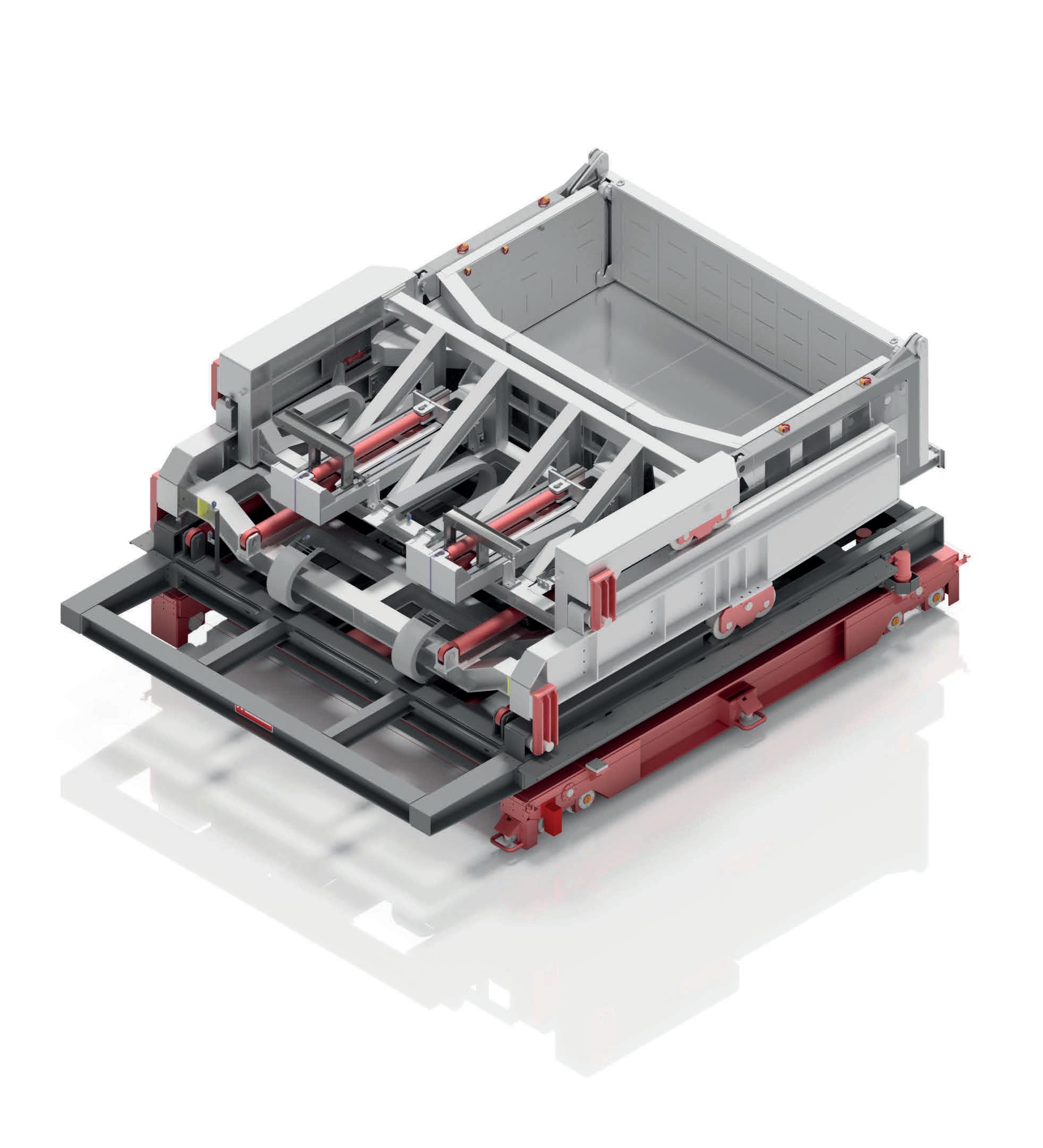

AUTONOMOUS CHARGING & SKIMMING MACHINES

Focus on US Extrusions

By Myra Pinkham*

While it is expected that demand for US extruded aluminium will soften this year, longer term, the outlook appears to be bright, despite end use market demand continuing to fluctuate.

“Clearly the US extrusions market has been facing a number of challenges over the past few years,” Jeffrey Henderson, president of the Aluminum Extruders Council (AEC), pointed out, not the least of which was the Covid-19 pandemic. Meanwhile, he said, once everyone started to get back to work, and extruders were looking to do whatever they could to catch up with the resultant pent up demand; including increasing the additional US production capacity with a total of 27 new extrusion presses expected to be installed just this year and approximately 36 being installed in the next two years.

According to Stephen Williamson, CRU’s aluminium research manager, the majority of this new US capacity will be made up of large presses which will be used to produce extrusions either for automotive, aerospace and defense applications.

“At this time last year everyone was generally happy, just frustrated that they couldn’t get enough metal and didn’t have enough workers,” Lynn Brown managing

principal of Longpoint Associates, said. “But while extruders had very robust order book this time last year, that isn’t the case this year, Brown observed. Daria Efanova, head of research at Sucden Financial, agreed, noting that while over the long term the market is expected to remain expansionary, recently US aluminium extrusions demand has been easing.

Even last year was a tale of two halves. Matthew Abrams, CRU’s North American aluminium extrusions market analyst, declaredthat post pandemic lead times for some extrusions, depending upon its size and its application, were out almost a year, with the industry average being at least 20-30 weeks. But toward the end of 2022, with inflation and interest rate hikes coming more into play, extrusion demand has started to slow down pretty quickly, in certain end use markets.

As a result, despite a very strong first half, data from the Aluminum Association indicated that for 2022 US demand for extruded products was only up 1.4% year over year, and Abrams is predicting that there will likely be further downward pressure at least through the third quarter of 2023, which could result in a 2% year on year decline.

Clearly extrusions demand was very soft during the first quarter of this year. According to Mike Stier, vice president of strategy and finance for Hydro Extrusions North America, US extrusions demand was down about 8-10% year on year during the first quarter due to a combination of declining real demand and inventory correcting . He explained that last year when lead times were very long many customers engaged in prebuying extrusions to protect their supply chains.

There are other factors that have been influencing this. For example, Efanova noted that since it takes two to three quarters for monetary policy tightening to be felt by consumers, the US is just starting to see the first round of the Federal Reserve’s interest rate hikes filter into the real economy.

Ever since the second half of last year, US soft alloy aluminium extrusion lead times have come in very steadily, and, according to Abrams, as of mid-April they had narrowed to approximately 4-8 weeks. It, however, has been a different story for larger press sized, hard alloy extrusions. The lead times for these are still out almost a year due to a combination of higher defense spending, and commercial

EXTRUSION 13 Aluminium International Today May/June 2023

*US correspondent

Aerial View of Hydro Plant. Image courtesy of Hydro

airframe builders, Boeing and Airbus having stepped up their build rates in line with the return of air travel.

For most of this year, the shortfall in US extrusions demand is said to be coming from the building and construction sector. This isn’t surprising given thatconstruction, particularly the housing market, has been one of the first segments of the US economy to feel the brunt of the rising interest rates and slower consumer demand, according to Efanova

She said that in the next two to three months there could be a slight uptick in extrusions demand from the construction sector, given that there are already some early signs of US mortgage rates stabilizing and even reducing. But while that could bring some consumers into the market, Efanova questions whether it will be sustainable. “We will continue to see US home builders’ confidence at lower levels over the course of the year, and, even with demand recovering slightly, housing inventories will remain constrained for prospective homebuyers.”

But on the plus side, some newly built homes contain more aluminium extrusions than they had in the past. Multifamily residential construction has largely remained resilient, and nonresidential construction, which, according to Abrams,accounts for about 25% of US building and construction extrusions demand will see a net positive this year, especially once US infrastructure construction picks up, assisted by the recently passed bipartisan infrastructure bill.

All of this, as well as strength from other end use markets, is expected to somewhat offset the drop from the housing market. Longpoint’s Brown said this is definitely true when it comes to the automotive industry, particularly rela to electric vehicles (EVs). He maintains that even with supply chain issues affecting

semiconductor chips and certain other automotive components, business isn’t soft for any extruders who have significant automotive business.

Hydro’s Stier agreed, noting that automakers have been, and will continue to, add aluminium extrusion applications in their vehicles, both for lightweighting and for EV applications, resulting in a longterm upside for automotive extrusions demand. Efanova said that while this has been the case for both Internal combustion engine (ICE) vehicles and EVs, the largest acceleration in automotive extrusion demand is for battery electric vehicles (BEVs). BEVs require extruded aluminium for the battery, motor housings, and other structural components. In fact, Efanova said BEVs use twice as much aluminium as ICE vehicles, which is a net positive for extrusions even with the loss of engine block components.

This is supported by a new survey that Ducker Carlisle conducted for the Aluminum Association which concluded that the aluminium content per average North American vehicle will increase by 100 net lbs per vehicle (PPV) from 2020 to 2030. He also predicted that the aluminium content of BEVs will increase from 242 PPV to 885 PPV (85% more than ICE vehicles); extrusions will be the fastest growing product,rising by an average of 34 PPV between 2020 to 2030.

Brown noted that while the US BEV share is currently far behind that in Asia and Europe, its share is already growing fairly rapidly. In fact, the US Environmental Protection Agency is projecting that, with its proposed new emissions standards, the BEV share could rise to 67% of all US vehicles by 2023.

However, there are some challenges, including range anxiety as a result of the lack of battery charging infrastructure. Efanova also pointed out that the environmental policy in the US is different

than that in Europe. The policy in the US focuses on incentivizing the manufacturing and sales of EVs rather than prohibiting the use of ICE vehicles. These incentives, such as those in the Inflation Reduction Act (IRA), aim to promote an uptake in US EV production and sales in the coming years.

Brown said that this will be positive for the extrusions industry as the BEVs’ battery boxes could require 100-200 lb of extruded aluminium , as well as side rails or rocker panels, with big aluminium losses in EVs in comparison to ICE vehicles, as they have castings used for the engine block.

Extrusion demand is also being propped up by certain other end use markets. Brown observedthat the industry has been seeing good demand for solar energy installations and will see more with the renewal of tax incentives and other provisions in the IRA. “Commercial trucks and trailers continue to be strong as well, as we are still moving a lot of freight across the continent,” Stier said.

But some of this demand is being met with imports, AEC’s Henderson said, given that Section 232 tariffs upon aluminium extrusion imports have been dropped. “As a result, US consumers are paying inflated prices because of the Section 232 but we don’t have an offsetting tariff to protect us from import,” which he says have been flooding the market, although, he continued,the AEC are talking with the Commercial Department on this issue.

On the other hand, Henderson noted that extrusions are included in the recent announcement of a 200% tariff on imports from companies that use Russian aluminium, “But the question is how the Customs Department will police that,” he said, stating that there will need to be a tracking system where importers will not only have to declare what metal they are bring into the US but where the billet and

Aluminium International Today May/June 2023 EXTRUSION 14

Hydro Commerce. Image courtesy of Hydro

PRECISION ONLINE SHAPE MEASUREMENT AIR BEARING SHAPEMETER

With 50 years of operation and continual innovation under its belt, the Air Bearing ShapeMeter offers market leading levels of continuous measurement feedback for flatness control.

• Low maintenance and maximum equipment reliability.

• Aerospace precision product designed to withstand heavy industrial environments.

• Modular design enables easy installation with minimal downtime.

950 INSTALLED GLOBALLY

primetals.com

ingot for those products came from.”

In any case, there is a general consensus that this stepped up tariff will have little impact. Matt Meenan, a spokesman for the Aluminum Association, noted that in recent years many US aluminium companies have diversified away from Russian metal, which accounts for about 3% of all US aluminium imports. Nevertheless, he said that the US aluminium industry stands united in any, and all, efforts deemed necessary by the US government, and its allies, to address the ongoing crisis in Ukraine.

Another upcoming issue for US aluminium extrusion companies is sustainability and the push for green aluminium. Meenan said that the US aluminium industry was an early mover in addressing its carbon footprint, with voluntary carbon emissions reduction efforts, and continues to take action to become more sustainable.

However, the impact of the “green aluminium” push upon the US extrusions market is still somewhat in early stages. “It is an issue that extruders are very aware of and that they don’t want to get behind on,” Abrams said. The development of “green aluminium” has somewhat been

slowed by defining “green aluminium.”

While there still aren’t any green aluminium premiums, Williamson said they should be coming soon and that once that happens it will create more consumer pull.

Stier said that some green conversations are already occurring, some of which are being supported by the passage of the IRA. “Over time the IRA will spur some green investment, but it is still too early to see that quite yet,” he said that most of the movement related to improving the industry’s carbon footprint through Scope 3related to the raw materials being used.

Efanova noted that the US extrusions market is looking to introduce more recycled products, as well as use more secondary aluminium billet. She said that the roughly 625,000 metric tonnes of North American secondary aluminium billet capacity that is expected to come online in 2024 is a good indication that more companies are choosing to use secondary aluminium, including billet produced using alternative energy sources such as wind and solar, for their extrusions to lower their carbon footprints.

This has been a focus for Hydro, which recently announced one year after

breaking ground, that the company is planning to startup its state-of-the-art aluminium recycling plant in Cassopolis, Mich., this fall. “A strong recycling and remelt plant gives us the capacity we need to support our extrusions production with recycled product,” including the use of more post-consumer scrap, Stier said.

He continued that the plant is being complemented by the sourcing of greener ingot and billet to feed its cast houses. “Using ingot and billet produced from clean energy sources contributes to a lower carbon footprint. He said Hydro has promised to have 4 kilograms of carbon dioxide per kilogram of aluminum, vs. the global average of 17 kilograms, helped by their use of solar, wind and hydroelectric power.

While there are some near-term concerns due to certain geopolitical and economic issues, Williamson said that he believes that the mid- to long-term outlook for the US extrusions market is strong, noting that this will be supported by investments that extruders are making in their plants, equipment and workers. Efanova agreed, predicting that US extrusions demand will enter a new stage of growth starting in 2024. �

Aluminium International Today May/June 2023 EXTRUSION 16

2 5 Manage your aluminum more safely and more productively using less space with Combilift’s materials handling solutions combilift.com • Safer product handling • Optimised production space • Improved storage capacity • Increased productivity & output • Enhanced profits

Alu Today Liz A5 April 202.indd 1 12/04/2023 11:06:13

Safety Storage Efficiency

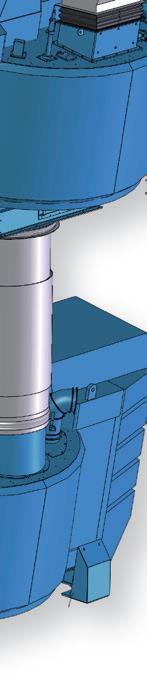

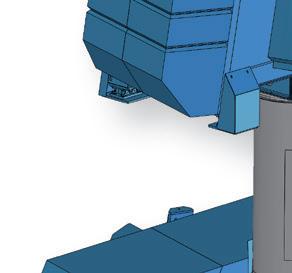

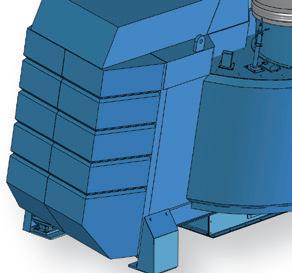

ALTEKs Melting Solutions Tilting Type Rotary Furnace (TTRF®) has been developed over 30 years, incorporating several unique features to maximise operational efficiency and fit seamlessly into your casthouse. PART OF OUR LEADING END-TO-END DROSS MANAGEMENT SOLUTION Industry-leading tilt rotary furnace technology Maximising aluminium recovery and reducing energy consumption • 1T to 40T capacity • Multi-directional door minimises heat loss • 20° tilt back feature • Pin-drive rotation system • Variety of burner and fuel configurations • Turnkey melting plant solutions • Handles all scrap types • Unprecedented process knowledge Altek Europe Limited, Lakeside House, Burley Close, Chesterfield, Derbyshire, S40 2UB, UK +44 (0) 1246 383737 © 2023 Harsco Corporation. All Rights Reserved. altsales@harsco.com | www.altek-al.com

Ensuring extrusions meet the mark in meticulous surface quality

By John Courtenay*

John Courtenay, Chairman of MQP, grain refiner specialist for the global aluminium industry, said: “Aluminium is used in the manufacture of a wide range of extrusions due to its lightweight, highly recyclable properties and the addition of grain refiner is required to cast crack-free billets, minimise defects and improve surface quality.

“The issue is that the potency and efficiency of grain refiners varies significantly, plus companies need to know the grain refiners they use to cast their extrusions will fit their environmental and sustainability obligations, partly in how they improve efficiency, but also in the metal that’s used in the manufacture of grain refiner. In today’s climate, they also want to save money by reducing addition rates.”

MQP is increasingly working with major casthouses in the business of producing alloys with high tensile strength - typically higher than 400MPa (UTS) – together with enhanced recyclability, machinability and corrosion resistance. These properties are essential for high stress components such as extrusion-based crash management systems, BIW structural components and battery boxes for electric vehicles.

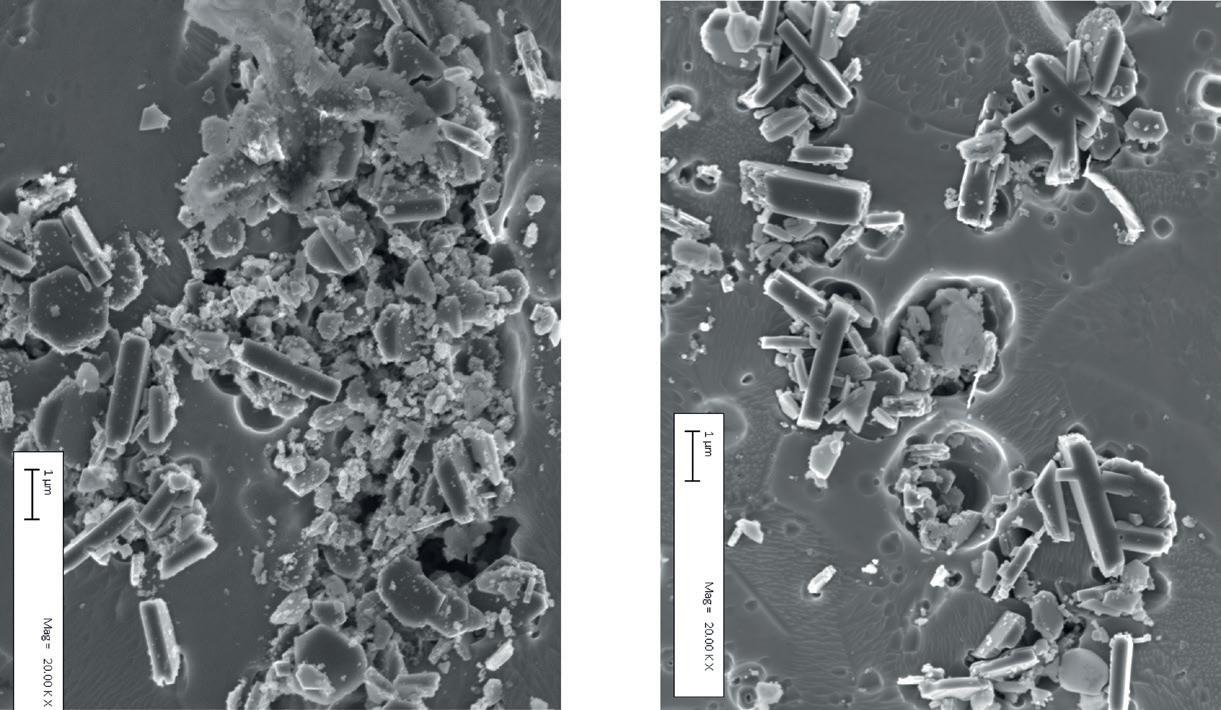

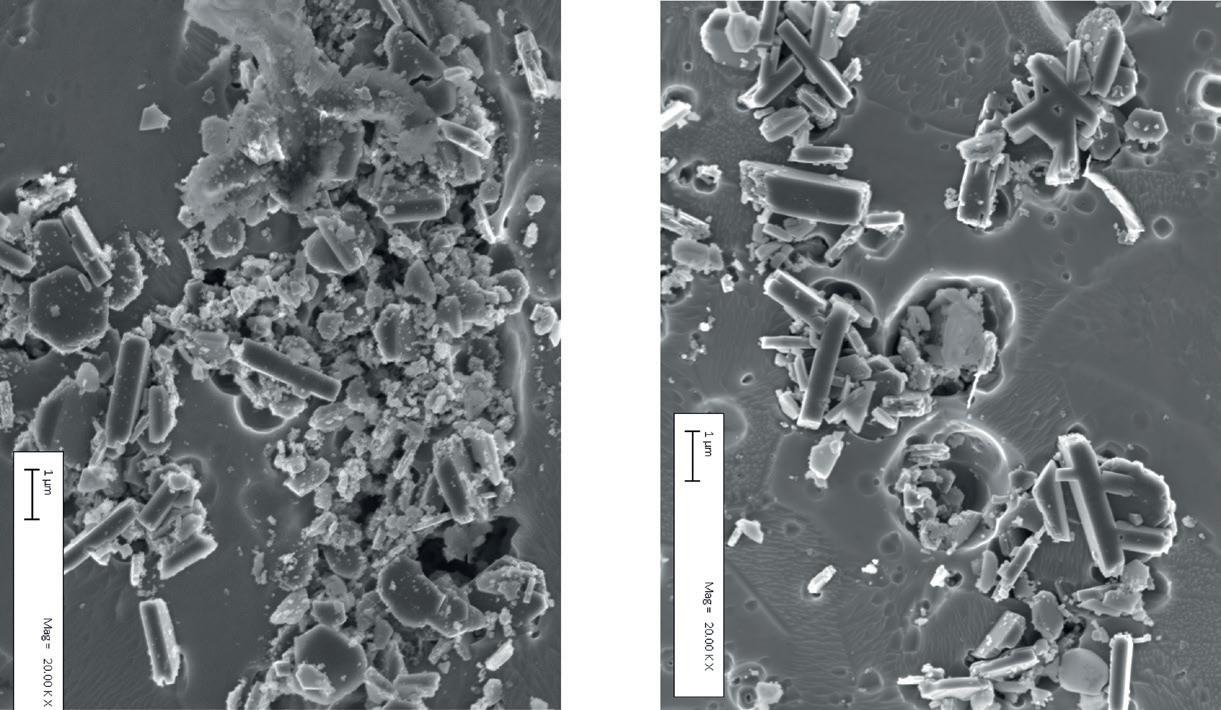

The challenge is that casthouses are increasingly having to add more zirconium to melts to achieve this high tensile strength, but through MQP’s research at BCAST, it was discovered that zirconium has a poisoning effect on grain refiner. Using state-of-the-art electron microscopy, a need was identified for an ultra-potent 5:1 grain refiner to overcome the Zr poisoning effect, resulting in the development of Optifine 5:1 125. This enables casthouses to successfully cast high strength zirconium containing 6000 and 7000 alloys mitigating the zirconium ‘poisoning’ problem.

“One of the major US players is currently trialling Optifine 5:1 125 to ensure optimum melt quality for a range of extrusions,” said John. “These vary from automotive extrusions such as trims and rails on SUVs and wall sections for trains, to big and wide aluminium extrusions such as offshore helidecks and micro extrusions that weigh no more than 15g/m and

provide high-precision tolerances from +/0.05 mm. These need a very fine, equiaxed grain structure for improved engineering performance.

“Grain refiner is, arguably, a casthouses’ second biggest consumable spend after refractories and by using Optifine instead of standard grain refiner, reducing the cost of grain refinement by 50% saving up to three dollars per tonne, resulting in savings of hundreds of thousands of dollars a year in a medium-sized plant.

“This particular customer also offers low

carbon aluminium that carries a footprint of 4.0 kg CO2 or less per kilo of aluminium, compared to the 16.7 world average. Using Optifine 5:1 125 means they can even more effectively meet their pledge to offer certified low carbon aluminium products with a transparent footprint. It’s manufactured using hydro-electric power or wind power, which results in far lower polluting CO2 emissions, and we also recycle customers’ scrap to make this product.” �

Aluminium International Today May/June 2023 EXTRUSION 18

*Chairman of MQP Optifine is today used in 42 major casthouses worldwide in the production of over six million tonnes of aluminium alloys a year.

Low magnification examination of longitudinal sections from rod showing the cleaner and more uniform structure of Optifine 5:1 125

0417W Al-5Ti-1B (63%)

6878T Al-5Ti-1B (125%)

High magnification examination with SEM of longitudinal section. The 63% efficiency sample shows salt reaction products surrounding the forming TiB2 particles. In the Optifine 5:1 125 sample the TiB2 particles are more perfectly formed with little or no salt reaction product present

0417W (5:1) (63%)

6878T (5:1) (125%)

+44 (0121) 684 0175 info@mqpltd.com mqpltd.com The next dimension in grain refinement... Contact us today to discuss your refinement needs. made with low carbon aluminium 125% relative efficiency 5:1 125 5:1 125

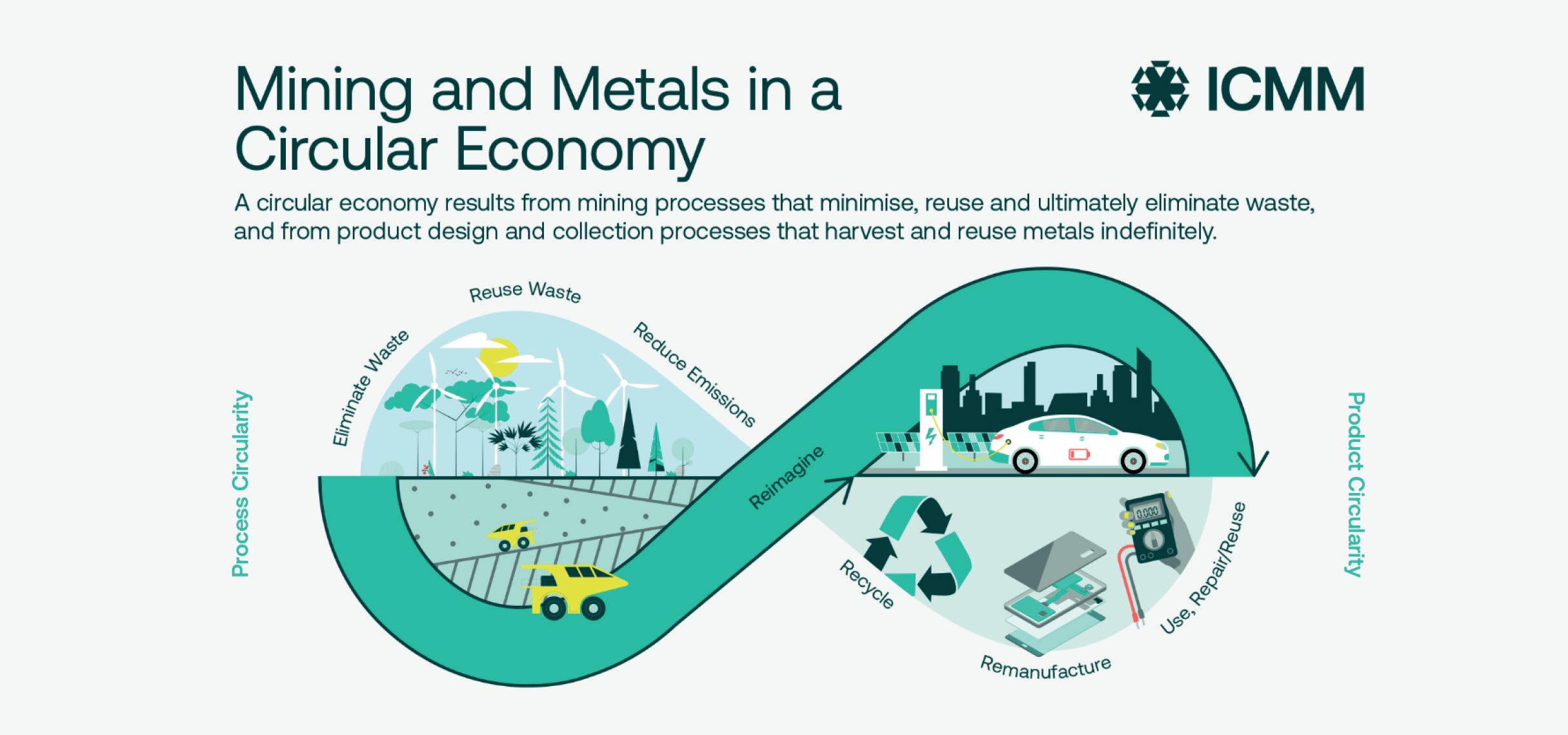

Circular, Inclusive, and Net Zero

Zahra Awan* spoke with Jerome Lucaes** to find out more about his plans for the business and his motivation to help build a more sustainable metals and mining, and manufacturing sector.

Empowering business transformations with real climate impact, Fast Forward Zero was founded in 2022 by business and sustainability expert, Jerome Lucaes, is one of the few business leaders with real experience and premium sustainability achievements that have been transformative for the metals markets and their supply chains.

Inspired by his 25+ years’ of experience and determination to create a better society, Jerome resigned from a lucrative corporate position to help business leaders transition faster to Net Zero Carbon and transform in a more inclusive way.

WHAT INSPIRED THE START-UP OF FAST FORWARD ZERO?

JEROME LUCAES (JL):

I started and created the company in December 2022, and it went public at the beginning of February. In 2022, I made the decision to embark on a new life of changes (and uncertainties), after voluntarily resigning from a comfortable corporate position.

Frankly, regaining freedom of time and having new experiences have been more rewarding than the money I lost! I’m not doing it because it’s fashionable; I’ve spent the past 15 years convincing people, shaping coalitions, pioneering, contributing to serious sustainability and decarbonisation challenges.

What inspires me is my determination to be useful to society. I am at a point in my career where I have accumulated a unique set of expertise and experiences. I started working on climate science issues 30 years ago: At University, doing climate change modelling, in business-oriented roles, business development strategy, sales and marketing, product development in the metals industry.

With my scientific background and business experience, I wanted to link the two together. I want to say to the world that: There is an urgency, backed by science. My mission is to help create a zero-emissions society.

NET ZERO 21 Aluminium International Today May/June 2023

*Editorial Assistant, Aluminium International Today **CEO, Fast Forward Zero

COULD YOU PROVIDE A BRIEF OUTLINE AS TO WHAT THE FAST FORWARD ZERO IS, AND WHAT IT INTENDS TO ACHIEVE?

JL:

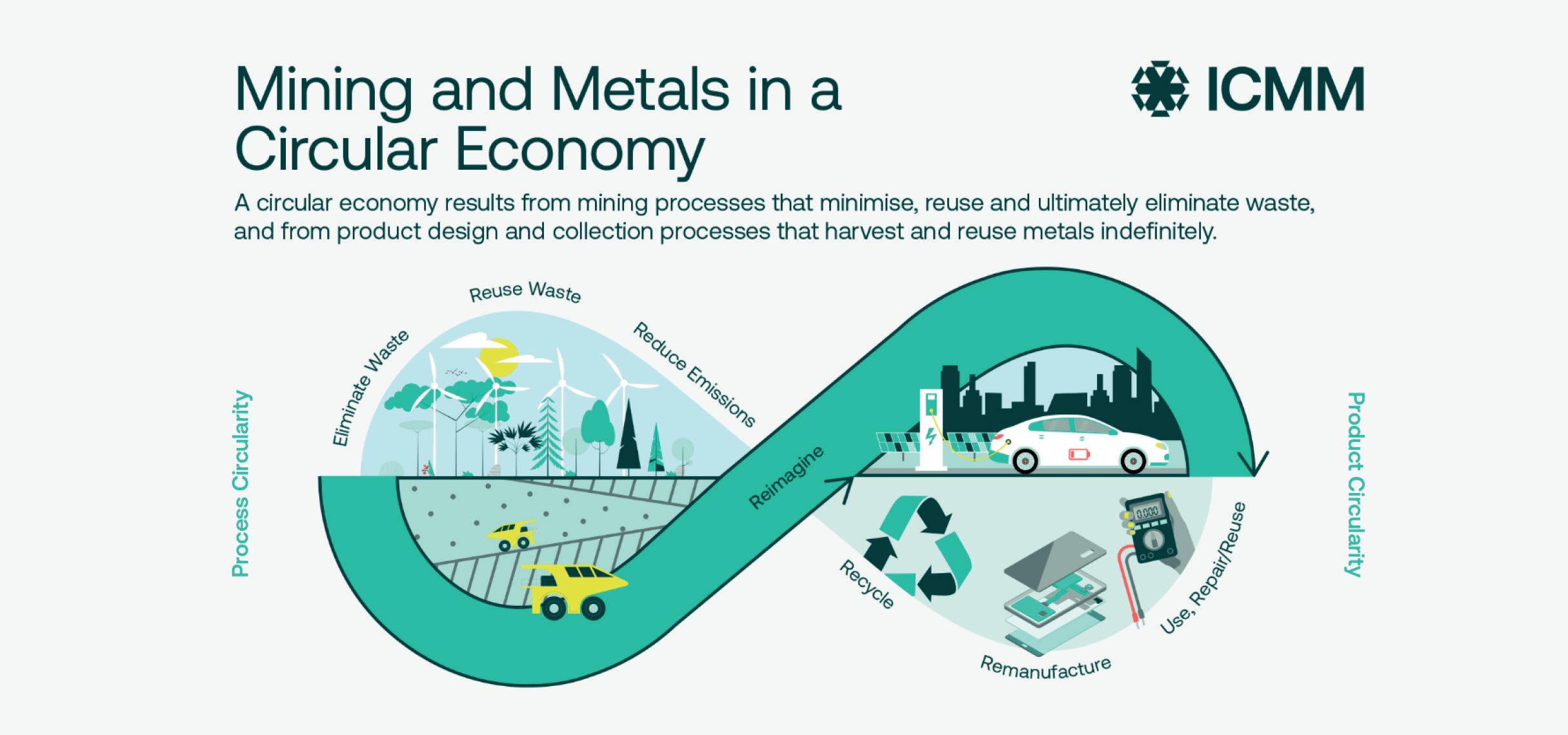

Fast Forward Zero help investors and other business leaders build collaborative coalitions to shape better systems to achieve carbon neutrality.

It’s clear that we need to reach Net Zero carbon emissions. We all need to take steps towards this transition. FF0 focuses on metals and mining and their supply chains, automotive, food and beverage, electricity, transportation, and consumer electronics; we either help the businesses that produce and transform those materials lower their emissions, or we assist those who are buying the products and the materials to source and develop sourcing strategies to lower carbon emissions. Our aim is to decarbonise the entire supply chain.

The decarbonisation journey is not easy and requires collective effort. Collaboration is key; there is a need for coalitions for the industry to work innovatively and solve complex issues.

Fast Forward Zero aims to inspire and connect partnerships between universities, researchers, companies, and in the future providers of new technologies, to assist in

the transition to net zero production. Another type of collaboration to consider is supply chain collaboration. Large companies have the common challenge of reducing the carbon footprint of their supplier purchases. Asking their suppliers to reduce their footprint without economic benefit is not exactly an attractive offer, so it is important to establish the right ecosystems for these supply chains. Decarbonisation is key, and this is what we aim to achieve at Fast Forward Zero.

WHAT IS YOUR DEFINITION OF SUSTAINABILITY?

JL:

There is a clear definition for sustainability, which is when a human activity does not harm and can be done without harming those involved (environmental, social, governance: ESG). As well as not compromising the potential of the activity to continue for generations to come.

Any sustainable business or product must demonstrate that it is serving the needs of society with a minimal impact on the planet and on the people.

We’re talking about Net Zero, carbon transformation, and climate management (environmental sustainability), which is the most prominent sustainability topic these days. However, it is completely interlinked with all the other sustainability topics: Governance and social sustainability. Each aspect has its challenges, and all the challenges must be tackled at the same time.

We also need to understand that we cannot get to zero carbon if we are committing to changes that are shifting to alternative unsustainable solutions. For example, electrical vehicles are not a solution to reducing carbon emissions when considering the consequences of consuming 10 or 20 times more lithium.

This is why, at Fast Forward Zero, we believe in a net zero transition that is inclusive of all the other sustainable development goals.

DO YOU THINK THERE SHOULD BE A SHIFT IN THE ATTITUDE TOWARDS SUSTAINABILITY? SHOULD THE INDUSTRY PRIORITISE SUSTAINABILITY OVER ECONOMIC BENEFITS?

JL:

There should definitely be a shift.

The first shift, which is already happening, is to get people, business leaders and investors to understand the problem and the solution to the problem. The second is prompting companies to ensure their ecosystems and their supply chains, are aligned to avoid conflicting priorities. The third thing is to move away from the focus on short-term benefits.

Moving away from short-term benefits, I believe, is key. The typical quarterly results deadline is a killer with regard to the sort of decisions that are beneficial for societies, the company, and the planet in the long term.

This sort of shift requires a total mindset change.

This is why FF0 was formed. To help companies accelerate their transition. It’s about helping them with expertise, smart business strategy, and technical Support. It’s about collaboration.

Whilst the climate crisis is top of the business agenda, routes to low carbon models remain complex, overwhelming, conflicting, and business specific. At Fast Forward Zero we understand these complexities and draw on decades of experience to create relevant solutions for businesses, investors and associations.

We want to empower business transformations with real climate impact.

Aluminium International Today May/June 2023 NET ZERO 22

Significantly reducing charging times, whilst improving operator safety. Our fully automated X-Series scrap charging machines are now available with interchangeable charge boxes to streamline the charge process times, reduce cycle times and increase throughput.

+44 (0) 1384 279 132 | sales@mechatherm.co.uk | www.mechatherm.com

TAILOR-MADE ROBOTIC SOLUTIONS

▪ Plate removal and replacement in the ceramic foam filter

▪ Coil waste removal from the rolling mill unwinder

▪ Strap cutting and removal

▪ Machine tending for aluminum components

▪ Ingots handling and palletizing

▪ Coils marking and tagging

ALUMINUM PLANT UPGRADING AND RETROFITTING

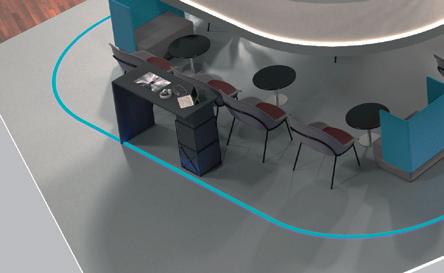

By introducing digital technologies, aluminum producers can notice a significant leap in productivity, while offering a better control over the production process and customer reach. This also provides better safety and environmental sustainability.

OUR EXPERTISE

Automation and Process Control, Electrical Engineering, Distribution Systems HV/MV/LV, MCC and Drive Panels, Safety Management, PLCs & Drives, DCSs, HMIs & SCADA, Data Management, Cloud & IIoT.

polytec.bmgroup.com

sales@bmgroup.com

Hydro’s HalZero technology reaches a new milestone

Hydro is entering a new development stage for its HalZero production technology. The company will invest in a test facility supported by the Norwegian government. With this step, Hydro is on track to deliver pilot production of zero-carbon primary aluminium by 2030. Nadine Bloxsome* spoke with Hans Erik Vatne** to find out more about the next steps of this project and the planned timeframe for reaching a Net Zero aluminium industry.

HalZero is a brand-new process for production of primary aluminium. Instead of carbon dioxide, only oxygen is emitted from the process. If Hydro succeeds in this development, it could revolutionise the aluminium industry.

Decarbonising industrial sectors is one of the most important contributions to reducing global greenhouse gas emissions. Hydro has been working on early phase development of the HalZero technology at Hydro’s Technology Center in Porsgrunn, Norway for seven years. The Norwegian government, via state enterprise Enova, has granted NOK 141 million for the construction of a test facility. The total investment is expected to be approximately NOK 400 million.

“We are very happy with the support by ENOVA,” says Hans Erik. “They have funded around 30% of the total costs of

this pilot phase and have good incentive programs for different technology readiness levels (TRL). The higher the TRl level, the higher the cost of piloting. We will therefore most likely seek partnerships for taking this technology to industrial scale.”

Zero-carbon aluminium has properties that are essential in the green shift. The metal is light and is weather resistant, which is significant for, among other things, electric cars, building facades and solar panels.

Development of HalZero is part of Hydro’s technology roadmap to reduce the emissions associated with aluminium production. HalZero is primarily suited for new production capacity. Hydro is working in parallel to develop carbon capture and storage for its existing aluminium smelters while increasing the use of renewable

electricity and testing green hydrogen in the value chain.

“We are preparing the final investment decision with the aim to start construction towards the end of 2023,” explains Hans Erik. “We plan to produce the first metal from the pilot in 2025. In parallel we are preparing for a scaled-up next stage pilot that will be larger and more integrated. The detailed time plan for this is not ready. Given a successful testing and pilot phase, and that necessary support and framework conditions are in place, a full verification of HalZero at industrial scale is planned by 2030.”

The aluminium industry needs optionality to increase its chances of reaching Net Zero by 2050. Working on several decarbonisation routes in parallel increases the chances of success and the speed at which we will be able to reach

NET ZERO 25 Aluminium International Today May/June 2023

*Editor, Aluminium International Today **Chief Technology Officer and Head of Corporate Technology Office at Norsk Hydro

Herøya, Prosgrunn plant where HalZero is being developed. Image courtesy of Hydro

FACTS ABOUT THE HALZERO PROJECT

� HalZero is a new production process for primary aluminium that emits oxygen instead of carbon dioxide (CO2)

� In the HalZero process, alumina is chlorinated and becomes aluminium chloride in a process that also produces carbon dioxide. Instead of releasing the CO2 to the atmosphere, it is sent back into the process and reused in the chemical reaction in a closed loop. This makes the electrolysis process completely greenhouse gas emission free.

� The HalZero process differs significantly from the current production of primary aluminium and is being developed for use in new production facilities.

the ambitious climate targets.

Preparation

Technology for Carbon Paste

Choose the Eirich solution:

• Low investment costs

• Low operating and maintenance costs

• Simple and swift commissioning

• Optimum mixing and cooling conditions

• Excellent paste quality

• Maximum plant availability

• All key machinery is manufactured in our own workshops

• Reliability for more than 150 years eirich.com

“We will continue our efforts within recycling as circularity is a prerequisite for a sustainable aluminum industry,” says Hans Erik. “We need to be sure that all this excellent aluminum that can be recycled over and over again is recycled at high rates and optimum yields. In this area, advanced sorting technology (to separate different alloys from one another) is key. In addition to using more end-of-life scrap, we are working to switch to renewable energy – green hydrogen, electrification or other – in our casthouses to decarbonise the recycling process and reduce the footprint of our products towards zero.”

“We see CCS as the solution to preserve the value of our well-operated and well-invested Hall-Heroult smelters, as there is no carbon-free technology available at present and because changing to a new carbon-free technology would be extremely costly and thus take very long,” continues Hans Eirk. “Hydrogen is a potential fuel in our casthouses and possible for anode baking furnaces but has no role in the electrolysis process itself. At the same time, we continue to optimise and continuously improve productivity and energy consumption in our existing Hall-Heroult plants through new technology elements, use of digital solutions like digital twins incorporated directly in the control systems of the cells and improved cathode solutions, as these smelters will still be around for many years.

This technology as well as the highly skilled workforce in our smelters have enabled us to reduce emissions significantly. This is important, since any one kilo of CO2 that is not produced in the electrolysis process, will be one kilo less that we need to capture.’

“I am optimistic about the goal of reaching Net Zero by 2050,” says Hans Erik. “We now have several initiatives in the industry for new carbon-free technology, where inert anodes and HalZero are well-known examples. The industry needs to pursue different solutions, as decarbonising smelting is very challenging both technically and economically. One or more of these solutions need to succeed in a 10-year horizon. In addition, we depend on cost-efficient methods for CCS to utilise and preserve the value of the huge legacy investments in our industry.” �

Aluminium International Today May/June 2023 NET ZERO 26

Image courtesy of Hydro

precimeter.com

When sustainability becomes a duty

Life cycle assessment and recycling management make automotive and industrial companies fit for the future. By Dr Jens Ramsbrock*

In March 2020, the European Commission adopted the new Action Plan for Circular Economy. It aims to promote sustainable product design while reducing waste in resource-intensive sectors – including electronics and ICT, battery and vehicle manufacturing, and the plastics industry – as part of the European Green Deal.

The revision of EU legislation on batteries is just one building block in this context. On the one hand, it is intended to make life cycle assessments (LCA) mandatory and, on the other, to regulate the use of resources. Thus, the new Batteries Directive illustrates the challenges facing the automotive sector and industry in general

with regard to LCAs and effective circular economy. In order to prepare companies for these new legislative requirements and corresponding customer needs, it is useful to always embed a LCA in the context of sustainability management and circular economy. In addition to in-house expertise, especially in engineering and automotive,

*(Geophysicist and Sustainability Economist), Senior Expert Sustainability and LCA at ARRK Engineering

Aluminium International Today May/June 2023 SUSTAINABILITY - LIFE CYCLE ASSESSMENT (LCA) 28

ARRK Engineering can draw on the knowhow and product development history of its parent company Mitsui Chemicals Group, all of which is incorporated into the optimisation of the LCA results.

Two developments in the 1970s gave rise to the first life cycle analyses as we know them today: on the one hand, the worldwide increasing volume of waste, which is pushing more and more disposal systems to their limits, and on the other hand, emerging energy bottlenecks and the associated realisation that a large proportion of the raw materials used are not available in unlimited quantities. Accordingly, LCA at that time focused on the effective use of resources and the reduction of emissions from products. Over the years, the concept of Life Cycle Assessment, also known as LCA, has

been continuously expanded and refined. Today, it encompasses a holistic analysis of the product system from cradle to grave – ideally even from cradle to cradle as an approach to a continuous circular economy. Regulatory instruments such as the EU’s Circular Economy Action Plan and the accompanying legislative tightening, e.g. the revision of battery legislation currently underway, are now making LCA mandatory in an increasing number of sectors and industries.

Pressure from legislation and customer requirements

Among other things, the new EU Battery Regulation stipulates that rechargeable industrial and commercial batteries with

for the CO2 footprint must be complied with. According to DIN EN ISO 14040 and 14044, the LCA required to determine these and similar values consists of four phases: Definition of target and scope, life cycle inventory, impact assessment, and evaluation. Depending on the defined scope, the analysis covers all relevant input and output flows. These include raw materials and material procurement, energy, transport, (partial) processing, waste, emissions and discharges into water and soil – both during production and the use phase, right up to end-of-life scenarios.

On the one hand, legislators are increasingly demanding life cycle assessments in various sectors. On the other hand, the analyses can also be useful or even necessary for a second reason: More and more processing companies are demanding corresponding evidence in order to make their own production more resource-efficient and to equip themselves for future requirements. Even now, this is clearly noticeable in the automotive industry. ARRK Engineering has already linked the balances with an in-house team of experts who work with selected areas in the cross-section of the company and can be called in for projects as required. At the beginning, the object of consideration must be sensibly and clearly defined and the methodology to be applied must be determined. Then, all the relevant information, including any interdependencies and interactions, must be collected before dedicated software – with access to eco-impact data – can start the calculations. The third step is interpreting the results and deriving feasible optimisation proposals as well as any further LCA determination loops.

A lot of know-how and intuition required

internal storage must have a CO2 footprint declaration as of 1 July 2024. As early as 1 January 2026, a label indicating the performance class for CO2 intensity will be mandatory, and finally, as of 1 July 2027, corresponding maximum values

A typical challenge that requires a lot of know-how and finesse from the implementing experts can clearly be found in the nature of new products: As a rule, hardly any data is available for the use and end-of-life phases before the launch, since they result from the final recycling rate of individual components and materials as well as from actual usage behaviour. Therefore, it is common to use estimates or model calculations in this respect. It must be taken into account that many parameters affect individual phases and process steps in different ways. If conditions change, e.g. due to the development of new recycling processes, these in turn would have to be retroactively incorporated into the LCA.

In addition to ecological factors, social aspects are also becoming increasingly important in public awareness and thus

SUSTAINABILITY - LIFE CYCLE ASSESSMENT (LCA) 29 Aluminium International Today May/June 2023

SUSTAINABILITY - LIFE CYCLE ASSESSMENT (LCA)

also for many companies. In order to also meet these new demands, an extension of the methodology offers the potential to take these additional parameters into account, in the sense of a so-called SocialLCA (S-LCA) in accordance with the UN Environment Programme. Improving the eco-balance with the help of the circular economy

The use of lightweight materials in the automotive industry serves as an illustrative example of how technological progress shifts energy consumption and environmental impact from one phase of the product life cycle to another. For example, a vehicle consumes less energy in the form of fuel during the use phase due to its reduced weight. However, the energy input in the manufacturing phase can increase due to raising parameters such as pressure and temperature, which are necessary in the individual production steps of e.g. CFRP components. Yet, current research results from Chalmers University of Technology indicate that energy consumption and the CO2 footprint in the production of CFRP components may be significantly reduced in the future, with circular economy plays a decisive role. By producing carbon fibres using lower-

energy methods such as microwaves as an alternative to classic melting furnaces, the overall eco-balance of lightweight vehicles can be improved. This gives them an advantage over vehicles made from conventional materials. Likewise, there are various aspects of the entire life cycle of a vehicle that should be taken into account: It is worthwhile not only to look at the recycling process, but also to focus on the service life or production.

Comprehensive competencies from engineering to materials management

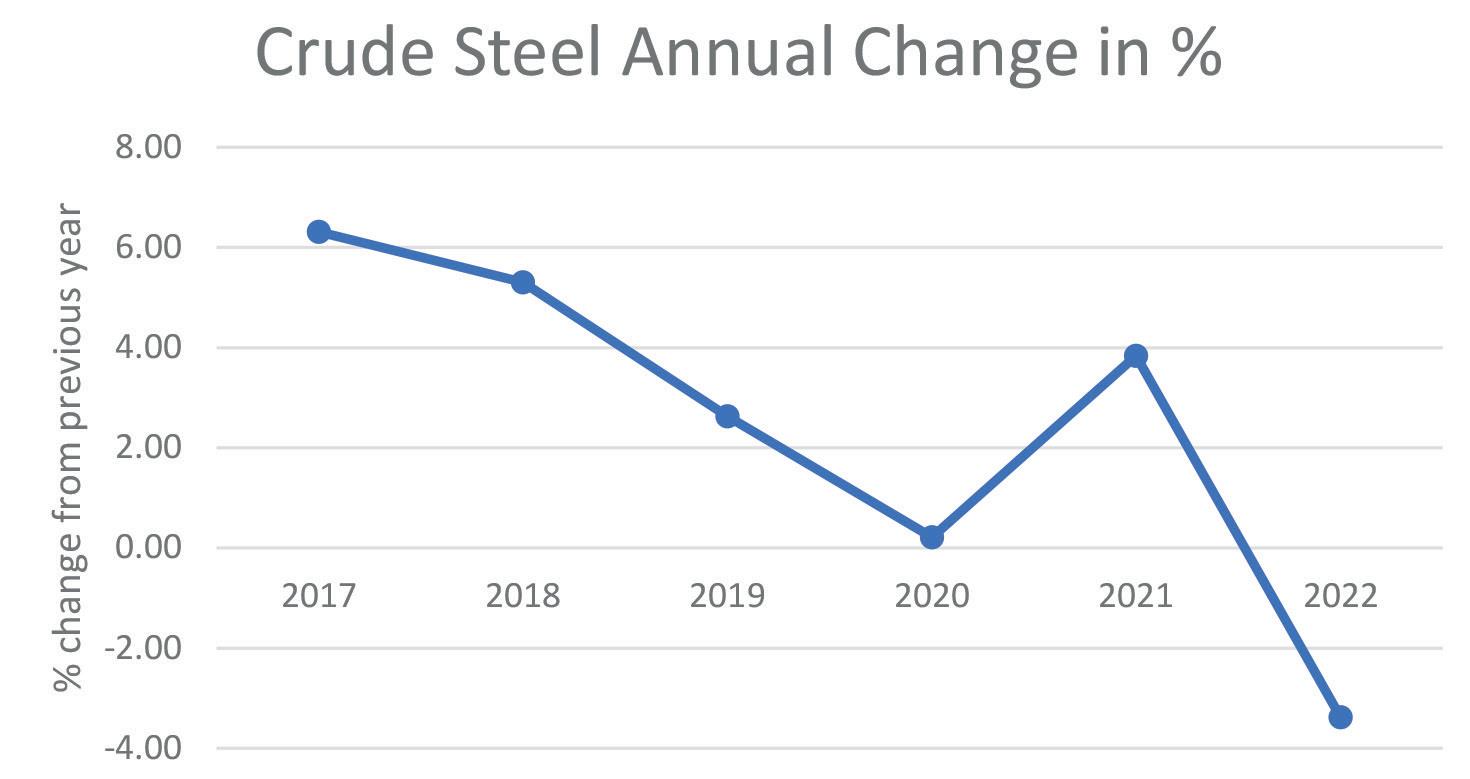

In order to master the challenges of life cycle assessment, a precise definition of goal and scope as well as an alignment of expectations and the underlying methodology are essential. Implementing companies such as ARRK Engineering are not dependent on any particular software. The analysis can be carried out flexibly with the client’s preferred tool. In doing so, the LCA specialists not only draw on their own engineering know-how, especially from automotive development, but also on indepth expertise in the areas of sustainable materials and the associated compliance requirements as well as environmental