Scan to subscribe to Mining’s weekly newsletter – delivered to your inbox every Wednesday. Published by

Scan to subscribe to Mining’s weekly newsletter – delivered to your inbox every Wednesday. Published by

Chief

Chief

Assistant Editor Prealene Khera

Design

Jacqueline Buckmaster

Head of Design Blake Storey

Business Development Manager Terry Braithwaite

Client Success Manager

Louisa Stocks

Head Office

Prime Creative Media

379 Docklands Drive

Docklands Victoria 3008

P: +61 3 9690 8766 enquiries@primecreative.com.au miningmagazine.com.au

Subscriptions

P: +61 3 9690 8766 subscriptions@primecreative.com.au

Mining is available by subscription from the publisher. The rights of refusal are reserved by the publisher.

Technology has taken hold of the mining industry, bringing smarter and more efficient ways of operating.

Technology is revolutionising the mining sector, with new solutions improving the synergy of the mining value chain, driving higher safety standards, and creating new environmental opportunities.

The beauty of technology is that while a product might have advanced to the point that is delivering tangible benefits for a mining operation, there is often scope for continued development.

This is where a mining company plays a key role, providing the local knowledge and data to tailor and smarten systems, with the potential to leverage artificial intelligence (AI) to further augment a solution.

The Winter edition of Mining celebrates the mining sector’s technology proponents, with innovators offering new ways to unlock competitive advantages on mine sites.

Whether it’s Joyce Mechanical Services, which is helping the mining industry extend the life of its machinery, or Australian EVS, which is providing a practical pathway for electrification, or Viva Energy, which is driving the future of renewable diesel, there are endless options for miners to implement next-generation technologies for their benefit.

This edition also sees Accenture provide its perspective on the future of green steel, while Deloitte discusses the immense efficiency gains that can be achieved from artificial intelligence.

Several events are also in the spotlight, including Asia Pacific’s International Mining Exhibition (AIMEX), the WA Mining Conference and Exhibition, PNG Expo and the Prospect Awards.

Mining also takes the opportunity to analyse Northern Star’s acquisition of De Grey Mining, and the world-class Hemi project that comes with it, while we also look to the future under a renewed Federal Government following Labor's re-election in May.

Mine closure and rehabilitation is also discussed, with a new training course looking to bridge industry knowledge gaps.

Tom Parker Managing Editor

Drop Tom Parker a line at tom.parker@primecreative.com.au or feel free to call him on 03 9690 8766 to let him know what you think. Don't forget to follow Mining on social media – find us on LinkedIn, X and YouTube.

Mining acknowledges Aboriginal Traditional Owners throughout Australia and pays respect to their cultures and Elders past, present and emerging.

Ahead of Anglo American selling its steelmaking coal business to Peabody Energy, the company has achieved several key technology milestones.

‘new’

Instead of investing in expensive new machines, mining companies can rebuild the assets they already own.

Northern Star Resources has acquired De Grey Mining, rocketing the miner to new heights.

Research has revealed significant holes in the knowledge of mine closure processes, but a new training course is working to bridge the gap.

Mines and Petroleum Minister David Michael is set to launch this year’s WA Mining Conference with a much-anticipated opening address.

have offered up insights on how the company foresees artificial intelligence driving global copper demand.

Despite the current lithium downturn, there is plenty of optimism in the battery metal, with backing from governments and investors alike.

E mpowering your mine operations with Roto’s high pressure flexible shaft series pumps. Unleash the solution that challenges excess wate r, ensuring safe and efficient operations ; the Underground Maintena n ce Engineers’ Choice for ground water control.

Features:

•Robust construction for prolonged life and reliable performance

• Adaptable for challenging underground environments, available in fixed station configurations for single lift or staging along with portable packaged solutions

• Forge a direct connection with the manufacturer, ensuring personalised support,

Ahead of Anglo American selling its steelmaking coal business to Peabody Energy, the company has achieved several key technology milestones.

For more than 100 years, Anglo American has worked to fulfil its purpose: re-imagining mining to improve people’s lives.

Coinciding with this purpose is Anglo’s ‘FutureSmart Mining’ agenda, which is the company’s innovation-led approach to sustainable mining.

Anglo believes this approach is integral to building a mining industry with minimal physical footprint, and one that goes beyond carbon neutral and works in partnership to achieve a greater goal.

“These are the step-change innovations that will transform the nature of mining – how we source, mine, process, move and market our products – and how our stakeholders experience our business,” Anglo said. “It is about transforming our physical and societal footprint.

“We envisage a much-reduced environmental footprint from new ways of mining, by using a number of precision mining technologies and data analytics.”

Anglo implements a collaborative approach to regional economic

development, while its global stretch goals, aimed at delivering improvements to areas such as health and education, drive the company’s ambition to create truly sustainable and thriving communities.

“In order to live up to our purpose, we are changing the way we operate through smart innovation that connects technology, digitalisation and a holistic approach to sustainability,” Anglo said.

A clear illustration of this is the decade-long vision Anglo has had for its

steelmaking coal mines in the Bowen Basin of Queensland.

After using the last 10 years to improve safety and efficiency in its underground coal mining operations, Anglo’s ‘mine of the future’ vision became a reality earlier this year.

In March, all of Anglo’s underground coal mines in Queensland began operating simultaneously from remote operation centres (ROCs).

risk to hazardous areas by 22,500 hours across our Bowen Basin mine sites.”

Only one known mine globally had achieved sustainable remote operations before Anglo’s Australian operations did: the San Juan coal mine in the US, owned by Westmoreland.

Anglo attributed the rapid pace of technological innovation – especially in areas like data analytics, automation and digitalisation – to unlocking opportunities for the next-generation of mining in Australia.

Anglo head of operations Matt Cooper said more than 1000 systems initiatives had enabled remote operation success during the company’s decadelong journey.

“Each advancement towards our vision introduced new obstacles, requiring the development of further technology capable of meeting unique demands,” Cooper said.

Anglo American has reduced exposure risk to hazardous areas by over 20,000 hours across its Bowen Basin mines since adopting remote operations.

Not content to rest on its laurels, March also saw Anglo notch another milestone: 10,000 longwall mining shears from said ROCs.

“At Anglo American, we have reimagined where our people can remotely manage operations from a safe distance, using real-time data to make informed decisions,” Anglo American Australia automation superintendent Matthew Wakeford said.

“Since transitioning to remote operations, we have reduced exposure

“But if we are to unlock the full potential of these advancements, we must consistently integrate the seasoned expertise of our workforce – those who have deeply understood and mastered the complexities of coal mining through decades of experience.”

Cooper said Anglo would be equipping their people to grow with the industry as they were “irreplaceable”.

“By developing state-of-the-art technologies and prioritising the wellbeing of our workforce through a collaborative approach, our steelmaking coal mines in Australia have emerged as leaders in the industry, reshaping the future of underground coal mining on a global scale,” Cooper said.

Anglo has also utilised industry-leading personal proximity detection systems to keep workers safe underground,

and trialled remote-controlled stockpile dozers.

The dozers, designed to improve operator safety, were trialled at the Capcoal complex near Middlemount to reduce exposure to concealed stockpile voids.

“Upskilling our workers in this new technology is paramount to its success because their expertise is irreplaceable, even when the work is done remotely,” Anglo Capcoal general manager George Karooz said in June 2024.

The operation is expected to reduce in-cab dozer exposure time by 45,000 to 75,000 hours per year once the technology is fully deployed across all sites.

“Operating our fleet of dozers from a safe distance will reduce the number of hours in the cab and fully remove our operators from the dozer seat in what is another significant advancement in autonomous mining,” Wakeford said.

Anglo’s plan is to ramp up and retrofit its entire fleet, totalling 13 dozers across the company’s Capcoal and Moranbah operations.

A new owner

These autonomous advancements come as Anglo shifts its focus towards its copper operations in South America and its iron ore assets in South Africa and Brazil.

The Woodsmith polyhalite fertiliser mine being developed in the north-east of England will also be a mainstay for the company.

To maintain this focus, Anglo has announced the divestitures of its steelmaking coal, nickel and platinum businesses.

Anglo American achieved 10,000 longwall mining shears from its remote operating centres in March.

Anglo will sell its five Queensland coal mines – Aquila, Capcoal, Dawson, Grosvenor and Moranbah North – to Peabody Energy for up to $US3.775 billion.

The deal, along with the finalised sale of Anglo’s 33.3 per cent stake in Jellinbah Group to Zashvin for approximately $US1.1 billion, is expected to generate $US4.9 billion for Anglo.

The acquisition will allow Peabody to capture substantial synergies between its existing Australian coal assets and the soon-to-be acquired mines.

It will also transform Peabody into a leading coal producer with Tier 1 mines situated within the world’s strongest steel markets.

The transaction is expected to be completed by the third quarter of 2025.

In early June, Anglo American finalised the demerger of approximately 51 per cent of its interest in Valterra Platinum, formerly known as Anglo American Platinum, which Anglo chief executive officer Duncan Wanblad said would enhance the company's focus on its “world-class” positions in copper, iron ore and crop nutrients.

MMG Singapore Resources will become the new owner of Anglo’s nickel business, comprising two ferronickel operations – Barro Alto and Codemin – and two greenfield growth operations – Jacaré and Morro Sem Boné – in Brazil, via a $US500 million deal.

Anglo has also planned an exit from its 85 per cent stake in diamond arm De Beers. The company cited tough market conditions as the reason behind the divestment and said it will exit De Beers at the right time.

While Anglo will soon no longer have a presence in the Bowen Basin of Queensland via its coal mines, its legacy in the region will live on, with its technological milestones blazing a new trail for what’s possible in autonomous mining.

By pioneering new technologies, Anglo is redefining what mining is and can be for the next generation of industry and community.

And there is no doubt Anglo will continue this mission as it homes in on its copper, iron ore and crop nutrients operations.

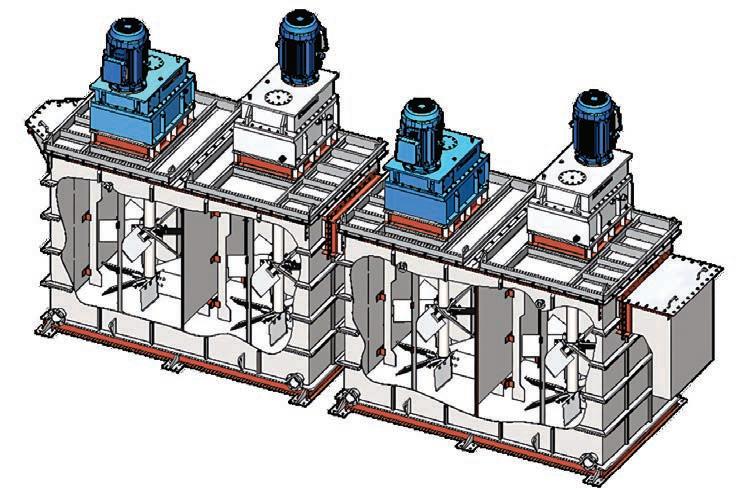

Attrition scrubbing is the process where a mineral is scrubbed primarily by the action of the slurry particles impacting one another. This type of particle scrubbing achieves the desired “cleaned” particles while minimizing wear on the equipment. Results of scrubbing.

Exposes fresh surface of particles to reagents

Cleans particles surface contaminants, oxides, slimes, clay and calcium

Reduces particle size

4 kw –150 kW per cell in various materials of construction

Standard sizes from 500 litres to 20 m³

Steel production is responsible for more emissions than shipping and aviation combined.

The steel industry has a significant role to play en route to net zero, with Australia to be a key cog in the decarbonisation journey.

By Eric Croeser, managing director and mining and metals lead APAC region, Accenture

As the world accelerates towards net zero, heavy industries are undergoing a rapid transformation.

Steel production is responsible for more emissions than shipping and aviation combined, so no surprise the sector is racing to reinvent itself. Market volatility, evolving consumer expectations and a shifting policy landscape make decarbonisation both urgent and complex.

The surge in green steel demand and production in recent years is a positive sign. Globally, more than 110 green steel projects, with a combined value of more than $US95 billion, were announced in 2020–23. However, ongoing economic and geopolitical uncertainty could stall momentum altogether – unless intent quickly turns into action.

Australia is uniquely positioned to lead the green steel transition. With worldclass magnetite reserves and high-purity hematite in the Pilbara, abundant renewable energy resources, and policies that actively support downstream processing, the foundations are strong. But the pace of change is accelerating, and the first-mover advantage is real.

Unlocking green steel’s potential at scale will take more than new furnaces. It will demand a shift in thinking altogether – of supply chains, digital infrastructure, and the workforce – to prepare for this new era.

The rise of scrap

Scrap metal is becoming one of the most important feedstocks in steelmaking, offering a far lower emissions profile than iron ore. But while the market for scrap is growing, it is fragmented, unpredictable, and marked by highly variable quality.

Electric arc furnaces (EAFs) can require

up to six times more scrap metal than traditional blast furnaces, and producers need consistent feed to produce steel that meets modern quality standards. This makes supply security and quality forecasting mission-critical.

Australia is already acting on this opportunity. Instead of just exporting raw materials, there’s a clear push to refine and process them locally, turning industrial sites into modern powerhouses and building a stronger, more competitive sector right here at home.

The goal is clear: create a competitive domestic green steel sector that doesn’t just mine the inputs, but refines and processes them onshore.

To meet this vision, steel producers are rethinking how scrap is sourced by pursuing buyback programs, vertical integration, and digital scrap marketplaces to secure reliable inputs.

Mining companies will increasingly be part of this conversation, particularly as demand grows for recycled metals, precision feedstocks, and tighter integration between raw material inputs and downstream processing.

Alongside scrap, hydrogen-based direct reduced iron (DRI) is emerging as the other key pathway to low-carbon steel. In this process, green hydrogen replaces carbon-based materials (such as coal) as the reductant, cutting process emissions significantly.

Hydrogen, however, introduces new safety considerations – such as increased explosion risk, material embrittlement, and the need for specialised leak detection – that many traditional steelmaking environments are not equipped to handle. Building that infrastructure, while locking in reliable renewable-hydrogen supply, will be central to scaling DRI competitively.

The move to green steel represents more than just a shift in physical infrastructure; it’s a system-level reset. New furnaces must be supported by smarter digital architecture capable of connecting disparate data sources, adapting to volatile inputs, and optimising operations in real time.

predictability and energy competitiveness are emerging as two of the most critical factors for long-term success.

Yet many steel producers still operate on legacy systems that were not designed for the flexibility and intelligence needed today.

According to Accenture's research, the ability to connect operational technology (OT) and information technology (IT) is now foundational to building competitive, decarbonised operations.

For businesses to modernise their fundamental technology capabilities –their “digital core” – they must begin with cloud-based data systems that provide clear visibility across the entire value chain. This enables real-time insights into supply chains, predictive quality control, and integrated energy monitoring.

When combined with AI and automation, these systems can significantly reduce waste and uncover operational efficiencies, ultimately boosting the bottom line.

At the same time, next-generation enterprise resource planning (ERP) platforms like SAP S/4HANA provide the level of control required to manage raw materials, monitor energy consumption, and streamline maintenance in increasingly complex and adaptive steelmaking environments.

As seen in other resource-intensive sectors, companies that fail to digitise risk falling behind – not just in efficiency, but in their ability to meet emissions standards and capitalise on emerging demand.

As the steel sector transitions to low-emissions production, operational

EAF operations, while cleaner and more flexible than traditional blast furnaces, are inherently more sensitive to input variability and external market forces. From inconsistent scrap metal quality to energy price spikes and supply chain bottlenecks, the margin for error is shrinking.

That same volatility hits downstream steelmakers when ore or energy inputs fail to arrive on spec or on time. These disruptions are not minor – they account for an estimated $67 billion in lost productivity across the global mining industry each year.

Meeting customer expectations for low-emissions steel at a competitive price will require smarter planning tools and production simulation platforms capable of managing this variability in real time.

The ability to forecast input quality, adapt to dynamic scheduling and optimise output under changing conditions is now fundamental to maintaining profitability and performance.

At the same time, energy use is becoming a defining factor in steel’s cost structure. With electricity accounting for between 15 per cent and 20 per cent of total production costs in EAF operations, access to reliable, low-cost renewable power is critical. Without it, even the most advanced green steel operations will struggle to remain economically viable.

The ambition is clear: not only to export the materials needed for the global energy transition, but to manufacture them domestically – cleanly, competitively, and at scale.

For mining and metals producers alike, this means energy strategy can no longer be treated as a support function. Long-term competitiveness will depend on securing access to renewables, building energy partnerships, and

volatility of inputs and the rising complexity of energy will be best positioned to lead in the green steel economy.

The move to low-emissions steelmaking via DRI, EAFs and hydrogen demands a wholesale rethink of roles, safety protocols and operating models.

Hydrogen raises new hazards that call for specialised leak-detection, real-time monitoring and revised emergency plans, while AI-enabled maintenance and remote supervision are already reducing field risks and lifting productivity.

Meeting this moment hinges on workforce readiness. Targeted reskilling, backed by digital tools and a strong safety culture, will separate leaders from laggards as green-metals capacity grows.

For miners, the mandate is equally clear: shift from supplying ore to enabling low-carbon value chains. By securing quality scrap, linking with renewableenergy infrastructure and delivering traceable, high-purity inputs, the sector can anchor the green-steel economy.

Ultimately, success will flow to those who fuse materials expertise with data intelligence – the intelligent convergence of “atoms and bits” that will define tomorrow’s sustainable industry.

The mining industry has the potential to achieve significant efficiency gains from AI. But operators must be strategic in their approach.

By Deloitte Australia

The mining and metals sector is being squeezed on both ends. Demand for traditional mining products continues to grow and is now joined by an increasing need for the green and rare earth minerals that will power the energy transition.

Meanwhile, on the supply side, operators face pressures from depleting deposits, rising costs, sustainability expectations and talent shortages. As a result, organisations are seeking ways to optimise operations sustainably.

For leaders, the solution to this squeeze is to become technologically curious. Smart operations like artificial intelligence (AI), digital twins, and predictive analytics are revolutionising the industry. In particular, AI’s capabilities to mine insights from data at speed have the potential to drive massive efficiency gains.

Take, for example, preventive maintenance optimisation, which typically involves labour-intensive data analysis and error-checking. Generative AI (GenAI) can automate the processing of historical work order data, enabling the quick determination of failure rates and optimisation of maintenance schedules. In our experience, the time required to analyse work order content can be dramatically reduced from 160 hours to less than eight hours for a batch of 5000 work orders. This acceleration not only saves time but also enhances productivity, leading to operational expenditure (opex) savings of around 15–25 per cent annually.

Similarly, Deloitte has developed an executive reporting agent that allows leadership to quickly access insights from large, data-heavy reports without relying on data engineers or manual search, providing real-time intelligence for faster decision-making.

These kinds of efficiency gains cannot be ignored. Any organisation that does not act risks being left behind. But at the same time, it can be hard to bite the bullet when the implementation risks of AI seem insurmountable, such as data security concerns and uncertainty over return on investment.

There are guardrails your organisation can put in place to minimise AI risks. Deloitte’s recent ‘AI at a crossroads: Building trust as a path to scale’ report outlines five key pillars of mature AI governance needed to achieve trustworthy AI.

The first is organisational structure. It is essential to clearly identify roles accountable for managing AI standards and addressing emerging issues. Most companies place these responsibilities in the hands of the board or C-suite, while others assign them to a centralised ethics and risk team.

In mining and metals, there’s no one-size-fits-all structure – what matters is having one. A miner operating across jurisdictions might choose a global body, while a domestic operator could entrust a C-suite member, like the chief technology officer or chief financial officer.

The geolocation of the AI platform or the server storing its data is also crucial, as some jurisdictions pose higher risks than others. This must be a key consideration for any multi-jurisdictional miner developing risk policies for AI usage.

Next are AI policies and principles – such as timelines for implementing governance standards, ethical frameworks, and risk and reporting guidelines. Having clear principles helps build employee trust in AI, particularly where there are work, health and safety implications.

The third pillar focuses on managing AI-related risks in day-to-day operations. A crucial part of good AI governance is having a system for employees to report issues or concerns.

Our research shows two in five organisations lack such a mechanism. Those with formal systems receive five times more queries and twice as many reported incidents – suggesting that those without may be unaware of emerging risks.

Mining companies often oversee decentralised operations, so a centralised reporting system is essential. Data-heavy processes, like work order analysis, could be corrupted by malicious actors feeding false data into AI models.

Elsewhere, we know of one incident where a deepfake impersonation of a key decision-maker was used to approve an otherwise unauthorised purchase. Being able to escalate AI risks quickly is key to minimising impact.

Pillar four – people and skills – is critical to ensuring trustworthy AI. By our estimate, just 56 per cent of employees in a typical organisation have the skills to use AI responsibly, emphasising the need for organisations to invest in training to boost AI skills and fluency in the workforce.

talent, and unlock data-driven ways of working across roles. For instance, Deloitte has developed a health, safety and environment incident investigation suite that automates aspects of investigations and provides datadriven insights.

There is also potential elsewhere –mine maintenance technicians could use AI to diagnose issues, analyse data, and optimise schedules, freeing up capacity and improving safety by reducing exposure to heavy equipment.

The fifth and final pillar is adaptability – ensuring your governance systems can evolve with shifting needs and new challenges. Constantly reviewing systems and processes ensures your AI strategy remains effective and trustworthy.

It’s clear that transformative AI

Proactive training and reskilling can reduce costs, enhance safety, attract

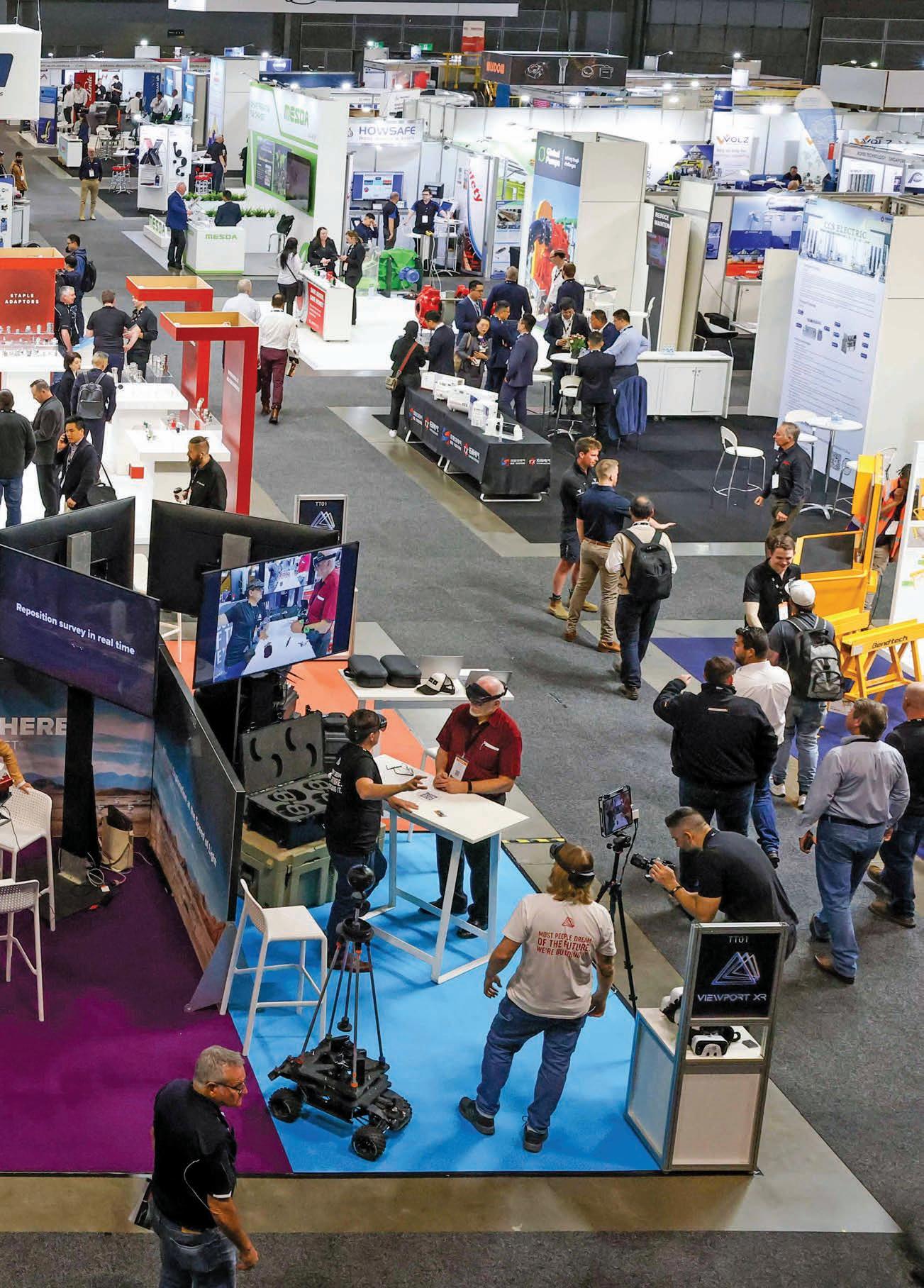

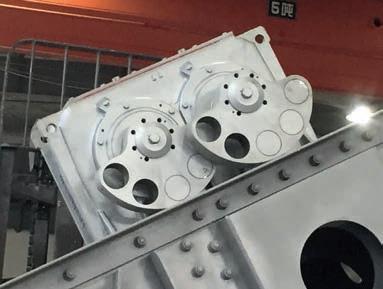

Instead of investing in expensive new machines, mining companies can rebuild the assets they already own.

Over the past decade, the mining sector has undergone remarkable technological advances aimed at increasing efficiency, production, and profitability.

With the rise of artificial intelligence and next-generation technologies, the future of mining looks vastly different from the past. But a critical question remains: how much of a difference can these technologies realistically make to today’s operational efficiency?

In an era marked by evolving environmental regulations and a global push for sustainability, traditional mining is being reshaped by innovation, accountability, and necessity. Governments and consumers alike are calling for cleaner, more responsible methods of extracting the minerals essential to modern life.

To meet these expectations, mining companies can pursue the latest technologies often at great cost or adopt innovative alternatives that deliver similar or even superior outcomes at a fraction of the price. These alternatives not only reduce mining waste but also minimise environmental impact.

One core principle stands out: new doesn’t always mean better.

A common assumption is that technological advancement requires complete replacement. In many cases, however, the heavy equipment already operating across Australian mine sites isn’t obsolete – it simply needs a forwardthinking rebuild approach.

Instead of scrapping entire fleets and investing in expensive new machines, mining businesses can rebuild the assets they already own. This strategy not only maximises the value of existing investments but also integrates reliability upgrades that often exceed the standards of new equipment.

Refurbishment enables companies to reduce capital expenditure, minimise environmental impact, and accelerate return on investment all while maintaining a competitive edge.

The benefits of machinery rebuilds are substantial. New equipment typically involves high costs and long lead times often exceeding 18 months. Refurbishing existing equipment costs significantly less and can be completed in far shorter timeframes, reducing site disruption and keeping operations on track.

Rebuilding also extends the life of valuable assets without compromising on performance. Instead of waiting over a year for new machinery to arrive, companies can restore their existing fleet to optimal condition in just weeks. This reduces costly downtime and ensures smoother, more consistent operations.

Joyce Mechanical Services, based in Queensland, has established itself as a leading provider of heavy machinery rebuilds in the Bowen Basin and beyond. Known for its highly skilled team and innovative solutions, Joyce Mechanical Services supports clients in minimising downtime and maximising productivity through expertly executed rebuild programs.

"Over the years, we’ve developed Joyce Mechanical Services into a true alternative to new capital replacement by delivering best-in-class overhauls for mobile mining equipment,” Joyce Mechanical Services director Charlie Watts said.

“This has been achieved through a disciplined approach, strict adherence to our systems and procedures, and a commitment to continuous improvement underpinned by our ISO 9001, 14001, and 45001 certifications.

“Above all, it’s the skill, dedication, and passion of our people – combined with decades of industry knowledge and experience – that drive the quality outcomes we’re known for."

One of the company’s standout offerings is Harmonic Stress Relief, a unique service that forms part of its advanced rebuild process. This technique subjects machinery to controlled high-RPM testing to identify and relieve internal stresses that accumulate during normal operation.

A key focus is on chassis stress relief, targeting structural areas to release built-up tension prior to reassembly or return to service.

Where traditional rebuilds focus on mechanical wear and component replacement, Harmonic Stress Relief goes deeper addressing hidden stress points that can otherwise lead to early failure. This approach improves structural integrity, enhances durability, and reduces future maintenance requirements, making it a forward-thinking strategy for machinery longevity.

Another hallmark of Joyce Mechanical Service’s capability is its in-house thermal spray technology, which is emerging as a superior alternative to traditional dipped galvanising.

Unlike galvanising, which involves chemical baths that can be environmentally harmful and produce significant waste, thermal spraying offers enhanced corrosion protection with minimal environmental impact. This process creates a highly durable protective coating that provides a barrier against corrosion and degradation, delivering up to 30 years of protection.

“Thermal anti-corrosion treatment offers a significant advancement in protecting mining assets against the harsh operating environments we see across the sector,” Joyce Mechanical Services managing director Adam Joyce said.

“By applying this treatment, we’re able to extend the service life of structural components by up to 30 years, reducing the need for costly

mid-life repairs or replacements. It’s a smarter, more sustainable alternative to traditional methods like hot-dip galvanising, particularly when environmental impact and durability are key considerations."

A machinery rebuild extends the life of valuable assets without compromising on performance.

This service is the only one of its kind in Australia offering thermal corrosion protection as a cleaner, safer alternative to traditional hot-dip galvanising.

Clients benefit from expert application, improved environmental outcomes, reduced maintenance needs, and decreased equipment downtime making it a practical, forward-looking solution for modern mining operations.

While cutting-edge technology has its place, particularly in safety and data analytics, it’s a mistake to assume that every challenge requires a brand-new solution. Efficiency, reliability, and productivity can often be achieved more sustainably and cost-effectively through rebuild and refurbishment.

Rebuilding represents a smarter allocation of resources. It reflects an evolved understanding of value not just in terms of financial return, but also in maximising the durability and performance of current infrastructure.

As the mining industry evolves, companies must strike a balance between embracing new technology and optimising the assets they already own. Strategic, considered decisionmaking will define long-term success in a competitive and environmentally conscious industry.

Often, the best path forward isn’t to replace the old but to rebuild it as good as new.

One

Founded by Edwin Higginson, a fleet industry veteran with experience managing national commercial fleets for companies such as Woolworths, Qube Ports & Bulk and McColl’s Transport, Australian EVS was born from the practical frustrations and opportunities of the industry itself.

“All my background has been in managing commercial fleets,” Higginson told Mining. “Then, about seven years ago, we started our consulting business to assist major fleets in a range of services, and more and more we were getting asked how to practically transition to zero emissions over the next 10 to 20 years.

“From our fleet experience, we knew it wasn’t as simple as just buying new electric vehicles (EVs), but there would need to be a range of solutions for commercial fleets and specialist equipment, from EV infrastructure, training, workshops, compliance, EV modifications and custom electric drive solutions.”

expensive or customised vehicles that can’t simply be replaced off the shelf.

“There were huge gaps, especially when it came to practical fleet applications,” he said. “That’s where Australian EVS came in. We focused on real-world engineering to convert existing and specialist vehicles, helping fleets overcome technical hurdles and plan for the future.”

At the core of Australian EVS’ offering are its modular ‘e-Kit’ electric conversion systems. These drop-in kits are designed to replace diesel and petrol powertrains mid-life – providing a compelling alternative to traditional engine rebuilds.

“In Australia, on average, the total age of a car is 21 years, but for commercial vehicles it can be 30 years or more,” Higginson said. “These vehicles usually have one or two engine rebuilds during their lifetime, which means we can offer an electric conversion instead of another diesel overhaul.”

Higginson also realised the market lacked a specialist solution for repowering existing fleet assets – particularly

This approach provides three key benefits: improving performance, reducing operating costs and drastically lowering emissions.

Australian EVS has found particular interest in sectors like mining and heavy industry, where custom modifications and harsh environments can render off-theshelf EVs impractical.

The e-Kit platform is scalable and flexible. The e-Kit 4 is suited to classic car conversions and small machines but Australian EVS’ main focus is commercial vehicles.

“The e-Kit 6 is what we use in standard utes and vans,” Higginson said. “Then we go up to the e-Kit 8 for higher performance, and even larger systems for buses and semi-trailers.”

The conversion e-Kits are not only about replacing diesel, but customers can also specify the required range, power output, charging needs, and advanced features like regenerative braking or vehicle-to-grid integration.

All components are bench-tested in Australian EVS’ facility before being sent to customers, often with installation support for mechanics and workshops.

As a showpiece, Australian EVS converted a brand-new dual cab Toyota Australian EVS is providing a innovate pathway for mining companies to embrace electrification.

LandCruiser 79 Series – a cult vehicle in Australia’s harshest conditions.

“The electric version has three times more power than the original V8 diesel,” Higginson said. “It retains its high/low range 4x4 system, 3.5-tonne towing and one-tonne payload, but can now do 0–100km/hr in six seconds, has a 600-kilometre range, fast-charging capabilities, and costs a fraction of the price to run.”

It also comes at a perfect time, with Toyota recently ceasing production of the highly regarded V8 powertrain.

Despite the upfront costs being slightly higher than a diesel rebuild, Higginson said the long-term savings of an electric conversion are substantial.

“Our commercial fleet conversions are equivalent to a diesel over roughly 150,000 kilometres on a whole-of-life cost basis, and even quicker when using solar power. You will also reduce your emissions by 58 tonnes of carbon per vehicle over this distance when using the grid.

There are additional benefits when operating an electric vehicle, such as instant torque, lower maintenance, regenerative braking, mobile battery storage for vehicle-to-load and vehicle-to-grid, quieter operations and zero emissions.

One of the key differentiators for Australian EVS is its understanding of Australian conditions and what it takes to operate in harsh conditions, especially in mining.

“We use brand-new components and engineer everything in-house,” Higginson said. “When we receive a bespoke build, we use 3D scanning technology to custom design how each component and battery box will be installed into the vehicle using the vehicle’s existing mounting points.

The finished product takes up about the same space and weight as the original diesel setup. We can then add a wide range of options depending on the customer’s requirements, and additional batteries for longer range if needed, with the largest request we’ve seen being over 1000km for a WA client.

“Overseas manufacturers just don’t understand what we deal with in remote Australian regions, especially with our extreme temperatures, and how tough the equipment needs to be to operate in mines here,” Higginson said.

“Our conversions mean that 90 per cent of a client’s vehicle remains the same as the rest of their fleet and with our support, they can be maintained by an on-site workshop.”

Interest in Australian EVS’ e-Kits has grown rapidly, with mining and other industries under increasing pressure to reduce costs and hit emissions targets.

“We believe that moving to electric drive solutions should first of all improve performance and reduce operating costs, with the reduction in emissions being an added bonus.” Higginson said.

Fleet operators are drawn to Australian EVS’ flexibility and engineering expertise.

“Some of the projects we’re currently working on include a modern Nissan

Patrol conversion for a farmer who lives off-grid, a bus conversion, and some mine-spec LandCruisers,” Higginson said.

“We are also working on some R&D (research and development) projects for specialised equipment manufacturers that currently use diesel engines to power their off-highway vehicles.”

Australian EVS isn’t trying to replace the entire vehicle fleet overnight. Instead, the company is offering a practical, engineered pathway for operators to transition gradually without compromising on performance or reliability.

“Our speciality is bespoke EV engineering for the real world,” Higginson said. “We help fleets keep the vehicles they already know and trust – but cleaner, quieter, and far more efficient.”

FMT is helping Australian mining companies limit downtime through its raft of site-specific engineering solutions.

Established in 1995, Field Machine Tools (FMT) is Australia’s largest stockist of specialist on-site machining and portable maintenance equipment.

range of portable equipment suitable for a large range of applications, material and specifications.

FMT is a dry-hire-only company –one that never competes against its customers for on-site service work – with conveniently located branches in

FMT offers the on-site repair and maintenance machines that can minimise maintenance times and keep equipment working.

The company’s wide range of portable equipment is available for rent or purchase, Australia-wide from its three branches. This includes equipment for machining applications such as portable milling machines, portable lathes, clamshell pipe lathes, flange facers (outside diameter and inside diameter mount), line boring machines, vessel grinding machines and pneumaticbased drills.

FMT is also the Australian agent for major international brands, which has expanded to include Specialized Fabrication Equipment (SFE) Group products.

SFE Group was founded in 2019 with the vision to offer the world’s most comprehensive range of orbital welding, pipe fabrication, precision engineered applications and cutting solutions for a wide variety of industries.

The company’s new product ranges include Mathey Dearman, B&B Pipe & Industrial Tools, TAG Pipe Equipment, AXXAIR Orbital Solutions, PPM Pipe Purge Masters and Fit-Up Pro.

Mathey Dearman offers a comprehensive range of pipe fitting equipment, pipe flame cutting and bevelling machines, pipe alignment

and reforming clamps and pipe rigging equipment.

B&B Pipe & Industrial Tools is dedicated to pipe handling with pipe fixtures, pipe jacks and stands, mega rollers and stands and material handing carts for pipes.

The TAG Pipe Equipment range of heavy-duty pipe cutting and bevelling machines includes prep machines, clamshell lathes, E-Z FAB machines, E-Z pipe saws and PMM plate bevel machines.

AXXAIR designs and manufactures orbital tube working machines for cutting, bevelling, squaring and welding as well as customised solutions for various industries.

PPM Pipe Purge Masters is dedicated to pipe purging products, applications and solutions. This intertwines with other product applications such as the orbital welding offering from AXXAIR.

The historic product range Fit-Up Pro by Mathey Dearman has its own brand under the SFE banner for fit up, alignment and layout tools, which supports other product applications within the SFE Group.

Magnatech offers a range of pipe, tube, automatic, and arc welding machine equipment for gas tungsten arc welding

FMT’s wide range of portable equipment is available for rent or purchase.

(GTAW), gas metal arc welding (GMAW) and flux cored arc welding (FCAW) welding applications.

Field Machine Tools is a privately owned Australian company that provides engineering solutions for field applications to minimise downtime.

The scope of operations is providing the most complete product lines available to original equipment manufacturers, maintenance providers, field service companies, power stations, petro chemical plants, the mining industry and other related industries.

POPULAR CHOICE OF HEALTH, SAFETY & ENVIRONMENTAL EXPERTS

Viva Energy is at the forefront of supplying renewable diesel to Australian mining operations.

As the adoption of sustainable practices ramps up across the Australian mining sector, cutting emissions on sites could be a matter of asking one simple question: What fuels the industry?

The type of fuel mine operators use to power their haulage fleet and equipment can be a key indicator of the carbon footprint they’re creating.

According to a 2024 Climate Change Authority report, nearly 68 per cent of fuel-combustion emissions on mine sites are produced through the use of diesel as a fuel in machinery.

Given this high-carbon profile, operators are shifting gears from conventional diesel to an eco-friendlier and more sustainable alternative.

Enter renewable diesel.

Chemically similar to its petroleumderived counterpart, renewable diesel offers a convenient switch for those wanting to close the gap on emissions.

In Australia, Viva Energy is bolstering the uptake of this sustainable substitute, which it describes as “a drop-in replacement for diesel”.

Providing a distinct roadmap to a lower carbon future, Viva Energy’s renewable

diesel, also known as hydrotreated vegetable oil (HVO), is emerging as a potential pick for an increasing number of mining operators.

“Alternative fuels such as renewable diesel are the next step in decarbonising heavy vehicle and machinery fleets, while other technologies such as electrification are likely to require equipment and infrastructure replacement and will take time to implement,” Viva Energy’s carbon solutions manager Robert Cavicchiolo told Mining

According to Viva Energy, HVO is a renewable diesel made from waste sources like vegetable oils and animal fats via a process called HEFA (hydroprocessed esters and fatty acids).

It is manufactured through a hydrotreatment process, using hydrogen and catalysts at high temperatures and pressures.

One of the biggest advantages of Viva Energy’s renewable diesel is that it can seamlessly integrate into your existing machinery and storage tanks without the need for modifications.

Renewable diesel is also International Sustainability & Carbon Certified (ISCC) certified, ensuring that the

sustainable materials are traceable and meet recognised chain-ofcustody requirements.

“Viva Energy ensures the quality and consistency of our renewable diesel with our dedicated product quality team,” Cavicchiolo said. “This ensures it meets the recently introduced Australian Fuel Quality Standards (Paraffinic Diesel) Determination 2025.”

As a sustainable choice, renewable diesel can help mine operators drastically reduce their Scope 1 emissions based on a lifecycle assessment basis.

It also possesses low temperature properties, both when used in its pure form or after being blended with diesel. Having a high cetane number, renewable diesel may also promote cleaner and more efficient combustion.

Not only a strong operational performer, but renewable diesel has the potential to have a longer storage life than diesel when correct fuel monitoring housekeeping is employed at site.

“Alternative fuels such as renewable diesel are important tools in the energy transition,” Cavicchiolo said. “They help companies reduce emissions without any

modification to existing infrastructure or equipment.”

Supplying renewable diesel is not Viva Energy’s only avenue of innovation, with the company continually enhancing its broader product portfolio, including its hydrocarbon solutions.

Viva Energy offers comprehensive fuel and lubrication management options, along with tank and equipment solutions that are vital to safely store, dispense, and monitor renewable diesel.

“Our expertise ensures your business receives the best advice, service and equipment for storing, dispensing and maintaining all of your hydrocarbon needs,” Viva Energy hydrocarbon solutions manager Matt Gill told Mining

diesel refuelling and lubricant top ups.

coal production.

Providing clients with a “one-stop solution” to maximise the life of their hydrocarbons, Viva Energy’s products cover fuel equipment such as tanks, spill kits, hoses, nozzles, pumps and fuel management systems, as well as storage and condition monitoring options.

These hydrocarbon offerings have significant tangible outcomes for mine operators.

One of Viva Energy’s coal mining customers was experiencing extended

To solve that problem, Viva Energy designed and built a custom in-pit splashand-dash facility that had the flexibility to move and follow the coal seam whilst staying as close to the circuit as possible.

This solution included a fuel management system and automatic tank gauging to monitor vehicle consumption and tank levels.

After the implementation of the splashand-dash facility, the client enjoyed numerous benefits, such as reducing travel time by 2044 hours per year, a 2.19 per cent reduction in overall diesel

According to Gill, these benefits are within reach of all mine operators who decide to partner with Viva Energy.

“With our customer, we were able to effectively build a custom facility that had flexibility and could follow the coal seam whilst staying as close to the circuit as possible,” Gill said. “This therefore led to an increase in annual production.”

With alternative fuels like renewable diesel and custom storage solutions, Viva Energy is continuing to steer the industry – for the benefit of businesses and the environment alike.

The need for accurate, rugged and reliable measurement tools has never been greater in the mining industry.

Emissions-monitoring technology is driving cleaner, safer and smarter operations in the Australian mining industry.

In 2025, safety, sustainability and compliance aren’t just buzzwords for the mining industry, they’re critical to operational success.

As the sector responds to stricter emissions regulations and rising environmental, social and governance (ESG) expectations, the need for accurate, rugged and reliable measurement tools has never been greater.

Testo is leading the charge with its emission measuring solutions. More than just individual instruments, Testo’s range seamlessly integrates hardware, software and service. The company’s cutting-edge tools – particularly the testo 340 and 350 emissions analysers – offer the mining sector the precision and durability it needs for mining operations.

The testo 340 is a compact, portable flue gas analyser ideal for spot checks and routine service. Lightweight and easy to carry, it excels in confined spaces. It measures key gases like oxygen (O2), carbon monoxide (CO), nitric oxide (NO), nitrogen dioxide (NO2) and sulphur dioxide (SO2), which are essential for combustion and safety checks.

With interchangeable sensors and extended measurement ranges, the testo 340 adapts to various tasks, including testing diesel-powered vehicles and generators, monitoring air quality and quick diagnostics.

“It’s a flexible, field-ready tool for quick emissions testing and tuning,”

Testo industry specialist Nihal Nadeem told Mining

The testo 350 goes a step further, purpose-built for in-depth emissions analysis. Its modular design separates the control unit from the analyser box, so sensitive components remain protected while the smart probe operates directly at the emission source.

It is ideal for in-depth emissions analysis of large-scale diesel engines or ventilation systems, during commissioning, tuning and audits, and monitoring air quality trends long term.

“The testo 350 is a powerful, high-end analyser designed for compliance reporting and deep diagnostics in harsh industrial environments,” Nadeem said.

In the mining sector, these tools have distinct advantages.

In certain mining applications, air quality can deteriorate quickly due to high concentrations of CO, NO, NO2 and SO2.

In mining operations, CO build-up is often caused by incomplete combustion in diesel engines, Nadeem said, and nitrogen oxides are also produced in high temperature combustion.

“Having these gases in the air is dangerous even in low concentrations,” he said. “Chronic exposure can lead to long-term health issues including lung damage and heart diseases, or even fatality.”

In addition to jeopardising worker safety, these conditions reduce the efficiency of mine ventilation systems, driving up operational costs.

Testo’s analysers allow teams to diagnose and act on these risks in real time. Both devices measure gases directly at the emission source, enabling rapid identification of exhaust leaks, engine malfunctions or unsafe air conditions.

“With the testo 340 and 350, you’re not just measuring air quality, you’re actively managing it,” Nadeem said.

The testo 350’s advanced diagnostic capabilities are especially valuable in root cause analysis, allowing teams to track engine performance and correlate emissions spikes to specific equipment or conditions.

“Having the 350 as part of a preventive maintenance kit allows engineers to address issues directly at the source,” Nadeem said.

Better combustion enabled by the testo 340 and 350 also leads to lower fuel consumption, fewer emissions and reduced maintenance costs, contributing to more sustainable and cost-effective operations overall.

As ESG considerations grow in importance, the testo 340 and Testo 350 are essential.

On the environmental front, they help mining operators quantify

Scope 1 emissions by measuring direct emissions from companyowned equipment.

The testo 350 features smart data logging and report generation for regulatory submissions, internal audits and sustainability disclosures.

“The devices also play an important role in reducing environmental impact,” Nadeem said. “For example, with the 340 and 350, mining operators can see emissions from specific diesel engines and then tune them accordingly to reduce output.”

Regular testing with both devices enables mining operators to track progress on emissions reduction, demonstrating tangible improvements over time.

Importantly, Nadeem said, all Testo devices can fulfil Environmental Protection Agency (EPA) standards.

When it comes to social goals, Testo’s technology supports worker health and safety by enabling proactive air quality management. Real-time alerts help teams respond immediately to emissions spikes or ventilation failures, protecting workers from prolonged exposure to harmful gases.

“In essence, the testo 340 and 350 detect issues before they become emergencies,” Nadeem said.

From a governance perspective, Testo’s in-built reporting tools simplify

ESG and compliance workflows. Data can be exported for external or internal reporting, ensuring mining companies can provide credible, measurable and verifiable disclosures.

Mining operations are often subject to extreme conditions, where dust, vibration, corrosive gases and high temperatures are the norm. The testo 340 and 350 have been engineered to thrive in these environments.

“Testo devices are built specifically for harsh conditions,” Nadeem said. Their rugged construction includes impact-resistant housing, rubberised edges and sealed components for protection in the field. Built-in self-checks and smart diagnostics add another layer of reliability.

Equipped with industrial-grade gas filters and temperature protection systems, the Testo analysers operate in all conditions, from dusty mine shafts to hot engine exhaust streams to high-moisture flue stacks.

“With the right accessories, the probes and sensors can tolerate flue gas temperatures of up to almost 1800°C,” Nadeem said.

The sensors and filters are designed for long operating life, even with frequent exposure to aggressive gases. They can be replaced by team members

on-site, making maintenance fast and easy.

With a dedicated network for calibration, service and training, Testo offers premium after-sales support to ensure ongoing performance and customer confidence.

“We provide three-day turnaround for servicing the 340 and 350,” Nadeem said. “On top of this, we have a dedicated team of industry experts to support our customers, offering regular webinars and training sessions to guide best practice use.”

Testo has long been a trusted partner to the mining sector, offering smart, cutting-edge solutions and industryspecific support.

In the demanding environment of mining, the testo 340 and 350 are more than just lab tools – they provide the flexibility, durability and precision the industry needs to safeguard workers, manage emissions and drive operational success.

Northern Star has acquired De Grey Mining, rocketing the miner to new heights.

Asector-changing acquisition seems to hit the gold industry every year – and 2025 is no exception.

In May, Northern Star Resources finalised its acquisition of De Grey Mining, positioning the company among the world’s top five gold producers.

The jewel in the crown is the Hemi gold project in Indee, Western Australia – a mine with a mineral resource estimate of 11.2 million ounces of gold and a projected annual output of 530,000 ounces.

A conceptual study of Hemi in December demonstrated the potential

for underground mining to run in parallel with open-pit mining at the site, presenting a strong case for further studies, while not distracting from the primary focus of the Hemi project development.

The study followed Hemi’s mineral resource estimate increasing by 1.3 million ounces in November to sit at 264 million tonnes.

Now, under the terms of the acquisition, De Grey shareholders will receive 0.119 new Northern Star shares for each De Grey share held, equating to an implied offer price of $2.08 per share.

“The acquisition of De Grey is strongly aligned with Northern Star’s strategy and contributes to our purpose of generating superior returns for shareholders,”

Northern Star managing director and chief executive officer Stuart Tonkin said in December.

“De Grey’s Hemi development project will deliver a low-cost, long-life and largescale gold mine in the Tier 1 jurisdiction of Western Australia, enhancing the quality of Northern Star’s asset portfolio to generate cash earnings.”

Tonkin said the Northern Star team looks forward to integrating Hemi into its portfolio and building

“We remain on track to achieve our full year production and cost guidance.”

Northern Star closed the quarter with $265 million in net cash and $1.2 billion in cash and bullion.

strong relationships with the Kariyarra People, the Traditional Owners of the land in which Hemi is situated, and additional stakeholders.

“The acquisition of De Grey is strongly aligned with Northern Star’s strategy to generate superior returns for shareholders,” he said.

Hemi joins the Fimiston open pit, also known as the Super Pit, in Northern Star’s booming WA gold portfolio. Expected to continue operating until at least 2035, Northern Star is investing $1.5 billion to double the Super Pit’s milling capacity as it aims for 900,000 ounces of annual production by 2029.

Hemi joins Northern Star’s Super Pit in the company’s Western Australian gold portfolio.

Combined with Hemi, Northern Star is aiming to reach an annual output of 2.5 million ounces by the late 2020s.

This was underpinned by Northern Star’s strong December quarter, which saw 410,249 ounces of gold sold at an all-in sustaining cost (AISC) of $2128 per ounce. The Kalgoorlie production centre performed the strongest for the quarter, recording 208,035 ounces sold.

“Our continued focus on operational performance, cost control and capital discipline position us well for significant growth in free cash flow generation, complemented by a high gold price environment,” Tonkin said at the time.

Like the Northern Star team, those at De Grey are excited by the merger and the prospects it provides to Hemi.

“Given the high-quality nature of Hemi, De Grey is in the fortunate position to have had many avenues to progress the asset, including mergers and acquisitions,” De Grey managing director Glenn Jardine said in December.

“The transaction that we have entered with Northern Star is a highly attractive opportunity for De Grey shareholders in terms of the upfront premium, as well as retaining ongoing exposure to Hemi and gaining exposure to the broader Northern Star portfolio.”

With the gold price seeing record prices of $US3300 per ounce and being projected to increase further, 2025 has set the scene for Northern Star to expand its Tier 1 gold mining portfolio.

The Queensland Government is committed to preserving the future of the state’s mining sector.

The Queensland Government has revealed a series of initiatives to drive growth and investment across the state’s mining and freight sectors, particularly in the northwest region.

This has seen the Queensland Government ink a new deal with Glencore, allowing third parties to access copper tailings from its Mt Isa Mines site.

The commitment is set to help innovate tailings reprocessing as the Mt Isa underground copper mine closes its doors in July.

With its Mt Isa underground copper operations scheduled to close in July, Glencore is assessing the future of its Mt Isa copper smelter and Townsville copper refinery.

“The number one issue on my desk is the future of the Mount Isa copper smelter,” Last said.

“I’ve met with Glencore CEO Gary Nagle twice since we formed government, and I’ve held numerous other discussions to keep the smelter’s future on the agenda.

“The (Queensland) Government is doing all it can to ensure its continued operations. As part of our negotiations, Glencore has agreed to allow thirdparty access to the copper tailings at the Mount Isa site, opening up new processing opportunities and valueadd potential.

“This is a significant boost for local workers, contractors and suppliers right across the supply chain.”

Amid the closure of its Mt Isa copper mine, Glencore is minimising job losses while continuing to invest in its assets.

This includes investing in the long-life George Fisher mine, which produces zinc, lead and silver. George Fisher’s mine life extends to 2042, with Glencore focused on upskilling its workforce, expanding production and advancing its fleet.

Pearce said the agreement with Glencore is “proactive” and “should be commended for facilitating the opportunity for innovation”.

“The types of companies that are innovative enough to tackle these opportunities are usually small and nimble, so allowing third parties to do testing on large tailings opportunities is a huge step forward,” Pearce said.

An incentive package has also been established to reduce access charges on the Mt Isa rail line.

The package is expected to provide significant savings for emerging rock phosphate producers while increasing freight volumes and supporting new entrants in the market.

“We want to see mines opening, not closing,” Queensland Natural Resources and Mines Minister Dale Last said.

“That’s why we’re incentivising phosphate on the Mount Isa rail line, to

take the pressure off new and existing rock phosphate rail users while they develop their operations.

“Global demand for phosphate is strong, and north-west Queensland is well positioned to benefit. We’re taking action to ensure emerging producers get the support they need to scale up.”

AMEC chief executive officer (CEO) Warren Pearce welcomed the announcement, describing it as “a sensible step to increase exports and incentivise expansion of this important commodity”.

Harmony Gold’s Eva copper project will also see a helping hand, with the Queensland Government’s newly formed Resources Cabinet Committee to aid the delivery of any outstanding approvals or information required to move the project toward construction.

“We’re also cutting red tape, backing investment, and creating the conditions for long-term jobs in the north-west,” Last said.

“This is particularly important as Eva Copper reaches its key financial decisions.”

Pearce said progressing Eva – an iron oxide copper-gold resource thought to become the largest copper mine in north-west Queensland – is a welcome move, “considering the challenges of getting greenfield resource projects approved” in the state.

Research has revealed significant holes in the knowledge of mine closure processes, but a new training course is working to bridge the gap.

In the realm of modern mining, the end of a mine’s life has become as critical a part of the mining chain as its opening.

As new projects emerge across Australia, industry behemoths and juniors alike must prove they can leave the environment as pristine as they found it before any minerals were extracted.

Research from CSIRO has projected at least 240 Australian mines are set to close by 2040, with a peak expected by the end of this decade.

But there’s more to closing a mine than having a plan for rehabilitating tailings dams and backfilling. It’s a massive collaborative effort between miners, governments, regulators, and local and First Nations communities. Required expertise ranges from land restoration to social science to finance to geotechnical and other specialist knowledge.

It’s vital that all involved have an understanding of what’s expected and how they will be affected; however, a new report from the Cooperative Research

Centre for Transformations in Mining Economies (CRC TiME) has revealed significant gaps in mine closure and post-mine transition-related education and training.

CRC TiME is dedicated to examining and helping transform what happens after mining ends on economic, social, cultural and environmental levels.

“Executing closure projects and getting them through the system is really important to a healthy mining industry,” CRC TiME chief executive officer Guy Boggs told Mining

Supported by the Federal Government Department of Industry, Science and Resources’ Cooperative Research Program, CRC TiME has worked with some of the biggest names in Australian mining, including BHP, Rio Tinto, Fortescue and South32.

According to its report, ‘A strategic review of education and training: Mine closure and transitions’, published in collaboration with the Mining and Automotive Skills Alliance (AUSMASA),

there is no nationally consistent approach to mine closure education and training and knowledge gaps were found across all levels.

In fact, only 13 per cent of relevant cohorts surveyed by CRC TiME had detailed knowledge of mine-closure planning processes.

Boggs said this signals an urgent need for tailored training and education that meets not only the needs of industry but Traditional Owners, community members, and others experiencing these changes in their day-to-day lives.

“Regions across Australia are experiencing or preparing for significant change. Some are transforming as major mines come to an end, while others are readying for the development of critical and other minerals,” he said.

“While planning for mine closure and post-mine transitions should begin early and across the life of an operation, this does not always happen.

“Building skills and knowledge within and outside of industry on these critical

dimensions can help ensure this occurs. However, as the report shows, there are scant education and training options.”

CRC TiME research director Tom Measham emphasised that while onthe-job training for teams is important, there remains scope for a more unified approach to mine closure across the sector.

“The report also found there was virtually no equivalent training for others involved in the closure process, including regulators and those who will making use of the land next,” Measham told Mining.

“This inspired us to create a course available for anyone to undergo that will equip them with the knowledge they need for informed participation in the mine closure process.”

Working in partnership with the University of Queensland and Curtin University, CRC TiME has developed the Foundations of Mine Closure and Sustainable Transitions course as part of the solution.

As Measham highlighted, this course is available to anyone in the industry or community to benefit from. Its material is free to access at any time and will only come at a cost the participant if they wish to receive a formal certificate of completion.

Participants cover a broad range of areas, including community engagement, regional economic transitions, comparing regulation and policy across jurisdictions,

respectful and effective practices, and cost evaluations.

CRC TiME’s mining research partners include Hanson Australia, Iluka, MMG, BHP, Rio Tinto, Energy Australia, Alcoa, Fortescue, South32 and Newmont.

These partners have allocated a portion of their committed funding over CRC TiME’s life to developing the course as part of a suite of education and training initiatives.

A cornerstone of the course is built on understanding that closure planning and execution is a multidisciplinary area that relies on a host of different groups in industry, community and government.

“The course has been developed to address needs identified in the report and we expect to see further education and training options over the next few years,” Measham said.

“Ultimately, we’re not thinking of mine closure as an end, which is why it’s so critical to engage people at all levels to get involved in the transition into what comes next.”

WA Mines and Petroleum Minister David Michael is set to launch this year’s WA Mining Conference with a much-anticipated opening address.

Returning to Perth on October 8–9, the WA Mining Conference and Exhibition (WA Mining) is set to once again bring together the mining industry’s brightest minds for two days of high-impact networking, insightful presentations and the latest in mining technology.

Now firmly established as one of Australia’s premier mining events, WA Mining 2025 is expected to surpass previous years, building on the momentum of a highly successful 2024 edition.

WA Mines and Petroleum Minister David Michael will deliver the opening address on the first day of WA Mining, following his reappointment to the portfolio after the state election earlier this year.

“I’m looking forward to seeing what the future holds for these industries that are so critical for Western Australia, Australia and global decarbonisation efforts,” Michael said in a statement.

This year’s WA Mining Conference will unite leading figures from industry, government and academia to explore the major themes shaping mining’s future – from education and training pathways to prepare the next generation, to the integration of sustainable practices and the pursuit of resource optimisation.

Given the expansive geography of WA’s mining sector, WA Mining plays a vital role in bringing key industry players together in one central location – encouraging collaboration, sparking innovation and driving meaningful business outcomes.

“The WA mining industry is very collaborative, and a lot of people in the industry know each other or have crossed paths in the past,” Michael said.

“Events like WA Mining offer an opportunity for people to catch-up, connect and exchange notes on the trends across the sector.

“I was thrilled to see the collaboration, innovation and development on display when I attended the event in 2024 and I’m looking forward to seeing the industry come together and drive progress in 2025.”

Having earned a reputation as a mustattend event for WA mining professionals, WA Mining continues to grow in scope and relevance.

The event features a robust conference program alongside a bustling exhibition

floor, offering attendees a comprehensive view of the sector’s future.

The conference component – spanning two days – will see industry experts delve into the pressing issues and transformative developments shaping modern mining.

From technological advancements to global market fluctuations, the agenda is designed to equip attendees with critical insights and practical knowledge.

“We have carefully curated our conference program to ensure we’re covering the topics the industry is actually interested in,” Prime Creative Media marketing manager mining events Rebecca Todesco said.

“We’re inviting leaders from across the industry to share their insights, meaning attendees can walk away from the event with not only business connections but also skills and knowledge that they can share with the rest of their team on-site.”

The agenda will explore key topics such as the role of traditional commodities in today’s market, strategies to address workforce shortages through education and training, and the economic impact of investing in WA projects.

Attendees will also benefit from sessions on Australia’s position in the global critical minerals supply chain, progressive approaches to mine waste management, and the digital technologies reshaping operations.

“Key industry figures will share practical examples and proven approaches, helping attendees discover valuable perspectives and unlock actionable market intelligence,” Todesco said.

Networking remains a cornerstone of the WA Mining experience. With 92 per cent of 2024 attendees based in WA, the event offers a uniquely targeted platform for connecting with local industry leaders, suppliers and stakeholders.

Some of the mining sector’s leading names – including Komatsu, Blackwoods, Martin Engineering, Pinnacle Hire, and VIPER Metrics – are already confirmed for 2025, reaffirming the event’s importance as a business and innovation hub.

WA Mining also reinforces the central role of Western Australia in the broader mining ecosystem. As a global leader in a range of commodities, including iron ore, lithium and gold, the state continues to be a powerhouse within Australia’s resources economy.

“WA continues to be a critical piece of the mining puzzle,” Todesco said. “By bringing the industry to WA, we’re bridging the gap between the

country’s mining powerhouses and east coast businesses.”

With its strong emphasis on innovation, practical knowledge-sharing, and strategic networking, WA Mining remains essential for professionals aiming to lead in the ever-evolving mining landscape.

Tickets are now on sale, and with demand expected to exceed capacity once again, early registration is a must.

The WA Mining Conference and Exhibition takes place in Perth from October 8–9. For more information, visit waminingexpo.com.au/getinvolved

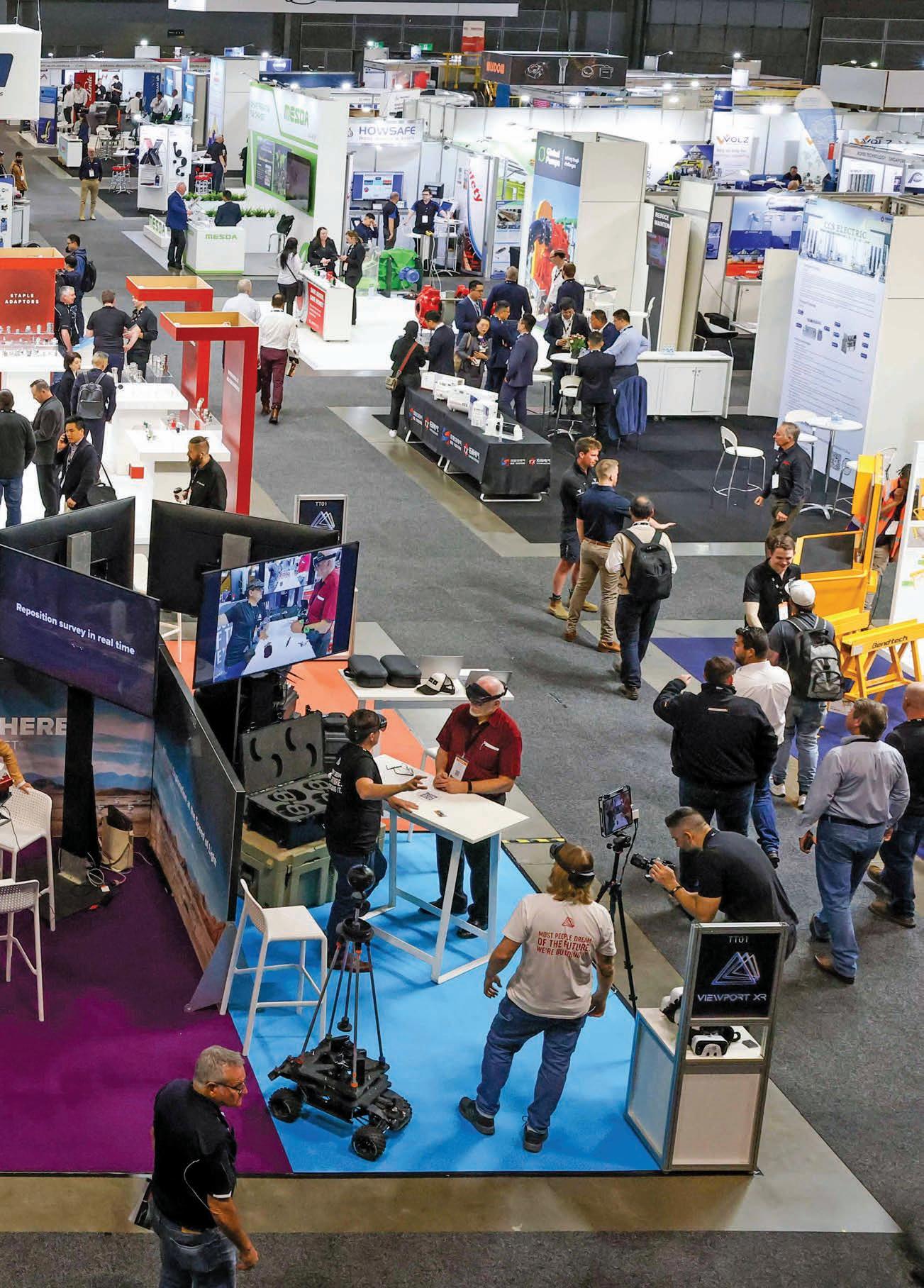

Companies like Ontoto will use AIMEX 2025 to unveil nextgeneration mining technologies to the industry’s major players. The AIMEX conference program

With Australia’s longest running mining show set to make its debut in Adelaide this September, anticipation is building across the industry.

From September 23–25, Asia Pacific’s International Mining Exhibition (AIMEX) will gather innovators, operators and decision-makers under one roof to explore the future of mining.

Among the many exhibitors preparing to take centre stage is industrial data logging specialist Ontoto, ready to unveil its latest advancements in remote sensing and data capture technology.

“We’re looking forward to catching up with existing clients, but more importantly having the opportunity to create new connections the Australian mining sector, as well as the international community,” Ontoto general manager Sarah Oliver told Mining

“It’s not just about showing them what we can do, it’s also about listening to what they think is missing in the market and, if we don’t already do it, working with them to create it.”

Oliver believes AIMEX is a critical platform for companies like Ontoto to drive its mission, and the industry, forward.

“As a vertically integrated company, we have found that more and more

mining companies are open to innovative solutions and are sourcing new equipment directly,” she said.

“Being able to have face-to-face interactions with the people who actually use the equipment is the best way to showcase what Ontoto can do.

“We were attracted to the event through the great experience we had with other Prime Creative-managed expos.”

AIMEX’s value goes beyond the tech on display. It’s also an event where attendees can gain insights, spark partnerships and discover emerging trends reshaping the mining industry.

“In today’s market there are constant changes – new ways of doing tasks are created, with technology taking over from manual processes, and regulations are ever-changing, necessitating new approaches to how we have always worked,” Oliver said.

“Staying within your office or on-site doesn’t inform you of what’s now available.

“It’s not just exhibitors marketing their new gear, it’s also exhibitors seeing what someone else has developed and identifying synergies with each other.”

As AIMEX 2025 approaches, Ontoto is gearing up for a showcase that will not only highlight its technological prowess, but also its commitment to listening, learning and building a more sustainable

future for the Australian mining industry.

The mining industry is getting behind this year’s AIMEX like never before. This includes support from major industry bodies that are keen to bring their expertise to the conference and exhibition floor.

Leading not-for-profit industry association for the Australian mining equipment, technology and services (METS) sector, Austmine, is officially backing AIMEX.

Prime Creative Media general manager – events Siobhan Rocks said the team is thrilled to welcome Austmine as a valued association partner for AIMEX 2025.

“Prime Creative Media has worked closely with Austmine for years, with a joint vision to bolster the industry and those who work in it,” Rocks said.

“We’re excited to extend our partnership to include AIMEX, but also we’re looking forward to supporting Austmine in the delivery of its own South Australian event.”

Adding to the state’s impressive exhibition offerings, South Australia is also the home to Austmine’s Copper to the World.

Austmine director of membership, marketing and events Vanessa Haberland said the organisation was looking forward to partnering with Prime Creative Media in delivering AIMEX.

AIMEX attendees will gain insights, spark partnerships and

Creative Media for many years, with a shared commitment to strengthening the METS sector and driving innovation in mining,” Haberland said in a statement.

new Adelaide home, welcome everyone back for Copper to the World 2025, and work together to create valuable opportunities for mining suppliers, innovators, and industry leaders to connect, collaborate, and showcase world-class solutions.”

of the mining industry’s most pivotal events, bringing together the latest in technological innovation, insightful expert presentations and unparalleled networking opportunities.