Australian 3PL Coghlan’s warehouse transformation is a gamechanger. With Dematic’s ColbyRACK high-density storage and mezzanine solution, Coghlan boosted capacity by 10%, streamlined workflows, and cut costs—all within their existing building footprint.

The scalable design supports future growth, while Colby’s locally-based engineering teams enabled rapid response to ensure compliance with evolving regulations. Coghlan now operates more efficiently and impresses clients with a layout built for performance. For companies facing similar challenges, Colby delivers smart, scalable solutions with Australian-made, quality racking and shelving that works.

Learn more at www.colby.com.au

MHD Supply Chain Solutions is published by Prime Creative Media

379 Docklands Drive, Docklands VIC 3008

Telephone: (+61) 03 9690 8766

Website: www.primecreative.com.au

THE TEAM

Chairman: John Murphy

CEO: Christine Clancy

Managing Editor: Mike Wheeler

Editor: Phillip Hazell

Business Development Manager: William Jenkin

Design Production Manager: Michelle Weston

Art Director: Blake Storey

Graphic Designers: Danielle Harris, Jacqueline Buckmaster

Client Success Manager: Caitlin Pillay

FOR ADVERTISING OPTIONS

Contact: William Jenkin

william.jenkin@primecreative.com.au

SUBSCRIBE

Australian Subscription Rates (inc GST) 1yr (11 issues) for $99.00 2yrs (22 issues) for $179.00

To subscribe and to view other overseas rates visit: www.mhdsupplychain.com.au or Email: subscriptions@primecreative.com.au

MHD Supply Chain Solutions magazine is recognised by the Australian Supply Chain Institute, the Chartered Institute of Logistics and Transport Australia, the Supply Chain and Logistics Association of Australia and the Singapore Logistics and Supply Chain Management Society.

magazine is owned by Prime Creative Media. All material in MHD is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. The opinions expressed in MHD are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

If there is one thing the global supply chain learned in the past five years, it is that resilience is no longer built on spare capacity alone. It is built on data, decarbonisation, and long-term planning. The stories in this issue reflect how those three forces are now converging across every layer of the logistics ecosystem.

At the infrastructure level, the Port of Melbourne’s newly released 2055 Port Development Strategy sets out a 30-year roadmap for how Victoria’s largest trade gateway will grow alongside the state’s economy. With freight volumes expected to rise sharply as population and consumption increase, the challenge is no longer just how much capacity the port has, but how intelligently that capacity is connected to road, rail and surrounding industry. Long-range planning, rather than short-term expansion, is now shaping how Australia’s largest ports prepare for the next generation of trade.

At the customer interface, FedEx’s latest Returns Survey highlights a different kind of pressure point. Returns have become one of retail’s most complex and costly logistics functions, even as consumers continue to expect fast, frictionless service. The growing role of artificial intelligence in managing these flows shows how digital tools are moving from support functions to front-line operational infrastructure, shaping how logistics providers balance customer experience with commercial reality.

And across the entire global network, DHL’s accelerating decarbonisation program shows how sustainability is no longer confined to pilot projects. From sustainable aviation fuel and low-carbon marine fuels to electric lastmile fleets and renewable-powered distribution centres, 2026 marks the year when climate commitments are being translated into industrial-scale logistics investment.

Together, these stories tell a clear story about the year ahead. Supply chains are entering 2026 with sharper data, longer horizons and higher expectations. The question is no longer whether the sector will change, but how quickly organisations can align their networks, technology and infrastructure to keep pace.

Welcome to the next chapter of global logistics.

Phillip Hazell Editor, MHD Supply Chain Solutions

At Toyota, we’re proud to be at the forefront of innovative material handling energy solutions including electric, lithium ion, hydrogen fuel cell*, and also offer our exclusive I_Site forklift telematics system helping to track and reduce energy usage. With a comprehensive range starting from pallet jacks right up to eight tonne counter-balance models, make the switch to Toyota’s electric forklifts built with quality top of mind, and that’s just part of the Toyota Forklift Advantage.

not available for sale in Australia.

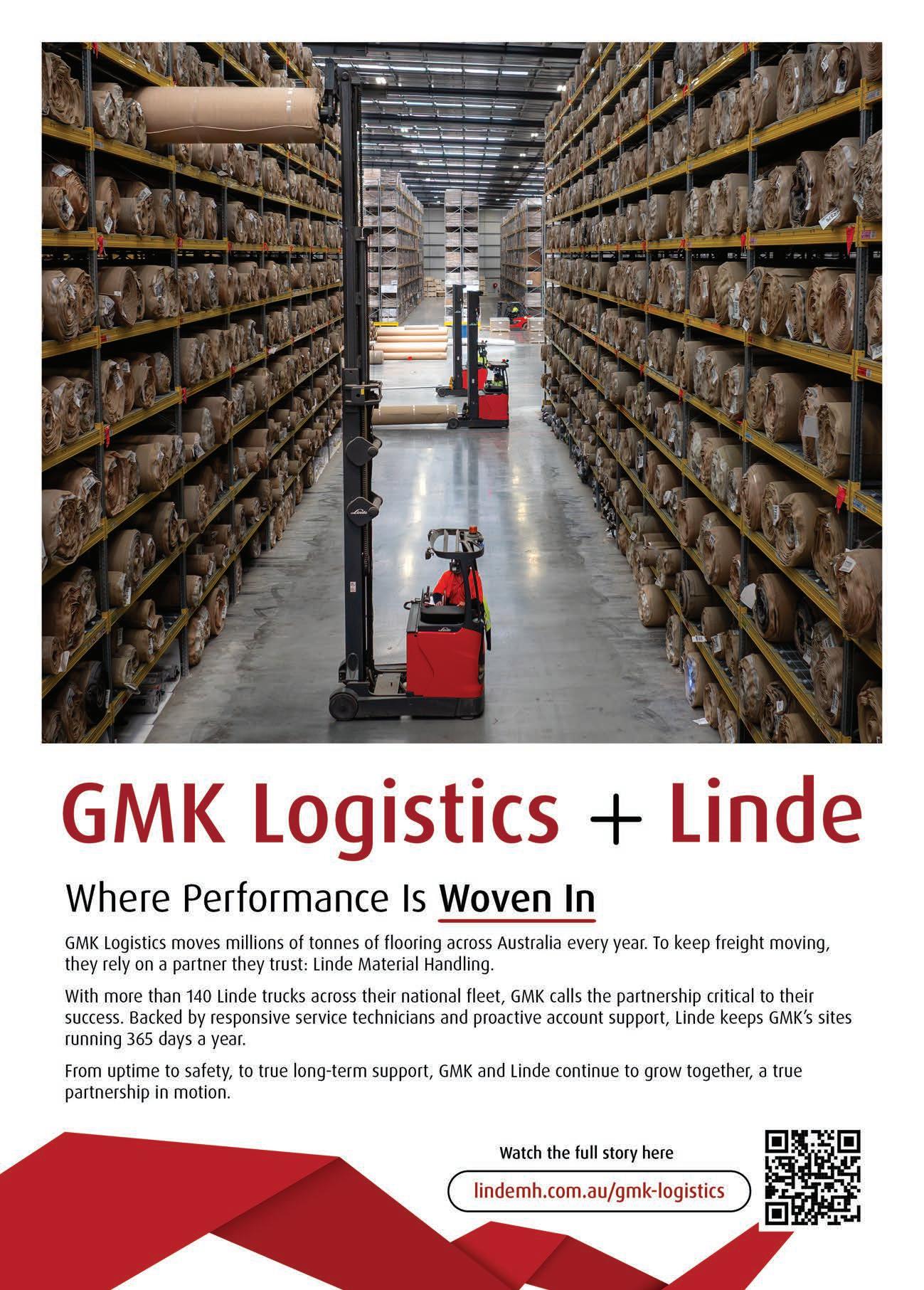

12 Linde powers GMK’s national flooring logistics fleet

20 Argon & Co’s NEOS delivers standardised supply chain planning

32 Toll secures landmark Defence logistics services contract

36 Ontime modernises fleet operations with real-time logistics

38 Radaro delivers truck-aware, real-time route optimisation

40 Cario addresses gaps in static freight ETAs

42 Tarot builds real-world traffic into route optimisation

16 Toyota forklifts power Downer’s rail maintenance operations

22 Jungheinrich delivers sustainable, high-uptime lithium-ion fleets

44 EnerSys uses data to optimise forklift energy

26 Dematic delivers AutoStore automation for MNSS spare parts

30 Vanderlande enables scalable, future-ready fashion warehouses

03 Ed’s Note

Industry News

Linde Material Handling supports GMK Logistics with specialised forklifts, telematics and service support, enabling reliable, efficient and data-driven handling of high-volume flooring freight across a national multi-site operation.

DHL Group has entered 2026 with a major acceleration in its global decarbonisation program, rolling out large-scale investments across air, sea, road and logistics infrastructure as it works toward net-zero greenhouse gas emissions by 2050.

During 2025, the logistics group expanded several of the core levers in its sustainability strategy, including sustainable aviation fuel, low-carbon marine transport, zero-emission lastmile delivery and renewable-powered warehousing. Together, the projects mark a shift from pilot programs to industrial-scale deployment across DHL’s global network.

One of the largest steps came in air freight, where DHL signed one of the biggest sustainable aviation fuel agreements in the United States.

Under a three-year deal with Phillips 66, the company will purchase more than 240,000 metric tonnes of SAF, equivalent to around 314 million litres, primarily to supply its West Coast air network. The agreement is expected to cut lifecycle carbon emissions by approximately 737,000 metric tonnes of CO2e.

In ocean freight, DHL partnered with CMA CGM to purchase 8,800 metric tonnes of second-generation biofuel made from used cooking oil, enabling an estimated reduction of 25,000 metric tonnes of CO2e on a well-to-wake basis. The initiative supports lower-carbon shipping across key global trade routes.

On land, DHL continued expanding zero-emission transport. In Germany, the company added 2,400 new electric delivery vans to its Post and Parcel

fleet, bringing its total electric vehicles to more than 35,000. The expansion means around one-third of German postcodes now receive zero-emission last-mile deliveries.

DHL also pushed into nextgeneration hydrogen transport, signing an agreement in Saudi Arabia to pilot hydrogen-powered trucks as part of a wider feasibility study for regional hydrogen infrastructure.

Beyond vehicles, DHL is also investing in renewable-powered logistics infrastructure. In Thailand, the company launched a solar-powered distribution centre designed to generate 100 per cent of its energy on-site through a 4.2 MWp solar array and battery storage, providing a template for future low-carbon logistics facilities worldwide. ■

Port of Melbourne has released its 2055 Port Development Strategy (PDS), setting out a 30-year framework to guide future capacity, efficiency and infrastructure planning at Australia’s largest container and general cargo port.

Published on 23 December 2025, the strategy outlines how the Port intends

to develop over the next three decades to support Victoria’s growing trade task, while remaining flexible enough to respond to changing economic, technological and community needs. All Victorian ports are legislatively required to maintain a Port Development Strategy under the Port Management Act 1995 (Vic) and to

review it every five years.

The 2055 PDS identifies a series of long-term planning directions and potential projects aimed at improving port capacity and supply chain efficiency as Victoria’s population and freight volumes increase. These include options to optimise existing land and infrastructure within the

port precinct, plan for future container capacity, and improve road and rail connectivity to support more efficient landside freight movements.

Port of Melbourne Chief Executive Officer Saul Cannon says the strategy reflects the port’s role in supporting Victoria’s economy. “As the manager of the Port, we are committed to delivering capacity and supply chain efficiencies to meet the growing needs of our economy. As our population increases, the Port’s capacity must grow too, and

we will continue to innovate to find the right solutions to the challenges and opportunities we face. This means continuing to engage with our stakeholders about the Port’s future growth and development,” says Cannon.

The strategy has been informed by extensive consultation with government, industry and community stakeholders. According to Port of Melbourne, this engagement was central to balancing a wide range of views on how the port should grow, including considerations

around transport connectivity, environmental management and the interface between port operations and surrounding urban areas.

Port of Melbourne says the 2055 PDS is designed as a guiding framework rather than a fixed project list, allowing development priorities to evolve over time. The strategy aims to support Victoria’s competitiveness and economic prosperity, while ensuring the port continues to operate as a critical piece of state infrastructure for decades to come. ■

FedEx has released its third annual Returns Survey, revealing that U.S. consumers and retailers are entering 2026 with sharply different priorities as the cost of handling product returns continues to rise.

The survey, conducted by Morning Consult in December 2025, shows shoppers still strongly favour free and frictionless returns, even as retailers increasingly move toward charging fees to offset growing logistics and processing costs.

Nearly two-thirds of U.S. consumers say a retailer’s return policy influences whether they make a purchase, rising to 75 per cent among Millennials. At the same time, 59 per cent of consumers say they would consider avoiding a retailer that charges a return fee. That figure is

even higher among Gen X shoppers at 65 per cent and baby boomers at 72 per cent.

Despite this resistance, FedEx says retailers are under pressure to introduce or expand fee-based return models in 2026 to protect margins while still trying to preserve customer loyalty.

The survey also points to a growing role for artificial intelligence in managing the returns process. One in five consumers now report using AI-powered chatbots to find information about shipping and returns. Among those who have used AI-driven customer service during a return, 53 per cent say the experience was more satisfying than working with a human support agent.

Jason Brenner, senior vice president of digital portfolio at FedEx, says AI is

becoming central to reducing friction in what is now one of retail’s most complex operations.

“At a time when returns are becoming more frequent and more complex, reducing friction is critical for customers,” Brenner says. “AI is playing an increasingly central role in that effort.”

The survey also shows rapid growth in simplified return models. Familiarity with no-box, no-label returns rose to 48 per cent in 2025, up from 37 per cent a year earlier, while usage increased to 41 per cent from 31 per cent.

FedEx says these options are increasingly seen by consumers as convenient and stress-free, reinforcing expectations that returns should be as easy as making a purchase. ■

Cut energy costs, lift uptime, and track CO 2.

Measurable ROI with Jungheinrich

GMK Logistics partners with Linde Material Handling to support reliable, efficient and data-driven flooring freight operations nationwide.

GMK Logistics has earned its reputation as a provider in specialised warehousing and transport for Australia’s flooring industry. From carpet and vinyl to a range of floor coverings, GMK manages complex, high-volume movements of roll and palletised product every single day.

To keep this freight moving seamlessly, GMK Logistics, and its parent company CTI Logistics, chose Linde Material Handling to power their national fleet. Across Australia, Linde’s equipment supports daily operations across the entire CTI Logistics’ group, providing GMK Logistics with reliable equipment ready for the demands of flooring freight.

Sarah Halpin, CEO of GMK Logistics, knows just how critical this partnership is.

“Linde is a big part of our business,”

she says. With more than a hundred forklifts in our fleet, we need a partner we can count on. Linde isn’t just a supplier; they’re a key part of how we deliver for our customers.”

GMK made the switch to Linde in 2018, following CTI Logistics’ successful rollout in 2015. Since then, the partnership has grown in step with GMK’s expanding national footprint, including the development of its flagship facility in Victoria.

A reliable fleet tailored to GMK Logistics’ application

GMK Logistics operates six sites around Australia, including New South Wales, Queensland, Victoria, South Australia and Western Australia. Across this network, the business moves thousands of tonnes of flooring every year –much of it heavy, long and awkward roll product that demands precision

handling and reliable equipment.

Sarah explains the scale: “Interstate, we ship around two million kilograms of freight every week. Add local and country deliveries, and it’s about 5.3 million kilograms. Because we work with roll product like carpet and vinyl, everything takes longer to load and requires much more precision. The material handling equipment we use is absolutely integral.”

To meet these demands, Linde supplies a fleet of reach trucks, internal combustion forklifts, and order pickers, with selected units configured with specialised prongs for handling carpet and other roll products. Craig Cullen, National Operations Manager QLD, oversaw the transition at key sites including Yatala.

“The reliability of the Linde equipment has been exceptional. The R20 reach trucks deliver outstanding

efficient, which means we’re more productive, spend less time refuelling and keep our operating costs down thanks to Linde’s hydrostatic drive system. Together, that efficiency translates into faster processing, improved accuracy and less product damage thanks to Linde’s precision controls.

“And Linde’s customer service? Exceptional. If we need advice, they’re just a phone call away.”

Sarah agrees that reliability and application-fit have been gamechangers.

“The fact that we use prongs for the product we move means the fleet has to handle that requirement,” she says. “Linde’s equipment does that, and more. With pre-start checks, daily monitoring and advanced software, we can stay proactive and keep everything running smoothly.”

Service support is another cornerstone of the partnership.

“Linde provides scheduled servicing and on-site technicians at all of our sites. Preventative maintenance keeps the fleet moving, and if there’s ever

every time. They know which trucks need attention and bring the right parts. We even keep a small stock holding on site, so trucks are back in service fast.”

For Sarah, the results speak volumes.

“The reliability of the Linde fleet since we brought them on board has been second to none.”

As GMK Logistics continues to scale nationally, the role of digital fleet intelligence has become increasingly important. Linde supports this growth with FleetFOCUS, its advanced telematics system that gives GMK clear visibility of utilisation, impacts and upcoming service requirements across the fleet. The platform also boosts safety and simplifies maintenance with features like impact monitoring and operator access control. Brett explains how FleetFOCUS drives daily operations.

“FleetFOCUS helps us track impacts and utilisation, which supports both

safety and productivity,” he says. “It’s a critical part of how we run our sites.”

Beyond day-to-day monitoring, FleetFOCUS powers GMK’s regular review process. Brett and his team meet with Linde regularly to analyse reporting, identify opportunities and assess how well each truck is being utilised.

“We look at what we’re using, what we’re not, which vehicles are slowing down, and where we need to lift productivity,” Brett says. “It helps us pinpoint where additional training or adjustments can improve efficiency.”

This data-driven approach ensures GMK continuously refines fleet efficiency as the business expands.

Innovation that creates real value

GMK Logistics was recently introduced to the Linde Customer Portal, Linde’s latest digital innovation designed to deliver full fleet transparency. Still in its trial phase, the portal was rolled out to select customers, and Linde Key Account Manager, Jube Shuttleworth, knew GMK would benefit immediately.

The portal provides a secure, centralised hub where GMK can view its fleet in real time, log service calls, track maintenance and access billing summaries.

“GMK has multiple sites, a large fleet and many stakeholders,” Jube explains. “Managing that through emails and phone calls can be challenging. The portal provides them a single platform where they can log in anytime, see the status of their fleet, track servicing and review billing. It saves time and offers complete transparency.”

From day one, GMK saw the value for planning, especially when equipment requires servicing or repair.

“Machines will go down from time to time – that’s a reality,” Jube says. “The portal helps them see what’s happening in real time, move trucks if needed and set expectations for the day. It’s all about improving operational efficiency.”

Anthony Minuto, State Manager NSW, calls the portal a game-changer.

“Before, everything was manual. We had to call over the phone, and prestart checks were on paper. Now we

have a portal on the forklift where we do a 16-point safety check. If there’s an issue, we flag it and get a response from Linde within minutes.”

When GMK Logistics first moved to Linde, some operators were hesitant. That changed fast.

“Nobody likes change, but within days they noticed the comfort,” Sarah says. “Less vibration, better ergonomics, improved pedal layout and armrests. We haven’t had a single complaint since.”

Brett hears the same at Epping.

“Operators love the comfort. Getting on and off the reach trucks is easier with the foot wells, and the trucks aren’t clunky like others on the market.”

He adds, “When you give people good equipment that looks good, feels

Behind GMK Logistics’ fleet is a partnership built on communication

“We don’t see ourselves as just a supplier,” Jube explains. “We see this as a long-term partnership. We constantly ask, ‘How can we do it better today and how can we prepare for tomorrow?’” ■

Automated sortation enhances multiple stages of the supply chain by enabling:

> Efficient unloading of inbound containers

> Streamlined cross-docking for rapid distribution to retail outlets

> Cost-effective order picking

> Fast and precise shipping sortation

Vanderlande provides a variety of line sorters, including sliding shoe and pusher sorters, as well as loop sorters such as cross-belt and tilt-tray sorters, tailored to meet your specific needs. Our sortation systems are designed to support customers at any stage of their automation journey, whether they are just beginning or already highly experienced.

Learn more at www.vanderlande.com/warehousing/systems/sortation

Downer uses TMHA forklifts for safer, efficient rail maintenance supported by telematics and rapid servicing.

owner, a provider of integrated services in Australia and New Zealand, has turned to the reliability, safety and performance of Toyota Material Handling Australia (TMHA) forklifts for its Rail & Transit Systems (RTS) warehouse operations in New South Wales.

Downer is a major provider of rollingstock asset management with over a century and a half of experience. In New South Wales, they designed,

built and now maintain the Millenium and Waratah train fleets which accounts for 50 per cent of Sydney’s train fleets.

RTS uses Toyota forklifts at a number of its warehouse facilities, including in the Sydney suburb of Auburn, and Hexham and Cardiff, outside of Newcastle. Warehouse Manager Paul Barlow has been using Toyota forklifts for more than five years, and over time has moved exclusively to TMHA,

currently in year two of a five-year long-term lease at Downer’s Auburn Maintenance Centre.

Paul says that using Toyota forklifts works well for the business, thanks to their high levels of technology, including the I_Site telematics system, which helps to track forklift utilisation, improve driver safety and monitor damages. The Toyota forklifts include electronic features which Paul finds useful.

“We can see driver utilisation, how long the forklifts have been used, how many hours it’s been used per day, we can check high- and low-impact damage, our drivers can do a safety inspection prior to hopping on a forklift in the morning or before a shift,” Paul says.

“So, our drivers have to complete a series of safety questions around the forklift before they hop-on, and it operates. That was the technology that we wanted.”

Paul added that the shift away from physical paperwork to higher digital capability as well as the safety credentials of the forklifts have been warmly received by both management and the forklift operators.

“The online safety questions and our pre-start inspections are quite handy, and the guys like that instead of having to fill out manual paperwork, so that’s a big plus,” Paul says.

“The safety elements around the forklifts, like halos and safety barriers, are good,” Mr Barlow said.

At Downer’s Auburn Maintenance Facility, the company undertakes the routine maintenance of 1,092 train cars putting 100 trains into service for the people of Sydney every day, while housing five total Toyota units.

With a preference for zero operating emission battery electric technology, Downer Auburn uses 8FBE18 and 8FBN30 electric counterbalance forklifts, an OME120HW electric order picker and an RRE140H high-reach truck, along with a single 8FG40N LPG counterbalance forklift. TMHA’s team, including Area Sales Manager, Matt Hoare, and Major Account Manager, Michael Provan, helped Downer accessorise its machines to suit the parameters of their warehouse.

“The machines were all specced up to a Downer standard for our warehouse conditions, including the type of tyre

and how high or low that mast can rise. This means we can have limits on the ability to lift to a certain height,” Paul said.

“We have a whole lot of overhead wiring around our site because we’re a rail maintenance depot, so we can’t go anywhere near that overhead wiring. We have safety height cut-outs on our machines, so you don’t get within the three-metre exclusion zone of that overhead wiring. Features like that played a part of the selection process when we went to tender.”

Downer’s Toyota forklifts are used for a range of purposes in the Auburn facility, including lifting various equipment in and out of trains using specialised forklift accessories.

“When you see the trains on a platform you see all the roof equipment and the pantographs, the forklifts are required to lift large pieces of equipment like that,” Paul says.

“They’re lifting upwards of 1.8 tonne, and that’s just for general warehouse usage. We also use the forklifts with special attachments to fit materials or items to the trains as well, so we’re lifting things like seats and batteries in and out of the trains, we install and uninstall air compressors inside the train, and they use special attachments to do that kind of stuff.”

One particular benefit of choosing Toyota is the fast and convenient servicing provided by TMHA and its extensive team of knowledgeable service technicians, who are able to minimise forklift downtime with quick and responsive callout times.

“The servicing’s great,” Paul says. “If there’s a problem with the forklift, there’s a number we contact and they’re generally out within four hours as per their initial agreement. Here at Auburn we operate 24/7, 365 days a year – public holidays, the works.” ■

For more information freecall 1800 425 438 or visit online at www.toyotamaterialhandling.com.au

You didn’t set out to become a fleet manager. But somewhere along the road, your growing business turned into a full-time logistics operation stress, costs constant distractions piling up.

Managing vehicles, drivers, compliance, delays, maintenance – it's exhausting, expensive, and pulls focus from your real priorities. he truth Most businesses are wasting time and money trying to manage logistics they’re not trained for.

Our professional last mile metro delivery service is built for businesses like yours. We handle every detail – from dispatch to doorstep – with reliability, efficiency, and brand-level professionalism. No more early morning driver calls. No more compliance headaches. No more fleet-related fire drills.

Just smooth deliveries and peace of mind.

Book your no-obligation Ontime Fleet X-RAY today Call our team on 1300 778 919 to discover how much deliveries are really costing your business, and discover how Ontime can deliver business fleet solutions that save you money, time headaches.

44,000+

550,000+

300+

Fluidra streamlines ANZ supply chain planning with NEOS, aligning people, process and tools through a Kinaxis-powered global planning platform.

Fluidra, a manufacturer of residential and commercial pool components, has undertaken a multi-year supply chain planning transformation to assimilate how demand, supply and inventory decisions are made across its operations. In Australia and New Zealand, the program was delivered with support from NEOS by Argon & Co, a supply chain and technology consultancy and systems integration specialist. NEOS worked with Fluidra’s local supply chain team and global Centre of Excellence to implement the Kinaxis Maestro planning engine – a system focused on concurrent and constraintbased planning. The project was part of a wider global initiative to align Fluidra’s global S&OP (Sales and Operations Planning) model.

The transformation is structured around three core pillars of people, process and tools, and is intended to move the organisation away from fragmented, region-specific planning approaches. For ANZ, the goal was to move from multiple planning tools to a single system that enables consistent decisions while accommodating local requirements.

Prior to the transformation, Fluidra’s supply chain planning was largely decentralised, with regions operating independently and using different tools and methods. While this approach provided local flexibility, it limited global visibility and made it difficult to coordinate planning decisions across markets.

“We had three main regions, and each region sort of really did their own

thing,” says Terry Wilson, Supply Chain Manager at Fluidra.

“When we look at it from a global perspective, we’ve got over 500 sites globally. The main thing was being able to get to a point where we could run a global S&OP (Sales and Operations Planning) process, and to do that, you really need to have a global platform.”

As the organisation grew through acquisition, this fragmentation became increasingly difficult to manage. Aligning demand, supply and inventory assumptions across regions required manual reconciliation, and planning outcomes varied depending on local tools, data structures and levels of planning maturity.

From an early stage, Australia and New Zealand were identified as priority markets within the global rollout, despite being smaller than some regions by volume.

“ANZ is one of the biggest regions for Fluidra,” Terry says. “So, it’s a key market for us.”

The region also presented distinct planning challenges. Long inbound lead times into Australia needed to be balanced against customer expectations for rapid order fulfilment, creating ongoing tension between inventory levels, service performance and responsiveness. Terry explains that Fluidra’s average inbound lead time into Australia is around four months, but the order book typically extends to no more than a few weeks at any given time.

“We’ve got long lead times, but a customer base that demands orders that are placed today, delivered today

and sent tomorrow,” Terry says.

This environment increased the need for a planning platform capable of exposing risk early, testing scenarios quickly and supporting informed trade-offs across demand, supply and inventory.

Fluidra’s acquisition strategy added further complexity. Over time, the organisation inherited multiple ERP environments across several regions.

“The company has grown a lot by acquisition over the last five to six years,” Terry says. “With those acquisitions comes different ERPs. Even if we’ve had the same ERP, we have different versions throughout the world.”

Rather than attempting to replace ERPs, Fluidra introduced a standardised planning layer through Kinaxis to sit above existing transactional systems. This approach allowed the organisation to standardise planning processes and logic while continuing to operate heterogeneous ERP environments underneath.

Before implementation, supply planning in ANZ relied on a combination of Excel spreadsheets, ERP outputs and Power BI reporting, with no single system supporting end-toend planning or structured scenario analysis.

“We never really had a core platform to do supply planning,” Terry says. “It was a combination of Excel spreadsheets, our ERP and Power BI.”

A critical enabler of the transformation was improving master data quality and governance.

Consistent item hierarchies, lead times, sourcing rules and planning parameters were required to ensure the planning engine produced reliable outputs. This work ran in parallel with system implementation and process design, reinforcing the principle that technology alone would not resolve planning challenges without disciplined data and process foundations.

NEOS supported Fluidra as the implementation partner for the ANZ rollout, working closely with both the local supply chain team and Fluidra’s global Centre of Excellence. A key objective was ensuring the region adopted the global planning model without creating bespoke configurations that would be difficult to maintain over time.

“You want a global model template which makes it easier to maintain,” says Nathan Singhavong, Practice Lead at NEOS. “If you’re diagnosing something, you’re diagnosing it the same way, no matter which region it is.”

NEOS facilitated workshops with the ANZ planning team to document existing processes across demand planning, inventory management and optimisation, and supply planning. These processes were mapped against the global Kinaxis design to identify gaps and regional requirements.

“We sat down with Terry and walked through the as-is processes for manufacturing, distribution planning and processing,” Nathan says. “We then created a couple of tailored user stories specific to ANZ.”

Those use cases were reviewed

with Fluidra’s global architects and incorporated into the standard model where appropriate, avoiding regional divergence while ensuring operational relevance.

While the core planning model had already been deployed in EMEA, additional configuration and validation were required for ANZ. NEOS supported system configuration, data validation and testing to ensure planning outputs reflected real operating conditions.

With DILO (day in the life of) testing following a standard UAT process, planners were able to build upon the fundamentals of the tool and begin parallel validation of supply outcomes.

This approach supported change management by allowing planners to understand system behaviour, validate numbers and build trust in outputs before the platform became business critical.

The ANZ supply chain manages more than 15,000 SKUs across finished goods, parts and spare parts. In this environment, even small changes in demand or supply assumptions can have material impacts on inventory exposure and service performance.

The new planning environment allows planners to identify risks earlier, assess trade-offs more quickly and understand the downstream implications of decisions across planning horizons. This has reduced reliance on manual workarounds and improved visibility across demand, supply and inventory.

While forecast accuracy improvements have been incremental, Terry notes that responsiveness, scenario capability and confidence in planning outputs have been equally important outcomes.

For Fluidra, the ANZ implementation forms part of a broader shift in how supply chain planning is governed globally. The focus is on embedding consistent processes, data standards and tools that can scale as complexity increases.

By aligning ANZ with the global planning model and consolidating planning activities into a single platform, Fluidra has established a foundation for continued improvement. The project demonstrates how a global planning framework can be applied locally, with NEOS supporting the translation of global design into practical, operational outcomes for the ANZ business.

“The big thing for us is being able to understand exactly where our constraints are,” Terry says. “Not just in the lines that produce our finished goods, but in all downstream activities.” ■

Jungheinrich helps warehouses cut energy use, boost uptime and competitiveness through lithium-ion fleets that support ESG compliance.

As warehouses across Australia face rising energy costs, tightening ESG requirements and ongoing labour constraints, material handling equipment is being judged less on upfront price and more on how well it supports longterm operational performance. For Jungheinrich Australia, sustainability has become a practical lever for improving uptime, lowering total cost of ownership and strengthening customer competitiveness rather than a standalone environmental goal.

“Moving more with less” is how the company describes this shift. According to Martin Strogilakis, Head of Product Management at Jungheinrich Australia, the concept reflects a move toward

forklift fleets and energy systems that deliver higher productivity, lower operating costs and greater resilience while also reducing emissions.

“At Jungheinrich, ‘Moving more with less’ reflects our commitment to sustainability as a strategic advantage. It’s not just about reducing emissions, it’s about making warehouses more efficient, circular-ready and safe,” Martin says. “By analysing our customers’ processes and understanding their operational needs, we deliver tailored solutions that optimise their forklift fleets and transition them from traditional internal combustion or leadacid trucks to advanced lithium-ion technology, which is quickly becoming the industry standard.”

For customers, that transition is less about meeting environmental targets and more about removing friction from day-to-day operations. In highvolume facilities, the ability to keep trucks moving and avoid energy-related disruptions directly affects service levels, labour efficiency and profitability.

“Every material handling operation faces pressure to optimise costs and minimise downtime,” Martin says. “Our lithium-ion technology delivers higher uptime, faster charging and consistent power output. This allows customers to operate fewer trucks without compromising productivity.”

Energy efficiency is another

operational advantage.

“Compared to lead-acid batteries, lithium-ion consumes about 20 percent less energy during utilisation, which translates into lower energy bills, reduced maintenance costs and reduction of unplanned downtime, especially in demanding multi-shift environments,” Martin says.

That combination of energy savings and availability changes the economics of warehouse fleets. Fewer trucks are required to achieve the same throughput, maintenance schedules are simplified, and space previously allocated to battery rooms and change-out areas can be returned to productive use. What is often described as sustainability in this context shows up for customers as simpler, more predictable operations.

Those operational gains are increasingly linked to reporting and compliance as well. Large retailers, manufacturers and logistics providers are now required to measure, report and reduce emissions across their

supply chains, including the equipment used inside warehouses.

“Evolving ESG regulations require companies to measure, report and reduce emissions,” Martin says.

“Jungheinrich Australia provides transparent energy and CO2 data, helping customers meet compliance requirements confidently and avoid costly penalties. Our Total Cost of Ownership and product carbon footprint calculations use real customer data to quantify savings and demonstrate measurable reductions in emissions.”

For customers, that data turns forklift fleets into auditable assets. Instead of estimating or relying on generic benchmarks, businesses can show exactly how much energy their equipment uses and how those numbers change over time as fleets are modernised.

Sustainability also now plays a role in how warehouses compete for business. Many logistics providers serve global brands that expect their suppliers to demonstrate environmental performance alongside price and service.

“Sustainability is now a competitive differentiator,” Martin says. “Global

brands demand sustainable supply chains, and by partnering with Jungheinrich, customers can showcase reduced CO2 emissions and transparent reporting. This strengthens brand reputation, helps win new contracts, and builds loyalty.”

Martin adds: “We lead by example.

Recognised by TIME as one of the Top 500 Sustainable Companies worldwide and with SBTi-validated climate goals, we’re committed to becoming one of the most sustainable companies globally.

“Working with Jungheinrich helps customers stay ahead of regulatory requirements, meet stakeholder expectations, and future-proof their business.”

At a time when both customers and workers have more choice, that positioning matters. Modern, energyefficient fleets support quieter, cleaner and safer working environments while also providing the data required to satisfy customer and regulatory scrutiny.

Asset life is another area where sustainability intersects directly with cost. Rather than treating equipment as disposable, Jungheinrich builds

circularity into how fleets are supplied and maintained.

“Circularity is fundamental. It’s about designing systems that keep resources in use for as long as possible,” Martin says. “Our portfolio includes durable equipment, remanufacturing programs like JUNGSTARS and multi-stage battery life cycles. For example, JUNGSTARS save up to 80 percent CO 2 compared to new production. Rental and used equipment models further reduce environmental impact, making sustainability economically viable.”

For customers, remanufactured and rental equipment provides flexibility and capital efficiency without sacrificing performance. Fleets can be scaled up or refreshed without committing to full new purchases, while still benefiting from modern energy and safety technology.

Uncertainty around energy pricing,

labour availability and regulation is only increasing. Martin says that investing in efficient, sustainable material handling is a way to reduce exposure to those risks.

“Energy prices, labour availability and regulatory requirements are increasingly unpredictable,” Martin says. “Investing in efficient, sustainable technology reduces risk and ensures long-term resilience. Our solutions adapt to future changes in energy infrastructure and compliance frameworks, giving customers confidence to stay ahead of market demands.”

Safety remains a core part of that

“Our AI-based assistance systems protect employees, materials and goods while promoting ergonomic, healthy workplace design. This ensures fast processes and supports automated environments without compromising safety.”

For Jungheinrich customers, sustainability ultimately shows up in practical terms: lower energy bills, fewer trucks, less downtime, stronger reporting and safer operations. The environmental gains are real, but they are delivered through the same mechanisms that drive productivity and profitability. ■

Last mile delivery is where freight plans are tested. Cario unifies first, middle, and last mile in a unified freight control tower. Logistics teams gain the visibility, insights and predictive AI-driven control to spot issues early and act proactively before they escalate.

ETA 2 days late due to weather delays – notify customer

MNSS deploys AutoStore with Dematic to boost spare parts fulfilment, space efficiency and productivity without increasing workforce.

Mohamed Naser AL Sayer & Sons (MNSS) is an automotive distributor in Kuwait, responsible for genuine Toyota and Lexus spare parts. Known for innovation and operational expertise, the company invests in advanced technology to drive productivity, employee wellbeing, and customer satisfaction across its network.

Following a period of growth, MNSS recognised that its traditional spare parts warehouse operations could no longer keep pace with rising customer demand. As the company expanded, it became clear that its workforce wouldn’t be able to scale at the same pace, making automation essential for boosting productivity without increasing headcount.

“The business was experiencing a period of rapid growth, and we weren’t sure we could meet the manpower

requirements that came with it,” says Desmond Chunthun Lew, Senior Business Director of Parts & Group Logistics, Mohamed Naser Al Sayer and Sons. “So, it was really important for us to find automation which allowed us to improve productivity to meet growth without increasing our manpower.”

This need for scalable productivity and efficiency led to MNSS’s investment in an AutoStore system integrated by the world’s leading supply chain automation specialist, Dematic. The system’s compact, high-density storage and retrieval solution has since delivered space savings, faster order fulfilment, and a big improvement in service levels.

Prior to automation, MNSS’s warehouse operations were reliant on manual

picking and storage. While effective at a smaller scale, the system began showing limitations as the company expanded. Accuracy and speed, critical for spare parts operations, became harder to control, and the physical space required to hold inventory was growing unsustainably.

“We wanted to better service our customers with faster delivery and fewer errors. That’s the basis of what we were aiming for. The added benefit was a substantial reduction in warehouse space requirements,” says Bengt Kurt Schultz, Chief Operations Officer, MNSS.

The impact of space optimisation alone was transformational. “We went from 5,000 square metres to a 560 square metre footprint, so a huge saving in space,” explained Mubarak Naser Al Sayer, Chief Executive Officer, MNSS. “In Kuwait, space is scarce and

expensive. The cost saving at the end of the year is substantial.”

For MNSS, automation wasn’t only a cost-cutting measure, but it was also a strategic response to workforce shortages that threatened to limit the company’s ability to grow. The business wasn’t confident it could achieve the manpower increases needed to deliver those improvements, making it essential to adopt an automation system capable of boosting productivity and supporting its growth targets.

MNSS evaluated several proposals as part of its automation journey before selecting Dematic as its automation partner and choosing to implement the AutoStore system, a cube-based automated storage and retrieval solution known for its efficiency and adaptability. The appeal of AutoStore’s unique design, along with Dematic’s history, experience and reputation, provided the confidence that the project would deliver the required performance and be completed on time and on budget.

Mithun Perinchery, Head of Sales for the Middle East, Türkiye and Africa at Dematic, said the partnership was a natural fit.

“MNSS had a clear vision of what they wanted to achieve, like improved speed, accuracy, and scalability, and AutoStore was perfectly suited to those goals,” Mithun says. “Our role was to ensure the system delivered tangible operational and business results from day one.”

After several design iterations, MNSS and Dematic implemented an AutoStore system tailored to the company’s spare-parts business.

MNSS’s new automated warehouse was designed for a capacity of 16,000 SKUs, with around 25,770 totes within the cube across 24 levels. The AutoStore system was engineered for throughput of 500 bins per hour; 400 bins per hour at the picking ports and 100 bins per hour for put-away

operations. The system features 18 robots, two conveyor ports for decanting and four carousel ports for picking.

“To date, we’ve picked and shipped more than 700,000 lines,” Wilfred Kwaku Atuobi, Senior Manager, Logistics & Warehousing, MNSS says. “On average, we move around 2,200 lines each day to our various branches. The system works smoothly, intuitively and Dematic has provided fantastic support since going live.”

A key factor in the project’s success was its seamless integration with MNSS’s enterprise systems.

“We didn’t have any issues integrating it into our ERP system,” Bengt added. “Everything worked perfectly, we received the support we needed, on time and with the results we expected.”

This integration allowed MNSS to maintain real-time visibility of inventory and orders while avoiding downtime during the transition.

Like any large-scale infrastructure project, MNSS’s automation journey was not without challenges. One of the most significant obstacles was the physical condition of the warehouse floor.

“We discovered that the floor where the AutoStore was to be installed had a slope issue,” Atuobi explained. “It set the project back slightly, as the slope was more than 1 per cent, which isn’t compatible with the system, so we had to level the floor before installation could proceed.”

Dematic’s technical expertise proved invaluable in resolving issues quickly.

“Dematic’s professionalism was evident throughout the project,” said Atuobi. “They quickly understood our requirements, supported us through the design and engineering stages, and executed the installation with exceptional efficiency, completing the system in the shortest possible timeframe.”

The entire project, from contract signing to go-live, was completed in just six months. “Since implementation,

system uptime has remained near 100 per cent, validating the company’s investment and demonstrating that the project achieved the outcomes we set from the start,” Atuobi said.

The AutoStore system now handles all of the company’s small and medium-sized parts, items that previously required manual handling, allowing faster and more accurate fulfilment. Since the system supports every customer group, including service, retail and over-thecounter channels, it has significantly reduced downtime and shortened lead times compared to the previous manual distribution process. These improvements in delivery speed, space utilisation and order accuracy have directly enhanced customer satisfaction.

“We wanted to better service our customers, with faster delivery and fewer errors in delivery,” Bengt says. “That’s what we were aiming for and we achieved it.”

The MNSS AutoStore implementation is one of the first projects of its kind in the Middle East’s automotive industry, setting a new regional benchmark for warehouse efficiency and operational excellence. As one of the earliest adopters of this technology in the region’s automotive sector, the project has delivered a strong example of how next-generation automation can be implemented on time and on budget while transforming fulfilment performance.

For Dematic, the implementation also highlights the company’s growing role in enabling automation across the Middle East and other expanding markets.

“This collaboration shows how flexible and adaptable AutoStore can be,” says Muthin. “By working closely with MNSS to understand their growth ambitions and operational constraints, we were able to deliver a system that not only meets today’s needs but can scale for tomorrow.”

• 90 per cent reduction in warehouse footprint (from 5,000 sqm to 500 sqm);

• 700,000+ order lines picked and shipped since go-live;

• 99.9 per cent system uptime since go-live;

• seamless ERP integration with existing SAP system; and

• accuracy, productivity and speed improvements without additional manpower.

A year on from go live, MNSS continues to report strong performance, high system uptime, and satisfaction among both staff and customers.

“We’ve saved a lot of time, especially for our staff,” explained Wilfred. “Everyone connected to the project has been really happy with the results, and we see our partnership with Dematic continuing to create value for the company and its investors well into the future.”

MNSS plans to expand its automation journey with Dematic, exploring additional AutoStore deployments to support new product lines. ■

If you would like to see the full MNSS transformation, scan here:

Vanderlande examines how modular, software-led warehouse design is helping fashion supply chains scale and adapt.

As fashion retailers and logistics providers face rising customer expectations, labour constraints and increasing operational complexity, warehouse design is playing a more prominent role in operational planning. Across Australia and New Zealand, fulfilment operations are being reviewed in terms of how they are built, expanded and managed over time.

Warehouse design does not centre on a single technology or standalone automation project. Many operations are structured to allow for staged expansion and system modification, enabling facilities to be adjusted as requirements change. Whether operating an in-house distribution centre or a multi-client 3PL facility, a common consideration is maintaining consistent operational performance while allowing for future system changes.

Within this context, automation is typically implemented incrementally rather than as a single large-scale transformation. The focus is on designing warehouse platforms that can support operational change and capacity growth over time, rather than fixed, one-off outcomes.

Fashion supply chains operate in a fastmoving environment. Product lifecycles are short, assortments are broad, and customers expect reliable delivery across multiple channels. E-commerce, click-and-collect, ship-from-store and returns are commonly supported within the same fulfilment operation.

Alongside these demands, organisations face ongoing structural constraints. Labour availability remains limited, wage costs continue to increase, and many facilities operate from buildings not originally

designed for omnichannel fulfilment. In Australia and New Zealand, long transport distances and dispersed populations add further complexity, placing greater emphasis on operational efficiency and consistency.

These conditions affect both retailers operating their own distribution centres and third-party logistics providers managing multi-client facilities. In each case, operations are required to maintain service levels, manage demand variability and scale capacity while controlling cost and operational risk.

Omnichannel changes everything Store replenishment, wholesale fulfilment, e-commerce orders and returns each behave very differently. Store orders tend to be predictable and pallet- or cartonbased, wholesale volumes are typically larger but customer-specific with defined delivery windows, while online orders are fragmented, time-critical and highly variable, and returns introduce additional complexity through reverse flows, inspection and re-processing.

Running these flows in parallel within one facility requires more than additional labour. It demands systems that can dynamically prioritise work, balance capacity and adapt in real time.

“Omnichannel fundamentally changes how warehouses need to operate,” says Katie Budd, Sales Manager at Vanderlande. “Retailers and logistics providers need solutions that can flex between store and online fulfilment, rebalance priorities throughout the day and continue to perform under peak conditions.”

As a result, many organisations are moving away from siloed fulfilment models and toward integrated operations, where different order profiles are handled through a shared, intelligently orchestrated platform.

A defining characteristic of today’s market is that growth happens in both brownfield and greenfield environments.

Some organisations are investing in new, purpose-built facilities designed to support long-term network strategies. Others are upgrading existing warehouses that must continue operating while capacity, throughput and accuracy are improved. In practice, most organisations manage a mix of both. In brownfield environments, the priority is continuity. Operations cannot stop, and changes must be introduced in phases. Automation therefore needs to fit within existing footprints, integrate with current systems and deliver benefits incrementally. Brownfield upgrades often focus on relieving bottlenecks, reducing manual handling and improving throughput without disrupting daily operations.

Greenfield projects, by contrast, allow greater freedom of layout and design. However, even here the focus has shifted away from over-engineered, fixed solutions. Organisations increasingly want facilities that can grow in stages, adapting to demand rather than locking in capacity too early. This convergence has led to a shared design philosophy: build systems that are modular, scalable and future-ready, regardless of whether the starting point is a new site or an existing one.

Automation is commonly used to support flexibility within warehouse operations, but its role is defined by how it is applied rather than by automation itself. In practice, automation is implemented to support scalability,

consistency and operational control, rather than as a standalone objective.

Vanderlande works with fashion businesses using modular systems that can be introduced in stages. In many cases, operations begin with batch picking and sortation to support throughput, reduce reliance on manual labour and improve accuracy. As volumes increase or service requirements change, additional capabilities, including goods-to-person systems, can be integrated into the existing operation.

“Fashion businesses rarely stand still,” Katie explains. “Our role is to help customers start at the right level for today, while ensuring the solution can grow with them tomorrow. That ability to scale without disruption is what protects long-term investment.”

This phased approach allows organisations to align capital expenditure with growth, rather than committing to large, upfront projects that may not match future needs.

Sortation has emerged as a cornerstone of modern fulfilment operations because of its flexibility and adaptability. It supports a wide range of use cases, including batch picking, cross-docking, store replenishment and e-commerce fulfilment, and can operate either as a standalone solution or as part of a broader automated system.

“Vanderlande’s sortation capability stands out for its ability to combine modular design with industrial robustness, enabling customers to deploy proven sorter technology in complex brownfield sites and scale it confidently over time,” says Roald de Groot, Director of Sales at Vanderlande Australia.

Vanderlande’s POSISORTER and CROSSORTER are examples of modular sortation systems used within fashion and apparel fulfilment operations. Both systems can be deployed in brownfield or greenfield environments and are designed to support phased expansion as throughput requirements change. Their compact footprints allow them to be installed in space-constrained facilities, while their engineering design supports consistent operation

and energy-efficient performance over extended service lives.

As Roald explains, these systems allow organisations to start small and scale gradually, adding chutes, capacity or additional automation layers as business needs evolve.

Behind the physical equipment sits a software layer that orchestrates workflows across people, processes and machines. This software provides real-time visibility into operations, dynamically prioritises orders and ensures that resources are used effectively.

In omnichannel environments, where priorities can shift hour by hour, software-driven orchestration is essential. It allows operations to respond quickly to demand changes while maintaining service levels and stability.

This software-first approach also supports long-term adaptability. As new automation modules, workflows or business models are introduced, they can be integrated into the existing control architecture rather than requiring a complete redesign.

Whether running a dedicated in-house distribution centre or operating as a third-party logistics provider, organisations face similar pressures: variability, growth, labour constraints and rising customer expectations.

Vanderlande’s approach supports both models. Independent operators

gain a clear roadmap to modernise their facilities at their own pace. 3PLs benefit from flexible platforms that can support multiple customers, changing volumes and evolving service requirements without repeated reinvestment.

Local service and support play a critical role in sustaining performance. Ongoing maintenance, optimisation and technical expertise ensure systems continue to deliver value throughout their lifecycle.

As Roald notes, “Automation today is not about installing isolated technologies. It is about creating a platform that evolves. When software, automation and processes are aligned, organisations gain resilience, scalability and predictable long-term value.”

Fashion supply chains will continue to evolve as customer behaviour, channels and market conditions change. The organisations best positioned for the future will be those that treat their warehouses not as static assets, but as adaptable platforms.

By combining modular automation, software-led orchestration and a staged investment approach, businesses can build operations that grow with them. Whether upgrading an existing site or developing a new one, the goal is the same: flexibility, scalability and longterm resilience.

In this environment, the future of fashion fulfilment is not defined by a single technology, but by the ability to adapt, integrate and scale with confidence. ■

Toll’s $1.5 billion Defence contract consolidates national logistics to strengthen resilience, readiness and long-term operational sustainment.

Australia’s Defence logistics network is set to undergo its largest structural overhaul in more than a decade, following the award of a $1.5 billion national contract to Toll Remote Logistics Proprietary Limited.

The 10-year Defence Theatre Logistics (DTL) agreement will see Toll

national distribution and retail logistics across the Australian Defence Force, consolidating two long-running contracts previously held by Linfox and Ventia into a single, integrated national model.

The move reflects a broader shift in Defence’s logistics strategy under the 2024 National Defence Strategy, which

readiness and the ability to sustain prolonged operations across Australia and the Indo-Pacific.

Steve Roughsedge, Senior Vice President of Theatre Supply Chain at Toll Group, says the DTL contract gives Defence a single logistics partner responsible for warehousing and distribution across the Defence Joint

Logistics Units with ADF personnel who require access to equipment and storage.

“The one program combines two previous contracts that split the delivery of retail services (localised storage and delivery of goods) and the warehousing and distribution services, which addressed strategic storage and distribution across the broader network,” he says.

“Additionally, this new program includes an ability for the ADF to ask Toll to provide personnel, equipment and facilities to support operational contingencies, such as deployments to support exercises, humanitarian relief of other operations.”

Under the new arrangement, Toll will manage more than 50 Defence sites and

a national distribution network linking major bases, support facilities and operational units.

The contract includes responsibility

18 primary sites and 38 support warehouses, covering the full range of Defence inventory management tasks. These include receiving, storing, inspecting, transferring and issuing equipment and supplies, ranging from routine consumables to vehicles and oversized assets.

In practical terms, the DTL contract places Toll at the centre of the Defence supply chain, responsible for ensuring the right equipment is available in the right place, at the right time, whether for day-to-day operations, major exercises or contingency deployments.

Retail services will also be provided at selected Defence locations, enabling ADF members to order, transact and collect items locally rather than relying on centralised procurement and long lead-time delivery. The model is designed to reduce delays, improve service levels and give units greater autonomy in managing their operational requirements.

“Toll is arguably the largest provider of core logistics services in Australia, and has built a vast network of logistics capabilities across this terrain for more than 130 years,” Steve says.

“To support our commercial customers Toll’s existing network contains more than 14,000 personnel across more than 300 sites, 3m+ square metres of warehousing, more than 3,000 trucks and tens of thousands of pieces of MHE, and so the scale and scope of the Defence requirement is something Toll work with every day.”

Toll was selected following a traditional Request for Tender process that allowed Defence to assess best-of-breed logistics providers operating in the current market. Steve says the outcome reflected a combination of operational effectiveness, efficiency and flexibility, supported by Toll’s breadth of capability across the commercial logistics sector and its extensive experience supporting Defence across a wide range of logistics services.

“Strategically, the faith demonstrated by the ADF in contracting with Toll provides broad confirmation of the reliability, effectiveness and agility that Toll can deliver to any large-scale consumer of such services,” Steve says. “It firmly announces the demonstrated value Toll can bring to the Defence sector, anywhere within our region.”

Steve says the program also builds on Toll’s long history of supporting ADF operations, including decades of involvement across multiple areas of the Defence logistics spectrum and direct in-country support during regional operations such as East Timor and the Solomon Islands. He adds that innovations developed and delivered under the DTL program will expand Toll’s internal capabilities while broadening its Defence sector footprint.

The transition to the new operating model will be delivered through a phased approach, allowing sites, systems and

personnel to be progressively migrated while maintaining continuity of service across the network. During the transition, Defence acknowledged the contribution of incumbent providers.

“I wish to thank Linfox and Ventia, as the transitioning service providers, for the difference they have made to Defence’s logistics system and their continued support to Defence,” Steve says.

Delivering the program will require a workforce uplift, with around 800 additional personnel expected to join Toll nationally across warehousing, inventory management, transport, retail operations and network coordination. Steve says the expanded workforce is critical to supporting the scale, geographic reach and operational tempo of the program.

Roughsedge, Senior Vice President of Theatre Supply Chain,

“Across the network we are pulling together a team heavily invested in the mission and playing their part every day to keep the wheels of Defence turning,” he says.

Steve explains that the DTL contract reflects a broader shift in Defence thinking, with logistics increasingly recognised as a strategic enabler rather than a back-office function.

“By centralising logistics delivery under a single national contract, the model is intended to improve coordination, visibility and responsiveness across Defence’s supply chain, ensuring it can support both routine readiness and higher-intensity operations without becoming a limiting factor,” he says.

According to Steve, transitioning to the DTL model is one of the most demanding elements of the program, as it involves migrating a live national logistics network while sustaining Defence operations. Despite the longterm nature of the contract, the handover from existing arrangements is being carefully phased to ensure continuity and minimise risk.

“There is nothing trivial about engaging hundreds of new staff members over such a geographic spread,” Steve says. “particularly when combined with the integration of Defence IT environments, new systems such as the ADF ERP, and the establishment of large volumes of new equipment including vehicles and delivery assets.”■

Combining internal combustion-like power with clean energy, the Hyster XTLG Outdoor Electric Forklift Series delivers the performance, durability, and reliability you’ve come to expect from Hyster — now powered by integrated lithium technology. Available in capacities from 2 to 7 tonnes, it’s the sustainable solution that doesn’t sacrifice strength, speed, or uptime.

Ontime Delivery Solutions is modernising fleet operations by replacing legacy systems with real-time logistics technology.

For transport operators managing large, complex fleets, legacy technology can become both a constraint and a risk. Systems that once supported basic tracking and dispatch often struggle to meet modern expectations around real-time visibility, customer communication and operational flexibility. Replacing those systems is rarely simple, particularly when they are deeply embedded across fleet operations, customer service and internal administration.

For Ontime Delivery Solutions, the decision to transition away from legacy software followed growing pressure from customers and the need to modernise operations at scale. The business operates more than 600 vehicles and services clients with specialist delivery requirements, where visibility, certainty and responsiveness are increasingly non-negotiable.

“We are partnering with a publicly listed business that already provides solutions for companies such as Amazon and Amart,” says Walter Scremin, CEO of Ontime Delivery Solutions. “From our point of view, we are probably the biggest transport company that they are transitioning over.”

The move represents an operational shift rather than a simple software replacement. Ontime has spent more than 12 months working through development, testing and staged deployment to ensure the new platform aligns with the realities of its service model and customer expectations.

At the core of the transition is a clear gap between what legacy systems could deliver and what customers now expect from logistics providers. As delivery networks become more complex

and end customers demand greater transparency, technology has moved from being an internal tool to a visible part of the service experience.

“It was about overall modernisation,” Walter says. “I believe their technology is leading edge and they are providing everything that is required of the marketplace right now. People are about information, people are about wanting transparency, it is about ease of use, and it is about it looking good.”

While GPS tracking and vehicle visibility have existed for years, Walter notes that usability and presentation now play a far greater role in how customers engage with logistics platforms on a daily basis. While vehicle tracking can be delivered in many ways, presentation and usability play a growing role in how customers perceive service quality. Equally important was the technology provider’s ability to continuously evolve the platform in response to operational feedback and changing requirements.

“They have a team of people that are continually developing the software,”

Walter says. “To be quite honest, we have been working with them for the last 12 months getting prepared for it. We have the bulk of our clients already experiencing it, and the feedback has been absolutely wonderful. They love it.”

Migrating core systems across a fleet of more than 600 vehicles presents a level of complexity that goes well beyond smaller transport operations.

For Ontime, the transition required careful sequencing to avoid disruption while accommodating the business’s highly specialised service model.

“It is an incredibly big decision when you are running 600-plus vehicles to transfer everything over,” Walter says. “The period of time it has taken is a result of all the new development they have needed to do, because we are quite particular and idiosyncratic in the service that we provide our clients.”

Ontime’s approach differs from standardised logistics models that prioritise uniformity over flexibility. Instead, its technology is shaped around specific customer requirements rather than forcing customers to adapt

to rigid systems. Ontime does not take a one-size-fits-all approach, instead developing its technology around specific customer requirements rather than standardised solutions.

That differentiation required close collaboration during development.

“It has been a massive eye opener for them as well,” he says. “Just understanding all the differentiation that we need.”

One of the most notable outcomes of the new platform is the level of realtime visibility now available across Ontime’s fleet operations. Customers are no longer limited to static tracking or delayed reporting, instead gaining live insight into vehicle locations, delivery progress and order sequencing. This visibility has been particularly valuable for customers managing timecritical or complex deliveries, where certainty around execution directly affects downstream operations.

“The main feedback we get is certainly the ease of use,” Walter says. “You are not just able to see your vehicles tracking, but you can see the orders as they are delivered in real time. You can see the actual order sequence as it is being done.”

The platform also enables dynamic route optimisation in the field, allowing drivers to respond to changing priorities without disrupting the broader delivery run.

“Drivers have the ability to do route optimisation while they are out in the field,” he says. “If a client’s needs change all of a sudden and they say, ‘Forget about delivery number three, go straight to five because it is urgent,’ they go and deliver five and then they optimise the whole thing again.”

According to Walter, this flexibility delivers efficiency benefits across the supply chain, from drivers and contractors through to customers.

“It is about efficiency gains,” he says. “It is making the driver’s life easier, and as a result it is more efficient for everybody. The client gets the cost benefit and the service benefit, and our contractors get the benefit of doing it in the most efficient manner, which

helps reduce their costs so they are not running around all over the place.”

Previously, Ontime’s legacy systems did not support real-time visibility, in-field flexibility or dynamic route optimisation.

Beyond operational efficiency, the new system has changed how Ontime’s customers communicate with their own end customers. Automated messaging and live updates are now embedded into the delivery process, helping manage expectations and reduce uncertainty. Delivery runs are planned with estimated times of arrival before vehicles leave the depot, allowing customers to proactively communicate delivery windows.

“Prior to the driver leaving, the run is sorted and it has an ETA beside it,” Walter says. “From a customer service point of view, they can advise their clients approximately what time the driver will be there or what time window they will be there.”

As deliveries progress, those estimates update automatically.

“If they are running behind or running ahead, it alters,” he says. “They have that live information all the time where they can keep their clients informed.”

For Walter, the impact on customer confidence is clear.

“There is nothing more frustrating than sitting at home because you are told there is a delivery coming and you are just sitting there going, ‘Is it coming or not?’” he says. “We have all taken a day off and then it never shows up. That is what people want to avoid.”

The transition has also expanded Ontime’s reporting capabilities, providing customers with deeper insight into delivery performance and service outcomes. Rather than relying on static reports, customers can now generate their own data views that support analysis across service windows, driver efficiency and lastmile performance.

“The reporting tools are more comprehensive,” Walter says. “It is

easier, and all the information is being collated. Clients have the ability to produce their own reports.”

For Ontime, the availability of this data strengthens its role as a transport partner rather than a transactional provider. Ontime positions itself as a long-term transport partner, using performance data to support more informed, collaborative discussions with customers.

While the transition is well advanced, some internal functions remain on legacy systems as final elements are completed. Customer-facing operations, however, have largely moved to the new platform. Ontime has identified a small number of critical issues that must be resolved before full go-live, largely related to internal functions such as invoicing. Walter expects the full rollout to be completed by the end of the first quarter of the new year.

“There will be ongoing development forever,” he says. “But certainly by the end of the first quarter it will be done.”

The new technology also underpins Ontime’s growing presence in specialist sectors such as food distribution and mobility and healthcare equipment. These industries place higher demands on service quality, communication and delivery execution. In mobility and healthcare deliveries, services often extend beyond drop-off, requiring in-home or on-site setup at hospitals and private residences. These services require trained drivers capable of working with elderly or mobility-impaired customers in sensitive environments.

“That is a great example of needing a specialist carrier with a specialist service,” he says. “Once you get that foothold, it grows. People see you are doing it for someone else and it gives them reassurance.”

For Ontime Delivery Solutions, the move away from legacy systems is not simply a technology refresh. It represents a structural shift in how the business delivers transparency, flexibility and trust across the last mile, at a scale aligned with the evolving expectations of modern supply chains. ■

Radaro has launched Route Optimisation 4.0, replacing car-based mapping with truck-aware, real-time routing to help large delivery networks plan and execute routes more reliably.

Radaro has released Route Optimisation 4.0, a major update to its delivery planning platform that replaces consumer-grade mapping with truck-specific routing and realtime location intelligence, allowing large delivery networks to plan and execute routes based on the actual constraints of commercial fleets.

In response to a significant increase in industrial market demand for Radaro’s capability, the release marks a structural change in how Radaro builds routes, shifting from car-centric navigation tools to HERE Technologies’ enterprise tour planning and location intelligence platform. The new engine is designed to account for heavy vehicles, mixed fleets, compliance rules, traffic conditions and real-time operational change, rather than simply finding the shortest path between stops.

According to Radaro CTO and co-founder Arie Spivak, the change is driven by the growing complexity of last-mile delivery operations across wider cross-industry utilisation.