Volume 25 Number 3 - March 2025

Volume 25 Number 3 - March 2025

03. Editor's comment

05. Pipeline news

Contract news and updates from Saipem, Eni, Penspen and more.

KEYNOTE: HYDROGEN PIPELINE TRANSPORT

08. From science fiction to reality

World Pipelines Contributing Editor, Gordon Cope, studies the future of the global midstream hydrogen economy.

15. Hydrogen's tipping point

Kimberly Sari, ILF Consulting Engineers.

19. Verifying the hydrogen flow of the future Niamh Rogers, Lucie Dangeon-Vassal, and Rémy Maury, Cesame-Exadebit.

CONSTRUCTION

25. A progressive approach to pipeline welding Jason Blubaugh, Miller Electric Mfg. Co.

FLOW

31. Ensuring flow assurance in a changing environment Jim Bramlett, Tracerco.

COATINGS AND CORROSION

33. CUI management: manual vs predictive inspection Dr Prafull Sharma, CorrosionRADAR.

ENVIRONMENT

37. Robust solutions for the new energy sector Nora Brahmi and Corinne Willecombe, Vallourec.

HEAVY EQUIPMENT

42. Superior protection, faster installation Meghan Connors, PipeSak.

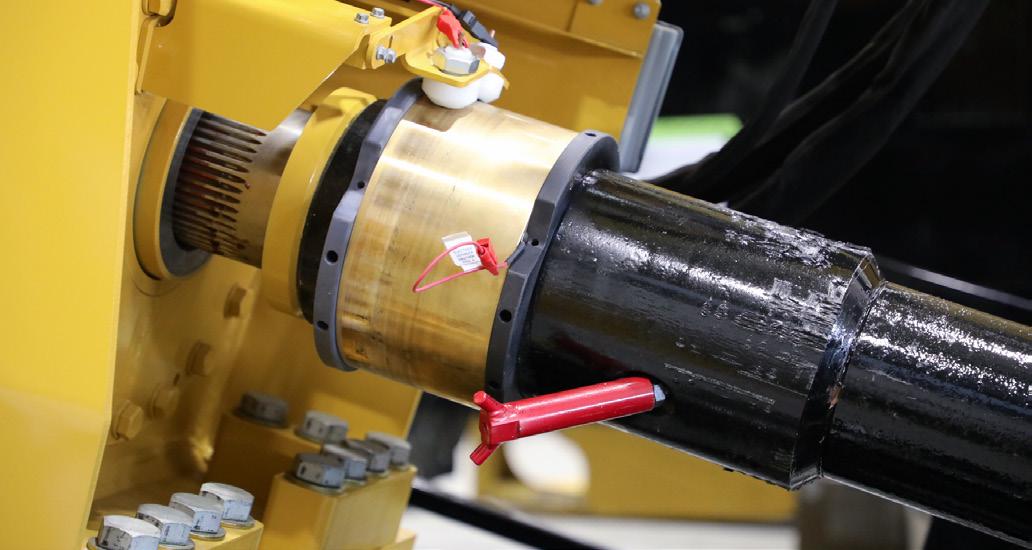

51. Maximising productivity with maxi rig maintenance

Kelly Beller, Vermeer Corporation.

SYSTEMS AND SOFTWARE

55. A new dawn for GIS and pipeline integrity management

Michael Ray and John Minassian, Emerson.

AWARD WINNERS: YPI

61. Recognising young achievement

Zachary Booth, DNV, and Kaushal Shah, ICF.

Ultimate Surface Preparation – Made in Germany. The world’s only hand tools that can “sandblast”. The patented Bristle Blaster® Technology removes corrosion and coatings quickly and thoroughly. At the same time, the Bristle Blaster® creates surface preparation grades comparable with Sa2½ (SSPC-SP 10/NACE No. 2) to Sa3 (SSPC-SP 5/NACE No. 1) and roughness levels of up to 120 μm Rz. Consequently, surfaces that have been treated by the Bristle Blasting tool have a

and visual cleanliness that mimics those

MANAGING EDITOR

James Little

james.little@worldpipelines.com

EDITORIAL ASSISTANT

Alfred Hamer alfred.hamer@worldpipelines.com

SALES DIRECTOR

Rod Hardy rod.hardy@worldpipelines.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@worldpipelines.com

SALES EXECUTIVE

Daniel Farr daniel.farr@worldpipelines.com

PRODUCTION DESIGNER

Amy Babington amy.babington@worldpipelines.com

HEAD OF EVENTS

Louise Cameron

louise.cameron@worldpipelines.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@worldpipelines.com

EVENTS COORDINATOR

Chloe Lelliott chloe.lelliott@worldpipelines.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@worldpipelines.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@worldpipelines.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@worldpipelines.com

ADMINISTRATION MANAGER

Laura White laura.white@worldpipelines.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.worldpipelines.com Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada: World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Avenue, Folcroft, PA 19032.

In a few ways, the pipeline industry is currently revisiting the past.

Texas-based Energy Transfer’s lawsuit against Greenpeace has made it to the courts in North Dakota. The trial, which is expected to last into April, sees Energy Transfer allege that protest tactics by the environmental organisation delayed the Dakota Access Pipeline project.

The lawsuit accuses Greenpeace of an “unlawful and violent scheme to cause financial harm to Energy Transfer, physical harm to its employees and infrastructure, and to disrupt and prevent Energy Transfer’s construction of the Dakota Access Pipeline”.

Greenpeace says it did not lead the protests, which took place near the Standing Rock Sioux Reservation, saying that it instead helped support “nonviolent, direct-action training” on safety and de-escalation on-site.

You’ll recall that the protests drew crowds of over 10 000 to the encampment, as they attempted to block the path of the pipeline from crossing the Missouri River, upstream from Standing Rock. The protests started in April 2016 and ended in February 2017 when the National Guard and police cleared the site.

Energy Transfer brought a similar federal lawsuit in 2017, arguing that protesters had violated the Racketeer Influenced and Corrupt Organisations Act (Rico), which is an allegation commonly made against organised crime groups. A judge dismissed the case.

The new state trial is taking place in conservative North Dakota. If it is found that Greenpeace tried to delay construction of the pipeline, defamed the companies behind it, and coordinated trespassing, vandalism and violence by pipeline protesters, then damages could run to US$300 million. Greenpeace says it would “face financial ruin, ending over 50 years of environmental activism”.

In another blast from the past, President Trump has declared that he wants the Keystone XL pipeline built, pledging easy regulatory approvals for the previously cancelled project. The permit for KXL was revoked by the Biden administration in 2021, following years of opposition and delays under Obama (who rejected it in 2015).

The multi-billion dollar, 1200 mile pipeline project was designed to bring oilsands from western Canada to US refiners and was owned by TC Energy Corp.

South Bow Corp., the oil pipeline business that spun off from TC Energy Corp., has indicated that it is not interested in a revival of the project. Parts of the system, which runs through Alberta, Montana, South Dakota and Nebraska, have already been dismantled, and key permits have long since expired.

“If not them, perhaps another pipeline company,” Trump said in a post on his social media network. “We want the Keystone XL Pipeline built!”

Back to 2025 and the challenges of getting new pipeline infrastructure in the ground still remain: in the keynote article for this issue, our correspondent Gordon Cope writes about how the building of hydrogen pipeline transport has gone “from science fiction to reality” (p.8). ILF writes about the specific regulatory, financial, stakeholder and supply chain hurdles that are bottlenecking hydrogen pipeline projects in Europe (p.15). PipeSak describes working with several pipeline operators (TC Energy, Williams, Enbridge) on protecting pipe coatings during construction (p.42). And I speak to the two winners of the PPIM 2025 YPI Award for Young Achievement about what it’s like to be a young pipeliner in 2025, and how the future looks to this new generation of pipeline workers.

Global oil and gas contract value remains stable in 4Q24: GlobalData

The global oil and gas industry experienced a 15% quarter-onquarter decrease in the total number of contracts, from 1596 in 3Q24 to 1353 in 4Q24. Despite the dip in volume, the overall contract value remained stable, driven by the announcement of some major contracts in Africa, reveals GlobalData.

GlobalData’s latest report, ‘Oil and Gas Industry Contracts Review by Sector, Region, Terrain and Top Contractors and Issuers, Q4 2024,’ reveals that the overall contract value remained relatively stable at US$39.2 billion in 4Q24 compared to US$38.8 billion in 3Q24.

The major contracts announced in the African region include Tecnicas Reunidas and Sinopec Engineering’s US$4 billion new deep conversion oil refinery project in Algeria’s Hassi Messaoud region, and US$1.4 billion Wuhuan Engineering and WeDo’s ammonia and urea plant project in Angola.

Pritam Kad, Oil and Gas Analyst at GlobalData, comments: “Sinopec Engineering replacing Samsung Engineering to partner with Tecnicas Reunidas for the 5 million tpa deep conversion refinery project in the Hassi Messaoud region of Algeria was a

significant value booster, along with the support from JGC Indonesia US$2.4 billion compression contract for the Tangguh LNG contract, Saipem’s US$1.9 billion GranMorgu subsea development contract in Suriname, and Wuhuan Engineering and WeDo’s contract for an ammonia and urea plant in Angola. These contracts were crucial in keeping the contract value stable despite the decline in volume.”

Operation and maintenance (O&M) represented 50% of the total contracts in 4Q24, followed by procurement scope with 30%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 10%.

Some other notable contracts during the quarter were Bram Offshore and Starnav Servicos Maritimos’ US$2.74 billion construction and charter contract from Petrobras for 12 Platform Supply Vessels (PSVs) and Saipem’s US$1.9 billion contract from TotalEnergies EP Suriname for the EPC, supply, pre-commissioning, and commissioning assistance for the subsea umbilicals, risers, and flowlines (SURF) package for the GranMorgu project in Suriname.

Saipem announces agreement in principle for merger with Subsea7 Saipem and Subsea7 have announced that they have reached an agreement in principle on the key terms of a possible merger of the two companies through the execution of a Memorandum of Understanding (MoU). The proposed combination is expected to create a global leader in energy services.

The combination of Saipem and Subsea7 will be renamed Saipem7, and will have a combined backlog of €43 billion, revenue of approximately €20 billion and EBITDA in excess of €2 billion.

The merger would create a global organisation of over 45 000 people, including more than 9000 engineers and project managers. Saipem and Subsea7 shareholders will own 50% each of the share capital of the combined company. Subsea7 shareholders will receive 6.688 Saipem shares for

each Subsea7 share held. Subsea7 will distribute an extraordinary dividend for an amount equal to €450 million immediately prior to completion.

The transaction is expected to deliver material value creation for the shareholders of both Saipem and Subsea7. Annual synergies of approximately €300 million are expected to be achieved in the third year after completion, with oneoff costs to achieve such synergies of approximately €270 million.

The combined company will be listed on both the Milan and Oslo stock exchange. Siem Industries, reference shareholder of Subsea7, as well as Eni and CDP Equity, reference shareholders of Saipem, have expressed their strong support and intend to vote in favour of the transaction.

Completion is anticipated to occur in 2H26.

Kazakhstan’s primary oil export route, managed by the Caspian Pipeline Consortium (CPC), was disrupted due to a drone strike on 17 February at the Kropotkinskaya pumping station. Situated in the Kavkazsky district of Kuban, the station is the largest CPC pump station in Russian territory, CPC said.

The attack, involving seven drones, has been labelled as an act of terrorism by the consortium.

While the CPC did not directly attribute the incident to Ukraine, an official from Ukraine’s SBU security service claimed responsibility for the attack, stating that it targeted the pumping station and the nearby Ilsky oil refinery, reported Reuters.

The strike occurred a day before US Secretary of State

Marco Rubio met Russian Foreign Minister Sergei Lavrov in Saudi Arabia for Ukraine war talks.

In a statement, CPC said that, as a result of the strike, the Kropotkinskaya pumping station “has been taken out of service. Crude transportation through Tengiz-Novorossiysk pipeline system is being maintained at reduced flowrates.”

The CPC pipeline is a key channel for global oil supply, with Kazakhstan contributing approximately 1% of the world’s oil.

The Tengiz-Novorossiysk pipeline spans 1511 km, carrying more than two-thirds of Kazakhstan’s oil exports along with crude from Russian oilfields, including those in the Caspian region. Other shareholders in the CPC include Shell, Italy’s Eni and the Russian state.

6 - 10 April 2025

AMPP 2025

Nashville, USA

https://ace.ampp.org/home

5 - 8 May 2025

6 gas

20th Pipeline Technology Conference Berlin, Germany

https://www.pipeline-conference.com/

5 - 8 May 2025

Offshore Technology Conference 2025 Houston, USA

https://2025.otcnet.org/

19 - 23 May 2025

29th World Gas Conference (WGC2025)

Beijing, China

https://www.wgc2025.com/eng/home

25 - 29 May 2025

Annual Pipe Line Contractors Association of Canada (PLCAC) Convention

Banff, Canada

https://pipeline.ca/

10 - 12 June 2025

Global Energy Show 2025 Calgary, Canada

https://www.globalenergyshow.com/

25 - 26 June 2025

Carbon Capture Technology Expo North America 2025 Houston, USA

https://www.ccus-expo.com/about/registrationnorth-america

9 - 12 September 2025

Gastech Exhibition & Conference

Milan, Italy

https://www.gastechevent.com/visit/visitorregistration/

On 17 February, the Minister of Petroleum and Mineral Resources of the Arab Republic of Egypt Karim Badawi, the Minister of Energy, Commerce and Industry of the Republic of Cyprus George Papanastasiou, the Chief Executive Officer of Eni Claudio Descalzi, as well as TotalEnergies; signed in Cairo the Host Government Agreement for the exploitation of Cyprus’ Cronos Block 6 resources.

This agreement is a step on the way to establishing a gas hub in the Eastern Mediterranean capitalising Egypt’s existing hydrocarbon infrastructure and positioning Cyprus as a gas producer and exporter. It outlines a comprehensive framework enabling a rapid development of the Cronos gas discovery offshore Cyprus: the gas will be transported and processed in existing Zohr facilities to be then liquefied in the Damietta

Penspen announces US$120 million new contract awards

Penspen has announced US$120 million awarded in new contracts during 2H24, a 14% increase on the same period in 2023, taking total 2024 sales to over US$225 million.

Middle East and Africa Region represents 26 new contracts with a total value of US$98 million including study, FEED, detailed design, integrity assessment, fitness-for-service (FFS) assessment, project management supervision and consultancy services.

The Kingdom of Saudi Arabia Region has two new renewable energy-focused framework agreements covering the provision of study, FEED, detailed design and project management supervision services for hydrogen production, wind and geothermal energy supply.

In the UK and Europe region, Penspen reports 57 new contracts with a total value of US$16 million including fuelling terminal operations, pipeline maintenance and inspection, hydrogen repurposing, hydrogen blending, carbon capture studies, gas compression upgrades, and pipeline diversions.

In North America and Latin America, there were 18 new contracts with a total value of US$5 million including projects for pipeline fitness for service, electrical interference and cathodic protection studies, gas pipeline project management, production operations support, and environmental testing.

LNG plant for export to European markets. Eni CEO, Claudio Descalzi, commented: “This agreement paves the way to bring Cyprus’ gas to the market in a timely fashion, contributing to energy security and competitiveness of energy supply. This project leverages Egypt’s existing infrastructure, including export facilities, which are a key enabler for developments in the Region. Egypt and Cyprus reaffirm their roles in the emerging energy hub of the Eastern Mediterranean, which is set to play an increasing role in the global gas supply in the near future”.

Discovered in 2022 and subsequently appraised in 2024, Cronos gas in place is estimated at more than 3 trillion ft3 Additionally, Block 6 encompasses further potential resources under exploration and appraisal.

• US approves LNG exports, forms energy council to boost oil and gas

• Energy Transfer and CloudBurst sign agreement for natural gas supply to data centre project in Central Texas

• Five countries sign joint declaration of intent to continue work on southern hydrogen corridor

• ECITB Census reveals challenges facing oil and gas

• Howard Energy Partners acquires operating interest in Midship Pipeline

Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

PROTECTIVE OUTERWRAPS

World Pipelines’ Contributing Editor, Gordon Cope, studies the future of the global midstream hydrogen economy.

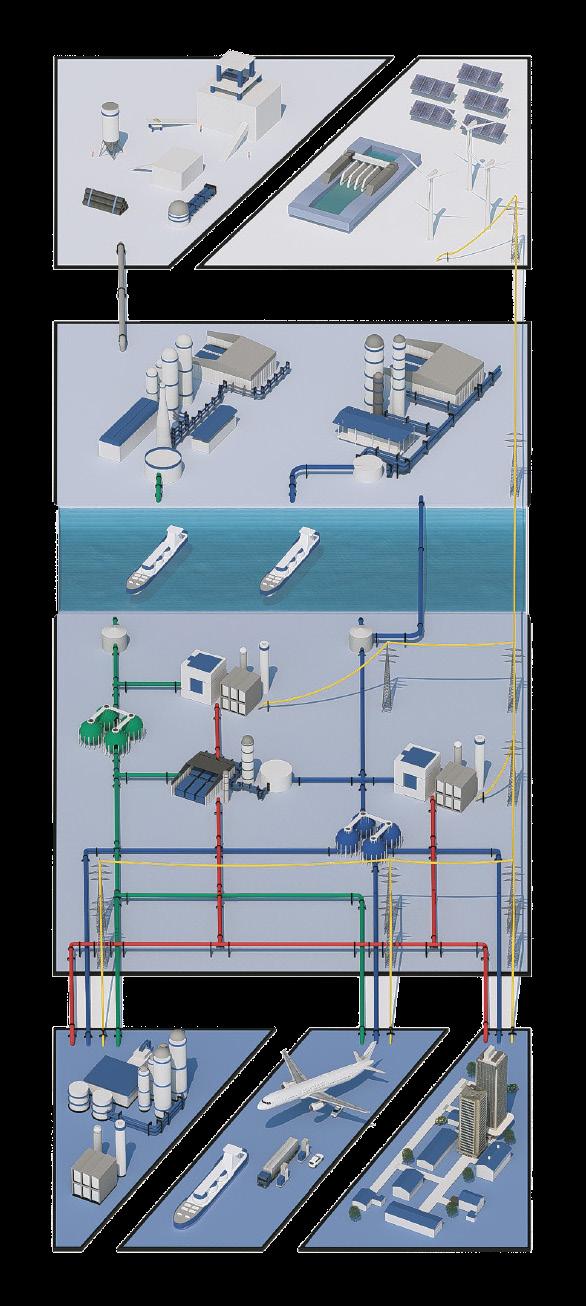

nce considered the realm of science fiction, the hydrogen economy is now achieving reality. A combination of environmental goals and the spectre of energy warfare has super-charged its implementation.

The EU is leading the way. Over €13 billion has been earmarked for improving hydrogen technology, production and demand. Analysts calculate that approximately US$23 billion is needed to build offshore wind farms to generate an estimated 300 terawatt hours (TWh) of power, enough to create up to 15% of the estimated hydrogen consumption in 2050.

The Netherlands has launched an ambitious plan. Up to 700 MW of generation has been slated for the Ten noorden van de Waddeneilanden site in Dutch waters. In late 2023, Dutch gas network operator Gasunie began pipeline construction near the port of Rotterdam, with the intention of connecting four regional hydrogen hubs by 2030 (although the company recently announced permitting issues and staffing problems have pushed that deadline out to 2033).

Germany is also pursuing an aggressive adoption policy. The core production and distribution network has been estimated to cost US$21.6 billion and extend for 9700 km, and would to be built by private investors and financed by user fees. Germany’s gas transmission association FNB Gas announced that the first 525 km of the hydrogen core grid would be built in 2025 by converting 507 km of existing gas pipe and building 18 km of new pipe. They estimated that the entire system would be completed by 2032.

Other countries have announced similar plans. Ireland is exploring a subsea pipeline to deliver hydrogen to Scotland, which would augment the designs that the Net Zero Technology Centre in Aberdeen has regarding converting the country’s abundant wind energy into exports. The Centre estimates that a newbuild hydrogen pipeline capable of meeting 10% of mainland Europe’s needs would cost £2.7 billion and be online by the mid-2030s.

Belgium’s gas transmission operator Fluxys plans to spend US$2.19 billion on a hydrogen pipeline network that would connect Dunkirk, Zeebrugge, Ghent, Antwerp, Liege, Cherlero, Mons and Brussels by 2033.

UK-firm HyNet is planning an 85 km dedicated-hydrogen pipeline network that will be the backbone of its plan to supply the industrial region of Liverpool with low carbon energy. In phase 1, blue hydrogen will be produced and consumed at the Stanlow Manufacturing Complex and nearby off-takers. Phase 2 will see up to 270 km of new pipe extended throughout the region to serve regional utilities. In addition, salt caverns will be converted to hydrogen storage in order to smooth supply and demand profiles.

When it comes to rolling the EU network out, however, significant technological and economic challenges exist. For instance, AC transmission of electricity from offshore wind farms faces unacceptable power losses as distances exceed 100 km. One way to avoid losses is Power to Gas (P2G), in which seawater is desalinated as feedstock in order to create hydrogen through electrolysis on-site, then transporting the gas to shore via repurposed natural gas pipelines. While research is focusing on surmounting technical difficulties, transferring such a mass of new technology to industrial scale at an offshore site will be fraught with difficulties.

Secondly, hydrogen causes embrittlement in traditional steel pipelines, creating the potential for catastrophic failure. Holland’s Gasunie asserts that existing gas networks are safe, while international experts express doubts, causing implementation delays. German utility giant Uniper, which is part of Gasunie’s plan to build the Delta Rhine Corridor (DRC) to connect the Port of Rotterdam to Germany, has spoken publicly about its concerns over the delays that are pushing commissioning from 2030 to 2034. In September 2024, the expected approval of Germany’s core hydrogen pipeline network by the country’s Federal Network Agency was also delayed due to redesign issues.

African nations are eyeing the immense market in Europe and making plans. Algeria is keen to leverage its abundant solar and wind power to deliver low-carbon hydrogen to the EU. State-owned energy firms Sonatrach and partners have signed a memorandum of understanding with Italian grid operator Snam, VNG of Germany, and Austria’s Verbund to launch feasibility studies for large-scale green hydrogen production and a pipeline network across the Mediterranean. Tunis is also eager to participate. Germany and Italy

are planning a hydrogen-ready pipeline, dubbed SoutH2, that would receive gas from Tunisia and deliver it to northern Europe.

While abundant supplies of cheap natural gas makes security concerns in North America far less onerous than Europe, both Ottawa and Washington have imposed net-zero goals by 2050 on wide swathes of their economies. As part of the goals, they have followed up with multi-billion-dollar subsidies, research grants and tax incentives to promote hydrogen.

Major refining sectors in Alberta and the US Gulf Coast (USGC) already possess hydrogen pipeline networks. In the latter, over 2500 km of dedicated pipelines move several million tpy of hydrogen from its sources of manufacture to refineries and petrochemical plants.

Spurred by incentives of up to US$3/kg, hydrogen manufacturers are investing in solar/wind farms, electrolysis plants, and carbon capture and sequestration (CCS) systems. Air Liquide has 20 plants in the USGC and operates over 900 km of the regional hydrogen pipeline network. In order to supply commercial quantities of low-carbon hydrogen, the company is building the Blue Energy Complex in Louisiana. As part of the complex, Air Liquide is installing a module to produce 750 million ft3/d of blue hydrogen. The system will capture up to 95% of CO2 from its auto-thermal reforming (ATR) unit; in all, the complex will permanently sequester 5 million tpy under nearby Lake Maurepas.

In Canada, Air Products is building a revolutionary hydrogen energy complex in the Fort Saskatchewan industrial region near Edmonton, Alberta. The CAN$1.6 billion facility will create 2200 tpy of blue hydrogen, also using ATR. Air Products will then use its 55 km pipeline network to deliver blue hydrogen to Shell’s diesel refinery, as well as to third parties in the industrial region.

Engineering trials have shown that blends of up to 5% hydrogen do not cause steel embrittlement, and there is widespread interest among North American utilities to mix low-carbon hydrogen into existing pipeline networks. New Jersey Resources Corp. is building a green hydrogen project in Howell, New Jersey, and will inject the output into its system. Atlanta-based Southern Company, which serves over four million customers, is experimenting with gas/hydrogen blends in its infrastructure. Virginia-based Dominion Energy is pursuing a 5% blend of hydrogen in their natural gas pipelines.

The state of California is taking the next step. It is using a US$1.2 billion grant from the US Department of Energy to create a regional clean hydrogen hub, to be operational by the end of 2033, that will supply a wide array of industrial users. As part of the initiative, Southern California Gas (SoCalGas) is developing Angeles Link, a dedicated, green hydrogen pipeline system that could deliver enough hydrogen to displace the equivalent of 3 million gal./d of diesel fuel. The pipeline would likely originate in the wind and solar-rich desert east of Los Angeles, where third parties would produce the low-carbon hydrogen, and terminate within the Los Angeles basin near current utility plants or the port of Los Angeles. In October 2024, Spain’s RIC announced plans to build a 1GW electrolyser plant on 300 acres in the Mojave Desert, 300 km east of Los Angeles. In December 2024, SoCalGas filed a state application to advance Phase 2, which would further extend the network beyond the boundaries of the Los Angeles basin.

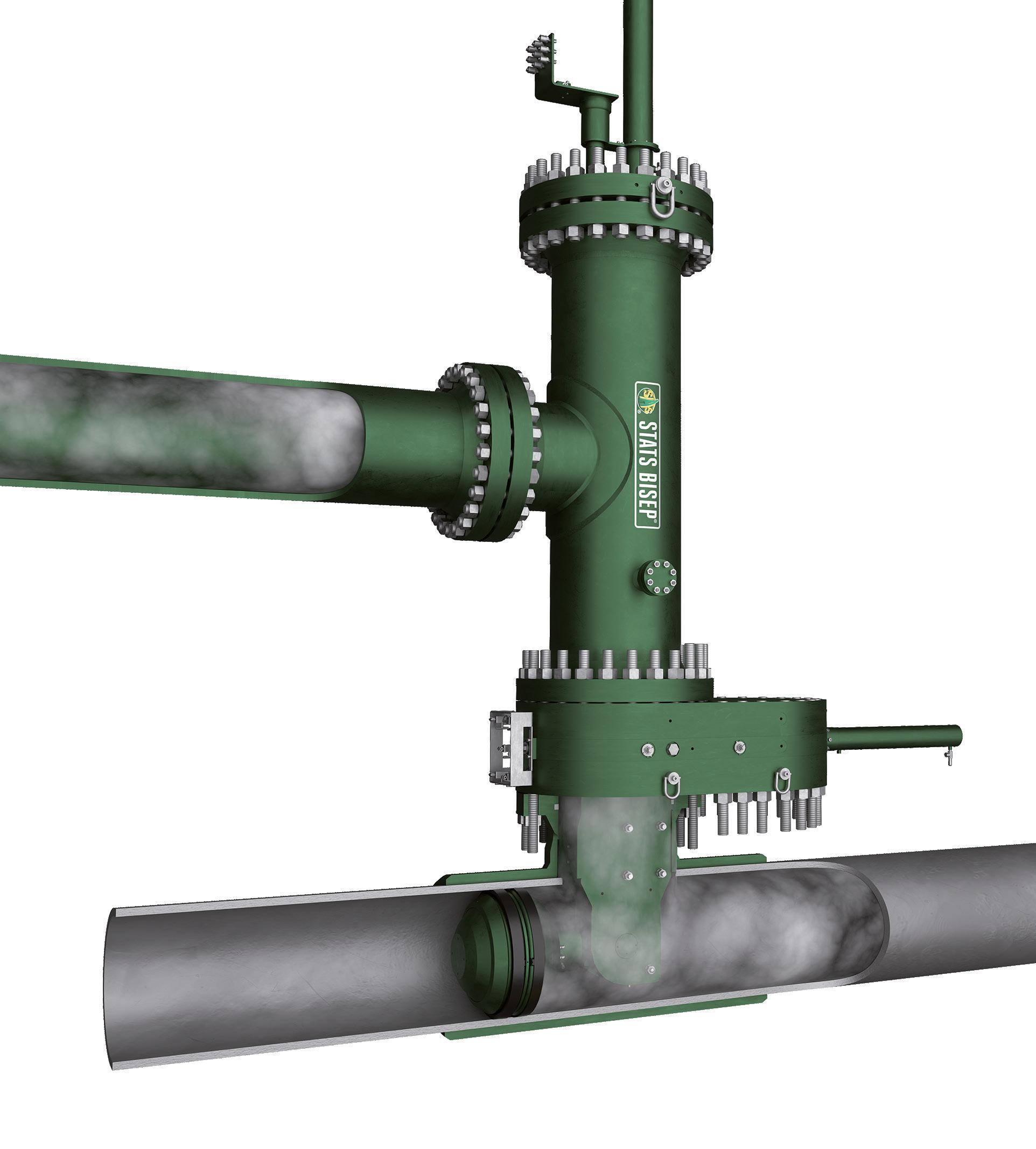

integrated bypass maintains production during isolation

Dual Leak-Tight Seals

Double Block & Bleed Isolation

Isolated Pipeline

Monitored Zero-Energy Zone

The BISEP® has an ex tensive track record and provides pioneering double block and bleed isolation while

dual seals provide tested, proven and fully monitored leak-tight isolation, ever y time, any pressure.

Jurisdictions throughout Asia have announced ambitious plans to participate in the hydrogen economy. In October 2024, the largest province in South Korea announced it would build a comprehensive clean hydrogen network. North Gyeongsan’s system will include a small, 100 MW nuclear reactor to produce ‘pink’ hydrogen through hydrolysis, and a 1000 km pipeline network to deliver the fuel to users.

China is the world’s largest producer of traditional hydrogen, with approximately 33 million tpy made from coal and natural gas. In 2022, Beijing announced a multi-decade plan to build a complete low-carbon hydrogen value chain; an initial goal of at least 100 000 tpy has been set for 2025. So far, 64 000 tpy of solar and wind-powered electrolysis capacity has been created by Sinopec and other energy firms, with the goal of adding another 160 000 tpy by the end of 2025. In January 2024, construction of the world’s longest hydrogen pipeline began. The line will stretch 737 km from a green hydrogen facility in the city of Zhangjiakou to the port of Caofeidian (located 250 km southeast of Beijing). Tangshan Haitai New Energy Technology and China Petroleum Pipeline Engineering Corporation, developers of the US$845 million line, say the project will promote the export of green hydrogen.

Japan is deficient in traditional fossil fuels, and views hydrogen as a next-generation energy source that will decrease GHG emissions and augment security. In addition to boosting hydrogen supplies from 4 million tpy to 12 million tpy by 2040, it is investing heavily in hydrogen-related research in order to power diverse sectors. Nippon Steel has converted a blast furnace to hydrogen, lowering CO2 /t emissions by 33%. Tokyo Gas, which imports almost 13 million tpy of LNG, intends to blend e-methane and hydrogen into its distribution system. In March 2024, it also launched a hydrogen pipeline network to deliver fuel to the former residence of athletes at the Tokyo Olympics and Paralympics.

In February 2024, refiner Idemitsu Kosan announced it would build a 10 000 tpy green hydrogen plant in partnership with Hokuden, a utility located on Japan’s northernmost island of Hokkaido. The plant will be built in the port of Tomakomai and connected to the refinery via pipeline. Idemitsu is also participating in ExxonMobil’s planned 900 000 tpy low-carbon hydrogen and ammonia plant in Baytown, Texas. The plan is to offtake ammonia and deliver it to the company’s import terminal in Shunan City, on the island of Honshu, where it will be subsequently distributed to industries and utilities for combustion.

The hydrogen economy faces a daunting task; how do you finance a new form of fuel when there are no takers? BNEF, a consultancy, estimates that just 12% of proposed clean hydrogen projects have contracted off-takers. “No sane project developer is going to start producing hydrogen without having a buyer for it, and no sane banker is going to lend money to a project developer without reasonable confidence that someone’s going to buy the hydrogen,” noted a BNEF analyst.1

The paucity of firm contracts is forcing producers to rethink projects. In September 2024, Shell, citing lack of market demand, cancelled plans to build a low-carbon hydrogen plant on Norway’s west coast. The same month, Equinor also announced that it would not build a pipeline designed to carry up to 10 GW of blue

hydrogen from Norway to Germany, citing a lack of customers and uncertain regulatory framework. In October 2024, Spain’s Repsol announced that it would pause 350 MW of electrolysis capacity in its home country, due to tax policy and demand concerns.

Plans to build pipelines are also getting ahead of the regulatory framework necessary to grant permissions and certify safety. In North America, several states, including Texas and North Dakota, have passed legislation allowing intra-state networks, but any efforts to cross borders run into a roadblock. The Department of Energy’s (DOE) Federal Energy Regulatory Commission (FERC) is responsible for interstate natural gas lines, but doesn’t have the authority to approve hydrogen pipelines. While some call for federal regulations, others worry that an overreaching bureaucracy would stifle nascent initiatives with red tape.

A very large question looms over the future of the hydrogen economy; the discovery of white, or natural hydrogen deposits. Virtually ignored by energy companies until very recently, it turns out that the earth has enough to last for several millennia; the USGS speculates that there could be as much as 5 trillion t beneath the ground. Geologists are piecing together where it is being produced (where water comes in contact with basalts), and coalescing into reservoirs (similar to gas traps). Currently, there are over forty companies searching worldwide for economic deposits, including Canadian, Australian, American and European firms.

This may not be all bad. While the spectre of stranding expensive electrolysis plants hangs over the sector, natural hydrogen may turn out to be a blessing in disguise. Experience with unconventional resources has revealed that it now takes about two decades for new sources of energy to dominate the market (shale gas went from virtually nothing in 2005 to now accounting for the majority of the 115 billion ft3/d produced in North America). In the space of the next decade, the cost of green hydrogen is expected to approach the magic US$1/kg range through advances in technology. At the same time, discoveries of cheap natural hydrogen reservoirs will gain traction. Green hydrogen plants can be built anywhere (normally near refineries and such), while hydrogen reservoirs will require extensive pipeline networks to deliver to market.

While the former will enrich solar and wind power producers, the latter will benefit the midstream sector.

The rollout of the hydrogen economy will likely proceed in a patchwork manner as governments, energy producers and industrial consumers wrestle with mandates, markets and demand. The EU will continue to nurture its development, spurred by both net-zero legislation and energy security concerns. The Chinese government has sent a clear message to state-owned enterprises; full steam ahead. Japan, with its eye to the future, will continue to invest heavily in R&D and infrastructure. The Trump administration has expressed its aversion to hydrogen subsidies and tax breaks and will likely put the brakes on some North American projects. Regardless, pipeline companies will play an integral part in those projects that succeed, facing significant risks as well as substantial rewards.

References

1. https://oilprice.com/Latest-Energy-News/World-News/Shell-AbandonsNorways-Hydrogen-Projects-Due-To-Lack-Of-Demand.html

CLEAN & PROFILE IN A SINGLE STEP

NEAR WHITE/ WHITE METAL CLEANLINESS

he hydrogen sector in Europe is at a critical crossroads, with stakeholders navigating varying levels of readiness. Transportation stakeholders, for example, benefit from a relatively structured regulatory environment, enabling them to push forward. By contrast, other key players, such as offtakers, operate within uncertain conditions that hinder the development of the sector as a whole. This uneven playing field highlights an urgent need for alignment across the supply chain, particularly as Europe pushes toward its ambitious decarbonisation goals.

Regulatory clarity: uneven ground for stakeholders

Regulations play an essential role in shaping the low-emission molecule and hydrogen market. While the European Union has made significant progress in establishing directives, such as those governing ‘green’ hydrogen and Renewable Fuels of Non-Biological Origin (RFNBO), many Member States lag in transposing these directives into national legislation. This delay creates an uneven environment for stakeholders.

Kimberly Sari, ILF Consulting Engineers, highlights the necessary changes and alignment to push Europe’s hydrogen sector past its tipping point.

Transportation stakeholders benefit from clearer regulatory structures, such as those guiding the repurposing of natural gas pipelines for hydrogen transport and storage. This regulatory certainty allows them to make informed decisions and implement long-term plans. However, developers and offtakers face greater uncertainty. For developers, ambiguity in standards, particularly around the classification of ‘low-carbon’ hydrogen, complicates project planning and investment decisions. For offtakers, the lack of a consistent framework for hydrogen use across sectors, such as maritime and heavy industry, reduces confidence in committing to long-term agreements.

The EU’s ‘Fit for 55’ package offers a roadmap for cutting greenhouse gas emissions by 55% by 2030. However, achieving these targets requires more than ambitious legislation. It demands coordinated efforts among stakeholders across the value chain, from policymakers and financiers to developers and offtakers. Without a clear regulatory environment for all stakeholders, these efforts remain fragmented, slowing the pace of development.

Financing: a misalignment of needs and risks

Financing remains one of the most significant bottlenecks in Europe’s low-emission molecule and hydrogen market. The financial sector is well-established and ready to invest in low-emission molecule projects, but its traditional risk management tools are often incompatible with the unique challenges of these projects. Developers struggle to demonstrate bankability due to high upfront costs,

extended project timelines, and a lack of long-term offtake agreements that would secure revenue streams.

This misalignment leaves even the most promising projects at a standstill. Public financial institutions like the European Hydrogen Bank and initiatives like H2Global are working to mitigate these early-stage risks by providing auctions and guarantees that attract private investment. While these mechanisms are helpful, they are not sufficient to meet the sector’s growing needs.

Risk-sharing remains a key issue. The short- to mediumterm planning preferences of offtakers clash with the longterm financial commitments required by developers and financiers. This mismatch creates a vicious cycle: offtakers are hesitant to commit without established infrastructure and stable pricing, while developers cannot secure financing or proceed with projects without those commitments. Breaking this cycle requires innovative solutions, including government-backed guarantees, new financing tools, and stronger collaboration between stakeholders.

Developers: leading the charge despite hurdles

Among all stakeholder groups, developers have made the most progress in preparing for a low-emission molecule and hydrogen-driven future. They are actively working on large-scale production and import projects to meet Europe’s ambitious targets. However, their efforts are frequently stymied by two major obstacles: difficulties in obtaining financing and the absence of long-term agreements with offtakers.

Securing a final investment decision (FID) for capital-intensive hydrogen projects requires careful planning in both engineering and financing. Developers must navigate tight deadlines, evolving regulatory requirements, and high levels of financial risk. These challenges are further compounded by the absence of long-term commitments from offtakers, who often prefer flexible, short-term arrangements that allow them to adapt to energy price volatility. Despite these challenges, developers remain optimistic about the future. High-level political support, substantial engineering solutions, and the potential to repurpose existing natural gas infrastructure provide a foundation for growth. However, to accelerate progress, developers need stronger commitments from other stakeholders, particularly financial institutions and offtakers.

The transportation and storage of hydrogen present another set of challenges. Europe’s existing infrastructure is insufficient to support the intercontinental transportation of low-emission molecules and hydrogen and its domestic distribution within the continent. Key investments are needed to expand ports, pipelines, and storage facilities. Repurposing existing natural gas infrastructure offers a practical solution for some of these challenges. For

Versatile

High Strength

Convenient

Corrosion Resistant

Excellent Cost-to-Strength Ratio

Conformable

AQUAWRAP:

Low Cost

Simple and Easy-to-Use – Just “Rip & Wrap”

Cures in Wet Conditions and Underwater

Excellent Toughness – Resists Cracking

Heat Resistant to 250°F.

Non-Hazardous

30-Minute Working Time,

Perfect for Long Installations

High Strength

instance, converting natural gas pipelines into hydrogen pipelines could reduce costs and accelerate deployment. Cavern storage also holds significant potential for stabilising supply, particularly as hydrogen production scales up.

The main hurdle in infrastructure development is timing. The rapid growth of hydrogen demand requires infrastructure to expand at a similar pace. This necessitates close coordination among transmission system operators, government agencies, developers, and offtakers. Without proactive investment and planning, infrastructure bottlenecks could stall the market’s development.

Offtakers hold the key to unlocking the full potential of Europe’s low-emission molecule and hydrogen market. Their willingness to enter into long-term purchase agreements provides the revenue certainty developers need to secure financing and move projects forward. However, many offtakers remain hesitant due to regulatory uncertainty and the lack of a clear business case for hydrogen adoption.

To address this hesitancy, policymakers must establish clearer regulations and quotas for hydrogen use across industries. These measures will provide the market signals offtakers need to commit to long-term agreements. Additionally, pricing models that reflect the green premium of low-emission hydrogen should be standardised to support early adopters.

Financial tools and policy mechanisms can also play a role in reducing ‘first-mover’ risk for offtakers. By providing guarantees or subsidies, governments can encourage companies to take the initial steps toward hydrogen

adoption. These commitments will, in turn, create a ripple effect, enabling developers to secure financing and accelerating the overall market cycle.

The low-emission molecule and hydrogen market is stuck in a classic “chicken-and-egg” dilemma. Developers need offtakers to commit before they can secure financing, while offtakers need a reliable supply and clear market conditions before they can commit. This cycle of hesitation slows progress and jeopardises Europe’s decarbonisation goals.

Breaking this cycle requires coordinated action across the stakeholder value chain. Governments must step in to provide early-stage support through subsidies, guarantees, and public-private partnerships. Developers and offtakers must work together to establish long-term agreements that align with the needs of both parties. Financial institutions, in turn, must adapt their risk management tools to better align with the realities of low-emission molecule and hydrogen projects.

The recently published white paper, Low-Emission Molecules: Insights into an Emerging Sector, offers valuable insights into these challenges. Based on interviews with 31 industry managers, the paper highlights the barriers and opportunities within the low-emission molecule and hydrogen market and provides actionable recommendations for accelerating progress.

Key strategies include decoupling production from offtake, fostering vertical cooperation among stakeholders, regulating the transport of low-emission molecules, establishing strategic hydrogen reserves, protecting first movers, and adopting business case hedging. These recommendations provide a roadmap for stakeholders to overcome current challenges and create a more integrated, efficient hydrogen market.

As Europe races to meet its decarbonisation targets, the hydrogen market must accelerate its development. This requires stronger collaboration, clearer regulations, and innovative financing solutions. By addressing the current misalignments and breaking the cycle of hesitation, stakeholders can unlock the full potential of low-emission molecules and hydrogen as a key driver of the energy transition.

The findings of the white paper serve as a vital resource for policymakers, developers, financiers, and offtakers. With coordinated efforts and a shared commitment to progress, the hydrogen market can overcome its current challenges and drive the clean energy future in Europe.

Niamh Rogers, Lucie Dangeon-Vassal and Rémy Maury, Cesame-Exadebit, present an initiative for flow measurement traceability for hydrogen in gas networks.

o mitigate the most severe consequences of climate change, it is imperative to significantly decrease greenhouse gas emissions. Achieving this goal necessitates a reduction in Europe’s dependence on fossil fuels, as well as the rest of the worlds.

Hydrogen presents a viable and sustainable alternative, capable of being transported and distributed across long distances through gas networks while addressing societal, economic, ecological and technological objectives. Seasonal or daily hydrogen storage can be performed underground, or in the existing natural gas networks,

enabling it to match energy demands with unforecastable and variable renewable energy sources like solar and wind. Gas Distribution System Operators (DSOs) and Transmission System Operators (TSOs) are central actors, as they will transport hydrogen using repurposed and new pipelines across Europe, with over 57 000 km of hydrogen pipelines by 2040.6 In fact, the European Network of Network Operators for Hydrogen (ENNOH) has been established in 2025 to support this extensive network.7

The European Union is dedicated to establishing Europe as the first climate-neutral continent by 2050. Realising this ambitious objective necessitates a comprehensive overhaul of the European energy system, which is responsible for over 75% of the EU’s greenhouse gas emissions.1 To achieve these targets, many technological innovations are essential and, focusing on hydrogen, an acceleration on the development of a dedicated infrastructure is expected. Pipelines are considered the most effective means of transporting large quantities of hydrogen, particularly across extended distances.9 Nevertheless, the existing deficiency in infrastructure poses a significant barrier to this progress.

Recent research at the European Gas Research Group outlines that due to hydrogen’s lower calorific value, the energy conveyed by pipelines is lower than that of natural gas, from a volumetric standpoint. Therefore, a significant increase in the gas velocity in the pipeline is necessary to compensate for the lower energy value per cubic metre if the operative pressure is maintained around the values typical for existing natural gas networks.8 Despite largescale decarbonised hydrogen projects proliferating across the world, there is currently a lack of capability to conduct calibrations for pure hydrogen within gas networks. Such capability is urgently needed to establish the link between hydrogen flowmeters and the SI-units of measurement. Existing natural gas network measurements heavily rely on calibrated flowmeters to ensure the accuracy of their readouts and avoid any biases when trading takes place. Successful supply chain management hinges on precise measurements; therefore, without them, the penetration of the hydrogen market as envisioned by decision makers will not be achievable.

Developing calibration capability for pure hydrogen flow in gas networks

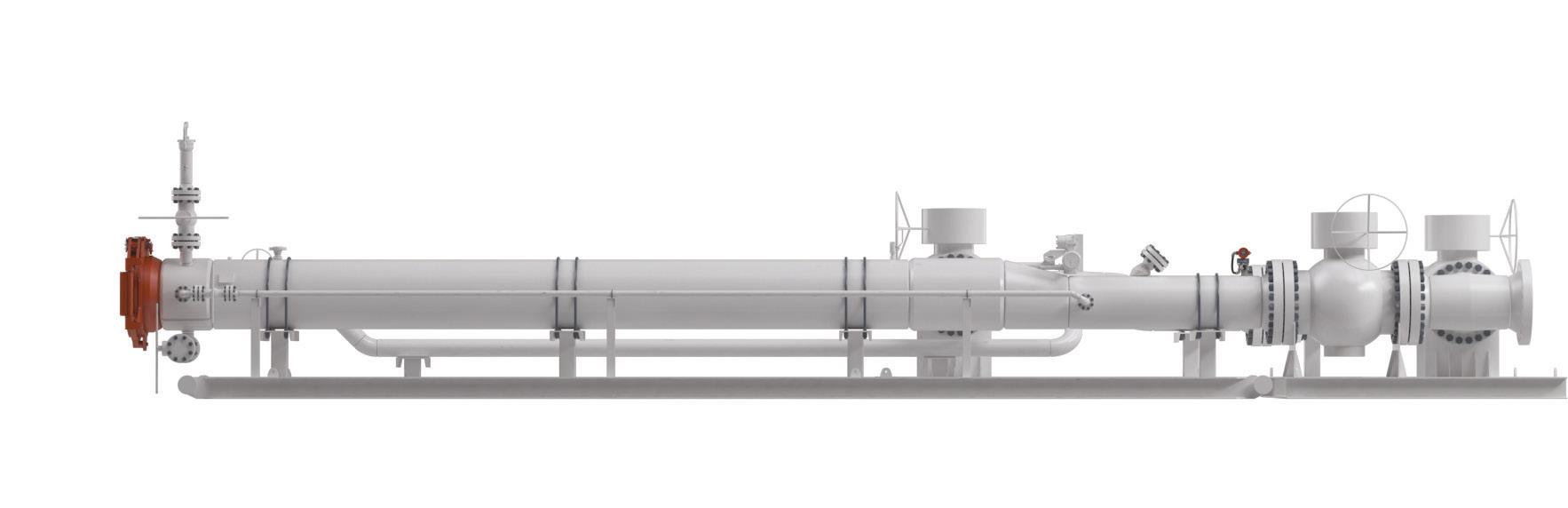

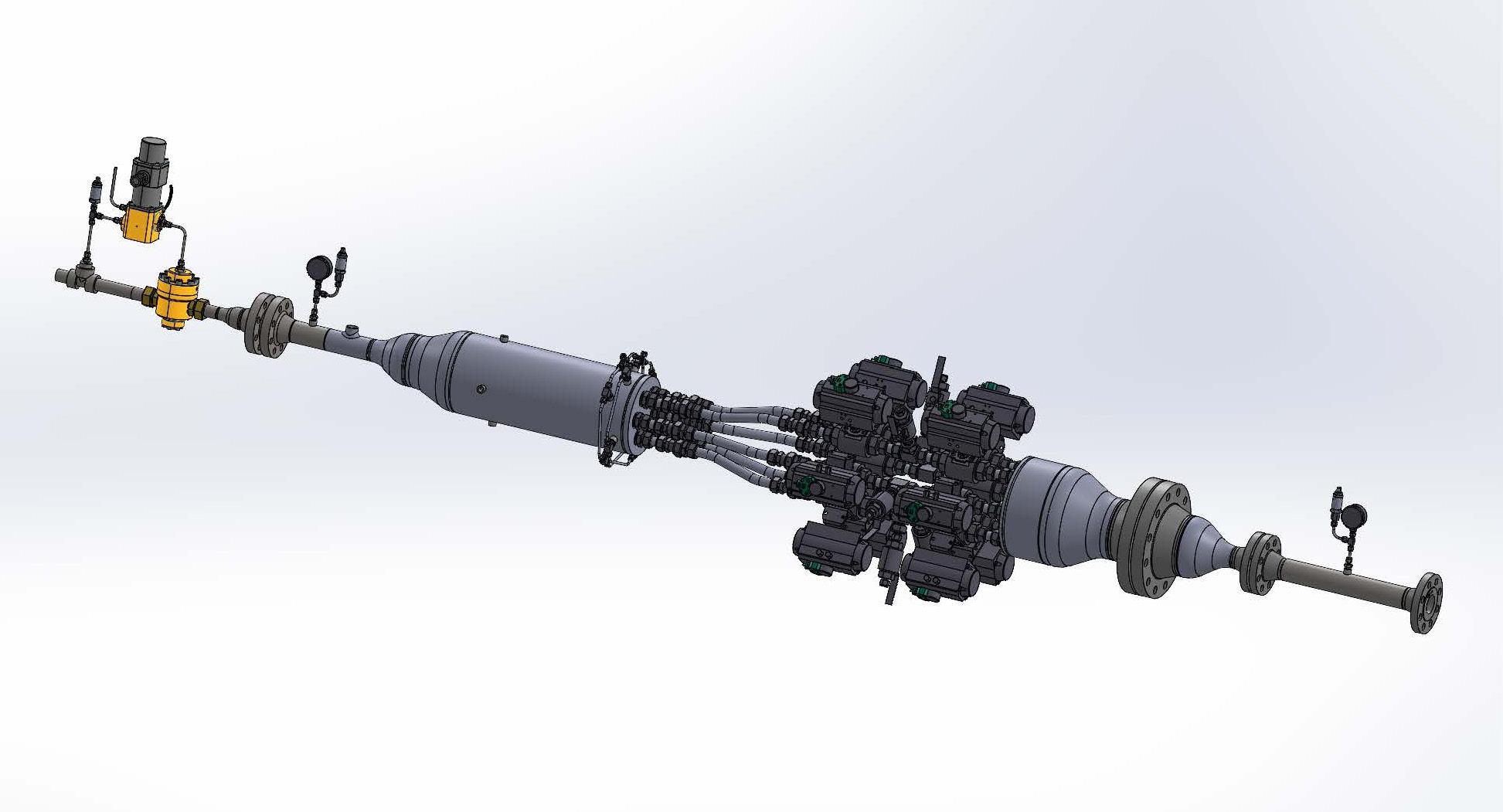

Recently, a project dealing with the capability to calibrate hydrogen flowmeters at high pressures and high flowrates in the typical range of gas networks was developed. The project is called H2FlowTrace. On 1 September 2024, the H2FlowTrace initiative was launched, consisting of 17 partners from 11 different European nations, co-financed by EURAMET, coordinated by Cesame-Exadebit. The consortium unites National Metrology Institutes (NMIs), and Designated Institutes (DIs) specialised in flow measurement, gas metrology, and the assessment of physical properties. This project is further enhanced by the inclusion of research institutes, industrial entities and a university. The multidisciplinary and collective knowledge and expertise in flow measurement within the consortium will be leveraged to tackle the measurement challenges associated with hydrogen flowmetering (as well as those associated with hydrogenenriched natural gas (HENG), in order to enhance energy management benefits.)

The 36 month project is currently at the seventh month, making good progress. The project will be completed in August 2028.

The consortium aims to rectify the deficiency by facilitating the establishment of a large-scale verified metrological framework through the development of metrological infrastructures across a wide flow spectrum, so that calibrations of pure hydrogen and HENG flowmeters can be performed in which traceability to the SI-units of measurement is established. This development holds the potential to strengthen Europe’s prominent role in the hydrogen economy.

H2FlowTrace seeks to address this challenge. The primary goal is to create a system for tracking gas flow of hydrogen within gas networks. The specific aims include:

1. To establish a robust metrological infrastructure (Figure 1): for flowrates up to 1300 m3/h at 0.1 MPa(g) or 45 m3/h at 3.3 MPa(g) with a primary focus on pure hydrogen but also enabling traceability for HENG blends in small industrial meters, with a measurement uncertainty of 0.20% or less.

2. To establish a robust metrological infrastructure for flowrates of 200 m3/h to 10 000 m3/h, and pressures of 0.3 MPa(g) to 6.2 MPa(g) for pure hydrogen and HENG blends in large industrial meters, with a measurement uncertainty of 0.30% or less.

3. To design and test traceability transfer skids for pure hydrogen and HENG blends. In addition, to carry out intercomparisons to determine the equivalence of independent traceability chains based on primary standards, secondary standards using a bootstrapping/upscaling approach, and secondary standards calibrated with alternative fluids to hydrogen.

Once a pipeline is in production, debris within the system can be more extreme, with sand or scale or wax deposits. This can require more specialist pigs to be used, where designs are more focused and offer the ability to be adjusted as part of a progressive cleaning programme.

Propipe pigs are designed specifically for each pipeline and offer optimum performance to maintain maximum production pressures and flow.

Standard Pigs - No Bypass

Propipe Pigs with Bypass

Full testing facilities and the Trident pig tracking range are available.

4. To perform (i) primary calibrations of domestic gas meters (ultrasonic, diaphragm, thermal mass flow) with air and/ or methane and with pure hydrogen up to 30 m3/h at atmospheric pressure, and (ii) primary and secondary calibrations of industrial gas meters (ultrasonic, rotary, turbine) with air and/or natural gas and hydrogen/natural gas blends at flowrates of up to 1000 m3/h and pressures of up to 6.2 MPa(g). Based on these results as well as existing data, to deliver statistically meaningful datasets for air, natural gas, or other alternative fluid calibration for the transferability to hydrogen gas flow conditions for domestic and industrial flowmeters.

5. To demonstrate the establishment of an integrated European metrology infrastructure and to facilitate the take up of the technology and measurement infrastructure developed in the project by the measurement supply chain (accredited calibration and testing laboratories, European Metrology Network for Energy Gases), standards developing organisations (ISO/TC 30, OIML TC 8/SC 7, CEN/TC 237) and end users (energy gas transmission, distribution operators, FARECOGAZ, ENTSOG, Hydrogen Europe).

This project further aims to integrate the SI traceability of measurement institutions with the capability of key industrial stakeholders to transport hydrogen at the required flowrates and pressure levels.

As previously stated, the European Union aims to establish a carbon-neutral environment by 2050,1 while also setting specific climate and energy objectives by 2030, with hydrogen potentially playing a crucial role in this endeavour.4

The EU’s initiatives for energy system integration and hydrogen development are instrumental in achieving these goals, supported by frameworks such as the Next Generation EU Recovery Package,2 the European Green Deal,3 and the EU Hydrogen Strategy.4 Nevertheless, the journey will encounter various technical challenges. Hydrogen is pivotal for facilitating the energy transition, offering the capability to carry renewable energy minimising the use of fossil fuels, and serving as both short-term and long-term energy storage to address supply intermittency.

The expansion of hydrogen utilisation is significantly reliant on metrology (the science of measurement), necessitating a

robust metrological infrastructure for accurate hydrogen flow measurement, which will be addressed through objectives 1, 2, and 3. Objective 4 focuses on generating new insights regarding the compatibility of different meter types with hydrogen. Establishing best practices and ensuring traceability to the SI units of measurement in hydrogen flows will be vital for the efficient operation of decarbonised gas networks. In the long run, this will foster trust in billing, fiscal and custody transfer measurements, and maintain public support for the transition to net-zero carbon dioxide emissions. Ultimately, this will contribute to a positive environmental outcome. Furthermore, the use of hydrogen as a fuel in the automobile industry could greatly diminish greenhouse gas emissions in the future, further permitting the ability to achieve the EU’s objectives. For example, positive effects have been already seen in the past since improved traceability for hydrogen flow measurement significantly bolsters the approval process for hydrogen refuelling stations. This advancement could enable the market of hydrogen-powered vehicles, including public transport buses, trucks, and cars, thereby contributing to a reduction in greenhouse gas emissions and the consumption of fossil fuels. At the border separating two nations, flowmeters are installed to facilitate the sale of energy in transit. However, in the context of hydrogen networks, there is currently no infrastructure that is metrologically linked to the International System of Units (SI) for the calibration of these meters. The H2FlowTrace initiative aims to address this deficiency by developing two mobile skids (SSTS and LSTS) designed to accommodate a broad spectrum of flowrates, thereby meeting the requirements of gas transporters within the networks.

This project aims to develop an integrated service for the measurement of traceable hydrogen (blend) gas flow, which will enhance metrological traceability with SI-units for gas networks. In domestic applications, datasets will facilitate the assessment of transferability of calibrations using alternative to hydrogen fluids in gas flow applications. This is crucial for promoting hydrogen as a viable energy source, as establishing flow measurement traceability is essential for gaining the trust of consumers and gas meter manufacturers in achieving the necessary accuracy standards for measuring hydrogen and/or HENG. Meter manufacturers will benefit from new traceable calibration facilities, allowing them to conduct research and development with pure hydrogen at flowrates and pressures

pertinent to large industrial meters. Consequently, industry end users will be empowered to make informed choices since manufacturers will be able to better assist end-users in their decisions regarding hydrogen flowmeters, backed by the metrology community and validated calibration facilities.

Moreover, the datasets produced through this initiative will allow the consortium to evaluate the reliability and cost-effectiveness of calibrations using alternative fluids (HENG, natural gas, nitrogen, water, etc.) for various types of gas meters, including ultrasonic flow, thermal mass flow, diaphragm, and Coriolis meters. Consequently, this will lead to significant cost reductions for testing and calibration laboratories. Ultimately, this will facilitate a rapid increase in the use of hydrogen and HENG, with minimal modifications required to the existing metrological infrastructure. Furthermore, establishing metrological traceability for hydrogen and HENG gas flow in industrial settings will enable the current test loops within the consortium to gain full confidence in the calibrations they conduct for industrial clients.5 The comparison of hydrogen and HENG facilities, along with a comprehensive calibration campaign involving at least 40 industrial gas meters, will serve as a fundamental element for creating a metrologically harmonised hydrogen and HENG transmission infrastructure.

Ensuring the accuracy, repeatability, traceability, and costeffectiveness of flow measurement is essential for fostering the sustainable development of the hydrogen sector in Europe and eventually the world. This focus will contribute to

a more robust market for hydrogen technology and service providers, thereby stimulating innovation and creating new job opportunities for citizens across the continent. The long-term effects of this initiative will include facilitating manufacturers in the design and certification of advanced flowmeters, as well as empowering gas network operators to advance their hydrogen infrastructure projects.

1. European Commission, ‘A European Green Deal’, https://ec.europa.eu/info/ strategy/priorities-2019-2024/european-green-deal_en published 3 October 2022, accessed: 13 January 2025.

2. European Union: NextGenerationEU, https://europa.eu/next-generation-eu/ index_en published 3 October 2022, accessed 13 January 2025.

3. European Commission, ‘A European Green Deal’, https://ec.europa.eu/ commission/presscorner/detail/e%20n/ip_19_6691 published 3 October 2022 accessed 13 January 2025.

4. European Commission, ‘A hydrogen strategy for a climate-neutral Europe’, https://ec.europa.eu/energy/sites/ener/files/hydrogen_strategy.pdf published 3 October 2022, accessed 13 January 2025.

5. SALEEM, M.A., and RIEZEBOS, H., ‘JIP renewable gases; results on performance of turbine and ultrasonic flow meters up to 30 % Hydrogen and 20 % CO2’, in North Sea Flow Measurement Workshop, 2021. Accessed 13 January 2025.

6. European Hydrogen Backbone, ‘EHB initiative to provide insights on infrastructure development by 2030’, https://ehb.eu/files/downloads/EHB-initiative-toprovide-insights-on-infrastructure-development-by-2030.pdf published 10 July 2023, accessed 13 January 2025.

7. ENNOH, The European Network of Network Operators for Hydrogen, https:// ennoh.eu/the-future-HTNOs-take-a-step-further-towards-the-establishment-ofENNOH.html, published December 2024, accessed 13 January 2025.

8. European Gas Research Group (GERG), ‘Determining Energy Capacity for H2 in existing NG pipelines’, https://www.gerg.eu/wp-content/uploads/2022/07/ GERG-Energy-Capacity-final-publishable-summary.pdf, published November 2023, accessed 13 January 2025.

9. Hydrogen transportation and distribution (p 187 - 224), https://www. sciencedirect.com/science/article/abs/pii/B9780323955539000030, published 2024, accessed 13 January 2025.

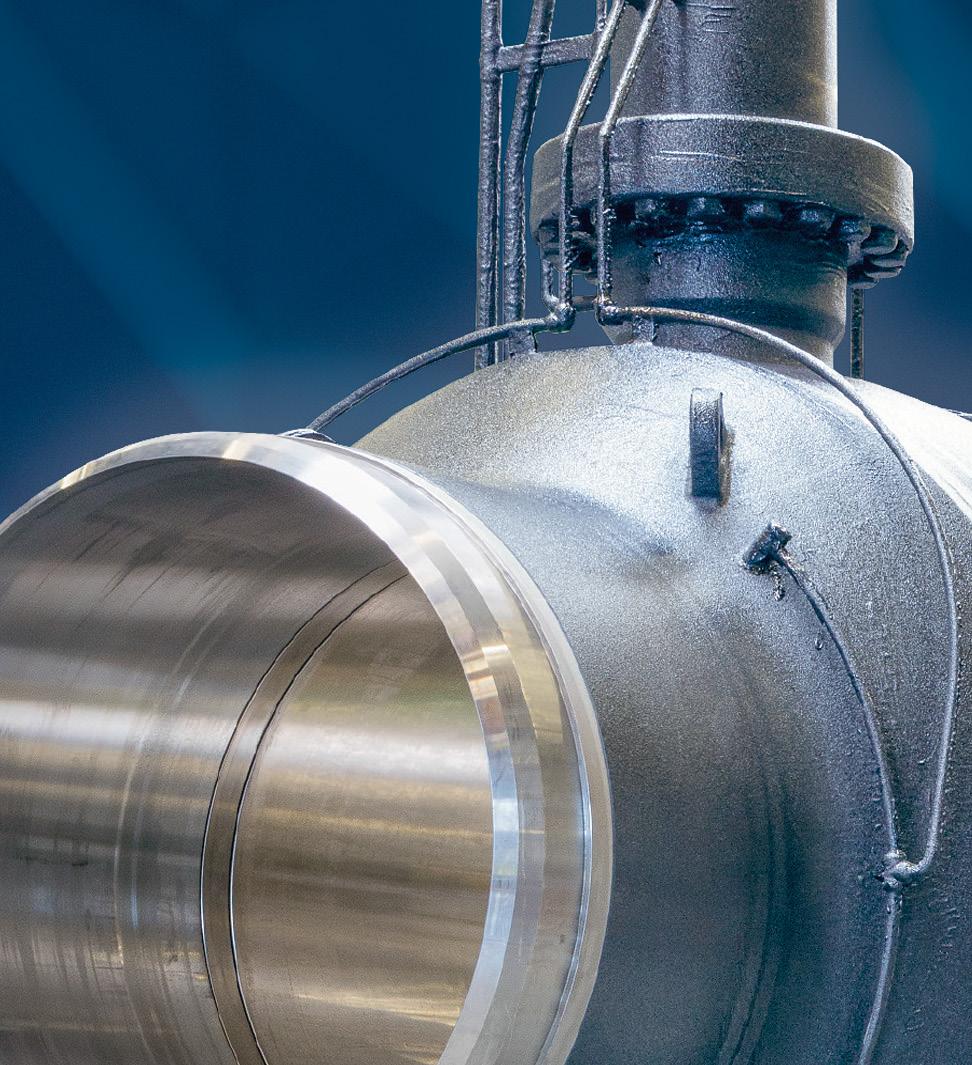

Jason Blubaugh, Corporate

Account Manager-ConFab, Miller

Electric Mfg. Co. argues that it is necessary for pipeline operators to begin a progressive approach to pipeline welding by adopting new technologies and methods.

ipelines move energy products over long distances and are a critical component to a nation’s infrastructure, making the integrity of their construction paramount to mitigating failures and environmental disasters. Deemed one of the most challenging types of welding, pipeline welders face complex welding positioning, harsh working environments and the need

for precision, adaptability and extensive knowledge of pipe materials and corresponding filler metals. These factors present themselves at varying times, and it’s a welder’s job to work through any adversity to still produce robust, high-quality welds suitable for their intended service application.

For oil and gas pipelines specifically, there’s increased scrutiny around weld quality and longevity – and the expectations in front of pipe welders today are significantly different than what they were just decades ago. Pipeline material manufacturing practices are everevolving, regulatory environments are ever-changing, and there are many additional enhanced requirements on project execution and maintenance work.

As such, welders need extensive training and the right certifications to demonstrate proficiency in the demands of pipeline welding. There must be adherence to strict quality standards, where rigorous welding codes, standards and regulations must be administered and met. Multiple weld passes adhering to a detailed welding procedure specification are applied to produce sound, workmanlike weld quality. The completed welds are inspected for defects using various non-destructive testing methods, such that any welds that don’t meet acceptance criteria standards are repaired or sometimes entirely cut out – a time-consuming and costly setback. The pressure and stakes are high.

For Enbridge, a North American energy company, the demand for quality, practicality, consistency and efficiency has never been more imperative. The conventional welding practices known and used for decades aren’t always suitable for today’s modern materials or the design

parameters required on some pipelines. Looking at the enhanced design requirements for modern pipelines, as well as the regulatory landscape, Enbridge sought to expand its pipe welding toolbox with new methods, and long-time partner Miller Electric Mfg. Co. assisted Enbridge with the new challenges it was experiencing. Miller supported the energy company in evaluating and incorporating advanced welding equipment and processes that would provide additional capabilities for more advanced applications.

When designing and constructing high-strength, straintolerant pipelines, welding engineering is critical when accounting for girth weld mechanical properties in addition to base material strengths and chemical compositions for the materials being welded. With the advancements of modern steel and pipe manufacturing practices in the interest of weldability, mechanical properties, quality and costs, it remains paramount that weld strength overmatching be considered when selecting appropriate welding processes and consumable combinations to mitigate the risks of weld strength undermatching and heat-affected zone softening. These risks are further addressed via control of the mechanical properties and chemical compositions of the steel and line pipe being procured. Enbridge has implemented requirements within pipe manufacturing specifications to control upperbound yield and tensile strength limits along with defined chemical composition ranges.

On the field girth welding front, Enbridge also implemented requirements within field welding construction specifications requiring the use of lower heat input welding processes and higher-strength welding consumables for high-grade pipe. This further bolsters the approach of producing girth welds with adequate margins of strength overmatch versus the adjacent pipe materials being joined.

The shift toward lower heat input welding processes and higher strength welding consumables has resulted in the use of additional welding options to supplement conventional approaches. Oftentimes, this requires additional welder training and engagement with welding equipment and/ or consumable manufacturers to fine-tune products or support training efforts. The incorporation of additional welding options resulted in further interest and evaluation of alternative welding processes outside of conventional stick welding.

Manual shielded metal arc welding (SMAW, or stick rod welding) has been the preferred method among pipe welders and construction contractors for its ability

Since 1948, Tinker & Rasor has been a trusted name in holiday detection, relied upon by pipeline professionals worldwide. For over 76 years, our holiday detectors have set the benchmark for performance and reliability, ensuring the integrity of protective coatings by detecting coating flaws with precision. With a legacy of innovation and toughness, Tinker & Rasor continues to lead the industry, delivering cutting-edge solutions to safeguard pipeline coatings and maintain quality standards across the globe.

to reliably produce welds in nearly all environmental conditions since the flux coating on the electrode protects the weld from contamination. Cellulosic stick electrodes used for stick welding on pipelines use electrodes with a cellulose-based flux coating. Cellulosic electrodes like E6010 are especially popular in pipeline welding because of their ability to provide deep penetration and accommodate a multitude of challenging fit-up conditions in a rugged field environment.

When employing stick welding on cross-country pipelines, the root pass is typically installed in the downhill travel direction, with subsequent passes completed downhill using either a cellulosic or low-hydrogen downhill electrode, or alternatively, in an uphill travel direction using an uphill low-hydrogen consumable. All the various combinations have pros and cons and may be appealing to contractors or welders depending on proficiency of the work force, project-specific mechanical property requirements or other miscellaneous drivers. Advantages of low-hydrogen stick rod consumables, such as a very low hydrogen content, can be advantageous when attempting to mitigate risks of hydrogen-assisted cracking on susceptible materials, increasing weld metal strength or trying to reduce heat input, which would be common of a downhill low-hydrogen electrode with a faster travel speed, while conventional cellulosic-coated consumables may be appropriate for other applications.

Marrying pipe welding with RMD

Enbridge had its pulse on the industry – and took note of the increasing opportunities to supplement ongoing and future work with more semiautomatic and mechanised welding processes to offer improvement opportunities with respect to productivity, weld quality and mechanical properties of girth welds. Enbridge consulted with Miller to identify new, practical and efficient ways to produce high-quality welds suitable for modern day design and service conditions.

Understanding the heightened drive – and need –for high-quality welds, Miller recommended Enbridge begin implementing Regulated Metal Deposition (RMD®) MIG welding (modified short-circuit GMAW), using its ArcReach® Smart Feeder system paired with Hobart® MEGAFIL® 240M metal core filler metal.

ArcReach Smart Feeder delivers excellent RMD and pulsed MIG welding up to 200 ft away from the power source and without control cables. ArcReach capabilities allow parameters to be adjusted at the point of use on the feeder or remote to maximise productivity and minimise the time spent walking back to the power source. All of this amounts to increased uptime and improved jobsite safety. When out in the field, the Smart Feeder runs off the Miller® Big Blue® series engine drive power source. When plug-in power sources are possible, Miller suggested the XMT® 400 ArcReach®.

To obtain welds with consistent mechanical properties and chemical compositions and to minimise the risk of cracking in critical applications, the MEGAFIL 240M has the

properties needed for high-integrity welds and produces higher deposition rates than solid wire. It seamlessly bridges gaps if the fit-up is slightly askew and has excellent low-temperature impact toughness, which can be highly desirable to operators managing existing and constructing new pipeline systems in extreme cold climate regions.

Knowing the industry’s reputation for being averse to adopting new technology, Miller anticipated that many pipe welders were likely to be sceptical about implementing RMD welding – seeing stick welding as a trusted, tried-and-true process. Typical GMAW sees the short circuits occur at erratic intervals and with varying intensity. Producing codequality root passes with traditional short circuit GMAW requires significant skill, causing many to bypass this hightouch, highly sensitive process. Fortunately, technology has significantly advanced short circuit welding.

With the Miller RMD technology, the welding system anticipates and controls the short circuit and reduces the welding current to create a consistent metal transfer. This allows for uniform droplet deposition, providing welders with the ability to control the puddle much easier. RMD also allows for exceptional tolerance for high-low misalignment between pipe sections because the technology will automatically compensate.

Knowing that implementing and adopting RMD was going to be a unique challenge with longstanding pipe welders, Miller invited Enbridge welders on-site to its headquarters in Appleton, Wisconsin, USA, to thoroughly teach and train them on the products. This required a lot of hands-on training to help the welders with their technique and familiarisation with the process and product. With the setup for this advanced process significantly more complex than stick welding, there was substantial training around proper equipment setup and best practices for using RMD. Miller worked hard to ensure the welders were comfortable with all aspects of the RMD process before they started using it on the pipeline.

The Miller training team was comprised of welding engineers, specialists and UA Pipefitters – individuals who are well versed in the challenges and nuances of pipe welding. Alongside the welders, the group troubleshot issues and accepted product feedback in an effort to make the equipment an even stronger asset. Miller welding engineers and specialists also went onsite with Enbridge to help train contractors to ensure they were comfortable with the process and equipment during weld procedure qualification states of a project lifecycle before ever using it in the ditch. These trainings focused highly on transitioning to using a MIG gun and establishing and maintaining good technique, which is paramount for RMD success. When welding in the 5G position, a welder should begin in the twelve o’clock position, keeping the arc in the centre of the puddle and moving the electrode back and forth across the gap using a half-moon motion. Once gravity starts to push the puddle down the joint, the welder should stop weaving and concentrate on directing the electrode into the centre of

the weld puddle. On approaching the five o’clock position, a slight side-to-side motion should be used until reaching six o’clock, ending the bead on a feathered tack weld. Going from side to side can help flatten the weld bead and minimise the need to grind high points. Due to the large weld pass ligament size, using RMD on the root pass can eliminate the need for a conventional ‘hot pass’ (the second weld pass in a field girth weld), allowing welders to move straight to the first fill pass.

From root to final weld pass, welders maintain the downhill approach. Downhill travel direction is generally faster, requiring greater welder control since gravity is helping the process. Additionally, the size and scale of the pipe – which can be anywhere from 24 - 48 in. in diameter, typically – significantly impacts the physical exertion required to lay a clean weld when going downhill. With coaching from the Miller team and openmindedness from the welders, once it clicked, there was an overwhelmingly positive response to implementing the new process and determining where RMD might begin to be a suitable application for construction and maintenance needs.

But all this assistance wasn’t a one-and-done. Miller continues to work with Enbridge to evaluate training needs and schedule on-site visits – whether that’s in Appleton or alongside the welders out in the field. If issues arise in real time, weld specialists deploy to help within days and stay until the issues are resolved.

A true partner impacted positive results

Since first implementing RMD welding, Enbridge has had the opportunity to further evaluate RMD’s potential primary applications and weld metal mechanical properties. Highly satisfied with both, it will continue to look for new opportunities to incorporate RMD technology into new construction or active maintenance operations work. This additional tool in the toolbox will no doubt be a great asset as more welders begin using it in their day-today work.

While Enbridge and Miller have always had a positive partnership, the collaborative efforts to fuel productivity and improve weld quality were particularly impactful given the company’s welding technology and product innovations. Enbridge

appreciated the tenacity in Miller proposing something different to much of the onshore cross-country pipeline welders and contractors – which can sometimes be an uphill battle due to standard growing pains. In an industry that is critical of, and sometimes resistant to, change, thorough evaluation and scrutiny of such a significant change is not only commonplace but necessary. But the proof was in the pudding through thoughtful and consistent training, which isn’t something other OEMs always offer. As Enbridge continues to evaluate opportunities to expand the use of RMD across its pipeline projects, it looks forward to ongoing innovation and collaboration to continue enhancing its operations.

Ideal for measuring the remaining wall thickness and the effects of corrosion or erosion on tanks, pipes, or any structure

n 6 Models available including Corrosion, Xtreme, Multiple-Echo, Low Frequency, and Precision

n All models include Min Scan mode, memory, statistics, and USB

n Advanced models include: A-Scan, B-Scan, Bluetooth, and WiFi

n Weatherproof, dustproof, and waterresistant—IP65-rated enclosure

Scan here to learn more

PosiTector UTG M features Thru-Paint capability to quickly and accurately measure the metal thickness of a painted structure without removing the coating.

PosiTector gauge body accepts ALL ultrasonic wall thickness, coating thickness, surface profile, environmental, soluble salt, gloss, and hardness probes manufactured since 2012.

+1-315-393-4450 n 1-800-448-3835 techsale@defelsko.com n www.defelsko.com

low assurance is the lifeline of offshore and subsea oil and gas operations, ensuring the smooth and uninterrupted transportation of hydrocarbons from reservoirs to processing facilities. This seemingly simple task becomes more challenging in deepwater and ultra-deepwater environments, where high pressures, low temperatures, and long pipeline distances create fertile grounds for blockages caused by hydrates, asphaltenes, wax, and scale. Operators must redefine how they identify, address, and prevent flow assurance challenges in this high-stakes field.

The industry is changing, driven by ageing assets, technological advancements, evolving industry demands, environmental concerns and regulatory pressures. Embracing and preparing for this change is essential, and rapid receipt of accurate data is as crucial as ever, as maintaining flow is essential for operational success.

Advanced diagnostic and measurement solutions are required to ensure the efficient and uninterrupted flow of hydrocarbons in pipelines, wells, and processing systems.

Jim Bramlett, Commercial Manager – The Americas, Tracerco, explores how the technology, sustainability, and efficiency shaping the energy sector as a whole are reflected by changes in flow assurance.

A pipeline sitting 9000 ft below sea level has immense pressure, and not all tools can operate at those depths. Wells are changing – they are getting hotter and have increased pressure – and the way a company operates them has to change in accordance. It may be that more chemicals are needed to prevent an issue, but this can only be planned for if the necessary insights have been gathered.

As assets are ageing and the life of fields are decreasing, companies are using longer subsea tiebacks to maximise recovery from distant fields while reducing the need for new infrastructure. This lowers costs and extends the life of existing facilities, but it’s a longer run, and a flow assurance issue in a longer subsea tieback can disrupt hydrocarbon flow, leading to blockages such as hydrate or wax formation, increased downtime and costly remediation efforts. Put simply, operators can’t fix what they can’t find.

An operator we worked with in the North Sea had a suspected blockage in a 6 in. flexible riser to a semi-submersible production platform and needed to obtain information on the location. After evaluating a variety of pipeline inspection technologies, the North Sea operator decided to deploy Tracerco’s non-intrusive screening technology, ExplorerTM

The technology works by scanning pipelines through any type of coating to obtain a mean density profile along the pipeline. The results confirmed a full-bore blockage of the Naturally Occurring Radioactive Material (NORM) scale in the loop leading up to the mid-water arch.

This information allowed the operator to commence remediation activities with confidence. Typically, 50 - 80% of remediation attempts fail the first time, and further attempts double the associated cost. Therefore, an operator needs to determine the exact nature of a flow assurance issue before wasting resources. With our insights, operators can get it right the first time, increasing efficiency and reducing operational costs and production downtime caused by ineffective remediation.

The industry faces increasing pressure to reduce its carbon footprint and be sustainable. As a result, chemical usage for flow assurance is being optimised to minimise environmental impact. Companies can reduce the risk of environmental issues and ensure environmental compliance during pipeline commissioning and decommissioning projects by obtaining a full picture of the pipeline’s contents and condition at the earliest stages.

Historically, flow assurance relied heavily on modelling or reactive methods to address problems like hydrate formation, asphaltene, wax deposition or scaling after they occurred. A proactive approach is now essential, using advanced analytics to predict and mitigate issues before they impact operations.

To support customers in visualising the condition of subsea pipelines, Tracerco developed the DiscoveryTM CT scanner to proactively see integrity flaws of piggable and unpiggable subsea pipelines in real-time. Baseline scanning is carried out right after operations begin, followed by periodic scans to identify any buildup before it becomes a bigger and more expensive issue for companies. This non-intrusive, field-proven diagnostic technology is designed to address challenges related to flow assurance, such as blockages,

deposits and flow restrictions within pipelines and subsea flowlines, delivering real-time insights.

We were recently contacted by an operator in the Gulf of Mexico as a pipeline was blocked during start up after a planned platform turn around. After several unsuccessful attempts, the operator couldn’t remediate the line, suggesting that more information on the location, size and nature of the blockage was needed. We conducted an inspection campaign to locate and measure the size of the deposit and fully characterise the type of blockage in the line. Explorer was deployed first by the operator to measure the mean density of the pipeline contents. Once it had confirmed where the pipeline sections with the largest deposit were, Discovery was used to characterise the pipeline contents at each of the specified locations.

The operator’s feedback was that in just ten minutes of scanning, Discovery had shown the company more about the pipeline’s condition than all the modelling that had been carried out in the two years prior. It again proved the real benefits that could have been achieved if more detailed insights had been gathered before the start-up.

It is critical that businesses invest in predictive maintenance. Blockages can be caused by multiple issues, such as changes in the well dynamic. It could be a change in pressure, a change in fluid composition, or they may be producing more water. Maintaining uninterrupted flow and minimising downtime is essential to the financial success of a project, with operators facing significant production downtime when flow is disrupted.