Advances in data analytics, rig capabilities, and experience merit a new approach to drilling uids technology for unconventional drilling. AES Drilling Fluids introduces AQUA-FLEX, an optimized water-based drilling uid, to align performance requirements with the actual well risks of maturing elds.

AES DRILLING FLUIDS

WINTER 2022

MAGAZINE |

Subscribe online at: www.energyglobal.com/magazine

The premier source of technical and analytical information for the renewable energy industry, covering solar, wind, bioenergy and storage.

10 The Making Of MENA

OilfieldTechnology’s Deputy Editor, Emily Thomas, provides an overview of the upstream oil and gas sector in the MENA region, and discusses the opportunities and challenges facing the industry.

14 Refining The Risks

Matthew Offenbacher and Richard Toomes, AES Drilling Fluids, USA, explain how data analytics can lead to simpler, more cost-effective drilling solutions.

18 Up For The Challenge

Jessica Stump and Matt Jennings, NOV, USA, discuss recent advances in drill bit technologies and their advantages in challenging drilling environments.

22 Optimising Vessel Operations

Ali Cetin and Vegard Solum, 4Subsea, and Cristina Evans, Subsea7, Norway, explain how machine learning and digital technologies based on data are paving the way for improved vessel response predictions, as well as better informed operability and weather windows.

25 An Underwater Upgrade

Greensea Systems Inc., USA, considers how the upstream oil and gas industry’s underwater operations could be on the cusp of a period of technological development.

Front cover

Advances in data analytics, rig capabilities, and experience merit a new approach to drilling fluids technology for unconventional drilling. AES Drilling Fluids introduces AQUA-FLEX, an optimised water-based drilling fluid, to align performance requirements with the actual well risks of maturing fields. Read AES Drilling Fluids’ article on P.14 to learn more about AQUA-FLEX.

28 Connectivity Is Key

Alastair MacLeod, Ground Control, UK, explains why consistent, reliable connectivity is vital for the upstream oil and gas industry to monitor and analyse data and enable quick and effective business decisions.

Connectivity is key

32 Rewriting The Rule Book

Roar Sletta, Norway, and Fouzi Bouillouta, UAE, Baker Hughes, explain how digital technologies are rewriting the rule book for the upstream oil and gas sector during a time of transition.

A Deep Dive Into Robotic Technologies

Danny Constantinis, EM&I Group, Malta, outlines the advantages of robotic, diverless subsea technologies over more traditional manual methods.

The Human Factor

ISSN 1757-2134

may be reproduced, stored

retrieval

copyright

All

opinions

publisher,

endorse

More from Like us on Facebook Oilfield Technology Join us on LinkedIn Oilfield Technology Follow us on Twitter @OilfieldTechMag 03 Comment 05 World News

Copyright © Palladian Publications Ltd 2022. All rights reserved. No part of this publication

in a

system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the

owner.

views expressed in this journal are those of the respective contributors and are not necessarily the

of the

neither do the publishers

any of the claims made in the articles or the advertisements.

36

Management Anup Rama, LANXESS, USA, explains how the right biocide solution can optimise oilfield productivity, hydrocarbon quality, and asset integrity at a reasonable cost.

40 Microbial Control

45

Marina

Brazil,

prioritising

solid safety programme in order to mitigate and minimise human error within well control operations. AES DRILLING FLUIDS Advances in data analytics, rig capabilities, and experience merit a new approach to drilling uids technology for unconventional drilling. AES Drilling Fluids introduces AQUA-FLEX, an optimized water-based drilling uid, to align performance requirements with the actual well risks of maturing elds. MAGAZINE WINTER 2022

Mieli, Wild Well Control,

discusses the importance of

a

he Industrial Internet of Things (IIoT) has been transforming global industries and driving digitalisation for some years now and the oil and gas sector is no exception. From asset management through to remote performance monitoring and maintenance, the IIoT ecosystem delivering efficiencies and productivity to meet the demands of an ever-evolving energy landscape. However, everything is underpinned by reliable and resilient connectivity. After all, fragmented picture and data gaps can give wildly inaccurate depiction of operations and assets, and if connectivity is not made a priority, it can cause serious problems. Alastair MacLeod, Ground Control, UK, explains why consistent, reliable connectivity is vital for the upstream oil and gas industry to monitor and analyse data and enable quick and effective business decisions. Globally, the oil and gas industry has been in the spotlight in recent months, arguably more so than ever before. While there mutual drive for nations to reduce reliance upon hydrocarbons, energy security has climbed the agenda, not least because of the conflict in Ukraine. This has meant a shift – even if it is temporary one in strategy, which has impacted economies and upstream suppliers significantly. What is evident however, is that the industry continues to innovate to meet challenges like these head on, and IIoT at the heart of this. Given the often hostile and remote nature of the environments in which oil and gas plants are situated, the ability to monitor and analyse data, enabling quick, 29 28 28

TETRA

TETRA

TETRA

TETRA

TETRA

TETRA

TETRA

05/2022 © TETRA Technologies, Inc.

Rights Reserved.

All

Portfolio

CS Neptune® Completion Fluids

CS Neptune® Divalent Completion Fluids To 15.4 lb/gal • 350°F (177°C)

CS Neptune® High Density Divalent (HDD) Completion Fluids To 15.7 lb/gal • 290°F (143°C)

CS Neptune® Extra High Density Divalent (XHDD) Completion Fluids To 17.5 lb/gal • 350°F (177°C)

CS Neptune® High Density Monovalent (HDM) Completion Fluids To 13.1 lb/gal • > 350°F (171°C)

Our

Neptune®

of high-density completion

are

industry. Customized

the densities required for ultra-deepwater and

applications yet free of zinc and other priority pollutants,

are

productivity.

competitive

cost.

applications.

operators

a multi-purpose high-density

information or

CS Neptune® Extra High Density Monovalent (XHDM) Completion Fluids To 15.7 lb/gal • > 350°F (177°C)

novel TETRA CS

family

fluids

revolutionizing the

with

high-pressure

TETRA CS Neptune fluids

less corrosive and maximize well

They offer a unique technical and environmental solution while providing

overall

As an added bonus, they can double as the basis for low-solids reservoir drillin fluids and other

Everything

need in

completion fluid. Visit tetratec.com/neptune for more

contact us at completion-fluids@tetratec.com.

CS NEPTUNE® FLUIDS: The Environmental Choice to Maximize Productivity and Enhance Well Integrity General corrosion of Q125 steel with TETRA CS Neptune 14.7 lb/gal fluid at 265 °F / 129 °C Mils / Yr 0 4 8 10 6 2 7 14 21 Days Up to 7x less corrosion than zinc

Emily Thomas, Deputy Editor emily.thomas@palladianpublications.com

The highly anticipated global football tournament, the FIFA World Cup 2022, is well underway in Qatar, despite a series of controversies surrounding the choice of the Gulf state as host. A string of human rights issues, the impact of extreme temperatures on players, and suspected corruption in the bidding process, have all fuelled the debate on whether the tournament should have been allowed to go ahead in the Middle Eastern country. Furthermore, concerns have been raised over the treatment of migrant workers who have been tasked with exhaustive work, including the construction of seven new stadiums and the rehabilitation of an eighth.

An estimated US$200 billion has been spent on infrastructure to accommodate the sporting event, with transport links, airports, and accommodation facilities all under construction or refurbishment for the proceedings. It comes as no surprise, therefore, that Qatar has been recorded as the fourth richest country in the world, and its valuable and abundant oil reserves and successful upstream sector are largely to thank.

Qatar ranks 13 th in the world for oil reserves, with 25 244 000 000 bbl, and 14 th in the world for oil production, producing 1 987 193 bpd. The country also has the world’s third-largest proven natural gas reserves, and projects are ongoing to maintain its position as a key industry player. Sembcorp Marine, for example, recently completed work for two offshore wellhead platforms for Qatar’s largest offshore oilfield, Al Shaheen.

According to GlobalData, Qatar’s economy is forecast to grow at a pace of 4.6% in 2022 compared to 1.5% in 2021. 1 Ratings agency Moody’s has also changed Qatar’s credit outlook from ‘stable’ to ‘positive’, as a result of high energy prices, a high level of per-capita income, and vast hydrocarbon reserves with minimal extraction cost. 2 The surge in oil and LNG prices in recent years has generated a large revenue windfall for Qatar, leading to a fiscal surplus of around 9.5% of GDP in 2022. 2

Tourism and tourist spending, ticket revenue, and an estimated 1 million visitors to the country during the World Cup can also only be a positive sign for the country’s economy, however, undoubtedly human rights concerns and the controversy surrounding the host nation has, for many, tainted one of the most celebrated tournaments in the history of the sport.

To read more about the opportunities and challenges facing the upstream sector in the MENA region, take a look at our regional report on P.10.

References

1. www.globaldata.com/media/business-fundamentals/fifa-world-cup-rising-fossil-fuel-exportsto-drive-qatar-economy/

2. www.moodys.com/research/Moodys-changes-the-outlook-on-Qatar-to-positive-affirms-Aa3-PR_470168

Contact us

Editorial

Managing Editor: James Little james.little@palladianpublications.com

Senior Editor: Callum O’Reilly callum.oreilly@palladianpublications.com

Deputy Editor: Emily Thomas emily.thomas@palladianpublications.com

Editorial Assistant: Isabelle Keltie isabelle.Keltie@palladianpublications.com

Design

Production: Kate Wilkerson kate.wilkerson@palladianpublications.com

Sales

Sales Director: Rod Hardy rod.hardy@palladianpublications.com

Sales Manager: Ben Macleod ben.macleod@palladianpublications.com

Website

Digital Administrator: Leah Jones leah.jones@palladianpublications.com

Digital Events Coordinator: Louise Cameron louise.cameron@palladianpublications.com

Digital Content Assistant: Merili Jurivete merili.jurivete@palladianpublications.com

Marketing

Administration Manager: Laura White laura.white@palladianpublications.com

Reprints: reprints@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.oilfieldtechnology.com

Winter 2022 Oilfield Technology | 3

Comment

BEYOND PREPARED

In today’s oilfield, the status quo isn’t good enough anymore. Oil and gas companies must be more efficient than ever before, eliminate downtime at every possibility and be ready for anything that can affect productivity. At Cudd Well Control we are beyond prepared with the industry’s leading experts, a broad portfolio of advanced well control services and the latest technology-driven equipment to keep production flowing. Whatever the challenge, wherever the location, we are ready with the next generation in preventive, critical intervention and recovery services.

Call us today to ensure you are beyond prepared. cuddwellcontrol.com

to keep your operations running

OPEC+ prepares for market uncertainty with two million bpd production cut

Speaking after the recent OPEC+ meeting, Ann-Louise Hittle, Vice President, Macro Oils, at Wood Mackenzie, said, “The decision by OPEC+ to continue with its recently agreed two million bpd production cut through the end of 2023 is not a surprise, given the uncertainty in the market over the impact of the 05 December EU Russia crude oil import ban and the G7 price cap. In addition, the producers’ group faces downside risk from the potential for weakening global economic growth and China’s zero Covid policy.”

The outcome fits with Wood Mackenzie’s short-term forecast, which assumed a continuation of the recent cuts. Despite the OPEC+ production cuts, Wood Mackenzie’s forecast shows a balanced market for 2023 with adequate supply. The forecast for 1.8 million bpd of global oil supply growth in 2023 is nearly matched with an expected increase of 2 million bpd for demand for the year.

Hittle said, “Prices are currently weighed down by expectations of slow demand growth, despite the EU oil import ban on Russian crude and the G7 price cap. The adjustment to the EU ban and price cap is likely to support prices temporarily.”

Hittle added that under the EU ban, crude oil exports that go to Europe currently will need to clear into more distant markets, or additional supply will need to be shut in.

“EU nations that import Russian crude oil either by ship or from the Druzhba North pipeline will need to replace those volumes with waterborne imports, increasingly pulling on crude oil exports from the Middle East, West Africa, and US. The crude import ban is followed by a product import ban for the EU starting 05 February. With the distillate market already tight, the product ban could support crude oil prices in 1Q22,” said Hittle.

Norway

Equinor has submitted the plan for development and operation (PDO) for Verdande to the Ministry of Petroleum and Energy. The subsea development secures important oil volumes to the Norne production vessel. Verdande will be put on stream in the fourth quarter of 2025.

Geir Tungesvik, Equinor’s Executive Vice President for Projects, Drilling & Procurement, said: “Verdande will provide important local and regional ripple effects. It will also help meet the energy demanded by European customers.”

Comprising the Cape Vulture and Alve North-East discoveries, Verdande is located in the Norwegian Sea at water depths of 350 – 380 m, around 300 km south-west of the city of Bodø in North Norway.

TotalEnergies has awarded Semco Maritime a five-year contract for the provision of manpower and construction service on offshore installations in the Danish part of the North Sea. The contract covers November 2022 – October 2027 and strengthens the long-standing strategic collaboration with TotalEnergies.

The contract builds on years of constructive cooperation including the ongoing re-development of the Tyra field and establishes a framework for extended collaboration in existing projects and for the provision of manpower in ad hoc projects. Semco Maritime expects to engage a significant number of skilled onshore and offshore workers under the contract, which will cover more than one million work hours.

Senior Vice President Oil & Gas, Semco Maritime, Anders Benfeldt said: “We are very pleased to strengthen our already close ties with TotalEnergies with the signing of this important contract, which we consider a vote of confidence after years of great cooperation. Ensuring efficient operations and a stable energy supply from the North Sea is of critical importance to TotalEnergies and the Danish people, and we are committed to providing an excellent team with a stellar track-record to get this job done.

The extended collaboration with TotalEnergies and Semco Maritime will unlock synergies across projects, ensuring smoother operations, swift assistance based on closer working relationships, and deeper understanding of the specific conditions and needs on each offshore installation. The closer ties will contribute to ensuring efficient operations, ultimately securing the Danish energy supply from the North Sea with the Tyra project as a particular important priority.

The contract commenced on 01 November 2022 and ensures a long-term planning horizon enabling Semco Maritime to attract, retain and further develop highly skilled onshore and offshore workers for the contract and future assignments.

The discoveries were proven in 2017 and 2020 respectively and contain a total of 36.3 million bbl of recoverable oil equivalent.

Saudi Arabia

Keppel Offshore & Marine Ltd has, through its wholly-owned subsidiaries, signed bareboat charter contracts with ADES Saudi Ltd. Co. for two jackup rigs to be deployed in Saudi Arabia. This brings the total number of rigs Keppel O&M has on charter with ADES to four.

The charters will be for a period of five years, expected to commence in 1H23, and projected to generate total revenue of about US$155 million for Keppel O&M, which includes modification works to prepare the rigs for deployment.

These are the fifth and sixth bareboat charters secured by Keppel O&M this year.

Winter 2022 Oilfield Technology | 5

TotalEnergies awards Semco Maritime a five-year contract in the Danish North Sea

31 January – 02 February 2023

SPE Hydraulic Fracturing Technology Conference and Exhibition Texas, United States spe-events.org/hydraulicfracturing

07

– 09 March 2023

SPE/IADC International Drilling Conference and Exhibition 2023 Stavanger, Norway drillingconference.org/welcome

01 – 04 May 2023

Offshore Technology Conference 2023 Texas, United States 2023.otcnet.org

05

– 08 September 2023

Gastech Exhibition & Conference Tampines, Singapore gastechevent.com

Web news highlights

Ì

Ì

PCSB announces oil and gas discovery at the Nahara-1 well in Block SK306

Equinor postpones Wisting project investment decision

Ì NOPSEMA welcomes new Chief Executive Officer

Ì

Tracerco supplies technology to Scarborough Gas Field

Ì Emerson to help enable carbon-efficient production from Equinor’s Martin Linge North Sea development

To read more about these articles and for more event listings go to: www.oilfieldtechnology.com

Oil and gas industry leaders and UK government discuss energy security, net zero and investment

Government and industry gathered on 30 November to discuss energy security, the energy transition to net zero, and challenges to maintaining investment in the North Sea.

Industry bodies, representatives from the Department for Business, Energy and Industrial Strategy (BEIS), the Treasury, and the Scottish Government attended the North Sea Transition Forum in London.

Hosted and chaired by industry regulator, the North Sea Transition Authority (NSTA), the forum sets the strategic direction for the UK oil and gas industry and oversees the work of seven task forces.

Forum members discussed several priority areas for 2023, including regulatory, fiscal and political areas. The industry is forecast to contribute £14.9 billion in tax receipts during the 2022 – 2023 financial year, however industry members raised concerns around the case for continuing investment following recent changes to the Energy Profits Levy.

Steps to support the future of the UK’s supply chain for current and future energy projects were also on the agenda, as was the importance of building on the opportunities of carbon capture and the hydrogen economy.

The forum is accountable for the delivery of the North Sea Transition Deal with the UK Government, which made clear the oil and gas industry’s vital role in helping Britain meet its energy demand and achieve net zero.

Signed in March 2021, the deal committed oil and gas companies to drive down their emissions, including through platform electrification, and make multibillion-pound investments in carbon capture and hydrogen projects.

In addition, industry pledged to ensure that at least half of spending on UK energy transition and decommissioning projects goes to UK supply chain companies by 2030.

Updates on progress to deliver the deal were provided. The sector cut its own emissions by more than 20% between 2018 – 2021 and the NSTA is pushing the industry to go further and faster on reductions to meet targets agreed in the deal, including by clamping down on flaring and powering platforms with clean electricity.

Dr Andy Samuel, NSTA Chief Executive, said: “Today’s frank and constructive conversation has helped focus positive actions for industry, government and the NSTA to take over the coming months in support of energy security and a healthy supply chain whilst accelerating the energy transition.”

Deirdre Michie, Chief Executive of industry body Offshore Energies UK, said: “The forum is a key arena for engaging with the government and ensuring that long-term fiscal and policy plans are in place to support the UK’s energy security while driving the transition to cleaner, low-carbon energies of the future.”

Valaris renews service and maintenance agreement with Survitec

Valaris has confirmed that it has renewed, for an additional three years, the service agreement it has in place with survival technology solutions provider, Survitec.

An extensive network of more than 400 service stations around the world combined with streamlined lifesaving appliance maintenance were key factors in the decision by Valaris to remain with Survitec.

The master service and supply contract covers the annual and five-year inspection, servicing, and maintenance of LSA, including lifeboats, davits, and fast rescue crafts across Valaris’ global fleet of 11 drill ships, 5 semi-submersibles and 36 jack-up rigs.

Jim Cook, Head of Business Development – Energy, Survitec, said: “This significant development is indicative of the global energy sector’s preference for a company capable of servicing third-party, multi-brand safety and survival equipment through a single point of contact.”

6 | Oilfield Technology Winter 2022

We know POWER sections.

We know what the oil and gas industry demands – to go faster, deeper and farther.

It takes leading edge technologies. Meticulously designed power sections that are precisely engineered, manufactured and calibrated to deliver maximum drilling and thru-tubing performance. Elastomer technologies researched and developed to ensure reliability downhole in corrosive, high temperature, high torque or high wear applications. An elite line of power sections ranging from 1-11/16” - 11-3/4”.

We set the industry benchmark for power section innovation, quality and performance – because we know what it takes to power your downhole drilling operations around the globe.

Learn more at Abacodrilling.com

Stator

Rotor Elastomer

© 2022 Abaco Drilling Technologies. All rights reserved. LEADING POWER SECTION TECHNOLOGY

BP starts production from Trinidad and Tobago’s Cassia C facility

BP Trinidad and Tobago LLC (bpTT) has confirmed that its Cassia C development has safely delivered first gas.

Cassia C is bpTT’s first offshore compression platform and its biggest offshore facility. It will enable bpTT to access and produce low pressure gas resources from the Greater Cassia Area. The platform, bpTT’s 16 th offshore facility, is connected to the existing Cassia hub which lies approximately 35 miles off of Trinidad’s southeast coast.

Cassia C is expected to produce, at peak, about 200 – 300 million standard cubic feet a day of gas. Production will go towards meeting bpTT’s gas supply commitments and will be important to sustaining T&T’s LNG and petrochemical industries.

David Campbell, bpTT president, said: “First gas from Cassia C is an important milestone for bp in Trinidad and Tobago. This first offshore compression facility will allow us to unlock new resources and bring much-needed gas to market. I am immensely proud of the teams which have been working hard to bring this facility online.”

Ewan Drummond, BP Senior Vice President, Projects, Production, and Operations, said: “I am proud of our achievement to deliver this project while keeping our people safe throughout a global pandemic. Cassia C is a great example of bp’s resilient hydrocarbons strategy in action – providing the energy the world needs now and helping us invest in the energy transition. I would like to thank our team for their commitment in the safe execution of this project.”

The Cassia C platform’s jacket – its legs and supporting frame –was built at TOFCO (Trinidad Offshore Fabricators) and installed in 2020. Its topside structure was built in the McDermott fabrication yard, Altamira, Mexico and was installed in 2021.

The Cassia C project is an important step in bpTT’s Area Development Plan, which outlines the direction and pace of the company’s activities to develop hydrocarbon resources in its licensed marine acreage in Trinidad and Tobago.

The plan includes a combination of exploration, development projects and activities focused on maximising production from bpTT’s acreage.

First gas from Cassia C follows the recent sanction of the Cypre development and the execution of the gas supply agreement with the National Gas Company.

PGS awarded Mediterranean survey contract

PGS has been awarded a 3D exploration acquisition contract in the Mediterranean by an independent energy company. Ramform Hyperion will commence acquisition in late November and expect to complete it in mid-January 2023.

President & CEO in PGS, Rune Olav Pedersen, said: “We continue to experience increased exploration activity in this prolific region and are very pleased with this contract award. We currently have the Ramform Hyperion working in the Southeast part of the Mediterranean and this contract secures visibility for the vessel into next year.”

gas intensity

A new analysis of North Sea oil and gas production by S&P Global Commodity Insights illustrates the degree that greenhouse gas (GHG) intensity can vary from one oil and gas asset to the next, and the factors that ultimately determine it.

The average GHG intensity of production in the UK and Norwegian areas of the North Sea was 12 kg of carbon dioxide equivalent per barrel of oil equivalent (kgCO 2e/boe) in 2021. A deeper analysis revealed that nearly two thirds of total production was found to have an intensity below that basin-wide average. Meanwhile, assets responsible for just 20% of total production generated half of the basin’s total GHG emissions.

Overall, individual assets across the basin displayed a wide variability, ranging in GHG intensity from less than 1 kgCO 2e/boe to nearly 150 kgCO2e/boe. Such a wide range is consistent across all the regions that have been explored to date and highlights the challenges of averages, the report finds.

The findings are derived from a new S&P Global Commodity Insights capability. The new capability, built upon existing proprietary upstream databases and emerging sources such as reported emissions and satellite flaring data from the Earth Observation Group, makes it possible to estimate the totality of an upstream oil and gas play’s emissions and emissions intensity.

Kevin Birn, Global Head for S&P Global Commodity Insights’ newly formed Centre of Emissions Excellence, said: “In every play where we have looked, we continue to find wide variability in the greenhouse gas intensity with any one asset potentially being significantly different from the average.”

The considerable variability of the findings illustrates several key factors that ultimately influence the GHG intensity of an asset. These include productivity, where younger and more productive fields tend to be less GHG intensive than older, more geologically challenging fields. The latter also may require energy-intensive enhanced recovery techniques, increased drilling to maintain productivity, and older technology can also put upward pressure on emissions intensity.

Other factors that impact the GHG intensity of individual assets include the degree to which operations can be electrified and the degree of venting and flaring.

The S&P Global Commodity Insights analysis compared production in the United Kingdom and Norwegian areas of the North Sea to illustrate the influence of these factors.

The analysis found that, on average, UK production in the North Sea was nearly three times more GHG intensive (23 kgCO2e/boe) than Norwegian production (8 kgCO2e/boe).

Norwegian operations were advantaged on a GHG intensity basis as, on average, fields tended to be less mature and with a greater share of output from larger, more productive, and technologically advanced operations. Additionally, Norway benefited from electrification projects that tie back to Norway’s relatively low-emission, hydro-dominated power grid.

8 | Oilfield Technology Winter 2022

S&P Global Commodity Insights shows that two thirds of UK and Norway North Sea oil and gas production has lower-than-average greenhouse

AES DRILLING FLUIDS

IT'S IN THE DETAILS

AES Drilling Fluids: Product, service, and solutions to meet every challenge

It's not just innovative drilling fluid solutions – it's the knowledge and experience to recommend them when needed.

It's not just the facilities near your drilling location – it's the people and equipment that never keep you waiting.

And it's not just our years of experience drilling thousands of wells – it's the data analytics and experienced account managers that allow you to make the most cost-effective decisions with the correct information.

DETAILS MATTER.

WWW.AESFLUIDS.COM

The making

10 |

Oilfield Technology’s Deputy Editor, Emily Thomas, provides an overview of the upstream oil and gas sector in the MENA region, and discusses the opportunities and challenges facing the industry.

The outlook for the MENA region’s oil and gas industry is looking promising, with oil-exporting and GCC countries anticipated to benefit from a spike in energy prices, and from the opportunity to boost production and divert more of their crude oil towards Europe. Oil-and-gas-driven projects are therefore expected to increase government and private energy sector revenues.1 Developing oil-importing countries, however, are likely to suffer, exposed to macroeconomic risk inflicted by the Russia-Ukraine conflict,

commodity and food insecurity, and higher levels of inflation.1 Since the beginning of the conflict with Ukraine, oil importers in the region have seen growth of domestic interest rates and market-based bond yields, leading to a 5 percentage point increase in the interest-payments-to-revenues ratio for Egypt and Jordan, and a 2.6 percentage point increase for Tunisia.2 Moreover, it is expected that global oil prices will remain high for some time.

According to APICORP’s ‘Annual MENA Energy Investment Outlook 2022’,

investment in new oil supply needs to keep pace to avoid a period of market tightness. 1Q22 data shows that MENA’s five-year forward-looking investments top last year’s 2021 – 2025 figure by 9%, at a total of US$879 billion.1 The industry across the region has shown no signs of slowing down, with a host of projects in the pipeline.

North Africa

North Africa’s upstream oil and gas sector is centred around the three producing countries of Libya, Algeria, and Egypt. In a

of MENA

| 11

move to support Libya’s National Oil Corp. (NOC) and help increase the country’s oil production, TotalEnergies and ConocoPhillips have recently completed a joint acquisition of 8.16% interest held by Hess in the Waha concessions. TotalEnergies’ interest in these concessions has now increased from 16.33% to 20.41%. In 2020, the company’s total oil production amounted to 84 000 boepd, coming from the offshore Al Jurf field, the El Sharara onshore area, and the Waha fields.3

TotalEnergies has also recently signed a new production sharing contract with Sonatrach, Occidental, and Eni in the Berkine Basin in Eastern Algeria. The contract is for a period of 25 years for onshore Blocks 404a and 208, with a dedicated carbon reduction programme in place to help reduce the fields’ carbon intensity.4 Also located in the Berkine Basin, Eni has announced the start-up of a new HDLE/HDLS oilfield after it was discovered in March this year. The field is currently producing 10 000 bpd, and an acceleration plan is in development, with new wells to be drilled in the new year. The project is set to help reach and surpass the target of 120 000 boepd of equity production in Algeria in 2023.5

The upstream sector in Egypt is also considered dynamic, with industry giants such as Chevron and ExxonMobil becoming involved in the market in 2019.6 Another giant, BP, was recently awarded new blocks in the Offshore Nile Delta by the Egyptian Natural Gas Holding Co. BP now holds 82.75% of the Northwest Abu Qir offshore area, 100% of the recently awarded North King Mariout block, 50% of the Bellatrix-Seti East block, 100% of the King Mariout offshore area, 50% of the North El Fayrouz offshore area, and 100% of the North El Tabya area extension, producing around 70% of Egypt’s gas overall. Karim Alaa, BP’s Regional President, Egypt, Algeria, and Libya, said that, “acquiring this acreage is part of [the company’s] strategy to maintain a longer-term plateau production rate.”7

UAE

The UAE is home to the 6th largest oil reserves and the 7th largest gas reserves in the world, and efforts are being made to ramp up production in order to keep up with demand.8 Abu Dhabi National Oil Company (ADNOC) recently announced in a board meeting that plans are being made to bring forward its capacity expansion from 2030 to 2027. Targets currently stand at 5 million bpd. The UAE’s hydrocarbon reserves have increased this year by 2 billion stock tank barrels (STB) of oil and 1 trillion standard cubic feet, making the accelerated production capacity an even more attractive prospect. ADNOC aims to drive AED175 billion (US$48 billion) back into the UAE economy.9

Saudi Arabia

Saudi Arabia’s upstream sector is in a phase of expansion, led by integrated energy and chemicals company, Saudi Aramco. The company is well known for operating the Ghawar and Safaniah oilfields, and has thrived as a result of higher crude oil prices, achieving a record quarterly net income of $39.5 billion in 1Q22.10 The company has recently signed 59 corporate procurement agreements (CPAs), valued at $11 billion, with 51 local and global suppliers and manufacturers; the agreements are estimated to create 5000 jobs in Saudi Arabia. Big names such as Baker Hughes, Halliburton, and SLB, are among the companies who have signed agreements with Saudi Aramco, and the commodities covered by the CPAs include wellheads, pipes, and compressors, to name a few. The agreements fall under the ‘iktva’ programme, started up by the company to establish an efficient and reliable supply chain in Saudi Arabia; the programme has now contributed over $130 billion to the country’s gross domestic product.11

Iraq and Iran

Rather than expanding, Iraq is currently reducing its crude oil production, in keeping with OPEC’s planned production levels. In 2020, average production levels for the country totalled around 4.3 million bpd, most of which came from the Rumaila oil fields.12 Many international oil companies also have a presence in Iraq; TotalEnergies recently completed the divestment of its interest in the Sarsang oilfield, to ShaMaran Petroleum Corp., a company listed in Canada and Sweden, for a sum of $155 million. In 2021, this share of production equalled around 3500 bpd.13 Unlike Iraq, Iran has not been subject to OPEC’s production cuts, as sanctions have already constrained its crude oil production. These sanctions, alongside the COVID-19 pandemic, saw the country’s oil production plummet to a 30-year low in 2020.14 At the end of 2021, however, it was recorded that Iran held 24% of the Middle East’s oil reserves; as crude oil prices increased, and Iran exported more oil to China, the country saw some signs of recovery.14

Syria

Despite holding significantly smaller reserves than other Middle Eastern countries, the upstream sector has always been a key source of revenue for the Syrian government. Back in 2008, it was recorded that the country produced 406 000 bpd,15 however by 2018, these levels had dropped by over 90%. Since the outbreak of the Syrian Civil War, the industry fell to its knees, as oilfields were seized by the Islamic State or damaged in air strikes. Of course, this means that the country has since been heavily reliant on imports, mainly from Iran, yet even this has become difficult due to sanctions imposed by the US, and so the country struggles on to find an alternative.16

Tunisia, Jordan, Israel , Lebanon, and Morocco

Tunisia’s production has also been hampered in recent times, and has been declining from a peak of 120 000 bpd to 60 000 bpd in 2013. While the country aims to increase its production, employment-related protests and delays in orders have unfortunately pushed back the goalposts for new developments.17 The neighbouring country, Jordan, has even fewer reserves at an estimated 1 million bbl recorded in 2014, and relies on imports to meet 90% of domestic demand.18 Until recently, Israel was similarly reliant upon imports to meet the country’s demand, however recent discoveries mean this could be changing.

According to Reuters, oil and gas producer, Energean, has just made a natural gas discovery off the coast of Israel at its Zeus exploration well19 and TotalEnergies and ENI have also signed an agreement to implement a maritime boundary which has been reached between Israel and Lebanon. The exploration will begin with the procurement of a drilling rig and mobilisation of teams, and will “respond to the request of both countries to assess the materiality of hydrocarbon resources and production potential in the area,” according to Patrick Pouyanné, Chairman and Chief Executive Officer of TotalEnergies.20 Lebanon currently relies almost exclusively on imports, therefore any hydrocarbon discoveries in the country could begin to contribute towards a reduced energy dependency on external markets.21

Morocco also plans to reduce its dependence on foreign imports, as a country that has not exceeded production of 5000 bpd. The country hopes to turn to the development of more renewable energy sources in order to meet domestic needs.22

Oman and Kuwait

Oman began its commercial oil production in 1967, and today, around 70% of the country’s annual budget is made up through the

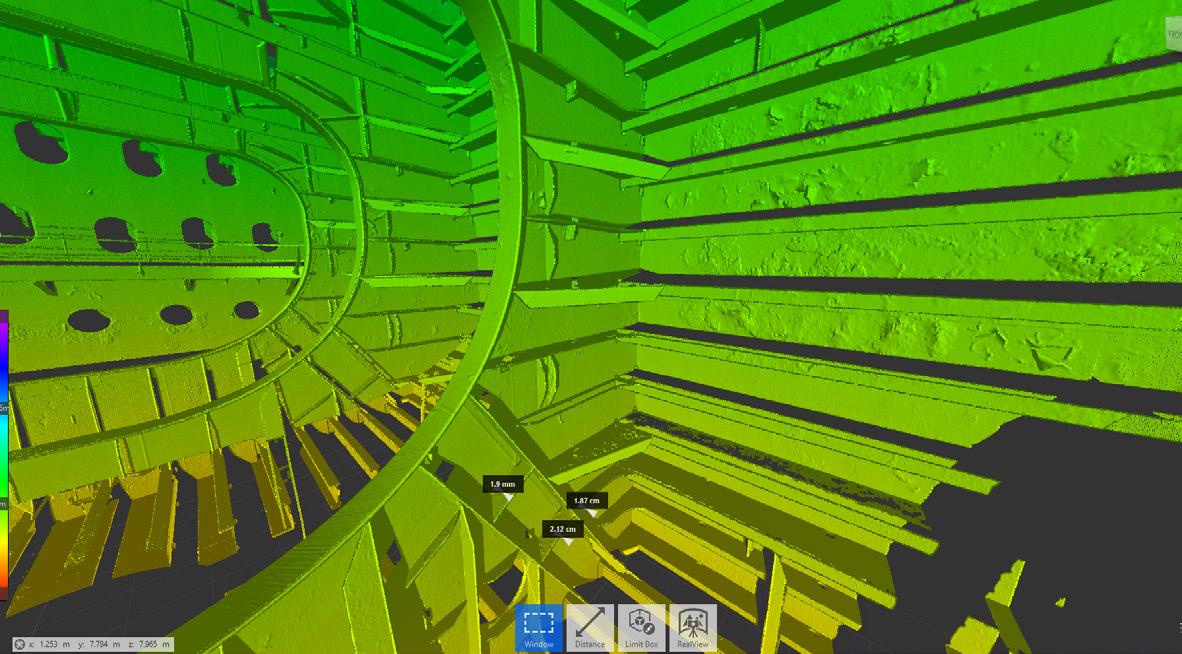

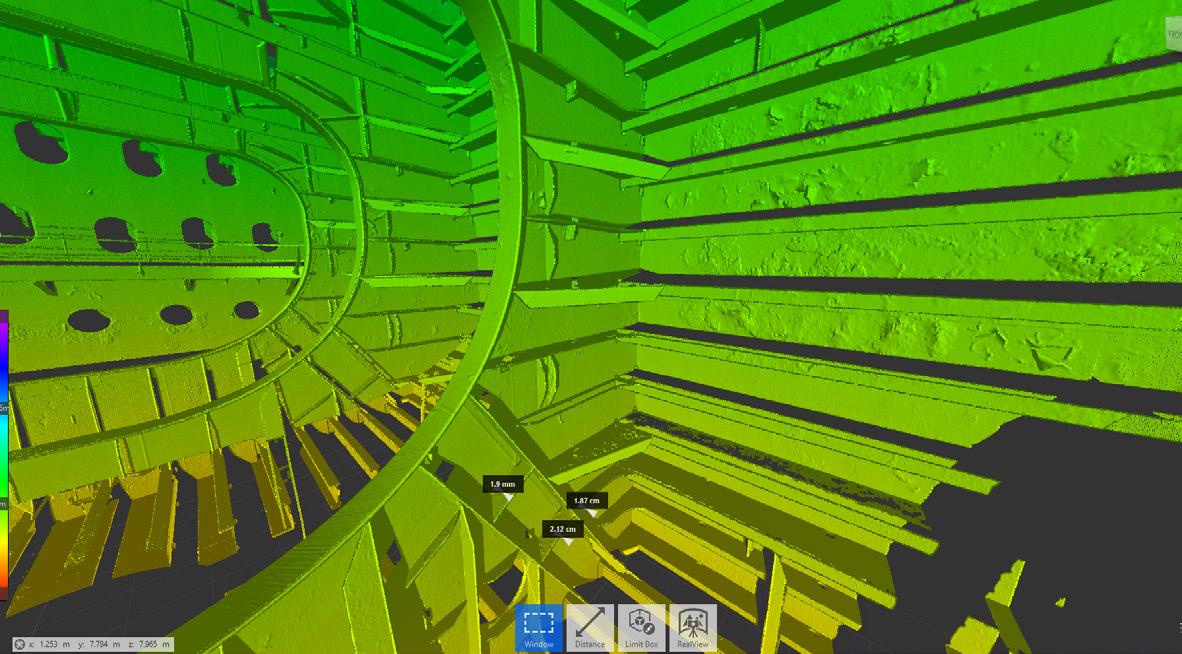

12 | Oilfield Technology Winter 2022

industry’s success.23 Earlier in the year, Shell, TotalEnergies, and OQ signed an EPSA to explore natural gas and condensate in Block 11. Shell is the established operator of the block, with a 67.5% working interest, while OQ holds 10% and TotalEnergies holds 22.5%. The companies’ activities will see seismic acquisition of 1400 km2 and following this, some exploration wells in the new year.24 Oman’s complex geology means that 3D seismic analysis is often required in order for exploration, and the upstream sector in the country has recently expressed interest in digital systems for remote well monitoring. Similarly, Kuwait’s upstream sector has emphasised a focus on optimisation of its oilfields. In 2009, Kuwait Oil Co. launched its GC-01 Kuwait Integrated Digital Field (KwIDF) pilot project in the Burgan field with the aim to achieve integrated operations for measurement and control of oilfield assets. The project encouraged real time accurate data, and automated and smart workflow executions.25

Qatar

Qatar is another major player in the MENA region’s upstream sector, with around 25 billion bbl in oil reserves, and exports making up a majority of the country’s revenue.26 There is currently a spotlight on Qatar as the host of the 2022 FIFA World Cup, and according to TradingPedia, the tournament is costing the country the equivalent of three billion bbl of crude oil; the analysis states that it will take Qatar over four years to pay off the costs of the competition in full.27

Bahrain and Yemen

Bahrain’s oil revenue largely comes from the onshore Bahrain field and the offshore Abu Safah field. The country is considered a fairly small producer, although some significant discoveries have been made within the last few years. On the west coast, an estimated 80 million bbl of oil were discovered, while 10 – 20 ft3 of deep gas reserves were also uncovered beneath the legacy Bahrain field. These discoveries require

further investigation, but are nonetheless exciting developments for the sector.28

The upstream sector in Yemen, on the other hand, has been badly affected by the ongoing civil war between the Rashad al-Alimi-led Yemeni government and the Houthi armed movement. Reuters reported on the Houthis’ recent drone attack on oil ports in government-held areas, which are said to have disturbed exports.29 It was reported that the attack constituted an attempt to loot oil by preventing a vessel from docking. Current oil production in Yemen is below 80 000 bpd, a far cry from the 127 000 bpd produced prior to the start of the war.29 With the government reliant on revenue from the upstream sector, the country’s economy is an uncertain state.

Conclusion

Overall, the MENA region’s upstream sector presents a mixed picture. On one hand, a number of oil-producing countries will be seen to benefit from higher crude oil prices and the opportunity to divert its exports towards Europe, as it shuns Russian oil. New discoveries, continued exploration, optimisation and digitalisation strategies, and plans to ramp up production, are all positive signs for the industry. On the other hand, developing importing countries are struggling to keep up with rising oil costs and are burdened by the effects of the Russia-Ukraine crisis, whilst the upstream sectors in war-torn countries such as Yemen and Syria are suffering, and huge economic repercussions will be felt. What is clear is the importance of the MENA region in meeting the world’s energy demands. The coming months will present many opportunities and challenges for the upstream sector, and it remains to be seen how these will be handled.

Notes

For a full list of references, please visit www.oilfieldtechnology.com/ special-reports/30112022/the-making-of-mena-references/

Download technical white papers for free from companies across the upstream industry Review new trends and technologies www.oilfieldtechnology.com/whitepapers/

REFINING

Technological advances simplify operations and reduce costs when the application addresses known requirements and limits the risk of unknown challenges. Experience reduces unknown risk, creating opportunities to reduce overall cost.

In the drilling fluids domain, invert emulsion and high-performance water-based drilling fluid systems mitigate a broad set of drilling risks – many of which do not exist in today’s unconventional wells. A new drilling fluid system, paired with experience and a robust set of well data, is tailored to focus on the true risks of these applications to eliminate unnecessary costs.

Invert emulsion drilling fluids (IEFs) provide operational simplicity, tolerate many contaminants, and maximise rate of penetration through lubricity and inhibition. Considered an environmentally-friendly alternative, high performance water-based drilling fluids (HPWBDF) maximise shale inhibition using an

14 |

THE RISKS

encapsulating polymer, amine, and anti-accretion surfactant combination. In most cases, a complementary lubricant provides supplemental torque reduction.

With the price-sensitive, well manufacturing approach used in unconventional shales, IEFs and HPWBDFs introduce costs that address challenges which are not always present. In earlier development phases, many wells were drilled with brine and water. As unconventional shale transitioned to a boom, fluid technology was needed to overcome rig limitations and personnel shortages. IEFs provided supplemental

Matthew Offenbacher and Richard Toomes, AES Drilling Fluids, USA, explain how data analytics can lead to simpler, more cost-effective drilling solutions.

Matthew Offenbacher and Richard Toomes, AES Drilling Fluids, USA, explain how data analytics can lead to simpler, more cost-effective drilling solutions.

| 15

Figure 1. AES ANALYTICS map tool feature allows users to quickly filter data to a target formation, where dozens of XRD/mineralogy lab results can provide further understanding of location-specific drilling risks.

lubricity, low maintenance, and simplicity – particularly as operators entered new areas with limited knowledge of formation compositions and drilling challenges.

Years of experience show that many, but not all, formations in unconventional basins do not require IEFs or HPWBDFs. Savings are available through leveraging data analytics to select and optimise fluids technology for lower risk wells. AQUA-FLEX is a new, optimised water-based drilling fluid system (OWBDF) designed to reduce costs by pairing data and system components with actual well risks. In the case of losses, a lower per-barrel cost generates immediate savings.

Well identification

Over time, large volumes of well data and formation properties accumulate to align well risk with fluid requirements. In the data analytics dashboard (Figure 1), risk events are filtered by the target reservoir, geographical location, and likelihood of a fluids-related drilling issue. Paired with laboratory analysis, including x-ray diffraction data, it becomes clear that shale inhibition is not a significant factor to well risk. This information eliminates many cost-intensive HPWBDF components.

Pipe life and torque management

Figure 2. Cheesing (left) and greasing (middle) are the result of many lubricant incompatibilities during the screening process, whereas a compatible lubricant (right) will have little-to-no evidence of cheesing/greasing.

A key limiter for long laterals is torque. Friction reduces weight applied at the bit, limiting rate of penetration. Sustained high torque limits pipe life, increasing overall cost. In some cases, the benefits of an aqueous fluid were completely offset by the cost of an entirely new drill string due to damage from excess torque. Since that time, pipe costs have increased more than 90%. Any transition to lower-cost aqueous fluids requires a low coefficient of friction to extend pipe life.

BRINEX, the first lubricant offering in the AQUA-FLEX system, demonstrates effective torque reduction while remaining compatible with base fluids ranging from freshwater to saturated sodium chloride brine. The broad application scenarios of BRINEX maintain simplicity while delivering sustained torque reduction.

Figure 3. Lubricity performance of BRINEX as measured on the LEM in various brine samples.

Table 1. Lab screening of various experimental additives used to reduce fluid loss and generate thin, lubricious filter cake.

Experimental blend no. #1 #2 #3 #4 (WALLPLEX)

Exp additive #1, % wt. 29% 29% 33% 29%

Exp additive #2, % wt. - - 9% 13%

Exp additive #3, % wt. 29% - - 33%

Exp additive #4, % wt. 42% 42% 58% 25%

Exp additive #5, % wt. - 29% - -

API fluid loss, cc/30 min 11.3 No control 7.5 6.1

*Base test fluid consisted of 9.2 lb/gal NaCl brine, 0.25 lb/bbl soda ash, 0.25 lb/bbl caustic soda, and 0.5 lb/bbl xanthan gum.

Lubricant development begins with compatibility screening in common base fluids at expected drilling conditions. The lubricant is added to the base fluid and stressed by contaminants to identify cheesing and greasing tendencies. Cheesing or greasing compromises torque reduction and creates issues with the circulating system, such as blinding screens.

Cheesing occurs when the lubricant forms an emulsion, creating chunks of material in the base fluid. Greasing occurs when solids in the fluid become oil-wet and agglomerate. Figure 2 shows cheesing, greasing, and a passing compatibility.

Lubricity is measured using a lubricity evaluation monitor (LEM). The LEM provides a baseline coefficient of friction readings to compare to treated fluid. The LEM was modified to capture different lubricant concentrations during the same test via a syringe pump. This helps to identify the optimal concentration to provide the largest torque reduction. Figure 3 details BRINEX’s performance on the LEM in several brine sources, each with different properties.

Wellbore quality

While shale is generally impermeable, there is occasional need for filtration control to aid in mechanical shale stability

16 | Oilfield Technology Winter 2022

and to seal permeable streaks. WALLPLEX is a single-sack blend of materials that aid in developing a wall cake when necessary, via sweeps of material or, to quickly ‘mud up’ in a critical situation.

The optimised blend for WALLPLEX was developed by combining attributes of products known to enhance wellbore stability, improve lubricity, and reduce fluid loss. Blends of new and historically proven additives were tested using freshwater, produced water, and saturated field brine to establish the optimum blend for expected formation properties.

Table 1 shows the optimised fluid loss for the blend and Figure 4 shows the resulting lubricious filter cake.

The simplicity of the mixture reduces the requirements for the rig crew to maintain appropriate ratios of multiple products. A single-sack solution also limits the amount of material shipped to location, simplifying logistics and reducing trucking costs.

Rate of penetration

Clear, high-spurt loss fluids maximise rate of penetration as cuttings at the bit rapidly reach equilibrium pressure with the wellbore. When fine solids accumulate in the fluid system, they can form a seal that slows this equilibrium, reducing the rate of penetration.

To maintain clear fluids, a flocculant was introduced to improve solids separation through solids control equipment. The liquid polymer additive is injected prior to the centrifuge where it adsorbs on to solids, agglomerating them into larger particles that more readily separate in the equipment.

While dewatering is a very common concept, the simplicity of a liquid additive performing across a range of base fluids is essential to the AQUA-FLEX concept. AES FLOC 4003 minimises solids, effectively reducing water usage through lower dilution rates.

Case history

The key to cost and technology optimisation is matching the drilling fluid components to well demand. The engineering team utilised the in-house data analytics platform to match well risk to an application in the Midland Basin. Offset performance indicators and clay characterisation data confirmed torque – not reactive shale – was the primary well challenge.

A 7.88 in. lateral section was planned using water as the base fluid with a standard corrosion control programme. After drilling out the intermediate casing shoe, drilling commenced, monitoring torque. As torque reached programmed limits, sweeps of BRINEX were introduced, ultimately treating the whole system at 1.5% v/v. This allowed for a 50% increase in weight on bit and 50% increase in rate of penetration.

2 – 4 lb/bbl WALLPLEX sweeps were pumped every stand to provide supplemental torque reduction and to seal any permeable zones. Sweep returns were diverted to limit the introduction of solids. To maintain rate of penetration gains, solids were controlled through dewatering using AES FLOC 4003, limiting dilution requirements and water usage.

At total depth of the ~14 000 ft interval, a BRINEX pill was spotted

before running casing. Casing was run to bottom with no issues and cemented.

Results

The well, and many more, have drilled as effectively as IEFs or HPWBDFs, at a much lower cost. Base oil savings alone exceed US$100 000 while reducing the environmental impact and carbon intensity of the drilling operation. AQUA-FLEX is now used across many fields, with future improvements in torque reduction promising to displace even more traditional applications in the future.

Figure 5. WALLPLEX enhances lubricity in the AQUA-FLEX system.

Winter 2022 Oilfield Technology | 17

Figure 4. Filter cake generated by WALLPLEX on an aloxite disk.

Up for the

s drilling applications have increased in scope and complexity, the demands on drill bits have expanded. To increase drilling efficiency and performance, these tools are expected to enhance the rest of the bottomhole assembly, ensure the directional and formation targets are achieved, and reduce nonproductive time (NPT).

Tungsten carbide roller cone insert bits were used to drill hard rock formations for many years. However, slow rate of penetration (ROP), bearing life durability, and re-runnability limitations have ended progress in economic and performance advantages. Over the last decade, thermal and mechanical impact resistance developments and manufacturing techniques and processes

have enabled polycrystalline diamond compact (PDC) drill bits to become the standard in the industry. While conventional PDC drill bits increase ROP, they generate excessive torque, limiting their durability in large-diameter and hard and interbedded applications. In addition, although hybrid drill bits reduce torque, ROP is slower, and the re-runnability depends on the bearings used in the roller cones.

NOV’s ReedHycalog business unit has developed the Pegasus™ series drill bits to help maximise ROP, durability, stability, and steerability in large-diameter drilling applications. The bit features a dual-diameter and shankless design, high-performance cutters and inserts, and no moving parts, and the new fixed-cutter PDC bit helps

18 |

Jessica Stump and Matt Jennings, NOV, USA,

discuss recent advances in drill bit technologies and their advantages in challenging drilling environments.

challenge

operators drill faster, reduce torque generation, and run multiple times without repair.

The drill bit’s dual-diameter and shankless design increases lateral stability and reduces the impact of lateral vibration. The pilot section of the bit pre-fractures the hard formation for the reamer section to reduce torque and improve drilling efficiency. The enhanced gauge length removes the shank of the bit and places the bit breaker slot in the gauge. This increases the gauge pad area and shortens the length of the bit to improve stability, maximise steerability, and reduce downhole vibration when sliding.

NOV’s ION+™ PDC cutter technology is used to improve drilling performance and economics. 4 mm thick diamond tables

and ultra-deep leach technology help the cutters to deliver an increased volume of impact-resistant material, enhanced thermal stability, and improved tangential strength, reducing flexing and cracking. This combination allows the cutters to stay sharper longer, resulting in higher ROP and longer interval lengths in challenging interbedded applications.

The bit’s cutter geometries help improve durability and ROP and reduce torque. The working ridge of ION+ 5DX shaped cutters is optimised to withstand sudden impacts while imparting higher compressive loads into the formation for more efficient and effective rock failure. ION+ 4DXC shaped cutters increase point loading in the axial and tangential directions, improving

| 19

fracture propagation and reducing mechanical specific energy through torque reduction while increasing ROP. Alternating these shaped cutters along the cutting structure improves efficiency and durability by providing a smooth and low torque response from the bit.

When drilling large-diameter wells in hard formations, higher weight-on-bit requirements generate frictional energy, which can lead to cutting element damage and inhibit drill bit performance. The new bit includes two cutting elements. Chisel-shaped diamond elements protect the primary cutting structure and reduce severe torque fluctuations. These leached PDC inserts promote a higher ROP by pre-fracturing the formation, allowing the adjacent cutters to propagate these fractures and achieve a higher depth of cut more efficiently. Being strategically placed in secondary cutting positions enables the cutters to be aggressive, even in applications with hard stingers or conglomerates. In addition, Struts™ high-density impregnated cutting elements combine the toughness of carbide and the hardness of diamond to provide a flexible component that is impact and wear resistant. These Struts provide a secondary element that shares the primary cutter load, preventing overload damage to the primary cutting structure.

Case studies

Geothermal drilling applications are known for igneous and volcanic rocks that result in hard and abrasive formations. Therefore, like in oil and gas wells, conventional PDC bits are prone to thermal wear, excessive torque generation, impact damage, and lateral vibration.

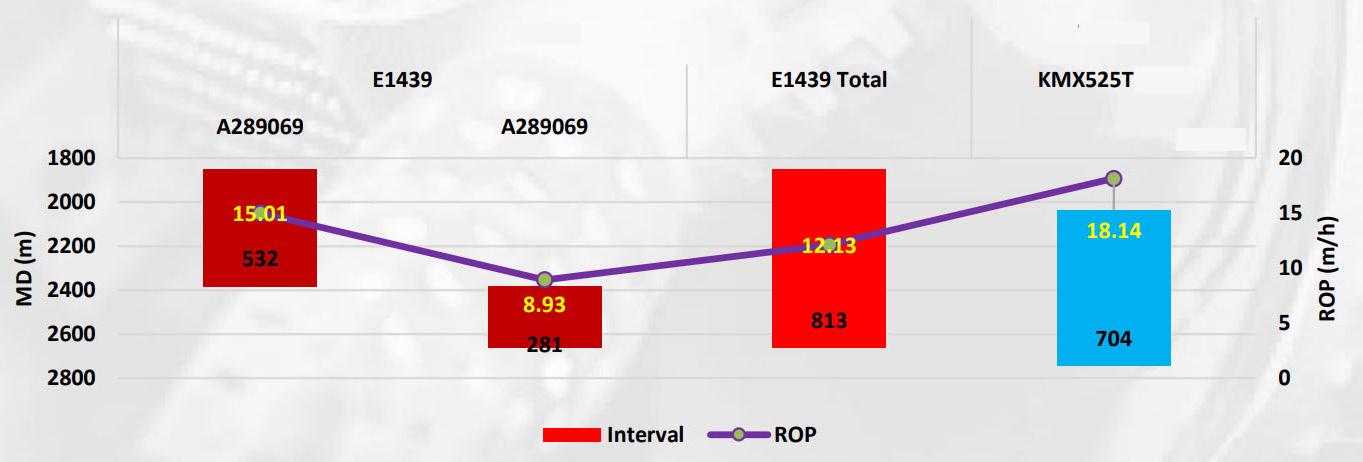

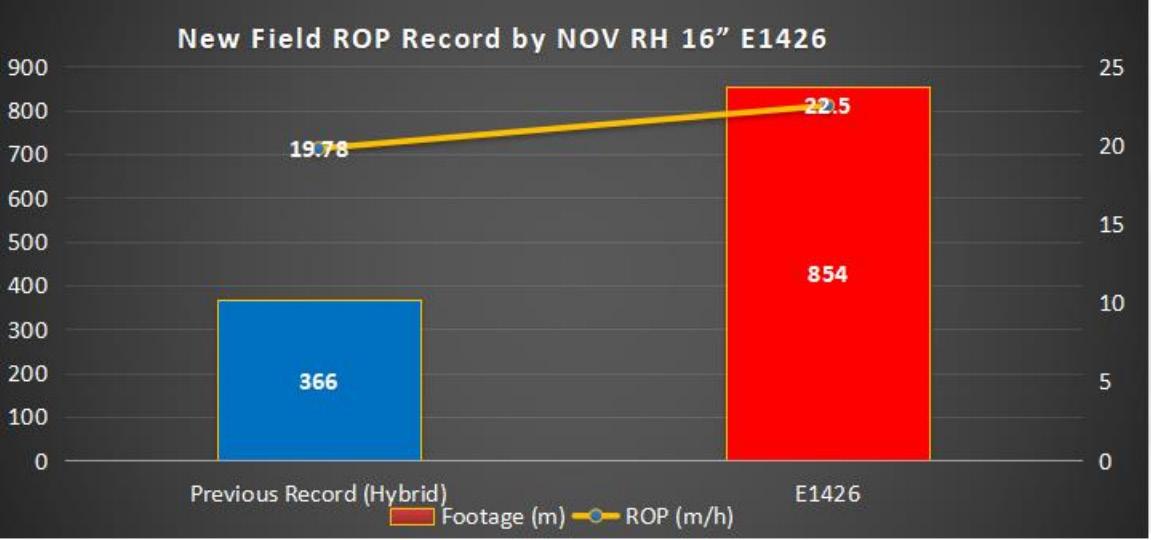

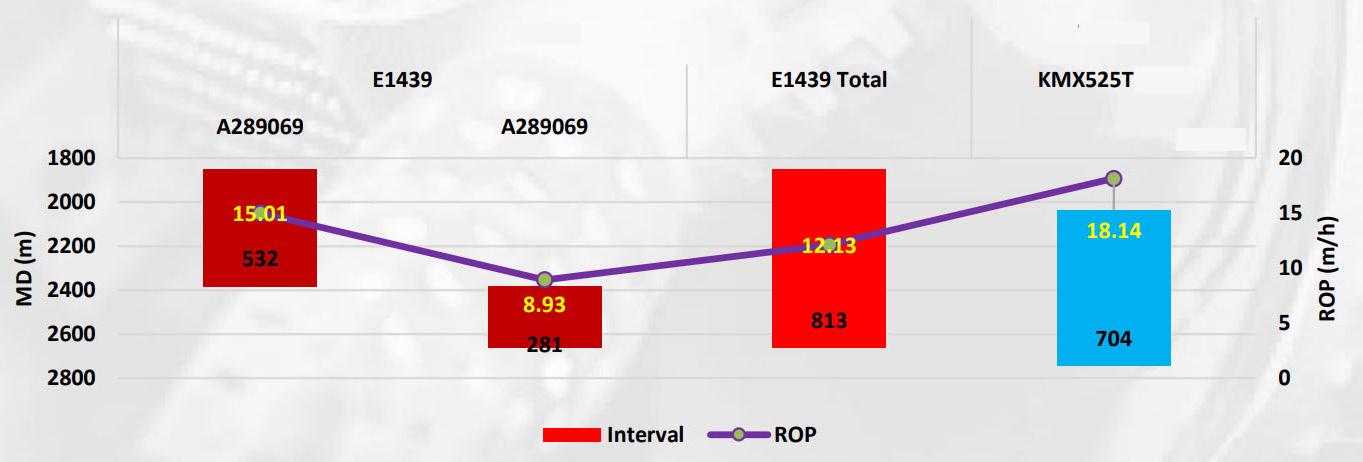

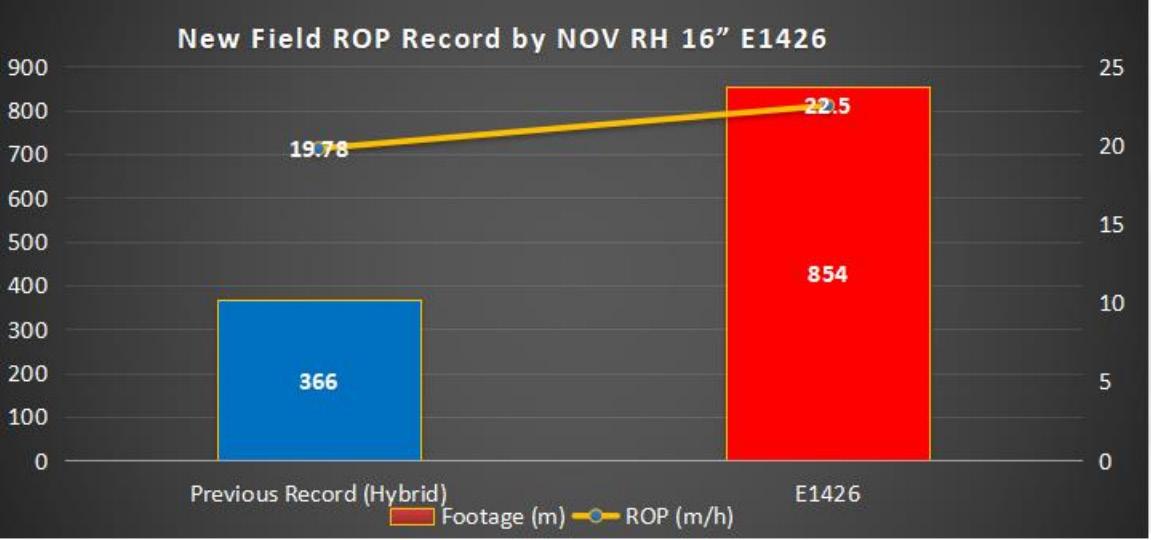

An operator in New Zealand needed to drill a 16-in. geothermal section in the Tauhara field through the volcanic deposits with sandstones and tuffs. NOV’s 16-in. Pegasus E1426 drill bit drilled a total interval of 854 m (2801 ft) in one run, from casing shoe to total depth (TD), the second longest field footage, and set the field’s ROP record of 22.5 m/hr (74 ft /hr) (Figure 2). The bit was run on a positive displacement motor on a 1.15° bent housing setting. It remained at the 16-in. diameter and drilled the desired section. The bit produced an excellent re-runnable condition: 1-1-CT-C-X-I-NO-TD. Finally, the fixed-cutter PDC drill bit had a lower torque signature than standard PDC designs and had no torque issues throughout the run.

In addition, the Pegasus 12¼-in. E1439 drill bit achieved all of its objectives on its maiden run through tougher drilling challenges and harder formations in the Tauhara field. The dual-diameter PDC bit drilled a total interval of 813 m (2667 ft) with a ROP of 12.13 m/hr (40 ft/hr) (Figure 3). The Pegasus reached the section TD and exhibited a satisfactory dull condition: 1-3-BT-S-X-I-WT-TD. Plus, the rig’s drilling supervisor and directional driller reported smooth torque and steady drilling

Conclusions

Over the last decade, advances in PDC cutter manufacturing and leaching technologies have enabled operators to drill farther and faster, and drill larger-diameter wells in challenging drilling environments, including geothermal. With improved thermal and impact resistance and reduced torque generation, new drill bit technologies can help battle any drilling challenge in any application to keep operators in the zone and reduce drilling days and costs.

20 | Oilfield Technology Winter 2022

throughout the bit run.

Figure 1. New advances in drill bit technology enable operators to drill faster, reduce torque generation, and run multiple times in large-diameter applications.

Figure 2. The Pegasus 16-in. E1426 drill bit set the field’s ROP record.

Figure 3. The 12¼-in. E1439 drill bit drilled a total interval of 813 m with an ROP of 12.13 m/hr.

A

www.globalhydrogenreview.com

The Winter issue of Global Hydrogen Review is out now Subscribe for free:

new magazine focused on the global hydrogen sector

ompanies using offshore vessels to complete exploration, construction, or support work most often have to adjust their schedules due to unfavourable weather conditions, which is a costly restraint on operability as downtime can last for hours, days, or even weeks at a time. Operating windows are determined based on the relationships between the weather and vessel movement; uncertainties in these predictions may result in activity being ceased prematurely. It has been estimated, by shipping insight specialists StratumFive, that a lack of insight into marine weather can account for up to 80% of the impact on performance.

To improve the efficiency of offshore operations, existing assumptions and calculations based on conventional response amplitude operators (RAOs) should be challenged and improved. The International Association of Drilling Contractors (IADC) defines the RAO as the “ratio of a vessel’s motion to the wave amplitude causing that motion and presented over a wide range of wave periods.”

4Subsea, in conjunction with Subsea7, has developed a machine learning approach that uses sea state forecasts to predict vessel response ranges. The results can be used not only to improve wave-vessel response predictions, but also to improve the understanding of existing RAOs and their shortcomings.

Machine learning and data-based digital models

In a world where energy companies are increasingly alert to the safety, economic, and climate elements in decision making, wave-induced vessel motions are either inevitable, or often not feasible to mitigate without compromising on economic and environmental concerns, such as fuel consumption and payload capacity. Accurately describing wave-vessel interaction is essential for sustainable operations.

22 |

| 23

Ali Cetin and Vegard Solum, 4Subsea, and Cristina Evans, Subsea7, Norway, explain how machine learning and digital technologies based on data are paving the way for improved vessel response predictions, as well as better informed operability and weather windows.

The model developed by 4Subsea has a purpose of estimating the vessel response (power) spectrum when provided with a sea-state. In effect, the methodology establishes the effective RAO amplitudes, which, in combination with a wave spectrum, produces the response range.

4insight is a solution for optimising vessel operations based on data from onboard systems. The asset’s operability is improved using measured response information and live weather data, combined with machine learning and AI for prediction. The technology can thereby reduce fuel consumption and emissions, as well as improve safety and

economic performance as it provides decision support to onshore and offshore personnel.

The technology behind the solution is designed to receive and compute large amounts of data, from the model for example, and unlock key metrics which can highlight trends and predictions. The platform contains digital twins of the assets and helps operators improve information quality and manage the ownership, security, sharing, and use of information, while at the same time reducing operational costs and risk.

This type of technology has several benefits:

Ì It can enable optimisation of vessel operations using live data from onboard systems and optimises power generation for actual weather and ongoing operations.

Ì

It reduces risk and improves operability of vessels using actual vessel response and recorded weather conditions and allows engineers to set up interactive operating procedures using sensor data as limiting parameters instead of subjective judgements.

Ì

The technology accommodates integrated operations between the onboard crew and onshore support organisation and enables safe sharing of data with relevant stakeholders. It can also be used for early anomaly detection in operations and onboard systems, allowing mitigating actions to be taken before a situation escalates to a problem.

A key feature of such models is that they incorporate conventional RAOs as prior knowledge and use it as a fall-back solution in the absence of sufficient data. A properly trained and tuned algorithm will always perform at least as well as the previous information. Such models can be used with zero information, as they will revert to the prior conventional RAO.

The digital model may in practice be deployed whenever and retrained regularly. As the information develops, the system will gradually put less emphasis on prior knowledge and more on current data, becoming more accurate as a higher amount of figures are accumulated.

However, a shortcoming is that the model requires stationary RAOs. Typically, this affects one degree of freedom, namely roll, the tilting motion of the ship from side to side. This movement changes with a vessel’s payload and depends on sea state, amongst other things.

In addition to providing predictions, digital models may present additional information/feedback to engineers. For instance, comparing the forecasts made by the model and existing RAOs may be used to confirm or validate the existing RAOs. Furthermore, the estimated RAO may reveal unexpected response characteristics which may trigger comprehensive investigations. The proposed machine learning model appears to be sufficiently flexible yet robust enough to be applicable in real-world scenarios, and provide tangible benefits over the conventional, solely RAO-based approaches.

In practice

Over the past five years, AI and the energy sector have become more and more intertwined, and technologies such as those discussed in this article will not be the last developments of this nature. The ability to predict wave-vessel interaction with precision will be key.

Digital models can be used not only to improve vessel response predictions, but also to evaluate the performance and improve our understanding of existing RAOs and their shortcomings in real-world applications. Ultimately, this approach can be used to better inform operability and weather windows.

24 | Oilfield Technology Winter 2022

Figure 1. Predicting vessel response.

Figure 2. Pipelaying vessel digital twin.

Figure 3. Digital twin of FPSO.

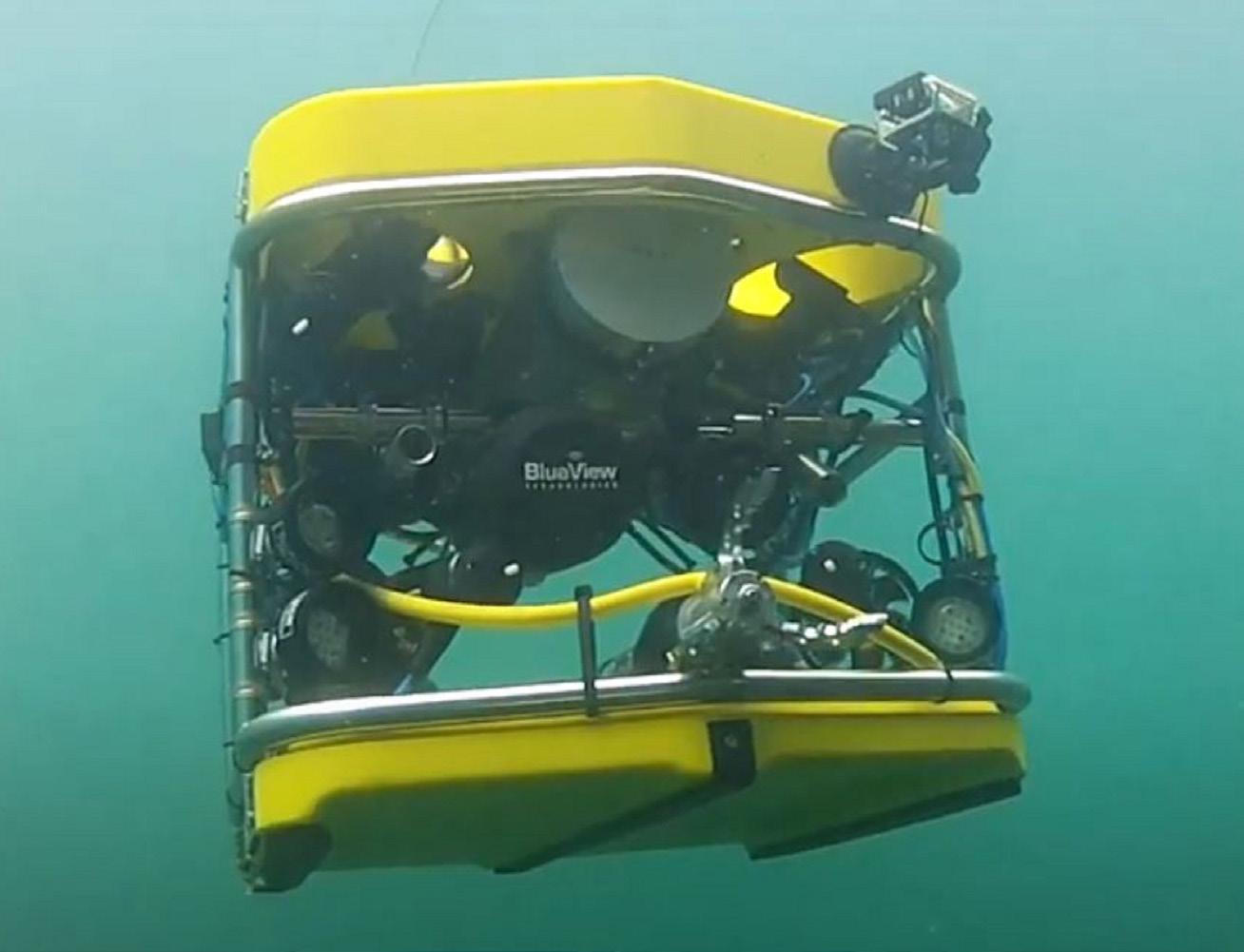

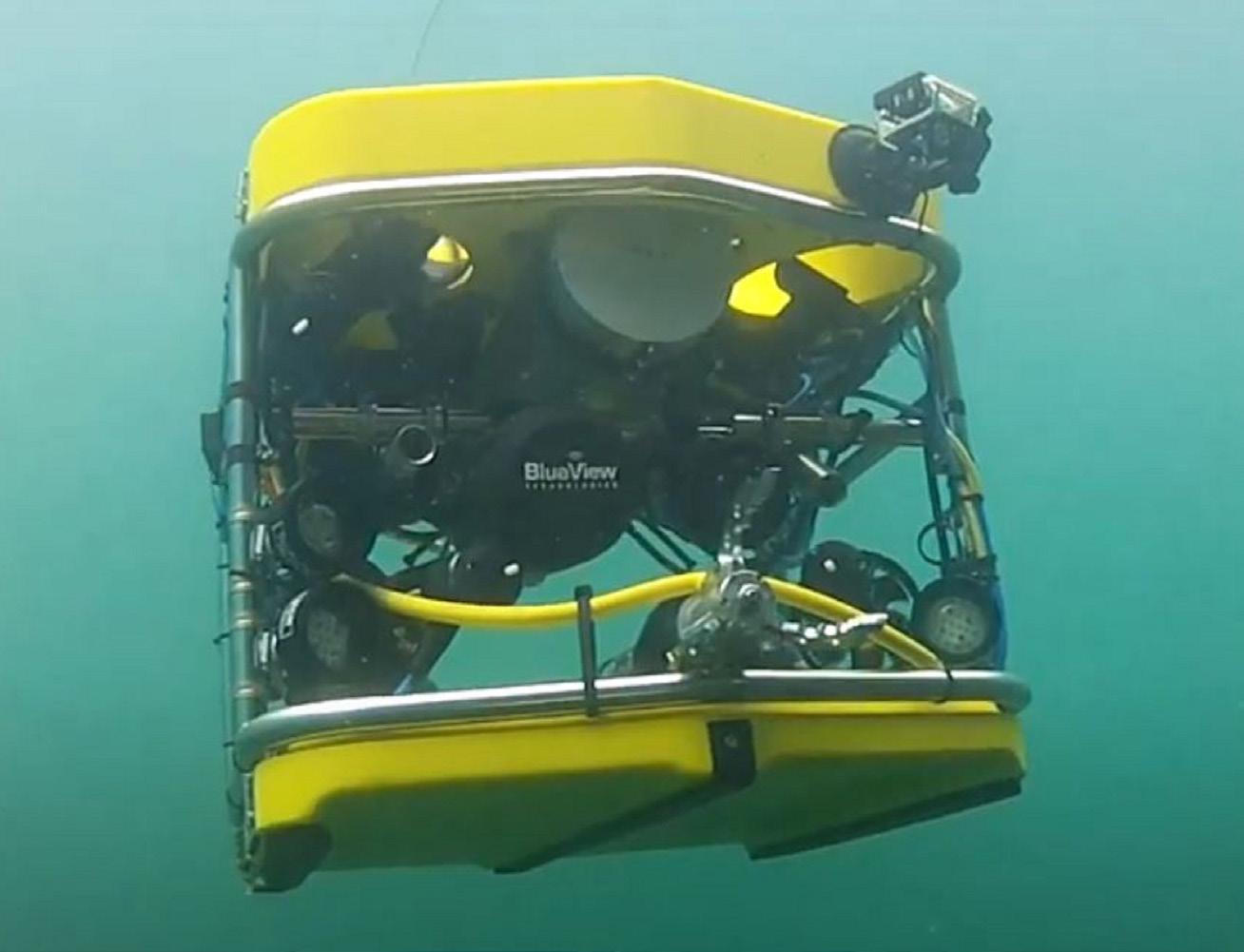

Greensea Systems Inc., USA, considers how the upstream oil and gas industry’s underwater operations could be on the cusp of a period of technological development.

Military operators have been early adopters of AUVs (autonomous underwater vehicles), but Greensea Systems Inc. believes that the same benefits are now ripe to carry over into the oil and gas sector.

The military’s foresight and willingness to invest in systems at the development stage mean that enough of the upfront cost and new adopter risks associated with technologies have now been taken, allowing oil and gas companies to make the leap into unmanned and autonomous underwater systems. In short, the world’s navies have spent millions of dollars over the last decade or more in effectively de-risking underwater autonomy, ready for the oil and gas industry to capitalise on it.

In fact, companies with little established business in the oil and gas sector are thought to pull in around 50% of their revenue from the industry in as little as five years from now, thanks in part to their head starts in defence-developed products.

One area of task-based technologies that could carry almost straight across are the inspection activities associated with explosive ordnance disposal (EOD).

AN UNDERWATER UPGRADE

| 25

As a bread-and-butter task of underwater military activity, Greensea was quick to build a specific suite of software to cater for it. A more capable robotic team member can only support maritime threat mitigation for EOD. Developed with the US Navy, EOD Workspace 6 represents a new generation of software providing a solution for EOD missions.

The system uses integrated inertial navigation, vehicle control, automated tasks, payload integration, and target-relative positioning, combined in an intuitive software solution to provide a new concept in surveying and disrupting underwater threats. However, it is not a great leap of the imagination to see how EOD Workspace’s multi-mode vehicle control could allow more human divers to be taken out of harm’s way in the oil and gas sector. As EOD technicians can pass as much or as little responsibility onto the vehicle as the operation requires, so too can commercial subsea operators. Click-and-go, drag-and-follow, and point-of-interest orbiting make any ROVs more useful tools than ever before, whether they are monitoring sea mines or gas pipelines.

Autonomous vehicles do not get tired and can perform under more varying and extreme conditions than human divers. Larger areas can be searched and surveyed, with many daily subsea inspection tasks springing immediately to mind.

Open architecture

Greensea’s OPENSEA is an open architecture platform for ocean robotics. The company has delivered more than 2500 of these systems, mainly for customers within the science, research, and defence sectors.

Thanks to internal investment and support from the US Department of Defense, Greensea now has the software stack to assist the future of robots working in the ocean, including ROV autonomy, seafloor-to-horizon communication, and support for perception systems. This technology has been deployed on multiple platforms as it is agnostic to the vehicle. It also helps solve the larger problem of conducting ROV operations when there is no longer crew offshore, something much more complex than just controlling an ROV over a satellite connection.

The robot agnostic autonomy package can adapt to various autonomy objectives, and provides a linchpin for Greensea’s oil and gas industry plans.

Potentially one of the greatest opportunities that exists for underwater operations is the adoption of open architecture, or better yet, the requirement that technology is open architecture.

The offshore industry does not have the capital structure to expect that any single provider is going to be able to deliver an end-to-end technical solution for robots operating in the subsea sector as we move into the future. So, to achieve capability in any sort of desirable time frame, separate technology providers will have to collaborate, either at the manufacturer level or the customer integration level, to deliver solutions. Arguably, only architecture can make this possible. It creates a way for customers to realise significant advancements without financing a single manufacturer to build it all, and provides options.

Open architecture ensures the best solution is found because operators are not beholden to a single manufacturer. It can also help to ensure the best technical solution, because if multiple technology components could work in an application, it creates competition between manufacturers to deliver the best.

Open architecture also allows technical solutions and capabilities to decouple from specific robots and platforms, and migrate to available ones. Customers can pick hardware platforms and the autonomy modules required to propel them.

One operator, multiple vehicles

There is already some robotic technology and some very limited automation currently in offshore subsea operations of course, but the oil and gas industry is largely still operating on a ‘remote control’ concept, rather than proper autonomy. The sometimes risk-averse nature of the industry means that the usual current operation model dedicates one vehicle to one team of operators. As technologies mature though, it is clear to see the limitations of this model when the technologies exist and are proven for one human operator to oversee a team of underwater robots, rather than a whole team of humans operating a single ROV.

Breaking out of the confines of one operator managing a single vehicle can only come by increasing autonomy. Safe C2, Greensea’s communication technology, provides effective communication support for autonomous systems despite working over a very low bandwidth and high latency connection to a supervisor.

The technology hurdle addressed in Safe C2, which makes the long-range control of an ROV practical, is handling of the data stream back and forth between the very distant operator and the submerged vehicle. Safe C2 manages this critical data stream by monitoring bandwidth

26 | Oilfield Technology Winter 2022

Figure 1. Greensea’s vision is that resident vehicles will rest on the seabed for months at a time, ready to swing into action when required.

and latency, and prioritising and transmitting the data required to ensure the current task is completed successfully while maintaining the situational awareness the operator requires to make on-time decisions.

Early adopters

The subsea industry is showing signs of not only accepting but requiring remote Inspection Maintenance and Repair (IMR), as well as light intervention capabilities. The offshore industry is ready to adopt more efficient methods of operation, and that starts at minimising crew and equipment offshore, especially to do tasks that could be automated. The oil and gas industry uses different platforms to the defence industry, but this is not really an issue when using open architecture systems.

Given these early trends towards remote robot operation and supervision within the offshore sector, Greensea has developed a scalable solution to address the overall problem of operating subsea robots from platforms without in-place crew. Specifically, the autonomy solution for remote and autonomous ROV operation includes integration for shipboard systems such as handling gear, USV helmsman interfaces, and even autonomous tether management to leverage more out of traditional ROVs that are already part of the operator’s fleet, by reconfiguring these existing assets for more remote operation.

Subsea vision

The existing model of sending ships with crews and ROVs offshore to do basic IMR tasks is perhaps a tired concept. The same can be said for intervention tasks. It is true that many of the basic intervention tasks performed by ROVs offshore are relatively simple, and it is hard

to comprehend the cost of these basic tasks when you add the costs of vessels, crews, ROVs, and logistics.

We are moving rapidly towards a world where robots will be residents of offshore installations, both on the surface and subsea. IMR and basic intervention tasks will be performed by these resident robots being supervised by personnel anywhere in the world. In doing so, we will also realise the economic benefits of scale, because a single supervisor will be able to command and assist multiple robots at once.

They may be tetherless or tethered, depending on the application. But, they will be largely autonomous, capable of communicating with supervising operators from the seafloor to over the horizon, and capable of perceiving and assessing their environment. With this concept, man’s presence in the oilfield offshore will be constant, infinite, and affordable. What is clear is that there are capabilities out there that the oil and gas industry can be using within its vast scope of undersea activities that could reduce costs, increase safety and also tackle some of the industry’s environmental burdens in one fell swoop, but it will take an industry player or two that shares the vision.

This will require a shift in industry mindset, and like any shift, early adopters will play a key role. It is not going to be as simple as buying the technology and then putting it to work. Almost all industries are still emerging from a hardware-centric worldview. Traditionally, all industries, but especially conservative ones like the oil and gas sector, have had a tendency to identify capabilities with hardware. When new capabilities are needed, new hardware is purchased. In this case though, the full benefits will only be realised through a more extensive overhaul of working practices, and this will take a set of forward-thinking industry partners.

requires a global publication Global publication

online at: www.oilfieldtechnology.com/subscribe

Subscribe

Connectivity

he Industrial Internet of Things (IIoT) has been transforming global industries and driving digitalisation for some years now and the oil and gas sector is no exception. From asset management through to remote performance monitoring and maintenance, the IIoT ecosystem is delivering efficiencies and productivity to meet the demands of an ever-evolving energy landscape.

However, everything is underpinned by reliable and resilient connectivity. After all, a fragmented picture and data gaps can give a wildly inaccurate depiction of operations and assets, and if connectivity is not made a priority, it can cause serious problems.

28 |

is key

Alastair MacLeod, Ground Control, UK, explains why consistent, reliable connectivity is vital for the upstream oil and gas industry to monitor and analyse data and enable quick and effective business decisions.

Globally, the oil and gas industry has been in the spotlight in recent months, arguably more so than ever before. While there is a mutual drive for nations to reduce reliance upon hydrocarbons, energy security has climbed the agenda, not least because of the conflict in Ukraine. This has meant a shift – even if it is a temporary one – in strategy, which has impacted economies and upstream suppliers significantly.

What is evident however, is that the industry continues to innovate to meet challenges like these head on, and IIoT is at the heart of this. Given the often hostile and remote nature of the environments in which oil and gas plants are situated, the ability to monitor and analyse data, enabling quick,

| 29

effective business decisions and automation, would not be possible without the rapid, real-time delivery of data.

Connecting the dots

In a recent report, analysts McKinsey & Co. suggested that advanced connectivity “could add up to US$250 billion of value to the industry’s upstream operations by 2030.”1 In addition, the report also recommends that technology to improve connectivity needs to be leveraged, and that is where satellite comes into play.

There are data challenges at every stage of the well lifecycle, and while for many operators satellite has been deemed an expensive option in the past, it is reducing in cost as more providers diversify their offerings. In addition, and crucially, the cost of an ‘always on’ connectivity solution is a drop in the ocean when compared to the potential costs and repercussions of having no data to support operations, especially when you consider the bandwidth required for such data is relatively low, in comparison to, for example, livestreaming HD video.

Global spotlight: The challenge