A Green Alliance Emerges

Balancing energy security alongside climate solutions in Vietnam

We understand how you need to reduce complexities at your plant.

CLEAN PROCESS + CLEAR PROGRESS

You strengthen your plant’s safety, productivity and availability with innovations and resources.

Improve your processes with our comprehensive portfolio of measuring instruments, solutions and services:

Tank gauging for liquified natural gas

Tank gauging for liquified natural gas

Real time management of storage tanks for safe and efficient operation, highest inventory accuracy and transparency.

Tank gauging commissioning

Tank gauging commissioning

Improve your processes with our comprehensive portfolio of measuring instruments, solutions and services:

Do

Proservo NMS81: Most accurate tank gauging instrument (±0.4mm) for SIL3 applications runs independent of boil-off gas.

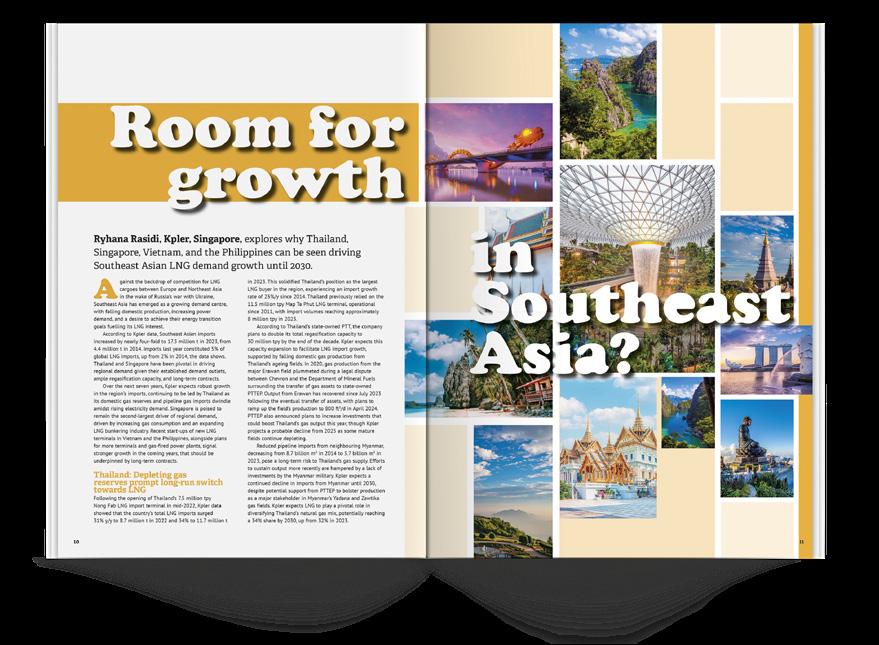

Room for growth in Southeast Asia?

Ryhana Rasidi, Kpler, Singapore, explores why Thailand, Singapore, Vietnam, and the Philippines can be seen driving Southeast Asian LNG demand growth until 2030.

Enabling safe and reliable LNG production

Jillian Davidson, Solution Director, AspenTech, details how LNG operators can embrace digital and analytical tools to help enhance operational efficiency.

David Lewis, Energy Capital Vietnam, USA, outlines delivering energy security with decarbonisation in Vietnam.

Ralph Weiland, Optimized Gas Treating, Inc., USA, discusses the use of piperazine as a reaction promoter in combination with N-methyldiethanolamine for enhancing carbon dioxide removal rates.

32 Navigating future landscapes

Rostom Merzouki, Director, ABS Global Gas Development, Qatar, depicts how changes in commercial market dynamics and the demand of the energy transition will directly impact vessel design and operations.

37 Harnessing cold energy

Paolo Danesi, Exergy International, Italy, considers a breakthrough in LNG regasification efficiency.

41 Ensuring stable power

Nico Jansen van Rensburg and George Bitar, Siemens Energy, provide an overview of the unique challenges of designing electrical supply systems for e-LNG plants and outline specific measures for addressing harmonic disturbances and ensuring stable power.

44 Cryogenic trends

Jyoti Singh, Research Analyst, and Shalom Divekar, Lead Analyst, MarketsandMarkets, delve into the transition towards clean energy, propelling the demand for LNG and

Since 2005, the US has reduced emissions from energy consumption by approximately 20%, or over 1 billion t – the largest aggregate amount in the world. Most has come from coal-to-gas switching and brought emissions to levels not seen in nearly 40 years.

Energy Capital Vietnam outlines a repeatable formula for incorporating this same model into Vietnam, one industrial park at a time.

COMMENT

MATHIAS ELSPAß PARTNER AND HEAD OF THE GERMAN ENERGY & INFRASTRUCTURE GROUP,CLIFFORD CHANCE

In the midst of an evolving energy landscape, LNG plays a pivotal role in ensuring Germany’s energy security. As the nation transitions towards a renewable energy future, the intermittency inherent in solar and wind energy sources warrant a dependable backup to uphold stability in the energy supply. This is where LNG emerges as another crucial player and vital component in bridging the gap during the renewable energy transition.

German legislators have not only recognised but actively embraced the critical role of LNG within the national energy framework. Recent legislative milestones, such as the enactment of the LNG Act and other legislative frameworks aimed at bolstering the LNG infrastructure, serve as linchpins in addressing this need. These laws not only signify the government’s commitment to LNG, but also underscore its indispensable position within the country’s energy supply matrix – at least until 2043 when the LNG infrastructure should be operated with green hydrogen and its derivatives.

Despite the apparent stability in energy supply, characterised by a notable absence of significant disruptions in recent years, the energy sector is currently undergoing a profound transformation. Establishing a robust energy infrastructure is now more imperative than ever, with the development of domestic LNG capabilities emerging as one cornerstone of this foundation.

Germany’s energy transition, which is echoed across the EU, illustrates the shift away from fossil fuels towards renewable energy sources. This transition, while essential for environmental sustainability, presents the challenge of so-called ‘dark doldrums’ – periods marked by the absence of wind and solar energy. During these times, the importance of a diversified energy portfolio, including LNG, becomes evident.

Managing Editor

James Little james.little@palladianpublications.com

Senior Editor Elizabeth Corner elizabeth.corner@palladianpublications.com

Editor Jessica Casey jessica.casey@palladianpublications.com

Editorial Assistant Théodore Reed-Martin theodore.reedmartin@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

To address these demands, the German government has outlined a strategy that includes a new generation of power plants capable of offsetting the unpredictable nature of renewables. Baseload-capable gas-fired power plants, supported by LNG infrastructure, are central to this strategy. They are not merely transitional tools but are expected to play a significant role in the energy landscape for years to come, even as the country’s shift to green hydrogen materialises with LNG infrastructure, as well as power plants ready to be operated with green hydrogen.

Germany’s LNG infrastructure is nascent but poised for substantial growth. A diverse group of strategists and investors are actively involved in existing projects and laying the groundwork for new ventures, signalling a market ripe with growing opportunities. Indeed, one of Germany’s first land-based LNG terminal, on which Clifford Chance advised, represents a significant milestone in the country’s energy transition journey.

The path forward for Germany’s energy sector is one of balance and foresight, where LNG stands out as an essential element in bridging the gap between the present and a sustainable, renewable-dominated future. It remains to be seen how the market will develop; however, it is evident that it will continue to captivate investors in the coming years, given the pressing need to expand this infrastructure in order to diversify the existing landscape and provide reliable import capacities for the future uses, such as green hydrogen.

As the country navigates the complexities of the energy transition, the advancements in LNG infrastructure will not only cater to immediate energy security needs, but also pave the way for the integration of more renewable sources, thereby solidifying Germany’s position as a pioneer in the global move towards a greener, more resilient energy ecosystem.

Sales Manager Will Powell will.powell@palladianpublications.com

Production Designer Kate Wilkerson kate.wilkerson@palladianpublications.com

Events Manager Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant Kristian Ilasko kristian.ilasko@palladianpublications.com

Digital Administrator Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager Laura White laura.white@palladianpublications.com

SHAPING THE FUTURE OF ENERGY

With technologies that pave the way

For a sustainable and efficient future

Global Trafigura to commercially deploy Daphne Technology solution on LNG carrier

Daphne Technology has been selected by Trafigura for its first commercial deployment of PureMetricsTM, scheduled for the summer of 2024.

Under the terms of the agreement, Daphne Technology will deploy its PureMetrics system aboard an LNG carrier chartered by Trafigura and managed by Latsco LNG LLC. PureMetrics directly measures and accurately reports real-time tonnes of greenhouse gas (GHG) emissions to the environment, eliminating inaccurate reporting based on fuel consumption estimates.

With a combination of an array of sensors, multi-source data integration, and approved methodologies and algorithms, PureMetrics ensures compliance with EU Monitoring, Reporting, and Verification (EU MRV) and International Maritime Organization Data Collection System (IMO DCS) regulations. PureMetrics' compare and optimise functions further improve operational efficiency, reducing GHG emissions and costs for the operators. PureMetrics was awarded approval in principle from Lloyd’s Register in June 2023.

The planned approach for implementing PureMetrics in Trafigura's fleet involves ensuring seamless integration with existing systems and processes, addressing technical challenges, and adhering to evolving environmental regulations and GHG emissions standards.

South Korea

Canada

Seaspan Energy launches the Seaspan Lions LNG bunkering vessel

Seaspan Energy has launched the second of its three 7600 m3 LNG bunkering vessels, the Seaspan Lions, named after the twin peaks of the North Shore, or known as Ch’ich’iyúy Elxwíkn (‘Twin Sisters’ or ‘Two Sisters’) to the Squamish Nation.

This series of vessels is named after West Coast mountains and the first two vessels, the Seaspan Garibaldi (‘Nch’k_ay?’) and the Seaspan Lions (Ch’ich’iyúy Elxwíkn), will be delivered in 2024, with the third vessel arriving in 2025.

The Seaspan Lions will provide LNG fuelling services for vessels on the West Coast of North America, becoming the first company to provide LNG bunkering in the Pacific Northwest. The Seaspan Garibaldi is set to deliver low-carbon solutions to the global market and will be based in the Panama region.

This series of vessels are each 112.8 m in length, 18.6 m in width, and 5 m in draft, with a design speed of 13 knots. The LNG bunkering vessels are being built by CIMC Sinopacific Offshore & Engineering.

Seaspan worked closely with VARD Marine Inc. to incorporate emerging technologies into the design, resulting in a decrease in emissions and underwater noise. The design is focused on safe, efficient, and economical refuelling of multiple ship types with an ability to transfer to and from a wide range of terminals. This will allow the vessel to engage in ship-to-ship LNG transfer and coastal and short-sea shipping operations.

ORION SPIRIT to set sail as Korea's 500 th LNG carrier exported since 1994

M inistry of Trade, Industry, and Energy Minister, Dukgeun Ahn, attended the naming ceremony for the LNG carrier ORION SPIRIT on 18 April 2024 at Samsung Heavy Industries’ Geoje Shipyard. Marking the 30th anniversary of Korea's first LNG carrier built in 1994, the ORION SPIRIT is the 500th LNG tanker to be exported and will be handed over to J.P. Morgan Chase & Co. LNG carriers must be able to safely transport liquid gas at temperatures below -163˚C and require highly advanced

technology, costing over KRW 300 billion per vessel. Only nine countries around the world have successfully built the cutting-edge fleet. There are 680 LNG carriers presently in the water, three-quarters of which were built by Korean shipyards, and the construction of another 256 vessels are underway. Korean shipyards raked in US$13.6 billion worth of global ship orders in 1Q24, winning 100% of total LNG and ammonia carrier orders. The high-value orders won in 2021 have entered the export stage this year as well.

LNGNEWS

Japan

KEYS Azalea completes bunkering in west Japan

On 10 April 2024, KEYS Azalea, an LNG bunkering vessel owned and operated by KEYS Bunkering West Japan Ltd – a joint venture established by Kyushu Electric Power Co., Inc., NYK Line, ITOCHU ENEX CO., LTD, and Saibu Gas Co., Ltd – bunkered LNG for the pure car and truck carrier Daisy Leader at the port of Hiroshima. This is the first LNG bunkering after KEYS Azalea's delivery and the first ship-to-ship LNG bunkering in western Japan.

KEYS Azalea is equipped with a dual-fuel engine that can operate on both LNG and fuel oil. The LNG fuel supplied to Daisy Leader was shipped from the Tobata LNG terminal of Kitakyushu LNG Co., Inc.

LNG fuel offers excellent environmental performance compared with traditional marine fuels. It is expected to be a bridge solution for decarbonisation, virtually eliminating sulfur oxide emissions and reducing approximately 80% of nitrogen oxide emissions and 30% of carbon dioxide emissions.

Italy

Uninstallation of Livorno terminal completed by OLT

OLT Offshore LNG Toscana has confirmed that the uninstallation operations of the FSRU Toscana terminal off the coast of Livorno have concluded.

The terminal will now be towed with the support of two tugs to the port of Genoa. It will remain at the dock for about a month to begin the first phase of the maintenance intervention aimed at replacing the bearing of the anchoring system, a system designed and built to ensure the rotation of the terminal around the geostationary turret that is permanently anchored to the seabed.

Following a tender procedure, the company awarded the contract for the maintenance interventions to San Giorgio del Porto S.p.A.

It is expected that in early June, the FSRU Toscana will then be towed to the port of Marseille, once again at the SGdP yard, where maintenance will be completed.

Shipyard activities are expected to be completed by mid-September, to be followed by operations to re-install the terminal in its current site offshore Livorno. It is expected that FSRU Toscana will resume operations from mid-October 2024.

Canada

Black & Veatch receives full notice to proceed for Cedar LNG FLNG

Global LNG infrastructure solutions leader, Black & Veatch, in partnership with high-tech shipbuilder, Samsung Heavy Industries (SHI), has received full notice to proceed from Cedar LNG LP partners to begin constructing Cedar LNG’s floating liquefaction facility to be located in Kitimat, British Columbia.

Black & Veatch will be responsible for complete topside design and equipment supply, including its market leading PRICO® technology. SHI will be providing the hull with the containment system, and fabrication and integration of all topsides modules.

Cedar LNG is strategically positioned to leverage Canada’s abundant natural gas supply and British Columbia’s growing LNG infrastructure to produce industry-leading, low-carbon and cost-competitive LNG for overseas markets. The near-shore export facility will feature electric-driven equipment powered by renewable energy, making it one of the lowest-carbon-intensity LNG facilities in the world.

THE LNG ROUNDUP

X TotalEnergies launches Marsa LNG project

X Class NK issues statement of fact for methane slip reduction system developed by Hitachi Zosen, MOL, and Yanmar PT

X Himalaya Shipping receives 10th dual-fuel bulker

Through the strength of our North American assets, we are dedicated to helping enable the global energy transition, thoughtfully pursuing avenues to lower the carbon intensity of our LNG, and developing low carbon solutions to meet the market demand for clean, reliable energy.

At Sempra Infrastructure we develop, build, operate and invest in the infrastructure critical to meet the world’s energy and climate needs.

LNGNEWS

Peru

07 – 08 May 2024

ILTA 2024 Annual International Operating Conference & Trade Show

Texas, USA

https://ilta2024.ilta.org

07 – 09 May 2024

Canada Gas Exhibition & Conference Vancouver, Canada www.canadagaslng.com

13 – 16 May 2024

Asia Turbomachinery & Pump Symposium 2024

Kuala Lumpur, Malaysia

https://atps.tamu.edu

11 – 13 June 2024

Global Energy Show Canada 2024 Calgary, Canada www.globalenergyshow.com

26 – 27 June 2024

Downstream USA 2024 Texas, USA

https://events.reutersevents.com/petchem/ downstream-usa

20 – 22 August 2024

Turbomachinery & Pump Symposia Texas, USA https://tps.tamu.edu

03 – 06 September 2024

SMM 2024 Hamburg, Germany www.smm-hamburg.com

17 – 20 September 2024

Gastech 2024

Texas, USA

www.gastechevent.com

MidOcean Energy completes acquisition of 20% in Peru LNG

MidOcean Energy, an LNG company formed and managed by EIG, a leading institutional investor in the global energy and infrastructure sectors, has announced the completion of its previously announced agreement to acquire SK earthon’s 20% interest in Peru LNG (PLNG), owner and operator of the first LNG export facility in South America.

PLNG’s assets comprise a natural gas liquefaction plant with 4.45 million tpy processing capacity, a fully-owned 408 km-long pipeline with 1290 million ft3/d capacity, two 130 000 m3 storage tanks, a fully-owned 1.4 km-long marine terminal and a truck loading facility with capacity of up to 19.2 million ft3/d. PLNG, operated by Hunt Oil Company, is one of only two LNG production facilities in Latin America, located in Pampa Melchorita, 170 km south of Lima.

Morgan Stanley acted as exclusive financial advisor to MidOcean on the transaction. Latham & Watkins acted as legal advisor to MidOcean on the transaction.

Lithuania

KN Energies, Hoegh LNG Klaipeda, and the Lithuanian Maritime Academy agree on development of seafarers' competences

AB KN Energies, UAB Hoegh LNG Klaipeda, and the Lithuanian Maritime Academy (LAJM) have signed a tripartite agreement, committing to developing and enhancing the competence of seafarers in the servicing, management, and maintenance of FSRUs and LNG carriers.

According to Darius Šilenskis, CEO of KN Energies, such a step is welcome and far-sighted considering the geopolitical situation, ensuring the development of seafarers' competences required for servicing FSRU and LNG carriers in Lithuania and the rest of Europe.

The tripartite agreement regarding the development of young seafarers' competences was signed by Mindaugas Navikas, Chief Commercial Officer of KN Energies, Mindaugas Petrauskas, CEO of Hoegh LNG Klaipeda, and Vaclav Stankevic, Director of the LAJM. Based on the agreement, LAJM committed to reviewing and adjusting maritime study programmes to provide students with more knowledge of the maintenance, management, and servicing of LNG terminals and LNG carriers. Additionally, KN Energies together with Hoegh LNG Klaipeda agreed to create conditions for paid internships and lectures at the terminal, and to finance these activities.

Under the agreement, KN and Hoegh LNG Klaipeda will provide up to two students with a paid internship on board the vessel for up to six months. The students will also receive practical lectures during which the seafarers in charge of the Independence terminal will share the specifics of their work and best practices on LNG carriers.

KN Energies will reimburse other costs related to the cadets' internship and will pay a remuneration in line with the market level for the internship. After the studies, both companies reserve the right to make job offers to the best students. It is foreseen that the study programmes will be updated, and the students will be ready to start their internships at the terminal from 2025.

Chart cryogenic storage products are integral to the virtual pipeline facilitating increased energy independence and security through LNG and liquid hydrogen. By utilizing cryogenics to store gas in liquid form the tanks are much smaller than their gaseous equivalents. Cryogenic tanks are shop built and total storage capacity is modularized, reducing project cost, complexity, risk and timescale.

Room for growth

Ryhana Rasidi, Kpler, Singapore, explores why Thailand, Singapore, Vietnam, and the Philippines can be seen driving Southeast Asian LNG demand growth until 2030.

Against the backdrop of competition for LNG cargoes between Europe and Northeast Asia in the wake of Russia’s war with Ukraine, Southeast Asia has emerged as a growing demand centre, with falling domestic production, increasing power demand, and a desire to achieve their energy transition goals fuelling its LNG interest.

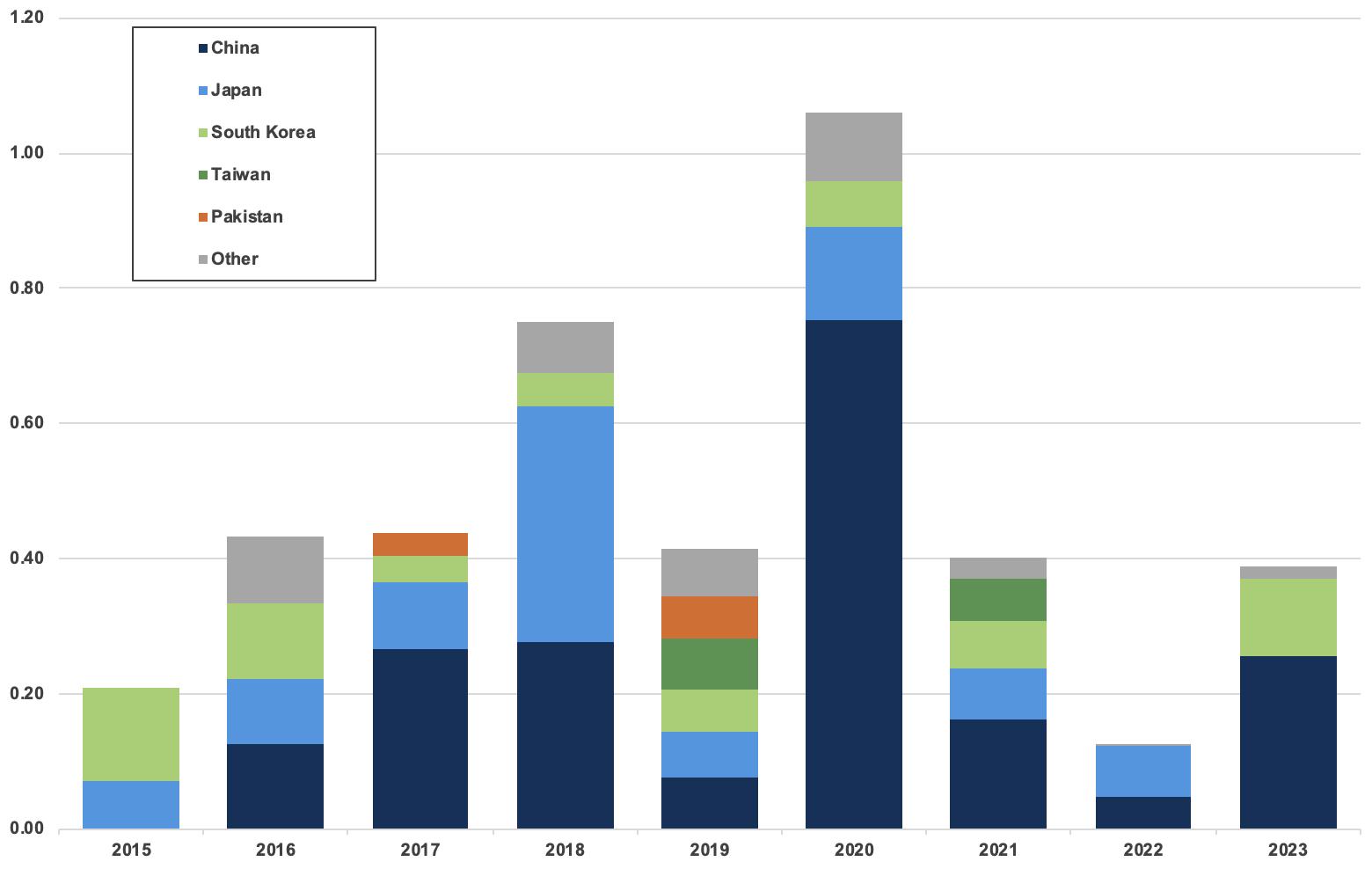

According to Kpler data, Southeast Asian imports increased by nearly four-fold to 17.3 million t in 2023, from 4.4 million t in 2014. Imports last year constituted 5% of global LNG imports, up from 2% in 2014, the data shows. Thailand and Singapore have been pivotal in driving regional demand given their established demand outlets, ample regasification capacity, and long-term contracts.

Over the next seven years, Kpler expects robust growth in the region’s imports, continuing to be led by Thailand as its domestic gas reserves and pipeline gas imports dwindle amidst rising electricity demand. Singapore is poised to remain the second-largest driver of regional demand, driven by increasing gas consumption and an expanding LNG bunkering industry. Recent start-ups of new LNG terminals in Vietnam and the Philippines, alongside plans for more terminals and gas-fired power plants, signal stronger growth in the coming years, that should be underpinned by long-term contracts.

Thailand: Depleting gas reserves prompt long-run switch towards LNG

Following the opening of Thailand’s 7.5 million tpy Nong Fab LNG import terminal in mid-2022, Kpler data showed that the country’s total LNG imports surged 31% y/y to 8.7 million t in 2022 and 34% to 11.7 million t

in 2023. This solidified Thailand’s position as the largest LNG buyer in the region, experiencing an import growth rate of 25%/y since 2014. Thailand previously relied on the 11.5 million tpy Map Ta Phut LNG terminal, operational since 2011, with import volumes reaching approximately 8 million tpy in 2023.

According to Thailand’s state-owned PTT, the company plans to double its total regasification capacity to 30 million tpy by the end of the decade. Kpler expects this capacity expansion to facilitate LNG import growth, supported by falling domestic gas production from Thailand’s ageing fields. In 2020, gas production from the major Erawan field plummeted during a legal dispute between Chevron and the Department of Mineral Fuels surrounding the transfer of gas assets to state-owned PTTEP. Output from Erawan has recovered since July 2023 following the eventual transfer of assets, with plans to ramp up the field’s production to 800 ft3/d in April 2024. PTTEP also announced plans to increase investments that could boost Thailand’s gas output this year, though Kpler projects a probable decline from 2025 as some mature fields continue depleting.

Reduced pipeline imports from neighbouring Myanmar, decreasing from 8.7 billion m3 in 2014 to 5.7 billion m3 in 2023, pose a long-term risk to Thailand’s gas supply. Efforts to sustain output more recently are hampered by a lack of investments by the Myanmar military. Kpler expects a continued decline in imports from Myanmar until 2030, despite potential support from PTTEP to bolster production as a major stakeholder in Myanmar’s Yadana and Zawtika gas fields. Kpler expects LNG to play a pivotal role in diversifying Thailand’s natural gas mix, potentially reaching a 34% share by 2030, up from 32% in 2023.

Domestic gas-for-power demand is also expected to drive imports, aided by new LNG buyers within Thailand. In 2019, Thailand’s state-run utility EGAT made its first LNG import via PTT’s Map Ta Phut terminal under a 4 – 8 year agreement for 1.5 million tpy to supply its gas-fired power plants. In late February 2024, Thai power firm, Hin Kong, also made its debut as an LNG importer after receiving its first cargo via the Nong Fab terminal to supply its power plant in the Ratchaburi province. Thailand has four other licensed LNG importers who have yet to begin imports via the terminal, but some partly have not as they await clearer regulations and much lower LNG prices. Among the licensed firms include Gulf Energy, B.Grimm, and Egco. Besides power, Kpler sees gas demand from the industrial sector growing which could support Thailand’s total gas consumption growth over the next seven years.

Despite high gas prices in recent years, Thailand’s spot LNG demand has surged due to shrinking domestic reserves, weak Myanmar pipeline imports, rising consumption, and limited long-term contracts. Approximately 56% of total Thai imports were spot volumes in 2023 (i.e, 11.7 million t in 2023 minus 5.2 million tpy of long-term contracts), compared to 41% in 2022 and 22% in 2021. PTT’s robust spot demand was also evident through its tender activity, awarding 22 tenders for 121 cargoes in 2023 vs 23 tenders for 59 cargoes in 2022, per Kpler data. Given this relatively inelastic demand, Kpler expects spot volumes to remain supported in the future to meet Thailand’s domestic demand.

Singapore: Growing domestic needs and LNG bunkering expansion

In 2023, Singapore’s LNG imports rebounded by 35% y/y to nearly 5.2 million t as global gas prices eased from record highs in 2022, per Kpler data. The increase was fuelled by the commencement of a new 10-year long-term contract with QatarEnergy for 1.8 million tpy of LNG, allowing Qatar to overtake the US as Singapore’s second-largest LNG supplier for 2023. Australia, meanwhile, remained the top supplier. Since the opening of its first and sole existing 11 million tpy regasification terminal, SLNG, in 2013, Singapore has been importing LNG at an average growth rate of around 21%/y. In February 2024, France’s TotalEnergies and Singapore’s Sembcorp signed a new deal for 0.8 million tpy of LNG for 16 years, starting in 2027.

Kpler forecasts steady LNG import growth for Singapore until 2030, amid plans to build a second 5 million tpy LNG terminal by the end of the decade to strengthen gas security and replace declining pipeline imports. As a small nation with limited energy resources, Singapore has relied on importing natural gas from its neighbours, Malaysia and Indonesia, to meet domestic demand. Though pipeline gas supplies remain sufficient for now and the SLNG terminal is still underutilised, Kpler expects piped gas imports to continue declining and support LNG imports in the coming years.

Kpler sees LNG imports being further supported by growing power and industrial gas demand. Going forward, YTL PowerSeraya’s plans to build a new 600 MW combined cycle gas turbine by the end of 2027 to boost Singapore’s gas-fired power generation capacity. According to the Energy Market Authority, Singapore’s gas consumption has increased at an average annual growth rate of 1.8% over the past 10 years, with 83.4% of gas supply used for power generation and 14.7% for industrial demand in 2022.

More recently, the Singapore government plans to establish a single gas buying entity – Gasco – in 2024 to help centralise purchases in the power sector to protect against future gas supply shortfalls and volatile electricity prices. The plan was in response to record global gas prices in 2022, which led to a decline in LNG imports due to an aversion to costly gas purchases by utility companies. Kpler expects the new gas entity could help encourage more gas buying from the power sector in the long term.

A growing portion of Singapore’s imports are expected to meet the increasing demand for LNG bunkering. Plans to build a second terminal will help promote such LNG-related services as Singapore aims to be a major LNG bunkering and trading hub in the region. According to Singapore’s Maritime and Port Authority, LNG bunkering volumes jumped from 16 000 t in 2022 to 110 000 t in 2023. Leveraging Singapore’s strategic location and strong maritime infrastructure, the country often re-exports a portion of its total imports. Kpler data show that the country re-exported about 13% of its imports on average over the last decade – mostly to bigger Northeast Asian buyers.

Vietnam and the Philippines: Emerging LNG buyers seeking coal-to-gas transition

Within the past year, Vietnam and the Philippines entered the LNG market as new buyers, driven by coal-to-gas

Safe Navigation, Secure Investment

Energy Capital Vietnam has the local knowledge, expertise, and core values necessary to develop an integrated LNG-to-power project in Southern Vietnam.

Integrity. Vision. Intelligence.

ecvholdings.com

Mui Ke Ga LNG. Operational Excellence. Coming in 2025.transition efforts and falling domestic gas supplies. Vietnam brought online its first regasification terminal, Thi Vai LNG, which has a 1.1 million tpy capacity and imported a 0.08 million t commissioning cargo in July 2023. The terminal will serve the 812 MW Nhon Trach 3 power plant, scheduled for commercial start-up in mid-November 2024, and the 812 MW Nhon Trach 4 plant, which could open in mid-May 2025. Meanwhile, the Philippines inaugurated its 3 million tpy Philippines LNG (PHLNG) import terminal in April 2023, followed by the 5.25 million tpy Batangas LNG terminal in October. Kpler data shows that the Philippines imported a total of 0.6 million t via both terminals in 2023.

This year, Kpler anticipates gradual growth in Vietnam’s LNG imports, but this will rest on the completion of the Nhon Trach 3 plant to provide a demand outlet. State-owned PV Gas announced its plans to supply industrial customers with LNG via Thi Vai from 2Q24 and has launched a tender. So far, Vietnam has not imported LNG since its commissioning cargo for this reason, while spot prices have also been relatively high in recent years. Given that Vietnam does not hold any term contracts, it may need to solely rely on the spot demand this year to provide feed gas for the power plant. Conversely, the Philippines’ LNG demand growth is projected to rise as PHLNG serves San Miguel’s existing Ilijan power plant,

and a new three-year LNG contract supplied by Vitol started in April. The Philippines’ First Gen, however, has no long-term contracts, leaving the company to purchase only spot volumes for now. Nonetheless, First Gen has imported 0.21 million t of LNG since October 2023.

Beyond 2024, Kpler sees the potential for stronger imports as both countries intensify their carbon reduction efforts, increase their gas-for-power demand, and counter falling supply. In May 2023, Vietnam’s government approved its latest Power Development Plan to replace coal with natural gas as a primary energy source by 2030 and increase LNG’s share in power generation to 14.9% or 14.5 million tpy. The plan includes the building of 13 new LNG-fired power plants with a total capacity of 22.4 GW to come online by 2030.

Kpler’s LNG demand growth outlook assumes timely construction of proposed LNG terminals, with the Philippines’ Department of Energy having approved five additional LNG projects that could boost import capacity by the end of the decade. Work is currently underway to expand Thi Vai’s import capacity to 3 million tpy by 2026. The company is also developing the 6 million tpy Son My LNG terminal project which will serve the power plants in the Son My area and south-central region. The first phase of the project (3.6 million tpy) is slated for completion by 2026 – 2027. Meanwhile, offshore gas exploration challenges due to maritime disputes with China in the South China Sea continue to weigh on both Vietnam and the Philippines’ domestic production amid ageing gas fields. While Vietnam approved its National Energy Masterplan for 2021 – 2030 in August 2023, aiming to commission two major upstream gas projects by the end of the decade, the government has projected domestic gas production between 5.5 billion m3/y and 15 billion m3/y by 2030, factoring in potential delays and uncertainties. In the Philippines, domestic gas reserves from the largest Malampaya field are depleting, with the 414 MW San Gabriel power plant reportedly forced to shut for a few days in September 2023 due to limited output. The Malampaya field is expected to potentially run dry within the next 2 – 3 years without successful gas exploration efforts.

Southeast Asia’s LNG potential will depend on sufficient investments and stable global gas prices in the long run

Overall, LNG demand prospects are positive in the region, though long-term growth rests on Southeast Asian governments committing to their LNG infrastructure investments to reach their projected demand growth over the coming years. However, Kpler sees the need for long-run global LNG prices to be stable in order to encourage such investments, particularly for new players like Vietnam and the Philippines. On the contrary, new gas field exploration discoveries could pose some downside risks to the LNG forecast as higher domestic production loosens market fundamentals.

Jillian Davidson, Solution Director, AspenTech, details how LNG operators can embrace digital and analytical tools to help enhance operational efficiency.

On average, natural gas releases 50% less emissions than coal upon combustion. As a result, natural gas is uniquely positioned as a transition fuel to support an affordable and secure energy transformation through the displacement of coal power electricity generation. Ideally, natural gas is transported via pipelines. But in the absence of that being feasible, natural gas is compressed into a liquid for ready transport to alternative markets. Environmentally-sustainable, safe, and reliable delivery of LNG to consumer markets requires investment in new and expanded infrastructure, continuous process improvement, increasingly robust supply chain networks, and collaboration across members of the value chain. This can be achieved by applying digital solutions across the asset lifecycle.

A raft of obstacles in place

A new global gas order

The LNG market is poised for continued near-term growth, fuelled by market demand in Europe and Asia

and the beneficial impact of displacing coal fired electricity generation with natural gas. McKinsey, for example, recently reported that the global demand for LNG is expected to increase by 1.5 – 5%/y until 2035. 1 Preventing a shortage in supply requires additional investment in both liquefaction and regasification facilities; however, conflicting energy transition scenarios and evolving regulation is a risk for future expansion of the market and may deter investment. Capital discipline and supply chain agility will be required to entice additional investment needed to meet forecasted LNG demand.

Limited responsivity to market dynamics

Looking to the future, the global LNG market is likely to be subject to substantial geopolitical and price risk. Inflexibility of long-term contract commitments, current infrastructure limitations, and the cost of LNG storage and transportation are a few of the challenges the LNG industry must overcome to be more responsive to market dynamics. To overcome these challenges,

the industry needs to invest in infrastructure and improve collaboration across partners such that volume can be best allocated to meet demand and optimise the value chain systematically.

LNG production is an energy intensive process

One of the primary challenges in the LNG industry is optimising the performance of the cryogenic multi-stream heat exchangers, which are central to the gas liquefaction process. These heat exchangers are complex due to their geometry, subjectivity to external weather and temperature variables, and the multiple streams flowing through them. Improved handling of these units presents a significant opportunity for margin improvement as energy costs represent the largest controllable operating cost to an LNG operator, with a typical LNG plant consuming 10% of its own feed.

Enhancing the ability of a site to optimise run rates based on the thermal efficiency of these trains, with digital solutions and advanced sensors, can drive overall profitability, lower energy consumption, and provide a substantial pathway for carbon abatement.

Personnel limitations – a double-edged sword

Natural gas and liquefaction plants often run lean and mean. Advanced sensors and automation technology are a valuable supplement to boots on the ground. Virtual training simulators can also empower operators to run the plant under the most optimal conditions and improve responsivity to process changes.

Feed quality variability

Understanding variability in natural gas inlet feed composition and impurities prior to entering the cryogenic process is critical to defining the best plant configuration, technology and procedures to prevent load disruptions. Digital twins can help simulate and predict the effects of feed quality on plant operations and prioritise corrective action. The agility to respond to feed quality changes with advanced process controls (APC) is imperative to reduce the operating costs of pretreatment and liquefaction and maximise throughput.

Evolving policy around carbon intensity

Calls to action to transition away from fossil fuels, increase renewable energy production, and improve energy efficiency are increasing. As such, so are the policies, regulations, and commitments to do so. While natural gas itself in the near term has been given a bit of a reprieve; to maintain its benefit, increased weight is being placed on producers to limit carbon dioxide (CO 2) and methane emissions during the production and transportation of LNG. Industry leaders must plan strategically to lower the carbon intensity of their operations in advance of increased future regulations. This can be accomplished via improved site efficiency, optimised energy consumption, electrification of assets with renewable energy, leak detection and prevention, and carbon capture technologies.

Key drivers to overcome industry headwinds

These are among the most significant headwinds facing the industry today but at a more granular level, offsetting these challenges boils down to four key operational areas. These are all critical as any shortfalls can lead to a loss in profit and potentially impact safety and environmental compliance.

Minimising resource utilisation

Efficient use of energy and other resources in the production process is critical. The goal is to manufacture products while consuming the least possible amount of energy (and thereby limiting emissions) and resources, which not only reduces costs, but also aligns with environmental sustainability goals.

Maximising equipment uptime

Ensuring that equipment is continuously operational, avoiding performance upsets, and meeting production targets is another key area. This is fundamental because if equipment is not functioning, other factors like energy consumption, product quality, and cost management suffer and can significantly affect the site’s bottom line.

Optimising product yield and quality

Achieving the highest possible yield and quality of product is a major objective. This involves fine-tuning production processes to ensure that output meets the desired standards of quality and quantity, which in turn maximises profitability and customer satisfaction.

Cost and risk management across asset lifecycles

The fourth key performance indicator focuses on optimising the cost and managing the risks associated with all asset expenditures over their lifecycles. This encompasses making strategic decisions on investment, maintenance, and upgrades of equipment to ensure the most efficient use of capital and resources over the long term.

Building digital and predictive analytics capabilities to ensure long-term financial success

Each of these key initiatives are interconnected and deficiencies in any one of them can have a cascading effect on the others. Digital technologies can be leveraged to determine the right balance between critical performance metrics and sustainable production. When done strategically, LNG producers have the potential to unlock significant value through evaluation of business trade-offs, improved visibility across the organisation, improved overall energy efficiency, reduced emissions, and maximised production.

Drive operational excellence with a site wide view of the plant

The prime objective of an operational liquefaction plant is to minimise energy consumption and maximise production while operating at changing product demand rates, feed qualities, and under varying ambient temperature and weather conditions.

Improve production performance with rigorous process simulation

Process digital twins, highly accurate replicas of the physical plant at both a molecular and site-wide level, enable this. Digital twins can be used to drive higher production performance and collaboration across siloes. Offline models allow a company to run simulations, identify and troubleshoot bottlenecks, and optimise asset performance with ‘what-if’ analyses in a risk-free environment. In addition, this solution can accurately model critical equipment such as compressors, the cryogenic heat exchanger trains and drive better understanding of the impact of external temperature and weather conditions on their efficiency.

Data-driven decisions can be made feasible by combining first principles models with real-time plant operational data to optimise the assets online. These rigorous models can dynamically update scheduling plans for higher fidelity and map the operations more effectivity to external constraints.

Coupling digital twins that simulate the complete overpressure protection system of the plant with integrated safety and control systems can be used to improve overall site safety and further de-risk operations.

Empower operations with advanced process controls

Advanced process controls (APC) can significantly enhance operational efficiency, yielding maximum product output at minimal costs and drive more autonomous operations. This helps to achieve new performance standards and minimise the need for operator intervention by improving the ability of an asset to respond to external variables automatically and in a timely manner.

Case study: How a 1 – 2% increase in LNG production was achieved with APC

A supermajor operates a large two train liquefaction plant in a remote tropical location. The plant is integrated with a local offshore gas facility. The liquefaction plant was constrained as the site relies on air fin cooled technology to liquefy natural gas. They were therefore susceptible to ambient temperature, weather, and wind speed conditions, which significantly limited production rates on warmer days. Prior to installing APC technology, operations manually modified production rates to ensure the plant was within safe operating limits (constraints include propane compressor discharge pressure, CO 2 content of sweet gas, etc.) and to avoid freezing in cryogenic system.

To overcome these limitations and improve consistency of operations, the site deployed APC to control the production rates against thermal constraints. As part of this upgrade, the key control variable was modified from the LNG flow to the mixed refrigerant discharge temperature and flow rate. This allowed the site to significantly reduce operator interventions by 90% and improve LNG production by 1 – 2%.

Automated control systems enable online adjustment of LNG plant operations, ensuring optimal performance and minimising operational costs from energy waste. These systems are also integral to asset performance

management (APM) solutions, incorporating predictive and prescriptive maintenance capabilities.

Maximising asset utilisation with technologies that proactively identify signs of degradation in performance or infrastructure

Over recent years, APM has advanced significantly. At the forefront of this digital transformation are technologies that can proactively identify signs of degradation in performance of physical infrastructure. These technologies identify normal operational patterns, detect anomalies, and recognise signs of degradation that could lead to equipment failure if unaddressed.

These solutions leverage a combination of existing monitoring technologies and advanced artificial intelligence and machine learning techniques, abstracting complex engineering and data science elements to ensure user-friendly functionality and enable current personnel to develop sophisticated detection strategies. As a result, APM can provide early warning of potential issues, sometimes weeks or months in advance. This early detection is crucial for LNG operations, allowing for process adjustments to prevent incidents or plan safe, orderly shutdowns.

Leading APM solutions offer the ability to learn from one asset and apply those learnings to similar equipment with minimal effort. This scalability ensures that once a pattern is detected in one machine, it can be quickly identified in others, providing comprehensive coverage.

This increase in visibility into operational health is instrumental in prioritising maintenance schedules and capital decisions, meeting production targets, improving safety, and reducing potential for environmental excursions. Improved operations and asset uptime give a company the overall competitive edge needed to persevere in the face of industry transformation.

Looking to the future – finding the right balance to providing reliable energy with lower emissions

By adopting digital twins and advanced process controls for online optimisation and harnessing the power of asset performance management systems, incorporating predictive, and prescriptive maintenance capabilities, LNG operators can significantly enhance their operational efficiency. These technological advancements are not only instrumental in driving down costs and optimising production, but also play a crucial role in ensuring environmental sustainability and meeting regulatory requirements.

As the global LNG market continues to grow and evolve, the adoption of these sophisticated digital and analytical tools will be a key differentiator for industry leaders. By embracing these technologies, LNG operators can navigate the complexities of the modern energy landscape, ensuring profitability, sustainability, and resilience in an ever-changing world.

References

1. ‘Crunch time in the North American LNG industry: How to meet demand’, McKinsey & Company, (7 December 2023), www.mckinsey.com/industries/oil-and-gas/our-insights/ crunch-time-in-the-north-american-lng-industry-how-tomeet-demand

REGISTER FOR YOUR COMPLIMENTARY VISITOR PASS

Gastech 2024 show floor features include:

Gastech Hydrogen

Accelerating towards a hydrogen-powered decarbonization

50,000

Transforming energy through vision, innovation and action

Gastech is the largest energy exhibition and conference for natural gas, LNG, hydrogen, climate technologies, energy manufacturing and low-carbon solutions - providing the defining answers of the coming decades as the world decarbonizes its energy system.

Showcasing 800 exhibitors from across the energy value chain, and 1000s of innovations, technologies and solutions driving the energy transition.

Gastech Climatetech

Decarbonizing the energy value chain

Attendees 800 Exhibitors 20 International pavilions

Organized by:

Gastech Shipping and Marine

Investing in LNG infrastructure and decarbonizing the marine value chain

5,000 Delegates

500 Ministers and global energy CEOs

1,000 Speakers

125 Countries

Emerging economies like Vietnam face daunting challenges in balancing wealth creation with emissions reduction and environmental sustainability. Unlike the more mature, slower growth power markets found in the US and Europe, Vietnam is realising over 10% annualised electricity growth and must rapidly build out new generation capacity to keep up with its voracious demand. An estimated US$150 billion in new investment is required to deliver another 70 GW within the next decade, making Vietnam one of the more attractive power markets in the world.

Vietnam signed onto one of the developing world’s most aggressive climate mitigation commitments in 2021 at the United Nations Climate Change Conference in Glasgow (COP26) while simultaneously pledging to phase out coal power and establish a domestic carbon market. These are courageous policy ambitions for any nation, but especially for Vietnam.

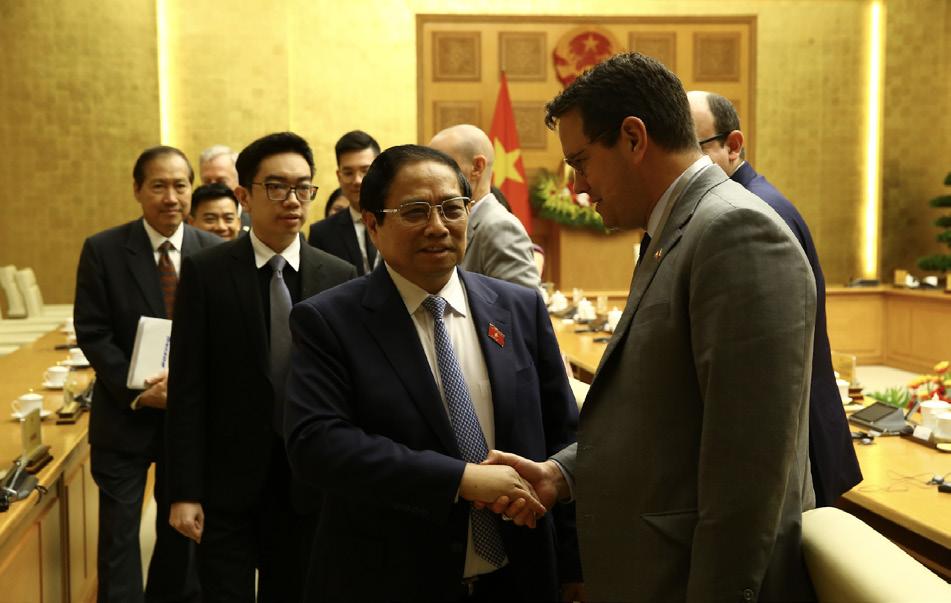

To support these bold objectives, Energy Capital Vietnam (ECV) and SaigonTel (SGT) formed the Green Alliance with the joint mission of delivering low carbon industrial parks with reliable, turnkey power via distributed LNG for discerning tenants with continuous power needs. ECV is a US-based industrial development and management company focused on energy and infrastructure within Vietnam. SGT is a leading Vietnamese industrial real estate and infrastructure developer whose existing industrial tenants include some of the most well-known global technology brands from around the world, all of whom have their own aggressive net-zero commitments.

This is also why the Green Alliance initiated steps to empower provincial policy development with carbon market expertise and streamline integration with the global voluntary markets. By assisting localities in adoption of international standards in carbon management, those localities become more attractive to investors seeking conscientious supply chain carbon accountability.

New policy framework emerges

In May 2023, Vietnam issued Power Development Plan VIII (PDP8), a new framework for the power sector which codified the centrality of domestic natural gas and LNG imports in providing a foundation for renewables expansion over time. Vietnam aims to import more than 22 million tpy by 2030, putting it on track to capture approximately 20% of new global LNG demand over that same period. This step alone will greatly reduce the carbon intensity of Vietnam’s national power grid, which is predominantly coal. Large scale, integrated LNG power, like the Mui Ke Ga (MKG) LNG project being developed by ECV in Binh Thuan province, represents one of the most pragmatic, cost-effective solutions to satisfy Vietnam’s precarious need for energy security and climate solutions.

PDP8 equipped the Vietnamese Government with new legal tools to better manage its licensing process and improve accountability among licensed projects, while incorporating private sector market feedback. Now, all licensed projects must demonstrate steady progress; those more than 24 months behind may become subject to a government review process to validate

COVER STORY

David Lewis, Energy Capital Vietnam, USA, outlines delivering energy security with decarbonisation in Vietnam.

that the project remains feasible. Far too many licensed projects in Vietnam have failed to advance, and these new accountability tools are intended to shore up grid availability to reliable power sources over time. The MKG project has been identified within internal government reports by the Institute of Energy as one of the more technically sound and commercially viable LNG projects within the southern region.

In April 2024, the Government Office issued an implementation plan for PDP8 which includes several legislative mandates such as a direct power purchase agreements (DPPA)

regime for private offtake, rooftop solar for self-consumption and authorises carbon market development. All policies designed to help develop an industrial ecosystem of green, low carbon industrial parks. In June 2024, the Ministry of Industry and Trade (MOIT) is expected to issue a circular for implementing PDP8 which will include a revised list of projects approved for operation before 2030, opening access for the MKG project to proceed with the licensing process.

Linking energy development with climate responsibility

For Vietnam, LNG represents a major improvement in carbon emissions from its coal-dominated national grid. Moreover, Vietnam is on the frontlines of an increasingly animated global dialogue regarding a ‘just transition’ in energy. But any premise of ‘justice’ in this transition requires that Vietnam not step backwards in reliable power delivery to its population or industry. While there may be aspirational hopes around advanced storage, next-generation nuclear, or other technology further out on the technology development curve, the opportunity immediate available for execution is the transition towards natural gas, which can also support greater renewables adoption.

On a gross reduction basis, if a terawatt-hour of coal generation can be replaced with half renewable electricity and half LNG power, it represents roughly a 75% reduction on gross emissions (prior to considering Scope 3 emissions of those verticals). This is why the Green Alliance is pursuing an ‘all of the above’ strategy to decarbonise industrial parks that includes rooftop solar, battery storage, energy efficiency improvements, and low carbon technologies to reduce emissions through avoidance and reduction. Dispatchability is what makes natural gas a compelling tool within a holistic decarbonisation strategy that respects the underlying needs of energy-dense emerging economies like Vietnam. Unlike other sources, natural gas can quickly be ratcheted up and down, maximising moment to moment availability from renewables.

ECV and SGT believe a novel and socially impactful pathway exists to reduce the remaining ‘wedge’ of emissions from natural gas towards a near ‘net-zero’ basis. This can be achieved by using the economic tentpole of new assets, like LNG power, as a driving force for simultaneous co-investment into meaningful emissions reduction opportunities within Vietnam. By focusing on the next generation of carbon offsets project types – forestry, agriculture, littoral blue carbon, transport electrification, and urban climate resilience – and tying new development with a localised portfolio of carbon mitigation assets, the Green Alliance believes that LNG power assets and low carbon industrial parks could become core components of a multi-decade net zero trajectory.

Provincial level decarbonisation plans

ECV and SGT announced the formation of the Green Alliance during the Long An Provincial Investment Promotion Day in July 2023, which was attended by Prime Minister Pham Minh Chinh. The Green Alliance signed a memorandum of understanding (MoU) with Long An provincial authorities to develop Vietnam’s first low carbon industrial park and implement other net-zero strategies. This will serve as a foundation for developing a broader provincial roadmap for Long An to reach net-zero emissions by 2050.

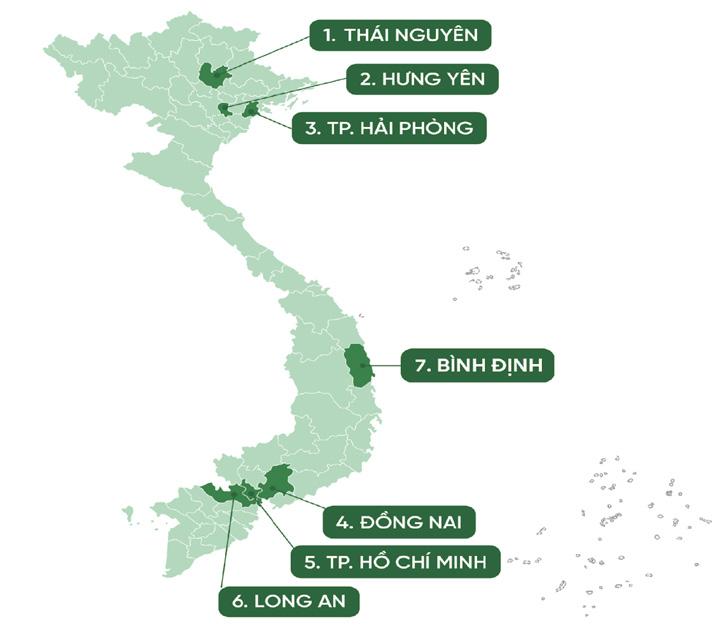

Since then, ECV and SGT have signed similar green growth and decarbonisation strategy agreements with six more provinces,

including Dong Nai, Thai Nguyen, Hung Yen, Hai Phong, Binh Dinh, and Ho Chi Minh City.

The Green Alliance has become a driving force advocating on behalf of sustainable development policies and secured funding for provincial green growth plans in Long An, Dong Nai, and Thai Nguyen. Additionally, the ECV and SGT have partnered with Ho Chi Minh City on a green development project and signed an MoU for a private-sector innovation centre.

In March 2024, the Green Alliance initiated provincial training seminars with authorities from Long An and Dong Nai, which will

soon begin pilot programmes to support carbon market development. Lessons learned in these two provinces will be incorporated into similar programmes rolled out across the other four provinces. These initiatives showcase the Green Alliance’s commitment to propelling Vietnam towards a greener future through smarter regulations.

Replicable and scalable

The Green Alliance has incorporated lessons from similar carbon market developments in neighbouring countries through recent partnerships with reputable Taiwanese and Korean partners. All parties appreciate how gas promotes maximal use of renewables through fast starts/stops for grid balancing and load efficiency. This reduces the carbon intensity of power without compromising the integrity of supply.

Modular gas-fired power plants also offer relatively fast construction and installation timelines and phased expansion capabilities to match growing demand over time. This replicable model, operational flexibility, and easy onsite maintenance helps to ensure access to uninterrupted power. High reliability is crucial in advanced manufacturing and data storage systems more commonly found in the higher value sectors of an economy. These same power demands are also found in continuous manufacturing operations, which deliver lower costs, faster production, greater automation, and predictive maintenance, all qualities commensurate with the knowledge economy Vietnam intends to cultivate.

Key challenges

Vietnam’s ‘just transition’ strategy towards being an energy-dense, low carbon, advanced economy will take decades to execute. This is best evidenced by growing coal imports in 2024 to stave off power shortages experienced in 2023. Ironically enough, shortly after PDP8 was issued, blackouts began across the northern region due to severe droughts, which reduced typical capacity from hydropower. This weather anomaly was further exacerbated by noble attempts to quickly transition towards cleaner power by reducing coal imports. But Vietnam cannot transition away from coal without a reliable, secure alternative to transition towards. Thus, new power from natural gas and LNG is of paramount importance to government authorities who now fully appreciate prioritising security when it comes to energy. The role of LNG within the energy mix is likely to grow over time should other planned generation sources not materialise as planned.

Peering into the future

Climate concerns around ‘locking in’ natural gas and LNG infrastructure fail to acknowledge that the alternative is coal. The immediate ability of natural gas and LNG to dramatically cut emissions while simultaneously supporting renewables is self-evident. Policies which enable greater adoption of natural gas and LNG can become key components in comprehensive, multi-decade decarbonisation strategies. Policies restricting access to natural gas and LNG infrastructure are directly contributing towards greater coal consumption and higher global emissions, just as evidenced in Vietnam.

Natural gas and LNG imports offer Vietnam a strategic solution to its ambitious net-zero goals. By facilitating green projects focused on efficient utilisation of LNG, the Green Alliance is helping to pave the way for a smoother energy transition. Supporting Vietnam’s climate aspirations starts with securing the supply of electricity for the continued prosperity of its people.

Promoted amines for CO2 Removal

Ralph

Weiland, Optimized Gas Treating, Inc., USA, discusses the use of piperazine as a reaction promoter in combination with N-methyldiethanolamine for enhancing carbon dioxide removal rates.

This article reviews the application of piperazine as a reaction promoter for enhancing carbon dioxide (CO2) removal rates from syngas preparatory to its conversion to ammonia and from natural gas prior to liquefaction. Apart from a few tangential references, the focus is on piperazine-promoted N-methyldiethanolamine (MDEA), this being the most increasingly used solvent today in most CO2-removal applications. After addressing CO2-piperazine chemistry and piperazine degradation products, consideration is given to CO2 vapour-liquid equilibria in aqueous piperazine and MDEA-piperazine composite solvents. Reaction kinetics between CO2 and piperazine are critical to its successful application, both in amine systems and in hybrids such as Shell’s Sulfinol-M® process.

CO2 reactions with piperazine-MDEA solvents

CO2 absorption by tertiary amines is fundamentally different from absorption by primary and secondary amines in that the latter react rapidly and exothermically

with CO2 to form carbamates, whereas the former do not. Thus, regeneration of primary and secondary amines is comparatively more energy intensive, making a tertiary amine like MDEA preferable from an energy standpoint. Its disadvantage is that it does not react directly with CO2, so absorption rates are not enhanced by reaction with the amine. However, reactivity can be gained in a tertiary amine system if the solvent is spiked with a relatively small amount of a very fast-reacting amine. This produces a blended solvent just as alkaline as before (and therefore with the same high CO2 capacity), but now with high reactivity and therefore able to absorb CO2 much more rapidly.

Deep CO2 removal is achieved by using a relatively small concentration of a highly reactive amine such as piperazine. Piperazine reacts very quickly with CO2 which greatly enhances absorption rates, and then the piperazine carbamate gradually decomposes and releases the CO2 back into solution as bicarbonate. The hydrogen ion (acid) produced in the original piperazine reaction is mopped up by MDEA (base) which, therefore, really acts just as a sink for hydrogen ions:

Figure 1. Parity plot pf CO2 partial pressure over MDEA solutions (435 measurements) dashed lines indicate ± factor of two deviation from mean.

2. Parity plot of CO2 partial pressure over MDEA + piperazine solutions (238 measurements). Dashed lines indicate ± factor of two deviation from mean.

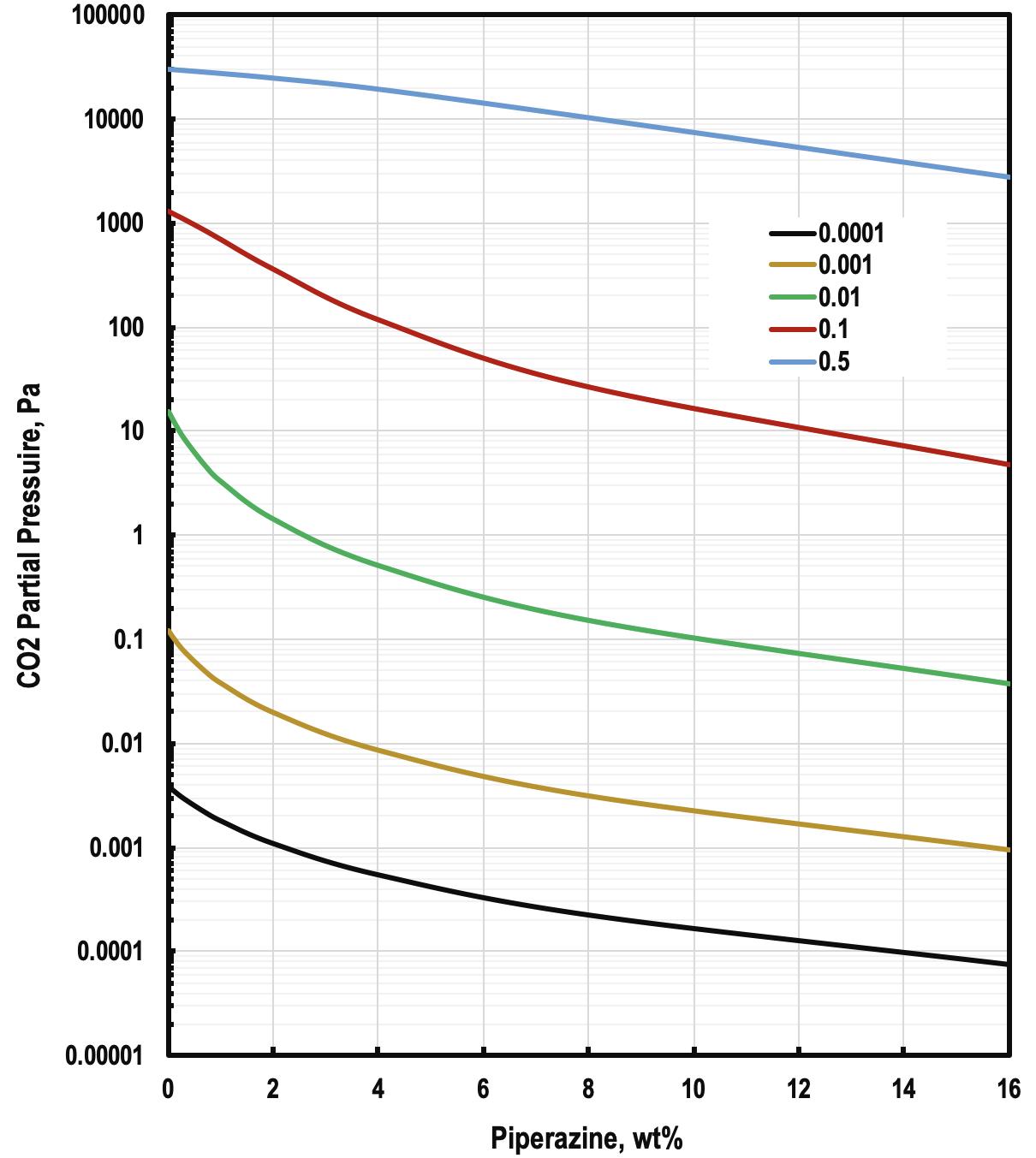

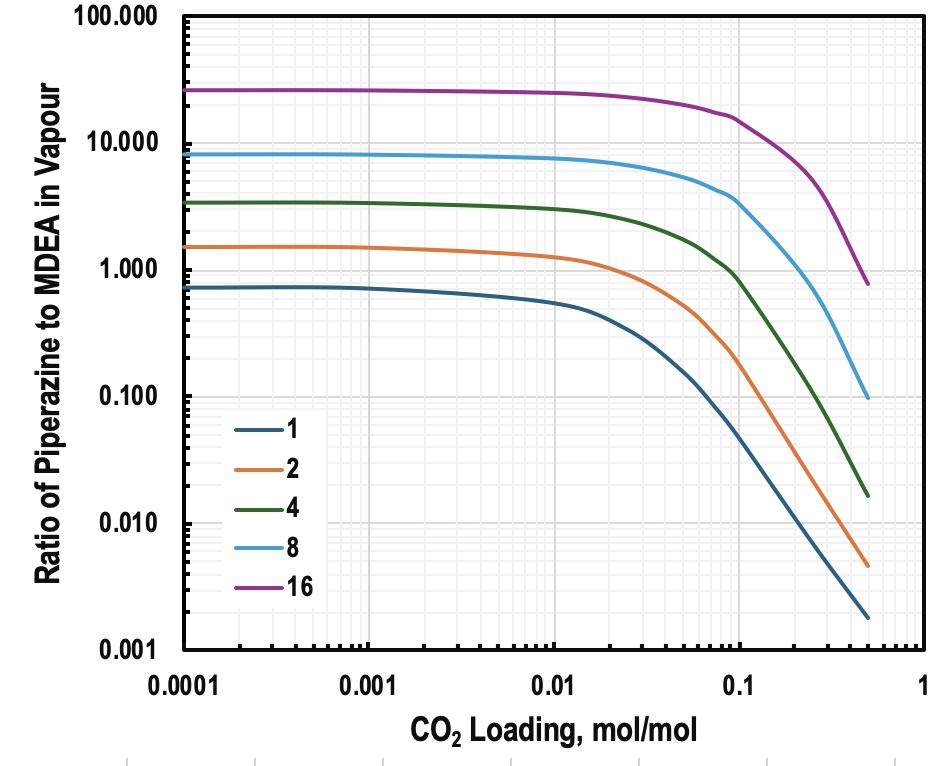

Figure 3. Simulated effect of piperazine concentration on CO2 partial pressure with CO2 loading as parameter. Temperature = 35˚C, 40 wt% total amine strength, ProTreat® simulation.

HNRNH + CO2 HNRNCOO� + H+ HNRNCOO� + H2O HNRNH + HCO3 MDEA + H+ MDEAH+

There is a little more to the chemistry than this, however, because piperazine is a diamine. Thus, piperazine monocarbamate can react with another CO2 molecule to form the dicarbamate, and the dicarbamate can hydrolyse to reform the monocarbamate and release a bicarbonate ion:

(5)

(2) (3) HNRNC00� + CO2 COO NRNCOO� + H+ COO NRNCOO� + H2O HNRNCOO� + HCO3

Piperazine is a very effective activator, although it is not the only one used commercially. Regardless of which promoter is employed, when using an activated MDEA solvent, one is dealing with a highly reactive system in which a substantial amount of heat is released by:

z The physical dissolution of CO2 into the liquid solvent.

z Its subsequent reaction with a low concentration of the reactive amine (small heat effect).

z The titration reaction of tertiary amine with released hydrogen ions (substantial heat generated).

When the solvent contains only MDEA, CO2 absorption generates bicarbonate and hydrogen ions, MDEA does not react with CO2, but each hydrogen ion neutralises an MDEA molecule:

+ H2O HCO3 � + H+ MDEA + H+ MDEAH+

(3)

One of the more interesting technical aspects of the CO2-piperazine-MDEA system is that the role of MDEA is not to react with CO2 but to remove hydrogen ions from the solution. Keeping the hydrogen ion concentration low virtually eliminates one of the chemical components (H+) that would push back against CO2 dissolution into water via Equation 6 and hamper bicarbonate formation. The high capacity of MDEA for CO2 comes from its ability to act as a sponge for hydrogen ions – low absorption rates result from its nonreactivity, a deficiency overcome by piperazine.

Figures 1 and 2 indicate the variability in the literature data on the solubility of CO2 in MDEA and in MDEA + piperazine, respectively, and they also show the goodness of fit of ProTreat’s® thermodynamic model to the data. An interesting question is what effect piperazine has on the equilibrium CO2 partial pressure. There are several ways to pose this question.

Commercially, practitioners think of amine concentration in terms of the units of weight (or mass) percent, probably because solvents are bought and sold by weight. However, when the solvent contains two (or more) amines, a rational study of blend formulation is not so straightforward. Should a comparison between 2 wt% and 8 wt% piperazine be based on a fixed MDEA concentration, or a fixed total amine concentration? Or should the basis be wt% at all? On balance, this is a thermodynamic question, and the language of solution thermodynamics is molality, not mass fraction, or mass percent. Which units to use depends on whether the results are to be applied commercially (mass basis) or to achieve deeper scientific understanding (molal basis).

In this case, the interest is commercial (vs theoretical) so Figure 3 shows an example of the effect of varying piperazine concentration (wt%) in a 40 wt% total amine solution as a function of CO2 loading at 35C with CO2 loading as parameter. A typical CO2 loading at the lean end of a CO2 absorber in an LNG application is 0.01 mol/mol (green line in Figure 3). Here, 2 wt% piperazine lowers the CO2 backpressure by a factor of 10 and 4 wt% piperazine lowers it by a factor of 25. These are substantial reductions, so it can be concluded that piperazine acts through both equilibrium and reaction kinetic effects. It is also worth noting that equilibrium CO2 partial pressure is most responsive to piperazine addition at low concentration, although the response is also quite evident right across the whole range of piperazine concentrations. Reaction kinetics and equilibrium work together to determine the packing depth or tray count in an absorber, whereas equilibrium sets the maximum allowable loading to meet product specifications.

A new technology

In the area of CO2 capture, a new technology called CESAR1 has emerged. This solvent consists of 40 wt% total amine with a piperazine-to-AMP (2-amino-2-methyl-1-propanol) molar ratio of 1:2.1 Piperazine-to-AMP solvent blends are now being used commercially in post-combustion CO2 capture applications. For example, several test campaigns are being conducted by RWE at their Niederaussem Innovation Centre, Bergheim, Germany, as part of the so-called Sustainable OPEration of post-combustion Capture plants (SCOPE) project. SCOPE is a follow-on from the ALIGN project2 and involves more than 20 partners

from Germany, the Netherlands, the UK, Norway, India, and the US. This project seeks to overcome existing barriers to the accelerated implementation of carbon capture utilisation and storage (CCUS). This is to be achieved by making available recommendations on methods of reducing emissions based on representative pilot facility testing, simulations, cost-benefit analyses and case studies for the design and operation of amine scrubbers for carbon capture and the approval process. ProTreat is being used as SCOPE’s simulation benchmark and is being updated as the project progresses.

AMP is a primary amine; however, it is sterically hindered so it does not react with CO2. Because hindering blocks the access of CO2 to the amino group, AMP exhibits the same chemistry as MDEA. Thus, most of the foregoing discussion concerning piperazine promoted MDEA also applies to CESAR1. CESAR1 solvent offers a 22% reduction in energy consumption for coal-fired and 15% for gas-fired power plants over 30 wt% MEA, heretofore the CO2 capture standard.

Hazards

Except as a vapour, piperazine itself is not a particularly hazardous chemical, as witnessed by its safe and effective veterinary use as a livestock anthelmintic (dewormer) since 1953. Its use as a solvent component in gas treatment, however, has raised concerning issues. Piperazine, being a secondary amine, can form N-nitrosopiperazine and dinitrosopiperazine by reaction with nitrogen dioxide (NO2) which absorbs into the solvent as nitrite. Nitrosopiperazine is carcinogenic. This is concerning in general, but especially when piperazine is used as a component (or alone) in solvents for

CO2 capture. Combustion gases invariably contain substantial concentrations of nitrogen oxides (NOX) of which NO2 is a prominent species.

As discussed in an article by Fine et al. (2013),3 one approach to mitigating the generation of nitrosopiperazine is to pretreat the flue gas with a sulfite solution in an absorber to remove NOX. However, pretreatment via absorption could add substantially to the cost of CO2 capture because of the large equipment needed to handle the enormous gas volumes and the energy required to overcome the additional pressure drop across the extra pretreating column. In a detailed article, Rochelle (2022) has discussed much about hazards that must be addressed in amine-based gas treatment.4

Amine volatility and recovery

All the alkanolamines used in gas treatment exhibit sufficient volatility to warrant the implementation of water washing of the treated gas to recover any small amine vapour content and to capture and retain solvent entrainment (second to leaks and spills, probably the principal way solvents are lost from the system). Spillage and entrainment are unique to each plant’s operation; vaporisation losses are not. Piperazine has a relatively low molecular weight and a high enough vapour pressure for there to be comparable concentrations of piperazine and MDEA in the treated gas despite piperazine being only 2 – 3 wt% of the solvent while MDEA is at 10 – 20 times greater concentration.

Figure 5 shows how the equilibrium level of piperazine in the treated gas at 35˚C varies with piperazine concentration

and solvent CO2 loading. Given that a typical absorber lean-end CO2 loading is around 0.01 mol/mol in LNG applications, Figure 5 illustrates that piperazine could vaporise at nearly 30 times the rate of MDEA in a high-piperazine blend. In carbon capture applications, however, a CO2 lean loading of 0.1 – 0.2 is more typical, and piperazine vaporisation is much lower. Nevertheless, water washing the treated gas can greatly reduce amine losses, particularly piperazine. Entrainment capture is an added benefit, as is removal of nitrosamines.

Conclusion

Piperazine is an extremely fast reactor with CO2 and is the most used reaction rate promoter in MDEA-based amine systems for gas treatment. There are enough high-quality literature data available to permit development of very accurate models for CO2 absorption and solvent regeneration in both MDEA and piperazine-MDEA systems, and piperazine-AMP solvents are also being developed and tested. Simulation is the most obviously effective way fundamental data can be used in design and operations, and ProTreat is presently being used as the benchmark CO2-capture simulator in the multinational SCOPE project to commercialise the piperazine-AMP solvent process (called CESAR1).

References

1. COUSINS, A., FERON, P., HAYWARD, J., JIANG, K., ZHAI, R., CSIRO Report EP189975, (2019).

2. GARCIA, S., VAN DER SPEK, M., WEIR, H., SALEH, A., CHARALAMBOUS C., et al., ‘Guidelines and Cost-drivers of Capture Plants Operating with Advanced Solvents, Project 271501’, ALIGN CCUS D1.4.3, (Janaury 2021).

and dinitrosopiperazine

3. FINE, N., GOLDMAN, M., NIELSEN, P., ROCHELLE, G., ‘Managing N-nitrosopiperazine and Dinitrosopiperazine’, Energy Procedia, Vol.37, pp.273 – 284, (2013).

4. ROCHELLE, G., ‘Air Pollution Impacts of Amine Scrubbing for CO2 Capture’, 16th International Conference on Greenhouse Gas Control Technologies (GHGT-16), pp. 23 – 27 (October 2022).

Figure 5. Piperazine in vapour (left) and molar ratio piperazine to MDEA in vapour (right). Effect of CO2 loading (piperazine wt% as parameter) on equilibrium ppmv piperazine-to-MDEA ratio in the vapour. Temperature = 35˚C, 40 wt% total amine strength, ProTreat® Simulation.

Downstream generated

Downstream’s

world is moving. Our customers are moving in terms what their expectations we don’t act now, if we start making changes to industry, we’re going to ourselves in a situation we no longer have an industry that’s going to be supported by our customers.

$613 billion of operating cashflow between 2021 and 2023. Yet CAPEX OPEX are normalizing at new lows, and supply chain issues and workforce shortages further hindering ROI. Despite the return cashflow, winning budget and delivering value creation is proving to be more challenging ever before.

To secure the budget that remains and produce reliable value creation, downstream decision makers must prioritize the most competitive work that also delivers on decarbonization goals, master the art of predictable cost control to ensure reliable ROI, become highly effective in data driven decision making to maximize asset utilization, meet the workforce crisis head to resource the needs of today’s downstream industry.

our industry, we’re going to find ourselves in a situation where we no longer have an industry that’s going to be supported by our customers.

Romain, SVP, General Counsel & Corporate Secretary, NOVA Chemicals

- Byron Romain, SVP, General Counsel & Corporate Secretary, NOVA Chemicals

To secure the budget that remains and produce reliable value creation, downstream decision must prioritize the most competitive work delivers on decarbonization goals, master predictable cost control to ensure reliable become highly effective in data driven decision making to maximize asset utilization, meet workforce crisis head to resource the needs downstream industry.

In our action-packed exhibition 3,500+ budget gatekeepers from across reliability, maintenance, turnarounds, capital projects, digitalization and decarbonization will explore 160 booths, expo tours, product demos, workforce development opportunities and much more. Attend FOR FREE to meet the innovators behind the latest solutions, tools, equipment and components to meet all your procurement needs and deadlines in 2024 and beyond.

keynote speakers

Katie Ellet President, Hydrogen Energy and Mobility

Katie Ellet President, Hydrogen Energy and Mobility

Rostom Merzouki, Director, ABS Global Gas Development, Qatar, depicts how changes in commercial market dynamics and the demand of the energy transition will directly impact vessel design and operations.

Understanding the future of the LNG sector requires a comprehensive analysis of market dynamics, regulation and emerging technology that will shape the next generation of LNG carriers.

The commercial landscape of the LNG market is anticipated to experience fundamental change; in particular the replacement of traditional 25-year charters with short-term and medium-term contracts of 3 – 7 years.

This shift carries profound implications for LNG carriers, necessitating increased operational flexibility. Vessels must be prepared to call at new ports, operate as floating storage for extended periods, facilitate partial cargo discharges and engage in regular ship-to-ship (STS) transfer operations.

Shipowners ordering the next generation of LNG carriers for such contracts face increased investment risks compared to those built for long-term projects. This financial landscape

necessitates a measured approach, prompting shipowners to opt for well-established technologies to mitigate operational risks.

The adoption of new technology introduces an additional layer of complication, potentially requiring charterers to agree to non-standard time charter party clauses.

To further mitigate financial risks and align with the evolving dynamics of LNG carrier financing, the traditional model of full capital expenditure amortised over the vessel’s life may be superseded by financing with one or two capital injections over the vessel’s 25-year lifespan.

This adjusted financial model aims to sustain the vessel’s competitiveness against newer, more modern counterparts, ensuring its viability and relevance throughout its operational life.

As the industry adapts to these financial nuances, shipowners, financiers, and charterers must all recalibrate their strategies to navigate the evolving demands of LNG shipping.

Regulation

The regulatory backdrop to LNG shipping has emerged as a central focus industry discussion, sparking debates about its consequences and making imperative a nuanced examination of the real impact of these measures.

The regulatory landscape is multifaceted, with specific attention from shipowners directed towards ‘one-off’ measures that directly influence vessel design, notably the Energy Efficiency Existing Ship Index (EEXI) and Energy Efficiency Design Index (EEDI). These measures wield a direct influence on vessel certification and impose limitations on vessel speed, thereby significantly shaping operational dynamics.

The regulatory landscape now also extends beyond design-centric measures, encompassing market-based interventions such as the Carbon Intensity Indicator (CII) and the EU Emissions Trading System, designed to improve efficiency and reduce emissions. The collective goal of achieving a net-zero carbon footprint for shipping by 2050 propels both these market-driven initiatives, steering the industry towards sustainable practices.

Inherent in this pursuit is the understanding that demand for LNG as a pivotal energy commodity is driven directly by end-users. Consequently, regulatory measures such as carbon taxes aimed at shipowners/operators, create an intricate interplay between regulatory measures and their economic implications for these end users.

Increasing efficiency

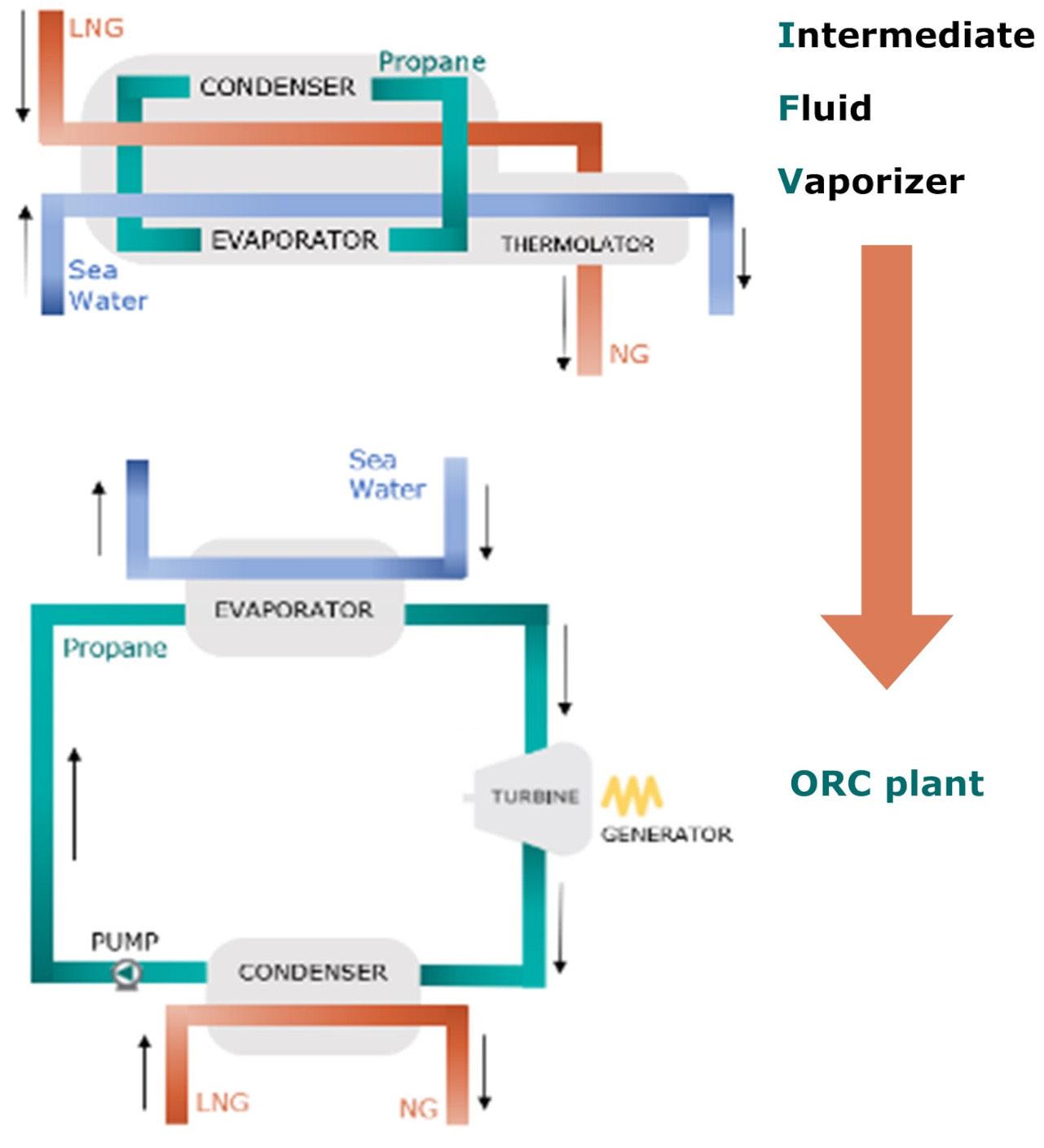

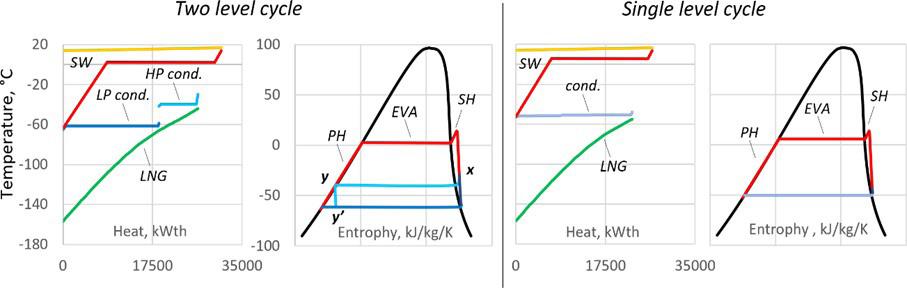

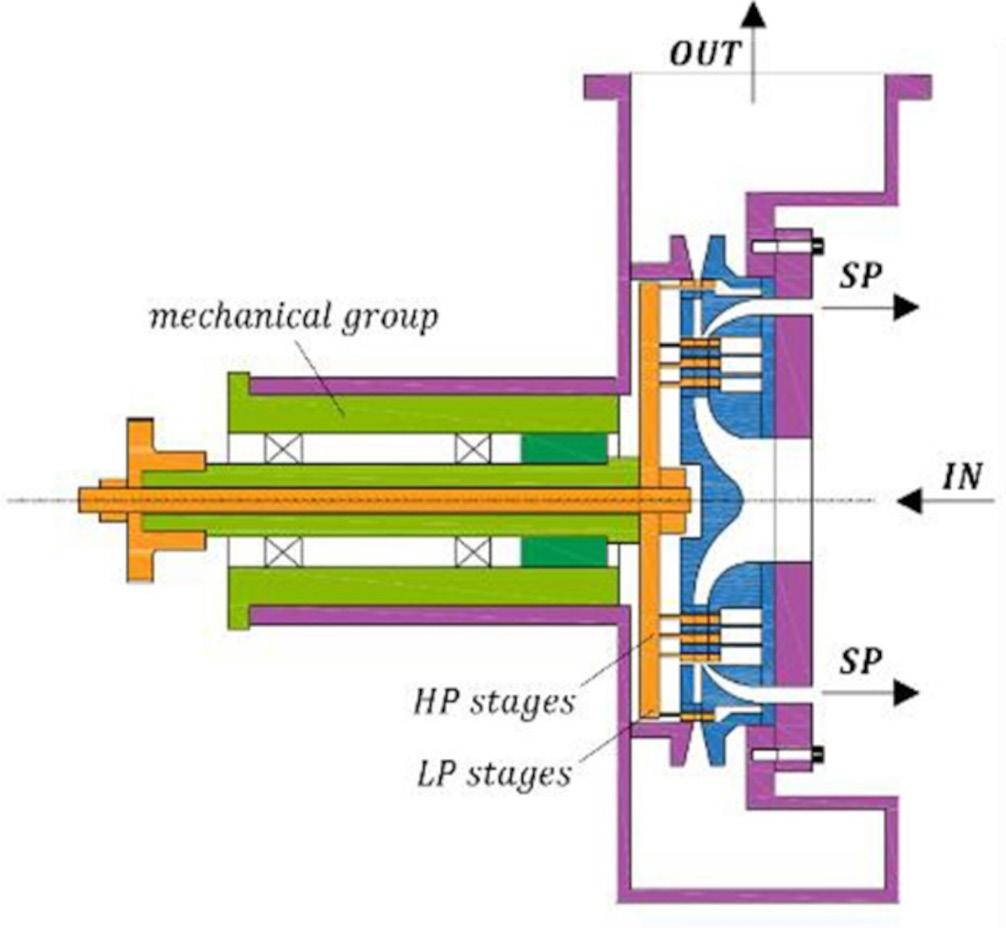

In the pursuit of heightened efficiency on the LNG carriers of the future, a crucial aspect involves reducing heat losses to the air. This can be achieved through the implementation of a waste heat recovery system (WHRS) based on the organic rankin cycle (ORC).

This innovative approach harnesses and utilises excess thermal energy that would otherwise dissipate into the atmosphere. The ORC system, known for its efficiency in converting waste heat into useful power, not only addresses environmental concerns by minimising heat emissions but also contributes significantly to the overall performance optimisation of LNG carriers.

Another pivotal strategy in advancing the efficiency of future LNG carriers involves capitalising on the temperature associated with the cargo that needs to be vaporised for fuel usage. This ‘cold source’ could be used to optimise existing onboard heat exchange systems, such as HVAC and low temperature central cooling. This innovative approach turns a necessity into a source of efficiency, leveraging the low temperatures of the LNG cargo itself to facilitate the vaporisation process for fuel consumption.