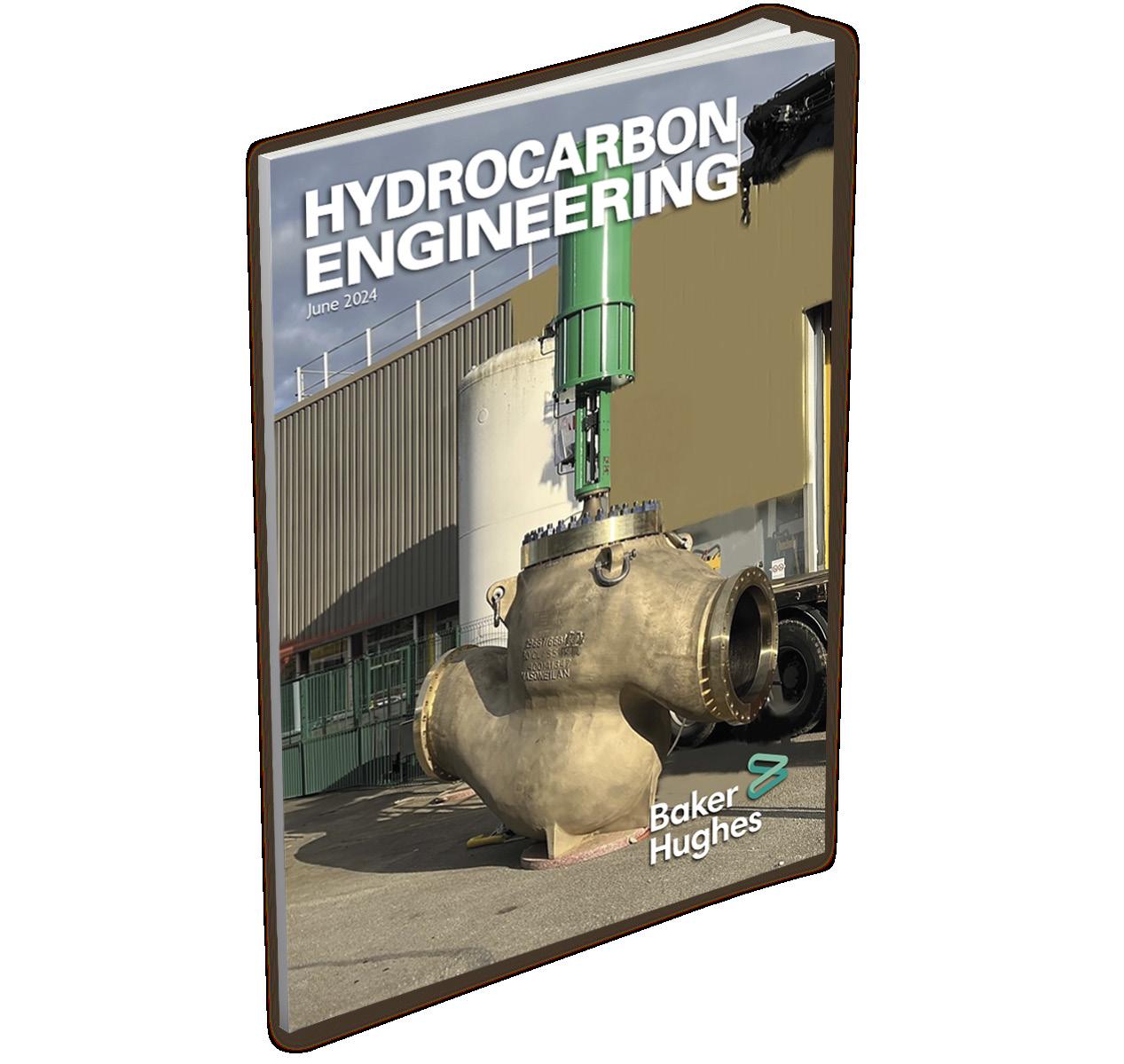

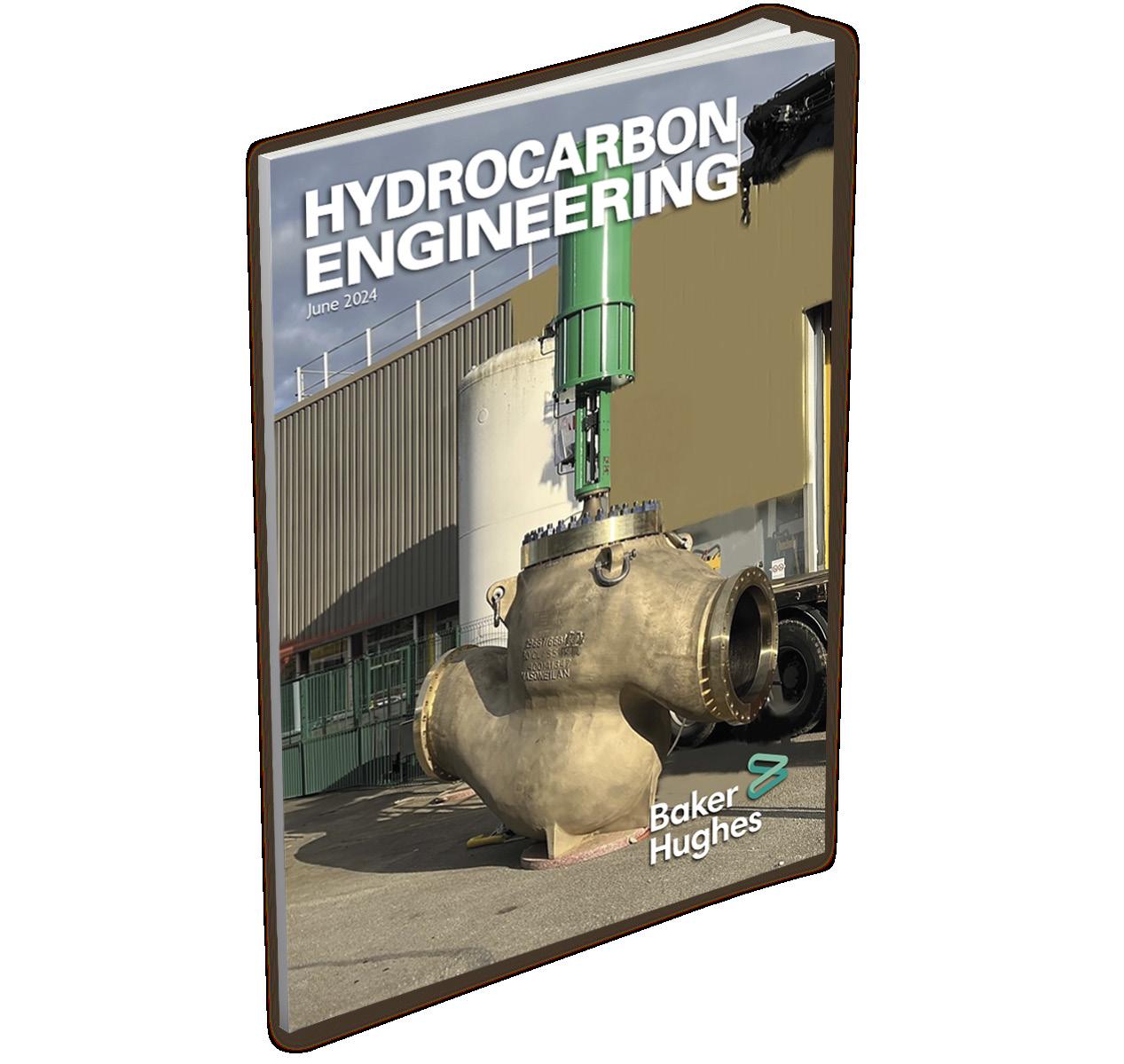

June 2024

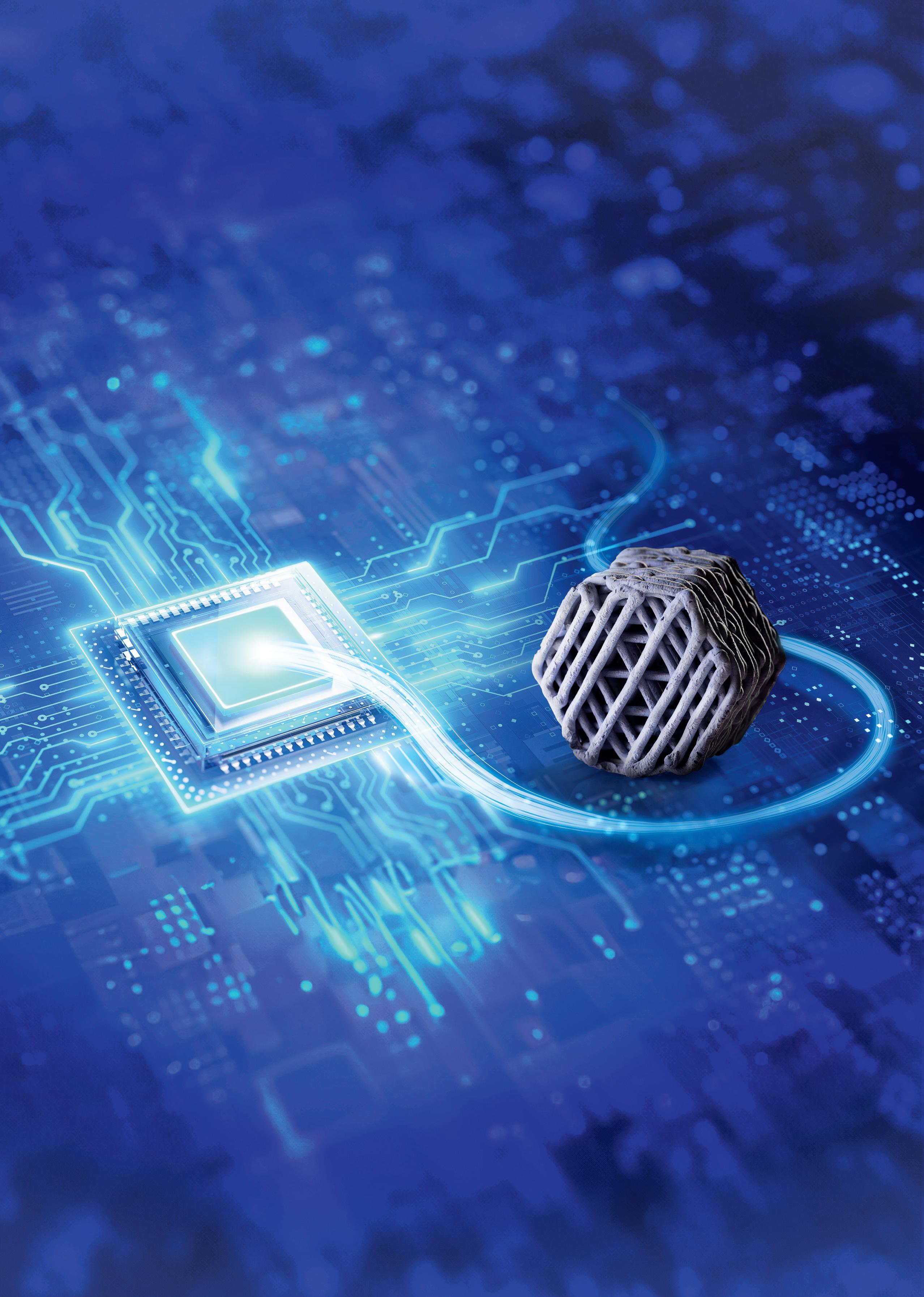

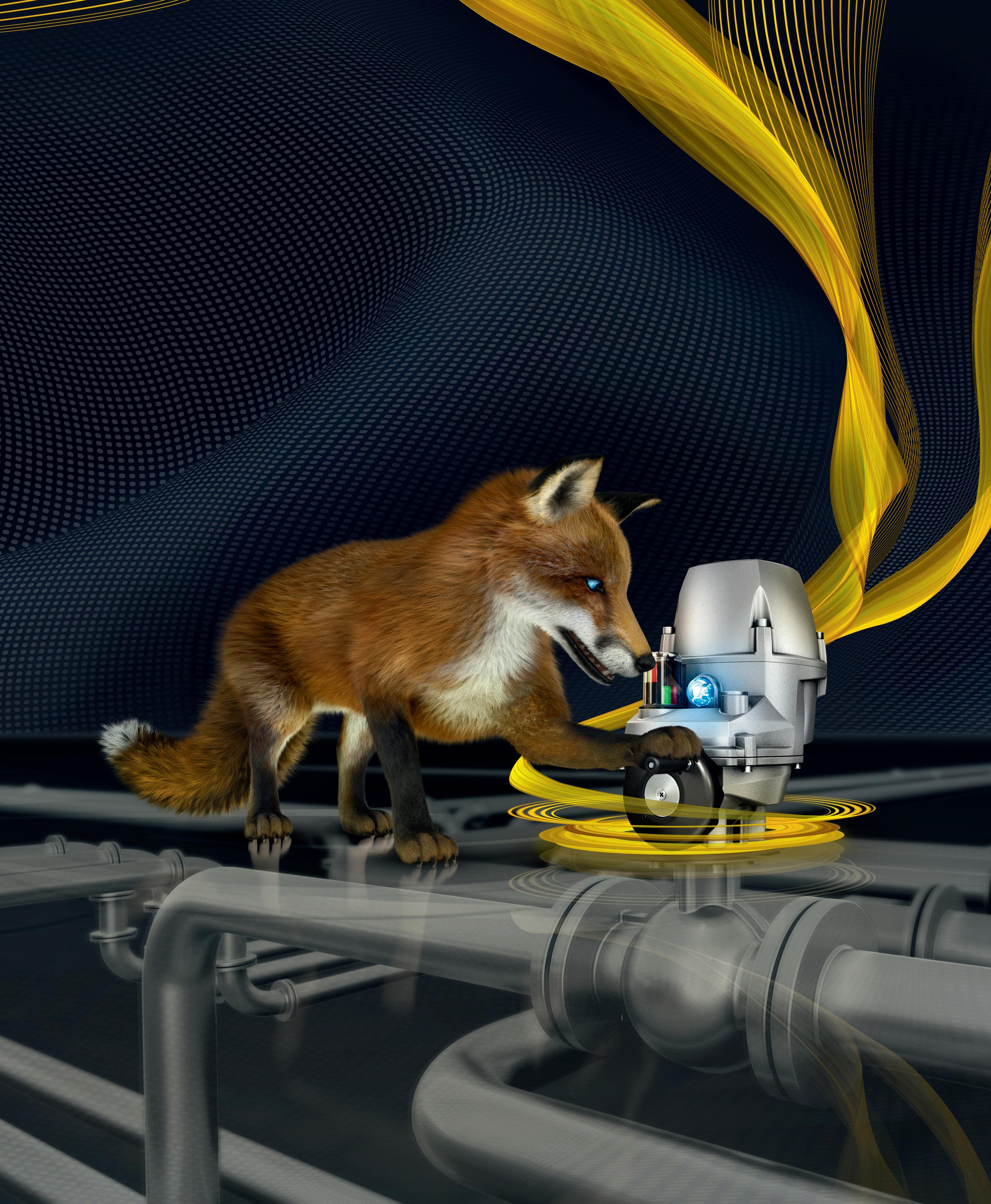

Don’t let foulants in your feedstock devalue your fi nal product. Get more out of your reactor with ActiPhase® technology. Our proven filtration system has a unique, active component that changes soluble foulants into solids, locking them away in its reticulated chambers so they can’t break out. That’s the Crystaphase Experience.

crystaphase.com

38 Conquering challenging applications

or languish

Gordon Cope, Contributing Editor, discusses the state of oil and gas markets in South and Central America and considers how countries can realise their energy potential amongst political storms.

14 Navigating low product demand: part one

In the first part of a two-part article, Scott Baker, Ram Paul Bajaj and Ross Storey, Shell Catalysts & Technologies, alongside Marc Donnelly, Eickmeyer & Associates, consider the operational challenges facing ethylene oxide operators as a result of low turndown, and the short-term solutions that are available.

19 An essential step

Jaap Bergwerff, Ketjen, explains why the hydroprocessing of waste plastic oils is an essential technology in the chemical recycling of waste plastics.

23 Cracking the case of hydrocarbon catalysis

Taco van der Maten, Malvern Panalytical, the Netherlands, discusses the use of X-ray diffraction (XRD) as a valuable tool for catalyst characterisation.

26 Maximising precious metal catalysts

Bradford Cook, Sabin Metal Corp., USA, outlines best practice control points for refiners looking to maximise the value and lifecycle of precious metals catalysts.

33 Growing value through collaboration

Virginie Bellière-Baca, Sulzer Chemtech, discusses customer partnership, innovation, and the endless evolution of technology in the downstream industry.

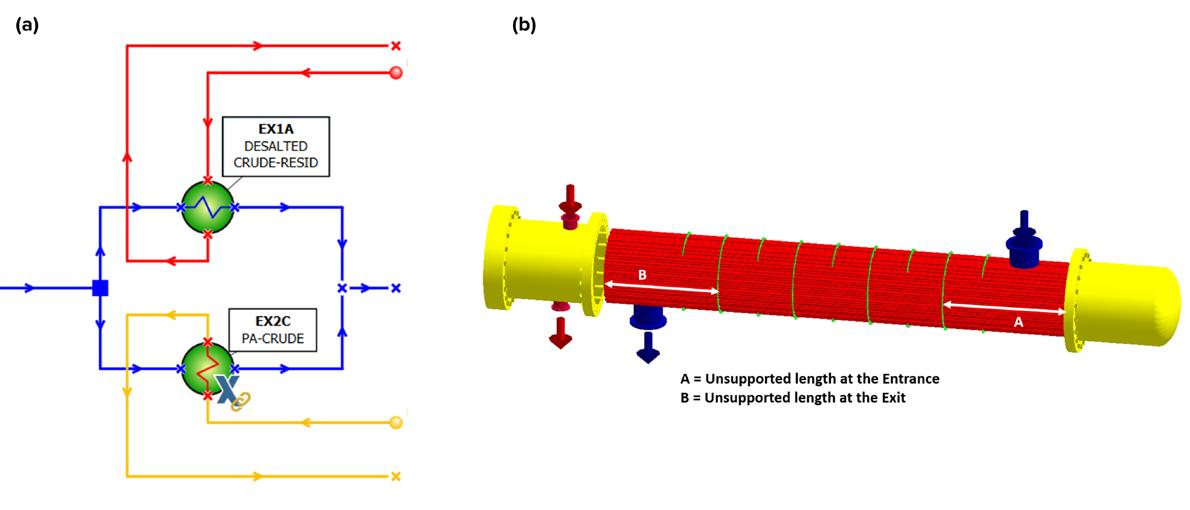

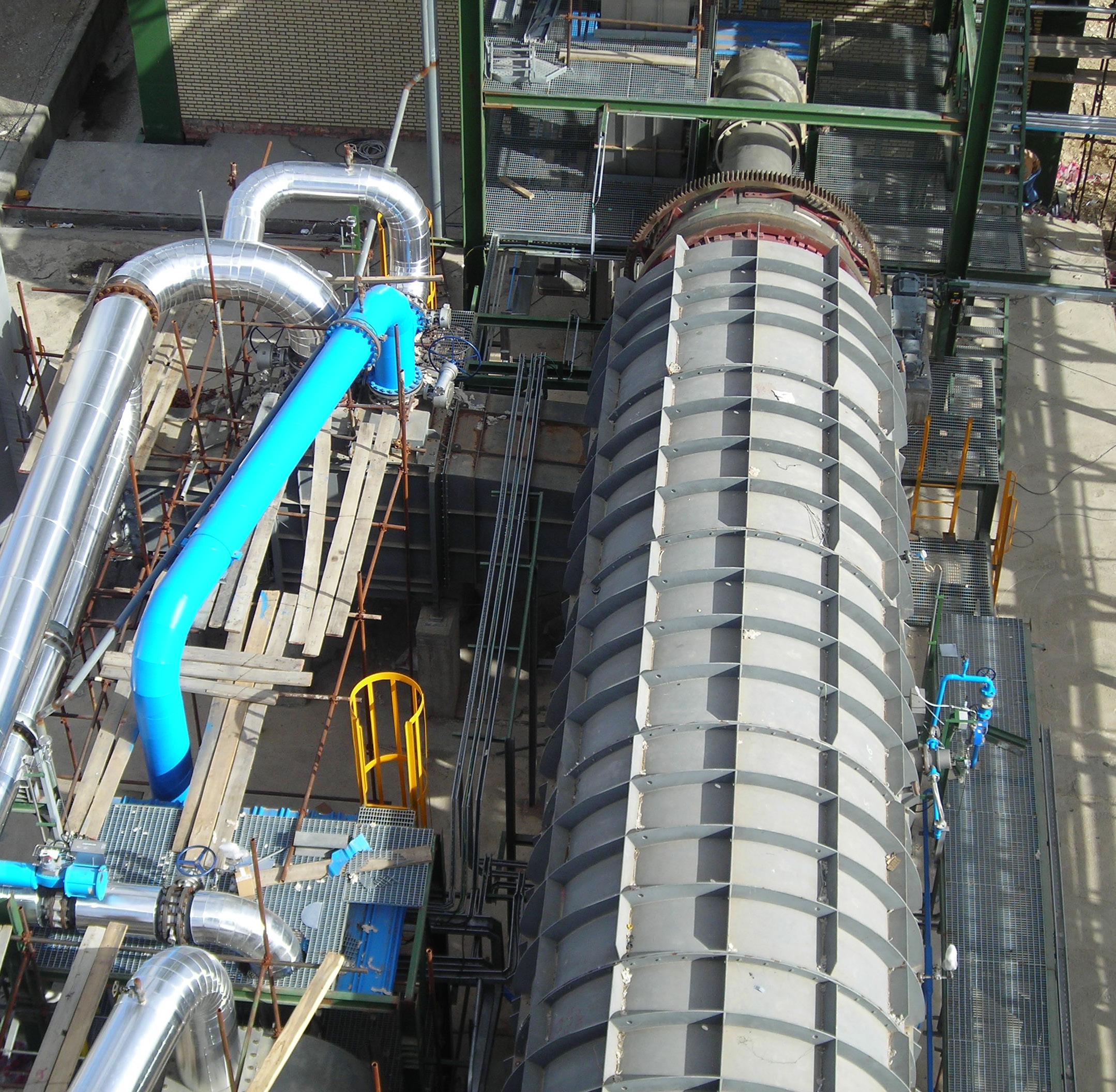

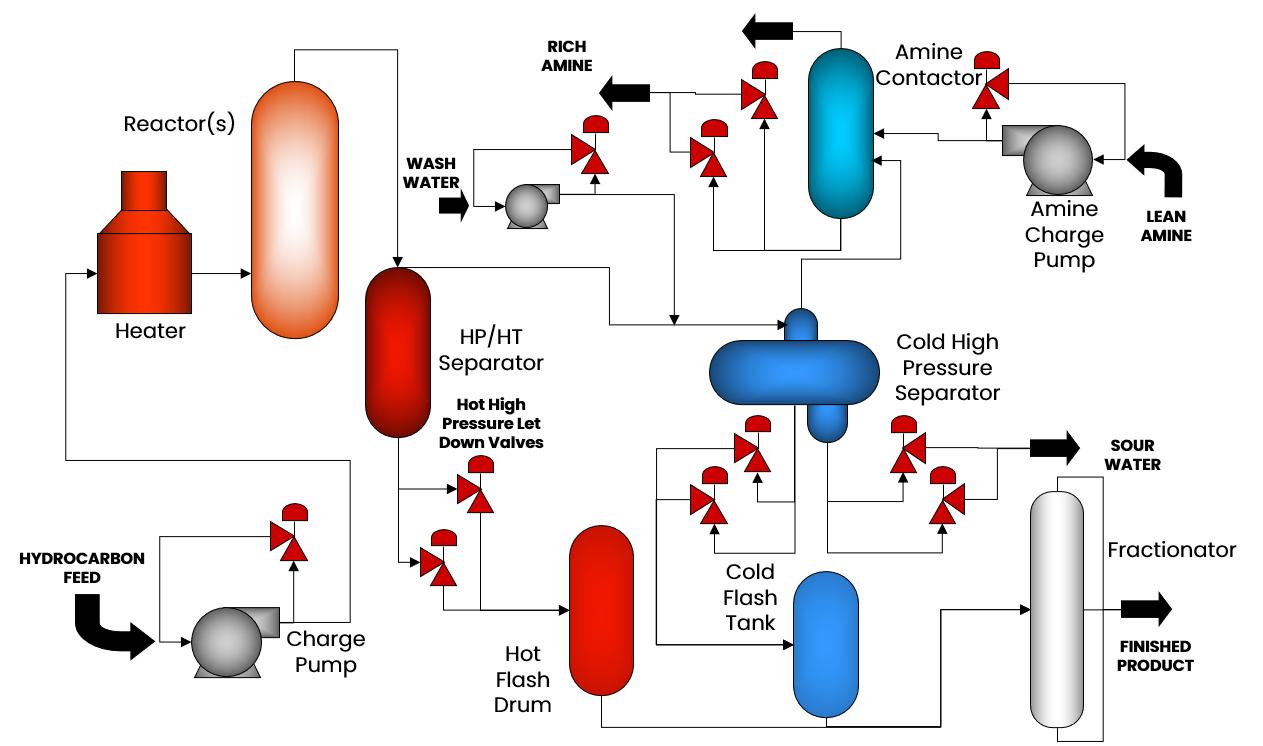

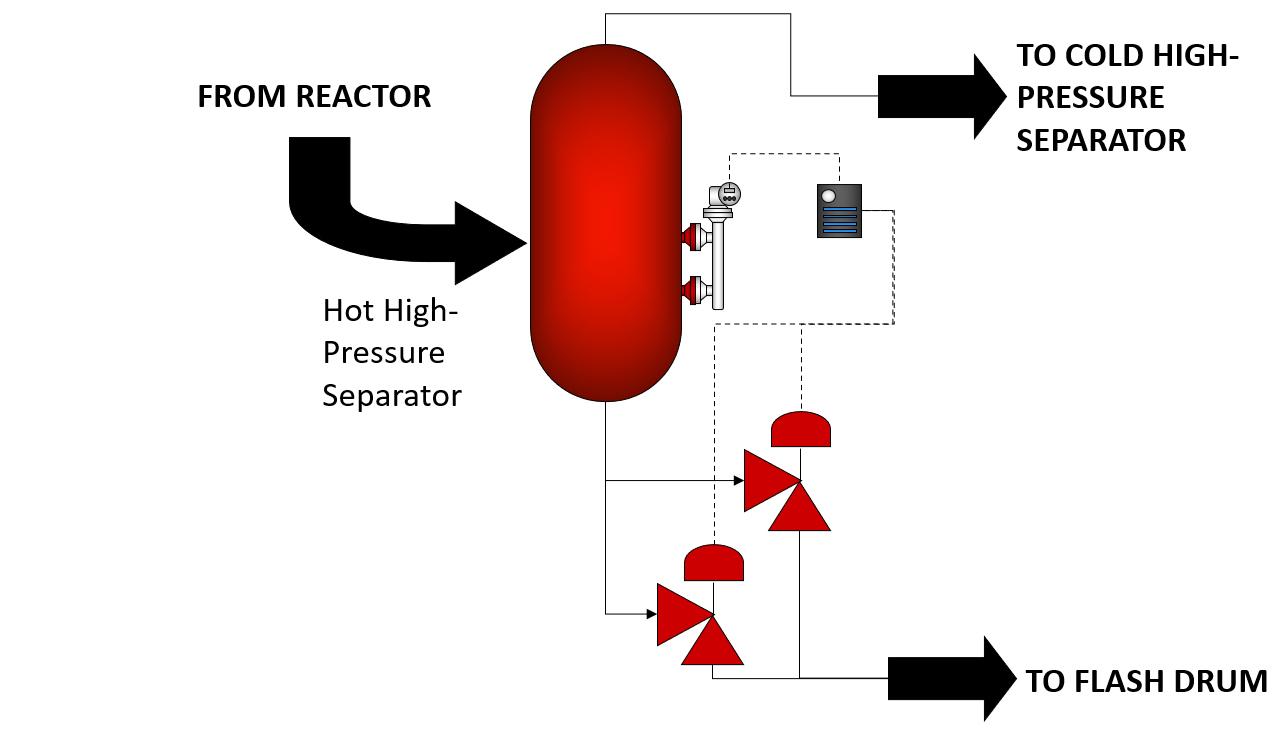

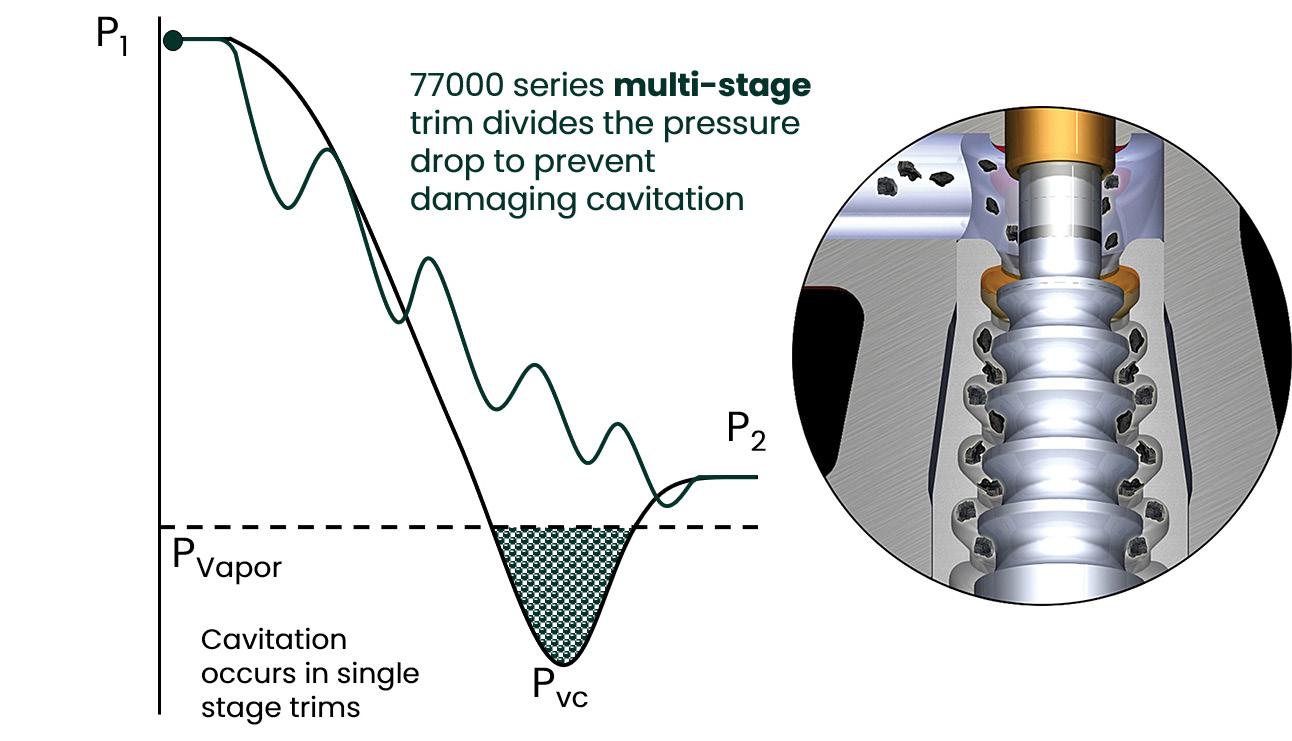

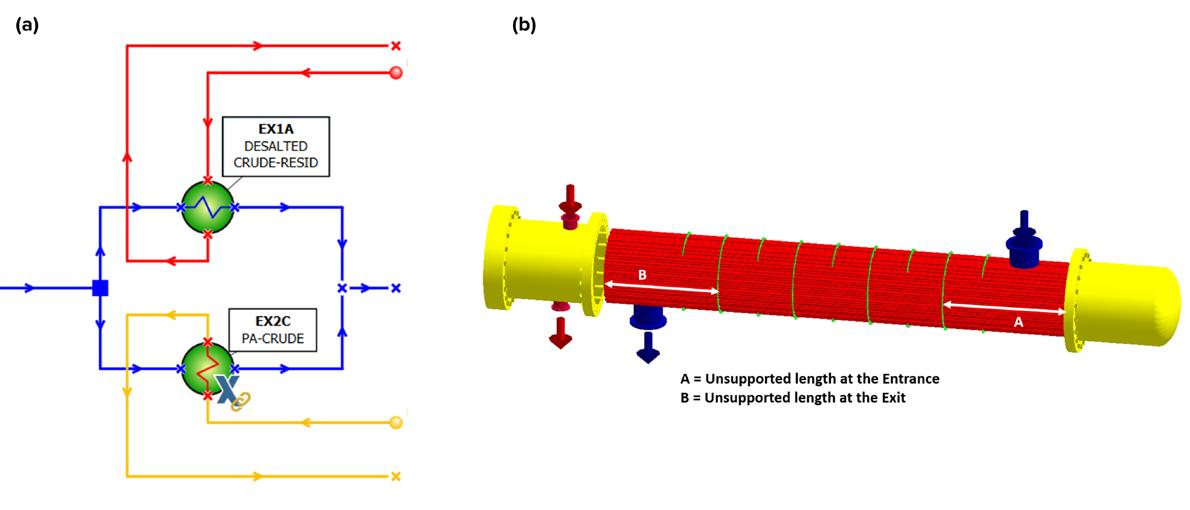

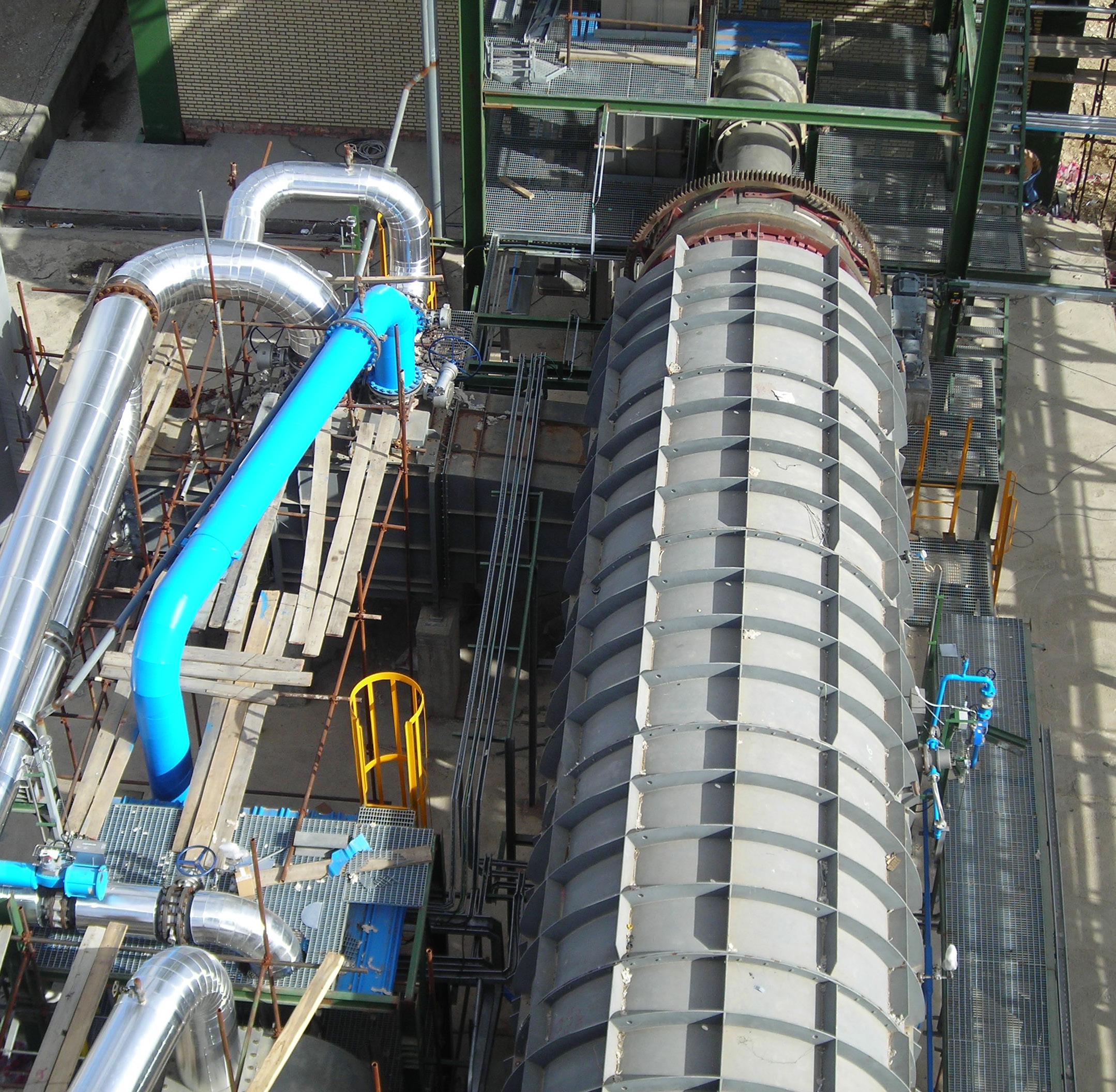

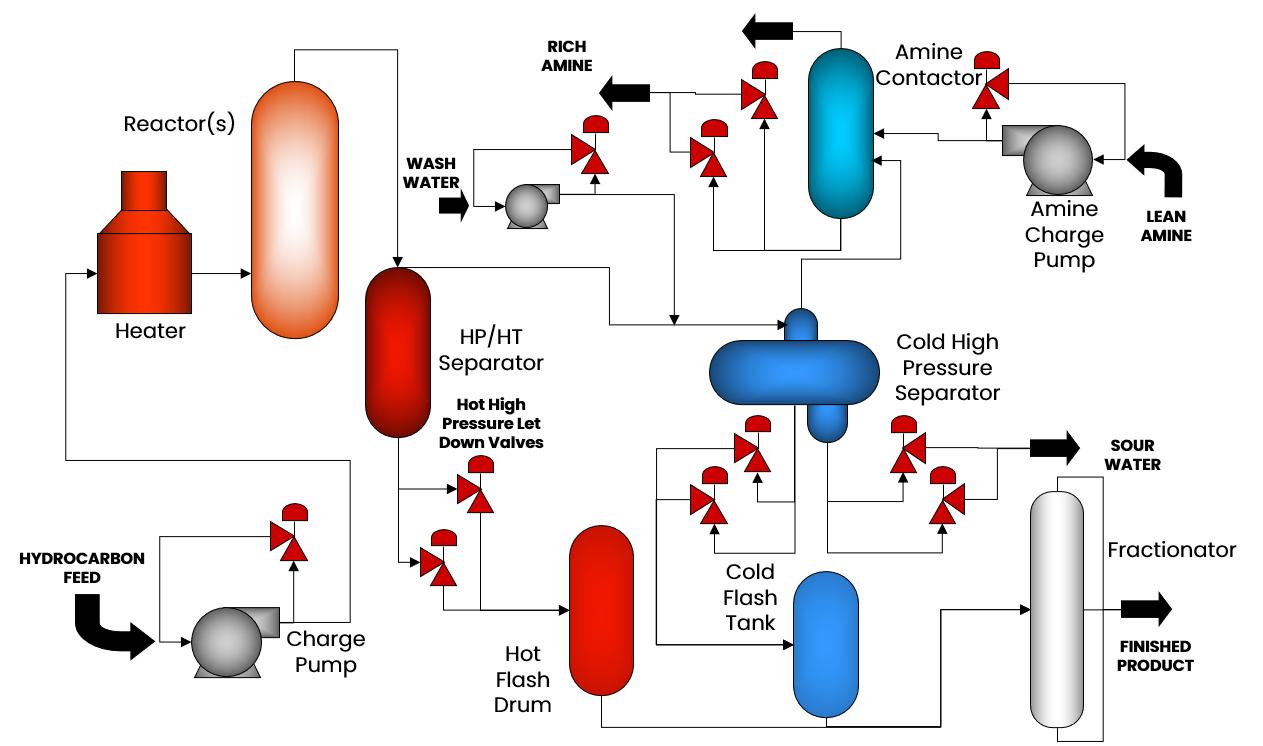

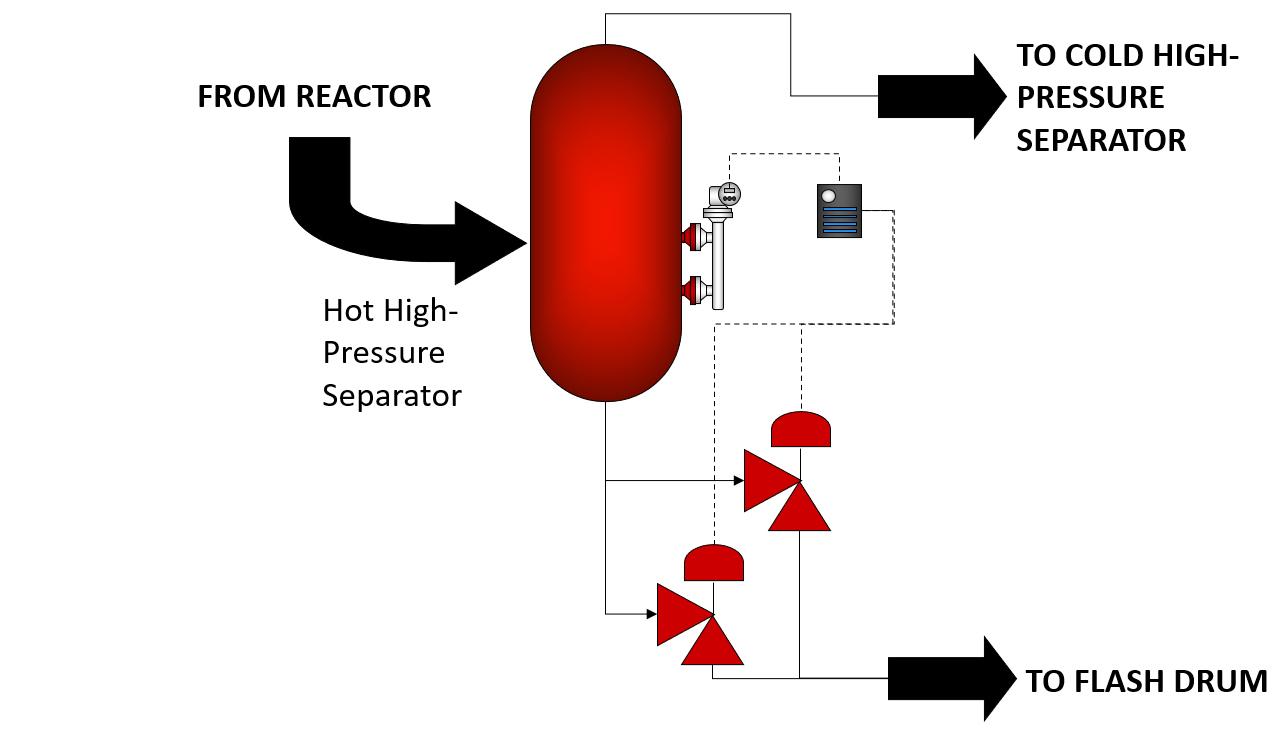

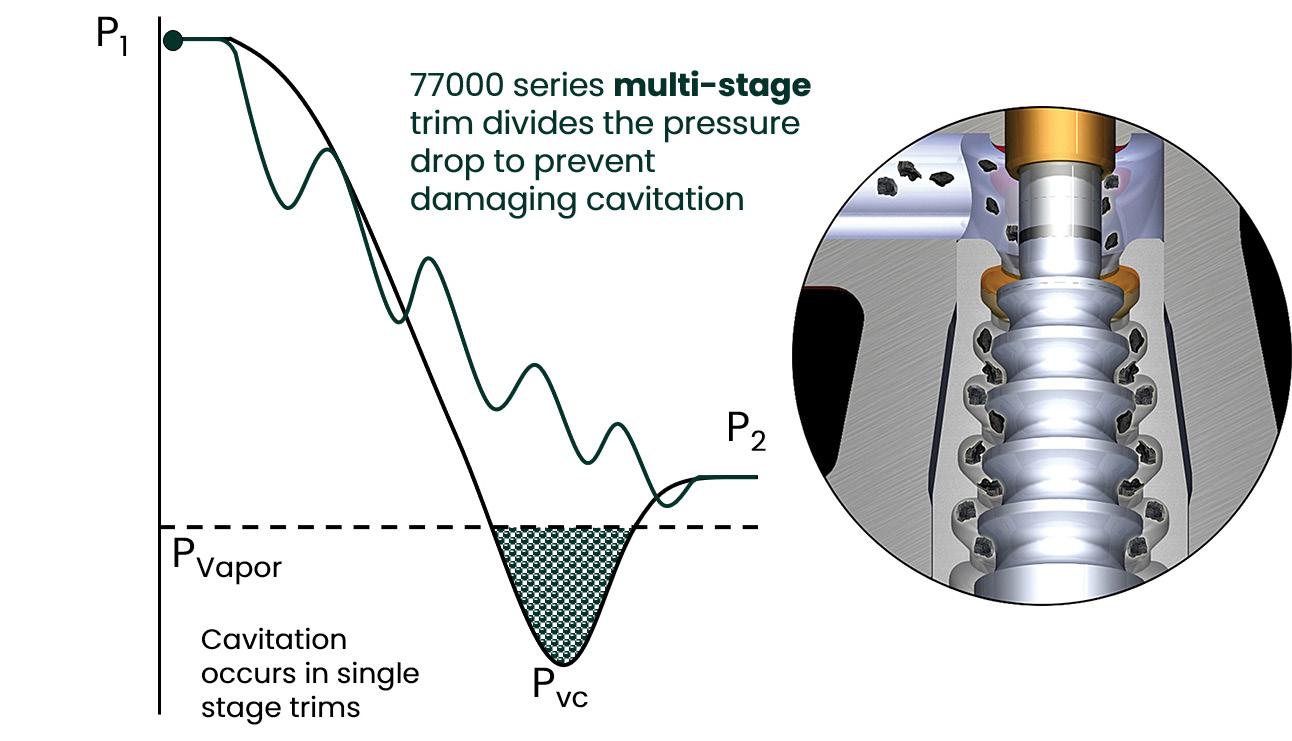

Rebecca O’Donnell and Raghavendran Mahalingam, Baker Hughes, explain why the hot high pressure separator let down valve solution is one of the toughest applications in the hydroprocessing process.

43 Seawater solutions

Desalinated seawater can serve as a reliable alternative to freshwater for industrial plants, but challenges abound. Gregory Gedney and Dave Noblin, Greene Tweed, USA, explain.

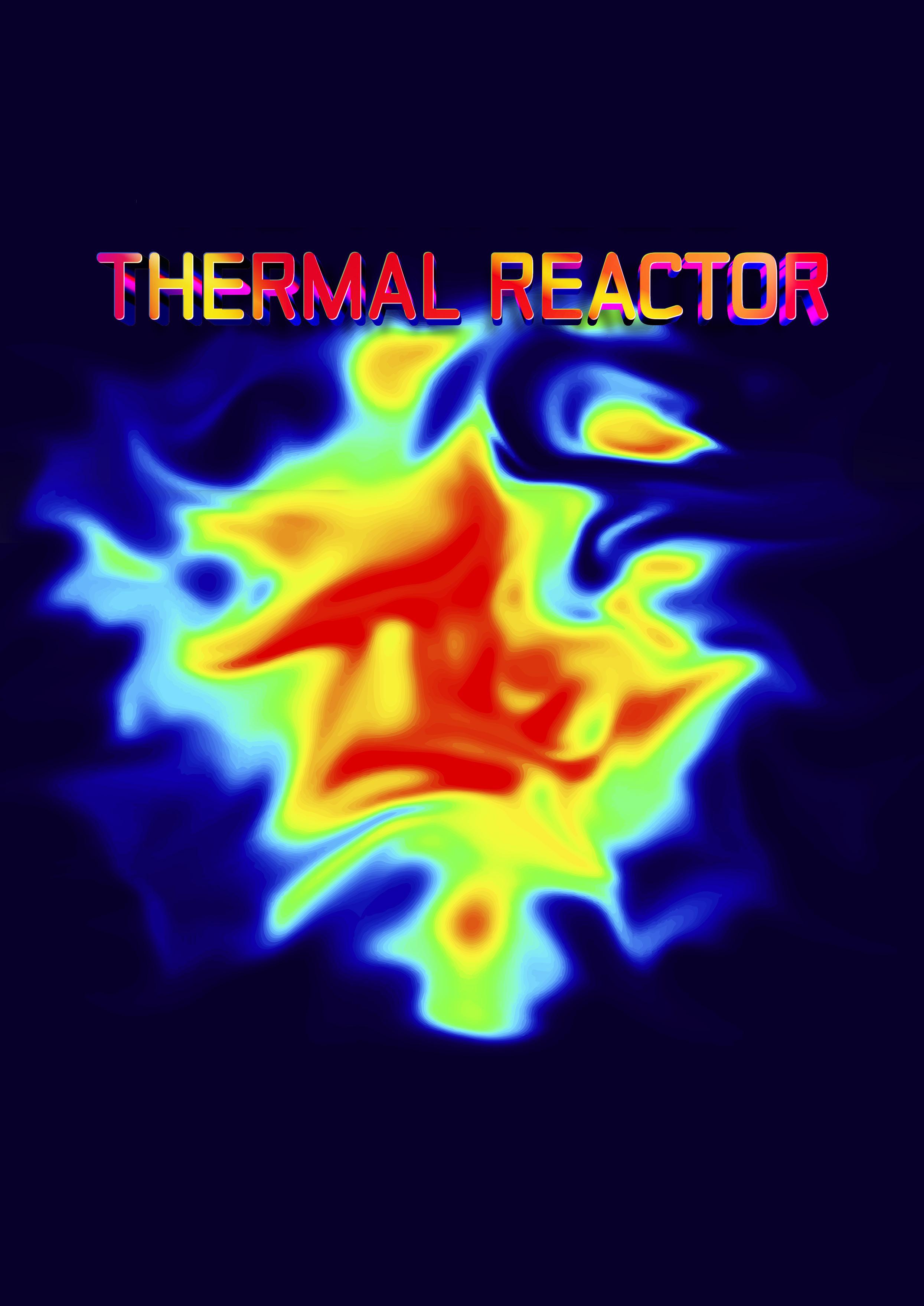

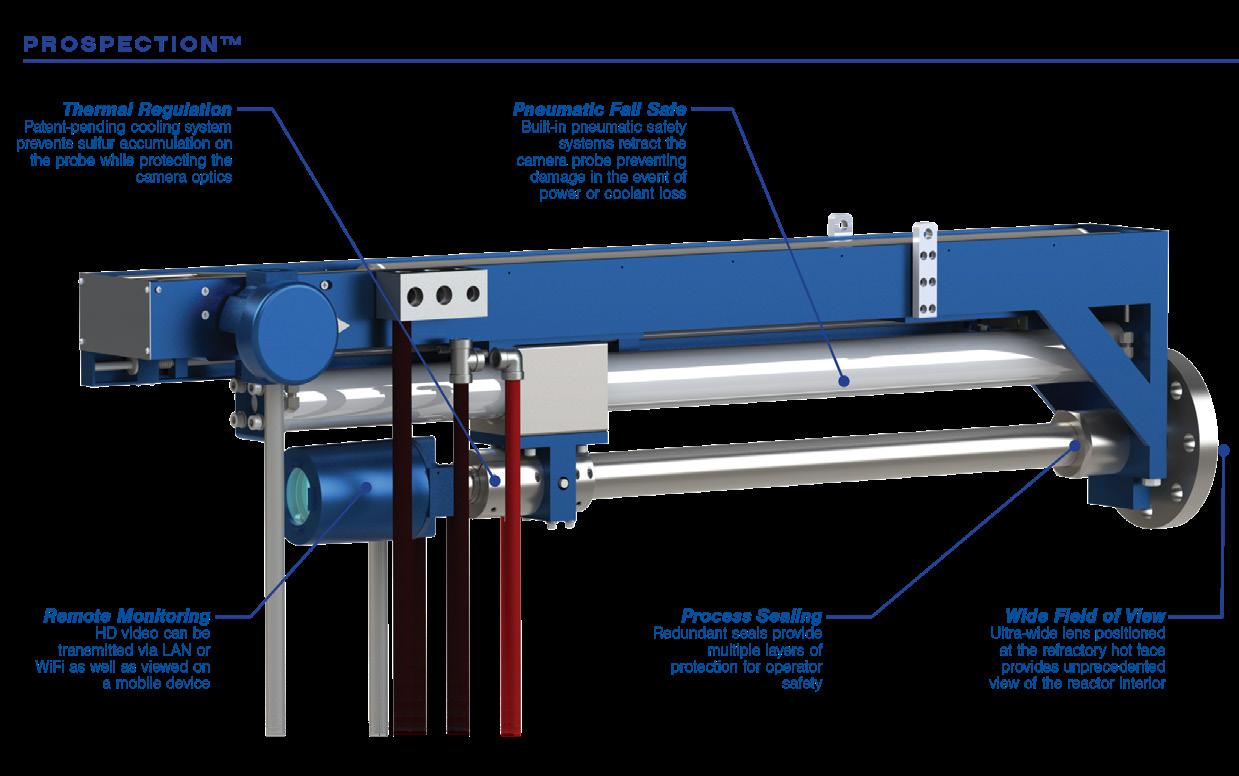

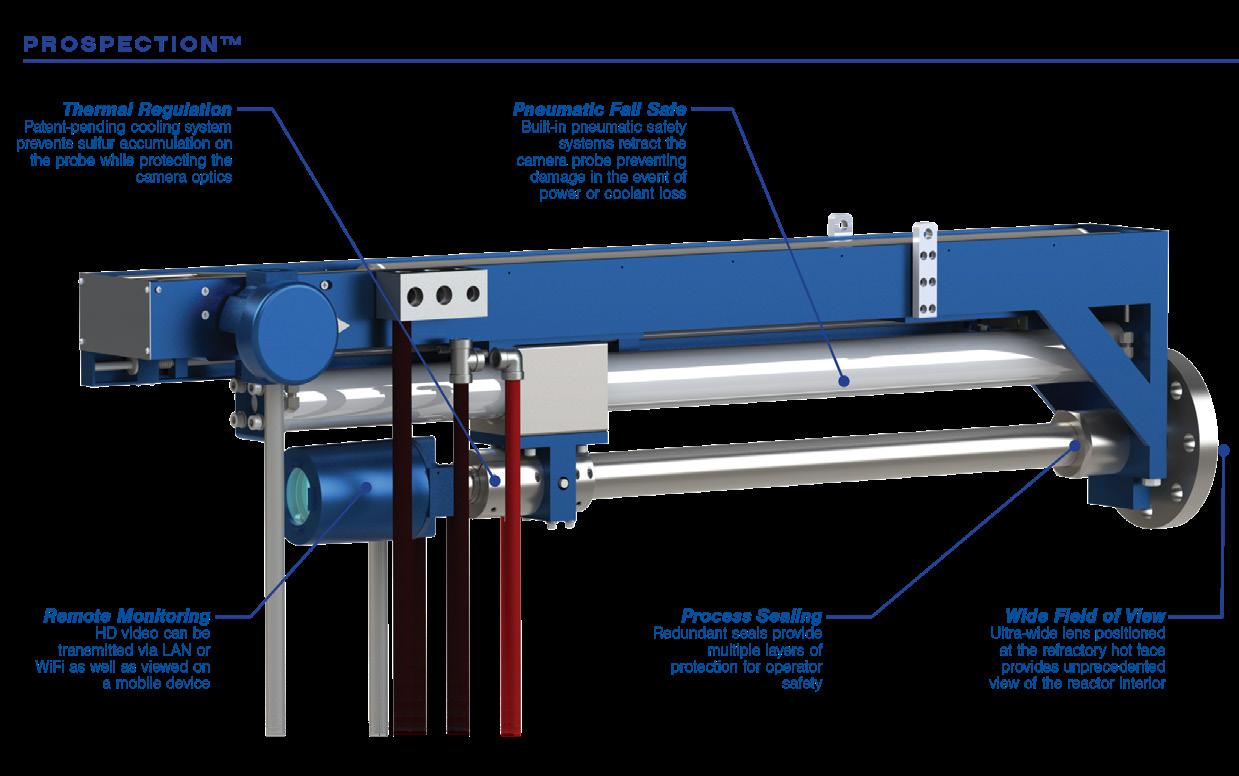

45 Advanced thermal reactor inspection

Martin McCallister, Delta Controls Corp., USA, explains how a process inspection camera designed for continuous online inspection of SRU thermal reactors can help operators monitor the performance of units.

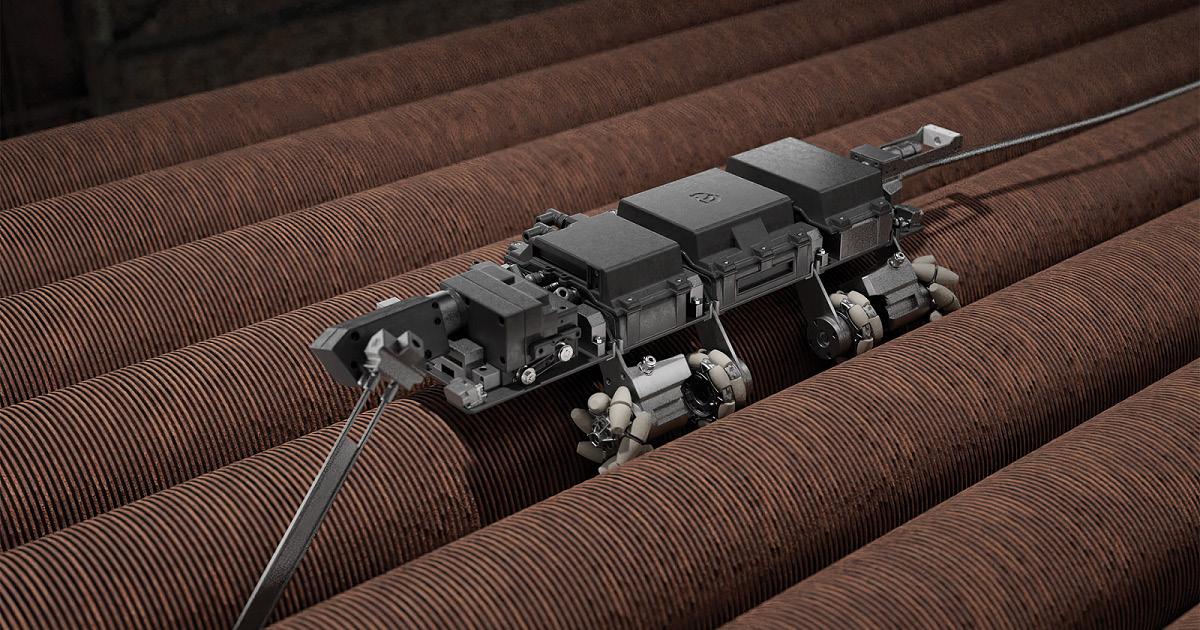

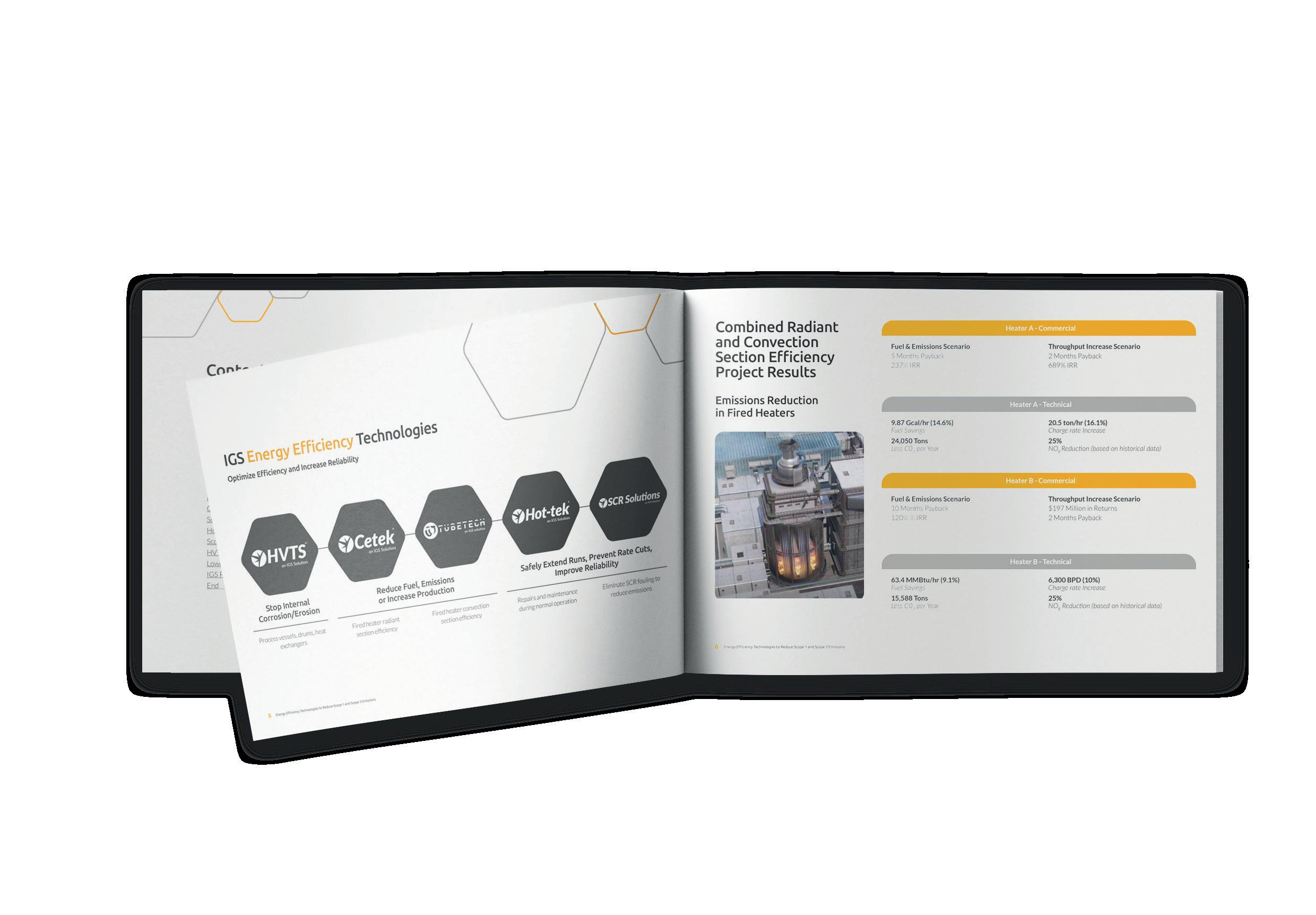

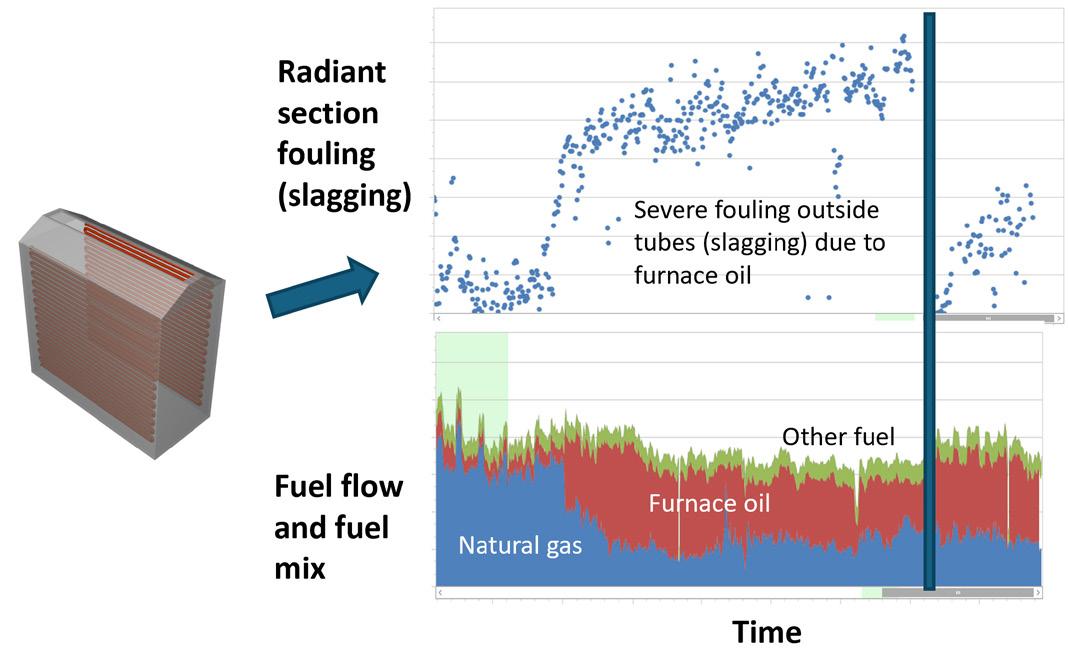

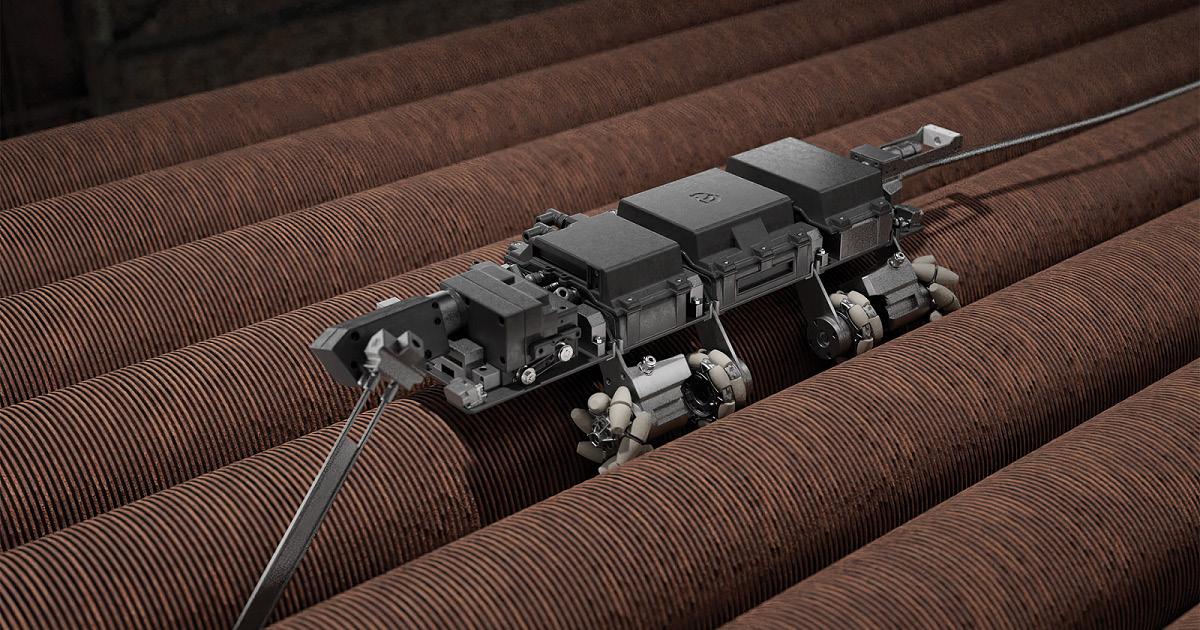

51 Smooth operations

Christian Chanel, Integrated Global Services (IGS), USA, presents a guide to optimising convection section performance in ethylene furnaces.

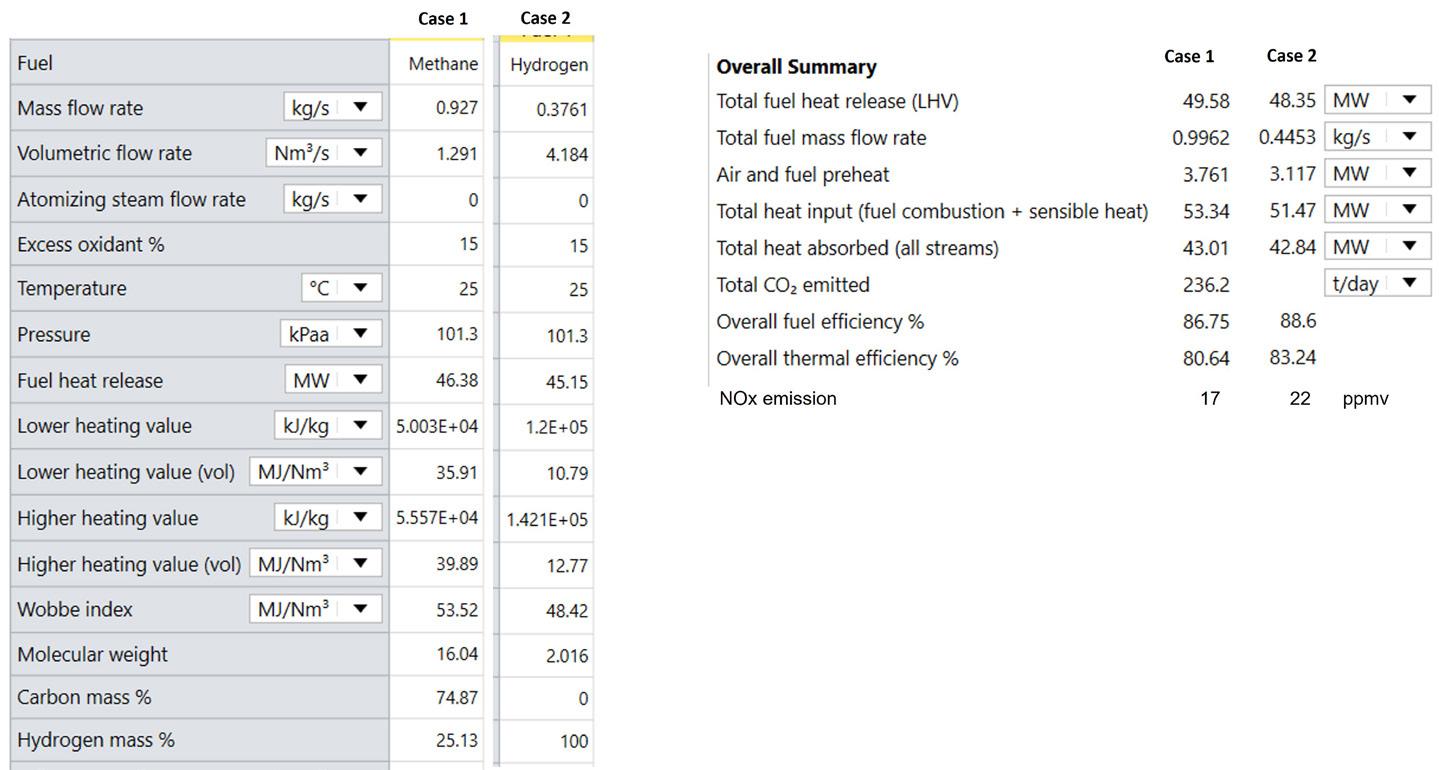

55 Fuelling the future

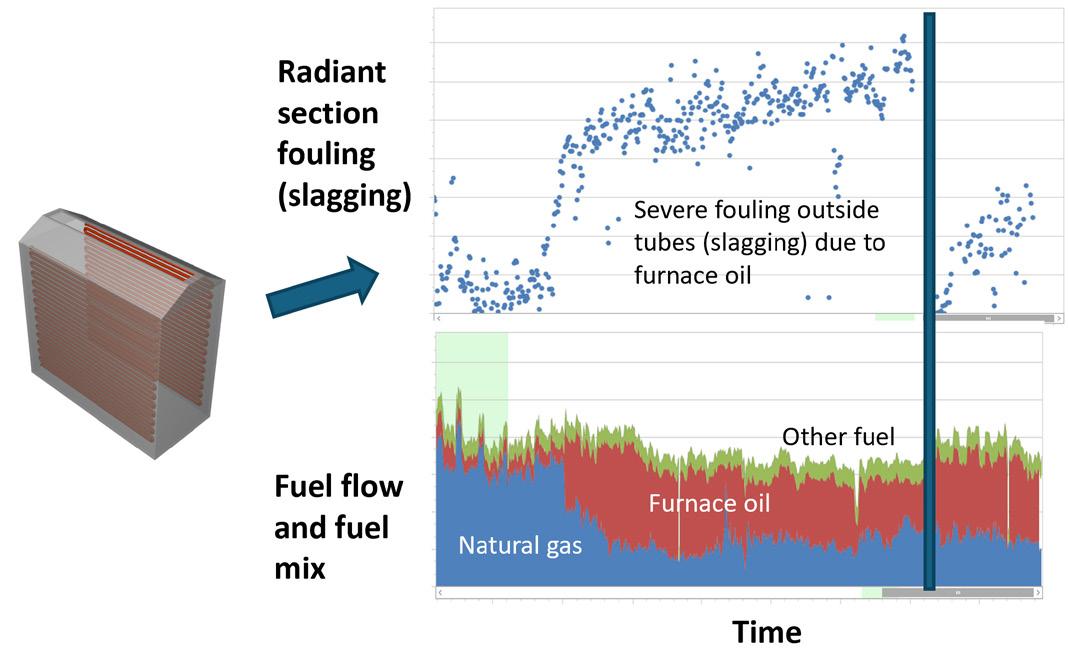

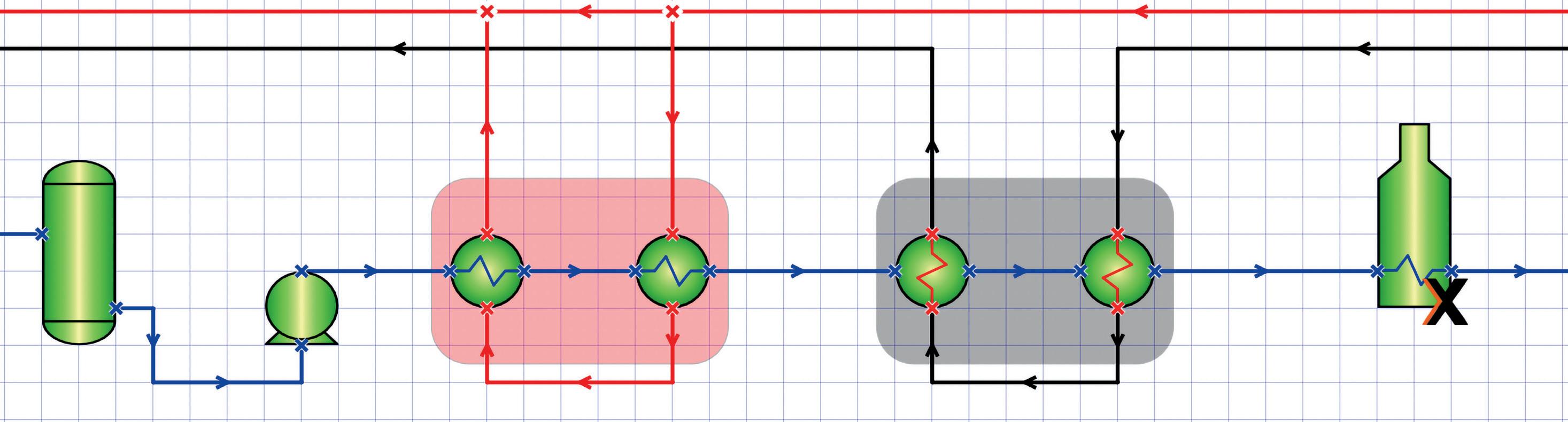

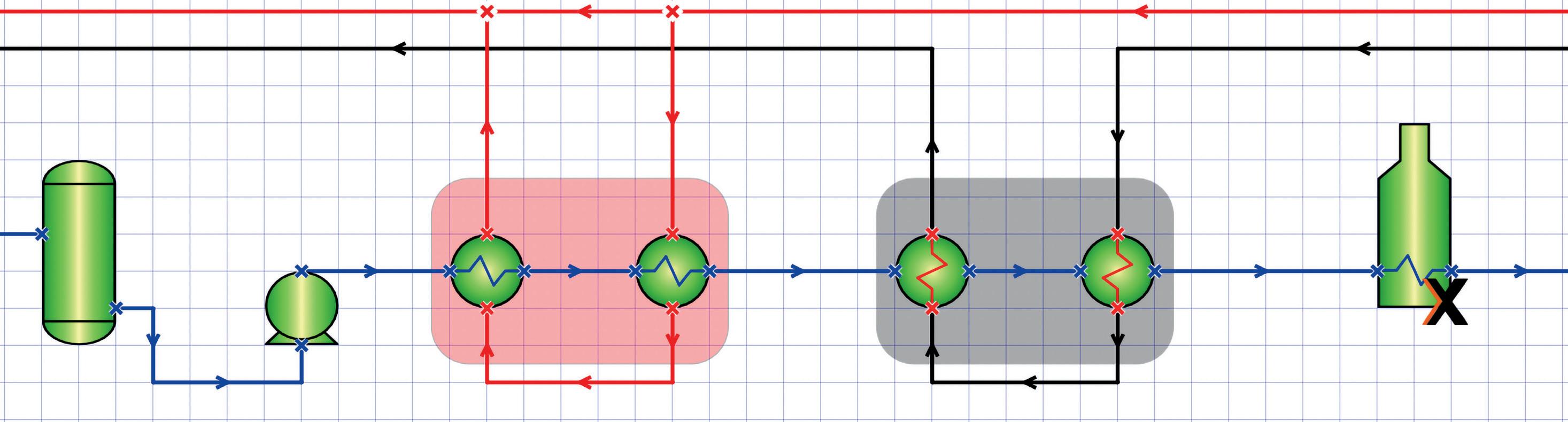

E. M. Ishiyama, D. Oakley, J. Kennedy, S. J. Pugh, and H. U. Zettler, Heat Transfer Research Inc. (HTRI), discuss the advantages that digital innovations can offer in tackling challenges faced by contemporary refineries during the energy transition.

61 Paving the way for greener systems

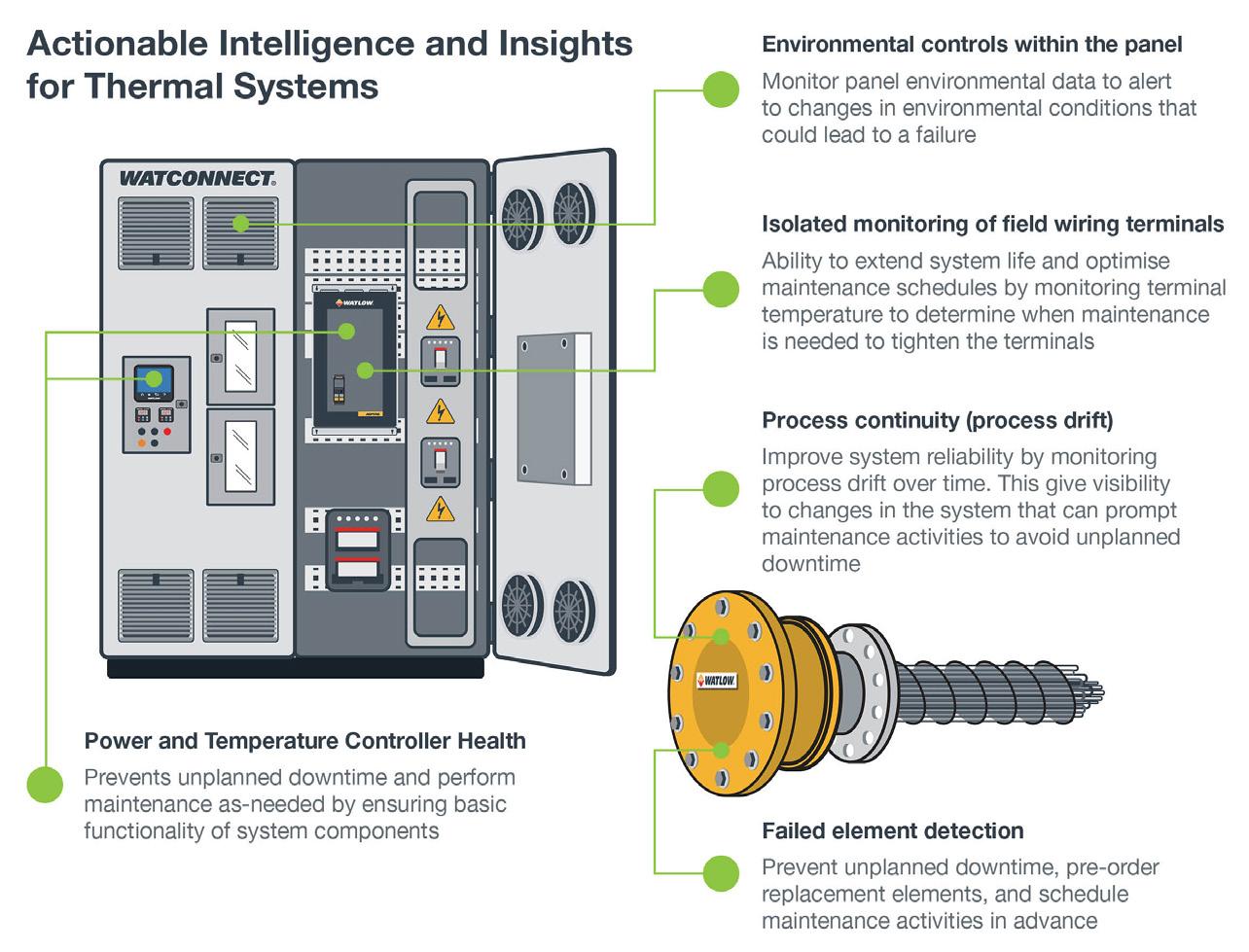

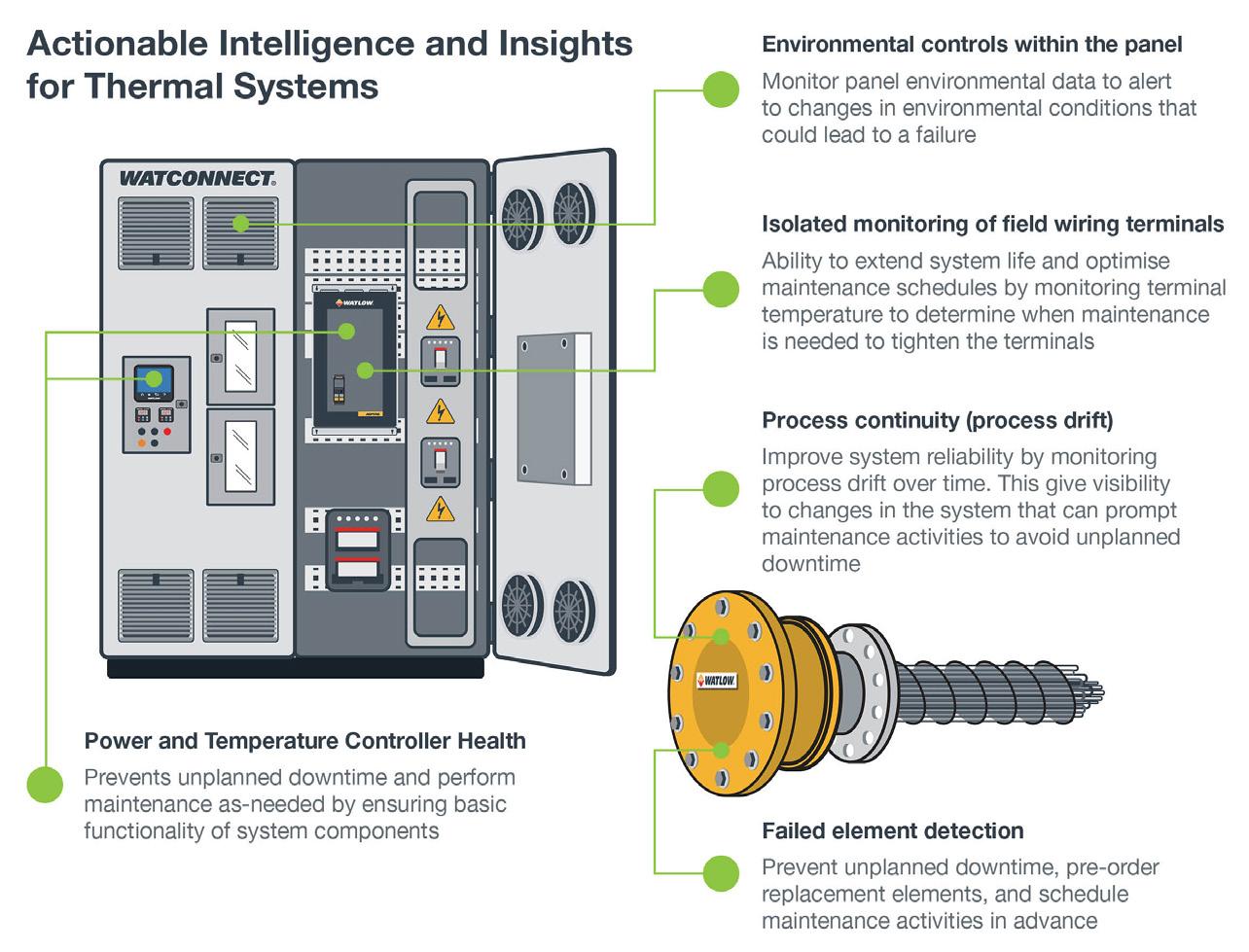

Chelsea Hogard, Watlow, USA, considers the importance of data insights in mitigating the risks associated with process heating and aiding the transition to more efficient systems.

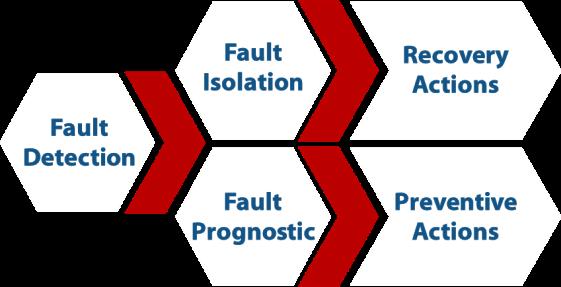

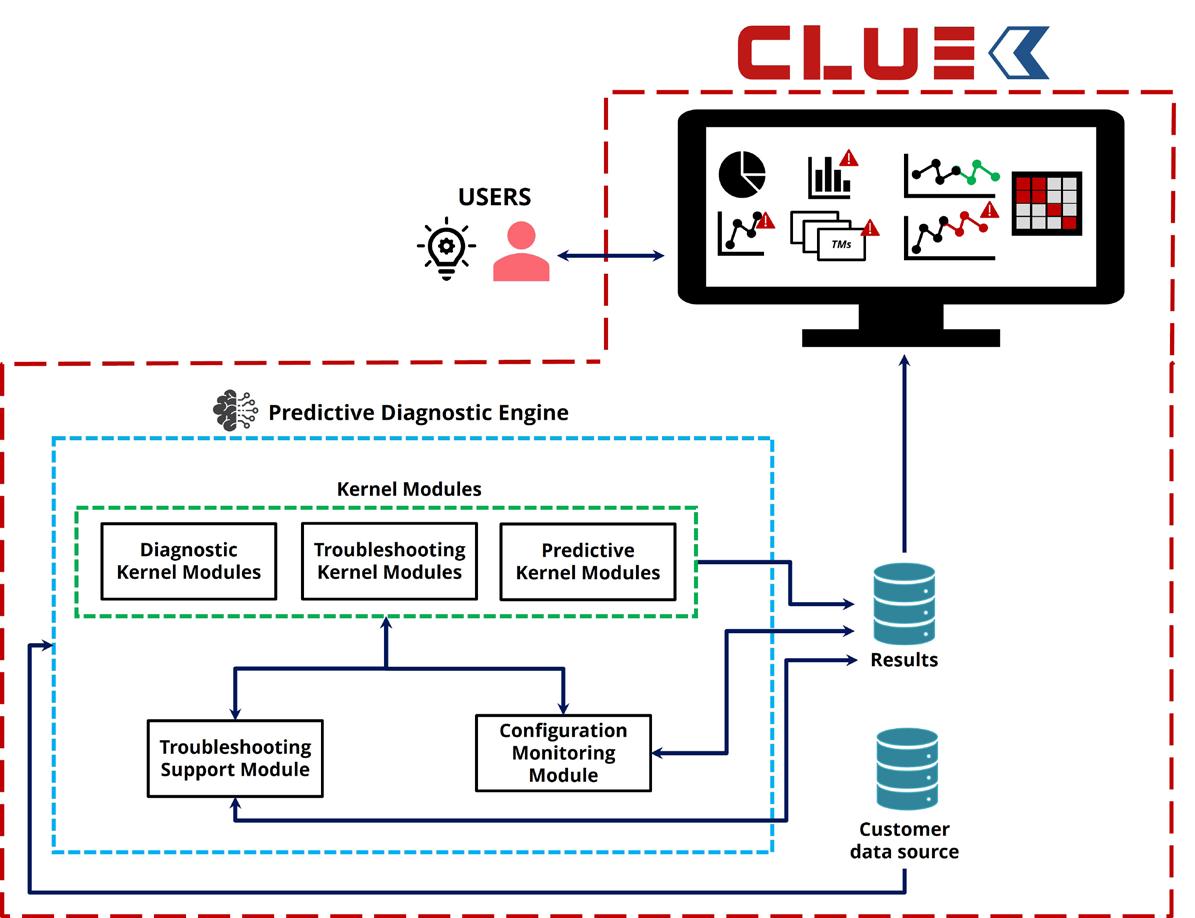

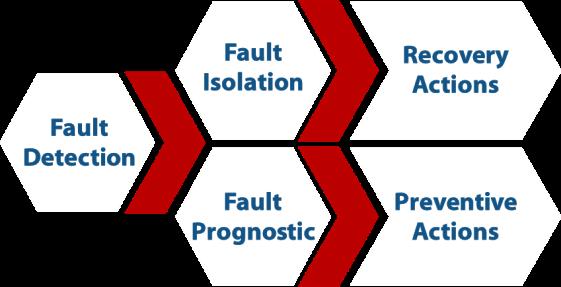

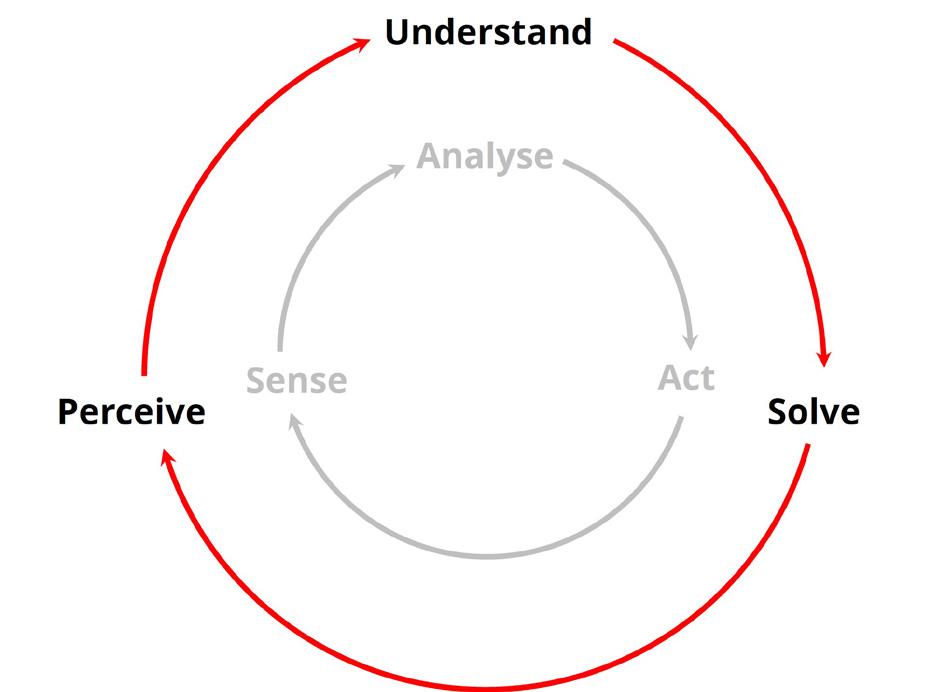

65 Intelligent plants

C. Brighenti, A. Brighenti and M. Ricatto, S.A.T.E., Italy, explain the journey to increased autonomy for hydrocarbon processing plants.

72 Q&A with...

Hydrocarbon Engineering talks to Dr. Matthias Schwab, Director of New Business Development & Sustainability, BASF Process Catalysts.

Hydroprocessing, integral to downstream oil and gas refining, aims to eliminate detrimental components like sulfur and nitrogen from crude. Valves play a critical role in these operations, requiring careful consideration due to extreme conditions. Turn to p. 38 to learn which solutions address these challenges with innovative designs and material selections, ensuring longevity and reliability.

CONTENTS June 2024 Volume 29 Number 06 ISSN 1468-9340 THIS MONTH'S FRONT COVER CBP019982 Hydrocarbon Engineering Like Join Hydrocarbon Engineering @HydrocarbonEng Follow CONVERSATION JOIN THE 2024 Member of ABC Audit Bureau of Circulations Copyright© Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. 03 Comment 05 World news 08

Flourish

Cut your CO2 emissions in half with ET Black™ Carbon Black Technology

ET Black™ is a state-ofthe-art technology that complies with the most stringent environmental regulations now and in the future. Plus, the flexibility to produce all ASTM grades, and specialty grades, in a single plant. ET Black™, the technology of reference for producing carbon black obtained by thermal decomposition of highly aromatic oils.

Find out more at: www.igoforETBlack.com

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

EDITORIAL ASSISTANT Poppy Clements poppy.clements@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITORS Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

COM MENT

great summer of sport is just around the corner. 2024 brings the return of the Olympic Games to Paris after exactly 100 years and on Friday 14 June, Germany will open its doors to a mass of frenzied football fans from across the continent as it hosts the UEFA European Championships. After football’s international governing body, FIFA, misleadingly promoted the 2022 Qatar World Cup as ‘carbon neutral’ – a strategy which attracted criticism from advertising authorities that found the supposed carbon offsetting measures to be problematic –UEFA, football’s European governing body, has pledged to make Euro 2024 the greenest football tournament to date. The tournament’s ESG strategy is backed by a €32 million investment, and no oil and gas companies have been selected as commercial partners. This stands in stark contrast to FIFA’s very recent announcement at the end of April of its new sponsorship deal with the largest oil and gas company in the world, Saudi Arabia’s Aramco.

A15 South Street, Farnham, Surrey GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Key to its aim for Euro 2024 to become the reference point for climate-responsible sporting events, UEFA has urged national teams to strongly consider travelling between fixtures by bus or train, rather than opting for heavily polluting domestic flights. The match schedule has been adapted to promote shorter distance journeys in the tournament’s group stage, and free public transport is being offered to ticket holders in an attempt to reduce the carbon footprint of spectators. Following through on these measures will be key to UEFA’s reputation as a sustainable sporting governing body following last year’s decision to expand European club football and schedule an additional 177 fixtures across three tournaments in the 2024-25 season – a choice which BBC Sport highlighted could result in teams and fans travelling a total of approximately 2 billion air miles.¹

However, the downstream industry is progressing when it comes to making our planet’s skies cleaner. At the heart of this progress is the role of catalysis and the development of higher quality catalysts to develop more efficient pathways for the transformation of feedstocks into sustainable aviation fuel (SAF). As just one example, last year, ART, a joint venture (JV) of Chevron and Grace, launched a hydroprocessing catalyst solution to produce renewable diesel and SAF from 100% renewable sources, such as vegetable oils, refined oils, animal fats, and greases. Today, it is clear that continued innovation has never been more important, and the development of modern catalyst technologies will be vital in meeting increasingly stringent emissions reduction targets. Articles in this issue from Shell Catalysts and Technologies, Malvern Panalytical and Ketjen dive into the invaluable role of catalysts in the downstream industry, and explore the role that they will play in a more sustainable future.

With the mounting pressure to decarbonise affecting all corners of the industry, collaboration and partnerships will be key in the transition, a topic which is explored in more detail on p. 33 of this issue by Sulzer Chemtech. As UEFA has stated, ‘only in unity’ can the power of football as the most popular sport in the world be leveraged to successfully spread a sustainable message.² And only through collaboration and continued innovation will the downstream industry create a greener future.

This month, the city of Frankfurt in Germany will not only be one of 10 host cities of UEFA’s Euro 2024, but also to ACHEMA, an event which aims to foster sustainable connections in the process industries. If this is where you are picking up this copy of the magazine, you can register to Hydrocarbon Engineering for free by scanning the QR code and keep up-to-date with the downstream industry’s energy transition.

1. https://www.bbc.co.uk/sport/football/67159156#:~:text=BBC%20Sport%20research%20 suggests%20the,1.5%20billion%20in%202022%2D23.

2. ‘Our strategy for a sustainable UEFA Euro 2024’, UEFA, (July 2023).

POPPY CLEMENTS EDITORIAL ASSISTANT

WORLD NEWS

Hungary | MOL inaugurates polyol complex in Tiszaújváros

MOL Group recently held an inauguration ceremony in Tiszaújváros to celebrate the completion of its polyol complex, which boasts a capacity of approximately 200 000 tpy of polyol.

MOL, thyssenkrupp and Evonik IP signed the licence agreement for the complex in summer 2017, and the foundation stone was laid in September 2019.

The main units were transported to Tiszaújváros between 2019 and 2020, mainly by water, and were followed by the completion of the complex’s hydrogen peroxide, propylene oxide, polyol and propylene glycol plants.

The Tiszaújváros plant will produce polyol using one of the most efficient and environmentally friendly methods available today.

UK | Stanlow Refinery celebrates centenary

EET Fuels (formerly Essar Oil UK), which owns and runs the Stanlow Manufacturing Complex, recently celebrated the 100 th anniversary of the Stanlow Refinery.

Established in 1924 as a bitumen production site, Stanlow has been a vital pillar of the UK’s energy sector for a century, providing essential products and transportation fuels, and supporting the nation’s economic growth.

The centenary celebration will encompass a series of events and initiatives that recognise Stanlow’s significant contribution to the Cheshire community, the local region, and the country as a whole. At the same time, the company will use the centenary to recognise, celebrate and give thanks to the communities connected to Stanlow, while demonstrating its long-term commitment to support these communities into the future.

USA | AFPM announces winners of Annual Safety Awards

The American Fuel & Petrochemical Manufacturers (AFPM) has announced the winners of its 2023 Annual Safety Awards. These awards are part of a comprehensive programme developed by the AFPM Safety and Health Committee to promote safe operations in the refining and petrochemical industries, and to recognise facilities that have outstanding occupational and process safety performance.

The highest honour, the ‘Distinguished Safety Award’, is awarded to the top sites with outstanding safety performance, programme innovation, and safety leadership. This honour was awarded to four facilities for achieving a sustained, exemplary level of safety performance: Marathon Petroleum Co. (Canton Refinery); Marathon Petroleum Co. (Robinson Refinery); Phillips 66 (San Francisco Refinery) and Phillips 66 (Sweeny Refinery).

Global | Ethylene downcycle puts 24% of global capacity at some risk of closure

Aseries of unprecedented challenges to the global ethylene industry means that as much as 24% of global capacity is now under some threat of permanent closure, according to new research by Wood Mackenzie.

The report ‘Global Steam Cracker Closure Threat 2024’ states that 114 assets out of 330 screened are at some risk. This represents around 55 million tpy of 2023’s total global ethylene capacity with more than half of that figure being at a medium or high risk of closure.

“The global ethylene industry is currently navigating a downcycle,” said Alan Gelder, Vice President of Refining and Chemicals Research at Wood Mackenzie. “The industry has faced multiple headwinds and uncertainties, stemming from a global pandemic, the Russia-Ukraine and Israel-Hamas conflicts, an economic downturn and significant capacity overbuild.”

The report states that China’s strategy of phasing out small and aged facilities and replacing them with more cost-competitive and

energy-efficient crackers will have an impact domestically and across Asia.

Wood Mackenzie has identified 3.3 million t of Chinese ethylene capacity as being at high risk of closure and 2.4 million t as being at medium risk.

China’s increasing ethylene self-sufficiency will impact Northeast Asia producers the most, with 9 million t of capacity vulnerable to closure. The report adds that Southeast Asian crackers benefiting from advantaged feedstock will not be affected as negatively.

June 2024 HYDROCARBON ENGINEERING 5

WORLD NEWS

DIARY DATES

26 - 27 June 2024

Downstream USA

Galveston, Texas, USA events.reutersevents.com/petchem/downstream-usa

20 - 22 August 2024

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

05 September 2024

World Energy Transition Conference

Virtual www.accelevents.com/e/worldenergytransition2024

17 - 20 September 2024

Gastech Houston, Texas, USA www.gastechevent.com

22 - 25 September 2024

GPA Midstream Convention San Antonio, Texas, USA www.gpamidstreamconvention.org

24 - 25 September 2024

IDW – Downstream Conference Warsaw, Poland www.europetro.com/idw

15 - 17 October 2024

AFPM Summit

New Orleans Louisiana,, USA summit.afpm.org

04 - 07 November 2024

ADIPEC

Abu Dhabi, UAE www.adipec.com

11 - 14 November 2024

ERTC Lisbon, Portugal

www.worldrefiningassociation.com/event-events/ertc

03 - 05 December 2024

Valve World Expo

Düsseldorf, Germany www.valveworldexpo.com

21 -22 January 2025

NARTC Houston, Texas, USA

www.worldrefiningassociation.com/event-events/ nartc

USA | Worley to support Bayou Bend CCS project

Worley has been selected to design and evaluate carbon dioxide (CO 2 ) gathering, handling and sequestration facilities for the Bayou Bend CCS LLC joint venture, located along the Gulf Coast in Southeast Texas, US.

The Bayou Bend project includes a CO 2 storage footprint of nearly 140 000 acres of pore space.

The Gulf Coast has one of the heaviest concentrations of CO 2 emissions in the US, making this project pivotal in enabling hard-to-abate industries, such as

refining, cement, steel, chemicals, and manufacturing, to meet their climate goals. Carbon sequestration along the Gulf Coast helps to support a broader national effort to reduce carbon emissions.

Mark Trueman, Group President, Americas for Worley, said:

“Innovative projects like Bayou Bend will potentially enable CCS at scale and help many more companies achieve their net zero goals, supporting Worley’s purpose of delivering a more sustainable world.”

Germany | BASF and IPP agree to market ammonia, methanol and melamine plants

BASF and International Process Plants (IPP) have entered an agreement to market ammonia, methanol and melamine plants located at BASF’s Verbund site in Ludwigshafen, Germany.

The plants have become available as BASF implements structural measures at its Ludwigshafen site to ensure competitiveness in a changing European market environment, as

announced in February 2023. BASF will continue to produce ammonia and methanol in other assets at the Ludwigshafen site. The two companies have agreed not to disclose financial details of the deal.

The agreement includes the integrated production assets for ammonia (380 000 tpy), methanol (165 000 tpy) and melamine (51 000 tpy).

China | TotalEnergies and SINOPEC strengthen cooperation

TotalEnergies and China Petroleum and Chemical Corp. (SINOPEC) have signed a strategic cooperation agreement to deepen their collaboration, notably in low-carbon energies.

TotalEnergies and SINOPEC have been working together for many years, notably in Angola and Brazil in upstream operations, and more generally in various domains such as oil, LNG, oil product trading, and engineering. Recently, the companies

have joined forces to develop a 230 000 tpy sustainable aviation fuel (SAF) production unit at a SINOPEC refinery in China.

This strategic cooperation agreement aims to further develop the partnership between TotalEnergies and SINOPEC, and seize new opportunities by leveraging their respective expertise. In particular, the two companies plan to combine their R&D expertise in biofuels, green hydrogen, CCUS and decarbonisation.

June 2024 HYDROCARBON ENGINEERING

6

Visit us at ACHEMA in Frankfurt Hall 4 Stand D48

Capturing green opportunities

Carbon capture and storage or utilization (CCS/CCU) is a key strategy that businesses can adopt to reduce their CO2 emissions. By selecting the right technologies, pressing climate change mitigation targets can be met while benefi tting from new revenue streams.

Sulzer Chemtech offers cost-effective solutions for solvent-based CO2 absorption, which maximize the amount of CO2 captured and minimize the energy consumption. To successfully overcome technical and economic challenges of this capture application, we specifically developed the structured packing MellapakCC™. This packing is currently applied in several leading CCS/CCU facilities worldwide, delivering considerable process advantages.

By partnering with Sulzer Chemtech – a mass transfer specialist with extensive experience in separation technology for carbon capture –businesses can implement tailored solutions that maximize their return on investment (ROI). With highly effective CCS/CCU facilities, decarbonization becomes an undertaking that can enhance sustainability and competitiveness at the same time. For more information: sulzer.com/chemtech

8 June 2024 HYDROCARBON ENGINEERING

Gordon Cope, Contributing Editor, discusses the state of oil and gas markets in South and Central America and considers how countries can realise their energy potential amongst political storms.

Over 650 million citizens occupy the region stretching from Mexico to Argentina, with another 100 million expected by 2050. Fortunately, the region is blessed with abundant oil and gas reserves to deal with growing demand; sadly, a wide disparity in the various nations’ ability and will to produce those reserves will mean some states will flourish, while others languish.

Guyana

Over the last decade, Guyana has been transformed from an impoverished nation to one of the world’s biggest oil and gas success stories. Offshore discoveries by ExxonMobil and partners in the Stabroek Block have resulted in an estimated 11 billion bbl of recoverable oil resources, with the potential for far more discoveries.

June 2024 9 HYDROCARBON ENGINEERING

In late 2023, ExxonMobil connected its latest floating production, storage and offloading (FPSO) vessel, named Prosperity , to the Payara project, boosting the country’s production to over 600 000 bpd. Projections call for a total of 12 FPSOs producing up to 1.5 million bpd by 2027.

While most production is destined for export, Guyana is keenly interested in developing its domestic economy. The offshore discoveries, for instance, contain a significant proportion of associated gas. In hopes of reducing expensive fuel imports, the government negotiated a US$1.9 billion gas-to-power project with ExxonMobil to monetise the gas. The project includes a US$1 billion pipeline that extends 225 km from the Stabroek block to a 300 MW power plant near Georgetown. ExxonMobil has almost completed the pipeline, but the power plant is about six months behind schedule, and government officials now expect it to come online in late 2025.

Venezuela

Venezuela sits at the opposite end of the spectrum in the region. With an estimated 304 billion bbl of reserves, the country has seen its output plummet from over 3 million bpd to an estimated 800 000 bpd in early 2024. Much of the problem can be attributed to mismanagement, corruption, and a lack of maintenance. The immense 940 000 bpd Paraguana refinery complex has been the scene of a score of failures. In mid-2023, the fluid catalytic cracker (FCC) at the complex’s Cardon refinery failed, resulting in the shutdown of gasoline production. While President Maduro makes frequent headlines promising a return to historic output, independent estimates suggest that the country’s once flourishing oil and gas sector would need at least US$200 billion to restore viability.

Brazil

Brazil is the Latin American powerhouse of oil and gas. By the end of 2023, thanks largely to the pre-salt play, total crude and gas production reached 4.7 million boe/d. State-owned Petrobras has announced plans for 11 new floating FPSO vessels through 2027 alone; analysts expect the country will exceed 5 million boe/d by the end of the decade.

The majority of the country’s production growth (almost 20% in the last two years), has been through state-controlled Petrobras. But now, with the election of Luiz Inácio Lula da Silva (Lula) in 2022, the company has taken a new approach. Under previous administrations, Petrobras had been divesting non-production assets (such as refineries, fertilizers and petrochemicals), to bring down its debt load. Under Lula, asset sales that have not been finalised have been suspended, and US$5.2 billion has been set aside to invest in solar and wind power over the next five years.

While critics say the changes are designed to increase political rather than economic capital, Petrobras is certainly not eschewing the latter. Its 2024 - 2028 budget plan stands at US$102 billion; US$73 billion is slated for

exploration and production, primarily in the pre-salt, as well as new frontiers in offshore equatorial regions in northern Brazil and West Africa.

In addition, Petrobras announced in January 2024 that it would finish expansion plans on Train One at its 100 000 bpd Abreu e Lima (RNEST) refinery, nearly a decade after the expansion was halted due to the massive ‘Car Wash’ corruption scandal. Train One will add 15 000 bpd capacity, while Train Two, slated to start in late 2024, will bring total capacity up to 260 000 bpd when work is finished in 2028.

IOCs and NOCs are also busy in the pre-salt. Shell, Ecopetrol and TotalEnergies recently contracted Modec to design a US$3 billion FPSO for its Gato do Mato discovery, located 250 km from Rio de Janiero at depths exceeding 2000 m. The discovery consists of light, low-sulfur crude with associated gas. Although the field is not fully explored, initial well tests indicate sufficient reserves to support 70 000 bpd production for several decades. While Shell already accounts for over 450 000 boe/d in production in Brazil, most is in minority partnerships with operator Petrobras. Being majority operator of a major offshore field would be a significant change for its operational profile in the country.

Argentina

Argentina’s Vaca Muerta shale play has been a resounding success. The basin in Neuquén province holds an estimated 16 billion bbl of recoverable oil and 308 trillion ft 3 of associated gas. In early 2024, unconventional production reached almost 400 000 bpd. The output has decreased the country’s reliance on imports, and the building of pipelines has spurred efforts to export associated gas to regional neighbours and tap into the lucrative international LNG market.

After decades of fiscal mismanagement, however, Argentina is in dire financial straits, and the play has become a political football. During Javier Milei’s successful run for Argentina’s presidency in 2023, the Libertarian made sweeping campaign promises to rear in government spending in an attempt to curb raging inflation. Part of his platform was to privatise over 40 state-run companies, including YPF, the national oil champion and prime investor in the Vaca Muerta.

When he tabled an omnibus package to congress in January 2024, however, YPF’s privatisation had been taken off the table, and Milei’s administration is currently weighing alternatives. YPF, which is 51% owned by the government, is investigating plans of boosting market capitalisation fourfold by the end of the decade by divesting conventional assets and focusing on the Vaca Muerta. By 2030, the play is expected to be producing 1 million bpd and up to 4 billion ft 3 /d of gas, generating up to US$20 billion in annual revenues.

Argentina still relies heavily on imported fuels, however. The country has approximately 600 000 bpd of domestic refining capacity; YPF accounts for around half, including the 189 000 La Plata refinery near Buenos Aires and the 105 000 bpd Lujan de Cuyo refinery in Mendoza. In 2019, the company announced that it would spend

June 2024 HYDROCARBON ENGINEERING 10

Grace, the global leader in FCC catalysts and additives, introduces MIDAS® Pro catalyst, for resid cracking in high iron applications.

This innovation, built on our workhorse MIDAS® catalyst platform, proved its capacity to handle even the worst Fe excursions. In commercial trials with multiple in-unit applications, MIDAS® Pro catalyst demonstrated sustained bottoms cracking in the face of iron spikes that measured among the highest in the industry. Diffusivity levels were consistently high, indicating no transport restrictions with concentration of Fe. This improved iron tolerance allows refiners to operate at higher iron levels which increases feed processing flexibility and profitability.

Talk with your Grace partner about the advantages of MIDAS® Pro catalyst today. Learn more at grace.com

MIDAS® Pro catalyst offers the solution for resid cracking in high iron environments. Gain feed flexibility with better bottoms upgrading.

Turn iron into gold? Alchemy? No. It’s chemistry.

more than US$2 billion to carry out a desulfurisation process at both plants and to increase production. By late 2023, the company was producing a record 310 000 bpd of gasoline and diesel, and expects to add another 20 000 bpd of output in 2024.

The growth in gas production is also expected to offer opportunities for LNG exports. The Vaca Muerta produced 2.7 billion ft 3 /d of associated gas in late 2023, and is expected to exceed 4 billion ft 3 /d by 2030. YPF has been working to establish a floating LNG (FLNG) plant in the Atlantic port of Bahia Blanca. It recently signed a memorandum of understanding (MoU) with Petronas to enter into an ambitious project that would, in addition to the FLNG plant, establish a 5 million tpy onshore plant. Ultimately, the two companies envision investing up to US$56 billion to create a 25 million tpy complex generating up to US$20 billion in annual exports.

Colombia

Colombia is South America’s third largest oil producer, with an output of over 700 000 bpd. Only eight years of reserves are left, however, and the country needs to significantly increase exploration in order to maintain production. The future of the country’s oil and gas sector was cast into doubt in September 2022, when Gustavo Petro was elected as new president. The left-wing candidate had run on a platform of eliminating contracts for oil and gas exploration and a ban on fracking. He lost little time stacking Ecopetrol’s board of directors with his own slate of candidates, one that would focus on a transition to renewables such as wind and solar. During COP 28 in late 2023, Petro also announced the country would invest US$32 billion in green transportation, clean energy and climate adaptation.

Reality is beginning to intrude, however. Fossil fuels represent a major portion of the government’s revenues, and the country can ill afford to turn its back on the sector. In late 2022, when President Petro visited the port of Barrancabermeja, the site of Ecopetrol’s century-old 250 000 bpd refinery, he stressed that Colombia’s future energy needs would be supplied by renewables. Ecopetrol had previously announced a US$780 million plan to upgrade the plant with an expansion of its hydrocracking unit. Petro’s speech placed the future of the plant in doubt, but, in mid-2023, Ecopetrol finally began work to improve fuel quality, develop blue and green hydrogen and carbon capture, utilisation and storage (CCUS).

Companies also continue to invest heavily in exploration. Ecopetrol and Petrobras are drilling the offshore Orcas Norte 1 appraisal well in the Tayrona block, hoping to tap into massive gas reserves in the area. Shell and Ecopetrol are drawing up plans to develop the Gorgon discovery in the ultra-deep-water COL-5 block. In the onshore Llanos region, Geopark and Hocol are pursuing several recent discoveries.

Mexico

For the last decade, Mexico’s oil and gas sector has been buffeted by political storms. When Enrique Pena Nieto

was elected in 2012, he eliminated the state monopoly in oil and gas and invited international operators to participate in upstream to downstream activities, resulting in billions of investments.

The honeymoon ended with the election of Andrés Manuel López Obrador (AMLO) in 2018. The president cancelled licencing rounds and limited Pemex’s JVs with deep-water explorers. Over the course of his presidency, AMLO has also made domestic self-reliance of fuels a priority. The country consumes around 1.6 million bpd of gasoline, diesel and jet fuel. Pemex owns six refineries with a capacity of approximately 1.5 million bpd, roughly enough to meet domestic demand. But output has historically been well below potential due to lack of maintenance, mismanagement and theft, and as a result, needs to import significant amounts of refined fuels to meet its needs.

To achieve self-reliance, Pemex has been spending significant capital to improve output; for instance, it earmarked US$2.6 billion in renovation funds for the 315 000 bpd Tula refinery near Mexico City, which has operated at half capacity for the last several years. Pemex is also commissioning its new Dos Bocas refinery in the state of Tabasco. A pet project of AMLO, the US$12.5 billion facility officially began operations in 2022, but is not expected to reach its 340 000 bpd capacity until 2025.

All this is having a beneficial effect. Pemex projects its 2023 rate of gasoline, diesel and jet fuel production of 655 000 bpd to climb to over 1 million bpd in 2024 as Dos Bocas comes on-stream, and upgrades and repairs at its other six refineries improve output. As a result, in April 2024, Pemex’s trading arm began cancelling export contracts for its benchmark Maya crude, a heavy, sour feedstock primarily used by USGulf Coast (USGC) refineries.

This creates a bit of a dilemma. While curtailing crude exports will provide the new Dos Bocas refinery with sufficient feedstock when it is finally completed, Tabasco has a shortage of natural gas, which could hinder production unless new gas pipelines to the Yucatan are completed over the next several years.

AMLO has not impeded gas exports, however, and the country’s LNG sector has great prospects, with over 60 million tpy either approved or seeking permits. In March 2024, Sempra announced that Phase 1 of its Energía Costa Azul (ECA) LNG project in Baja, California, would enter commercial operations by mid-2025. The 3 million tpy train will be serviced by Sempra’s 500 million ft 3 /d GRO line, with gas sourced in the US. When compared to competitors in the USGC, the site has a significantly reduced transit time to key Asian markets, and Sempra has plans to expand the former regasification terminal to 12 million tpy in Phase 2.

The proposed Mexico Pacific Ltd (MPL) LNG project is located south of ECA on the Sea of Cortez in Sonora State. The latest plan is to build three trains totalling 14.1 million tpy capacity in Phase 1, and a

June 2024 HYDROCARBON ENGINEERING 12

further three trains in Phase 2, doubling capacity to 28.2 million tpy.

The Biden administration’s pause on LNG development has complicated Mexico’s long-term LNG plans, however. In January 2024, the White House placed a temporary halt on permit approvals for LNG exports to non-free trade countries while the Department of Energy (DOE) reviews their environmental impact. The DOE also issues permits for LNG terminals in Mexico that would re-export natural gas from the US. While the pause does not impact ECA, it does place projects like MPL in doubt as potential investors weigh the impact.

Problems

A wide variety of above-ground complications abound within the many countries of South and Central America:

n Colombia, which relies on oil and gas for one-quarter of its revenues, can ill-afford missteps as it eschews fossil fuels in favour of green energy; protests from the disaffected poor and violence from guerrilla groups already engulf many parts of the country.

n Mexican President, AMLO, is backing former Mexico City Mayor, Claudia Sheinbaum, in this year’s federal election. She is heavily favoured to win, but it is unknown whether she will continue the populist politics of her mentor or strike her own path; this uncertainty raises investment risks.

n Guyana is embroiled in a controversy with Venezuela over ownership of a large portion of the former’s country. The region of Essequibo has been under dispute for over a century; with the discovery of huge reserves in its offshore waters, Venezuela’s President Maduro has trumpeted claims of sovereignty as a popular diversion to his country’s woes.

n Argentina’s Vaca Muerta shale play has the potential to turn the country’s economy around. However, its current President Milei lacks widespread political support to make the systemic changes needed to reform the country. If his austerity measures foment social upheaval, the country will once again find itself on the verge of financial collapse.

In conclusion, while Central and South America have tremendous potential to improve through the prudent development of energy natural resources, the temptation to appropriate the assets and cash flows for political considerations outweighs the common good in many jurisdictions. Those countries that resist the urge to squander their patrimony and instead invest in infrastructure, education and modernisation will benefit for many decades to come.

Let ProTreat® Be Your Guide

The Leading Simulator for CO2 Capture

Solvents:

• Primary, secondary, promoted amines

• CESAR1 (updated with data from DOE partnership & tested within EU-funded consortium “SCOPE”)

• Amino acid salts

• Enzyme catalysed & amine-promoted carbonates

• Ionic solvents

• High strength piperazine

• Chilled ammonia

Applications:

• Stationary power generation

• CO2 capture from LNG-fueled ships

• Renewable methane from landfill gas and organic waste

• Hydrogen production via reforming

Ferrybridge Pilot Plant, Ferrybridge, UK, 100 TPD

Reliable:

• New CESAR1 model updated with cutting edge lab and plant data from DOE partnership

• Thoroughly tested as part of EU-funded research consortium “SCOPE”

Contact us for a free trial

Optimized Gas Treating, Inc. www.ogtrt.com +1 512 312 9424

In the first part of a two-part article, Scott Baker, Ram Paul Bajaj and Ross Storey, Shell Catalysts & Technologies, alongside Marc Donnelly, Eickmeyer & Associates, consider the operational challenges facing ethylene oxide operators as a result of low turndown, and the short-term solutions that are available.

Ethylene oxide (EO) producers typically convert EO into monoethylene glycol (MEG), which is easily transported via established networks for trading worldwide. However, MEG capacity is currently overbuilt compared with MEG demand and consequently prices are very low. The market for high-purity EO (HPEO) is more stable, but HPEO can only be transported locally or regionally, not globally.

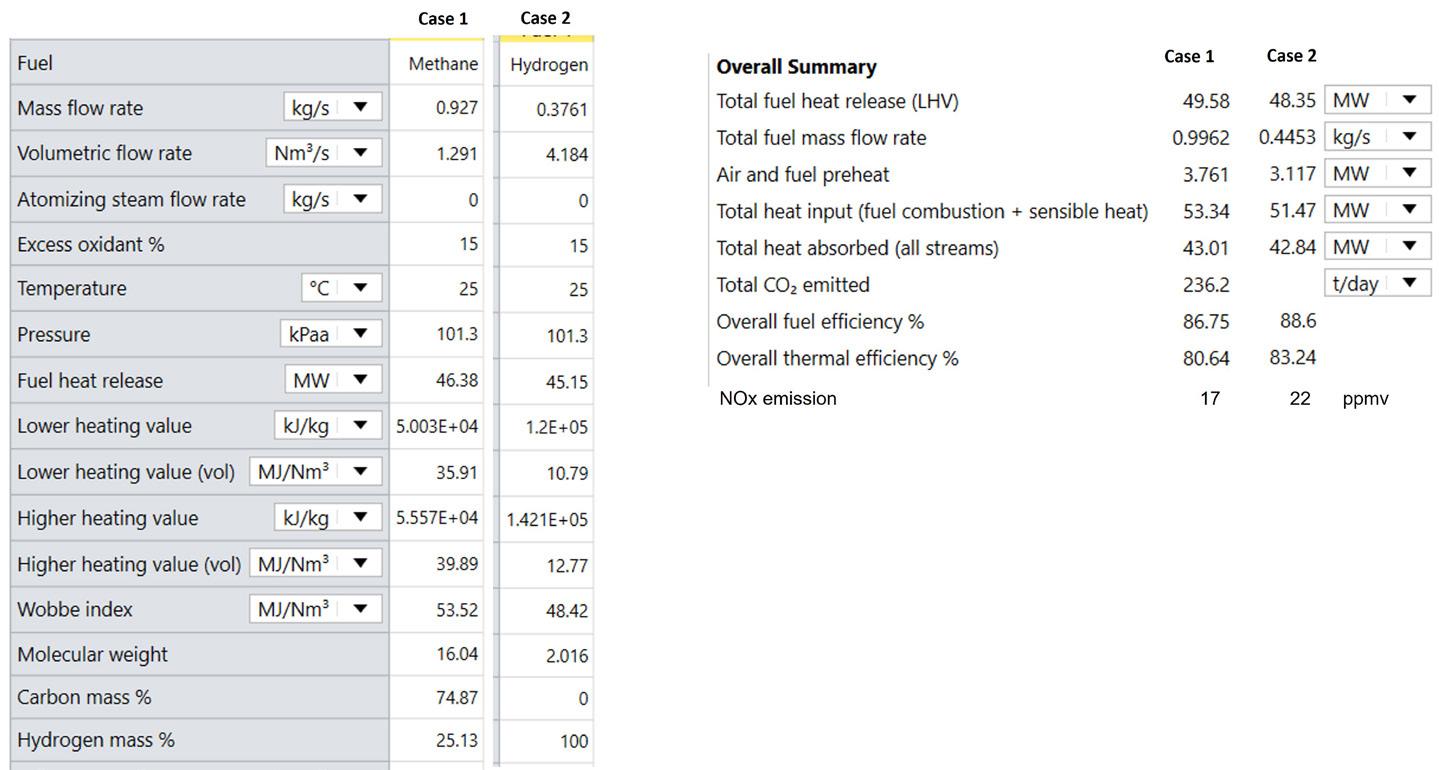

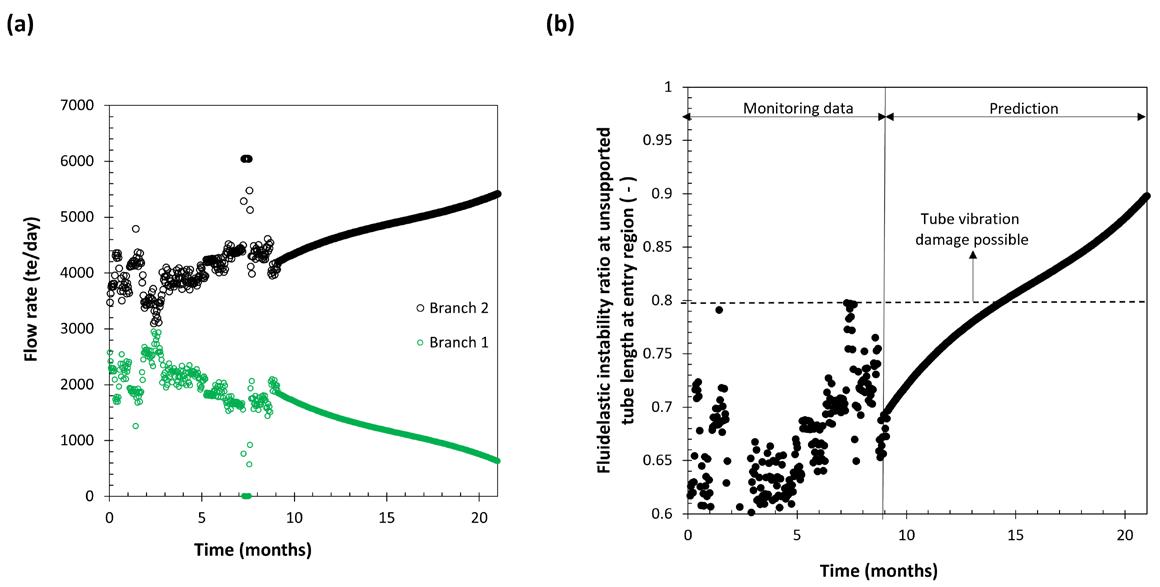

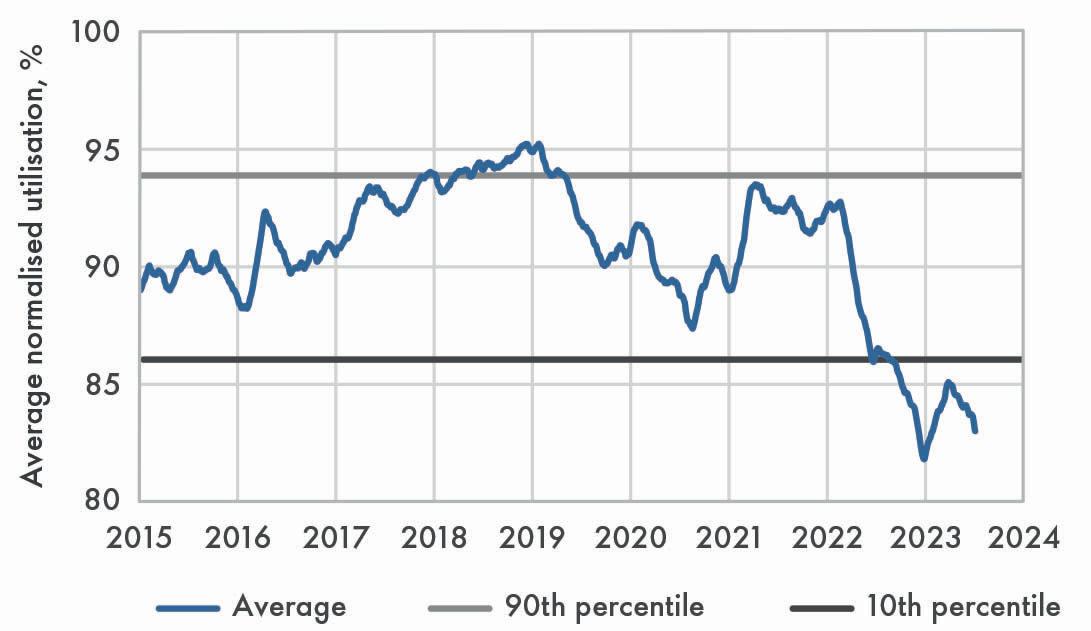

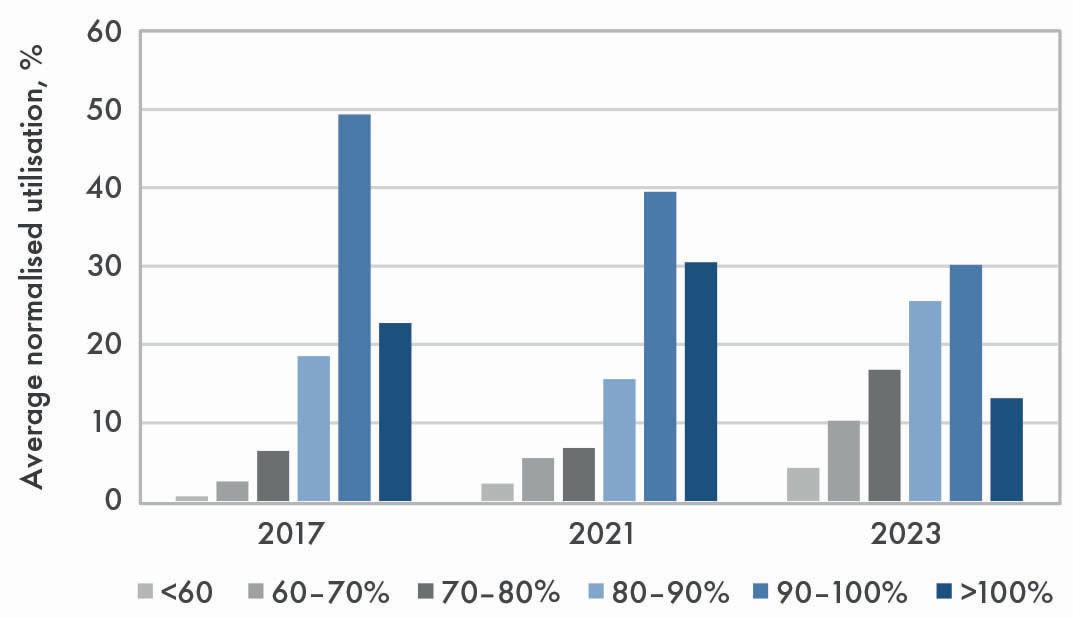

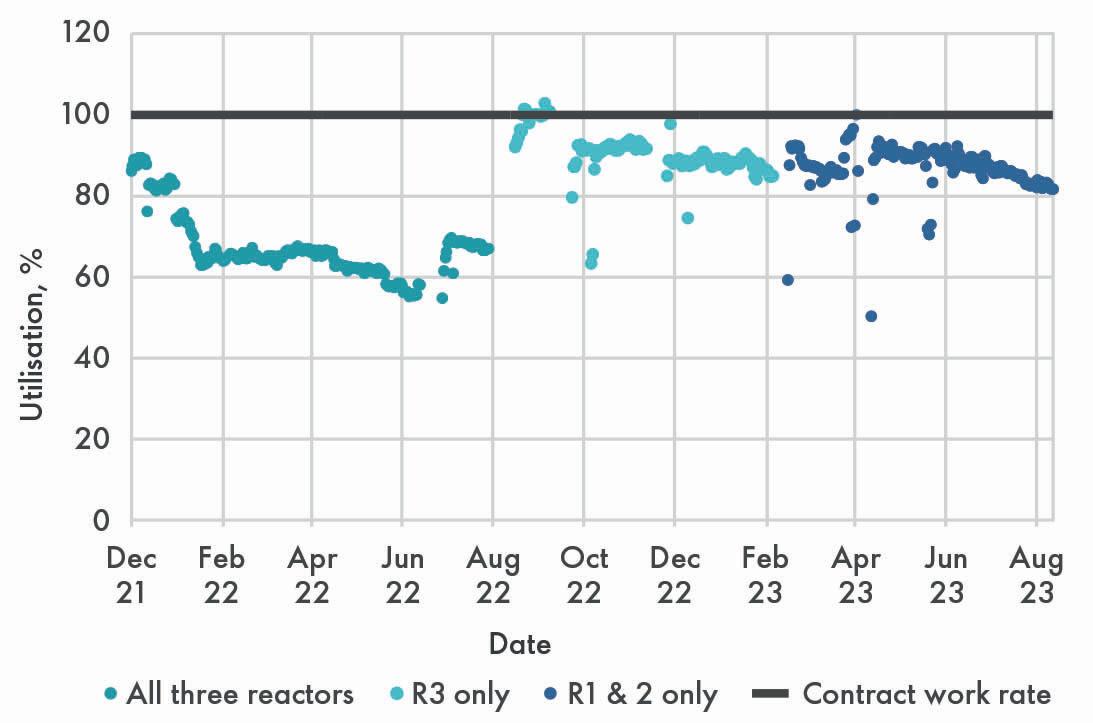

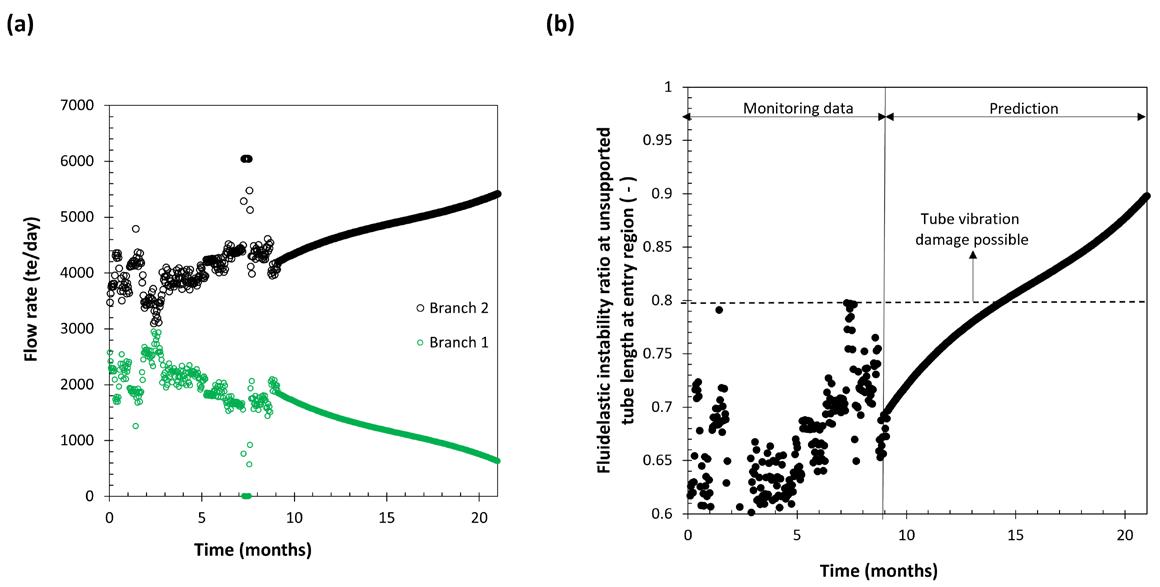

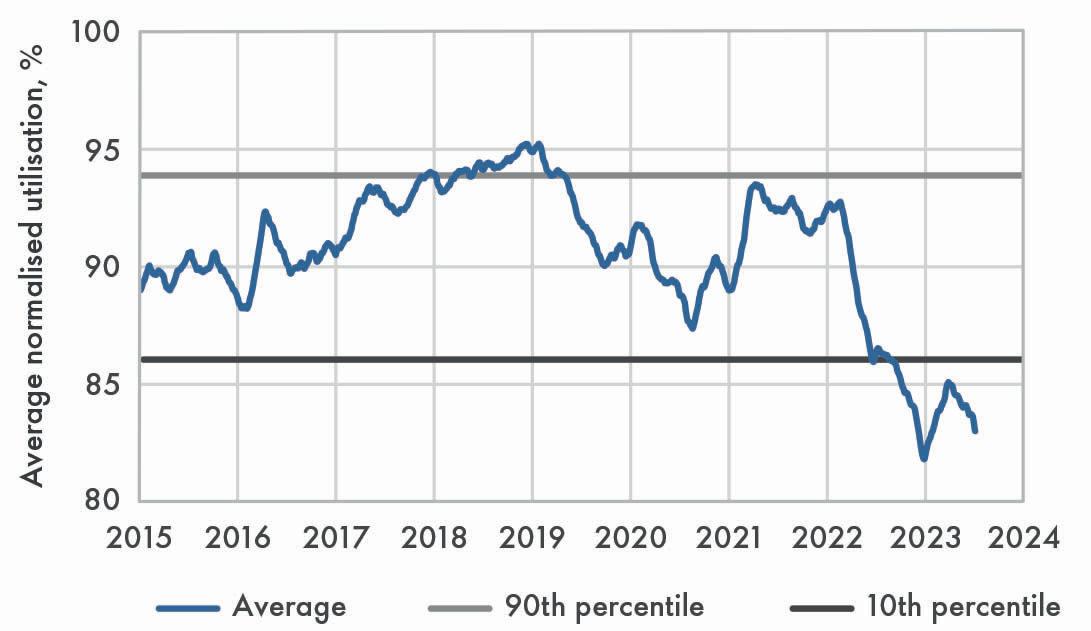

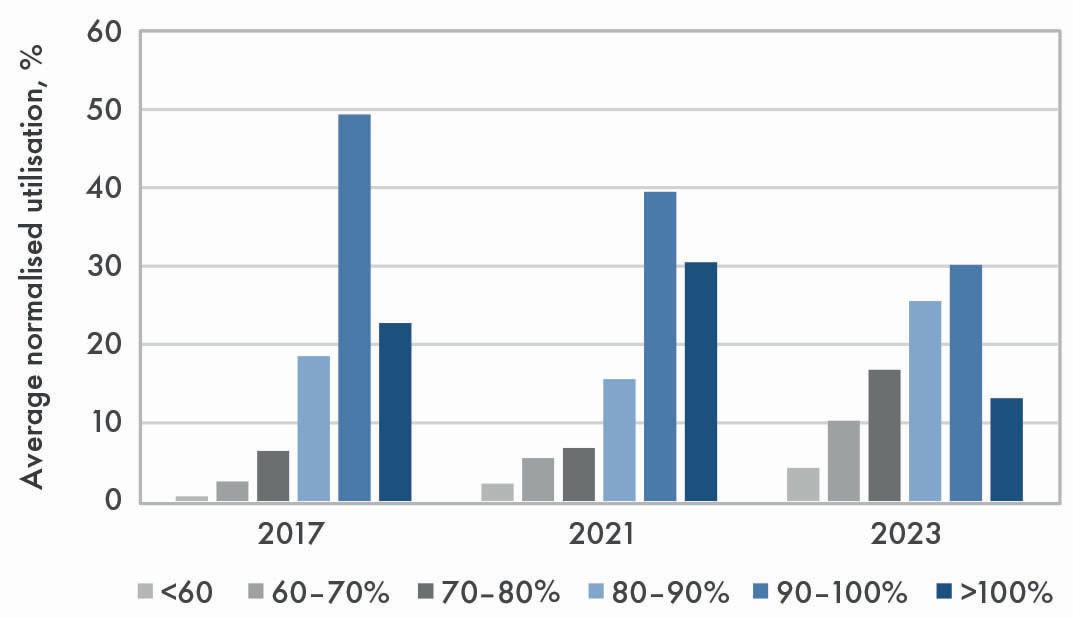

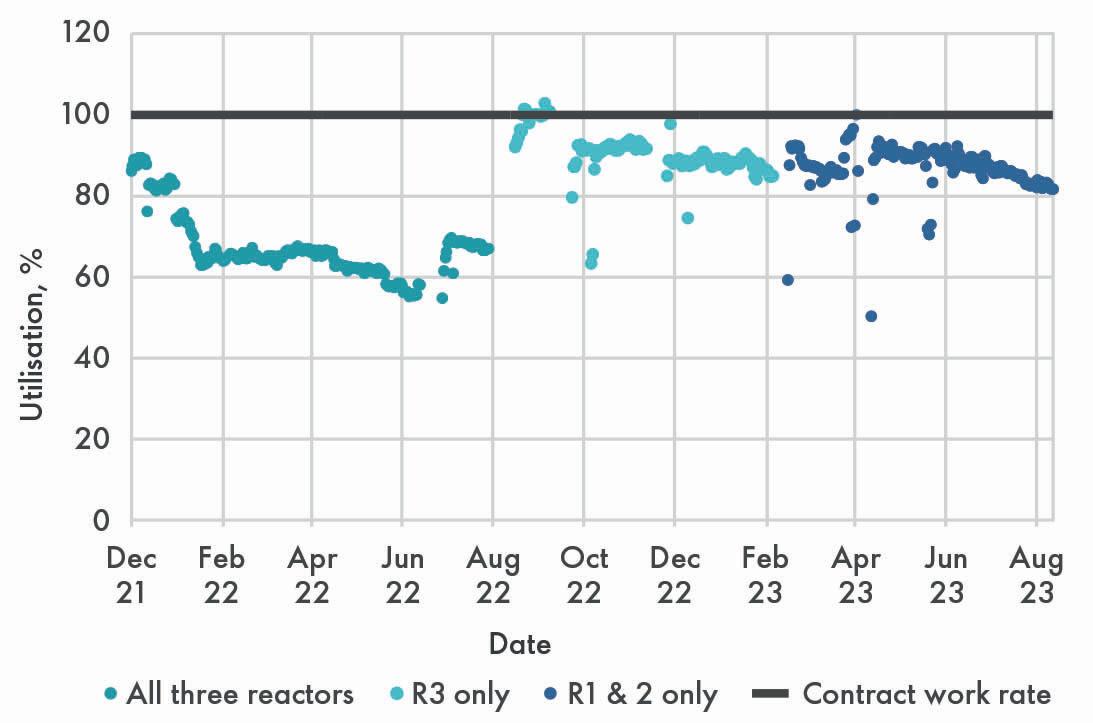

In response, EO plant operators are reducing their normalised work rates, or utilisation rates. An analysis of the normalised work rates of all Shell EO catalyst customers over the past eight years reveals that average utilisation has dropped from more than 95% in 2019 to less than 85% in 2023, as seen in Figure 1a. The distribution of work-rate ranges, seen in Figure 1b, indicates a significant shift to lower utilisation between 2017 and 2023. In 2017, less than 10% of customers were operating at utilisation rates below 80% (the sum of the three grey bars), shifting to more than 30% of customers by 2023. At the end of 2023, the average normalised work rate was well below that seen during the COVID-19 pandemic.

June 2024 14 HYDROCARBON ENGINEERING

June 2024 15 HYDROCARBON ENGINEERING

The challenges posed by low turndown

Low work rates, also known as low turndown, can present operational challenges. In recent decades, many plants have seen an upward capacity creep – the result of various debottlenecking schemes. However, operators forced to reverse this trend can encounter plant hardware constraints in attempting to achieve low turndown. This is a consequence of running at lower temperatures, which improves catalyst life and selectivity but creates lower steam pressure and a set of suboptimal operating conditions.

Fortunately, strategies and solutions exist, and some plants have been able to run under low turndown conditions by consulting closely with Shell Catalysts & Technologies. In part one of this two-part article, short-term solutions will be considered, with examples of tried and tested startegies. Part two of this article will characterise medium and long-term solutions. It is important to note that, while Shell Catalysts & Technologies has assisted some customers in implementing various operational modes to manage low product demand, the effectiveness and outcomes of these solutions may vary depending on specific circumstances and operational contexts.

Short-term solutions

All plants have a design work rate, which is by definition a utilisation of 100%. Depending on the design, it is possible to exceed this by setting more ambitious target

work rates, increasing the utilisation by 10 - 25%. Similarly, there is scope for running at lower work rates of 70 - 80%, which represents turndown operation. What happens when utilisation rates are below 70% or, even lower, at less than 60% – a situation defined as low turndown?

Shell Catalysts & Technologies has assisted some of its customers to implement three different modes of operation to cope with managing low product demand. Considered as short-term solutions, each mode has its own operational challenges and benefits.

Case study 1: operating at extremely low work rate

This case study involves a unit designed for a work rate of 145 kg/m³/hr (100% utilisation). The first catalyst charge was run at 125% of design and the second, owing to pandemic and market conditions, was restricted to 90% of design. The third charge is now running at less than 60% of design work rate because of ongoing poor market conditions.

The challenges faced by running at such a low work rate included catalyst operating constraints and plant hardware limitations, associated with low heat generation. In this case, modifications were made to pressure control valves on the coolant steam drum and reactor outlet gas cooler. These modifications removed the plant limitation and enabled operation using lower-pressure steam. The low catalyst temperature resulted in a sluggish chloride response and, additionally, a potential water impact to the catalyst under extremely low inlet carbon dioxide (CO2) levels was identified. To resolve these issues, the inlet oxygen content was reduced significantly and close attention was paid to chloride optimisation.

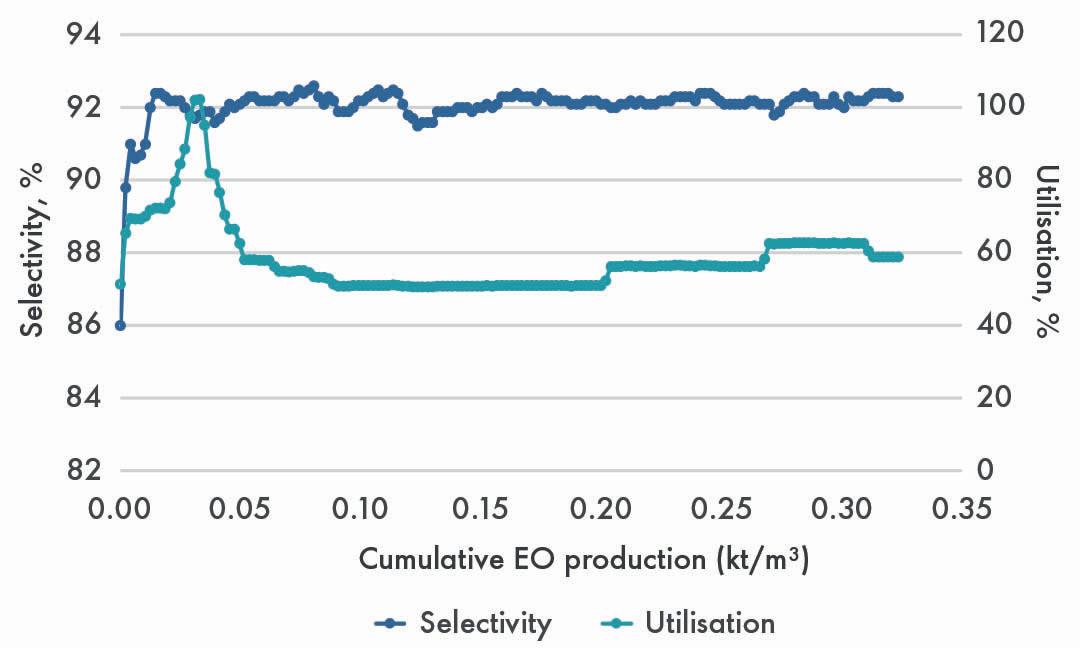

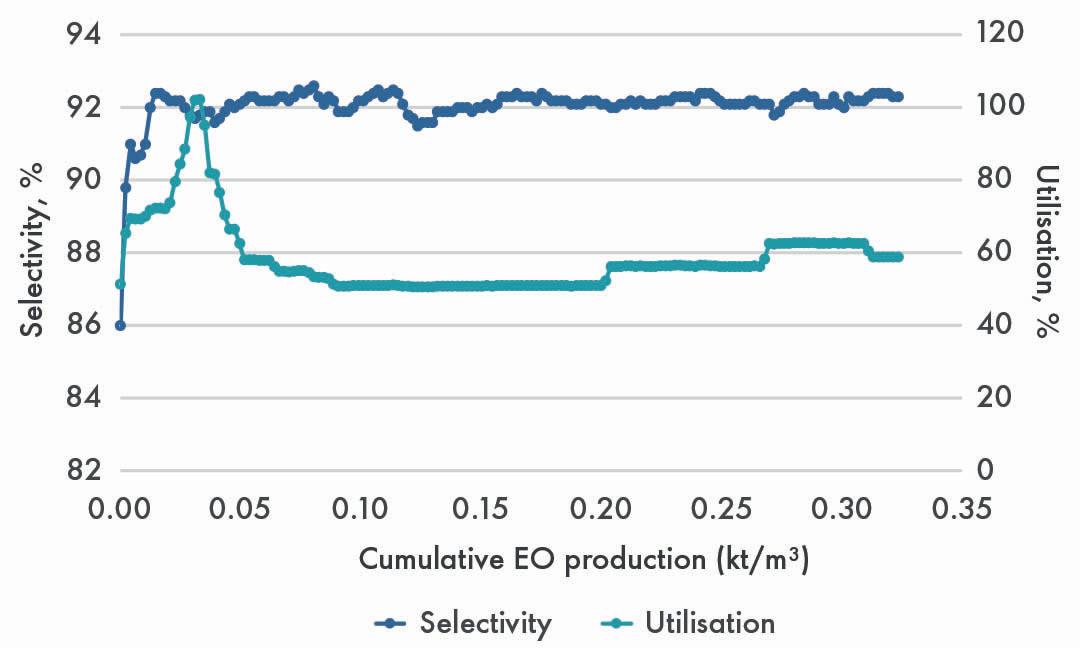

Following the catalyst optimisation procedure, operators reported being able to run at less than 60% of design work rate (less than 85 kg/m³/hr), and with excellent selectivity of approximately 92.3% (Figure 2). Furthermore, the catalyst lifetime should be greatly extended under these mild operating conditions.

Case study 2: start/stop operation

The second case study focuses on the operation of a single reactor with a capacity of 140 000 tpy of ethylene oxide equivalent (EOE). The main products include HPEO, MEG and EO derivatives. The operator was experienced in the use of high-selectivity catalysts, having operated with five charges of a latest-generation product. The average work rate of charges 1 to 3 was 270 kg/m³/hr. The current charge started up in 2022.

June 2024 HYDROCARBON ENGINEERING 16

Figure 1. Average normalised work rate (a) and distribution of work rates (b) for Shell EO catalyst customers.

a) b)

Figure 2. Stable operation and enhanced selectivity of the catalyst at reduced work rate.

Specialty Chemical Solutions

SUPERIOR PROCESS AND WATER TREATMENT SOLUTIONS DRIVEN BY SERVICE EXCELLENCE

Improving reliability, increasing throughput, and enhancing the efficiency and flexibility of operating units is important to you. Halliburton Multi-Chem offers a broad selection of chemistries, equipment, services, and automation to ensure successful results.

Through onsite technical service and engineering support, Multi-Chem collaborates with you to deliver solutions to your challenges. We’re here to help you.

halliburton.com/specialty-chemicals

© 2024 Halliburton. All Rights Reserved.

Product demand dropped during the operation of the fourth charge, when the average work rate was 200 kg/m³/hr. When faced with a work rate below 150 kg/m³/hr, less than 56% of charges 1 - 3, operations were constrained by the coolant pressure valve, low temperatures and inefficiencies. Clearly, an alternative mode of operation was required.

A new strategy was developed, driven by EO product storage constraints and typically involving one to three weeks of operation followed by a shutdown of one week in duration, when the reactor bed was under a nitrogen

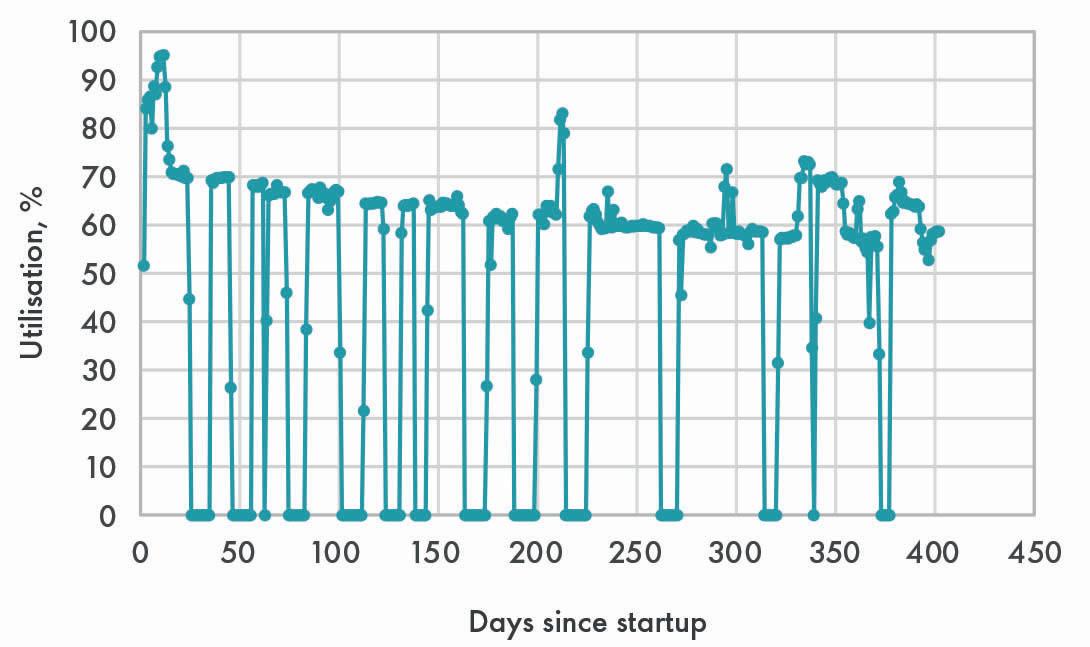

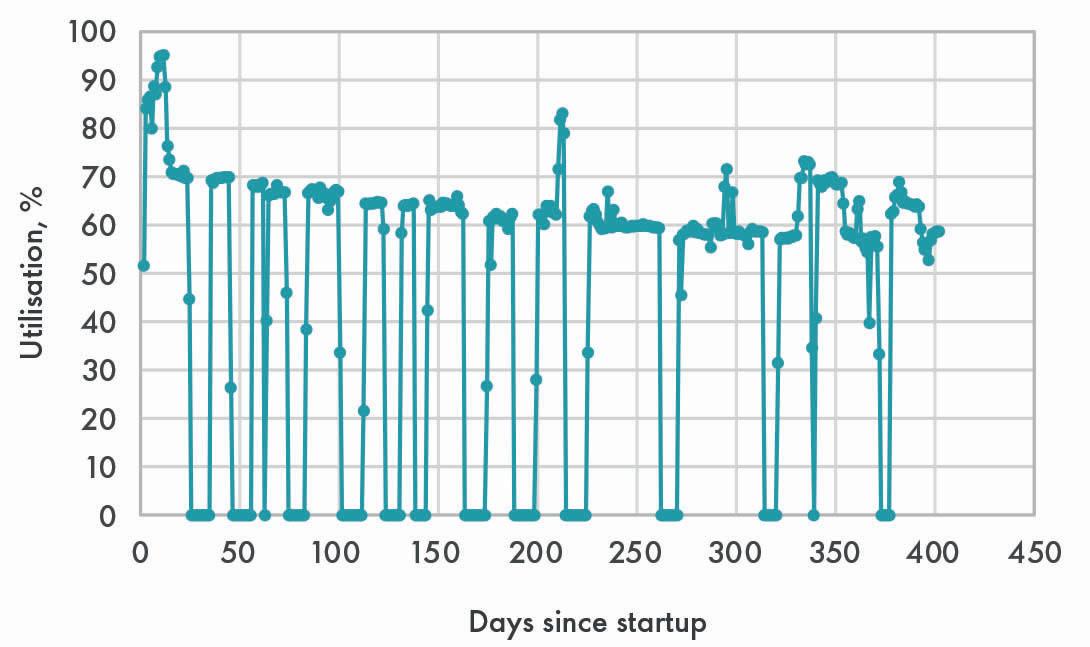

purge. On depletion of the storage level, and when there was sufficient demand, the unit was restarted. Although transient operation comes with inherent challenges, such as potential equipment damage caused by thermal stresses, liquid backflow and the challenge of chloride optimisation, the plant has been successfully operating in this cyclic mode since mid-2022. The strategy has the benefit of providing opportunities to execute routine and preventive maintenance activities during stop periods, if needed. The cyclic work rate is shown in Figure 3.

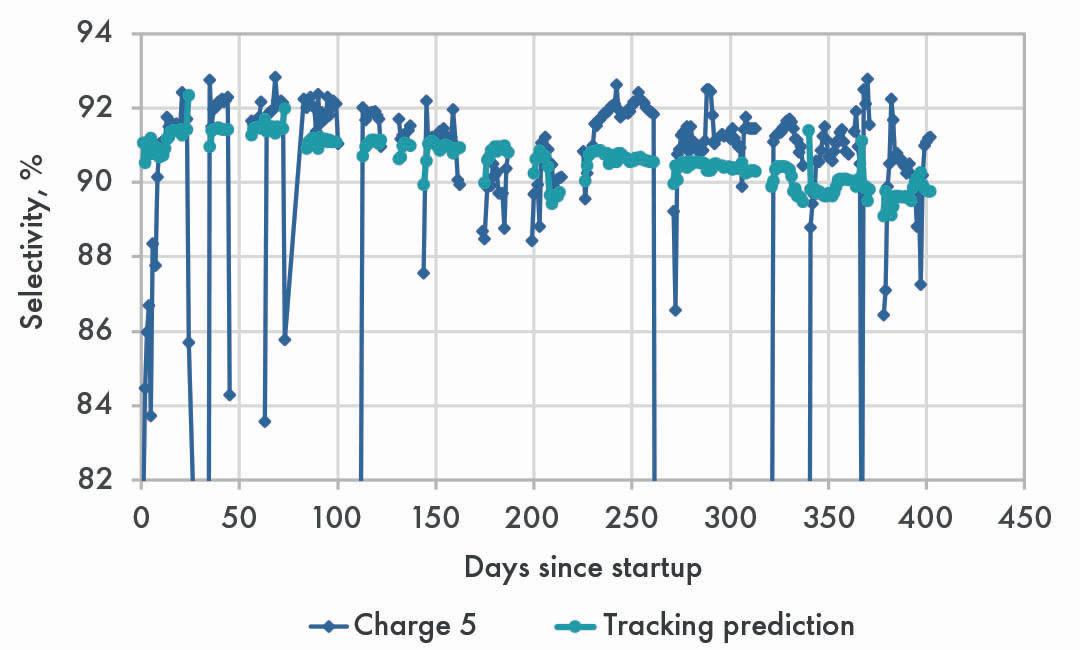

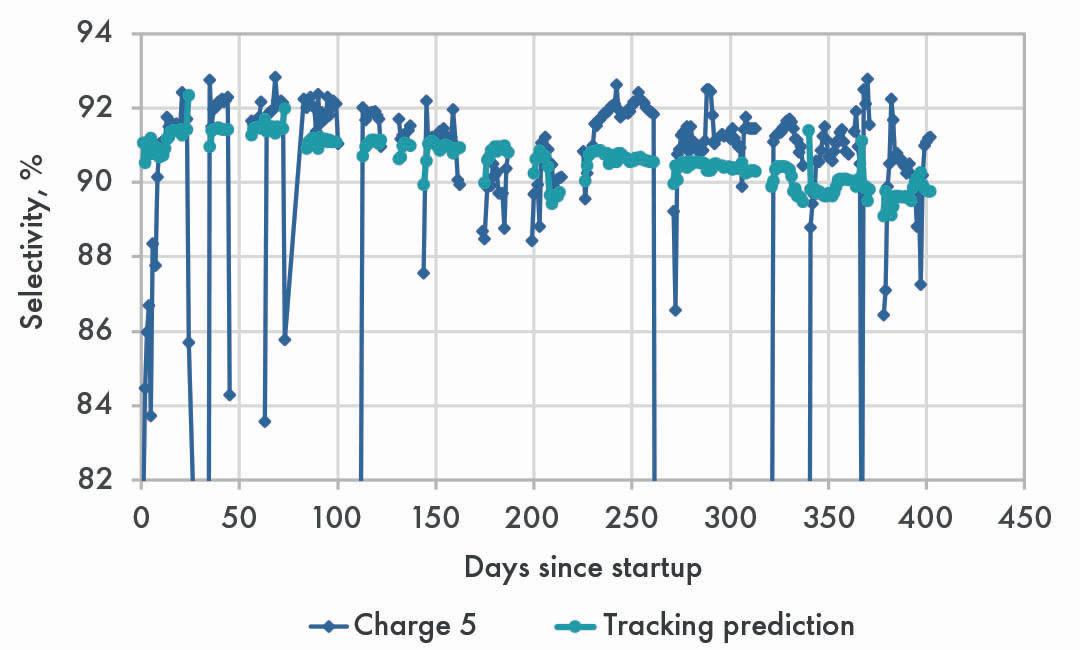

The operator’s deep experience with the catalyst enabled them to successfully achieve manageable work rates and stable operation. The potential difficulty in optimising chlorides during short uptime periods was overcome and energy savings were realised by eliminating utilities to the unit during stop periods. Despite the dynamic operating conditions, the catalyst performance has remained robust, with excellent selectivity, and exceeded tracking predictions, as shown in Figure 4.

Case study 3: reducing the number of reactor trains

Many plants operate with multiple reactors that are run in a parallel configuration. The reactors may be identical, or of different sizes, which is the case at the plant in this case study. A three-reactor system is found comprising small, medium and large reactors in parallel with a design work rate of 250 kg/m³/hr. The company is currently running its sixth charge of high-selectivity catalyst, which was started up in 2021.

In 2021, due to declining market conditions, the operators attempted to run at a lower work rate of 160 kg/m³/hr, or 64% of design work rate. After operating this way for nine months, the company then adopted a novel operating strategy. This entailed running the large reactor (R3) first, while the other two were blocked off, and then switching to the operation of R1 and R2 while R3 was shut down. The combined catalyst volume in R1 and R2 equalled the volume of catalyst in R3, so this mode of operation entailed running only half the reactor catalyst capacity at any one time.

In this way, work rates of 220 - 228 kg/m³/hr (88 - 91% of design work rate) were achieved, equivalent to a 45% turndown of plant capacity.

By isolating individual reactors in a multitrain configuration and protecting the reactor beds with inert gas blanketing, flexible operation was achieved. The benefit of this strategy is the ability to operate the reduced reactor trains at near normal work rate, promoting stability and good catalyst performance. This blocked-out mode of operation also provides the ability to perform changeout of catalyst in an isolated reactor train while the other is still running. Additionally, the operator reported energy savings of 400 - 2000 kWh at its plant when running with reduced reactor trains. The work rates for the various reactor combinations are shown in Figure 5.

In the second part of this article, which will appear in the September issue of Hydrocarbon Engineering, the medium and long-term solutions for EO producers facing low work rate conditions will be discussed.

June 2024 HYDROCARBON ENGINEERING 18

Figure 3. The cyclic work rate of start/stop operation (100% = 270 kg/m3/hr).

Figure 4. Selectivity of the catalyst charge during stop/start operation.

Figure 5. Work rates for different reactor combinations at the plant.

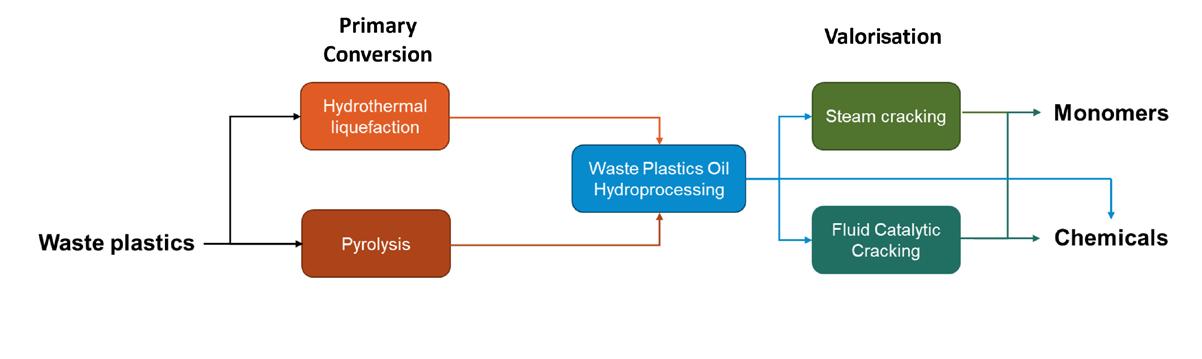

The rapid progress in development of technology for the recycling of waste plastics is driven by two main factors. First, the introduction of recycled content can partially replace fossil feedstocks as a raw material for producing plastics, thereby reducing the carbon footprint of this invaluable material. Second, the effective recycling of waste plastics results in valorisation of this waste stream, providing a powerful additional incentive for reducing the environmental problem of waste plastics. These drivers have stimulated pledges from producers to increase the recycled content of plastics and legislators to introduce subsidies and mandates for the recycling of waste plastics. For example, the recent revision of the EU Packaging and Packaging Waste directive stipulates the reuse, recycling and other forms of recovering of packaging waste (instead of its final disposal) including specific targets for the recycling rate of plastic packaging.

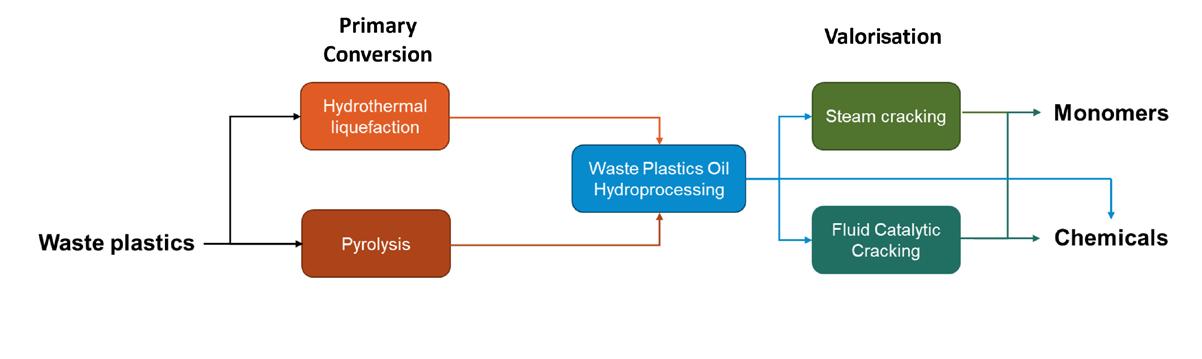

A sound strategy for decreasing waste plastics begins with avoiding the use of plastics where better alternatives exist and reusing plastic items as often as possible. When end-of-life is reached, or when reuse is not an option (e.g. for reasons of hygiene), recycling provides a better alternative than landfill or incineration. For pure plastics streams of a homogeneous composition, mechanical recycling or chemical solvolysis provides an efficient low-energy route to recycling. However, for mixed plastics streams, these routes are not an option, and significant energy input is required to break the carbon-carbon bonds present in the polymers. Via pyrolysis or hydrothermal liquefaction, a mixed waste plastics stream can be converted into a waste plastics oil (WPO) which can serve as a raw material for the production of new plastics or chemicals. This article will explain

Jaap Bergwerff, Ketjen, explains why the hydroprocessing of waste plastic oils is an essential technology in the chemical recycling of waste plastics.

June 2024 19 HYDROCARBON ENGINEERING

why hydroprocessing is an essential technology for this type of chemical recycling of waste plastics.

Different routes exist for the valorisation of the circular carbon that is contained in WPOs, as illustrated in Figure 1. Depending on the available assets or economic circumstances, monomers or chemicals can either be produced by processing of a purified WPO in a fluid catalytic cracking (FCC) unit or a steam cracker. Regardless of the route taken, hydroprocessing of the WPO is likely required. While the FCC catalyst can handle a certain concentration of contaminants, for introduction in a steam cracker, stringent specifications must be met. Moreover, a feed with a lower boiling point will result in higher yields of valuable monomers. This article will describe how hydroprocessing can be applied to upgrade WPO to a suitable feedstock.

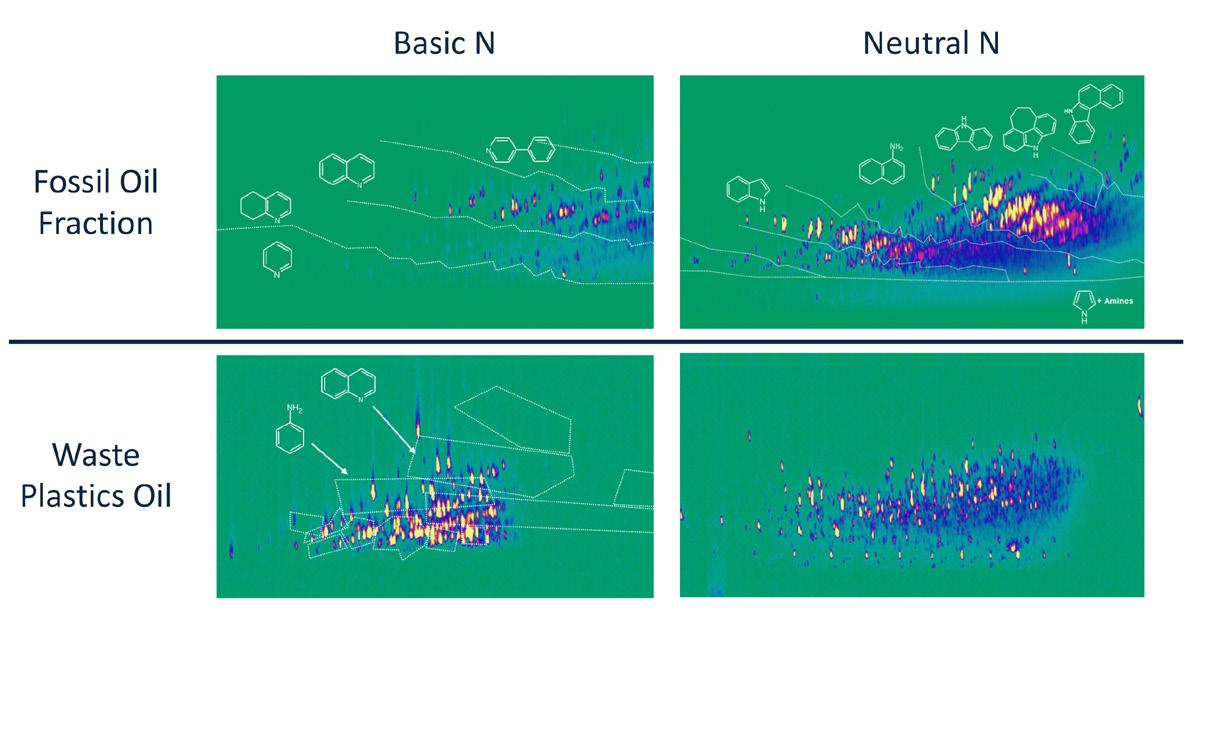

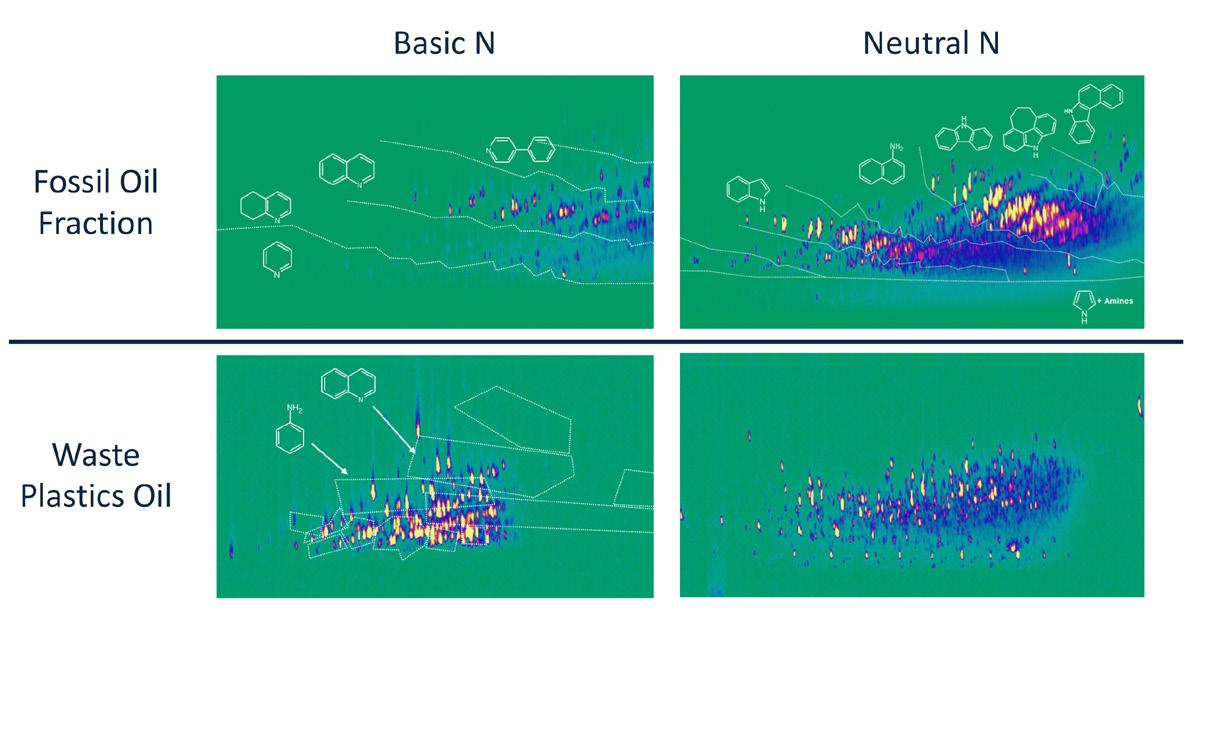

Waste plastics oil composition

Before an effective hydroprocessing strategy can be developed, it is critical to understand the composition of the feedstock. A molecular fingerprint of the organic matrix can be obtained via multi-dimensional chromatography techniques combined with selective detectors for speciation. A quick comparison of the speciation of the N-compounds present in a typical WPO and in a fossil oil fraction, as shown in Figure 2, reveals that the type of N-compounds present in both oils is completely different.

The composition of WPOs can vary greatly depending on the source of waste plastics and conversion technology used. The nature of the polymers in the mix, but also the presence of curatives, paints and other additives added to the plastics, and even non-plastics, present in the mix will affect the oil composition. Figure 3 illustrates the large variation in composition and physical properties encountered. Depending on how value chains develop, it is possible that the production of WPOs is carried out on a relatively small scale close to the waste collection location, while hydroprocessing of aggregated WPOs is carried out at a larger scale at a location linked to its valorisation. In any case, before developing a suitable strategy for the hydroprocessing of WPOs, understanding the composition of the feedstock and its fluctuation to be treated is critical. Finally, just as the composition of WPO depends on the plastics sources, it is bound to vary over time. The catalyst system will need to be sufficiently robust to deal with fluctuations in impurities concentration and reactivity and with changes over time.

Figure 2. GCxGC-NCD plots showing the speciation of neutral (left) and basic (right) N-compounds in a fossil oil fraction (top) and a WPO (bottom). In these graphs, the location of a compound reflects its boiling point (x-axis) and polarity (y-axis).

Depending on the waste plastic source and conversion technology applied, the WPO can be more paraffinic or can contain a higher concentration of aromatics. The presence of highly reactive di-olefins originating from thermal cracking reactions can make crude waste plastic oils very difficult to handle and sometimes even unstable under storage.

The presence of heteroatoms in WPOs can originate from many different sources. In Table 1, the different elements, their origin and the nature of the molecules present in the WPO are listed. Oxygen in WPOs can be present in many different forms and originate from many different sources. In general, the hydrodeoxygenation (HDO) reaction of most of these compounds will be relatively rapid, but species like phenols can require more severe conditions and/or a dedicated catalyst solution.

A closer look at Figure 2 shows that, in fossil oil fractions, N is mostly contained in aromatic rings and significant hydrogenation is required to liberate N from these compounds. On the other hand, the N-compounds that are generally present in waste plastic oils, such as primary amines, are generally less refractory and therefore relatively easier to decompose. In the

June 2024 HYDROCARBON ENGINEERING 20

Figure 1. Different pathways for the chemical recycling of waste plastics for the production of new plastics or chemicals, highlighting the role of WPO hydroprocessing.

Figure 3. Range of properties and composition as found in a collection of WPOs, illustrating the extreme variation amongst different WPOs.

two-dimensional gas chromatography (GCxGC) plots, this is expressed as a lower boiling point (more to the left) and a lower polarity (more towards the bottom of the plot). Nevertheless, the very high concentrations present in the WPOs still require sufficient hydroenitrogenation (HDN) activity of the catalyst system.

Whereas in hydroprocessing of fossil fuels, the near complete removal of highly refractory S-compounds, such as substituted dibenzothiophenes, is a real challenge, the S-species present in WPOs are generally more reactive.

Dealing with the presence of halides is a specific issue in the hydroprocessing of WPOs. Originating from PVC or flame retardants, the organic halides will rapidly decompose over typical hydroprocessing catalysts to form HCl or HBr. Obviously, the presence of these compounds can create corrosion issues and puts specific demands on materials used in the process. Moreover, when combining with the NH3 liberated in the HDN reaction, precipitation of NH4Cl or NH4Br in colder parts downstream of the main reactor can cause significant operational issues in lab-scale and commercial reactors.

Silicon (Si) and phosphorus (P) are contaminants common in WPOs but are also found in fossil oil fractions, waste and residue oils and bio-oils. As in these applications, dedicated guard bed catalysts can be applied to decompose Si- and P-containing compounds and capture the element and their inorganic salts on the catalyst.

While present at low concentrations, it is still critical that a full account of all elements is made. Even at low concentrations, elements like arsenic or lead can have a significant impact on catalyst activity and their accumulative effect over a cycle can result in a severe impact on activity. Understanding the

Table 1. Origin and nature of different contaminants that can be present in WPOs

Element Origin in waste plastic streams Molecular presence in waste plastic oils

O PET, paper, organic contaminants Large range of different compounds

S Polysulfides

Rubbers, plasticisers

Thiols, thiophenes

N Polyamides (Primary) amines, pyridines, nitriles

Cl PVC

Br Polybrominated hydrocarbons

Flame retardants

Si Silicones

Organic chlorides

Organic bromides

Sealants, surfactants (Substituted) cyclic siloxanes

P Organophosphates

Corrosion inhibitors, flame-retardants

Arylphosphates, polyphosphates

Metals (Cd, Cr, Fe, Mo, Ni, Pb, Sb, Ti, Zn, and others)

Organo-metal compounds

As a reflection of the variety in origin of the plastic feed, a range of different metals can be detected in WPOs.

A range of fillers, plasticisers, catalysts, inks, pigments

x KETJEN Renewables POSTER_210mmx146mm.pdf 1 4/30/24 3:29 PM

RENEWABLES

Catalysts matter! Our bespoke catalyst solutions are tailored to your needs no matter where you are in your energy transition journey, helping you achieve your sustainability goals and maximize profits.

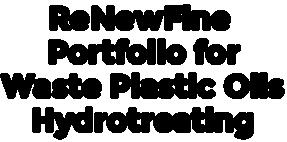

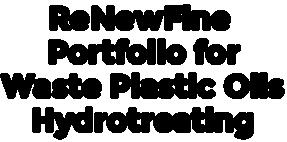

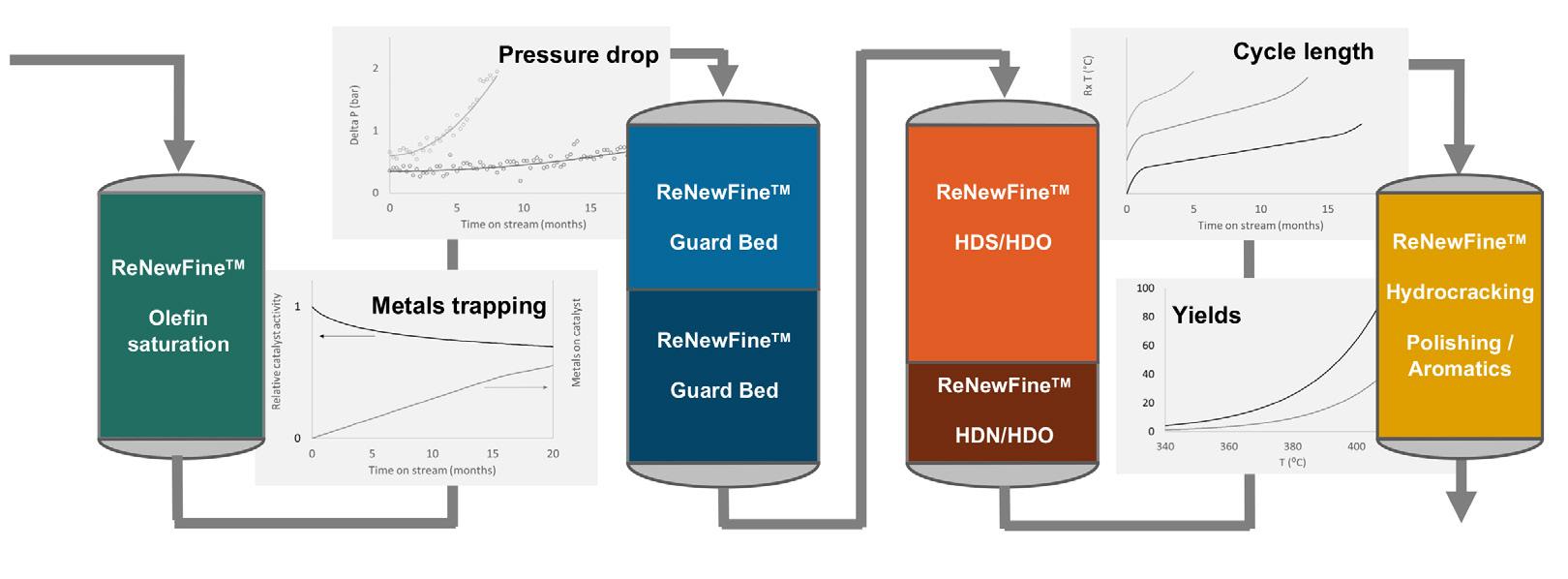

As an independent catalyst producer, we have the expertise to help you succeed in operating your assets autonomously. Our ReNewFine portfolio works regardless of your process technology.

ReNewFine Portfolio for Renewable Diesel & SAF ReNewFCC Portfolio for FCC co-processing applications As an industry leader, we provide a comprehensive portfolio of catalyst solutions

more information, scan the QR code.

For

ReNewFine Portfolio for Waste Plastic Oils Hydrotreating

ADVANCING SUSTAINABLE SOLUTIONS

interaction of the different metals with the active catalysts is key to designing an effective catalyst system that is able to prevent catalyst poisoning, allowing these elements to exit the reactor via the product.

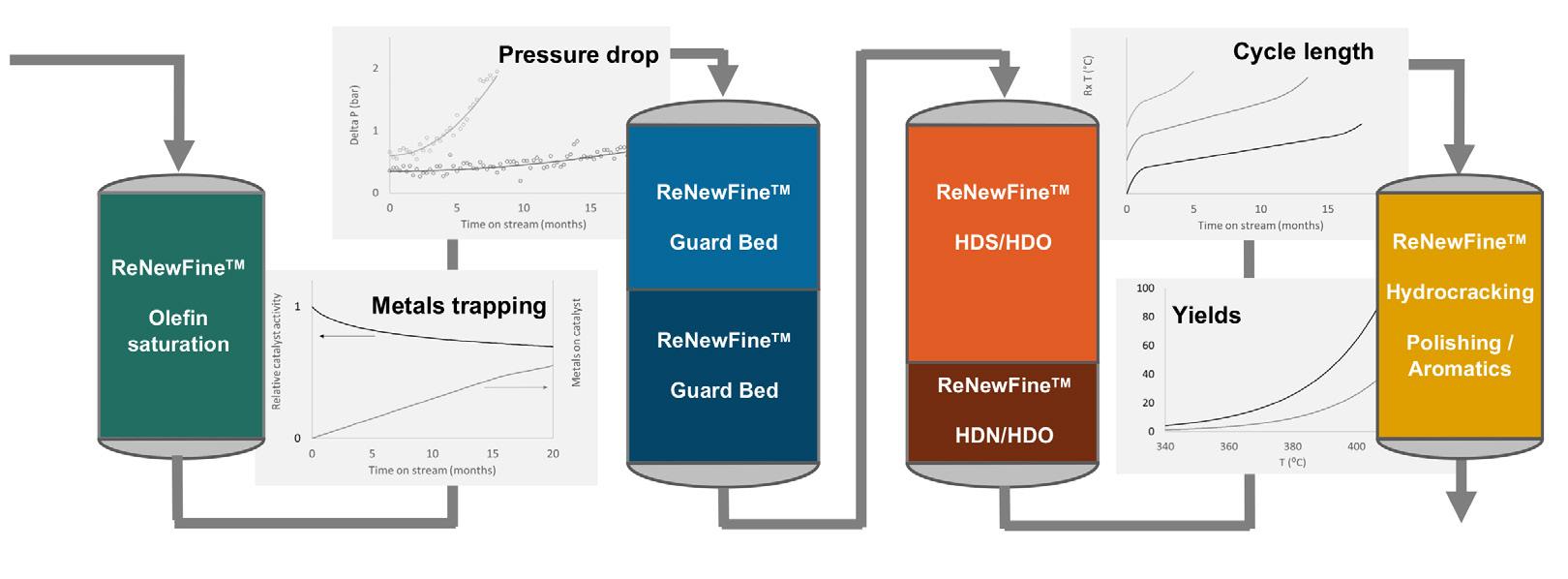

Hydroprocessing strategies

Before hydroprocessing is carried out, in designing a catalyst system for the upgrading of WPOs, the composition of the feedstock and product are both of critical importance. In general, the reactions that are taking place over the entire system are executed in order of reactivity of the reactants. In Figure 4, a catalyst system for WPO hydroprocessing is presented, where it should be noted that the exact process scheme and number of reactors can vary in practice. First, a low temperature hydrogenation step can be carried out to saturate the reactive di-olefins that are present in the feed. In this way, a severe exotherm on the main catalyst bed is prevented, resulting in potential uncontrolled polymerisation and catalyst deactivation. This step results in a stabilised WPO that can be further upgraded.

Subsequently, inorganic impurities, such as P and Si are removed by dedicated guard bed catalysts. Depending on the concentration of these impurities, one approach could be to use parallel guard bed reactors to allow for exchange of the catalyst while continuing the process. When designing the optimal guard catalysts, the aim is always to provide sufficient

activity to capture all contaminants in the guard bed layer, without causing deposition near the external surface of the catalyst particle, which results in deactivation. This means accessibility of guard bed catalysts is maximised, while reactivity needs to be tailored. Since the reactivity and molecular size of the impurity-containing molecules in WPO can be very different from other types of feedstocks, dedicated guard catalysts are required for this application.

Based on decades of experience in the hydroprocessing of a range of feedstocks, a deep understanding of the effect of catalyst composition on hydrodesulfurisation (HDS), HDN and HDO activity has been obtained. Using this expertise, a complete ReNewFine catalyst portfolio was developed for the removal of these heteroatoms from WPOs. The result of this step is a purified pure hydrocarbon stream. Figure 5 shows the results of an experiment in which a WPO was processed over a series of ReNewFineTM catalysts to remove S and N. Complete HDS and HDN conversion was already obtained at a reasonably low temperature.

Finally, a post-treatment step may be required to alter the physical properties of the product. When the product is applied as steam cracker feed, hydrocracking may be used to achieve a lower average boiling point and optimise monomer yields. In the production of waxes or oils from certain paraffinic WPOs, isomerisation can help to improve the properties of the product, while deep hydrogenation may be required to produce certain chemicals.

Conclusion

Hydroprocessing is a critical step in the valorisation of WPOs to produce new chemicals and plastics, regardless of the feedstock used or the desired product. In addition to the process lay-out and reaction conditions, a detailed understanding of the composition of these feedstocks is the basis for designing catalyst solutions for WPO hydroprocessing. Once a molecular fingerprint of the WPO has been obtained, using a range of dedicated catalysts and an application model that contains the catalyst activity profile, the optimal ReNewSTAXTM catalyst loading can be designed.

June 2024 HYDROCARBON ENGINEERING 22

Figure 4. Schematic representation of a process for the hydroprocessing of WPO, illustrating the different steps that are required, and some critical parameters to follow and model.

Figure 5. Results of a hydroprocessing test with a WPO, showing the removal of S and N as a function of T.

Taco

van der Maten, Malvern Panalytical, the Netherlands, discusses the use of X-ray diffraction (XRD) as a valuable tool for catalyst characterisation.

When it comes to the catalytic cracking of hydrocarbons, the name says it all: catalysts – often zeolites, in modern refineries – have proved to be a game-changer in helping the industry produce higher volumes of higher-value petroleum products. As catalysts become more efficient, so too do the economics, land use, and resource consumption of refineries. Furthermore, by enabling the shift away from more energy-intensive thermal cracking, catalysis plays a central role in reducing the environmental footprint of the hydrocarbon value chain.

Catalysts are used in the petrochemical industry for accelerating chemical processes of all kinds. Different catalysts are used for different purposes, so there is no one catalyst that rules all. For example, a catalyst that excels in oxidation reactions may not be as effective as another catalyst in the amination process. These varying properties make it more challenging to find efficient catalysts. More catalysts mean more possibilities, leading to increased sampling workloads and longer testing periods to find

catalysts with the optimal properties for a given process. In the petrochemical industry, these tests take up valuable time in a highly competitive market.

In everything from the cars we drive to the materials used in our homes and workplaces, and even the production of solar energy, catalysts are hard at work behind the scenes.

The need for speed in catalyst development

What is more, demand for catalysts is growing, with market projections forecasting a compound annual growth rate of at least 4% for the next decade. This is partly driven by the expected increase in demand for the polymers, chemicals, and petrochemicals to support the world’s growing population. At the same time, the environmental crisis is spurring the continuous development of new processes and technologies that are based on waste materials and benefit from the influence of catalysis – including carbon capture and utilisation (CCU) and the conversion of waste household plastics into new feedstocks

June 2024 23 HYDROCARBON ENGINEERING

or biofuels. If we are to realise such innovations at the scale required for a successful sustainability transition, meeting the additional demand for catalysts will be crucial.

More specifically, fulfilling this demand will require not only more catalytic materials, but better ones. And just like the outputs they enable, the catalysts themselves will need to be more cost efficient and more sustainable to produce.

In turn, whether the analysis of the material is taking place in an R&D lab or as part of a refinery’s quality-control procedures, reliable and in-depth characterisation of catalysts is fundamental. Only then is it possible to understand the precise properties of a sample, what those properties mean for the reactants, and how to optimise these properties to ensure the right balance between performance and efficiency.

From area to zeta

It is important to remember that catalyst characterisation is key to more than just designing and developing new catalysts that perform well under the intended conditions of use. After all, thorough analysis is also essential for designing and developing petrochemical processes and platforms that perform in agreement with the catalysts, at the intended scale.

With this in mind, researchers and refineries looking for a comprehensive understanding of a given catalyst should ensure their assessment includes physical, structural, and elemental analysis. Within these categories, several properties can affect the outcome of a catalytic process, including particle size and shape, surface area, crystalline structure, porosity, and zeta potential. In general, zeolites used in hydrocarbon cracking increase the rate of reaction as a result of the surface binding and pore-intrusion to the reactants. Achieving the optimal catalyst structure and surface chemistry for the process in question is therefore a priority.

Advanced characterisation with the X factor

In the petrochemical field, X-ray diffraction (XRD) is an extremely valuable tool for catalyst characterisation. It is based on the premise that, by using an X-ray source and detector to measure a sample’s scattering angle at a fixed wavelength and by applying Bragg’s law, users can determine the space between the

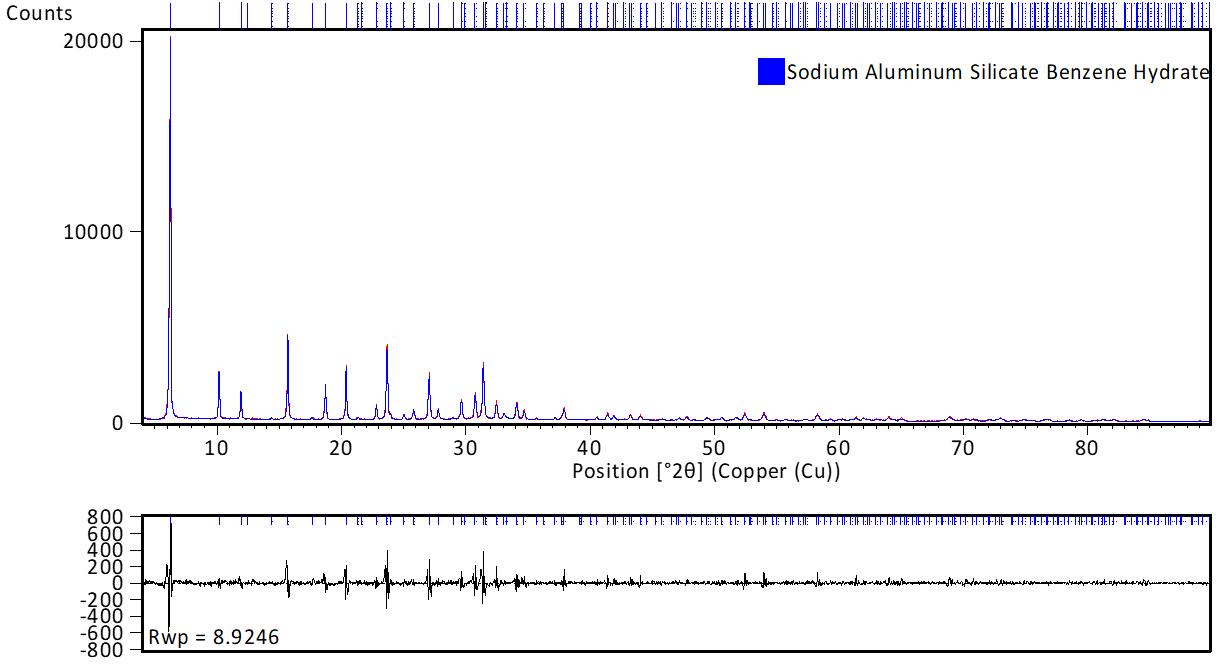

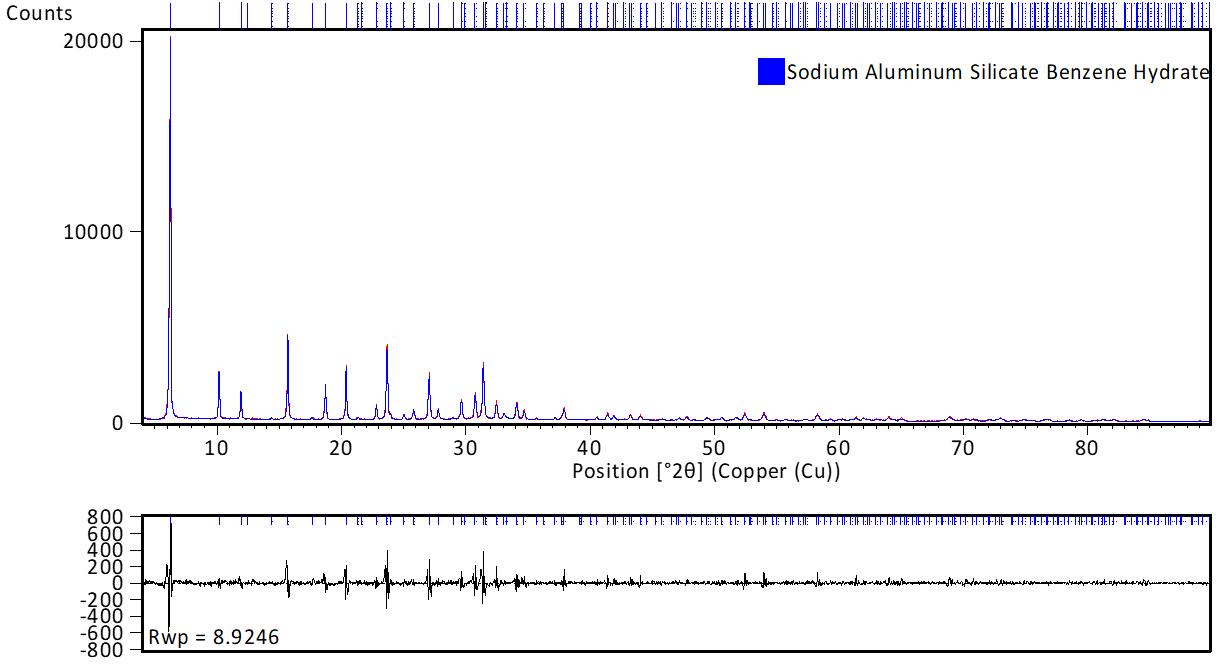

Figure 1. Example of an X-ray diffractogram of a zeolite interacting with benzene hydrate – upper graph –demonstrated by a good fit between the predicted and measured data, as indicated by the low fitting residuals –lower graph.

scattering planes of a material. In turn, this enables phase identification and quantitative analysis of the sample under investigation. Recognised in industry for years as an invaluable tool, several international test methods have been developed. Listed below are several of the most used test methods.

ASTM test methods1

n D5758 - Standard Test Method for Determination of Relative Crystallinity of Zeolite ZSM-5 by X-Ray Diffraction.

n D4926 - Standard Test Method for Gamma Alumina Content in Catalysts and Catalyst Carriers Containing Silica and Alumina by X-ray Powder Diffraction.

n D8352 - Standard Test Method for Determination of Relative Crystallinity of Zeolite Beta by X-Ray Diffraction.

n D5357-19 Standard Test Method for Determination of Relative Crystallinity of Zeolite Sodium A by X-ray Diffraction.

Regarding hydrocarbon processing in particular, this technique provides information on the bulk structure and composition of solid catalytic materials, such as the zeolites and metal oxides used in catalytic cracking. Therefore, XRD is often used in hydrocarbon catalysis research to determine crystalline structure and size, as well as unit cell size. Crystalline/amorphous rations are used in quality control. On top of this, when analysed using an XRD instrument with non-ambient chambers, catalysts can be examined under a variety of conditions (such as pressure, temperature, and humidity), thereby unlocking insights into reaction pathways and intermediate phases. Users can also monitor processes that influence the activation of a catalyst, such as oxidation or reduction reactions.

Better yet, not only is the underlying theory sound, but XRD brings all kinds of in-use benefits for scientists – those in the lab as well as in industrial settings. Requiring minimal sample preparation and relatively little time for an analysis (often under 20 minutes), XRD is a fast and convenient technique that is popular in industrial environments. Non-destructive, versatile, and highly accurate, these tools enable users to gain valuable insights into a catalytic material, and thereafter make informed decisions about optimising its performance in refinery processes.

Complementary techniques for a comprehensive understanding

In any characterisation activity, it is important to examine a hydrocarbon processing catalyst from as many perspectives as possible in order to paint a full picture of its properties. Indeed, XRD is an important technique that can provide important insights into catalyst samples. X-ray fluorescence (XRF) technology, for instance, can be used to support elemental analysis of the catalytic material. Highly precise and reproducible, this spectroscopic method can help determine the Si/Al ratio of a zeolite, for example, or even the presence of so-called catalyst poisons, thereby helping prevent chemical deactivation.

Meanwhile, small-angle X-ray scattering (SAXS) measures the scattering that results from fluctuations in electron density at the nanometer scale, making it an extremely useful technique for many catalysts and a good complement to XRD. With SAXS, users can determine particle and pore size, volume-weighted size distribution, and the specific

June 2024 HYDROCARBON ENGINEERING 24

surface area of crystallites. Alongside this, investigation of short-range atomic order via pair distribution function (PDF) analysis enables a better understanding of nano- and non-crystalline materials and amorphous phases. In this way, SAXS can complement Brunauer-Emmett-Teller (BET) and Barrett-Joyner-Halenda (BHJ) pore size and volume analysis test.

For refineries and labs seeking a fully cutting-edge characterisation approach, it is time to take advantage of the growing availability of automated analysis instruments and intuitive, custom-built analytical software. These are both areas that have made significant advancements in recent years and are now supporting faster, simpler, data-driven analysis in the lab and at the production line, thereby helping to improve catalytic processes – and related margins and efficiencies – still further.

Catalysing a more sustainable petrochemical industry

The petrochemical landscape is changing fast, and that change must speed up further as the sustainability transition takes hold. More efficient catalysts – that enable more sustainable operations and applications alike – can help refinery operators to step on the pedal.

For that, of course, catalyst development itself needs to stay ahead of the pace. With accurate and reliable XRD, supported by other complementary methods, users are assured of robust and informative characterisation that will enable both catalytic materials and the reactions they accelerate to perform better and more efficiently.

XRD: the fast method for the future of petrochemicals

XRD is driving catalyst development in several ways. Solid growth and environmental pressures are encouraging research into better catalyst materials, so that the market can effectively serve the growing demand for polymers, chemicals, and petrochemicals.

In the search for better catalysts, innovative new materials can only be discovered if researchers understand the precise properties of their catalyst. This understanding, gained through in-depth XRD characterisation, sheds more light on how the reactants will behave and how best to optimise their reactions.

XRD characterisation is an excellent method for unlocking the secrets of a catalyst material. It is widely supported by several test methods and offers a variety of analytical advantages. XRD often provides analysis in less than 20 minutes, and it works on multiple samples while not destroying them in the analytical process.

XRD is a fast, convenient analytical method for innovators seeking to optimise their catalyst materials. Combined with other technologies such as XRF or SAXS, XRD is the foundation of a characterisation process that enables innovation in a rapidly changing petrochemical landscape.

Note

An extensive list of ASTM International Catalyst Standards can be found at https://www.astm.org/products-services/standards-andpublications/standards/catalyst-standards.html

June 2024 HYDROCARBON ENGINEERING 26

Bradford Cook, Sabin Metal Corp., USA, outlines best practice control points for refiners looking to maximise the value and lifecycle of precious metals catalysts.

The value of precious metals continues to rise both in terms of their pricing in the marketplace, and their critical, technical applications in plants. Precious metals are likely among the most reused substances on planet Earth as they are almost always retrieved and recycled regardless of the form they may take. Many petroleum and petrochemical processes use catalysts containing precious metals (PMs) – most commonly platinum, palladium, ruthenium, rhodium, gold and rhenium. When the time comes for these catalysts to be replaced (changed out during turnaround), the plant realises a level of restored efficacy to the process, increased speed of process reactions, etc. After the spent catalysts are sent to a precious metal refiner, a vast majority of catalyst owners focus only on the final returned value contained, and in so doing they miss opportunities to learn best practices and protect their

profits. This article seeks to provide readers with an overview of the various control points within the precious metal catalyst life cycle, and what knowledge can be gained to maximise financial returns while minimising difficulties.

Control point one: the purchase

Proper lifecycle management must include every step or action where the precious metal catalyst is handled and whenever calculations are made regarding the PMs contained. The first point that must be understood clearly is the amount of precious metal purchased within the fresh catalyst. If your company had some of this material sampled and tested, well done. The variability of precious metals loading when the catalyst was manufactured means that each catalyst bead is slightly different, so it stands to reason that each drum of the catalyst is also

June 2024 27 HYDROCARBON ENGINEERING

slightly different. Manufactures of products containing precious metals try very hard to keep the level of that ingredient to the minimum, agreed-upon amount. Consider the law of averages: half of the drums of catalyst produced will contain less than the average amount of precious metal, and half will contain more than the average. If a catalyst manufacturer makes reformer catalyst in batches of millions of kilos, how will you know which drums you received? The second key issue is the amount of water the catalyst contains at purchase. The average water content should be listed on the certificate when the catalyst was purchased and will factor in when evaluating the spent catalyst PM value when the reactor is ultimately changed out. Knowing how many ounces of precious metals you have is only possible with thorough record-keeping ‘from the cradle to the grave’ of the catalyst life cycle.

Control point two: in-situ considerations

Excuse my dust

Throughout this catalyst life cycle, dusts are being formed (also known as ‘fines’ in the industry). The catalyst beads rub together during the vibration of road transport, so the first consideration comes when the fresh catalyst is being loaded into the reactor. Reactors should never be loaded (or unloaded) in a high wind. Many catalysts – particularly alumina-based catalysts – are impregnated with PMs on their exterior surface to enhance their efficacy, so fines can contain two to ten times more PM per kg than the original catalyst bead. For example: typical precious metal catalysts are loaded at 0.25% platinum, so losing 1 kg of fresh catalyst beads is like losing 2.5 g of platinum, which is about €70.00 at today’s prices. Losing 1 kg of dust during the catalyst’s life cycle can be the equivalent of 20 g of platinum or greater, which is €500 of precious metals or even more.

Carbon negatives, et al

It is also important to remember that throughout the catalyst’s life cycle, many impurities accumulate in the

catalyst during processing: coke, carbon, and other elements if additives have been used to extend the catalyst’s life. All these factors have an effect concerning the final recovery at the precious metal refiner.

Another aspect worth mentioning is that once the spent catalysts reach the PM, refiner tests are carried out to determine the carbon and coke content, the moisture content, benzene levels, etc. This information is initially used to see if any thermal reduction is necessary to clean the catalysts of these impurities before proper sampling can take place. However, some savvy process engineers use this impurity information to obtain critical data on their previous run. For example, does the high carbon content in the spent catalyst from this reformer unit indicate that there was a channelling issue? Specific knowledge of reactor operation could be enhanced by examining the condition of the spent catalyst.

Control point three: the reclaim

The turnaround

Proper packaging and weighing and ultimately classifying the spent catalysts for international shipment can be a daunting task – especially for someone who does not handle such things regularly. Many petroleum and petrochemical firms outsource the changeout completely, but a watchful eye is still needed from the ‘inside’ to ensure that all precious metal-containing materials have been fully collected, that the cargo is fully secure, and that hazardous classification has been completed correctly. At the end of the day, losses and liability will hit the operator’s bottom line – not the contractor’s.

Transport and logistics

Taking responsibility for the shipping of hundreds of tons of spent catalysts containing millions of Euros worth of platinum, palladium, or other valuable metals is best left to experts. Sabin International Logistics Corp. (SILC) is responsible for arranging the transportation of customers’ spent process catalysts from virtually any point on Earth to Sabin’s recovery and refining processing facilities. When shipping spent precious metal-bearing catalysts, operators must comply with a labyrinth of domestic and international rules, regulations, permits, and many other roadblocks. As with many other complexities in the arena of international trade, a specialist is often required to help sort this out.

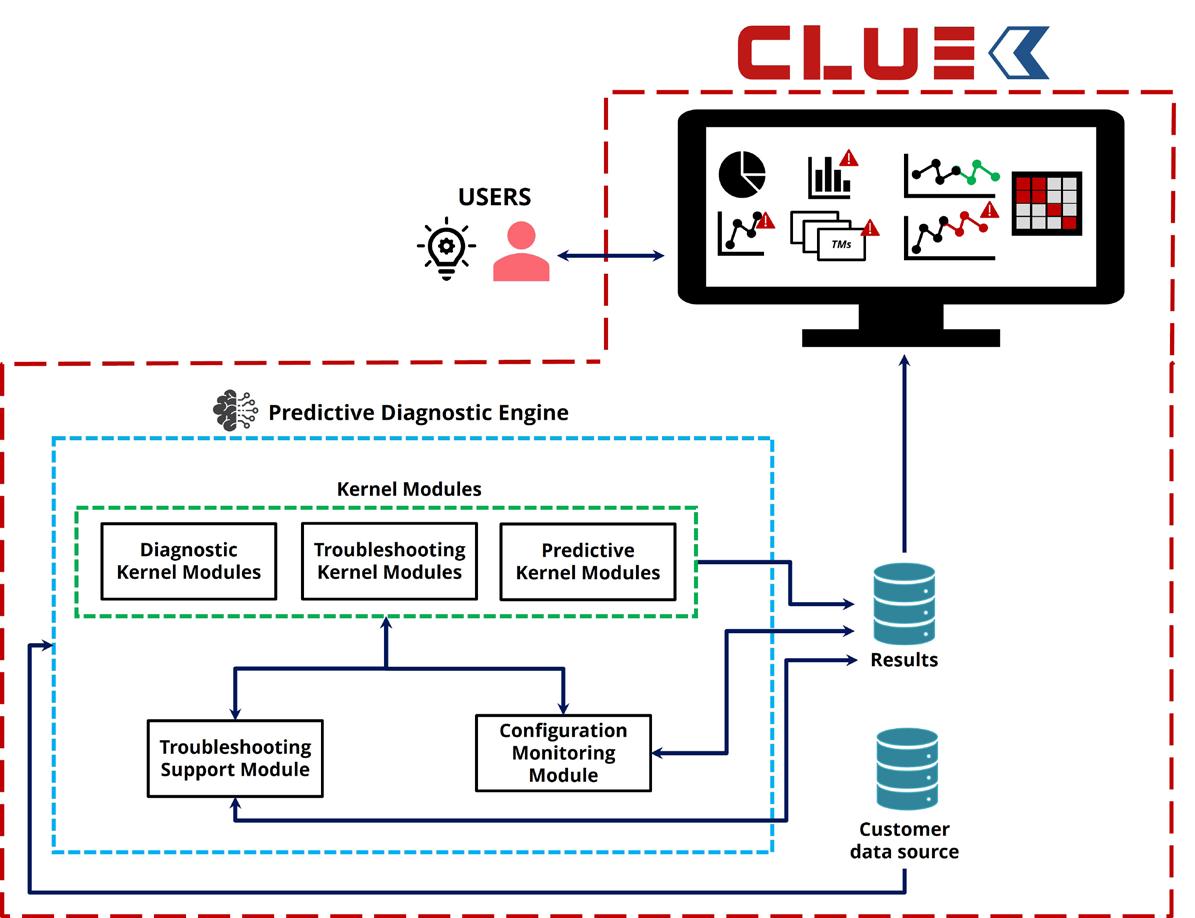

Choosing a PM refiner