Advancing Overpressure Protection

Fully certified portfolio of ASME I & VIII with proven quality and performance, exceeding industry expected standards

Predictive maintenance and diagnostics through our Valve Lifecycle Management suite of tools

Supported by a global network of certified Green Tag™ service centers Safer, cleaner and more efficient flow control.

Table 2 lists the 33 African countries without oil production. Net imports are assumed to equal consumption. These are small to mid-sized markets. Oil demand for these 33 countries totalled approximately 808 500 bpd in 2023, slightly less than Egypt’s consumption. Kenya and Ethiopia are the largest markets among the non-producers. Kenya had a refinery but, for economic reasons, it ceased running crude oil and was converted to a product terminal.

Among the non-producers, several countries are actively pursuing oil development. These include Burundi, Eswatini, Malawi, Namibia, Rwanda, Sierra Leone, and Somalia. In order to

launch new exploration and development projects, governments typically use a mix of strategies such as conducting seismic surveys and geological mapping, hosting licensing rounds to attract international companies, and codifying policies and laws that clarify the process and offer incentives for investment. Governments often use production sharing contracts (PSCs) to balance their need for revenue with the need to make projects attractive to foreign companies.

Demand growth and net imports continue

Africa is a vibrant and growing market. The Energy Institute/BP ‘Statistical Review of World Energy’ notes that African oil demand grew at the robust rate of 1.2%/y during the decade 2013 - 2023,3 despite the sharp downturn caused by the COVID-19 pandemic. In 2013, African oil demand was 3.753 million bpd. This grew at a rapid rate of 1.54%/y between 2013 and 2019, reaching 4.113 million bpd in 2019. The pandemic caused demand to collapse to 3.694 million bpd in 2020, and then recovery brought demand to 4.244 million bpd in 2023. The African Energy Chamber anticipated even more rapid demand growth, forecasting growth rates of 3.1% between 2023 - 2026.4 The events of 2025 are likely to slow some of this growth, but in relative terms, Africa will remain a growth market.

As Table 2 illustrated, at least 33 African countries rely solely upon imports for their fuel needs. Some of these had refineries in the past. Some were small and inefficient, and they could not compete with supplies from external refineries. Kenya’s refinery, for example, was converted to a product import terminal, and the government is considering the site also as a strategic petroleum reserve.

Figure 1 presents the growth in Africa’s refined product imports between 2015 - 2023, as reported by the Energy Institute. In 2023, Africa imported 133 million t of product, while exporting 30 million t. In net terms, imports accounted for 53% of demand.

The continued growth of oil demand in Africa, coupled with a refining sector that is both quantitatively and qualitatively substandard, continues to motivate countries to build new refineries. With imports supplying over half of demand, there is room, only as long as the capacity expansions can compete with foreign imports.

Refining: new planning parameters

Table 1 noted the 15 refining countries in Africa. Some existing refineries process little crude, however. Other countries have had refineries in the past, but these have been closed. As noted, many African refineries are small and relatively unsophisticated. Some were built decades ago in the 1960s, 1970s, and 1980s.

As time passed, infrastructure aged, and the costs of repair, maintenance, and upgrading rose beyond what was rational to produce fuel that no longer met international quality standards. Refining technology advanced remarkably as industrialised nations began to progressively tighten fuel quality standards. Africa was considered one of the last places on earth where refineries were still able to market poorer quality fuels. Indeed, Algeria was the last country in the world to fully phase out the use of leaded gasoline, officially achieving this in July 2021. Sub-Saharan Africa had phased out leaded gasoline by 2006, beating Algeria by 15 years. In contrast, however, Japan fully banned leaded gasoline 20 years prior, in 1986. Africa has lagged behind the rest of the world for decades.

Table 2. African countries without petroleum production

There were many reasons African countries have sought to build refineries, including:

n National sovereignty.

n Strengthening regional influence.

n Fuel supply security.

n Capturing value-added from processing domestic crudes.

n Import substitution.

n Production of exportable commodities.

n Using refineries as anchor sites to stimulate additional economic development.

n Integrating refineries with petrochemical plants.

These reasons still exist, and many African countries have plans to build or expand their refineries. These include Nigeria, Angola, Ghana, Algeria, Uganda, and Libya. Sierra Leone plans to resuscitate its small refinery, closed since the mid-1980s. However, building new refineries or fully modernising older ones with new technologies is costly. African refinery utilisation rates remain anaemic, estimated at approximately 55%. Asia and the Middle East have been completing massive refinery expansion programmes, and they manage to provide high-quality fuel to smaller markets in Africa at a lower cost. Currently, refinery construction projects must pass rigorous economic analysis as well as meeting some or all of the previous listed reasons. Moreover, financing oil refineries has grown more difficult as international banks and lending agencies are pulling away from fossil energy projects in favour of renewable energy projects.

Nigeria’s Dangote project changed the regional market by satisfying multiple goals, by ‘super-sizing,’ by integrating refining with petrochemicals, and by getting there first. At 650 000 bpd, it is Africa’s largest refinery, and one of the largest in the world. The refinery began processing crude in 2024, and it began exporting gasoline and jet fuel by the end of that year. In 2025, it achieved 85% capacity, with plans to reach full capacity in 2026. Nigeria’s fuel prices have gone down, its import bill has fallen, and it is earning export revenue.

Because the region remains import-dependent, and because demand is forecast to continue to grow, the

Dangote project has not derailed other refinery plans. However, it could postpone some that are not as far along as others. Nigeria is also restarting the Port Harcourt and Warri refineries, and it is adding capacity by installing smaller, modular refineries. Ghana is also using small modular refineries to decentralise refining and increase resilience. Also in Ghana, China’s Sentuo Group is building Phase 2 of the Sentuo Oil Refinery. In Angola, the China National Chemical Engineering Co. (CNCEC) is building the 200 000 bpd Lobito refinery. Uganda’s long-awaited 60 000 bpd Hoima refinery is now moving forward after recently signing an implementation agreement an investment company in the UAE.

Pragmatism today, flexibility tomorrow

Africa is such a vast and diverse continent that summarising its petroleum sector is challenging. There are major oil producers and OPEC members with decades of experience in global markets. There are potential producers hoping to find partners to develop resources. There are countries without commercial reserves. There are major refiners, there are countries with modest, antiquated refineries, and there are countries wholly reliant on fuel imports. There are major coastal installations with extensive petroleum infrastructure, contrasting with landlocked areas receiving fuel by truck.

While many African governments hope to expand their upstream and downstream oil industries, most have grown more pragmatic and flexible in their strategies. 21 of the 54 countries produce oil. 33 do not, but many hope to change this. 15 have refineries, though some process crude sporadically if at all. There are continual plans to upgrade, modernise, or build grassroots refineries, but few move forward unless they satisfy multiple objectives, and all must look to the competitive horizon. In recent years, social and environmental goals have been intertwined with energy policies. International agencies favour clean and renewable energy investments rather than fossil energy. However, some African companies believe that natural gas development should be favoured as a medium-term option if it is less costly than renewables.

So much of Africa’s future depends on its young, vibrant population. It is difficult to overstate the importance of protecting public health, education and welfare, fostering innovation, and satisfying domestic demand. The global environment has changed also, and African countries will need to depend more on their own people and their neighbours. Pragmatic, cost-conscious strategies today can ensure flexibility tomorrow.

References

1. hts.usitc.gov

2. www.census.gov

3. https://www.energyinst.org › statistical-review

4. energychamber.org

Figure 1. Africa’s rising product imports, 2015 - 2023 (million t).

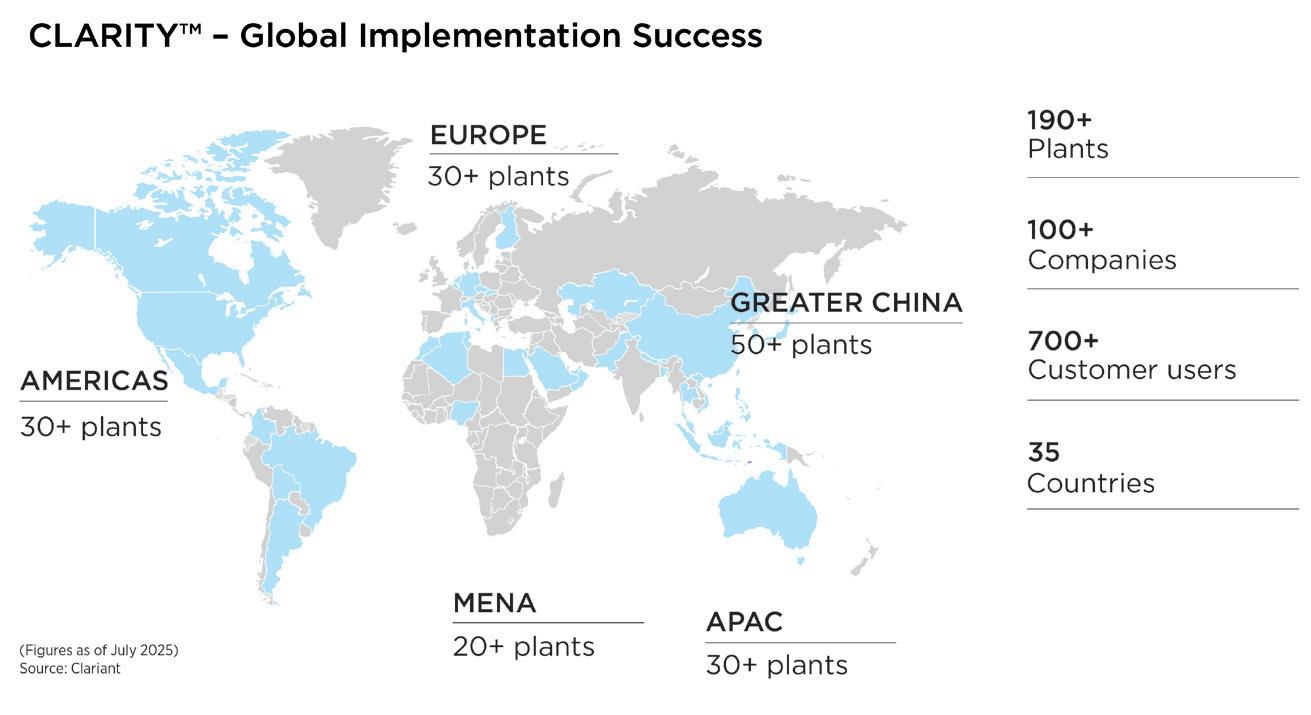

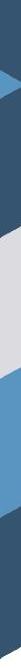

The CLARITY platform, developed by Navigance, emerged from this initiative and now supports over 190 plants globally (Figure 1). This widespread adoption demonstrates the value of automating data sharing, eliminating manual processes prone to human error, and enabling evidence-based, collaborative decision-making.

From data visualisation to operational intelligence

With this robust data foundation established, the focus has shifted toward extracting deeper insights and value from the accumulated information. The initial phase of digitalisation provides secure, customisable dashboards for real-time performance monitoring, creating the necessary infrastructure for more advanced applications. This progression represents a natural evolution from basic data visualisation to operational intelligence.

The next frontier leverages sophisticated AI systems and ML tools to translate raw operational data into actionable insights. These technologies enable automated pattern recognition for catalyst health monitoring,

predictive analytics for performance forecasting, and anomaly detection for risk mitigation. By building upon the standardised data architecture already in place, these advanced capabilities can be deployed more efficiently and effectively, accelerating the path toward fully optimised catalyst operations.

Augmented catalyst monitoring, operation, and optimisation

Building on these foundations, catalyst management has become a primary focus for digital innovation, given its critical role in chemical production. As one of the most influential factors affecting plant efficiency, safety, and sustainability, catalysts present a high-value opportunity for advanced analytics applications.

Clariant’s CLARITY Prime represents this new generation of AI-powered systems, employing sophisticated learning technologies that enable predictive maintenance, enhanced performance insights, and advanced technical support. The platform uses ML to project catalyst performance throughout its lifecycle, allowing production plants to adjust operating parameters proactively, schedule maintenance more effectively, and optimise processes based on data-driven forecasts. This approach represents a significant advancement from traditional monitoring methods, transforming how catalyst performance is managed in chemical operations.

Figure 1. CLARITY’s global implementation as of May 2025 demonstrates widespread adoption across 190+ plants in 35 countries, with strong presence in Greater China (50+ plants) and balanced distribution across other regions. (Source: © Clariant).

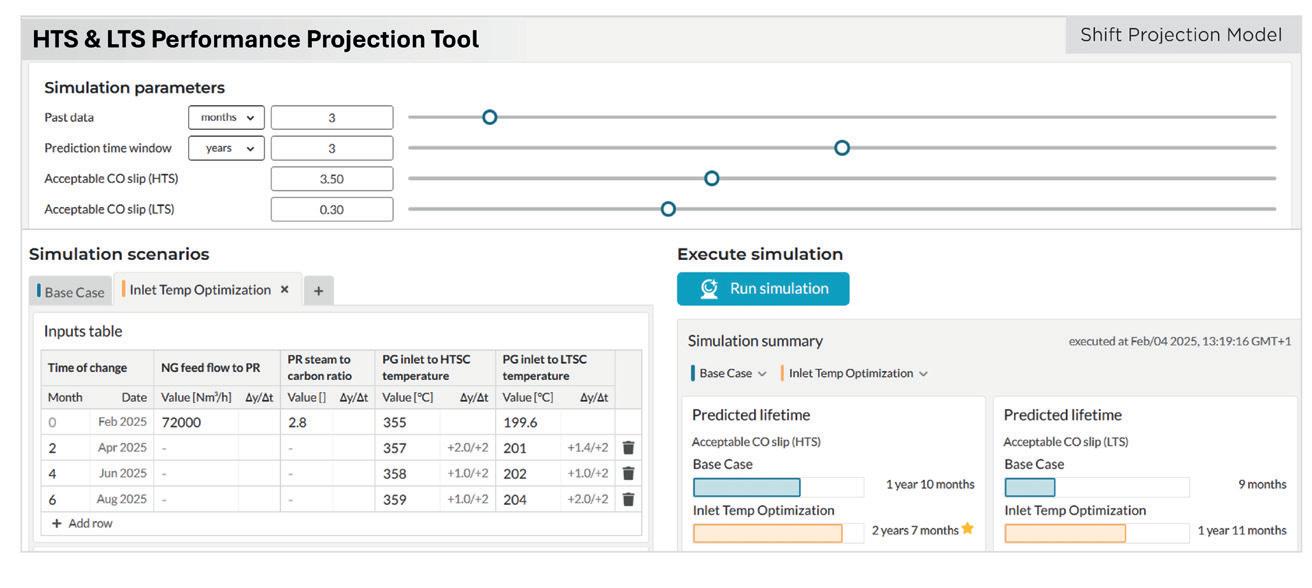

Figure 2. CLARITY Prime dashboard showing the high temperature shift (HTS) & low temperature shift (LTS) catalyst performance projection tool used at Indorama’s ammonia plant. The modelling interface enables data-driven decision-making for catalyst lifecycle management and maintenance planning. (Source: © Clariant and CLARITY).

Case studies: ammonia production

Indorama: enhanced stability and efficiency

CLARITY Prime was first adopted at Indorama in one of its ammonia trains at its world scale fertilizer manufacturing facility in Port Harcourt, Nigeria. The implementation of the technology involved close collaboration with Indorama, whose extensive operational experience and process expertise helped shape it into a user-focused solution tailored to real-world operational needs. The result is an AI-powered service that provides the plant with advanced catalyst monitoring, including automated health alerts based on real-time performance indicators. These alerts enable proactive measures to maintain production stability, while ML-based projections help optimise catalyst performance throughout its lifecycle. Additionally, the service provides direct access to catalyst experts, ensuring immediate guidance and troubleshooting support when needed.

The implementation of the system at the plant has demonstrated tangible benefits across multiple operational areas. In one instance, automated alerts helped Indorama’s team collaborate with technical experts to optimise the high temperature shift (HTS) reactor’s inlet temperature, thus improving carbon monoxide (CO) slip performance. During plant load changes, digital monitoring has enabled precise adjustment of the primary reformer firing to maintain optimal operation. Furthermore, catalyst performance projection has significantly enhanced decision-making for turnaround planning based on economic considerations, allowing for more strategic resource allocation. (Figure 2).

Yara: interactive optimisation raises production

Yara has adopted CLARITY across its worldwide network of ammonia production facilities. One of its plants has transitioned to implement CLARITY Prime, enabling advanced capabilities, including innovative soft sensors for critical measurements, a catalyst lifetime projection tool, and an interactive shift optimiser.

Soft sensors use mathematical models, existing sensor signals, and process knowledge to estimate critical variables when physical instruments encounter errors. Their integration proved particularly valuable at one of Yara’s ammonia plants when a gas chromatograph (GC) experienced technical issues. Due to reliable CO concentration estimates at the low temperature shift (LTS) reactor outlet, GC failure was quickly identified, allowing reliable maintenance of shift reactor performance.

The interactive shift optimiser combines first-principle models with plant-specific ML to enable independent optimisation of shift section performance. For Yara, this has allowed quick optimisation of setpoints after load changes to minimise CO slip and maximise production. Retrospective analysis of operating data has uncovered daily energy savings potential of 20 - 40 GJ at a single plant, which translates to annual cost reductions of €100 000 - 200 000 (Figure 3). Overall, the enhanced availability and accuracy of

measurements have allowed Yara’s plants to safely operate closer to design limits.

Expanding augmented services across chemical processes

Propylene production: advanced monitoring and troubleshooting

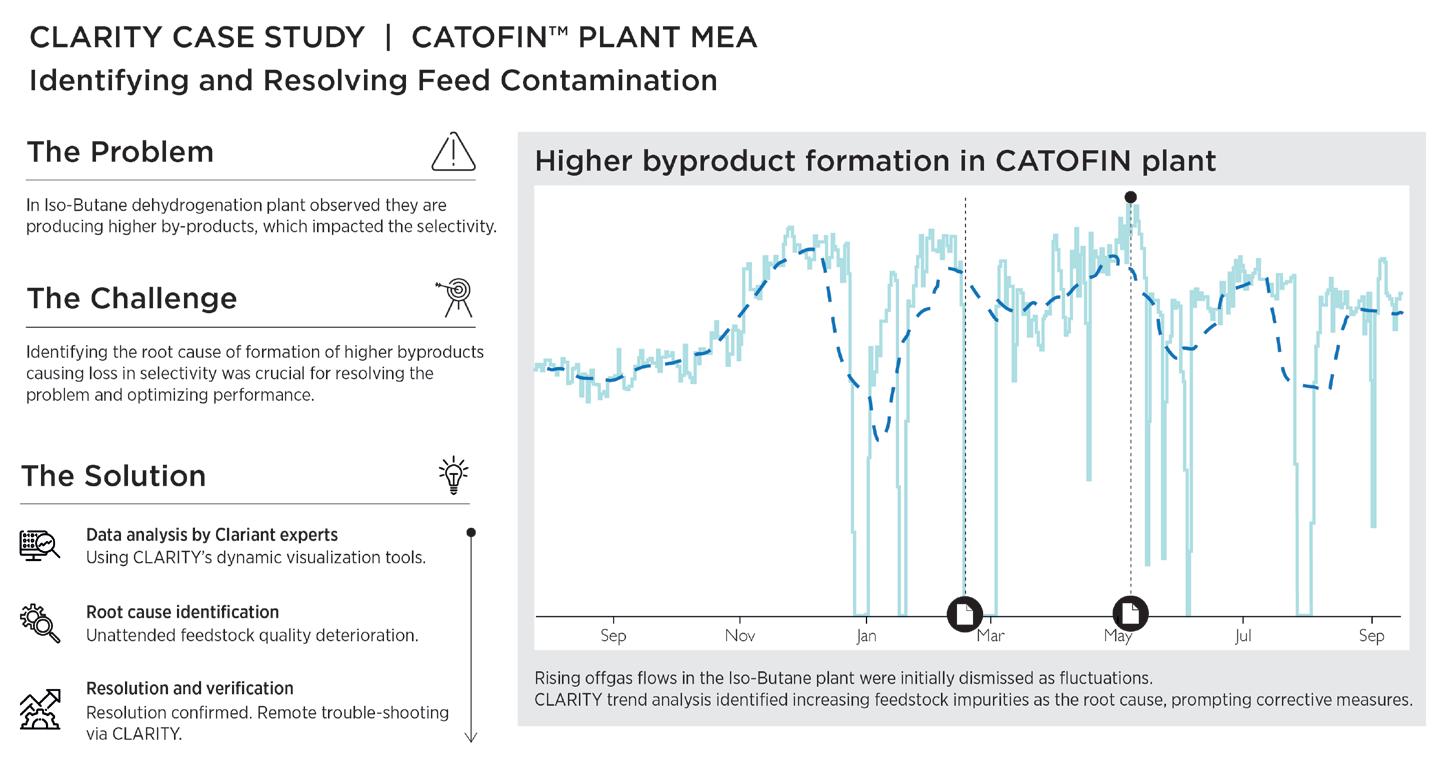

Typical challenges in propylene production include detecting feed contamination, optimising catalyst performance, and maintaining high selectivity. These issues often cause production disruptions and require extensive troubleshooting. CLARITY Prime’s AI-powered digital monitoring can now address these issues through advanced data analysis.

Plants using CATOFINTM technology benefit from continuous catalyst health assessment through pattern recognition algorithms that detect subtle performance shifts before they impact production. Predictive analytics forecast catalyst behaviour and recommend timely

Figure 3. Retrospective analysis showing optimisation potential in Yara’s ammonia plant through intelligent dew point constraint management illustrates how CLARITY Prime’s predictive analytics can optimise carbon monoxide (CO) slip while maintaining safe operating parameters. (Source: © Clariant and CLARITY).

Figure 4. Case study of a CATOFIN plant where CLARITY Prime identified feedstock quality deterioration causing higher by-product formation, enabling remote troubleshooting and resolution through advanced data visualisation and expert analysis. (Source: © Clariant and CLARITY).

interventions, while anomaly detection helps to identify deviations from optimal operating parameters.

A recent case at a CATOFIN dehydrogenation plant demonstrated the value of digital analytics when operators faced increasing by-product formation affecting selectivity (Figure 4). Through sophisticated data analysis and correlation tools, experts remotely identified the root cause as increasing feed contaminants (propene). The platform revealed an 81% correlation between feed impurity levels and increased off-gas flow – an insight conventional monitoring would have missed.

This remote troubleshooting capability enabled a targeted calibration check, confirming no catalyst performance issues and providing a clear path to resolution. The digital approach improved selectivity while eliminating costly on-site investigations and preventing unnecessary catalyst replacement.

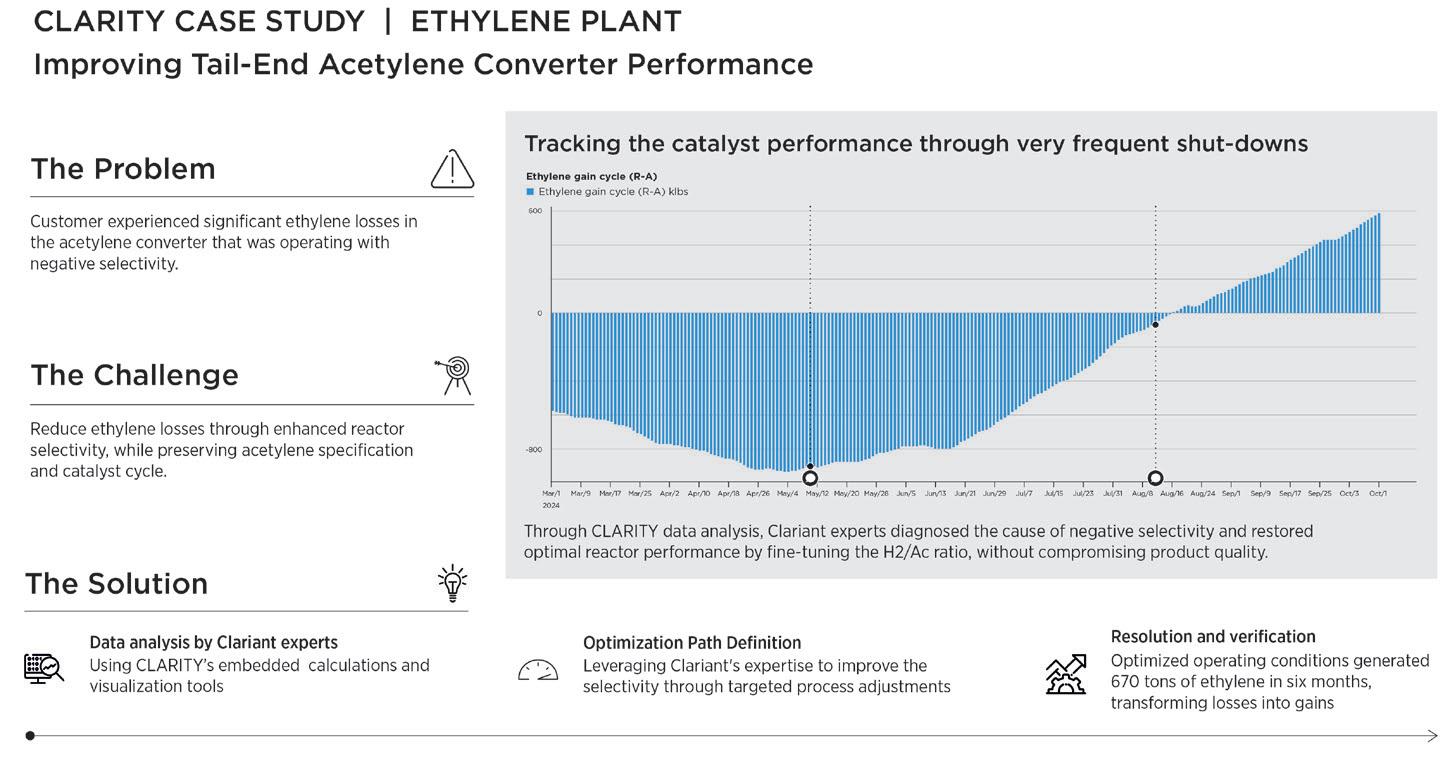

Ethylene production: streamlined steam cracker operation

Managing multiple C2 tail-end selective hydrogenation reactors presents significant challenges for petrochemical engineers due to the complexity of processes. CLARITY Prime addresses these issues through a variety of digital technologies, including upset prediction, operation conditions simulation, virtual hydrogen analysis, performance tracking, and automated alerts.

Upset prediction tools are particularly valuable as they address the persistent challenge of maintaining on-spec performance during feed rate fluctuations, acetylene concentration shifts, or CO instabilities. Using proprietary, reactor-specific modelling, these predictive systems deliver early warnings of potential acetylene leaks and reactor disruptions before they escalate into costly off-spec events.

The operations conditions simulator allows optimisation of reactor performance through scenario modelling. By simulating the effects of inlet temperature fluctuations, hydrogen-to-acetylene ratio changes, and acetylene feed variations on the weighted-average bed temperature,

operators can precisely adjust parameters to ensure consistent acetylene conversion (Figure 5).

Together, these tools help to streamline monitoring, optimise performance, detect potential upsets, and model operational changes prior to implementation. This comprehensive approach supports maximum unit efficiency while maintaining strict quality standards in today’s demanding petrochemical environment.

Conclusion

As the chemical industry continues its digital evolution, AI will play an increasingly central role in catalyst management – one of the most critical levers for plant performance, efficiency, and sustainability. The current implementations already demonstrate how ML can transform plant data into actionable intelligence – from detecting catalyst degradation patterns early to projecting performance under varying operational conditions. This enables a shift from reactive troubleshooting to predictive and prescriptive support.

Looking ahead, the focus will be on continuously evolving these tools based on operational data, learned insights, and direct feedback from users. This iterative development approach ensures that digital solutions remain relevant, practical, and closely aligned with the real needs of plant teams. At the same time, the scope of advanced digital services will expand to additional catalyst applications, broadening the value of these tools across technologies and industries.

As more data becomes standardised and accessible through digital platforms, the potential for cross-plant benchmarking, global performance optimisation, and even generative AI interaction models becomes tangible. Catalyst management will continue to evolve with AI-assisted tools, where engineers can simulate scenarios, receive intelligent recommendations, and make data-backed decisions quickly and with confidence.

By 2030, Clariant aims to provide technical support to customers fully digitally, enabling faster, more targeted collaboration and maximising the benefits of data-driven decision-making. This represents an ongoing transformation in how expertise is delivered, shared, and scaled globally.

Figure 5. Performance improvement case study at an ethylene plant where CLARITY’s embedded calculations and visualisation tools helped optimise the acetylene converter operation, resulting in 670 t of additional ethylene production over six months. (Source: © Clariant and CLARITY).

The vision is clear: AI will not replace human expertise, but it will amplify it, empowering plant teams to navigate complexity with greater precision, reduce operational losses, and extend catalyst lifetimes. This future is already being crafted, driven by the belief that smarter operations lead to greater efficiency and sustainability – benefitting both people and planet.

Acknowledgements

Clariant gratefully acknowledges Indorama and Yara for their close collaboration during the implementation of CLARITY Prime.

Cindy Crow, AVEVA, USA, considers the opportunities and challenges that new technologies, such as artificial intelligence (AI) and generative AI (Gen AI), could have for digital hydrocarbon processing.

The hydrocarbon processing industry has been undergoing significant transformations due to the rapid advancements in digital technologies. Among these advancements, artificial intelligence (AI) and generative AI (Gen AI) have emerged as powerful tools that promise to enhance operational efficiencies, improve decision-making, and drive innovation across the hydrocarbon value chain. While there is considerable optimism regarding the potential of these technologies, many hydrocarbon processing companies struggle to realise sustainable business value. This article explores the dichotomy between the excitement surrounding digital technologies in the

hydrocarbon processing industry and the actual opportunities they present. Furthermore, it highlights five critical elements that must be implemented to effectively harness the full potential of advanced analytics, AI, and Gen AI.

The promise of digital technologies in the hydrocarbon processing industry

The hydrocarbon processing value chain is complex, involving multiple stages across refining, petrochemicals, transportation, storage, and distribution. Each of these stages generates vast amounts of data that, when leveraged effectively, can lead to significant improvements in efficiency, safety, and profitability. The integration of

digital technologies, particularly advanced analytics and AI, holds promise for transforming this data into actionable insights and business value. These are the key areas of opportunity:

n Optimising operations: AI can analyse historical data to predict equipment failures, optimise maintenance schedules, and enhance operational efficiency. For instance, predictive maintenance models can help anticipate equipment failures before they occur, thereby reducing downtime and maintenance costs.

n Improving decision-making: advanced analytics enables real-time monitoring of operations, providing decision-makers with critical insights to make informed choices. This capability is essential in a volatile market where rapid adjustments are necessary to maintain competitiveness.

n Enhancing safety and compliance: AI-driven solutions can identify potential safety hazards and compliance risks by analysing operational data and environmental conditions. This proactive approach helps in mitigating risks and ensures regulatory compliance.

n Driving innovation: Gen AI offers the ability to simulate various scenarios and outcomes, allowing hydrocarbon processing companies to explore innovative solutions for complex challenges. This can lead to new business models, enhanced product offerings, and improved customer experience.

Despite these promising applications, the reality for many hydrocarbon processing companies is that the transition to a digital-first approach has not been as seamless as anticipated. The struggle to translate technological advancements into tangible business value raises questions about the feasibility and implementation of these digital initiatives.

The challenge of delivering sustainable business value

The hydrocarbon processing industry is characterised by its capital-intensive nature and the long-term investments required for infrastructure development. While there is enthusiasm for digital technologies, many companies face

significant challenges in integrating these solutions into their existing operations. Some of the key hurdles include:

n Data silos: many companies operate with disparate systems that create data silos, making it difficult to access and analyse data comprehensively. This fragmentation hampers the ability to derive actionable insights and limits the effectiveness of AI applications.

n Lack of data governance: without proper data governance, organisations struggle to maintain data quality and consistency. Poor data quality can lead to inaccurate insights and undermine the credibility of AI-driven decisions.

n Resistance to change: the adoption of advanced analytics and AI often requires a cultural shift within organisations. Employees may resist changes to established processes, leading to slow adoption and underutilisation of new technologies.

n Skill gaps: the successful implementation of AI and advanced analytics requires a skilled workforce capable of interpreting data and leveraging these technologies effectively. Many hydrocarbon processing companies face challenges in attracting and retaining talent with the necessary expertise.

n Short-term focus: in a sector where short-term profitability is often prioritised, there may be reluctance to invest in long-term digital transformation initiatives. This short-sightedness can hinder the exploration of innovative solutions that could yield significant returns in the future.

Given these challenges, it is essential for hydrocarbon processing companies to adopt a strategic approach to digital transformation that focuses on foundational elements that can enable the effective use of advanced analytics, AI, and Gen AI.

Five critical elements for successful advanced analytics, AI, and Gen AI

To bridge the gap between this excitement and opportunity, hydrocarbon processing companies must implement the following five critical elements to harness the full potential of digital technologies:

Data management framework

A robust data management framework is critical for enabling effective advanced analytics and AI. This encompasses both unstructured and operational data. Hydrocarbon processing companies should establish a centralised data repository that integrates data from various sources, ensuring that it is accessible for analysis. The quality of the data must be a primary focus.

Figure 1. Strategic alignment and operational excellence.

Key considerations:

n Implement data integration tools that can consolidate data from different systems.

n Establish data standards and protocols to ensure consistency in data collection and storage.

n Create a data architecture that supports scalability and adaptability as new data sources emerge.

Governance and leadership with subject matter expert (SME) system of record ownership

Effective governance and leadership are essential for ensuring accountability and ownership of data systems. Companies must implement systems of record that are asset-based and encompass operational data, maintenance data, engineering data, geospatial data, and financial data.

Key considerations:

n Define clear roles and responsibilities for data ownership at various organisational levels. It is best to have a SME provide the leadership for their respective areas of domain expertise.

n Establish a governance framework that promotes accountability and continuous improvement in data management practices.

n Ensure alignment between systems of record and business objectives to enhance decision-making.

Layers of bidirectional integrated analytics and visualisation

Developing a comprehensive analytics framework is crucial for leveraging operational data quality. This framework should include the following components:

n Basic object model: tags and associated metadata should be linked to an asset using asset class templates, providing a structured approach to data organisation.

n Descriptive analytics: assets and their associated attributes should describe the asset characteristics, enabling deeper insights into performance and behaviour.

n Diagnostic analytics: this layer involves adding calculations, event frames, and notifications to facilitate proactive, exception-based operations. Key features should include the ability to investigate events, develop expressions, create event triggers, and back cast through high-fidelity historical data to find events and determine causality.

n Simple predictive analytics: through utilising formulaic, first-principal, or rule-based expressions, organisations should be able to predict future performance while comparing planned vs actual outcomes with notifications.

n Prescriptive analytics: more advanced analytics leveraging AI and machine learning (ML) should be employed to provide guidance, effectively replicating the insights of SMEs.

n AI and learning: AI and Gen AI, along with advanced large learning models (LLMs), should be utilised to predict and respond accordingly to optimise hydrocarbon processing operations.

Redefinition of the partnership between OT and IT

An effective digital transformation requires a redefined partnership between operational technology (OT) and information technology (IT). This partnership should clarify roles and responsibilities, ensuring that both domains collaborate effectively.

Key considerations:

n Foster a collaborative environment where IT and OT teams work together to leverage the strengths of both disciplines.

n Enable SMEs to actively participate in the development and implementation of AI and Gen AI solutions.

n Align the goals of IT and OT with the overall business strategy to ensure that digital initiatives support operational excellence.

Alignment between business strategy, operational excellence, and digital strategy

Successful digital transformation hinges on the alignment of business strategy, operational excellence, and digital strategy. Hydrocarbon processing companies must define clear objectives and metrics to measure the success of their digital initiatives. This key concept is illustrated in Figure 1.

Key considerations:

n Develop a digital transformation roadmap that outlines the steps needed to achieve desired outcomes.

n Regularly assess and adjust strategies based on evolving market conditions and technological advancements.

n Engage stakeholders at all levels to ensure alignment and buy-in for digital initiatives, fostering a culture of collaboration and continuous improvement.

Conclusion

The hydrocarbon processing industry stands at a crossroads, with the potential to leverage digital technologies like AI and Gen AI for transformative growth. While there is significant excitement and optimism surrounding these advancements, the reality is that many companies face challenges in delivering sustainable business value. By focusing on foundational elements such as strategic data management, governance, integrated analytics, collaboration between OT and IT, and alignment with business objectives, companies can effectively harness the opportunities presented by digital technologies. Ultimately, the success of the hydrocarbon processing sector in the digital age will depend on its ability to embrace these changes and adapt to the evolving landscape of energy production and consumption.

Note

• This article is published with contributions from Craig Harclerode while at AVEVA.

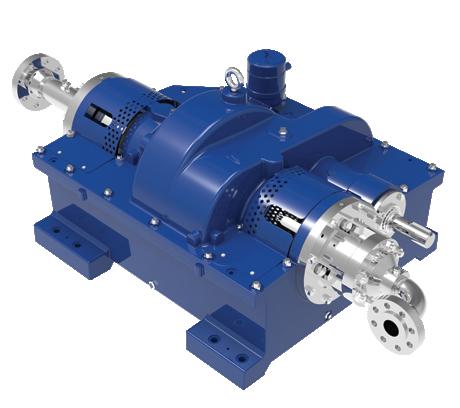

Shane Harvey, Justin Iwinski, and Mario Valdivieso, Ebara Elliott Energy, USA, discuss important considerations in making the switch to electric compressor drivers in ethylene cracker applications.

Ethylene compression trains (Figure 1) have traditionally been steam-turbine driven because of high power demand and the availability of steam generated from the cracking process. Global trends to curtail emissions and increase efficiency have highlighted additional benefits of electrification (motorisation) of critical processes, including ease of maintenance and the ability to recover power from the generated steam. But reaping the benefits is not as simple as dropping an electric motor into a functional process. Selecting the best driver configuration requires careful evaluation of the process requirements, often necessitating significant changes to the train startup and operating philosophy.

Typical compression services in ethylene production include multistage iso-cooled arrangements for charge gas and cracked gas, and sideload refrigeration arrangements for ethylene, propylene, and propane, each with unique process characteristics. Simulation tools can be used to ensure that a motor is sized properly for process conditions and operational expectations, and to evaluate the torque requirements during acceleration for various electrical configurations. These configurations include direct-on-line (DOL), variable frequency drive (VFD), or soft-start current limiting devices. A major hurdle for effective analysis is understanding how certain parameters affect the starting load torque of a compressor. This article will identify the critical parameters, and demonstrate the sensitivity of each parameter on the simulation output.

Critical startup simulation parameters

The two categories of parameters needed to accurately determine the compressor gas load and required acceleration torque are compressor design details and loop configuration details. Compressor design details are available from the original equipment manufacturer (OEM), and the loop configuration details can be obtained from the site and/or operations.

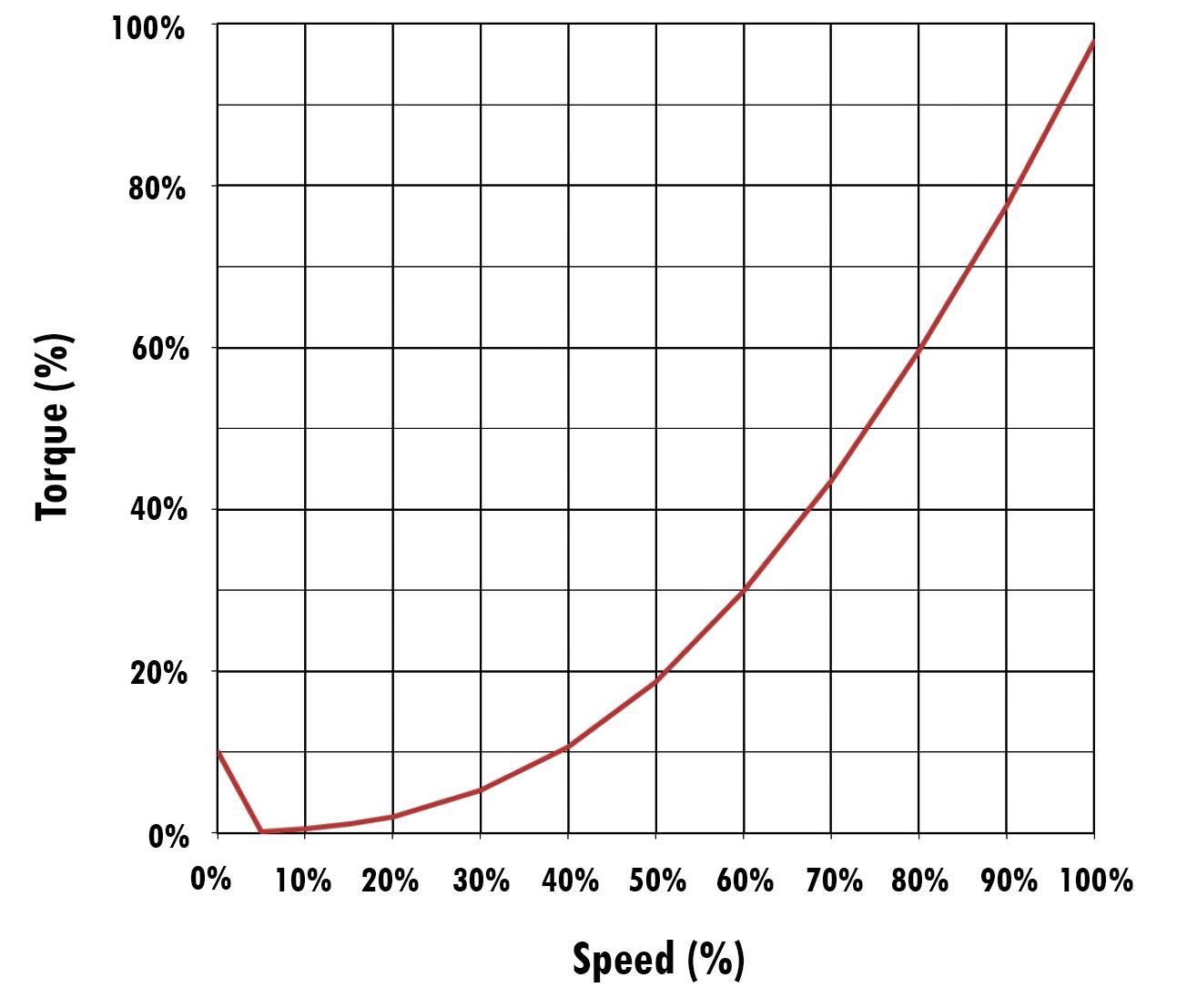

The parameters are used with simulation tools to develop a compressor load curve, also known as a speed vs torque curve, which illustrates the torque required from the motor to accelerate the compressor through the speed range to a point where performance control can be enabled (Figure 2). This speed may be the low end of the continuous operation speed range for a variable speed drive, or it may be motor rated speed in the case of a fixed speed drive. The relationship of torque and speed is a primary gauge for evaluating parameter sensitivity.

Compressor design details

Compressor design details include performance information, which maps the gas conditions at the inlet to the expected discharge conditions, given the head/efficiency curves at a given speed. The power absorbed by the compressor is also derived from the performance information.

Loop configuration details

Loop configuration details relate to parameters external to the compressor, such as auxiliary equipment datasheets, piping and instrumentation diagrams (P&IDs), process licensor documentation, or operator experience/site trend data. Assumptions related to the motor operation, such as acceleration time/schedule and available torque, are included in

the configuration details. When switching from a steam turbine to an electric motor driver, these assumptions will be entirely new. Skillful application of the starting assumptions can result in efficient torque utilisation from the motor.

Parameter startup torque sensitivity

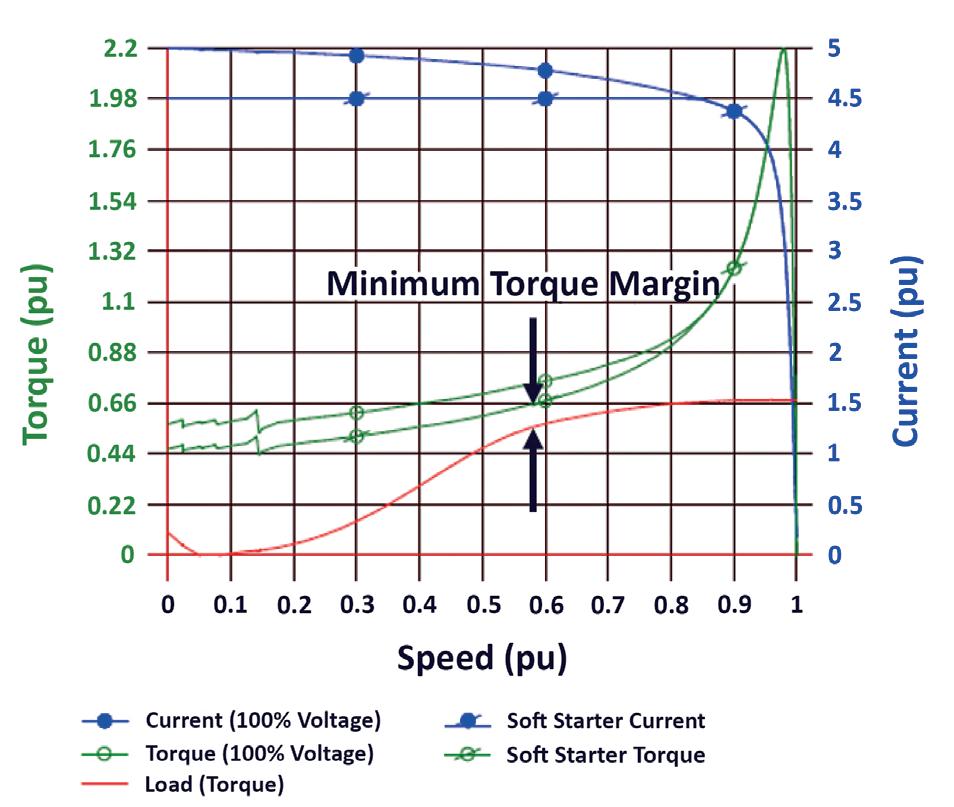

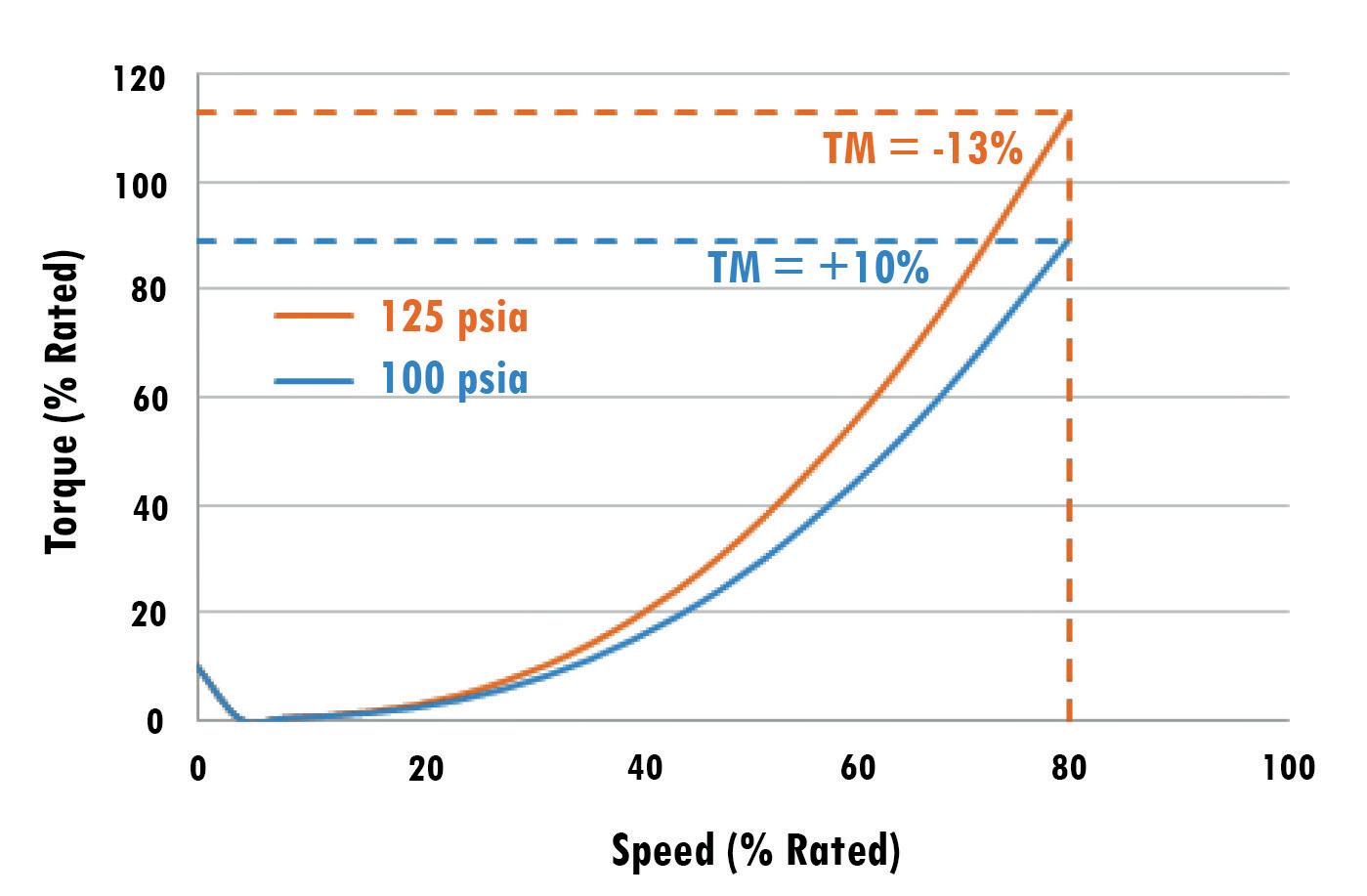

The advantages of each motor type can be quantified in a startup simulation where the relevant parameters may be amplified or muted by the drive type selection. The primary value used to compare torque between cases is the torque margin (TM), defined as the difference between available torque from the motor and compressor load torque, expressed as a percentage of the available motor torque.

TM (%) = ττmotor - ττ load) / ττmotor

In accordance with American Petroleum Institute (API) specifications, conventional sizing of an electric driver is based on 110% of the highest power required for any of the

specified operating conditions. API further specifies that a 10% torque margin must be maintained between the driven equipment load torque and the motor developed torque during acceleration. Evaluation of this margin is especially critical on DOL configurations where the motor torque capability, already limited in the mid-speed range, must consider a potential voltage drop to 80% rated voltage. Soft-start capability must consider a current-limited motor torque curve. Despite these limitations, the TM during startup should not be permitted to influence the motor rating because of the potential for a negative impact to operating efficiency. Therefore, it is optimal to find a starting sequence that fits within the power constraints of a conventionally sized motor.

Figure 3 illustrates a soft-start motor capability curve and simulated compressor load curve, with torque availability reduced through a current-limiting soft-start device. Despite lowering motor torque availability, limiting current may also benefit the starting load torque profile by enabling a longer acceleration time, thus minimising the acceleration torque required.

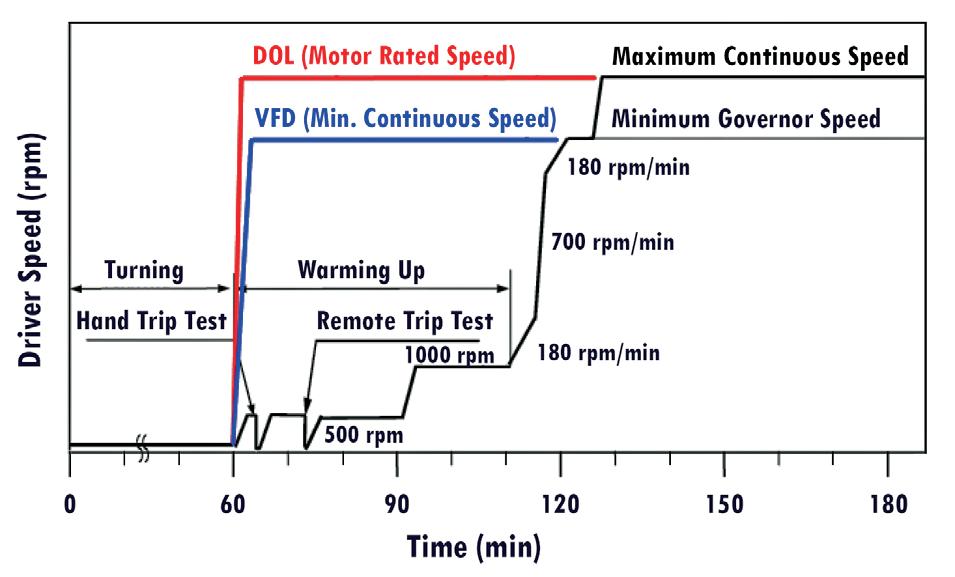

Speed and acceleration schedule

A steam turbine acceleration schedule may exceed an hour in duration. VFD acceleration time is adjustable, generally several minutes in duration. DOL acceleration must be very fast due to the heating associated with the large current draw; overheating risk can manifest in less than 30 seconds. A notational overlay on the steam turbine acceleration schedule highlights the time scale differences (Figure 4).

In terms of torque, the slower acceleration of a VFD and the ability to limit the acceleration to the minimum continuous speed of the compressor is a distinct advantage over DOL. When developing the electric motor startup sequence for the compressor, the final speed and ramp rate can be manipulated to minimise the torque demands of the motor. Figure 5 illustrates a comparison of a VFD acceleration for a single-section mixed refrigerant compressor, assuming a 120-second linear ramp with equivalent starting conditions. The only difference is the final speed: 80% and 100% rated speed.

Initial starting conditions (pressure/temperature)

Because compressor load is proportional to inlet pressure, initial conditions can be a major contributor to startup load torque for ethylene production services, especially in refrigeration loops that can see vapour pressures much higher than compressor design. Using the example from Figure 5 and assuming a fixed-speed application, it is not practical to size the motor to 165% of the conventional rating to accommodate acceleration to 100% speed. Instead, the starting conditions can be manipulated to manage torque.

Figure 6 illustrates a comparison of a VFD acceleration for a single-section mixed refrigerant compressor, assuming a 120-second linear ramp to 80% rated speed with different starting loop pressures. This parameter may be difficult to change because it is largely based on gas inventory, loop volumes, and process/ambient temperatures. In any case,

Figure 1. Electric drive double-flow large frame compressor typical for stage 1 crack gas service.

Figure 2. Sample speed vs torque curve.

the startup conditions must be specified for accurate torque modelling.

Throttle valve effects (process control method)

A VFD configuration can mimic the speed variation of a turbine driver, but a DOL fixed-speed configuration may need some other type of process control. A suction throttling valve (STV) can provide a means of process control while also providing a mechanism to reduce the

compressor inlet pressure during startup. This method can be employed on VFD configurations specifically for the purpose of reducing starting torque when accelerating with very high system loop pressures.

Downstream pressure

The system resistance downstream of the compressor is another factor when evaluating startup load torque. If the compressor must be started against a closed discharge block valve, there will be no opportunity for mass to leave the loop during acceleration. However, if the conditions downstream support mass flow out of the compression loop to a downstream condenser/accumulator; for example, a slow acceleration via VFD can move mass out of the compressor loop, ultimately reducing the inlet pressure when the compressor reaches higher speed ranges.

System volumes (suction/sideload/discharge)

System volumes directly influence the pressure rate of change around the compressor loop. A large suction volume will resist changes in pressure, resulting in higher load torque for a given initial vapour pressure. Likewise, a larger discharge volume may allow a more torque-friendly redistribution of mass throughout the system, enabling an effective pressure drop at the compressor inlet.

This volume effect is why locating an STV near to the compressor inlet results in a more favourable pressure drop and reduced torque load. If an STV is placed upstream of the suction drum/recycle tie-in, it will be ineffective at reducing the pressure at the inlet due to the large trapped volume. Recovering the torque caused by a poorly placed STV may take a significant pressure reduction via flare or other means.

System inertia (gear ratio effects)

Electrification efforts may have a significant impact on compressor train inertia due to the relative increase in rotating mass of a motor rotor over a turbine. The system inertia contributes to the acceleration component of the load torque profile. A motor vendor will consider the compressor gas load plus the inertia of all rotating components (motor, couplings, gear, compressor) when evaluating if the system will reach the desired speed before motor thermal limitations come into play.

Another important concept to consider when switching from a direct coupled steam turbine to a motor-gear drive is the effect of a speed increasing gear on the train inertia. Reflecting the inertia of high-speed components to the low-speed shaft introduces a multiplier equal to the gear ratio squared, effectively increasing the total string inertia at the motor shaft. Preserving torque margin by other means discussed in this article will ensure that there is adequate acceleration torque available for the increased inertia, a concern that is nearly negligible in steam turbine drives.

Other considerations

Beyond the increased starting torque associated with faster acceleration schedules, other torque related effects can lead to compressor design implications. For example, the criteria for shaft end sizing are very different between

Figure 4. Steam turbine acceleration schedule with VFD motor and DOL motor overlay.

Figure 5. Torque comparison, varied final speed (VFD).

Figure 3. Induction motor capability curve (soft-starter) and compressor load curve.

Trust Ebara Elliott Energy for prompt, professional single-source on-site turbomachinery services.

Ebara Elliott Energy’s (EEE) field service organization offers trustworthy, on-site turbomachinery services no matter where equipment and operations are located. Our turnkey approach includes experienced personnel, complete tooling, and project planning and scheduling regardless of system size, process application, or equipment manufacturer. EEE field service crews are supported by our worldwide network of service centers.

Learn more about our range of service capabilities at elliott-turbo.com.

Trusted Solutions for a Sustainable Future

steam turbine and motor drive applications. Analysis for motor drives must consider steady-state and transient torsional excitations, as well as short circuit air gap torque on the order of 3 to 15 times the full motor rated torque. When switching from a steam turbine to an electric motor driver, it is likely that a larger compressor shaft end will be required.

Increasing the compressor shaft end size can force an increase in the size of the journal bearings, which are limited to the size of the bearing housing. Once the largest shaft end/bearing journal combination is exceeded, the only option on the compressor design is to go to the next compressor frame size. Larger shaft end sizes add to the overhung weight of the compressor, which can result in

rotordynamic complications. Changes to the compressor frame size can also affect the design head, efficiency, and overall performance of the compressor.

Various types of shutdown/startup scenarios that may be encountered should be shared with the simulation vendor. Air run dry out or nitrogen purge operations can see molecular weights that are different from design, resulting in varying flow rates and load torques. Condition variations with respect to cold/hot restarts, seasonal process gas changes, or seasonal ambient temperatures can also influence the speed vs torque curve. A comprehensive startup analysis should include these effects so that the highest load torque case is captured.

Summary

Dynamic simulation tools provide a method to evaluate the configuration and conditions surrounding a centrifugal compressor in order to optimise the startup sequence for efficient motor sizing. The optimisation process can include adjustments to a variety of configuration parameters that play a role in the dynamic behaviour of the system.

Simulations also provide the flexibility to experiment with alternate configurations/sequences in order to meet the existing plant electrical conditions, or to identify the scope of utility upgrades that may be necessary to support an electrification initiative. Understanding which parameters are fixed and which may be varied will help identify where a successful startup configuration can be engineered.

Figure 6. Torque comparison, varied initial pressure.

Oskar Schnabel and Markus Sauerborn, Atlas Copco Energas GmbH, Gas and Process Division, demonstrate how petrochemical companies can maximise gas process efficiency with compander technology.

The chemical and petrochemical industries are major sources of industrial CO2 emissions, which makes reaching carbon neutrality a major challenge for the sector. Nevertheless, almost all of the world’s leading chemical and petrochemical companies have committed to achieving net zero by 2050 and have developed their own decarbonisation roadmaps to achieve this goal.

Among the many different approaches formulated in these roadmaps, some key technologies and strategies

have become apparent; which include the use of green or blue hydrogen, carbon capture, utilisation, and storage (CCUS), the electrification of operations, the use of renewable energy, and improving energy efficiency. Recovering and converting all sources of waste energy into useful outputs significantly improves the energy efficiency of many operations. The advantage of this approach is that companies can reduce their energy consumption without the need to change core processes but rather tap into existing energy streams and reuse them.

A major focus in this regard is the recovery of waste heat, which is typically the largest form of energy lost in chemical and petrochemical plants. Key to recovering and reusing waste heat is compressor and expander technology,

key components of not only industrial heat pumps and mechanical vapour recompression (MVR), but also in the creation of liquid hydrogen, and in CCUS projects.

Recovering waste heat

The method of recovering waste heat depends on its temperature level. In many gas processes, waste energy is contained in a pressurised, hot waste gas stream. In this case, waste heat and also the pressure energy can be recovered by the application of an expander that has been used in the industry for a long time.

Recovery can be broadly categorised under two concepts:

n Converting the mechanical energy of the expander to pressure energy, where the expander is connected to a compressor stage.

n The expander is connected to a generator and the mechanical energy is converted to electricity.

Alternatively, a combination of the two can also be deployed. The expander is connected to a motor-generator compressor train, and either the expander reduces the load on the motor, or it runs the entire train, generating electricity and driving the compressor at the same time.

Gas expansion in radial inflow turboexpanders

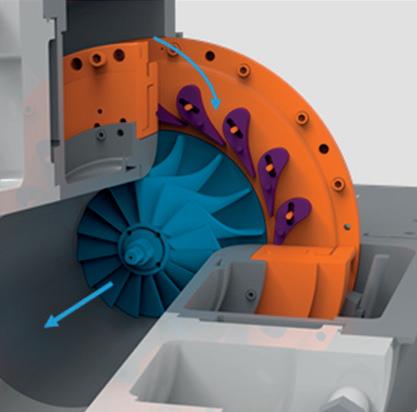

Radial inflow turboexpander technology refers to the flow direction through the impeller/wheel, with capacity control via adjustable inlet guide vanes (IGVs) as seen in Figure 1. IGVs ensure efficiency remains stable at a high level over the turndown range. After entering the turbine housing, the gas flow is accelerated through the IGVs with Mach numbers of up to 1.4 before the impeller inlet. During acceleration through the IGVs, the static pressure decreases, resulting in a static enthalpy drop of around 50%.

The accelerated gas then flows through the impeller, where energy and momentum are transferred from the gas to the impeller and thus to the turbine shaft. The advantage of the radial inflow is its compact and robust structure at high-stage efficiency. The maximum possible enthalpy drop per expansion stage can be up to 220 kJ/kg. The minimum pressure ratio should be equivalent to an enthalpy drop no smaller than 30 kJ/kg. It is important to note that there does not have to be a high-pressure ratio: in many cases, most of the energy comes from the temperature and not from the pressure, and increasing the temperature has quite a large impact on the recoverable energy.

Typical applications of separate turboexpanderscompressor trains are hydrogen and natural gas liquefaction, cryogenic hydrocarbon separation in ethylene or propylene production, or air separation processes. Expanders are also employed in pressure let-down applications, where the gas pressure from a pipeline needs to be reduced, and the energy recovered and converted to electrical energy.

Compander technology

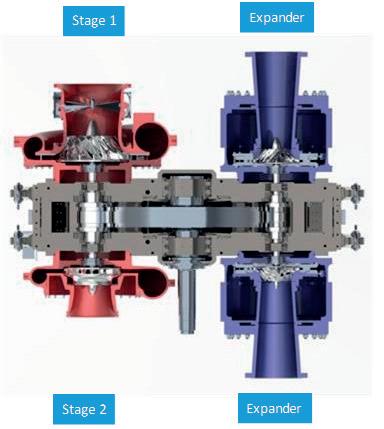

Derived from the words ‘compressor’ and ‘expander’, companders integrate both technologies in the same unit.

Figure 1. Expansion in expander stage.

Figure 2. Compander.

Figure 3. 6 Stage GT-Series compressor.

This integration relies on integrally geared centrifugal compressor technology, which provides the design flexibility to realise the integration of the turboexpander into a centrifugal compressor (see Figure 2).

Characteristic of integrally geared design is the overhung impellers on the pinion shaft ends, which means each pinion can bear one or two opposing compressor or one or two opposing expander stages or the combination of both. Each pinion is connected to the bull gear via a dedicated gear toothing, so that the speed and power can be different for each rotor (a rotor consists of the pinion and impeller) as shown in Figure 3.

The power recovered from the expander stages is mechanically delivered to the compressor stages or – in the case of two expanders running back-to-back on the same pinion – diverted to the bull gear. In this case the expander pinion is an actual driver. The main driver just supplies the balancing power which cannot be covered by the expanders. With direct mechanical transmission, companders efficiently use the energy recovered on the turboexpander side to power the compressor’s energy cycle, which provides major savings in compressor energy consumption.

With both compressor and expander stages on a single gearbox, companders feature just one oil system, one control system, and one seal-gas panel – enabling a faster installation time and a smaller footprint. After all, when it comes to the decision on whether or not to utilise an expander for energy recovery purposes, it is all about investment and operating costs vs energy recovered. With the reduced installation of the compander solution compared to a free-standing expander generator train, this ratio is tipped to the positive side.

Case studies

Hydrogen peroxide to propylene oxide (HPPO) plant

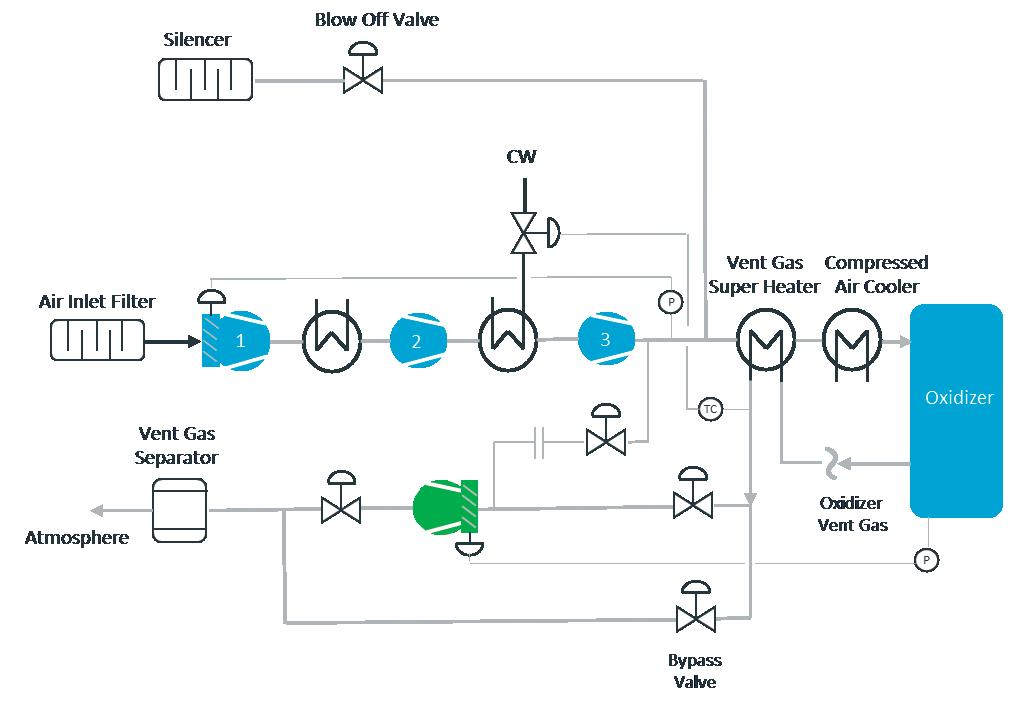

Hydrogen peroxide is required as an oxidation agent to produce propylene oxide in an HPPO plant. The hydrogen peroxide is created from hydrogen and atmospheric oxygen in the same plant. Ambient air is compressed in four stages to around 10 bars and then feeds to the oxidiser column where the hydrogenated hydrogen oxidises to hydrogen peroxide. After the reaction, the spent air is routed to the expander where the energy contained in the spent air stream is recovered and then passed on to the solvent recovery unit. The spent air enters the expander at 150˚C and 8 bara and leaves at around 10˚C and 1.35 bara. Due to the high-volume flow, the flow is split and expanded into two expander stages running in parallel. The expander stages run on the same pinion back-to-back, so the pinion is actually a driver of the bull gear. The compressor

stage 1 and 2 and stages 3 and 4 run back-to-back on two separate pinions driven by the bull gear (see Figure 4).

The enthalpy of the spent gas leaving the oxidation column is increased by the spent gas pre-heater using the hot discharge air stream of the compressor. A spent gas heater is installed to ensure the temperature of the spent gas entering the expander is sufficient to maintain the expander discharge temperature above 0°C to avoid freezing of constituents.

As a result of the expander integration in this particular case, the air compressor stages consume around 12.5 MW, compressing a volume flow of around 142 000 m3/h, and the two turbines combined recover around 4.5 MW, which is approximately 35% of the compressor power.

Figure 4. Compander in HPPO.

Figure 5. Compander on a phenol process.

Compander in a phenol process

Phenol is produced by the oxidisation of cumene, using ambient air as a source of oxide. The compander feeds ambient air compressed in three stages to approximately 8 bar into an oxidiser. After the reaction, the spent air (now 96% nitrogen) leaves the oxidiser column and is routed to the expander stage before it is sent to a vent gas separator and eventually to atmosphere. Before entering the expander, the enthalpy of the spent air is increased by the super heater, which transfers enthalpy from the compressor discharge air flow to the spent air flow. The energy recovered by the turbines would otherwise be lost in the after cooler since the compressed air going into the oxidiser needs to be cooled down (see Figure 5). The inlet temperature of the expander is around 90˚C at approximately 4 bar and expands to spent air stream down to 1.5 bar.

The main driver is an electric motor. The expander stage runs together with the first compressor stage on the same pinion. Compressor stage 2 and 3 run back-to-back on a separate pinion. To ensure that the discharge temperature of the expander remains above 0˚C to avoid freezing of constituents in the spent gas, the inlet temperature to the expander needs to be controlled. This is realised by controlling the discharge temperature of the air compressor by regulating the intercooler duty between stage two and stage three. The reduced cooling duty increases the compressor power consumption, but the additional power is offset by the energy recovered by the turbine.

The compressor requires around 6.2 MW for the compression and the expander recovers around 1.1 MW, which means the integration of the expanders leads to energy savings of around 18%.

Nitric acid

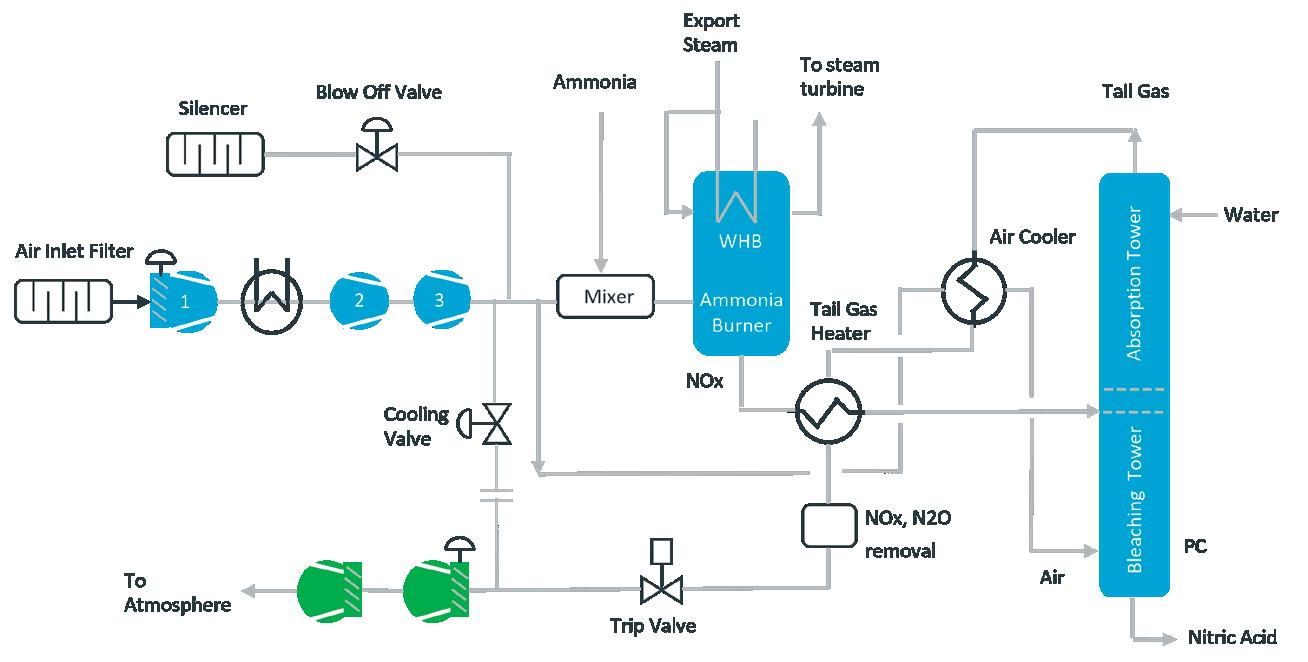

In the catalytic oxidation of ammonia, nitrogen monoxide is generated and further oxidised to nitrogen dioxide, which is then absorbed in water, forming nitric acid. During this process, the oxide for the reaction comes from ambient air.

The compressor compresses the air from ambient to 10.3 bar and leaves the compressor at 206˚C. The inlet temperature to the first expander stage is 375˚C at a

pressure of 6.3 bar and expanding to ambient pressure. There are two expander stages which run together with the compressor stages on separate pinions.

The enthalpy of the tail gas to the expander is increased by the air cooler and the tail gas heater, recovering waste heat from two sources: the compression process and the NOX stream from the ammonia burner (see Figure 6).

The high temperature of the tail gas has several implications: an expansion in one stage is not possible since the enthalpy drop is directly proportional to the required speed of the impeller, which would exceed the mechanical limits in this case. Because of the high enthalpy drop, the expansion must be done in series in two stages. In addition, the expander stages need to be separated from the gearbox to avoid excessive heat input into the gearbox. This means that the expander housings have their own suspension and insulating plates, separate from the expander housings from the gearbox.

Further design elements include a special design for the impeller shaft connection in order to withstand the high temperatures, while the turbine casings are made from chromium-nickle (CrNi) stainless steel due to the possible formation of acid in condensate.

In this case study, the compressor consumes 4.7 MW and the two turbines together deliver 2.7 MW, resulting in 57% of the compressor power being recovered.

Conclusion

Integrally geared compander technology provides great flexibility in design and in the operation of gas compression and expander processes in one unit. As the three case studies highlight, integrating expander stages into the compressor unit allows the direct and efficient energy recovery of waste heat and pressure energy from expendable gas streams. This improves overall gas efficiency in the compression-expansion process.

With industrial CO2 emissions high on the agenda across the chemical and petrochemical industry, reaching carbon neutrality is an ongoing challenge. Maximising gas compression process efficiency, with the utilisation of companders, helps improve overall plant efficiency and reduce CO2 emissions.

Figure 6. Compander in nitric acid.

Joe Salinas, Global Compression Services, USA, highlights how a customised approach to piston service and upgrades can provide refineries with time-saving solutions, improved value, and greater convenience.

Packing cases play a critical role in compressor operation, sealing the compressor cylinder that carries gas through the system. However, many original equipment manufacturer (OEM) packing case designs are 40 - 50 years old, which may limit their efficiency and environmental compliance. To address this, Global Compression Services (GCS) is involved in the manufacturing and supply of both OEM and aftermarket parts, components, and engine accessories for reciprocating compressors and ignition and control systems, and is developing a zero emission packing case, designed to help refineries meet modern environmental regulations. When a packing case vents to the atmosphere, upgrading to a steel packing case and installing a specialised zero emission packing to prevent any gas leakage is preferable.

Traditionally, packing cases are made from cast iron, a porous material that allows process gases like hydrogen and methane to permeate the packing case, complicating reconditioning efforts.

Replacing cast iron packing cases with cases made from 1045 or 4140 steel, which are machine-lapped to a precise 7 - 8 RMS finish, creates a highly smooth, sealed surface that effectively prevents gas leakage.

Unlike cast iron, which can ‘sweat’ or release retained gas due to its porosity, steel cases with a perfect RMS finish provide a robust barrier, preventing gas from escaping into the atmosphere. This not only enhances the packing case’s durability but also contributes to zero emission standards, supporting refineries in achieving stricter environmental compliance.

Unique piston design

In January 2023, two custom-designed 27.75 in. pistons were delivered to a refinery’s reciprocating compressor in Corpus Christi, Texas, US. These featured a unique three-piece configuration with two aluminium halves and a steel centre section. Custom-built for the refinery’s specific operational requirements, each piston took approximately six to eight weeks to manufacture. Produced on CNC machines, the pistons achieved high precision and efficiency, allowing for reduced labour and quicker turnaround times.

Originally, the compressor had hollow cast pistons, which were prone to failure under the extreme temperatures (200 - 500˚F) encountered in refinery operations. A solid piston design with a steel core and aluminium ends can withstand such temperature fluctuations without failure. This solid design provides greater durability and reduces the risk of compressor shutdowns at high temperatures, addressing a major limitation of the OEM’s original cast pistons.

Designed specifically for oilfield and refinery environments, pistons are also built to resist sour gas, which can severely corrode pistons and valves. In the custom design, anodised aluminium is used to prevent gas penetration, offering an ideal solution for South Texas operations where sour gas is prevalent.

Utilising steel vs cast iron

On a new project, GCS first retrieves a gas analysis from the refinery. The gas analysis reveals the composition of the gas that the piston is going to be pumping. Based on the gas analysis, engineers will recommend the material for that piston in that operation. If the wrong material is used in combination with an abrasive and/or corrosive gas, the metal will degrade over time

and the piston will fail. Using the proper material with the right gas ensures a long run time.

The design process begins with obtaining a piston sample or print, which is carefully measured and assessed by engineers. Based on these measurements, they either refine the existing design or create a new one. In many cases, the piston requires aluminium, for which GCS uses aircraft-grade 6061 T6 aluminium for optimal durability. For the centre section, cast iron or steel is selected according to the application’s specific requirements, with a three-piece piston design being the most common. In some situations, a solid cast iron piston is required, which limits upgrade options.

While high-grade aluminium is resistant to corrosive gases, it will eventually degrade over time. To address this, pistons are designed with a modular structure: a durable steel or cast-iron centre section flanked by aluminium ends. This design enables efficient recycling and repair. If the aluminium ends become unusable, they can be replaced while reusing the centre section, or vice versa. The worn part can be swapped out without needing to replace the entire piston, as would be required with an OEM piston. This modular approach supports both sustainability and cost-efficiency in piston maintenance and replacement.

Case studies

Hydrogen non-lube system

A refiner operating a pure hydrogen non-lube system with specific cylinder frames was experiencing significant wear issues with piston ring and rider bands, which required replacement every two months. GCS recommended a specialised polymer material for the rings and rider bands, custom-engineered for durability in non-lube systems. They overhauled and upgraded the entire piston assembly, implementing a tailored Teflon-based design that could withstand the demands of hydrogen service without lubrication. Since the upgrade, the refiner has achieved a runtime of over two years, surpassing previous performance.

Valve upgrade

Another refiner required a valve upgrade for compressors handling gas with high liquid content. Originally using steel rings, the compressors were updated by GCS with high-performance peak rings and entirely new valve assemblies. To reduce liquid presence in the compressors, the refiner also implemented separators and dryers in the system. GCS recommended switching from cast iron to steel valves, which improved durability and performance. This upgrade extended the valve lifespan to over a year initially, and the design was subsequently standardised across all the client’s compressors. The new valves now operate for up to two years without issues, offering robust leak protection even in liquid-rich environments.

Refineries often purchase frame packages from OEMs and then turn to companies like GCS for maintenance and repair services. Valves can be reverse-engineered and repaired to meet specific operational needs, providing an alternative to OEM replacements. Computer numerical control machines are used for precise repairs, with programming tailored to each valve’s specifications to ensure accuracy.

Figure 1. Piston steel centre section.

Figure 2. Two aluminium piston halves.

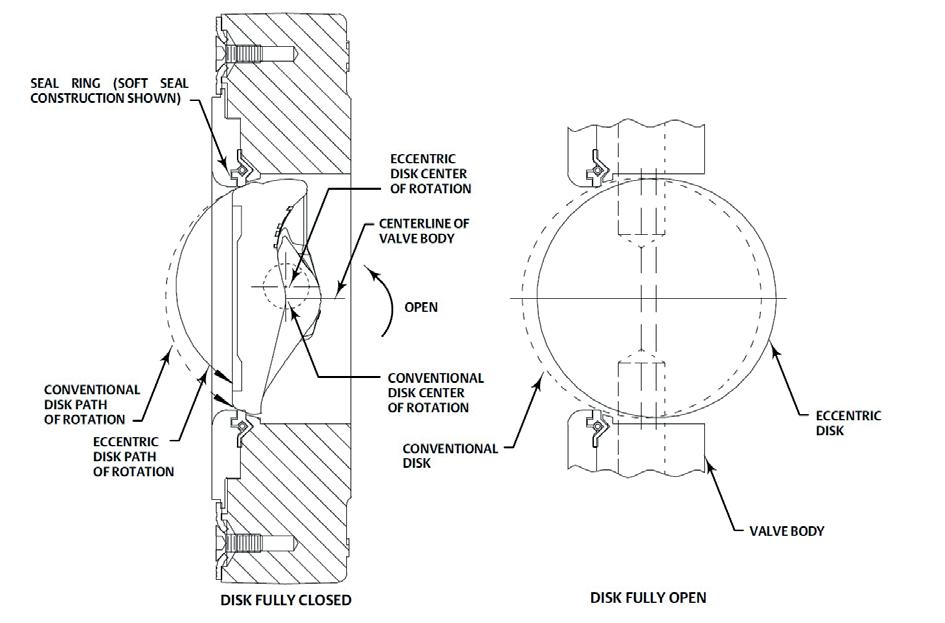

Quarter turn valves strike a difficult balance between sealing, cost, longevity, and process control performance. Wade Helfer and Bryan Leger, Emerson, USA, explore how integrating the supplier’s understanding of the required trade-offs with an end user’s expertise can help identify the correct valve construction for each application.

Soft seals

With the disc in the ‘fully closed’ position, a quarter turn valve relies on the seal to provide tight shutoff (Figure 1). As the valve closes the last few degrees, the disc presses against the seal to arrest flow. A soft seal utilises

2. These before (left) and after (right) photos show how the surface texture of a chrome plated disc changes after being tested in a manner that approximates field conditions. The surface damage results in striations that make sealing difficult as the valve closes.

polymeric materials to provide a malleable surface for the disc to press against. As the actuator drives the disc into the soft seal, it moulds itself to the surface of the disc to fill any voids, creating a leakproof seal.

Valves with soft seals can achieve extremely low leakage rates regardless of pressure drop and, in most applications, provide extended service life. They also achieve this tight shutoff without using a great deal of actuator torque, and the required torque remains fairly constant over the life of the seal. There are a wide range of polymer options – so different sealing materials can be selected to handle difficult process fluids. As a result, valves with soft seals are the first choice for most applications as they perform well, last a long time, and require relatively small actuators for operation.

Unfortunately, a limitation of soft seals is temperature. When process temperatures approach 400°F, these seals begin to break down. Some special materials can exceed this threshold by a limited amount, but beyond that, they should not be used. Fluids with abrasives can also erode soft seals quickly, causing a loss of material each time the valve closes, and eventually premature failure.

Metal seal challenges

Valves with a metal seal are better suited to handle elevated temperatures and slurry type fluids. However, metal seals have their own set of constraints.

Unlike soft seals, which easily conform to the shape of the disc’s surface, a metal seal relies on a precision fit to achieve tight shutoff. Higher seat loads may also be required to minimise the remaining micro-sized gaps that reside between the disc and seal to meet certain leakage standards, such as FCI 70-2 Class VI and ISO 5208 Rate AA.

Valves with metal seals can also experience surface damage on the mating regions of the seal and disc as the valve is cycled. This abrasive type of wear (Figure 2) causes an increase in leakage over time.

With continued use, the abrasive wear produced by components in contact will also increase the load requirement to initiate rotation. Figure 3 displays a torque vs pressure drop comparison for soft and metal seals. Valves with soft seals generally require a fixed amount of torque for a given pressure differential, regardless of the parts’ condition. However, the required torque for a valve with a metal seal at that same differential pressure is higher and increases as the mating parts wear.

3. This chart shows the actuator torque required to unseat a valve with soft and metal seals. Note how a worn metal seal requires far more torque, especially at high differential pressures.

This increase in torque is indicative of increasing system friction within the valve assembly. Friction has a detrimental effect on the valve’s ability to properly control a process loop, leading to erratic performance and higher process variability.

Metal seal design options

End user requirements for metal seated valves should include obtaining the overall performance and longevity associated with

Figure 1. This diagram shows how a disc from an eccentric butterfly valve wedges against the soft seal to achieve tight shutoff.

Figure

Figure

API 617 Centrifugal Designs to 100MW, 40MPa

API 618 Reciprocating Designs to 20MW, 60MPa

API 617 Centrifugal Designs to 100MW, 40MPa

API 618 Reciprocating Designs to 20MW, 60MPa

ASME PTC10 type 2 testing capacity to 30MW (gas turbine), 50MW (motor)

For more information, visit our website: www.sbw-intl.com

Scan QR for brochure, or Contact:

ASME PTC10 type 2 testing capacity to 30MW (gas turbine), 50MW (motor) For more information, visit our website: www.sbw-intl.com

Head office & Manufacturing: Shenyang, China info@sbw-intl.com

Global Sales Director: chenqiming@sbw-intl.com Middle East & North Africa: yangyang@sbw-intl.com

Scan QR for brochure, or Contact: Head office & Manufacturing: Shenyang, China info@sbw-intl.com

xianganding@sbw-intl.com

Director: chenqiming@sbw-intl.com

xianganding@sbw-intl.com

liusong@sbw-intl.com

soft seals, while minimising the cost impact. An efficient way to achieve this goal is to delay the onset of abrasive wear and slow down its rate of damage accumulation.

Offsetting the shaft from the centreline of the flow path allows the disc to follow an eccentric disc path of rotation (Figure 1). As a result, the seal quickly loses contact with the disc as it rotates out of the fully closed position, and parts that do not touch while in motion cannot wear down.

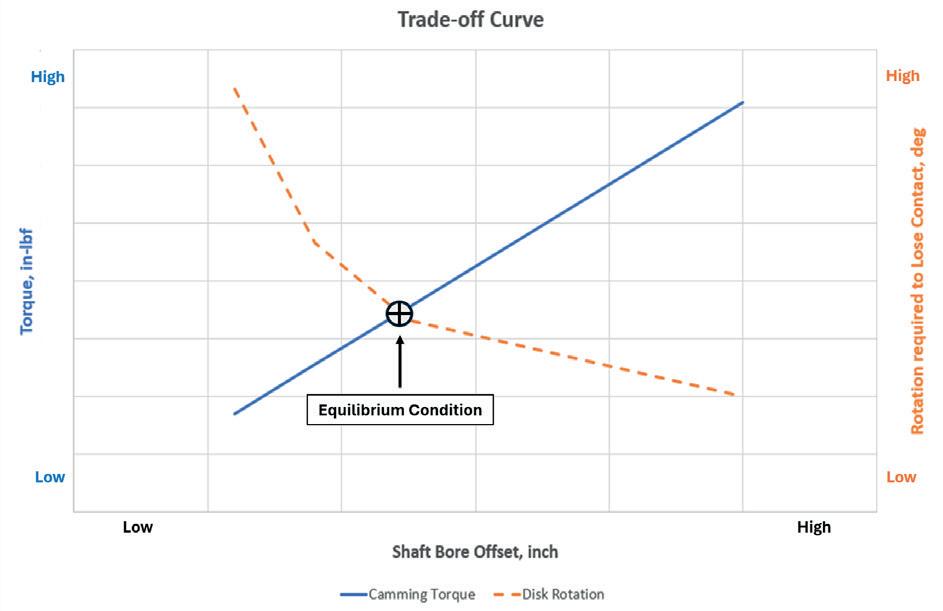

However, offsetting the shaft exacts a price in the form of camming torque, one of the four torque components (packing, bearing, sealing, and camming) used to size actuators. Figure 4 provides a trade-off curve to help identify an optimum shaft offset that minimises camming torque, and to minimise the amount of rotation required for the seal and disc to lose contact.

Hardening the surface of critical components by using special coatings or penetrating treatments is an effective way to preserve the surface finish and maintain its coefficient of friction. Penetrating treatments, such as nitriding, are tunable processes that allow adjustment of the hardness profile for the associated part. This allows the valve manufacturer to influence the rate of wear tied to the mating parts, and to bias the hardness levels such that the surface damage occurs on the component of choice (e.g., the seal instead of the disc as shown in Figure 2).

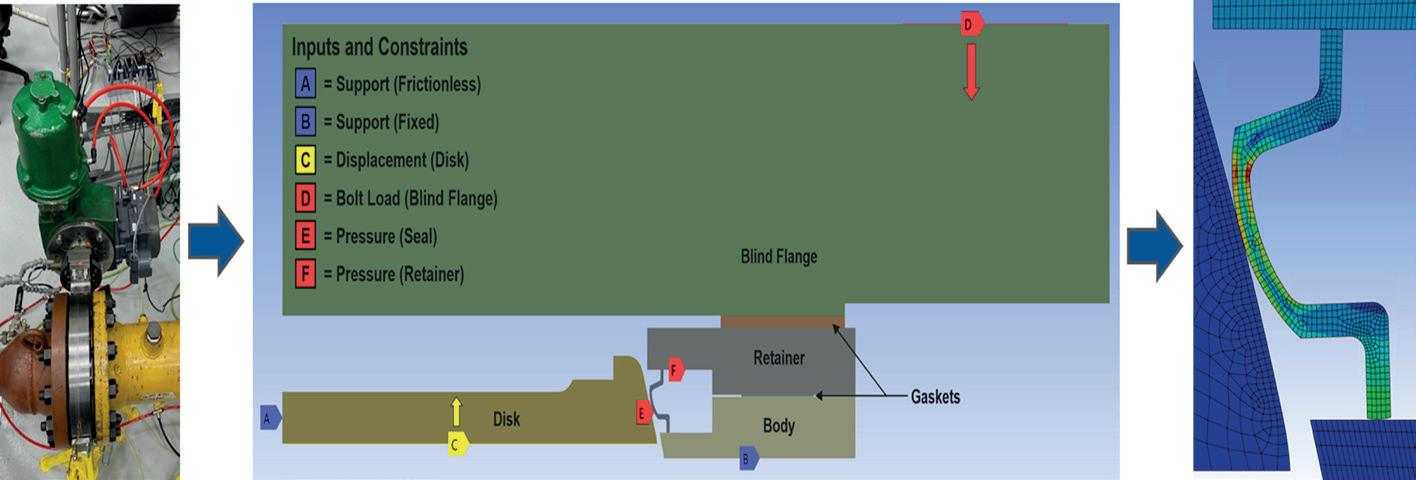

Adjusting the seat load is another tool for extending the longevity and performance of the seal. It needs to be high enough to pass the factory acceptance leakage test, but not so high as it will accelerate abrasive wear. Due to the complex nature of metal sealing systems, identifying the correct seat load has been one of the more daunting aspects of design, but simulation software has simplified the process.

With a properly constructed and characterised model, one can predict the load reaction between the seal and disc (Figure 5). This load reaction value will be indicative of the expected sealing torque and leakage rate.

Elevated temperature cycle testing provides an opportunity to observe the impact of the design decisions and trade-offs made during the design development cycle. It also allows one to leverage experimental data to set an appropriate safety factor for actuator sizing (Figure 3). This margin is a fail-safe to eliminate drivetrain binding, a potential mode of failure for high temperature or slurry type applications.

End user influence

End users play a vital role in determining the makeup of the valve construction because a successful valve installation starts with an accurate description of the process conditions. The valve sizing documents provided to the supplier typically include two conditions: operating and design.

It is common for the maximum design conditions to cover extreme situations that deviate significantly from the expected operating range. Because the specified valve will be constructed to handle the design conditions, end users should exercise caution when specifying the maximum design temperature as it needs to be accurate, but not needlessly overstated. Undue conservatism in this area can unnecessarily push the valve into metal seated constructions.

Overstating the requirements typically raises the cost of the valve construction, and in some cases, it hinders the valve’s ability to provide optimal process control, creating higher process variability.

Conclusion

Selecting an appropriate control valve for an application starts with an accurate and complete description of the process conditions, and end users can help by confirming these conditions are not overly conservative. If the conditions exclude the use of soft, non-metallic components, then valves with metal trim are a natural candidate. Metal seated valves can provide reliable performance over an extended service life, but they must be chosen thoughtfully. Consulting a knowledgeable supplier is a good first step to making the correct design choice.

Figure 4. Trade-off curve that characterises this example relationship between shaft bore offset with camming torque, along with the disc rotation required for losing contact with the seal.

Figure 5. Model of the valve assembly for predicting the load reaction between the seal and disc.

Brian Callahan, Kerry Drake, Le Song, Dan King, and Tyler Monzel, Greene Tweed, USA, consider how new advances in crosslinked PEEK expand the performance capabilities of polymers in a wide range of applications and environments.

As applications become more demanding with increased expectations for long service life, they require improved reliability and durability while operating conditions and media exposure chemistries become more severe. More corrosion inhibitors, completion fluids, well fluids, and other high and low pH environments or other severe fluids can push polymeric components (such as backup rings, seal assemblies, v-rings, end adapters, bushings, bearings, valve seats, connectors, and structural components) to their limits because their strength and

durability decrease with increasing temperatures and more aggressive chemistries. However, advances in polymer chemistry are enabling new materials that can solve these challenges and usher in new options for material selection to improve performance, expanding the limits beyond what was previously available.

Overcoming polymer limitations in extreme environments

Polymers have properties that vary depending on the temperature of the application and the inherent

thermal response properties of that polymer. Understanding polymer class and properties can help more accurately predict application performance. Using data collected at 73°F (23°C) for design and safety factor calculations may lead to invalid estimation of properties and failure in the field, particularly when used in demanding environments such as high temperatures, or high pressures, or when exposed to aggressive chemicals if material properties are not properly accounted for under these conditions.

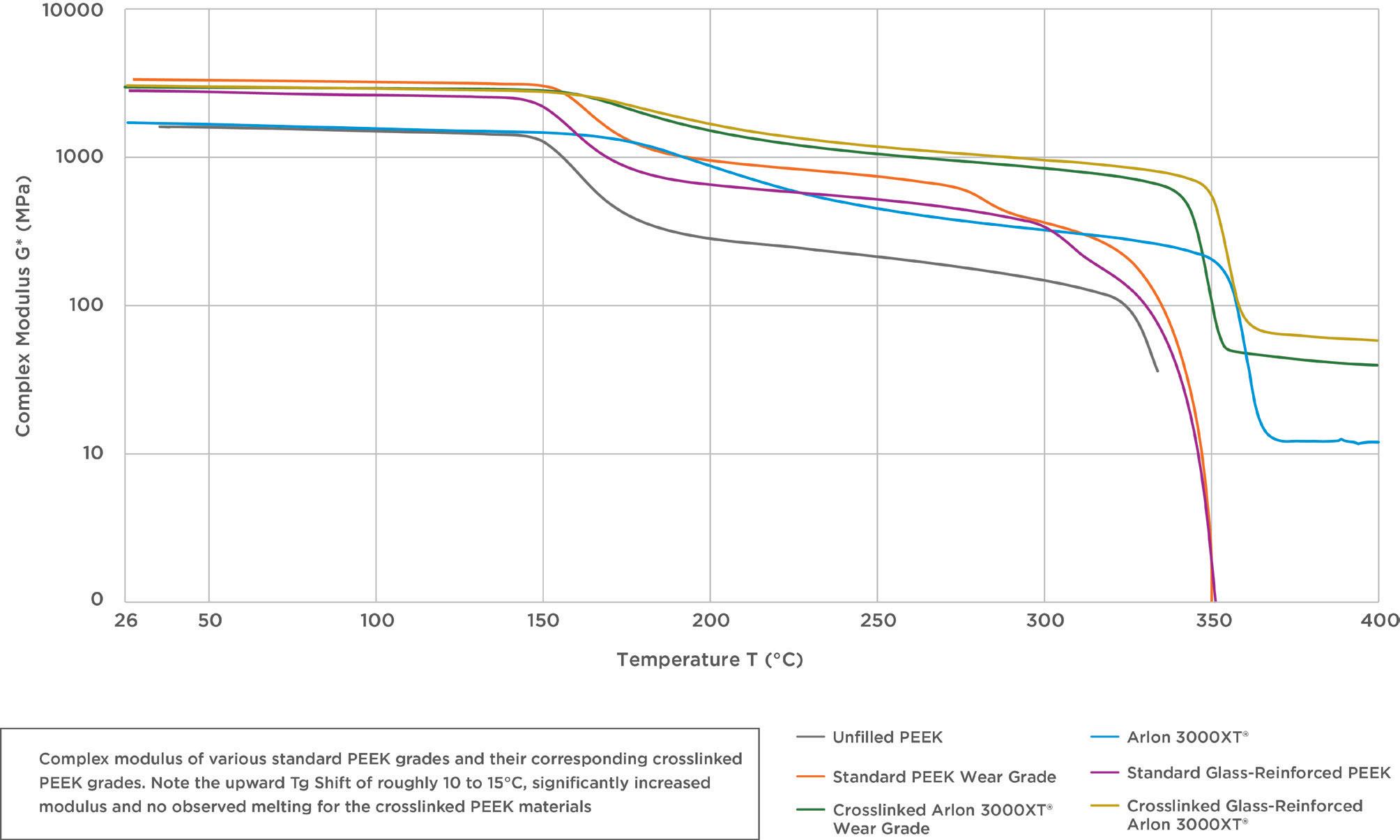

Seals, seats, bushings, and bearings are often made of filled or unfilled polytetrafluroethylene (PTFE) for its excellent friction properties and nearly universal chemical resistance, or from polyetheretherketone (PEEK) for its high durability, high strength, creep/extrusion resistance, and chemical resistance. These materials are excellent up to their limits, but the physical properties of PEEK begin to decline above 300°F (149°C), its glass transition temperature (Tg) where the strength and stiffness drop-off, and a maximum continuous service temperature around 500°F (260°C) in severe applications, with maximum excursions to roughly 600°F (316°C). PTFE’s mechanical performance limit starts significantly lower than PEEK and tends to decrease with increased pressure or temperature, with a maximum service temperature around 500°F (260°C). As pressures and temperatures increase, the addition of reinforcing fillers such as glass and carbon fibres can extend this range by increasing stiffness, which has a particularly big impact at temperatures above the glass transition temperature. The limitations of these materials drive the switch to metal components at

extremely high temperatures, but this sacrifices the improved sealing, reduced friction, weight reduction, and improved chemical resistance properties of these polymers.

A breakthrough

Greene Tweed commercialised the first crosslinked PEEK, Arlon 3000XT®. This patented material platform was developed to withstand more extreme conditions, retaining the mechanical properties associated with PEEK up to 650°F (343°C), often paired with aggressive chemical environments. This is in contrast to some crosslinking systems found in the literature or patent applications which utilise different chemistries that are typically less robust.