9 minute read

Crisis? What crisis?

Alan Gelder, Wood Mackenzie, UK, discusses the key attributes of successful future refineries as the oil and gas sector recovers from the COVID-19 pandemic.

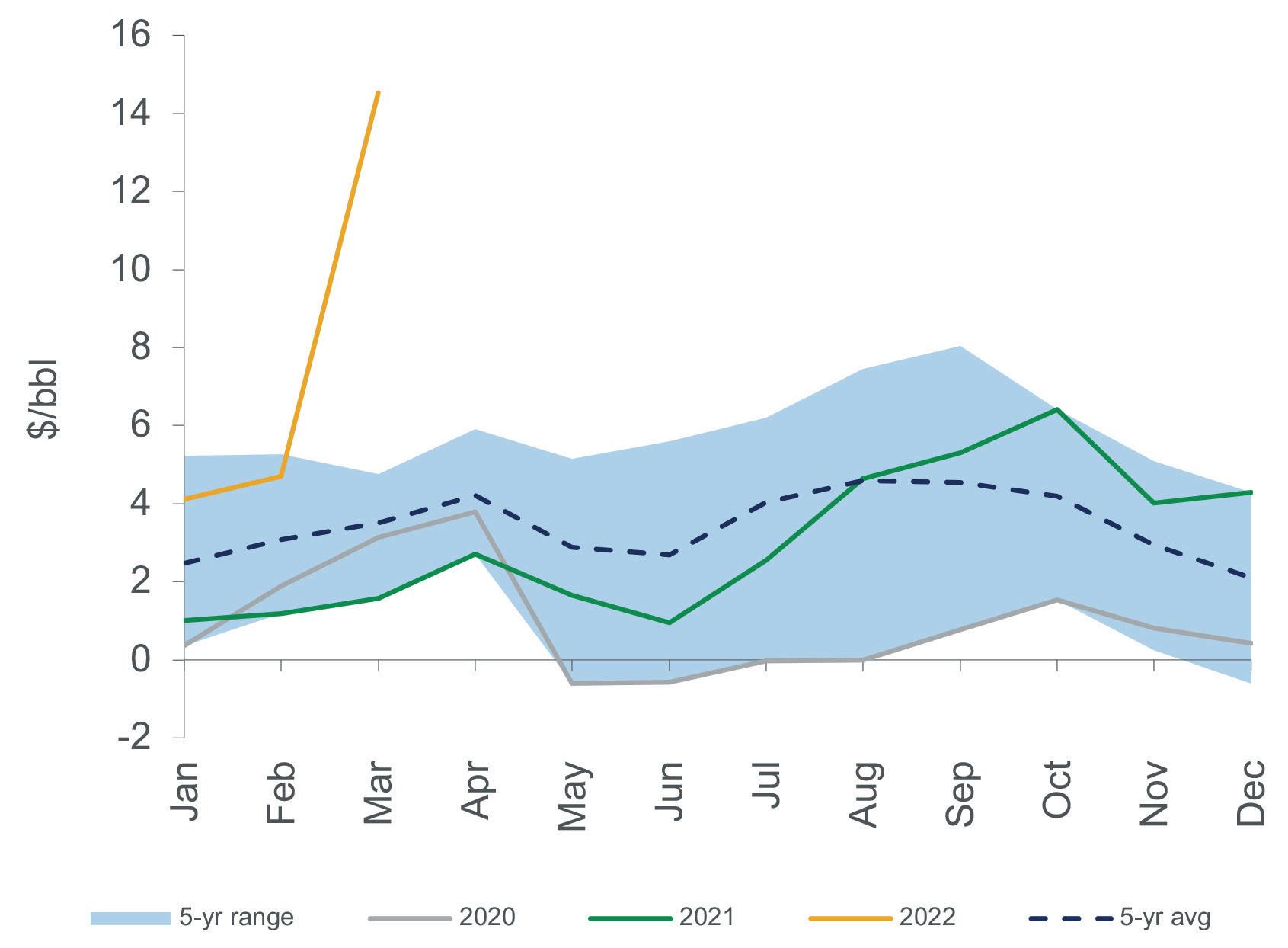

The global refining sector is currently enjoying a post pandemic recovery boom, with its March 2022 composite monthly margin at record highs. This is a very different situation from the depths of the global pandemic, which was only two years ago. Wood Mackenzie’s Refinery Evaluation Model indicates that few refiners in Europe were cash positive in 2020. Other regions experienced similar challenges, triggering the rationalisation of almost 3 million bpd of refining capacity.

Since then, oil demand has recovered strongly, and it is expected that 2019 levels will be breached during 2023. In the meantime, global distillate inventories have fallen to record lows, lifting diesel crack spreads and the global composite refining margin to unprecedented levels, as shown in Figure 1. The existential threat to the viability of the refining sector presented by the global pandemic now seems a distant memory, with the sector apparently in rude health (in gross margin terms).

However, the picture is not quite as rosy as it seems, as the surge in profitability has not been shared by all. European refiners are dealing with very high costs for natural gas and carbon emissions, and are operating at lower crude throughputs than expected for the prevailing gross margins as a result. In addition to this, China’s exports are being constrained by lower quotas, and the oil market is concerned about the potential future loss of supply of Russian crude and diesel to international markets because of the Russia/Ukraine conflict.

Russia/Ukraine conflict represents a geopolitical crisis

Russia’s invasion of Ukraine reminds us that the refining sector must adapt to changes in primary energy sources such as oil and natural gas. Global oil and European natural gas prices were already rising prior to the conflict, and European refiners had to adapt to natural gas feedstock being more costly than many of its products on an energy equivalent basis. This resulted in constrained European crude processing and a shift to lighter, sweeter crudes, such as West Texas Intermediate (WTI). Global distillate inventories continued to fall, setting up the conditions for the price shock that was – and continues to be – experienced in 1Q22 – 2Q22.

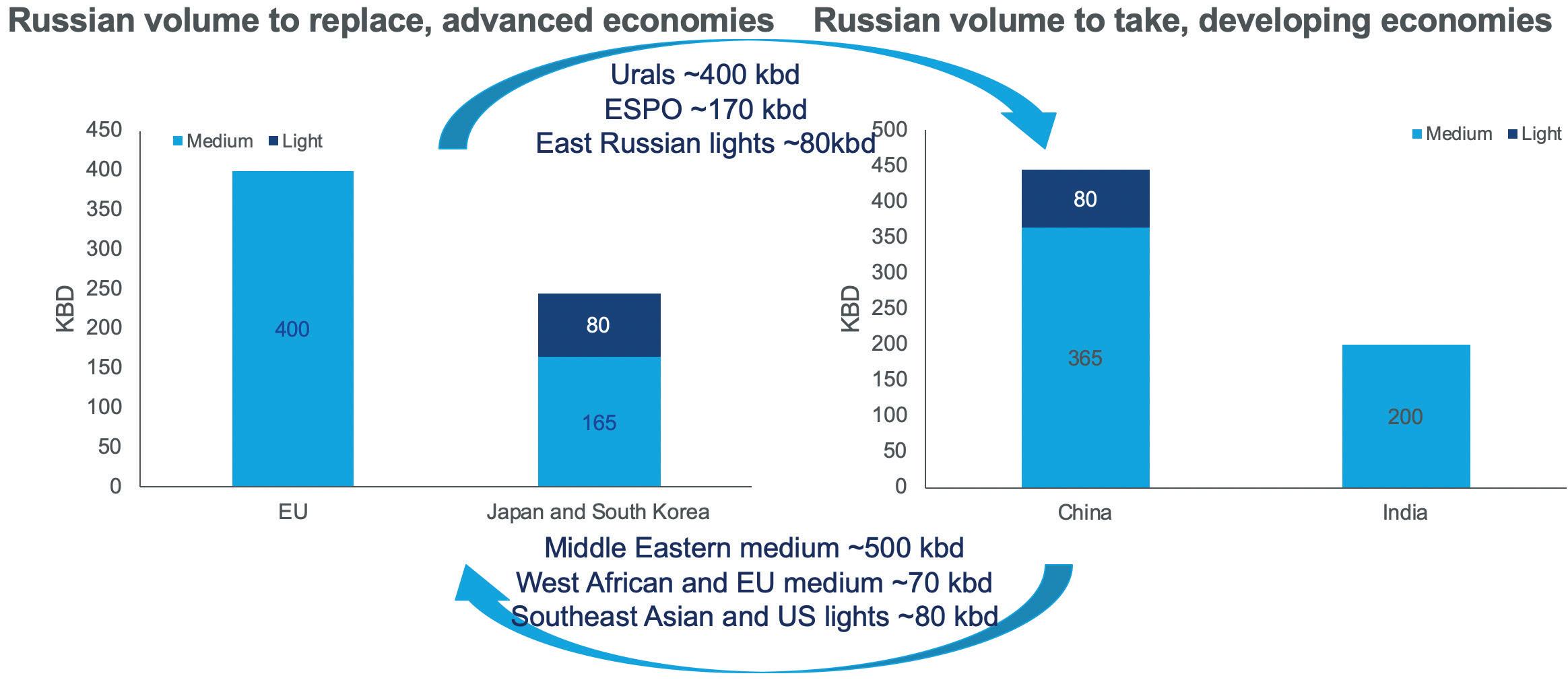

Crude oil prices rose further from late February 2022, when Russia invaded Ukraine, as the oil market focused on the potential loss of supply from the world’s second largest producer of crude and condensate. Several companies announced their exit from Russia and ‘self-sanctioned’ against the future purchase of Russian energy, in addition to import bans from a few advanced economy countries. This has resulted in ‘crude swapping’, as shown in Figure 2, as Urals needs to clear to Asia to find buyers at a price that is highly attractive, as many logistical, financial and political challenges remain. At the onset of the conflict, refining margins fell as product prices did not rise as quickly as crude. However, margins then strengthened as the oil market focus shifted to fears of a European diesel shortage, strengthening distillate crack spreads to record levels. Crack spreads for products not in tight supply eased. This highlights that refining is secondary to global crude oil market events – only refined products in tight supply can quickly pass on crude price increases along the value chain. Refiners need to continuously adapt to changes in the landscape of primary energy supply and use. The lesson emerging from the conflict for many regulators is to accelerate the energy transition by the faster adoption of locally-sourced renewables, in order to improve resilience and security of supply.

Figure 1. Wood Mackenzie global refining composite margin (US$/bbl) (source: Wood Mackenzie). Figure 2. Russian crude trade flow changes between advanced and developing economies for 2022 (source: Wood Mackenzie).

Resilience in the face of the energy transition

The energy transition is the critical mega-trend for the refining sector, as it involves decoupling the growing need for energy and mobility from the demand for fossil-based hydrocarbons. The energy transition is establishing how we achieve a pathway to net zero greenhouse gas emissions to avoid potentially catastrophic climate change. For the refining sector, the key pillars of the energy transition are: n Electrification of demand, enabling the use of electricity generated from renewable sources. n Lowering the carbon intensity of liquids used in

‘hard to electrify’ sectors. n Reduction of refinery emissions associated with the transformation of feedstocks into products.

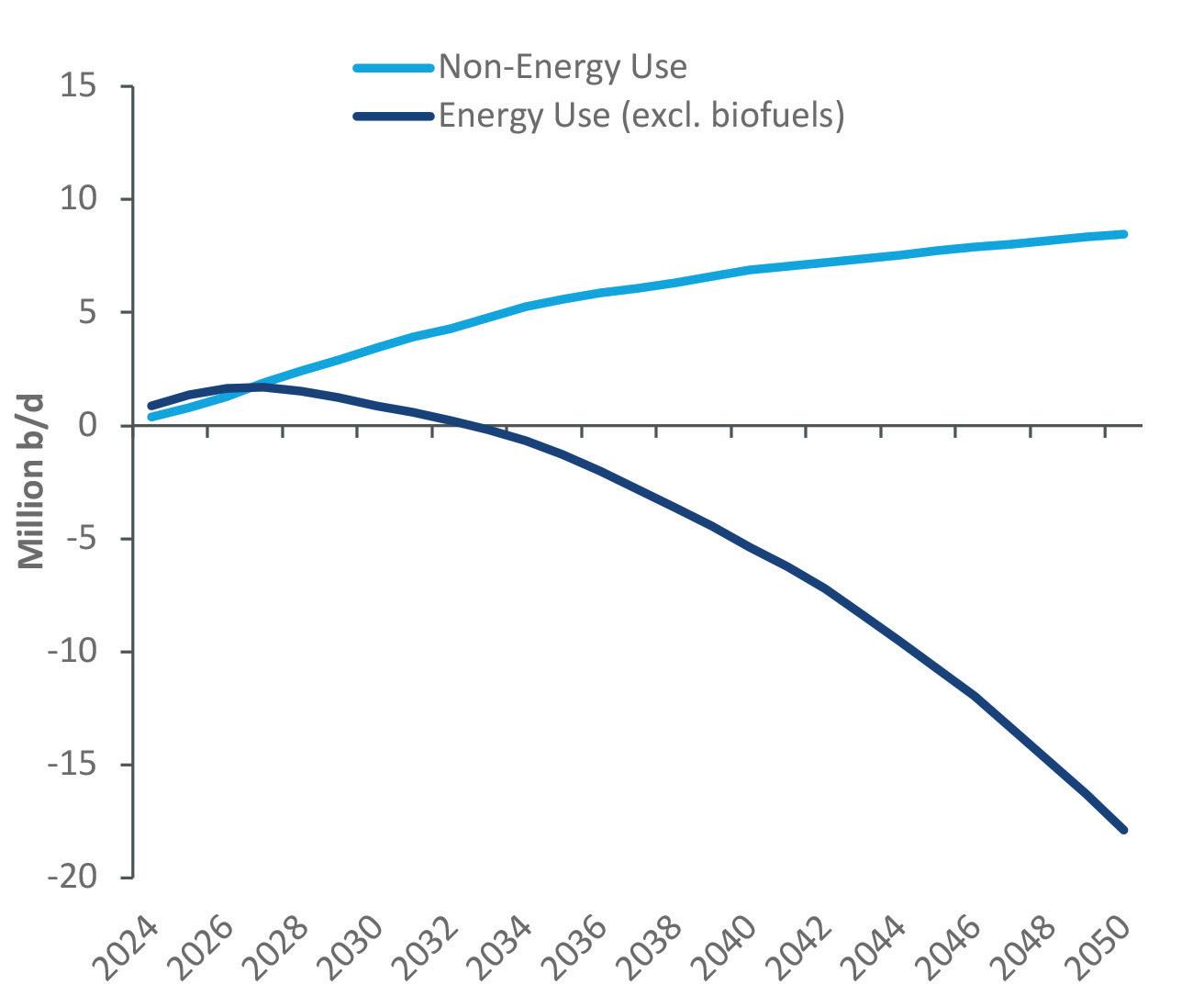

Wood Mackenzie’s ‘Energy Transition Outlook’ is its base case view across all commodity and technology business units, so incorporates the evolution of current policies and technology advancement playing out in the future to 2050. It is broadly consistent with a 2.5˚C global warming view. Led by the electrification of the passenger car segment and fuel efficiency gains, global oil demand for energy use peaks within this decade, whilst non-energy use (primarily petrochemicals) continues to grow, as shown in Figure 3. The key future opportunities for the refining sector are petrochemicals and liquid renewables, with a future pathway to synthetic/e-fuels, and low-carbon petrochemicals. 2020 has demonstrated the commercial significance of petrochemicals, as only one ‘fuels only’ refinery in Europe achieved a positive net cash margin (NCM – defined as gross margin minus fixed and variable costs), compared to 17 integrated refinery/petrochemical sites (leaving almost three-quarters of European operational sites at a negative NCM). The added value from petrochemicals depends upon the site’s location, petrochemical yield (as a percentage of overall products), and the value chain of the chemical, as shown in Figure 4.

Figure 3. Energy use of fossil-based oil reaches a peak by 2027 (source: Wood Mackenzie). Figure 4. Global NCM Uplift (US$/bbl) vs wt% petrochemicals, split by region (source: Wood Mackenzie).

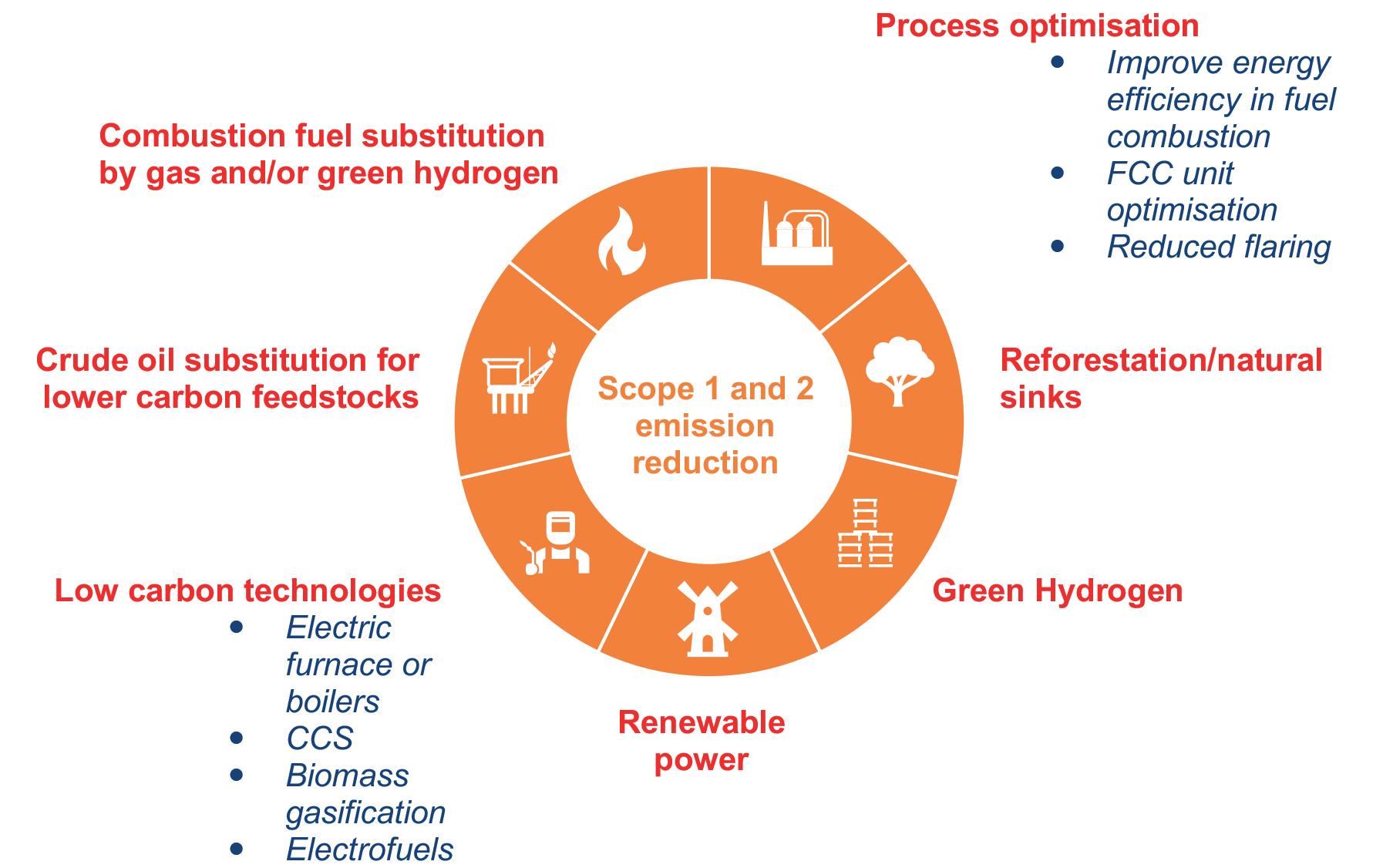

Figure 5. Carbon mitigation techniques for refiners (source: Wood Mackenzie).

Clearly, higher values are achieved through greater petrochemical yields. Unless FCC refiners can shift to materially-higher olefin yield, hydrocracking configurations are better placed to adapt to an energy transition that is led by the passenger car segment.

These integrated sites benefit from attractive commercial performance and are competitively strong as a result. They are also well-positioned for the future growth in the significance of petrochemicals as a source of oil demand, with their positive cash flow enabling them to invest in the growing circularity of petrochemicals and the decarbonisation of their other liquid products.

The production of low-carbon liquids is a major opportunity for the refining sector, as such liquid biofuels can address the ‘hard to electrify’ sectors of aviation and heavy-duty commercial trucking. There are product quality specifications that limit the use of ethanol in gasoline, and FAME (biodiesel) in diesel/gas oil. This has led to the greater need for hydrogenated vegetable oils (HVO), or renewable diesels, to comply with the requirements to increase the renewable content of transport fuels (primarily in Europe and the US – particularly in California, with its low-carbon fuels standard). Existing refineries are well-positioned to produce such renewable diesels from vegetable oils as these feedstocks can be co-processed within existing hydrotreaters after initial pre-treatment.

Sustainable aviation fuels (SAFs) is an increasing area of focus for both regulators and airlines, to support the decarbonisation of air travel. The production process is, again, very similar to the production of jet fuel via hydroprocessing, so offers an exciting growth opportunity for refiners. SAF production typically produces some bio-naphtha as a byproduct, which can be an attractive feedstock to support the decarbonisation of the petrochemical sector. These low-carbon liquid fuels require the availability of both low-carbon hydrogen and appropriate feedstocks. With declining costs for green hydrogen, the availability of low-carbon feedstocks becomes increasingly critical. Here, the refining industry needs to be innovative and collaborative to both secure access to sustainable agricultural residues and waste streams (municipal, petrochemicals, etc), and then develop and deploy the technology to convert these feedstocks into liquids.

Refiners will remain in the business of transformation, but the feedstocks to be transformed must be increasingly part of the circular economy.

Refiners also need to address their own emissions, as they represent around 3% of the global total. Asia is the dominant source of these refinery Scope 1 and 2 emissions, as it is the region with the largest refining capacity, and tends to use more heavy liquids and coal for its internal fuel. Around 80% of the emissions are associated with the key refinery processes of combustion for chemical transformation and separation, with less than 5% associated with the production of hydrogen by steam reforming. There are a variety of carbon mitigation techniques, as shown in Figure 5.

For deep decarbonisation, refiners will have to adopt new technologies such as carbon sequestration, utilisation and storage (CCUS), green hydrogen, and renewable power, the commercial viability of which is highly dependent upon government policies, costs of carbon emissions, and technology development. Refiners need to have a clear understanding of the emissions profile of an operational site and be prepared to partner with others to successfully develop and deliver the necessary reductions. Regulations and the establishment of a price for carbon emissions can play a

role in supporting these necessary investments. Refiners, however, must acknowledge that carbon policies are unlikely to provide a level playing field, but they need to adapt to retain their social licence to operate. For regulators, the challenge of an uneven playing field is that it accelerates refinery rationalisation, which has adverse consequences for energy security resilience, as highlighted by the current Russia/Ukraine conflict.

Close ties with regulators, governments, and the broader stakeholder community will become increasingly important in order to minimise the risk of unfair competition and subsequent carbon leakage, along with the delivery of a just energy transition.

Key attributes of successful future refineries

The energy transition requires refiners to adapt – business as usual is no longer an option. Being a highly-competitive, cash positive site is necessary, but may no longer be sufficient to ensure long-term viability. A cash positive position is advantageous to addressing the potential additional costs of carbon emissions. However, for those sites that are competitively strong, the requirement is to deliver low-carbon operations through: n Low-cost operations and improved optimisation through digitalisation. n Fuel efficiency improvements and process electrification. n CCS on large emissions sources, such as FCCs, gasifiers, and hydrogen production units, via partnerships with logistics and upstream operators. n Green hydrogen.

These advantaged sites can be a platform to produce lower-carbon-intensity fuels, such as liquid biofuels and ultimately synthetic e-fuels (which combine captured CO2 and low-carbon hydrogen) that regulators desperately seek. Given the uncertainty around the size, scale and nature of these investments, it is expected that companies will focus their energy transition investments on those sites that have high NCM and low emissions intensity, which are typically highly-integrated refinery/petrochemical sites located in industrial clusters, supported by a broader network of small bio- and pyrolysis sites (as the economies of scale of moving and processing agricultural residues and wastes are very different from crude oil).

The refining business is about to embark on another major transformation – this time, it is to transform itself to supply low-carbon fuels in a circular economy, where both site and fuel emissions will join a site’s competitive position as critical determinants of its future success.