5 minute read

Calculating the cost of ownership

Alejandro Plazas, ValvTechnologies, Latin America, explains why considering the total cost of ownership of valves will ultimately pay big dividends.

All industries calculate the total cost of ownership, particularly when they plan new projects or evaluate unit maintenance costs. Unit by unit, they evaluate equipment, seeking the lowest lifetime cost. The challenge is to realistically and reliably apply the concept to different processes, industries and equipment.

Thinking of a valve as an investment rather than a cost changes perspectives. This article discusses how to calculate the

total cost of valve ownership, specifically when it comes to isolation valves. The process entails considering the cost of equipment acquisition, maintenance, repair and replacement, all during a specified time.

Steps to take

The first step is to define isolation valve failures and consider the following risks: n Leaks through the stem create fugitive environmental emissions. n Internal leaks through the seats of a closed valve. These leaks degrade process safety, availability and efficiency. n Valve locking or stroke issues, mainly on emergency shutdown valves (ESDVs) and blowdown valves (BDVs). If a valve that isolates a process does not move, the consequences can be catastrophic.

Next, it is important to evaluate the total cost of ownership through the following five steps:

Define the time range

To fully analyse the economics of a valve purchase, the use of two operating windows or scheduled plant shutdowns is recommended.

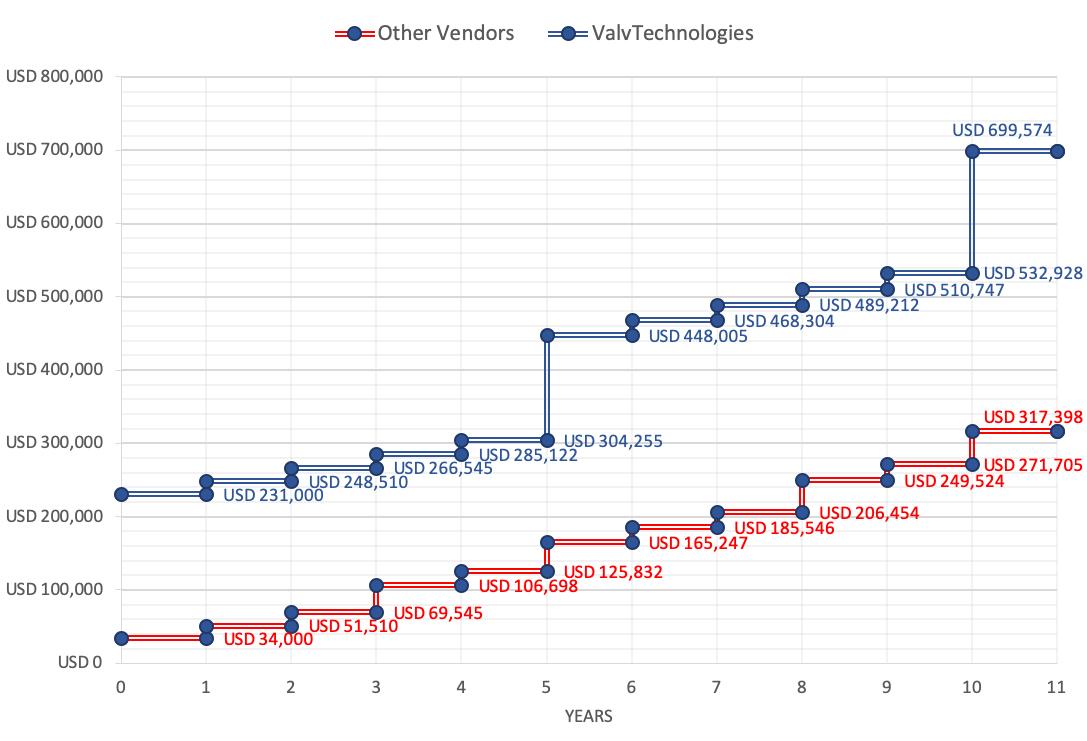

Figure 1. Comparison between the valves’ initial purchase, maintenance and replacement costs during the specified time range.

Figure 2. Comparison between initial purchase, maintenance and replacement costs, plus the costs of unscheduled shutdowns to change valves. Identify the valves to analyse

For simplicity, no more than four valves are recommended at one time. Valves that have some relationship to each other should be chosen, enabling you to fully understand their operational effect on the plant.

Calculate total maintenance costs

Include the valves’ initial purchase price, installation cost, preventive maintenance costs, repair costs (multiplied by the number of repairs expected during the valves’ operational life) and replacement costs (multiplied by the number of replacements expected during the identified period). This is shown in Figure 1.

Installation costs are sometimes negligible and sometimes quite high. In offshore applications such as FPSOs and platforms, installation and transportation costs can approach the purchase price of a new valve.

To evaluate a valve purchase, it is important to consider not only the aforementioned maintenance costs, but also the costs of valve failures, including the following:

Unscheduled shutdown costs

Valve failure can cause an unscheduled shutdown if it creates a safety risk to people or the environment, or damages equipment. First, it must be determined whether the process needs to be stopped completely to replace the valve, thereby reducing production, or if it is a batch process that requires an extended cycle time due to the intervention. Second, costs needed to be quantified. Start with the per-day cost of a unit shutdown; divide it into an hourly cost; then multiply by the number of hours needed to repair or replace the valve (see Figure 2).

Efficiency-related costs

This analysis is one of the most complex because it requires a high level of process knowledge. Some specific examples include:

Increased fuel consumption

If drain and vent valves in boilers, generation and cogeneration plants leak, the energy required to

heat the water is lost, since the steam never reaches the turbine. This reduces the plant’s thermal efficiency and increases its fuel costs. These losses and increases can be calculated using the heat rate and the cost of fuel.

Calculating the total cost of ownership

Lengthened operating cycles for batch applications

If an isolation valve of a multitrain decoking system leaks, the pressure available for the cutting water system declines, increasing the time required to decoke the reactors. This longer coking/decoking cycle shrinks overall production. To calculate this, multiply the additional time by the hourly cost calculated for unscheduled shutdown costs.

Increased downtime due to leaking valves

In refinery fractionator-tower bottoms systems with two pumps, pumps must be periodically shut down for maintenance. In this case, the failure of an isolation valve will considerably escalate downtime.

Many other costs can be associated with isolation valves, however the determination of the aforementioned costs permits a useful analysis.

Table 1. The cost of ownership

This article will now evaluate two possible solutions for calculating the total cost of ownership of a catalyst withdrawal application in an FCC unit.

Solution 1

n Two gate valves. n Valve 1 must be replaced annually, and valve 2 every two to three years. n Operational window: five years. n Shutdown cost: US$250 000/d. n Time required to change valve 1: 1 hour. n Time required to change valve 2: 36 hours. n Valves 1 and 2 begin to leak after six months of operation. n Catalyst loss per day: 1 kg/d average during six months.

Solution 1 Solution 2 Difference**

Valve purchase price Total purchase, maintenance and replacement costs* Total purchase, maintenance and replacement costs, plus cost of unscheduled shutdowns* US$20 000 US$210 000 -US$190 000 US$317 398 US$699 574 -US$382 176

US$3 502 719 US$699 574 -US$2 803 145

Total purchase, maintenance, replacement and unscheduled shutdown costs, plus cost of lost catalyst* US$3 717 197 US$699 574 -US$3 017 623

Note: *Total costs calculated for 10 years ** Negative value means solution 2 is more expensive than solution 1 when only considering purchase, maintenance and replacement costs Solution 2

n Two ValvTechnologies zero-leakage ball valves for isolation, and a gate valve for throttling. n Operational window: five years. n Shutdown cost: US$250 000/d. n Replace gate valve every two years. n Replace valve 1 every five years. n Replace valve 2 every 10 years. n Time required to change gate valve: 1 hour. n Time required to change valves 1 and 2: none, because it is performed at the scheduled shutdowns. n No catalyst loss. n Analysis time: 10 years – equivalent to two operational windows.

Conclusion

For solution 2, the decade-long total cost of ownership is just 25% of solution 1 (see Figure 3), despite its higher initial investment. The difference lies in eliminating costs for unscheduled shutdowns and catalyst losses.

Similar analysis has shown comparable results in a variety of processes and industries, including: n PIG launchers and receivers. n Delayed coking units. n Dehydration with molecular sieve. n Instrumented safety systems. n Fractionation-tower bottoms. n Catalytic cracking units. n ESDVs and BDVs. n Gas injection (API 10 000).

Using these tools to calculate the total cost of ownership before making your next valve purchase will likely pay big dividends.

Figure 3. Comparison between initial purchase, maintenance, replacement and unscheduled shutdown costs, plus the cost of catalyst lost from valve leaks.