Summer 2023

03 Comment

04

Moving the needle

Jamie Maule, Cornwall Insight, UK, provides an overview of hydrogen development across Europe.

10

Building a strategy

Conrad Purcell and Shu Shu Wong, Haynes and Boone LLP, discuss hydrogen’s role in energy security and the decarbonisation of the UK’s energy sector.

15

Hydrogen: a springboard for the energy transition

Nuno Antunes, Association of International Energy Negotiators (AIEN), talks about the challenges of creating a green and low-carbon hydrogen economy, and how the AIEN member network is attempting to take steps to support this.

17

Continuing the green journey

Jon Constable and Stephen Peng, Protium, speak about their experience of using electrolyser technology in green hydrogen projects as end-to-end project developers, outlining the pitfalls and lessons learned.

21

Decentralised hydrogen – the key to decarbonising transport and logistics?

Richard Yu, IMI Critical Engineering, explains why decentralisation is key to the energy transition, and how applied knowledge of flow control systems is helping to accelerate the hydrogen economy in key industries such as transport and logistics.

24 Boosting electrolysis efficiency

Michael Immel, Holzapfel Group, Germany, explores how plating solutions can help to improve the efficiency of electrolysis in hydrogen production.

28 Mitigating risk

Cory Marcon, Endress+Hauser, USA, discusses how hydrogen permeation can pose risks to plants, and how this can be managed with the right instrumentation.

32 Creating confidence in hydrogen measurement

Mahdi Sadri, TÜV SÜD National Engineering Laboratory, UK, considers a range of measurement challenges for the hydrogen economy, and how these can be overcome.

36 Developed infrastructure for widespread distribution

For the hydrogen economy to grow, decisive action on investment and infrastructure is needed. Manish Patel, Air Products, explains.

40 Meeting new demands

Louis Mann and Daniel Patrick, Atlas Copco Gas & Process, USA, and Mazdak Shokrian, Plug Power, USA, discuss how turboexpander cooling technology can support hydrogen liquefaction expansion.

46 Going far beyond

Marion Erdelen-Peppler, ROSEN Group, Germany, considers the issues surrounding the use of hydrogen in exisiting pipelines, and explains why ROSEN has decided to build a hydrogen test laboratory.

50 Preparing for the maritime transition

Dr. Gunnar Stiesch, MAN Energy Solutions, Germany, assesses the key role that hydrogen will have to play in the maritime energy transition.

55 Pipe dream?

Sundus Cordelia Ramli, Topsoe, Denmark, explains why green hydrogen could help to decarbonise the steel sector.

This month's front cover

Building a low-carbon future together! The unique combination of Chart and Howden’s expertise and technology provides a range of solutions to support your energy transition, through the provision of hydrogen and LNG as clean burning fuel alternatives for power and transportation; and decarbonisation through the companies’ carbon capture processes.

Copyright©

@HydrogenReview like join Global Hydrogen Review @Hydrogen_Review follow

transmitted

the

of the claims

in the articles or the advertisements.

Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or

in any form or by any means, electronic, mechanical, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do

publishers endorse any

made

Join the conversation

2023

Summer

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Callum O'Reilly callum.oreilly@palladianpublications.com

Deputy Editor Bella Weetch bella.weetch@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Chris Atkin chris.atkin@palladianpublications.com

Sales Executive Sophie Birss sophie.birss@palladianpublications.com

Production Manager Kyla Waller kyla.waller@palladianpublications.com

Events Manager Louise Cameron louise.cameron@palladianpublications.com

Events Coordinator Stirling Viljoen stirling.viljoen@palladianpublications.com

Digital Content Assistant Merili Jurivete merili.jurivete@palladianpublications.com

Digital Administrator Leah Jones leah.jones@palladianpublications.com

Admin Manager Laura White laura.white@palladianpublications.com

“ I’m told that people listen to celebrities more than experts, which is ridiculous. But if that’s the case, I want to tell you something…”

That’s Cara Delevingne, the British model and actress, talking to us via her TikTok channel. And what does she want to tell us? “Hmmm. Industrial emissions,” she whispers, while spraying her face with a new beauty product. “That’s what this face mist from Vattenfall is made with.”

Ms Delevingne then clarifies – in both this TikTok video and an accompanying glitzy advertising campaign for Swedish multinational power company, Vattenfall – that her new face mist is made with “emissions from fossil-free hydrogen; a fuel that emits water instead of carbon dioxide (CO2).” She goes on to explain, in layman terms, the process behind green hydrogen production, and why it has the potential to do much more than produce emissions so clean that they could be sprayed on your face. Green hydrogen has the potential to revolutionise how we power entire industries.

In a separate press release, Vattenfall explains that the face mist in question is made from actual wastewater from the HYBRIT factory, a pilot plant that the company owns together with Swedish steel manufacturer, SSAB, and mining company, LKAB, that uses fossil-free hydrogen in the value chain to produce fossil-free steel.

At first glance, it is easy to dismiss this advertising campaign as a spoof. Cara Delevingne certainly seems to be in on the joke, knowingly poking fun at her roots in the high-fashion industry (she is seen strutting around a mock energy plant in a slinky dress before jumping into a pool of industrial wastewater). And that’s because the campaign is a spoof. Of sorts. A spoof with a serious message. “We’re not getting into the beauty industry”, Vattenfall reassures us. You can’t buy a bottle of this face mist. “It’s a 50 ml bottle of systemic change.”

The message behind the campaign is that green hydrogen has the potential to decarbonise entire industries, and thereby reduce carbon emissions significantly. Ultimately, it can help to bring us closer to fossil-free living within one generation. And if people really do listen to celebrities more than experts, then this campaign is an ingenious way of spreading the word to a wider audience. “I think the tongue-in-cheek way that we’ve tried to make people aware of the subject is really smart”, Delevingne told Harper’s Bazaar. “People approach conversations about the environment and climate change with a lot of fear, and there are so many people who just won’t engage for that reason.”1

Editorial/advertisement offices: Palladian Publications

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999 www.globalhydrogenreview.com

Green hydrogen is, of course, a key theme throughout this issue of Global Hydrogen Review. And while we may not have an A-list celebrity onboard to tell you more, we do have a range of articles from experts in the field on topics including green hydrogen project development, PEM electrolysis, how plating solutions can improve the efficiency of electrolysis, and the role of green hydrogen in decarbonising the steel sector. This issue also covers a range of other interesting themes, including infrastructure development, pipeline transportation, hydrogen’s role in the maritime energy transition, and much more.

1. STRUNCK, C., ‘“Being a model was taxing on my value system”: Cara Delevingne on eco-activism and fast fashion’, Harper’s Bazaar, (10 May 2023).

Callum O'Reilly Senior Editor

4

Jamie Maule, Cornwall Insight, UK, provides an overview of hydrogen development across Europe.

As net zero targets loom closer, there is an ever-increasing need to accelerate decarbonisation efforts across Europe, and move away from dependence on fossil fuels. In the midst of the energy crisis, brought on by Russia’s invasion of Ukraine, this need has become more apparent – as has the necessity to further protect energy security.

Low-carbon hydrogen is an effective means of combining these two objectives. Not only can hydrogen – if created electrolytically or with the use of carbon capture, utilisation and storage (CCUS) technologies – act as a replacement for gas in many industrial processes, it can do so while contributing little to no carbon emissions. With such credentials, it is perhaps unsurprising that, increasingly, hydrogen is being pursued as a decarbonisation solution across Europe and the world at large.

Differing approaches

Owing to its nascency, wide range of production methods, and debate surrounding its most cost- and time-effective applications, there is no singular consensus on how hydrogen should contribute towards net zero. However, it is understood to be part of the solution. Recent policy developments at both the supranational (EU) and national level have, while allowing for differences, fostered some greater alignment across Europe, as focus is increasingly being placed on the development of renewable hydrogen. This becomes clear when looking at recent developments within the EU and the UK.

Close to consensus

At an EU level, the Hydrogen Strategy for a climate-neutral Europe, as well as the REPower EU Plan, outline common objectives for member states in their collective net zero transition. If implemented correctly, this should facilitate the production (10 million t) and import (10 million t) of 20 million t of renewable hydrogen within the EU by 2030.

In order to reach this ambitious target, 2020’s Hydrogen Strategy previously outlined two phases of hydrogen development that have since been expanded with the introduction of the REPower EU Plan in May 2022. While the initial phase one targets aimed for 6 GW of electrolysers by 2024, Russia’s invasion of Ukraine has accelerated the need for hydrogen across Europe (see Figure 1), with the EU now aiming to deploy 17.5 GW of electrolysers through the ‘Hydrogen Accelerator’ programme by 2025. While targets have changed, the fundamentals of EU-wide hydrogen development remain largely the same, as production will primarily be sited around demand centres, with transport and storage still in the planning stages until the latter half of the decade. During the second phase, hydrogen transportation will expand through the development of a pan-European grid, allowing for intercontinental and international trade. To meet growing demand, electrolyser capacity will scale up to 40 GW by 2030 – with an additional 40 GW across eastern and southern neighbourhood countries – while hydrogen will become more cost-competitive with natural gas through

5

demand-side support policies. Alongside this, hydrogen will be increasingly pursued for long-term energy storage.

Funding this transition will prove to be one of the major barriers to renewable hydrogen development in the EU, as current estimates suggest that between €335 – 471 billion will need to be raised from 2020 to 2030.1 The bulk of this investment (€200 – 300 billion), however, is not needed for hydrogen infrastructure itself, but rather for the further development of 80 – 120 GW of solar and wind generation, to be connected to electrolysers. While much of this must be financed through private investment, the EU and member states have a key role to play in providing the incentives to unlock private capital.

To bolster investment in both domestic EU production and third country import of renewable hydrogen, the European Commission introduced the European Hydrogen Bank (EHB) on 16 March 2023. Through competitive auction rounds, the bank’s central role is to lower the cost gap between fossil-based and renewable hydrogen until it reaches a “level that private offtakers are willing and able to cover.” While auction design has not yet been finalised, the first round for domestic production will have a budget of €800 million and will aim to connect EU domestic supply and demand for renewable hydrogen, supporting producers by providing a fixed payment per kg of hydrogen for up to 10 years. Similarly, a separate

auction has been proposed to set a fixed price between international producers and EU consumers.

To further link supply and demand of hydrogen throughout the EU while developing business models and furthering research and innovation, the European Commission has called for the doubling of Hydrogen Valleys – industrial clusters –from 23 in 2023 to 46 by 2025. This will not only increase both supply of and demand for hydrogen, but will also allow for the development of best practices within the industry, create a wealth of new jobs, and make hydrogen more investable in both the short- and long-term – while also increasing public perception of the uses of hydrogen. Assuming this doubling is met, hydrogen production, transportation and industrial applications will undergo significant development, allowing them to become more investable and commercially-viable.

Moreover, final decisions on the Renewable Energy Directive’s Additionality Delegated Act (which sets the definition for renewable hydrogen, among other things, and affirms the principle of additionality) and the Methodology Delegated Act (which concerns greenhouse gas emissions savings calculations) have brought further clarity to the European hydrogen market. With the principle of ‘additionality’ now firmly set, and nuclear added as a renewable source of hydrogen production, investors and generators now have the necessary legal certainty to begin developing projects and contributing to the growing hydrogen economy. While not exhaustive, these developments will allow the EU to expand their hydrogen capabilities, and are vital steps towards the attainment of 2030 targets. Of course, success can only be assured if individual member states also work towards achievement of their individual hydrogen strategies. According to research conducted by Cornwall Insight’s Low-Carbon Hydrogen Index, significant progress has been made by many EU member states over the past year.²

Zoom in on the UK

The UK further cemented its hydrogen ambition in 2022, as April’s British Energy Security Strategy saw capacity targets double from 5 to 10 GW – of which half should be electrolytic – by 2030. In application, the fuel will be used primarily to cover industrial demand (see Figure 2) and provide flexibility through storage. To facilitate this increase, the government has been working to provide investors with more clarity on the future role of hydrogen within the UK, while also dedicating more funding to hydrogen projects throughout the country.

Providing a more consistent flow of communication between the government and the UK’s emerging hydrogen sector, the now Department for Energy Security and Net Zero has released several key documents over the past year to ensure that the market is kept in the regulatory loop.

Principally, April 2023’s Hydrogen Net Zero Investment Roadmap, an update to the previous year’s Hydrogen Investor Roadmap, provides a clear outline of past and future developments within the sector. Among other things, the roadmap provides dates for several key milestones such as the development of hydrogen business models, trials and final decisions on hydrogen’s

6 Summer 2023 GlobalHydrogenReview.com

Figure 1. Hydrogen use by sector in the EU by 2030 (source: European Commission Staff Working Document Implementing the REPower EU Action Plan).

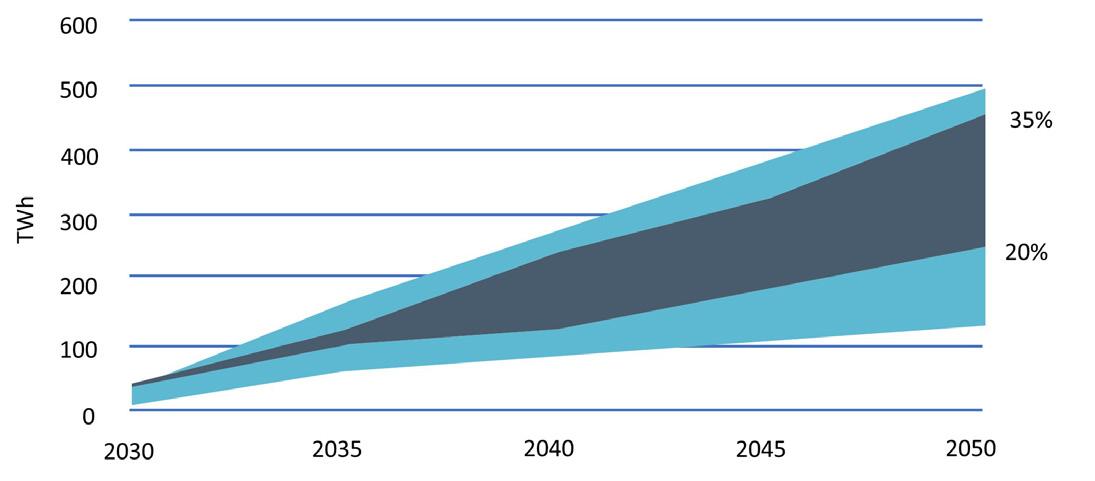

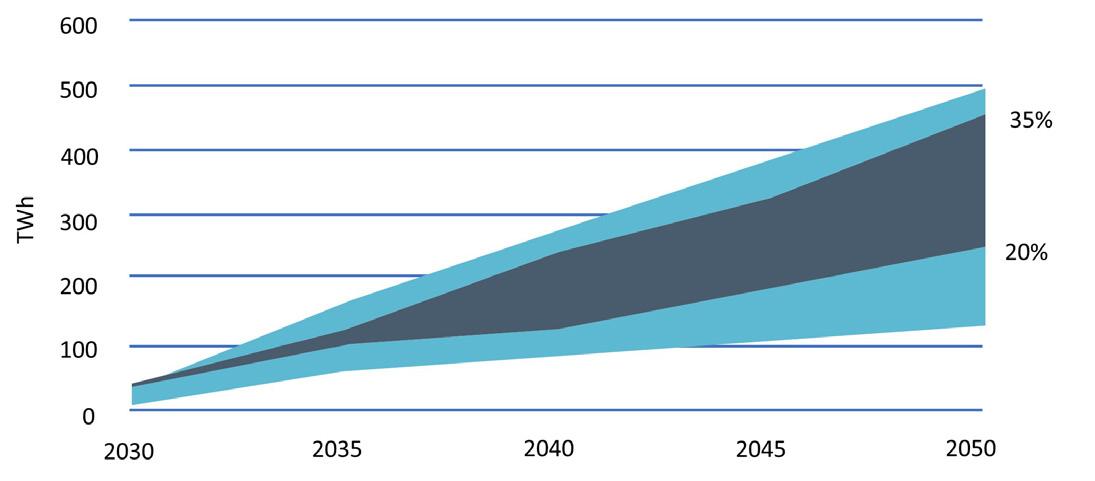

Figure 2. Projected hydrogen demand in the UK, 2030 – 2050 (source: DESNZ Hydrogen Net Zero Investment Roadmap).

use in domestic heating, and the viability of blending hydrogen into gas networks. While some of these decisions will not be made until 2026, it is nonetheless beneficial for the sector to know its future direction of travel in order to inform investment decisions in the short and longer term.

As the roadmap also provides estimates for hydrogen demand within the UK towards 2050 (see Figures 2 and 3), developers and investors are provided with further clarity on the expected size, scale and opportunity presented by a growing UK hydrogen sector. Coming alongside regular Hydrogen Strategy updates to the market – an overview of government activity in the hydrogen space over the preceding six months – investor confidence in the UK’s hydrogen sector is certainly improving.

The UK has also been backing targets with funding over the past year, as the ‘Powering Up Britain’ announcements in March 2023 confirmed the first 15 successful applicants from the £240 million Net Zero Hydrogen Fund. In this first round, £37.9 million will be made available for development (Strand 1) or capital (Strand 2) expenditure to help de-risk investments and lower lifetime costs, allowing projects to progress with a greater degree of certainty.

The second round accepted applications until May (Strand 1) and June (Strand 2) 2023, with a total of £45 million in the potential funding pot. Meanwhile, progress continues to be made on the development of the Hydrogen Production Business Model – which seeks to provide revenue support to low-carbon hydrogen projects – as the design has been finalised and the first 20 projects, of which many are electrolytic, have been selected. While the outcome of the round remains to be seen, with £58 million of revenue support allocated and with project applications totalling 408 MW – of which only 250 MW can proceed – it is clear that hydrogen projects are receiving significant support in the UK. In order to further advance the target of 2 GW hydrogen capacity by 2025, an additional allocation round will award contracts for up to 750 MW of capacity in 4Q23.

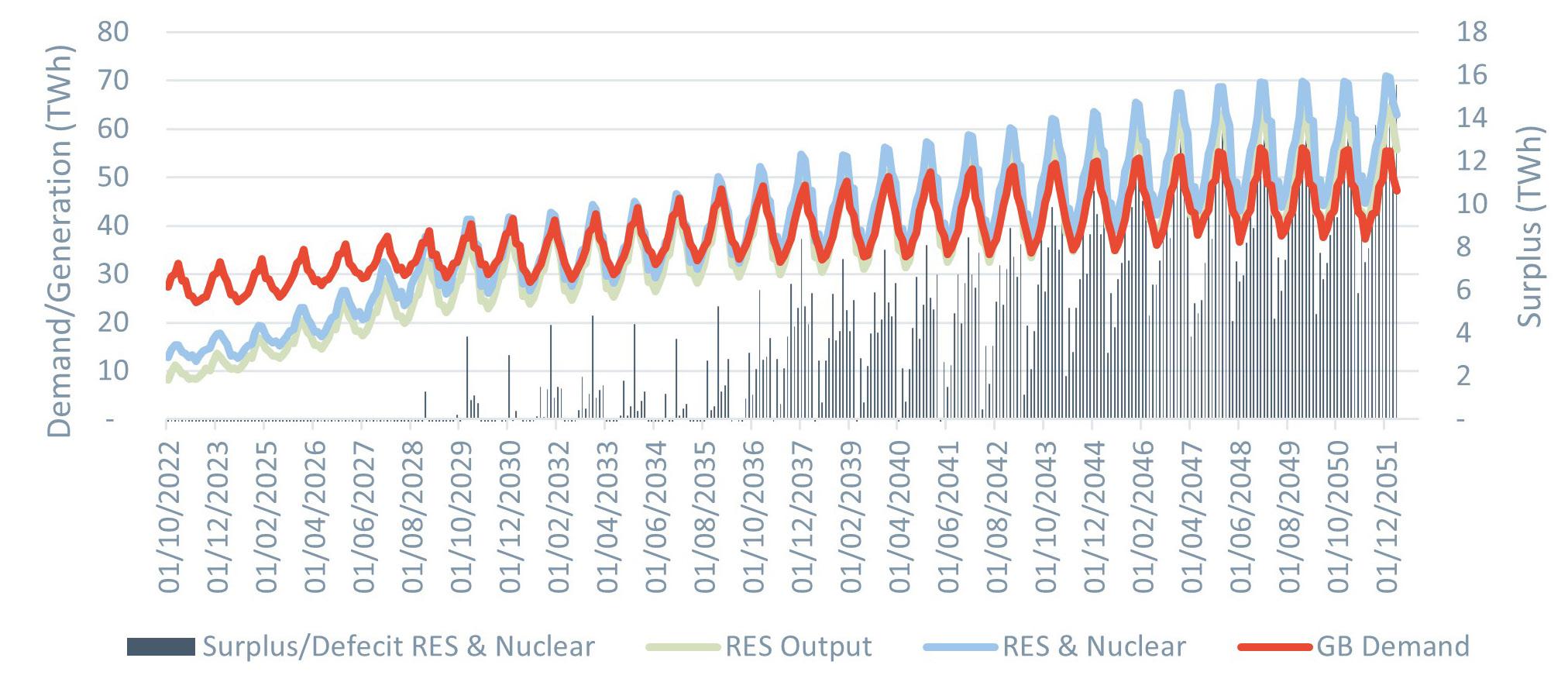

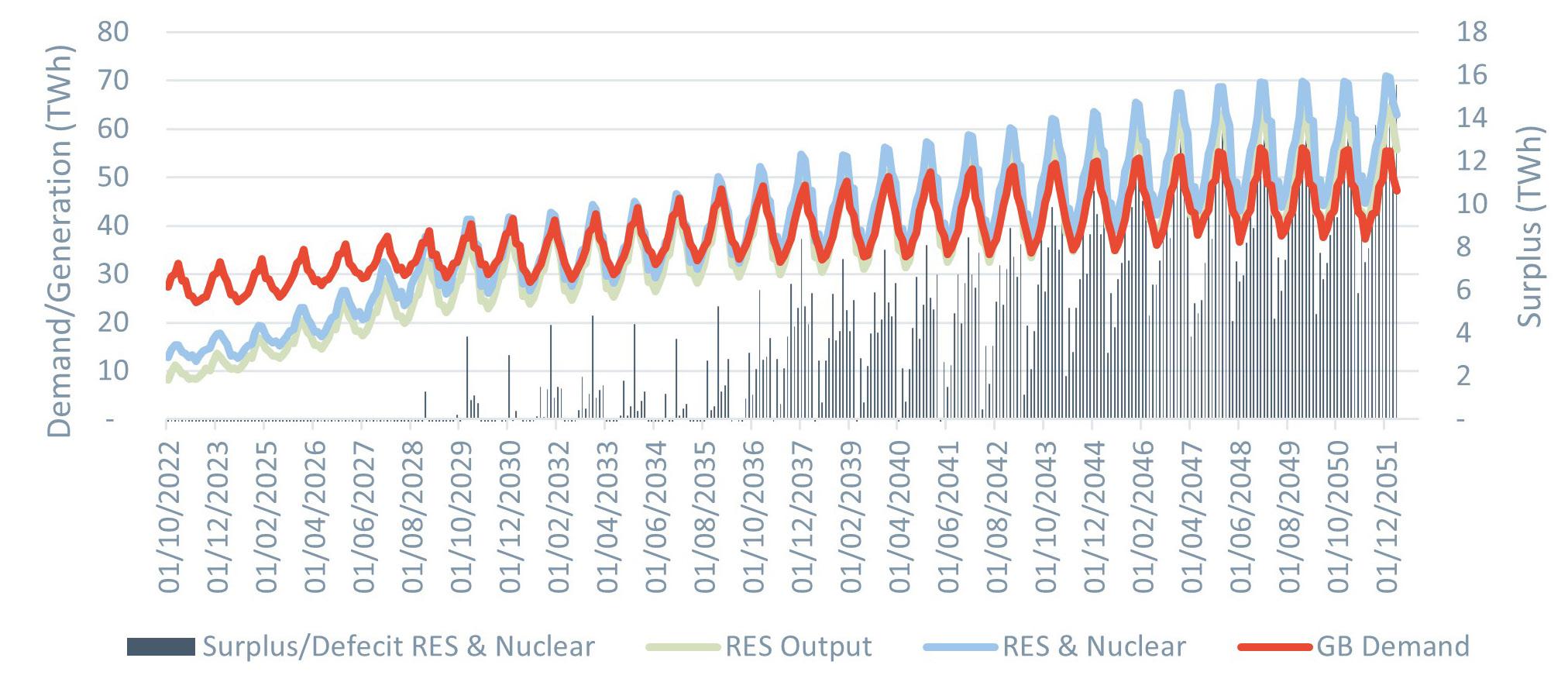

Despite such strong progress, the UK still has some work to do to develop its nascent hydrogen sector and deliver targets on time. On the one hand, it is necessary that the government further outlines plans for hydrogen transport and storage (T&S) as it is currently unclear how investment will be unlocked, what T&S infrastructure will look like, and who will build it. It is also key that the government acknowledges that with increasing competition for surplus electricity – through further electrification of industry and the growing presence of electric vehicles – the UK’s hydrogen sector will require dedicated sources of electricity to balance supply and demand (see Figure 4).

Conclusion and outlook

The European hydrogen economy continues to show promise for the future, as both the EU and national governments have been furthering their capacity ambitions while working to make hydrogen more viable at scale. This is no time for complacency, however, as the global hydrogen economy continues to become more competitive, with the US, India, China and Saudi Arabia – among others – all increasing both their appetite and funding for hydrogen development. As such, it is imperative that while hydrogen ambition continues to grow across Europe, it is met by concrete action to meet targets. In order to do this, European countries must work to secure supply chains, upskill labour forces, and incentivise investment in the still-nascent hydrogen economy.

References

1. ‘Communication from the commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions’, European Commission, (16 March 2023), https://eur-lex. europa.eu/legal-content/EN/TXT/?u ri=CELEX%3A52023DC0156&qid=16 82349760946

2. MAULE, J., ‘Furthering clarity and capacity: The UK increase low-carbon hydrogen commitments’, Cornwall Insight, (20 April 2023), https://www. cornwall-insight.com/our-thinking/ chart-of-the-week/furtheringclarity-and-capacity-the-ukincrease-low-carbon-hydrogencommitments/

8 Summer 2023 GlobalHydrogenReview.com

Figure 4. Monthly renewable energy sources and nuclear generation and demand (source: Cornwall Insight).

Figure 3. Hydrogen demand range for industry in the UK, 2030 – 2050 (source: DESNZ Hydrogen Strategy Analytical Annex).

MOBILITY SAF E-fuels HYDROGENATION DEHYDROGENATION STEAM REFORMER INDUSTRY CO₂ CCUS PURIFICATION PURIFICATION H2 UNDERGROUND STORAGE POWER GENERATION LOHC (TOLUENE) LOHC (MCH) ELECTROLYZER DAM Axens Activity CO2 H2 H2 COMMODITY Click here Your roadmap to Low Carbon H2 Discover Axens Solutions for the Production, Transport & Storage and Purification of Hydrogen

10

Conrad Purcell and Shu Shu Wong, Haynes and Boone LLP, discuss hydrogen’s role in energy security and the decarbonisation of the UK’s energy sector.

Against the backdrop of the UK’s Hydrogen Strategy, which was announced in 2021 and was hailed as a ‘green industrial revolution’, hydrogen has played an increasingly critical role in the decarbonisation of the UK’s energy system.

Pilot projects

Across the UK, a number of pilot projects have used hydrogen. For instance, last year Centrica Business Solutions announced that it will commence a 12-month trial to inject hydrogen into its existing 49 MW gas peaking plant in Brigg, Lincolnshire, England, with the use of HiiROC’s technology that produces so-called ‘emerald hydrogen’ – a type of hydrogen created using a process called Thermal Plasma Electrolysis.

This is the first time that hydrogen will be used within a grid-connected, gas-fired power plant. Blending hydrogen with natural gas will reduce the

11

overall carbon intensity of the plant. Additionally, the byproduct of emerald hydrogen is a form of solid carbon called carbon black, which can be captured easily and has commercial value, as it is used in the production of tyres, rubbers and toners, and also in building materials and soil enhancers.

The outcome of this trial will be important in informing future use cases of this technology and its wider deployment across gas-fired peaking plants.

Hydrogen is also being trialled in the quest to develop a cleaner and more efficient transportation sector in the UK. The first phase of a pilot project kickstarted at Teesside Airport in Darlington, England, with the use of vehicles fitted with 100% hydrogen, zero-emission engines.

The UK’s Hydrogen Strategy

The raft of pilot projects in the hydrogen sector has been propelled by the UK’s commitment to work with industry to meet its ambition to develop the country’s low-carbon hydrogen production capacity. The UK announced a £105 million funding package through its Net Zero Innovation Portfolio as a first step towards building the UK’s low-carbon hydrogen economy. The funding package takes the form of various grants to businesses and developers to support the development and trials of solutions to switch industry from high- to low -carbon fuels such as natural gas to clean hydrogen, for instance.

Additionally, in April 2022 the British Energy Security Strategy was published, outlining the government’s plan to double its hydrogen production target from 5 GW to 10 GW by 2030. In order to meet this target, the Net Zero Hydrogen Fund (NZHF) was announced, whereby £240 million of available funding will be distributed to eligible low-carbon hydrogen projects across four strands. Which strand a project can apply for depends on its maturity and the level of support required:

y Strand 1: DEVEX support for early projects to cover FEED studies and post-FEED studies.

y Strand 2: CAPEX for projects that do not need a hydrogen business model (HBM). A project applying for this strand must exist on its own merit and solely require CAPEX support.

y Strand 3: CAPEX for projects requiring an HBM.

y Strand 4: CAPEX for carbon capture, utilisation and storage (CCUS) projects requiring an HBM.

The HBM is a financial support mechanism incorporated into strands 3 and 4, and is designed to subsidise operational costs to encourage and support the hydrogen market. It is provided together with funds granted through the NZHF, as a long-term revenue support contract.

The HBM has many similarities with the Standard Contracts for Difference Terms and Conditions for Allocation Round 4 for low-carbon electricity, as well as the Heads of Terms for the Dispatchable Power Agreement and the Heads of Terms for the Industrial Carbon Capture Contract for the CCUS programme. Based on the government’s published indicative heads of terms for the HBM (Indicative HBM Terms), it is clear that the intention is to proceed with a contractual, producer-focused

business model that is applicable to a range of hydrogen production pathways. Some of the key elements include:

y A variable premium price support model where the subsidy is the difference between a ‘strike price’ reflecting the cost of producing hydrogen and a ‘reference price’ reflecting the market value of hydrogen.

y Setting a reference price based on the producer’s achieved sales price, with a floor at the natural gas price, and a contractual mechanism to incentivise the producer to increase the sales price and thereby reduce the subsidy.

y Providing volume support via a sliding scale in which the strike price (and therefore subsidy) is higher on a per unit basis if hydrogen offtake falls.

y Allowing small-scale hydrogen transport and storage costs to be supported through the business model where necessary, taking into account affordability and value for money.

y Introducing a levy to fund the business model from 2025 at the latest, subject to consultation and legislation, with the first electrolytic projects being funded through general taxation if they are operational before the levy is in force.

Allocation of risk, and potential legal issues

Different stakeholders of low-carbon hydrogen projects, whether it be the investors or developers, will have to consider a number of issues when allocating and managing potential risks, as set out in the following sections:

Investability

In order to apply for a particular strand under the NZHF, the project will need to meet certain eligibility criteria. For instance, in terms of strands 1 and 2, the business must be registered in the UK, the project must be completed in the UK, it must use technology tested in a commercial environment at a Technology Readiness Level 7 or above, and the business must intend to exploit results from or in the UK.

Projects that are successful in applying for strands 1 or 2, for instance, will receive grants that are paid quarterly, and only after quarterly audits are completed (which would include a visit from the appointed monitoring officer).

In addition to the lack of certainty in receiving each quarterly grant, due to the dependence on the successful satisfaction of an audit, another ongoing – and perhaps bigger – concern may be whether there would be a change in policy and thereby the framework of the aforementioned low-carbon hydrogen business model, if and when there is a change in government.

These are issues that would need to be taken into account when calculating the project metrics and determining the risk allocation when negotiating relevant agreements for the project.

Structure of hydrogen projects

As demonstrated through pilot projects using hydrogen (such as the collaboration between Centrica Business Solutions and HiiROC to inject hydrogen into a gas peaking plant), the development of hydrogen may require the

12 Summer 2023 GlobalHydrogenReview.com

We understand how you need to reduce complexities at your plant.

CLEAN PROCESS + CLEAR PROGRESS

You strengthen your plant’s safety, productivity and availability with innovations and resources.

Endress+Hauser helps you to improve your processes:

• With the largest portfolio of safety instruments that comply with international regulations

• With applied technologies and people who have extensive industry application know-how

• With access to accurate and traceable information

Do you want to learn more? www.endress.com/oil-gas

collaboration of investors and developers/technology providers.

A point worth noting is that the Indicative HBM Terms provide for a term of between 10 – 15 years which reflects, amongst other things, a balance between providing price support certainty for producers for a proportionate and reasonable period, whilst not locking in production pathways for the long-term. It also serves as an indication as to the possible or potential duration of a joint venture (JV), if it is entered into.

Some of the usual list of issues for investors to consider when entering into a JV include the obligation to contribute funds to the JV company, the ownership of intellectual property rights, the mechanics of funding (whether by way of shareholder loans or the issue of preferred shares), voting rights, tag and drag along provisions, and deadlock resolution mechanisms.

Adaptability of existing plants

The use of hydrogen by power generators will raise a number of issues that need to be addressed and considered in advance. The first and main concern will be to ensure that the technology being used to generate power, such as a gas-fired turbine, can be adapted to run on blended fuel. This is important to ensure that the owner of the plant does not invalidate the performance and defect warranties that the technology provider offers with its equipment, for instance.

The owner of the plant will also need to ensure that the reliability and performance of the plant are not affected in a way that negatively impacts any obligations it has to provide power under the terms of any existing power sales contracts.

If the plant’s performance is negatively affected by the use of blended fuel, the owner of the plant may be penalised for under-performance of its plant and failure to meet its generation obligations.

Looking forward

The aim will be for hydrogen to replace fossil fuels, with green hydrogen (a type of hydrogen that produces no harmful greenhouse gas emissions) being the sole produced type. However, green hydrogen is still in its infancy, and hydrogen has so far not been used at scale due to the costs associated with its production and the maturity of the various technologies already in existence for other forms of energy.

Fortunately, with the UK government’s commitment to and backing of the hydrogen industry, in the form of various grants and subsidies, the development of low-carbon hydrogen projects across the UK has witnessed strong growth. Low-carbon hydrogen will no doubt play a very important part in the UK’s energy security and the country’s aim to create a diverse and secure decarbonised energy system – ultimately helping the UK to meet its commitment to achieve net zero by 2050.

Global Hydrogen Review Online

Visit our website today: www.globalhydrogenreview.com Home to the latest hydrogen news, analysis and events

Nuno Antunes, Association of International Energy Negotiators (AIEN), talks about the challenges of creating a green and low-carbon hydrogen economy, and how the AIEN member network is attempting to take steps to support this.

In order to deal with the issues of climate change, society is working towards an energy transition that is eliciting a change in industry segmentation. There is recognition that different forms of energy make up the sector, and that they need to work together if we are to meet decarbonisation targets. There will be no net zero without a contribution from green and low-carbon hydrogen.

However, what does this mean for the oil and gas industry? At surface level, the diversification of energy companies to meet the needs of the energy transition can be seen in brand changes. Statoil has become Equinor, Total has changed to TotalEnergies, Qatar Petroleum is now QatarEnergy, and the Association of International Petroleum Negotiators (AIPN) has become the Association of International Energy Negotiators (AIEN) to reflect the needs of members. However, these are more than just name changes. The new names reflect substantive changes that underline the evolution of the oil and gas industry in the context of the energy transition.

We have relied on petroleum products for a long time. First, it was liquids. This was then followed by a greater demand for gas. Of course, petroleum will remain in focus for many years yet, but a number of other energy sources are now entering the mix, and there is a broader focus on what is needed in order to meet energy demands for the future. When factoring in more expensive energy, a number of hurdles lie ahead.

At the 2022 International Energy Summit (IES), Gunther Newcombe OBE, Project Coordinator, Orion Clean Energy Project (Shetlands), explained: “Hydrogen is part of an integrated energy solution but, whereas electricity is simple, hydrogen is more complicated. A hydrogen economy is a balance between equity, environment, and energy security. Whereas focus has been on the environment, geopolitical events have put greater emphasis on security and affordability.”

AIEN, which is a member voluntary organisation, supports the energy transition in a number of different ways. The launch of three taskforces earlier this year – hydrogen;

15

carbon capture, utilisation and storage (CCUS); and the broader subject of environmental, social and governance (ESG) –endeavours to respond rapidly to emerging issues in the wider energy realm.

Hydrogen: all the colours of the rainbow

Hydrogen has been produced from methane for many years, and has become one of the key focuses of the energy transition. Production from methane does not combat the issue of carbon emissions, and so companies are looking for ways to increase the volume of hydrogen that is produced from renewables or other low-carbon emission sources. There is a whole rainbow of colours associated with hydrogen, reflecting its technology and feedstock, as well as its associated carbon footprint – from black hydrogen produced from coal with carbon emissions; grey (carbon emissions) and blue (carbon captured using steam reforming from natural gas); through to green hydrogen produced via electrolysis powered by renewable electricity.

Other colours remain underexplored, such as turquoise hydrogen (methane split into hydrogen and solid carbon through pyrolysis), and white hydrogen (which already exists in natural form, and whose potential is yet to be uncovered).

As the hydrogen economy develops, and more colours are effectively added to the hydrogen rainbow, localised production methods will vary depending on regional resources and circumstances, as well as applicable legislation.

The hydrogen taskforce

Generally speaking, one of the biggest challenges associated with creating a green or low-carbon hydrogen economy is overcoming the inertia required to get the ball rolling. Legislation and regulations are still developing, and contracts and clauses will vary from archetypical oil and gas contracts. How projects are financed is one major hurdle.

At the IES, Manuel Manrique, Hydrogen International Business Development Manager, Repsol, said: “The question is how we create a global hydrogen market and commoditise it. We require solutions for transportation and projects need to be bankable. This requires offtakers to give certainty.”

For oil and gas projects, joint ventures (JVs) typically constitute entities that are similar. For hydrogen, however, there may be varied stakeholders, including traditional oil and gas companies (majors included) and utility companies, who are not typically used to working with each other on energy projects. Although some parallels may be drawn with traditional oil and gas, there is still a lot of work to be done with regards to how contracts will reflect the differences in the types of projects and contributions of various stakeholders.

Currently, not many green hydrogen projects have commenced production. The first full-scale industrial plants will probably not be online until late next year. As such, AIEN’s Hydrogen Taskforce has started up to try to help members to fill knowledge gaps when it comes to the hydrogen sector. Defining the deliverables, such as model contracts and clauses, will help to accelerate the development of hydrogen projects.

In order to develop green and low-carbon hydrogen such that it becomes a key actor in the decarbonisation journey, all those involved in the industry need to help one another by pooling knowledge and experience. Alongside the creation of materials

to help facilitate projects, forums for knowledge sharing and discussing how to overcome challenges are critical to the creation of a viable hydrogen economy. Hydrogen production requires input from legislation, as well as financial/economic and technical standpoints to understand difficulties, overcome hurdles, and ultimately make projects bankable. Only then will significant green and low-carbon hydrogen production be realistic. Ultimately, the more voices that join the choir, the faster hydrogen resources and deliverables will be developed.

The hydrogen value chain

While oil and gas is quite neatly apportioned through upstream, midstream and downstream production, hydrogen requires a slightly distinct approach. Upstream, there are several ways of producing all of the different colours of hydrogen, with specificities in each value chain. Downstream, how hydrogen is utilised will also vary. The best option is using it in applications where electrification is technically or economically unfeasible. It is in the harder-to -abate sectors, such as refining, steelmaking, fertilizers (ammonia), or even in aviation (through synfuels) that green or low-carbon hydrogen can have the most impact in terms of decarbonisation.

Midstream, how one ships, stores and transports hydrogen, or combines hydrogen with carbon capture technology (e.g., synfuels), are all areas to be further investigated. The offtaker (and how it uses hydrogen) may have to be considered in order to define technical aspects of a project. Where transportation is necessary, perhaps not all clients will want to receive hydrogen in the form of ammonia. How to transport hydrogen when production is not onsite will be a critical consideration when designing hydrogen projects.

The cost of hydrogen

How much users will be willing to pay for hydrogen will impact project viability. Different regions are looking at supporting the creation of hydrogen economies in different ways. Globally, the cost of green hydrogen production is expected to drop. The most optimistic forecasts are eyeing up a target of US$1.5/kg by 2030. At present, however, it is difficult to place green hydrogen on an equal footing with grey hydrogen in terms of production costs, and how these will be equalised through government support could become critical for the emergent hydrogen market.

At the IES, Emily Sykes, Vice President, Energy Transition Fund, Copenhagen Infrastructure Partners, explained: “Scale is a bigger issue than price. As hydrogen technology scales, prices will come down. The challenge is how to get offtakers to start buying hydrogen. Certainty in this area will make projects viable.”

Conclusion

We are on an energy transition journey, and this will not happen overnight. While there are many hurdles to overcome, hydrogen offers a promising means for decarbonising certain hard-to-abate sectors. The sharing of knowledge and experience can provide a springboard for the acceleration of hydrogen market development, and the AIEN Hydrogen Taskforce is focused on bringing AIEN members together and collaborating with other organisations to achieve common goals and facilitate value creation in the hydrogen sphere.

16 Summer 2023 GlobalHydrogenReview.com

Hydrogen, in particular green hydrogen produced via electrolysis, is seen as key to the global energy transition and meeting ambitious net zero targets by 2050. As the technology progresses, end users in industry increasingly see it as an answer to decarbonisation and ultimately removing carbon dioxide (CO2) emissions from their operations altogether.

In February 2023, Protium announced a partnership with the University of South Wales (USW) to deploy its first 100 kW electrolyser in Baglan, South Wales. This is the UK’s largest anion exchange membrane (AEM) integrated electrolyser, sourced from Enapter.

This partnership highlights the critical role that green hydrogen can play in reducing greenhouse gas emissions from industry. Commissioning of the Pioneer project also marks a significant milestone in building a network of hydrogen-generating facilities for the UK’s green hydrogen infrastructure.

How the technology works in practice

AEM electrolysers feature a semipermeable membrane that conducts negatively-charged ions to carry out water electrolysis, using renewable energy to split water molecules into hydrogen and oxygen. This combines the affordability of alkaline electrolysers with the flexibility, fast response, compact size, and high hydrogen purity of proton exchange membrane (PEM) technology.

AEM technology is also highly scalable, with small-to-medium production needs met by stacking as many units as necessary in cabinets. The particular product variant selected for the Pioneer project was the AEM Electrolyser EL 4.0 Liquid Cooled (LC). This was chosen because the limited space available in the 20 ft shipping container meant that an external water-cooling system was essential.

When operating at full capacity, the electrolyser will generate around 40 kg/d of hydrogen at a pressure of 35 barg. The hydrogen

17

Jon Constable and Stephen Peng, Protium, speak about their experience of using electrolyser technology in green hydrogen projects as end-to-end project developers, outlining the pitfalls and lessons learned.

will then be compressed up to 450 barg using a compressor, which enables the hydrogen to be transferred into a series of manifold cylindrical pallets (MCPs) that are used for transportation and storage of the finished hydrogen product at a pressure of 300 barg. This is suitable for use in a variety of applications, such as fuel for vehicles, stationary power systems, or heat.

The integration was achieved very quickly, as the devices have hybrid hardware-software capabilities that streamline and speed up commissioning (and unlock remote monitoring and control). A toolkit was also used to create energy management systems.

Tools such as Enapter’s Energy Management System Toolkit make it possible to cut the deployment time for such projects even further. It is possible to use premade blueprints to integrate third-party energy devices, or control entire energy systems from one place, regardless of the individual components and what software languages they communicate with. Such software will not only increase the speed at which green hydrogen projects can be rolled out, but also unlock further value by tying energy production to wider data sources and automated decision making; integrating AEM electrolysers within industrial systems via the OPC UA Industry 4.0 protocol; and giving developers/integrators of energy solutions open-source tools to innovate.

Green hydrogen: project development

The process of developing a green hydrogen project is not dissimilar to developing any other type of energy project. The facility must be designed to the relevant standards, correct permits must be in place, and planning consent must be granted prior to construction. However, there are no specific design standards or regulations for green hydrogen projects. Therefore, developers need to use existing standards and regulations, some of which are not fit for purpose. For example, the permitting process treats green hydrogen as it would a large chemicals facility. As these projects are new and not yet on a significant scale in the UK, planning authorities are not as familiar with them, and the framework needs to be developed to facilitate the introduction of hydrogen into the country’s infrastructure. It is worth noting that this is very common for the introduction of new technologies.

A typical development begins with finding a location for the project, followed by design, procurement of equipment, and finally construction and commissioning. Where the Pioneer development differed from a typical project is that Protium procured the electrolysers first.

The electrolysers are unable to generate hydrogen on their own without additional balance of plant items, such as water treatment and drying. To achieve this, Protium approached Fuel Cell Systems, one of Enapter’s UK integration partners, to combine the electrolysers and balance of plant items into a single 20 ft shipping container to achieve modularity for the system.

The site

During the electrolyser integration step, Protium evaluated several sites for deployment. An ideal green hydrogen site typically includes:

y Availability of electrical power – both grid and behind the meter renewables.

y Availability of water – mains water for small- and medium-scale projects; seawater for large-scale projects.

y Familiarity of hydrogen and other high-pressure gases.

y Access to technical expertise and subject matter experts in hydrogen.

y Proximity to key offtakers.

Protium has partnered with the University of South Wales’ Hydrogen Centre to deploy this first electrolyser, as both parties see this initial project as a catalyst for additional hydrogen production in South Wales. Through commercial operations, the team will also create knowledge of how to operate the technology.

Planning and permitting

Protium concluded that the development fitted within the developmental boundary provisions for the University site. Working alongside a planning specialist, the company applied for standard rules low impact installation part A. With typical permitting processing times reaching six months or more, Protium worked with Natural Resources Wales (NRW) to develop a new permitting process specific to green hydrogen. This will reduce the permitting process to around two months, and is due to be rolled out later in 2023.

Technical design and safety case

Hydrogen is at the forefront of discussions surrounding decarbonisation and net zero, but in fact it has been used safely by industry for many years. The first hydrogen fuel cell was developed in the 1800s, and hydrogen has been used in oil refining, petrochemical, steel, and fertilizer production for over half a century. Years of research and development and practical experience have made it possible to develop rigorous engineering controls and guidelines to mitigate the risks of producing, transporting and using hydrogen.

Established production methods such as electrolysis are now being scaled up and deployed at larger centralised and smaller localised production hubs, each covering a few acres, creating the need to review and update regulations so that the right processes are in place to help developers deliver and operate safe facilities.

Green hydrogen builds on − and draws knowledge from − other industries in order to maintain inherently-safe design standards. When it comes to designing, constructing and maintaining a

18 Summer 2023 GlobalHydrogenReview.com

Figure 1. The University of South Wales’ Hydrogen Centre.

green hydrogen production facility, developers also draw on learnings from the smaller bank of facilities that have been developed. As of January 2022, there were around 25 similar facilities in operation internationally, with the largest being the 3 MW system operated by ITM Power in Tyseley Energy Park in England.

While there are many engineering, procurement and construction (EPC) companies looking to develop skills within the hydrogen industry, the size of the Protium electrolyser meant that a partner with experience of deploying small-scale electrolyser facilities in the UK was required. Fuel Cell Systems also had experience in this end of the UK market, and was selected to integrate the Pioneer system.

The design for the Pioneer system was completed in December 2022, and installation commenced in January 2023.

Commissioning and looking to the future

Protium started the construction phase of the project in January 2023, with commercial operation in March 2023. With up to 65% of the levelised cost of hydrogen coming from electricity, the company is working with Siemens to develop a digital twin to optimise the production of hydrogen, with the aim of utilising electricity when the price is low and halting production when the price is high. With the digital twin, Protium aims to deliver the lowest levelised cost of hydrogen to its clients, enabling a feasible and cost-effective energy transition.

Lessons learned

Reading about the deliverability and cost of developing a hydrogen production facility in a consulting report is one thing, but delivering and scaling up projects is another issue altogether. When it comes to getting a small-scale electrolyser system online, some of the key learnings from the Pioneer project are outlined in the next section.

Managing inherent safety

A key aspect of any project is ensuring that inherent safety is achieved within the design. By its nature, hydrogen is more flammable than natural gas. However, being a much lighter

molecule, it also disperses faster. Therefore, achieving adequate ventilation for a hydrogen system is a key challenge to prevent hydrogen from reaching its flammability limit (4% v/v in air).

In order to achieve an inherently-safe site, many key pieces of equipment were deployed outside of containers to ensure maximum natural ventilation and to prevent hydrogen build-up.

Additionally, the hydrogen container was fitted with forced ventilation, which ensures that hydrogen can never reach its flammability limit. Explosion-proof equipment is also used where needed.

Supply chain disruptions

The ongoing war in Ukraine, coupled with a surge in demand for green hydrogen products, has put a squeeze on the supply chain in nearly every area of the mechanical manufacturing of products. It is not typical to see costs increase by over 30% and lead times increase by over 100% in the space of a few weeks. From a developer perspective, this puts pressure on placing orders early and managing contracts to prevent cost overruns.

Stakeholder management

An often overlooked aspect of projects is stakeholder management. Green hydrogen is a nascent industry and many key stakeholders are unfamiliar with hydrogen compared to other fuel sources. The key lesson here is that a developer’s job extends to educating all stakeholders about green hydrogen, including the benefits and drawbacks of utilising hydrogen in their processes.

The future

Project Pioneer demonstrates the ongoing development of the UK hydrogen market. One of the key takeaways from the project has been to demonstrate the importance of scaling up in the market, proving the technology and processes, and leveraging the lessons learned. This has meant that Protium has been able to deliver outcomes more quickly, which is important for the wider market. The project has brought different parts of the market together on the green hydrogen journey – supply chain, transportation, safety parties, electrolyser manufacturer, university partner and employees – giving everyone the chance to grow, analyse, learn, and scale up for the future.

20 Summer 2023 GlobalHydrogenReview.com

Figure 2. Pioneer One project timeline.

Hydrogen has long been recognised for its potential to decarbonise industry, not least in transport and logistics. The 2015 Paris Agreement highlighted the key role that it is expected to play in the race to reduce emissions, making up a significant portion of fuels used by the middle of the century.1

Despite high hopes, however, uptake of hydrogen has lagged in comparison to the ambitious targets set by the scientific community. At the current rate, it will only constitute 5% of the energy mix by 2050 – well below the agreement’s stated goal.

Adoption in transport and logistics has been slow for several reasons, although the continuing availability of cheaper fossil fuels is arguably the biggest obstacle. In the UK, the rollout of infrastructure required for widespread adoption has also raised concerns. The UK’s Petroleum Industry Association, for example, recently criticised the government for delaying publication of key business models for future hydrogen storage and transport.²

The worldwide market for hydrogen-fuelled vehicles, including heavy goods vehicles (HGVs) and forklifts, is expected to grow exponentially – from US$1.19 billion in 2021 to US$36.9 billion by 2030 according to one forecast³ – yet this hinges on the ability to refuel fleets remotely. This is a huge challenge, especially in the early stages, but there are positive signs. Centrica recently announced that it would inject hydrogen into one of its peaking plants for the first time.⁴ If successful, this trial will pave the way for low-carbon power using some of the UK’s existing infrastructure, and the transport and logistics sector will have further evidence of the benefits that it needs to expand its own use of hydrogen.

PEM’s promise

Centrica’s trial will also pose questions about accessibility. If hydrogen is proven to be effective at larger power facilities, then it will be more important than ever to increase its availability

21

Richard Yu, IMI Critical Engineering, explains why decentralisation is key to the energy transition, and how applied knowledge of flow control systems is helping to accelerate the hydrogen economy in key industries such as transport and logistics.

across businesses and warehouses with easily accessible onsite fuel cells. One effective way to do this is by using electrolyser technology – more specifically, polymer electrolyte membrane (PEM) electrolysis.

PEM promises to deliver large volumes of pure hydrogen more sustainably than other production methods, which typically involve the use of fossil fuels. These types of hydrogen – otherwise known as blue, grey, black or brown – come with a carbon penalty, and still account for a large percentage of the hydrogen used by industry today. So-called green hydrogen, however, avoids the use of fossil fuels by relying on electricity generated using renewables. This opportunity is now being spearheaded by newer, more efficient technologies based on PEM, offering businesses a commercially-viable option for the first time.

Still, low-carbon hydrogen will remain difficult in the short- to medium-term, given that most facilities continue to be powered by a grid that is dependent on fossil fuels. When factoring in this, alongside the rising costs that punctuate today’s business landscape, it is understandable why some organisations might view the fuel as a longer term prospect. Consequently, this situation has increased interest in decentralised electrolyser technology as a more affordable means to create hydrogen onsite.

For transport and logistics organisations, this distinction is vital. Given the ongoing boom of fuel cell vehicles and the expansion of ultra-low emissions zones, upgrading existing fleets will soon be necessary. Yet with further delays to nationwide hydrogen

infrastructure, there is a risk that only those with large financial reserves will be able to consider it as an option.

Turnkey solutions

So-called turnkey solutions are important because they lower the CAPEX that is necessary to begin making green hydrogen. While many analysts believe that the ‘cost curve’ is now flattening, the CAPEX needed for production still remains prohibitive for smaller businesses. According to the International Renewable Energy Agency (IRENA)’s report, green hydrogen currently costs between two and three times more per kg when compared to blue hydrogen.⁵ Even if businesses were working against the lower end of that scale, green hydrogen would still struggle to make a case in terms of cost-competitiveness.

It is this thinking that has led companies, such as IMI plc, to apply pre-existing knowledge of process systems to the hydrogen sector, creating energy-efficient packages for smaller scale facilities. Unlike other electrolyser designs, integrated skid solutions can be housed in standard shipping containers and deployed with minimal disruption at a much lower cost. Some of these containers can also be fitted with fuel cells and storage systems, eliminating the complications that can arise once the hydrogen itself has been extracted – a common stumbling block for organisations without the ability to capture CO2 when reforming the steam from natural gas. Digital twin analysis can also be used to improve the efficiency of the electrolyser stack, balance supply and demand, and optimise surrounding equipment, giving smaller organisations access to advanced electrochemical processes and instrumentation without having to gamble on a large or untested investment.

The future

It is important to point out that this technology already exists and is in operation at larger plants. However, the size of the available solutions – operating at 10 MW up to 1 GW – means that they are only suitable for the biggest names in the industry. Taking this into account, modularity, scalability and affordability will be key to ensuring that clean hydrogen can be fully harnessed in the transport and logistics sector.

In order to make fuel-celled fleets a reality, applied knowledge of existing systems will be required. This is why PEM electrolysis, made possible in decentralised turnkey solutions, is critical. Improving access to green hydrogen should be a cornerstone to any decarbonisation efforts, but the sector cannot wait for infrastructure to catch up with ambition. Decisive action is required now.

References

1. ‘Hydrogen at risk of being the great missed opportunity of the energy transition’, DNV, (14 June 2022), https://www.dnv.com/news/ hydrogen-at-risk-of-being-the-great-missed-opportunity-of-theenergy-transition-226628

2. ‘UKPIA calls on Government to speed up publication of its hydrogen transport and storage business model or risk Net Zero targets’, UKPIA, (22 November 2022), https://www.ukpia.com/media-centre/ news/2022/hydrogen-transport-and-storage/

3. ‘Fuel Cell Vehicle Market Size, Growth, Demand, Opportunities & Forecast To 2030’, altenergmag.com, (11 February 2022), https:// www.altenergymag.com/news/2022/11/01/fuel-cell-vehicle-marketsize-growth-demand-opportunities-forecast-to-2030/38484/

4. LAWSON, A., ‘Peak power: hydrogen to be injected into UK station for first time’, The Guardian, (23 October 2022), https://www. theguardian.com/environment/2022/oct/23/peak-power-hydrogeninjected-uk-station-centrica

5. ‘Green hydrogen cost reduction’, IRENA, (December 2020), https:// www.irena.org/publications/2020/Dec/Green-hydrogen-costreduction

22 Summer 2023 GlobalHydrogenReview.com

Figure 1. Turnkey solutions support hydrogen use for power-to-mobility.

Figure 2. IMI VIVO applies engineering knowledge to increase hydrogen accessibility.

Michael Immel, Holzapfel Group, Germany, explores how plating solutions can help to improve the efficiency of electrolysis in hydrogen production.

24

High-quality plating solutions for production equipment components can significantly help to boost the efficiency of electrolysis, and are a key step towards transforming energy generation and upscaling hydrogen production to an industrial level.

It is common knowledge that hydrogen is set to play a key role in solving the problem of how to store renewably-generated energy and thus make a major contribution to achieving carbon-neutrality in the energy, industrial and mobility sectors. The production of climate-friendly green hydrogen in particular can help supply part of the current demand for energy from renewable, carbon-free sources. As hydrogen is a flexible source of energy in terms of storage and transportation, it also makes using energy generated from renewable sources possible in other sectors.

However, this development greatly depends on achieving large-scale production of hydrogen as a transportable and storable source of energy in the near future. The electrolysis process to produce hydrogen needs to be optimised in order to ensure that it can be

efficiently and sustainably produced on a major scale in the long-term.

The role of surface technology

Optimising alkaline electrolysis can be a helpful way of achieving this aim. Surface technology is also playing a vital role in making hydrogen technologies fit for the future. As a result of developing the corresponding functional layers, surface technology can offer new properties to the components that are used in alkaline electrolysis, by way of adding protective features that make them more durable, effective and efficient, for example.

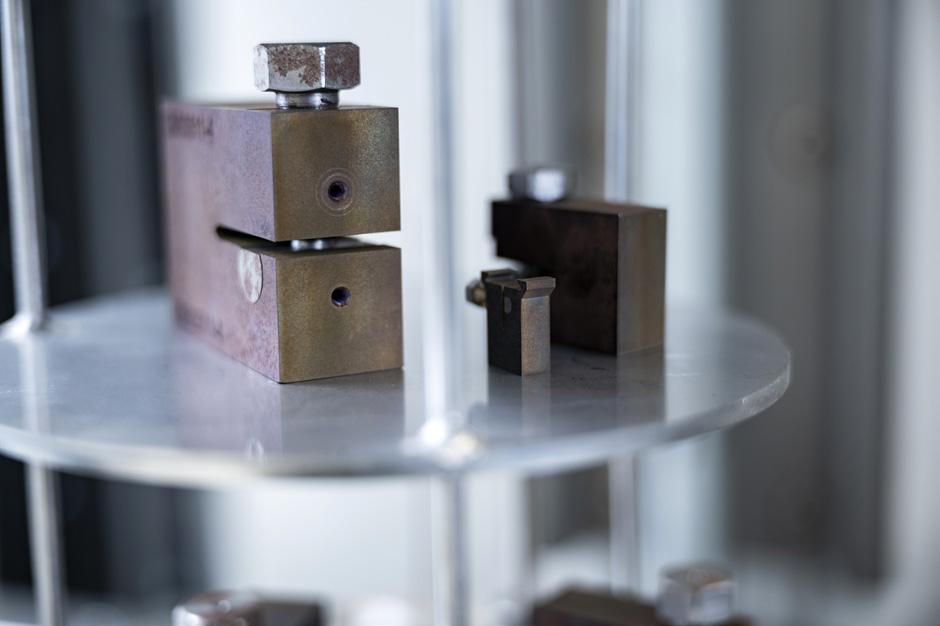

Electrolyser components that require plating

Within the overall system of alkaline electrolysis, the electrolysis block is the essential component that enables water to be broken down into its two components: hydrogen and oxygen.

An electrolysis block consists of various electrolysis cells. An alkaline pressure electrolysis cell, on the other

25

hand, consists of the following functional components: working electrodes, a bipolar plate, a membrane with a pressure ring, a cell frame (with collectors for removing the gas and supplying the electrolyte), and a three-layer electrode package. This package is made up of the bipolar plate, also called a separator plate, a cathode, and an anode (cathode for generating hydrogen, anode for generating oxygen) and arranged in so-called cell stacks or electrolysis stacks. The composition of these individual parts in the electrolysis cell can have a direct impact on the efficiency of hydrogen production.

First and foremost, it is necessary to plate the individual components in order to improve the durability and service life of the entire system. Moreover, applying a corrosion protection layer can make the parts considerably more resilient.

Energy efficiency can also be improved. From a mechanical point of view, this treatment ensures that the electrode packages deliver optimal performance. Electroplating, for example, enables the process to be upscaled to industrial level. The process of electroplating can rule out any mechanical damage and deformation of the electrodes that can occur when coating with atmospheric plasma spraying (APS) or vacuum plasma spraying (VPS) at high temperatures.

Plating options for electrolysis components

Electroplating has long been established as a production technology that is suitable for large series, such as for applications in the automotive industry. Electrode package components, such as anodes, cathodes, separator plates and end plates, as well as cell frames and water-bearing components installed in the electrolysis block, can be plated with a functional anti-corrosion layer. There are a number of different tried-and-tested electroplating processes available for this purpose, such as electroless nickel, nickel sulfamate, electroplated nickel, silver, tin, zinc-nickel, or combinations of these processes.

Plating to improve efficiency

Aside from protecting against corrosion, electroplating technologies are also key for optimising electrolyser production. The Holzapfel Group has developed a special nickel-based process in which the anode, the cathode and the separator plate are plated to improve long-term stability. To boost efficiency and prevent degradation, the cathode is plated with an additional layer that works as a catalyst. One of the effects of this special layer is that the electrolyser’s active surface area is increased, which leads to a higher performance density, making it possible to produce a large amount of hydrogen within a small installation space. This in turn reduces the volume of investment.

Compared to nickel plating, these specific coating processes ensure significantly greater efficiency and therefore a more economical mode of operation due to lower energy consumption, as the electrochemically active platings reduce the amount of energy consumed for gas production.

Upscaling to industrial level

Specialists in the field of surface technology are collaborating with various institutes on research and development projects to improve electroplating methods and, above all, to make them available for industrial series production. For instance, alkaline electrolysis technologies are being developed to enable electroplating methods for electrodes on an industrial-scale, with the aim of making them ready for the market. The goal is to take successfully validated materials and plating processes from the technical prototype stage and develop them for deployment on an industrial-scale. The main focus is on validating selected materials and processes that will drive the transition from small series to processes that are suitable for large-series production, combined with low material and production costs as well as the potential to exclude the use of precious metals. One of the main challenges over the next few years will be the ability to develop these technologies for use in the large-scale electrolysis industry, based on suitable materials and processes with the potential to cut costs.

Developments

Companies within the surface technology sector, such as Holzapfel Group, currently offer, and are constantly improving, plating technologies for hydrogen production

26 Summer 2023 GlobalHydrogenReview.com

Figure 1. Core electrolysis block component – structural elements of an alkaline pressure electrolyser/diagram of a cell stack.

Figure 2. Functional principle of a single alkaline electrolysis cell.

plants and electrolysers. A range of services are available to customers, including electroplating processes that make the catalytic effect more efficient (thus boosting overall effectiveness by saving energy), as well as solutions for scalable processes and options for assembling and testing stacks. The Holzapfel Group develops, produces and assembles complete customised electrode packages with gas-tight, materially-bonded connections. The Group’s solutions for ensuring efficient, sustainable electroplating have been successfully tested in various projects and are currently being further developed in collaboration with partners and institutes.

With alkaline water electrolysis, plating can also be carried out on a large-scale: components up to the size of 2300 x 2100 mm can be effectively plated with functional layers.

Specialised nickel process

One of the company’s most significant developments to date is electroplated Raney nickel coatings, which offer distortion-free deposition. Studies have shown that flat electrodes and those made with Raney nickel coatings currently have excellent results when it comes to the electrical efficiency of alkaline electrolysers. The advantage of flat, electroplated anodes and cathodes is that they can be positioned in the cell with the smallest possible distance to the membrane (zero gap). As a result, the development of the electroplated Raney nickel coating helps to improve

the energy balance in the stack of the electrolysis block and therefore in the electrolyser system as a whole. Electroplated surfaces also make it possible to plate a significantly larger area of the electrode. According to current estimates, this will enable the industrial-scale production of electrodes from one piece, for most electrolyser sizes. The key factor here is to develop production line technologies that ensure that the plating thickness and metal distribution on the electrode surfaces is consistent and distortion-free. The Holzapfel Group is collaborating with partners to achieve this aim.

WE ARE READY FOR THE GREEN FUTURE

Figure 3. A 3D sketch of an alkaline electrolysis block.

Figure 3. A 3D sketch of an alkaline electrolysis block.

Performance You Can Trust LaserGas™ II MP Measure impurities in hydrogen and carbon dioxide with our highly selective and sensitive extractive multipass analyzers LaserGas™ III Hydrogen Fast, selective and sensitive measurements for process control and safety applications with our single path and open path analyzers Made in Norway - with passion for Technology and Nature www.neomonitors.com

28

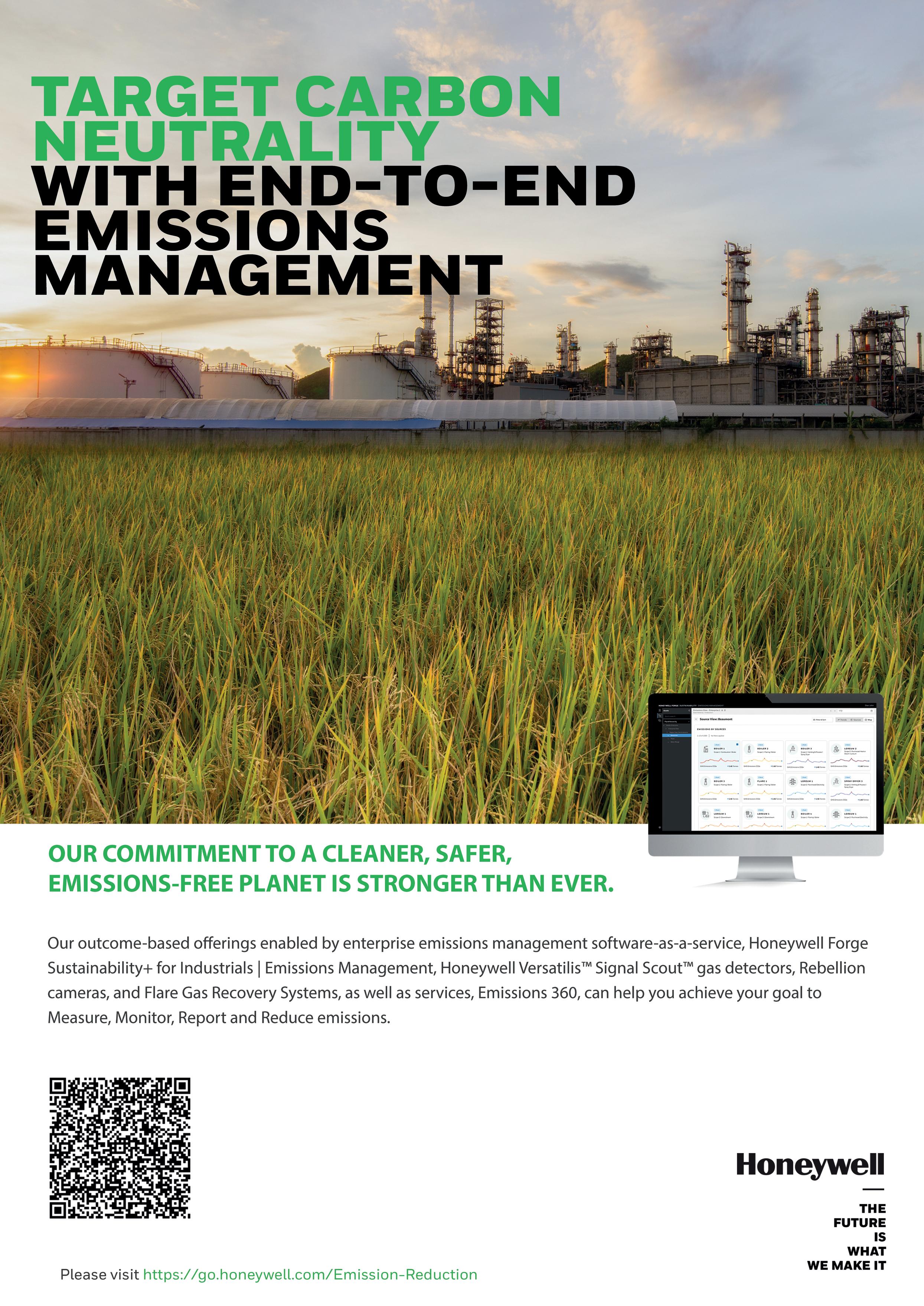

The hydrogen economy is now gaining renewed attention as leaders in both the public and private sector feel a growing sense of urgency to decarbonise the industrial economy. Hydrogen is a clean-burning molecule that can be produced without emitting harmful pollutants. This can be achieved through various methods, including traditional steam methane reformation (SMR), gasification processes with carbon capture, or electrolysis that utilises low-cost or excess renewable energy in the electric grid.

In the transition towards a net zero economy, hydrogen has emerged as a promising solution for reducing emissions in difficult-to-electrify thermal loads, as well as in the ‘greening’ of refineries and chemical processes. There is an active, rigorous debate on how to prioritise the use of this molecule, as it is still expensive to produce in comparison to traditional or alternative fuels and energy carriers. However, its use is unavoidable in the context of a carbon-neutral society. By 2050, hydrogen production is expected to make up 12% of the world’s energy supply with a wide range of novel applications such as blending hydrogen in natural gas, or utility-scale electrolysers.1

It is important that highly-reliable measurement instrumentation is used throughout the hydrogen value chain – from production to end user. Due to its challenging nature, it is essential to seek expert consultation on hydrogen processes and specific advice on the evolving instrumentation challenges in this emerging market. One critical measurement, pressure, poses a particular risk: the permeation of hydrogen through the process membrane.

What is hydrogen permeation?

In direct hydrogen gas service, hydrogen molecules dissociate on the diaphragm surface of the pressure transmitter. Next, hydrogen atoms lose electrons and the subsequent hydrogen ions diffuse through standard 316L or Alloy C diaphragms. Once on the other side of the metal diaphragm, the hydrogen ions capture electrons and recombine into hydrogen molecules (see Figure 1). The permeated hydrogen finds its way into the fill fluid of the pressure cell.

The speed and degree at which permeation occurs is impacted by the process pressure and temperature.

Why is hydrogen permeation detrimental to pressure transmitters?

The dangers resulting from hydrogen permeation are not immediate. So long as sufficient process pressure

is maintained on the diaphragm, the hydrogen molecules will remain in solution. It is only when the process pressure drops to near or below atmospheric pressure that damage occurs (see Figure 2). With reduced process pressure, hydrogen molecules in the fill fluid leave the solution and form gas bubbles. This happens very quickly, increasing the fluid volume and internal pressure. As the pressure cell or diaphragm seal is a closed environment, this additional volume has no means of escape. Consequently, the thin 316L/Alloy C membrane becomes distended, resulting in irreparable damage.

Hydrogen production

There are three emerging technologies for large-scale electrolysis, which is the process of splitting water with high DC currents into its constituents: hydrogen and oxygen. These technologies are proton exchange membrane electrolysis cell (PEMEC), alkaline electrolysis cell (AEC), and solid oxide electrolysis cell (SOEC).

Pressure is an important parameter, as many of these technologies operate based on differential pressures across the membrane. After the water is converted, the hydrogen gas is treated/dried for the eventual end use. Outlet pressure or differential pressures across critical components are important indicators of a healthy process, and are used for Safety Instrumented Systems (SIS) or functional safety requirements in some cases.

As such, the risk of hydrogen permeation in pressure transmitters is ever-present when using these new production techniques, as various process conditions are present that can directly impact the risk of hydrogen permeation through pressure transmitter diaphragms.

Hydrogen blending

There are more complicated matters at hand, deviating from the typical hydrogen applications of the past such as methanol production, hydrogenation in refineries, or petrochemical facilities. As seen in recent power plant demonstrations, such as Long Ridge Energy’s hydrogen-ready power plant in Hannibal, Ohio, US, there is growing interest in blending hydrogen into natural gas to reduce the carbon content in gas pipelines or fuel systems.

Figure 3 illustrates the use of pipelines in the hydrogen sector. Compressors are used to inject blended gas back into the pipeline. It is critical to keep the injection pressure higher than the pipeline pressure to ensure that the blended gas will be

29

Cory Marcon, Endress+Hauser, USA, discusses how hydrogen permeation can pose risks to plants, and how this can be managed with the right instrumentation.

pushed into the pipeline. Any pressure transmitters on the blended gas line and downstream of this injection site would be subject to some increased percentage of hydrogen by volume. Failures in pressure measurements could cause a potential trip in the control loop if the supply pressure faults. Negative effects on plant uptime and the supply chain, as well as high maintenance costs, must of course be avoided at all times.

The risks of permeation are different at various blends of hydrogen, offering further complexity to end users or engineering firms that are designing new systems or validating the existing infrastructure’s capabilities relative to the potential percentage of hydrogen by volume.

What can be done to mitigate the risk of hydrogen permeation?

The most common approach is to apply a gold coating to the external face of the diaphragm. This gold layer increases the density of the diaphragm, thus creating a diffusion barrier to impede hydrogen permeation. When properly utilised, gold coating will decrease hydrogen permeation up to 106 times, due to its very low diffusion coefficient.

A wide variety of gold coatings are available, but not all are suitable for hydrogen permeation prevention. A nominal coating thickness of 25 µm strikes a good balance between protection and cost. A thinner coating is more difficult to apply evenly and risks the development of pinholes and reduced protection.

Hydrogen permeation in conjunction with metal diaphragms is relentless. Consequently, no coating will prevent this phenomenon from occurring. However, a properly employed gold coating is a cost-effective method to significantly reduce hydrogen permeation and extend the life of pressure transmitters.

If hydrogen is blended with natural gas, the volume of hydrogen present is reduced. This results in a reduction of the risk of hydrogen permeation – but it does not eliminate it. As such, the most conservative design approach, even with blended applications, is to utilise gold coated membranes. If hydrogen blending is temporary or < 10% by volume, traditional 316L stainless steel membranes could also be employed.

Extending the portfolio

Hydrogen is considered the most economical and energy-efficient way to store green energy. As a result, governments are pushing to increase its availability by enhancing the capacity of electrolysers. There is also a current shift away from centralised energy production and storage towards smaller scale local production and use. Thanks to the introduction of the PMP21, with optional gold-coated diaphragm, a lower cost option is now available for electrolyser original equipment manufacturers (OEMs) making smaller, modular designs.

For high-pressure applications, pressure transmitters with gold-coated diaphragms are the industry standard. For example, the PMP21 with its pressure limit of 400 bar is suitable for compressor stations and tube trailing filling applications. With ingress protection ratings of up to IP 68, and high-quality materials such as 316L, the Cerabar PMP21 is designed for the harsh conditions in the process industry.

Conclusion

As the process industry moves towards net zero, the demand for decarbonisation continues to grow. This increased focus on the production, storage and use of hydrogen as a clean energy carrier and direct or blended fuel has resulted in the emergence of new applications and measurement challenges: when not treated right, hydrogen can cause safety issues and create a potential weakness in the system. It is therefore crucial to partner with knowledgeable instrumentation providers to mitigate risks.

Reference

1. ‘Global hydrogen trade to meet the 1.5˚C climate goal: Trade outlook for 2050 and way forward’, IRENA, (2022), https://www.irena.org/-/ media/Files/IRENA/Agency/Publication/2022/Jul/IRENA_Global_ hydrogen_trade_part_1_2022_.pdf

30 Summer 2023 GlobalHydrogenReview.com

Figure 1. Hydrogen ions diffuse through a diaphragm.

Figure 2. Hydrogen embrittlement on pressure transmitter diaphragm.

Figure 3. Renewable hydrogen blending in the natural gas network (source: Australian Energy Council).

As the leading innovator, we continue to supply our customers with the technology, methods, and consultancy to make the best integrity management decisions for their assets. No matter what the future holds, renewable hydrogen as a flexible energy carrier plays a vital role in moving the industry further; we want to make sure you are ready.

Fit for the Future. Ready for Hydrogen.

www.rosen-group.com

32