HARDWOOD MATTERS

March

March

THE

CALL FOR NOMINATIONS

STATE AND FEDERAL AGENCIES PARTNER WITH HARDWOOD LUMBER INDUSTRY FOR RESEARCH

NHLA RULES APP LAUNCH

EXECUTIVE COMMITTEE

Jon Syre, Chairman Cascade Hardwood, LLC

Bucky Pescaglia, Vice Chairman Missouri-Pacific Lumber Co., Inc.

Jeff Wirkkala, Past Chairman 2020-2022 Hardwood Industries, Inc.

MISSION LEADERS

Sam Glidden, ITS and ITSEF GMC Hardwoods, Inc.

Ray White, Lumber Services

Harold White Lumber Inc.

Joe Pryor, Education Services Oaks Unlimited

Rich Solano, Convention Pike Lumber Company, Inc.

Stephanie VanDystadt, Membership & Networking DV Hardwoods, Inc.

Rob Cabral, Market Impacts Upper Canada Forest Products, Ltd.

DEPUTY MISSION LEADERS

Burt Craig, Membership & Networking Matson Lumber Company

Tom Coble, Market Impacts Hartzell Hardwoods, Inc.

Dennis Mann, Convention Baillie Lumber Co.

Tom Oiler, Lumber Services Cole Hardwood, Inc.

Brant Forcey, ITS and ITSEF Forcey Lumber Company

George Swaner, Education Services Swaner Hardwood Co., Inc.

COMMITTEE CHAIRMAN

Sam Glidden, Rules GMC Hardwoods, Inc.

National Hardwood Lumber Association PO Box 34518 • Memphis, TN 38184-0518 901-377-1818 • 901-382-6419 (fax) info@nhla.com • www.nhla.com

To serve NHLA Members engaged in the commerce of North American hardwood lumber by: maintaining order, structure and ethics in the changing global hardwood marketplace; providing unique member services; promoting North American hardwood lumber and advocating the interest of the hardwood community in public/private policy issues; and providing a platform for networking opportunities.

For advertising contact:

John Hester

j.hester@nhla.com or 901-399-7558

Dallin Brooks, Executive Director dallin@nhla.com

John Hester, Chief Development Officer j.hester@nhla.com

Renee Hornsby, Chief Operating Officer r.hornsby@nhla.com

Dana Spessert, Chief Inspector d.spessert@nhla.com

Carrie Davis, Executive Administrator d.freeman@nhla.com

Desiree Freeman, Controller d.freeman@nhla.com

Ashley Johnson, Office Administrator a.johnson@nhla.com

Jens Lodholm, Database Manager j.lodholm@nhla.com

Mark Bear, National Inspector m.bear@nhla.com

Tom Byers, National Inspector t.byers@nhla.com

Mark Depp, National Inspector m.depp@nhla.com

Kevin Evilsizer, National Inspector k.evilsizer@nhla.com

Simon Larocque, National Inspector s.larocque@nha.com

Benji Richards, Industry Services Sales Manager b.richards@nhla.com

Geoff Webb, Dean of the Inspector Training School g.webb@nhla.com

Roman Matyushchenko, Instructor of the Inspector Training School r.matyushchenko@nhla.com

Melissa Ellis Smith, Creative Director m.ellis@nhla.com

Julia Ganey, Member Relations Manager j.ganey@nhla.com

One thing all of us in the hardwood industry can count on is change. Except for the NHLA grades, everything is always in a constant state of change. How you identify, accept, and adapt to the change makes all the difference.

One topic not commonly discussed is logistics. However, it is one of the four key areas our businesses depend upon, and we need it to survive. We must transport logs/ lumber to our facilities. We must manufacture and sell lumber from said raw materials. Then we must get that product to our customers, whether across the street, in North America, or worldwide. Enter the logistics puzzle.

Domestically, transportation and logistics have had a dramatic change to accommodate the just-in-time inventory desire of customers. What once were full truckloads of a single thickness, grade, and species have morphed into highly mixed truckloads with specific delivery dates, pushing the inventory burden back to the sawmills and concentration yards. Meeting these delivery needs requires a network of trucking firms and strong relationships who can provide the right equipment, well-maintained trucks, the correct tarps, well-insured, and quality and safety-conscious drivers.

Similar to creating critical relationships with customers, equipment suppliers, mechanics, and loggers to keep your operation running smoothly, a reliable trucking outfit goes a long way to servicing your customer base successfully. It should garner the same strategic plan.

We have found most of our success does not come from the lowcost trucker but from the trucker who shows up on time and with the correct equipment to haul our lumber on relatively short notice.

That trucker is an extension of our brand. The lumber needs to arrive clean, dry, and on time. The delivery process is your customer’s first impression of your business! A substandard result can make

procuring the next order difficult or generate potentially costly lumber claims.

Looking at our industry from a macro sense, I question if we don’t pay enough attention to the “last mile” providers that are a vital link to our customer relationships. Should we as an industry band together and help these companies define industry-wide standard operating procedures for transporting kiln-dried hardwoods and similar products? Every time I see a Central Oregon Trucking Company truck headed to the East Coast or a Roehl Trucking Company taking Alder to Wisconsin, I think, could that guy benefit from being able to haul a load of White Oak to LA or bring back a load of Walnut to Portland? Even if you are helping a competitor deliver a load of lumber in a macro sense, the bigger issue is we are keeping hardwood lumber relevant by assisting one another in coordinating the efficient and proper transportation of hardwood products.

I am reviewing the growth in Mexico. What makes lumber more expensive to ship there? One thing is having to unload at the border at a freight forwarder, then the forwarder reloading a Mexican truck to cross the border and deliver the goods in country.

At Cascade, we are just starting to deliver lumber to our customers on the same truck, avoiding these charges and delays. Yes, I am divulging a slight competitive advantage. But, if a lot of companies could figure this out, would the industry benefit by delivering lumber at competitive prices to keep solid hardwood relevant in Mexico? You bet.

Internationally, the challenges loom larger than the space in this column permits. Forwarders provide invaluable services in moving our goods around the world. Without a solid forwarder, customs delays, demurrage charges, and distressed inventory thousands of miles away can all increase your logistics costs in a hurry.

Innovative solutions that the right forwarder can offer include warehousing options, vessel tracking options, and repeatable document preparation, all of which help to minimize logistics costs. Having

a credit-qualified, trustworthy customer where payments are not required in advance of the document’s release also helps. Relationships matter.

Relationships and networking regularly come up as part of complex solutions to new challenges and changes in our industry. One of the most significant benefits of NHLA membership is the networking opportunities created at the Annual Convention and the immediate connection of NHLA membership when meeting someone new. My suggestion is to expand your horizons at these networking events. The logistics companies provide us with a service that is often taken for granted. We are guilty like any other company here. Cascade now sees how logistics firms are critical to our success as business

improves. We plan to strengthen these relationships and cultivate new ones in 2024 to serve our customers better.

Thank you for taking the time to read my article. I hope you, your family, and your business are all well.

Take care.

Jon Syre NHLA Chairman | Cascade Hardwood

We are excited to announce that nominations are now open for five key positions on the NHLA Board of Directors.

Categories Available:

• Three positions for individuals from "Active" member companies.

• One position for an individual from a "Sustaining" member company.

• One position for an individual from an "Associate" member company.

Be a driving force in the hardwood industry's future. Nominate a colleague or yourself to serve on the NHLA Board of Directors. Your leadership can make a significant impact! All individual nominees must be employed by a NHLA member company in good standing.

Nomination Process:

To nominate yourself or a deserving colleague, please submit the following:

• Full Name and Contact Information

• Company Affiliation and Member Category

• Brief Bio or Resume

• Statement of Interest

Nominations should be sent to info@nhla.com. Questions should also be sent to info@nhla.com.

ACTIVE MEMBER:

An active member is a company based in the U.S. or Canada that is actively involved in the manufacturing, custom kiln, drying, wholesale or distribution of hardwood lumber, plywood, or related products.

Association Member:

An associate member is a company who are consumers of North American hardwood or cypress lumber, veneer, plywood and related products for manufacturing. For Example: Cabinet shops, furniture, flooring, and pallet manufacturers.

Sustaining Member:

A sustaining member is a company who supplies services, materials, or equipment to the active or associate members or owners of North American hardwood timberlands providing the basic raw materials for the industry. For example: insurance agencies, equipment manufacturers, logisitics providers, software, etc.

Everybody in the South got a cold winter and some surprise snow this year, and the West Coast, too. As for the rest of the continent, those hardy folks had to deal with it all: too much snow, not enough snow, hot and cold, it swings back and forth with no control. It is dubbed climate change, and pollution is to blame. While we have caused more than our fair share of pollution, humans are not the only sources. Forest fires, volcanic eruptions, meteors, Pangaea (continental drift), and other factors impact the climate too. We have very little control over our climate and a lot of control over our environment. Therefore, I suggest using another term: Forest Change.

We must teach people and governments that the forest is constantly changing. We cannot preserve the forest in a static state. We cannot stop Forest from changing! We need to help people and governments accept that the forest will change and recognize that all forests are managed forests. Some are managed for wood products, some for recreation, some for preservation, some for mixed-use, and some for wildlife. If we manage all forest uses with a dynamic life cycle, we can account for changes, accept them, prepare for them, and even cause some of them. Most importantly, we will value the “changing forest” as much as the “old-growth forest.”

The current Biden Administration created new protections for “old-growth forests” and “mature forests” to combat climate change. But they missed the point that the forests change. I warned industry associations this would happen if they did not work with the Administration. They opposed the idea and would not define old growth. Here is a direct quote from my email to the coalition a year and a half ago.

“I like the response, but isn’t it a little like swimming upstream? They are not asking you why they should define [old growth]; they are asking how to define it. I think we as an industry should send a

second letter, on NHLA letterhead, if need be, defining forest management and an extreme definition of old growth (having a super majority of +500-year-old trees) and mature (having a majority of +250 year old trees). Helping them to understand that all forests are managed, even old growth and mature forests. That way they can tell their progressive left flank that they have done something to save the environment and still not inhibit forest management as you indicate in your letter. “

I was shot down and told to stay united, and if they pushed back enough, they would listen because the USFS agreed with the associations. Well, that backfired.

We can’t just say that today’s forest fires are due to climate change from yesterday because they are also caused by natural forest change. People debate climate change, but they don’t speak about forest change. Many people believe a tree will live until you cut it down; that is ignorant and absurd. The fact that our forests will be changing one year, ten years, 100 years, or even 1,000 years from now is why we will still be using hardwoods 1,000 years from now.

At some point, a tree will die, and at some point, it will age to the point that it begins to rot, becomes less insect resistant, and more susceptible to fire. At some point, it will always make sense to manage the forest by removing trees for wood and storing the carbon from them by creating wood products. Climate Change is only half the story because, while the weather impacts the forest, the forest keeps growing and degrading regardless. If you want to tell our industry story, talk to others about forest change and find one common ground to grow them on.

Dallin Brooks NHLA Executive Director dallin@nhla.com | 360-823-3898

Dallin Brooks NHLA Executive Director dallin@nhla.com | 360-823-3898

Iwas sitting waiting to get a prescription filled, scrolling through Instagram, and I noticed a woman, not much younger than Moses, playing a game of Scrabble on her iPhone. It struck me that it wasn’t that long ago I would hear a commercial say, “There’s an app for that,” and I had NO idea what they were talking about. What’s an app, and how do you use it? Fast forward just 16 years and smartphone apps have become essential to our daily lives. Whether for work, play, or staying updated on the latest news, apps have revolutionized how we access and interact with information.

NHLA has embraced the digital age by introducing two groundbreaking apps that promise to enhance connectivity, streamline access to industry resources, and provide information at your fingertips.

1. NHLA COMMUNITY APP: At the forefront of our technological leap is the NHLA Member Community App, a tool designed to foster collaboration and engagement within the NHLA membership and hardwood community. The app features a comprehensive calendar showcasing all hardwood industry events, ensuring members stay informed about upcoming gatherings, conferences, and seminars. Beyond event listings, the Community App facilitates member-to-member connections, allowing professionals to network seamlessly. Users can post updates and share insights on the app’s Wall, creating a dynamic and interactive space for industry discussions. Additionally, the app serves as a hub for committee information and delivers breaking industry news in real time. The app is for NHLA members only!

2. NHLA RULES APP: Complementing the Community App is the NHLA Rules App, a comprehensive resource that consolidates the “NHLA Rules for Inspection of Hardwood Lumber and Cypress” into an accessible digital format. To learn more about this app see Chief Inspector Dana Spessert's Rules Corner or page 20.

As we navigate the hardwood industry’s intricacies, NHLA’s new apps stand as a testament to the industry’s commitment to innovation. The Community App and Rules App provides a user-friendly experience and empowers industry professionals with tools that facilitate networking, information exchange, and adherence to industry standards. In a world where technology continues to shape how we work and communicate, NHLA’s apps are a significant step forward, bridging the gap between modern and traditional in the hardwood industry.

John Hester NHLA Chief Development Officer j.hester@nhla.com | 901-399-7558

John Hester NHLA Chief Development Officer j.hester@nhla.com | 901-399-7558

In the January/February issue of Hardwood Matters, NHLA featured a group of RAHC donors who contributed via the NHLA membership dues invoice. However, it's important to note that the published list was not comprehensive, and the following list, obtained from the Real American Hardwood Coalition, combines contributors from all sources. Some companies gave directly to RAHC, while others contributed through NHLA. We extend our appreciation to all the companies that supported the mission of the Real American Hardwood Coalition in 2023. If you have any questions about the list of RAHC donors please email info@realamericanhardwood.org.

Looking ahead to 2024, NHLA encourages the industry to continue supporting the promotion of Real American Hardwood. Contributions can be made by visiting www.realamericanhardwood.com/industry.

A. W. Stiles Contractors, Inc.

Abenaki Timber Corp.

AJD Forest Products

Alan McIlvain Co.

Allegheny Hardwood Utilization Group

Allegheny Wood Products, Inc.

American Millwork

American Walnut Manufacturers Association

Amy Coyner

Angelbeck Lumber Co., Inc.

Appalachian Hardwood Manufacturers, Inc.

Appalachian Lumbermen’s Club

Appalachian Woodlands Consulting

ATI International LLC

Atlanta Hardwood Corporation

Baillie Lumber Company

Baird Brothers Fine Hardwoods

Battle Lumber Co., Inc.

Bee Forest, LLC

Bent Wood Solutions, LLC

Besse Forest Products Group

Billsby Lumber Company

Bingaman & Son Lumber, Inc.

Bob Uglow

BPM Lumber LLC

Brenneman Lumber Co.

Brewco, Inc.

C.B. Goodman & Sons Lumber, Inc.

Cascade Hardwood, LLC

Cersosimo Lumber Co., Inc.

Church and Church Lumber

Clark Lumber Company, Inc.

Classic American Hardwoods

Clear Lake Lumber Inc.

Cole Hardwood Inc.

Collins Corporate

Cummings Lumber Co., Inc.

D & M Forestry

Dallin Brooks

Decorative Hardwoods Assocation

Deer Park Lumber Inc.

Delta ERC

Devereaux Sawmill, Inc.

DRYCO Lumber, LLC

Dwight Lewis Lumber Co., Inc.

East Anderson Hardwoods

East Ohio Lumber Co.

East Perry Lumber Company

Empire State Forest Products Association

Falcon Lumber, Ltd.

Farrow Lumber Co.

Forest City Trading Group

Forks Lumber Company

Frame Hardwoods, Inc.

Frost Hardwood Lumber Co.

G & G Lumber, Inc.

G. L. Beaumont Lumber

Gat Creek

Gates Milling, Inc.

GMC Hardwoods, Inc.

Goodfellow, Inc.

Granite Valley Forest Products - Welter

Great Lakes Kiln Drying

Green Ridge Forest Products

GreenTree Forest Products, Inc.

Gutchess Lumber Co. Inc.

Hanafee Bros. Sawmill Co., Inc.

Hardwood Distributors Association

Hardwood Industries Inc.

Hardwood Manufacturers Association

Hardwood Market Report

Harold White Lumber, Inc.

Hartzell Hardwoods, Inc.

Heartland Hardwoods, Inc.

Hermitage Hardwood Lumber Sales, Inc.

Hinchcliff Lumber Company, Inc.

Hochstetler Milling, Ltd.

Hochstetler Wood, Ltd.

Holt & Bugbee

Hull Forest Products, Inc.

Huron Forest Products, Inc.

HW Chair, Ltd.

Indiana Hardwood Lumbermen’s Association, Inc.

Industrial Vision Systems, Inc.

J. M. Wood Products

James Ritter Lumber Co., Inc.

James W. Steen

Jasper Seating Company, Inc.

Jeff Wirkkala

Jenkins Forestry Solutions, LLC

JoeScan, Inc.

Johnny Asal Lumber Co., Inc.

Jones Lumber Company

Josey Lumber Company, Inc.

Kamps Hardwoods

Keiver-Willard Lumber

Kendrick Forest Products

Kentucky Forest Industries Association

Kepley-Frank Hardwood Co. Inc.

Keystone Wood Products Association

King City Forwarding USA

Kittrell Appraisals

Kretz Lumber Co., Inc.

Krueger Lumber Co., Inc.

Lake States Lumber Association

Lakeside Lumber Mill LLC

Landvest, Inc.

Lewis Lumber Products

Linda Jovanovich

Lumbra Hardwoods Inc.

M. T. Forest Products

Maley & Wertz, Inc.

Mantra Inspired Furniture

Maxwell Hardwood Flooring, Inc.

Mayfield Lumber Co.

McClain Forest Products, LLC

McDonough Manufacturing Co.

Middle Tennessee Lumber Co., Inc.

Middleton Lumber Co., LLC

Miller Wood Trade Publications

MO PAC Lumber Company

Mount Storm Forest Products, Inc.

Mueller Bros. Timber, Inc.

National Hardwood Lumber Association

National Wood Flooring Association

Neff Lumber Mills, Inc.

Netterville Lumber Co.

New England Kiln Drying Association

North American Forest Foundation

Northern Hardwoods

Northern Tier Hardwood Association

Northland Forest Products, Inc.

Northwood Resources Inc.

NWH

Oaks Unlimited, Inc.

OFS

Ohio Forest Products LLC

Ohio Forestry Association

Ohio Valley Lumber Drying Association

PA Lumbermens Mutual Ins. Co.

Pacific Coast Wholesale Hardwood Distributors Association

Pardee Resources Company

Parton Lumber Co., Inc.

Paul Miller, Jr.

Peach State Lumber Products, Inc.

Penn York Lumbermen’s Club

Penn-Sylvan International, Inc.

Pennsylvania Forest Products Association

Pierson Lumber Co., Inc.

Powell Valley Millwork

Premium Hardwoods, Inc.

Prime Lumber Company

Primewood

Quality Hardwoods LLC dba Forks Lumber Co.

Quality Hardwoods, Inc.

Reel Lumber Service

Rex Lumber Company

Ron Baltzley Hardwoods, Inc.

Ron Jones Hardwood Sales, Inc.

Roy Anderson Lumber Company

Salamanca Lumber Company

Saroyan Lumber Co.

Schaller Hardwood Lumber Co.

Shaver Wood Products Inc.

Southern Cypress Manufacturers Association

Springfield Hardwood Products

Stevie Brown

Stoltzfus Forest Products

Stutzman Lumber Ltd.

Tally Express-DMSi

TBM Hardwoods

Terry Smith

Thomas & Proetz Lumber Co.

Thompson Hardwoods

Tigerton Lumber Co.

Tioga Hardwoods, Inc.

TMX World Shipping Company Inc.

Townsend Lumber, Inc.

Trumbull County Hardwoods, LTD

Turn Bull Lumber

Vexco Inc.

W. R. Deacon & Sons Timber, Inc.

W.M. Cramer Lumber Co., Inc.

Walnut Creek Lumber Co., LLC

Walnut Creek Planing

West Virginia Forestry Association

Western Hardwood Association

Wheeland Lumber Company

Wood Components Manufacturers Association

Wood Products Manufacturers Association

Yoder Lumber Co., Inc.

In response to a relatively flat market for graded lumber, there is much interest and activity toward developing structural markets for hardwoods. Significant research has been conducted recently on the development and use of hardwood resources in engineered materials and products, such as cross laminated timber (CLT), glued laminated timber, and laminated veneer products. To steer and coordinate future federal and state research priorities, the USDA Forest Products Laboratory and Mississippi State University co-hosted a structural hardwood needs assessment workshop in Madison, Wisconsin on November 7, 2023.

• Create a forum for industry leadership to meet with state and federal researchers.

• Review recent research conducted on the development and use of lumber and engineered hardwood materials and products

• Develop a corresponding research needs assessment document to guide future research efforts.

• Stair and guard system design/engineering software that can develop building code-compliant structures.

• Wood rail tie research needs include NDE of ties in track to identify maintenance / replacement needs, NDE of ties to assess on- versus off-grade, automated wood identification, and economics/supply.

• Hardwood timber mats. There is a need to develop and implement minimum standardization for grading and strength/stiffness evaluation.

• Hardwood mass timber. There is a current and pressing need for more species and grade layup performance.

• Increasing wood in Department of Defense applications. These include but are not limited to: permanent wood buildings and structures, modular housing, design for portability, domestic species for trailer, bridge, and container decking, alternative species for pallets and crating.

Thirty-six individuals, including active scientists and research leaders, from the following organizations participated in this day-long event: USDA Forest Service Forest Products Laboratory (research); USDA Forest Service State, Private, and Tribal Forestry; U.S. Endowment for Forestry and Communities; National Hardwood Lumber Association; Timber Products Inspection Company; Railway Tie Association; North American Matting Association; Stairbuilders and Manufacturer’s Association; Department of Defense Army Corps of Engineers, DEVCOM, and GVSC; Dearborn Companies; Anthony Hardwood Composites; and University researchers from Appalachian State University, Michigan Technical University, Mississippi State University, and West Virginia University

THE FOLLOWING INCLUDES THE DISCUSSION / RESEARCH TOPICS HIGHLIGHTED:

• Implementing and developing hardwood design values. There is a pressing need for developing allowable design values for additional species such as alder, honey locust, sweetgum, sycamore, and yellow poplar.

• Machine stress rating / nondestructive evaluation (NDE) of hardwoods for structural and engineered applications.

• Thermally modified wood for structural applications; retaining better performance.

Outcomes of meetings like this help guide future research priorities and expenditures at the state and federal levels. By coming together in forums like this we maximize the impacts of our research and minimize redundancy across research programs.

A larger and more broadly scoped follow up meeting hosted by NHLA is being scheduled for May 8-10, 2024.

Rubin Shmulsky, Ph.D., Professor and Department Head, Mississippi State University

Rubin Shmulsky, Ph.D., Professor and Department Head, Mississippi State University

Congressman Tom Tiffany (WI-07) and Congresswoman Ann Kuster (NH-02) introduced bipartisan legislation to support domestic hardwood products. H.R. 6880, the Hardwood Products Access and Development Program Act, permits the Secretary of Agriculture to authorize grants that bolster domestic industry efforts and research that directly supports end-user information on the benefits of hardwood products.

This will allow various non-profits, universities, and other eligible applicants to research the low carbon footprint and sustainability of domestically produced hardwood products to educate the public on the benefits of these products.

“Wisconsin is home to numerous hardwood manufacturers, and this important legislation will inform consumers on the sustainability of domestically produced hardwood products,” said Congressman Tiffany. “I will continue to promote Made in America wood products that benefit our environment and economy.”

“New Hampshire’s hardwood foresters generate some of the highestquality products in the world – we need to ensure they have the support to continue serving their customers,” said Congresswoman Kuster. “American-grown hardwood offers an incredible opportunity to create more sustainable, durable products in countless industries right here at home. I’m proud to help introduce this legislation today to support our wood producers and strengthen our economy and supply chains.”

“The U.S. hardwood industry is a multi-billion-dollar industry supporting over 1.8 million jobs, mostly in rural, underserved areas. Although wood products are widely recognized as sustainably produced and have significant carbon storage capacity, public awareness and recognition of these qualities is limited. The domestic industry and domestically produced products, including flooring, cabinetry, doors, mouldings, railway ties, pallets and other hardwood building and infrastructure products will benefit greatly from the much needed research and education dollars through the enactment of the Hardwood Products Access and Development Program Act. This essential funding will help sustain and grow the hardwood companies and their employees in rural, agricultural communities across the country,” said Dana Lee Cole, Executive Director of the Hardwood Federation.

“Consumers around the world express a strong preference for U.S. hardwood home finishings and furnishings but are often confused by the mixed messages they receive from non-sustainable competitor products. The Hardwood Products Access and Development Program Act will put important data into the hands of decision makers and allow them to make the best choices for their homes and the environment,” said Troy Brown, President of Kretz Lumber in Antigo, WI.

“The U.S. hardwood industry is proud of the products we produce and the forest, carbon reduction and storage as well as home health benefits that are realized from modern forest management practices that supply the raw materials to our mills. The Hardwood Products Access and Development Program Act will facilitate the development and sharing the science-based data that supports our claims as one of the most environmentally friendly building materials available,” said Jameson French, President and CEO, Northland Forest Products, Kingston, NH.

As everyone is aware, 2024 is an election year. Every one of the 435 seats in the U.S. House of Representatives are up for grabs as are 34 Senate seats. Returning members, their opponents and candidates running for open seats, will all be hitting the campaign trail trying to speak to as many constituents as possible. Don’t be caught short if you run into a 2024 hopeful. The Hardwood Federation has talking points on multiple topics you can access.

The Farm Bill includes a forestry title that impacts the U.S. hardwood industry in multiple ways; it is reauthorized every five years. The bill was scheduled for action last year but was deferred until 2024. Below are several key legislative items the Hardwood Federation is supporting related to the Farm Bill. Many of these were initiated in 2023 and will continue this year. In most cases, we have already provided recommendations and language to make sure hardwood is included and reflected in program benefits, but we need your voice to support Hardwood Federation requests we have already sent to House and Senate offices to include these measures as part of the final Farm Bill package.

Please encourage candidates to support the following potential provisions in the Farm Bill:

HARDWOOD EXPORT PROMOTION FUNDING –

Securing funding for export programs that support the hardwood industry is always at the top of our Farm Bill list. The Hardwood Federation strongly supports the bipartisan Agriculture Export Promotion Act of 2023 which would essentially double the funding for the MAP and FMD programs that fund AHEC operations. Budget constraints will make it tough for doubled funding to pass, but the Federation continues to advocate aggressively for continued funding for both programs at increased or current levels.

TIMBER INNOVATION FOR BUILDING RURAL COMMUNITIES ACT – This bipartisan, bicameral bill, sponsored by Senators Wyden (D-OR) and Crapo (R-ID) and Reps. Salinas (D-OR), Gluesenkamp Perez (D-WA) and Duarte (R-CA) could be folded into a final Farm Bill.

The proposal includes several positive provisions for the industry including establishing a USDA platform measuring, collecting, and sharing data related to the carbon benefits of wood products, and recognizing the value of carbon reduction and environmental benefits of wood in building design and furnishings in USDA grant programs.

This fall, Senate and House members introduced the bipartisan “Jobs in the Woods Act.” (H.R. 5344, S. 3063), a bill that would provide education grants ranging in size from $500,000 to $2 million to promote jobs in the understaffed timber industry and U.S. Forest Service. Legislative champions include Reps. Chavez-Deremer (R-OR) and Gluesenkamp-Perez (D-WA) on the House side and Sens. King (I-ME) and Risch (R-ID).

Another bill that could potentially be included in the Farm Bill is the Hardwood Access and Development Program. In an important milestone for the hardwood sector, Reps. Tom Tiffany (R-WI) and Annie Kuster (D-NH) have sponsored HR 6880, the Hardwood Products Access and Development Program (HAP) bill in the House.

• The program would support research efforts related to the environmental and health benefits of domestically produced hardwood products.

• Eligible entities include non-profit organizations serving the U.S. hardwood sector (including the Real American Hardwood Coalition and other hardwood focused associations), universities and research organizations.

• Research related to environmental and health benefits of domestic hardwood products, research related to consumer attitudes and knowledge of hardwood products, promotion of research to the public and potential consumers, demonstration projects highlighting environmental and health benefits of hardwood products are all included as potential activities related to the HAP.

• Up to $25 million over five years in funding is included in the bill language.

We are very pleased to have a House bill and are now focused on getting a companion bill in the Senate which will be necessary for even a chance of getting the bill folded into the Farm Bill. Ask current Senate members to sponsor a companion bill . . . and ask House members to add their name as a co-sponsor to the bill by sending a letter to your member of Congress.

You can copy/paste the following URL into your browser: https:// mstr.app/da3bcdb3-e93e-4c5c-9ae1-a6d84058748f

Be on the lookout for Hardwood Federation e-mails and texts providing you with additional opportunities to reach out directly to your members of Congress on these and other legislative actions. Next month we will share items related to taxes and transportation. Or you can check out our website www.hardwoodfederation.com for information on all the key issues we are tracking.

The global logistics landscape is currently undergoing significant upheaval, impacting various industries, including the hardwood lumber sector. Recent developments, such as issues in the Red Sea, have sent ripples through the industry, affecting both exports and imports. In this month’s feature, we delve into discussions with Stephen Zambo from AGL Group and Chad Fiala from ITG Transportation Services, Inc., to gain insights into the complexities and dynamics shaping the industry’s logistics landscape.

Stephen Zambo sheds light on the far-reaching effects of recent disruptions on hardwood lumber exports and imports. He discusses the challenges arising from increased freight rates, longer transit times, and supply chain disruptions stemming from issues in the Red Sea. With freight rates on the rise and capacity constraints exacerbating the situation, the industry is facing unprecedented challenges in maintaining schedule reliability and managing costs.

NHLA: Stephen, thank you for joining us today. Could you start by outlining the key challenges the hardwood lumber industry is facing in terms of global logistics?

Stephen Zambo (SZ): Certainly, Renee. The Red Sea situation has become a focal point affecting not only the hardwood lumber community but all import and export sectors. The Red Sea shipping crisis is a result of Houthi rebel attacks on cargo ships and tankers and is causing hundreds of vessels to avoid the Suez Canal, one of the world’s most important waterways. The increase in freight rates is a significant concern, primarily driven by a diversion of shipping routes around the Cape of Good Hope due to the Red Sea disruptions.

NHLA: How does this redirection impact the industry?

SZ: The rerouting increases fuel costs and transit times, leading to a surge in operational expenses. What›s more, there›s a noticeable reduction in capacity moving into the Middle East, compounding the challenges. The Panama Canal drought, conflicts in Israel and Ukraine, and the Red Sea issues have created a sort of perfect storm for escalating freight rates. Import rates have nearly doubled in the last 45 days, with export rates gradually following suit.

NHLA: Beyond the freight rates, are there other aspects that the industry is contending with?

SZ: Absolutely. An often-overlooked consequence of the Red Sea situation is the impact on container availability. Ships taking longer routes mean delays of 7-10 days on average, leading to shortages in container availability, particularly in inland locations like Chicago, Columbus, Nashville, Chippewa Falls, Louisville, and Cincinnati.

NHLA: How does this affect schedule reliability?

SZ: The repeated delays in vessel arrivals are translating into supply chain bottlenecks, resulting in a lack of schedule reliability. This, in turn, causes challenges in planning pick-up dates and times, putting strain on the market.

NHLA: Amid these challenges, are there any emerging opportunities for the hardwood industry?

SZ: Interestingly, yes. We're observing new opportunities in Mexico and India. With the decoupling of US/China trade and increased

foreign investment in Mexico as a "near shore" solution, there's a noticeable uptick in loads going to both destinations. More shipments are heading to the border in Texas and interior Mexico than before.

NHLA: Thank you, Stephen, for providing insights into these critical dynamics. It›s evident that the industry is navigating through a complex web of challenges and opportunities.

SZ: My pleasure. It›s crucial for us to understand and adapt to these evolving circumstances in the global logistics landscape.

Shifting the focus to domestic shipments, Chad Fiala provides his perspective on the challenges and opportunities in managing domestic logistics. With an anticipated continuation of supply chain disruptions and capacity constraints, companies must adapt to ensure operational efficiency and competitiveness in the market. Fiala emphasizes the importance of proactive communication with customers and strategic planning to navigate the evolving landscape effectively.

NHLA: Chad, what can hardwood companies anticipate in terms of domestic shipments and logistics for the upcoming year?

Chad Fiala (CF): When you look at overall supply chains, one of the first questions asked is when are we going to get back to normal? And the first point is, whose definition of normal are we using and what is normal, right? We certainly don›t see a return to any type of normal in 2024. A major issue that I'm foreseeing for this year is not just costs but capacity. Over the last six months more than 30,000 trucking companies have gone out of business due to a very rough 2023. I don't see that slowing down soon. In January, you had renewals (vehicle registrations, operating authority, insurance, driver licenses and qualifications, safety compliance, permits, International Fuel Tax Agreement (IFTA), etc.) that’s expensive. A lot of trucking companies couldn’t afford to do that. In April, taxes are due. A lot of companies aren’t going to be able to pay their taxes. Because of this, I believe capacity is going to be constrained, especially if there is any type of spike in volume. And then when you go back to the Red Sea and the SUEZ Canal and what’s going to happen with supply chains, there is going to be some congestion/delays. There is going to be some backup again. So, supply chains are still going to have some challenges, and that’s going to influence the capacity. Unfortunately, that is going to raise costs, transportation costs.

NHLA: What actions should hardwood companies take? How can they effectively navigate and maintain a competitive edge in 2024?

CF: I think salespeople need to be in really good communication with their international customers and buyers to encourage them to buy a little bit in advance and not wait until they›re running down on inventory. We're starting to see that here in the U.S. on the import side, a lot of retailers just stopped buying because they stocked up on so much inventory. Now inventory is being depleted. One little crisis with a vessel delay, and you›re going to see major retailers with no patio furniture, and we›re headed into spring. That›s a big problem. The sales reps at the lumber

We're observing new opportunities in Mexico and India. With the decoupling of US/China trade and increased foreign investment in Mexico as a "near shore" solution, there's a noticeable uptick in loads going to both destinations.

If a driver is delivering a shipment in Green Bay, WI and we have an export shipment to pick up in Milwaukee, we would attempt to “street-turn” that container so that the driver can stop in Milwaukee to load instead of driving empty all the way back to the rails in Chicago. This not only can reduce carbon footprint but can also provide cost savings to everyone involved.

companies should heed this and be in good communication with their buyers to encourage them to plan and be prepared for delays. This will aid in safeguarding them by ensuring their sales and orders are secured, thereby preparing their buyers for any potential delays.

NHLA: What other aspects of the logistics industry are currently capturing your attention?

CF: Another thing that we’re keeping an eye on, and no one has hit a home run on this yet, is concern over carbon footprint. I know that it’s big with the hardwood industry just being at the NHLA convention. I loved hearing the seminar on that. In the transportation world, as far as the carbon footprint is concerned, something we’re doing is keeping an eye on electric vehicles. I think we’re still far from that being a nationwide solution. It’s happening in California, but when you look at the weight of most lumber loads, that’s going to be challenging. But drayage in general, domestically speaking, I do see electric vehicles being a part of the picture just because they’re shorter hauls. When you talk about long haul, full truckload flatbed, I don’t see our grid being able to handle that soon. But internally, for ITG, we have measures to help with costs and the carbon footprint. Have you ever heard the term street turning?

NHLA: Tell me about street turning.

CF: In the container drayage world, there are imports and exports. We see that many international shipments in the hardwood industry are for export out of the U.S. Before sending a driver to the rails/ depots to get an empty container to be loaded, we first look at our import business and see if we have loaded containers already on the street to re-load for export once empty. If a driver is delivering a shipment in Green Bay, WI and we have an export shipment to pick up in Milwaukee, we would attempt to “street-turn” that container so that the driver can stop in Milwaukee to load instead of driving empty all the way back to the rails in Chicago. This not only can reduce carbon footprint but can also provide cost savings to everyone involved. I do see that being a topic in 2024 and certainly within the next three to five years. For dry van and flatbed shipments domestically, ITG focuses on reducing empty mileage, or deadhead, when picking up and delivering to lumber companies by strategically re-loading our drivers to specific origins/destinations.

Special thanks to Stephen Zambo with The AGL Group www.theaglgroup.com and Chad Fiala with ITG Transportation Services, Inc. www.itgtrans.com for contributing to this article.

If you need a logistics provider, please consider the following NHLA Member Companies. Visit the Membership Directory on www.nhla.com for more information.

• Blair Logistics

• Center-Line Group

• Dunavant Global Logistics Group

• EFM Transportation

• Fr. Meyer’s Sohn NA LLC

• Giorgio Gori USA, Inc.

• Interglobo North America

• ITG Transportation Services, Inc.

• King City/Northway Forwarding Ltd

• Laufer Group International

• Point Global Logistics

• Richard Murray & Co.

• Speed Global Logistics Inc.

• The AGL Group

• TMX Shipping Co.

Throughout the year, NHLA will be hosting webinars and educational sessions with the intent of keeping our members updated on logistic barriers and solutions. As the year unfolds, we remain dedicated to providing relevant, timely and actionable information to ensure our members are well-equipped for 2024 and beyond. Please visit nhla.com and review the Hardwire enewsletter for more logistics information.

NHLA has moved into a new era of modernization with the first-ever release of the NHLA Hardwood Lumber Grading Rules on a smartphone app. This app has many different features, with more features coming soon.

A feature I am particularly excited about is the Cuttings Calculator. The calculator is not only for whole numbers and fractions computations but also has a feature that allows the user to add multiple Cuttings on the board and list them for reference while grading, with a running total of Cutting Units. This list of Cuttings also allows for removing a Cutting and recalculates the total Cutting Units.

You can access the Cuttings Calculator in a few ways: click on the cutting calculator listed in the table of contents or go to settings and change the “Launch Page” to open the calculator when opening the app.

After navigating to the calculator, it is as simple as clicking on a whole number on the left, a numerator on the top right, and a denominator on the bottom right. After entering the first whole number and fraction:

• Click on any mathematical symbol (+ - x ÷) in the bottom left.

• Repeat the whole number and fraction entry.

• Click on the equals sign (=) in the bottom right corner.

The total for that equation will show in the window at the top right corner.

To add a Cutting to the list, click the “Add Cut” button in the bottom center of the calculator. The Cutting then moves to the top left-hand side of the calculator. Each Cutting added to the list will have a running total of Cutting Units.

If a Cutting needs to be replaced/removed, click on the Cutting in the list, and you will be prompted to “Cancel” or “OK” to remove the Cutting, and the total will be updated. If all Cuttings need to be removed, click the “CCuts” button in the top left.

If you make a mistake while typing in a number, there are back arrows under each series of numbers to remove and replace with the corrected number. To clear and return to 0, click “C” in the upper left area.

The NHLA Inspector Training School adopted the use of the Cuttings Calculator a few years ago due to the time spent teaching fractions; it has also helped speed up Board Runs.

As you might expect, the entire NHLA Rules Book is in the app. The “Table of Contents” page allows the user to click on any of the listings, and it will jump to that page. A Menu pop-out provides access to the “Table of Contents” and the “Settings.”

In “Settings,” the “Font Size,” “Side Spacing,” and “Launch Page” can all be set.

We do plan on updating the NHLA Rules app to include additional languages. We hope you enjoy utilizing the new NHLA Rules app’s unique features.

Please contact Chief Inspector Dana Spessert at d.spessert@nhla.com with any questions.

April 1-4

$PC: Hardwood Sawmill Process Control

A 3-day course to teach your team the first steps in implementing your own Yield Improvement program using statistical process control techniques adapted to a sawmill environment.

Venue: NHLA Headquarters

Location: Memphis, TN

April 8-11

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: Expo Richmond/ Meadow Hall

Location: Doswell, VA

Instructor: Mark Depp, NHLA National Inspector

APR

April 8-11

Spanish Language

Intro to Hardwood Lumber Grading

For Spanish speakers an Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: Expo Richmond/ Meadow Hall

Location: Doswell, VA

Instructor: Benji Richards, NHLA Industry Services Sales Manager

Mark Bear, NHLA National Inspector

April 8-19

Inspector Training School Online Training Program

MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters

Location: Memphis, TN

Module 2: Online study

Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor:

Roman Matyushchenko, NHLA ITS Instructor

April 15-18

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: WV Wood

Technology Center

Location: Elkins, WV

Instructor: Mark Depp, National Inspector

May 6-17

Spanish Language

Intro to Hardwood Lumber Grading

For Spanish speakers an Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber. Housing and week-day meals are included.

Venue: NHLA Headquarters

Location: Memphis, TN

Instructors: Roman Matyushchenko, NHLA ITS Instructor and Mark Bear, NHLA National Inspector

June 10-Aug 2

Inspector Training School 207th Class

Traditional 8-week hands-on training to achieve a certificate of completion in Hardwood Lumber Inspection.

Venue: Pennsylvania College of Technology

Location: Montgomery, PA

Instructor: Roman Matyushchenko, NHLA ITS Instructor

August 12-23

Inspector Training School

Online Training Program

MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters

Location: Memphis, TN

Module 2: Online study

Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor: Roman Matyushchenko, NHLA ITS Instructor

Hardwood Markets Matter, and it is important for NHLA to share market details of the entire Hardwood Industry. We appreciate the support of allied associations and publishers in gathering and sharing this important market information that can help you understand the complete hardwood industry picture.

www.hardwoodreview.com

Upper-grade and #1 Common prices trended quite differently in 2023. To illustrate this, consider the displayed kiln-dried 4/4 index of five Appalachian species: Sap/Btr Hard Maple, Sap/Btr Soft Maple, Area 1 Red Oak, White Oak and Poplar. Prices for both grades fell during the first half of the year. Since mid-July, however, FAS/1F prices have risen 20%, on average, compared to gains of only 8% for #1 Common—and FAS/1F prices either held up better, or grew more, than #1 Common prices for all of these species except Poplar.

There are several reasons upper grade prices have outperformed #1 Common prices over the last six months, chief among them log supplies and log qualities. Sawmills widely reported declines in log size and quality in 2023, most notably for White Oak, for which veneer and stave markets compete aggressively for higher quality sawlogs. Smaller and lower-quality logs yield a smaller percentage of upper-grade lumber. According to the USFS, 36% of the lumber sawn from a 16” grade 1 White Oak sawlog is FAS or FAS/1F. Upper-grade yield drops to 15% and 10% for grade 2 and

3 logs, respectively. The yield of #1 Common lumber, however, is virtually identical for grade 1 and 2 White Oak logs, and grade 2 Red Oak logs actually yield a higher percentage of #1 Common lumber than grade 1 logs. Additionally, even small reductions in average log sizes compound the upper-grade yield loss, especially in grade 2 logs. A 14” grade 2 White Oak log, for example yields only 7.6% upper-grade lumber, half the percentage yield of a 16” log.

Secondarily, the overall decline in hardwood lumber production since the summer of 2022 has disproportionately impacted uppergrade lumber availability relative to demand. Comparatively, #1 Common is more available and in lower demand.

www.hmr.com

The HMR Demand Index (HDI) is a feature in HMR Executive® that illustrates monthly trends in reported demand from 10 major domestic markets for hardwood lumber. Components of the index are color coded with various shades of blue when demand is slow, they transition to gray when demand is fair, and then to light red and deep red when demand moves from good to strong.

Index for January, which is published the first week of February.

Cabinets

Residential Flrg.

Truck Trailer Flrg.

Upholst. Furniture

Wood Furniture

Moulding/Millwork

Wood Components

Board Road

Pallets

Railroad Ties

Wood ties and timbers used on our nation’s railroad infrastructure support freight, passenger trains, and help us continue to thrive as a country. There are over 136,000 miles of track in North America to maintain. This requires a large effort, and annually, wood tie and timber producers bring 18-20 million ties to the marketplace. These ties and timbers are not simply “industrial” products, these are integral pieces of architecture, with strength and structural integrity at the forefront of the procurement process. Railway Tie Association is the membership group that represents those tie producing entities and end-users that run railroads on them, and more, and helps to keep wood tie markets strong and sustainable - and has been doing so since 1919. One of our annual tenants is providing education in our premiere event called the Tie Grading Seminar. This article is a representative snapshot highlight of that prestigious educational offering focusing on wane identification and allowances in wood ties and timbers.

Mainline railroad crossties today are generally 7”x9”x8’6” grade 5, predominately oak and hickory, “sleepers” or pieces of wood utilized to hold up rail, anchor in ballast, and have locomotives and railcars roll over the top of them. When it comes to wood tie grading, defects can express themselves in various ways and in a myriad of capacities. Wane is easily identified as the lack of xylem, and if substantial in presence, can drastically reduce wood tie quality.

Wane observed in wood ties is lack of wood and is the product of sawing of a crosstie from too small of a log (in singular renderings or multiples, refer to previously published Heartwood Orientation). It is the outer portion of a tree. Wane present in wood ties can inhibit the tie plate from seating properly. If not seated properly, the tie plate can rock, and as it is the interface between the wood tie and rail, and loosen spikes and create gauge failure, potentially causing derailments. Allowances for wane, per tie grade and size, is presented in the below table:

Grade Tie Wane Specification

6x8 Max. 1” wane on top RBA (rail-bearing area)

7x8 Min. 8” face in RBA (no wane/square)

7x9 Max. 1” wane in top RBA & max. 1” anywhere on bottom

Industrial Tie Wane Specification

6x8 Min. 6” face in RBA

7x8 & 7x9 Min. 6” face in RBA & outside RBA, up to 5” wane allowed on top and bottom

Limitations for crosstie defects are delineated in the AREMA 30 standards and covered extensively at the RTA annual Tie Grading Seminar. Please visit rta.org for more information on wood ties and timbers, the Tie Grading Seminar, and other offerings RTA provides to our industry.

SOURCES:

• Railway Supply Institute: https://www.rsiweb.org/data-technical-r esources/rail-supply-economic-impact-study/

• Railway Tie Association: https://www.rta.org/why-rta

• American Railway and Engineering Maintenance-of-way Association: https://www.arema.org/AREMA_MBRR/Committees/30.aspx)

Examples of wane in wood ties: left is a green tie downgraded at the tie processing facility (bark is also not allowed in grade ties), and right is a tie with excessive wane that made it all the way to track (notice the anti-split plate is larger than surface area of cross-section, which creates a safety hazard to railroad workers with over-hanging metal).

ABOVE ANSWER, PLEASE PROVIDE CONTEXT FOR MARKET, WEATHER OR OTHER CONDITIONS.

Minnesota, Iowa, Wisconsin, Michigan, N Indiana, N Illinois: Everything is slow for hardwood markets. Pulpwood is dead. -30 degrees a couple weeks ago turned into 45 degrees and rain - road restrictions have already started in some areas.

West Virginia: a lot of mills are low on log inventory, some because of weather but mostly because of lumber markets.

Virginia: Flooring, Pallet, and Poplar not moving well. Weather has been mostly wet and cloudy making logging difficult. Some slowdowns and quotas are starting to be put in place on ties.

New England 1: With very poor and warm weather conditions throughout the area, most mills will not have enough logs to make it through to Spring breakup. Tie production has slowed more due to log availability. There has been some increase in demand for and pricing for #1C & #2C lumber, most mills do not have the log inventory to capitalize on this increased demand.

Pennsylvania: Some Pallet and Grade Lumber markets are seeing better pricing.

E Texas, NW Louisiana: Pallet sales are continuing to be a struggle hopefully the economy will pick up. Logs has been good but its getting wet now.

Mississippi: Crosstie demand remains strong. recent winter storms have hindered logging.

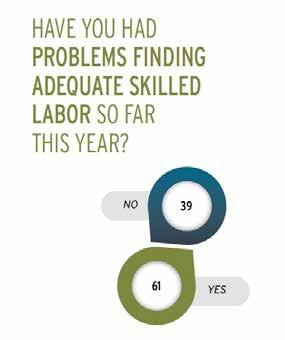

According to Hardwood Floors magazine’s 2024 Industry Outlook, filling critical positions remains a challenge for nearly 61 percent of NWFA members. Most said that the challenge is about the same as it was in 2022. Those who have found some success in finding labor have used referrals as the most successful strategy, as well as social media and classifieds.

The Real American Hardwood Coalition has launched its Build Your World™ campaign in partnership with Magnolia Network. The ads are inspiring a national audience by educating them on the benefits of Real American Hardwood® products.

The campaign was made possible thanks to voluntary contributions from the hardwood industry. Your continued support is critical to advance the initiative and reclaim market share for the benefit of all industry stakeholders.

Help Build Your World. Learn more about the RAHC’s promotion efforts, see a list of supporters, and make a voluntary, tax-deductible contribution at RealAmericanHardwood.com/industry or scan the QR code.

Here you will find our current job listings.

To see more details of the job or to post a job, visit www.nhla.com/resources/careers-center

MILLERS

NC

Church & Church Lumber seeks a qualified person to perform maintenance duties in the kiln dry facility to keep operations running smoothly and efficiently.

Send your resume to: wilma@churchandchurchlumber.com

Church & Church Lumber Company, LLC PO Box 619 | Millers Creek, NC 28651 336-973-5700

NWH is seeking a full-time lumber inspector. Primary duties and responsibilities include consistent and accurate grading of surfaced and green lumber in a high production manufacturing operation. The successful candidate must be NHLA certified or equivalent experience, have the flexibility and ability to work in a team oriented, fast paced work environment with primary focus on personal and team safety behaviors.

Send your resume to: sarah.devries@nwh.com

NWH

718 2nd Avenue SW | Onalaska, WI 54650 608-783-2215

Allegheny Wood Products, Inc., a leading Appalachian hardwood lumber manufacturer, is looking for a highly motivated candidate for a Lumber Grader position. The position is located in Beckley, WV. The primary responsibilities include grading/inspecting green lumber.

Send your resume to: HR@alleghenywood.com

Allegheny Wood Products, Inc. 212 Resource Drive | Beckley, WV 25801 304-257-1082