P3 • Bankrupted postmasters robbed of compensation by ‘unjust’ tax deductions • Government and Post Office pledge to fix mistakes and get fairer payouts to victims ANOTHER SCANDAL ON THE HORIZON 7-20 MARCH 2023 STRICTLY FOR TRADEUSERSONLY NATIONAL LOTTERY P2 P12 How to sweeten your sales and stay on top of the latest category trends New operator Allwyn to launch survey for stores this summer ahead of takeover P4 HOME DELIVERY Retailers dropUber Eats over removal of popular listing and pricing function SUGAR CONFECTIONERY MORE CHOICES. MORE SALES. THE RED BULL 250ML RANGE. SEE SALES FLY. STOCK UP TODAY. 12518_Feb_2023_Retail Express Dummy Front Cover_260x215mm_V1.indd 1 16/02/2023 15:41

The National Living wage increase in 2023 and low unemployment rates are causing difficulties for store owners in finding, training and retaining strong teams. This edition of The Retail Success Handbook examines recruitment strategies in a competitive job market, maximising efficiencies and retaining employees. We also explore ways to improve employee skills and loyalty, while maintaining profitability, including:

Best practice for recruiting and onboarding staff

Creating value through staff incentives and staff welfare

Exploring effective options to train and boost productivity

Smarter ways to promote products and interact with customers more effectively

Supplier websites, tools and services that can be used for training staff and improving customer service – and how to use them effectively

A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS The Retail Success Handbook RECRUITMENT, RETENTION & TRAINING The Retail Success Handbook: Recruitment, Retention and Training Optimise your business and staff efficiencies with the latest edition of The Retail Success Handbook DON’T MISS OUT Order your copy from your magazine wholesaler today or contact us on 020 3871 6490

£4.99 On sale 22 March

Only

PLUS

REVAMPING SOFT DRINKS Everything you need to know to keep the category thriving this summer 17 betterRetailing.com CATEGORY ADVICE SOFT DRINKS 17 soft drinks has always important for tailers, and key throughoutthe cost-of-living crisis. and growing it’s also diverse, incorporating subsuch as health, coffee avoured ers their prefer to make they’re making their allocating appropriate space ing lines, making note trends, the Prime saga demonstrated. especially tant warmer summer most important soft Lastsummer, drinks sales, knowing the trends uencing shopper will help build on this However, they contend with cost-of-living healthier appetites, according Gouldsmith, wholesale Suntory Beverage (SBF the navigate economic wecanexpect rise shoppers more price-conscious and look with family at says. However,few categories shoppers stick options ahead label, with branded higher label, says spokesperson.we’ve ing long-term towards lower sugar, consumers more health being,” Gouldsmith THE SOFT DRINKS OPPORTUNITIES DON’T SOFTEN YOUR SALES JASPER HART looks at how to make your soft drinks sales sing as we move into spring 34936_Britvic_Retail Express_260x75mm_Landscape_HR.pdf P17 7-20 MARCH 2023 STRICTLY FOR TRADEUSERSONLY NATIONAL LOTTERY P2 P12 How to sweeten your sales and stay on top of the latest category trends New operator Allwyn to launch survey for stores this summer ahead of takeover P4 HOME DELIVERY Retailers dropUber Eats over removal of popular listing and pricing function SUGAR CONFECTIONERY • Bankrupted postmasters robbed of compensation by ‘unjust’ tax deductions • Government and Post Office pledge to fix mistakes and get fairer payouts to victims ANOTHER SCANDAL ON THE HORIZON P3

Megan Humphrey, editor

Allwyn to kick-off communication to stores

licence for a decade, starting 1 February 2024.

However, the latter is definitely something the government has on its side. Almost everybody, whether a business owner or not, is being affected by the cost-of-living crisis right now. Bills are sky high, and are set to soar even further. The sting will be made all the worse at the end of this month when support from the government is also set to come to an end.

I think the scary thing is that this isn’t anything new. Businesses will tell you they’ve gone as far as they can in reducing their energy use, with most now left with no other choice but to pass extra costs onto shoppers. In recent weeks, it’s been tough to shy away from the stark industry warnings that, without a lifeline, thousands of independent business are to be forced to close their doors permanently, leaving the economy in a dire state.

KEEP YOUR EAR TO THE GROUND

Last March, the Gambling Commission announced the company had won the bid to operate the Lottery’s fourth

I truly believe local shops have played their part in trying to cut costs, but it’s crunch time. The next month will be vital for the survival of your business, so be sure to keep your ear to the ground.

Ministers need to face the reality that without support, small businesses will be driven to close. Retailers have compromised, and now it’s time for the government to step up and pledge their continued support for those serving the UK.

We will be doing our bit to keep you in the know, when and if anything is announced in the coming weeks.

@retailexpress betterRetailing.com facebook.com/betterRetailing

News editor Alex Yau @AlexYau_ 020 7689 3358

Dia

Stronach

020 7689 3375

News reporter Jill Lupupa jill.lupupa@ newtrade.co.uk

In its bid, Allwyn was committed to a adopting a “digital-�irst approach”, claiming it would double the money generated for good causes, build on a “cutting-edge technology platform” to improve player protection, invest in retailers and improve convenience access for participation.

Retail Express understands the company is currently

Vape fines

SHOPS are facing �ines of up to £5,000 for failing to provide a take-back service for used vaping products, as enforcement is set to ramp up.

A message from Booker sent to partnered stores last month read: “The Of�ice for Product Safety and Standards

working on a detailed communication plan, to be shared with retailers very soon. It’s also expected the �irst piece of direct correspondence will be when stores will be asked to participate in an in-person site survey this summer to better understand individual set-ups and equipment.

In addition, the company wants to reassure that retail remains the heart of its bid, and whatever changes are

made, it will provide store owners the opportunity to grow sales, alongside subsequent network growth. Alongside this, it is understood retailers will receive similar terms and conditions to their current Camelot contracts.

Two weeks ago, the Post Of�ice con�irmed it would be ending its relationship with the National Lottery when the third licence comes to an end.

For the full story, go to betterRetailing.com and search ‘Allwyn’

03

Payzone price hike

will be carrying out enforcement activity on retailers who are not compliant…from the end of March 2023.”

To achieve compliance, stores selling less than £100,000 of electrical devices per year can join a Distributor Takeback Scheme.

For the full story, go to betterRetailing.com and search ‘vape’

Eco-pack warning

announced the rise from 99p to £2.99 while also stating it would be scrapping and simplifying unspeci�ied “additional contract charges”.

Stores will automaticallyroll over to the new price unless they contact Payzone in the 30 days after the price-hike date. For the full story, go to betterRetailing.com and search ‘Payzone’

05 PO boosts spend

POST Of�ice (PO) branches are helping to generate an extra £3.1bn spend in nearby businesses, according to a new survey.

A London Economics report published last month revealed that in two in every

�ive visits to branches, money was also spent in neighbouring stores and premises.

During 2021 to 2022, PO generated £4.7bn in economic impact across the UK, and for every £1 spent by PO, an additional £1.51 is generated.

Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment.

ber of beverages with no- or low-plastic packaging used for energy drink Prime. The packaging, which uses cardboard instead of plastic, is sometimes unable to support the weight and shape of the drink. Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied.

For the full story, go to betterRetailing.com and search ‘packaging’ For the full story, go to betterRetailing.com and search ‘Post Office’

The five biggest stories this fortnight 01 02

04

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Senior features writer Priyanka Jethwa @PriyankaJethwa_ 020 7689 3355 Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Deputy insight & advertorial editor Tamara Birch @TamaraBirchNT 020 7689 3361 Production editor Ryan Cooper 020 7689 3354 Sub editor Jim Findlay 020 7689 3373 Sub editor Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 020 7689 3367 Senior account director Charlotte Jesson 020 7689 3389 Commercial project manager Ifzal Afzal 020 7689 3382 Senior account manager Lindsay Hudson 020 7689 3366 Account managers Marie Dickens 020 7689 3372 Megan Byrne 020 7689 3364 Management accountant Abigayle Sylvane 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say

crunch time

The energy crisis enters

WHOLESALERS have warned of potential wastage on soft drinks. Speaking at a Federation of Wholesale Distributors event last month, AF Blakemore general manager Bruno Krssak said the wholesaler had experienced a numFeatures writer Jasper Hart 020 7689 3384 @JasperAHHart 41,206 Audit Bureau of Circulations July 2021 to June 2022 average net circulation per issue

WHEN a crisis hits, its hits everyone. We saw this when the coronavirus pandemic swept the nation. When something of this magnitude takes hold, it doesn’t care who you are, and certainly doesn’t make exceptions.

Specialist reporter

MEGAN HUMPHREY

UPCOMING National Lottery operator Allwyn Entertainment is to begin communicating directly with independent retailers for the �irst time later this year, with the launch of an in-person survey.

PAYZONE is to increase its weekly fee for stores using its legacy terminal by more than 200% to £2.99 per week, starting on 27 March.

An email from the �irm’s commercial director, Simon Lambert, sent on 27 February and seen by Retail Express,

Postmasters hit by ‘unjust’ Horizon scandal tax blunder

MEGAN HUMPHREY VICTIMS of the Post Of�ice’s (PO) Horizon

IT scandal have had the majority of their compensation payouts ripped away due to “unjust” tax deductions.

More than 700 branch managers were given criminal convictions between 2000 and 2014 when a glitch in the PO’s computer system, Horizon, made it look as though money was missing from their accounts.

The scandal has been described as the most widespread miscarriage of justice in UK history. Although PO has begun issuing compensation through its Historical Shortfall Scheme, designed to repay those who lost out, some postmasters have missed out on hundreds of thousands of pounds due to tax deductions on their payouts.

Last month, the Daily Mail revealed one in particular, Francis Duff, was told he owed £71,533 in income tax on his compensation, and £251,359 will be taken under bankruptcy proceedings, leaving him with just £8,000.

Tax lawyer Dan Neidle has slammed the government for its wrongdoings, describing them as “scandalous”. He told Retail Express: “The �irst problem is that the compensation payouts, which are for loss of earnings, are taxable in the

same way as normal earnings. Unlike normal earnings, multiple years are being taxed at the same time, pushing the victim into a high tax bracket.

“The second problem is that the compensation is covering events from many years ago, so a large amount of the payment is interest. This is fully taxable, and 20% of the tax will be withheld by the PO. The remainder of that will be payable by the victims on their self-assessment return. They aren’t being warned about this and hence why this news has been uncovered.”

Neidle went on to stress that a lot of victims won’t obtain tax advice, and therefore won’t declare the interest on their tax return, so could fall into default with HMRC. “These people have already gone through hell and back and they are now being asked to pay an accountant to stop them being taxed thousands of pounds,” he said.

As a result, Neidle is calling for a blanket tax exemption for all postmasters.

“What makes this worse is that this has happened at the hands of a company owned by the government again,” he said. “The government has a special duty here, even if some people have been taxed already, this should be undone.”

In the last week, the Business Department has promised to consider the

individual circumstances of those affected postmasters, and “make offers accordingly”. A spokesperson for the PO told Retail Express: “PO and our shareholder, the Department for Business and Trade, are working to ensure all victims of the Horizon IT scandal are returned to the �inancial position they should have been in had the wrongs not occurred.

“We want to see fair compensation for all victims and, together with the government, are looking at is-

sues raised so that if any unfairness is found in individual cases, this can be addressed.

“We are acutely aware that, in some cases, shortfalls caused severe impacts on postmasters’ lives. The Historical Shortfall Scheme provides for the human costs, such as personal injury, distress and inconvenience, harassment, loss of reputation and bankruptcy costs if these are directly related to shortfalls.”

Retail Express also understands that if a postmas-

ter does not accept an offer, it is possible for it to be revised and the scheme provides for reasonable legal or accountancy advice.

When asked what affected postmasters should do, Neidle advised: “I know that it’s unusual advice from a tax lawyer, but I don’t think they should do anything. I have faith that the government is going to see there is only one answer here, and do the right thing. The government have a responsibility for everything that has gone wrong in the past.”

How are you using niche products to boost sales and profits?

“We are selling homemade samosas at £1 each. We’re doing 100-150 a day, and because they’re homemade, I’m doubling my money easily. I know food to go is working, but I want a unique product that people can identify with my store only. The only way to do that is to make my own food. Using social media is also a good tool to see the latest trends and try to grab shoppers.”

Serge Notay, Notay’s Convenience, Batley, West Yorkshire

“I installed an iSqueeze machine about three days ago, and it is helping generate between £40 and £50 in daily sales. The margins also range from 43% to 54% depending on which size bottle customers buy. Seeing how little time we’ve had with it, I’m amazed at how popular it is. You can see the process. You push the tap, and the machine starts. You can see the oranges drop in, get cut and squeezed, and that it’s just a single ingredient.”

“The best category for high margins is vapes. We’ve looked at getting independent suppliers to improve margins. We have also invested in slushies, which is a big hit in the summer. We have no overheads with our machine, and it always creates a buzz. Keep an eye on your range and tweak products where you will have price control to improve your margins across the board.”

Serge Khunkhun, One Stop Bilston, Wolverhampton, West Midlands

AF BLAKEMORE: A new hybrid store combining the Spar and Philpotts sandwich brand is set to open for independents. The company-owned site will open on 6 April and is based at Brindleyplace in Birmingham. Retail Express understands that if successful, it is likely the concept will be made available to Spar franchise stores supplied by Blakemore.

JACK’S: Booker is set to launch more premium products into the Jack’s range as part of a 100-line expansion of the own-label range this month. The wholesaler said: “Launches are planned across important categories such as cake, frozen, grocery, crisps and snacks, soft drinks, confectionery and deli.” The additions are expected to bring the total Jack’s brand to around 630 lines, according to retailers.

GOOD WEEK BAD WEEK

ATMS: NoteMachine retailers are to see monthly commission levels drop by hundreds of pounds, after the provider proposed a reduction in rates. Stores were sent letters in January, stating it would not be able to offer retailers the same commercial terms. It said this was due to a reduction in “overall transaction levels in the market and a reduction in the fees we receive from Link”.

For the full story, go to betterRetailing.com and search ‘NoteMachine’

COFFEE: Tchibo is increasing the daily cost of its coffee machines for retailers by £1 and £2 from April. The firm has blamed the decision on “dramatic increases in operational costs”. The daily cost of Tchibo to Go machines will rise by £1, while Smokin’ Bean machines will increase by £2.

For the full story, go to betterRetailing.com and search ‘Tchibo’

03 betterRetailing.com @retailexpress facebook.com/betterRetailing megan.humphrey@newtrade.co.uk 07597 588972

7-20 MARCH 2023

express

yourself the column where you can make your voice heard

Do you have an issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

Goran Raven, Raven’s Budgens, Abridge, Essex

Serge Khunkhun

INDEPENDENT retailers have been forced to disable home delivery services after Uber Eats removed their access to its range-management function.

Last month, store owners reported being unable to access the ‘Menu Maker’ feature, which enables them to edit their Uber Eats product listings and pricing.

Instead, retailers were being asked to email individual changes.

One affected retailer, who asked not to be named, told Retail Express: “We have thousands of products through Uber Eats. It used to take an hour each day to make changes. This has set us back by weeks.

“We’ve waited weeks for a response. Uber Eats begged for our services during the

pandemic. Their whole attitude has changed now.”

Another claimed that poor service from Uber Eats had forced them to disable the service.

Retail Express understands the issue has affected more than 20 independent stores across England, with Menu Maker being disabled to clamp down on small shops adding “non-compliant items”.

One store owner claimed these “non-compliant items” included vaping lines.

Retail Express found a number of Uber Eats partnered multiples, such as Sainsbury’s, Tesco, Co-op, One Stop and Morrisons, selling vaping products.

An Uber Eats spokesperson said: “We want to be the best partner to retailers and our door is always open for feedback.”

Retailers turn off Uber Eats service One Stop’s new EPoS

DEDICATED TO THE true Pleasure BALANCED MOISTURE

ONE STOP franchise stores have been told to expect a new EPoS system later this month.

The convenience chain celebrated the opening of its 1,000th store in Wolverhampton two weeks ago.

On the day, managing di-

rector Sarah Lawler said the system records automatically, removing the need for scanning, and houses an integrated real-time connection between back office and online delivery menus, helping to improve efficiency.

THE FED BACKS DRS ROLLOUT • of rolling •

THE Fed is urging the Scottish government to not give in to pressure to delay the upcoming deposit return scheme (DRS).

Ministers remain under extreme strain from drinks producers, retailers and trade bodies to delay the scheme, due to go live on 16 August.

New design

GREAT TASTE, SATISFYING AROMA SOFT AND EASY TO HANDLE 70% OF CONSUMERS WILL BUY AGAIN AFTER EXPERIENCING THE TASTE* For Tobacco Traders Only. *Based on ITUK commissioned research (Horizon Blind Blend research Oct 2020), 182 respondents.

said: “Many retailers have invested in changes to the layout and fittings of their shops.” For the full story, go to betterRetailing.com and search ‘One Stop’’ For the full story, go to betterRetailing.com and search ‘DRS’

Lost Mary vape recall

ANOTHER popular vaping brand was taken off sale at the end of last month over poor legal compliance.

Booker and One Stop urged stores to stop selling Lost Mary ‘BM600’ products and return stock for credit.

Messages seen by Retail Ex-

press show a packaging ‘legal issue’ affecting 12 lines, with distributor Phoenix Trading “voluntarily withdrawing” them. The move comes amid increased focus from regulators after Elfbar admitted some stock had illegal e-liquid levels last month.

NEWS 04

ALEX YAU

The Fed’s national deputy vice-president, Mo Razzaq, acknowledged the issues. He 7-20 MARCH 2023 betterRetailing.com For the full story, go to betterRetailing.com and search ‘Lost Mary’

INTHE UK Source: Nielsen Total Off Trade market data to 31.12.22 Enjoy Responsibly. TOP 10 PRODUC T RANGE CAMPO VIEJOTOTAL

NO.1SPANISHWINEBRAND

PRODUCTS

Cash for stores from Cadbury

JASPER HART

MONDELEZ International has launched a campaign offering shoppers the chance to win cash prizes for themselves and their local independent retailers.

‘The big win-win’ promotion, which is running until mid-May, invites consumers to nominate their local shop for the chance to win a cash prize that matches their own.

To enter, shoppers must purchase a participating Cadbury product, go to bigwinwin.cadbury.co.uk, and enter their details and those of their local independent store for its chance to win a matching cash prize.

There are 50 £1,000 prizes

and 50 £500 prizes, giving 100 customers and retailers the chance to win.

The promotion is running across Cadbury’s full singles and Duos range in plain and price-marked packs.

Additionally, �ive retailers have the chance to win £100-worth of Cadbury singles stock, provided they are a registered member of Mondelez’ Snack Display category-advice website.

By registering or logging in and �illing out the entry form, they will be entered into the prize draw.

Frederike Grohmann, brand manager for Cadbury singles at Mondelez, said:

“We hope the ‘Big win-win’ campaign will encourage

Changes to L&B Blue from Imperial

IMPERIAL Tobacco has announced a range of developments across its Lambert & Butler brand.

As part of the changes, Lambert & Butler Blue Real Blue and Blue Bright Air Filter have been renamed Blue Original and Blue Bright, to create a more recognisable presence for retailers in wholesale depots and on shelves.

Meanwhile, Lambert &

Butler Blue Bright and New Crush will feature Fresh Protect packaging, which offers the products more protection and has a resealable foil. All varieties will have an RRP of £10.90 for a pack of 20.

Additionally, the brand’s rolling tobacco range will be known as Lambert & Butler Blue Rolling Tobacco. It also has tips and premium papers that burn slower.

DCS Group launches store advice site

HOUSEHOLD, health and babycare distributor DCS Group has launched a website, corerange.com, to help convenience retailers navigate these categories.

The site is free for retailers to use and lists all the latest category and product insights. The supplier says it uses market data and shopper insights to maintain impartiality.

It also recommends wholesalers use the site to ensure they are listing the bestselling products.

Matt Stanton, head of insight at DCS Group, said: “We want to make insight and data more accessible than ever before to those who need it. The categories are

communities to support their local independent stores in these turbulent times.”

In support of the campaign,

the supplier is providing social media content, outdoor advertising, PoS and digital material.

Malibu launches wholesale-only PMP

PERNOD Ricard UK has launched a £2.19 pricemarked pack (PMP) format of its Malibu Pineapple ready-to-drink (RTD) variety, exclusively to wholesale.

The new format comes as the RTD can category is growing by 22% in convenience stores, with Malibu Pineapple the fastest-growing spirit mixer can, growing by 120%.

It is available from national wholesalers including Dhamecha, HT Drinks, Imperial and Parfetts, in cases of 12 250ml cans.

Chris Shead, off-trade channel director at Pernod Ricard UK, said: “The cocktail

Yazoo relaunches Choc Mint variety

FRIESLANDCAMPINA has relaunched Yazoo‘s Choc Mint variety following its success as a limited-edition product.

The �lavour is available now in plain and pricemarked 400ml bottles, with a 1l bottle set to launch this month. According to Maren Fuhrich, brand manager at Yazoo, it sold the most volume out of all of the brand’s limited-edition �lavours, and attracts up to 30% incremental shoppers.

In keeping with the brand’s ongoing sustainability commitments, the bottles are made from 100% recycled PET and feature a peelable sleeve for kerbside recycling. The pack design is by illustrator

Tomas Dogg, who was involved in the brand’s ‘Find a designer’ social media campaign last year.

Bonds candy cup range for charity

important and contain essential, high-value products that convenience stores should stock. They drive shoppers into stores, both for planned top-up shops and distress missions.”

WORLD of Sweets has launched a range of Bonds of London Candy Cups, proceeds from the sales of which will go to The Honeypot Children’s Charity.

The range is designed around fantastical themes that encourage children to use their imaginations. It consists of Teddy Bears’ Picnic, Pirate Adventure and Magical Forest varieties.

The packaging features a resealable lid for portion control, is made from 30% recycled material and is also kerbside recyclable.

Additionally, 10p from each sale of the new varieties will be donated to The Honeypot Children’s Charity, which supports children

aged between �ive and 12 who are young carers, with respite and learning breaks.

trend continues and the popularity of RTDs has accelerated as consumers seek out convenient formats. Our new PMP premix can will drive presence in impulse, ensuring further visibility in the ‘grab and go’ moment.”

Twix gets first ice cream variety

MARS Chocolate Drinks and Treats (MCD&T) has launched Twix Ice Cream Cones.

The ice cream features a combination of caramel ice cream with caramel sauce wrapped in a wafer cone and topped with biscuit pieces. It is available as a four-pack with an RRP of £3.50.

This marks the �irst time the popular chocolate con-

fectionery brand has been developed into an ice cream cone format.

The launch comes as Mars Ice Cream grew by £11.5m last year, grabbing a 42% share of the total ice cream market. According to the supplier, it has delivered more than six times the growth of the category average in the past �ive years, more than any other manufacturer.

Non-HFSS Starburst

Fruit Squares

MARS Wrigley has launched Starburst Fruit Squares, its �irst HFSS-compliant fruity confectionery, in Spar Stores.

Starburst Fruit Squares are available in Fruit Mix and Tropical Mix varieties. The new range is vegan and made with 80% apple puree. Each variety will have an RRP of £1 for a 25g pack. Fruit Mix contains apple, strawberry, blackcurrant, and orange �lavours, while Tropical mix has pineapple, mango, passion fruit and lemon.

Kerry Cavanaugh, marketing director at Mars Wrigley, said: “As fruity confections are growing by 17% year on year, the Starburst brand is a perfect platform for Mars

Wrigley’s �irst HFSS-compliant fruity confectionery venture, bringing an additional audience of 1.4 million to the sector.”

06

CCEP strengthens its Reign with Mang-o-Matic launch

COCA-COLA Europaci�ic Partners (CCEP) has launched Reign Mang-o-Matic, the newest variety of its Reign Total Body Fuel energy drink brand.

Available now, Mang-oMatic has been launched to drive momentum behind the brand, which the supplier says is the number-one performance energy drink in Great Britain, growing by 9.5%. It is also HFSScompliant.

Mang-o-Matic has a tropical �lavour that combines sweet citrus and �loral mango. Like the rest of the Reign range, it contains 200mg of

naturally sourced caffeine, vitamins B3, B6 and B12, and branchedchain amino acids (BCAAs), which the supplier says contribute to the reduction of fatigue. It is available as a 500ml plain can. Convenience retailers also have access to PoS materials from my.CCEP.com to drive shopper interest. An accompanying ‘Train with Reign’ promotion offers a four-day �itness retreat in Ibiza.

Customers can win £100 through Doritos’ on-pack promo

PEPSICO has launched an on-pack promotion across packs of Doritos offering shoppers the chance to win £100 with an accompanying TV campaign, ‘Devour Doritos your way’.

Running across the core Doritos range, as well as the recently launched HFSScompliant pizza �lavours until 30 May, the promotion taps into the growth of larger sharing formats, which are now the biggest savoury snacks format.

It is also aimed at the growing number of shoppers favouring nights in.

Alex Nicholas, Doritos

senior marketing manager, said: “Recent research has suggested as many as 71% prefer staying in.

The occasion is now worth £2.5bn, showing a huge demand from consumers who

The occasion is now worth £2.5bn, showing a huge demand from consumers who

are willing to trade up on snacks when staying in.

“Our on-pack promotion encourages customers to enjoy their ‘night in-in’ with Doritos and is therefore a must-stock for retailers.”

NORDIC This product contains nicotine. Nicotine is an addictive subst

SPIRIT DOES IT AGAIN!

07 7-20 MARCH 2023 betterRetailing.com Excellent ** WWW.NORDICSPIRIT.CO.UK For more information go to: nordicspirit_uk nordicspirituk *Winner Nicotine Pouch Category, Survey of 8,000 people by Kantar. **Trustpilot rating correct as of January 2023.

IT’S A WINNER *

IT

PRODUCTS

Walkers community fund returns

JASPER HART

PEPSICO has launched its Walkers community fund competition for the second year running, giving 10 retailers the chance to win £2,000 each to support their local neighbourhood.

To enter, retailers have until 5 April to purchase two cases of any 48-82g £1.25 price-marked pack (PMP) or Kurkure 80g £1 PMP.

They can also text ‘COMMUNITY’, their full name, their business name and postcode to 85100.

Mike Chapman, head of wholesale at PepsiCo, said: “Convenience stores have always played an important role within their local com-

munities, but never has this been more the case than during the past few years. We know 73% of independent retailers have engaged in some form of community activity in the past year alone, and we expect this to continue. With this competition, we hope to help retailers give back to their communities with a signi�icant prize up for grabs.

“Sharing RRP PMPs account for 49.1% of crisps and snacks value sales within the crisps, snacks and nuts segment, and represent an important driver of savoury snacking sales within the convenience channel.

By focusing the competition on RRP PMPs, we’re helping

KP Snacks expands Flavour Kravers

KP Snacks has expanded its KP Flavour Kravers nuts range with the launch of a Sour Cream & Chive variety.

The launch intends to capitalise on the popularity of dairy �lavours, which the supplier says are the secondbiggest in the crisps, snacks and nuts category, despite there previously being no dairy �lavours within nuts.

Since launching last March, Flavour Kravers has contributed £2.5m in sales for KP Nuts. It is particularly popular with younger consumers, whose purchasing decisions are driven by interesting �lavours.

The overall KP Nuts range has a retail sales value of £85.1m.

Häagen-Dazs’ new macaron range

GENERAL Mills has launched a new Häagen-Dazs macaron ice cream range, made in collaboration with pastry chef Pierre Hermé.

The range is launching across wholesalers this month, having launched already in Asda. It is available in Strawberry & Raspberry and Double Chocolate Ganache varieties in pint and mini-cup formats, with respective RRPs of £5.35 and £4.80.

Jose Alves, head of HäagenDazs UK, said: “Pierre Hermé is celebrated for his exquisite macarons and together with the iconic ice cream of Häagen-Dazs, a new era of magical indulgence is here.

The partnership showcases

retailers to drive their snacking sales further.”

Retailer John Wilson, of The Corner Shop in Cel-

Lilt rebranded as Fanta fl avour

lardyke, Fife, who was a winner of last year’s competition, used his money to restore a local tidal pool.

Ferrero launches ice cream trio

FERRERO UK has launched a trio of ice creams based on its Ferrero Rocher and Raffaello brands, backed by a £2m marketing campaign.

Ferrero Rocher Classic, Ferrero Rocher Dark and Raffaello ice creams are available now in single sticks with an RRP of £2 and multipacks of four with an RRP of £4.75.

The Ferrero Rocher ice creams are coated with crunchy hazelnut pieces and �illed with a smooth hazelnut-�lavoured ice cream, while the Raffaello ice cream sticks consist of a crispy coating with a sprinkling of coconut shavings and almond pieces, with a coconut-�lavoured

ice cream.

Ice cream is the largest category within frozen, with a 23.3% market share worth £1.4bn, while chocolate ice cream sticks grow by £26.4m over the summer.

COCA-COLA Europaci�ic Partners (CCEP) has axed soft drink Lilt after nearly 50 years and relaunched it as Fanta Pineapple & Grapefruit.

Available now in 330ml cans, and 500ml and 2l rPET bottles, the new Fanta line retains the original drink’s tropical taste.

Additionally, Lilt Zero has rebranded as Fanta Zero Pineapple & Grapefruit, which also contains no sugar or calories. It is only available as a 2l rPET bottle.

Lilt was launched in 1975 and was sold only in the UK, Ireland, Gibraltar and Seychelles. It became

popular thanks to its Lilt Man parody adverts in the 1980s, as well as the Lilt Ladies in the 1990s.

Kingsway launches

Mega Value range

HANCOCKS has expanded its Kingsway pick-and-mix range with a new Mega Value range.

The range includes Kingsway Value Peach Rings, Sour Bears, Sour Dummies, Jelly Blue Babies, Fizzy Cola Bottles and Fizzy Cherry Cola Bottles.

Exclusive to Hancocks, the range varies in size from 2.5kg to 3kg, with RRPs from £7.99.

The Mega Value bags can be identi�ied by their yellow labelling to differentiate them from the brand’s core range.

Kathryn Hague, head of marketing at Hancocks, said: “Introducing the Mega Value range is all about moving with the

Captain Morgan gets pack update

the true craftsmanship of both brands; passionate about innovating and reinterpreting classic favourites and creating extraordinary experiences.”

The supplier is supporting the launch with a marketing campaign including experiential events and in�luencer activity.

DIAGEO has unveiled a pack redesign across its Captain Morgan rum brand.

The new look features a new gold brush stroke that indicates the quality of the liquid in the bottle, as well as a refreshed version of the brand’s Captain icon.

It is rolling out across the entire Captain Morgan range, with the aim of attracting new adult drinkers to the rum-based spirits category.

Samori Gambrah, global brand director at Captain Morgan, said: “This new pack design highlights the delicious spice of our liquid and character as a brand. It will allow us the �lexibility we need to show up in a

dynamic way in our sponsorships, live events, collaborations and packaging around the world.”

current �inancial pressure consumers and retailers are under and offering them the best value for money.”

Jacob’s Mini Cheddars make TV return

PLADIS UK&I has brought its Jacob’s Mini Cheddars brand to TV and on-demand with the ‘Welcome to Cheddar Town’ campaign. The campaign runs until the end of March with additional exposure on social media and in cinemas.

It features an animated land inspired by the brand’s bright colours and sunburst logo. It also spotlights three

varieties – Mini Cheddars Original, Mini Cheddars Red Leicester and Mini Cheddars Nibblies Cheddar & Smoked Paprika.

Aslı Özen Turhan, chief marketing of�icer at Pladis UK&I, said: “Since we launched our Welcome to Cheddar Town platform in 2021, the brand has secured a position as a top-10 crisps and snacks brand.”

08

Nisa invests in wholesale savings

NISA has announced a £6m investment into the wholesale price (WSP) of more than 1,000 branded products as part of its retailer support strategy.

The symbol group said it took the decision across the most important ambient categories to its retailers – beers, wines, spirits, soft drinks and tobacco – based on market data to give stores the most valuable savings.

Some of these reductions include a £6.62 saving on a case of four-pack Carlsberg Export pint cans, a £5.97 saving on a case of Hardys VR Chardonnay and a £1.48 reduction on a case of JPS

Mars and Galaxy launch Mocha Lattes

Coca-Cola partners with Marvel

Players Real Red King Size. Other savings include £1.95 on a case of 24 CocaCola 330ml cans, and £7.72 on Smirnoff Vodka 70cl, whose new WSP will be £70.74 after its £69 promotion expires.

Topps partners with major race event

TOPPS has become the of�icial licencing partner of motorsport event 24 Hours of Le Mans.

The partnership sees exclusive trading cards featuring artwork from the original race posters from 1923 to the present day.

Mark Catlin, Topps general manager of international sports and entertainment, said: “As one of the most prestigious and historical

licences in motor sport, 24h Le Mans is a brand we are excited and honoured to be representing in their centenary year.”

Stéphane Andriolo, director of customers and events at the Automobile Club de l’Ouest, added: “We are very pleased to sign this partnership with Topps. These products will enable all Le Mans 24 Hours enthusiasts to enjoy the race.”

James Hall extends food acquisitions

SPAR wholesaler for the north of England James Hall & Co has acquired Lancashire dairy company Ann Forshaw’s and its associated brand Alston Dairy.

The acquisition sees the wholesaler expand its food manufacturing portfolio to �ive, adding Alston Dairy to Clayton Park Bakery, Fazila Foods, Graham Eyes Butchers and the Great Northern Sandwich Company.

Dominic Hall, joint managing director of James Hall & Co, said: “We are keen to grow the business further and see a huge amount of potential in the Ann Forshaw’s brand. We will grow the presence in more Spar stores and continue

MARS Chocolate Drinks and Treats (MCD&T) has launched new HFSS-compliant Mars and Galaxy Iced Coffee Mocha Lattes.

The launch comes as �lavoured milk is now worth £568m, an increase of 16% year on year, while coffee�lavoured milk is worth £207m and growing by 20% year on year.

The two �lavours have an RRP of £1.85, and while stored ambient, the supplier said they are best served chilled.

Michelle Frost, general manager at MCD&T, said:

“We believe we have a winning formula with a

combination of the nation’s two favourite milk �lavours, our distinctive brands and price-marked packs.”

Baileys partners with Eurovision

DIAGEO has announced a three-year partnership between Baileys and the Eurovision Song Contest, which is taking place this year in Liverpool.

As of�icial partner to the event, which is happening from 9 May to 13 May, the cream liqueur brand is providing treat inspiration and recipes for viewing parties. It will also be providing activity at Liverpool Arena, the contest venue.

Jennifer English, global brand directory for Baileys, said: “At Baileys, we are huge fans of the Eurovision Song Contest. It is the world’s most joyful global celebration of inclusive and diverse cultures and

communities. As the world’s most-loved spirits brand, we are thrilled to announce Baileys’ partnership with the Eurovision Song Contest.”

COCA-COLA Europaci�ic Partners (CCEP) has partnered with Marvel to launch ‘The Multiverse awaits’, which is the largest collaboration to date between the supplier and Marvel’s parent company, The Walt Disney Company.

The campaign includes an on-pack promotion with six limited-edition Marvel-themed designs, three for Coca-Cola Zero Sugar and three for CocaCola Original Taste. They are available across cans, bottles and multipacks of both varieties and feature the icons of Marvel superheroes Captain America, Loki,

She Hulk, Iron Man, Black Panther and Black Widow. The promotion offers shoppers the chance to win a trip to the Marvel Avengers Campus at Disneyland Paris and other exclusive prizes by scanning QR codes on promotional packs.

Tanqueray launches new global campaign

DIAGEO has launched a new global campaign for Tanqueray gin called ‘Let’s live magni�icently’.

The campaign, which is Tanqueray’s �irst global marketing push since 2018, includes a series of 10-, 20and 30-second TV and digital adverts, as well as outdoor advertising.

These highlight the joy in everyday moments, such as rooftop drinks with friends or an aperitif before dinner.

Nitesh Chhapru, global brand director of Tanqueray, said: “At the heart of the campaign is a simple idea that we all have the choice to turn any moment into something special with just a bit of inspiration and imagina-

Roberts rebrand spotlights roots

to develop products in new categories, ensuring that greater numbers of customers can enjoy Ann Forshaw’s products.”

ROBERTS Bakery has put its Cheshire roots and focus on quality and local community at the heart of a major rebrand.

The rebrand includes a new logo featuring the Northwich-based bakery’s cooling towers alongside a ‘Raised in Cheshire’ strapline.

Bill Thurston, managing

director at Roberts Bakery, said: “It is a celebration of all that Roberts has done very well for over 130 years, baking great products to meet the needs of real people, and will be the foundation for recovery after a challenging few years. It sets out a clear offer to those who know us and those who don’t – from Northwich to the nation.”

tion; as we believe life is best served magni�icently over a Tanqueray & Tonic.”

Rockstar unveils Refresh range

BRITVIC is expanding Rockstar Energy with the launch of the Refresh range, in Strawberry & Lime and Watermelon & Kiwi varieties. Both �lavours will be available to convenience and wholesale from April.

Strawberry & Lime will be available in a 500ml can with an RRP of £1.35. Watermelon & Kiwi, meanwhile, will be available in a £1.29 price-marked pack (PMP). The supplier hopes this will drive impulse purchases, with 66.9% of stimulant sales in convenience coming from PMPs.

To support the launch, the supplier will hand out more than four million free cans across 10 cities throughout

the year. It is also launching a campaign in May which will include outdoor, in-store and digital advertising.

09 7-20 MARCH 2023 betterRetailing.com

OPINION

RETAILER OPINION ON

THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3358 for the chance to be featured

AVAILABILITY: How are you managing fruit and vegetable shortages?

“WE’VE managed to maintain a good supply. Sales have increased by 30% as shoppers either can’t get the stock from their supermarket, or are being limited. We haven’t seen any huge gaps at wholesalers or cash and carries. As small businesses, we are able to react when supermarkets are struggling.”

Sue

“I’VE been going to a local supplier to get my stock levels up. Customers have been understanding. I’ve been told the issues are going to continue until May at the very latest. There isn’t much that we can do about it. As small businesses, we just need to carry on and fill gaps where we can.”

We haven’t seen any huge gaps

ENERGY: Are you worried about costs when gov’t support ends next month?

“WE got an engineer to swap out our bulbs for more energyefficient ones. There are fewer small businesses out there now. The government do care about us, but I think it’s wrapped up in larger businesses, as well. They get a better deal than us.”

“I DON’T necessarily think the government are the first ones to be blamed. I think we have to make sure we are managing our businesses efficiently and we are being treated fairly. We can see that market prices are going down, so I think there is optimism.”

VAPING: Have you made any category changes since the tank size scandal?

“THERE has been a voluntary recall, so we are still selling them. If I had to take my vapes off sale, I would be losing up to £2,000. As soon as suppliers tell me to stop selling it, I will, because I know I’ll get my money back.”

“I’VE been keeping in touch with my supplier. I don’t stock the Elfbar 600 and Lost Mary vapes any more. I want to be compliant. People are buying other brands that we sell instead. I want to continue being a responsible retailer”

Eugene Diamond, Diamond’s Newsagent, Ballymena

People are just buying other brands

CRIME: Have you seen a shoplifting rise during the cost-of-living crisis?

“PEOPLE have mostly been stealing alcohol. The police don’t tend to respond very quickly. The bigger problem is that perpetrators know that once they get arrested, they won’t be kept in. I lose around £3,000 every year from shoplifters targeting my shop.”

Mo Razzaq, Premier Mo’s, Blantyre, South Lanarkshire

“THE people doing it know that the police won’t come out for anything under £200. It’s madness, really. I am relying on my staff to keep their eyes open. There are probably a lot of people who’ve done it that are getting away with it because we haven’t noticed.”

10

Mark Dudden, Albany News & Post Office, Cardiff

Samantha Coldbeck, Wharfedale Premier, Hull

Anita Nye, Premier Eldred Drive Stores, Orpington, Kent

We can see market prices going down

I lose around £3,000 every year

Nithyanandan, Costcutter Epsom, Surrey

Harj Dhasee, Mickleton Village Stores, Gloucestershire

Trudy Davies, Woosnam & Davies News, Llanidloes, Powys

10 MARCH ISSUE OF RN Pricewatch: see what other retailers are charging for cider and boost your own profits Finding a USP: where to find your store’s unique selling point – and how to use it to drive sales Refit or refresh? Top tips for giving your shop a new look + STAY INFORMED AND GET AHEAD WITH RN betterRetailing.com/subscribe ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor

COMING UP IN THE

‘Police response over attempted robbery was impressive’

MY store was closed after a potential robbery. Someone came into the store on the morning of 19 February, came up to the counter and asked me to hand them over money. We have a panic button installed, which I pressed immediately.

I told them I’d pressed it and that the police would be here soon. They ran straight off. The police were quick on the scene, and arrived with a number of patrol cars and sealed everything off as a crime scene. They even brought in a helicopter. I was

really impressed. I later found out that the perpetrator �ilmed themselves in the act and uploaded it on social media platform TikTok. It went viral. During the process, the police were great at staying in touch and updating me. Two days later,

Alert stock

I was noti�ied a 20-year-old man had been arrested and released on bail.

I do want to thank the community for their support.

Eugene Diamond, Diamond’s Newsagent, Ballymena, Northern Ireland

& Davies News, Llanidloes, Powys

We’ve recycled 500 vapes since Christmas

“WE started giving away free food during the pandemic to struggling families in the local area. I promoted this on our Facebook page at the time. I’ve been serving my community for 40 years, so I feel like I have a duty to help. We started to get messages from people during the cost-of-living crisis, claiming they were too embarrassed to come in and admit they couldn’t afford food. As a result, we make up a carrier bag full of supplies and deliver it to them directly.”

The latest news on Elf Bar and Lost Mary is shocking, but, in my opinion, has been blown way out of proportion. Booker, Bestway and supermarkets have delisted all of them, but it was only a suggestion to do this. It was a voluntary recall. While some wholesalers have offered credit and to accept returns of these vapes, my supplier hasn’t done this because it was a voluntary recall. It means that if we removed all our stock, we’d lose approximately £1,000-worth of stock, which we can’t afford – especially in today’s economic climate.

Retail Express speaks to a retailer standing out and staying ahead of the curve

The challenge with the government is they seem to be viewing this news as a category-wide issue, rather than just a supplier. If it was any other category, they would approach the supplier and fix it this way. They should be concentrating their efforts on those who are selling illicit vapes and next-gen products every day.

I’ve read many articles about under-18s being able to buy vapes and other next-gen products, but any responsible retailer would never morally do this. The internet is a huge problem in enabling this.

To gain access, all they need is to click a button or input their date of birth to say they are over 18 and they are in. Anyone can lie on that. But if you come to my store – or most other convenience stores – we’ll ask for proof. The government needs to be focusing more on online retailers and the few retailers who sell to under-18s. These retailers don’t care about selling to someone underage, as it’s about the money. Currently, it seems the government is tarring us all with the same brush.

The government is also encouraging recycling, without giving us the resource to do so. We’ve just launched a vape recycling scheme, which came about after we noticed how many were being thrown on the floor. There isn’t much guidance on setting this up, but all retailers need is a box for recycling them in store.

We’ve been posting about the scheme on social media and we’re the first in Wales to offer the scheme. I know it’s working because retailers have been asking about it and we’ve recycled about 500 vapes since Christmas.

Our biggest challenge and shock was how many consumers weren’t aware they can’t be recycled at home. So, we’ve been talking to them and they are now getting in the habit of bringing them in when they buy more, which is all part of being a responsible retailer.

11 betterRetailing.com 7-20 MARCH 2023 Letters may be edited LETTERS

Get in touch @retailexpress betterRetailing.com facebook.com/betterRetailing megan.humphrey@newtrade.co.uk

07597 588972

Photo credit: Twitter - @EDiamond136

‘We deliver free food to struggling families’

Omran Awan, Premier Michaels Superstore, Newcastle upon Tyne

COMMUNITY RETAILER OF THE WEEK

TRUDY DAVIES Woosnam

ENTER SUNTORY Beverage & Food GB&I has partnered with Retail Express to offer five retailers the chance to win £50-worth of Lucozade Alert, the high-caffeine energy drink with vitamin B3 to help reduce tiredness. This year, it’s back with a striking new can design across all three varieties: Cherry Blast, Tropical Burst and Original Lucozade. WIN £50-worth

Lucozade

Fill in your details at: betterRetailing.com/competitions This competition closes on 4 April. Editor’s decision is final.

TO

of

SWEETENING THE DEAL

CHARLES WHITTING finds out what trends and opportunities exist within the sugar confectionery category this year

A GROWING CATEGORY

WHILE the past 12 months have brought considerable challenges for retailers and their customers alike, the confectionery category has continued to perform well, as people look for small and affordable purchases that can improve their day.

“The confectionery category grew by 2.9% versus the year before, suggesting that while many are strongly seeking value, they still want to treat themselves. However, in particular, we’ve seen that ownlabel products have lost share

in the chocolate and candy categories as consumers increasingly gravitate towards brands that they recognise and trust,” says Susan Nash, trade communications manager at Mondelez International.

Phil Moutray, from WM Moutray & Sons in Dungannon, County Tyrone, knows he can get higher margins for his store from confectionery, even if he’s selling the increasingly popular pricemarked packs (PMPs).

“People like to know the

prices up front. With PMPs, you’re not getting the same margins, but they’re still pretty good, and if you’re willing to shop around the wholesalers, you can find the good deals that can net you 30% margins,” he says.

“We’ve shopped around and seen a difference of £6 per box, and that’s huge.

“The two or three hours I spend checking prices with local wholesalers has made all the difference for us.”

Moutray has also noticed

customers are trading up in pack size to follow the ‘spend more, save more’ mantra when it comes to treating themselves.

“A standard Cadbury bar is 85p, but for £1.25 they can get a big bar and people are content to pay that bit more to get a lot more,” he says.

are

“Single sweets aren’t selling like they used to, but we’ve found over the past few years there’s been huge growth in bags of sweets instead.”

CATEGORY ADVICE SUGAR CONFECTIONERY 12 7-20 MARCH 2023 betterRetailing.com

70%

WORK HARD. PLAY HARD.

of home, 42% of consumers are chewing gum whilst working or studying

are already seeking Chewing Gum to help them in their work & study moments and Extra® has the largest share of the category

When out

Shoppers

say going to live music events is part of their mental wellness plan WITH OUR NEW NATIONAL ON-PACK PROMOTION LIVE 01.01.23 – 26.03.23 GET YOUR SALES TO WORK HARD UK 18+. Purchase any promotional pack of EXTRA® or AIRWAVES® between 01.01.23 to 26.03.23. Scan the QR code to register details and last 4 digits of the barcode for a chance to win a pair of Reading Festival 2023 tickets. 39 pairs of tickets to be won with EXTRA® and 9 pairs of tickets to be won with AIRWAVES®. Wrap up draw for entries registered between 27.03.23 and 30.06.23 with 1 pair of tickets with EXTRA® and 1 pair of tickets with AIRWAVES® to be won. Maximum 1 entry per person, per day. Retain receipt. For EXTRA®, see www.extragum.co.uk/work-hard-play-hard for details and full T&Cs. For AIRWAVES®, see www.airwavesgum.co.uk/work-hard-play-hard for details and full T&Cs. Promoter: Mars Wrigley Confectionery Limited, 3D Dundee Road, Slough, Berkshire, SL1 4LG. © 2023 Mars or Affiliates. (Source: YouGov, LN Soundboard) Deadline Friday, I GOT THIS!

Women in Convenience aims to address this inequality and make meaningful changes.

We are asking female retailers to complete our short survey, to share their thoughts and experiences, so that we can begin to understand what is behind the inequality, and how Women in Convenience can best help tackle the issues that female retailers face in the workplace.

The survey can be accessed at the following link: bit.ly/3wPzrmR or by scanning the QR code.

We really appreciate your time – thank you.

You can find out more about Women in Convenience and how to get involved by visiting betterRetailing.com/women-in-convenience

Over 75% of female retailers feel that there is inequality in the independent convenience sector.

Supporting partners

CATEGORY ADVICE SUGAR CONFECTIONERY

TAKING CONFECTIONERY TO THE NEXT LEVEL

CONFECTIONERY is not just purchased for personal impulsive consumption, but also as a gift, whether it’s for the upcoming Easter celebrations or for birthdays, work anniversaries or as a thank-you present.

“It’s very important for retailers to stock a large variety of sweets to meet all of their customers’ needs,” says a spokes-

RETAILER VIEW

person for Hancocks. “Based on purchasing trends, pick ’n’ mix is the most popular among customers, as well as gift ranges. Because of this, independent retailers should ensure they have a variety of gifting options for all occasions.”

Customers will be on the lookout for these gift products, but they can also provide strong

impulse sales, particularly around nationally celebrated holidays, so retailers should make sure they are prominently displayed and merchandised for maximum effect.

In addition to gifts for others, retailers can also lean into unusual and trending products. Moutray’s stores have a big children’s range of sweets, par-

ticularly if they are located near to a local school, and he’s found that novelty items sell well.

“We have a candy dispensing toilet that kids picked up on, and toy guns that shoot sweets. Things like that – and lollipops as well – kids like the fun of it and they’re big sellers. You can also get a 35-40% margin on those silly types of sweets. We

really focus on the trade before and after school.”

Uthay Soundararajan, from Inverleith Costcutter in Edinburgh, has leaned into the US confectionery trend, picking up products from Hancocks on a regular basis to keep his offer fresh.

“They are selling well all the time,” he says. “Customers are

always looking for something new and we have two shelves of US confectionery. I don’t keep the whole range.

“For example, Jolly Ranchers has four flavours and I’ll only stock two, but then the next time I order, I’ll get the other two. It means that people can get something new every couple of weeks.”

“WE try to stick with PMPs. They’re the one thing that always works. If the price went up, I’d struggle to update that price if it wasn’t price-marked.

“I try to keep the confectionery right at the front by the till. It’s a big impulse seller and it means that I can keep an eye on them for security reasons. I don’t keep them on the counter, but on the shelves. When the kids come in with their parents – we have a primary school nearby –they’ll choose sweets and ask their parents to buy them while they’re waiting at the till. It’s a small shop, but we have three metres of shelves for confectionery and I’ve installed fibre display units. That creates a nice display and customers really prefer it to the boxes. It presents a better appearance to them.”

15 7-20 MARCH 2023 betterRetailing.com

15

Uthay Soundararajan, Inverleith Costcutter, Edinburgh

MARKETING YOUR SUGAR CONFECTIONERY

SUGAR confectionery has traditionally been a till-side category, driving impulse sales at the point of purchase.

The introduction of HFSS legislation looked set to make this positioning no longer feasible for affected stores. However, the number of affected stores appears to be fewer than anticipated, meaning the till remains an important place for driving impulse sales. It remains to be seen if the legislation in multiples and larger stores will have a wider impact on customer

purchasing behaviour overall, leading them to look elsewhere for their sugar confectionery.

However, even if this did happen, it would still provide retailers with another selling opportunity by positioning them in secondary or even tertiary locations around the store. Stores should be trying to implement this anyway.

“Retailers should make use of aisle-end displays for eyecatching novelty items, placed at a low height so children can spot them. Aisle-end displays

can also be used to showcase easy-to-grab sugar confectionery items, such as our Bond’s Shaker Cups,” says a spokesperson for Hancocks. “All confectionery products should be displayed with clear and appropriate PoS.

“Themed shelving and displays in store are a great way for retailers to encourage promotional sales and appeal to customers of all ages. New confectionery products and seasonal items should be prioritised in store merchandising and placed

near the front of the store for maximum impact.”

Retailers can also lean on the impulsivity of confectionery to drive incremental sales as well. While Moutray has the majority of his confectionery displayed by the till, he also has some located next to his coffee machine.

“Very often, we’ll do a deal where you can get a coffee and a chocolate bar for a special price,” he says. “That works and it’s building sales in two high-margin products.”

New products

New products to purchase

Kingsway Mega Value range

World of Sweets, formerly Hancocks, has expanded its Kingsway pick ’n’ mix range with a new Mega Value range. It includes Kingsway Value Peach Rings, Sour Bears, Sour Dummies, Jelly Blue Babies, Fizzy Cola Bottles and Fizzy Cherry Cola Bottles. They vary in size from 2.5kg to 3kg and have an RRP from £7.99.

Cadbury Duos

Cadbury is expanding its Duos range with the launch of Twirl Xtra. The Twirl Xtra is rolling out with an 80p RRP and is being supported by in-store PoS and activation.

Candy Realms Fizzy Mix Cup

This launch from World of Sweets is packed with a mix of marshmallows and fizzy jellies, including gummy bears, twin cherries, bubble-gum bottles and peach rings. The pick ’n’ mix cup has an RRP of £1.99.

Rowntree’s HFSS-compliant gummy sweets

Nestlé Confectionery has launched a HFSS-compliant range of Rowntree’s gummy sweets, consisting of Berry Hearts, Safari Mix, Gummy Bears and Jelly Snakes. The range is made with real fruit juice and 30% less sugar than other Rowntree’s products, and has no artificial flavourings, colourings or sweeteners. The range will launch later this year at an RRP of £1.35, following an initial supermarket launch.

Starburst Fruit Squares

Mars Wrigley has announced its launch of Starburst Fruit Squares, as its first HFSS-compliant launch into the fruity confectionery space. The two varieties, Fruit Mix and Tropical Mix, launched in Spar stores on 27 February with an RRP of £1.

SUGAR-FREE OPPORTUNITIES

THE purpose of the HFSS legislation was to limit the amount of exposure customers had to products high in fat, sugar and salt.

This has led some suppliers and manufacturers to start investing in the creation of no-sugar options within confectionery. Where sugar is still being used, there are drives to reduce its presence. For example, Mondelez’s new range, The Natural Confectionery Co Juicy Snakes, features real fruit juice and 30% less sugar than standard equivalents.

This investment has seen rewards already, with Perfetti Van Melle’s (PVM) sugar-free range of gums and mints growing by 22% year on year.

“Innovation is a key driver for the category,” says Mark Roberts, marketing and trade marketing director at PVM.

“Within PVM’s Mentos Gum range, for example, new Mentos Sugar Free Fruit Gum is completely sugar-free, but offers the taste credentials of an indulgent, refreshing treat. As a result, Mentos Gum is currently driving two-thirds of the

growth of the fruit gum market. There is a clear opportunity to provide shoppers with more sugar-free and betterfor-you products that offer portion control and added health benefits – this will be vital in supporting category growth around Easter.”

In addition to sugar-free, the growing number of flexitarians, vegetarians and vegans in the UK makes it potentially worthwhile to include some products with vegan certification to provide a point of difference.

CATEGORY ADVICE SUGAR CONFECTIONERY 16 7-20 MARCH 2023 betterRetailing.com

DON’T SOFTEN YOUR SALES

THE SOFT DRINKS OPPORTUNITIES

THE soft drinks category has always been important for retailers, and continues to be a key sales driver throughout the cost-of-living crisis.

Worth £10.6bn and growing by 10%, it’s also increasingly diverse, incorporating subcategories such as functional health, protein, iced coffee and flavoured water. Retailers need to know what their shoppers prefer to make sure they’re making the most of

their ranges and allocating appropriate space to the bestselling lines, while making note of any trends, as the ongoing Prime saga has demonstrated. This is especially important as we move into warmer weather, with summer the most important season for soft drinks sales. Last summer, soft drinks reached £786m in value sales, and knowing the trends influencing shopper behaviour will help retailers build on this

figure. However, they have to contend with the cost-of-living crisis and healthier appetites, according to Matt Gouldsmith, channel director, wholesale at Suntory Beverage & Food GB&I (SBF GB&I).

“As the nation continues to navigate the ongoing economic pressures, we can expect to see a rise in nights in as shoppers become more price-conscious and look to spend time with friends and family at home,”

he says. However, soft drinks is one of the few categories where shoppers continue to stick to branded options ahead of own label, with soft drinks branded spend 36% higher than own label, says a Red Bull spokesperson.

“Secondly, we’ve been seeing a long-term trend towards drinks with lower sugar, as consumers become more aware of their health and wellbeing,” Gouldsmith adds.

17 7-20 MARCH 2023 betterRetailing.com CATEGORY ADVICE SOFT DRINKS 17

SIGN TODAY!UP Free POS Kits Free Product Trials Exclusive O ers See website for full Terms and Conditions. To get started and claim your free case, scan the QR or visit atyourconvenience.com Increase your shop’s sales and grow your business 34936_Britvic_Retail Express_260x75mm_Landscape_HR.pdf 1 24/02/2023 16:21

JASPER HART looks at how to make your soft drinks sales sing as we move into spring

Maximise fast-selling lines and avoid out-of-stocks by ensuring the number of facings you give to products reflects their rate of sale. Heidi Vossen-Barnes, Senior Manager Independent Convenience To find out more, visit betterRetailing.com/IAA or contact the team on iaa@newtrade.co.uk // 020 7689 0500 Join the Independent Achievers Academy today and take advantage of: A free, comprehensive health check for your store

chance of being recognised for your efforts A network of success-driven retailers

invitation to the IAA Learning & Development Festival on 3 July

tip

Coca-Cola Europacific Partners

IAA

Headline partners Supporting partner #ALWAYSIMPROVING #IAA23

The

An

The leading learning, development and recognition programme helping retailers grow profitable sales Top

from

The

is supported by leading industry brands who recognise that retailers want free support to increase profits

CATEGORY ADVICE SOFT DRINKS

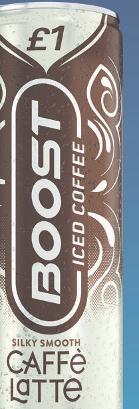

ENERGY DRINKS

ACCORDING to Adrian Hipkiss, marketing and international business director at Boost Drinks, energy is the largest soft drinks segment in the independent channel, with £1 in every £3 spend on soft drinks being spent on an energy drink.

Energy drinks cover a range of needs, from stimulation and sports hydration to functional health, and are characterised by consistent launches and grand promotions that attract shopper attention.

“Flavoured energy continues to be the fastest-growing [soft drink],” says a Nisa spokesperson. “This is through new products and continual improving taste profiles and options in full and low sugar making it accessible to all consumers. They are supported by large media campaigns and on-pack promotions from gaming companies, events and experiences, which consumers relate to.”

The sports drinks sector is also experiencing a sales rebound as pre-pandemic behav-

iour returns. “It is safe to say that not only are sports drinks sales recovering, but they’re also rising at a rapid rate,” says Hipkiss. “Over the past 52 weeks, sports drinks have become the second-fastestgrowing category within soft drinks, with 27% value growth year on year.”

Brands are also important: Boost Sport is the number-two sports drink brand in value and volume, selling more unit sales than the third, fourth and fifth brands combined.

RETAILER VIEW

Imtiyaz Mamode, Premier Wych Lane, Gosport, Hampshire

“WE’VE got equal amounts of English and US soft drinks, but if I compared them, 65-70% of sales are from US products. We sell more of them all the time, whether it’s winter or summer. When customers ask me to get something, we usually buy one or two cases to see how it goes. We started selling an energy drink called G Fuel and customers started switching to it from Monster – now we have 12 flavours of it.

“Bigger bottles sell well on weekends, but we have a school next to our shop and get a lot of kids coming in to buy drinks, and they go with a smaller can or bottle because they can’t get bigger ones into school.”

23 19

IRI SYMBOLS & INDIES/NI CONVENIENCE VOLUME 52WEEKS 28/11/22

BIGGEST

SYN0774_RetailExpress_HalfPage_Ad_FullRange_128x339mm.indd 1 17/02/2023 14:52

GREAT VALUE

MARGINS EVER!

Top tips

Red Bull’s five key principles for driving soft drinks sales

Arrange your soft drinks fixture by shopper need states, depending on whether consumers are looking for a treat or something more functional. For example, refresh (colas and flavoured carbonates), energise (energy drinks), replenish (sports, juice and juice drinks) and hydration (waters).

Ensure you provide the appropriate space to sales for your range, by looking at value sales and unit sales. Sports and energy has a combined 35% share of the category, so should equate for 35% of the fixture. Within sports and energy, give maximum space to the most profitable lines.

Less is more when it comes to offering the right range, ensuring adequate supply of the lines that drive 80% of your category sales value.

Visibility is key to helping your shoppers find what they need quickly. Use key brands to signpost the category, such as Red Bull for sports and energy. Place bestselling lines at eye level – also known as the strike zone. Block brands together to help them stand out. Shoppers can only see products within a 1.3-metre breadth, so merchandise similar products vertically.

Displaying products in multiple locations is a proven way to increase soft drinks sales. For example, in the chiller or by the till point for impulse purchases and at the gondola end or a dedicated display for take-home.

RETAILER VIEW

Meten Lakhani, Premier St Mary’s Supermarket, Southampton

“WITH a big student population, we sell in excess of 70 cases of 2l drinks a week, especially on Fridays and Saturdays with alcohol. We offer two-for-£3 on Diet Coke and Coke Zero, and have held to that, so we sell a lot.

“I’ve not bothered with Prime. My kids bought it from Asda for £2.50, so for me to sell it, I’d have to get it in for £8.50 to sell for £10. I really don’t want it behind my till, as it’s one of those products that would get stolen and cause a lot of hype. At that price, it’s not a good advertisement for my store when Asda is selling it for £2.50. I’m probably missing an opportunity, but I’d rather miss this one.

“When something new comes out, I’m a bit dubious and wait a week or two, but when my kids start talking about it, I know it’s hyped up. I initially didn’t buy Mogu Mogu off the rep, then my daughter mentioned it, so I got it in and it’s flying out.”

LOW- AND NO-SUGAR DRINKS

“WE know the way people live is changing. Health is becoming more important and, especially with younger shoppers, we’re seeing increased demand for lower-calorie products and a significant reduction in the consumption of alcohol,” says Adrian Troy, marketing director at Barr Soft Drinks.

“Increasingly, customers have been looking to moderate

their sugar consumption, and legislation such as HFSS has provided retailers an opportunity to highlight key low- and no-sugar ranges,” echoes the Red Bull spokesperson. “As a result, low- and no-sugar soft drinks are the bestselling sector (£1.5bn) and fastestgrowing, up by 12.8% versus full-sugar at 12.5%.”

Within this segment, the

role of bottled water cannot be understated, especially given the high temperatures seen last summer.

Bottled water sales have grown by 33% in the past year in convenience stores, while the overall soft drinks category has grown by 11%.

“We expect this trend to continue, and believe that it will unlock further opportu-

nity for the flavoured water and sparkling sub-categories,” says Charlotte Andrassy, head of category developments & impulse at Danone UK & Ireland. “We know consumers respond positively to tasty, yet healthy, water alternatives and ranges including Evian’s sparkling water in a can and Volvic Touch of Fruit help us tap into this demand.”

SOFT DRINKS 20

CATEGORY ADVICE

GETTING TRENDY

AMID the broader macro trends affecting the category, it’s crucial to remember the effect that social media trends and the arrival of imported US and European lines have had on retailers’ sales in the past few years.

Despite these lines often incurring a higher price for customers, they are happy to cough up, as they are intrigued

by the different flavours.

“Our US Fantas and Mountain Dews and Mogu Mogu are all doing well,” says Meten Lakhani, who runs Premier St Mary’s Supermarket in Southampton. “Even for 20p extra a can, they sell just as well, they’re not affected by price.”

This is part of what Ben Parker, GB retail commercial

Soft drinks news

Tango Editions

Britvic has launched Tango Paradise Punch Sugar Free. The latest entry in the Tango Editions rotation flavour series, it contains orange, mango and tropical flavours. Previous Editions launch Berry Peachy Sugar Free delivered £10.7m in retail sales last year.

Prime Tracker

The Prime Tracker app, which helps customers find stockists of the viral energy drink, has begun taking applications from independent shops to list them, provided their pricing is deemed acceptable.

Lucozade Alert

SBF GB&I has refreshed the look of its Lucozade Alert range to improve on-shelf standout and drive sales. The range has amassed £8.1m in value sales since launching in September 2021.

Lilt

Coca-Cola Europacific Partners has scrapped the Lilt brand after nearly 50 years and relaunched it as Fanta Pineapple & Grapefruit, doing the same for its Lilt Zero variety. Available in 330ml cans and 500ml and 2l bottles, the new Fanta line retains Lilt’s tropical taste.

Yazoo

director at Britvic, describes as a “lipstick effect, where shoppers are switching from expensive purchases to treating themselves with smaller treats and indulgences”.

It’s especially important for helping retailers who are unaffected by HFSS legislation, as they have free rein to place these products in high-footfall

areas. Kay Patel, of Best-one Wanstead in east London, sells a lot of Fanta Tropicool, a Polish import, to his Eastern European clientele for £1.89 per 500ml bottle, and says sales occasionally outstrip those of Fanta Orange, which sells for £1.09 price-marked.

Meanwhile, retailers continue to profit from customers’

willingness to pay well over the odds for Prime, even as its availability at RRP continues to expand through convenience. Patel sold through an initial order at £10 per bottle before

pay *RECOMMENDED RETAIL PRICE

Christmas, before a reduced price in his second order enabled him to charge £6.99, which was naturally also a hit. He is currently charging £7.99, with sales still strong.

NOW * DDTL-PR-002433_LUCOZADE_ALERT_TRADE_AD_RE_240x172_v3.indd 1 06/02/2023 12:24

21 7-20 MARCH 2023 betterRetailing.com

FrieslandCampina has relaunched Yazoo’s Choc Mint variety following its success as a limited-edition product. The flavour is available now as a 400ml and 1l bottle. over LUCOZADE, LUCOZADE ALERT AND THE ARC DEVICE ARE REGISTERED TRADEMARKS OF LUCOZADE RIBENA SUNTORY LTD. © LUCOZADE RIBENA SUNTORY LTD. ALL RIGHTS RESERVED.

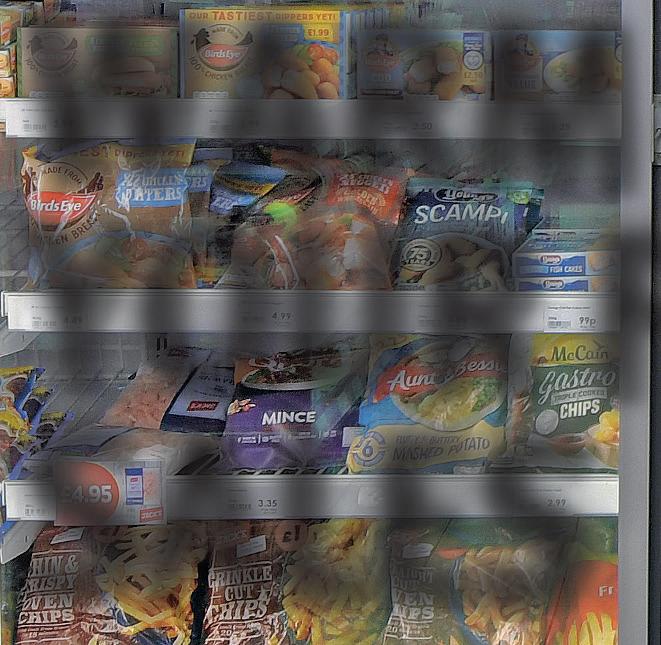

WARM UP YOUR FROZEN SALES

CHARLES SMITH finds out how retailers can show value in their frozen food ranges to drive repeat purchases

HOW VALUE IS AFFECTING FROZEN FOODS

RISING costs mean shoppers are looking for products that offer value for money, so there’s an opportunity for stores to focus on and invest in their frozen food ranges.

These value-conscious decisions are seeing shoppers prioritise price-marked packs (PMPs) and own-label products over known brands.