• Exclusive: 98% of councils given no indication of funding levels to enforce single-use vape ban

• Shops urged to still follow law while retailers warned of likely rampant black market

DODGY vape sellers could be left unchecked after the disposable-vapes ban, as most UK councils are unclear on the level of funding they will receive for enforcement.

Of the 119 Freedom of Information (FOI) responses received by Retail Express detailing funding levels to enforce the ban, only two councils were able to con�irm their allocated funding for 2025 and 2026.

This means 98% of respondents are in the dark about the level of resources they will receive to enforce restrictions starting on 1 June.

Coventry City Council con�irmed that £790,818 will be allocated to the Central England Trading Standards Authority region.

Of this, £543,285 will fund the recruitment of nine new Tobacco Control Of�icers, with the remainder allocated for storage and disposal of con�iscated products.

Meanwhile, Nottinghamshire County Council stated it will receive £168,000, not all of it to police the ban. It stated £45,000 will be allocated for tackling underage sales and £123,000 for illegal tobacco enforcement.

Meanwhile, a report released by of�icials from Edinburgh trading standards this month warned the body has not been given any additional resources to tackle the upcoming ban, placing extra

pressure on staff.

The report stated: “Enforcement and seizures will also require speci�ic storage and specialist disposal arrangements, which will also require to be funded.”

An initial £10m has been allocated to National Trading Standards by the government to support enforcement.

However, councils are expected to use this funding to also manage restrictions related to the Tobacco and Vapes Bill currently progressing through the House of Lords.

Meanwhile, retailers have been sent letters from some trading standards bodies reminding them of the vape ban. A letter sent to stores by the London Borough of Merton, seen by Retail Express, said: “Trading

standards is reminding the business community that single-use vapes will soon be banned. Trading standards will make inspections to check compliance.”

Other retailers have also reported trading standards of�icers coming into stores and incorrectly seizing disposable vapes this month, despite the products still being legal for sale.

Businesses that fail to comply once the ban comes into force could face legal action, with �ines starting at £200. Repeat breaches may result in further enforcement, including stop notices or, in serious cases, prison sentences.

With funding still unclear, some retailers claimed they have been left to manage the transition independently with little guidance

“RECENTLY, we invested signi cantly in a full re t that included a redesigned store layout, enhanced product range and modernised in-store branding. We’re proud to serve our local area, and this recent investment in the store reflects that. It’s not just about new signage – it’s about o ering the right range to customers, improving security and creating a store our community can feel proud of.” Raheem Ali Razaq, Nisa Royston, Glasgow

from their local council. Judith Mercer, from Hamilton News in Belfast, said: “Several weeks ago, I was horri�ied thinking ‘what am I going to do here?’, but I’ve taken the decision to start bringing in the new compliant products.”

Meanwhile, Joey Duhra, of Premier Jules Convenience Store in Telford, Shropshire, said he had been running promotions such as threefor-£10 to get rid of as many lines as possible.

He told Retail Express: “It’s better than having to throw them away afterwards or risk a �ine.”

Despite the uncertainty around funding and criticism from retailers, senior government �igures urged shops not to ignore the upcoming ban and remove all their disposable stock

SELECT & SAVE: The symbol group has launched a concept store in Birmingham, focusing on fresh and chilled food. One of the store’s unique features is a butchery counter, which serves customers halal meat. It is branded under the banner ‘Go Fresh Local in Partnership with Select & Save’.

For the full story, go to betterretailing.com and search ‘Select & Save’

“WE grew our product range by 54%, which includes a wide range of products from more than 190 local suppliers. The store is now the area’s newly upgraded destination for locally sourced fresh produce, homemade meals cooked up with local ingredients, an outstanding range of hot and cold food to go, plus everyday essentials and services.”

John Fox, Eurospar Greencastle Street, Northern Ireland

the night before it comes into force.

James Lowman, ACS chief executive, warned it is likely the “majority of councils” will be left to enforce the disposable-vapes ban “with no additional resources”.

He added: “For responsible retailers who are preparing and adapting their businesses to comply with the ban, this raises serious concerns about rogue traders selling cheap disposable vapes after the ban is introduced with no fear of reproach.

“It is crucial that those who �lout the ban face enforcement action and that trading standards teams have the resources they need to be able to deal with the illicit trade in their communities.”

PROPERTY: Award-winning retailers Judith and Roger Smitham have sold their Spar and Post O ce store in Cornwall after 24 years of ownership. The retailers, who still have another site, said the decision would allow them to prepare for retirement. The sale to new owners was facilitated by commercial property agents Manish Jadav and William Trott.

For the full story, go to betterretailing.com and search ‘Smitham’

WAGES: Proposals to increase the minimum wage for 18-to-20year-olds have been put forward by the Low Pay Commission. The body has suggested increasing the current £10 hourly rate to £12.21, equivalent to a £488 weekly rise before pension and National Insurance contributions. This new rate would also mean shops must pay NI contributions on sta working eight hours a week or more, if the proposals are approved.

NEWSPAPERS: Another recharge by The Telegraph has led the Fed to demand fairer recharges for overclaimed vouchers. It is understood this recent recharge by the national publication is for vouchers processed threeto-four months ago. However, independent retailers are only given weeks to dispute claims from publishers that they were credited for unsold copies.

“WE have many local residents living nearby the shop, so we wanted to o er them an extensive chilled and fresh range, as well as an in-store bakery, food to go, barista-style co ee and premium frozen products with the refurbishment. We’ve been a part of this community for a long time and know how important it is for residents to have access to quality, a ordable food close to their homes.”

SHYAMA LAXMAN

PEPSI Max is back with a new take on its Thirsty For More platform, fronted by David Beckham.

The platform promotes the mindset of going after what you love without second-guessing, according to the supplier. The campaign �ilm, starring Beckham, depicts moments that make life more fun, ending with Beckham delivering the message: “If you love it, it’s never a waste.”

The campaign will be supported by series of activa-

tions to amplify the �ilm, which went live as a 30second TV spot in early May A “blue carpet” will be rolled out in unexpected locations across the UK including Cardiff and Liverpool, inviting consumers to “enjoy �lexing their unapologetic style”, while the ‘Thirsty for More Challenge’ will offer passers-by the chance to “seize the moment and do something they really want to enjoy”, says the supplier.

Steven Hind, chief marketing of�icer for beverages, UK&I at Pepsi, said: “Our

SNACKING brand Raise has launched two �lavours for its nut clusters: Raspberry and Coconut & Almond, available at an RRP of £1.79.

Available now to independent retailers, these variants are Raise’s �irst HFSS-compliant products.

Packed with almonds, cashews and pecans, the new Raise Nut Clusters provide protein, �ibre and antioxidants, with less than 5g sugar per pack. They are also gluten-free and vegan.

The brand is donating 1% of every sale to charity Magic Breakfast.

HARD seltzer brand White Claw has launched its �irst tequila-based ready-to-drink (RTD) cocktail: White Claw Tequila Smash.

Available in two �lavours, Strawberry Lime and Mango Passion Fruit, the cocktails have an ABV of 5%. They incorporate 100% Mexican agave Tequila Blanco with real fruit juice, and have only 80 calories per can.

White Claw Tequila Smash RTDs are available through Morrisons and Co-op at £2.50 RRP.

latest campaign empowers people throughout the UK to pursue their passions without any fear of judgement.”

ORGANIC snacking brand

Biona has announced the launch of three chocolatecovered fruit and nut snacks, available to convenience retailers at a £2.29 RRP.

The snacks are available in three variants: almonds, cherries and strawberries. The almonds are ovenroasted and sprinkled with sea salt, whereas the fruit versions contain freeze-dried strawberries or cherries,

preserving their natural �lavour, nutrients and colour. All three products are coated with Fair Trade-certi�ied dark chocolate containing 62% cocoa. The snacks are also free from palm oil.

COCA-COLA Europaci�ic Partners (CCEP) is bringing Schweppes into the readyto-drink (RTD) cocktail space for the �irst time with the launch of Schweppes Mix – a range of pre-mixed cocktails, which is available in two variants.

Gin Twist, which has an ABV of 5.5%, is a crisp and refreshing citrus-forward blend.

Paloma Bliss, with an ABV of 6%, combines grapefruit and tequila. Both lines are available

to convenience retailers in 250ml cans at an RRP of £2.20.

NESTLÉ Confectionery has unveiled its latest Aero �lavoured sharing bar, which has a coconut �lavour. Aero Coconut is now available to retailers across the UK and Ireland at a £1.50 RRP.

‘bubble-less’ pack found by shoppers, as part of its latest promotion.

RED Star Brands has announced the UK relaunch of its Black Raspberry �lavoured sparkling water into Boots stores nationwide from May, with convenience availability to follow.

Available at a £1.50 RRP, it is made with natural fruit �lavours. It contains antioxidants and vitamins D, B6 and B12. It is also HFSS-compliant and has 12 calories.

Black Raspberry is the latest variant to join the Sparkling Ice line-up, including Strawberry Watermelon, Kiwi Strawberry, Orange

The limited-edition Aero Coconut joins the line-up of �lavours released by the brand last year, including Aero Strawberry and Choco-Hazelnut, as well as a Peppermint gifting bar.

Mango, Pink Grapefruit and Cloudy Lemon. The launch will be supported by a marketing campaign entitled ‘Anything but subtle’ across PoS materials and social media.

The new limited-edition bar is also part of the Aero Lost Bubbles campaign, where the brand is offering a £10,000 prize for each

PREMIUM aluminium bottled water brand Re:Water has introduced a new 330ml bottle, for both still and sparkling water.

The 330ml bottle is made using 100% recycled aluminium and is available to convenience retailers through AF Blakemore. It has an RRP of £1.79.

This new bottle joins the original 500ml size, which has an RRP of £2.49-£3.49.

A larger 750ml bottle is also set to join the line-up later this year.

Ben Richardson, co-found-

er of Re:Water, said: “Our research revealed a strong demand for 330ml aluminium bottles over cartons and cans. This new size is ideal for removing plastic while offering a premium sustainable solution at a lowerentry point.”

SHYAMA LAXMAN

CARLSBERG Britvic is expanding its 7Up range with 7Up Pink Lemonade, a zero-sugar variant incorporating �lavours of lemon, lime and raspberry.

The launch capitalises on the growing role of innovation in driving growth in the �lavoured carbonates category, which over the past three years has accounted for 35% of total �lavoured carbonates value growth, said the supplier.

Research also demonstrates that the colour pink cues �lavour, hydration and refreshment, making the

pink liquid and packaging a key factor in driving shopper engagement, the supplier added.

7Up Pink Lemonade will be available to convenience retailers in 330ml cans, 500ml bottles (in plain or price-marked packs), 2l bottles and multipacks of eight 330ml cans.

The launch will be backed by a multimillion-pound campaign launching this summer, including out-of-home, social media, in�luencers and shopper marketing.

Ben Parker, vice-president sales – off trade at Carlsberg Britvic, said: “7Up Pink Lemonade represents a fresh

twist for what is such a popular brand. As one of the largest brands in the fruit�lavoured carbonates retail space, bringing in £77m in retail sales value, it presents an opportunity for consumers and retailers.”

7Up is the number-one lemon-and-lime brand in Britain.

WHITE Claw’s limitededition hard seltzer drink, White Claw Green Apple, will be entering UK stores for a limited time this summer.

Made from natural �lavours, triple distilled spirit and sparkling water, White Claw Green Apple has an ABV of 4.5% and 95 calories per serving. Originally launched in the US, it will be available in the UK through Morrisons and Co-op at

£2.50 RRP, as well as online from May onwards.

Michael Dean, marketing director UK at White Claw, said: “Green Apple has been one of our most talked-about drops in the US, so we’re buzzing to bring that crisp, juicy �lavour to the UK.”

NOMADIC has launched Power Oats, a new range featuring a combination of yoghurt and oats which is rich in protein and vitamin D.

The range is available now in Zingy Raspberry and Vibrant Vanilla varieties, each available in a 150g pot with a £1.50 RRP.

Also containing gutfriendly cultures to boost

consumers’ immune systems, its launch follows on from Nomadic’s launch of its Power Pots last year, marking another addition to its ‘Power Portfolio’ of proteinled products.

FOLLOWING a successful grocery launch, Pringles is launching its Hot Blazin’ Fried Chicken variety in convenience.

It is available to convenience retailers from Bestway, Dhamecha, Parfetts, Sugro and Unitas at an RRP of £2.75. To support the launch, the brand has announced a year-long partnership with Chelsea and England footballer Cole Palmer.

Seanáin McGuigan, Pringles brand manager UK&I, said: “With the rise in popularity of hot and spicy foods in the UK, our new Blazin’ Fried Chicken �lavour taps into this trend to give consumers more variety and choice when it comes to spicy snacks.”

BROTHERS Cider is expanding its range with two new permanent lines: new Pineapple & Passionfruit and the returning Toffee Apple.

Both varieties have a 3.4% ABV and will be available from the “end of spring” in 500ml cans, at £1.50 RRP.

“Pineapple & Passionfruit draws on the brand’s heritage of bringing interesting and innovative �lavour combinations to the category, and adds a refreshingly tropical angle to the range,”

the supplier said. Meanwhile, Toffee Apple has historically been one of the most popular �lavours.

JIMMY’S Iced Coffee is launching a limited-edition Donut variety as it looks to court shoppers looking for “unusual” coffee �lavours.

The new variety is available to convenience retailers at a £1.70 RRP. The launch comes as ready-to-drink coffee has grown from £343m to £367m in the past year, while 74% of Gen Z are on the

lookout for new and unusual coffee �lavours, and 77% of them �ind limited-edition coffee �lavours appealing.

PEPERAMI has expanded its chilled snacking offering with the launch of a range of £1 price-marked Chicken Bites single packs, aiming to tap into the food-to-go market.

Chicken Bites are available in two �lavours: Tikka and Roasted. Each variant comes in 45g packs and contains 95kcal. The launch comes as the chicken snack market continues its growth trajectory, increasing by 21% over the past two years, now worth more than £165m.

Shaun Whelan, Jack Link’s convenience/wholesale and OOH controller, said: “As the UK’s numberone chilled meat brand, we are offering retailers a strong opportunity to drive incremental sales and margins.”

COCA-COLA Europaci�ic Partners (CCEP) is adding a Guava variety to its Relentless energy drink range, tapping into the �lavour’s popularity with Gen Z.

Available now, the new variety comes in a £1 pricemarked 500ml can, as well as a plain version.

Relentless is the numberone energy drinks brand in Britain, worth £37.6m.

Get ‘Relentless’ly refreshed with new Guava drink

The supplier will support the launch with in�luencer and ambassador partnerships, sampling, and appearances at music and cultural events.

PoS will be available from my.ccep.com.

SHYAMA LAXMAN

KP Snacks is marking its �ive-year partnership with The Hundred –the fast-paced 100-ball cricket competition –by launching its biggest Hundred-themed onpack promotion.

It offers consumers a chance to win £20,000, in addition to daily cash and cricket-themed prizes, such as New Balance x Everyone In cricket bats, ball and stump sets.

The promotion will run until 17 August, across brands that feature on the Hundred teams’ shirts, including Popchips, Butterkist, PomBear, Tyrrells, KP Nuts, Hula

Hoops, McCoy’s and Skips.

The supplier said it will also further the Everyone In initiative by building 100 community cricket pitches, mainly in densely populated and underprivileged areas, by the end of 2025.

Kevin McNair, marketing director at KP Snacks, said:

“As we celebrate our �ifth year of partnering with The Hundred, we’re more excited than ever to launch an onpack promotion featuring our biggest prize yet, along with a fun and engaging mechanic that’s sure to intrigue customers.

“Encouraging healthier lifestyles and supporting community well-being remain core priorities for us. We’re

NO Saint, a new vape brand that claims to be more environmentally friendly than most big brands, has launched in selected convenience stores, across London and south-east England.

The supplier says its pod device (RRP £19.99) can last up to two years and is made without many of the hazardous materials found in other vapes.

Its 18 pod varieties (RRP £11.99 for 2x2ml) include Jasmine Tea, Iced Matcha Latte, Lychee

Nectar, Pineapple Nectar and Limoncello.

The device also uses near�ield communication (NFC) technology to deter underage use.

and enjoyable for everyone.”

READY-TO-DRINK (RTD) protein brand U�it has unveiled a rebrand of its core shake range.

The refreshed bottles aim to spotlight the brand’s accessible positioning and premium taste credentials.

The design update will appear in multiples this month before rolling out across wholesale and convenience listings later this year.

Supplier Lacka Foods is supporting the rebrand with a £150,000 investment into an advertising campaign.

vibrant and re�lects our quality and taste credentials while staying true to our accessible positioning.”

Angie Turner, head of marketing at Lacka Foods, said: “The new look is clean,

WKD has launched a summer ready-to-drink (RTD) variant, WKD Cherry Ice, inspired by the growth of cherry �lavours across several drinks categories.

It is available now in 70cl bottles (standard RRP £3.38 and £3.29 price-marked packs) and in 330ml cans, which will also feature in the brand’s popular mixed 10-pack format.

The new variety is designed to resonate with WKD’s core 18-to-24-yearold target audience, said its supplier.

GRACE Foods UK, supplier of Caribbean food and drink, is celebrating the 50th birthday of its Encona hotsauce brand with the launch of branded limited-edition bottles, now available to convenience stores.

As part of the anniversary celebrations, the supplier has shopper activations in place in supermarkets and independent convenience stores across the UK.

Encona will also partner with Time Out London for Hot Sauce Summer at Between the Bridges – a seasonal food and entertainment pop-up venue on the South Bank, featuring

an outdoor beer garden, street food, live music and DJ nights.

GRENADE has relaunched its range of high-protein, low-sugar shakes, available to convenience retailers now, at £2.75 RRP.

KELLOGG’S has added to its cereal line-up with the launch of High Protein Bites, available to convenience retailers from July, at a £3.50 RRP.

High Protein Bites – available in Choco Hazelnut �lavour – are high in �ibre, non-HFSS and contain 21% plant-based protein.

The launch is in keeping with the growing trend of protein-rich breakfast, with more cereal products declaring the bene�its of protein on pack increasing by 23% in the past year.

The new non-HFSS range is available in �lavours including Chocolate Fudge Brownie, Chocolate Salted Caramel, Cookies & Cream, Strawberries & Cream and White Chocolate.

Each 330ml bottle contains over 25g of protein, is low in fat and sugar, made from natural �lavours and colours, and is suitable for vegetarians.

The packaging can be recycled at home, including the cap and sleeve. Retailers can also avail a range of PoS, including fridge and �loor

Fiona & Vince Malone from Tenby Stores: “We’re delighted to be able to expand our home delivery service to include more vulnerable members of our community.”

16 winning National Lottery stores, voted for by the public for their outstanding local community support, each won £5,000! Here are some examples of how the winners plan to spend their prize...

Sheraz Awan from Westerhope Convenience Store: “We’re planning to expand our community shop and the free food offered for those in need of our support.”

SHYAMA LAXMAN

PLADIS is celebrating 100 years of McVitie’s Chocolate Digestives with one of its biggest campaigns for the brand to date.

The campaign, entitled ‘100 Years of the Nation’s Greatest Invention’, will place the biscuits alongside ground-breaking innovations such as the wheel, mobile phones and sliced bread.

By juxtaposing the grand with the everyday, the campaign aims to suggest that McVitie’s Chocolate Digestives “might possibly be the nation’s greatest invention”.

As part of the centenary celebrations, McVitie’s is offering an on-pack competi-

tion, where £100 will be up for grabs every 100 minutes.

To participate, shoppers need to purchase a pack from the McVitie’s Chocolate Digestives range and scan the on-pack QR code. The promotion is live until 22 June.

Meanwhile, packs in wholesale will offer retailers the chance to win cash every 100 minutes.

Retailers will also be supported with PoS, free-standing display units and shelf wobblers to catch shoppers’ attention.

WARBURTONS has joined forces with Academy Awardwinning actress Olivia Colman in its latest advertising campaign, ‘The Inspection’.

The two-minute ad shows Colman representing the �ictional Department of National Treasures (D.O.N.T), storming into Warburtons HQ, placing the bakery under her jurisdiction.

KIDS’ yoghurt brand Petits Filous has unveiled a new campaign called ‘Mischief Makes Us’.

The advert highlights the nation’s crumpet obsession, with 71% of crumpet-eating Brits considering it a cornerstone of British culture, and 41% agreeing crumpets deserve National Treasure status, said the supplier. The campaign is now live on social media.

CHOCOMEL is relaunching its ‘Sharing Not Required’ campaign this year with a £3m investment.

This will bring Chocomel’s total investment in the category to £18m since 2023 when it �irst launched.

It will run until September across video-on-demand, as well as in cinemas and out-of-home channels.

The campaign is projected to reach 75% of UK adults an average of four times.

Live until November, the campaign features children caught in the act of mischief.

With more than a £2m investment from parent brand Yoplait, the supplier says the new campaign seeks to “drive maximum engagement and awareness with parents, recruit new shoppers and reinforce the bene�its of forti�ied kids’ yoghurts”.

Earlier this year, the brand introduced its reformulated recipes, with less sugar, ensuring its yoghurts are healthier, while appealing to children.

MARS Wrigley has unveiled its new ‘Off Your Game’ football campaign for Snickers, fronted by José Mourinho, double Ballon d’Or Feminin winner Aitana Bonmatí, and England and Arsenal star Bukayo Saka.

C&C GROUP has announced a multimillion-pound investment into its Magners cider brand, led by a new campaign titled ‘Magnertism’.

The campaign will run throughout the summer across TV, digital, outdoor advertising and social media.

It coincides with the usual time of year that cider sales start to pick up, with volume

With a new tagline ‘Too tasty to share’, the campaign taps into the growing trend of treat culture and self-indulgence, said the supplier.

The campaign will also see in-depot and in-store PoS, boosting shopper engagement and retailer penetration, the supplier added.

PoS, as well as in�luencer activations. Participating lines include Snickers, Mars, Twix and Bounty. Prizes include once-in-alifetime football experiences, JD Sports vouchers worth £100 and £1 coupons to purchase chocolate.

The new campaign runs until 30 June and is backed by £1.5m media investment, spanning social media and OOH advertising, in-store

growing in April compared to March by double-digit percentage points in each of the past three years.

This volume growth is set to build steadily until September, according to Circana �igures.

CADBURY has announced an opportunity for 10 retailers to receive exclusive social

media promotional kit for an upcoming Cadbury Dairy Milk launch.

CADBURY has launched the Community Game Changers competition for �ive retailers to win up to £1,000. Ten stores will be awarded £500 and 15 runners-up will take home a Cadbury hamper.

To enter, retailers need to

The kits contain props, PoS materials and stock to help create content to drive shopper interest. Ten winners will be tasked with creating social media content using the assets provided. The two best pieces of social media content will be awarded £500 each.

Retailers who wish to take part should complete the entry form available on snackdisplay.co.uk by 31 May.

share 300 words on Mondelez’ International’s trade site, snackdisplay.co.uk, describing how they have been Community Game Changers by 1 September.

WITH disposable vapes banned from 1 June 2025, thousands of retailers are turning to Haz Tech for fast, legal and cost-e ective disposal. Its all-in-one service includes UNrated vape bins, multiple sizes of secure point-of-sale tubes, national swap-out collections and UK-based recycling – with traceable, end-toend documentation that proves full legal compliance.

Every kit is ready to deploy, with scalable options for any retail setup – whether you need to clear 50 vapes or 5,000. Its service continues beyond the ban, supporting safe disposal for rechargeable and re llable vape products. Stay legal. Act responsibly. Recycle with con dence – now and a er 1 June.

Disposable vapes are banned from 1 June, but vape recycling doesn’t stop there. HAZ TECH ethical, safe, compliant and cost-e ective vape recycling now and beyond the ban

James R, Premier retailer, Birmingham

“WE had 600 vapes le on the shelf, and Haz Tech collected them in 24 hours. It gave us great peace of mind knowing everything was handled legally and safely.

“The process was smooth, space was freed up and our customers appreciated the clear green message.

“Sta were on board, the bins looked professional and it was zero hassle from start to nish. Highly recommended.”

jack matthews

bradley’s supermarkets, Leicestershire This switched on retailer attracts more customers with Monster flavours. Do you? To hear more just visit salessupercharged.co.uk by scanning the QR code now.

RETAILER OPINION ON THIS FORTNIGHT’S HOT

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

The compliant devices look similar to disposables

HOME DELIVERY: How vital is the service to your business?

IT’S a steep learning curve, but it’s about educating potential customers. Overall, home delivery is a service we can’t

“OUR home delivery service is nearly set up and we’ve decided to work with Booker for their Scoot service. When we were conducting our refit, home delivery was a service we wanted. Booker has already teamed up with a number of fellow Premier retailers”

HS2: How have the major works affected your store?

“ WE’RE averaging around £7,000-£8,000 less a week.

Running two businesses, we’ve been quite adversely affected, and not only by the road closure. Customers haven’t got a huge amount of time, so they’re heading straight for where they need to be, rather than making pit stops.”

Avtar Sidhu, St John’s Budgens, Kenilworth

“IT’S had an impact – not just on sales, but also the way I’ve been running the store. Staff have not been able to get to work and my own journey time to the store and cash and carry has tripled. We were given no warning of the closure. The only way I found out was customers talking about disruption.”

retailer

It’s had an impact on sales and on how I run the store

VAPES: Are you confused by illegal and compliant devices?

“DISPOSABLE vapes are going to be banned in less than two weeks. However, a lot of the refillable and rechargeable vapes look exactly the same as their disposable counterparts. If you put a disposable vape next to a rechargeable, it is honestly really difficult to tell the difference.”

Kaual Patel, Nisa Torridon, London

“ SOME of the prices on rechargeables compared to soon-to-be-illegal disposables aren’t that different in most cases. They look very similar and I think it will be very difficult for the public and trading standards when they come to do inspections to tell the difference.”

Shahid Ali, Morrisons Daily Mintlaw, Aberdeenshire

We

Goran

Julie Duhra, Jule’s Convenience Store, Telford

The busier the customer is, the lazier they are

can’t do without home delivery now

SALES: Which interesting services are generating you money?

“WE work with a company called KeyNest to provide a collection service for Airbnb keys. It’s £2 commission per pick up. All you need is a safe box and that’s provided by KeyNest. Sometimes people will come back and shop with us when they collect their keys as well.”

Rohit Kapoor, Shambles Off Licence, York

“WE accept dry cleaning from customers throughout the week and we get £20 a week in commission from the dry cleaners we work with. When it comes to premium things like dry cleaning, people just want the convenience. The busier the customer is, the lazier they are.”

Shelley Goel, One Stop Gospel Lane, Birmingham

TAMARA BIRCH explores the tobacco category, key customer trends and the future of the category

TOBACCO is an important category, but for many retailers, low margins of 5-10% mean other categories have to work harder to boost overall store pro ts.

Boosting your margin, especially within tobacco, roll-your-own (RYO) and cigarettes, is about buying smarter and more strategically. This is the advice of Kay Patel, owner of Global Food & Wine and Best-one in east London.

He says: “You have to shop around. If you can’t sell more,

you need to buy better. While it’s not needed as much with tobacco as it is with vapes, you need to make sure you have the availability in store. This also means the same for manufacturers, ensuring the products are available in wholesalers for us.”

Retailers have noticed the category decline recently and say another challenge is gauging what shoppers want to buy. Faraz Iqbal, of Premier Linktown Local in Fife, says his range depends on the age

of his customers.

Iqbal says: “Our older customers can still be brand loyal, but many of our younger adult smokers, they’re de nitely geared towards more of our value RYO and cigarettes.”

If you’ve yet to do it, review your category and be strict about what is actually selling using your sales data. It might be that some lines aren’t selling as well as you thought and need to be reviewed or discontinued.

Prianka Jhingan, head of marketing, Scandinavian Tobacco Group UK

“TOBACCO remains one of the most important categories for an independent retailer to get right, not only for the revenue it brings into their tills, but as a driver of footfall and repeat business from regular customers and the associated basket spend, which goes with that.

“While traditional tobacco sales have been in decline for some time now, what’s le is still huge and, of course, many consumers have been transitioning over to next-gen products, such as vapes or nicotine pouches, which are becoming an increasingly important part of the mix.”

UK'S Nº1* PAPER BRAND

*EPOS Data (May, 2024)

WHAT RYO and cigarettes you should stock will depend on your customer base, but Patel says to stock as wide a range as possible.

“We pride ourselves on stocking all tobacco lines because if our competitors don’t stock them, they’ll come to us, so it’s a good sales strategy for now,” he says.

Iqbal recommends the same and says, over time, he has removed slower sellers. “Our

range has declined and it’s becoming re ned, but it’s still a footfall driver and we don’t want to lose customers that come in regularly.”

If you’re looking to do the same as Iqbal, it might be worth focusing on value, as Andrew Malm, UK market manager for Imperial Brands, says this will be a long-term trend.

“Smokers are shopping around to nd a product they enjoy smoking without it hit-

ting them too hard in the pocket,” he says. “With products in the lowest-pricing tiers now worth 72% of all cigarette sales in the UK, it’s clear sales in the category are driven by demand for value.”

Within RYO, Malm says 30g packs are now the most-popular format and recommends including these formats across a wide range of brands, from Embassy Signature to JPS Players and Riverstone.

It’s also important not to forget RYO accessories, as this can help boost overall spend.

“Accessories are great to help increase overall margin, with our average pushing 3040%, but the price di erence for cash margin is lower than this,” Iqbal explains.

Products such as rolling papers, like Rizla or OCB, as well as lters, matches and lighters, are all must-haves to boost that smoker’s basket spend.

Tobacco and Vapes Bill passes through the Commons

The latest reading of the Bill passed with a vote of 366 to 41 and there was support for measures including a proposed retailer licensing scheme. The upcoming display ban was criticised by retailers and industry bodies for potentially harming e orts to quit smoking.

A generational ban has been proposed

The law will make it illegal for anyone born on or after 1 January 2009 to purchase tobacco products. If approved, the ban will increase the legal age for buying such products by one year, every year, starting from 2027.

Possible display bans could cause signi cant upheaval

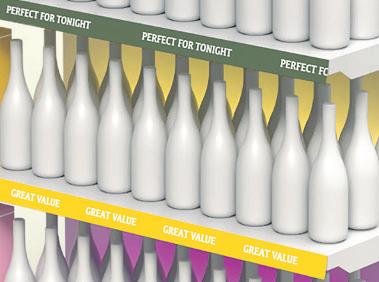

The exact limits on where shops can display nicotine products under the Bill are yet to be con rmed. Labour’s then-health minister, Andrew Gwynne, backed the removal of “brightly coloured” vaping products “from the shop floor, countertops and shop windows” earlier this year. Gantry manufacturer Navarra Retail Systems told Retail Express this would relegate vapes to behind the counter, meaning the choices stores have already made or are making now over gantries could leave them “trapped” in the future.

VEKARIA also o ers US candies such as Nerds and Sour Patch Kids, which have a dedicated xture in his store. He says these are not permanent lines and function as “treats” rather than everyday staples.

This is mainly due to the price, as they can be up to £4 a bag. As children are the main drivers of his sugar confectionery sales, he must cater to the limited pocket money that kids

have, by ensuring the bulk of his range is within the £1 mark.

With his US confectionery, Vekaria likes to mix up the range semi-regularly to keep things fresh

“I don’t like having the full range in all the time,” says Vekaria.

“If something goes and it was a fast seller, I’ll replace it. If it just ticks over, I’ll get

something new in. When customers come in, they’ll see a new item and hopefully pick that up.”

Kaual Patel, of Nisa Torridon Convenience Store in Hither Green, south London, feels US sweets have had their day, but he says they can still help to increase basket spend due to their high prices.

However, retailers must ensure the lines they stock don’t

contain ingredients that do not meet UK’s food safety standards, as Trading Standards could seize the stock and ne retailers who are in breach.

“You have got to stay on top of your suppliers,” says Patel. Packaging must bear the manufacturer’s import details as well as health warnings.

“These are key things which a lot of retailers are missing,” he adds.

Bebeto launches Forest Fruits lled sweets

Bebeto has added a new Forest Fruits variety to its bagged sweets range. Forest Fruits consists of centre- lled gummy treats inspired by the flavours of cherries, strawberries and raspberries. They are free from arti cial colours and flavours, halalcerti ed, and available in a 10x130g hanging-bag format from Parfetts, Bestway and Dhamecha. They have a £1 RRP.

Haribo’s limited-edition lines

Haribo has added two limited-edition varieties to its confectionery range: Haribo Groovy Goats and Haribo Harry Potter. The £1.25 price-marked bags are available from wholesalers including Nisa in cases of 12, giving 30% pro t on return. The Haribo Harry Potter bag comprises fruit and colaflavoured gums, and sweet foam gums, in shapes based on the bestselling wizard franchise. Haribo Groovy Goats comprise goat-shaped gums in a mix of flavours.

Bonds Sharing Bags

World of Sweets marked the 130th anniversary of the brand Bonds of London with the launch of a sharing bag, comprising top-selling flavours including lemon sherbets, pear drops, butter mintoes and rhubarb & custard. Retailers can purchase the bags in either price-marked or non-price marked packs, with an RRP of £1.25.

Feeling Berry Good with Mentos

Perfetti Van Melle is expanding its Mentos sharing bag range with the launch of the Feeling Berry Good variety. The new bag is vegan-friendly and comprises three flavours: cherry, blueberry and raspberry. It will be available to independent retailers later this year at an RRP of £1.50.

Gumi Yum Surprise

Gumi Yum Surprise is a new product from World of Sweets set to launch this year. It includes eightfruit-flavoured gummy candy strips that feature a toy inside. The sugar dusted candy is layered in eight flavours – cherry, strawberry, orange, pineapple, lemon, green apple, blue raspberry and grape. Inside the egg are collectible toys including wildlife characters and Transformers characters.

KATARIA positions hanging bags of sugar confectionery at her store’s entrance. She nds that hanging bags pricemarked at £1 do well, especially among families with children as they also have more quantity as opposed to a bar of chocolate.

Retailers should also display their range at the counter and on the till to drive impulse sales. O ering PMPs can give customers a sense of a value, especially as shoppers battle the ongoing cost-of-living cri-

sis, boosting impulse sales. Mancini also suggests placing larger share bags in secondary locations, to create a “valueled range for all occasions”.

Vekaria feels sugar confectionery is a category that people don’t necessarily buy multiple units or multipacks of unless they are on a speci c mission for it. He says the best way to encourage shoppers to add sugar confectionery to their baskets is to have them on promotion.

“Cross-merchandising with

seasonal or event-led displays – such as football tournaments, back to school or Halloween – adds relevance and boosts basket spend,” says Mancini. “Promotions should be regular, but not overcomplicated; consistent multi-buys like ‘two for £2’ or ‘three for £1.50’ work well.”

Lastly, Mancini says using social media or loyalty schemes to spotlight launches can drive tra c and repeat sales, especially with younger consumers. with

ANNE BRUCE nds out how retailers can make the most of summer with the right alcohol ranges and promotions

WHEN the sun comes out, demand for alcoholic drinks goes up, as customers head out to enjoy barbecues and social gatherings.

In summer, around 20% of overall shop sales are of alcoholic drinks, according to Bipin Chawla, who owns the Late Stop 24 shop in Bangor, Gwynedd, up from around 17% in winter, with customers also shopping later as they enjoy the long summer nights.

Types of alcoholic drinks in demand also vary seasonally, he says. Chawla’s best

summer sellers are ready-todrink (RTD) lines, ciders and white wine.

Fiona Malone, of Tenby Stores & Post O ce, in Pembrokeshire, brings out her summer drinks range after Easter. She agrees with Chawla that RTDs tend to be the big sellers for her female customers, while men tend to favour ciders, often in multipack format.

Booker retail managing director Colm Johnson comments: “We see a clear shift in consumer preferences to-

wards lighter, more refreshing options – fruit ciders, white wines, ready-to-drink cocktails and chilled bottled lagers. Multipacks also gain popularity, o ering both convenience and value for group occasions.”

Consumers generally reach for easy-drinking, refreshing beers, says Caitlin Brown, otrade category development executive at BrewDog. “Session lagers and low-calorie options are perfect for long outdoor events or casual gatherings,” she adds.

Source: NIQ Data MAT to 05.10.24

CONTINUES TO TACKLE PLASTIC POLLUTION IN PARTNERSHIP WITH PLASTIC BANK.

RETAILERS and suppliers agree that the availability of chilled options is key to driving impulse sales in summer.

According to BrewDog’s Caitlin Brown, 30-to-45-year-olds have stated that seeing a drink

chilled in the store versus ambient is the primary driver of purchase. Indeed, Malone’s top tip for boosting summer alcohol sales is to “keep it all nice and cold”.

Retailers who have the fridge

space should be looking to get as much of their summer alcohol into them, with Booker’s Johnson recommending larger packs and slabs be refrigerated where possible as well.

Retailers should also look

to increase facings on key summer lines and ensure strong stock levels, particularly ahead of good weather spells or key events. Availability is everything when the sun shines.

Colm Johnson, retail managing director, Booker

“CREATING standout in-store experiences is key to driving alcohol sales – especially during the summer months when shoppers are on the lookout for seasonal inspiration.

“Retailers can maximise impact by dual merchandising alcohol with barbecue essentials, snacks and summer favourites to encourage bigger baskets.

“Eye-catching displays and well-dressed chillers also play a big role in attracting attention.

“Themed displays tied to events like Father’s Day, sporting xtures or festivals help tap into the moment and give customers an extra reason to pick up a drink or two.

“Retailers should also look to increase facings on key summer lines and ensure strong stock levels, particularly ahead of good weather spells or key events. Additionally, creating in-store o ers, like exclusive bundles or promotions, will help retailers stand out from the competition and give shoppers an extra reason to make a purchase.”

CHAWLA says customers buying alcoholic drinks for summer events will seek out promotions, so he makes sure that his range features as many promoted lines as possible to drive sales.

Customers will often buy in bulk, drawn to promotional offers such as ‘three for £6’ on

RTDs or 10-pack deals on ciders, Malone reports. She puts up any wobblers or PoS available from suppliers to highlight the shop’s summer o ers.

With the climate in the UK often unpredictable, retailers should also react quickly to make the most of shortterm weather forecasts, set-

ting up temporary lager and craft beer xtures to maximise sales during sunny spells, suggests Brown.

“O ering discounts and limited-time o ers creates a sense of urgency for shoppers looking to stock up on their favourite drinks,” advises Mash Gang’s Michael Baggs.

CHARLES WHITTING talks to retailers about what they’ve changed about their store’s overall layout

We have fridges that are constantly changing according to the seasons. What layout changes have retailers made? – Jeet Bansi, Londis Meon Vale, Stratford-upon-Avon, Warwickshire

Vas Vekaria, Kegs N Blades, Bolton, Greater Manchester

Lewis Woodward, Nisa Colley Gate, Halesowen, West Midlands

“I HAD a full re�it because I couldn’t get enough of my kegs on shelves. Now I have a section which is a 4x5m beer cave just for the kegs. I can �it 300-400 kegs now. Previously, we had 100 on display and had to �ill it up every day.

“When it comes to store layout, a clean and tidy shop is the key. I always get comments on how clean and tidy we are. We do a full clean of the shop every two-to-three months where we get everything exactly the way it should be. It’s less about layout, but make sure your drinks are cold, especially in summer. Drum it into staff because people will go elsewhere.

“We had planograms when we were with Premier, but we parted ways with them a few years ago and we know what works. The staff might say that something would work better and we’ll try it out somewhere in the store. If it doesn’t work, you can always put it on the counter and get rid of it.”

the next issue,

3

Vidur Pandya, Kislingbury Mini Market & Post O ce, Northamptonshire

“WE recently had a re�it and opened up the front aisle by a metre. We’d had our drinks machines there and customers would get stuck and cause a pinch point.

“Now, we’ve got a nice open front to the shop and it’s given us space to add four new promotional bays.

“We’ve moved the food-and-drink-to-go machines further into the store and have a dedicated on-the-go section. We originally allocated three bays to US confectionery, but sales are dropping off, so we moved impulse crisps into that section. Now, there’s a big run of impulse crisps, snacks, confectionery and all our milkshake, Rollover and smoothie machines.

“We’ve also created a dedicated barbecue section, with featured displays above the big Wall’s freezer. We’re looking to introduce a protein and health supplement section to the front of the shop as well.”

“OUR re�it is still in its �inal touches because we’ve done it in phases. The main aim was to make the store more accessible. We wanted less clutter, fewer things in people’s way.

“It’s reduced the amount of impulse products we’ve got on display, but it’s more accessible and there’s more breathing space in every aisle. It’s made it more warm and welcoming. We looked at our EPoS data to work out which lines to discontinue to make room.

“We moved the fresh and local produce like bread and cakes to the front of the store to create that fresh and visually appealing environment. We highlight with PoS that we’re offering the ‘best of local’, bringing that local buying spirit which is one of our unique selling points. We’ve moved the groceries that were at the front of the store to the back and we’ve put greetings cards back with the post of�ice, which has worked well.”