Alex Yau, editor

OVER the most recent bank holiday weekend, I had the pleasure of visiting Edinburgh with my wife for the marathon. I should clarify it was my partner who ran 26.2 miles through the historic city and its outskirts – my longdistance running days are well behind me.

Like many other major events, marathons really bring the local community together. Unsurprisingly, small shops like yours are always among the local businesses to get involved.

It was no di erent for the Edinburgh Marathon, which nished in Musselburgh, a small coastal town on the outskirts of Scotland’s capital.

Situated around the corner from the nish line was Pinkie Farm Convenience Store, a very impressive Spar run by leading retailer Dan Brown.

The store’s sta had worked tirelessly on ensuring its shelves were lled with fresh sandwiches, pasta pots, co ee and breakfasts for runners and spectators. With more than 35,000 runners participating in the marathon, the store had a captive audience throughout the day.

Comments made by people in the store and on social media showed how well the shop had engaged with the event.

CHARLES WHITTING

SOFT drinks giant Carlsberg Britvic has pledged to ensure independent retailers aren’t left out ahead of the introduction of the Deposit Return Scheme (DRS) in October 2027.

Speaking to Retail Express at its annual Soft Drinks Review last month, the �irm’s director of commercial sus-

tainability, Tom Fiennes, said it was working closely with suppliers, trade bodies, retailers and the DRS scheme administrator.

He added: “We’re trying to cover all the different areas that include smaller independents as well. We are very conscious that you’ve got big and small players who have been involved in the conversation, and we don’t want

to be seen as making decisions that are going to impact smaller players.

“The scheme administrator was appointed last month and they’ll be making sure they are listening to everyone that needs to be involved. Retailers will absolutely be consulted, brought into the

There doesn’t need to be a major marathon for you to engage with your community in a similar way. Is a nearby school holding a sports day you can donate goods to? If your store is based on the route to a music concert, perhaps you can hold an in-store event relating to the artist for those passing by?

Editor Alex Yau

alex.yau@ newtrade.co.uk 020 7689 3358

News editor Ciarán Donnelly ciaran.donnelly@ newtrade.co.uk 07743 936703

News reporter

Kwame Boakye kwame.boakye@ newtrade.co.uk

Production manager

Chris Gardner 020 7689 3368

Senior production & content editor

Ryan Cooper 020 7689 3354

Senior designer Jody Cooke 020 7689 3380

Designer Lauren Jackson

Editor – news Jack Courtez jack.courtez@ newtrade.co.uk 020 7689 3371

Features editor Charles Whitting charles.whitting@ newtrade.co.uk 020 7689 3350

Features and advertorial writer Shyama Laxman shyama.laxman@ newtrade.co.uk

Head of marketing

Kate Daw 020 7689 3363

Head of commercial Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Account director Lindsay Hudson 07749 416 544

Account manager Lisa Martin 07951 461 146

Specialist reporter Dia Stronach

dia.stronach@ newtrade.co.uk 020 7689 3375

Editor in chief Louise Banham louise.banham@ newtrade.co.uk

Features writer Jasper Hart jasper.hart@ newtrade.co.uk 020 7689 3384

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital Luthfa Begum 07909 254 949

conversation and, most importantly, they will very much be considered in the process.

“You can’t leave people behind in this process and that’s why I talk about collaboration so much. Retailers, wholesalers, ministers and trade bodies have all come together to have these conversations.”

INPOST’S £106m acquisition of Yodel faces a legal hurdle, after a High Court injunction by Shift and Corja Holdings.

The company claims to hold warrants entitling it to 66% of Yodel’s share capital, a controlling stake in the business. Shift’s CEO, Jacob Corlett, said: “While deeply frustrating that InPost announced an acquisition without clear ownership agreed, I’m pleased interim court protections are now in place.”

The company is to introduce a “handling fee” next month, with the rate still to be decided.

Dhamecha operations director Garry Jarvis said the fee will be implemented due to rising costs, but con�irmed it will not be introduced on personal cards. He also recommended paying using the Dhamecha app to avoid fees. For the full story, go to betterretailing.com and search ‘InPost’

the full story, go to

FRAUDSTERS who say they can help retailers claim corporation tax relief have been targeting small shops, HMRC has warned.

The government body warned retailers to be cautious of agents who promise stores savings on research and development relief. Many of these applications are found to be ineligible, meaning retailers will have to pay back the full relief with interest, and also face potential �ines.

search ‘HMRC’

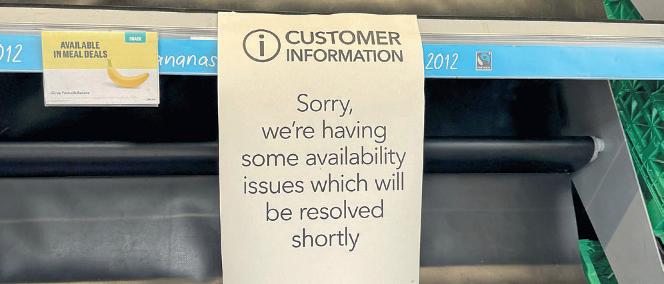

INDEPENDENT retailers supplied by Nisa have been unable to escape availability issues linked to a cyber-attack that devastated stock levels for the multiple. One multi-site operator claimed they had begun seeing gaps in chilled during recent deliveries, while a Costcutter retailer added they had also experienced similar issues, stating: “I don’t know when the gaps will be �illed. It’ll have a knock-on effect as it can’t be �ixed overnight.” For the

SUBPOSTMASTERS have warned the National Federation of SubPostmasters (NFSP) may struggle to secure funding after its current agreement with Post Of�ice (PO) ends in March 2030.

The warning came as the NFSP held its annual conference last month, where the focus was on the trade body’s future. During the event, a �ive-year plan was unveiled, outlining plans to enhance member bene�its, strengthen public affairs and advocacy, support community development and reform its regional structure.

The plan re�lects direct input from members and is built around �ive priorities identi�ied through research conducted by the NFSP last year.

In his keynote presentation, NFSP chief executive Calum Greenhow said the strategy was designed to place postmasters at the centre of the organisation’s future plans, with progress to be driven by collaboration, practical action and a supportive culture across the network.

However, despite the pledge, Vince Malone, of Tenby Stores & Post Of�ice in Pembrokeshire, raised concerns about the NFSP’s long-term �inancial sustainability.

“It’s �ive years away, so it’s good that it’s talk-

ing about it now,” he told Retail Express. “But to �ill the funding gap once the current agreement expires is going to be dif�icult. We need the correct structure in place with people who have the right capability.

“The NFSP doesn’t have a history of generating income – it’s been given an income for so long. That’s my biggest concern.”

Malone also pointed to fairer payment for subpostmasters. He added: “The elephant in the room is always about pay. It’s got to make sure postmasters are paid a fair wage for the job they do.”

Vidur Pandya, of Kislingbury Mini Market & Post Of�ice in Northamptonshire, echoed Malone’s concerns, but expressed hope that the NFSP’s efforts and new banking deal would improve pay.

He said: “Costs are going up, but not the pay packet. The biggest takeaway is that it’s looking into it. The banking framework has been there for �ive years now, which would provide better remuneration.

“If a card is declined by the bank, we don’t get paid because the transaction hasn’t gone through. One of the changes will be that, whether the transaction fails or passes, there will still be some form of remuneration.”

At the conference, Greenhow reassured members that the body intends to be-

come more self-suf�icient, with changes to remuneration in the pipeline.

He said: “PO obviously has a plan to increase remuneration to postmasters by £250m by 2030 – including £120m by March 2026. It’s about cutting costs centrally and franchising out its directly managed branches, which will save tens of millions of pounds per year. It plans to divert that into postmaster remuneration.

BOBBY’S: The confectionery wholesaler is targeting national expansion for its Apex merchandising service. Reps will go into stores and remerchandise a retailer’s confectionery range, including products from Bobby’s and rival suppliers. The rm’s national Apex service manager, Paul Kitt, said the service has led to increased sales for retailers.

For the full story, go to betterretailing.com and search ‘Bobby’s’

DELICE DE FRANCE: A new food-to-go range consisting of chilled sandwiches, salads and paninis has been launched by the supplier. The new line-up is made up of 16 core lines, including eight sandwiches. The company also unveiled new sweet pastries that can be thawed in store.

“SOME customers always stick with speci c brands and that’s where we nd it di cult when we are running price promotions on cigarettes, because we are trying to o er an alternative brand to what a customer wants. Although there will be certain brands that may be cheaper, nine times out of 10 a customer will not buy it.”

Danial Nadeem, Spar Motherwell Road, Bellshill, North Lanarkshire

Greenhow added that the NFSP will also work with commercial partners to offer exclusive products and services across the PO network, generating revenue to cover costs and share pro�its.

However, he acknowledged members’ concerns over the pace of change.

“There was a lot about [pay off] tomorrow,” he said. “But what became clear from the delegates was that there are colleagues in the network who need help and support

“By 2030, the aim is to increase revenue signi�icantly. Combined with reducing central costs, this will result in better remuneration for postmasters.”

now. [Pay off] tomorrow could be too late.”

Commenting after the event, a PO spokesperson said: “Postmasters and strategic partners offer essential services in their communities and they must be paid fairly. Our transformation plan will deliver a sustainable business with better-supported postmasters and partners, products and services.

“This year is about building strong foundations to deliver change that bene�its our postmasters, partners, customers and shareholders.”

BOOKER: Rat droppings discovered during an inspection led to Booker’s Broad Oak Road branch in Kent being given a two-outof- ve food hygiene rating. A Booker spokesperson said maintaining safety and cleanliness was a “top priority”, with the rm working closely with the local authority for improvements.

For the full story, go to betterretailing.com and search ‘Booker’

HFSS: Retailers should still prepare for upcoming promotional restrictions on high fat, salt and sugar products, despite delays on a separate advertising ban. The ACS said: “The rules will mean that regardless of store size, retailers with 50 or more employees will have to stop multibuy and volume promotions for HFSS products.”

For the full story, go to betterretailing.com and search ‘HFSS’

“ALTHOUGH the average margin on cigarettes is minimal, a small margin is still a margin. Unless retailers can nd a viable product to replace cigarettes with, it is worth continuing to stock them. I recommend preparing for the downfall. Get your replacements in early. Those products may sit on the shelf for a while, but your regular customers will start to know that you have them.”

Michael Burnell, The Vapourist, Chester eld

“CIGARETTES and tobacco are not very pro table. The margins range between 5% and 10%. Any line that doesn’t sell is discontinued. I don’t think cigarettes will ever be pro table. Margins are very small, taxes are high and they’re expensive. A retailer’s best bet is to maintain strong working relationships with suppliers to keep prices low, and attract and retain customers.”

Buckinghamshire

CIARAN DONNELLY

SHOPS are now banned from selling disposable vapes, with retailers facing potential £200 fines and stock seizures if found to be selling the devices.

Shops are being urged to check for the ‘three Rs’ of compliance – refillable, rechargeable and replaceable.

This means devices must be refillable using either e-

liquid or pods, rechargeable by means of a charging port on the device and replaceable through a coil that can be replaced.

British American Tobacco head of corporate and regulatory affairs Sam Millicheap told retailers last month that the replaceable coil requirement poses the biggest risk of tripping shop owners up

A coil is replaceable when it is built into a replaceable pod

or can be separately replaced on the device itself, he warned Retailers’ last-minute preparations were hampered by false information provided by trading standards teams and mixed messaging on the requirements around stocking refillable pods.

Days before the ban, trading standards incorrectly told south London retailer Rishin Patel to dispose of £1,000 of stock which was to remain le

gal after the ban, without leaving the required paperwork recording officers’ details or suggested actions. When contacted by Retail Express, Merton Council said the officers had mistakenly believed any vape above 600 puffs would be illegal after 1 June.

Meanwhile, the ACS warned shops could face compliance headaches if not selling pods to allow them to easily prove

BESTWAY is still searching for a supplier for Costcutter’s own label after the Co-op deal ends in December, saying it could remain within Co-op Wholesale.

Bestway managing director Dawood Pervez said dual-branded stores are performing well. He predicted convenience channel growth, saying the segment could outgrow supermarkets this summer, calling consumer shifts towards supermarkets a “slight hiccup”.

The wholesaler added it is expanding services, including book and recycling offerings, and van deliveries beyond news trade.

CEO Jon Bunting emphasised efforts to mainatin carriage charge rates and denied plans of price hikes due to added services. De-

THE Scottish government has postponed the proposed 25p ‘latte levy’ on disposable cups, a move welcomed by the Fed.

Retailers had warned the charge would unfairly impact local shops and fail to curb waste.

Fed president Mo Razzaq said it could drive customers to larger chains and offered no incentive for using recycled cups.

SHYAMA LAXMAN

FOLLOWING seven steps on soft drinks ranging and merchandising can help a retailer add an additional £5,000 to their till.

That was the advice from Carlsberg Britvic at the launch of its 2025 Soft Drinks Review on 15 May. It said the seven sales-driving steps are worth £225m in total sales over three years.

The company advised retailers to add value to their water range by stocking �lavours, formats and water with functional bene�its to encourage customers to trade up. Alongside this, retailers can get more sales from sugar-free drinks by dual-

siting them on �ixtures and promotional ends, as well as offering healthier meal and snack solutions. As health is a growing priority for shoppers – with 35% of soft drinks shoppers classed as ‘health moderators’ and 26% as ‘health actives’ – the supplier said educating shoppers about available functional drinks is crucial to help them make proactive decisions. It added that energy drinks have witnessed 93% category growth in the past 10 years, so retailers should capitalise on this by offering a wide array of options to drive value sales.

Food to go and treats are two of the top-three shopper missions. Soft drinks can

MARS Wrigley has unveiled Skittles Citrus, a mix of �ive fruit �lavours: Orange, Lemon, Lime, Mandarin and Blood Orange. The supplier hopes to attract new shoppers while also attracting trial from loyal Skittles shoppers.

Florence McGivern, Skittles senior brand manager, said: “Citrus is the perfect way to bring something fresh and exciting to our iconic Skittles lineup. Our �lavour experts at Mars Wrigley HQ have been perfecting this vibrant mix of �lavours for months.”

therefore be paired with food to drive impulse sales and boost basket spend. Likewise, treat missions can be made attractive by offering innovative products in different �lavours and formats.

Lastly, with occasions for home socialising on the rise, Carlsberg Britvic recommended retailers pair soft drinks with snacks and/ or alcohol, if permitted, to increase basket spend.

AHEAD of the summer holidays, World of Sweets has added new lines from Crazy Candy Factory and Barratt to its range of kids’ novelty products.

HEINEKEN UK is expanding its range of premium ciders with the introduction of Old Mout Mango & Passionfruit, now available across wholesale and convenience channels.

Mango & Passionfruit is vegan and gluten-free, contains natural �lavours and no added colours.

�losses available in 50g tubs (RRP £2), and Fruit Salad Duo Drops (RRP £1).

HEINEKEN UK released a new look for its Foster’s lager brand last month, including Foster’s and Foster’s Proper Shandy, highlighting its Australian roots.

The company said the ‘classic lager’ segment is worth £790m in the offtrade, with Foster’s occupying 32.3% share of the segment.

The rebrand employs Australian symbols like the country’s �lag and a red kangaroo, and reintroduces the use of the ‘Amber Nectar’ label.

The launches include Paint Dripz, available at an RRP of £1.29, and Dip n Dunk 3-in-1 fruity lollipop (RRP £1), which comes in three �lavour combinations.

Lines from Barratt include Wham and Fruit Salad Candy Flosses, available in 20g cups retailing at £1, Dib Dab and Flumps

It is available in 10x330ml cans and single 500ml bottle formats with an ABV of 4%.

formats with an ABV of 4%.

The new variant is set to help retailers tap into a range of occasions over the summer months, from barbecues and festivals to sporting events, the supplier said.

The new branding appears on packaging across all lines in the core Foster’s range, including 4x440ml, 10x440ml and 18x440ml multipacks, as well as Foster’s Proper Shandy, which has generated more than £9.3m in value sales in the past year.

MONSTER has partnered with British Formula 1 racing driver Lando Norris to launch a sugar-free energy drink called Monster Lando Norris Zero Sugar. Monster Lando Norris Zero Sugar combines Monster Energy blended with a Melon Yuzu �lavour. It will be available this month in plain and pricemarked 500ml cans, and plain 4x500ml multipacks. The launch follows the continued success of Monster’s zero-sugar range, which includes Monster

TROPICANA has launched Tropicana Sparkling – a range of fruit juice-infused sparkling water – into the convenience channel.

Available in Zesty Orange and Tropical Twist variants, each 250ml can of Tropicana Sparkling contains 30% pure and handpicked, natural-origin fruit juice and no added sweeteners.

Both variants have an RRP of £1.35. They can be ordered via wholesalers including Booker, Bestway, Dhamecha, Parfetts and United Wholesale Scotland.

Ultra, up 18% in value sales over the past year. and older drinkers, who are familiar with the original Breezer.

BACARDI is relaunching its Breezer ready-to-drink (RTD) range in the UK this month.

The three varieties of Breezer – Zesty Orange, Zingy Lime and Crisp Watermelon – have a 3.4% ABV, and come in 27.5cl glass bottles.

Bacardi Breezer was �irst launched in 1990 and became one of the UK’s mostpopular alcopops, before being discontinued in 2015. The launch comes as sales of �lavoured alcoholic beverages account for nearly half of the RTD category.

The supplier aims to target Breezer at two distinct consumer groups: Gen Z, who are new to the brand,

SHYAMA LAXMAN

MONDELEZ International is expanding its Cadbury Twirl range with the launch of a limited-edition White Dipped variety.

Set to launch this month, Twirl White Dipped comprises a milk chocolate Twirl covered in a layer of creamy white chocolate. It will be available to convenience retailers at an RRP of 99p.

The launch of Twirl White Dipped follows the success of previous limited-edition Mint, Caramel and Orange Twirl varieties, with Orange being made a permanent line in 2021.

Katya Savelieva, brand manager for Cadbury Twirl at

Mondelez International, said:

“The combination of milk and white chocolate is proving to be a consumer favourite, already growing ahead of the wider chocolate category.

“Bringing this increasingly popular combination to life in the form of a Cadbury Twirl with its distinct swirly and melty chocolatiness will offer consumers something completely new and unique that we’re certain they’ll love.”

The supplier will support the launch with a social media campaign and in-store activations.

BEBETO has expanded its freeze-dried sweets range, Freeze Crunchy, with the addition of Bubble Gum Bottles and Blue Raspberry Rings varieties.

The two new �lavours will be available in shelfready packaging of 12x35g pouches, each with a £2 RRP.

Wholesalers at launch include Parfetts and Dhamecha. The new products come in the wake of the success of the initial Freeze Crunchy launch, which generated £4m in retail sales from nearly two million packs within six months, according to supplier Kervan Gida UK.

Available: 11 June

SWIZZLES has launched two HFSS-compliant varieties: Squashies Tropical and Squashies Sour Shooting Stars.

The news comes off the back of the rising popularity of sour and tropical �lavours, according to the supplier.

sour �lavour combinations of pink lemonade, starfruit & peach and cola lime in shooting star shapes. Both lines are available in hanging bags, while Squashies Tropical will also be available in price-marked packs.

RRP: £1.15

Available: now

RIOT Labs has launched a four-strong range of OMG e-liquid �lavour pods com-patible with its Connex device.

The 100% recyclable pods come in four variants: Blueberry Sour Raspberry, Pineapple Ice, Strawberry Blueberry Ice and Cherry Cola.

Ben Johnson, founder and CEO of Riot Labs, says: “Amid increased govern-

Squashies Tropical feature parrot, pineapple and watermelon shapes in �lavours of mango & passion fruit, pineapple and watermelon.

Meanwhile, Squashies Sour Shooting Stars feature

ment regulation in the sector and the disposables ban, we must not forget the hundreds of thousands of adult smokers who are currently using disposables, proven to be the most-effective quitting tool, as part of their quitting journey.”

RRP: £2.99

DEDICATED low- and no-alcohol brewer Nirvana Brewery has launched a 500ml bottle format for its IPA.

The move is part of the brewery’s ‘long pour’ strategy – ensuring drinkers can enjoy low & no beers in as ‘normal’ a format as they can full-strength ones. The IPA also remains available in keg and 330ml bottles.

Becky Kean, founder of Nirvana, said: “No & low beers are predominantly in smaller-sized cans or bottles, but we know that these drinkers often want a more satisfying serve – whether that’s a pint on draught when out, or pouring a beer at home. There’s also a strong

REPUBLIC Technologies UK has launched the Smarter vaping product range, claiming it to be the �irst with no mesh coil pod system.

The pod-system range consists of the Smarter Mini (RRP £9.99), offering up to 800 puffs per replaceable pod, and the Smarter 6K (RRP £12.99), allowing up to 6,000 puffs per re�ill, with a 2ml + 10ml rechargeable tank.

Both products conform to changes in the UK legislation covering disposable vapes, with the Smarter Mini

incorporating a replaceable, longer-lasting ceramic coil which sits outside the pod. Available: now

JTI UK has expanded its Nordic Spirit nicotine pouch range with the addition of a Raspberry variety. According to the supplier, it has a quicker and stronger �lavour release, as well as increased moisture content. It is available through wholesalers or via the JTI360 website. Its launch comes in the wake of research that shows nicotine-pouch consumers are looking for greater �lavour choice.

GLOBAL vape brand SKE has unveiled a new product lineup, comprising eight lines.

SKE Bar and SKE 600 Pro are available to convenience retailers, with six more lines available later this year.

SKE Bar is a pre-�illed pod system, similar in design and �lavour pro�ile to SKE Crystal Bar.

SKE 600 Pro contains magnetically secured pods, a one-piece PCTG body, antileak technology, 400mAh hour battery and fast-charging USB-C port.

The launch is accompanied by a brand update to position SKE’s products for the new “post-disposables era”.

RRP: £5.99

BLENDSMITHS has entered the ready-to-drink space with the launch of its How Good! range, which comprises two crafted sodas and three functional shots.

The two How Good! sodas are a Lemon & Ginger �lavour with ginseng and ashwagandha, and Mint & Thyme, made with holy basil and rhodiola.

Meanwhile, Turmeric, Ginger and a Mango & Ginger option make up the trio of How Good! shots.

Both categories of drinks, which are caffeine-free, are available to buy through wholesalers that include Stores Supply, Mr Lemonade, Bidfood, Lomond Fine Foods, Delicious Ideas and Faire.

£2.50 for the sodas (330ml) and shots (60ml)

WORLDof Sweets has joined forces with Vimto to launch Vimto Jazzies, Vimto-�lavoured candy topped with crunchy sprinkles.

The launch is aimed at tapping into the ‘newstalgia’ trend – a desire for familiarity that is combined with novelty.

Vimto Jazzies come in 120g bags. They are available in price-marked and nonprice-marked packs.

Kathryn Hague, head of marketing at World of Sweets, said: “This new addition is the perfect

example of how we are combining classic confectionery formats with exciting �lavour innovations.”

RRP: £1.25 Available: now

SWIZZLES is marking the 70th anniversary of its Refreshers brand with the launch of a Tropical Chew Bar variety, which comes in mango & pineapple �lavour and retains the �izzy sherbet centre.

The supplier also marked the anniversary with the launch of The Great Community Refresh in May.

This initiative invites people to nominate a community project, group or asset in need of a ‘refresh’. Seven winners will receive a prize of £1,000 to support this refresh.

Refreshers Tropical are available in price-marked boxes of 60, with a 20p RRP. Available: now

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

My role in the shop: supervisor

What do you like most about working in convenience?

I really love working in the local community and engaging with those who live in it, whether that’s on the shop floor or at charity events held by the shop.

What happens in a typical day?

I’m involved in many parts of the store, including managing the social media to raise the shop’s pro le online and nding new products to help the store stand out.

What’s been the most exciting product you have had in store lately?

We started working with a local family who produce their own tikka masala range. We’ve sold thousands of jars since putting them on the shelves.

Have you helped organise any notable events?

Every year, we hold what’s called a pavement festival outside the shop. We invite local suppliers to have stands and we raise money for charity through various initiatives.

How do you approach social media?

We post about new products and also make sure to post about ways we have given back to the community, such as fundraising events we’ve been involved in.

The launches sold out after going on sale

INPOST: Will the axing of over-thecounter parcel services impact you?

“WE don’t do it for commission, we do it because 80% of parcel customers also buy an item in store. Many of them are �irst-time visitors and become regulars because of the quality of service, range and value.”

Sag Hussain, Premier – The Avenue Convenience Store, Middlesbrough

“IT’S a shame they’re stopping because it does quite well here, but only two or three per day buy something else. There’s no chance we can �it a locker and we don’t work with a locker provider, so that will be the end of InPost parcels here.”

Lynda Brown, Brown’s News, Halifax

NATIONAL LOTTERY: How does it feel to win Allwyn’s quarterly prize draw?

“I WAS overjoyed when I found out I’d won and couldn’t believe it. Part of the £10,000 prize money will be used to pay off my mortgage. It was an amazing feeling. Being rewarded this way by Allwyn gives shopkeepers a chance to feel appreciated for all of the work that we do.”

Amy Fowler, Arncliffe Stores, Middlesbrough

“I WON £1,000. My wife and I have been saving for a holiday. It’s something we really need at the moment as she’s been doing overtime at her job where she provides childcare relief for families with children with special needs. Any money leftover will be used to buy more stock.”

I will buy more stock for the shop

ALCOHOL: How are you standing out with your range?

“I’M launching my own readyto-drink cocktail range off the back of successful gin and craft beer products. It will be branded under my store’s Torridon Convenience name. The gin and craft beer launches have been successful, selling out shortly after going on the shelf.”

Kaual Patel, Nisa Torridon Convenience, London

“WE stock Guinness Pinter starter packs. They allow our customers to have fresh beer at home and offer 10 pints. Customers simply put it in the fridge and it tastes fresher than regular cans of beer. The ingredients are sensitive, so we recommend customers drink them quickly.”

Vas Vekaria, Kegs N Blades, Bolton

80% of parcel customers buy something else

MEETINGS: What have you learned from recent retail visits?

Store owner: Natalie Lightfoot, Londis Solo Convenience, Glasgow

Want to recommend a star member of sta ? Call 020 7689 3358 or email alex.yau@newtrade.co.uk

I’m grateful for the opportunity

“I HAD the opportunity to explore Belfast’s retail scene with Spar’s Scottish Guild and witnessed the exceptional standards set by the Henderson Group. Its commitment to store excellence, operational ef�iciency and delivering best food-to-go truly stands out.”

Danial Nadeem, Spar Motherwell Road, Bellshill

“I RECENTLY had the honour of attending my �irst independents board meetings for the Association of Convenience Stores as an ACS ambassador. I still consider myself a bit of a newbie in this industry, so moments like this are both humbling and empowering.”

Nathalie Fullerton, One Stop Dumbarton Road, Glasgow

16TH JUNE - 10TH JULY 2025 16TH JUNE - 10TH JULY 2025

MONDAY 16TH JUNE - GLASGOW

UNITED WHOLESALE GLASGOW, G33 4UL

UNITED WHOLESALE GROCERS SPRINGBURN, G21 4BY

WEDNESDAY 18TH JUNE – MANCHESTER

PARFETTS STOCKPORT, SK4 2JP

BESTWAY BOLTON, BL4 9TP

THURSDAY 19TH JUNE – MANCHESTER & LIVERPOOL

BESTWAY MANCHESTER, M40 8WT

BESTWAY AINTREE, L30 6UZ

FRIDAY 20TH JUNE – LIVERPOOL

DHAMECHA LIVERPOOL, L30 4XL

PARFETTS AINTREE, L9 5AL

TUESDAY 24TH JUNE – BIRMINGHAM

LIONCROFT ASTON, B6 5AD

DHAMECHA WEST BROMWICH, B70 0DD

WEDNESDAY 25TH JUNE - BIRMINGHAM

BESTWAY BIRMINGHAM, B11 2BJ

PARFETTS BIRMINGHAM, B11 2BH

THURSDAY 26TH JUNE – BIRMINGHAM

DHAMECHA SMETHWICK, B66 2NW

FRIDAY 27TH JUNE – LEICESTER

BESTWAY LEICESTER, LE4 5PN

DHAMECHA LEICESTER, LE1 2LB

MONDAY 30TH JUNE – LONDON

DHAMECHA WEMBLEY, HA9 0TU

BESTWAY ROYAL PARK, NW10 7BW

TUESDAY 1ST JULY – LONDON

DHAMECHA HAYES, UB3 1RY

BESTWAY TOTTENHAM, N17 0DX

THURSDAY 10TH JULY – MANCHESTER

PARFETTS STOCKPORT, SK4 2JP

Chief executive of

‘We need to stub the illicit tobacco market out’

THERE was a great piece in the Sunday Times recently highlighting the issue around counterfeit and non-duty paid tobacco. Our business and our retailers are particularly exposed due to high demand and two large nearby ports in Hull and Immingham. Both serve commercial and leisure traf�ic.

The illicit trade is damaging in so many ways. Legitimate retailers are losing valuable footfall and pro�its, which is impacting up the chain through wholesalers such as us, and the suppliers. The consumer gets a wonderful deal, but they are usually not buying the product they think they are, which is often very danger-

COMMUNITY RETAILER OF THE WEEK

Natasha Orumbia, The Vegan Patty Lady, director

‘I got started through retailer’s belief’

“EVERY brand has a beginning, and I’d like to thank Kaual Patel, who runs Nisa Torridon Convenience in south London. Before I even fully believed in The Vegan Patty Lady, he believed in it for me. He watched me walk into the post o ce day a er day, shipping out my handmade patties to friends and family for feedback. One day, he simply said: ‘Get yourself retail-ready packaging. If you bring them here, I’ll sell them.’ I was confused, but I trusted him. Before he even tasted a single patty, he gave us shelf space. This is how The Vegan Patty Lady was born.”

ous to health. Ultimately, this is funding organised crime on a large scale, with frankly no penalty – and that is funding other areas which cause misery to many, including drugs, prostitution and illegal immigration.

The wholesale trade needs to step up as well. Many of these outlets have the illusion of trading with a small

amount of legitimate stock. We need to not supply individuals or outlets that are convicted and to support our legitimate customers who have helped build our business for decades. It’s time to stub the illicit tobacco market out.

Andy Morrison, trading director, Dee Bee Wholesale

Headsets help my sta feel connected and safe

SHOP the is a major problem for independent convenience stores and we’ve made several investments to help us to combat it.

Headsets are among the most powerful tools we have.

It means that our sta members can stay connected, talking to each other without other people being able to hear. So, you can ask for some help or some advice or whatever. It was a relatively small investment, but it’s been a great thing to have at our disposal.

We’ve had them for 12 months now – we got them at the NCS trade show where we saw someone who was displaying them. It was a bit weird at rst for the team, but they love them now. We have four headsets per shop and each set of four cost £750 as a one-o fee, with no further subscriptions. None of them have broken – they recharge easily and they’ve been great.

It’s not just for crime prevention. If you’re in the stockroom with your head down, you might miss something, but with headsets you can hear what’s going on, and if someone has a question about anything in the shop, you can answer and help out.

But importantly, if you can hear a situation is going downhill, you can intervene. If you’re in a situation yourself, you might have previously felt that you were on your own and no one was coming to help you. But now you know that everyone is listening, so you don’t feel alone. You can just press a button, ask someone to come to where you are and it’s done.

When it comes to crime prevention, there’s no right or wrong way to deal with problematic customers. We’re learning all the time, and I always tell my sta that there’s always next time.

“ON 1 May, it was that time again in the year where all our retail family came together for the fourth annual Raj Aggarwal Golf Day. The event was to support my late husband Raj’s legacy and prove that we all stand together. It was attended by retailers and suppliers, and we raised nearly £25,000 for local charities. I wanted to say a big thank-you to all suppliers who have made this day possible, including Molson Coors, AF Blakemore, Booker and many more. It was a golf day, but attendees could choose non-gol ng activities, and there was even an evening dinner for guests.”

The RETAILEXPRESS team nds out about mastering the essentials with eight major suppliers

RETAILERS are always looking for the next big trend to help boost their sales. But it’s important not to forget the key categories that are the bedrock of a convenience store’s turnover – snacks, so drinks and next-gen nicotine products are all crucial sales drivers.

Over the next nine pages, Retail Express will be sharing some of the best advice on core categories from some of the country’s leading suppliers.

Red Bull explores the growth of functional energy drinks, and the need to balance a core range with consistently driving excitement through stocking innovation.

AG Barr looks at the value of the multibillion-pound carbonates category, and how Irn-Bru is driving sales through launches.

BrewDog explains how it can act as a signpost for the cra beer category, as well as how more beer drinkers are seeking moderation in their consumption.

With the disposable vapes ban now in e ect, BAT UK examines the alternatives that retailers can turn to, such as nicotine pouches and pod devices.

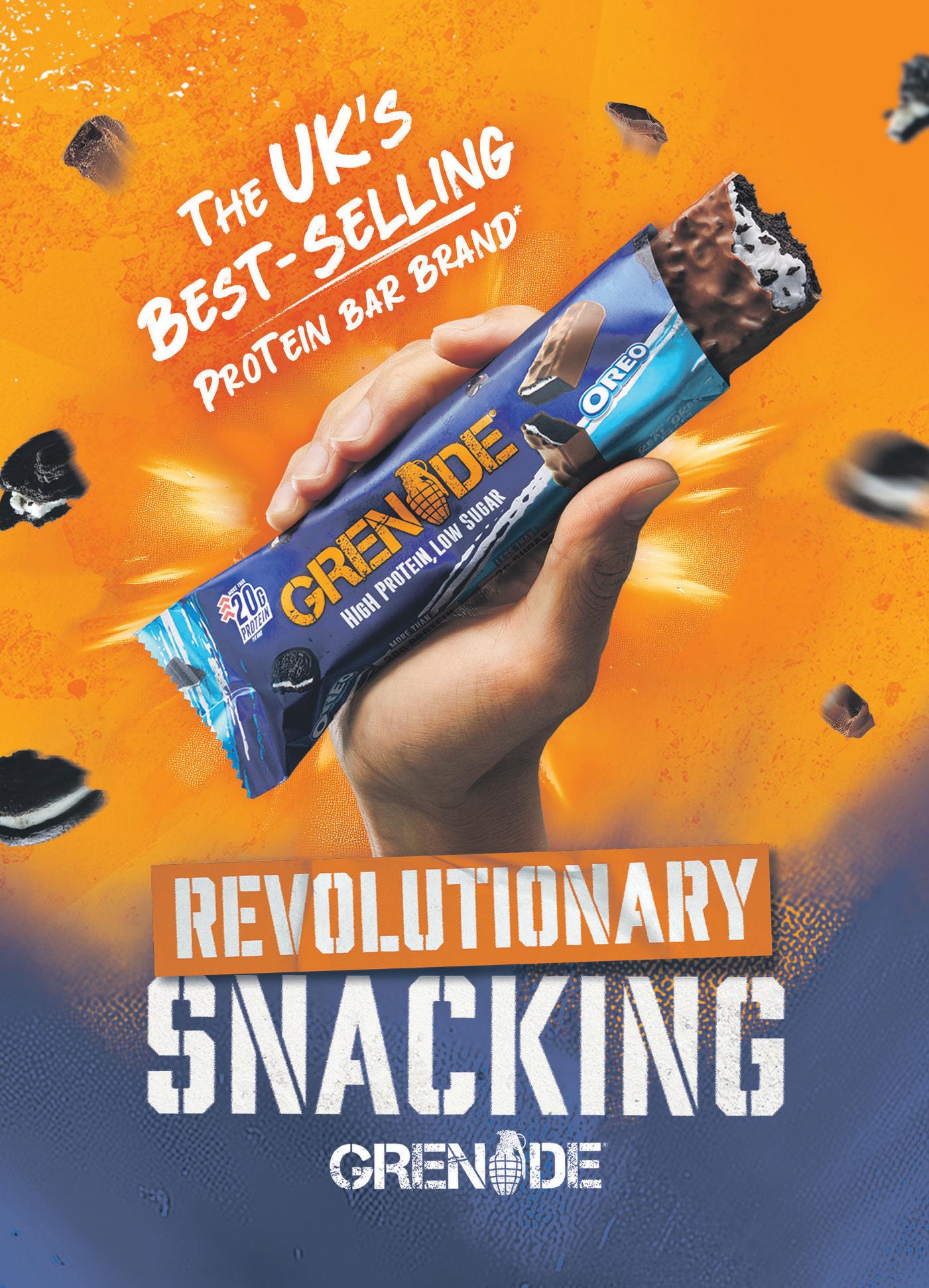

Protein bars have broken out beyond the taste of tness enthusiasts, and Grenade examines how retailers can take advantage by maximising category visibility.

Funkin Cocktails gives advice on how to make the most of the booming ready-to-drink alcohol category, which is growing far ahead of overall alcohol.

Weetabix spotlights the need for retailers to ensure they have a robust breakfast o ering.

And nally, Swizzels emphasises the versatility of its bagged sweets range, which includes shopper favourites such as Love Hearts and Chew Bags as well as new additions to its Squashies range.

FUNCTIONAL energy drinks are recruiting shoppers faster than any other so drinks category, with penetration up by 10.7% vs 2020, particularly with under-25s1

Core lines are hugely important and should be wellstocked, with multiple facings – however, there is also a need for new products to drive excitement, trial and value into the category.

Innovation has been vital to the success of energy drinks’ growth, particularly around new flavours, which have helped broaden the category’s appeal to new groups of shoppers, where taste was previously a barrier.

For Red Bull, new products are largely incremental: nearly half of shoppers who buy Editions are new to the brand2, acting as a gateway to the core range.

AS the signpost to the energy category, Red Bull is the UK’s number-one single-serve brand, with Red Bull Energy Drink 250ml selling more in value than any other single so drinks line3. In fact, it sells more units than any other food and drink line4. Red Bull Energy Drink 355ml and 473ml also sit in the top 10 lines5. Additionally, the Red Bull range has broad appeal. Red Bull Sugarfree appeals to an older, more a luent shopper than the average energy drinks shopper6, and Editions shoppers tend to be younger, with 60% under 357

FOR the 70% of so drinks sales that are planned, shoppers are likely to head straight to the main chiller, so it is crucial that their favourite brand is available and easy to nd. Use core lines to signpost each category, stocked at eye-level, brand-blocked and multi-faced to ease ndability. However, it is important to also consider second placement opportunities to drive incremental sales across the store.

1Kantar Combined Panel | Total Market | Penetration % | 52 weeks to 29.09.2024, 2Kantar Combined Panel, Buyer Numbers vs YA, MAT 21.01.2024, 3Nielsen Scantrack, Total Coverage, 52 w/e 08.02.2025, 4Nielsen Scantrack, Total Coverage, 52 w/e 22.03.2025, 5NIQ data | Food & Drink | Total Coverage (52 w/e 22.03.2025), 6Kantar Worldpanel | Combined Panel | Total Market | 52 w/e 09.07.2023, 7Kantar Worldpanel, Combined Panel, MAT 07.07.2024

• Irn-Bru

CARBONATES is the largest and most-shopped so drinks segment, valued at £7bn1. While all so drinks experience a summer sales boost, carbonated drinks boast one of the largest, with a 18% jump in warmer months2 Innovation plays a huge part in the growth of the market, with flavour extensions and limited-editions leading the way and attracting new shoppers by being an a ordable way for shoppers to treat themselves.

LAST year’s launches, Wild Berry Slush and Raspberry Ripple, became a top- ve take-home and drink-now innovation3 – 34% of people who bought them were new to the category4 and the launches led to a 23% upli on core Irn-Bru Xtra, too5.

This summer, the brand has launched Irn-Bru Xtra Nessie Nectar and Unicorn Tears, backed by a £2m social, digital and outdoor campaign, reaching 70% of 16-to-34-year-olds. While Irn-Bru’s success in Scotland is well-documented, it is now a top- ve carbonate nationally6. With an £8m brand investment throughout 2025, Irn-Bru’s regular and Xtra varieties are must-stock products for all retailers.

HOW CAN YOU GET MORE FROM CARBONATES? In partnership with WHAT ARE THE

RETAILERS can make the most of Irn-Bru Xtra’s two unique, limited-edition flavours by using its new range of PoS and digital assets until the end of June. The brand has invested £2m to support the launch in a cheeky way to deliver high awareness of the products and drive retailers’ sales.

With Irn-Bru growing six times faster than the total carbonates sector7, it’s a great time to merchandise the range in a high-visibility location to cash in this summer. Stock Irn-Bru Regular, Xtra and Xtra Legends Edition alongside each other to see the best upli .

In partnership with

• Punk IPA 4x330ml can

• Hazy Jane 4x330ml can

• Wingman 4x330ml can

IPA is the most-popular and best-performing style of cra beer in convenience, worth 65% of the cra -beer market1, and BrewDog is worth 71% of the cra -beer category2 BrewDog Punk IPA acts as a signpost for cra beer, so shoppers look for it. With more consumers focusing on moderation, 43% are reducing their alcohol consumption3 With continued demand, low- and no-alcohol will play a stronger role in future shoppers’ repertoire. In fact, as more sober-curious shoppers search for alternatives, this sub-segment is outperforming total beer in impulse4.

BREWDOG shoppers spend 22.5% more on their total basket than average beer shoppers5. As an initial cra o ering, Punk IPA and Hazy Jane New England IPA four-can multipacks are worth 51.3% of the category in impulse2 and can help increase a shopper’s total spend in store. The cra consumer also enjoys buying new products6 Retailers should rotate their range twice a year to reflect di erent seasons, with Wingman Session IPA for the summer and Black Heart Stout when the weather is cool. Wingman (4.3% ABV) taps into the growing session-IPA occasion and is now the fastest-growing cra -beer brand2

RETAILERS need to be prepared to react quickly to make the most of short-term weather forecasts, setting up temporary beer xtures to maximise sales during sunny spells. This can boost immediate and long-term revenue. If chiller space is available, cra beer should be sited here, as 76% of men want chilled beer from the fridge when shopping in convenience stores7

The 4-6x330ml can multipack is key for socialising, worth 60% of the category and growing8. However, the single format is also popular9 and works well as a twofor-£5 or buy-one-get-one-free o er.

1Circana Total Impulse. Latest 12 wks to 12.05.24, 2Circana Data – Total Convenience to 16.02.25 latest 52 wks, 3Bespoke shopper research, Vypr 2025, 4Circana Data – 01.09.24 Total Impulse, 5Convenience Retailer x Shopper Loyalty data 52 w/e 20.01.25, 6Vypr Customer Research – Sep 2024, 7BrewDog Bespoke Shopper Research– July 2023, 8+20.9% in latest 52 wks. Circana data up to 16.02.25, 9Worth 16.1% of the category and growing by 52.4% in latest 52 wks – Circana data to 16.02.25

THE nicotine-pouch category has grown signi cantly in recent years, giving retailers a prime opportunity to drive sales and pro ts. It’s a challenge for retailers to understand what’s right for them, in terms of brands, flavours and strengths – as well as how to make the most of their category display. There’s a continued natural evolution in terms of the popularity of mint and fruit flavours among adult nicotine consumers. New products, like Velo’s Icy Fruits range, are among those catering to the increasing preference for innovative fruit flavours with a cooling sensation.

Category development continues to see a varied range of strengths and pack sizes to make sure pouches cater for those adult nicotine consumers who are familiar with them as well as category newcomers.

BAT is proud of the ongoing commitment to quality and innovation that drives Velo – and which has already made it the UK’s number-one nicotine pouch with consumers1. Working with Velo means retailers can bene t from a di erent kind of support – to truly make the most of the opportunities in the category. For one thing, it’s important to keep close to reputable suppliers, and reps who will guide and educate retailers on the right choices, as well as o er competitive prices. And there’s a great range of educational material and display solutions available to support Velo, so please get in touch with your local sales representative to make the most of these.

THE right display of nicotine-pouch products can really make the di erence when it comes to helping your adult nicotine consumers nd and purchase the products they want. It’s good practice to keep your brands visible and your ranges together. Group by flavour, with the mint options together and the fruit options together. And keep a clear order of strength – from the low-nicotine-strength options up to the high-strength end of the range. The low-strength options in Velo’s Mellow range from 4mg to 6mg are key to have as a starting point when looking for an alternative to smoking or vaping.

• Vuse Go Reload Mint Ice 20mg kit

• Vuse Go Reload Blueberry Ice 20mg kit

• Vuse Go Reload StrawberryIce 20mg kit

IT’S a fascinating and challenging time for the category following the recent enforcement of the ban on disposable vapes. An increasing number of adult nicotine consumers are now looking to turn the page and move to quality alternative nicotine products.

It’s early days following the introduction of the ban, but products such as Vuse Go Reload continue to o er adult nicotine consumers the high level of quality and innovation they have come to expect from the premium end of the category, with a rechargeable and reusable pre- lled system. Products like this also o er adult nicotine consumers the choice of the same intense flavour sensations they have come to expect from disposable vapes.

NOT all vapes are made the same, but Vuse is the product of a belief in doing things the right way. Vuse stands for an ongoing commitment to quality and innovation, and is a globally trusted vape brand, enjoyed by millions of vapers worldwide1. In the UK, the brand continues to represent leadership and quality as the UK’s number-one rechargeable vape brand2. In an increasingly crowded marketplace, adult nicotine consumers face the challenge of a choice that gives them peace of mind, and a premium brand that also o ers intense sensorial experiences.

A WINNING range is all about making the right blend of brands, products, flavours and strengths available for adult nicotine consumers. Then, it’s about understanding the best way to display those products so the right ones can be found easily by you and your customers. Following the ban on disposable vapes, future-compliant products, including re llable and rechargeable devices, should start to take centre stage in your display.

1Based on Vuse estimated value share of vapour pods and pre- lled devices from Recommended Retail Price in total retail in key vapour markets: USA, Canada, France, UK, Germany, Poland and Spain as of October 2024. As of September 2024, Vuse has an estimated 11.7 million consumers worldwide. 2NielsenIQ RMS, Closed System Nicotine Devices, UK total retail market 18-months 02.11.2024. For more information, please visit vuse.com/gb/en/claim-substantiation

• Grenade Oreo 60g

• Grenade Chocolate Chip Salted Caramel 60g

• Grenade Chocolate Chip Cookie Dough 60g

WITH 86% of people admitting they snack1, there are lots of opportunities for retailers to meet shoppers’ snacking needs. More than half of these adults want to reduce sugar in their diet, so they’re making more conscious choices, but despite this, they aren’t willing to compromise on taste or indulgence.

This has driven the growth of protein-packed snacks. No longer con ned to tness enthusiasts, they are now picked up by all kinds of shoppers choosing better-foryou products. Forty per cent of consumers eat protein bars as a snack in-between meals or on the go1. This search for tasty, healthier options ensures high-protein snacks remain in demand within convenience stores.

AS the UK’s bestselling protein bar brand, Grenade understands the importance of a great protein range. Working alongside retailers for many years, Grenade has driven the category forward, growing total protein bars to £157m in the latest 52 weeks, holding a 45% share2. Grenade’s innovation with new products and collaboration with retailers to drive visibility of protein bars across the market has catapulted protein bars into a must-stock range for retailers. With growth driven by more consumption and consumers entering the category, it’s vital retailers capitalise on the potential protein ranges provide.

THE perfect protein range is simple for retailers to implement. Having the best products, in the best location in store, and making them easy for consumers to nd will drive incremental sales for any retailer’s business. Stocking Grenade’s bestselling range, including the number-one seller, Grenade Oreo, will ensure consumers have their favourite protein bar on hand. As impulse snack products, it’s vital protein bars can be found alongside snacks such as confectionery and crisps. Place them next to the counter to maximise visibility of the range and drive incremental last-minute purchases.

• Passion Fruit Martini

• Blue Raspberry Martini

• Strawberry Daiquiri

THE ready-to-drink (RTD) cocktail category is booming, with sales growing at more than double the rate of the wider RTD segment1. Whether shoppers are looking for a refreshing and intriguing serve while on the go or to savour at home, bar-quality cocktails have never been easier to enjoy.

It’s important to stock the classics like Funkin’s bestselling Passion Fruit Martini year-round, as these will always be popular with shoppers.

Alongside old favourites, we also know that there’s a growing trend for bold and nostalgic flavours, particularly amongst Gen Z drinkers. Flavour- lled innovations like Apple Sour Martini, new this summer, and Blue Raspberry Martini, which launched last spring, from Funkin are sure to stand out on shelf and turn heads at the chillers.

THE RTD cocktail category is one not to miss out on. In 2024, sales of RTD cocktails stacked up to £161m, making up a quarter of the total RTD category1. And it’s cocktails that are driving growth, as they are increasingly stealing share – with sales of cocktails up 13% year on year compared to the total RTD category at +7%1

When it comes to choosing what to stock, Funkin is the UK’s number-one cocktail brand, worth £26.7m and growing 10% year on year1. Sales of Passion Fruit Martini doubled between 2022 and 2023, and are still growing2.

SMART and simple merchandising is key to unlocking sales of RTD cocktails. In the fridges, opt for bestselling cans – such as Funkin’s Passion Fruit Martini, Blue Raspberry Martini and Apple Sour Martini – ready for impulse purchases and immediate consumption. Ahead of hot sunny days, local festivals and bank holidays, make sure you’re well stocked and able to replenish chillers frequently to keep up with demand.

Alongside single cans, Funkin’s Mixed Cocktail Party Packs appeal to groups as well as those stocking up ahead of hosting duties. Consider merchandising next to barbecue supplies to capitalise on a variety of needs.

• Weetabix Original

• Weetabix Crispy Minis Chocolate

• Alpen

BREAKFAST is celebrated as the most important meal of the day, and cereal is o en a planned purchase. Whether customers are coming in to restock their favourites, or in a rush to grab something because they’ve run out at home, it’s essential to stock household-favourite brands. There’s a de nite shi towards quality over quantity, and brand volumes are now recovering against private label. Shoppers are willing to pay more for premium breakfast products. Clear nutrition labelling and health credentials on-pack continue to play a key part in purchase decision; breakfast cereals that are compliant with HFSS legislation and feature no ‘red tra c lights’ represent an ideal and tasty choice for the whole family to enjoy. On-pack promotions entice shoppers with incentives.

WEETABIX Original is the number-one cereal brand in the category1, with value up by 4.7% and volume up 3.8% in November. Shoppers come into store looking for trusted favourites and Weetabix delivers. A staple in British households for more than 90 years, every pack of Weetabix Original is made from 100% wholegrain wheat grown within a 50-mile radius of its mill in Burton Latimer. Retailers can complement Weetabix Original with bestselling Weetabix Crispy Minis Chocolate. This fun alternative has attracted a 21% increase in new shoppers2, proving it to be very worthy of shelf space.

FOCUS on stocking a range of core bestsellers to make it easy for your customers. Include a variety of household brands that shoppers trust and are familiar with. Pairing bestselling cereals with new flavours and innovations will also help to draw more attention to exciting new products on shelf. Weetabix has recently introduced Weetabix Caramelised Biscuit into its popular Crispy Minis range. Put the biggest sellers on the middle shelves to help your customers identify them easily. Stocking PMP versions of bestsellers also helps to build trust with customers, showing them they are securing best value.

• Squashies Original 120g

• Scrumptious Sweets 173g

• Squashies Tropical

• Squashies Sour Shooting Stars

AS we move through 2025, the key trends and opportunities we’re seeing is for new, innovative flavours, retro products and a more health-conscious consumer.

The latter trend, backed by renewed discussion surrounding high fat, sugar and salt (HFSS) compliancy, has led Swizzels to create two fantastic new additions to its existing Squashies range in the form of Squashies Tropical and Squashies Sour Shooting Stars.

Swizzels’ main aim has always been to create exciting new products with incredible flavours. Being able to incorporate HFSS compliancy into new products has meant it can tick all the boxes for consumers looking to enjoy a great-tasting treat, and for retailers who are limited by merchandising regulations in relation to confectionery.

For consumers who are keen to purchase well-known and retro products, core Swizzels lines such as Love Hearts, Chew Bars and Variety Bags are as popular as ever.

SWIZZELS’ new products for this year, Squashies Tropical and Squashies Sour Shooting Stars, are the perfect addition to any existing Squashies range and open up a new opportunity for retailers, especially those whose store size requires them to comply with HFSS regulations. By incorporating the launches into the range, retailers are able to showcase these new products at till points, on gondola ends and in o - xture space close to the front of stores, ensuring increased visibility and incremental sales.

Squashies Tropical are also available in a price-marked pack as it’s evident that consumers are more likely to add confectionery items to their basket and stay within their budget if they have con dence that the price they see on the packaging is the price that they will pay at the till.

RETAILERS should fully use the space they have around till points, front of store, gondola ends and any available areas they have near confectionery-related items. Ensuring that there is a confectionery product near to the so drinks aisle, for example, is a great way of increasing impulse purchases and adding to those all-important incremental sales.

Retailers and suppliers talk to SHYAMA LAXMAN on the importance of breakfast in convenience and putting together the right range

STAPLES like bread, butter and spreads occupy a signicant portion of convenience revenue sales. Within bakery, breakfast is the largest sector, worth £1.1bn, says Rachel Wells, commercial director at St Pierre Groupe.

Georgina Thompson, head of marketing for butters, spreads and oils at Saputo Dairy UK, says value sales for the subcategory stand at £194.6m. A retailer can therefore simply start by o ering an “entry level” breakfast range, according to Atul Sodha, of Londis Hare-

eld in Uxbridge, west London. Based on location and instore provisions, retailers can then go further, with on-thego solutions or ingredients for cooking a bigger breakfast from scratch.

Nishi Patel, of Londis Bexley Park in Dartford, Kent, makes between £6,000-£8,000 per week on his hot-food-to-go range, and up to 20% of that comprises breakfast solutions. Sodha, whose store opens at 6am seven days a week, sees peak breakfast trafc until 10 30am, then a

surge in shoppers at lunchtime and in the evening. Sodha says that with more people working from home, retailers should be “geared up” all week long with their breakfast o ering.

For Vidur Pandya, of Kislingbury Post O ce & Village Store in Northamptonshire, breakfast does not feature in the top 10 categories in his store, but adds incremental value. Shoppers coming in for a morning beverage will pick up a cereal bar. It pays to be “well stocked”, says Pandya.

“WE sell local eggs, bacon, sausages, beans, hash browns and mushrooms for people that want to do fry-ups,” says Sodha.

Pandya, Patel and Sodha also sell hot baked items, like steak bakes and turnovers, as well as pastries, such as croissants and Danishes, to cater to the morning rush. Pandya’s hot bakes go for £2.75 each and pastries for £1.75.

“You’re looking at up to £200 in sales a day,” he says.

Atul Sodha, Londis Hare eld, Uxbridge, west London

However, retailers who are looking to o er food to go will have to contend with “red tape” around food safety and hygiene.

Companies such as Country Choice and Cuisine de France can support with equipment leasing and training, but if you’re making it from scratch, the responsibly for food safety and allergens falls to you.

Sodha acknowledges that not all retailers would be equipped to produce food in

store, but they could start by trialling something simple –for example, o ering microwaveable breakfast burgers from Rustlers – to see if it nds traction with customers.

O ering versatile products, such as Weetabix’s cereal biscuits, which can be used in multiple ways – from being added to yoghurt bowls to bases for cheesecakes – can give shoppers con dence that they are getting more for their money.

Retailers also agree that protein is a trending category worth exploring. Patel o ers meal-replacement solutions from brands like Huel, chicken snacks and beef jerky from Wild West.

Pandya places protein-based cereal bars and flapjacks, from brands such as Grenade, next to his in-store co ee machine. This positioning works twofold – either as a complete breakfast solution or as an impulse buy.

“MAKE sure you’ve got food you can warm up from the chiller. There are cheaper co ee machines out there. If you’ve got customers who don’t have local options to buy co ee, you can even just get a kettle and go from there. That could turn into something where you decide that you want to invest in a machine.

“Secondly, consistency and perseverance are key. You have got to do it for a period so you stay in people’s minds and become a destination.

“Lastly, make your outlet the most amazing one you can. My sta are encouraged to look at what people are buying and recommend products.”

Nishi Patel, Londis Bexley Park, Dartford, Kent

“IF you are looking to o er food to go, then start with one hot tower. Don’t fear generating waste as that gives an indication of how much food is being cooked and sold. Update your product range based on what your customers are looking for. Give them a good range of fresh produce to cook from scratch. O er premium and value lines, as well as trending products if there’s a demand for it in your local area.

“Keep pushing the sales by promoting your credentials, whether its made fresh in store or multibuy deals.”

Vidur Pandya, Kislingbury Post O ce & Village Store, Northamptonshire

“EPOS data tells you a lot about what’s selling in store. If you can bring it down to a product level, you can see why it’s working well or not. Look at the data to promote slow sellers, which mostly tend to be on the bottom shelves.

“You can put your value range at the bottom for the bene t of people who are looking for value and would be inclined to look at the pricing. So, they will look at the whole drop. Have high-value and branded items at eye level. Every store is di erent, so what works best is looking at your data and your planogram.”

PATEL used to o er vegan sausage rolls and gluten-free products, but stopped as they didn’t work for his store.

“I think people who are gluten intolerant or vegan shop di erently to our normal target

market audience,” he says. Sodha and Pandya, on the other hand, continue to o er free-from products, such as vegetarian samosas, glutenfree cakes from Mrs Crimble’s, bread from BFree and cereals

from Nestlé Go Free.

“We get a lot of families coming in, so we’re trying to cater to the whole family and not just certain individuals. We’re thinking on a wider level,” says Pandya.

While having free-from options in every category can create an inclusive shopping experience, if space is at a premium, focusing on the “biggest value and volume categories” should be a priority.

Merchandising tips from Georgina Thompson, head of marketing for butters, spreads and oils at Saputo Dairy UK

Right brands

Stock top-selling lines and well-known family favourites with strong brand names that consumers know and love.

Right range

O er breadth over depth of range. Include products from each sub-segment to satisfy a broad array of consumer needs. Ensure block butters and spreadables are complemented with top-performing spreads and a dairy-free o ering.

Right price Drive sales and support shoppers with pricemarked variants of popular lines. O ering transparency and perceived value, this clear and consistent pricing helps manage budgets.

PATEL has positioned his hotfood towers by the front door, whereas his cook-from-scratch range is merchandised within the category – such as grouping the meats together – as these tend to be intentional buys. Bakery items and eggs

are separated based on cheap, medium and premium options.

Patel receives support from Country Choice in the form of in-store advertising and PoS. He also relies on social media for promoting his range.

Opposite his freezers, Pan-

dya has two bays dedicated to bread. He also displays croissants within these bays as the fresh smell of baked goods is enticing for customers. Cereals are merchandised towards the rear of the store.

The idea is that as customers walk around the store to grab items, they could spot and buy additional things. Flapjacks and cereal bars are merchandised near the till and next to the co ee machine as these work well to drive impulse sales.

“ONE of my pledges for sustainability is to use a lot of my waste,” says Sodha. He uses sausages nearing their sell-by date and turns them into sausage rolls in his instore kitchen. Sometimes, he carves out customer’s names on the sausage rolls before baking to add a point of difference to his o ering.

Sodha also uses other ingredients, like stale bread and bananas about to go o ,

to make bread pudding and banana bread. Selling these items at nominal prices enables him to reclaim some margins on goods that otherwise would be binned.

“My USP is that you’re going to get a multitude of things in the store, and we will use any way possible to be sustainable,” says Sodha, who also uses recyclable packaging to further his sustainability endeavours.

Sweet Freedom’s Choc Pot Hazelnot

Sweet Freedom has unveiled a new nut-free variant called Choc Pot Hazelnot. Naturally sweetened with apple and carob, it is free from palm oil, re ned sugar and arti cial sweeteners, and has 15 calories per teaspoon. It’s available to retailers at an RRP of £15.07 for a case of six jars.

Nomadic’s protein-rich Power Oats

Nomadic has launched Power Oats, a new range featuring a combination of yogurt and oats that is rich in protein and vitamin D. The range is available now in Zingy Raspberry and Vibrant Vanilla varieties, each available in a 150g pot with a £1.50 RRP. The range also contains gut-friendly cultures to boost consumers’ immune systems

Trek launches high-protein, low-sugar range

Protein snack brand Trek has announced the launch of a new high-protein, low-sugar range, available to convenience retailers from the end of May. The core high-protein, low-sugar range features soft centres in Choc Caramel and Choc Peanut Butter, coated in chocolate and layered with caramel. Also joining the line-up is a new high-protein Bisco bar.

®Reg, Trademark of Société des Produits Nestlé S.A.

CHARLES WHITTING nds out how technology is helping retailers run more e cient businesses, while in-store services attract more customers

TECHNOLOGY should enable retailers to do a multitude of things – complete simple tasks faster or more e ectively, and number-crunch data to provide useful information that can be analysed and acted upon to improve a store’s overall o er.

Some technologiesrequire signi cant up-front costs – like electronic shelf-edge labels or self-service tills – but others

can be as simple as an HR management app or an upgraded EPoS system.

“I had a very dated EPoS system and now I have MSP Systems,” says Minesh Keshwala, from Spar Ash Close in Barlborough, Derbyshire. “It now only takes me an hour to do all my ordering, which has freed-up lots of my time to concentrate on the shop floor and

nding deals and unique products. It’s easy for the sta to use as well and it’s no problem to create new deals on certain products.”

Vijay Aanasane, from Foxhole Store in St Austell, Cornwall, uses his Booker EPoS system to analyse his sales and identify what’s selling well and what can be removed from the shelves. This technology

WHILE new technologies might o er retailers the ability to complete tasks faster or more accurately, like most machines they are often only as good as the person operating them. Re-

tailers need to train their sta on how to use this equipment on a day-to-day basis, but they should also be talking to their provider to nd out what else is available to them and how

they can make their tech go even further.

“Even the best tech won’t deliver if people don’t know how to use it properly,” says Rob Lough, head of growth at

VIEW

allows him to see exactly what is selling rather than what he personally witnesses on the shop floor.

“It’s really important for our vapes,” he says. “Rather than having a massive range, we can look at what customers are buying and cut the range down so it’s right for them. We get daily and monthly reports and it’s very easy to navigate.”

MHouse. “And for things like self-checkout, a little customer guidance goes a long way – if shoppers feel con dent, queues move faster and sales stay strong.”

John O’Neill, retail sales controller, Parfetts

“THE most important areas of retail that bene t from technological support are ordering, EPoS, store management and security. E cient ordering systems reduce out-of-stocks and overstocking, while advanced EPoS solutions provide actionable sales data and streamline transactions. Technologies like electronic proof of delivery and route planning improve logistics, and AI-driven marketing tools help boost footfall and customer loyalty. Addressing shop the with smart security solutions is also increasingly vital in today’s retail environment.

“When it comes to in-store services, consider parcel collection, click & collect, bill payment and community events. These can attract new customers and encourage repeat visits. Hosting in-store events, tastings or special promotions can also create memorable experiences that set a store apart from competitors, fostering a stronger connection with the local community.”

Stacey Williams, business development director, Gander

“SOME retailers are saving up to £800 per week and reducing their annual waste costs by as much as £20,000 per store. By ensuring yellow-stickered items sell 40% faster, our existing retail partners are achieving an 88% sell-through rate on reduced food.”

M-Cube, spokesperson

“HIGH-RESOLUTION LED screens serve as dynamic canvases for storytelling, promotions and real-time updates – e ectively capturing customer attention and driving foot tra c. These technologies not only increase customer engagement and footfall, but also contribute directly to driving sales.”

IN-STORE services give customers additional reasons to come into your store. They drive footfall that can be converted into additional sales, while also providing a small commission as well with limited extra sta , space or time required. Parcel collection services like InPost lockers or Evri deliveries are some of the most widespread examples.

“Ninety-six per cent of the UK’s urban population currently live within just one mile of a ParcelShop, and previous research conducted

by Evri found that 30% of customers using a parcel service also bought something in store,” says an Evri spokesperson.

With in-store services associated with national brands like parcels or Airbnb key collection, it’s worthwhile using their widespread recognition and power to put your shop on the map. With other, more local services, retailers will need to do more of the shouting themselves, whether it’s dry-cleaning pick-up, external laundry or key cutting.

Alan Ring, CEO, Halos

“TAKE body-worn cameras, for example. Unlike traditional CCTV, body cameras go where your sta go – recording what’s happening, picking up audio, and even letting you or your team see what’s going on in real time from somewhere else. And if something does happen, you’ve got clear proof of exactly what went down.”

Mike Severs, sales and marketing director, Volumatic

“WE would recommend to retailers to invest in products that o er extra security, such as forgery detectors, secure cash storage and anything where exposure to cash is limited for both employee and customer. Volumatic o ers a number of technology products that can help retailers.”

ALONGSIDE the store, I have a second job, leading a department that takes emergency calls for the police, so I work in the shop and then do 8pm-4am night shi s four times a week. On top of that, I have sixyear-old twins and a ve-year-old daughter.

I’ve learned to prioritise and better understand what’s important. In November 2023, I had a mini stroke – it was a wake-up call that I was doing too much. Now I’m more careful about what I commit to, and I recognise that I have to say no to certain things. I recognise when my pot is about to overflow and choose to prioritise myself.

To do that, I plan in advance. For example, if I have a big commitment, I ensure I’m not working in the shop the day before.

I must admit, I’m able to do this because I have a fantastic manageress. We have an open line of communication with the team, letting them know what’s expected of them, with a detailed handover for every shi .

And with my kids, I make sure to spend quality time with each of them individually, even if it’s just a trip to the park. It’s all about planning.

Retailers must prioritise themselves and shouldn’t be scared to say no.

The low- and no-alcohol market is going from strength to strength, and, as it grows, it’s also widening, as TIM MURRAY reports

THERE’S no longer any question over whether low- or no-alcohol (low & no) options are a fad. People, especially younger generations, are choosing low & no content options more and more.

“In 2024, sales of no-alcohol beer surged by 20% compared to the previous year, reflecting strong consumer demand,” says James Fowler, vice president of sales for UK/ Europe at Bero. “The total low

& no market more than doubled year on year.”

A quarter of adults are drinking low & no more than they were a year ago, according to Club Soda. Some 44% of 18-to24-year-olds considered themselves to be occasional or noalcohol drinkers in 2023, up from less than a third the year before.

And as King sher Drinks head of marketing John Price adds: “Those 18-to-24-year-

old consumers who are purchasing more low & no now are more likely to convert to lifelong fans of the brand.”

Other trends are beginning to emerge within low & no, with Alex Loveday, co-founder and sales director of Mash Gang, noting: “People are choosing to drink alcohol-free on select days or even ‘zebra striping’, which is when they alternate between alcohol and alcohol-free beverages.”

There is also a common misconception that no-alcohol is con ned purely to Dry January, as people rid themselves of post-Christmas excess, and Stoptober.

“Demand for low & no generally stays the same throughout the year, but like other alcohol categories, peaks during the summer and festive periods,” says Heineken category and commercial strategy director Alexander Wilson.

Make sure your alcohol-free section is easy to nd and signposted

O er sampling of alcohol-free

Equalise o ers – if you have a promotion on alcohol, do the same with alcohol-free

It’s not all about Dry January – December and July are the busiest months for alcohol-free

Train your sta to navigate customers to options and share their knowledge, especially if you are used to doing more consultative sales

Don’t forget to share what you have on social media

Peter Patel, Costcutter Brockley, south London

“LAST year was our biggest ever for low & no – we saw 25% growth in it across the 12-month period. As we head towards the warmer weather, I think we’re probably up about 10-12% compared with last year.

“We started quite early and there wasn’t a lot of variety, but now we’ve got a complete bay devoted to it. The market for it is becoming wider. It started with lower-age demographics and now it’s all adult age groups getting into it.

“Heineken Silver has done well, Peroni is good. The problem with beer now is there are a lot coming into the market. There’s more choice and the market is more saturated.

“Wine is still growing and there are now 20 or 30 more lines than a few years ago. It’s much less of an add-on now we have a bay. We have PoS showing it’s a low & no range. The whole xture is labelled. When we put it in the chiller, we highlight it behind the SEL, which makes it stand out a bit more.”

ONE of the key reasons for the ongoing growth of the sector has been the improved taste, with suppliers and manufacturers upping their game to improve the quality of their o erings.

“It’s not a category that’s price driven, which is great. It gives better margins and we don’t have to price promote,” says Peter Patel. “What’s really driving it is the taste.”

And, with the quality get-

ting much better, consumers’ tastes have become more sophisticated.

Bolle Drinks CEO Gary Read says: “Consumers are craving higher-quality beer that feels special and isn’t presented as a poor cousin of the main beer brand.

“Brands such as Mash Gang, Big Drop and Nirvana are answering this trend, as alcohol-free brands dedicated to full flavour.”

Inch’s

LOW & no beer now makes up around 2% of the overall UK alcohol market, according to IWSR data, and is quite clearly way ahead of the curve compared with wine and spirits. Despite its greater growth –20% year on year – wine and spirits are catching up, both in terms of perception and sales. No-alcohol wine was up 8% in 2024 and spirits by 7%.

Laura Willoughby MBE,

founder of Club Soda, says: “In the Club Soda tasting room, wine is our biggest-selling category. In spirits, moodenhancing and functional spirits are very popular. But we are moving away from there being just one beer in your local shop. People expect to see wines, spirits and beers.”

Within the di erent categories, it’s worth also taking a di erent approach with re-

The latest launches in low & no

Inch’s 0.0 from Heineken claims to be the “ rst de-alcoholised cider in the UK” low-alcohol market. It saw a 47% sales increase in 2024.

Mash Gang

A Lesser Evil is a new non-alcoholic chocolate and cherry stout from Mash Gang. The company has also launched a permanent core range of beers in 330ml formats, taking in Chug, Glug and Journey Juice.

1664

1664 Biere 0.0% is joining Carlsberg Britvic’s roster of low & no o erings, available in packs of 6x330ml cans. It’s being launched with a multimillion-pound marketing campaign, including TV.

Bolle

Bolle Spritz Classico is a new RTD no-alcohol aperitivo. It is available in 750ml bottles and has an RRP of £19.99.

gard to no-alcohol versus lowalcohol.

“There are some very good no-alcohol wines out there, but not as many as in beer and spirits,” says Jo Taylorson, head of marketing and product management at Kingsland Drinks. “Lower-alcohol wine is a di erent matter. Wine can be naturally lower alcohol from certain regions and countries, and with small interventions in