Taking a deep dive into the latest technological innovations and markets available to the wholesale channel

Taking a deep dive into the latest technological innovations and markets available to the wholesale channel

Paul Hill

Editor

Two of the key areas we chose to focus on this edition – tech and international markets – have become huge talking points in the business world in recent months and clouded by uncertainty, be it through political friction, shifting regulations or disruptive companies.

But behind the noise, real opportunities are taking shape that wholesalers are, and should be, taking advantage of.

Exporting and importing are no

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Senior content and production

editor Ryan Cooper

Senior designer Jody Cooke

Designer Lauren Jackson

Contributors Tamara Birch, David Gilroy, Tim Murray

Production manager

Chris Gardner

longer just about moving products between borders; they’re about strategic partnerships, efficiencies and staying agile in an industry that is requiring wholesalers to set themselves apart in a rapidly evolving market.

Likewise, while technologies like automation, AI and digital tools have sparked debate, they’re also powering a new era of smarter wholesaling.

From predictive analytics to supply chain optimisation, these innovations aren’t just trends – they’re becoming necessities.

This issue dives into how wholesalers can not only adapt, but thrive, in this new environment, with insights from experts and case studies from those already making headway.

Meanwhile, earlier this year, I had the chance to visit Jersey, where I visited two forward-thinking wholesalers who are forced to be innovative because of the geographical restrictions they find themselves in. Their approaches to tech, sustainability and new markets offer valuable lessons and a reminder that innovation isn’t limited to mainland operations.

SALES

Head of commercial

Natalie Reeve 020 7689 3367

Associate director

Charlotte Jesson 020 7689 3389

Account director

Lindsay Hudson 020 7689 3366

Account manager

Lisa Martin 020 7689 3364

Printed by Acorn Web Offset

Ltd, Loscoe Close, Normanton Industrial Estate, Normanton, West Yorkshire, WF6 1TW

Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT

Newtrade Media Limited, 11 Angel Gate, City Road, London EC1V 2SD Tel 020 7689 0600

Better Wholesaling Insight is published by Newtrade Media Limited, which is wholly owned by NFRN Holdings Ltd, which is wholly owned by the Benefits Fund of the National Federation of Retail Newsagents. Reproduction or transmission in part or whole of any item from Better Wholesaling may only be undertaken with the prior written agreement of the Editor. Contributions are welcomed and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information.

P4-5: Viewpoint

David Gilroy asks wholesalers to unleash the ‘skunks’ for longer-term tech solutions

P6-7: Interview

We pay a visit to Jersey to find out how a wholesaler operates on the island

P8-12: International

Why the international market could be a huge growth opportunity

P14-15: Spotlight

How an alcohol wholesaler is still going strong after more than 200 years

P16-17: Deep dive

How a global messaging technology is transforming the way wholesalers work

P18-20: Foodservice Focus

Tim Murray reports on the latest trends and developments in the catering world

P22: Buying Groups

The Caterfood Buying Group speaks about its biggest developments

P24: Buying Groups

Caterforce on what it is doing for its membership

P26: Buying Groups

NBC on how it’s achieved growth this year

P28: Buying Groups

Sterling Supergroup reveals all the goings on in the business

P30: Buying Groups

Sugro explains its latest plans for its members

P32: Buying Groups

Unitas gives an insight into its recent work

P34: Buying Groups

The Wholesale Group talks through its first six months

CATEGORY ADVICE

P36-42: Sector review

The latest opportunities within the world of price-marked packs

P44-51: Sector review

Finding out about all the trends and developments across alcohol

https://bit.ly/3lvj7FC

viewpoint: Wholesalers need to step outside the day-to-day and look further ahead for longer-term tech

Are you ready to seize the future? Then unleash the skunks. The term ‘Skunk Works’ refers to a specialised and often secretive group within an organisation that focuses on advanced, breakthrough or innovative projects. Typically, such groups work with a high degree of autonomy, minimal bureaucracy and a streamlined process to foster rapid development. This small team can concentrate solely on the project without the distraction of their day jobs.

They operate in many commercial enterprises across a spectrum of industries, including aerospace, technology, pharma, biotech and the automotive industry. Examples include Facebook Reality Labs, Toyota Research Institute, Johnson & Johnson Innovation and Disney’s Imagineering. A Skunk Works team will scour the world across multiple sectors for ideas, then develop them

into workable pilots for potential rollout. Three key areas in wholesale would benefit from a Skunk Works approach.

The integration of advanced technologies in wholesale checkouts and payment systems is transforming the commercial landscape. By embracing AI-powered checkouts, contactless and mobile payments, real-time B2B transactions, biometric authentication, and blockchain technology, operators can enhance efficiency, security and customer satisfaction.

Staying abreast of these innovations is crucial for businesses aiming to remain competitive in the rapidly evolving wholesale market. The adoption of contactless and mobile payment methods has surged, particularly in the UK and Europe. In 2023, contactless cards were used in 62% of all card transactions in the UK. Mobile wallets such as Apple Pay and Google Pay offer customers a secure and convenient way to make purchases, often incorporating biometric authentication for added security. Firms are responding by upgrading their point-of-sale systems to accommodate these payment methods, thereby reducing queue times and enhancing the overall shopping experience.

In the wholesale sector, the shift towards real-time B2B payments is gaining momentum. A study by PYMNTS Intelligence revealed that 81% of large retail firms consider real-time payments pivotal to their

operations. These systems enable instant transaction processing, improving cash flow and operational efficiency. Additionally, 85% of retailers are likely to collaborate with fintech companies to enhance their real-time payment solutions. Biometric authentication methods, including fingerprint scanning and facial recognition, are becoming increasingly prevalent in payment processing. These technologies offer enhanced security and convenience, reducing the risk of fraud. By incorporating biometric authentication, retailers can provide a seamless and secure checkout experience, aligning with consumer expectations for quick and safe transactions.

Inventory management has long been a cornerstone of wholesale operations, but with the rapid evolution of technology, the systems of the past are quickly being replaced by smarter, faster and more predictive solutions. As wholesale businesses grapple with increasingly complex supply chains, fluctuating demand and tighter margins, future-forward inventory management powered by advanced tech is becoming not just a competitive advantage, but a necessity. One of the most significant advancements is the use of AI to improve demand forecasting accuracy. AI algorithms can analyse massive data-

sets, including historical sales, seasonal trends, market shifts, social media signals and even weather data to predict future inventory needs. For wholesalers, this means fewer stockouts, reduced overstock and optimised procurement cycles.

Internet of Things (IoT) devices are transforming warehouses into smart environments where real-time inventory visibility is the norm. Radio frequency identification (RFID) tags, global positioning sensors (GPS) and smart shelves enable automatic tracking of items from inbound logistics through to delivery. This granular tracking not only boosts inventory accuracy, but also enhances security and theft prevention. Combined with warehouse automation systems like robotic picking and autonomous forklifts, it creates a seamless, efficient and responsive logistics ecosystem.

Blockchain is another technology gaining ground in wholesale inventory management because of its ability to offer immutable, time-stamped records of every transaction and inventory movement. This transparency is especially valuable for managing complex supply chains with multiple stakeholders. Through blockchain, wholesalers can verify product origin, track shipments in real time and ensure compliance with regulatory standards. That’s particularly important in sectors

like pharmaceuticals, food distribution and electronics.

Beyond AI forecasting, machine learning models are being used to continuously improve inventory strategies. These models learn from past performance and adjust recommendations in real time based on new data. This enables more dynamic replenishment planning, automatic safety stock adjustment and even scenario planning, allowing businesses to test the impact of disruptions like supplier delays or demand spikes before they occur.

Augmented reality (AR) is starting to play a role in inventory picking and stocktaking. With AR glasses or mobile apps, warehouse staff can receive visual guidance on where items are located and how to handle them, speeding up processes and reducing errors. As AR hardware becomes more affordable, this technology will likely become a staple in high-volume wholesale warehouses looking to improve labour productivity.

The wholesale industry worldwide is rapidly embracing advances in robotics, intelligent storage systems and smart order assembly. Advanced robotic arms, equipped with AI and computer vision, are now capable of identifying, picking and packing a wide range of items.

Startups such as RightHand Robotics and Covariant are pushing the boundaries by enabling robots to handle even irregularly shaped items, making them perfect for wholesale businesses that deal with diverse inventory. By 2030, robotic picking systems are projected to perform more than 65% of all warehouse picking tasks globally, according to Interact Analysis. Automated storage and retrieval systems (ASRS) have become a staple in modern wholesale distribution centres. These systems use robotic shuttles, lifts and conveyors to retrieve items from high-density storage racks with speed and precision.

Future-ready warehouses are embracing mobile and modular racking systems that adapt to seasonal demand, stock keeping unit (SKU) turnover rates and evolving storage needs. These systems are often integrated with robotic platforms that move entire shelving units on command – no forklifts needed. Instead of warehouse employees searching for products, goods-to-person (GTP) systems bring the products to the pickers. These set-ups significantly reduce worker fatigue and increase productivity. Retailers such as Ocado and Zalando are already using GTP robots to fulfil thousands of orders per hour. For wholesalers, GTP can drastically speed up large, multi-line order fulfilment while reducing picking errors. AI is revolutionising how orders are grouped for picking.

By analysing orders in real time, smart systems batch orders with overlapping SKUs or similar picking zones to minimise movement and boost throughput. Combined with robotics, this leads to a synchronised flow of orders from picking to packing to loading docks. The future of wholesale order fulfilment is not just about individual technologies, but how they connect. Cloud-based warehouse management systems (WMS) integrate robotics, storage solutions and order assembly into a unified platform. These systems provide real-time visibility into operations, enabling data-driven decisions on labour allocation, inventory forecasting and system performance.

Our industry is full-on and demanding. So, there’s a need to find tech solutions to improve customer service, streamline business and enhance profitability. Over to you, skunks! l

Hill speaks to the Channel Islands wholesaler’s managing director

What’s the story of Cimandis?

Cimandis was originally formed in 2002 as part of the Sandpiper Group and is now the largest wholesaler across the Channel Islands.

Bidcorp, the parent company of Bidfood, bought us back in 2015 as a strategical acquisition – they were always trying to supply the islands and then decided to purchase us as a way of having a definitive imprint here. It’s proven to be a massive success.

Subsequently, Caterfood Buying Group was formed to unify the independent businesses owned by Bidcorp, with Cimandis being one of the earliest members. As the group has grown, with the likes of Turner Price and Harvest Fine Foods being acquired, it has massively benefitted Cimandis, our product range and how we can support our customers. Caterfood Buying Group is a very collaborative, forward-thinking group

and has the ambition of supplying every corner of the UK.

Who and what do you supply?

Having sites on Jersey, Guernsey and Alderney means businesses there are our main customers. In addition, we deliver to the smaller islands of Herm and Sark, where there are no cars allowed, so deliveries are made by boat, and then by horse and cart.

We supply to almost every sector, including gyms, retail outlets, hospitals and schools. High-end restaurants – of which there are a lot across the islands due to the presence of the offshore finance industry, and the locals’ appreci-

ation of quality food – are also key customers. The bulk of our products come from the UK, but we do also source from several local producers, too.

There is a diverse range of nationalities on the islands, so having a variety of high-quality ingredients is important to our customers. For example, the Channel Islands are home to a significant diaspora of Portuguese Madeirans, so there are a lot of fantastic Portuguese restaurants we supply to.

What gives your business its USP?

As well as having the mindset, nimbleness and reputation of a

local independent, we have the strength and power of Bidcorp, and can pull on Caterfood Buying Group’s resources, so it’s a unique proposition. We also have access to Bidfood insight and data, which helps us with the latest trends around the marketplace.

Being based in the Channel Islands also sets us apart from the rest of the UK. From a food perspective, we have fantastic local products, such as fresh seafood, Jersey Royal new potatoes and Jersey milk, plus now there’s our own farm-to-fork Jersey beef. Local provenance and supporting local producers leads to a higher expectation of quality when cus-

tomers visit food establishments. Furthermore, our proximity to France – we’re only 14 miles from the northern coast – allows us to import French produce easier than you would on mainland UK.

What are your growth plans for the years ahead?

In the 18 months since I’ve joined, we have been massively focused on growing our range and new product development. This is something we showcased at a trade show and we flew over suppliers so they could see it first-hand.

In addition to this, alongside other members of the group, we are growing the own-brand Caterfood Collection range, and the plan is to take it to more than 1,000 products across three tiers in the next few years.

Despite a challenging 2024, this year started very well, with new business and sales growth being a priority. We have had a very successful Easter period and look like we’ll have a very busy summer

season ahead. New product development and range are always easy ways to increase sales, and recent launches into soft drinks and confectionery have seen incremental growth.

What is the overarching strategy for the business over the next five-to-10 years?

Our strategy will be to keep doing what we’re good at, and to offer the best products and service.

Naturally, as Caterfood Buying Group continues to expand, we will benefit from that in relation to new products and better buying power.

Otherwise, our focus is really on the customer experience. For example, we have recently refreshed our online shop, MyCimandis, which includes an app to make ordering as easy as possible.

What is the biggest challenge the business faces?

Most of our product range relies on being shipped to the islands,

which is one of the main challenges we have as Portsmouth to Jersey/Guernsey is one of the most expensive lanes of shipping in the world.

We order from UK suppliers which transport products down to Portsmouth. A shipping agent then oversees getting them on the ferry, which usually sails six days a week. However, the islands have huge tidal patterns to manage and, in the winter months, winds can mean ferries are cancelled.

The islands are quite a seasonal market, and visitor numbers are down due to local tourism being hit in recent years by the growth of low-cost air travel to other parts of Europe.

Being located on an island, we’re naturally restricted from an expansion standpoint as well, which is why customer service is so important.

It’s up to us to maintain fantastic relationships with our customers and continue to promote new product development and our growing range. l

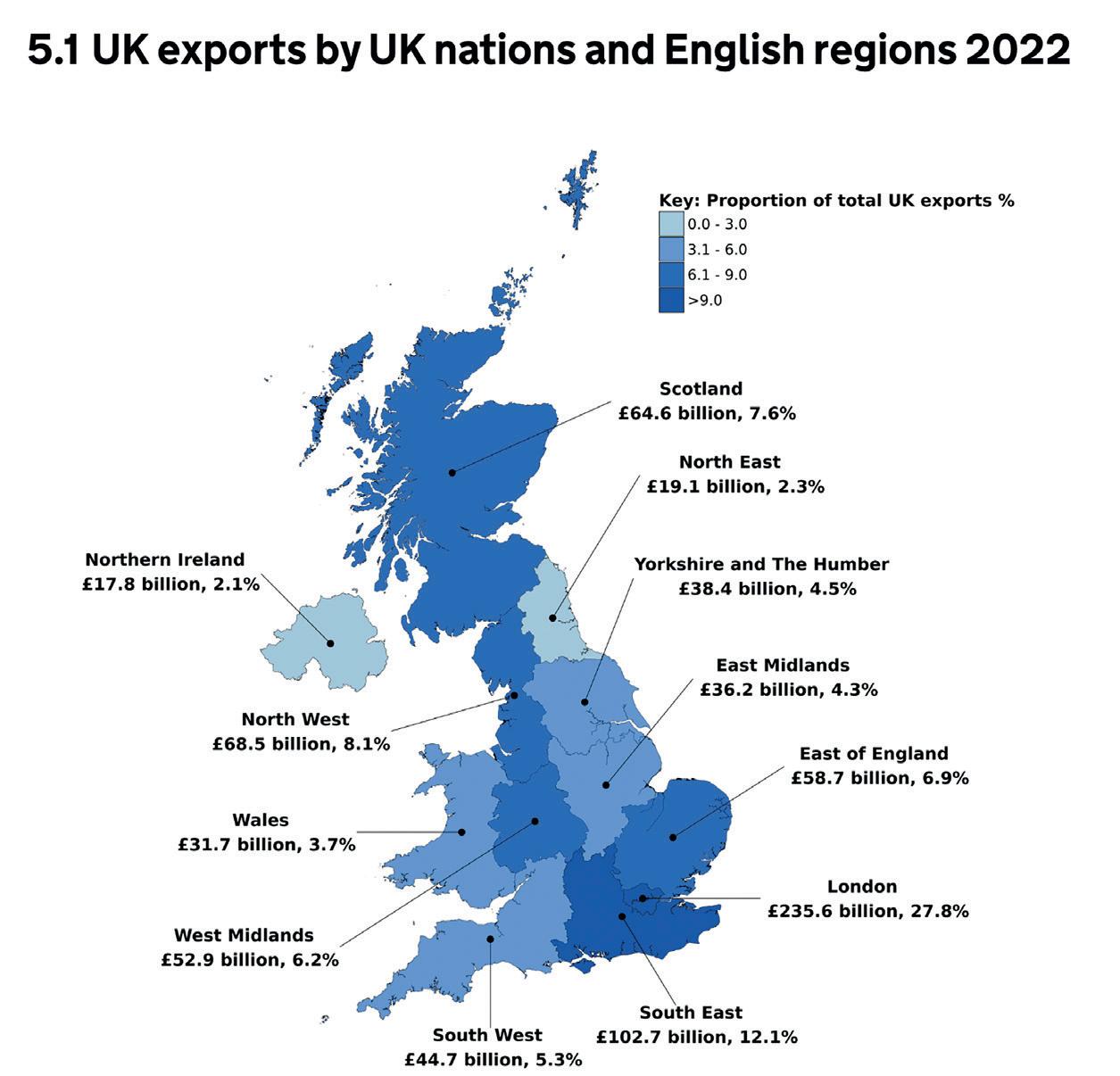

Paul Hill looks at how international trade can be a new avenue for wholesalers to differentiate their businesses

With inflation still squeezing margins and consumer behaviour evolving rapidly, many wholesalers are discovering that the best way to grow is to look beyond the UK.

The import and export of food-and-drink products has been brought to the public’s attention recently with President Trump’s tariff proposals. Once a niche or reactive part of the business, imports and exports is starting to become more of a vital pillar for certain wholesalers as they look to differentiate themselves in an ever-challenging market.

According to the UK’s Department for Business and Trade, food-and-drink exports were valued at £1,803bn in 2024, a 2.6% increase year on year, with imports into the UK worth £922.9bn.

These figures highlight a growing opportunity and a need for strategic positioning.

From exporting British brands to the Middle East, to introducing premium European fresh produce into UK foodservice, wholesalers can become logistics-savvy, compliance-conscious global operators.

But how can they make the leap from local to international –and what are the challenges, risks and real rewards?

“Diversifying into export was a game-changer for us,” says Debbie Harrison, joint managing director of Sheffield-based

wholesaler Pricecheck, whose business now trades in more than 100 countries.

The company found that what may be standard in the UK can be premium overseas.

Pricecheck’s export division now contributes more than a third of the company’s revenue, and has seen consistent annual growth. The business is proof that UK wholesalers can thrive abroad with the right strategy and structure in place.

At the heart of Pricecheck’s international growth is a mix of local market understanding, cultural sensitivity and regulatory preparation, with the compliance team ensuring correct labelling, customs documentation and

product certifications are in place for each market.

Harrison adds: “Research is key. While visiting the territory may seem obvious, it’s the best way to understand the markets.

“Consider target demographics, competitors and market trends, as well as whether it works alongside local regulations and cultural preferences.”

For many UK wholesalers, exports begin with food and drink brands that have strong heritage appeal. Biscuits, confectionery, sauces and even health-and-beauty products with UK provenance are in demand across Asia, Africa and the Middle East.

Crucially, it’s not just about big-volume players. Mid-sized wholesalers are also developing bespoke export arms, working

Food and drink exports for the year up to March 2025 (1.4% growth)

£881bn

Food and drink imports for the year up to March 2025 (3.8% growth)

£922.9bn

The number of GB businesses exporting 285,100

Proportion of GB businesses exporting 11.6%

LINDOR 38g

A key entry point to premiumise your singles range. Available in PMP.

LINDOR 200g Drive trade-up at key gifting seasons Create a winning range with the

with UK brands to serve diaspora markets or niche international retailers looking for UK innovation.

While the export opportunity is large, imports are just as vital— particularly in driving product innovation and satisfying demand from UK foodservice operators and retailers for fresh, sustainable and premium international lines.

One area of growth is fresh produce. UK wholesalers increasingly partner with international suppliers that offer year-round availability, high environmental standards and logistical reliability.

Wholesalers are even going as far as Australia for products, with government agencies such as Austrade acting as a bridge between suppliers and international clients, many of which fall into the wholesale category.

Austrade not only represents Aussie products from a promotional standpoint, but also acts a business facilitator.

Modern wholesalers must master not just the sourcing, but the speed. Whether it’s Pricecheck working in the Netherlands, or Belgian wholeslaler Calsa deliv-

ering to London within 16 hours, turnaround time is increasingly a competitive advantage.

Wholesalers are investing in digital inventory management, customs tech platforms and bonded warehousing to support fast, compliant trade.

Green logistics is also gaining traction, with importers and exporters alike looking to offset carbon footprints, reduce packaging waste and improve loading efficiency.

“We invested in 576 solar panels and reuse heat from our refrigeration,” says Jeroen Buyck, chief executive of Calsa. “Sustainability isn’t just ethical –it’s what our customers expect.”

In 2025 and beyond, global thinking is no longer optional for wholesalers – it’s imperative. For those willing to invest in compliance, partnerships and strategic market exploration, international trade is a powerful growth engine.

Whether you’re importing tomatoes from Belgium, exporting Cornish sea salt to Qatar or launching a private-label range in Poland, the tools, technology and demand are all there.

• Plant-based ready meals – High demand in Europe (Germany, Netherlands, Scandinavia)

• Craft alcohol (gin, whisky and cider) – Popular in Asia, US and Australia

• Superfoods (moringa, sea moss, jackfruit) –Import from Africa, Caribbean and Asia

• Functional drinks (kombucha and herbal tonics) – Import from US and Asia

• British cheeses and dairy alternatives –Export to Middle East and Asia

• Alternative proteins (insect and mushroombased) – Import from Thailand, Netherlands and Nordics

• Premium coffee and cocoa (single origin) –Import from Africa and Latin America

• Healthy and ethical snacks (gluten-free and sustainable) – Export to Asia and Gulf States

• Pan-Asian and African ingredients (gochujang, teff and yuzu) – Import into UK

• Classic British foods (tea, biscuits and jam) –Export to China, India and US

Expanding internationally is not just about revenue, it’s also about relevance. As UK consumers diversify their tastes and global markets look to British heritage and innovation, wholesalers that move early can establish long-lasting trade routes.

As the UK foodservice and convenience wholesale sector grapples with inflation, supply chain disruptions and evolving consumer tastes, one opportunity is standing out: looking beyond domestic borders. Importing innovative global products and exporting British specialities. l

• Conduct market research: demographics, demand, competition

• Register for an EORI number

• Understand labelling, packaging and compliance requirements in each country

• Use freight forwarders or customs brokers for ease

• Adapt your product assortment and pricing to market expectations

• Attend trade shows such as IFE, Gulfood and Anuga to make connections

• Test the market with small batches before full-scale launch

• Work with government and trade organisations such as Austrade for country-specific supply deals

• Vet your suppliers’ quality, accreditations and logistics capacity

• Check UK import requirements (e.g. FSA, customs tariffs, health certificates)

• Maintain cold-chain compliance for perishables

• Review duty and VAT implications for profitability

• Consider sustainability: carbon footprint, recyclable packaging

• Develop pilot campaigns to trial new categories or flavours

PH: How does VLAM’s business model work?

NVA: VLAM (Flanders’ Agricultural Marketing Board) is a non-profit organisation dedicated to promoting Flemish agricultural products domestically and internationally.

It operates primarily through a product-oriented approach, using specialised websites for fruits and vegetables (belgianfruitsandvegetables.eu) to connect foreign importers with Belgian suppliers.

VLAM’s activities include organising participation in international trade fairs and events, facilitating business-to-business connections and providing marketing support.

At VLAM, we want to facilitate the export of fruits and vegetables by supporting the Belgian

exporters and cooperatives in promoting the fresh produce with a generic approach.

What product trends and opportunities are emerging that UK wholesalers can take advantage of within the Belgian market?

The biggest advantage of Belgian fresh produce is the proximity to the UK. This allows the delivery often on the same day when the order was placed. This rapid turnaround is a significant advantage for UK wholesalers seeking to offer fresh fruits and vegetables to their customers.

Another important trend is quality and uniformity of our fresh produce. If you order tomatoes, you know what to expect – they will always be the same shape, the same colour and fresh.

Belgian companies, often family businesses, offer significant flexibility, allowing them to tailor their product offerings to meet the specific needs of UK wholesalers.

This adaptability can be beneficial in catering to niche markets or responding to changing consumer preferences. Besides that, Belgian companies have adapted their work with the continually changing Brexit guidelines. This has resulted in even larger volumes exporting to the UK.

Another key opportunity is the

wide range of products. Thanks to a long-standing tradition in trade, Belgian growers and exporters possess deep expertise in the British market.

They develop varieties the UK market demands, such as vine and cherry tomatoes, peppers, aubergines, leeks, strawberries, Conference pears, Belgian and curly endive. Pears in particular are available year-round.

How can wholesalers increase their product offering from Europe? For fresh produce, we particularly suggest to prioritise logistics

and freshness: short distance to the UK enables fast delivery – use this to offer ultra-fresh produce.

Wholesalers should also work directly with producers or co-ops in countries like ours to reduce middlemen, and improve pricing and control.

Lastly, focus on quality and sustainability – Belgian produce is grown with care and in controlled environments. l

Paul Hill speaks to the sales director of the leading alcohol wholesaler in Jersey

What’s the Randalls proposition?

The history of Randalls stems from two brothers back in the early 1800s who started working in breweries and eventually started one of their own. One went to Guernsey, the other stayed in Jersey to run the business that would become the Randalls of today. We carried on brewing under Edward Greenall until the 1990s, when we stopped and chose to invest in pubs instead, and then the brewery became the first to import beer into the island via Scotland and Newcastle.

Now we import all the wet products needed to run an ontrade hospitality business. We also supply the pubs we own, of course, as well as free trade customers, with the aim to always provide good-quality drinks at a decent price, while providing the best customer experience to the

venues we supply. We do this by treating our customers more like business partners.

What products do you trade in?

We work in pubs solely across Jersey and compete with three other drinks wholesalers on the island. We and Liberation are the only importers of draught beer and the only wholesalers who work across all alcohol categories. We also run and supply our own pubs, but also supply to independent outlets across the island.

We import many of our drinks from the UK as well as a few

products from Italy and France. We choose to go further afield because, despite the UK links of customer preferences like beer and ale, there is also the French influence with more wines consumed here compared with mainland UK.

When it comes to product development, we use the UK as a testing ground because there tends to be a similar response here, but that’s not to say everything that works on the mainland will succeed in Jersey. To facilitate this we work with one freight company to get the products into the port.

What gives your business its USP?

The history, certainly, but I think it’s mainly down to the fact that we’re always there for our customers and give them the support they need to grow. However, customer service isn’t really a USP anymore as a lot of companies have realised that they had to up their game in that field, but I like to think we do it very well.

What are your growth plans for the years ahead?

We bought an outlet in 2018 called The Boathouse, which was a big turning point for us as it was a two-floor restaurant/bar and, as a result, the first premium venue we worked with. This led to us evolving our product offering and it has worked very well. Following this, we bought a similar premium venue called Beach Club and this diverse strat-

egy is one we’ll be sticking with moving forward when the right acquisition opportunity arises in Jersey. As well as this, we’re also looking for a larger distribution centre due to outgrowing our current one.

What is the strategy for the next five-to-10 years?

We’re currently at 21 outlets and aiming to get to 25 in the coming years, which could be achieved by opening new facilities or buying customers we already supply to. The first step is a new PanAsian restaurant/bar called Nomu that should open later this year.

There is also an idea to slightly diversify into the hotel trade, although this is a very difficult market to crack.

There’s also the possibility of acquiring a food wholesaler, and we have looked at buying one in the recent past, but it was the wrong timing.

Overall, there’s no definitive

acquisition strategy in place – it’s instead a matter of considering the opportunity if the right offer comes up at the right time.

What is the biggest challenge that the business faces?

Working on the island, you’re restricted with how much you can expand, with it only being a population of 100,000 people and low footfall. It’s also difficult from a staff perspective, with work permits needed to work on the island. Wetherspoons has tried and failed to base its business here, which shows the difficulty companies face with legislation, freight costs, duties and location. Furthermore, although we have lower tax rates, everything else is so expensive that it balances out.

It’s hard to be unique on the Channel Islands, with most outlets tending to sell a bit of everything. For example, specialist vegan and craft beer places have opened and closed in recent years. l

Year formed 1823

Growth rate 5%

Fleet size 4 HGVs, 5 warehouse vans, 4 cellar services vehicles, 3 sales rep cars

Employees 450 including pub staff (50 head office and warehouse)

Pubs owned 45 (22 managed)

Buying group

The Wholesale Group

Paul Hill looks at how the global messaging technology is transforming the way wholesalers work

There’s been a growing influence of WhatsApp technology in wholesale recently and this stems from the success of the messaging app, which is the number-one digital communication platform in the world.

Some of the industry’s biggest wholesalers have established their own channels and shown how WhatsApp can quickly become an essential part of their business.

“The size of the opportunity isn’t exclusively for the big boys. WhatsApp costs and use are scalable depending on what each business needs, and the impact of the high engagement the platform offers can be felt across customer groups of any size,” explains Lauren Johnson, head of impulse e-commerce at Mars Wrigley.

Rob Mannion, chief executive of b2b.store, adds: “With nearly three billion global users of the

• Nearly three billion WhatsApp users in 100-plus countries

• Eighty per cent of UK phone users say WhatsApp is their most-regularly-used messaging service

• Meta reports a 98% read rate for messages, compared to an average of 22% for emails

• More than 94% of total global internet users used or visited chat or messaging apps more than once in the past month

• Compared with SMS, b2b.store customers reported a 9% spend increase after receiving a WhatsApp message

• A Meta survey found marketers using messaging see a 58% increase in leads

• 75% of people in a Gartner survey said they wanted businesses to communicate by messaging

• Users of b2b.store’s WhatsApp platform have seen 188% higher open rates compared with the reported average for email

free consumer app, that’s what most people think of when asked about WhatsApp, but there are three versions to choose from.

“WhatsApp Business is a free downloadable app aimed at SMEs with basic upgrades to sell products in small quantities, while WhatsApp Business API, is a service that enables software businesses to build apps of their own to interact with WhatsApp’s infrastructure.

“It’s more powerful, and gives

businesses the chance to harness WhatsApp’s huge captive audience with an enhanced messaging experience.”

Mars Wrigley and b2b.store recently partnered to create a guide to the technology specifically aimed at the wholesale channel. Wholesalers can check out the full guide (b2b.store/download-b2bwhatsapp-guide) to see how the global messaging technology is transforming the way wholesale businesses work.l

1. Make and stick to a content plan: At the heart of every successful content channel is a plan, and WhatsApp is no different. It is advisable to have a clear map of what you’ll be posting and when.

2. Have clear calls to action: It sounds like an obvious point to make, but having a clearly defined idea of what you want a customer to do before sending a message is the place to start. Sometimes the whole point of sending a message gets forgotten.

3. Speak to people how they want to be spoken to: Tone of voice is crucial in any communication, but it’s doubly important on a platform like WhatsApp because it’s primarily an informal place to chat with friends and family.

4. Split your strategy: Content is rarely a onesize-fits-all thing, so segmenting your customers depending on their preferences could be the best way to maximise engagement.

5. Keep an eye on the results that each message achieves: Track what’s working – and what’s not – by watching the message analytics to see what’s being read and engaged with most. Having the ability to see message performance isn’t available on the free versions of WhatsApp, so is a clear example of an added service that professionalises your messaging strategy.

• Identify which WhatsApp use is most relevant to your business

• Understand your audience and what type of messages will resonate best with them

• Pick a WhatsApp provider to fit your needs

• Fulfil all WhatsApp Business API criteria to successfully set up an account

• Double-check all GDPR and data security considerations are taken into account

• Create a full content strategy to plan out when and what you will send

• Work on message templates and ensure you’re using all relevant functionality to make the best message experience

• Follow messaging best practice in order to get the best possible customer engagement

• Continue to review analytics and amend approach based on data

As we enter the busy summer months, freshfruit-and-veg wholesaler Smith & Brock has turned to foodservice logistics company Podfather to optimise its fleet logistics and improve service.

The software is helping the foodservice wholesaler make its 7,000-or-so deliveries a week to restaurants, hotels and caterers without getting bogged down by a paper-based workflow.

The old system caused huge problems when items weren’t delivered, as the depot had to wait

for paper manifests to come back before sorting resolutions, meaning delays and second deliveries.

The wholesaler is using Podfather’s logistics planning, route optimisation and ePOD solution across the board, and as well as improving overall service, it is also helping achieve its green goals.

Co-founder Nick Fowler said: “The primary driver for change was financial reasons. With early morning or even overnight deliveries to sites where there were potentially multiple kitchens or preparation rooms, we had no way of proving exactly what was

delivered, when it was delivered or where it was left.

“At best, we had a scratchy signature on a paper manifest. This meant we had either to rectify the shortfall, which meant another delivery, or give a credit note, neither of which was great for a growing business.”

At JJ Foodservice, walk-in customers can now avail themselves of the same offers as customers pre-ordering online, thanks to the introduction of new self-service kiosks across its depot network.

The kiosks have proved to be a hit with customers – they took in approximately £575,000 of orders

in the first month after going live.

“The best way to save at JJ was to order online in advance – but that meant counter customers were missing out,” said chief operating officer Kaan Hendekli.

“Now, they can enjoy the same savings in branch, with our quick and easy-to-use kiosks. The response has been fantastic. The kiosks are making shopping even easier, saving customers time, reducing costs and improving convenience nationwide.”

Meanwhile, foodservice giant Brakes has launched a Ways To Save scheme, aimed at helping independent food businesses.

As well as Ways To Save, which offers ideas on reducing costs and waste, alongside recipe ideas – all prominently displayed on its website – it has launched a cashback offer, covering more than 500 Sysco Classic products and giving up to 20% off further Sysco and branded products.

Harlech Foodservice’s new price-comparison tool, meanwhile, is helping customers benchmark prices for its 50 bestselling products against

Booker prices – helping them to make savings.

The Harlech 50 is updated every Monday and, in March, showed 14% savings. Head of purchasing Josie Swift said the check gives customers security and is disrupting the market.

Unilever Food Solutions UK&I (UFS) has launched the third of its annual Future Menus reports, looking at how the

foodservice sector can appeal to Gen Z consumers. The demographic is the only one where a majority eat out at least once a week, with a quarter eating out “multiple” times each week.

More overwhelmed by long menus than other groups, they are keen on “adventurous, global cuisine”.

Key trends for Gen Z-ers are borderless cuisine (diverse food influenced by globalisation and migration); street-food couture (gourmet street food); diner-designed personal and immersive dining experiences; and modernised comfort food.

Assessing latest trends, Quorn recently said that as consumer confidence continues to return, elements such as sustainability and health will come to the fore, as well as noting that consumers –more than half – are increasingly considering protein in their diet.

Sustainability, in the form of reducing waste, is also one of the key trends identified by St Pierre Groupe, alongside premiumisa-

• Elite Fine Foods has added to its NPD range, Elevate, with the launch of New Yorker Bagels. The Sussex-based wholesaler, which is part of Caterfood Buying Group (CFBG), is importing the bagels, which are made in the US, with seven flavours on offer. They’re available exclusively through Elite, before being made available to other CFBG members.

• Over in foodservice kitchens, Prowrap has launched Speedwrap Pro into the foodservice channel, a new cling film that aims to make kitchens safer, thanks to its sheathed cutting blade. It also reduces plastic waste. Prowrap’s XL foil sheets are also being recommended for larger food items, such as burgers and burritos.

• On an international level, Zest Food Partners has formed a partnership with Belgium potato products supplier Global Fries for its entry into the UK foodservice wholesale market. This collaboration will see Zest lead on sales and marketing support, helping Global Fries establish a strong foothold in key areas of wholesale. The partnership will provide support to foodservice buying groups and their members, including trade-show participation, regular account management and development, and customer visits.

tion and indulgence.

The Phat Pasty Co, meanwhile, has been looking into the public’s ongoing love with Cornish pasties. Its research shows that almost nine in 10 consumers want British meat, and almost three-quarters would be aggrieved if they bought food labelled ‘British’ that didn’t contain mainly homegrown product.

More than half the population eat a sausage roll or pasty at least once a fortnight, while around 42% are interested in meat-free and plant-based pasty options.

In personnel news, Birchall Foodservice has made a raft of promotions to its leadership team, with Gill Smith appointed as managing director, Nicola Watson becoming commercial director and Steve Chadwick taking on the role of head of sales and marketing.

The company said the three appointments were part of its strategy to promote from within and nurture talent at its Burnley headquarters. l

• Frank Dale Foodservice has launched two products for buffet-style eating and afternoon teas, with both a mini topped naan bread selection and a mini chocolatesponge-cake selection available from its food distributor Central Foods. The former features 15 types of topped mini garlic & coriander naan – Bombay potatoes, aubergine & red pepper curry, and red lentil & spinach dahl.

• Lamb Weston has “reimagined” the classic chip with its new Frenzy Fries. The company said the three-sided fries offer a “perfectly imperfect” shape.

• Delice de France’s spring/summer range for this year includes 42 new products, taking in current trends such as international flavours with its Continental savouries range. There’s also an international flavour to many of its sweet products, with a range of three authentic Pastel de Nata products from Portugal and Cardamom Knots.

• Pallini Limoncello, the world’s leading brand for the drink by volume, has announced a new deal with Proof Drinks as its exclusive UK distributor.

• Old J Spiced Rum has got together with condiment and sauce specialist Tubby Tom’s for the rum company’s first move into the foodservice market. Pineapple Honey Glaze is a sticky and sweet spiced glaze infused with Old J’s Pineapple Spiced Rum.

Phil Atyeo, managing director

BWI: What has been your most significant achievement over the past 12 months?

PA: This is hard to pick as we’ve had so much going on at Caterfood Buying Group (CFBG) in the past year. As we continue to grow, we have developed our central team in order to support the members where required and to further accelerate new and ongoing projects. Our Caterfood Collection products have also grown substantially, with ranges covering the day-today requirements of our customers, but also stepping into premium and innovative lines.

CFBG now also comprises eight strong and individual members, with the acquisition of Hull-based Turner Price in July 2024, which is a fantastic business with a phenomenal team and has been a great addition. It has also added the much-needed geographical reach of the north of England to our buying group.

What is your unique selling point?

That we’re different. At CFBG, we’re genuinely building a new way of doing business, and that’s with our suppliers and our members. We want the very best products for our customers and to create mutually beneficial working relationships with our suppliers. That includes working with smaller, more artisan suppliers that perhaps have never worked with a wholesaler or buying group before. Nevertheless, if they have a great product, we’ll provide them with the support to get their brand into the foodservice market.

Price

Number of members 8 Group buying power £300m

We also encourage a truly collaborative ethos between our eight members: we are all here to help each other, to share resources, ideas and best practice, and to learn from each other.

How have you expanded and attracted new members over the past 12 months?

We have been doing a lot of work internally to make sure we have the best people, products and processes in place to support CFBG as we continue to grow. This means that when we do acquire more members, we will continue to be in great shape to support and onboard those businesses, growing the group as efficiently and collaboratively as possible. With the growth of CFBG in the foodservice market and our increased brand presence, we have had multiple conversations with prospective new members and affiliate members, which is very exciting. In most cases, it is businesses reaching out to us because they are intrigued about CFBG and keen to be a part of its future.

What are your plans to help members over the next 12 months? Our priority is always to make sure that our member businesses each have the right support, functionality and plans in place to support them in the current market, and to prepare for sustainable future growth for their business.

On top of that, our focus right now is on our own brand, Caterfood Collection, which is growing incredibly quickly and has some exceptional products within it. We have three tiers – Caterfood Basics, Select and Premium – and it’s all about developing fantastic products at great prices to give our members a compelling own-label proposition.

We have just launched our first Caterfood Premium product, which is a range of Ultra Crunch fries, available in four different sizes. We spent a lot of time comparing and taste-testing all of the top manufacturers in the industry to find a superior product that we wanted to put our name to. On top of having an excellent product, we know that we can offer these premium chips at a competitive price. l

At Caterfood Buying Group we’re proud to do things differently. We put our members, people and products first; championing great food and the way it brings people together. We have ambitious plans and will achieve them by working collaboratively with our suppliers and members.

JOIN US FOR THE JOURNEY

We’re always happy to hear from like-minded people and businesses. If you want to join Caterfood Buying Group or are interested in building a partnership with us - let’s talk.

Gary Mullineux, managing director

BWI: What has been your most significant achievement over the past 12 months?

GM: Over the past 12 months, Caterforce and its members have achieved outstanding milestones, underlining the group’s unwavering commitment to growth, innovation and collaboration.

The group’s combined turnover has surged to £870m – a 10% year-on-year increase and a remarkable 62% rise since 2019, far exceeding the market’s 25% growth. This momentum was celebrated at Caterforce’s largest-ever biennial conference, held at Wembley Stadium in November 2024, where more than 350 members, suppliers and partners convened to explore future strategies around digital innovation, AI integration and sustainability.

What is your unique selling point?

With nine members and a combined turnover of £870m, Caterforce offers suppliers one of the most efficient, cost-effective routes to access 46,000 foodservice customers across the UK and Ireland. Our bespoke Price Hub platform delivers pricing transparency for members while significantly streamlining administration for suppliers, enhancing accuracy and operational efficiency.

What truly sets Caterforce apart is the quality of our data. Our dedicated head-office data team maintains bestin-class standards, ensuring clean, reliable information. And the insights generated through our Sales Hub provide suppliers with actionable data on product performance across the group.

Foodservice customers 46,000

Collaboration is central to our culture. With no competition clauses, members freely share knowledge and best practices in a uniquely supportive environment. Each member is a proud regional champion, and every one of them holds a seat at the board table – actively shaping the group’s strategic direction.

What are your plans to help members over the next 12 months?

Over the next 12 months, Caterforce will continue to support its members with a strong focus on value, innovation and growth. With no membership fee and a commitment to delivering commercial returns, members benefit from all the advantages of group buying, including competitive pricing through economies of scale.

Last year, members benefited from a 13% increase in income distribution, reflecting the group’s strong performance. Our central team will continue to manage multiple commodity tenders to secure the best prices and highest-quality products.

Members also benefit from six Supplier Presentation Days, offering opportunities to discover new products and build supplier relationships.

Our five exclusive, award-winning own-brand ranges already offer a competitive edge, and this year we’re expanding them with 50 product

Year-on-year

launches, further strengthening member offerings. In addition, Caterforce provides full-service marketing support, including PR, award entries, photography, email platforms, seasonal food and drink trend guides, and multichannel recipe content to inspire customers. Additionally, this year, our focus is on supporting members’ sales teams –encouraging collaboration at all levels, facilitating a culture of learning from each other and sharing best practice.

What are the biggest challenges for your members over the next 12 months?

Over the next 12 months, our members will face the same challenges affecting the entire foodservice sector, such as rising operational costs and the ongoing impact of the cost-of-living crisis on consumer spending. In response, Caterforce will focus on supporting its members with the right product mix at the right prices.

Through strategic commodity tendering, competitive group buying and the expansion of our award-winning ownbrand ranges, we aim to help members protect profitability without compromising on quality.

Our pricing strategies, underpinned by robust data and insight, will ensure members stay agile. l

46,000 customers £870m turnover

9 members

David Lunt, managing director

BWI: What are the key elements of your buying group?

DL: We have two companies in the group – National Buying Consortium (NBC) and National Distribution Network (NDN). The group is an independent, member-owned business whose members service retail, foodservice, hospitality, e-commerce and export channels, delivering directly to more than 45,000 outlets. NBC takes care of all matters relating to the activities of a typical buying group, and NDN is our route-to-market solution. All members of the group are shareholders and they receive benefits of membership without any management fees.

What are your unique selling points?

For our members, we operate as a consortium, which means we can undertake business activities and achieve results way beyond the resources of a single member. The benefits of this are clear – our members get the brands they need, and at prices that allow them to be competitive. In addition, we provide specific support through the NBC Toolkit so that our members can market their businesses to their customers.

We offer these benefits:

• Our members get access to brands at competitive prices and realistic quantities.

• Our suppliers’ brands get access to our members through one contact point.

Number of members 65

• Brands get to their consumers through a safe and flexible supply chain with reduced credit risk exposure, centralised order-to-cash facilities and centralised bulk purchasing.

In this way, we operate as a fully integrated business for members and suppliers.

How have you expanded and attracted new members over the past 12 months?

We have expanded carefully, making sure potential new members share our values and will add strength to the group. As part of this, we introduced an associate membership category that allows the group and potential new members to get to know each other before the last step of shareholding.

What do your members think of the group?

One of our more recent members, 6868 Fast Food, had this to say: “We considered very carefully the various options we saw for joining a buying group and we chose NBC because we felt like we would be part of the family, not just another number. In addition, the flexibility of its associate membership option really provided us with a ‘yes, please’

decision without a major outlay of first-year management fees.”

What do suppliers think of the group?

One of our more recent additions as a new supplier, Capri-Sun, said: “Since we started trading in 2024, our sales through the NBC group have grown consistently each period. We have surpassed all expectations and the trading members have been engaged and keen to collaborate with us. We set up supply and invoicing via NDN right at the start and this has been the basis of driving our growth with the group.

“The team have been really efficient and positive to work alongside. This allows time for us to focus on driving end-user engagement to develop further when ordinarily members might not be able to meet the minimum-order-quantity criteria.”

What are your plans to help members over the next 12 months?

Working to improve the supply chain processes between our members and suppliers. By providing the services of a fully integrated business, we truly believe we are the alternative buying group. l

Our members service retail, foodservice, hospitality, e-commerce and export channels and deliver a wide variety of brands to over 45000 outlets.

NBC CAN BE YOUR PARTNER TO MAKE A REAL DIFFERENCE TO YOUR BUSINESS

Daniel Larkin, chief commercial officer

BWI: What has been your most significant achievement over the past 12 months?

DL: At Sterling Supergroup, our members are our top priority.

As the original foodservice buying group, and with nearly six decades of experience, we take a personalised approach to support each member, ensuring their unique needs are met. With a not-for-profit model, we are the trusted partner for independent wholesalers seeking long-term growth and success.

The past year has brought significant positive changes to our group, enhancing our offerings to members. Our dynamic head-office team has expanded with new commercial and marketing capabilities, leading to a new website and improved branding. Our new member marketing support includes our monthly publication, Under Our Hat, which provides market information, event news and promotions.

We have added many new lines to our Sterling Caterers Essentials brand, including award-winning products. Additionally, we welcomed three new members – Mason Foodservice, Golden Glen and Inter Fresh Produce.

What is your unique selling point?

As a not-for-profit with a member-led board and no joining fee, all profits are returned to our members, ensuring they benefit directly from our shared success. We drive profitability through centralised supplier promotions, efficient rebate management, and competitive, transparent pricing.

Number of members 34

Members enjoy exclusive access to the Sterling Caterers Essentials brand, now valued at more than £30m.

The more they support the brand, the greater the benefits for all. While the range is award-winning and competitively priced, we recognise every member is unique.

They require the flexibility to make decisions tailored to their business needs, free from constraints imposed by a head office to meet compliance levels.

Our members span key locations across the UK and Ireland, meeting local demand while using the group’s collective strength and the SCE brand to stand out from the competition.

How have you expanded and attracted new members over the past 12 months?

We’ve increased our brand visibility within the foodservice sector. Recent marketing efforts, including a new membership information pack, have helped us welcome three new members and engage with other independent wholesalers.

A new buyer at head office has also strengthened our ability to secure competitive terms, pricing and promotions. We continue to enhance member benefits through strategic partnerships and stronger supplier relationships. Our online presence has improved

In partnership with

with a new asset library and marketing materials for the Sterling Caterers Essentials brand. We’re also expanding our award-winning own-brand range and are actively developing new products with suppliers.

What are your plans to help members over the next 12 months?

Sterling Supergroup has always seamlessly blended community with commerce, a tradition we continue to strengthen. Our extensive experience provides a solid foundation for confidently adapting to future changes, enabling us to support our members in this evolving industry.

We focus on sharing our expertise and helping our members grow their businesses by offering dedicated support and essential tools.

We will enhance our event portfolio by introducing a ‘Meet the Member’ opportunity, alongside our spring exhibition, September conference and member buying meetings.

These events will build stronger relationships between members and suppliers, providing suppliers with a platform to promote their products. l

For more information, please head to sterlingsgroup.co.uk

"Thanks to Sterling, we've seen accelerated growth in our business, due to having access to a direct supply of products and being able to share information with like-minded people in the group.

Sterling head office provides us with excellent support as well as helping to negotiate competitive prices and special offers.

It's so good, we use their award winning Caterers Essentials range as our bwn label; giving us exclusivity in our delivery area.

The Sterling trade shows throughout the year are also a great place to meet and connect with others in the industry and discover even more fantastic deals!

They also offer very effective Member Marketing Support, and a monthly publication "Under Our Hat" that includes own label and member updates, and priceless market information. In summary, being part of the � Supergroup has had a hugely positive impact on our business."

In partnership with

Emma Senior, managing director

BWI: What has been your most significant achievement over the past 12 months?

ES: I took over the role of Sugro managing director nearly three years ago. It has been a very busy few years, we moved offices two years ago and took the opportunity to also completely rebrand. Last year was a milestone for the business, as we celebrated our 40th anniversary. We also achieved 19 years of consecutive growth in overall trading.

Our membership continued to thrive with numerous new members and suppliers joining us, extending our focus from traditional categories such as chocolate and confectionery to other lines such as everyday grocery items and foodservice.

Finally, I am extremely proud that we were the number-one buying group in the prestigious Advantage Group Survey for the second year running.

What is your unique selling point?

Our variety of members and the digital offering we provide them is unique. Because we are member-owned, we really must determine what our members need from us. There is no point launching something that isn’t going to work for them, and the digital element is an area we were very quick to move on, ahead of others in the sector. We were also the first in the industry to offer retail and, more recently, foodservice sample boxes.

Sugro is known as the ‘family buying group’, and that is very true – our members support each other and our team works very hard to understand its

Convenience and foodservice Sectors operating in

£2.5bn

Number of members 90 Group buying power

unique businesses to ensure they have the right offer.

How have you expanded and attracted new members over the past 12 months?

We don’t have a target for growing our member numbers. Our strategy is to develop our existing members and gradually add new ones if they are the right fit for the Sugro Group.

Having said that, five new members have joined the group this year, but if we had no others for the rest of 2025, that would be fine. We don’t have a definitive target in mind. We are very transparent in our recruitment criteria and wouldn’t want to offer false hope of deliverables if they weren’t possible. However, we are always keen to talk to potential new members.

The main reason wholesalers join us is the increase in buying power we provide and our support in accessing suppliers. We have two large UK events, which enable members to engage with those suppliers.

This is particularly useful for those smaller-to-medium-sized wholesalers

that otherwise would not speak to manufacturers.

What are your plans to help members over the next 12 months?

Having worked in a larger manufacturer for 20 years (Mondelez/ Cadbury), I have a very good understanding of what suppliers want from buying groups, so it is key to align those needs to those of our members.

The right digital offering is key to all parties and the Advantage Survey recognised Sugro as being ahead of its competitors. We have our main partner, b2b.store, in addition to our own in-house web and ordering solutions.

Working with key suppliers, we also plan to continue our category support through our Drive your Sales platform. This is our digital magazine, which offers our members key advice.

We are also continuing to support members who face issues with increasing minimum order quantities, by using our distribution partner, Forrest Fresh. Finally, we are starting to explore AI options to understand how we might support this area. l

OVER 40 YEARS OF TRADING WITH EXCELLENT DIGITAL SOLUTIONS: ALL-IN-ONE ECOMMERCE SOLUTION WITH PERSONALISED APP AND WEB DEVELOPMENT, OPEN BANKING, E-LOYALTY REWARDS SCHEME AND WHATSAPP FOR BUSINESS CAPABILITIES

• Member-Owned Buying Group with Diversity and Focus on Growth at its Heart

• Industry Leading Promotions across all Impulse, Grocery, Food Service and Non-Food Categories

• Central Distribution and Central Invoicing Services

• Dedicated Business Development Support

• Events Calendar including two Annual Trade Shows and Overseas Convention

• Personalised Marketing Leaflets

• Full Category Support via Sugro Digital Drive Your Sales Magazine and Online Portal

• Opportunity to Join Sugro Insight Service (SIS)

• Digital Signage and Procurement Services

John Kinney, managing director

BWI: What has been your most significant achievement over the past 12 months?

JK: Our members and supplier partners have seen how Unitas Wholesale’s unrivalled scale and commitment to providing a Fitter, Fairer and Faster service is delivering incremental benefits for wholesalers, and measurable return on investment for suppliers.

With no other shareholders or directors taking dividends, and no requirement for the central operation to build its bank balance year on year, we were able to increase the revenue returned to members by 17%, and by 35% over the past five years.

That’s in addition to more than £3m in cost savings through our Unitas Procurement scheme for business consumables, and a significant cashflow boost for members from faster turnaround of invoices and retro payments

Suppliers have also reaped the rewards of this partnership, with Unitas members outperforming the total retail market in impulse, soft drinks, confectionery, non-edible grocery, tobacco alternatives and frozen during 2024. This is just one of the reasons that suppliers voted us their number-one retail wholesaler in the 2025 Advantage Report.

Unitas also had a record number of suppliers exhibiting at our trade show, connect25, and attending our conference in Portugal, which provided the perfect platform for insight, knowledge sharing and relationship building.

What is your unique selling point?

Representing more than a quarter of the entire wholesale sector, Unitas members offer brand owners incredible reach into more than 180,000 retail, foodservice and on-trade customers.

Their combined turnover is more than twice that of any other buying group, and more than three times in retail. Thirteen of our members feature in The Grocer magazine’s Big 30 list of the UK’s leading wholesalers. We leverage this unbeatable buying power to offer members the best trading terms and conditions available and, unlike other buying groups, every penny of those centrallynegotiated terms goes directly to wholesaler members, who are Unitas’ sole owners.

How have you expanded and attracted new members over the past 12 months?

Our focus is on delivering a Fitter, Fairer, Faster service for our existing members. This year we have introduced a new £2m incentive scheme for members who are active in our promotional schemes and Support Centre initiatives. We think it is fair that those who contribute most to the group receive the most from it.

Rewarding members for their participation works for suppliers, too, as it means Unitas is actively incentivising greater compliance in promotions and product launches.

What are your plans to help members over the next 12 months? We are building on the added value our Support Centre provides through promotional programmes. Our retail and foodservice promotions are built around key events in the calendar, all backed with huge support and innovation from suppliers. Promotional activity is publicised through depot, store, print and online materials, aimed at both customers and consumers.

We also provide depot and store merchandising materials, support for retailers and caterers, in addition to consumer-facing leaflets. We’re helping members introduce digital screens into depots to spotlight their partnerships with suppliers.

In the coming months, we will be revamping the Plan for Profit resource for retailers and expanding our own-brand range to give consumers that all-important value alternative to mainstream brands. Our Meet the Member events in June (on-trade) and July (foodservice) will give suppliers dedicated access to our wholesalers. l

BWI: What has been your most significant achievement over the past 12 months?

TG & JD: The Wholesale Group was formed on 1 January 2025, bringing together two groups with more than 90 years of wholesale experience.

Our most significant achievement is that, already, we have 257 wholesale members with a combined turnover of £4.52bn, accounting for 13.7% of the UK wholesale market.

Since inception, we have welcomed 15 new members who have chosen us having been previous members of other buying groups.

What is your unique selling point?

We are the home of independent wholesale and passionate about supporting independent family businesses, many of which have been in operation for multiple generations. We, too, are a family business, and we recognise what drives these businesses forward, with our shared vision and values at the heart of what we do.

The Wholesale Group is incredibly proud of its talented and highly experienced head-office team. Our collective expertise spans every aspect of wholesale, from buying to own brand, ensuring that our knowledge across the board is second to none.

As a group, we are focused on service and underpinned by the latest technology. We use data to drive incremental growth with both our suppliers and members. Our focus on technology is demonstrated brilliantly by our Accelerate platform. This platform provides extraordinary

Tom Gittins and Jess Douglas, joint managing directors

Number of members 257

value for members and suppliers, providing access to all our products, prices, specifications and promotions, saving them significant time and resource.

We also have a central distribution facility and geographical hubs, which support our smaller members. Through this data, we can see where products end up, and we work closely with suppliers to maximise their supply-chain efficiency. Every member gets a share of the profits, and the more turnover members put through the group and the more members engage with our head-office marketing campaigns, the higher proportion of profit they receive at the end of the year.

Pre-merger, we have grown profit share every year since 2020 and we are committed to supporting growth for all members. This support includes a packed promotional calendar, group events, a ready-to-use toolkit of sales resources and marketing materials, and our industry-leading digital magazine and website, Chef Insider.

What are your plans to help members over the next 12 months?

To satisfy demand for high-quality, professional products created specif-

£4.52bn

ically for the needs of chefs, caterers and industry kitchens, The Wholesale Group has created an own brand, Chef Assured. The range provides a core range of high-quality foodservice products for everyday use, supported by two sub-brands: Chef Prestige, a range of premium ingredients delivering exceptional taste and specification, and Chef Hygiene, providing cleaning, hygiene and janitorial solutions.

We will continue to lead from the front with our focus on using technology to support members and suppliers as we further develop our Accelerate, Data Insight and AI projects over the coming months.

In addition, we provide our members and supplier partners with a series of events where they can plan for the months and years ahead.

We have held three events so far in 2025, including our first trade show in March, which saw more than 100 supplier brands represented and 600 people in attendance.

Our foodservice fair takes place in September, and our annual conference is in October. All our events are free to members l

Tamara Birch

Price-marked packs (PMPs) are more in demand than ever, as consumers look for better value from convenience stores. In fact, when purchasing PMPs, more than half of shoppers (51%) feel reassured they are not being overcharged.

Brands are also core drivers for shopping PMPs, but price remains a key consideration, ranking number two in importance and sitting in the front of mind when shopping the PMP fixture.

“Shoppers are more careful about what they spend their money on,” says a Red Bull spokesperson. “In this instance, PMPs can be a purchase driver, helping to deliver a perception of value to shoppers, therefore wholesalers can support retailers and their customers and make their decisions in store easier by supplying PMP options.”

Paul Muench Wholesale and convenience national account manager, Cereal Partners UK

“One of the key trends we’re seeing is increased shopper demand for transparency and value – especially in the current economic climate. PMPs offer a clear price that builds trust and reassures consumers they’re getting a fair deal. There’s also a noticeable shift towards healthier options within the PMP space, with high-fibre and low-sugar varieties. Finally, we’re seeing more crossover innovation, to meet evolving shopper tastes.

“To boost core range sales, wholesalers should focus on stocking the most in-demand, recognisable brands in PMP format, while ensuring consistent availability. Clear depot visibility and strong product placement

can also drive engagement and encourage retailers to buy into the range. Education is key – sharing insights with retailers on shopper behaviour and the benefits of PMPs can help increase buy-in and loyalty to core lines.

“At CPUK, we offer a wide range of PMPs across our bestselling brands, including Shredded Wheat, Shreddies, Cheerios and Nesquik. These are tailored specifically for the wholesale and convenience channels to help drive consumer trust and sales. We work closely with our wholesale partners to ensure they have the right range, promotional support and visibility in-depot to make the most of PMP opportunities.”

Ben Parker, vice-president of commercial off-trade UK at Carlsberg Britvic, echoes this and says that wholesalers that stock PMPs can signal to shoppers and retailers that they understand the current market challenges and are providing affordable options for consumers.

“Wholesalers can meet shopper needs within PMPs by stocking popular brands in a variety of PMPs, catering to different occasions, such as food to go and nights in, and signposting this value to retailers,” he says.

A product that achieves this could be the new Robinsons 750ml plus 33% extra pricemarked bottle at £1.59 in Orange and Apple & Blackcurrant single strength.

Also within soft drinks, sports and energy is a key sector for PMPs, according to the Red Bull spokesperson, delivering £60m

Robinsons £1.59 750ml Squash – This new soft drink PMP is exclusive to wholesalers, and spans Robinsons’ Orange and Apple & Blackcurrant single-concentrate flavours.

Red Bull Summer Edition White Peach – Red Bull’s latest Editions flavour is available in £1.65 PMP cans, as well as 250ml plain packs and 355ml sugar-free versions.

in value growth annually, a 7.3% increase. “Sports and energy contributed 65% of all PMP growth this year, with Red Bull delivering more than half of this growth, adding £31m in value, up 14% versus year annum,” the spokesperson says.

To help wholesalers maximise this growth opportunity, Red Bull launched its latest Summer Edition variety in a White Peach flavour, available now in £1.65 PMP cans.

“Demand for flavoured energy drinks within the PMP category has never been stronger, acting as an entry point to the category, making it a key area in driving penetration and recruiting new shoppers,” the spokesperson adds.

Wholesalers stocking new products in a PMP variety entices retailers to stock up, as it helps meet the ongoing shopper mission of offering the right price.

Nik Naks Tangy ’N’ Cheesy £1.25 PMP – Nik Naks Tangy ’N’ Cheesy combines the brands Nik Naks texture with a cheese flavour and is available as a £1.25 PMP.

Monster Lando Norris Zero Sugar – Monster has partnered with British F1 driver Lando Norris to launch a Zero Sugar variety. It will be available from June in PMP 500ml cans.

In fact, if a retailer stocks primarily PMPs, product launches in this format could encourage them to stockpile.

Wholesalers can also help PMPs stand out with the right displays in depot, especially near the till, for any last-minute purchases.

Fifty-seven per cent of impulse shoppers buy PMPs within the crisps, snacks, nuts and popcorn (CSNP) segment, driving £325m in sales. Stuart Graham, head of convenience and impulse at KP Snacks, says £1.25 PMPs are a key format for wholesalers, independents and symbol stores to focus on, as it accounts for 50% of CSNP sales, worth £324m in the wider category.

“Eighteen of the top 20 bestselling lines are £1.25 PMP and, of those, six are KP brands,” Graham says. “Our range of

Peperami £1 Chicken Bites – Peperami Chicken Bites single packs come in Tikka and Roasted flavours. Each 45g pack contains 95 calories and comes in a £1 PMP.

Kepak PMP rebrand – Kepak has launched new imagery and product names for its core PMP range: The Iconic Quarter Pounder and The Ultimate Chicken Sandwich.

large-format PMPs is worth £122.6m and our range includes Hula Hoops Big Hoops BBQ Beef, McCoy’s Flame Grilled Steak, Nik Naks Nice ’N’ Spicy and Nik Naks Rib ’N’ Saucy.”

These larger-format PMPs are a strong choice for ‘hunger-fill missions’, while smaller formats offer higher value and meet daytime snacking and occasions where consumers need something to tide them over.

Graham points towards the

likes of Space Raiders (40p PMP), Discos, Skips and Wheat Crunchies (50p PMP), as well as Hula Hoops and Pom-Bear (65p PMP) as must-stock lines.

Fresh and chilled snacks

Meanwhile, fresh-and-chilled snack options could include Peperami, which recently launched a £1 PMP Chicken Bites range, or Rustlers’ redesigned PMP range.

The manufacturer plans to