RECENTLY, I’ve got into mahjong, a tile-based game similar to poker where the winner is determined by the hands they play.

I’ve been playing at a café where, a er regular service hours, the dining area is converted to make space for four separate mahjong games.

The café is a similar size to many convenience stores, measuring between an estimated 800 and 1,000sq .

It hosts several games every month, with each session sold out within several days.

Every session has 16 players in total, meaning the owner has found a great way of generating additional revenue outside of his normal business.

There are similar examples of how independent retailers have managed to make additional income out of regular trading hours by ‘gamifying’ what they o er to customers.

Meet & Deep News in Twickenham notably held its own game show during New Year’s Eve.

The disco lights were rolled out and plenty of jokes were made.

Broadcast on its Facebook page, the event gained a lot of interest from customers in store and viewers online.

Similarly, London-based South Korean convenience store Saba has held corporate events in the evening, organising games for groups of nearby o ce workers.

RETAILERS HAVE MANAGED TO ‘GAMIFY’ THEIR BUSINESSES

Of course, nding similar additional sources of income will depend on resources and usable floor space.

For those who are able to, there appears to be a lot of fun in doing so.

@retailexpress betterretailing.com facebook.com/betterretailing

Editor Alex Yau alex.yau@ newtrade.co.uk 020 7689 3358

News editor

Ciarán Donnelly ciaran.donnelly@ newtrade.co.uk 07743 936703

News reporter

Kwame Boakye kwame.boakye@ newtrade.co.uk

Production manager Chris Gardner

020 7689 3368

Senior production &

Ryan Cooper 020 7689 3354

Senior

Jody Cooke 020 7689 3380

Designer Lauren Jackson

Editor – news Jack Courtez jack.courtez@ newtrade.co.uk 020 7689 3371

Features editor Charles Whitting charles.whitting@ newtrade.co.uk 020 7689 3350

Features and advertorial writer Shyama Laxman shyama.laxman@ newtrade.co.uk

Head of marketing

Kate Daw 020 7689 3363

Head of commercial Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Account director Lindsay Hudson 07749 416 544

Account manager Lisa Martin 07951 461 146

Specialist reporter Dia Stronach dia.stronach@ newtrade.co.uk 020 7689 3375

Editor in chief Louise Banham louise.banham@ newtrade.co.uk

Features writer Jasper Hart jasper.hart@ newtrade.co.uk 020 7689 3384

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital Luthfa Begum 07909 254 949

CIARÁN DONNELLY

SUBPOSTMASTERSare

to get a share of a further £53m in remuneration by the end of the year, Post Of�ice (PO) has announced.

In an update sent to branches, seen by Retail Express, PO chair Nigel Railton said the increase will be driven by a number of deals. He added:

“We recently landed our new deal with the banks, and we have improved our terms with other providers, too.

“That means we can afford £18m of further top-ups, which will be paid evenly over the remaining 10 months of this �inancial year.

“We will be making a stepchange in marketing investment in the coming months

that is projected to drive a £17m remuneration increase.

“This equates to a total of £33m in top-ups already paid and a further £53m of additional remuneration.”

The chair added that total remuneration paid would increase by 21% to £86m by the end of the 2025/2026 �inancial year.

Railton said: “In the past

�inancial year, postmaster remuneration totalled £405m. That was unsustainable for [postmasters].

“At the launch of our Transformation Plan, I said we wanted to improve postmaster remuneration by up to £120m this year, which is a 30% increase year on year.”

is to axe Yodel services in some partnered stores from 19 June.

In a letter sent to affected retailers, seen by Retail Express, the company said the decision was “due to changes in dynamic network requirements”.

In February, the parcel service was removed in some stores due to low volumes.

One affected partner described the decision as a “kick in the teeth”.

“Customers don’t really like paper receipts due to the time taken to write their details,” he said. For the full story, go to betterretailing.com and search ‘PayPoint’

by long queues. Conversely, Maqsood Akhtar, of Blackthorn News in Rotherham, welcomed the decision.

For the full story, go to betterretailing.com and search ‘Evri’

ALLWYN may U-turn on its 10-scratchcard sales limit after retailers suggested a player card system could better support healthy play limits during a recent event in Edinburgh.

Nathalie Fullerton, of One

Stop Dumbarton Road in Glasgow, told Retail Express she had put the suggestion to Allwyn chair Justin King at the event this month, and King said it was something that could be considered in the future.

A RETAILER has raised nearly £7,000 from a Deposit Return Scheme trial.

Mo Razzaq, of Premier Mo’s in Blantyre, set up the trial in November to help raise awareness before the legislation rolls out across England, Scotland and Northern Ireland in October 2027. Since the trial started, nearly 70,000 used cans and plastic bottles have been returned, with customers receiving a monetary voucher for returning the containers. For the full story, go to betterretailing.com and search ‘Allwyn’

SCAMMERS posing as trading-standards of�icers and other council of�icials have targeted more convenience stores in attempts to steal vapes and money.

Several retailers told Retail Express they had seen a spike in imposters approaching them in recent weeks.

In one instance, Booker reps warned store owners of two incidents in London where individuals used fake council IDs to visit stores and attempt to seize legal vapes.

The scammers were unsuccessful as the retailers knew they had been purchased legitimately from Booker, and the incident has since been reported to the council.

In another incident this month, Ken Singh, of Love Lane Stores in Pontefract, West Yorkshire, received a scam call from someone claiming to be from the council’s health-and-hygiene department.

He told Retail Express: “I’ve noticed an uplift in scam attempts. There were a lot of tell-tale signs that the call wasn’t genuine.

“They said they needed to come for an inspection and that I had to pay them £49.99 to conduct it. I could hear a lot of background noise that shouldn’t have been there.

“The scammer said they

were from Wake�ield Borough, which was immediately a red �lag as Wake�ield isn’t even a borough council. They were using all the wrong terms.

“When I asked for details, they gave me a mobile number and were unable to provide an email address.

“I didn’t pay them, but decided to call their bluff and told them to visit. Nobody has been to my store.

“It’s worrying if you’re an older retailer, as they’ll often be easier targets. They’re the ones scammers will often try to take advantage of.”

Elsewhere, Vas Vekaria, of Kegs N Blades in Bolton, Greater Manchester, has told staff to remain vigilant if they receive a visit from someone claiming to be from trading standards or another government body, following recent warnings.

He said: “I’ve told staff to be aware and not to entertain them unless I’m in the shop.”

Kaual Patel, of Nisa Torridon Convenience in Hither Green, south London, warned: “Sometimes it’ll be the smaller shops who will be targeted, or the retailers whose �irst language isn’t English.

“These targets will be intimidated into co-operating if something looks of�icial.”

Earlier this year, Northumberland County Council sent of�icial warnings out after fake letters were being sent by scammers

“I LOOK at the shop’s bank account every day, and if the gure is not right, I start to ask questions to understand what’s happened. We look at things like, ‘What’s gone out?’ or ‘Have we paid another invoice?’. If you put your stock payments on your credit card, you’re going to pay it anyway because it’s linked to your bank account and you get cashback, so you have an incentive.”

Neil Godhania, Neil’s Premier, Peterborough

claiming to be from the Chartered Trading Standards Institute (CTSI).

In one instance, one letter reportedly included CTSI branding.

A similar scam was being conducted in the East Riding of Yorkshire this year.

Of�icial trading-standards guidance states that retailers should ask for ID if they are suspicious of someone claiming to be from trading standards.

It will include details such as their name, department and local authority.

Trading-standards of�icers will also have business

cards. If they do not, the of�icers will at least leave visit sheets, notices and advice lea�lets with contact details of their local authority.

Absence of these is a red �lag. Imposters will also likely become argumentative when challenged on whether they are a legitimate trading standards of�icer.

Advising further on what retailers need to look out for, Kerry Nicol, external affairs manager at the CTSI, told Retail Express: “It’s deeply concerning to hear that businesses are being

targeted by criminals that are impersonating tradingstandards of�icers.

“To exercise powers, of�icers must be authorised in writing, and if requested by the business, they must provide evidence of that authorisation.

“If a business is concerned about the legitimacy of someone entering their business premises, they should contact their local council to check their credentials.

“If something doesn’t add up, they should report it to their local trading-standards service immediately.”

“WE scan every product as it comes out of the delivery cage, and that means the EPoS keeps track of every product we should have on our electronic delivery note, compared with every product in the cage. It provides us a list of everything we haven’t received and anything we need to claim for. That’s a big problem with some suppliers because their picking accuracy isn’t the best.” Alex Kapadia, multi-site retailer

“MY approach to managing cashflow is that you’ve got to make sure you’re making enough money to invest back into the business. We do quarterly advance forecasts to make sure of where we’re going. You’ve got to think about where your business is going in three months and if you need to invest money as a result of this review.”

Extra

BOOKER: The wholesaler is to launch a fresh-and-frozen-food brochure, highlighting standout lines, including own-brand products such as Jack’s. Booker Retail managing director Colm Johnson said: “It’s about helping retailers make the most of what the market is telling us customers want more of.”

For the full story, go to betterretailing.com and search ‘Booker’

SPAR SCOTLAND: The symbol group has launched cold co ee variants for its Barista Bar food-to-go concept. Available to the chain’s retailers across Scotland, the new range debuted in Dan Brown’s Pinkie Farm convenience store in Edinburgh.

For the full story, go to betterretailing.com and search ‘Barista Bar’ 17-30

DISPOSABLE VAPES: Nearly half of independent retailers in London visited by Retail Express were still selling the products, a day after the ban came into force. A visit to 50 shops on 1 and 2 June found 24 were still selling disposables, with many showing little e ort to comply with the new legislation.

For the full story, go to betterretailing.com and search ‘vapes’

CRIME: Nearly all independent retailers warned that rising crime levels, increased costs and legislation are making it harder for them to survive, according to a recent Fed survey. The survey found that 66% of members experienced a spike in shop theft, violence and abuse incidents since January this year.

For the full story, go to betterretailing.com and search ‘crime’

ALEX YAU

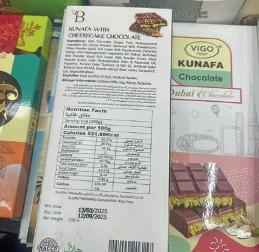

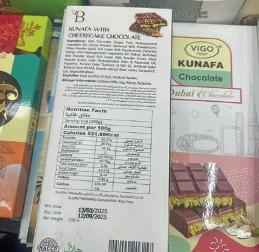

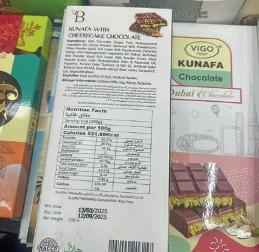

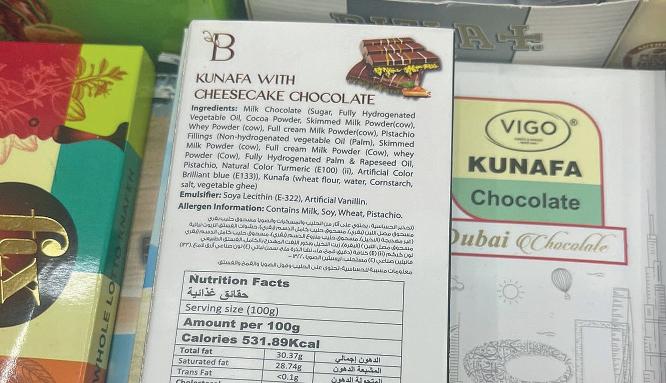

RETAILERS risk breaching allergen and labelling laws by stocking some lines of imported Dubai chocolate.

The chocolate bar has gone viral in convenience stores this year, with many supermarkets and confectionery suppliers jumping on the bandwagon with their own imitation products.

However, retailers have

been urged to be cautious of where they get the product from.

Mosin Chopda, of One Stop Carlton Convenience in Salford, told Retail Express: “It’s a trend we’re getting involved in, but we’re being careful as some products have ingredients and labelling that don’t comply with UK law.

“There have been some instances where duty hasn’t been paid on the product it-

self. We’re ensuring we’re a responsible retailer.”

New advice from Suffolk Trading Standards for businesses released this month stated: “The Food Standards Agency has advised there are safety issues with the chocolate. Many of these imported products are not formulated for the UK market.”

The warning said noncompliant product includes undeclared allergens; missing,

incorrect or misleading labelling; “poor-quality” ingredients; imported ingredients that have not been proved safe for consumption; unauthorised food additives and chemical contamination.

Suffolk Trading Standards added: “Businesses should check where they are sourcing the chocolate from and must ensure it complies with legal requirements, particularly those relating to food safety.”

BESTWAY has chosen ITS, MSP and Henderson Technology as its preferred EPoS providers for symbol and unaf�iliated sites.

The deal, which is the �irst time the wholesaler has appointed preferred suppliers, means retailers will receive preferential terms if they choose any of the three �irms. Each company will specialise in different segments, including smaller convenience, larger format symbol sites and forecourt operators.

MUDWALLS Food Group recorded one of its busiest months on record in May, after providing a lifeline for stores affected by the Co-op cyberattack. The wholesaler worked hard to get 1,000 lines, working with approximately 175 small producers. Managing director Jonathan Lippett said: “Our volume tripled and we pulled in extra resource.”

SHYAMA LAXMAN

CADBURY has launched four limited-edition Cadbury Dairy Milk Summer Edition bars, as well as a brand-new Cadbury Dairy Milk Iced Latte �lavour.

Available to retailers this month, the packaging of the four summer-edition bars includes elements of a traditional UK summer, such as deck chairs, umbrellas, kites and in�latables.

The wrapper visually transforms to reveal a deep blue colour when the bars are chilled, the supplier said.

Retailers can purchase a mixed case containing all four designs, available in nonprice-marked 110g packs,

while the umbrella design is available in 95g price-marked packs (PMPs). Each pack has an image encouraging consumers to ‘Chill to Reveal’ the unique design.

The Summer Editions launch will be supported by digital and in-store activations, with the same message.

The brand has also launched a Cadbury Dairy Milk Iced Latte �lavour, which combines smooth coffee cream with biscuit pieces.

The new variety is available in PMPs and non-PMPs, at £1.69 and £2, respectively.

RED Bull is expanding its �lavoured zero sugar portfolio with the introduction of Red Bull Sugarfree Lilac, incorporating �lavours of grapefruit and blossoms.

With �lavoured functional energy catering to 12 million shoppers, Red Bull Sugarfree Lilac follows the successful launch of Red Bull Pink in 2024.

Red Bull Sugarfree Lilac is available in 250ml plain (RRP £1.65) and £1.60 price-marked cans as well as a 355ml can (RRP £2.10), 473ml can (RRP £2.60) and

250ml cans in packs of four (RRP £5.40). Available: July

MARS Wrigley has relaunched Maltesers White Chocolate after more than a decade. The relaunch is in response to the rising popularity of white chocolate, which witnessed a 12% uplift in 2024.

It also taps into shoppers’ desire for nostalgic products, the supplier said.

Clare Moulder, Maltesers senior brand manager at

Mars Wrigley, said: “White chocolate is a growing trend. As the number-two favourite chocolate brand in the UK, we are perfectly placed to answer this demand.

“We know white chocolate versions of favourite brands appeal to under-35s, so this launch is set to bring existing as well as new consumers to confectionery aisles.”

Available: now

BREWDOG has collaborated with Co-op and Booker to introduce two new fruity beers, available exclusively to convenience stores.

orange peel and notes of sherbet. It is available now through Booker.

FOUR Loko has unveiled its latest vodka-based ready-todrink (RTD) �lavour called Hawaii, available to convenience retailers.

The launch comes off the back of the brand’s 28.1% growth over the past 12 months. The RTD incorporates �lavours of pineapple and raspberry and has an ABV of 8.4%. The striking pink, yellow and purple can aims to drive on-shelf visibility to help maximise sales, said the supplier.

Four Loko Hawaii will feature in music festival and

trade activations throughout the summer, including Barcode Festival 2025 in July. RRP: £3.49

Fruit Burst IPA, with an ABV of 4.4%, is a modern pale ale crafted with bold hops and infused with tropical passionfruit and berry notes. It is available now exclusively to Co-op.

Orange Crush, with an ABV of 4.3%, is an IPA incorporating tangy citrus aromas alongside zesty

RRP: £6, £5.50 promo (Fruit Burst IPA); £7.49, £5.99 (Orange Crush)

WALL’S has launched a range of Takeaway Pockets in three �lavours.

The three varieties include Wall’s Takeaway Pocket Pepperoni Pizza Slice, Takeaway Pocket Cheeseburger Slice and Takeaway Pocket Bombay Potato Curry Slice. The launch builds on the success of the brand’s slices range and is aimed at younger shoppers, the supplier said.

MADRI Excepcional has announced its �irst-ever on-pack promotion to win VIP and general admission tickets to All Points East music festival.

the QR code to access a digital platform and submit their details.

Sophie Mitchell, marketing controller at Madri Excepcional, said the promotion will build on the brand’s “growth momentum” and “help retailers drive sales”.

Live until 31 July, the promotion runs across 4x440ml, 10x440ml and 15x440ml multipacks of the lager. For a chance to win, consumers must purchase promotional packs, scan

are perfect for grabbing on the go or as part of a meal deal, according to Wall’s. RRP: £1.50

Ready-to-eat straight from the pack or enjoyed heated up later on, the new pockets

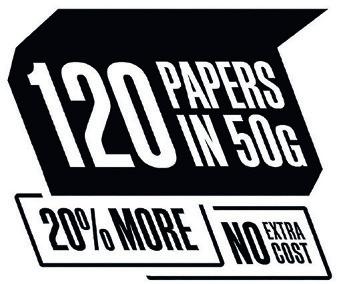

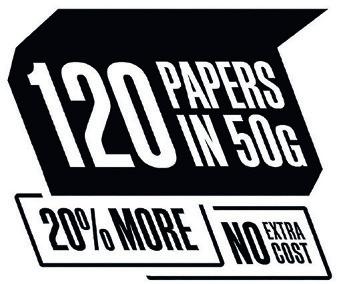

JTI UK has increased the number of roll-your-own (RYO) tobacco papers across its 50g pouch range from 100 to 120.

The upgrade will apply to all JTI’s RYO brands, including Amber Leaf 50g, Kensitas Club 50g, Benson & Hedges Blue 50g, Sterling Essential 50g, Sterling 50g, Holborn Yellow 50g and Old Holborn Original 50g, with no increase in price

The increased pack size comes as ultra value products continue to grow their share in the tobacco category.

According to the supplier, one 50g pouch will provide 66% more cigarettes than a 30g pouch.

SHYAMA LAXMAN

COCA-COLA Europaci�ic Partners (CCEP) has kickstarted a competition for convenience retailers, who stock lines from the company’s alcoholic ready-todrink (ARTD) portfolio.

The giveaway is part of CCEP’s ongoing commitment to support wholesalers by encouraging volume-driving purchases from retail customers, while also rewarding convenience retailers.

The competition runs until 14 August, offering convenience retailers a chance to win a customised Ford E-Transit electric van or one of 10 £500 depot vouchers. Participating lines include Jack Daniel’s &

Coca-Cola, Jack Daniel’s & Coca Cola Zero Sugar, Jack Daniel’s & Coca Cola Cherry; Absolut Vodka & Sprite, Absolut Vodka & Sprite Watermelon; Bacardi & Coca-Cola; and Schweppes canned cocktails Gin Twist and Paloma Bliss.

The competition will be live across major wholesaler including Booker, Bestway, Dhamecha and Parfetts.

Retailers can enter by purchasing four or more cases of the ARTD range from their chosen wholesale depot in a single transaction.

Upon qualifying,

KINGFISHER has launched a new �lavour for its Peacock cider brand called Peacock Passion Fruit & Guava.

It will be available to convenience retailers from this month onwards.

The new Passion Fruit & Guava �lavour from Peacock combines the tanginess of passion fruit – an on-trend �lavour among younger drinkers – with the sweetness of guava and has an ABV of 4%.

Peacock �irst launched in the UK in 2016 and underwent a rebrand in 2024,

they can scan the QR code and enter their details on ccepartdwinavan.co.uk.

Retailers can enter the competition multiple times. Valid entries will be entered

CHUPA Chups has added to its jellies range with the launch of Apple Laces, now available through wholesalers Bestway and Dhamecha.

COCA-COLA has announced a new three-year partnership with the Premier League for the 2025/26 season, with exclusive on-pack promotions in stores across the UK and Ireland.

The partnership involves fan activations such as centre circle experiences, access to tickets, as well as other football-themed experiences.

Participating lines include Coca-Cola Original Taste, Coca-Cola Zero Sugar, Powerade and Smartwater.

Rob Yeomans, vice-president, commercial development at Coca-Cola Europaci�ic Partners GB (CCEP), said: “Coca-Cola’s brand purpose is about bringing people together, and that’s

It builds on the 26.9% growth of apple-�lavoured sweets since 2024. Other jelly lines include Sour Mixed Belts, Sour Apple Belts, Sour Strawberry Belts, Strawberry Laces and Sour Bites and Tubes.

into a random prize draw in August 2025 and winners contacted shortly thereafter. Sign up with Cîroc for a lux holiday

Kim McMahon, brand manager of Chupa Chups said the “unique” and “share-

able format” of the jellies had found traction with a teen audience, and the brand was hopeful of replicating similar results with the new line. RRP: £1.25

aiming to broaden its appeal among a younger audience. RRP: £2.70 (500ml bottle)

exactly what happens on match days.

“This partnership is a brilliant opportunity to connect with fans through the drinks they know and love – we know it will drive sales.”

PLADIS is expanding its McVitie’s Jaffa Cakes range with the launch of a limitededition Hot Honey Flavour, combining the sweetness of honey with chilli heat.

It is available at an RRP of £1.50, with a £1.49 pricemarked pack (PMP) also set to launch.

“Hot honey is a �lavour

that’s trending globally amid a bigger movement that’s seen people embrace sweet and spicy across a wide range of food products,” said Jessica Woolfrey, marketing manager at Pladis UK&I. Available: July

CIROC is offering independent retailers the chance to win a £2,000 luxury holiday voucher, to spend on a destination of their choosing. The competition follows the launch of the recently unveiled limited-edition Ciroc Strawberry Limonade.

lowed by a phone call within 48 hours of being randomly selected by

Running until 28 June, UK convenience retailers and employees aged 18 and over can enter by completing a short form found at: bit.ly/4jAv3OE.

The winner will be contacted via email during the week of 4 July 2025, fol-

SAN Miguel has launched an on-pack promotional campaign called ‘Spanish Summer No Matter Where’, giving 28 shoppers the chance to win a trip to Ibiza on 29 September, which is San Miguel Day.

their chance to win. Additionally, San Miguel will also be launching a price-marked pack in its 4x440ml and 4x568ml formats.

Running across multipack can and bottle formats, until October, the limited-edition packaging will be available through wholesale.

To enter, shoppers simply need to purchase a promotional pack and scan the code for

WEETABIX has launched its ‘Weetabix All-Stars campaign’ – aimed at driving category value, shopper engagement and household penetration.

Backed by more than £1.5m in media support, the campaign features Sir Mo Farah, Dame Jessica EnnisHill, Ade Adepitan MBE and Leah Williamson OBE, sharing personal stories of the role Weetabix played in their success.

Rolling out to Morrisons, Nisa and Spar, the campaign’s call to action is, ‘We’ve Had

BREWDOG has unveiled a series of packaging updates across Punk IPA, Hazy Jane, Lost Lager and Elvis Juice beers.

The new designs are rolling out across all packaged formats including bottles, cans and outer packs.

They are intended to provide each beer with more of an individual visual identity, as part of the supplier’s �irst packaging update since 2020. The new packaging does not have a �ixed launch date, as BrewDog works through

the stock of existing designs, ensuring no packaging will go to waste.

PRINGLES and Cheez-It have launched ‘Flavour Fest ’25’, a series of wholesale depot takeovers to help retailers drive snack sales.

The activation between the brands is running until 10 July at major depots across the UK.

During the campaign, retailers will get to sample new �lavours, enjoy oneday-only offers, enter prize giveaways and access exclusive PoS bundles.

The brands’ representatives will also be present to provide expert guidance, category insight as well as merchandising strategies

to help retailers maximise the snacking opportunity.

DASH Water has unveiled a new packaging design that incorporates fruit imagery while highlighting the brand’s health and sustainability credentials.

Each pack is ClimatePartner-certi�ied and fully recyclable.

Alongside the new design, the brand is launching a 12-pack format for the �irst time, available to independents at an RRP of £13.30.

Jack Scott, co-founder of Dash Water said: “We’ve always been known for

our health credentials – no sweeteners, no sugar, no calories – but our customers consistently tell us they love Dash for the taste.

“This packaging re�lects that: the bright, bold colours scream ‘refreshing’, while the fruit-forward design signals ‘natural’.”

WERTHER’S Original has unveiled a redesign across its portfolio, rolling out to convenience this month.

The new packaging, incorporating a modern and vibrant colour scheme, is aimed to enhance on-shelf visibility and simplify shopper navigation.

Andy Mutton, managing director at Storck UK said:

“With Werther’s Original being the number-one traditional sugar confectionery brand in the UK and having the highest brand recogni-

tion among sugar confectionery brands, this refresh builds on that momentum – injecting new energy into the brand while enhancing its shelf standout. Werther’s Original is now even better positioned to attract shoppers and help retailers drive continued sales growth.”

EMPIRE Bespoke Foods has launched details of its new online ordering system.

The launch is part of a website refresh, designed to simplify ordering and improve overall customer experience.

The new system has a host of features, including an improved payment gateway, live 24/7 stock availability checks across all ranges and enhanced �iltering and search facilities.

Retailers will also bene�it from regular seasonal online

offers and promotions, be able to store a ‘favourites’ list and access an interactive global brand map to check the source of their chosen products.

Additionally, a bespoke digital advertising campaign will support and help raise awareness of the new system.

PREMIER Foods has launched the third iteration of its ‘Summer of Cricket’ campaign. The supplier has partnered with registered UK charity Chance to Shine, which inspires young people through cricket in state schools and underserved communities.

The campaign, which aims to give retailers the opportunity to help more children discover a love for cricket and develop essential life skills, is divided into three phases, running over the course of the summer.

Top prizes include an

all-expenses-paid trip to India to meet former Indian cricketer Dinesh Karthik. For the full story, go to betterretailing.com and search ‘Premier Foods’.

RETAILERS have just over a week to win prizes as part of Swizzels’ The Great Community Refresh, a nationwide initiative to revive community spaces.

DELICE de France has launched Delice Fresh, a service offering bakery products without the need to prepare them on site.

Delice Fresh comprises 28 bestselling lines from Delice’s range of sweet and savoury bakes, including croissants, pains au chocolat, pains aux raisins, cookies and artisan breads, including baguettes, rolls and bloomers. Available at a range of prices, the range has a oneday shelf life.

Retailers can order up to

4pm to receive their delivery the following morning, seven days a week.

It comes in the wake of the 70th anniversary of its iconic chew bar Refreshers.

As part of the initiative, Swizzels is awarding seven prizes worth £1,000 each.

To enter, retailers must visit Swizzels’ website and share why their chosen community project deserves the prize and how it will be used to make a lasting difference. They have until 30 June to register their nominations.

POLISH lager brand Żubr has launched a £7.29 (4x500ml) price-marked pack (PMP), available to independent retailers via wholesalers Parfetts, Dhamecha and Bestway.

The launch follows fellow Asahi UK brand Tyskie, which launched a £6.79 PMP for its 4x500ml format in March this year.

Rob Hobart, marketing director at Asahi UK, said: “PMPs frequently drive a much higher rate of sale in convenience than their non-

price-marked equivalents.” The brand has grown by 10% in the year to 22 March 2025.

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

It will help improve the space

DISPOSABLE-VAPES BAN: Have you got rid of all stock?

“WE

“ALL the non-compliant stock we had was easily sold before the ban came into place. We’ve now got a range of compliant refillable devices. Like the run-up to the disposablevapes ban, it’s all about educating customers about these new products.”

EXPANSION: Are you taking on more convenience stores?

“I RECENTLY took over Justin Whittaker’s Premier in Royton. I’ve got a number of improvements to make to the store, including adding fresh food to go. I have a restaurant business, so this will help supply curries that are made from scratch.”

“WE’RE growing and we’re on the lookout. As Triple ‘a’ Foodhall continues to scale, we’re actively seeking new locations to bring our Foodhall concept to even more communities across the UK. We’ll consider existing units and new-build developments.”

We’re growing and we’re on the lookout

PRIDE MONTH: How are you supporting the event?

“I RECENTLY donated £1,000 to Tamworth Pride to help them with community engagement. We’re proud to support Tamworth Pride and help create a space where everyone feels celebrated and included. We’re committed to backing events that bring people together.”

Onkar Sandhu, Nisa Local Mile Oak, Tamworth

“A DONATION of £1,000 will help Number Forty buy more essentials such as phone chargers, panic alarms and refreshments – items people regularly ask for. It will also allow the hub to improve the space so it feels more welcoming to everyone, including the LGBTQ+ groups that regularly use it.”

Kevin Polley, Kash Retail, Ripon

Dipak Shah, H&R News, Camberley

Ken Singh, Love Lane Stores, Pontefract

More

LOW- AND NO-ALCOHOL: What is boosting sales for you? It’s about educating customers

“LOW- and no-alcohol is the best option for people having barbecues, summer drinks in their gardens or driving to events. I’ve got half a metre of space dedicated to the category. I’m doing gin as well as beer and wine. We’re selling up to £200-worth of low- and no-alcohol a week.”

Simon Dixon, Premier Lower Darwen, Lancashire.

“PEOPLE are being more sensible these days. If they’re going to out for barbecues, they’ll buy packs of beer, but they’re also buying alcohol-free alternatives. I have options from Guinness, Heineken and Peron and I plan to expand the range further as part of a recent refit.”

Julie Kaur, Jule’s Premier, Telford, Shropshire

‘JTI reps haven’t

I’VE been having an issue with JTI recently where my store hasn’t received any rep visits in nearly a year.

I’m concerned I’m missing out on offers. Can Retail Express help me resolve the situation?

Recent conversations with other retailers at the cash and carry suggest the problem isn’t limited to my shop.

The previous rep I had was great. However, they were

COMMUNITY

eventually moved to another postcode. Their new area includes one of my other shops, which is just down the road. I asked if they could still include both stores in their visit, but they said head of�ice would not allow them to. I think this is a ridiculous process as the only difference in postcodes is a digit.

Smylah Ahir, Harden Go Local and Post Of�ice, Bingley

‘We are helping people nd jobs’ Natalie Lightfoot, Londis Solo Convenience, Glasgow

“AROUND once a month, we’ve begun pinning a post at the top of our Facebook page with local jobs spotted being advertised. We’re asking local businesses looking for sta to add to the post. Anyone who spots a job sign in a window is encouraged to add details. If we nd just one person a job in the community here in Baillieston and the East End, it would be amazing. Roles we’ve helped with recruitment include a cleaner for Peek, an organisation which helps support children, young people and families.”

A JTI spokesperson said:

“We continually review our retailer call cycle. We are always looking at ways we can improve our support for retailers and ensure that our JTI business advisors have everything they need to offer the best possible service to the convenience community.

“Last year, we relaunched our independent retailer platform, JTI360. The new platform was developed with

retailers to help them stay up to date on all the latest news and trends. The site also allows retailers to earn points that can be redeemed for prizes.

“We understand that with proposed tobacco legislation changes and other industry pressures, these are challenging times for the convenience sector, and JTI remains committed to its retail partners.”

RETAILER OF THE WEEK

“OFFERING a home delivery service has been an important step in di erentiating ourselves from our competitors with deliveries in minutes and lots of special o ers. It was one of the services we required as part of a recent re t of the store. The service means we are now connecting with new customers and o ering a much-needed service to local people. Scoot is a new service with Booker, so we are delighted to be one of the early adopters. Booker has been a huge help with the launch pack, training and general support.”

You need to stay agile this summer

UK summers are unpredictable and weather can change really quickly. Last week, it was really warm, but this week the weather turned and we knew the store would be quieter and that customers would be buying totally di erent baskets.

I check the weather forecast every morning to see what’s predicted for the next couple of days and try to plan accordingly.

This is where store agility comes into play, so you can swap barbecue supplies for Sundayroast ingredients at the drop of a hat.

To do this, you’ve got to look to local suppliers –especially for perishable goods like meats, fruit and veg, and baked goods. We’ve also got a back-up local supplier for our frozen food.

With the bigger wholesalers, you put your order in on Monday and expect it on Wednesday, but local suppliers tend to do next-day delivery.

With my strawberry supplier, I can leave a message on their answering phone at 10pm and get my delivery the following day.

It’s so important to have local suppliers as a resource on your system because – as we saw from the Co-op situation last month – supply chains can drop very suddenly and you have got to ll your gaps.

While it is crucial to have a flexible supply chain in summer, agility remains important throughout the year. If it snows in winter and the roads are blocked, local suppliers will generally still be able to get their products to your shop.

This is what sets us apart from the multiples. We have extra access and supply points to help customers in need. Make the most of that and make sure you’ve got a good array of local suppliers to hand this summer and beyond.

TAMARA BIRCH talks to retailers to uncover the latest so drinks opportunities

FLAVOUR, energy drinks, water and natural drinks are driving the soft drinks category. This is according to Sunny Patel, owner of Lutterworth News in Leicestershire.

“Some popular health drinks are getting noticed,” he says.

“Energy drinks will always be number one, though. Booker’s own brand is proving popular because some shoppers are trying to save money.”

Patel also says that while there is a market for sugar-free options, most of his customers continue to buy full-sugar varieties.

Vidur Pandya, owner of Kislingbury Mini Market & Post O ce in Northamptonshire, has also noticed this. “Shoppers are buying regular Monster over Monster sugar-free, or buying Coca-Cola over Diet Coke,” he says. “I think it’s

because there’s a lot of media around the ingredients found in sugar-free drinks. It’s not a major concern for us yet, but shoppers are switching.”

As we approach summer, though, suppliers say flavour will be important across all subcategories. This is because shoppers are looking for something new that tastes good as well, with soft drinks becoming a strong treat purchase.

Coca-Cola unveils partnership with Premier League

The Coca-Cola Company has announced a threeyear partnership with the Premier League, signalling the brand’s return to the world’s most-watched football league. The partnership will bring supporters closer to the action through exclusive fan activations, centre circle experiences and access to tickets. The partnership will also span multiple brands within its range, including Coca-Cola Original Taste, Coca-Cola Zero Sugar, Powerade and Smartwater. It will launch the 2025/26 season with an exclusive on-pack promotion in stores across the UK and Ireland.

7Up brand refresh

Carlsberg Britvic has announced its 7Up brand will undergo a refresh and a new global repositioning called Super Duper Refresher. The sensory- rst platform is designed to rede ne and level up functional refreshment. Among the rst launches are 7Up Mint, 7Up Extra Fizz and 7Up Pink Lemonade.

Pepsi’s ‘Refresh the Game’ football campaign Pepsi has brought together football legends from across generations, clubs and countries in a new global campaign created by Copa90 and Nicole Ackermann, of Merman and Rascal. The campaign features worldclass talent, including Alexia Putellas, Lauren James, Caroline Graham Hansen, Farah Jefry and Leah Williamson, as well as David Beckham.

Cans ‘Mango’ makes UK market debut Cans, a new unsweetened carbonated soft drink range, has launched a new flavour: Mango. The flavour is a combination of Alpine water, Mango and e ervescent bubbles, and is available now from cans.co.uk. The full range will also be available to independents via wholesalers, including Brakes, Epicurium, JD Foods, CLF and Mahalo Suppliers at a £1.39 RRP.

Monster Lando Norris Zero Sugar Monster has partnered with British Formula 1 front runner, Lando Norris, to launch Monster Lando Norris Zero Sugar. The flavour combines Monster Energy blend with a Melon Yuzu flavour, which, according to CCEP, is “unlike anything else in the energy drink market”. It will be available from June in plain and PMP 500ml cans, and plain 4x500ml multipacks.

Robinsons 750ml plus 33% extra free PMP Carlsberg Britvic has launched a new Robinsons 750ml £1.59 PMP to o er retailers a bigger opportunity to attract family shoppers and reassure them they aren’t being overcharged when purchasing PMPs. It’s available now in wholesale, convenience and impulse, with the brand supporting retailers with a free PoS kit from atyourconvenience.com/ extrafree.

Tropicana Sparkling Zesty Orange and Tropical Twist

The two new sparkling water products are available now to convenience retailers. Each 250ml can contains 30% pure handpicked, natural origin fruit juice and no added sweeteners. They are also less than 65 calories per serve.

Barr on-pack promotion with Jurassic World Rebirth

The promotion gives shoppers the chance to win an adventure holiday in Lisbon with sea kayaking, high-ropes adventure park visit and dinosaur caves tour this June. AG Barr will support the promotion with an outdoor and digital advertising campaign and retailers will also have access to PoS materials.

Ben Parker, vice-president of sales o -trade, Carlsberg Britvic

ENERGY drinks are a huge sales driver for retailers, with Pandya and Patel citing Monster and Red Bull being the muststock brands. What’s more, both retailers say shoppers are less concerned about price.

“Energy drinks have been topping the soft drinks sales list for a long time, and Red Bull, Monster and even Rockstar are the main brands,” says Patel.

“SOFT drinks have been a key growth driver for convenience stores in recent years according to our latest So Drinks Review 2025. In fact, the average Brit drinks 225.3l of so drinks a year. That’s nearly half the amount consumed in the US and they’re also bought on 23.4% of shopping trips in convenience stores and responsible for £5.3bn in sales.

“But as shopper preferences evolve and a new generation of consumers come to the fore, retailers need a solid plan to continue to unlock additional opportunities for growth – of which there are plenty, according to our latest report.”

However, if your customers are concerned about price, a Red Bull spokesperson says multipacks are a good addition alongside single-can formats.

“Forty per-cent of consumers say larger sizes through multipacks is the best thing brands and retailers can do to mitigate rising prices, so it is essential to allow space for multipacks,” the spokesperson says.

FLAVOUR is the key trend within cola and carbonates, with Coca-Cola Europaci c Partners (CCEP) launching Coca-Cola Zero Sugar Lemon and Coca-Cola Zero Sugar Lime in the past year. CCEP has also focused on limited-edition releases such as its Oreo Zero Sugar collaboration earlier this year.

“One in ve buyers of Coca-Cola Creations were new to the Coca-Cola Zero Sugar brand, contributing to sustained brand growth following each launch,” explains Kate Abbotson, senior trade communications manager at CCEP.

“We’re also seeing that flavoured colas now account for 10.7% of growth in the £2.88bn cola market, underlining the value of flavour exploration in supporting the low- and no-sugar segment.”

Elsewhere, Pepsi Max

Cream Soda is proving popular, and is o ering muchneeded innovation in the soft drinks categories. “We nd shoppers are willing to pay more for these types of drinks,” Patel says.

While suppliers say lowand no-sugar cola drinks are increasing, both Patel and Pandya say that Coca-Cola Original Taste, Pepsi and its associated flavours remain just as popular.

Patel says: “Sales of sugar drinks haven’t dropped, and people are consuming the same amount they were a few years ago, but they are looking for that balance.”

Elsewhere, retailers say they’ve noticed an increased demand for “cleaner”, healthier and functional drinks.

Patel says: “There’s a higher emphasis on natural and Tenzing is taking a more prominent place on the shelf. Energy is becoming more health driven, but products using more natural ingredients are pushing further ahead.”

Pandya has noticed the

same, but says, for his store, functional drinks are bought by those heading for a workout.

Ben Parker, vice-president of sales – o -trade at Carlsberg Britvic, says this trend is unlikely to slow down.

“People who regularly buy into the category say they’d like to see a greater range of drinks that can fuel them throughout the day, like natural energy drinks,” he says.

Interestingly, Patel says that shoppers who buy spirits will opt for Diet Coke or Coke Zero as the mixer. “It’s probably due to spirits being lowercalorie so they’re balancing it out with a low-calorie soft drink,” he adds.

WATER is the subcategory within soft drinks that most customers will expect to see in a convenience store. In fact, according to Nic Yates, marketing director from Highland Spring Group, the subcategory is worth £1.8bn across the total market.

“A retailer’s soft drinks range should therefore include a prominent, well-stocked wa-

ter range,” he explains. “The things to consider when planning this xture include your brand mix, so well-known and trusted brand options, stocking core favourites, such as still and sparkling, bolstering with new ranges, like flavoured water and stocking a variety of formats.”

The subcategory holds importance due to its health at-

tributes. Although there are many health diets on the market right now, most will say water is king. Among these various diets, shoppers are reducing their sugar intake and increasing their water intake.

Gen Z are driving this trend, according to a spokesperson from Danone, which is “clearly reflected in their hydration habits”, and a demand for

viewing water as a key component to a healthier lifestyle.

If space is an issue, use your sales data to determine your top brand – or your top two – and include an on-thego format and a larger bottle, so you’re catering for multiple missions, while saving space.

In summer, if you’re out of water, you could risk losing a customer.

MILKSHAKES, for a lot of retailers, are commonly associated with children, however, Paulina Gorska, marketing lead at F’real UK says, other shoppers are willing to treat themselves.

“Amid the cost-of-living crisis, consumers are more inclined to splurge on little treats that lift their mood,” she says.

“F’real is positioned to meet that need, targeting shoppers who want to treat themselves with a ordable luxuries.”

For retailers with younger demographics, flavoured milk

Kate Abbotson, senior trade communications manager, Coca-Cola Europaci c Partners

“HEALTHIER choices have long been a priority for consumers, and that demand is showing no signs of slowing. Across GB, nearly three-quarters of consumers are reducing their alcohol intake, while one in ve has it out completely. So drinks, and especially lowand no-sugar options, continue to o er an appealing alternative.

“Retailers have a huge opportunity to tap into this trend by stocking a strong low- and zero-sugar line-up alongside core favourites. Standouts include Coca-Cola Zero Sugar, now worth more than £477m, Fanta Zero and Dr Pepper Zerooo, which is bene tting from its reformulated taste.”

could be an area to explore.

According to Kerry Cavanaugh, general manager at Mars

Chocolate Drinks & Treats, the subcategory achieved a 44.1% year-on-year sales increase in convenience stores.

If you’re just starting out with flavoured milk, Cavanaugh recommends going with a well-known brand, such as Mars and Mars Caramel, Maltesers, Milky Way and Galaxy shakes.

The full range is suitable for vegetarians and contains no added sugar.

Patel says within this subcategory most shoppers are

shifting towards protein:

“There’s certainly more of an emphasis on protein and we’re noticing that products with 15g of protein are the most popular.”

Pandya stocks lines with 50g of protein, but says they’re not as popular. “We used to stock U t 50g protein, but we discontinued it,” he explains.

“This is because it’s quite powdery and the texture wasn’t right for our customers.”

Instead, Pandya is focusing on isotonic sports drinks and still drinks for gym-goers. “We always sell a lot during the summer,” he adds.

SUPPLIER VIEW In partnership with Global Brands

Lauren Edwards, brand manager, Franklin & Sons

“THE demographic of traditional zzy drink consumers is evolving. We’ve seen rsthand how younger consumers are gravitating away from alcoholic beverages and towards so drinks, driven by sober curiosity and moderation drinking.

“Younger consumers especially are seeking drinks that deliver the same level of indulgence and depth of flavour as alcoholic beverages, but without the alcohol, and premium so drinks, such as Franklin & Sons, have carved out signi cant space in this market.

“Premium single-serve formats, especially sleek cans and glass bottles, are showing strong growth as consumers prioritise both convenience and aesthetic appeal. Therefore, retailers who thoughtfully curate their so drinks and mixers o erings – with an emphasis on sophistication, natural ingredients and appealing presentation – will secure a strong position in this rapidly expanding market.”

JUST a few short years ago, the global soft drinks market was dominated by US soft drinks, but Patel says this is no longer the case and instead, it has shifted to Asian drinks.

“Mogu Mogu is a popular brand,” he says. “Although it’s lled with sugar, shoppers almost justify it because it contains fruit juice.”

He says the international market is growing and shop-

pers are buying them, but says there’s limited scope. “You can go into a lot of stores and nd international products now, but there is limited scope to it,” he says.

Patel says other popular drinks include Kimura, a Japanese carbonated soft drink brand that contains a glass marble ball inside, and Thums Up, a cola drink from India that’s available from Dhame-

cha Wholesale.

This won’t be the same for everyone, though. For Pandya, the US soft drinks market is alive and well, but he says the products that sell have changed.

“We mostly focus on American Monster, Dr Pepper and other carbonated drinks,” he says. “It used to be all about American Fanta, but it’s shifted.”

SUMMER in the UK is hard to predict, but soft drinks sales are likely to be higher. Therefore, it’s important to have a strategy in place to ensure higher sales.

For Pandya, this means introducing more promotions, stocking bigger packs and running multibuys to cater for social occasions and sporting events.

“We’ll do a two-for-£3 on 2l bottles, for example, or we’ll

increase our range of isotonic sports drinks, too,” he says.

Patel, however, has a di erent approach. “Bigger packs means customers won’t return because they’re catered to,” he says.

“Customers who want a wider variety of soft drinks will come to us. They expect convenience and to get what they need, which is why they come to us,” he says.

Patel also focuses on price-

marked packs (PMP) so customers can see what they’ll be paying, or he stocks ownlabel lines from Booker or Bestway.

Pandya also emphasises the importance of supplier support to drive trial with new products, speci cally in soft drinks. “Product trials, PoS, free samples are all strong in helping us boost sales, as well as drive footfall to the store,” he says.

ANNE BRUCE nds out how retailers and suppliers are adapting as the disposable-vapes ban comes into e ect

WITH disposable vapes now banned, the next-gen nicotine category is in flux as the market adapts and retailers wait to see what products, brands and flavours come out on top.

Imtiyaz Mamode, of Premier Shop Wych Lane in Gosport, Hampshire, is tipping nicotine pouches as the product of the future.

He has a range of 70-80 on sale, from brands including Nordic Spirit and Velo, in different flavours and strengths.

“Customers can use these

anywhere and there are no restrictions,” he says. “We get 30-40% margin, which is similar to vapes.”

He has taken a hit on margin so that he can keep prices of rechargeable vapes at threefor-£13 following the ban.

Re ll pods are priced at £2.99, but he reports stock levels are low at suppliers, and he can’t get all the flavours he wants.

Sunny Sahota, of One Stop Hitchin Road in Henlow, Bedfordshire, is experimenting

with products such as Lost Mary’s rechargeable vapes.

At One Stop Carlton Convenience in Salford, Priyesh Vekaria says it is too soon to tell what the big next-gen nicotine sellers will be. “We need the brands and flavour houses to establish themselves. We are leaning towards rechargeable pre lled pods,” he says.

“We think a key core range will emerge, where before there were lots of challenger options on disposable vapes.”

He makes £5,000-£6,000 a

week on nicotine and alternatives, 30% on cigarette sales and 70% on vapes, and does not see that overall turnover dropping.

Eugene Diamond, of Diamond Newsagent in Ballymena, County Antrim, has seen “every ban in 45 years” and expects much more to come.

He says disposables were never big sellers in his store: “We have brought in some new rechargeable products recently, we do some re ll pods and liquids as well.”

John

Patterson, president, IKE Tech

“IKE believes technology could be used to eliminate youth access to products while preserving flavours and choice for adult consumers.

“The introduction of point-of-use age veri cation technology in vaping devices – in addition to pointof-sale protocols – would render any vaping product inoperable until the user’s age is veri ed.

“Additionally, technology exists, within the same platform, to geo-fence certain areas such as playgrounds, hospitals and schools to render devices inactive.

“Such technology, which we believe manufacturers should incorporate into their devices, could support the government’s e orts to crack down on youth use.”

On 1 June 2025, it became illegal for retailers in the UK to sell or supply single-use disposable vapes, even those without nicotine. Any remaining stock can’t be returned to its manufacturer

Store/dispose

Any remaining disposable vapes should be stored securely, away from the sales floor, and marked as not for sale until disposed of safely.

Choose reusable

As of 1 June, all vapes sold must be re llable (via re ll pods or e-liquid), rechargeable (with a working charging port) and have a replaceable coil (coil either in replaceable pod or replaceable in the device itself).

Fines

Retailers found selling disposable vapes could face a £200 xed penalty notice.

WITH the ban on disposable vapes now in place, retailers worry they may face prosecution if non-compliant products slip through the net.

Vekaria is working with Phoenix 2 Retail on his vape o er, which reassures him that products comply with the new rules banning single-use products.

“It is a di cult time for retailers. We are going to get stung for misselling if we buy in error,” he says.

“The e ciency of store teams will be a ected; checking and talking to wholesalers to ensure stock is compliant with the disposables ban, and educating customers about products.

“I don’t think turnover will reduce due to the ban, but it all eats into the margin as time is money.”

Sahota also has third-party support from his symbol in navigating the new rules: “One Stop o ers an app where

retailers can purchase vapes so that takes away any worries about compliance. I also have PoS from One Stop.”

Vekaria says government has put an unfair burden on retailers: “This is a half-baked piece of legislation. The government has not stopped disposable vapes from entering the UK, but retailers have to make sure they don’t sell anything non-compliant. Enforcement agencies are also short of resources.”

With strong margins to boost your business, nine bold flavours and a range of nicotine strengths that caters to every preference, Swedish-made FUMI is the perfect addition to your Nicotine Pouch category.

The vape tax A tax on vapes of £2.20 per 10ml of e-cigarette liquid will apply from October 2026. There will also be an increase of £2.20 per 100 cigarettes in tobacco duty.

The Tobacco and Vapes Bill

This bill will mean that people born since the start of 2009 will never legally be sold tobacco products. It may include new limitations on flavours, packaging and product display. The bill is also set to introduce a vape licensing scheme and provide strengthened powers of enforcement against those engaging in illegal sales. Dates and timings are still to be con rmed as the bill goes through Parliament.

Klar

Add these to your range

New brand Klar, a next-generation nicotine pouch that uses bioceramic technology, recently launched in the UK. The range includes flavours of mint and citrus, available in a range of strengths – Regular (3mg), Strong (6mg) and Extra Strong (9mg). Emplicure, producer of Klar, is now planning to expand its o ering.

Terea Silver

Philip Morris Limited has expanded its Terea range with the launch of Terea Silver. This joins its range of tobacco sticks designed for use with Iqos Iluma.

Edge Hybrid

Edge Hybrid X is a new closed/rechargeable pod system compatible with its LIQ range. Hybrid X has been designed to enhance Edge Liq flavours. RRP is £12 for the device.

Edge Nicotine Pouches

Edge Nicotine Pouches are available in ve flavours and multiple strengths, priced at £5 per can.

Edge Liq Nic Salts

Edge has launched the new Edge Liq Nic Salts range, using flavour data from its top-selling disposables. RRP is £3.50 per 10ml bottle.

Elfbar

Elfbar has expanded its Elfx series of vaping devices with the launch of the reusable Elfx Pro Classic Edition. It can be re lled with nic salts, including Elfliq, and features a colour screen interface so customers can personalise their settings, track usage and monitor battery life.

Other launches

These include the latest addition to the Lost Mary Nera series – a high pu count, pre lled pod kit with curved display screen and visible e-liquid level indicator. The device has a rechargeable battery designed to last a full day on a single charge and the kit comes with two 2ml pod cartridges and two 10ml re ll containers.

Navigate the disposable-vapes ban with ease

Online resources For guidance on the single-use ban, see gov.uk/ guidance/single-use-vapes-ban

Seek supplier support

Always check with your supplier that the products you are o ered have been noti ed and published by the Medicines and Healthcare products Regulatory Agency (MHRA). It publishes lists of noti ed products, updated weekly. Supply of unpublished products is an o ence.

Trade association resources:

Trade associations such as the Association of Convenience Stores (ACS) and the Scottish Grocers’ Federation (SGF), the Independent British Vape Trade Association (IBVTA) and the UK Vaping Industry Association (UKVIA), o er resources on compliance, recycling and best-practice advice.

Angelo Yang, associate general manager, UK, Elfbar

“RETAILERS should monitor rate of sale data to identify top-performing reusable products and flavours, using this insight to optimise shelf space and align inventory with demand.

“Given display space limitations, the best approach is to stock a diverse selection of products and flavours that cater to di erent adult preferences – and re ne the range over time based on sales performance and customer feedback. Supporting this with point-of-sale materials can help boost visibility and drive interest.

“With illicit trade expected to increase a er the single-use vapes ban, retailers must remain vigilant when sourcing stock.

“It’s also important for retailers to promote responsible disposal by highlighting any in-store recycling or takeback services.”

TOP stats

Cra ed using top-selling disposable-vape insights, the new Edge Liq range delivers premium flavours. EDGE has led the UK convenience 10ml category as the number-one brand since 2018

VAPING continues to grow as adult smokers look for dependable alternatives to traditional tobacco. The Edge Liq range o ers a value-driven, flavourpacked solution tailored speci cally for former disposable users. With 15 flavours, a £3.50 RRP and a 60% margin, Edge Liq presents an excellent revenue opportunity.

A study revealed that 37% of disposable-vape users would consider switching to 10ml eliquids following a potential ban1 – highlighting the importance of providing appealing, a ordable alternatives. Maximise this opportunity by positioning e-liquids near other next-gen products, using countertop display units and ensuring sta are trained to guide customers post-ban.

WITH many vapers still accustomed to disposable products, uncertainty around transitioning to other formats is increasing. However, evolving trends reveal a shift in consumer behaviour, with growing interest in nicotine salts, high-pu de-

vices and more cost-e ective vaping choices. High-pu -count formats offer better value compared to single-use options, but 10ml e-liquids are the most economical solution in the long-term. These bottles provide reduced

cost per use while allowing users greater freedom to explore a broader range of flavours, supporting a more personalised vaping experience.

2 3 4 1

Edge is the UK’s top-selling e-liquid brand in

Each 10ml bottle features a 50/50 PG/VG ratio and a 20mg nicotine strength.

Retailers that stock Edge Liq e-liquids enjoy a generous 60% margin.

Edge Liq is fully aligned with these emerging trends, o ering a comprehensive portfolio of 10ml e-liquids that combine regulatory compliance, transparent labelling and consistent quality. Its focus on flavour variety and manufacturing standards meets the rising consumer demand for reliable, long-term vaping alternatives.

Place your order now at wholesale.edgevaping.com and unlock Edge Liq’s bestselling flavours with high margins and strong

Stuart Vaughan, head of sales – branded retail UK, NextGen360 Ltd SUPPLIER VIEW

“VAPING continues to be a key growth driver for the convenience sector, with adult smokers increasingly switching to trusted e-liquids like Edge Liq. Made in the UK, Edge Liq o ers quality assurance and exceptional flavour, backed by consistent manufacturing standards. We’ve invested in PoS materials and retailer support to make selling simple and e ective, and are committed to supporting retailers as the category evolves.

“Edge’s strong margins, wide flavour range and reliable performance make it a standout choice for retailers. To maximise sales, we recommend keeping core flavours clearly visible, encouraging sta to con dently recommend products, and educating customers on the long-term value of switching to e-liquids from disposables.”

SHYAMA LAXMAN talks to retailers to understand the importance of impulse at the counter and how to tap into it

“IF you stripped a store of all other categories, and created one which only had impulse products, that business can still thrive in today’s economy,” says Priyesh Vekaria, of One Stop Carlton Convenience in Salford, Manchester, who makes up to £6,000 per week in impulse sales. In a di erent setting, Jonathan Cobb, of Miserden Stores & Post O ce in Stroud, Gloucestershire, makes £20 per day in impulse sales. However, at 350sq ft, Cobb’s store is considerably smaller than Vekaria’s 1300sq ft store, making £20 per day a strong return for Cobb.

This proves that regardless of a store’s footprint, it’s possible to maintain consistent growth in the impulse category.

WHILE confectionery, crisps, snacks, nuts and soft drinks are the top drivers of the category, retailers nd that sometimes placing unusual items on the till can work.

Vekaria, for example, has previously sold Ty’s Beanie Babies Soft Marvel keyrings. “It was an error on our ordering system,” says Vekaria, who received around 400 units of the product. Instead of returning it, he used the till space to clear the stock.

Charging £3 a unit, he was able to sell all the stock in about three weeks, with customers returning for other characters. While he couldn’t cater to incoming requests due to space restrictions, the incident reinforces the idea that if it is on the till, it is likely to sell. Cobb’s countertop range comprises chewing gum, mobile phone accessories from a brand called Fifo, packs of tissues and baked goods like brownies and lardy cakes procured from the local Halls Quality Bakers. Cobb also has his co ee machine on the counter, leading to additional purchases as people

invariably buy baked items to go with their co ees.

Priced at £2.50 a unit, he sells up to six units a day. “It is about 75% of what we sell o the counter,” says Cobb. While o ering healthier alternatives ensures diverse shopper needs are met, Vekaria recommends not isolating the products within the xtures. This way, shoppers are likely to pick up the healthier alternative as it provides them with choice, as opposed to sectioning products, which could create a “barrier to purchase”, says Vekaria.

“COUNTER space is prime real estate,” says Clare Newton, trade and shopper marketing manager at Swizzels.

Too many lines can make the counter feel overcrowded, thereby putting shoppers o .

“Retailers should aim for a selection of six-to-eight wellchosen lines; this gives shoppers a clear, focused choice without overwhelming them with options,” Newton adds.

“Retailers should consider

the visual impact of packaging. Bright colours, familiar branding and clear prices help the products stand out without taking up too much room.”

“We don’t have a huge counter, so it’s tricky what we put up there,” says Cobb. That said, small merchandising touches can turn limited space into sales opportunities, as Cobb found with the recently launched Lipton Kombucha range. “They sent us a PoS kit

that had loads of fans,” says Cobb. He placed the fans on the counter to generate conversation around the launch, giving away a free fan with every can purchased.

In less than one hour during a morning delivery, Cobb had sold three cans based on this mechanic.

Vekaria also places slow sellers on the till to give them a boost. This is especially the case with seasonal items,

like hot cross buns, but he extends it to baked goods in general, as he’s able to drive volume this way.

Cobb, however, is not in favour of placing slow sellers on the till, especially if they are short-dated or are reduced to clear, as he says they can “cheapen” the store.

Instead, make use of promotional bays and reserve counter space for high-margin items that will sell quicker.

Use of space

Use till space strategically to launch products and create buzz. Once the product nds traction, move it to the permanent xture and free up the till for another new product or campaign. Rotation keeps the impulse section fresh and exciting for shoppers.

Brand support

Work with brands and suppliers to o er promotions and giveaways to shoppers. This keeps the local community engaged and encourages repeat visits.

Local relevance

If you are using till space to also promote local events, make sure the promotional material ties in with your store’s branding and aesthetic.

Red Bull launches sugar-free Lilac Edition

Red Bull is expanding its flavoured sugar-free range with the introduction of Red Bull Sugarfree Lilac. Having launched into wholesale on 9 June, Red Bull Sugarfree Lilac, which incorporates flavours of grapefruit and blossoms, will roll out to wider convenience channels from July.

Seabrook launches Trebles price-marked range

Seabrook has launched price-marked packs (PMPs) of its Trebles range, now available in convenience. The range, which launched earlier this year in two varieties – Trebles Spicy Paprika and Sea Salt & Cider Vinegar – has a £1.25 price-mark.

Mars Wrigley to relaunch Maltesers

White Chocolate

Mars Wrigley is set to relaunch Maltesers White Chocolate after more than a decade. It will be available to independent retailers this month in a variety of formats. The relaunch comes o the back of the rising popularity of white chocolate, which witnessed a 12% uplift in 2024, the supplier said. The relaunch also taps into shoppers’ desire for nostalgic products, the supplier added.

RETAILERS should recognise the mark-up of their stores to understand what percentage of sales come from impulse to help them create the right ranges. “Impulse accounts for roughly 60-70% of our sales. There’s a huge portfolio of products, and that’s where our margin is,” says Vekaria. He also emphasises the value of the “80/20” rule, whereby 80% of his store’s sales come from 20% of the products, a bulk of which rest within impulse.

To capitalise on this, he places impulse products

across various locations in the store, in addition to the counter, thereby creating multiple buying opportunities. Bundling products as part of meal deals or o ering promotions leads to additional purchases. Lastly, sampling can have an impact. Even if there are no new products on o er, Vekaria recommends o ering classics, for example KitKat, to “rejuvenate” a shopper’s relationship with a staple. Additionally, Cobb says offering the product on promotion on the day is important to help close the sale.

Thornbury Refrigeration, an Arneg Distributor, has advertised in Retail Express for years. The regular positive response we

and

Robin Ranson, Thornbury Refrigeration

1

Jag Singh, Horsley Hill Premier, South Shields, Tyne and Wear

“WE’VE gone fully into global confectionery. We’ve dedicated one aisle to crisps and snacks and one to sweets. We source them from a small independent seller in Newcastle, although we sometimes use VSL Trade and Candy – we get 30-40% margins on them.

“We’re constantly changing the range, introducing new lines every few weeks. People get bored otherwise. As soon as something new comes in, we get a text from the supplier and we get it on the shelves. Sometimes, we’ll see a product trending online or someone will ask for it, and that will prompt us to get hold of it.

“People come from 50-60 miles away because we stock something no one else does. If they’ve travelled that far, they’ll probably spend £30-£40 on confectionery and crisps. It’s a big winner for social media because they have stand-out visuals. US products are still the best ones to go for.”

2

Jai Singh, MJ’s Premier, She eld, South Yorkshire

Benedict Selvaratnam, Fresh elds Market, Croydon, south London

“IT’S something we’re looking to explore. With our margins being cut elsewhere through price-marked packs, we’re looking for innovative ways to maximise pro�its. The margin US confectionery offers is very appealing, but we don’t want just to jump in without doing the proper research.

“Some of these products are unregulated and you might �ind the products you’re selling aren’t legal in the UK. Even if you’re buying from a reputable source, we’d be worried about any potential grey areas in case the labelling wasn’t correct.

“When it comes to world food, we’re getting more Eastern European, Asian and African customers, so getting products for them is something we’re keen to explore. It can’t be a half-hearted attempt because there are specialist stores and people will end up going to them instead if your offer’s not good enough. We’ll talk to customers, get the staples and go from there.”

In the next issue, the Retail Express

If you have any problems you’d like

“INTERNATIONAL food is a growth section in the store for us. We have about four or �ive different international ranges, but we’ve found the most promising areas are Asian and Indian foods, and there’s not much competition in our location.

“We try to zone them – we have Asian sections with rice, herbs and spices near the butcher, and Eastern European products and African products in their own section. It helps customers to get around the store more easily.

“It’s quite easy to source these products. We have about 20 suppliers, and you can get hold of more than 10 of them simply by Googling them and asking for a rep visit.

“You should pay attention to what your customers like. If they come in to buy your world foods, ask them what other brands and products they would like to see in your store, then �ind out how you can stock those.”