• First Post O ce Horizon inquiry report shows at least 13 suicides, 10 attempted suicides, plus mental breakdowns and alcoholism among the ‘many thousands’ harmed

LAST month, I travelled to Dublin to visit several flagship stores within the Maxol UK convenience chain.

Convenience stores across the Irish capital have o en been praised for being unlike any across the UK due to their impressive food-to-go ranges, and the four forecourts I visited certainly demonstrated this.

One site had an impressive ice cream and sundae concession, tapping into viral flavours such as pistachio. Another – which had a setup resembling a food court – boasted a range of Mexican, US and healthier-food options such as a salad bar.

However, it was the simplest option at the larger site that attracted the highest footfall during the day. This was a breakfast stand serving simple options that can be prepared easily and quickly by most independent retailers. Think jacket potatoes, hash browns, chips, fried eggs and breaded chicken.

It shows that, despite all the health fads or latest food trends lling the reels of Instagram or TikTok, customers will always gravitate towards the easiest, tried-and-tested options.

You don’t even need a large stand or kitchen to replicate some of the breakfast options from the Maxol site.

Jacket potatoes can be prepared and served to customers from a microwave, while there are plenty of suppliers there who can o er heated display units to store hash browns or chips.

WILL ALWAYS GO FOR FAMILIAR

Having a popular food-to-go option in your store needn’t be complicated or costly to implement.

@retailexpress betterretailing.com facebook.com/betterretailing

Editor Alex Yau

alex.yau@ newtrade.co.uk 020 7689 3358

News editor Ciarán Donnelly ciaran.donnelly@ newtrade.co.uk 07743 936703

News reporter

Kwame Boakye kwame.boakye@ newtrade.co.uk

Production manager

Chris Gardner

020 7689 3368

Senior production & content editor

Ryan Cooper 020 7689 3354

Senior designer

Jody Cooke 020 7689 3380

Designer Lauren Jackson

Editor – news Jack Courtez jack.courtez@ newtrade.co.uk 020 7689 3371

Features editor Charles Whitting charles.whitting@ newtrade.co.uk 020 7689 3350

Features and advertorial writer Shyama Laxman shyama.laxman@ newtrade.co.uk Cover

Head of marketing

Kate Daw 020 7689 3363

Head of commercial Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Account director Lindsay Hudson 07749 416 544

Account manager Lisa Martin 07951 461 146

Specialist reporter Dia Stronach dia.stronach@ newtrade.co.uk 020 7689 3375

Editor in chief Louise Banham louise.banham@ newtrade.co.uk

Features writer Jasper Hart jasper.hart@ newtrade.co.uk 020 7689 3384

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital Luthfa Begum 07909 254 949

ALEX YAU

RETAILERS are axing instore parcel services over reduced commission and other changes.

One retailer, who asked not to be named, told Retail Express they would be cutting their contract with DPD after it proposed to cut commission from 60p to 45p per parcel.

They said: “It’s �inished, as it’s not worth the effort or time to manage.

“DPD always provides the

argument that the service will attract footfall and additional spend into the store, but we’ve found this hasn’t been the case.

“Parcel customers never buy any additional products from us.”

Similarly, retailers are considering cutting Evri services after the company announced it would be moving to digital receipts.

One Evri retailer told Retail Express: “The move will just cause more frustration with customers as they’ll poten-

tially have to queue up even longer.

“We already get complaints from customers about this. It’s made me reconsider whether having parcel services is worth the headache.”

DPD failed to respond when challenged by Retail Express.

An Evri spokesperson said its digital receipts follow “a successful trial” with “feedback”.

claimed the digital receipts “improve customer experience” and cut carbon emissions by reducing paperreceipt printing.

The spokesperson said steps are being taken to tackle the biggest problem shops have reported with the new system – the need for customers to provide their email address in store for some parcels.

MORRISONS’ More rewards scheme has gone live in a franchise-owned store for the �irst time, making it the �irst supermarket loyalty scheme in an independent.

Morrisons Daily Congresbury in Bristol became the �irst franchise store to begin accepting More cards on 25 June.

Shop owner Priyanka Patel told Retail Express: “It’s only been a week, but the response from shoppers has been really positive.”

CO-OP is culling and downgrading some post of�ices due to “challenges in the current economic climate”.

Recent messages from Post Of�ice (PO) to customers, seen by Retail Express, revealed Coop is closing full branches in

eight of its stores. Seven will close completely, with one to be replaced by PO’s ‘lighter’ Drop & Collect services.

The move coincides with Co-op’s ongoing cost-cutting efforts. For the full story, go to betterretailing.com and search ‘Morrisons’

For the full story, go to betterretailing.com and search ‘Co-op’

A RETAILER has died after being stabbed in the chest, with police appealing for witnesses.

Merseyside Police said Niliani Nimalarajah was the victim of a domestic assault at Low Cost Food & Wine on Stanley Road in Bootle, Merseyside, on 20 June.

A 47-year-old man from Widnes was arrested at the scene on suspicion of murder. The suspect is in hospital in a critical but stable condition, according to Merseyside Police.

A RECORD number of retailers attended the fourth annual Women in Convenience event on 25 June.

The event featured panel discussions and speeches by Central Co-op chief executive Debbie Robinson and BAT’s Susanna De Iesu. Retailer Natalie Lightfoot said: “Listening to some truly inspirational leaders encourages us to be the main character in our story, look after ourselves and empower others.” For the full story, go to betterretailing.com and search ‘stabbing’

For the full story, go to betterretailing.com and search ‘Women

AT least 13 people may have taken their own lives due to the Horizon scandal, with many more contemplating suicide, the Horizon inquiry has found.

Volume one of the inquiry’s �inal report, published on 8 July, focuses on redress and the human impact of the scandal.

Sir Wyn Williams, chair of the inquiry, said that �igure – based on �igures provided by Post Of�ice (PO) in March, may have understated the number of suicides as some deaths were not reported to PO or the inquiry.

Sir Wyn stated: “I should stress that while I cannot make a de�initive �inding, there is a causal connection between the deaths of all 13 persons and Horizon. I do not rule it out as a real possibility.”

The report also revealed that at least 10 people had attempted to take their own lives on more than one occasion, and that 59 individuals had contemplated suicide.

System errors and personal liability Horizon, a computer system introduced into PO branches in 1999, was used for stock-taking, accounting and �inancial transactions.

Provided by International Computers Limited – later fully absorbed into Fujitsu –it soon drew criticism.

Sub-postmasters report-

ed errors as early as 2000, claiming the system made it appear money was missing.

Under their contracts, sub-postmasters were personally liable for any shortfalls, and in many cases this led to prosecutions, bankruptcies and emotional breakdowns.

One former postmaster, quoted in the report, said: “The mental stress was so great for me that I had a mental breakdown and turned to alcohol as I sunk further into depression.

“I attempted suicide on several occasions and was admitted to a mental-health institution twice.”

Evidence was also received from 19 people who said they had abused alcohol. One postmistress said she spent eight months in rehab as PO’s actions had

“turned her to drink”.

Speaking after the launch of the report, Sir Wyn said: “Many thousands of people have suffered serious �inancial detriment.

“Many businesses and homes have been lost; bankruptcies have occurred, and marriages and families have been wrecked.”

The report con�irmed that, prior to its rollout, some Fujitsu employees were aware that Legacy Horizon was “capable of producing data that was false”.

It was known to those employees that it could produce losses or gains in branch or Crown Of�ice accounts that were “illusory rather than real” and that Legacy Horizon would be

af�licted by “bugs, errors and defects”.

“A number of senior and not-so-senior PO employees knew – or at least should have known – that Legacy Horizon was capable of error,” Sir Wyn said.

“Yet for all practical purposes, PO maintained the �iction its data was accurate.”

Legacy Horizon was replaced in 2010 by HNG-X (Horizon Online), also supplied by Fujitsu, but the inquiry found it also suffered from “bugs, errors and defects” capable of showing illusory gains and losses. Sir Wyn concluded that PO and Fujitsu staff were aware of the defects

What happens next, and recommendations

The report con�irmed that

“THE lesson we learned from Ireland’s deposit-return scheme (DRS) was that if you don’t have a machine, you’re going to lose footfall because customers are going elsewhere. Companies have told us the multiples have already ordered machines. They want to be sure that as soon as it’s up and running, they’re ready, because there’s a nancial opportunity. I’ve already conducted several self-funded DRS trials in my store.” Mo Razzaq, Premier Mo’s Blantyre

“I’VE been following trade magazines closely for updates on DRS ahead of it coming into force across England in a couple of years. I believe the policy will provide a big opportunity for my store in attracting more footfall and sales from new potential customers. From a sustainability perspective, it’s also useful to be able to show your customers that you’ve got initiatives that are bene cial to the environment.”

Ken Singh, BB

Nevison Superstore, Pontefract

no claims for �inancial redress under the Horizon Shortfall Scheme (HSS) will be accepted after midnight on 27 November 2025.

It also recommended that:

• All HSS claimants should be entitled to legal advice, with costs covered by the Department for Business and Trade.

• A compensation process should be developed for close family members who suffered serious harm due to their relationship with those affected.

The department, Fujitsu and PO are expected to publish a report on restorative justice by 31 October.

The government’s formal response to the inquiry’s �indings is due by 10 October.

“THE new DRS is not coming into force in England until October 2027, but I’m getting prepared now, as the launch day will come much quicker than many shop owners will expect. DRS will be essential, as any stores that don’t adopt it are going to be left out. Some retailers will choose to apply for exemptions, but they will lose potential customers to sites that choose to operate DRS.”

ONE STOP: The convenience chain is trialling Tesco Clubcard redemptions in a “small number” of sites for the rst time. Customers will be able to redeem points when they present their Clubcard, Tesco Bank card or Tesco app in store. It is only being conducted in centrally-owned sites.

For the full story, go to betterretailing.com and search ‘One Stop’

JEMPSON’S: The multi-site retailer is to launch a new frozen ready meal range in the coming months. It will expand on a chilled range prepared on site at its Peasmarsh store, and distributed across its estate of eight stores. The retailer sells several hundred chilled ready meals a week.

For the full story, go to betterretailing.com and search ‘Jempsons’ 15-28

YODEL: The High Court has fast-tracked the trial which could determine the ownership of the parcel courier to October 2025. Shift and Corja, along with other parties, claim to hold warrants giving them rights to more than 75% of Yodel’s share capital – a majority stake.

For the full story, go to betterretailing.com and search ‘Yodel’

NEWS UK: The publisher has been criticised for its attempts to raise cover prices while also slashing margins. Analysis suggests retailers are to lose out on £3.8m over the next year due to the cuts to the Times and Sun margins from 14 July. The Fed said the cuts would lead to stores dropping newspapers.

For the full story, go to betterretailing.com and search ‘News UK’

KWAME BOAKYE

A NEWSAGENT who traded through the Troubles in Northern Ireland and remained the only small shop in the area is to close after 46 years.

Eugene Diamond, of Diamonds News in Ballymena, County Antrim, has announced his retirement and the sale of his business due to ill health.

He said the decision was a dif�icult one to make. “If it wasn’t for the illness, I wouldn’t be retiring,” Diamond told Retail Express.

Over the decades, Diamond has seen many changes in Ballymena.

He said: “When I took over my shop, I was in the middle of houses, and now it’s a massive shopping centre.

“Where the shopping centre is, there was a cattle mar-

ket that was open every day. Times have really changed; the only original thing still standing is my shop.”

Diamond described the role of a newsagent during a “grim time” for the country, stating: “Daily, you opened up a parcel of newspapers to hear of people dying, but the cease�ire made me emotional because it brought about peace for people.

Commenting on pivotal

moments in his career, Diamond described the introduction of the National Lottery in 1994 as a “big game changer” and highlighted the £1m his shop had raised for charity.

He also cited the closure of the News of the World newspaper in 2011 as a “terrible blow”.

Diamond concluded: “I love the business, I’ll miss the people and the daily craic.”

CO-OP Wholesale has pledged to improve deliveries and expand the Co-op own-label range for retailers.

The promises were made at the �irm’s �irst Retailer Summit, held on 26 June. One source told Retail Express the announcements at the event were positive, with further promises made to boost public awareness of its Making a Difference Locally charity initiative – a rebate dedicated for spending on local good causes.

AN £80m drop in sales has forced Prime Energy to launch a “strategic review”. The dip was revealed in the company’s results for the year ending 31 December, 2024.

During the same period, pro t fell from £3.7m to £312,393.

Director Max Clemons said:

“The company is now entering into a strategic review process to transition from an initial hyper growth phase to a more sustainable, long-term presence in the market.”

SHOPS are being urgently advised to remove Jolly Rancher products from shelves, following warnings that some lines pose “an increased risk of cancer”.

Last month, Food Standards Agency stated Jolly Rancher Hard Candy, Mis�its gummies, Hard Candy Fruity 2 in 1 and berry gummies contain ingredients banned in the UK.

SHYAMA LAXMAN

COCA-COLA Europaci�ic Partners (CCEP) has added a Fantasy Ruby Red variety to its Monster Energy Ultra range.

Originally launched in the US in 2024, it is now available exclusively through Booker ahead of a nationwide launch in August

The pink-coloured variety, which had an initial US launch in 2024, combines the Monster Energy blend with a grapefruit �lavour.

According to the supplier, the �lavour is “not too sweet, but not too tart, and boasts a fresh citrus taste”.

It is available in a £1.65 price-marked pack (PMP).

The launch will be supported by point-ofsale (PoS) kits, enabling wholesalers and convenience retailers to transform their depots and stores to “maximise visibility, excite shoppers and be part of another successful Monster launch,” the supplier added. Monster features heavily in What to Stock’s 2025 guide to the 25 bestselling energy drinks.

This year, the brand has solidi�ied its presence in store with the launch of Monster Lando Norris Zero Sugar, in partnership with British Formula 1 driver Lando Norris, as well as the addition of Rio Punch variety to its Juiced range.

WALKERS has launched two new formats of its Sensations Roasted Chicken & Thyme �lavour crisps.

Worth £17.5m RSV and Sensations’ second biggest �lavour, Roasted Chicken & Thyme will now be available in a 40g single pack and a 65g PMP.

The 40g single packs will help retailers provide more choice for shoppers looking for snacks on the move and offer opportunities to drive linked purchases through lunchtime meal deals, said the supplier.

PLADIS has expanded the McVitie’s Club brand into confectionery by launching McVitie’s Club Layers Orange chocolate bar.

The milk chocolate bar has an orange-�lavoured cream �illing and multiple layers of wafer. Initially available as a Spar exclusive for three weeks since launching on 30 June, the variety will roll out to convenience stores

and wholesale depots from 21 July.

Olivia Haley, brand manager at Pladis UK&I, said: “By taking the biscuit brand into a new category, confectionery, we can recruit new and younger consumers.”

RRP: 89p

The introduction of new pack formats coincides with the launch of an HFSScompliant recipe for Walkers Sensations Roasted Chicken & Thyme �lavour crisps, suitable for vegetarians. RRP: £1.10 (40g single pack), and PMP £1.35 (65g)

WORLD of Sweets has added two new lines to its Bonds of London charity range, which launched in April this year in support of Our Dementia Choir.

ROBINSONS and Fruit Shoot have partnered with Halfords for the ‘Win Your Summer Wheels’ campaign. The campaign includes an on-pack promotion giving shoppers a chance to win thousands of vouchers for bikes and scooters.

Shoppers simply need to purchase a qualifying pack of Robinsons Core, Readyto-Drink, Fruit Creations or

Fruit Shoot and upload their receipt for a chance to win. Every purchase also rewards customers with an £5 off when they spend £20 on cycling products online at Halfords.

The campaign will run until August.

ROWNTREE’S Jelly Tots and Fruit Pastilles have entered the soft sweets space as part of the Squidgers range.

The Fruit Pastilles Squidgers comes in �ive �lavours including blackcurrant, lemon, orange and strawberry.

Meanwhile, the Jelly Tots Squidgers are a mix of raspberry, apple, pineapple and orange �lavours.

Rowntree’s has also partnered with the Kids Pass family savings app.

The partnership will give parents and guardians three

According to the supplier, the launch taps into the growing popularity of sour and chewy confectionery, with the brand hoping to widen the range’s appeal. RRP: £1.25

The new �lavours include Soft Sherbety Lemons and Sour Melon Slices. While Soft Sherbety Lemons have a chewier texture, the Sour Melon Slices are available in a gummy format.

PLADIS is expanding its Flipz coated pretzels brand with the launch of a limited-edition Strawberry Cheesecake variety.

CADBURY has launched a campaign to celebrate its iconic Twirl variety called ‘Zero to Chocolately in Milliseconds’.

To support the launch, Pladis will bring back its ‘Grab a Grand’ on-pack promotion for the third year in a row from 25 August.

Running for 12 weeks, shoppers can win £1,000 each week. To enter, they need to buy a participating pack and scan its QR code. Every two entries generate a third free entry, encouraging repeat purchases.

RRP: £1.49 PMP (80g), £2 (90g) Available: Now

The campaign follows the launch of the limited-edition Cadbury Twirl White Dipped and runs across a variety of media channels, including out of home, digital and social.

It contrasts slow moments like waiting for someone to �inish typing a text with the instant chocolate hit of a Cadbury Twirl, which, “unlike life’s slow moments, gets straight to the good bit,” said the supplier.

SHYAMA LAXMAN

CEREAL brand Weetos has launched ‘Weetos World’, its �irst branded gaming experience on Roblox, developed in partnership with online pop-culture platform Fandom.

The game targets the platform’s core demographic of 9-to-12-year-olds and offers puzzles, challenges, and interactive zones for children and families.

To support the initiative, over one million limitededition Weetos packs are available, featuring a new design and a QR code linking to a dedicated Weetos hub on Fandom.com.

The campaign also includes

weekly prize draws until 31 August, with chances to win consoles and gaming bundles. Participating packs are available through wholesalers Bestway and Unitas.

All characters and game environments in ‘Weetos World’ were inspired by drawings from children related to Weetos employees.

Consumer testing of the updated packaging showed a 10% increase in purchase intent.

The campaign re�lects Weetos’ strategy to connect with families through play, while maintaining its HFSScompliant status and growing presence in the £10m UK cereal market.

BIONA has launched a range of organic Greek olives, available to convenience retailers from this month onwards.

Table olives are increasing in popularity in the UK, with total sales now valued at over £100m.

The new range consists of three different variants of Greek Queen Olives of the Halkidiki variety, each stuffed with either garlic, pepper or jalapenos, and Kalamata olives pitted in brine.

The products are certi�ied

sponsored

ROBINSONS’ Fruit Shoot has introduced accessible packaging for blind and partially sighted shoppers.

The new packaging makes use of NaviLens codes which when scanned with a mobile phone, allows partially sighted shoppers to easily see ingredients and nutritional information listed on the packaging. The information is also read out aloud.

in seconds, at a distance 12 times further than a QR code or barcode, as well as at an angle. The codes also work when out of focus and in low lighting.

The new packaging is available on Fruit Shoot multipacks, as well as on Apple & Blackcurrant 275ml single and price-marked packs.

The code also allows shoppers to locate the product using haptic technology, including sounds, arrows and vibrations. The NaviLens codes can be scanned,

YORKSHIRE Baking Company has announced the launch of its �irst-ever on-pack promotion in partnership with the Emmerdale Village Tour, to celebrate Yorkshire Day on 1 August.

and-greet experience at the outdoor �ilming location of the soap drama, Emmerdale. Winners will also receive bundles of Yorkshire Baking Company’s Mega Loaf cakes.

LANGTINS, a British confectionery company, has launched Noomz, a brandnew range of freeze-dried sweets, available in selected convenience stores.

Running for around six weeks, the promotion offers customers the chance to win a star tour and meet-

TO mark the launch of Cheez-It’s new 120g sharing format into symbols and independents, Kellanova has partnered with Retail Express to offer 10 lucky retailers the chance to win a £50 cash prize by �illing in an online survey.

All you need to do is answer �ive simple questions about Cheez-It and popular snack format sizes in your store. Simply go to the survey website below, enter your details and let us know your thoughts on the Cheez-It brand and your

To answer the survey, head to surveymonkey. com/r/XPT9WWJ

To enter, shoppers scan a unique QR code found on promotional pack labels, which leads to a dedicated competition entry site: yorkshiregiveaway.com

There are eight �lavours available in the range including Fruit Bites, Fruit Bears, Lemon Bites, Mini Rocks, Drift Rocks, Jelly Rings, Rain Burst and Sour Bites.

freshness. Mubarak Isap, managing director at Langtins, said: “Freeze-dried is one of the fastest growing segments in the confectionery market and a popular social media trend among Gen Z audiences.”

RRP: £2.49

customers’ sharing-snackbag buying habits to be in with a chance of winning.

Stay still and sip flavoured water

HIGHLAND Spring has expanded its still �lavoured water range in the convenience and wholesale sectors with the launch of three new �lavours.

The new variants are Juicy Strawberry, Tangy Apple & Blackcurrant and Zingy Lemon & Lime. They are sugar free and combine natural fruity �lavours with refreshing highland spring water drawn from Scotland’s Ochil Hills.

The launch will be supported with a new marketing campaign called ‘Make Your

The sweets are halalcerti�ied and available in resealable pouches to retain

LAUNCH

Day Fruitier.’ 250,000 samples of the new �lavours will be delivered via the Highland Spring Flavours Van to shoppers across the UK during a 96-day tour.

RRP: £1.75 (750ml) and £1.69 (1.25L)

FROZEN organic food brand

Pack’d has added two new products to its roster, available to convenience retailers.

The Dragon Fruit Smoothie Bowls kit combines frozen fruits and superfoods to create an immunity-boosting smoothie bowl, high in Vitamin C and D.

Consumers simply need to add the frozen fruit pouches to 200ml of water, coconut water, or plant milk to blend a fresh smoothie bowl in seconds.

Meanwhile, the Organic Açai is an unsweetened, scoopable Açai ideal for adding to smoothie bowls at home.

RRP £5.80 ( 2-pack 480g)

£5.80 (300g)

LAUNCH

NESTLÉ cereal brands have partnered with DC Studios and Warner Bros for an on-pack promotion celebrating the new Superman �ilm, which was released on 11 July.

The promotion gives shoppers across the UK and Ireland a chance to win holidays to the Six Flags Over Texas theme park in the US, as well 1,000 cash prizes.

To enter the draw, shoppers must purchase a participating pack of Nestlé cereals, scan the QR code, enter their unique product code and upload their receipt. Participating lines include Shreddies, Cheerios and Nesquik.

ASPALL Cyder has unveiled a new campaign called ‘Y Do Ordinary’.

JTI has unveiled a UK-�irst lemon-�lavoured cigarillo, Sterling Dual Capsule Xtra Yellow, launching this month. It features a lemon capsule in the �ilter, which can be clicked to release the lemon �lavour.

The lemon capsule comes in addition to the existing peppermint capsule.

According to the supplier, the success of the lemon �lavour in other categories provides retailers with an option to meet the continued demand for new �lavours.

RRP: £6.95

It promotes Aspall Cyder as a sophisticated alternative to prosecco and wine, positioning the brand as the drink of choice for elevated social occasions for a new generation of cider drinkers.

The campaign features striking visuals of the cider being poured into elegant cocktail glasses to challenge traditional perceptions.

It will be activated across out-of-home advertisement in key cities, as well as through targeted social ads and sampling activity in high-footfall areas.

THE ice cream category naturally contributes strong sales during periods of warm weather. However, with a proactive approach to ranging and merchandising, retailers can improve their sales all year round. That’s why we have created our ‘Five Steps to Sell’ recommendations to help drive extra pro ts:

PHILADELPHIA has partnered with the New York Bakery for an on-pack promotion celebrating the popular brunch of cream cheese and bagels.

The top prize includes brunch for two in New York City on a trip worth £1,000, as well as a host of brunchthemed prizes.

The promotion will be available on Philadelphia Original,

Philadelphia Light, Philadelphia Sweet Chilli, Philadelphia Garlic & Herbs and Philadelphia Chives.

Shoppers must scan the onpack QR code or visit philadelphia-brunch.com and add details from their purchase to be entered into a draw.

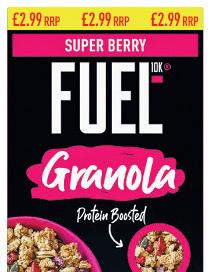

PREMIER Foods has launched price-marked packs (PMPs) across its Ambrosia and Fuel10K breakfast ranges. The new format will be available across Fuel10K’s granola and Ambrosia’s porridge pots line-up, including Apple and Blueberry & Golden Syrup (PMP £1.19) and Fuel10K Granola Chocolate and Super Berry (PMP £2.99).

To support the launch, Premier Foods has partnered with retail app Shopt, offering independent retailers a £3 reward when they stock Ambrosia Apple & Blueberry and Golden Syrup Porridge PMPs together, and Fuel10K Chocolate and Super Berry

Granola PMPs alongside each other, available for up to 345 redemptions for each product range.

Available: Bestway, Unitas and Sugro

1. Choose the right freezer for your business. Wall’s branded cabinets are the number-one driver of purchase, making them a must-have for retailers. Choose a freezer that suits the size of your shop and consider available space and footfall.

2. Stock Wall’s bestselling products. Ensure you have a wide variety to suit all customers for all occasions.

3. Stock new innovations and exciting flavours. Innovation is a key driver for the ice cream category. It keeps people excited, engaged and coming back for more.

4. Draw attention to your cabinet using free Wall’s PoS material.

5. Keep your cabinet clean and well-stocked. Ensure you also keep spare stock for busy summer weekends.

In a trial associated with Newtrade Insight, we teamed up with two fantastic retailers – Meten Lakhani, of Premier St Mary’s in Southampton, and Gursh Singh, of King’s Wines in Feltham, west London – to bring these steps to life in store. Lakhani saw his overall ice-cream volume sales increase by 26.2% year on year, while Singh increased sales of key Wall’s brands Magnum, Calippo, Cornetto and Twister.

Scan the QR code to nd out more

ECHO Falls has partnered with in�luencer GK Barry to launch a limited-edition fruit�lavoured wine called Summer Berries Fruit Fusion. The launch will be supported by a digital-�irst campaign, as well as a 360° shopper campaign, in store and online. Echo Falls will also team up with The Girlies Guide social community for a series of allfemale events.

Tom Smith, marketing and category director at Vinarchy, said: “In a category that has seen fewer NPD launches recently, we’re excited to bring a

seen signi cant growth in a short period

SYMBOLS: How does your group support you?

“MY wholesaler Appleby Westward provides an online training portal which is really useful. Overall, it costs me £200 year. It’s got stepby-step training and you get a certi�icate to show they’ve successfully passed at the end of each module.”

Susan Connolly, multi-site Spar retailer, Wiltshire

“PARFETTS pretty much leave you to your devices unless you contact it. I still get regular retail development adviser visits and more speci�ic support if I ask for it. Parefetts does it on a bespoke basis. If you want help, it will put it in place.”

Sasi Patel, multi-site Go Local retailer, Manchester

DHAMECHA: How will its introduction of card charges affect you?

“I HAD previously written to Dhamecha head of�ice, expressing my disappointment about its initial decision. The one request I made upon �inding out was for the charge not to be applied unless the retailer meets a minimum spend threshold such as a single £500 transaction.”

Subhash Varambhia, Snutch Newsagents, Leicester

“ A LOT of retailers are kicking up a fuss about the charges, but some of them are to blame. Many of them are using American Express cards to get loyalty points to claim free holidays, which is wrong in my opinion. As Dhamecha has shown, all those free holidays will end up costing them in the long run.”

Some retailers are to blame for these charges

HOME DELIVERY: What developments are you making?

“WE had fridges that were low to the �loor, and we indented the suspended ceiling above them to hold shelving and lightweight multipacks of crisps. That freed up space so I could expand my pet range. A lot of our online deliveries are instigated by a need to buy pet food.”

Natalie Lightfoot, Londis Solo Convenience, Glasgow

“SNAPPY Shopper has been a game changer. The EPoS integration has made a big difference, we can now offer real-time stock updates which wasn’t possible with our previous delivery provider. It is is a real step up and the marketing support has been invaluable.”

Kevin Wilson, multi-site retailer, Leeds

If you want help, they’ll put it in place

CONFERENCE: What recent events have benefited you?

“I LOVED the recent ACS Brand Day held in Wolverhampton last month. It enabled me to catch up with other retailers, as well as suppliers. The recent Women in Convenience event was also great, and I was happy to stand up and share my experiences.”

Julie Kaur, Jule’s Premier, Telford, Shropshire

“LAST month, I attended the annual Fed Conference and Awards, and I wanted to congratulate all the winners of the evening event, full of inspirational retailers and suppliers who help support all of us retailers across the industry. I salute them all for backing us.”

Trudy Davies, Woosnam & Davies News, Llanidloes

I RECENTLY sent a letter to our local MP, Henry Tufnell, sharing my thoughts on some key issues affecting retailers.

Retail crime has been a persistent concern for small convenience stores, highlighted by a video shown at the recent Fed Awards in Birmingham, which illustrated the signi�icant impact on independent retailers

I appreciate the introduction of a standalone offence for assaulting retail workers and the removal of the £200 threshold for prosecution.

However, more needs to be done, as retail crime continues to rise.

The rising cost of doing business is another pressing issue. The increase in National Insurance contribu-

COMMUNITY RETAILER OF THE WEEK

‘This isn’t just a business, it’s family’ Serge Notay, Notay’s Premier, Batley

‘Retail crime is a persistent concern’

tions has forced us to reduce staf�ing hours by 10%, and many others are struggling to keep their businesses a�loat. It’s also important to address the sheer number of regulations that affect our ability to operate effectively.

From High Fat, Salt and Sugar (HFSS) regulations to the deposit return scheme (DRS), vape and the pro-

posed generational tobacco bans, as well as the new employment law bill, these changes signi�icantly affect our sector.

We all agree on the need to build a brighter future. Fostering a thriving retail sector supports our economy and our country.

Vince Malone, Tenby Stores & Post Of�ice, Pembrokeshire

THE May bank holidays were big sales opportunities for us and we made sure we had all our multipacks well stocked in store and listed online on Snappy Shopper. Everything we do these days is geared towards home delivery, and we’ve found that when you get that right, then things in store go right as well.

In terms of summer opportunities, multipacks of drinks – whether beer or so drinks – are key, so you need to get all the varieties and lines in, but ice is the big one.

Even if the weather’s not great, when people have time o , they visit friends and want the instant grati cation of cold drinks. Then, of course, there’s all the stu for picnics, like salads.

The main thing retailers need to do when there’s a big event coming up is to use it to almost give your store a thorough stock check.

We look at our chillers and our shelves more closely to see if there’s anything missing.

Because we’re constantly working and three of us are doing the orders, sometimes a couple of lines might get missed from an order. Or they might suddenly become unavailable from our supplier and we’ve not changed supplier, so we don’t have it.

Use these big seasonal events like summer bank holidays to get your store ready with all the seasonal products that people want for them.

Also use them as chances to look at your store, nd and ll gaps and then build it up on social media.

Everything stands or falls on social media. Normally, within 20 minutes of us posting some new product on social media, someone will be ordering it on Snappy Shopper. It’s like we’re shaping their baskets for them.

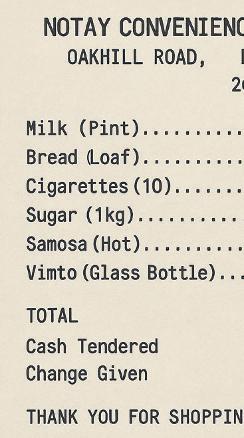

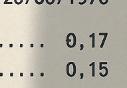

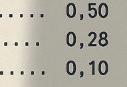

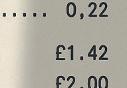

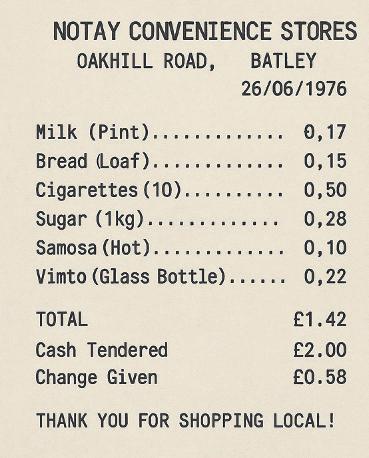

“WE were established on 26 June 1976, which means it’s been 49 years since our doors rst opened on Oakhill Road – and what a journey it’s been. From a small corner shop to a community cornerstone, we’ve stood through heatwaves, recessions, pandemics and everything in between. This isn’t just a business – it’s family, history, and heart. To every customer who’s popped in for milk, bread, a quick chat or even just a smile – thank you. We’re already planning something special for next year’s 50th, but for now, we raise a toast to 49.”

“OUR partnership with Patrick Brennan and his team at DNL Collective has been crucial to our growth and the expansion of Speed Queen Licensed Stores in Scotland. Speed Queen was the perfect t for our new RaceTrack Wishaw Store, and plans are underway to expand further across our retail estate. It enables customers to wash their clothes while shopping in a convenience store. Our eighth store has just recently opened, and we have a further three stores in their later stages of t out with the Speed Queen laundry machines.”

YOUR JOURNEY, CONNECT WITH OTHER YOUNG RETAILERS AND GET THE RECOGNITION YOU DESERVE

30 Under Thirty celebrates the success of the younger generation of retailers who are driving the convenience channel forward. Nominate yourself, a member of your team or a fellow retailer who deserves recognition!

Visit: betterretailing.com/30-under-thirty-rn Contact: anna. tzgerald@newtrade.co.uk FIND OUT MORE

Entrants must be aged 29 and under on 23 September 2025

The hotter the weather, the higher the demand for beer and cider, so keep an eye on the forecasts. TIM MURRAY looks at how the summer is progressing for the category

A DECENT start to the summer is always the perfect platform to grow sales of beer and cider, which are traditionally popular in the warmer months as people gather for long afternoons in back gardens, parks and festivals.

This year, the Met O ce’s long-range forecasting into August suggests that after potentially milder weather in late July, further heatwaves could be on the cards.

Heineken’s category & commercial strategy director, Al-

exander Wilson, says: “Last year, we noticed an anomaly in July, resulting in value dropping as the Met O ce reported a cool and dull July.

“However, in the rst weeks of August 2024, during the sunniest spells, the value of beer and cider peaked.

“We recommend that retailers pay close attention to weather forecasts and maximise sales opportunities by ensuring good availability of beer and cider stock ahead of sunnier periods.”

Peter Bhadal, Londis Woodhouse Street, Leeds RETAILER VIEW

“WE have a lot of student customers, so summer is a little bit quieter for us, but we’re looking at reinvesting in the store and adding a beer cave. We want to add a bit of theatre and we’re designing it right now.

“Customers are more willing to experiment with beers now, and the beer cave will give us a real point of di erence. We can bring in more new ranges and categories, too.

“There’s only so much we can t in, especially in the fridges, but this will increase our space. We should have it in place in September, when the students come back; we normally reinvest in new lines in September.

“I’d like to use more local cra beers from microbreweries, but it’s di cult getting a supply chain we can really connect with. Minimum orders make it difcult – a lot of them don’t have much range, but want minimum orders.”

WHILE single cans o er mixand-match opportunities as thirst-quenching purchases from fridges, multipacks are also important, especially if chilled, whether in beer caves or specialist areas.

Heineken’s Alexander Wilson says: “Single packs are

ideal for grab-and-go and summer-festival moments, and small-sized multipacks are a popular, accessible choice for those who are looking to share with friends.

“It is important to keep these packs chilled, so they’re ready for consumers to enjoy.”

Peter Bhadal, from Londis Woodhouse Street in Leeds, says 10-packs are his mostpopular multipack, with 12-packs also selling well.

Larger packs sizes and chilled multipacks are critical to cider sales, according to Westons’ head of business devel-

opment Darryl Hinksman. “Shoppers don’t want to buy lukewarm cider, so if retailers haven’t got the temperature right, they will miss out on sales,” he says.

“As summer is a time for entertaining, there is certainly a role for larger-pack formats.”

Promotions and marketing

Cornish Orchards

Cornish Orchards is aiming to highlight its homegrown heritage with a new campaign ‘Can You Trust Your Cider?’ campaign. The campaign will run across video on-demand channels, with social media and influencer activity also planned. The PoS will also be available to stores, featuring Cornish Orchards and another brand undergoing a polygraph test to check their claims of being made from British apples.

Crumpton Oaks

After its hip-hop-inspired Straight Outta Crumpton campaign, Aston Manor’s Crumpton Oaks brand is heading to the raves this year for its 1990s-themed Happy Applecore campaign.

Kopparberg

Kopparberg has partnered with tooth jewellery company Tu Tooth to o er limited-edition designer bottle openers. Running across TikTok and Instagram, the campaign is inspired by the fact that one in ve Gen Z drinkers admitted to opening bottle caps with their teeth, with a quarter of them chipping them.

Peroni

Peroni is running an on-pack summer promotion offering luxury holidays and money-o travel as well as accessories after teaming up with Secret Escapes and Antler. The promotion will be supported with social media, advertising media, PR and influencer activity, as well as PoS.

Rekorderlig

Rekorderlig’s Wild Berries and Peach-Raspberry varieties, which are now available in 500ml cans (see New Product box) will feature in the Molson Coors Beverage Company’s £1.4m summer Find Your Fruktig summer campaign. It will be running across out-of-home ads, social media and in stores, and will be supported by a sampling campaign.

CRAFT beer and cider have now become an established part of the overall category, with several launches continuing to excite interest.

An example of this is BrewDog’s Wingman, which launched in 2024.

Hannah Corker, head of customer marketing at BrewDog, says: “Wingman has tapped into the growing session-IPA occasion and is now the fast-

est growing craft-beer brand.”

The craft idea is also now rmly imprinted into the cider category, with customers eager for quality and craft.

Westons’ Darryl Hinksman adds: “Our latest Cider Report revealed premiumisation is stronger than ever, driven by consumers looking for products with genuine craft credentials – heritage, authenticity and expert production.”

The latest launches

Crumpton Oaks

Aston Manor has added Strawberry and Berry varieties to its Crumpton Oaks range.

Old Mout

Old Mout has launched its rst innovation in three years in the shape of Mango & Passionfruit. The tropical cider is available in 4x440ml and 10x440ml multipacks.

King sher

King sher has added a Peacock cider to its range, with the Passion Fruit & Guava variety available in 500ml bottles.

Rekorderlig

Rekorderlig has made its Wild Berries and PeachRaspberry flavours available in 500ml can varieties.

Staropramen

Staropramen has launched its rst ever pricemarked multipack, with its 4x400ml can packs carrying a tag of £6.

Westons

Westons celebrated its 145th anniversary by introducing the new Westons 1880 Vintage, inspired by one of the family’s original recipes.

BrewDog BrewDog has unveiled a new look for its four key lines: Punk IPA, Hazy Jane, Lost Lager and Elvis Juice. The colour palette, the banding and BrewDog’s logo all remain the same.

As cra ed cider continues to shine, convenience stores should capitalise on the ripe opportunity over summer. Prioritising premium lines, like HENRY WESTONS VINTAGE, is key to boosting pro ts

THERE’S no doubt that cider sales shoot up over summer –the latest Westons Cider Report showed that spring and summer bank holidays both feature in the top 10 ciderselling days1. So, to tap into the £1.1bn cider market, it’s important to stock the right products.

The crafted sub-sector is still where retailers should be focusing – up by 7.7% in the past year, outpacing total cider sales (-1.4%)2

The £576m convenience cider market is being rede ned by these premium crafted choices, fast becoming essential for retailers looking for long-term success. And there’s still headroom for cider to continue to grow. Crafted cider makes up 20% of total convenience cider sales, compared with 24% across total market2. Bridging this gap would bring in even more pro ts for retailers.

Darryl Hinksman, head of business development, Westons Cider SUPPLIER VIEW

“WE’VE lucked out with a sunny spring and we’re keeping ngers crossed this continues across the summer months – so keep your cider stocked up to make the most of any opportunities, as out-of-stocks are still the biggest barrier to cider sales. With cra ed cider performing well all year round, it’s a must-stock for any store owners wanting to make the most of the category in summer and beyond. Think premium, heritage brands which really deliver on flavour to keep your shoppers happy.”

must-stock products

Henry Westons Vintage 500ml, 8.2% ABV

Henry Westons 1880 Vintage, 6.2% ABV

Henry Westons Vintage Pear 500ml, 6% ABV

Henry Westons Vintage is worth

than the next bestselling line2 the stat £21.4m more

WHILE many may still see cider as a drink for older generations, the premiumisation of the category can entice younger drinkers into the category, too.

with a higher income) now accounting for 65.8% of spend for crafted cider, up from 61% last year, according to Westons’ 2025 Cider Report2

range and attract a new wave of consumers.

TOP TIPS

Younger shoppers, particularly those under 45, are actively trading up to premium drinks across categories. This makes crafted cider an aspirational yet accessible choice. And it’s already gaining traction with a luent consumers, with ABC1 shoppers (those

HENRY Westons Vintage is the UK’s number-one cider line – and it’s showing no signs of slowing down. Now worth £66.6m – a whopping £21.4m more than the next bestseller – one bottle is sold every 0.75 seconds2.

Henry Westons Vintage is really leading the charge when it comes to the growth of crafted. Rich in heritage,

Maximise chillers: Keep single bottles chilled in the fridge for customers on the go.

Consider cross-merchandising: Pair cider with barbecue items and snacks to maximise sales.

Crafted cider has the highest proportion of younger shoppers, with under-45s making up a larger share of spend compared to any other cider segment2. This clear shift towards quality and authenticity presents a huge opportunity for convenience retailers to refresh their cider

This summer, ahead of sunny days, bank holidays and local events, make sure your chillers are well stocked with bestselling ciders, including Henry Westons Vintage and the new Henry Westons 1880 Vintage, to be enjoyed in the sunshine, and multipacks are merchandised alongside barbecue favourites to encourage shoppers to stock up and see your cider sales soar.

2 3 4 1

5

Avoid out-of-stocks: Keep stock levels up, especially ahead of bank holidays and warm weekends.

Stock a range of formats: O er chilled singles and larger ambient multipacks for all shopper needs.

Think premium rst: Crafted cider taps into shopper trends as well as delivering higher pro t margins.

the family-owned cider maker sources all of its apples within 50 miles of the mill – only using traditional cider apples, from one year’s harvest, for a rich flavour, full of character. Shoppers are drawn to these quality cues, so making sure Henry Westons Vintage is stocked on shelf and in chillers is crucial to driving sales.

This year, Westons is celebrating its 145th anniversary and, to mark it, has taken inspiration from a recipe in the family archives to create Henry Westons 1880 Vintage. From the same legacy as the brand’s bestseller, it o ers retailers the opportunity to expand their range and capitalise further on the demand for the nest ciders.

SHYAMA LAXMAN talks to suppliers and retailers to nd out how to choose the right food-and-drink machines

ARJUN Patel, of Premier Cavendish Square in Swindon, Wiltshire, takes £1,200 a month through his drinks machines, with co ee one of his top ve sellers across the entire store, even in summer: a flat white priced at £1.75.

Next to his 850sq ft store, Patel also has a dedicated takeaway area, which serves food prepared on site, including sh and chips and Chinese,

bringing a six- gure annual revenue.

Kopi Kalanathan, who launched the Brakes hot-foodto-go concept at his Kirk Sandall Costcutter store in South Yorkshire last November, says he takes up to £5,000 in weekly sales, in addition to the sales generated by the drinks machines on the shop floor.

Kalanathan says that any retailer can get into this space

once they gure out their demographic and demand, which is the sentiment echoed by all the retailers that Retail Express spoke to.

While Kalanathan says food to go is the space to be in, offering maximum margins, Patel believes retailers looking to introduce food-and-drinks machines in store are better o starting with the latter as it requires minimal investment.

“COMMONLY found machines include slush machines, bubble tea stations, and milkshake dispensers,” says Mindy Rubin, managing director of Blue Ice Machines.

“These options are popular as the products o er high pro t margins and are known for their high-footfall appeal and quick preparation times.”

Fiona Malone, of Tenby

Stores & Post O ce in Pembrokeshire, recently also introduced an iSqueeze orange juice machine.

Combined with her co ee, slush and milkshake machines, Malone takes around £500 a week in winter, whereas in the summer that gure goes up to £2,000 a week. Priced at £2.19 (250ml), £3.19 (500ml) and £4.89 (1l,

Malone says that in-store sampling events, where sta dress up as an orange, and the smell emanating from the freshly squeezed juice has kept her customers interested in the offering.

Malone, whose monthly rent for the milkshake machine is £120, says that it was only after she started o ering it via Snappy Shopper that milk-

shake sales took o , with customers adding it to their full basket shop.

“We do a large size for £3, and a small for £1.50 which customers would pick up in branch,” she says.

She also o ers slushies and co ee through Snappy Shopper priced at £1.50 for a large slushy cup and a 350ml co ee for £2.50.

IMTIYAZ Mamode, of Wych Lane Premier in Gosford, Hampshire, has slush machines from Tango Ice Blast and Jolly Rancher and two F’real milkshake units.

In summer, he sells on average 45-50 cups a day, priced at £3 for a small cup and £4 for a large. Mamode’s milkshake sales range between 30 and 40 cups a day.

While sales go down in the summer months, Mamode doesn’t stash his machines away as he still nds takers for the drinks. This approach, however, might not work for all retailers.

“I know it’s a new standard of keeping it on all year round.

It depends on the demographic and the demand,” says Patel who puts his machines away in winter.

“If you’re not selling what’s the point in keeping it on?” he asks, adding that it creates additional operational costs like electricity and accounting for material wastage.

Equally, having a machine on the shop floor that’s not turned on does not look good.

Patel says that once summer is over, he will replace the space vacated by the slushie machine with a ready-to-drink (RTD) fridge.

Around ve years ago, Mamode also introduced a

self-serve ice cream machine from Fwip.

With up to six flavours to choose from, customers simply need to insert a capsule into the machine and press a button for the ice cream to be made.

Initially Mamode was only selling around ve cups a day and was on the verge of discontinuing the machine.

However, he says sales have picked up since and he sells between 15 and 20 cups a day at £3 a pop. Recently, Mamode also imported a cotton candy machine from Japan and sold up to 700 cotton candies within two months, at £3.50 a unit.

ADAM Hogwood, of Budgens in Broadstairs, Kent, says that of all food and drink machines, co ee machines are the most essential.

“Co ee is the place to start as it’s such a staple,” he says.

“You can walk down a high street and not see an ice cream or milkshake store, but you’ll see about three co ee shops.”

Hogwood has a Costa machine in store, averaging 40 cups a day.

David Lomas, of Lomas News in Bury, Lancashire, has one co ee machine placed on the

till in his 400sq ft store.

He got a secondhand Lavazza machine through Urban Co ee, paying £3,000 for the machine plus installation.

Though the cost of co ee beans has gone up, Lomas says he gets up to 78% margin on a cappuccino and makes up to £400 a month in pro ts.

“We can do up to 25 cups on a good day. On a bad day, probably 10,” says Lomas adding that his most expensive coffee is a Nutella latte priced at £2.75.

Lomas’s purpose-built cof-

fee unit is 50x40cm.

“It’s a small footprint. It doesn’t take up much room at all,” he says.

He displays breakfast items like protein bars and mu ns next to the co ee station.

“Though not o ered as part of any promotional deal, he says that customers invariably pick up a snack while getting a co ee.

As Lomas’ store is next to a Co-op that has an in-store Costa, he hands out free coffee vouchers to any customer who walks into his store with a

Costa cup, to generate traction around his o ering.

“I’m so con dent in the product and the price. Once they’ve tried it, you’ve got a converted customer, and they’re always going to come back,” he explains.

For retailers looking to o er in-store co ee machines, Lomas says to be mindful of the water supply to the machine.

They can either opt for machines that have a tank that needs lling in or have it plumbed into their main water supply as Lomas did.

Thierry Cacaly, CEO, Delice de France SUPPLIER

“COFFEE is rarely bought alone, and retailers can generate additional sales by o ering complementary treats. Pairing hot drinks with bakery items such as croissants, mu ns, or pastries enhances the o ering.

“Meal deals like ‘co ee and pastry for £4’ are e ective in driving spend. Strategically placing freshly baked goods near the co ee machine can tap into sensory appeal.

“Cross-merchandising and bundling not only increase the average transaction value but also help create a mini café experience within the store.”

Mindy Rubin, managing director, Blue Ice

“PROMOTE actively by using in-store signage, social media and local marketing. Introduce new flavours regularly to keep o erings fresh and ontrend. Maintain equipment rigorously according to manufacturer guidelines to ensure consistent uptime and performance.”

RELIABILITY of the machine and support in the event of a breakdown are key considerations says Hogwood, recounting his experience with the Tango Ice Blast machine one year when it was out of commission for six months and engineer support wasn’t fast enough. While things like initial out-

lay and nature of the contract are things to be factored in, Hogwood says retailers must also ensure the machines don’t hog the main electricity and/or water supplies.

He adds: “In case of any emergencies they should be easy to close o without disrupting anything else.”

Malone recommends doing a local survey to see what machines are available. “If there isn’t a co ee shop, that could be something that could be considered,” she says adding that all machines require regular cleaning to perform optimally.

There’s always merit in

thinking about the reasons behind any purchase. Hogwood says: “Think about the space the machine takes up, what else could you be doing with that space? Is it to grow the customer base?

“Is it to please the existing customer base? Is it to retain customers?”

ONCE IT’S IN STORE

“MILKSHAKE machines must be cleaned and emptied once a week,” says Malone. “The iSqueeze machine must be cleaned every day. That can take some time.”

Malone adds that as the store currently doesn’t have a dishwasher, the cleaning must be done manually.

Kalanathan echoes a similar sentiment in that he maintains a daily checklist of what needs cleaning.

Regular maintenance ensures he and his sta can x issues on their own, over a call with an engineer without incurring any fee.

“In a worst-case scenario, for example if the compressor is gone, we must call an engineer. Apart from that, cleaning the machine and

surrounding area and giving it good air flow will ensure it works perfectly,” he says. While Malone feels that a slush machine is the most pro table one, and what space-crunched retailers should opt for, Patel says the trend for slush has petered out, and potentially more so after the Food Standards Agency advised that products containing glycerol are not suitable for children under seven years old. He says he makes more from his co ee machine and must nd ways to keep the excitement around his slush o ering, for example by o ering alcoholic or energy-based slushes while being mindful of not serving the said varieties to children.

HIGHLAND Spring has expanded the availability of its Flavours range across the convenience sector. There are three refreshing products to stock up on now – juicy Strawberry, tangy Apple & Blackcurrant and zingy Lemon & Lime. All are sugarfree, combining fruity, natural flavours with refreshing Highland Spring water.

Nic Yates, marketing director, Highland Spring

As demand for quality, tasty and healthier drinks grows, HIGHLAND SPRING is shaking up the £283m1 still flavoured water category with a new and tasty range that retailers can stock up on now

The nationwide rollout includes a mix of formats, underlining Highland Spring’s commitment to working with its customers to meet every occasion. Watch out for a new marketing campaign – ‘Make Your Day Fruitier’ – featuring sampling to shoppers in London, Manchester and Birmingham, as well as dedicated PoS, promotions, social media and eld sales support.

Bringing disruption to a category that has huge potential, but has lacked brand choice until now, the campaign will drive trial, awareness and repeat purchase of Highland Spring Flavours this summer.

“OUR nationwide rollout of Highland Spring Flavours presents retailers with an opportunity to embrace change and drive sales. We want people to think flavoured water, think Highland Spring. It’s time to give everyone who values great-tasting, healthier drinks the chance to make their day fruitier. Since its initial launch, Flavours has not just shi ed spend, but driven real growth. This makes it a must-stock product line that will disrupt a category that has huge potential.”

SIMON KING nds out what approaches retailers are taking with the connected but contrasting categories of cereals and cereal bars

BREAKFAST cereals hold a consistent place in the basket of most convenience shoppers, while cereal bars are driven by their appeal as quick, on-thego options that sit between breakfast and snacking.

John O’Neil, retail sales controller at Parfetts, says the overlap between breakfast and snacking occasions continues to drive relevance, particularly

in urban and commuter-heavy stores.

“Customers want a balance of health and taste, with convenience playing a big role for cereal bars,” O’Neil says.

“Cereal bars see strong performance from chocolate, yoghurt-coated and fruit flavours.

“For cereals, traditional favourites like cornflakes, bran flakes, and chocolate-flavoured

pu ed cereals remain popular, especially among families.”

Avtar Sidhu, of St John’s Budgens in Kenilworth, Warwickshire, says consumers want di erent cereals even within single households, so making sure you have a good balanced range is hugely important.

Sidhu says: “It’s all about looking at the mission of

VIEW

Alice Boardman, marketing manager, Trek SUPPLIER

the consumer who shops the breakfast-cereal category, making sure it’s located alongside morning goods, including bread and milk. Jams, and tea and co ee, are part of a very breakfast-led mission.

“That would be another really good way to build that basket to make sure these are all sited within close proximity to each other.”

“SINGLE-bar formats continue to dominate in the convenience channel, fuelled by on-the-go impulse purchases, accounting for £121m in sales and 64% of total protein-bar sales exceeding the 27% share in the wider cereal-bar category. Protein bars in single formats are key to helping convenience stores drive growth.

“Larger bars (50g and above) are outperforming smaller varieties in convenience, as consumers seek longer-lasting, lling options to keep them fuelled.

“By stocking single bars and multipacks, retailers can cater to di erent purchasing occasions – meeting the needs of impulse snackers, while also capturing the growing demand for pre-planned protein consumption.”

NISHI Patel, owner of Londis Bexley Park in Dartford, Kent, says convenience retailers need to o er customers a full range of cereals.

“Retailers need to have healthy cereals, kids’ cereals like Coco Pops, and a good range of sweeter cereals,” Patel says.

Sidhu o ers options, which tick a lot of these boxes, with kids’ cereals located near the bottom, and mainstay products “from Nestlé, Kellogg’s and Weetabix” higher up with some healthy options and protein products on top.

Ken Singh, owner of BB Superstore Love Lane in Pontefract, West Yorkshire, has 10 di erent cereal bars, located within his confectionery display, but is thinking about dual-siting them nearer to his

breakfast items.

“Customers do ask me regularly if I sell cereal bars – that’s a sign it’s not in the right place,” he says.

Judith Smitham, owner of The Old Dairy – Pydar Stores in Truro, Cornwall, says a good cereal range will depend on xture size, and should be chosen according to best sellers from trusted sources, followed by local preference.

“We stock the top sellers nationally and no own brand except for porridge oats,” Smitham says.

“We make sure we have the right amount, so nothing is merchandised sideways. The top sellers have the most focus, but functional cereal is growing in popularity. Graband-go breakfast-cereal pots are popular.”

WITHIN cereals, price-marked packs (PMPs) work well in the convenience store sector, according to Singh

He adds that part of the appeal of PMPs is they reassure customers they are not being ripped o .

Patel adds: “PMPs are the way forward for cereals, otherwise you price yourself out

of being convenience retailers.

“Supermarkets don’t do price-marks, so it’s another way of bringing customers in to show our value.”

Sidhu recommends retailers lead with a price-and-value message with their cereals, saying as many as possible should be price-marked.

“Some of the cereals are

now more than £4, even if they’re price-marked, so make sure that you let the product do the talking,” Sidhu says.

“Pushing the price, which is already on the product, drives that value measure strong and hard. It’s all about that repeat value, which is very important for independent retailers.”

Multipacks can also be a

Susan Nash, trade communications manager, Mondelez International

“FOOD to go is a growing opportunity within the convenience sector. We are seeing consumers looking for a range of snacks, with a trend of replacing meals with snacks as they take advantage of being out and about more frequently.

“The ability to o er drinks and snacks together has the potential to help drive value and use, with many consumers looking for drinks and consequently deciding to trade up to drinks and snacks.

“A focus on lifestyle, consumer pro ling and location is also important to tap into more speci c sectors such as the opportunity for protein bars and drinks.”

sales driver, but Smitham says suppliers haven’t really understood this. “Not many multipacks are available, a single bar seems a ridiculous price,” Smitham says.

“Most schools will accept cereal bars in packed lunches, so why buy one from us at 79p when Tesco has a pack for £1.50?”

New non-HFSS range from Cadbury Brunch Cadbury Brunch has unveiled a new nonHFSS range in order to help retailers unlock additional healthier-snack sales from the brand. Cadbury Brunch Light is available in two flavours: Honey & Oat and Orange. Each bar contains fewer than 100 calories.

Kellogg’s expands range with High Protein Bites cereal

Kellogg’s has launched High Protein Bites, the newest addition to its cereal lineup. High Protein Bites, available in a Choco Hazelnut flavour, are high in bre, non-HFSS and contain 21% plant-based protein.

Belvita adds non-HFSS recipes on two of its top sellers

Belvita’s Soft Bakes recently introduced non-HFSS recipes on two of its top sellers, Choc Chip and Choco Hazelnut, bringing these flavours in line with the rest of the Soft Bakes range, which includes blueberry, lled strawberry, red berries, lled apricot and golden oats flavours.

Thornbury Refrigeration, an Arneg Distributor, has advertised in Retail Express for years. The regular positive response we receive

and

Robin Ranson, Thornbury Refrigeration

Thayanathan Santhirakumar, Premier Gleneagles Superstore, Grindon, Sunderland 1

2

Kinnari Patel, Honey’s of the High, Oxford

“WE’VE got more than 2,500 followers on Facebook and engage with our customers online. We’ve looked at TikTok as well, but haven’t yet got involved. We have an elderly customer base –TikTok is aimed at a younger demographic.

“We put our latest offers up on Facebook. We also run giveaways for customers, whether it’s alcohol, household items like fans or kitchenware products. Some of our customers can’t afford these kinds of things or they can’t come to the shop, so we let them know we offer delivery services, and sometimes we’ll give food away.

“When you have a new member of staff, introduce them to the Facebook page to show them how it works. Generally, we use a third-party company to do our posts, and I think more retailers should do that because not everyone is good at social media. I try to post every couple of days.”

Nila Patel, Premier Millbrook Mini Mart & Post O ce, Stalybridge, Greater Manchester

“WE have a Facebook and an Instagram account at the moment. We post around three or four times a week and have found that Reels and videos work better than images.

“With Reels, you can get a bit more information across and be more personal. It keeps things more engaging as well rather than just posters.

“When we get stock that’s niche or local to the area – like Hawkstone beer from Jeremy Clarkson’s farm, where we’re the only stockist in town – we highlight that.

“Whatever I post on Instagram goes onto our Facebook page, but we sometimes use different hashtags because they sometimes work better on one of the sites than the other. I want my audience to be growing organically. In the future, my husband and I are going to be more front-facing to build that personal connection with customers through the shop posts.”

“I PUT anything up that will stop people from just scrolling on. We’ll put up promotions we’re running, but I �ind the concepts that get the most engagement have a personal touch to them. Whether it’s a video with someone from the shop – a customer or a member of staff – those things tend to get more attention.

“With product activation, we try to make games out of them. For example, we recently did a promotion on the Bacardi and Coke ready-to-drink launch. I made a bat and got customers to throw it into the cooler to win something. It might sound silly, but it was memorable for customers.

“It’s hard to accurately point an increase in sales to that social media campaign, but it was all part of it. It put us on the map. We need to put ourselves out there – we do a lot for the community and social media spreads that message. The ethos we put out on online is the same as the store.”

In the next issue, the Retail Express team nds out how retailers are saving time in store. If you have any problems you’d like us to explore, please email