Calling all newspaper and magazine retailers… Give your employees all the benefits of a workplace wellbeing programme with absolutely no cost to your business.

Industry charity NewstrAid has teamed up with wellbeing experts Spectrum.Life to offer independent retailers access to a FREE Wellbeing Helpline and Website.

24/7 Wellbeing Helpline

Confidential ‘in the moment’ help and advice from clinically trained counsellors.

FREEPHONE 0808 196 2016

Text/WhatsApp ‘Hi’ to 00353 87369 0010

Wellbeing Website and App

Hours of industry leading health & wellbeing content supporting mind, body and life including:

• Mental health & lifestyle guides (wellbeing)

• Wellbeing podcasts (soundspace)

• Self-guided meditation (be calm)

• Eating plans & video recipes (nutrition)

• Exercise programmes & tracking (fitness)

• Exclusive benefits & savings (discounts)

https://newstraid.spectrum.life

Download the Spectrum.Life app from your app store.

I spoke to a few of you beforehand to get some questions you’d like to ask, and I can confirm they were heard loud and clear. All three interviewees were extremely transparent when it came to past mistakes, and their priorities for independent stores.

They were also very understanding of the cost pressures, and challenging trading environments facing stores. I appreciate it might not always seem that way, when you are hit with price increases, but giving them the benefit of the doubt, they are definitely putting a lot of effort into boosting revenue across multiple categories and services, in return.

Take PayPoint for example. Not only did it pledge not to cut parcel commission, despite pressure from carriers, but it has also announced a huge opportunity for Fed members to earn an extra £1,000 a year by selling digital cards and vouchers for Park Christmas Savings.

RETAILERSfear a UK vaping ban would decimate the convenience trade, following news the Australian government is to ban recreational vaping.

colours, nicotine concentrations and other ingredients will be introduced in Australia, alongside plain packaging. The sale of vapes will be restricted to pharmacies.

stricting sales through pharmacies would put even more pressure on the NHS.”

£10,000 for retailers who sell to minors and for vape retailers to be licensed.”

IT’S CLEAR THEY ARE TRYING TO RIGHT THOSE WRONGS

The Health Lottery is undergoing a brand refresh this summer, and is putting independent retail at the heart of that. Payzone, meanwhile, is working on some exciting things, which I’ll reveal in the next issue.

I’m not disputing that some of these companies have made some big mistakes in the past, but it’s clear they are trying to right those wrongs, which has to be commended. Do get in touch if there’s anything pressing you’d like me to raise with them next time.

News reporter

Jill Lupupa jill.lupupa@ newtrade.co.ukThe crackdown comes as experts say they are tackling an epidemic of young people taking up vaping, many of whom did not smoke.

Dennis Williams, of Premier Broadway in Edinburgh, said of the UK that while measures were needed to restrict sales, common sense had to apply.

Director general of the UK Vaping Association John Dunne said a similar ban in the UK would fuel a black market, and would not solve the problem.

Last week, Westminster hosted a debate on youth vaping, hearing some calls for an outright ban.

Restrictions on �lavours,

“Bans don’t work,” he aded. “They fuel illegal trade, and re-

Speaking on LBC radio, he said: “All this will do is make it dif�icult for adults to buy vaping products.

“We are calling for a �ine of

Environmental activist Laura Young has gained momentum with her campaign to ban the use of single-use disposables in Scotland, with 14 councils already pledging their support. @retailexpress

INDEPENDENTS are set to bene�it from a revamp in August of The Health Lottery that will include new drawbased games, PoS material and opportunities for more stores to add the service.

Announcing plans for the rebrand, The Health Lottery’s

chief executive of�icer, Lebby Eyres, said: “Independents are often on their own, so it’s important to us they aren’t left out of any promotions.”

The plan comes as rival the National Lottery prepares for new potential games and upgrades in stores.

A MIDLANDS retailer has gone from selling zero cups of coffee a week to selling 700 following the introduction of a loyalty scheme.Mandeep Singh, of Premier Singh’s in Shef�ield, told an ACS conference that discounted drinks through a customer

For the full story, go to betterretailing.com and search ‘Health Lottery’

BODY-WORN cameras could reduce the instance of retail crime by 40%, a policing expert has advised.

ing these

ence.

PLANET Doughnut is looking to expand its independent retail partnerships.

The company offers average margins of 45% across its range of 11 products.

Nisa retailer Tuf�ins, Morrisons Daily retailer Guy Warn-

loyalty card had been a gamechanger in store.

Lisa Hooker, PwC’s head of consumer markets, also urged convenience stores to prioritise delivering loyalty locally as Tesco, Sainsbury’s and Co-op increase their loyalty programmes.

For the full story, go to betterretailing.com and search ‘loyalty’

er and forecourt group SGN Retail are already stockists, with doughnuts delivered in boxes of 36 and minimum order determined by store. Planet Doughnut is also developing display stands for shops.

HELENA DRAKAKIS

HELENA DRAKAKIS

INDEPENDENT retailers are at “breaking point” one month after the government stripped them of any support to help keep the price of their energy bills down.

Last year, eligible businesses were given a lifeline when the Energy Bill Relief Scheme was introduced, giving them a discount on wholesale gas and electricity prices from October to March.

Leading up to the cutoff date, the ACS warned that 7,000 stores could be forced to close, if the support wasn’t extended.

Despite this, businesses were left in the dark. As a result, several store owners told Retail Express last week that their bills have seen a monthly uplift of more than £2,000.

Ruhail Shahazad, of Tremorfa Superstore in Cardiff, said he didn’t know how he was going to continue operating if more help was not made available.

“My bills were averaging £800 a month but now they have gone up to £4,700 with no support,” he said. “There must be more help. Retailers feel suicidal. I’ve spent decades building my business and now when I look at my wife and kids all I can think of is increasing bills.”

To save costs Shahazad has switched off half the fridges and freezers in his store. He added: “Coming

into the summer months, people want chilled drinks and ice creams. I am now losing customers.”

Meanwhile, David Lomas of Lomas News in Bury is in a �ixed contract with his supplier until December. Despite wholesale costs dropping he is still being charged 62p per KWh for electricity despite current rates being around 33p.

He said: “The energy minister must compel energy companies to renegotiate �ixed contracts on current prices. My energy costs have almost tripled to £400 a month for electricity but this would be higher if I hadn’t changed to LED lighting and turned a chest freezer off. It makes me so angry.”

According to the ACS, there is currently an estimated 6,900 independent convenience stores stuck in excessive �ixed contracts.

For an average convenience store facing rates of up to 95p per KWh, this would mean paying more than £75,000 per year for energy bills compared with £20,000 in 2021.

A spokesperson said: “Energy companies need to allow businesses to renegotiate their contracts or blend and extend them to relieve the acute pressure.

“We also need the government to support local shops by introducing tax and investment incentives, including reliefs, discounts or vouchers, to enable con-

venience retailers to invest in energy saving initiatives and in turn reduce their carbon footprint.”

The Fed’s national president, Jason Birks is also urging government to urgently address the issue. “The decision by the government to end the support being given to small businesses is extremely worrying.

“Many are struggling to remain open at present and reducing this relief is likely to see businesses close. Additional �inancial support must be given,” he said.

Energy consultant John Lyons said he had been contacted by a retailer now

paying an excess of £3,000 per month since the support scheme ended.

“Thousands of retailers are going to fall into this same category and with minimum wage and other costs going up, it’s a kick in the teeth,” he said.

He also reported that scammers were targeting retailers with fake contract offers and warned retailers not to agree to anything over the phone and always have offers in writing.

As well as reducing energy consumption by moving to LED lighting and using more energy ef�icient chillers, Lyon’s also urge

retailers to lobby their MPs for support. “If your MP is conservative stress that they won’t be in those seats if they don’t get support for small businesses.

“If stores go out of business due to rising energy costs, it means communities won’t get access to vital public services and it has a major impact on the economy as a whole.”

If you require emotional support, call GroceryAid’s 24/7 helpline on 08088 021 122, or NewstrAid’s 24/7 well-being helpline on 0808 196 2016, or text/WhatsApp ‘Hi’ to 00353 87369 0010.

LOTTERY: Retailers are being contacted by new National Lottery operator Allwyn to arrange site visits ahead of its takeover next year. Director of retail Katherine Challinor said Allwyn would be viewing equipment, its location and condition. Retailers will be given three weeks notice ahead of visits.

For the full story, go to betterretailing.com and search ‘Allwyn’

TRADING CARDS: The collectables category has experienced huge growth over the past six months. In Smiths News’ latest financial results, one shots saw an 88% uplift, driven by World Cup football collections and the continuation of Premier League and Pokémon trading cards.

Trading-card publisher, Panini revealed a “record level” of launch activity had contributed to the success of the category.

For the full story, go to betterretailing.com and search ‘trading cards’

SAFEWAY: Morrisons is phasing out Safeway own label and replacing it with own-label products in some areas, the supermarket has confirmed. A Morrisons spokesperson said the decision was part of a review to ensure the right range for customers.

For the full story, go to betterretailing.com and search ‘Morrisons’

CADBURY: Several of the brand’s products are being recalled following a food poisoning scare. The products, made by Müller, may be contaminated with listeria bacteria and are being recalled as a “precautionary measure”.

For the full story, go to betterretailing.com and search ‘Cadbury’

HELENA DRAKAKIS

HELENA DRAKAKIS

PAYPOINT and the Fed have teamed up to offer 1,500 retailers the chance to help customers spread the cost of Christmas by selling gift cards and vouchers as part of a savings club scheme.

Park Christmas Savings, now part of PayPoint, is the UK’s biggest Christmas savings club and around 350,000

families use it spread the cost of the festive period.

Now, retailers will be able to access earning potentials of £1,000 per year by recruiting savers in their local area.

Each participating store will receive a range of support through training, roadshows, digital and instore point of sale, and personalised saver communications, backed by a £2.5m advertising campaign.

Fed retailers who are not currently PayPoint retailers can also access an exclusive bundle deal of PayPoint One, Park Savings and parcels.

PayPoint chief executive Nick Wiles said: “We know that Fed members will be the perfect partners for Park Christmas Savings, given the important role they play at the heart of their communities. This forms part of our longstanding com-

mitment to add extra value and revenue into the pockets of all PayPoint retailer partners.”

The Fed’s national president, Jason Birks, said it is “a great opportunity for members to make more money from PayPoint in their store”.

The new scheme will roll out this summer ahead of the 2024 Christmas season.

Interested retailers can visit paypoint.com/parksavings.

THE second Golf and Family Day in honour of Raj Aggarwal, who passed away from Covid-19 in 2020, raised more than £30,000

The event, hosted by the ACS, on behalf of Sunita Aggarwal and the family, saw more than 200 guests join to-

gether at the Marriot ‘Forest of Arden’ in Warwickshire on 4 May.

In total, £31,643 was raised for Shef�ield Hospitals Charity and Leicester Hospitals Charity, bringing the overall amount raised by friends and family to £106,876.33.

NEWTRADE Media, the publisher behind RN, Retail Express and Better Retailing, has launched a free news and insight app for independents.

As well as offering the latest news, retailers will be able to stay competitive through a Better Retailing Club membership. This gives retailers access to a nationwide comparison tool, Pricewatch, plus data-led insights and peer-to-

peer shop floor advice. The app can be found by searching ‘Better Retailing’ on the App store and Google Play.

ELFBAR vapes are returning to stores following the withdrawal of non-compliant stock in February, retailers have reported.

Several of the brand’s ‘600’ range were withdrawn after a Daily Mail investigation revealed some had 50% more e-liquid than the 2ml legal limit. The company insisted the breach was a manufacturing error.

“Vapes are an important category for retailers. It’s good this is being cleared up,” said Blantyre retailer Mo Razzaq.

PRIYANKA JETHWA

‘MAKE pots of pro�it’ is the new campaign from Müller Yogurt & Desserts, designed to help retailers grow category sales in the chilled yogurts and potted desserts (CYPD) category.

Overall, the category is currently worth £2.9bn and is the third-largest sector in chilled. However, there is currently an estimated 938

million buying occasions for CYPD in convenience that are not being met due to retailers not having the right range.

Anthony Frankland, senior national account manager at Müller Yogurt & Desserts, told Retail Express that IRI data shows that 80% of all convenience store CYPD revenue comes from core range.

To help retailers tap into this opportunity, the supplier’s new trade website,

PERNOD Ricard has launched a range of ready-todrink (RTD) cocktails under its Absolut brand, including Passionfruit Martini, Espresso Martini and Strawberry Spritz, all with an RRP of £2.50.

The RTDs come in 250ml cans with an RRP of £2.50. Vodka-based RTDs represent 34% of total spirit-based RTD sales in the UK, and the launch will be supported by sampling activity across key cities and festivals, including

Mighty Hoopla and On The Beach.

Chris Shead, off-trade channel director at Pernod Ricard UK, said: “As the pre-mix can category experiences rapid growth, we want to be a leader within the premium RTD cocktail category, as we are in the premium spirits category.

“The new range offers consumers a premium cocktail experience, at an affordable price, in the convenience of a can.”

MINT Choc Chip is the latest limited-edition �lavour variety to join F’real’s milkshake range.

The new �lavour will be supported by digital PoS and social media assets, as well as new packaging and fresh artwork as part of a continued rebrand.

It follows the launch of F’real’s Bubblegum variety, which was a success in the US, and will be available from Booker, Eden Farm Hulleys and Consort.

Gemma Briant, marketing manager at F’real, said: “We’re con�ident that Mint Choc Chip will be another hit for retailers and consumers, as it has been heavily re-

makepotsofpro�it.co.uk, will provide a three-step plan to help stores get the basics right.

Step one is to stock the best products across key segments, ensuring all shopper missions are covered. Step two is to meet consumer needs for different occasions at the right time. Step three is to merchandise the category in the right way to make it easy to shop.

IRN-BRU Xtra is rolling out two limited-edition summer varieties – Tropical and Ice Cream. Both come in 69p pricemarked packs. Last year, new �lavours brought in £32m and around a third of this was in the summer months.

Irn-Bru Xtra grows by 12% in value during the summer.

The brand said: “Our limited-edition �lavours

always build excitement with shoppers. We also have a media plan that will get consumers excited about these �lavours.”

quested on social media, and has already proved hugely popular across the pond, as one of the top �ive bestselling �lavours. We are constantly listening to our fans and continually look for ways we can expand and grow the range to offer the most variation.”

PRIYANKA JETHWA

PERNOD Ricard is adding to its Absolut vodka range with the launch of a Wild Berri variety, available now from Booker Wholesale.

The supplier said the vodka has a sweet pro�ile and is made using natural �lavours, and contains no added sugar, sitting at 38% ABV.

Feeding into the cocktailsat-home trend, the supplier also added that Absolut Wild Berri can be used to create a wide range of serves, and can be paired with lemonade, or for those seeking more premium options, with lemon juice, sugar syrup and dark berry cordial.

Liam Murphy, brand director at Pernod Ricard UK, said: “The launch brings with it new ways and occasions to enjoy the �lavour of Absolut, whether that’s with a wide range of mixers or in a cocktail, and we’ve used our expertise and passion to create a premium vodka that allows its natural berry �lavours to shine through.”

The launch of Absolut Wild Berri is being supported by paid social and in�luencer activity, and forms part of the brand’s ‘Born to mix’ �lavours and cocktails campaign that is running throughout May and June.

Absolut Wild Berri has an RRP of £21.

GLOBAL Brands is launching a 10-pack format of its VK Blue variety into the convenience channel.

The launch will be shared through VK’s social channels and directly to subscribers’ inboxes with a giveaway to capture the interest of customers.

Convenience and wholesale listings include Parfetts, AF Blakemore, Nisa, United Wholesale Grocers, United Wholesale Scotland and Filshill.

Charlie Leaver, head of brand at Global Brands, said: “VK Blue is the original �lavour that kickstarted it all – the founding �lavour of a line-up that sees huge success in both the off-trade

and on-trade. VK is the number-one ready-to-drink option for students eight years running, with strong awareness and retention across our target audience.”

JTI has expanded its cigarillo range with the launch of the new Sterling Dual Double Capsule Leaf Wrapped, which contains peppermint and berry mint capsules.

The supplier said that the cigarillo category has continued to grow in grocery and convenience channels, particularly over the past 12 months, and is now worth approximately £8m a month.

Sterling Dual Double Capsule Leaf Wrapped has an RRP of £6 for a pack of 10 cigarillos.

There is also an exclusive introductory price-marked pack of 10 launching at £5.70 in the convenience and independent channels, available now.

MOLSON Coors’ Spanish-inspired lager, Madrí Excepcional, is back on TV screens with its ‘Door roja’ ad, supported by a £4m summer marketing campaign.

The �ive-month campaign will feature a 60-second TV ad, shot on location in Madrid, alongside UK city-wide takeovers, including events at Oast House in Manchester and Boxpark in London – featuring DJs from both Spain and the UK.

Alongside this, the campaign will span videoon-demand, experiential, social activations, in�luencer partnerships and outdoor displays, including billboards

and pop-up displays.

Sophie Mitchell, senior brand manager at Madrí Excepcional, said: “This interactive campaign is building on the momentum behind the brand. We’re keeping Madrí Excepcional front of mind throughout the summer, helping our customers to drive sales in their stores.”

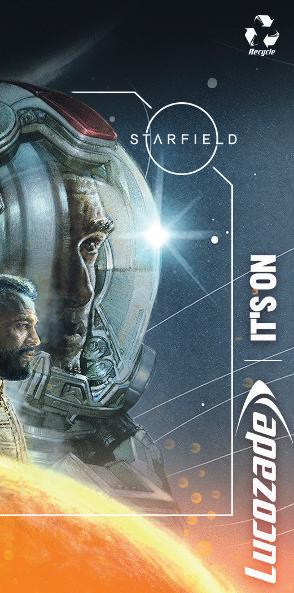

TO celebrate the launch of video game Star�ield, Lucozade Energy is teaming up with Bethesda Softworks and Xbox for a promotion offering shoppers the chance to win Xbox prizes.

The promotion will be on packs of Orange, Original and Zero Pink Lemonade varieties, and will be supported by in-store PoS material, outdoor media and paid social advertising.

Prizes include a onemonth Xbox Game Pass Ultimate subscription, and the chance to win an Xbox Series S every day. Additionally, participants will be entered into the draw to win prizes including Star�ield merchandise bundles.

The promotion follows last year’s partnership between Lucozade Energy, Xbox and Halo In�inite. The competition drew more than 580,000 entries – Lucozade’s biggest campaign ever.

BOOST Drinks is expanding its Energy Stimulation range with a Lemon & Lime variety.

The new �lavour will expand the brand’s Energy range in a category that is currently growing 15% year on year, and also accounts for 26% of all soft drinks value sales.

The new �lavour is available in 75p PMPs. The supplier said it will enable retailers to communicate value amid increased priceconsciousness.

It added citrus-�lavoured beverages continue to grow by 16% in the market, with growth in lime and lemon �lavours as well.

Adrian Hipkiss, marketing director at Boost Drinks, said: “The drink adds an-

other �lavour variety to our existing range, and provides a point of difference to the usual single-�lavour lines available on the market.”

BARRATT is launching Wham Space Babies, available to convenience retailers in £1.15 price-marked packs (PMPs).

The soft sweets have a sour taste pro�ile, and come in raspberry, apple, banana and strawberry �lavours.

The PMPs will be available in 12x100g bags, and can be ordered from Hancocks and Unitas. They are also available from Spar stores nationwide.

The supplier said with sour �lavours experiencing growth of 19.8% in value year on year, now is the perfect time to launch Wham Space Babies.

The launch will be supported by in�luencer marketing investment, as the brand

increases its reach across Instagram and TikTok to raise awareness.

CHOCOMEL has introduced a £1.69 price-marked pack of its premium chocolate milk, designed to help retailers boost on-the-go sales.

Coinciding with the brand’s latest £10m TV campaign, ‘Sharing not required’, which is expected to reach 80% of UK adults eight times, the brand said it will be more visible to consumers than ever before.

The launch will be supported by van sales to drive distribution, in-depot takeovers in partnership with customers, and commerce support.

Gabriella Sudall, marketing manager NPD at FrieslandCampina UK, said: “As purse strings tighten, it’s

important that we deliver compelling and competitive value for money for our customers, and support retailers in driving their premium milk drink sales.”

KP SNACKS has launched new ranging advice, ‘25 to Thrive’, to support retailers in bagging their share of crisps, snacks and nuts (CSN) growth. RETAIL EXPRESS uncovers more about it

CSN category penetration is back to its highest-ever level at 98%, and independent retailers have a huge role to play in both promoting the category and in ranging to meet shifting consumer needs and ultimately grow their own sales. For retailers, simplicity in ranging is

key to tap into core occasions and missions, and the new KP Snacks advice highlights the spectrum of CSN products, as well as shopper missions and occasions.

‘25 to Thrive’ is an impartial category-wide range recommendation of 25 bagged snacks,

which include single, sharing and price-marked packs (PMP) formats, meeting consumption needs at lunchtime, in the afternoon and evening.

ON-THE-GO snacking and meal deals remain in strong growth as consumers look for value reassurance. PMPs are particularly important in this content. The format has had significant growth and will stay increasingly relevant as

1 2

3

the cost of living remains high and consumers remain price conscious.

Nostalgia is also becoming more important with shoppers becoming less experimental, turning to familiar brands they trust, which is where her-

itage brands play a key role.

Another growing occasion is nights in, with shoppers looking for less expensive ways to entertain themselves or socialise with friends.

Sixty-two per cent of consumers think having

Find the new ‘25 to Thrive’ ranging

snacks in the evening is an affordable treat1.

The new KP Snacks category advice delivers the optimum balance of breadth and depth for retailers to bag their share of growth and meet today’s convenience shopper needs.

KP

SUPPLIER

“BAGGED snacks is a priority and scalable category, forecast for further growth. It’s a category to back, growing in both value and volume with high penetration. In good times or bad times, everyone wants an affordable treat and there’s a huge opportunity for retailers to double down on CSN as an incredibly important, scalable and thriving category.

“Retailers are frequently consumed by a wide variety of often contradictory messaging in terms of ranging, but by stocking our recommended 25 products with availability, display and impact, retailers can benefit from this growing category.”

FOLLOWING the launch of Robinsons Bene�it Drops last year, the brand is back with a new range of squashes called Robinsons with Bene�its.

The range comes in three �lavours in a 750ml format, with each containing a different functional bene�it.

The range is rolling out to supermarkets now, and will be available to convenience retailers in June, and comes in Vitality Peach, Mango & Passion Fruit; Immunity Orange & Guava; and Boost Raspberry, Strawberry & Acai �lavour varieties.

The brand said that almost two-thirds of shoppers said they are interested in beverages with a broad range of functional, better-for-you

bene�its, and the new range will provide a “convenient and tasty solution” to meet shoppers’ needs for healthier drinks at home.

Ben Parker, retail commercial director at Britvic, said: “At a time when over half of consumers have revealed that they want to see healthier soft drinks in retailers’ ranges, it’s the perfect time for us to expand the Robinsons range further to tap into this growing demand.

“This launch follows our recent rebrand of the entire Robinsons range and aims to offer consumers another premium squash for different occasions, sitting alongside our premium Fruit Creations range.”

WEETABIX is adding a new variety to its Melts range –Chocolatey Hazelnut – which will be available to retailers this summer after an initial launch in Asda.

The brand said chocolate hazelnut is an on-trend �lavour with broad appeal. The cereal is also HFSS-compliant, making it a healthier choice for consumers.

Ginni Farbon, Weetabix brand manager, said: “The launch of this new �lavour into our Melts range is set to be a hit with consumers as tasty cereal is the largest segment of the breakfast cereal category, with demand growing year on year over the past three years. With

PEPSICO is driving sales of its Walkers range with a new campaign, offering consumers the opportunity to win a free lunch.

The on-pack promotion will run until 25 June, during the peak lunch hours of 12pm and 2pm. It will be available across 33 lines, including the brand’s core

range of Walkers 45% Less Salt, Baked, Quavers, Wotsits, Monster Munch and Squares.

To drive awareness of the free lunch offer, Walkers is also bringing back its #Crispin or #Crispout campaign.

The campaign will ask consumers whether they prefer their sandwich with crisps inside, or as an ac-

companiment.

Philippa Pennington, Walkers senior brand marketing manager at PepsiCo, said: “By offering customers the chance to win a free lunch every minute between 12pm and 2pm, we are aiming to help retailers tap into the opportunity available within the lunch occasion.”

over half of consumers looking to reduce their sugar intake in their diets, Melts

will hit this sweet spot for them without compromising on taste.”

GRACE Foods UK has launched a new range of sparkling soda drinks. These include Kola Champagne, Pineapple and Cream Soda varieties.

The sodas will be available in 330ml glass bottles from independent retailers and wholesalers, with an RRP of £1.49.

Dorota Dziedzic, brand manager for Grace Island Soda, said: “We are excited to launch the Grace Island Soda range in time for May, which has three bank holidays.

“The drinks are uniquely Caribbean, bringing the tastes and �lavours of the Caribbean islands to the

great British summer.

“We think they will be popular with people looking for a soda with a tropical twist throughout the

summer months. They will also be perfect for barbecue season and for people looking for an alternative to alcoholic drinks.”

It’s an offence to sell tobacco to any person under 18 years of age. For tobacco trade use only. Not to be left within sight of consumers.

This is Jasmin. She’s one of many business owners who already use a smart meter to feel more in control of their budgeting, because smart meters help you track your energy use and costs over time. So like Jasmin, you can spend less time guessing and instead know how much you’re spending on your energy bills. Search ‘get a smart meter’ today.

PRIYANKA JETHWA

LYNX has unveiled limitededition packaging for its Africa variety as it looks to recruit Gen Z customers.

To drive penetration, it has also printed ‘G.O.A.T’ on its packaging, which stands for ‘greatest of all time’ – a phrase that it says resonates with a younger audience.

A QR code will be included on the back of packs of its antiperspirant, shower gel and body spray, and shoppers will be able to scan the code to unlock prizes and experiences.

Monique Rossi, marketing director of deodorant and skin cleansing at Unilever, said: “Lynx Africa is arguably the most iconic male fragrance on the market.

“Through social listen-

ing, we understand that it is much more than just the nation’s most-used fragrance, it is a huge part of UK culture. And, as culture evolves, so does Lynx, which is why we’re on a mission to boldly celebrate its G.O.A.T status and recruit the next

generation by getting closer than ever to their world.”

The refresh of Lynx Africa follows Unilever’s long-term strategy to drive value and further invigorate the deodorants category through encouraging trade up.

DEAD Man’s Fingers is expanding its range with the launch of a Vanilla Rum variety, available now with an RRP of £28 (35% ABV).

The new rum has vanilla and butterscotch �lavours, and the supplier said it has been designed to be paired with cola, or mixed in to create a rum-based cocktail. It is also the brand’s �irst rum to appear in a clear bottle, enabling customers to see the colour of the rum.

Rachel Adams, global marketing director at Halewood Artisanal Spirits, said: “Vanilla is an indulgent �lavour that of course has strong associations with rum. We wanted to dial that up for

our latest launch, creating a liquid which pairs perfectly with cola and mixes well into

ARGENTINIAN wine brand Trivento has rolled out a new campaign, ‘Discover your Trivento’, to encourage shoppers to �ind out which variety is best suited to their palate, by scanning a QR code which leads them to a quiz. It will span digital and social media, alongside outdoor advertising – which is expected to reach 33% of UK adults via 500 sites. A sticker with the QR code will be placed on more than 1.6 million bottles of the Trivento Reserve range.

Heather Jones, senior brand manager at Trivento, said: “We continue to see growth in our premium

varietals, which proves wine shoppers are happy to pay more when they know they

will get a superior quality wine. It’s the ‘good, better, best’ mantra in action.”

KP SNACKS has launched a £250,000 radio campaign for Pom-Bear. It wil include adverts and competitions designed to drive awareness of the snack brand.

The radio campaign will run until September in partnership with Magic Radio,

and features the brand’s core range – Original, Cheese & Onion and Salt & Vinegar. It will be offering listeners the chance to win a glamping adventure for four this summer.

Brian McMonagle, senior brand manager at KP Snacks, said: “Pom-Bear is an engag-

ing and trusted household brand that provides a lighter snacking option while still delivering on great taste. With our new campaign, we are looking to drive greater awareness of the brand, helping young families to add playful fun to all snacking occasions.”

CAPRI-SUN has announced it is partnering with Merlin Entertainments again with an on-pack promotion, this time for the World of Jumanji, at Chessington World of Adventures Resort. The promotion is designed to give young families a fun day out this summer, while boosting sales of Capri-Sun.

The promotion will give a free adult or child entry to Chessington World of Adventures Resort with a full ‘on the day’ priced adult ticket.

There are unique QR codes on �ive million promotional

packs of Capri-Sun until the end of June for shoppers to secure a voucher for buy-oneget-one-free entry. It is valid until 30 June 2024.

The promotional packs include multipacks of 4x200ml, 8x200ml, 15x200ml and 1l bottles.

Martin Attock, vice-president for commercial development at Coca-Cola Europacifc Partners, which manufactures and distributes the brand, said: “Last year’s promotion with Merlin Entertainments was a huge success. Across the 12-week promotional period it delivered a 30% increase in sales and increased rate of sale across

our Capri-Sun juice drinks and squash ranges.”

The on-pack activity is be-

ing supported by outdoor and social media advertising, and in-store activation.

COCA-COLA Europa-

ci�ic Partners (CCEP) has relaunched its salessupercharged.co.uk convenience retailer support initiative for a third year, designed to help retailers make the most of the energy drinks sales opportunity and win prizes.

The online platform will give retailers the latest trends and details on key energy drinks segments, as well as tips on ranging, as

energy drinks are growing strongly in convenience.

The 2023 campaign features three convenience retailers: Jack Matthews, from Bradley’s Supermarket in Quorn, Leicestershire; Amrit Singh Pahal, from H & Jodie’s in Walsall, West Midlands; and Natalie Lightfoot, of Londis Solo in Glasgow.

The energy drinks segment is worth £1.78bn –more than £969m of which

comes from convenience – having experienced 14% value growth and 6% volume growth in the past year.

Pippa Collins, associate director of commercial development at CCEP GB, said: “We wanted to continue working with leading convenience retailers who really see the opportunity that energy drinks present to help support the wider convenience sector.”

THATCHERS Cider has unveiled a new look for its Vintage Cider variety, including a higher ABV and a fresh pack design.

The cider now has an 8.3% ABV, up from 7.4%, to re�lect its premium positioning and appeal to vintage-cider drinkers.

It also displays a new label featuring Thatchers’ founder, William Thatcher, to emphasise its provenance and heritage. It is available in a 500ml bottle at an RRP of

£2.30, as well as a six-pack.

Jonathan Nixon, Thatchers commercial director, said:

“Thatchers Vintage has been a much-loved part of the Thatchers range for many years, and with this 2022 harvest, we’ve increased the ABV to 8.3% to further appeal to shoppers in the growing premium bottled cider category.”

Premium cider is currently the best-performing cider segment, seeing 4.9% growth in the past 12 weeks.

Smoking kills

What do you think? Call Retail Express on 020 7689 3358 for the chance to be featured

“I DON’T think it’s effective at all. Fines aren’t a deterrent. There needs to be prison time for these perpetrators to stop them. The problem with fines is that the products they are selling have such high margins, so they can afford to take the fine and carry on selling illicit cigarettes and making a profit.”

Alan Mannings, Shop on the Green, Chartham, Kent

ALCOHOL: What does the shelving of advertising proposals mean?

“WE’VE got enough laws to worry about without restricting where we sell alcohol in our stores. I’m definitely relieved. We’ve got tough restrictions on alcohol as it is. Compliance could’ve cost retailers a lot of money and we can’t afford to lose sales right now.”

Dennis Williams, Premier Broadway, Edinburgh, Scotland

“IF this went through, it would destroy businesses. It would be another nail in the coffin for retail. People want to come in and see what they are buying. For me, the question is how long has it been shelved, and instead, it needs to remain permanently off the table.”

Hussan Lal, Usave, Paisley, Scotland

Customers are definitely reassured

“IF they haven’t got the resources to find people who sell these illegal products, then it doesn’t matter if they have higher penalty fines to impose. Trading standards doesn’t always go everywhere it needs to be. I just get the feeling that this is the rhetoric they put out before inevitable implementing higher taxes.”

Atul Sodha, Londis Harefield, Uxbridge, Middlesex

How do relationships with MPs help businesses?

“I’VE been really surprised by how responsive my MP, Kim Leadbeater, has been. She’s very supportive of local businesses. It does benefit my store because she is active on social media, so anything I promote, she reshares and helps create awareness.”

Serge Notay, Notay’s Premier, Batley, West Yorkshire

“I’M a councillor and I think it’s vital for businesses to have a relationship with their local representatives. Retailers are talking a lot about the challenge of retail crime, but MPs don’t know how bad the situation is if shop owners aren’t telling them their experiences.”

Mo Razzaq, Premier Mo’s, Blantyre, Glasgow

VAPE: Is it reassuring that Elfbar has compliant stock for its 600 line?

“WE’VE started to get regular deliveries from One Stop over the past three weeks. I’d like to see more availability, but I can understand that it may take time for it to roll out. Customers are definitely reassured, which is helped by new packaging highlighting its compliance.”

Aman Uppal, One Stop Mount Nod, Coventry, West Midlands

“I’M not worried about customers being turned off. I buy all my Elfbar products from Booker, and now that they have them in again, they are a reputable source. I’ve also had them checked by trading standards, and they were impressed when I handed over all my paperwork and receipts.”

Atul Sodha, Londis Harefield, Uxbridge, Middlesex

Top

partners

DELIVEROO needs to do more to support smaller stores.

I’ve seen a decline in my sales since more supermarkets started getting on board last year.

I’m still using it, but I am considering dropping it if nothing changes.

The main issue is that we can’t compete on pricing like the multiples can.

We get charged 30% by Deliveroo on every transaction, so it’s just impossible for us to make a good pro�it when we are being outperformed.

I would love Deliveroo to give us some sort of promotion to give us an edge in a really dif�icult trading environment.

I’d also like to see Deliveroo streamline its process.

COMMUNITY RETAILER OF THE WEEK

For example, we are told that we need three tablets charged up at the till. I’m not worried about the energy usage, but I can’t understand why it needs to take so much space on my counter. We’ve stopped marketing it in the same way as a result. Instead, we are just dropping lea�lets off sporadically to let people in the area know we are doing it,

WHEN it comes to competing with supermarkets, our greatest weapon is our speed.

The supermarkets have so much space and will usually have so much stock that’s just not being sold, whereas we can identify what’s working and what’s not working and change it. We can reduce the price or put it somewhere where people can see it when they come in. We can attack the problem that same day whereas supermarkets might take days to work it out.

Each issue, one of seven top retailers shares advice to make your store magnificent

with a few posters in-store. I want to know if other retailers are �inding it impossible to compete with the supermarkets when it comes to services like this.

Sudesh Patel, Coulsdon Londis, Coulsdon, south London

Deliveroo failed to respond by the time Retail Express went to print

COMMUNITY RETAILER OF THE WEEK

In order to keep ahead of the supermarkets and get even further ahead, you need the right EPoS system. I joined Retail Data Partnership from PayPoint back in November and the information I can get from them is great. Retailers should talk to other retailers to find out what support they’re getting from their EPoS providers. I’m with Retail Data Partnership because I talked to a friend who told me that he’d got a 3% uplift in profits since he started using them.

You need to know what information you want to get from your EPoS provider and then find out if they’re offering it. Ask people who are using them what increases in margins it’s brought them.

It tells you if there’s a price change automatically rather than me having to go through and check the prices all by myself. How much time does that save? A lot. You’ve not got staff walking around the store looking at price changes, it’s all on our machines first thing in the morning in the report. We can then just print out the shelf-edge labels and away we go.

That’s a massive amount of time saving and allows us to get even further ahead of the supermarkets. And it’s also saving me money as well. Before you might have lost a couple of days’ worth of trading at the wrong price because you hadn’t had the time to check the prices and make the changes. And now that prices are changing ever more regularly these are ongoing savings and that’s building up more and more.

They also send me details of the 10 top-selling products in a category that’s been selling. So, if I’ve not got one of them, I can try to bring it in and see if it sells. And it tells me exactly when my sales were made, so I can assess whether I need to be open when I’m open and whether I need more staff on at certain times of day or the week.

“I RECEIVED an invite from Buckingham Palace to the King’s coronation garden party. I was told I had been invited for all the work I’d done in my community as an independent retailer over the years. They couldn’t tell me who had put me forward, which was a shame, as I’d have loved to thank them. I was so shocked when it came through the post. It was a fantastic experience, and one I won’t forget, especially as being a retailer who helps their community was the reason I was there.”

“WE wanted to install a defibrillator in our store last year when we had a refit, but we couldn’t find anyone to oversee it. Last month, we contacted local activist Claire Axom, who is focused on providing defibrillators in public spaces, and she quickly got one ordered and installed for us. We’ve had a great reception from the local community. We’ve had a lot of people asking for CPR training. We told Claire, and she is looking to set it up in a local pub, which is fantastic.”

‘We’ve installed a defibrillator’Vas Vekaria, Kegs ‘n’ Blades, Bolton, Greater Manchester – @VasVekaria

‘I was invited to the King’s garden party’Sunder Sandher, S&S One Stop, Leamington Spa, Warwickshire – @sundersandher

IMPERIAL TOBACCO has recently launched a raft of new products to help retailers tap into rising vape category trends. This includes two new ranges from Blu, a brand consumers know they can trust. RETAIL EXPRESS finds out more

ALREADY worth a sizeable £1.2bn, the vape category is forecast to grow to an impressive £1.4bn in the next three years1. Imperial Tobacco has seen many retailers seize the opportunity to tap into this high-growth category and with the number of vapers continuing to rise and new alternative

nicotine solutions emerging, there are further sales successes to be had for the retailers who can get their range right. To effectively tap into this booming category and retain their vaping customers, retailers must keep on eye on emerging trends. From the popularity of pod-mods to the rising

demand for disposables, by ensuring the products stocked in store respond to these key trends, retailers can meet the ever-evolving needs of their shoppers. Thanks to the latest launches from Imperial’s vape Blu brand, there’s an exciting range of products well placed to do just that.

DISPOSABLES are taking over the vape category, with the segment seeing incredible growth in the past year. In light of recent developments, many consumers are seeking out recognisable vaping brands.

To cater to this demand, Imperial Tobacco recently entered the disposable market with its Blu Bar range, offering a quality selection of fully compliant, disposable and ready-to-use vape products.

While demand for disposables may be rising, pod-mod devices still remain a popular choice for many vapers thanks to their ease of use and simple click-and-go format.

Tom Gully, head of consumer

1 2

marketing UK&I at Imperial Tobacco, says: “Through the launch of our next-generation pod-mod device, Blu 2.0, we’ve developed a product that looks better, tastes better and lasts longer than before.”

Imperial has a new dedicated trade microsite, Blu Bar Knowledge Hub, to provide retailers with everything they need to know about the new disposables range. Find out more by visiting blubarhub.co.uk

BLU BAR – A quality collection of disposable vapes available to retailers in six fl avours for an RRP of £5.992 per device.

BLU 2.0 – A new pod-mod device with six fl avours to choose from, each available in 9mg/ml and 18mg/ml nicotine strengths. RRP £6.99 and £9.99, respectively2 .

SUPPLIER

SUPPLIER

“TO tap into the growing demand for pod-mods and disposables, retailers need to ensure they are dedicating sufficient space in store for vapes. No two stores are the same, so it’s important to stock the right range for their customer base, including vape products from brands consumers know and trust, such as Blu Bar and Blu 2.0.

“There is a huge variety of different vape products available on the market today, so deciding what to buy can be a daunting task for consumers. Retailers are therefore in an excellent position to provide advice to shoppers on what products are best suited to them.”

With shoppers continuing to spend money on their pets and more people shopping local, CHARLES WHITTING finds out how retailers can use petcare as a consistent loyalty builder that keeps customers coming back

HALF the UK’s adults are pet owners, says veterinary charity PDSA, with 21 million cats and dogs creating a huge opportunity for independ ent retailers.

IRI data shows nearly 8% of UK pet food sales are in convenience stores, according to Samantha Crossley, UK marketing director at Lily’s Kitchen. With rising fuel prices driving more consumers to shop local instead of at supermarkets, the figure is likely to grow.

As convenience retailers look for strong-performing categories, Mars Petcare Panel research shows fewer shoppers seeking to save money on petcare than almost any other category, while also spending

elsewhere. Pet owners spend 15% more per visit and shop more categories than non-pet owners. This is a regular occurrence, the supplier says.

“Buying everyday pet food products tends to be highly planned, with Shopper Intelligence saying nine out of 10 shoppers plan their purchases,” says Armen Topalian, Mars Petcare sales director. “Last year, petcare shoppers’ spends per trip in convenience increased 21% in cat food and 27% in dog food, mainly driven by pet population growth and inflation.”

Over the next two years, he quotes Nielsen predicting sales will remain resilient, growing by £1bn as shoppers economise elsewhere.

Advice from Samantha Crossley, UK marketing director at Lily’s Kitchen, to grow petcare sales

Group petcare products by category, including main meals – both wet and dry options, treats and functional products.

Stock a strong selection of well-known brands in different formats. Place wet and dry separately, and put treats together on one shelf.

Range bestselling recipes from left to right.

Add life stage lines after the core range, again ranged left to right so shoppers can easily identify what they are looking for.

Indulge shoppers’ impulse missions for their pets. Disrupt them with PoS materials and feature high-value pet treats at till points, gondola ends and on clip strips.

PETER Bhadal has a strong range of petcare products at his Londis Woodhouse Street store in Leeds, despite his local demographic’s relative lack of pet ownership, because ultimately, for those people who do own pets, pet food

is as essential a purchase as milk or bread.

“We’re not a very big store, and we’re in a student area, so not that many people round here have pets, but it’s still important. I put pet food in a one-metre bay with five

shelves, in the middle of the store by the household products. Dry food is at the bottom, then tinned, and pouches at the top. I put dog treats there as well.”

Topalian suggests retailers encourage pet-owning shop-

pers into their stores by making their storefronts more pet friendly. Putting water bowls outside and offering a safe place to leave their dogs sends a message to people before they’ve even set foot in the shop.

WHEN it comes to the shopper mission for pet food in convenience stores, emergency stops are key. In the midst of a costof-living crisis, retailers need a core wet-and-dry pet-food range that offer good prices to their customers.

“People are moving to own label,” says Faraz Iqbal, of Premier Linktown Local in Kirkcaldy, Fife, “but pets prefer products they know.”

Pets’ preferences can mea that as well as value options, specific brands can be significant sales drivers, as customers and their pets will often refuse to compromise on food.

“Cats in particular can be fussy about changing pet food, confirms Crossley. “Helping pet parents understand the benefits of proper nutrition offers significant opportunities to help drive them to trade up.

“Petcare isn’t immune to the cost of living, though the natural pet food segment has been growing more than three times faster than the category for the past four years, and in the past year paced inflation at 19%.”

Wet food, while more expensive and premium, has enjoyed a growth in sales recently. Dog wet food value grew by 21% annually to October in grocery,

according to Mars Petcare’s Topalian, while cat wet food grew by 13%.

“Increasing flexi working means there is less need to leave dry food out for pets, and owners are switching to wet, which is perceived to be more enjoyable, higher in protein, and varied in taste and texture,” says Topalian.

“Cans are growing, driven by premium brands, but pouches are still by far the biggest format, and expected to remain the growth driver as owners continue spending on pets and look for more cost-effective options.”

Regardless of what’s trending, in the current climate, petcare products, like everything else, need to deliver on margin.

“Allocating space in a category like this, you need to go by the percentage of total sales and the margin. When we did the relay, we took out the lowmargin products and slow sellers,” says Iqbal.

“In the subcategories, our core sellers are dog and cat food, the basics, dry and wet, set out so they can see it, that’s what convenience is about.”

“Retailers should take the opportunity to grow sales by developing deeper relationships with shoppers and becoming go-to destinations for educated and informed advice on petcare,” he says.

Samantha Crossley, at Lily’s Kitchen, quotes Mintel’s 2020 Pet Food Report saying 34% of dog parents believe it’s good for their pet to regularly have plant-based meals, and 43% believe it’s healthy to limit their red meat consumption. “I don’t currently sell any plant-based brands, but if people requested them, I would. Petcare shoppers are loyal and regular customers, so we support them,” says Peter Bhadal.

“PETCARE is a staple seller here. Ours is in a standalone two-metre bay at the back of the store, next to stationery and other bits and bobs. Most of the sales are tins of dog and cat food, and cat and dog treats. Older brands such as Bonio sell less now.

“People still buy ‘dry’ dog and cat food, in boxes. Shoppers come in and buy everything in the section for their pets, not just food.

“We don’t do much else in pet foods, but if people wanted us to, we’d listen. We used to do fish food, and we sell bird food balls in the winter.

“Pet food shoppers’ basket spends are bigger than average, because people buy it with their other groceries as part of a planned shop.

“I don’t think people are spending any less on pets because of the cost-of-living crisis, it’s a necessity. If you’ve got a pet, it needs food, just like you.

“Smaller stores need to prioritise the core products, and location has a lot to do with it. If you’re surrounded by chimneypots, pet food is one of the essentials, but you must tailor your range to your customers.

“Pet food isn’t an impulse purchase, apart from maybe some treats. This is a category where there’s branding and flavours, but not really any buzz about new products.

“Dry food has seen innovation, but it’s been more about having a range for pets of different ages. Things look like staying as they are, unless someone comes up with something really good, with more benefits.”

Sustainability is playing a growing part in petcare purchases. Mintel’s 2022 report, A Year of Innovation In Pet Food and Products, suggests climate concerns are an increasing influence. Armen Topalian, at Mars Petcare, says: “One in three consumers has stopped buying certain brands or products, due to ethical or sustainability-related concerns.” Even dog-poo bags are getting greener. Lily’s Kitchen’s Planet-Friendly Poo Bags, made from renewable plant-based resources, are fully compostable and biodegradable. “Sustainability matters more now than it did,” says Bhadal, “especially for younger shoppers. The processing is more of a concern than the products and the packaging.”

Treats

Dog and cat treats’ value sales growth is trailing inflation, at 6% and 15.3%, says Lily’s Kitchen’s Crossley, suggesting owners are curbing spend.

“However, the ongoing boom of new pet parents since the pandemic and people spending more time at home with their pets since the lockdowns, means convenient nutrition and treating remain important concerns.” Even as budgets tighten, retailers can drive sales by offering treats with additional benefits. Established treats continue to sell strongly. Pedigree’s Dentastix treats range celebrated its 20th anniversary last year, supporting oral health for the four out of five dogs suffering from gum disease.

Getting creative

“Hay for rabbits is worth trying out as well, but it’s price sensitive, so it’s a no if there’s a pet shop nearby. B&M and Home Bargains have it, too, so it needs to be the right price,” says Iqbal.

THE chocolate category is a critical one for stores of all sizes, from the smallest shops selling single bars as impulse purchases to the largest stores offering a range of multipacks, singles and gifting options.

Amid a cost-of-living crisis, when people are looking for affordable treats and luxuries, sales of chocolate are defying the rise in prices and growing.

“Sharing products are growing channel sales, with choco-

late multipacks up 12% and sugar bags up 11%,” says Kenton Burchell, trading director at Bestway. “Chocolate singles still have the largest share of confectionery with a quarter of all sales in independent and symbol stores.

“Duos are growing by 9%.

Price-marked packs (PMPs) are important, with 96% of treat bags coming from PMPs.”

Multipacks and the bigger tablets of chocolate don’t just give customers a sense of val-

ue, they can also drive up the overall basket spend, turning a small shopping mission that features a bar of a chocolate into a bigger shopping experience that fits with the scale of a bigger pack.

Retailers should therefore consider their placement of multipack chocolate to take fuller of advantage of this sales opportunity, while ensuring their single bars are positioned in high-footfall and impulse areas.

WHILE the established lines and flavours remain key to sales and represent the majority of sales, new flavours are essential for driving interest and sales in chocolate, accounting for 28% of category growth and attracting new and younger customers.

“When new flavours come out, people are excited,” says Shisan Patel, from Jash in Birmingham. “There was a lot of buzz around the Twirl Orange and we couldn’t get enough stock to meet the demand because they hadn’t made enough. We’ve gone through orange and people are now a bit tired of it. We also haven’t noticed as many new products or flavours this year.”

In the past few years, retailers have seen orange, mint and salted-caramel versions of existing favourites launched by the big suppliers, along with other variations as well. While these options may not always establish themselves as long-term occupiers of the shelves, some have enjoyed a significant longevity in stores, and all generate interest and impulse sales when they are first launched.

“Salted caramel is incredibly popular with shoppers, and as a flavour is second only to orange in terms of growth over the past two years,” says Christine Bland, brand manager for Cadbury at Mondelez International.

AS well as new flavours, retailers should also consider introducing a premium range to contrast with their mainstream products. Recessions often drive people to buy less, but better, and with a greater emphasis on quality, sustainability and ingredients, an ‘artisan’ range can be a useful point of difference for your store.

Retailers shouldn’t ignore the potential of premium chocolate gift sets either.

“There is an increased demand for artisan chocolates, with consumers wanting quality and polished chocolates. Retailers can stock these for consumers purchasing for special occasions,” says Bestway’s Kenton Burchell.

As well as premium variants within the bigger brands and suppliers, retailers should also consider the benefits of bringing in other options that tap into the desire – especially from younger consumers – to purchase products that offer functionality, values and different ingredients.

“Don’t drive customers else-

where by failing to offer the brands that Gen-Z and millennials are needing to fuel their lifestyles. Chocolate is not just indulgence, and indulgence is mainly not about price. This means retailers need to get a strong range that taps into modern lifestyles, offering functional and low-carb/sugar options from key brands that

modern shoppers connect to,” says Ben McKechnie, managing director of Epicurium.

“There’s a lot of competition in the chocolate-covered protein bar category, with some great developments, including the

standout brand of Barebells which is taking on Grenade.

“Although it’s not traditional chocolate, these functional chocolate options are mainstream and outcompeting traditional bars.”

There is growing demand for organic, vegan, sugar free and gluten-free chocolates. Vegan options are also increasing in demand, with around 60% of millennials and Gen-Z expecting plant-based options, based on a report trend from Zinklar.

According to a report by Mordor Intelligence, brands are now creating functional chocolates with a combination of condition specific for everyday health, such as added vitamins (zinc, magnesium, iron and copper), botanicals, amino acids and natural ingredients.

With the cost-of-living crisis, Zinklar’s report stated that where price influences their purchasing, 30% of consumers buy less chocolate and 29% buy products on sale. Retailers should offer promotions when they can.

Brands have come up with summer flavours, including raspberry, to incorporate into white or dark chocolate. Lemon meringue pie, cherry coconut and watermelon are just some of the flavours to inspire customers with new summer trends.

THE price of chocolate is on the rise, while the size of the bars and multipacks continues to shrink. Retailers need to search around to find a price that will allow them to charge customers reasonably while still getting a good margin.

Patel has largely stopped getting his chocolate from Nisa because the 18% mar-

gin on the PMPs in particular wasn’t viable.

“You can get chocolate with 30-40% margins from cash and carries if you can find them on promotion,” he says. “We’ve been trying to increase our margins, but the prices have been going up here. The larger packs have gotten smaller and they’ve made the chocolate

less chunky, but customers have become used to that now. They used to moan about it, but it’s part and parcel of life these days.”

The influence of PMPs on chocolate is considerable, with some retailers stocking them almost exclusively to drive that impulse sale and retain that sense of consistency.

Price is incredibly important to customers, as well.

A spokesperson from Lindt and Sprüngli says the importance of PMPs cannot be understated. They added: “PMPs’ clear pricing encourages repeat visits from customers, they are more likely to trust the store and it allows them to budget accordingly.

“To this end, PMP purchasing (48.2%) and promotion purchasing (44.5%) has increased as inflation rises.

“PMP countlines are growing year on year in impulse, with an 18.1% increase in countline PMP in impulse.”

The fact that customers are always on the lookout for a deal means retailers need to

position prices and products cleverly if they are to drive sales one way or the other.

“If you offer a non-PMP bar of chocolate for 89p and a bigger sharing block for £1.29, people will move to the bigger sharing block every time, but if the bar is price-marked at 60p, then they’ll go for the small chocolate bar,” says Patel.

“CADBURY and Nestle products are the most popular, while Mars products such as Mars and Snickers always do really well. But I tend to favour Cadbury and Nestlé because they send reps and I don’t have a Mars rep. So, I’ve always got their products at the front with their equipment and PoS on the counter in a place to sell.

“The price of chocolate has gone up ridiculously, but we haven’t noticed a downslide in sales yet. We’re a small, local convenience store, so we don’t have room for multipacks, but because we’re on the river, we get a lot of boating people coming in to buy chocolate and nibbles for movie nights on the boat. We’re quite a seasonal shop in that respect.

“If there’s a new bar launched, we put the box on the counter so people can see it and they tend to pick them up. They might come in for cigarettes or anything else, but when they see a brand-new chocolate product on the counter, they’ll go for it.

“The new products don’t last, though, I can’t think of any that have become part of our core range, but we definitely try to get them in when they’re new. Yorkie Orange stuck around for a long while, but the Twirl Caramel didn’t go very well. The White Lion bar is popular at the moment.”

Cadbury has made its chocolate brand available as a topping sauce. With a growing number of retailers having in-store dessert bars and desserts a growing trend across the market, Cadbury has identified topping sauce as an opportunity. Cadbury Chocolate Topping Sauce is suitable for vegetarians and can be stored at an ambient temperature.

Cadbury has launched a new range of Salted Caramel chocolate, available in three formats: tablet, Nibbles and Cadbury Fingers. The tablets and the Nibbles are both 120g and have an RRP of £1.49 and £1.50, respectively, while the Fingers are 114g and have an RRP of £1.85. The launch is being supported by social media, digital marketing and in-store support including PoS material.

Cadbury has expanded its Duos range by bringing its bestselling singles product into this increasingly popular format. The launch of Twirl Xtra will help retailers to demonstrate even more value to their shoppers with one of the UK’s biggest chocolate brands. Twirl Xtra features even more of the Cadbury Twirl chocolate, with two longer pieces of chocolate in each consumer pack.

Mondelez International is offering shoppers the chance to win money-can’t-buy experiences with some of the biggest female athletes in football with the launch of its ‘World Class Wins’ on- and off-pack promotion. Through its Cadbury FC platform, the promotion – which heroes the female champions within the sport – will give shoppers the opportunity to score big and retailers the chance to get the ball rolling on spring and summer sales.

Following its acquisition by the Serious Sweet Company, Mighty Fine has added two new honeycomb flavours to its portfolio of chocolate-covered treats. The new flavours, Blonde Honeycomb and Sicilian Lemon White Chocolate, include Mighty Fine’s famous light and crispy honeycomb, covered in Sicilian lemon white or blonde chocolate. Both are suitable for vegetarians and are made with blossom honey.

Lindt Lindor has launched PMPs in two on-the-go Lindt Lindor stick flavours: Milk and Salted Caramel, at 95p per 38g. “We believe PMPs will only increase in popularity, especially as the clear pricing provides reassurance the shopper isn’t being over charged. We understand the importance of PMPs in the impulse sector and strive to support retailers by including our top-selling bars as PMPs,” says a spokesperson from Lindt and Sprüngli.

Sweetdreams Ltd has announced the launch of its new chocolate range, Gozo. Meaning ‘Joy’ in Colombia where the cocoa is harvested, the new Gozo line is positioned to sit in a category of its own, bringing together the chunky bloc-choc bite with the sophistication of luxury chocolate. The range includes six new 130g block chocolate bars made using single origin Cacao Fino de Aroma, ethically soured from Colombia via Luker Chocolate.

The bottled water market offers both challenges and opportunities for independent retailers looking to offer a healthy variety at a decent price, as MAX SCHWERDTFEGER discovers

BOTTLED water is a market that has grown by an estimated 3.7% in the past year, with on-the-go sales growing by as much as 28%. These figures are only going to increase as people continue to go back to the office and shopping habits resemble pre-lockdown levels. For independent convenience retailers to capitalise, they need to know what the key opportunities are when it comes to merchandising and ranging, and what end consumers are looking for.

“Bottled water is massive, and customers are buying much more than they did 12 months ago,” said Atul Sodha, Londis Harefield in Uxbridge.

“It’s always been a big part of the category, and there are loads of varied options. For me, it’s the flavoured waters that are driving sales right now.”

An obvious factor in driving sales is seasonality. According to Charlotte Andrassy, head of category development for beverages at Danone UK & Ireland, taking the hot weather

into account can help retailers drive sales further, especially given that bottled water sales are 56% higher in convenience stores in the summer months.

“Increasing space to stock waters in summer is crucial to allow retailers to capitalise on the higher demand,” she says.

Jason Byrne, from Kingswear Post Office in Devon, agrees that seasonality is important for selling bottled water, but not critical as there are still sales in winter. For this reason, he says he doesn’t take any of

his much

his bottled water options out during the quiet months as the product is always in demand.

“I have one row for soft drinks, but for water I have two, and even in the winter I don’t change it or the price because my margin is so good,” he says. “Retailers don’t have to do much because they sell on their own.”

For Sodha, improving sales of bottled water is about offering varied options and understanding that people different things.

Sodha, improving sales water

THE emphasis on meeting consumer choice stretches to sustainability and ensuring consumers can shop in the knowledge that what they’re buying isn’t damaging the environment.

Ben Richardson, co-founder of Re:Water, says that trends within the water industry and independent convenience stores have been a “moving market” for a long time and will probably continue to be so. He says customers are becoming more aware and more interested in sustainability.

“One thing that will not change is the end consumers’ demand that brands care for the environment and the planet,” Richardson explains.

“Customers are realising

the importance of being able to purchase an infinitely recyclable bottle and know that it can be reused and recycled properly.”

In a recent Newtrade Insight report, titled ‘Sustainability: The challenges and opportunities for independent convenience stores’, 46.6% of retailers said they will try to cut the amount of plastic they stock in the next 12 months. This is partly because they want to cut down on their own carbon footprint, but also in response to consumers wanting environmentally-friendly options. The clearest example of the importance of sustainability crossing over into sales of bottled water is in packaging, particularly plastic.

This begs the question: should suppliers of bottled water focus on manufacturing products specifically with an environmental focus, and how important is sustainability with such a stable commodity as water? Furthermore, how much do customers care about it?

According to Amy Burgess, senior trade communications manager at Coca-Cola Europacific Partners, companies’ eco-credentials are becoming increasingly important for consumers’ choices.

“Sustainability is now a key consideration for consumers, with one in four consumers changing brands based on sustainability perception,” Burgess says.

Burgess goes on to say that shoppers are also switching to brands with the strongest sustainability credentials at twice the rate of the average brand to emphasise how important the environment has become in consumers’ shopping journeys.

Edward Rayment, drinks brand manager at Empire Bespoke Foods, believes consumers are showing more interest in sustainability when it comes to the bottled water market and that they have “heightened concerns over single-use plastic”.

Echoing these thoughts, Danone’s Charlotte Andrassy says environmental factors, such as the use of plastic, are “increasingly on shoppers’

minds” and that retailers need to “reflect this wherever possible” by stocking as little as possible. Andrassy stresses that this macro-trend is going to continue in the near future, which means retailers and suppliers need to meet it.

An alternative to plastic bottles could be canned water, and this is something Danone have recently pursued with the launch of a new Evian sparkling water. Richardson believes that the category can only be seriously sustainable if it gets rid of plastic altogether, something that could be on the horizon usage of plastic is “changing significantly”.

Despite the emphasis on sustainable packaging from major suppliers, when asked,

some retailers are unconvinced, saying that instead customers’ interests are in value and convenience.

“The only question my customers ask when it comes to bottled water is whether it’s still or sparkling,” Byrne tells Retail Express.

“People don’t really ask about the packaging – they just want to buy it.”

Sodha thinks similarly, that whether or not the packaging is made sustainably is low down on customers’ priorities at present.

“I don’t think environmentally-friendly packaging is as important for customers. Right now, everything is about the cost-of-living crisis and the need for value,” he says.

ANOTHER focus suppliers and retailers need to be aware of is health, and where bottled water fits into consumers’ efforts to improve their well-being.

While sustainability might be a challenge, according to suppliers, health is a real driver in the market, with Andrassy calling it “a key consumer trend that is driving strong category performance”.

“Consumers are consciously trying to make healthier choices, with drinking more water being a top priority for their personal health commitments,” she adds.

This has been something of a boon for independent convenience stores, as people returning to the office, taking day trips and generally socialising

all contributing to the 28% bounce in ‘on-the-go’ sales in the past 12 months.

Sales of single pack formats of bottled water, the easiest to cater to on-the-go needs, have almost kept up with the wider category’s growth, rising by 21%.

This focus on health and onthe-go convenience presents a great opportunity for retailers, who should aim to stock a variety of formats and flavours.

“This trend is something independent convenience stores and newsagents can capitalise on,” Andrassy says. “We know plain and flavoured waters perform well for convenience stores, so retailers should look to stock a range of options across both sub-categories and

the top brands in each.”

Bottled water already outperforms soft drinks as a whole. The health factor in the bottled water category will only become more important as consumers shift towards healthier drink options.

By offering a wide range of flavour options, particularly in the smaller, on-the-go format, retailers can continue to capitalise on the growth.

According to Byrne, the single 500ml bottles of water are more popular than the larger, better-value 2l bottles as they are easier to carry and can be consumed straight away. This suggest that of all the key trends, on-the-go convenience is the most important in driving growth.

#IAA23

Shape, strengthen and supercharge your business at the Independent Achievers Academy Learning & Development Festival 2023

3 July 2023 | The Eastside Rooms, Birmingham

The IAA Learning & Development Festival will equip you with fresh ideas, new connections and a wealth of practical strategies to elevate your store.

Shape your business by sharing experiences and networking with retailers from across the country.

Brand new for 2023!

Strengthen your business with invaluable insights from expertled masterclasses on key industry trends and challenges.

Supercharge your business by discovering the products that will set your store apart at our hands-on trade exhibition.

PLUS – IAA 2023 Category Stars announced! Discover which stores are leading the way as this year’s stars of independent convenience retail are revealed.

Secure your FREE place today – scan our QR code, visit www.betterretailing.com/IAAfest or call 020 7689 0500

Jey

Jey

“IT’S not changed things massively. We used to always have one premium brand and one mainstream brand, and some customers would go for the premium option, but we have noticed that people are generally buying the cheaper product now, so we’ve adjusted the range and store layout accordingly.

“We sell Strongbow, but also have a Go Local cider called Lancer and that’s been increasing a lot. We’re selling six cases of Lancer for every case of Strongbow now because it’s cheaper. It’s the same with tobacco – people just want the cheapest options, so we went to all the tobacco companies and asked what discounts we could get from them.

“If retailers can carry cheaper products, they should, because some will be just as good quality as the branded, more expensive options. We still sell lots of Heinz baked beans at £1.75 a tin, but we have the £1 Go Local brand as well.”

“THE biggest things we’ve changed about our ranging and layout have been because of theft. In the past couple of months, we’ve had people stealing whole shelves of coffee and meat, so we’ve moved all the high-value products. My �irst priority is securing what we sell. The coffee is now in front of the counter and we stock-take the high-value products regularly.

“In terms of ranging, it’s important to have a good, better and best, but it’s also about driving promotions to offset any price increases. Some of the standard staples have gone up by 20%, so I’ve spent the past four days setting up promotions and putting them up around the store. Wherever you are in the store, it looks like there’s something there that has some value.

“As soon as customers think you’re expensive – and prices are going up faster than we can source cheaper versions – then that can be it.”

“SOMETIMES people are just looking for the budget options in certain categories, such as toilet roll. It doesn’t really matter what brands we stock as long as there’s an affordable option. When it comes to baked beans, however, we stock the Co-opbranded beans, the Best-one own-brand and the bestselling version, which is Heinz. People almost always go for the Heinz, but it’s important we give them the choice.