Megan Humphrey, editor

Megan Humphrey, editor

We set off at 6.30am, which gave us a rare opportunity to see London waking up. I had grand plans of doing a convenience store tour on my travels, but after a couple, I realised it would add on so much time that I’d still be crawling the very next day.

We set off at 6.30am, which gave us a rare opportunity to see London waking up. I had grand plans of doing a convenience store tour on my travels, but after a couple, I realised it would add on so much time that I’d still be crawling the very next day.

But what I did notice is the sheer number of convenience stores still thriving in the most central spots, the majority of which were traditional newsagents, still standing strong despite a challenging few years.

We saw papers being dropped, shutters going up and deliveries around the clock. It was a sunny day, and store owners reaped the rewards as shoppers took the chance to refresh, with a cold drink, or in some cases an ice cream.

It’s easy to get overwhelmed by conversations in today’s retail market, about technology, and how it’s essential in propelling your store’s sales. But what was evident for me, and clearly for those centrally located sites, is that traditional still reigns supreme.

TRADITIONAL STILL REIGNS SUPREME

Stereotypical lines and ranges that make convenience convenient are still very much in demand. Although moving with the times, and finding new pockets of revenue is important, don’t neglect the products and way of doing business that got you where are today in the process.

Shoppers rely on their local shop to provide them with all the staples they assume to be on sale, and I don’t think they’d be very happy if they started disappearing.

MEGAN HUMPHREY GOVERNMENTS need to work together to successfully crack down on the sale of illicit tobacco, according to Philip Morris Limited’s (PML) global head of illicit trade prevention operations, Nicolas Otte.

Speaking exclusively to Re-

free ‘Technovation’ event in Switzerland, Otte named Poland as an example for other countries to learn from.

“The decreasing consumption of illicit cigarettes in countries like Poland is remarkable and reassuring,” he said. “It showcases the impact of effective law enforcement against criminals pro�iting from illicit trade in a market where better alterna-

tives to smoking are available and more affordable.”

Otte went on to stress the need for more funding for trading standards to ensure laws are being enforced. “We hear accounts from retailers, complaining that they haven’t seen enforcement of�icers for years, which obviously pushes them to not feel con�ident in reporting,” he explained.

“Enforcement bodies are

understaffed and under resourced, so we need to look at getting everyone working together.”

Otte said PML could help facilitate such conversations. “I ask governments to please look, and we are happy to help because we are in a unique position to be working with different law enforcement agencies across the world.”

News editor Alex Yau @AlexYau_ 020 7689 3358

SUBPOSTMASTERS have demanded answers over the gap between Post Of�ice’s (PO) increased pro�its and the falling remuneration for branches.

Greenhow, explained: “If we talk abut what PO generates and what postmasters earn, a postmaster in 2021 earned 40p in the pound.

LOCAL shops in England and Wales have been warned to prepare for a new recycling law due to launch next year that will result in higher costs.

LOCAL shops in England and Wales have been warned to prepare for a new recycling law due to launch next year that will result in higher costs.

Specialist reporter

News reporterJill

Lupupa jill.lupupa@ newtrade.co.ukDuring a Q&A conference on 11 May, the National Federation of SubPostmasters’ chief executive, Calum

“In 2022, they earned 45p and in 2023 they earned 42p. We’ve lost £87m in mail revenues alone.”

While the �ine print of Department for Environment, Food and Rural Affairs’ (Defra) Environmental Act is yet

to be published, experts predict that all stores producing more than 5kg of food waste will have to pay for segregated food waste disposal, with the law likely to begin in 2024.

The requirement mirrors Scotland’s policy.

For the full story, go to betterretailing.com and search ‘remuneration’

THE government has announced measures in a bid to come down harder on those selling vapes to under-18s.

Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment.

loophole allowing ‘free samFeatures writer Jasper Hart 020 7689 3384 @JasperAHHart 41,206 Audit Bureau of Circulations July 2021 to June 2022 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied.

For the full story, go to betterretailing.com and search ‘vapes’

For the full story, go to betterretailing.com and search ‘food waste’

DELIVERY �irm Snappy Shopper has con�irmed a “change of strategy” by adding retailers beyond the grocery sector.

Vice president of groups and business development Greg Deacon said bringing on more businesses, such as coffee

shops, bakers and DIY shops, would help boost store sales.

“We’re looking to bring incremental sales and look at how we can use different types of stores to create more visibility of independent retailers,” he said.

A ‘CON ARTIST’ is cheating stores out of hundreds of pounds by selling vaping stands and products that never arrive, according to victims.

Retail Express understands the perpetrator has been targeting store owners since March by pretending to be from a major supplier to sell disposable vape lockable and countertop units on social media.

Asim Bokhari, owner of Shah Continental Foodstore in Small Heath, Birmingham, warned other stores to be wary when buying vape equipment or stock.

He paid £260 upfront for one of the units in April, but has still yet to receive anything. “I was told at the time that a few people had cancelled their orders, so I was getting a deal on the price,” he said.

“I was offered two �ixed lockable cabinets with a countertop unit, all of which included the price of delivery.”

Bokhari admitted he is even more “disappointed” because he carried out his due diligence and did some research on the claimant, and felt con�ident after seeing they were employed by a reputable company, Canna Group, a subsidiary of Cannapharma, which manufactures CBD consumer products in the UK and Europe.

“After I saw that they worked for them, I had con-

�idence in the service that was being offered,” he said. “I transferred the money right away, and was told the stands would arrive the very next day, but nothing came.”

Bokhari told Retail Express that he chased, but was told the perpetrator was on a week-long holiday and “the stands would arrive soon”, but still nothing has arrived, and they are failing to respond to any communication.

Aleem Akhtar, from Park Stores in Newcastle upon Tyne, only received a stand from the impersonator after making it clear that he knew the local area where the seller lived. The unit arrived late, didn’t match the description of the advertisement, and was of a “very poor quality”.

He explained: “I messaged them in March asking for details after seeing the advert. They sent me an invoice and I sent across £300 for two stands. I was promised they would be delivered the next day, but nothing came.

“I did my own research and said that I had family and friends located near to where the company was listed, and they told me that the parcel delivery company had been at fault, and they would be with me again the next day.

“They did turn up, but they were a much cheaper version of what I was promised. I would say they would

be worth between £20-£30. I asked for a return, but was given an excuse that the person selling them was in hospital. Since then, I’ve not been able to get a response.”

After several retailers had experienced poor service, they recruited help from the owner of a popular convenience store owners forum on Facebook, which the “scammer” �irst advertised the products on.

Steve Wilson, owner of two stores in Scotland, told Retail Express that he reached out and the impersonator responded, claiming that they had been in hospital for the past 12 days with “severe pneumonia”.

Wilson said: “They explained that they hadn’t had access to their phone, and that they would be released the next day and retailers should expect full refunds, but there would be a short delay as their bank account had been suspended due to a multiple complaints.”

As Retail Express went to print, it was understood that those affected retailers are still yet to receive refunds. Rav Singh Chatha, from Premier Northwood Lane Stores in Newcastle, under Lyme admitted he was communicating with the claimant, but “stopped after seeing warning messages from other retailers in the Facebook forum.” Director and chief operating of�icer of Dodds Heres, the owner and parent company of Canna Group, Adam

Mackenzie, con�irmed to Retail Express they were already aware of the issues, and lawyers are investigating. “I can con�irm that this person does not, nor has ever worked for any of our brands. They have never worked for any of the companies that sit under us. I’ve been contacted by several people over the past two months looking for the scammer, demanding their money back.

“Lots of people are looking for him – not just retailers. I’ve contacted them via LinkedIn, they replied to me until I mentioned that they

“YOU have to remove the Covid years because if you compare yourself to those unprecedented days, you’ll find things very difficult. Put those years aside and re-evaluate your business. Comparing yourself to 2019 is hard, but necessary, and it’s really like starting a new business. Go back to the basics. Look at your base costs, your cost lines and work out what you need to cover that before you’re profitable.”

Ranj Hayers, Mead Vale, Weston-super-Mare, Somerset“WE have 18 stores, and we don’t set the same targets for each, but we do weekly audits and quarterly reviews to analyse fast movers and low sellers. Over the past quarter, we saw a 22% sales increase across our estate and 5% margin growth. We look at merchandising and staff training to make sure we’re giving the local customers what they need.”

Jeyaseelan Thambirajah, multi-site operator, Cambridgeshire, Lincolnshire, Northamptonshire

were trading under the Canna Group, and then they cut all communication.

“I want to con�irm that we don’t manufacture any of the products that have been advertised by this person, and we want to help make this right.”

For legal reasons, Retail Express is unable to name the alleged fraudster.

Stores are advised to buy only from reputable vaping companies, to research them online, speak to other shop owners and call the head of�ice to check the person selling in store or online is authorised to do so.

“YOU have to constantly be doing something. I like to keep gross profit at a minimum of 22%, and keep turnover above inflation. The past two quarters haven’t been easy, but because we’ve been consistent with standards, social media and community interaction, we’ve grown in the past five weeks. My goal is to focus on not giving away margin while keeping prices fair.”

Serge Notay, Notay’s Convenience, Batley, West YorkshireDo you have an issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

COFFEE: Tchibo is rolling out Smokin’ Bean coffee machines to independent stores. The ‘Premio’ requires 1m2 floorspace of space, a 13-amp electricity supply, and a water supply. Stores must sell 15 or more cups per day to be eligible for the machine.

For the full story, go to betterretailing.com and search ‘coffee machine’

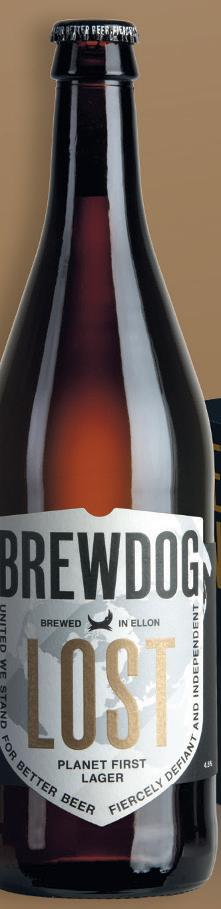

BREWDOG: A rep from the company has confirmed it is boosting its field support for independent retailers to help increase sales of its products. The investment has reportedly been made in Manchester, Liverpool and London, with support for stores in other parts of England to follow.

For the full story, go to betterretailing.com and search ‘BrewDog’

COURT ORDERS: Convenience service providers and suppliers have urged retailers in severe financial distress to find support immediately, as the number of winding-up orders filed against stores is rising again. Since 2010, there were 208 winding-up orders filed against independent retailers by major companies in the sector. Nisa and PayPoint filed more than half of these at 66 and 73 respectively.

For the full story, go to betterretailing.com and search ‘winding up’

NEWSPAPERS: News UK has come under fire for cutting profit margins for six months, as part of increases to the cover prices of The Times and The Sunday Times. From 10 June, weekday copies of The Times went up by 30p to £2.80. The Saturday edition went up by 50p to £3.50, while the Sunday Times rose by 50p to £4.

the column where you can make your voice heardJILL LUPUPA Serge Notay Vape stand received by Aleem Akhtar was described as “a much cheaper version” of what was promised

MEGAN HUMPHREY

THE Scottish government has confirmed it is to delay the introduction of a deposit return scheme (DRS) for a second time in two months.

Circular economy minister Lorna Slater gave a statement in Holyrood last week, claiming the earliest it would now be introduced is October 2025.

In her address, she blamed the UK government for re-

moving the requirement for stores to accept glass bottles, and claimed it had “offered no justification for removing one of the most significant parts of the scheme”.

The latest DRS plans for England and Northern Ireland, also due to be introduced in 2025, do not include glass.

The news will come as a further blow after it was only announced that it would be delayed until 1 March 2024,

in April, after Scottish first minister Humza Yousaf said he wanted to “re-set” the government’s relationship with business.

Scheme administrator Circularity Scotland’s chief executive, David Harris, described the news as “disappointing”. He said: “We made it clear that the industry was prepared, and that a scheme without glass is economically viable and is an opportunity for Scot-

land to provide a platform for a UK-wide DRS.”

The ACS’ chief executive, James Lowman, stressed: “It is absolutely essential that the governments of the UK work together to introduce a scheme that works for everyone, is effective at increasing recycling rates and does not impose unnecessary conditions on the retailers that will be delivering the scheme on the ground.”

BESTWAY is simplifying the rebate structure for its symbol group retailers.

The firm’s retail director, Jamie Davison, told Retail Express the decision for Best-one stores was based on feedback.

He added: “We’ve looked at the criteria and we’re going to reposition the whole scheme. The ethos is about how we can reward the best retailers. We want to be an easier business to work with.”

For the full story, go to betterretailing.com and search ‘Bestway’

A PIZZA vending machine supplier is targeting independent retailers for expansion, with stores generating annual sales of £70,000.

Revolution Pizza already has machines at four London sites, measuring two metres in height with the capacity to store 64 pizzas. The firm’s head of UK commercial operations, Vladimir Crasneanscki, told Retail Express the ma-

For the full story, go to betterretailing.com and search ‘Revolution Pizza’

chines were already successful in France, selling 20 pizzas, on average, a day.

LYCA Mobile has plans to add 500 stores in partnership with independent retailers in small towns and villages.

The SIM card provider currently has 30,000 cobranded stores across the UK. Chief sales officer Rob

Shardlow said: “We very much value the important role independent retail stores provide.

“The convenience store has been at the heart of our distribution strategy, and that will continue.”

For the full story, go to betterretailing.com and search ‘Lyca’

JASPER HART

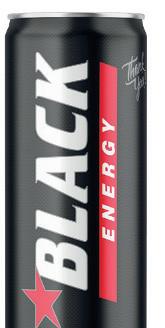

IMPORTER and distributor

Best of Poland has become the exclusive UK distributor for Black Energy, the number-one energy drink brand in Poland.

The partnership sees Black Energy, alongside further Polish brands Ngine, Frugo and 4Move, available from Best of Poland through a partnership with Polish distributor Foodcare.

Black Energy has more than 30 lines, focused on mental stimulation

and enhancing sports performance, as well as offering a variety of �lavours.

4Move has more than 20 lines, aimed at sport and performance-driven individuals through vitamins and supplemented hydration.

Frugo is intended for a younger audience, with natural caffeine and yerba mate, while Ngine is a traditional energy drink with caffeine, available in 250ml single cans and multipacks.

The importer said it aimed to deliver signi�icant sales for the brands across conveni-

ence, wholesale, foodservice and discounters. According to Kantar data, the energy drink category has recently gained 400,000 additional shoppers, meaning there is an opportunity to introduce them to new brands and �lavours.

Piotr Czuryński, export director of Foodcare, said: “We see a huge opportunity for brand and category growth within the UK market. Best of Poland won exclusive distribution rights due to their vast experience with the retailers operating in the world food category – they

BREWDOG has launched a dedicated webpage to help convenience retailers maximise the craft beer category in their stores.

The webpage provides retailers with access to the latest market insight and trends, ranging and merchandising advice and information on bestsellers.

BrewDog shoppers in particular, spend 28.8% more on their total basket than average beer shoppers, but craft beer sales lag behind the total category.

are talented experts who

are talented experts who know and are passionate about our products. We will be supporting them with extensive brand plans to drive joint sales and awareness.”

SUNTORY Beverage & Food

GB&I (SBF GB&I) has delisted several Lucozade and Ribena �lavoured lines.

These lines are no longer available: Lucozade Energy

Raspberry price-marked pack (PMP) £1.25, Ribena

600ml Raspberry & Rhubarb

PMP £1.50, Ribena 500ml

Raspberry ready-to-drink (RTD) PMP £1.19, Ribena

500ml Cherry & Apple RTD

PMP £1.19, and Ribena

Sparkling 2l and 330ml both PMP and standard pack.

“To ensure we are focusing on the right drinks in the right formats for our retail customers and shoppers, we have removed some drinks products from our range,” said Matt Gouldsmith, channel director route to market, SBF GB&I.

“We’re driving sales of Ribena with a TV advertising campaign very soon.”

According to the supplier, craft beer shoppers spend more on their total basket than any other beer shopper.

Hannah Corker, customer marketing manager – impulse at BrewDog, said: “Just 8.4% of craft beer sales go through impulse versus 28.1% of total beer, meaning the category hugely underindexes in this channel and has headroom for growth.”

has

WALL’S suasage rolls have undergone a rebrand that the brand claims is the largest in its history, as it aims to attract new shoppers.

The rebrand involves the brand’s biggest recipe change for a decade, as well as a packaging refresh.

The recipe change involves a blend of herbs and spices developed by the Wall’s team of chefs. Additionally, the upgraded sausage is wrapped in 64 layers of

pastry and a new glaze. A series of independent research studies was designed to understand what makes the perfect sausage roll. During these, consumers rated the new recipe higher than the previous one across six categories including appearance, �illing, texture and �lavour. Additionally, the packaging refresh includes the use of product photography for the �irst time in Wall’s history.

UNITAS Wholesale customers can now stock soft drinks inspired by Barratt’s range of classic sweets, following an exclusive partnership between the wholesaler, Valeo Snackfoods and Whatever Brands.

The range consists of 10 lines: four �izzy drinks based on Flumps, Dip Dab, Wham and Fruit Salad, each in two pack sizes, and two spring water bottles based on Fruit Salad and Wham.

The �izzy drinks range comes in 555ml PET bottles, each at an RRP of £1, and 850ml PET bottles, each at an RRP of £1.29.

Fruit Salad Spring Water and Wham Spring Water come in 500ml PET bottles at an RRP of 69p and are also HFSS compliant. They have been created with Wales-based Trederwen Springs.

BOOST Drinks is building out its Juic’d 500ml can range with the addition of a Blood Orange & Raspberry Crush variety

Launching this month, the new variety is made with 5% real fruit juice and is available in a £1.09 pricemarked pack. Its launch comes as orange is currently the fourthstrongest �lavour in soft drinks and second in juice, while raspberry is the sixth-

biggest �lavour in stimulation, growing by 58%, Additionally, the 500ml energy drink segment was the largest-selling in 2022, worth £503m and growing by 16% year on year.

The supplier is supporting the launch with in-store sampling across student areas in London, offering shoppers a gift alongside their purchase. There will also be outdoor, digital, radio and YouTube advertising.

HANCOCKS has added to new lines to its Bonds Pun Box range, which are called Just Peachy and Mon Cherry. Available at an RRP of £2, Just Peachy and Mon Cherry contain �izzy peach and �izzy cherry pick n mix sweets. Mon Cherry is also suitable for vegetarians.

The wholesaler says the names – “mon chéri” is French for “my dear” and “just peachy” means “everything is great” – make

the new launches strong affordable gift options for loved ones.

Kathryn Hague, head of marketing at Hancocks, said: “Pun Boxes are especially popular ahead of holidays, such as Valentine’s Day, Mother’s Day and Easter, but there will also be shoppers on the lookout for funny and sweet gifts for birthdays, anniversaries and other celebrations all year round.”

PRIYANKA JETHWA

TO celebrate its 60th anniversary, Scandinavian Tobacco Group UK (STG UK) is bringing out a range of limited-edition Signature tins to bring “excitement and interest” to the cigar category.

The supplier said the limited-edition tins have been designed to celebrate the brand’s anniversary and give retailers a talking point to their customers, as well as giving adult smokers something new.

It added that its Signature range should make up a key part of a retailer’s cigar offer, featuring Blue, which is the UK’s bestselling ‘traditional’ cigar; Original, a full-strength cigar; Red Filter, the UK’s

number-one traditional aromatic cigar; and Action, which is the fastest growing peppermint click �ilter cigarillo.

Meanwhile, the supplier also announced that it will be reintroducing 20-packs of its Blue and Original varieties.

Acknowledging limited space concerns for convenience

retailers, the supplier added that the larger packs won’t therefore be a focus for this channel, however, if retailers did want to stock it, it would be available to them. They stated that compared with a 10-pack, the larger format would offer better value for money, with this format in overall growth.

TROPICANA is entering the ambient juice category with three long-life juices, available in Smooth Orange, Original Orange and Apple �lavours.

The ambient juice category has seen sustained growth since the pandemic, and is

now worth £907m, growing faster than the chilled juice category.

The supplier explained that until now, shoppers looking for mainstream juice �lavours in the ambient category have had little choice but ‘from concentrate’

offerings, primarily from own-label options, due to the lack of branded varieties in this category.

All three will come in 850ml bottles with an RRP of £2.99, with a £2.75 price-mark pack also available.

KINGSLAND Drinks Group has added three new �lavours to its range of premium ready-to-drink (RTD) spirit-based drinks, Mix Up.

These include Coffee Rum & Cola, Pink Gin & Diet Lemonade, and Apple Rum, Lime & Ginger Ale varieties.

The supplier said the drinks tap into “established and emerging �lavour trends” in cocktails and RTDs.

“Coffee is now one of the biggest growing segments in the industry and total rum sales now amount to 13% share of the overall spirits category,” the supplier said.

“As consumers seek out more diverse �lavours,

Mix Up’s range provides convenience retailers with an opportunity to appeal to a

broader audience and attract younger shoppers to the sector,” they added.

SWIZZLES has launched a range of Drumstick Squashies Freeze & Squeeze Slush Pouches.

It is available in Original Raspberry and Sour Cherry & Apple �lavours, and is suitable for gluten free, vegan and halal diets. The pouches are packed in an ambient format, meaning they can be stored on shelf and frozen at home.

They come in single �lavour displays of 12 in shelf-ready packaging, with an RRP of £1.39 each.

The range is being exclusively distributed by Rose Marketing UK Ltd and is HFSS-compliant.

The leading learning, development and recognition programme helping retailers grow profitable sales

The IAA is supported by leading industry brands that recognise that retailers want free support to increase profits Headline

ASAHI UK is launching a four-pack of 440ml cans of its Peroni Nastro Azzurro lager. The new format features a top clip cardboard carrier, which is FSC-certi�ied, 100% plastic free and 100% recyclable.

It is available to convenience retailers from Booker, One Stop and national cash & carry outlets.

Its launch comes as smallpack premium lager cans are in growth. Premium and super-premium 440ml cans have grown annually by 33% and 32% respectively.

Within premium and super-premium lager, smalland mid-sized can packs were the only formats to grow share of the category in the 12 weeks to 4 March.

Additionally, most beer shoppers have a clear preference for buying either bottles or cans. One in four shoppers is solely a can buyer, according to Kantar Worldpanel data, giving Peroni Nastro Azzurro a new customer base to target.

Steve Young, sales director at Asahi UK, said: “Retailers should consider extending the space they dedicate to four-pack cans to offer shoppers greater choice as they socialise at home and in the garden this summer. With the brand equity that Peroni Nastro Azzurro carries, this new pack format is also a great solution for al fresco occasions like barbecues and festivals.

Four-pack lager is dominated by mainstream brands in convenience; however, the

biggest growth opportunity is in premium.”

The supplier recommends that convenience retailers dedicate 10% of their chilled beer space to premium fourpack cans.

FLORETTE has teamed up with outdoor activities company Go Ape on an on-pack promotion offering shoppers money off entry to its sites.

The promotion runs until the end of August. It offers discounted entry to Go Ape, alongside 40 £100 gift cards every month.

Participating Florette lines include Classic Crispy, Mixed, Baby Leaf & Rocket and Superfood.

Martin Purdy, commercial and marketing director at Florette UK, said: “We’re hoping that this promotion will make it easier for shoppers to keep enjoying family adventures while

also nudging them to keep fresh, nutritious foods on the plate – giving them and their families mental and physical health a boost.”

The promotion is part of Florette’s ongoing £1m

marketing investment this summer, which also includes sponsorship of the Food Network TV channel and a TV advertising campaign set to reach more than 8.6 million shoppers.

YOPLAIT UK is launching its largest campaign to date for kids’ yoghurt brand Frubes, including limited-edition packs and a six-�igure advertising push.

As part of the campaign, three limited-edition ‘Try me frozen’ packs in Strawberry, Banana and Strawberry and Variety packs are available to communicate the freezing opportunity for the yoghurt. Additionally, the new advertising creative themed around how frozen Frubes can go into lunchboxes in the morning and be defrosted by lunchtime will run across social media, in�luencer marketing and sampling

opportunities.

Ewa Moxham, head of marketing at Yoplait UK, said: “We are the only yoghurt brand in a tube and the only one to offer the versatility of being able to freeze. We are con�ident that kids are

COCA-COLA Europaci�ic Partners (CCEP) has launched its latest campaign for its Costa Coffee ready-todrink (RTD) chilled coffee range this summer, following strong growth.

The campaign includes social media video content, nationwide outdoor advertising, and sampling activity in high-footfall areas of London. Additionally, there will be festival partnerships with Pride, Mighty Hoopla, Barcode Festival, Car Fest and Kendal Calling.

The campaign comes as the Costa RTD range has grown volume sales by 47.5% and value sales by 59.4% in the past year, helping fuel the RTD coffee segment, which is now worth £280.5m.

Pippa Foster, associate director of commercial development at CCEP GB, said: “Our summer campaign is perfectly aligned with the key RTD chilled coffee need states – giving young adults a ‘boost’ or a ‘pick me up’ –and builds on Costa Coffee’s

THATCHERS Cider has unveiled a new TV advert in collaboration with animation studio Aardman.

The ‘Pint-sized perfection’ advert, which began airing on TV on 25 May, uses stop motion animation to bring viewers to Thatchers’ Myrtle Farm in Somerset.

It follows the cider-making journey, from orchard to glass.

Key �igures in the Thatchers story have been brought to life, such as fourth-generation cider maker Martin

Thatcher, the Thatchers hot air balloon from previous adverts and Myrtle, the family dog.

The advert involved a team of over 40 Aardman creatives, who took more than 480 hours to �ilm the 40-second commercial. It airs across TV, on-demand, cinemas and YouTube, and will be supported by 48-sheet and six-sheet outdoor advertising as well as social media promotion.

“Partnering with Aardman allows us to introduce

sampling success at freshers festivals and city takeovers in 2022.”

consumers to a new lighthearted, storytelling creative about our ciders,” said Thatcher.

going to love having one of their favourite snacks in a frozen format, especially as the weather starts to warm up. This is also a great way of minimising food waste and making our product last longer.”

What do you think? Call Retail Express on 020 7689 3358 for the chance to be featured

ILLICIT VAPING: Are you seeing an increase in trading standards officers?

“I HAVE not been visited by trading standards since the legislation came in around 2016, which involved restricting the advertising and age around the selling of vapes in stores. I don’t know why we haven’t been visited by a trading standards officer, but we are a responsible retailer.”

Dennis Williams, Premier Broadway, Edinburgh

SUSTAINABILITY: How will the singleuse plastic ban impact your store?

“WE stock wooden cutlery instead of plastic – we moved away from all that six-to-eight months ago as I thought it was better to be more environmentally friendly. All of our food to go uses aluminium packaging, too, which we get from Bunzl.”

Harj Dhasee, Mickleton Village Stores, Gloucestershire

You need equal representation

“IT’S not something we should be surprised by. It won’t affect us massively as we’ve been expecting it to happen, so we got prepared – most of the things we stock are recyclable. We’re always conscious that packaging is recyclable and sustainable.”

Sue Nithyanandan, Costcutter Epsom, Surrey

“I WAS visited two weeks ago and that is the first time since before the pandemic. The officers looked at whether my gantry was locked and at what I was selling. I believe more visits are taking place. I’m all for an increased presence by trading standards. Every retailer should abide by the law.”

Mo Razzaq, Mo’s Premier, Blantyre , South Lanarkshire

SALES: Has the warmer weather boosted your sales?

“ WE recently introduced Deliveroo, Just Eat and Costa Coffee. There’s no Costa near us, so the morning trade is picking up. Warmer weather means the beers, soft drinks, ice cream and wine and spirits are going up, and Red Bull is flying out.”

Shaelender Goel, One Stop Gospel Lane, Birmingham

“WE’RE selling more ice cream and lollies. Years ago, you’d sell more alcohol, but now we can’t compete with supermarkets on price. You can buy things from Tesco cheaper with a Clubcard than we can get from wholesalers.”

Omran Awan, Premier Michaels Superstore, Newcastle upon Tyne

It won’t affect us massively

DIVERSITY: How important is more diversity on retailer panels?

“DIVERSITY is very important; you need equal representation across the board from all different types of background. I’m in 15-to20 different retailer panels across the year. There needs to be a reflection of people on the ground – it’s just common sense.”

Amrit Singh, H & Jodie’s Nisa, Walsall

“IT’S needed in all elements of society – it would be good to see that happening in our industry as it reflects everyone on all levels. I’m in a few panels and it’s great to see a different makeup of people of all ages, gender, and backgrounds – we had a husband and wife in one panel.”

Aman Uppal, One Stop Mount Nod, Coventry

Smoking kills

BEL UK partnered with two retailers to demonstrate how its new Mini Babybel Original two-pack format can help to drive food-to-go sales

WITH78% of British consumers believing snacking should be part of a healthy diet1, the Mini Babybel Original two-pack was launched in convenience to cater to consumers looking to cheese and protein snacks for a grab-and-go fix. Being the number-one cheese snack format, Babybel has partnered with Retail Express to introduce the new format and offer category insights to improve sales. We see how they got on.

FOCUS ON DILIP PATEL

Krina News Ltd, Whitechapel, London

DILIP is in a busy area in Whitechapel, London, and has a mixture of customers, from families to passing trade. As a result, he has to cater for food-to-go and snacking missions. His challenge is displaying his range and different formats effectively to capture his customers’ attention.

Stock bestsellers: Mini Babybel Original twopack was introduced as it’s a beacon brand and will help attract shoppers to the category.

Product blocking: To improve the shopper experience and provide snacking options, Dilip’s on-the-go range was vertically blocked.

Brand recognition: Point of sale was introduced to highlight the addition of the new Mini Babybel Original two-pack and maximise sales.

“I ’M really happy with how the project went and the sales of the Mini Babybel Original two-pack over the six-week trial period. The changes made the food-to-go section stand out in a way it hasn’t previously and the two-pack sold really well. I’ll definitely be keeping the changes in place moving forward.”

J Robarts & Son, Codicote, Hertfordshire

FOOD to go is evolving, with shoppers seeking out more convenient, healthier snacking options. Nick’s biggest challenge is knowing what to stock to meet these trends. As cheese is an important source of protein and calcium, it meets these missions. What advice can Bel UK give?

Group products together: Lunch and snacking options were grouped, as well as similar cheese lines, to make the fixture easier to shop.

Maximise visibility: PoS materials, such as shelf-edge barkers, were introduced to boost sales and improve visibility.

Stock the right formats: The new Mini Babybel Original two-pack was introduced to meet snacking missions, complementing the six net.

“GROUPING the category products together has made both fixtures much easier to shop. The sales increase on the Mini Babybel Original two-pack is great and a third of my sandwich lines have increased also. I’m delighted that the six net in the dairy fixture has increased by 192%, too. I’ll be keeping the changes.”

1 Making fi xtures easy to shop is key to driving sales. Grouping snacking products, as part of a meal deal, can help.

2 Boost visibility with PoS when available to help top-selling lines, such as Babybel, stand out, drawing shoppers in.

3 Consumers are looking for cheese and savoury protein snacks for a quick fi x, so stock convenient grab-and-go options.

1 Ensure your food-to-go chiller is easy to locate and products are grouped to improve ease of shop.

2

3

Impulse buys are key, so should be displayed at eyelevel, in a prominent position to boost visibility.

Stock on-the-go SKUs towards the front of your store, and larger packs within their category.

EXPERT ADVICE

DONOVAN JAMES-MICHEL

National Account Manager, BEL UK

“IT’S fantastic that both retailers have seen such strong sales increases, and that Nick has seen an increase across his cheese category worth over £2,150 per year. Forty-eight per cent of consumers seek brands when looking for quality, so adding the new Mini Babybel Original two-pack, which was introduced to both stores, can help retailers to meet different snacking missions, drive interest in the category and boost sales.”

and Nick’s stores

WE’RE focusing on profitability within our business more than anything else.

WE need a company out there that doesn’t charge anything.

A lot of shops in Coventry have started taking cash only because card companies and banks charge money. Many retailers can’t recover the costs.

I’m doing cash only, too – I just started doing this as we lose pro�it with the merchants. We have no other choice. Before when I was accepting cards with a Payzone machine, I spent 99p every week. Then the charge

shot up to £2.99 a week so I �inished it – I was with them for 40 years.

I asked Payzone to help me as many regular customers were disappointed that they had lost access to the service.

However, Payzone just don’t care. If this was a supermarket asking for help, they would roll out the red carpet.

Payzone thanked me for my service, but said it’s up to me to continue the business or not. People would come

in the store just for top-ups and not to buy anything, so we were just being a service provider, which I don’t mind, but it was coming out of my own pocket.

Arif Ahmed, Ahmed Newsagents, Coventry

A spokesperson from Payzone said: “Over the past few years, Payzone has signi�icantly strengthened and expanded its offering, by welcoming partnerships in the energy market with British

Gas, Utilita and E.on Next, alongside more Transport, Housing and Local Authority payments. Payzone now gives retailers’ customers access to more services than ever before and the fees have changed to re�lect the growing variety of services available through the Payzone device. We appreciate that this is a tough trading climate for convenience store retailers and we’re sorry that one of our retailers is upset with the change and has had to stop offering our bill payment service.”

Each issue, one of seven top retailers shares advice to make your store magnificent

It’s an easier figure to focus on compared with turnover. There’s a saying that ‘turnover is vanity and profitability is sanity’, and your turnover figures are meaningless without the context of profit. Your profitability is largely coming from your purchasing, however, these can be driven up through efficiencies at work – making your staff work in better ways and implementing tactics that retailers might not think about. Wages have been on the lower scale for some time, but they’re rising now and we need to think about it properly. When it comes to energy, retailers are doing things they should have done years ago. Between energy and wages, which are our biggest costs, we have to ask how we can make our staffing unit more efficient. How can we stop them going from A to F to R to D, when they should be going from A to B to C to D. Inefficiencies in how they move around the store can add five or 10 seconds to every journey. It might not sound like a lot, but eight staff members losing 10 seconds on a journey they make 10 times a day, that adds up to almost a quarter of an hour each day. That’s 81 hours a year, which is over 80 hours’ worth of time lost because staff were walking the wrong way. Wages are eating up more and more profitability, so we can either increase our prices, get better prices from wholesalers or look at how we make our staffing more efficient and our lives easier.

At the moment, electronic shelf edges aren’t worth the investment for me. But pretty soon, the price will be low enough to make it worth spending money on them compared to the cost of paying extra staff wages to change the prices in store.

I visited the Red Bull racing team’s factory before Covid-19, and the team were ecstatic because they’d found a way to make the paint thinner, and therefore lighter which increased their car speed by 0.00003 seconds. That drop in weight along with all the other incremental gains was how they were going to build up to having an incredible, championship-winning car. If you can do something slightly better and more efficiently, then everything else ties into it and you can get a really good profitability number. It won’t work right away, you’ll need to work at the system and staff will have to be trained, but it will be worth it.

BREWDOG has partnered with Retail Express to offer five retailers the chance to win £50-worth of Lost Lager. Lager has not traditionally sat within craft beer – however, Lost Lager has changed that. With refreshment key during the summer months, lager has been identified as a significant means of recruiting new shoppers and driving incremental sales, with 31% of new Lost Lager shoppers entering the craft category post-buying Lost.

Fill in your details at: betterretailing.com/competitions

This competition closes on 11 July

Editor’s decision is final.

AMERICAN RTD brand BuzzBallz Cocktails has partnered with Retail Express to offer one retailer the chance to win £200-worth of stock. BuzzBallz Cocktails are available in six single-serve varieties (13.5% ABV): Choc Tease, Tequila ‘Rita, Strawberry ‘Rita, Lotta Colada, Chili Mango and Espresso Martini. The brand has launched a summer marketing campaign, including branded vehicles and a team of ambassadors to promote it in convenience.

Fill in your details at: betterretailing.com/competitions

This competition closes on 11 July

Editor’s decision is final.

RUSTLERS has expanded its range with a Marinara Meatball Sub Sandwich and partnered with two independent retailers to trial it and drive sales in the chiller. RETAIL EXPRESS finds out what you can learn from their success

KEPAK has launched Rustlers Marinara Meatball Sub Sandwich, with an RRP of £2.30, available in cases of four.

As consumers face rising prices from cafés and sandwich bars, the launch of the Marinara Meatball Sub Sandwich enables retailers to offer a much-loved quick-service restaurant favourite at a great price.

While the most popular foods for lunch remain sandwiches, soups and toasties, flavour-packed products, such as Italian options, are seeing the fastest growth, at 13%1.

Rustlers is growing by 39% in convenience – buoyed by the ‘fakeaway’ trend of enjoying restaurantstyle dishes at home. The brand is now worth more than £1.7m2.

TO test the new product, Kepak teamed up with two retailers –Imtiyaz Mamode, of Premier Wych Lane in Gosport, Hampshire, and Natalie Lightfoot, of Londis Solo Convenience, Glasgow. They committed to following Rustlers’ merchandising recommendations for three weeks and stocking the Marinara Meatball Sub Sandwich.

Mamode already offered a wide range of Rustlers products, but still saw brand sales increase by 12%.

Ensure Rustlers products are stocked together and highlighted with PoS, such as shelf strips. Mamode dualsited Rustlers in his lunch-to-go fixture and take-home chilled range.

When launching a new product, it can be hard to get customers to switch from old favourites. Lightfoot’s twofor-£3.50 deal got shoppers to try the Marinara Meatball Sub Sandwich.

Imtiyaz Mamode, Premier Wych Lane, Gosport, Hampshire

“SALES of Marinara Meatball Sub Sandwich started slowly, but as more shoppers tried it and told others, we saw sales pick up. We only have one outer left from the stock Rustlers sent us for the trial, so that’s a really good result.”

The launch is aimed at younger consumers, so TikTok is a good place to promote it. Mamode encouraged a customer to try it in store and give a review to drive engagement.

Lightfoot doubled the number of Rustlers facings and increased sales by 150%, with the new Marinara Meatball Sub Sandwich becoming her bestselling Rustlers product within the trial period.

“We’re happy with the results,” she says. “We found the range sold particularly well through our Snappy Shopper delivery service.”

“Sales have gone up across the range,” adds Mamode. “All the stock sold before the sell-by date, and we think sales will continue to grow.”

1Kantar, Worldpanel Division, Usage Panel, Total in home/carried out occasions, 52 w/e 07.08.2022, 2Nielsen Total Market, 52 w/e 18.02.2023

“I’M happy with the results of the trial. The PoS looks great and our chiller is much more attractive now. I was really impressed by the service from Rustlers throughout the trial. I’ll keep the range in place as we go into summer.”

The RETAILEXPRESS team partners with seven suppliers to offer insights, including ranging and merchandising advice, on key core categories

est products. Many are turning to social media such as TikTok to find the next viral product. But while it’s important to have regular new products enter your store to bring customers in, it’s just as vital to have a strong core range.

sential for retailers to succeed. But the challenge is knowing what’s currently trending and why certain categories should be stocked.

That is why the next 10 pages will be full of the latest trends, ranging and merchandising from leading suppliers.

seasoning and packet mixes will be provided by Schwartz, while Swizzels will offer insight on sugar confectionery.

BrewDog will provide a better understanding on craft beer and Puerto de Indias will provide retailers with information about its gin brand entering the UK market for the first time.

Achieving this will not only drive repeat custom but create customer loyalty.

but create customer loyalty.

Some categories are must-have daily essentials, like fresh and chilled and wrapped bakery, and are es-

BAT UK will focus on vapes and alternative nicotine products and how retailers can maximise sales within the category, while JTI UK offers advice, including on staff training, in the cigars and cigarillos category.

Advice about herbs, spices

Finally, for advice on crisps, snacks, nuts and popcorn, retailers should look to KP Snacks, while insight on sports and energy, and colas and carbonates, comes from Red Bull and Coca-Cola Europacific Partners.

THE contribution to overall volume growth in the vape category by disposable vape products remains a major trend and a major opportunity for retailers. Year-on-year growth in modern disposables seen in 2022 peaked at more than 3,500% by last summer1. The trend is expected to continue through 2023, alongside the development of the market for closed-system products. Vuse Go and ePod Vivid both appeal to an increasing number of adult nicotine consumers who want products that are innovative and rechargeable in a broad range of flavours and nicotine strengths.

THE Vuse Go and ePod Vivid ranges remain focused on innovation to cater for the ongoing shift in preferences among adult nicotine consumers. BAT UK is committed to driving the expansion of both product ranges to meet ongoing demand for bold, new flavour sensations in the disposable vape category. Vuse is the leading global brand2 and offers a trusted quality product among a growing multi-brand category. Vuse ePod Vivid also caters for those adult consumers who are attracted to more costeffective refills in a rechargeable device, as opposed to a disposable one. The Vivid flavour range is also available on Vuse Go, meaning adult nicotine consumers can retain these flavours if they switch devices.

KEEP your range stocked up and well supported with merchandise. Display reputable, popular brands and price competitively and clearly. In-store displays are the key to informing adult nicotine consumers about Vuse Go/Vivid, particularly those at point of purchase. Adult nicotine consumers can be confused by the number of products now on offer. Structured displays give retailers a clear advantage in terms of being able to organise existing products and highlight new ones.

1Nielsen, MAT w/e 04.6.2022, 2Based on Vype/Vuse estimated value share from RRP in measured retail for vapour (i.e. total vapour category value in retail sales) in key vapour markets: USA, Canada, France, UK, Germany as of May 2022. *Nielsen Total Coverage w/e 03.03.2023

• Schwartz Garlic Granules

• Schwartz Black Peppercorn Mill

• Schwartz Mixed Herbs

THE herbs, spices and seasonings category is in long-term growth, driven by an increase in scratch cooking. This has accelerated this year, given food inflation and the costof-living crisis. Within herbs, spices and seasonings, the fastest-growing sector is seasonings, which is in growth of 5.7%1. This is especially important during the summer months. In fact, more than 30%1 of sector sales come in the summer period. Branded seasonings are performing especially well as shoppers don’t want to compromise on the quality of flavour in their dishes.

SCHWARTZ is the largest dry ingredients brand, with over 43%2 of shoppers buying the brand in the past year. It is also the brand delivering the most growth to independent convenience retailers, having added £2.4m in herbs and spices sales1 with a faster growth coming from the impulse part of the market. The most important products to have in stock are Schwartz Garlic Granules and Schwartz Mixed Herbs, which have gained even more importance in the past year – growing by 16.8% and 7.3%, respectively1

CONVENIENCE retailers need to focus on availability for core staples, such as pepper, garlic and salt, which have been among the fastest-growing segments during Covid-19, which is still true today1.

Displaying herbs and spices in alphabetical order also helps shoppers navigate the fixture more efficiently. This will help increase basket spend and sales. Shoppers are also more likely to return knowing they can stock the full range from their local convenience store, especially if it’s needed last minute.

Also, utilising PoS on the herbs, spices and seasonings fixture in store will help the display stand out, helping sales. Social media can also play a role in helping to market your herbs, spices and seasonings range. If you are running a promotion on the range you offer, such as an evening meal solution, run this on different social media platforms and monitor sales using your EPoS data.

• Schwartz Cheddar Cheese

• Schwartz Creamy Pepper

• Schwartz Chili Con Carne

RECIPE mixes are a quick and easy way to make dishes. This might be why the growth is particularly prevalent in the most recent 12 weeks, showing at 9.2%1. Some of the largest growing flavours include British staples, like beef casserole (20.9%) and sausage casserole, as well as more exotic cuisine dishes, such as Mexican tacos (24.2%)1.

WITHIN Schwartz recipe mixes, there is a selection of more than 100 flavours for independent retailers to stock in their stores, but the bestselling lines are Schwartz Chilli Con Carne, Creamy Pepper Sauce and Cheese Sauce. These have grown incredibly fast in impulse stores this year, having grown by 49%, 9% and 38%, respectively1

The entire range moved into a new recyclable pack format in 2021, reducing the amount of waste going into landfill, coupled with a new pack design giving each range stand out on shelf.

The brand continues to drive growth with new products, tapping into new changing consumer eating occasions, delivering improved convenience and great taste – the two key needs of consumers in this category. Our innovation pipeline ensures customers keep returning to the fixture for inspirational meal ideas.

NINETY-ONE per cent of Schwartz recipe mix sales come from its top 102 lines, so having the key popular core lines at eye level is key for the planned purchase. Retailers should group by segment, protein types and usage, like recipe mixes, pour-overs and bags, then by brand. This is so shoppers can find choice and alternatives. Offer meal solutions using PoS or display cross-category features with other key ingredients to boost sales and spend. Retailers should also list new products and more sophisticated flavours to drive repertoire, trade up, but also appealing to younger families.

Check the success of these changes by using your EPoS data and talking with your customers about the products they want to see in store.

CRISPS, snacks and nuts (CSN) is a fast-growing, priority category with huge scale, and independent retailers have a key role to play in both promoting the category and ranging effectively to meet shifting consumer needs and ultimately grow their own sales. It’s a category growing in value and volume with high penetration. Even in difficult economic conditions, consumers are after affordable treats, so there’s a huge opportunity for retailers to double down on CSN as an incredibly important, scalable and thriving category.

For retailers, simplicity in ranging is key, and the new KP Snacks advice highlights the spectrum of CSN products, as well as shopper missions and occasions.

The ranging advice, ‘25 to Thrive’, is an impartial category-wide range recommendation of 25 bagged snacks with a breadth of range, including nuts and popcorn. It includes sharing and price-marked pack (PMP) formats, meeting consumption needs at lunchtime, in the afternoon and evening.

KP SNACKS’ category range uniquely covers all CSN and popcorn segments (CSNP). Its brands are highly relevant in today’s environment, delivering formats for all occasions across the entire value spectrum. KP Snacks is seeing growth in simple and economical lunchtime meals and ‘pick me up’ occasions where KP Nuts, McCoy’s and Hula Hoops perform well. Consumers are also turning to familiar brands they trust and recall, which is where heritage brands play an important role. PMPs are also a hugely important part of effective ranging. The KP Snacks portfolio offers a variety of leading PMP lines to suit all budgets and occasions.

THE ‘25 to Thrive’ advice gives guidance to retailers on the optimum core range for them to stock, with a simple, single-minded focus that delivers category, CSNP and KP Snacks growth. By stocking the recommended 25 products with strong availability, display and impact, retailers can ensure they benefit from this incredibly important category. Retailers should review their range in order to revive their sales, drive impulse purchases and thrive in today’s environment.

EVERY shopper need is different, so it is crucial that their favourite soft drink is available in a range of formats. Two in three Red Bull shoppers go into a store knowing which can size they want to buy1, therefore Red Bull Energy Drink is available in three can sizes – 250ml, 355ml and 473ml. Red Bull Energy Drink 250ml is ideal when on the go, with 50% of 250ml shoppers drinking a can straight after purchase. One in three Red Bull shoppers may drink larger cans later in the day, with Red Bull Energy Drink 355ml linked to gaming, studying and socialising, and Red Bull Energy Drink 473ml the choice for meal occasions2

SPORTS and energy is integral for convenience. As the category leader, Red Bull Energy Drink 250ml sells more than other single-serve soft drinks3 and drives the highest demand in the Red Bull portfolio4, so is a must-stock. However, flavours are becoming more popular and have been key to helping drive the growth of sports and energy in recent years. This is led by innovation, as shoppers look for variety and hydration. Red Bull is instrumental to the strong performance, outperforming total flavoured sports and energy by four times at 92%5

START by getting the right amount of space per category. Sports and energy is 35% of soft drinks sales5 – have you given it over a third of the chiller? Don’t scrimp on facings for your bestsellers. Red Bull Energy Drink sells more than any other single-serve soft drink – it will be near impossible to keep this, and your other bestsellers, perfectly chilled and available if they don’t have multiple facings. Put your bestsellers at eye level – Red Bull signposts energy and Coca-Cola indicates colas.

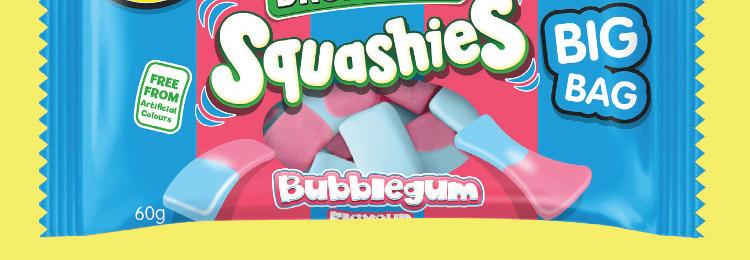

In partnership with

SUGAR confectionery has continued to grow by 10.3% over the past year1, and with this has come the desire from consumers to venture into trying diverse creations, such as the Swizzels vegan range. Available as an all-year-round offering, the vegan range – which features Scrumptious Sweets, Luscious Lollies and Choos – has continued to grow in popularity year on year.

Consumers are also often very willing to try new flavours and this is something Swizzels have always been keen to cater to with all their products. This also includes the introduction of a full family of Minions products, including Squashies, Chew Bars and the new Minions dip, which launched in May.

SUGAR confectionery has been growing in value consistently ahead of chocolate, so it’s the perfect time for retailers to ensure they’re stocking confectionery lines that consumers are actively seeking out in the market. Having a strong selection of Swizzels products, such as the bestselling hanging bag lines like Squashies, combined with fast-selling countlines such as Love Hearts, also helps to highlight that a retailer is a destination location for sugar confectionery impulse purchases, which helps to gain the level of repeat custom retailers are striving for.

IN symbols and independents, Swizzels grows faster than the total market, growing by 28.1% and 12.2%, respectively2. One of the many reasons this has been achieved is that retailers have been committed to stocking key Swizzels brands and by having a strong merchandising execution within their stores. Taking advantage of pricemarked packs, which are available, is also a great way of ensuring that customers are aware of the fantastic value for money they’re receiving, which is essential during turbulent economic times.

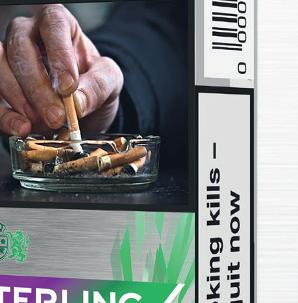

THE total value of the UK cigar market is approximately £284m1 and cigarillos is the leading segment, with a current market share of 46.4%2. The cigarillo category has continued to grow in the convenience channel3 and has experienced a strong 12 months. Now worth approximately £8m a month4, the category offers a significant opportunity to maximise sales, especially during the summer season and in the run-up to December5

JTI UK is the number-one cigar manufacturer in the UK2, with tried-and-trusted brands including Hamlet, King Six and Condor, as well as the UK’s leading cigarillo brand, Sterling Dual Capsule Leaf Wrapped.

Sterling Dual Capsule Leaf Wrapped has a 92.4% share of the market2. It is also the fastest-growing cigar and cigarillo brand in the UK6, and is therefore a must-stock for retailers.

JTI UK has built on this success with Sterling Dual Double Capsule Leaf Wrapped to encourage further sales, offering double the flavour with a combination of peppermint and berry mint capsules.

Berry is already a popular flavour within other categories, such as vape and heated tobacco, and the product’s lower price can cater to the growing number of shoppers looking for value-for-money tobacco options7.

CIGARILLOS offers a ‘cigarette-like’ proposition and retailers should be aware that demographics are different to those of traditional cigar smokers. Available in 10-packs with on-pack branding, and in a range of flavours, cigarillos are unique within the tobacco category and can drive sales for retailers. They should therefore be a key part of a store’s tobacco offering. Retailers should ensure they are fully stocked and have a mix of cigars and cigarillo varieties to offer throughout the year.

THE UK market is a key focus for Puerto de Indias in its international strategy. As the biggest gin market worldwide, Puerto de Indias believes there’s a high potential for a Spanish gin that is made with natural strawberries, which is its main difference among its key competitors. Puerto de Indias knows how relevant its natural ingredients are for its consumers. Furthermore, its studies show us that among Britons visiting Spain, over 37% come back home and would recommend the brand to their friends and family1. The brand is the number-one spirit in duty-free in Spain. Now, the supplier wants UK consumers to find its gin in the UK market.

PUERTO de Indias is the market leader in Spain’s strawberry gin segment, and a pioneer in creating the first gin from natural strawberries. Puerto de Indias is the creator of the pink gin category, and its strawberry gin is made with natural ingredients. According to the supplier, its product has led to other brands launching their own varieties. Following the success of its Strawberry variety, Puerto de Indias launched a Blackberry flavour –combining blackberries, cinnamon, violet and bilberries.

PUERTO de Indias Strawberry and Blackberry gin both have an RRP of £27 and have been reaching distribution agreements all over the UK. The manufacturer’s growth distribution strategy, both in the on- and off-trade, has already reached some national chains. Trade customers can buy Puerto de Indias gins from the likes of Matthew Clark, Bibendum, LWC Drinks, Enotria or HB Clark. Online retailers will also have access to the gin, such as Amazon, Master of Malt and Ocado.

To find out more about Puerto de Indias’ range, visit ginpuertodeindias.com/en or to sample, please contact sales@indiebrands.co.uk

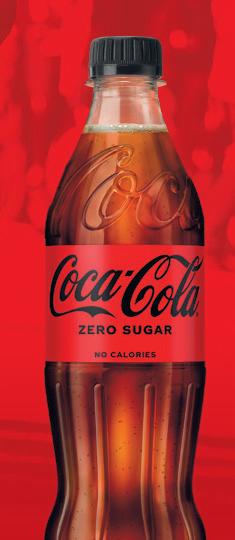

COLAS and flavoured carbonates are enjoying continued growth1. Varieties such as Coca-Cola Zero Sugar, Fanta Zero, Dr Pepper Zero and Sprite Zero are increasingly important as consumers continue to pursue balanced lifestyles. Twothirds of CCEP’s soft drinks volume sales come from zerosugar options2. However, CCEP continues to offer choice and encourages retailers to do the same. Environmental impact is also of growing interest to shoppers3. CCEP’s entire range of plastic bottles is recyclable, and all 500ml and smaller bottles sold in GB are made from 100% recycled plastic4.

CCEP’S portfolio of sparkling brands accounts for 65% value share of the colas segment and 46.4% value share of the flavoured carbonates segment5. In both cases, that’s more than its two closest competitors combined6. Within this, Coca-Cola is the number-one soft drinks brand in GB, led by Coca-Coca Zero Sugar, the fastest-growing major cola brand in retail7. Fanta and Dr Pepper are the numberone and number-two flavoured carbonates brands, with Sprite not far behind and growing, too8

STOCK up on leading brands, with the zero-sugar variants located next to the original ones. PMPs can create a point of difference versus larger stores, and can improve shopper perceptions of value9.

Use sales data to identify where you can make space for new innovations, and be sure to activate brand campaigns in store. And, with on-the-go and sharing packs of colas and carbonates both in growth10, don’t forget to cater for all occasions.

1Nielsen Total GB incl dis MAT Val w/e 25.03.2023, 2This is Forward 2021 Year End Report, 3Bespoke CCEP PDH Research, Kantar August 2021, 4Excluding labels and caps,5Nielsen Total GB incl dis MAT Val share w/e 25.03.2023, 6Nielsen Total GB incl dis MAT Val share w/e 25.03.2023, 7Nielsen Total GB incl dis MAT Val w/e 25.03.2023, 8Nielsen Total GB incl dis MAT Val and Vol w/e 31.12.2022, 9The recommended prices on CCEP PMPs are intended only as a guide for retailers, and they are free to set prices as they wish. Plain packs are also available, 10 Nielsen Total GB incl dis MAT Val and Vol w/e 25.03.2023

• BrewDog Punk IPA 330ml

four-pack

• BrewDog Hazy Jane 300ml

four-pack

• BrewDog Lost Lager 440ml

four-pack

WITH 70% of craft beer shoppers already shopping the category in convenience stores1 and 51% repeating their craft beer category purchase2, it offers a huge opportunity for retailers. Despite that, 8.4% of craft beer sales go through the channel versus 28.1% of total beer sales, meaning the category massively under-indexes, delivering significant headroom for growth3. For retailers looking at craft beer for the first time, a great place to start is Lost Lager. Lager has been identified as a significant style to introduce consumers to the category and research shows that 31% of new Lost Lager shoppers re-enter the category after buying the brand4

AS the category leader with a 57.9% share, BrewDog sells 4.1 cans every second5. BrewDog also holds six of the top 10 craft beer brands, with 45.6% of all sales coming from the top three: Punk IPA, Hazy Jane and Lost Lager6. BrewDog shoppers also spend 28.8% more on their total basket than average beer shoppers7. Listing top-performing craft beer lines, such as BrewDog Mixed, Lost Lager, Hazy Jane and Punk IPA multipacks, will help to upweight overall basket spend.

DRIVE penetration into craft beer via mixed pack options, which provides retailers an opportunity to upsell to larger, more valuable packs. What’s more, 76% of men want chilled beer from the fridge in convenience stores8. If chiller space is available, BrewDog should be sited there. PoS is also a great way to direct customers to the craft beer section and highlight taste credentials.

1BrewDog Bespoke Shopper Research August 2022, 2Kantar Worldpanel August 2022, 3Nielsen Scantrack 12wk w/e 25.02.2023 | Total Coverage, 4BrewDog Bespoke Shopper Research – interaction & Entry to Craft Beer –February 2023, 5Nielsen KAD Data 26 w/e 28.01.2023, 6Nielsen Scantrack 26 wk w/e 25.02.2023 | Total Impulse , 7Convenience retailer x shopper loyalty data 52 w/e 25.03.23, 8BrewDog Bespoke Shopper Research –Dunnhumby Shopper Thoughts Panel – July 2022

CATEGORY ADVICE PRICE-MARKED PACKS

With margins getting tighter, CHARLES WHITTING finds out where retailers can extract the most profit from price-marked packs

THE CHALLENGE OF PRICE-MARKED PACKS

PRICE-MARKED packs (PMPs) remain very popular with customers and many retailers. However, the lack of flexibility on price at a time when costs and inflation are changing so rapidly can put a massive strain on retailers’ margins if they rely too heavily on the category.

“Cash and carries are charging us more for PMPs, but we can’t charge customers

more so our profit is less,” says Ghanshyam Patel, from Frank Joiners Supermarket SuperShop in Sandwell Valley, West Midlands. “There’s no way around it and unless the wholesalers and suppliers help us, we can’t compete.”

Despite this concern, Patel continues to stock PMPs because they are what his customers want. During a cost-of-living crisis, being

able to offer customers prices that they know are the same elsewhere can be a good way to grow customer footfall, but also basket spend once they’re in the store.

“This year, more than ever, many shoppers will be looking for value from the category, and PMPs are a great way for retailers to provide this reassurance,” says Susan Nash, trade communications manag-

er at Mondelez International.

“Research shows that PMPs offer a number of advantages for convenience retailers. A fifth of shoppers say they would choose a particular convenience store if they knew it stocked PMP products, and 56% of retailers say they have been selling more PMP products during recent times, which emphasises the importance of value within the category.”

GIVEN their popularity, it can be tempting to use PMPs across a store’s entire offer – indeed there are retailers who have price-marked around 80% of their stock.

The role of PMPs in your store will depend on a range of factors. First of all, local affluency has to be taken into consideration. Jeyaseelan Thambirajah runs 18 stores in a variety of locations within East Anglia and the East Midlands, and he modifies the amount of PMPs he’s stocking accordingly.

“In Godford Road, it’s a working-class area and they’re really looking for PMPs, so that will have a lot more in it,” he says. “In our Budgens Hemingford Grey, the customer demographic is more affluent and they don’t want PMPs.

“We’ve still got some, but it’s about knowing where to put it and where not to put it. For us, customer service, staff training and merchandising is more important than how many PMPs you’ve got on the shelves.”

AT a time when people are looking for deals, retailers should look at PMPs in two key categories: value essentials and impulse options.

Impulsive PMPs should be dotted about to encourage people to pick them up as they move through the store.

Their highly visible price tags can shine out to customers and encourage additional sales. Impulsive categories for PMPs include confectionery, soft drinks and snacks, and visibility is key.

“Shoppers respond well to cross merchandised fixtures and clearly signposted sections in store that target specific occasions,” says Paul Robinson, controller of conven-

ience and wholesale at Perfetti Van Melle. “Add signage and PoS for a standout fixture that builds visibility in store. Talk to your rep about compelling deals to advertise at the till.”

The other important category is in essentials, particularly where value is considered one of the most important considerations for purchase.

Categories like cereals, household goods and multipacks factor in key shopper missions and, with PMPs alongside non-price-marked options, retailers can give customers a choice.

“We’ll continue to see cost pressures throughout the industry in the next few months, meaning shoppers will be fo-

cussing on value for money more than ever.

“This is where cereal has a huge advantage compared to other breakfast options, it is by far the cheapest solution, offering affordability, convenience, and great taste in a bowl from big brands that consumers love,” says Darryl Burgess, head of sales at Weetabix.

With more people socialising at home, catering to the big night in opportunity with PMPs can help to generate bigger baskets when people are looking to stock up without breaking the bank.

“Not only are beer and cider shoppers more prone to impulse buying compared with the typical shopper, but they

are also inclined to purchase items that cater to home-based events like the big night in,” says Sunny Mirpuri, director for wholesale and convenience at Budweiser Brewing Group.

“To capitalise on this consumer behaviour, retailers can create eye-catching displays featuring beer PMPs as centrepieces, particularly in crosscategory promotions with snacks such as crisps.

“Additionally, 57.5% of beer consumption takes place with food. Mealtimes with beer present an £140m sales opportunity to the off-trade, therefore placing PMP beer offerings next to food pairings will help independents boost basket spend.”

Matt Collins, trading director, KP Snacks

Matt Collins, trading director, KP Snacks

“PMPs have seen significant growth in the last number of years, with the format expected to continue increasing in both relevance and popularity. Not only do PMPs offer consumers great value for money, the clear pricing also gives them assurance that they are not being over charged. PMPs are a hugely versatile format that caters for multiple missions and occasions, whether that be hunger fill or sharing. Seventy percent of bagged snacks shoppers purchase items on impulse and PMPs drive these sales through clear messaging and displays.

“The PMP format is now the largest format within CSN across symbols and independents. Additionally, the role of category leaders and large brands will become even more important as shoppers turn to brands that they trust, recognise and recall. Brands help retailers drive sales and retain shopper loyalty – 42% of CSN sales go through the top five brands.”

TO SEE the best results from the use of PMPs, retailers need to find them at the lowest possible price and stock up when they’ve done so.

By talking to suppliers, wholesalers and symbol groups, it’s possible to identify when promotions might be coming up or to negotiate possible discounts on certain lines that will allow you to continue stocking these footfall drivers without hurting your margins.

“Walkers has helped us out on the crisps side of things,”

says Patel. “If you buy a certain quantity of stock from them, they give you a discount, which helps a lot.

“The more you buy, the bigger the discount, which can work out cheaper than the cash and carry.

“If you can talk to a rep then they might give you some more money off as well, but if I could go direct to the suppliers then that would be better. If we received more discounts we’d buy a lot more from them.”

Britvic has announced it

will be maintaining its profit on return percentage (PoR) across its range, including PMPs, meaning that when prices go up, the margin does as well.

“We will look to increase the PMP in line with inflationary pressures as well as the PoR%, to create more shared margin and an even stronger translation to cash margin,” says Ben Parker, retail commercial director at Britvic. “This is as a result of recognising the importance of listening to retailers.”

SUPPLIER

SUPPLIER

“THE most common argument against PMPs is that they limit a retailer’s ability to charge a higher price for the product. However, while there are certain, specific circumstances where charging a higher price could be an appropriate tactic, charging the correct price to build shopper loyalty and price confidence is more important in most cases.

“Shoppers are making fewer trips and are looking to pick up as much as possible in one place, and shoppers are also planning their trips in advance. While charging a higher price may drive a short-term margin gain with shoppers on distress missions, it will have a negative impact on shopper loyalty. With shoppers looking to save money, they will plan to shop in a store where they have confidence in the product prices, and will avoid stores looking to capitalise on distress missions by charging higher prices.

“Distress top-up missions account for just one in 10 of total convenience shopping trips, whereas planned topup missions make up one third and have a higher basket spend, so these are the missions that most retailers should be prioritising. PMPs over-index with shoppers purchasing on impulse, so introducing new products in PMP formats could help drive sales at launch.”

The latest launches

Chocomel has announced an inaugural PMP value offer for its 250ml Chocomel cans, with further plans to continue this offer across its share pack this summer.

Earlier last year Yazoo introduced a new PMP offer for the convenience channel, with 400ml bottles in all core flavours – Chocolate, Strawberry, Banana and Vanilla – available for two for £2.20, as well as one-litre bottles for £1.99.

Last year, KP Snacks launched McCoy’s Sizzling King Prawn in a large PMP format. The new McCoy’s PMP capitalises on prawn being the fastest growing flavour within the category, growing at 10% vs the category at 2.7%.

CHARLES SMITH identifies the different opportunities offered by cereals and cereal bars, and the ways retailers can grow sales in both

DOMINATED by familiar brands that have been around for generations, cereals present a quick, convenient breakfast option, taking just moments to down a bowlful. A

Bestway spokesperson quotes GlobalData saying total cereal purchases topped £2.6 billion

in 2021, with hot cereals the fastest growing segment. From their origins as extensions of the cereal brands, cereal bar sales are now worth around £1 billion and growing in importance in convenience as impulse snacks. Often placed at the front of the store,

sales benefit from recent HFSS restrictions and trends to healthier snacking.

The same suppliers make both cereals and cereal bars, but retailers don’t see them as one category. Avtar Sidhu, at St John’s Budgens in Kenilworth, Warwickshire,

THE big cereal brands have the lion’s share of sales.

Statista’s UK 2021 report shows Weetabix Original as the most popular breakfast cereal, ahead of Kellogg’s Corn Flakes and Quaker Oats

So Simple. Cereal brands have been reducing their sugar content in recent years, starting before the

government announced their plans for HFSS regulations, but reduced sugar alone isn’t enough for today’s healthconscious cereal shoppers, says Bestway’s spokesperson. Customers are looking for new flavours, low in fat, sugar and salt, and authentic flavours that are high in fibre. The Health and Care Act