Retailers

Retailers

Alex Yau, editor

AS cost pressures increase, many retailers I speak to are scrutinising every area of their shop to ensure they’re getting the most money they can out of it.

During the last day of a recent holiday to Paris, I used a service called Bounce to store my luggage in a partnered independent convenience store. The retailer used their stock room to hold not only my luggage, but also that of several other tourists.

For four bags, the price for the baggage drop-o was the equivalent of £25, but I was happy to pay the premium for the convenience of not having to lug suitcases around the French capital’s cobbled streets for several hours. This saved not just time and energy, but also sore calves.

It was also an easy service to use, with bookings done through an app in seconds. Upon arriving to the store, the retailer scanned a QR code and took a picture of the luggage in storage for security and peace of mind. Retrieving the luggage was a similarly straightforward experience.

The booking system also suggested demand for the service was high, with some allotted time slots in the day having been fully booked out.

When I went to collect my luggage, I was also happy to purchase a snack and bottle of water from the retailer, helping them generate additional income.

TO BE ON THE SHOP FLOOR

I appreciate not every store will be based in a location where they have the audience for such a service. However, it shows pro table services don’t necessarily have to be on the shop floor.

@retailexpress betterretailing.com facebook.com/betterretailing

Editor Alex Yau

alex.yau@ newtrade.co.uk

020 7689 3358

News editor Ciarán Donnelly ciaran.donnelly@ newtrade.co.uk 07743 936703

kwame.boakye@ newtrade.co.uk

Production editor

Ryan Cooper 020 7689 3354

Sub editors

Jim Findlay 020 7689 3373

Robin Jarossi

Head of design

Anne-Claire Pickard 020 7689 3391

Senior designer Jody Cooke 020 7689 3380

Designer Lauren Jackson

Production coordinator

Chris Gardner

020 7689 3368

Editor – news Jack Courtez jack.courtez@ newtrade.co.uk 020 7689 3371

Features editor Charles Whitting charles.whitting@ newtrade.co.uk 020 7689 3350

Features and advertorial writer Shyama Laxman shyama.laxman@ newtrade.co.uk

Head of marketing

Kate Daw 020 7689 3363

Head of commercial

Natalie Reeve 07856 475 788

Associate director

Charlotte Jesson 07807 287 607

Commercial project manager I y Afzal 07538 299 205

Account director

Lindsay Hudson 07749 416 544

Specialist reporter Dia Stronach dia.stronach@ newtrade.co.uk 020 7689 3375

Editor in chief Louise Banham louise.banham@ newtrade.co.uk

Features writer Jasper Hart jasper.hart@ newtrade.co.uk 020 7689 3384

Account managers Megan Byrne 07530 834 009

Lisa Martin 07951 461 146

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital Luthfa Begum 07909 254 949

JACK COURTEZ

THE government has pledged to take steps to crack down on business rates fraud following investigations by Retail Express and others into a serial scammer who cannot be identi�ied due to legal reasons.

Since 2017, Retail Express has repeatedly exposed the fraudster and their associates, who deceived hundreds of shop and other business owners into paying for rates savings the fraudsters failed to achieve.

In some circumstances, businesses were threatened with county court action unless they paid tens of thousands of pounds.

The fraudster said the claims against them were “false information”.

The investigations by Retail Express were discovered by the fraudster’s latest round of victims, and helped bring the convicted criminal responsible for the scams to the attention of the BBC’s Rip Off Britain and The Manchester

SENIOR retailers and drinks brands will be behind the body responsible for running the UK’s deposit return scheme (DRS) scheduled to launch in October 2027. The body is expected to be the lead bid to launch and

Mill last year.

Following the coverage, several of the fraudster’s latest scam companies were banned from managing business rates claims by the Valuation Of�ice Agency.

However, new company �ilings suggest those associated with the fraudster have attempted to skirt the ban by setting up further companies.

One of the latest victims is Bar Etna in Manchester. Last month, representatives of the bar and Retail Express contacted local MP Connor Rand to ask for help in stamping out rates scammers for good.

In a letter to Rand, Retail Express urged: “Please help us and others to stop this cycle of misery that is ruining the lives and businesses of honest people.”

Speaking in Parliament on 24 April, the Labour MP challenged the government to do more to protect small businesses, stating: “Bar Etna has suffered to the tune of thousands of pounds from a business rates scam.

“Thankfully, the licences of the fraudsters were sus-

run DRS.

Incorporation documents show senior �igures from Coca-Cola Europaci�ic Partners, Co-op, Heineken, Lidl GB, Radnor Hills and Tesco currently sit as directors of the company

For the full story, go to betterretailing.com and search ‘DRS’

SHOP theft reached an alltime high in 2024, according to the latest Of�ice for National Statistics �igures.

The �igures showed a 20% increase to 516,971 offences, bringing it to its highest level since current police record-

ing practices began in 2003. Commenting on the �igures, ACS chief executive James Lowman said: “The increase in shop theft shown by these �igures re�lects what our members are seeing every day in their stores.”

For the full story, go to betterretailing.com and search ‘crime’

pended, but they have since changed their company name and are back scamming small businesses again. It was the fourth time they have pulled this trick.

“Can we have a debate on the business rates scams crisis in our country, so that we close for good the loopholes

being exploited by these con artists?”

Responding to Rand, leader of the House of Commons Lucy Powell promised: “We are committed to reducing the number of these scams, and we will take steps to do that, but I will ensure [Rand] gets an update from ministers.”

THE number of stores complying with mandatory vape recycling legislation is increasing, according to a government source.

The source told Retail Express that, following an uplift in visits, independent retailers were becoming more aware of their responsibilities in offering a vape recycling scheme. It comes as retailers began receiving letters from the government warning they must comply with regulation.

PAYPOINT has kicked off its new UK-China parcel dropoff and collection service, with a targeted rollout to 7,000 Collect+ stores by the end of the year.

The rollout began last month, with priority being given to areas with high populations of Chinese and international students, where demand is expected to be strongest. The phased expansion will continue throughout 2025 until the full network of locations is established. For

A BELOVED Cambridgeshire newsagent was �looded with thanks from customers past and present, as its doors closed for the �inal time after 125 years in business.

Burrows Newsagent in Ely served customers for the last time on 26 April as third-generation owner Jeff Burrows retired after 60 years in the shop.

The shop’s �inal day saw “people coming in constantly saying ‘thank you’, bringing in presents and cards”, said Annabel Reddick, the shop’s only full-time employee and niece of Burrows. Reddick is the fourth generation of her family to work in the shop, after it was founded by her greatgrandfather in 1899. It then passed to her grandfather, and most recently was run by her uncle.

In that time, the shop has acted as a “hub” for the city through offering a unique “personal service”, Reddick said, explaining that “people come in, they pay for their for papers, they have a chat and they talk about what’s been happening”.

She told Retail Express: “It has always been very much a traditional family business. My mum worked here until a year before she died, six years ago. Another member of staff retired about the same time,

but he’s been coming back helping us. Predominantly, it has been just family that has kept it going.”

The shop also provided crucial delivery services to the city’s residents, which Reddick said made Burrows’ decision to retire a dif�icult one.

She said: “It was a massive decision for him. It was so hard because we’ve been part of the community and part of the high street for so long. And with our deliveries, you feel as though you’re letting people down.”

The family were also saddened by owner Jeff missing its �inal day due to illness, which Reddick called “the hardest thing ever, because he deserved to be here”.

Despite efforts to keep closing day “very low-key”, Reddick said the community could not be stopped from showering the shop with messages of thanks.

“We made a point of closing the door at 4pm and blocking the door, but we kept getting a �low of customers and visitors.”

The fanfare began a week prior to closing day, when more than 80 paper boys and girls throughout its history gathered at the shop to celebrate Burrows’ retirement.

“We did a call out for any old paper boys or paper girls to come along. More than 80 of them turned up to take a picture in front of the shop.

“You lose count of how many people you’ve em-

ployed and how many of these people over the years started their working life with a paper round.

“It was the start of earning a bit of money. It taught them to count and it taught them a bit of responsibility and commitment,” Reddick said.

As well as acting like “a tourist information centre” for the city’s historic centre and hosting famous performers from the nearby cathedral, Reddick attributed the shop’s importance to its community to remaining “a proper old-fashioned newsagents”, sticking to magazines and “a few greetings cards”.

“People loved it for what it was, so why change it?” she said.

“Every town and city is

“WE do get instances where the risk of escalation to abuse is high, but it’s all about how you deal with these incidents and calm customers down. For example, if someone is having a bad day, the simplest thing, such as getting them to pack their own bags, can set them o . We ask sta simply just to pack their shopping for them in a friendly manner to avoid any confrontation” Anonymous retailer

“IN realty, this is just the tip of the iceberg, as many incidents go unreported due to lack of con dence in the police and the justice system from independent retailers. We hope that the latest disturbing statistics on shoplifting from the O ce for National Statistics encourage the government to provide the nancial help that is urgently needed to tackle the surge in retail crime.”

Mo Razzaq, Mo’s Premier, Blantyre, South Lanarkshire

changing every day. You look around and you’re getting more and more vape shops, charity shops and barbers everywhere.

“We’ve seen some massive changes over the years, which I think is why this little shop has always had an appeal, because it’s always been the same, like a comfort blanket,” she added.

Neighbouring businesses also joined the celebrations, posting good wishes online.

In a farewell message, the Ely Museum wrote: “This well-loved newsagent has been a mainstay of Ely city centre during this time and played a signi�icant part in the history of Ely High Street, for which we are grateful. Burrows will undoubtedly be missed.”

BOBBY’S: The wholesaler has launched a free pick ’n’ mix stand for retailers who meet speci c ordering and footfall requirements. There are 20 trays for individual lines, with each medium and large cup sold generating 50%-70% margin. The company is currently trialling the stand at a Co-op store in Sta ordshire.

For the full story, go to betterretailing.com and search ‘Bobby’s’

BOOKER: The wholesaler has launched support to help retailers comply with Natasha’s Law legislation. This includes a database listing allergen and nutritional information for ingredients used in food to go.

For the full story, go to betterretailing.com and search ‘Booker’

“I DISCOVERED that a member of sta was stealing from me. I never have all the answers when dealing with issues like this, so have gone to my trade body, the Fed, for legal help, which has been invaluable. The Fed talked things through and helped me look at my procedures for dealing with these instances. I’m always posting questions on the Fed’s WhatsApp group whenever I need advice.”

Judith Mercer, Hamilton News, Belfast

FAKE SHOPS: Trading standards has warned of a rise in fake retailers linked to serious criminal activity, such as modern slavery, human tra cking, and the sale and supply of illegal vapes and tobacco. It warned telltale signs of these shops include unusually low prices that seem “too good to be true”.

For the full story, go to betterretailing.com and search ‘trading standards’

UNITAS: The wholesale group has had its trading director, Cheryl Hope, poached into the same role by Parfetts. She replaces Gurms Athwal, who joined the cash and carry operator in 2021. Parfetts, who recently appointed former Unitas senior executive Richard Bone as nance director last year, is a Unitas member.

For the full story, go to betterretailing.com and search ‘Unitas’

ALEX YAU

NEWSAGENTS and off-licences alleged to have been involved in black-market reselling of stolen goods have been raided by the Metropolitan Police.

Eight stores in south-west London were raided as part of the sting on 9 April, with confiscated goods including Fairy air freshener, Ferrero Rocher and Waitrose own-label

prosecco. The seized goods, worth a combined £150,000, were identified and recovered having previously been sprayed with a unique tag.

Following the sting, 15 arrests were made. These included 10 men, aged between 23 and 64, and three women, aged between 39 and 45, who were arrested on suspicion of handling stolen goods. They have since been bailed pending further enquiries.

A further two men, both aged 48, were arrested on suspicion of handling stolen goods in separate activity on 17 April. They were also bailed.

Met Police sergeant James Burke said: “Shoplifting pushes up prices for customers and often results in retail workers being verbally and physically abused.

“It also funds the drug trade, and contributes to antisocial behaviour and violence.

“The local officers in my neighbourhood team have put in months of hard work alongside impacted businesses to trial new tactics to drive down shoplifting in the area and have delivered impressive results here.

“The Met is focused on targeting those involved in coordinating this activity, and by disrupting their operation, we are confident we can re-

ALLWYN is to mystery-shop more than 16,000 stores this year as part of its latest ‘Operation Guardian’ scheme.

The checks will include 8,000 visits to assess staff knowledge, 4,298 visits testing for underage sale checks and 4,000 visits to ensure stores weren’t exceeding the recently introduced restriction for stores to not sell more than 10 scratchcards in a single transaction. Follow-up visits will be conducted in failing stores.

POST Office hero and campaigner Sir Alan Bates has warned that postmasters affected by the Horizon scandal may not receive compensation until 2027 unless they sue the government.

According to Sky News, Bates told victims in an email that suing the government is “probably the quickest way to ensure fairness”.

A government spokes-

been

than

CO-OP Wholesale is investing £800,000 in lowering wholesale prices across 100 own-brand lines, shortly after breaking a promise to offer stores cheaper prices than they can buy in Co-op stores.

Recent analysis found more than a third of Co-op’s 100 Aldi price-matched ownlabel lines were cheaper in Co-op stores than bought from Co-op Wholesale. Nisa said its promise did not apply to Co-op member pricing.

Do you go the extra mile to motivate, reward and develop your team?

If the answer is YES, enter the Better Retailing Team Development Award, and gain the recognition you, your store and your team deserve.

Don’t stop at Team Development. Enter one (or more) of our other categories:

Store Development

Community Hero

Effective Ranging & Availability

Customer Engagement

Responsible Retailing

Merchandising & In-store Display

Retail Innovation

SHYAMA LAXMAN

COCA-COLA and Bacardi have joined forces to bring a bar favourite into the ready-to-drink (RTD) category.

The collaboration between the brands dates back to 1900, with the introduction of the Cuba Libre cocktail at the American Bar in Havana.

The launch builds on growing demand in the RTD space, which is now worth £631m in Britain, and is the fastest-growing alcohol category globally over the past �ive years.

Available in 250ml cans with an RRP of £2.30, the launch will be supported by a marketing strategy

across multiple channels, with a range of PoS materials, including chiller dump bins, gondola ends and digital shelf strips, available to convenience retailers via my.ccep.com.

There will also be a summer marketing campaign across social media, checkout promotions, out-of-home advertising, and sampling at music festivals and sporting events.

Elaine Maher, associate director for alcohol ready-todrink at Coca-Cola Europacific Partners GB, said: “Bacardi

ASTON Manor has added Strawberry and Berry varieties to its Crumpton Oaks cider range, as it looks to expand its value offering.

The supplier says demand for �lavoured ciders is growing by 11% annually, and 40% of cider consumers are looking for new �lavours.

The new lines, which are available in pint cans with an ABV of 4%, each have a £1.50 RRP.

They will be available to convenience retailers this summer, having launched in Tesco stores in April.

FOLLOWING the successful launch of Rib ’N’ Saucy in 2024, KP Snacks has expanded its Nik Naks line with the release of a new �lavour: Tangy ’N’ Cheesy. It combines Nik Naks’ iconic texture with a traditional cheese �lavour and will be available in 45g grab bag format with an RRP of £1.15,

as well as a £1.25 pricemarked pack (PMP).

The supplier said the new product taps into the demand for “nostalgic and familiar �lavours”.

with Coca-Cola marks the next step in our strategy to premiumise the category by bringing world-class brands

together, building on the success of Coca-Cola with Jack Daniel’s and Sprite with Absolut Vodka.”

BADGER Brewery has added Red Rascal Cherry Mild to its roster of bottled ales.

It has a 4% ABV and combines the rich, malty character of a traditional mild ale with fresh cherry notes.

Keeping in line with previous packaging comprising wildlife characters, Red Rascal features a fox character, The Rascal, on the label.

Red Rascal is available to independent retailers via cash and carry and wholesale outlets, and direct from Badger Brewery, at an RRP of £2.15.

ENERGY drinks brand Phizz is set to launch a Phizz Daily Energy electrolyte range in two variants: Orange and Cherry.

Phizz Daily Energy is designed to give consumers an energy boost, while also tackling dehydration.

The range will be available to independent retailers via CN Foods, Tropicana and

CLF, at an RRP of £7.99 (20 tablets) and £19.99 (pack of 60).

The tablets are composed of 75mg total caffeine and guarana berry extracts, which contain three times more caffeine than coffee. The tablets release slow and sustained energy over time.

WORLD of Sweets has announced a partnership with actress Vicky McClure’s charity, Our Dementia Choir.

The partnership also celebrates the 130th anniversary of the brand Bonds of London, with the launch of a sharing bag comprising top-selling �lavours including lemon sherbets and pear drops.

The packaging will feature Our Dementia Choir’s logo, with 10% of pro�its going towards funding the charity.

The bags are available in price-marked packs or nonprice-marked packs, with an RRP of £1.25.

OPPO Brothers has refreshed its low-calorie ice cream range with the launch of a vegan ice cream sorbet range.

Oppo Refreshed is launching in Sicilian Lemon & Strawberry, Alphonso Mango & Passionfruit and Raspberry Coulis Swirl �lavours. It is available in a pack of three with 49 calories per stick, and has an RRP of £3.75.

Oppo Refreshed also has an ‘A rating’ on the NutriScore nutritional labelling system, which signi�ies that

the product has high nutritional value.

Convenience retailers will be able to order the range directly from distributor On the Rocks.

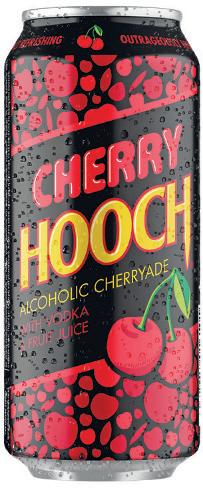

HOOCH has added another �lavour to its ready-to-drink (RTD) line up – Cherry Hooch.

Cherry Hooch has a 3.4% ABV and combines cherryade with vodka.

It is available to convenience stores in a 440ml can at an RRP of £1.70.

A 700ml bottle will be available to retailers in time for summer.

Owner Global Brands said value growth of cherry-�lavoured RTDs is up by 225% this year.

Cherry Hooch joins Lemon Hooch, Raspberry Pink Hooch and Tropical Blue Hooch.

WEETABIX Crispy Minis has teamed up with 16-year-old Olympic skateboarder Lola Tambling for a campaign to highlight its latest cereal �lavour.

The new variety, Caramelised Biscuit, is HFSS-compliant, high in �ibre and made with wholegrain wheat. It will be available across convenience and wholesale, including One Stop, Nisa, Booker, Spar and Unitas wholesalers, at an RRP of £3.49.

Building on the success of the launch earlier this year, the campaign is backed by a £400,000 investment across various advertising

ROBINSONS has announced the launch of a 750ml pricemarked pack (PMP), with 33% extra free, available in Orange and Apple & Blackcurrant singleconcentrate �lavours. They are available exclusively to the convenience channel, with a RRP of £1.59.

Robinsons is supporting retailers with a free PoS kit that can be obtained from atyourconvenience.com.

Ben Parker, vicepresident of commercial off-trade UK at Carlsberg Britvic, said: “Robinsons’ new PMPs offer an ideal solution, helping

retailers attract more customers with a greattasting product.”

PHILIP Morris Limited (PML) has added Terea Silver to its Iqos Iluma range.

It is available now in grocery, convenience and wholesale channels, with an RRP of £7.

Terea Silver is the latest addition to the Terea portfolio, designed exclusively for use with the Iqos Iluma device.

PML, said: “Terea Silver is a step forward on our mission to support adult smokers in making the switch away from smoking cigarettes.

It offers a toasted tobacco blend with notes of herbs.

Terea Silver expands the Terea �lavour range to 16, including six capsule-based Terea Pearls �lavours.

Anthony Loinsard, head of Iqos, UK and Ireland at

BESTWAY RETAIL proudly presents the 2025 Retail Showcase on 15 May at Coventry Building Society Arena – bringing together retailers from across the UK with the Bestway team and supply partners for a day of learning, collaboration and business growth

NOW in its third consecutive year, the Bestway Retail Showcase promises to be an event not to be missed.

Following the tremendous success of the 2023 and 2024 events, this year’s Showcase anticipates record-breaking attendance, with representatives from Costcutter, ‘best-one’, Bargain Booze and Extra Local alongside prospective retailers looking to join the Bestway Retail network.

More than 130 leading supplier partners will be exhibiting and o ering insight, core ranging, innovative products and growth opportunities. Leading brands will be among the exhibitors with great event deals and insight.

As Bestway is the only symbol retailer with store formats tailored to every retailer type, the 2025 Showcase will be the largest and most diverse of its kind.

Here is some feedback from retailers who attended last year’s Retail Showcase

“The trade show was absolutely the event of the year for us. It was packed with valuable information, inspiration and expert insight that have directly contributed to the growth of our business over the past year.”

“It was a fantastic opportunity to reconnect with fellow retailers and key suppliers, as well as meet potential new partners for future collaborations. The curated selection of suppliers was clearly aimed at helping us boost our pro ts, and the networking opportunities were exceptional.”

RETAILERS are in for a treat at the upcoming Bestway Retail Showcase 2025 – a dynamic event full of opportunities to connect, learn and be inspired.

From immersive experiences and live demos to exclusive deals and entertainment, this year’s Showcase promises to be the most exciting yet.

Attendees will explore interactive events, experience immersive zones and sample products, including a bar for exciting mocktails and cocktails with pairing demonstrations designed to boost in-

store customer engagement. There will be live demonstrations and best-practice workshops, including ‘Getting Set for Summer’ sessions, designed to foster collaboration and knowledge sharing. Networking opportunities will be abundant, allowing our retailers to connect with their friends and fellow community of operators, suppliers and Bestway colleagues.

A highlight will be exclusive market-leading deals and the chance to win fantastic prizes. One lucky retailer will win

£1,000 in store credit, two runners-up will each receive £500, and football fans could win a trip to Barcelona to watch the football.

A standout feature is the virtual reality tour of the dual-branded CostcutterBargain Booze convenience store – showcasing innovative layouts, cutting-edge products and margin-boosting solutions.

Retailers will also get to see the latest equipment and tech to help reduce operational costs – ranging from energye cient and labour-saving

tools to advanced security systems designed to safeguard business operations.

Another exciting reveal is Bestway Retail’s partnership with SocioLocal, a leading social media management platform for multi-location retailers. A live demo will show how it can drive footfall and improve digital engagement using both brand-level and local store content.

The day rounds o with a lively Country & Western afterparty featuring live music, themed fun and a thrilling bucking bronco ride!

“WE are delighted to be hosting our third Bestway Retail Showcase in 2025, in partnership with Better Retailing as our media partner,” says Bestway Wholesale’s managing director, Dawood Pervez.

“This event represents a signi cant investment in our retailer network – one that directly supports their growth and pro tability.

“The Retail Showcase is more than just an exhibition;

it’s a hub for innovation, collaboration and inspiration.”

It provides independent retailers with an invaluable opportunity to step away from their daily operations and gain insight into emerging trends, new products and innovations that can propel their businesses forward.

Equally as important, it serves as a platform for likeminded business owners to

exchange ideas, tackle challenges and forge lasting connections in a dynamic and supportive environment.

“Bestway Retail remains committed to empowering independent retailers with the tools, knowledge and networks they need to succeed,” adds Pervez.

“Our goal is to add value beyond supply – we are here to help our retailers truly thrive.”

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

My role in the shop: manager

What do you like most about working in convenience?

Convenience isn’t just working on the shop floor. I get to influence various parts of the business, from ensuring we get stock in on time to helping sta grow to the best of their ability.

What’s the most surprising part of your role? Technology plays a huge part in running the business, particularly arti cial intelligence. We have specialised cameras that use facial recognition and alert us to any potential shopli ers.

What’s been the most exciting product you have had in store lately?

We’re always trying to get new products in stock, which set us apart. One particular product is Angel Hair Chocolate, which has been quite popular on social media.

What has been your biggest achievement in retail? I’ve been here for ve years and have worked my way up to store manager. I’ve shown that I am ambitious enough to take on extra responsibility and am capable of doing so.

What does a typical day look like for you? I engage with customers all the time, which is an important part of my day. This can involve getting in products that they want to nding out about what has happened generally in their lives.

LOCAL: How are you promoting local suppliers?

“WE train staff in highlighting the history to customers. One of our most-popular products is Yok Chan’s Chilli Oil. We’ve been stocking the range for years and it’s made by a husband-andwife couple, with in�luences from Asia.”

Chris O’Connor, Eat 17, Walthamstow, London

“OVER the Easter bank holiday, we had the pleasure of welcoming a very special visitor to Partick – the Easter Bunny. We believe in going the extra mile to create memorable moments. Our goal is to make a positive impact.”

Nathalie Fullerton, One Stop Dumbarton Road, Glasgow

CHARITY: How have you recently raised money?

“WE recently raised £1,000 at our Lechlade Service Station’s Easter celebration. The funds were split between various local causes and institutions. A £500 donation from Co-op Wholesale’s Making a Difference Locally charity was shared.”

Paul Courtney, SGN

“THE Brook�ield Group aimed to raise £30,000 for disability sport charity Get Kids Going! by participating in the Boston and London marathons last month. We’re not just running for medals – we’re running to give children a chance to dream, compete and thrive.”

nationwide

We’re not just running for medals

SOFT DRINKS: What is doing well in your store?

“FIVE years ago, we only had one or two chilled coffee brands, but now we have seven or eight. Starbucks Caramel Macchiato is more expensive at £1.99, but it’s still a good seller. Because we’re a residential store, we try to stick with RRPs across all categories.”

Jey Sivapalan, 1 Stop Go Local Extra, Derby

“WE have had a few new products in the store recently. The Tutti Frutti Fanta has been catching a bit of attention from shoppers, though the new Más+ by Messi drink hasn’t quite taken off like Prime did –those early days of Prime were pretty crazy.”

Dipak Shah, H&R News, Camberley

Store owner: Nishi Patel, Londis Bexley Park, Kent

Want to recommend a star member of sta ? Call 020 7689 3358 or email alex.yau@newtrade.co.uk

Our goal is to make a positive impact Starbucks is expensive, but still a good seller We can only do so much on our own

SECURITY: Have your measures been successful?

“STORE security recently prevented a break-in attempt where the intruders tried to lever up the shutters and kick in the door. Thankfully, they gave up. However, we can only do so much on our own. The government needs to step up. Penalties must be tougher.”

Bay Bashir, Go Local Belle Vue Convenience, Middlesbrough

“AFTER a long and dif�icult few months following a devastating break-in, we’re relieved to share that our new shutters have now been installed. Their presence has brought a real sense of reassurance. Knowing there’s a visible deterrent offers some much-needed peace of mind.”

Ian Lewis, Spar Minster Lovell, Oxfordshire

‘We will defend ourselves against

IT’S unfortunate to write this, but with retail crime on the rise, we thought we’d remove any doubt that if anyone attempts to steal or shoplift from our store, they will be challenged.

The manager is very proactive, has lived in the area nearly 40 years and knows the area inside out.

We don’t discriminate – it doesn’t matter whether you’re male, female, a minor or an older customer. The same applies to what has been taken, be it a 15p chew bar or a bottle of wine – it makes no difference. You’d be wrong to think people won’t grass a friend up and pass their information on. We’ve had close

COMMUNITY RETAILER OF THE WEEK

‘It’s hard to take time o as a retailer’ Serge Notay, Notay’s Convenience Store, Batley

“SHOPKEEPERS need holidays, too. I have more than 20 years of experience running busy convenience stores, so I know how hard it is to take time o . That’s where I come in for fellow retailers who really need a break for a holiday or other reasons. I o er relief shopkeeping and holiday cover – stepping in to keep your shop running smoothly while you take a break or handle an emergency. I am trusted, experienced and available at short notice. I ask other retailers who need time o to get in touch and let me keep your tills ringing while you relax.”

mates and even family give information on those who have stolen.

We’re very resourceful and will always �ind out identities. We aren’t a large corporate store that makes millions and is able to absorb losses due to theft.

We’re a small, local, familyrun business that does its best to cater to the commu-

nity. All thefts are direct from our pocket and jeopardise our ability to trade and serve our community. Because of this, we will protect and defend ourselves against thieves. Anyone caught will be dealt with accordingly.

Andrew Board, Core Convenience Store, Durham

RETAILER OF THE

‘I ran the London Marathon for charity’

“I RAN the London Marathon on 27 April for the Stroke Association. In 2022, my mum su ered a stroke that was completely out of the blue and turned our family upside down. Thankfully, she has recovered, and her life is back to normal. Unfortunately, this isn’t the case for many stroke survivors, and the Stroke Association is the best place for many su erers and families to go to. The incredible work it has done in facilitating care and support for survivors is the reason I am raising funds for them via events.stroke.org.uk/fundraisers/amritsingh/ london-marathon-2025-charity.”

I WAS at the ACS Conference and the National Convenience Show in Birmingham a few weeks ago, and I took away some really interesting and inspirational ideas and products from them.

I particularly liked Joshua James, from Fresh & Proper in Fordham, Cambridgeshire, talking about how he invites the police into his shop for a cup of co ee to increase their presence.

issue, one of seven top retailers shares advice to make your store magni cent

At the trade show, there were so many stands, with lots of food for thought and plenty of innovation. There were so many new products and interesting ideas to look at. Some of the trends that stood out included the rise of global confectionery, with Australian and Japanese items featuring highly at one stand. There were also more pistachio-based products, showing that the ‘Dubai’ trend is still something people are interested in.

I also met lots of suppliers from Poland trying to get their products imported into the UK. As a retailer with a prominent Polish population in my community, it was really good to see these suppliers make the e ort to come here and network.

These trade shows are a great way to network, reconnect with suppliers that we know and to make new connections as well. Ultimately, it’s all about getting on top of what’s happening and nding out about places, people and products that you’ve not come across before, but which you can bring into your store to add a real point of di erence.

Meeting people in person builds that relationship so much better than over the phone or email. But as well as looking further a eld for the next unique selling point, as Joshua showed, it’s also critical to build those local connections within the community to strengthen your store’s presence among your customer base.

THE RETAIL EXPRESS TEAM nds out how fascias and symbol groups are working to help retailers give customers a strong value o er

THE cost-of-living crisis continues to bite, with rising energy prices, tariffs and in�lation all combining to tighten margins for retailers, but also making customers more aware than ever of the price of products on the shelves.

With this in mind, retailers need the support of their symbol groups and fascias more than ever to ensure that the lines they are selling combine competitive price tags without making their overall businesses unpro�itable.

This support can come in many forms and over the next few pages, Retail Express has spoken to the teams at Parfetts and Spar to detail what they are doing.

At the most basic level, it is about providing retailers with goods at decent prices at the cash and carry.

But it is also about providing advice and tips for growing sales and creating that perception of value that stores need to put out there.

It’s about providing marketing material and support, developing promotions

that will hit a retailer’s target audience at the right moments, and developing technology that helps retailers to save money elsewhere and enable them to keep prices competitive.

Over the next pages, Retail Express will hear from the symbol groups themselves, but also from retailers who run their shops with them, �inding out about how each symbol has helped them to save money and to pass savings onto their customers to grow footfall and retain loyalty.

“Co-op fresh products have completely changed our business. Customers come to us now over the supermarket and we’ve doubled our basket spend.”

How PARFETTS is o ering its retail customers strong value and enabling them to pass on this value to their shoppers

PARFETTS members bene t from competitive pricing. The wholesaler’s employee ownership model allows it to invest in low wholesale prices, helping retailers maintain healthy pro t margins, expanding its own label and building a national depot network.

Parfetts provides free business support, including free fascia membership, delivery, digital support, EPoS systems and marketing material.

Investment in digital innovation – such as streamlining ordering, improving operational e ciency and supporting customer engagement through digital tools – helps members to focus on their businesses.

Regular promotions are driving sales and customer loyalty. These are supported by a focus on local shopper needs to build long-term loyalty.

Members bene t from tailored business guidance to suit individual store needs, and a large national retail development advisor (RDA) network.

Visit www.parfetts.co.uk or email joinus@parfetts.co.uk to find out more

Our Symbol Group exists for one purpose, to drive business success & deliver your business even more profit.

Keep your independence but enjoy the support of an experienced retail team offering a dedicated promotional programme, a bespoke solution for every store and deals guaranteed to increase profits.

Shop & Go is our new symbol format designed to meet the needs of retailers who operate stores with a transient shopper mission in high footfall locations such as city centres, bus stations, train stations or forecourts.

DESPITE economic challenges, the UK wholesale sector remains strong. Parfetts helps independent retailers compete with supermarkets by using its buying power to secure competitive pricing while protecting margins.

Retailers bene t from free membership, delivery, digital store support, EPoS systems and marketing assistance, plus a 2% compliance reward for running promotions in full. These bene ts are designed to help stores operate e ciently, drive sales and thrive.

Parfetts has also expanded its own-label range to more than 200 products that offer great value to shoppers and optimise margins.

Increased promotional activity throughout the year helps increase margins, while signi cant investment in digital platforms is improving the ordering process, streamlining operations and enhancing customer engagement.

Parfetts provides bespoke support to align each retailer’s strategy with their speci c store and customer base.

Threeways Service Station, Burstwick, Hull

“WE bought the shop as a tiny garage about eight years ago, but knocked it down and rebuilt it about two years ago, then reopened it under the Shop & Go fascia last December.

“Before we signed up, I bought my stock from Parfetts anyway. I like its range and the reliable delivery.

“Now we’re with Shop & Go, I get the regular promotions and the 2% compliance reward, and I have regular

visits from my RDA. We can message him any time.

“The Go Local range sells really well, shoppers are picking it up across all categories.

The company prides itself on being easy to work with while enabling retailers to maintain full independence, empowering them to achieve sustainable growth.

“We’re just outside the village on an industrial estate, but the village shop closed last year, so people are using us as a village shop.

“Every three, weeks when the promotions

change, they send me all the leaflets and the posters for my A-boards, which helps me to communicate the promotions.

“We looked at other symbols, but even though Parfetts’ closest depot is an hour and a half away, we still like its service.”

The steps SPAR has taken to o er its retail customers value in the current climate

IN the current climate, o ering value is more important than ever. Shoppers are looking for ways to make their money go further, and convenience retailers who deliver strong value propositions will build loyalty and drive footfall. Spar’s wellstructured national promotional programme ensures its stores can o er competitive deals that appeal to cost-conscious customers

while maintaining margins.

Spar retailers bene t from ongoing national marketing and digital support, keeping their stores front of mind for shoppers. Campaigns like ‘Frozen Fortune’ and ‘Community Cashback’ not only help retailers engage their communities, but also provide opportunities to reward customer loyalty and drive store visits. Innovation is another key

Steven Singh

Spar Gourock, Inverclyde

“MY wife Gurwinder and I have been in local community retailing for 30 years. We joined Spar Scotland in March last year a er realising that buying from a cash and carry was no longer a viable option.

“We needed the backing of a wholesaler, and CJ Lang & Son Ltd and Spar Scotland have been fantastic partners. CJ Lang truly understands the Scottish market, which has been invaluable.

“The support has made a real di erence – taking a lot of the workload o me, especially on the admin side. Its promotions, deliveries and wholesale services have been excellent, and the team is always friendly and helpful. The EPoS system support has also been a game-changer for our store.

SPAR is built on the principle that retailers remain proudly independent while bene ting from the strength of a global brand. Each store is tailored to its community, combining local expertise with Spar’s collective buying power, marketing strength and operational support. This allows retailers to create unique stores that meet local needs while delivering a trusted shopping experience.

As a symbol group, Spar o ers independent retailers comprehensive support, including store branding, own-label products, nation-

advantage, with Spar bringing new and exciting products to market rst, such as the introduction of Más+ by Messi, giving Spar retailers a competitive edge. This, combined with tailored operational support from each Regional Distribution Centre (RDC), means Spar retailers are well placed to navigate challenges while continuing to meet evolving shopper needs.

al marketing, collective buying, promotions, IT solutions and logistics. RDCs provide products, deliveries and business manager support, allowing retailers to focus on running their stores.

With major investments in logistics and technology, RDCs ensure retailers have the right products at the right prices to thrive.

A key advantage of joining Spar is access to the exclusive own-brand range. With more than 750 carefully developed lines, Spar brand products drive sales, shopper satisfaction and

loyalty. The mix of internationally, nationally and locally sourced products sets Spar apart, ensuring quality, value and regional relevance. Spar’s own-brand legacy continues to give retailers a competitive edge.

“Spar Scotland has really helped us by giving

us the tools to o er our customers great value –whether through di erent product ranges, Spar ownlabel products or added services. Spar Scotland’s advertising on STV has been a big boost, too –customers come in asking about products they have seen on TV.”

SHYAMA LAXMAN talks to retailers about their energy drinks range, top products and predictions for 2025

THE prevailing view among retailers and suppliers is that energy drinks as a category is set to keep up the growth it has witnessed so far.

“The UK energy drinks market expanded to an estimated £3.4bn in 2024 and is expected to continue to grow in line with the nation’s preoccupation with health, sports and tness,” says Kieran Fisher, founder of Warrior.

Andrew Pheasant, account manager at Hell, attributes this to more brands entering the space as well as flavour innovations.

“The consumer base is continually expanding, with brands looking to recruit drinkers from di erent demographics, with sugar-free and added health bene ts featuring prominently within new products,” says Pheasant.

Retailers believe the category will continue to grow in 2025, not just in terms of flavour o erings, but also sizes.

“To take Red Bull as an example, just 10 years ago it was one line available: 250ml,” says Kay Patel, who runs several Best-one stores in east London.

“Now, you’ve got four different sizes, plus the multipacks. It’s in growth for us.”

Merchandising advice from Red Bull top tips

Get the right amount of space per category. Sports and energy accounts for 51% of the single-serve soft drinks value sales in impulse, so therefore should make up 51% of the space on the xture.

A 360° approach to visibility is the key to maximising sales. Front-of-store promotions can help drive an increase in sales, but also secondary-placed chillers by the till or meal-deals with food to go will continue to keep core lines top of mind and drive incremental sales.

Use core lines to signpost each category, stocked at eye-level, brand blocked and multi-faced to be easy to nd. Also consider second placement opportunities to drive incremental sales across the store.

DANIALL Nadeem, of Spar Motherwell Road in Belshill, North Lanarkshire, says 31% of his soft drinks sales come from energy drinks, while Patel sold more than 800 units in a week in one of his Best-one stores.

Amish Shingadia, of Londis Caterways in Horsham, West Sussex, sells about 400 units a week. Rather than experiment too much with the category, Shingadia says it’s prudent to stick to core brands, such as

Red Bull and Monster, which make up the bulk of his sales.

While new lines keep entering the market, he says they haven’t been as successful as the core range.

“The other lines sell maybe 10% of what those two major brands do,” says Shingadia.

Jonathan Cobb, of Miserden Stores & Post O ce in Gloucestershire, sells around 24 units a week, mostly to people under 30 years of age.

“We have a lot of builders, workmen, farmers and contractors who drink from the category, and that’s probably where our primary sales come from.”

Patel and Nadeem say in addition to the 18-t0-30-yearolds, they are now getting customers in their 40s and 50s buying from the category.

Shingadia’s energy drinks consumers range from tradesmen to mums.

ACCORDING to a spokesperson for Red Bull, flavour, function and price are the three trends that will de ne the energy drinks segment this year.

“Flavour extensions continue to drive trials within this category, with brands tending to focus on low- or no-sugar additions to appeal to more health-conscious consumers,” says Pheasant. He also believes innovation

in the sector will prove exciting for consumers.

A case in point is Hell A.I, which the brand claims to be the world’s rst energy drink to be created by arti cial intelligence. Launched in 2023, Pheasant says they had two production runs of 500,000 cans, which sold through.

“It drove great engagement with consumers and retailers, and provided genuine innova-

tion to the soft drinks category,” says Pheasant.

Patel says juice-flavoured energy drinks, such as those by Monster and Red Bull, are proving popular, not just because of taste, but because of their packaging as well.

“They look so eye-catching. They look good on shelves, it makes you want to stock the full range,” says Patel.

A Red Bull spokesperson

says function is becoming a key factor for consumers, evidenced by the growth of related products that are worth £3.9bn.

With 75% of shoppers considering health while choosing soft drinks, it’s important to o er a selection of sugar-free alternatives within the energy category, such as Red Bull Zero, which contains zero sugar and no calories.

React to current trends TOP TIPS

Kathryn Hague, head of marketing, World of Sweets

“Stock a variety of options and keep the range fresh with new flavours. Besides traditional energy drinks, retailers should also consider stocking up on healthier alternatives.”

Amish Shingadia, Londis Caterways, Horsham, West Sussex

“Look at your local Co-op or competition. If you’re in a symbol group, look at planograms from your symbol group. They can give you a very good indication of what to stock.”

Kay Patel,Best-one, east London

“Pay heed to suppliers’ advice on giving your range adequate space, such as adding an extra refrigeration unit as energy drinks are the most-pro table products in your fridge.”

“ANOTHER big factor in driving sales will continue to be price – or rather, perceived value,” says Fisher.

Nadeem o ers small and large formats from Hell, which have been performing well.

He adds: “Their smaller cans are price-marked at 79p, which is on par with own brand, and

they’ve got 500ml cans price marked at £1.”

Nadeem says it is important to carry a range to demonstrate value. Having previously offered only 250ml and 473ml cans of Red Bull, he started o ering the in-between 355ml cans at the recommendation of a supplier.

A DIVERSE range can include product launches from big brands, but it’s also worth looking at what impact global energy drinks can have on your sales.

Patel occasionally stocks Krating Daeng, a South-east Asian energy drink that is regarded as the ‘original’ Red Bull, priced between £3.99 and £4.99. While it doesn’t take away from existing purchases, it gives his store a point of di erence.

In the past, he’s also offered speci c brands, such as Ghost Energy, at the behest of a customer.

He delisted the line once his stock ran out as he had no renewed interest.

Shingadia, on the other hand, feels that the higher price point of energy drinks

from abroad, such as Gatorade, doesn’t justify having them in store considering the ongoing cost-of-living crisis.

Having said that, Shingadia recommends that for additional sales, retailers could look around their local area to nd any gaps in the market for newer kinds of energy drinks. He o ers “gym energy drinks”, such as C4 and Moose.

“When I went to my local gym, I saw a lot of youngsters chugging on them. They are expensive.

“We have got a few gyms next to us, and we have been selling it for a lot cheaper than the gyms,” says Shingadia.

At £2.50 per unit, he sells about a case per line per week, across six lines.

This soon translated into increased sales, and he now buys the 355ml cans by the pallet.

Shingadia feels that Lucozade and Solstic will start gaining traction. This is mainly driven by Monster’s price increase, thereby o ering shoppers choice between value and premium range.

Lucozade Alert launches cans with Anthony Joshua Lucozade Alert has unveiled a limited-edition version of its Mango Peachade variety in collaboration with its brand ambassador, boxer Anthony Joshua. The new version, which is available now, features Joshua on the front of 250ml and 500ml cans. The collaboration comes as zero-sugar stimulation drinks are growing by 27%.

Boost launches limited-edition Sport and Energy flavours

Boost Drinks has added two limited-edition lines, Blue Raspberry Energy and Cloudy Lemonade Sport, to its range. Both flavours are available in 250ml price-marked packs (PMPs) of 75p (Blue Raspberry) and 89p (Cloudy Lemonade).

Red Bull unveils Summer Edition White Peach

Red Bull has unveiled Summer Edition White Peach, its latest limited-edition seasonal variety. The new flavour includes notes of white peach and citrus peel, with a smooth and floral nish, the supplier says. It is available to convenience channels in regular and sugar-free varieties priced at £1.70 (250ml plain), £1.65 (250ml PMP), £2.10 (sugarfree 355ml) and £5.40 (4x250ml).

NADEEM says consistently reviewing one’s range is crucial to not burden the consumer with too much choice.

His range includes Monster, Red Bull, Rubicon Raw, Boost Energy, Emerge and Hell Energy, as well as own-label brand Spar Blue Bear.

“Focus on the bestsellers,”

he says. “Carry a wide range and siphon out what’s not selling as well.” Nadeem generally givesnew lines 13 weeks to see how they perform, before deciding to carry on o ering them or delist.

“We’ve done that with a lot of Monster. New flavours kept coming out – we were running

out of space,” he says. On reviewing his sales data, he found that he wasn’t selling even a case week of three-tofour lines, which were eventually discontinued. He says customers who came for those flavours ultimately swapped to something else.

Chief executive of

NADEEM and Patel say product visibility is crucial when it comes to driving sales.

Nadeem, for example, arranges his range in the chiller in ascending order of size.

“When the customer’s eye is drawn to the chiller, they are seeing all their options,” he says.

“Rather than doing a full

Kieran Fisher, founder, Warrior

“RETAILERS need to capture and engage shoppers by ensuring they have the right ranges available to them. Energy-drink shoppers are brand loyal and o en seek innovation from their favourite brands. Range expansion of new flavours is vital in keeping pace with demand, but this should be balanced with stocking core favourites to keep customers engaged.

“If retailers want their customers to see energy drinks as regular repeat purchases, promotions and discounts are key.”

shelf across, you give them the options on one side of the chiller.”

Shingadia relies on the power of double facings when it comes to merchandising his energy drinks range and making sure that everything is clearly laid out. He says single facings for energy drinks becomes “quite messy”.

As energy drinks form a core part of soft drinks, the two can be placed in the same chiller, albeit should be merchandised separately.

Nadeem’s line of energy drinks occupies a 1.25-metre bay across six-to-seven shelves. “Our energy is kept separate from our carbonates,” he says. “When they’re coming

in to look for energy, customers know one section has everything we carry.”

Cobb recommends placing energy drinks in or as close to one’s food-to-go area as possible. “Often, the sort of people who buy energy drinks buy a sandwiche or food with it,” he adds. “For us, it’s a good impulse buy by the till as well.”

TAMARA BIRCH talks to retailers to o er a full rundown on how to prepare for June’s disposable-vapes ban, from educating your customers to what to stock

THERE’S less than a month to go until the disposable vapes ban takes e ect and you need to ask yourself, are you prepared? If the answer is no, you need a checklist. Start by knowing which vapes will be compliant from 1 June. If a vape is both rechargeable and re llable, it’s una ected by the ban. However, if it is only one of these, it will be a ected. Likewise, if it has a coil you can’t buy easily and replace, it will be banned, and if a vape

has a single-use container that you can’t buy separately and replace, and you cannot re ll, it will be banned. The container could be a capsule, a cartridge, a pod or a tank. For a vape to be compliant, it must have a rechargeable battery, re lled with vape liquid either by lling up the tank or cartridge with e-liquid or by inserting pre- lled pods. If the vape has a coil that can be replaced by removing or replacing the coil, or removing and replacing the tank that con-

tains it, then it’s compliant. Have a plan in place for when you’ll stop ordering in disposables. Many retailers, including Vrajesh Patel, of Londis Dagenham in east London, have delisted slower lines already and are selling through their fastest-sellers. He plans to stop buying stock from mid-May.

“We’ll reduce any stock and still be left with a healthy 35% margin, and anything left the week before will be sold at cost price,” he says.

RETAILERS have consistently commented that customers aren’t as clued in on the ban and what it will mean for them. Unfortunately, it has fallen on retailers to inform their customers of what’s happening.

“When they buy a disposable vape, we tell them about the ban and o er an alternative, which is usually a like-for-

like compliant product,” says Sasi Patel, owner of multiple Go Local Stores in and around Greater Manchester.

Nathan Whiteside, of One Stop Cefndy Road in Rhyl, Denbighshire, recommends asking your symbol group or trade bodies for advice.

are company owned, so we’re watching what they’re doing, how they’re advising their customers, and then following that,” he says.

The key is to simplify the ban language. It’s easy to use technical language when explaining legislation, but try to simplify it, and have an alter-

“We have two more One Stop stores in the area that

Tomas Hammargren, chief risk-reduction o cer, Emplicure, producer of Klar

“Stocking alternatives isn’t enough – education must be a priority. Retailers should enhance instore and online messaging, provide sta training and promote responsible marketing to help consumers make informed decisions. This moment presents an opportunity to reshape the nicotine landscape in a responsible way.”

Andrew Malm, UK marketing manager, Imperial Brands

“By this point, retailers should have developed a clear plan for updating gantry displays, starting from 1 June, to guarantee that all disposables are fully removed from shelves. Ensuring that sta are thoroughly trained on the details of the ban, as well as the alternative products available, such as reusable pod systems, is also crucial.”

A spokesperson from Broughton “Equip yourself to educate customers on alternatives, such as heated tobacco products, nicotine pouches and other next-gen nicotine options, helping them make informed choices. Also o er a diverse range of products that cater to evolving customer preferences, ensuring you meet expectations and maintain customer satisfaction as the market shifts.”

Angelo Yang, associate general manager, UK, Elfbar “Vapes are classed as WEEE (Waste Electrical and Electronic Equipment) and must be recycled. Retailers with vape bin services should arrange disposal through the company they provide –this may involve a fee. If you do not responsibly recycle single-use vape stock by 1 June, your business is at risk of commercial loss and legal enforcement action.”

THE Fed and the Association of Convenience Stores (ACS) have plenty of materials that will help increase your team’s knowledge.

Vrajesh Patel printed a poster created by the ACS for his team that advises them on what’s been banned and how to tell the di erence between compliant and noncompliant stock.

“The ACS has been very good with tools and such to help us. There’s a membership cost, but it’s covered by our symbol group,” he says.

If you haven’t already,

sit your team down and ask if they know what the ban is and what their comfort levels are to discuss it with customers.

This will give you a better idea where the knowledge gaps are. From here, look to trade media, industry bodies or your symbol group for advice. Also, talk to other retailers about their strategies.

Whiteside says from an ordering perspective, he takes on the responsibility, but says his wholesaler, Vape Supplier Limited, is good at advising on sta training as well.

THE next popular subcategory in next-gen nicotine is dicult to anticipate and will vary depending on your customer demographic. For instance, more experienced vapers could choose an open system, as it o ers more flexibility, but vapers who bought disposables for its convenience might prefer a pod system.

There’s also a chance that

heated tobacco and nicotine pouches become higher in demand. It’s worth asking your shoppers if they have thought about what they plan to do, while also preparing yourself for the fact that they could easily change their mind once the reality of the ban hits home.

Sasi Patel, Vrajesh Patel and Nathan Whiteside all plan to focus more on pods, as they’re

the closest to disposables. However, they all agree they will increase their range slowly to gauge the direction the market will go after 1 June.

“We’ll be looking at pods and e-liquids, but also exploring other avenues,” Vrajesh Patel says. “We currently only stock Nordic Spirit, but will be open to stocking Velo and other brands, too.”

What’s new on the market NEW products

Nicotine pouches

XQS’s new flavours

In April, Scandinavian Tobacco Group launched XQS Raspberry Blackcurrant, Strawberry Kiwi and Berrynana Twist. Each flavour is 8mg and has a £5.50 RRP.

Klar’s UK launch

New nicotine-pouch brand Klar is available to independent retailers via Nisa, Appleby Westward and Aquavape. It is available in Mint and Citrus flavours at strengths of 3mg, 6mg and 9mg.

Nordic Spirit Frosty Mint and Frosty Berry JTI expanded its Nordic Spirit range in February with two new flavours: Frosty Mint and Frosty Berry. Each flavour has 12mg of nicotine per pouch, with a £6.50 RRP.

Heated tobacco

Terea Pearls’ two new flavours

Philip Morris Limited introduced two new Terea Pearls flavours, Riviera Pearl and Provence Pearl (RRP £7). Terea Pearls feature new capsule technology, which allows users to switch from a traditional tobacco blend to a unique flavour with a single click. They are only compatible with the Iqos Iluma device.

Liquids and pods

Blu bar kit and pod packs

With a £5.99 RRP, retailers can stock the recently expanded Blu Bar vape range in three new kit varieties and 11 new pod varieties. Each kit comes with a rechargeable device and flavoured pod. The new pod flavours are available in packs of two pods and allow up to 1,000 pu s.

Elfx Pro Classic Edition

The Elfx Pro Classic Edition from Elfbar is designed to be an accessible entry point to open-pod-vaping systems, with a focus on convenience. It can be pre lled with nic salts, including Elfliq, the same e-liquids found in Elfbar single-use and pre lled devices.

o cial advice from the Department for Environment, Food and Rural A airs (Defra) that retailers must ensure all stocks of disposable products are sold, with any remaining product disposed of safely, before 1 June.

stock risk being ned once the ban takes e ect and Defra says only compliant products should be bought from then on. So, retailers should be more concerned about having leftover stock than running out before the ban.

consulting. The key message is that it’s not too late to prepare for 1 June,” he says.

Dunne, director general of the UK Vaping Industry Association (UKVIA), says retailers found with single-use

“Defra has published a comprehensive guide for retailers, which explains the ban in plain English and it is worth

“Retailers must ensure they sell all single-use stock by 1 June, have su cient devices in stock to meet demand and do their best to inform customers of the changes.”

The guide can be viewed at gov.uk/guidance/single-usevapes-ban.

Thornbury Refrigeration, an Arneg Distributor, has advertised in Retail Express for years. The regular positive response we receive leads to

and

Robin Ranson, Thornbury Refrigeration

The RETAIL EXPRESS team nds out how shops are preparing to maximise warm-weather sales

1

Ron Patel, Ron’s News, Droitwich Spa, Worcestershire

“OUR demographic is 60% pensioners, but when the summer comes, we’ll be putting more emphasis on ice creams and soft drinks just the same.

“We’ll be sure to put more soft drinks in the fridge. The biggest growth we’ve seen at the moment and in the summer is energy drinks. That’s a huge market and we’ve seen a massive increase in sales. Light snacks – like crisps – get more popular in summer, but chocolate sales dip.

“As a newsagent, we generally sell everyday luxuries. These are the �irst things people stop buying when they’re struggling with expenditure in a cost-of-living crisis, so we look for new products in the trade magazines to keep things interesting.

“Warmer weather lifts people’s spirits and brings them outside, which takes them to us. Anything we can offer for on-thego snacks or picnics in the park is good for sales.”

2

Kuldeep

Singh, Carl’s Convenience Store, Oldbury, West Midlands

Gail Watling, Tidings Newsagents, Norfolk 3

“THE main thing we do is get more ice cream in and increase our soft drinks range. We’re next door to a primary school, so we get strong ice cream sales, and whether it’s carbonated drinks or bottled water, people will pick something up as long as it’s cold. We’ll increase the variety in our soft drinks as well – it’s usually pretty condensed in winter, but in summer, our customers are more interested in trying new things.

“We have �ive facings of Coca-Cola, three of Diet Coke and two of Coca-Cola Cherry at the moment, but by summer, we’ll have cut some back to make room for lines like Coca-Cola Lemon. It’s important to focus on impulse lines because people are out and about more and if parents take their kids out, they’ll always want something.

“I wouldn’t start putting stock outside, but that doesn’t mean it wouldn’t work for a different store.”

“WE have quite an elderly population, but in summer, we get the tourists coming to the coast, so we put in lots of gifts. We have clotted cream, fudge and shortbread. I don’t tend to go for ‘tat’ like magnets. I’d rather offer things people can eat, which tend to sell better.

“Aside from that, we don’t change the store too much. We de�initely see an increase in sales in the summer across all categories. Right now, we’ve got elderly couples coming here on holiday. In July and August, it will be children and families there for their summer holidays, and it will be younger adults coming here in September.

“The increased demand certainly means more cash-and-carry trips for us. We don’t have much room at the back of the shop, so we’ve now got an off-site space for summer storage. It’s not a shipping container, but it’s very similar.”

In the next issue, the Retail Express team nds out how retailers are tweaking store layout to boost sales. If you have any problems you’d like us to explore, please email