Chivas XV +28.7% in Impulse! No. 3 Premium Blend in the UK Total Of -Trade: Premium Blended Scotch +27.1% Source: Nielsen, Total Coverage, MAT to 18.06.22 Enjoy Responsibly

BETTERRETAILING RESOURCE Your guide to finding the products and services you need for your business RESOURCE INSIDEFREE 24 JANUARY-6 FEBRUARY 2023 STRICTLY FOR TRADEUSERSONLY ENERGY CRISIS P2 P20 Find out how stores are shaping up the category this year to increase sales Impact of latest reduced government support to small businesses revealed P4 PRICE-MARKED PACKS Wholesalers confirm margins are improving for retailers following decreases CRISPS & SNACKS P3 • Pressure mounts on local shops to comply with vape recycling legislation as campaign exposes streets littered with single-use products • What retailers need to know to avoid penalties and stay on the right side of the law ECO LAW PUTS STORES AT RISK VAPE FINES:

IT’S truly astonishing to hear the government has reduced the level of support it’s expected to give small businesses from April, to combat rising energy bills.

Although the details of this can be found in the adjacent story, I want to express my own concern. The pullback in relief is likely to force thousands of local shops to permanently close their doors, having a devastating impact on the industry.

There is no denying the sector is a resilient one, and we have witnessed that first-hand through the pandemic and its continued buoyancy during the cost-of-living crisis, but enough is enough.

It doesn’t take much to see many independent retailers are already on their hands and knees, and the loss of this lifeline may well be the final nail in the coffin.

Bills are expected to rise by nearly £3,000, and store owners have nowhere left to turn. The crisis has been going on for long enough that most store owners have already done all they can in cutting down energy use to make savings.

This will also no doubt have a detrimental impact on consumers, who are struggling themselves, and are relying on convenience to cut their own bills, whether that be petrol or promotions.

I urge you all to keep shouting about the financial strain you are experiencing, and make it impossible for the government to shy away from how they are treating the hardest-working businesses across the UK.

We will continue playing our part by speaking to MPs, and raising awareness of the uncertain future facing independent businesses.

Local shops to be hit by energy bill increases up to £3k

REDUCED government energy support will hit stores with rises of up to nearly £3,000 in their monthly bills.

Last week, it was announced that from April, the energy relief designated to businesses that signed contracts after 1 December 2021,

will be replaced. The level of discount is to decrease, while the threshold to receive the new relief is to increase.

Neil King, founder of energy broker Wiser Utilities said: “When the market peaked, the discounts [under the previous scheme] were up to 55p per kWh for electricity. The problem is, under the new scheme, the maximum dis-

count is 1.96p for electricity.”

He went on to stress that the complexity of calculating the difference between the relief schemes means many stores are unprepared for the increase.

King said: “There will be many stores that will only realise when their �irst bill comes through for April.”

David Lomas, owner of Lo-

mas News in Bury, Greater Manchester, added: “Right now, we’re just hoping and praying that what we’ve done to cut energy use will be enough when the next invoice comes in.

“To lose out on business energy relief would be a blow, we just have to wait and see what happens in the next �inancial year.”

For the full story, go to betterRetailing.com and search ‘energy’

Convenience woes Canned bubble tea

STAFF working in convenience stores have listed low wages, unpaid breaks, poor rota planning and training as their top gripes.

Newly released employer rankings by job comparison site, Breakroom, reviewed employee reviews of 20 con-

venience store brands including symbol groups.

Forecourt chain BP came out on top with 6.8 out of 10, whereas McColl’s was bottom with just 3.7 as the chain dealt with the fallout of hiring freezes, store closures and redundancies.

INDEPENDENT retailers are generating £1,500 a month in sales from selling canned bubble tea, Tempo Tea Bar.

Natalie Lightfoot, of Londis Solo Convenience in Glasgow, who was Tempo’s �irst retail partner, revealed she sells up to 80 cans a day during

peak season. James Docherty, who looks after Tempo’s external partner development, said the four-week shelf life helped drive sales.

Retailers can stock two of its �lagship �lavours, as well as a DIY kit, with a six-week shelf life.

For the full story, go to betterRetailing.com and search ‘Tempo’

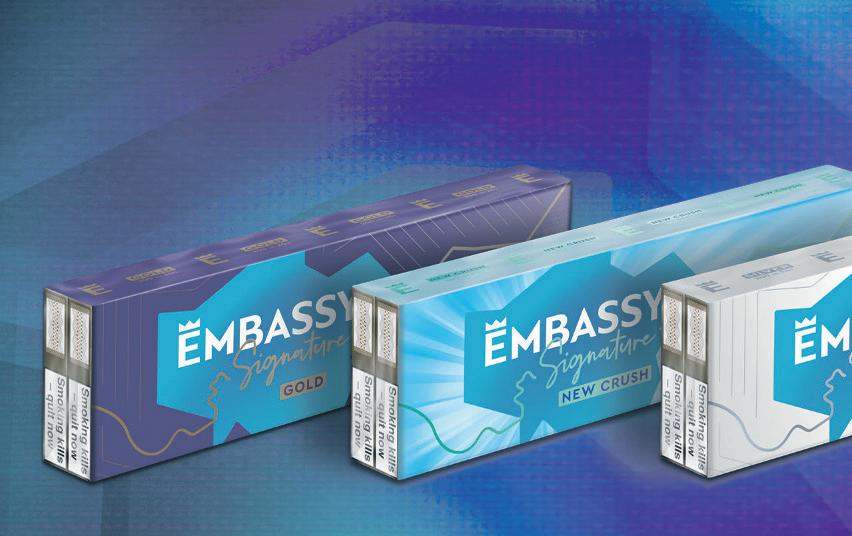

Tobacco crackdown

THE Labour Party has pledged to prohibit retailers from selling cigarettes to anyone born after 2008, if it wins the next general election.

Speaking to the BBC this month, shadow health secretary Wes Streeting said: “We’ll

be consulting on that and a range of other measures. The New Zealand government is doing it. We want to see how that works.

“If we’re going to get the NHS back on track, we also need to focus on public health.”

@retailexpress betterRetailing.com facebook.com/betterRetailing

The five biggest stories this fortnight 01 02

04 05

03

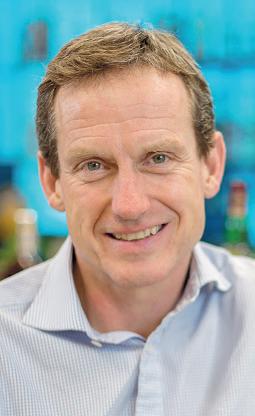

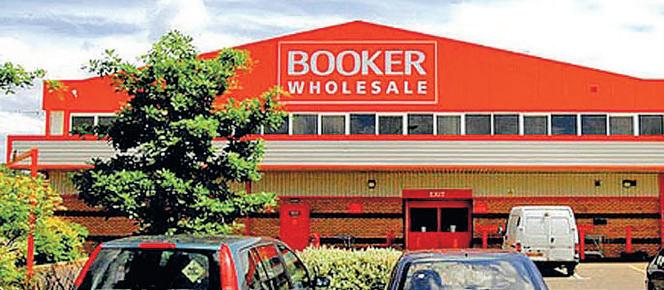

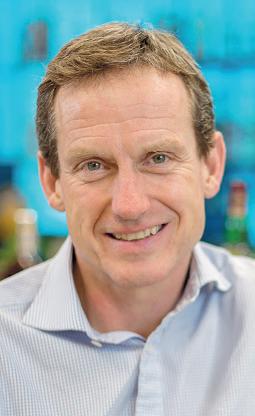

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Senior features writer Priyanka Jethwa @PriyankaJethwa_ 020 7689 3355 Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Deputy insight & advertorial editor Tamara Birch @TamaraBirchNT 020 7689 3361 Production editor Ryan Cooper 020 7689 3354 Sub editor Jim Findlay 020 7689 3373 Sub editor Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 020 7689 3367 Senior account director Charlotte Jesson 020 7689 3389 Commercial project manager Ifzal Afzal 020 7689 3382 Senior account manager Lindsay Hudson 020 7689 3366 Account manager Marie Dickens 020 7689 3372 Management accountant Abigayle Sylvane 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say There are very few lifelines remaining Tesco revisits pledge TESCO claims it is “working hard” to deliver Booker retailers the promises it made following its takeover of the wholesaler �ive years ago. Despite the introduction of Jack’s own-label range, stores claimed they have yet to see banking and mobile payment services. Tesco chief executive Ken

we

retailers

availability

value.” Features writer Jasper Hart 020 7689 3384 @JasperAHHart 41,206 Audit Bureau of Circulations July 2021 to June 2022 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment. For the full story, go to betterRetailing.com and search ‘breakroom’

Murphy said: “These are areas

are working on, but what [independent

are] really interested in is great

and

Megan Humphrey, editor

News editor Alex Yau @AlexYau_ 020 7689 3358

THE CRISIS HAS GONE ON FOR LONG ENOUGH

Retailer Abdul Majid will face a £1,500 per month rise in his bill

reporter Dia Stronach 020 7689 3375

Specialist

JACK COURTEZ

For the full story, go to betterRetailing.com and search ‘Tesco’

News reporter Jill Lupupa jill.lupupa@ newtrade.co.uk

Indies urged to comply with vape recycling laws

MEGAN HUMPHREY

LOCAL shops not complying with vape recycling laws are the latest target for an environmental campaigner who discovered hundreds of single-use disposable vapes dumped on the streets.

Laura Young, from Scotland, went viral this month after uploading a video to social media platform Twitter, claiming to have found 55 littered disposable vapes in just one hour, and has since continued to document her �indings.

As a result, Young is now calling for a complete ban on the sale of the products. When asked what sparked the campaign, she told Retail Express: “It seemed irresponsible that an electrical product being sold as recyclable was being disposed of as litter.”

The news comes after supermarket Waitrose made the move to stop selling the products at the end of December last year, over concerns of their negative impact on the environment and health of young people.

Current Waste Electrical and Electronic Equipment (WEEE) regulations state that anyone selling any type of product falling under the category must legally supply customers with a way of disposing them. However, UK Vaping Industry Association’s director general, John Dunne, revealed: “Up to now there has been genuine con-

fusion among the vaping sector about their responsibilities under the WEEE directive.

“Earlier this year, the Institute of Environmental Management and Assessment alluded to uncertainty around whether regulations covered the type of batteries found in vapes and also questioned the recycling infrastructure in place to support the sector to be more sustainable.

“This is why we are working hard as an industry to �ind a waste-management solution that minimises the impact of vapes on the environment, particularly when it comes to single-use disposables.”

Last week, in response to a consultation, the department for environment, food and rural affairs admitted that it hadn’t explored the issues around waste generated from disposables before.

It con�irmed it would review the current producer responsibility systems for WEEE and batteries, as well as plans to publish delayed consultations on both this year, including vapes.

When asked how independent retailers could sell the devices more responsibly, Young responded: “I’m a big supporter of local independent shops, but it doesn’t mean they have to let things slide just because a product is providing them an income.

“It is their job to know

what the regulations are, and they need to be put into practice, otherwise they are just irresponsibly selling. It’s a hard reality that everyone needs to face. I want to support people moving away from smoking, but in a way that doesn’t have unintentional consequences on the environment.”

Latest �igures from the Of�ice for National Statistics show that the proportion of tobacco smokers in the UK had fallen to the lowest level on record in 2021, with vaping devices such as e-cigarettes playing a major role.

There is evidence some independent retailers are offering the opportunity to recycle the products, including bestsellers El�bar and Lost

Mary, but CEO and founder of online wholesale start-up LocoSoco James Perry urged more to get on top of the law, as the campaign is “likely to catch the attention of trading standards”.

“Retailers need to take charge on this,” he explained. “It’s likely that regulators are going to start coming down hard on retailers as this becomes more of an important issue. Retailers can get a certi�icate to advertise in store when they successfully recycle the products.”

A spokesperson for Elfbar also con�irmed it would be introducing recycling boxes to its retailers. “We are engaging with one of the service providers, ERP,

providing data as required and assessing the recycling scheme,” they said.

Perry revealed the �irm is close to launching its own-branded plastic container for stores to implement. Dunne stressed the UKVIA “will be hosting a special summit on this topic in order to bring all stakeholders together” so that it can “come up with a viablelong-term solution that works for the industry and minimises the impact on the environment.

“Banning single-use vape devices is not the answer as this would deny millions of smokers the opportunity to switch to an alternative tobacco, which is at least 95% less harmful than smoking.”

GOOD WEEK

HOME DELIVERY: DeliveryDrop has slashed its sign-up fee to help retailers combat the cost-ofliving crisis. Instead of a one-off payment of up to £2,000 for the service, which includes a fleet of drivers, retailers now pay £500, and a weekly fee of up to £25.

For the full story, go to betterRetailing.com and search ‘delivery’

SMITHS NEWS: The news wholesaler has renewed its contract with Telegraph Media Group until 2029, which accounts for 11% of its newspaper and magazines revenues. The agreement marks its fourth major publisher contract renewal secured this year.

For the full story, go to betterRetailing.com and search ‘Smiths’

BAD WEEK

TOBACCO: JTI increased its wholesale and RRPs from 9 January. New price lists sent by wholesalers to stores show rises across nearly all products, including cigars, cigarillos, cigarettes and roll-your-own tobacco. The change comes amid increasing pressure on the category from cash-strapped shoppers.

For the full story, go to betterRetailing.com and search ‘tobacco’

AVAILABILITY: A ‘twindemic’ of Covid-19 and flu cases is putting a strain on staffing levels and medicine line availability. Andy Morrison, trading director of DeeBee Wholesale, said the firm had seen a shortage of medicines such as paracetamol. Sales of cough lozenges in December were 50% higher than the year before.

For the full story, go to betterRetailing.com and search ‘medicine’

“I’M lucky because my contract doesn’t end until 2024. It is a really scary time to be involved in the retailing game, but we’re fortunate that we are in a position where we can sustain the impact. The government should help out, and I can’t believe they can get away with not helping us. They need to be more involved and listen to our concerns and come up with long-term solutions.”

Amrit Singh Pahal, H & Jodie’s Nisa, Walsall, West Midlands

“I THINK the move is expected and things will be a lot more difficult for retailers. Electricity will be the last nail in the coffin. We were fortunate enough to save money during the pandemic, which we were going to use towards a refit, but now we are going to have to use it to pay for energy bills. We have to be very careful with how we spend our money.”

Samantha Coldbeck, Wharfedale Premier, Hull, East Yorkshire

“I’M very disappointed. The previous scheme was inadequate. Our bills have already gone up by 16% and this won’t even touch that. It should’ve been done as the percentage of your bill or as a set payment to each business, then everyone would see the same saving. We are doing range reviews to look at the pricing of products to see what we can do.”

03 betterRetailing.com @retailexpress facebook.com/betterRetailing megan.humphrey@newtrade.co.uk 07597 588972

24 JANUARY-6 FEBRUARY 2023

express yourself the column where you can make your voice heard Do you have an issue to discuss with other retailers? Call 07597 588972 or email alex.yau@newtrade.co.uk

your store?

What does the reduction in energy support from the government mean for

Aman Uppal, One Stop Mount Nod, Coventry, West Midlands

Aman Uppal

Discarded single-use disposables found by campaigner Laura Young

Price-marked pack margins improve

ALEX YAU

ALEX YAU

THE margins on pricemarked packs (PMP) are slowly improving as wholesalers continue to apply pressure on suppliers.

In 2022, wholesalers boycotted certain lines after suppliers increased the wholesale price without adjusting the price-mark. Treat bags supplied by Mars Wrigley Confectionery were ditched

by members of the Unitas wholesale buying group, which claimed the company was squeezing shared margin for retailers.

However, senior sources from six major wholesalers, confirmed margins were beginning to improve.

One said: “It is definitely getting better. Suppliers are listening and seeing the importance of the independent supply chain.

“Margins are improving by about 2-3%. More still needs to be done, but it’s a step in the right direction.”

Despite this, one industry figure said some beer and confectionery suppliers were still refusing to take action, but that not every company was squeezing the profit.

“Another one of our major gripes now is that the number of promotions available to wholesalers and retailers

has halved,” they said. “Suppliers are blaming an increase in their costs for this, which was the same reason they gave for squeezing margin previously. One benefit has come at the expense of another.”

Independent retailers confirmed to Retail Express that they have been affected by a reduction in promotions from their symbol group over the past few months.

For the full story, go to betterRetailing.com and search ‘PMP’

Sainsbury’s results

SAINSBURY’S claims to have “delivered its best possible Christmas” for customers, with retail sales up by 5.2%.

In its third-quarter trading update for the 16 weeks to 7 January, the supermarket recorded a like-for-like sales uplift of 5.9%, alongside gro-

cery rising by 7.1%, putting them 12.5% ahead of pre-pandemic levels.

Chief executive Simon Roberts said: “Millions of households managed their budgets differently, hosting larger gatherings again and treating themselves at home.”

For the full story, go to betterRetailing.com and search ‘Sainsburys’

JISP has pledged to improve its deals by reinvesting the £25 reward it pays to retailers to change promotions over each period.

The loyalty app provider confirmed to stores in December that it would be withdrawing the fee. Chief customer officer Greg Deacon said: “We want to ensure shoppers have great offers and deals, and we support this with Jisp-funded

products every three weeks. We have decided to reinvest these monies.”

Cash deposits drop

THE Post Office has experienced a gradual loss in cash deposits month on month.

According to its latest cash tracker, the company reported cash deposits are down 1.2% from £2.40bn to £2.37bn month on month,

with business cash deposits falling by 2% from £1.11bn to £1.09bn.

The drop was attributed to the impact of rail strikes, freezing weather and newly enforced strict bank deposit limits introduced this month.

For the full story, go to betterRetailing.com and search ‘cash deposits’

NEWS 04

REINVESTS IN REWARDS

JISP

For Tobacco Traders Only. *Retailers are free at all times to determine their own pricing. PROTECTION QUALITY FRESHNESS SIGNATURE EVERYTHING IS PREMIUM EXCEPT THE PRICE * – AVAILABLE ON –NEW CRUSH GOLD SILVER STOCK UP TODAY TO SALESNEWSEAL

PAID FEATURE BRAND SPOTLIGHT

What is Chivas Regal and why stock it?

CHIVAS Regal is the most-loved Scotch whisky in the UK1. Its premium 15-year-old blend, Chivas XV, has undergone a redesign, with the new bottle reshaped and elongated to stand taller and prouder on retailers’ shelves, while still retaining its recognisable rounded shoulders. The XV icon, wild in its styling, is also highlighted on the label and bottle capsule.

The Chivas XV Gold bottle features textured tones of champagne gold to add a celebratory feel, and the brand’s ‘luckenbooth’ signifier flexes as hard as the bottle – super-metallic and dripping in gold.

The new design seeks to capture the attention of a new successful, status-driven and style-conscious generation of Scotch whisky drinkers, aged 18-to-32 years old, who buy into new luxury, and mirror Chivas’ values of ambition, generosity and unapologetic success.

“WE’RE proud to deliver a redesign that speaks the language of a fresh new generation of Chivas drinkers while bringing established enthusiasts and connoisseurs along for the journey. Social media has introduced a new, broader audience to the whisky category – consumers with a hustle-first ethos that seek out upmarket brands to align themselves with. We have taken a bold approach with this redesign, with gold on gold crafted details, to cement Chivas XV as the ultimate celebration drink for the hustle generation.”

In

RETAIL

partnership with

betterRetailing.com 05 24 JANUARY-6 FEBRUARY 2023

Chris Shead, off-trade channel director, Pernod Ricard UK

Pernod Ricard UK (PRUK) has unveiled a new look for Chivas XV, which is part of the Chivas Regal brand, and is launching an impulse retailer promotion for its XV Gold variety. RETAIL EXPRESS finds out more

coins

of Chivas XV, available only to

retailers,

consumers to win £5,000 in cash.

Two unique golden

will be hidden in the caps of two bottles

independent

allowing

PRUK

has a range of Chivas XV PoS materials to support the gold coin promotion, including gold coin-style bunting, neck tags, counter mats, posters and strut cards.

including

and in-depot

and free-standing display

In action CHIVAS REGAL FOCUS ON: Key products 1 Savanta, 100 Most Loved Drinks Brands in the UK, 2 AC Nielsen, Total Impulse, Value Sales MAT to 10.09.22 Chivas XV Gold RRP: £39.99 Key stat Chivas XV is a top-10 premium blended Scotch in the impulse channel2 TOP 10 Chivas 12 RRP: £29.95 To find out more about Chivas XV and the full Chivas Regal range, head to chivas.com/en-GB or follow @ChivasRegalUK on Instagram

Chivas XV will be taking over HT Drinks depots and online with branding to disrupt the shopper journey,

external visibility,

vinyls

units.

PRODUCTS

Affordability to drive vape sales

JASPER HART

NEW data from KAM Media, on behalf of Philip Morris Limited (PML), has revealed that UK retailers can expect ‘affordability’ to be the deciding factor for adult smokers choosing a smoke-free alternative in 2023.

PML asked 250 UK convenience retailers what factors they believe will be important for adult smokers switching to smoke-free alternatives at the start of the new year and throughout 2023.

When asked what customers will look for when choosing a smoke-free alternative, retailers prioritised price,

with more than half (57%) agreeing that customers would select the cheapest products available, followed by those products offering the best overall value for money (18%). Smoke-free alternatives that offered the widest taste range available (10%) and those offering convenience and ease (5%) ranked third and fourth, respectively.

When retailers were asked what may prevent smokers from choosing a smoke-free product this year, price again was a factor, with six in 10 concerned that alternatives may be too expensive. Despite this, more than two-thirds (68%) agree that smokers will use smoke-free

CCEP refreshes taste of Dr Pepper Zero

COCA-COLA Europaci�ic Partners (CCEP) has refreshed the taste of Dr Pepper Zero, alongside an accompanying sampling and marketing campaign.

The new taste comes as the Dr Pepper brand is the number-two �lavoured carbonates brand in the UK, worth £150m, and is outperforming the segment in value growth.

Sampling activity will take place at universities and through food delivery services, and will be supported by a targeted outdoor and social media campaign.

Martin Attock, vice president of commercial development at CCEP, said: “We know that taste is the

number-one consumption driver for Dr Pepper fans, and we’ve identi�ied an exciting opportunity to make our Zero variety taste even better, with no signi�icant taste difference between it and the regular variety.”

products as a better alternative in 2023, with retailers themselves ready to support this transition.

More than half (56%) said they stock heat-not-burn

products, such as Heets tobacco sticks, which have an RRP of £5 per pack, and Iqos Originals Duo, to help their customers make the switch this year.

Oreo and Xbox launch on-pack promo

MONDELEZ International has launched a partnership between Oreo and Xbox, offering Xbox gamers exclusive content across top-selling games and the chance to win thousands of prizes.

As part of the partnership, the pattern on the Oreo cookie has changed to pay homage to the Xbox controller, with six embossed special edition cookies available.

Customers can then

scan these cookies on their phones (or enter the barcode from a participating pack online) to get Oreo-themed in-game content in the games Halo In�inite, Sea of Thieves and Forza Horizon 5. Other prizes include Xbox Series S consoles, Xbox Stereo Headsets and Xbox Game Pass Ultimate subscriptions, as well as a grand prize draw for a family holiday to California.

Urban Eat relaunches plant-based range

URBAN Eat has relaunched its plant based range, Roots, with four varieties, aiming to appeal to a broader demographic of shoppers.

The range includes a Cheeze & Pickle sandwich, a Falafel & Houmous sandwich, a Tomato & Pesto wrap and a new Spicy Bean wrap. The sandwiches have an RRP of £3.49-£3.69, while the Tomato & Pesto wrap has an RRP of £3.59-£3.79 and the

Spicy Bean wrap is priced at £3.59-£3.69.

At a recent press briefing, the supplier told Retail Express that with 72% of lunchtime food purchases being made up of sandwiches, it wanted to be the go-to choice for those looking for vegan options in the category.

KP Snacks pushes Hula Hoops Puft

KP Snacks has invested £1m in a new campaign for Hula Hoops Puft, ‘Hula licious, Hula lightful’.

Launching at the beginning of February, the campaign runs for six months across radio, on-demand and outdoor.

The strapline focuses on the range’s low-calorie credentials, with Puft containing 72 calories per pack.

Last year, KP Snacks relaunched Hula Hoops Puft to be HFSS-compliant with new packaging and a campaign that reached 39 million adults. The range has had a penetration growth of 23% in the past 24 weeks, has a retail sales value of £10m and is consumed by more than two million shoppers each year.

Mars launches vegan Maltesers drink

MARS Chocolate Drinks & Treats (MCD&T) has launched Maltesers Vegan Instant hot drink.

Its launch comes as the value of instant vegan hot chocolate has tripled in the past year.

Maltesers Vegan Instant is available in a 250g jar, which contains 10 servings, at an RRP of £2.99. It is launching initially in Aldi, with wider wholesale and convenience availability expected later in the year.

Michelle Frost, general manager at MCD&T, said: “We aim to ensure that everyone can enjoy the iconic �lavours of our renowned confectionery brands in different forms and formats.

With the growing number of consumers seeking vegan products, the launch of Maltesers Vegan was a natural range extension.”

STG redesigns Moments cigar packs

SCANDINAVIAN Tobacco Group UK (STG UK) has launched redesigned packaging for its Moments miniature cigar brand.

The new design has rolled out across packs of Moments Blue and Moments Original, with Moments Panatella to follow suit in May.

It consists of a larger, more simpli�ied logo and a fresher colour scheme with an

extended wisp of smoke. The cigars inside are unchanged.

The supplier said the redesign aids shelf stand-out and appeals to young adult smokers.

Moments is the fastestgrowing value-for-money cigar in the UK, although Natalya Scarpetta, marketing manager at STG UK, said it has under-traded in convenience stores.

Spar adds to ownlabel sweet range

SPAR has launched �ive own-label confectionery lines across take-home and impulse formats.

The new take-home varieties are Giant Strawberries, which are vegan and vegetarian, Yummy Bears and Sour Gummy Mix. Each has an RRP of £1.20.

Meanwhile, Sour Flames and Tilly the Turtle fruit jellies join the impulse range, with RRPs of 59p. The launch of Tilly the Turtle comes in the wake of Spar’s previous confectionery character, Myles the Meerkat.

Hannah Such, Spar UK assistant brand manager, said: “We are delighted with how well Myles the Meerkat is selling in stores and

we felt it was time to add a new character to the range.

Tilly the Turtle fruit jellies is perfect for consumers who have an interest in innovative confectionery.”

06

Budweiser delists Bud Light Seltzer

BUDWEISER Brewing Group UK&I (BBG UK&I) is set to delist Bud Light Seltzer in the UK, as it looks to focus on developing its other readyto-drink (RTD) brands.

Retail Express has seen correspondence from a leading wholesaler, advising that the range would be delisted “in the new year”.

Bud Light Seltzer launched in the UK in April 2021, and was the of�icial hard seltzer sponsor of the England football team during Euro 2020.

A spokesperson for BBG told Retail Express: “Bud Light Seltzer will

be discontinued in the UK, as BBG focuses on growing RTDs with proven consumer favourites, Corona Tropical and Mike’s Hard Seltzer.

Bud Light Seltzer lives on in other markets.”

New frozen chocolate banana brand

NEW snacking brand Pukpip has launched into convenience stores, offering a range of real frozen bananas dipped in chocolate.

The brand aims to tap into the rise of permissible but indulgent frozen snacking and desserts.

It is available to convenience retailers from CLF Distribution and Consort Foods in Milk Chocolate and vegan Dark Chocolate varieties. Each variety comes in a multipack of three at an RRP of £3.99. A White Chocolate variety is set to launch later this year.

Pukpip claims to be the �irst product of its type to

Global Brands acquires Hooch brand

GLOBAL Brands has purchased the Hooch, Hooper’s and Reef brands from Molson Coors Beverage Company.

The Midlands-based supplier, which claims to be the biggest branded supplier of packaged cocktails to the UK off-trade, has produced and distributed these brands under license from Molson Coors since 2012.

Its existing brands include VK, Franklin & Sons tonic and Amigos Tequila Beer.

Since 2012, Global Brands says Hooch has enjoyed “huge” growth, buoyed by the launch of Pink and Orange varieties in recent years.

Nino Beneta, managing

director of

Coors

and License EMEA & APAC, said Molson Coors was shifting its focus to its international beer brands, including Coors, Staropramen, Carling, Madrí Excepcional and Blue Moon.

launch in the UK, with its sister company Diana’s seeing sales success in the USA. The supplier says it is aimed at millennial female

shoppers.

New campaign for Müllerlight

MÜLLER Yogurt & Desserts has launched a campaign for Müllerlight, highlighting the range’s breadth of �lavour.

The campaign launched on 2 January and spans print and outdoor advertising, in-store PoS and radio.

Its messaging will change

each month in the �irst quarter of 2023, with initial artwork encouraging shoppers to “grab January by the spoon” and “lighten up those wintry nights”.

The campaign follows Müller’s recent Müller Corner campaign.

WKD extends Love Island tie-up

SHS DRINKS has announced that WKD has extended its partnership with reality show Love Island for a further two series in 2023.

The RTD alcopop brand, which is the number-one RTD in the on- and off-trade in the past 12 weeks, will be the show’s of�icial alcohol

partner for series nine, which airs from January to March, and series 10, which will air in summer. This marks the �irst time the show has aired two series in the same year.

The extension of the deal comes as WKD sales are at a 10-year high.

Fibre One launches on-pack promo

GENERAL Mills‘ snack bar brand, Fibre One 90 Calorie, has launched an on-pack promotion across its brownie range to drive sales.

The promotion, which runs until 20 February, offers shoppers the chance to win the ‘ultimate craveable experience’. There are more than 600 prizes up for grabs, including spa days.

Shoppers can enter the promotion by buying one of the following varieties: Chocolate Fudge Brownie, Cookies & Cream Brownie, Salted Caramel Squares, Birthday Cake Squares and Lemon Drizzle Squares.

JP Del Carmen, marketing manager at Fibre One 90 Calorie, said: “The ‘new year,

new me’ period is a key time for us to recruit new people to the brand and our Crave Club promotion will help us kick off 2023 in a big way.”

Jakeman’s launches sugar-free variety

MEDICATED confectionery brand Jakemans has launched a sugar-free version of its Throat & Chest variety.

The �lavour, which is Jakemans’ �irst sugar-free launch, is available in a 50g bag containing 20 lozenges at an RRP of £1.29.

It has no arti�icial colours or �lavours and is suitable for vegetarians.

Elizabeth Hughes-Gapper, brand manager for Jakemans, said: “It’s important we offer our customers a variety of �lavours and we are thrilled to be launching our �irst sugar-free product. It is something we hope to do across all of our �lavours and to begin with we have

Mondelez brings back football promo

MONDELEZ International has relaunched its ‘Win a day in their boots’ Cadbury promotion for a second year in a row, offering football fans the chance to win prizes through its Cadbury FC platform. To enter, shoppers must buy a participating pack, enter the barcode and batch code online, and select their

preferred experience day.

Prizes up for grabs are a VIP hospitality match day and stadium tour, a training day with club coaches and full training kit for the winner and a group of friends, or a meeting with a football legend with a behind-the-scenes day. Shoppers can also win hundreds of match tickets.

chosen a customer favourite, Throat & Chest, with its fresh menthol taste.”

Weetabix launches digital recipe book

WEETABIX has brought back its ‘Any which way a bix’ campaign with a free digital recipe book to inspire shoppers with healthy, affordable meals and snacks to counter the cost-of-living crisis. Every recipe in the book costs around 80p per serve. The supplier says it has been speci�ically developed by experts to cover all sorts of occasions throughout the day, with dishes such as a

Weetabix Smoothie, Weetabix Protein Ball, Weetabix Breaded Chicken and Weetabix Tiramisu.

The book will be supported by a £2m investment including a new broadcast advert that will also air across YouTube and ondemand.

There will also be in-store PoS and in�luencer activity across Facebook, Instagram and TikTok.

07 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com

Molson

Export

FOR EXISTING ADULT SMOKERS & VAPERS ONLY.

This product contains nicotine. 18+ only. Not a smoking cessation product. Fontem 2022. OVER 18 ONLY

PRODUCTS

Prime partners with Spar

JASPER HART

VIRAL soft drinks brand Prime has chosen Spar as one of its �irst of�icial routes into independent wholesale and convenience.

An employee from the brand’s parent company, Congo Brands, con�irmed the distribution deal on social media in January. It was initially available exclusively through Asda in 2022, before being made available in Aldi. They con�irmed to Retail Express that an “activation plan” was in place for further distribution into retail and wholesale, with “more information available as they are put in place”.

Spar Scotland has four 500ml �lavours available: Blue Raspberry, Tropical Punch, Ice Pop and Lemon Lime at a wholesale price of £13.85 for a case of 12. When sold at the £2 RRP, Spar said retailers can make a pro�it margin of 30.75%.

The brand has gained huge popularity due to being owned by viral YouTube stars Logan Paul and KSI. Its popularity has led to massive queues of people trying to get their hands on the product.

A Spar spokesperson said: “Spar is the �irst symbol group in the convenience channel to stock the Prime Hydration Energy Drink. While stocks last, it is cur-

‘Spectacularly nice’ hot-choc promo

MONDELEZ International has launched a ‘Spectacularly nice’ promotion across its Cadbury Hot Chocolate range.

The promotion runs for three months across Cadbury Drinking Chocolate 500g, Instant Hot Chocolate 400g and Highlights Milk Chocolate 220g.

To enter, shoppers need to buy one of these lines and enter their information at nice.cadbury.co.uk, or scan the QR code on the back of the pack.

Prizes up for grabs include London West End theatre evenings or an overnight trip to Paris, as well as hundreds of Cadbury Hot Chocolate ham-

pers including takeaway vouchers.

Lorena Moyano, brand manager for Cadbury Hot Chocolate at Mondelez, said: “These dark nights and chilly weather make everyone want to cosy up and spend time with loved ones, so why not do it in a spectacular way this winter with Cadbury Hot Chocolate?”

rently available in participating Spar stores in England, Scotland and Wales with

more Spar stores looking to make the product obtainable over the coming weeks.”

New Oat porridge from GBP

The Great British Porridge Co has added an Oatrageously Original variety to its range.

The new porridge mix is available in a 385g pouch, which contains eight servings at an RRP of £3.85.

It can be consumed on its own, or with other ingredients. “Smoothie bowls, bircher and overnight oats are becoming increasingly popular, so we wanted to offer porridge lovers across the country the chance to get creative with their breakfasts and design their own unique bowls of greatness using this delicious new launch,” said Matt Hunt, owner of The Great British Porridge Co.

For more information visit our blu bar Knowledge Hub. www.blubarhub.co.uk

08

EXPLORE A WORLD OF

www.blubarhub.co.uk

Domestos launches all-in-one spray

UNILEVER UK&I has launched Domestos Power Foam, which it claims is the UK’s �irst upside-down foaming spray.

Available in 450ml Arctic Fresh and Citrus Blast variants, each at an RRP of £3, the spray is intended as a one-stop cleaning solution across multiple household surfaces.

It is also bleach-free and has 360-degree spray trigger technology that works upside down, for hardto-reach areas. Additionally, the bottles are made from 50% post-consumer recycled plastic and are recyclable without the trigger and sleeve.

Unilever UK&I will

support the launch with a £10m marketing investment, including a TV advert and outdoor campaign from March. These will be preceded by a social media in�luencer campaign and in-store PoS available this month.

Ginsters launches new limited slice

GINSTERS has continued its run of limited-edition varieties with the launch of a Cauli�lower Cheese Slice.

The new �lavour is available until May at an RRP of £1.65. As with all other Ginsters products, it contains no arti�icial colours, preservatives or �lavours.

It comes in the wake of the relaunch of the Festive Slice over the Christmas period and the Creamy Garlic Mushroom Slice earlier

last year.

According to the supplier, these seasonal launches have delivered more than 600,000 new shoppers to the savoury pastry category and have driven 47% incremental growth.

Sam Mitchell, Ginsters managing director, said: “We are committed to bringing innovation to our category and this is just the beginning of our exciting plans for 2023.”

Quorn campaign focuses on taste

QUORN has launched its ‘So tasty’ campaign, designed to show Britain’s chicken eaters that its products taste as good as chicken.

The brand anticipates that the campaign will reach millions of consumers across TV, on-demand, digital and social media, as well as a mass sampling campaign.

It follows Quorn’s ‘So tasty, why choose the alter-

native?’ Deli campaign in September 2022, and highlights three of its top-performing products: Quorn Crispy Nuggets (Quorn’s number-one-selling chicken product), Quorn Crunchy Fillet Burger and Quorn BBQ Sticky Wings. These three lines are from the brand’s Takeaway range, which launched a year ago and is now worth £3m.

Hancocks expands Bonds Shaker Cups

HANCOCKS has expanded its Bonds Shaker Cups with a new single-�ill range.

The range features a mixture of �izzy and gummy sweets taken from top-selling pick-and-mix varieties.

Among the gummy Shaker Cups are Giant Strawbs, Gummy Meerkats and Dracula Teeth, while Green Cola Bottles, Fizzy Bubblegum Bottles and Fizzy Cherries make up the �izzy �lavours. Each Shaker Cup has an RRP of £2.50.

Chris Smith, marketing communications manager at Hancocks, said: “The new range of single-�ill Shaker Cups consist of Bonds’ bestselling sweets that are both gummy and �izzy to

ensure there’s something for everyone. They’re great for seasonal events, parties, gifting and sharing making them must-stocks all year round for retailers.”

STOCK UP NOW THAT’S

UNLIT

09 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com Cups �izzy

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS What

do you think?

NATIONAL WAGE:

“I WANT to pay my staff a reasonable wage. For many business, however, the wage bill is the biggest expense. Many business owners already work incredibly long hours, and they will run themselves into the ground doing 90-hour weeks.” Vince Malone, Tenby Stores &

“MANY retailers facing a cost-of-trading crisis will be asking staff to do more. There is an emotional pressure of feeling responsible for staff’s well-being, but also we are coping with increased demands from customers to donate food and groceries.”

“WE had a good Christmas, but by the week leading up to the new year, our sales had fallen beneath what we were hoping. Our fuel bills are rising, the National Living Wage is going up and the price of food is increasing, so it’s costing us an extra £500 a month.”

Bay Bashir, Go Local Extra Belle Vue Convenience, Middlesbrough, North Yorkshire

Notay’s, Batley, West Yorkshire

“SEND them a letter or an email asking for a meeting. If your police and crime commissioner is running a survey, then respond to it. You want to have that relationship where you can pick up the phone and get a response from someone.”

Jason Birks, Moscis Convenience Store, Peterlee, County Durham

“IT has been tough, but the government support did help when it mattered most. I know they haven’t continued with giving small businesses as much, but I do want to commend the chancellor, because at least they are still helping, even though it’s smaller.”

Guarave Sood, Neelam Post Office & Convenience, Uxbridge, west London

“WE have an annual meeting with our MP. We talk about local grants for businesses and what’s available, and then how my MP is going to help us. Ultimately, they want to keep that relationship strong because they’re after your vote.”

Harj Dhasee, Morrisons Daily Village Store, Mickleton, Gloucestershire

10

OPINION

What impact will the next rise have on mental health?

Mo Razzaq, Premier Mo’s, Blantyre, South Lanarkshire

RELATIONSHIPS: How are retailers connecting with local leaders? It’s costing us an extra £500 a month Send them a letter or an email

Business owners will run themselves into the ground

PRIME: Is the viral drink still an opportunity for stores?

COST-OF-LIVING: How are retailers reacting to the crisis?

“IT has definitely been a big seller in my store. I sold nearly £300-worth within three hours of selling it at £5. Purchases were limited to two per customer to manage demand. We’ve sold out now. However, the trend is at its height, so we have to make the most of it.”

Retail

Ian Lewis, Spar Minster Lovell, Oxfordshire

Call

Express on 020 7689 3357 for the chance to be featured

I think the trend will be dead very soon

“I THINK the trend will be dead very soon and there will be a number of independent retailers stuck with a lot of stock that they can’t sell. There is no denying it’s been popular, but store owners need to be very careful how much they buy into it, as it won’t last forever.”

COMING UP IN THE 27 JANUARY ISSUE OF RN Pricewatch: see what other retailers are charging for boxed chocolates and boost your own profits Hot drinks machines compared: find the right one for your store with our in-depth guide Nicotine pouches: the latest trends and opportunities in this profitable category + STAY INFORMED AND GET AHEAD WITH RN betterRetailing.com/subscribe ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor

Serge Notay,

Premier

Post Office, Pembrokeshire

Letters may be edited

Getting ready to pass on my business

In early January, we started refitting some of our five stores in partnership with our wholesaler, Parfetts. I now have a Local, a Go Local and a Go Local Extra store. This means we are offering our customers an off-licence, a mediumsized convenience store and a larger store, all within a one-mile radius.

‘Retailers need to be vigilant of PayPoint scam’

I’VE been told that one retailer in Durham has become the victim of a new PayPoint scam.

They said the person came in and asked to top-up their pre-paid card via PayPoint. They then ran the request and issued the voucher.

When the customer was prompted to enter their card

details, they opted for the ‘card not present’ option, which means they can get away with not paying.

I know retailers in the surrounding area are really worried about this, and I want to warn them to be aware of what’s going on. This is the second time scammers have targeted independent stores.

COMMUNITY RETAILER OF THE WEEK

‘We’ve installed a food donation box’

“WE have teamed up with local charity Take Ten to launch a ‘pay it forward’ box. We are encouraging people to come in and anonymously donate any food items they wish for those struggling in the community to take advantage of. The idea came from a customer telling me that she was really having trouble feeding her family, and I wanted to do more to help people with the cost-of-living crisis. If people aren’t comfortable with coming in and taking items, they can contact Take Ten, who will help them out.”

A few retailers fell victim to a fake cash pay-out voucher scam last November, so it’s important to raise awarness

Ali Awan, H&H Convenience Store, Gateshead, and branch secretary at the Fed

A spokesperson for PayPoint responded:

COMMUNITY

“To date, we haven’t had any retailers making us aware of this particular issue, but we’re always committed to offering the best possible support. We would strongly request that anyone with concerns or evidence of fraud within our network gets in touch directly and promptly so that we can take action.”

The new Go Local Extra fascia is more bespoke, and it means we can access stronger, more keenly-priced promotions. I always like to stock price-marked packs and strong promotions across our stores.

The cost-of-living crisis is affecting our business with higher wages for our staff and higher overall overheads.

A refit is a significant investment, but we’re fortunate to have built up a lot of capital, which is one of the benefits of having been in the industry for 25 years. We also saw an uplift from sales of £80,000 a week to £100,000 per week during Covid-19. This was all while maintaining our overheads at the same level, which meant our profitability jumped by 40%.

Any business that didn’t see a significant increase in their sales during the pandemic just wasn’t retailing properly, in my opinion.

By keeping our store standards high, remaining keen on price and ‘boxing clever’ with our buying, we’ve managed to hold on to those additional sales.

Looking further forward, I’m now 50 years old, and I’m starting to think about passing my business on to the next generation, so that I can start spending a bit more time with my wife.

RETAILER

OF THE WEEK

I have three children and one is already working in the business, while another is currently shadowing one of our store managers to see if they would like to join the business as well. As far as I’m concerned, family life is most important of all, so I want to ensure I’m passing on a stable business for them.

It’s also important to make sure they know how to respect each other and have discussions where they might not agree without things blowing up. That’s really important.

One of the benefits of working with young people is they see things you don’t and bring fresh ideas to the stores. I remember when some of our younger staff members started telling me about vaping and how big it was. That’s something I hadn’t seen at all but, by listening to them and taking their ideas on board, I was able to add an important and profitable category in store.”

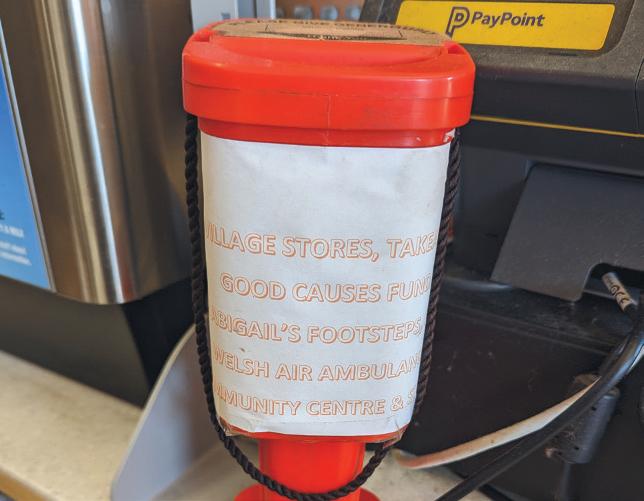

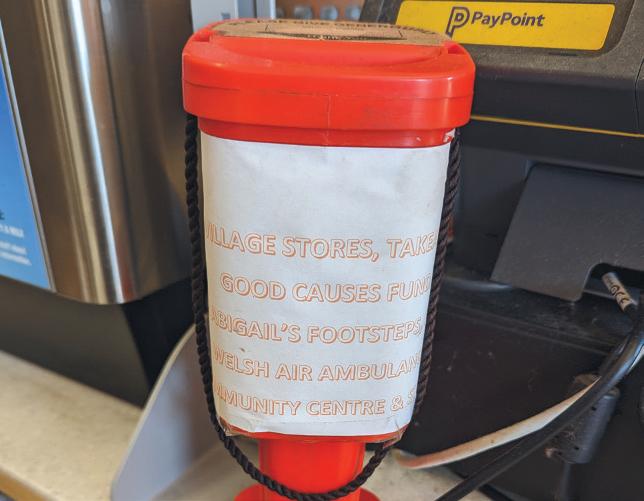

“WE’VE always tried to raise money for local charities with a counter collection tin. We’ve had one for five years, and in that time we’ve generated £1,500. However, we’ve just finished our latest round. We’ve decided to donate the money to Welsh Air Ambulance, who are a real asset, and two other charities helping support families who have experienced a stillborn. This one in particular is close to our hearts. It feels really good to be able to give back where we can.”

11 betterRetailing.com 24 JANUARY-6 FEBRUARY 2023

LETTERS

Get in touch @retailexpress betterRetailing.com facebook.com/betterRetailing megan.humphrey@newtrade.co.uk 07597 588972

Each issue, one of seven top retailers shares advice to make your store magnificent

‘We raised £205 with a counter collection’

Andrew Johnson, Dafarn Newydd, Llanwddyn, Powys –@LlanwddynShop

Serge

Notay, Notay’s Convenience, Batley, Leeds – @notays

BAY BASHIR Go Local Extra Belle Vue Convenience, Middlesbrough

DEMAND FOR SPRING SWEETS

TOM GOCKELEN-KOZLOWSKI reveals this year’s spring confectionery options and how to drive sales

SPRING INTO ACTION

IF you’re still coming to terms with the end of the annual Christmas sales bonanza, then, in the confectionery category at least, suppliers have good news.

“Spring is a good time to grow confectionery sales as there are three seasonal events to cater to – Valentine’s Day, Mother’s Day and Easter,” says Kathryn Hague, head of marketing at Hancocks.

“With Easter being the biggest confectionery season after Christmas, retailers can bring in a strong revenue stream from seasonal sales.”

And while the UK braces for turbulent economic times as costs continue to rise, retailers are hopeful that confectionery will be a category that remains strong.

“Confectionery is still very much an affordable luxury – even if prices are getting steeper,” says Arjan Mehr, who owns a Londis store in Bracknell, Berkshire.

“It’s important that stores keep their confectionery ranges ‘alive’ with the right mix of new products and bestsellers.”

While Easter remains the biggest single spring confectionery event, Mehr says stores shouldn’t forget Mother’s Day at any cost.

“It doesn’t matter where your store is, or who your customers are, people will spend their last penny on their mums, if they have to. We always make sure we have a good range of boxed chocolates for this reason,” he says.

CATEGORY ADVICE CONFECTIONERY 12

tel: 0330 202 0903 | email: help@worldofsweets.co.uk www.worldofsweets.co.uk

Sweet PARTNERS IN SUCCESS

EASTER PRODUCTS FOR 2023

THE big message from Susan Nash, trade communications manager at Mondelez International, is that stores must order sufficient stock of seasonal impulse and sharing favourites from “well-loved brands, such as Cadbury Creme Egg and Cadbury Mini Eggs”.

This year sees the arrival of the first-ever white choco-

late Cadbury Creme Egg to further expand this seasonal opportunity.

One of Mars Wrigley’s major new arrivals for Easter 2023 is M&M’s Easter Shapes, described as ‘hollow chocolate shapes filled with Mini M&M’s and individually wrapped in colourful foil’.

The firm says that the mar-

ket for these seasonal shapes is growing, with 15% of households buying Easter shapes and 13% of shoppers repeatpurchasing these as gifts during the Easter period.

Other Mars activity includes a new design for M&M’s Speckled Eggs and the return of Maltesers Bunny and Orange Bunny. Premium op-

tions, meanwhile, include a new Galaxy Caramel Truffles Luxury Egg.

Not every major launch is season-specific, however.

Nestlé Confectionery recently expanded its KitKat Chunky range with the launch of a limited-edition Caramel variety. Now available to convenience stores and wholesale with an

RRP of 70p, the product meets the number-one flavour trend in the UK, according to Kantar.

“We’ve taken it to the next level by combining a delicious layer of runny caramel with our crisp KitKat wafer to create a taste sensation,” says Callum Smith, assistant brand manager for KitKat at Nestlé Confectionery.

Hague, head of marketing, Hancocks

Hague, head of marketing, Hancocks

“IT’S important for retailers to expand their gift ranges for spring, as Easter, Mother’s Day and Valentine’s Day all bring customers to shops who are looking for treats to give to their loved ones. Hancocks offers a large selection of gifting products to help retailers cater to this demand.

“Retailers can be confident that the seasonal products will catch shoppers’ attention and result in sales by using PoS that is clear and appealing.

Making sure that the stands for promotional products are in a visible location will make it easier for shoppers to find what they’re looking for. Seasonal impulse treats should be placed near the tills to boost unplanned purchases.”

13 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com

Kathryn

SUPPLIER VIEW

Find out more about the companies listed here and many more on our betterRetailing.com Supplier Directory for independent news and convenience retailers.

From FMCG suppliers and back-office services to shop equipment and trade support, we are adding new suppliers every week.

Visit: bit.ly/supplier-directory or scan the QR code above.

CATEGORY ADVICE CONFECTIONERY

THE law around how retailers sell sugar confectionery in the UK has changed.

The arrival of HFSS location legislation last October affects stores of different sizes to different extents. Despite this, suppliers say that the new regulations will do little to affect the important role confectionery plays.

“Confectionery is one of the top-five categories purchased on impulse in convenience stores, and there is a clear opportunity to provide shoppers with more sugar-free and better-for-you products that offer portion control and added health benefits – this will be vital in supporting category growth going forwards,” says

SUPPLIER

VIEW

Sutherland, UK & Ireland sales director, Ferrero UK

“KINDER Surprise is a big focus for us at this time of year and accounts for 33% of Kinder unit sales during Easter. Kinder Seasonal is returning for Easter 2023 with familiar favourites such as Kinder Joy, Kinder Egg Hunt and Kinder Figures. Looking ahead, we’re confident 2023 will be even bigger for the Kinder brand, especially as we have a licence agreement with Disney’s Avatar to provide figurines in our 100g Surprise easter eggs. On top of this, we reimagined our Kinder packaging last year, bringing a more distinctive design and a refreshed Easter bunny image to maintain relevance for the Kinder brand during the season.”

Mark Roberts, marketing and trade marketing director at Perfetti Van Melle.

With this in mind, Perfetti Van Melle has further invested in its range of sugar-free sweets with Mentos Sugar Free Fruit Gum.

“Flavour is key when it comes to refreshment and is a particularly strong USP for

Mentos Pure Fresh Gum, which is shaking up the category by offering more than the traditional spearmint and peppermint flavours,” says Roberts.

Stores also shouldn’t forget that consumer diets are changing – particularly at the beginning of the year.

“With Veganuary 2023 shaping up to be the biggest yet,

Swizzels is offering its top tips

Swizzels is offering its top tips for those retailers hoping to appeal to [these] customers,” says Mark Walker, sales director at Swizzels.

“In 2022, 83% of Veganuary participants planned a permanent diet change, so it’s essential retailers stock a range of bestselling, well-known brands to entice customers.”

15 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com cider

Jason

ADAPTING TO HFSS REGULATIONS

Kinder Mini Figures 90g Kinder Surprise 100g & 220g Eggs Kinder Surprise Bunny 75g Kinder Surprise Bunny 55g DON’T MISS OUT THIS EASTER To find our full Easter range please visit: yourperfectstore.co.uk The Kinder Surprise range counts for 50% of total Kinder value sales over Easter! Nielsen Scantrack Total Coverage 13 weeks Easter Confectionery. Until WE 29.10.22

RETAILER VIEW

Avtar Sidhu, St John’s Budgens, Kenilworth, Warwickshire

“WE ordered our Easter eggs – a category we always sell out of – last summer, bumping up our order by 10%. Now, with the cost-of-living crisis, I’m less certain this was a good idea. Fortunately, confectionery remains an affordable luxury and impulse products such as Cadbury Mini Eggs and Cadbury Creme Eggs are selling strongly.

“Valentine’s Day and Mother’s Day are great opportunities for cross merchandising and we put together a display with confectionery, champagne, flowers and soft toys as well. One advantage here is that a lot of what you can sell for Valentine’s Day will carry over to Mother’s Day, too.”

MEDICATED CONFECTIONERY SALES BOOST

“THE approaching spring months will see a continuation of cold and flu symptoms after a busy winter period,” says Elizabeth Hughes-Gapper, Jakemans’ brand manager.

While a widespread national bout of ill health isn’t usually reason for cheer, there is at least a sales opportunity to be had, Hughes-Gapper says.

“These symptoms can be self-medicated, with consumers continuing to find quick and convenient shopping solutions for products offering symptom relief,” she says.

The medicated confectionery category is up by 73.8% in terms of value sales and 50.2% in terms of unit sales within the past 12 months.

“Independent retailers can maximise their sales by stocking a range of remedies.

Throughout the year, menthol lozenges – such as Jakemans – are an essential product to stock to soothe the symptoms of a sore or tickly throat and keep airways clear,” she says.

Illness is at an all-time high, following subsequent

lockdowns, and retailers have noticed an increased opportunity to sell medicated confectionery. “I’m seeing higher sales of cough sweets, during the colder months, but also year-round,” says Mehr. “There seems to be a switching away of chewing gum in favour of mentholflavoured sweets.”

RETAILER SUPPORT

WITH

Mondelez

“We

sign up today, and explore the many informative resources on Snack Display to help them maximise their sales and stay up to date,” says Mondelez’ Susan Nash.

Among tips for retailers from Bestway Wholesale, meanwhile, is merchandising the main area of your store so customers can easily shop the

category throughout the spring confectionery season, resulting in the potential of increased spend and repeat purchases..

“Bestway has the category advice tools to support customers and ensure they stock the ‘must stock’ lines, such as sharing bags and chocolate blocks,” says Kenton Burchell, trading director for the wholesaler.

CATEGORY ADVICE CONFECTIONERY 16

spring confectionery providing an opportunity to grow sales for all, suppliers stand ready to help.

recently launched a new retailer-focused website: Snack Display. The site includes product news, bestseller information, category advice, market trends and planograms.

encourage retailers to

BOSTON, E NGLAN D EST 1907 SAME GREAT FLAVOURS NATIONAL CAMPAIGN SUPPORT • TV • RADIO • OUTDOOR • PR • www.jakemans.com Jakemans Retail Express 128 x 150.indd 1 09/01/2023 16:49

BAKING UP BREAKFAST SUCCESS

Adapting

ranges to meet different shopper demands is vital when attracting the morning crowd, JOANNA TILLEY

reports

MEETING THE RIGHT NEED

WITH customers’ lifestyles and working situations more varied than ever, there is not a ‘one breakfast solution fits all’ strategy for this category. When millions returned to the office, demand for quick and easy solutions increased, and an additional 57 million servings were being chosen for being ‘quick to prepare’.

However, more people working from home has also resulted in other consumers enjoying more leisurely breakfasts. This second habit does not appear to be a threat to convenience as more than half of consumers working

from home are still buying breakfast and lunch from local retail outlets. This means convenience stores can win with both groups if they provide the right options for the quick snacker and slow riser.

Sandeep Bains, owner of Welcome Faversham in Kent, says retailers need to supply more than a flapjack for breakfast, as consumers are looking for innovation and choice.

“You need to be supplying a range. It’s no good sticking to one thing,” says Bains. “No one wants the same thing for breakfast every day.”

“WE are removing Costa Express from the store and adding Pret Express because we think they do better coffee, and they have oat milk and other dairy-free options, which will help expand our reach. It is important to offer a range of milk, as more people are avoiding dairy products. This will improve our coffee sales and make a vast improvement to our sales across the whole breakfast range.

“When people pick up our coffees, they will also be attracted to our hot breakfast range, which includes hot dogs, cheese twists, pastries and sausage rolls. Breakfast is a high-margin category, and we can also maximise sales by perfecting the range on our delivery platform. We have spent the past year pushing our instore bakery and we will continue to do so in 2023.”

17 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com CATEGORY ADVICE BOOSTING BREAKFAST 17

RETAILER VIEW * Non Price marked packs available. Retailers free to set their own prices ** Nielsen, total coverage exc discounters, value sales, w.e. 17.12.22 *** Nielsen, total independents & symbols, value sales, w.e. 17.12.22 POSITIVE ENERGY STARTS HERE BEST-SELLING BELVITA BREAKFAST FLAVOUR IN THE CONVENIENCE CHANNEL*** STOCK UP NOW 46755 NEW

Sandeep Bains, Welcome Faversham, Kent

ADVICE BOOSTING BREAKFAST

ARE MEAL DEALS WORTH IT?

WHILE offering a free coffee with a pastry is often used as a sales strategy, the retailers Retail Express spoke to did not feel this worked for their store.

Ian Handley, of Handley’s Go Local in Cheshire, says he has seen no significant increase in sales and believes it currently makes sense to stick with the higher margins that independ-

ent sales bring.

Bains agrees, believing that a strong range of coffee and pastries sells itself, and that many people picking up a coffee would naturally choose a pastry or something hot to go with it.

“If my suppliers explored this option, I might go with it, but, at the moment, we are

GET ON THE DELIVERY TRAIN

LONDIS Solo Convenience store retailer Natalie Lightfoot says delivery through Snappy Shopper has increased sales of more traditional items such as cereals, cereal bars and bread.

“The only thing we have changed in this category recently is offering home deliveries, and we offer the items at the same price as in store, to a three-and-a-half-mile radius,” says Lightfoot.

“This has helped as we have lost some trade around us because of businesses closing, but we have gained through this online service.”

Lightfoot says traditional Scottish potato scones are one of the top three sellers online, and that using local suppliers means they can compete

with the supermarkets with a more diverse range of locally sourced items.

Whether it is for delivery or in-store sales, Chris Dubois, Weetabix head of category and in-store excellence, believes retailers should be aware of the growing popularity of private-label products.

“Private label now represent more than 47% of volume sales in the category, a figure set to increase as discounting retailers have increased volume share from 42% to 48%,” says Dubois.

“To compete with this challenge, Weetabix offer a wide range of formats and pack sizes for all types of stores so that everyone has choice from a brand they trust.”

selling close to 20 hot dogs a day and these sales are creeping up,” says Bains.

“The cost-of-living crisis affects retailers, too, and we need good margin. Margin on coffee can be limited because we need to sell quite a few cups a day to make a profit.”

However, Samantha Winsor, marketing manager at Lant-

männen Unibake UK, thinks retailers should still consider meal deals as value becomes more important to shoppers.

“Linked deals and cross promotions are crucial, as 56% of millennials and gen Zs say a hot or cold drink and a Danish pastry pairing would increase their desire to purchase,” she says.

HEALTH AND TREATS

“THE latest data from Mintel shows fruit is the fourth-most popular food to be eaten at breakfast, after cereal, bakery and porridge,” says Andrew Bradshaw, UK sales director at Dole Sunshine Company.

Health is high on consumer radars, with 36% of breakfast consumers saying health reasons have prompted them to change what they have

for breakfast over the past 12 months. “This drive to be healthier is also apparent with the potential for breakfast foods to shout about calorie content, as 45% say they consider how many calories are in their breakfast as part of their daily intake,” says Bradshaw.

Susan Nash, trade communications manager at Mondelez International, says recent

research found that 19% of people pay more attention to the nutritional value of their food than they did before the pandemic and that aspirations for healthier eating often take most prominence in the morning.

However, retailers should consider a range with both healthy and sweet treats, as plenty of customers still look

to start their mornings with a sugary kick.

“The past 12 weeks have seen the sweet treats subcategories outperform traditional in value and volume,” says Rachel Wells, UK sales director of St Pierre Groupe.

“Brioche, croissants, sweet buns and pains au chocolat have had growth of 21%, 18%, 12% and 21%, respectively.”

Stock top-selling lines with strong brand names that consumers know and love. Product quality and brand familiarity drives selection for around a third of shoppers, and this is especially true within butters and spreads, a brand-rich category.

As well as dedicating shelf space to healthier options, ensure you make it easy for shoppers to identify healthy choices. An established brand within dairy-free alternatives, such as Vitalite, should be considered for customers following an avoidance diet.

Price-marked packs (PMP) are a proven way of bringing in sales within chilled. For breakfast categories such as spreads and cereals, which typically carry a significant price premium, PMPs are a way of ensuring an attractive deal for customers.

18 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com

CATEGORY

Allison Wallentin, category manager for convenience, Saputo Dairy UK

SUPPLIER VIEW

Three tips to grow breakfast sales

Our social channels are the quickest way to keep up to date with all things The Fed. From the latest industry news to upcoming events, membership benefits, partner offers and commercial support Join our retailer community today #TheFed Federation of Independent Retailers Fed The E s t 1 9 1 9 thefedonline.com 0800 121 6376 contactus@nfrn.org.uk @the_fed_nfrn @TheFedOnline YouTube @TheFedNFRN Twitter @TheFedVIP Facebook VIP @TheFedOnline Facebook @The Fed (NFRN) LinkedIn Make money, save money, make business easier! Instagram Follow us Instagram Subscribe to YouTube Follow us Twitter Join us Facebook VIP Like us Facebook Follow us LinkedIn RN 1/2 page horizontal.indd 1 09/12/2022 16:13 GET ORGANISED Bag better sales with BiGDUG’s range of retail shelving and storage to help you stay organised. WW W.B i GDU G.C O.UK 0333 200 529 9 Zinc & Walnut Display Shelving The trusted experts in space utilisation.

KEEPING SALES CRISP

JASPER HART outlines everything retailers need to know to optimise

sales this year

A CRUCIAL

OFFERING an appealingcrisps and snacks range is arguably more important than ever for convenience retailers, as the category continues to grow amid economic disquiet. “Crisps, snacks and nuts (CSN) is a fast-growing, priority category with huge scale,” says Matt Collins, trading director at KP Snacks. “Worth £3.8bn and growing by 8% year on year, CSN shoppers are spending an extra £100 in the category, up

CATEGORY

14% annually. And with 67% more people choosing convenience for their ‘main shop’ and one in five baskets containing a bagged snack, CSN represents an important opportunity for retailers to grow sales and footfall.”

Ushma Amin, of Londis North Cheam in south London, has three dedicated crisp areas in her store. “I have a custombuilt crisp area under my counter, a promotional aisle for new

flavours and styles, and I’ve also got another shelf. I mainly offer Walkers, KP, Bobby’s and Jack’s,” she says.

The implementation of HFSS restrictions has also had an effect, with challenger brands such as Proper and Eat Real pushing their healthy credentials alongside the reformulations from the market leaders, who have imposed targets on percentages of their ranges being compliant with the legisla-

chief

er cost per kg, we anticipate through-

tion within the next few years. Meanwhile, as shoppers look to reduce out-of-home spend, sharing bags and large formats continue to gain importance, says Aslı Özen Turhan, chief marketing officer at Pladis UK & Ireland. “Given that larger formats often represent a lower cost per kg, we anticipate similar sales success throughout the year ahead as shoppers look to pinch the pennies where they can,” she says.

CATEGORY ADVICE CRISPS & SNACKS 20

BALANCING RANGES

IT’S easy to think of the category as one that sells itself, such is the prominence of key brands from the likes of Walkers and KP Snacks.

According to KP Snacks’ Matt Collins, 42% of CSN sales come from the top five brands, while KP’s products are consumed by more than 20 million households, having delivered 44% of the category’s growth in the past five years.

However, the category isn’t

immune from the pricing pinch many customers are feeling, and some retailers have responded. “We’ve decided to go with the Jack’s range as it seems to be offering better value,” says Sanjiv Kumar, of Olive Store in Halesowen, West Midlands.

“We’ve made a key feature of promoting it so we can offer a value range to customers.”

Taste is the number-one priority, so customers will not shy

away from value-for-money options if they can provide the same taste they are used to from big brands.

Where there is interest in diversity in the category, it comes from younger shoppers eager for new experiences, according to Kirsten Reid, impulse category management lead at PepsiCo.

“We are seeing a clear need from Gen Z consumers for new and exciting flavours they can

enjoy during sharing occasions,” she says.

This influenced the supplier’s decision to launch two new Doritos varieties – Loaded Pepperoni Pizza and Triple Cheese Pizza – which also cater to sharing occasions, which are popular with younger shoppers.

“Gen Z makes up 67% of sharing with friends, playing an important role in sharing occasions,” Reid adds.

SUPPLIER VIEW

Aslı Özen Turhan, chief marketing officer Pladis UK & Ireland

“AS groups of friends and family look to reduce spend outdoors, they’ll continue to embrace evenings in spent playing games, watching movies and catching up. “As such, we can expect sales of larger formats –such as sharing bags – to remain in growth, already up by 16.1%.

“The core savoury snacking brands continue to lead the way in the category. In total retail, the top 10 crisps and snacks brands represent 52% of category growth. Bearing in mind that independent retailers have limited space in store, this means the bestselling crisps and bagged snacks should be every retailer’s biggest priority.

“While the core snacks are paramount, there’s no forgetting the role new products have to play when it comes to exciting shoppers and, ultimately, driving incremental sales. Stocking shelves with new products is a sure-fire way to drive engagement, encouraging shoppers to purchase on impulse – boosting overall spend in the process.”

THE rise in the proportion of sales from the Jack’s range in Amin’s and Kumar’s stores signals the importance of value in the category amid the costof-living crisis. Within larger brands, this is evidenced by the continuing growth of pricemarked packs (PMPs).

“PMPs have also had significant growth in the past few years and this format will stay increasingly relevant postpandemic,” says Collins. “Our range of large-format PMPs is worth £81.8m and is growing

by 28.4%.” Major launches in the category, such as Doritos’ Loaded Pepperoni Pizza and Nik Naks’ Scampi ’N’ Lemon, are available as PMPs.

“The way things are going, PMPs are what people pick up,” says Amin. “Most of them have gone up to £1.25 from £1, but we were selling smaller plainpack 30g bags for 80p plus. At that point, you’re paying 1.5 times as much to get double the value, so we’ve started to offer more larger PMPs.”

Kumar is taking a hard-line

stance on products across all his categories when it comes to margin. “We’re looking to delist any products falling below 30% PoR,” he says. “If a product’s not hitting that, we’re looking to delist it, unless it’s a very popular item we’ve got no choice but to stock.

“It’s got to be there, especially in an impulse category where it’s not a difficult sell. At the moment, Walkers, Golden Wonder and Kettle when they’re on promotion are in line with that, if not above it.”

21 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com

IMPORTANCE

PMP

CRISPS & SNACKS

SPOTLIGHT ON HEALTH

AS we move further into 2023, the impact of HFSS restrictions will start to become clearer.

Although the vast majority of convenience retailers are unaffected by the restrictions on positioning of HFSS products in their stores, shoppers’ appetites for healthier snacks are growing, with the segment up 20.2% annually, ahead of

the overall category. “Consumers are becoming increasingly demanding of their snacks, viewing health as a spectrum with traditional sector drivers, such as calories or fats a part of the consideration, alongside more emergent claims such as plant-based and high in protein,” says Helen Pomphrey, marketing director at Eat Real.

Healthy snacks that compete with the leading brands on taste are going to be a key part of the snacking landscape

this year, as challenger brands look to capitalise on the publicity caused by the legislation as well as customers’ desire for more healthy options.

These brands are more priceproof, according to Ben McKechnie, managing director at Epicurium, because they align more with shoppers’ values.

“Where a shopper connects with the values and ethics of a brand, they are still willing to allocate budget to those brands in spite of a slightly higher price,” he says. “The focus is on the value and not entirely price.”

CATEGORY NEWS

Keogh’s Crisps and Bobby’s have signed a deal that sees the latter become the former’s UK distribution partner. Keogh’s Atlantic Sea Salt & Irish Cider Vinegar, Mature Irish Cheese & Onion and Irish Atlantic Sea Salt are the first varieties available to convenience stores.

KP Snacks has invested £1m in the ‘Hula licious, Hula lightful’ campaign for Hula Hoops Puft. Launching at the beginning of February, the campaign will run for six months across outdoor, radio and on-demand TV, highlighting the range’s low-calorie credentials following its non-HFSS relaunch last year.

Pringles is launching an on-pack promotion across its core varieties in March, offering shoppers the chance to win a PC gaming setup worth more than £1,000, as well as other prizes including Logitech gaming equipment.

PepsiCo has launched a Walkerson-pack promotion giving shoppers the chance to win £250 every hour, running until 20 March across Walkers, Walkers 45% Less Salt and Walkers Baked. Shoppers can scan a QR code from participating packs to enter.

CATEGORY ADVICE

22 24 JANUARY-6 FEBRUARY 2023 betterRetailing.com