Alex Yau, editor

MANY excellent retailers I speak to regularly attribute their success not to themselves, but to the combined e orts of their teams. Of the many amazing stores I visit each month, the owners have no hesitation introducing me to their team members before explaining why they’re so vital to their business. I can think of only a handful of businesses that have become successful based on the e orts of just one person.

Although I don’t run a convenience store, ensuring Retail Express goes out with the industry-leading news and features you see every issue would only be possible with the amazing team behind it.

From editorial to production, and design to commercial, Retail Express wouldn’t be here without this collective e ort.

This issue, we’re giving you the opportunity to tell everyone else about the amazing member of sta you have in your store through a new section (p12) running every month.

Whether it’s the person who’s built a rapport with every single customer throughout the decades or the 16-year-old who, despite working only four hours a week a er school, gives it their absolute all, please don’t hesitate to get in touch and tell us why we should include them.

It can be anyone from a family member to a trusted employee living round the corner. If you’re in a similar position to me, I imagine it will be an incredibly di cult task narrowing it down to a single team member.

@retailexpress betterretailing.com facebook.com/betterretailing

ALEX YAU

DODGY vapes posing as legitimate rechargeables are entering the market ahead of the disposables ban.

Speaking on a webinar preparing businesses for the disposable-vapes ban last week, Chartered Trading Standards Institute (CTSI)

lead for tobacco and vaping David Hunt warned: “Compliant products after the ban must be re�illable, rechargeable with a USB port and have a coil that can be replaced by the user.

“Unfortunately, I have seen devices come across my desk where there’s been a USB port and it’s not been con-

nected when I’ve tried to charge them. We have powers to sample and test equipment. If we have intelligence from a consumer complaint that a device isn’t correct, we will go out and seize samples

“Checking USB ports and labelling is something I do with all the devices that come across my desk.”

Hunt also warned that re-

tailers who stock rechargeable devices from the 1 June disposables ban must also have re�illable liquids readily available to the customer, otherwise they will be in breach of legislation. He added: “When I go into shops and look around, I see plenty of devices that will be compliant, but I don’t see the re�ills or replacement tanks.”

YODEL’S parcel service has been removed from several PayPoint-partnered stores claimed to have been processing low volumes of parcels, the services company has con�irmed.

In a letter sent to retailers

THE British Retail Consortium has called for the Deposit Return Scheme to be delayed past its launch date of October 2027.

In its 2025 Manifesto for Retail, published late last month, the trade body

last month, seen by Retail Express, PayPoint said: “Yodel has been reviewing parcel volumes across the UK and has identi�ied a number of stores that, unfortunately, do not process enough parcels to offer the service.”

warned the government that the sustainability legislation, among other similar laws, would compound other challenges faced by many small shops, including upcoming hikes to National Insurance and minimum wage costs.

BOOKER has launched its latest Added Value Services Guide, claiming to save retailers more than £50,000 through the included deals.

The guide features more than 25 exclusive deals across a range of services designed to help retailers “make more and save more”. These include partnerships with parcel �irm InPost and drinks machine providers Costa Coffee and Calippo Burst, alongside home-delivery services.

CO-OP has launched a homedelivery service exclusively for independent retailers, with trial stores seeing higher spends than the industry average per transaction. Called Peckish, the service has replaced the Nisa To You service piloted with 30 Nisa retailers last year, with the multiple targeting 1,000 store sign ups within its �irst year. Co-op claims Peckish has the potential to have more than 3,000 store sign-ups in its third year.

CRIMINALS caught assaulting retailers will face more severe punishments under the government’s new Police and Crime Bill, designed to tackle retail crime across England and Wales.

Home secretary Yvette Cooper laid out the Bill in Parliament last month, with ministers aiming to pass the measures into law at the end of the year.

Measures include making the assault of a shopworker a separate offence and increasing powers to crack down on offenders who repeatedly commit antisocial behaviour.

The government also intends to recruit 13,000 police of�icers, create a new criminal offence for possessing a blade with the intent to harm and banning proli�ic offenders from entering town centres.

Explaining the impact for independent retailers, National Business Crime Centre lead superintendent Patrick Holdaway told Retail Express: “When a shopworker was previously assaulted, it would be very dif�icult to identify the crime. Police would have to go back and look at every single crime manually. They can now identify violence more quickly and create a better outcome.

“Police will also have access to greater detail and data to support prosecu-

tions. Courts will be able to put in a criminal behaviour order, which is more powerful and can stop offenders from going into certain areas. The Bill demonstrates that retail workers have been listened to and issues they are facing have been taken seriously.”

Separate offences for assaulting a shopworker in England and Wales were due to be implemented last year, but were delayed because of the General Election.

Scotland introduced a similar offence in 2021. Between its introduction and the end of 2024, 9,855 individuals (61%) out of 15,975 recorded incidents had been identi�ied as causing common assault, serious assault or threatening behaviour towards shop workers. It has not been con�irmed how many of these individuals have been arrested or prosecuted.

Commenting on the Bill in England and Wales, ACS chief executive James Lowman said: “We hope [the Bill] will send a clear message that shop theft and assaults on retailers will be taken seriously by both the police and the justice system.

“People running and working in shops deserve to be treated with respect, and we believe this Bill takes important steps toward that goal.”

Fed national president Mo Razzaq added: “For far

too long, the failure to protect retailers and shop staff has undermined con�idence in the police and the criminal justice system.”

Meanwhile, Nisa retail and sales director Katie Secretan described the Bill as a “hard-fought victory for retail”.

She said: “It has been shocking to see the rising levels of abuse, threats and violence independent retailers and their teams have faced while simply doing their jobs. This legislation is a vital step in recognising the seriousness of these crimes and ensuring a

“RECENTLY, I’ve tried to get a better handle on waste, which I wasn’t tackling in the past. I’ve employed a method called ‘Would you buy this?’. It applies to fresh food that’s short dated but perfectly good to eat. Whereas before I’d let it go past its use-by date and waste it, I’m now reducing the price in time for customers to buy it.”

Serge Khunkhun, One Stop Woodcross Convenience Store, Bilston

stronger police response is in place to protect those on the frontline.”

Although they welcomed the new measures, some retailers were skeptical on whether there would be enough resources to deliver on the measures.

Suresh Patel, of Premier Upholland in Skelmersdale, Liverpool, told Retail Express: “There are some concerns. Is it going to solve the problem of already overstretched police resources?

“Last week, I visited a retailer who had been attacked in his store and then the thieves came back

for a second time. It’s now so brazen and much more needs to be done to solve the problem of retail crime.”

Vince Malone, of Tenby Stores & Post Of�ice in Pembrokeshire, added: “Society needs to think about what we do about retail crime, because there’s plenty more we need to do. The police are still overstretched, courts have huge backlogs and prisons are bursting, so we need to think about what justice looks likes.

“My concern is we are looking at little pieces of the puzzle, whereas we need to see the bigger picture.”

BOOKS: A distributor of kids’ and teenage educational titles is generating nearly 50% margin for stores on each unit sold. Scorpio Books specialises in books that have been heavily discounted due to them being excess editions printed by publishers. The titles, which have an RRP of £9.99 on the high street, are sold to retailers for £2 with an RRP of £3.99 on a sale-or-return basis.

FOOD TO GO: F’real parent company Rich’s has launched a thaw-and-serve bakery range, generating more than 30% margin for stores. The pre-packed range includes cookies in Milk Chocolate, Triple Chocolate, White Chocolate and Oat & Raisin flavours, alongside a Milk Chocolate Mu n, Blueberry Mu n and Cinnamon Bun. Chilled and frozen wholesaler Eden Farm Hulleys is distributing the range to stores.

KNIVES: Retailers caught selling the dangerous items to under18s will face a maximum jail sentence of two years. The extension from a six-month sentence was passed under Ronan’s Law last month, and can apply to both sta members and store owners who processed the transaction. Ronan’s Law was named after 16-year-old Ronan Kanda, who was murdered in a stabbing in 2022.

MAGAZINES: ABC gures for 2024 showed a signi cant drop in newsstand sales. Analysis by RN revealed the sales of 11 titles dipped by more than 20% during the year. Those that increased their cover prices saw an average 11% drop in circulation, compared with an average of 9% among those who maintained their cover price.

For the full story, go to betterretailing.com and search ‘magazines’

“WE recycle everything from cardboard to cellophane and we’ve recently installed LED lighting. We also maintain our equipment well so it runs e ciently and saves energy. However, I would love solar panels, but to date I cannot get a company to call me back about coming out to do a site survey. I don’t know why they are not interested. It would also be great if we knew if government grants are available to do this kind of work.”

“I HOLD a management meeting every couple of months where we run through all of our underlying business costs and look at making the store more e cient. Saving money on utilities is important as our overhead costs have been rising. The most recent action I’ve taken is to remove one chiller from the shop floor and work closely with drinks manufacturers to t in chillers with doors to save energy and money.”

ALEX YAU

RETAILERS will be asked to prove they are not laundering money by wholesalers, under a crackdown by HMRC.

The regulation updated on 1 March requires retailers who make regular cash payments of £8,000 or more to provide an Anti-Money Laundering (AML) Supervision Registration number and evidence of approval

date to their wholesaler.

This can be applied for through HMRC, and those breaching the law “may face a civil �inancial penalty or criminal prosecution that could result in an unlimited �ine and/or a prison term of up to two years”.

Booker and Bestway are among the wholesalers now conducting these checks.

In a letter sent to retailers, seen by Retail Express, Booker

said: “HMRC has issued revised guidance, which now requires us to make sure our customers are appropriately authorised by HMRC to make high-cash payments before we can accept a high-cash payment from that customer.”

Bestway updates its checks in accordance with the guidelines in November. Parfetts joint managing director Guy Swindell said: “AML rules regarding high-value cash trans-

actions have minimal impact on our customers, as the majority now use digital-payment options and make more frequent and smaller purchases.

“However, we continually update our policy and practices to re�lect current HMRC guidelines, and we will continue to provide clear guidance to our customers and support them in meeting their obligations under AML legislation.”

A GRASSROOTS group started on Facebook to represent postmasters across the UK has partnered with the Community trade union.

Voice of the Postmaster (VotP) announced the partnership last month. Its three main aims are fair remuneration, independent representation and transparency about the future of every branch. VotP chair Richard Trinder said: “I urge every postmaster to join with Community union.”

IS to roll out a rebrand of its Wild Bean food-to-go operation to franchisees across the UK. The new design was unveiled last month at its new forecourt in Hammersmith, London. The store’s range has been targeted towards electricvehicle drivers waiting for their cars to charge. It has hot food to go, des-

MORE retailers can access “affordable” security tags to protect high-value stock such as alcohol, meat and baby powder. Security companyChirp Protect has partnered with Booker to distribute its products more widely. Chirp Protect commercial director Alex Ledsham told Retail Express prices start from £20-£30 a week with no upfront cost, with partnered stores reducing shrinkage by 50% to 90%.

PRIYA KHAIRA

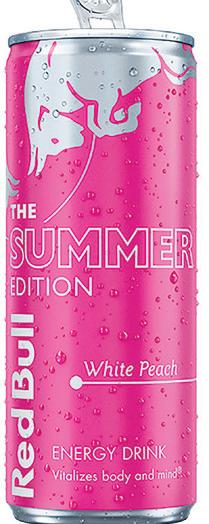

RED Bull has introduced a new limited-edition �lavour, Summer Edition White Peach, available now across all channels.

The launch comes as demand for �lavoured energy drinks continues to grow, with Red Bull’s Editions range playing a signi�icant role in attracting new shoppers and contributing to overall category growth.

The new �lavour combines white peach notes with hints of citrus peel and a subtle �loral �inish.

Consumer feedback on the �lavour has been positive, with many describing it as “refreshing” and “unique”,

according to the supplier. Research suggests the variety is likely to appeal to younger shoppers, who are increasingly driving demand for �lavoured energy drinks.

The Summer Edition White Peach is available in several formats: a 250ml can (RRP £1.70), a £1.65 price-marked can, a Sugarfree 355ml can (RRP £2.10) and a 250ml four-pack (RRP £5.40).

According to Nielsen data, �lavoured energy drinks have experienced signi�icant growth in the UK over the past year.

Other reports show that sales in the sub-category experienced a 28% rise during the same period.

Flavoured energy drinks

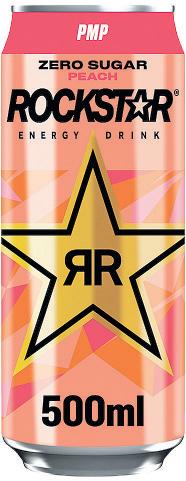

CARLSBERG Britvic has added Rockstar Energy Zero Sugar Peach to its line-up, available now in plain and price-marked packs.

The new �lavour joins the brand’s ‘two for £2’ 500ml can PMP offer, with individual RRPs of £1.35 (plain) and £1.29 (PMP).

Peach �lavours have had a 153% increase in sales value within the stimulant energy segment over the past year.

The new variety features packaging aligning with Rockstar’s partnerships with festivals.

are now responsible for more than 30% of the category’s sales.

VOLVIC has brought back its Touch of Fruit Sugar-Free Cherry �lavour, responding to growing demand for cherry�lavoured soft drinks, which had a 6% sales increase over the past year – particularly among younger and millennial consumers.

Previously discontinued in 2021, the relaunch follows 10% year-on-year growth

for the Touch of Fruit range in 2024.

The sugar-free cherry variety blends Volvic Natural Mineral Water with fruity �lavour, and will be available through wholesale and convenience channels from April.

HEINEKEN UK has expanded its Murphy’s Irish Stout range with new 4x440ml (£5) and 10x440ml (£12) multipacks, available now across grocery, wholesale and convenience channels.

The launch follows signi�icant growth in the stout category, which had a 23.7% increase in value and 18%

rise in volume across the total market.

Murphy’s experienced a 104% sales increase in 2024, with demand peaking in December due to a Guinness shortage, driving a 632% surge in on-trade pint sales.

ARCTIC Coffee has launched its Arctic Frappe range, featuring two �lavours: Caramelised Biscuit and Choc Fudge.

Priced at £1.40, the range targets Gen Z consumers, who are driving the growth of ready-to-drink (RTD) coffee, with more than half enjoying it at least once a week.

Forty-three per cent of consumers from this demographic consume RTD coffee twice a week.

The launch initially rolled out in Tesco and Morrisons. The supplier con�irmed it has plans to expand into wholesale and convenience channels.

COCA-COLA Europaci�ic Partners has continued its partnership with Jack Daniel’s by launching a Coca-Cola Cherry ready-to-drink can.

The cherry variety is available now from Booker. A nationwide rollout is planned for April.

MARS Wrigley has expanded its Extra Refreshers range with a new Watermelon Raspberry variety, now available nationwide in single packs with an RRP of £2.50.

The launch responds to growing demand for fruity gum �lavours, which has driven a 39% increase in value for Extra Refreshers over the past two years, particularly among younger shoppers.

Consumer testing showed 73% found the �lavour unique, with 69% saying they would purchase it.

The launch is supported by a national campaign, including sampling and in�luencer partnerships.

The UK version is available in 330ml cans with a 5% ABV, differing from the 7% ABV variety launched in the US in 2024.

Priced at £2.39 for plain and price-marked packs, the product offers a minimum pro�it on return of 26%.

CONFECTIONERY brand

Bebeto has unveiled two new Easter products.

Runny Eggs – liquid-�illed gummy soft fried eggs – are available in mango, orange and peach �lavours. The sweets feature a lemon liquid centre, marking the �irst use of liquid-�illed technology in a fried egg sweet. Also joining the Easter lineup is Spring Parade, a selection of fruit-�lavoured gummy sweets shaped like chickens, Easter eggs, sheep and bunnies.

Both launches aim to Bebeto’s

tap into growing demands for seasonal confectionery launches.

Raj and Manish Suchak

Coldean

Convenience 02, Brighton

“To know that our wonderful customers voted for us gives us tremendous pleasure.”

Voted for by the public, our winning stores have been recognised for going above and beyond to support their local communities.They have each won £5,000 in cash plus a Social Value store makeover worth £20,000!

Natalie and Martin Lightfoot Londis Solo Convenience, Glasgow

“It’s lovely when other people recognise something you’re so passionate about.”

A competition from Allwyn, operator of The National Lottery

PRIYA KHAIRA

SMIRNOFF has extended its range with Miami Peach, a new ready-to-drink (RTD) and spirit drink launching ahead of summer.

The variety is available in 70cl spirit drink (35% ABV) and 250ml RTD can mixed with lemonade (5% ABV) formats.

The launch follows strong growth in the �lavoured vodka category, which contributed £7.6m in offtrade sales last year.

Smirnoff aims to build on this momentum as

consumers seek new �lavour experiences for the summer season.

Jessica Lace, head of Smirnoff GB, said the brand has led growth in spirit �lavours with previous launches such as Cherry Drop, Mango & Passionfruit and Raspberry Crush – the latter of which became the biggest �lavoured spirit launch in the past three years.

To support the launch, Smirnoff is rolling out a 360-degree marketing campaign celebrating Miami’s vibrant culture

JTI UK has expanded its Nordic Spirit nicotine pouch range with the launch of Frosty Mint and Frosty Berry. Both options feature higher menthol and moisture content, along with an improved �lavour recipe, each containing 12mg of nicotine per pouch.

The launch targets the growing demand for stronger varieties, which now account for 60.1% of the nicotine pouch market. Mint �lavours continue to dominate with an 83.6% market share.

The pouches are available now, RRP £6.50.

across social and experiential channels.

Retailers can access instore promotional materials through Diageo One.

PEPSICO has announced a new on-pack promotion across Frazzles, Chipsticks and Cheetos in partnership with Merlin Entertainments.

Running until 30 June, the promotion offers shoppers a chance to win one of 5,000 prizes – including four tickets to a UK Merlin attraction such as Thorpe Park or Alton Towers.

The promotion follows recent rebranding for Frazzles and Chipsticks, featuring a refreshed pack design and compact multipack packaging.

RIOT Labs has launched Riot X, a new range of 12 “supercharged” e-liquid �lavours.

The new collection (RRP £3.99) aims to support smokers transitioning to pods and re�illable devices.

The range is available in nicotine strengths of 5mg, 10mg and 20mg, and �lavours include Blackcurrant & Passionfruit, Cherry Ice and Strawberry & Melon Chew.

A recent Riot Labs poll

found

TOM Parker Creamery has introduced The Guv’nor, a ready-to-drink (RTD) iced coffee range available through distributor The Cress Company.

The range comes in three �lavours – Original, Mocha and Caramel – in 500ml and 250ml glass bottles with metal caps, priced at £2.50 (500ml).

Rob Yates, CEO of Tom Parker Creamery, highlighted the category’s growth potential, particularly among Gen Z consumers, who value convenience and energy.

THE Hershey Company has introduced Reese’s Dipped Peanuts, now available through Booker.

The product features peanuts coated in peanut butter and covered in Reese’s signature milk chocolate.

The launch comes in pricemarked packs.

According to Statista, 80% of UK consumers are familiar with The Hershey Company’s products.

GLOBAL Brands has been named the of�icial UK distributor of Whipshots, a vodka-infused whipped cream co-founded by rapper Cardi B.

Available now in Vanilla and Mocha �lavours, Whipshots (10% ABV) is designed for adults to use as a topping for cocktails, shots, coffees, desserts and ice cream.

Priced at £11.99, the product aims to bring a unique offering to the UK market.

Since its US debut in 2021, Whipshots has sold more than six million cans.

YORKSHIRE-BASED distributor Continental Wine & Food (CWF) has launched Lacey’s Vodkashake, a vegan cream liqueur available in Strawberry and Banana �lavours.

Both varieties come in 70cl bottles with a 15% ABV, and are gluten- and dairy-free.

The distributor suggests serving the liqueur as chilled shots or mixing it into alcoholic milkshakes and cocktails.

The launch taps into rising demand for plant-based options.

STARBUCKS has enhanced its ready-to-drink (RTD) coffee range with the launch of the Skinny Latte Grande Cup (RRP £2.75).

The new variety was made available exclusively through Booker from late February, with a nationwide rollout following in April.

Part of the Chilled Classics range, the Grande Cup comes in a larger 330ml format, compared to the standard 220ml size of other products in the range.

The launch follows earlier additions to the range in January, including the Oat Based Cappuccino and Frappuccino Sip On Sunshine Limited Edition.

BRITISH Canadian brand

Pure Maple has relaunched its range of 100% pure maple syrups with organic certi�ication and updated branding.

The range includes Golden Delicate, Amber Rich and Dark Robust varieties, priced between £6 and £7.89 for a 236ml/312g bottle.

The rebrand features a new Leone bottle design, re�lecting Canadian maple syrup heritage, and targets growing consumer demand for natural sugar alternatives. According to Mordor Intelligence, the maple syrup category is predicted to grow by 7.9% by 2028.

The increase in sales, which is expected throughout the period, is driven by growing

consumer preferences for natural sweeteners and sugar alternatives.

JAMESON has announced a new ‘Must Be a Jameson’ campaign, aiming to reach more than 15 million consumers as part of a multimillion-pound investment.

The campaign runs until 14 April, featuring a TV partnership with Sky Sports, as well as video-on-demand platforms including ITV, Channel 4 and Prime Video.

Supporting its partnership with the English Football League, Jameson will host an experiential event at the Carabao Cup Final on 16 March, the day before St Patrick’s Day.

The campaign includes nationwide sampling in nearly 2,000 venues.

DATA: This feature is created by Newtrade Insight. Data is gratefully received from the ve retailers who participated in a 12-week trial of Nordic Spirit. Any data from other sources is cited.

Newtrade Insight partnered with JTI UK to trial two new Nordic Spirit varieties in ve independent retailers’ stores. Here’s how they fared

JTI UK has expanded its popular Nordic Spirit range with two new flavours: Frosty Berry and Frosty Mint. Designed to elevate the consumer experience, these variants feature higher menthol and moisture content combined with an improved flavour recipe.

Ahead of the launch, JTI offered retailers the exclusive chance to trial the products, to evaluate sales of the new variants relative to the category and existing Nordic Spirit lines. Retailers were supported by JTI business advisers who visited each participant’s

store and provided them with tailored PoS, advice on the products’ USPs and how to merchandise them.

Overall, four out of ve retailers saw an increase in sales across their overall Nordic Spirit ranges. Avtar ‘Sid’ Sidhu, of St John’s Budgens in Kenilworth, Warwickshire, and Sue Nithyanandan, of Costcutter Epsom in Surrey, were especially successful.

Sidhu saw a 433% increase in his total Nordic Spirit sales compared to the three months preceding the trial; 42% of his sales came from the two new

lines, a strong over-indexing and a net contributor to the category’s growth in his store. Meanwhile, Nithyanandan saw a 184% like-for-like Nordic Spirit sales increase, with the two new flavours accounting for 16% of this rise.

Participating retailers have shared key insight on how to drive further success with Nordic Spirit and the wider nicotine-pouch category.

All the participating retailers stocked a Nordic Spirit range pre-trial, alongside other prominent nicotine-pouch brands.

On average, Frosty Berry and Frosty Mint made up 19% of Nordic Spirit sales across the ve stores

SIDHU’S success demonstrates the power of a smart pricing strategy. His “twofor-£12” deal, designed to “hit the sweet spot between volume and value”, proved particularly e ective in driving trial and boosting Nordic Spirit sales. This suggests that strategic pricing can be a key driver of success for retailers looking to introduce new products like Nordic Spirit. He has also bene ted from a years-long journey of store development that has made his shop a leader in the tobacco-alternatives category,

meaning his customers trust his range and his products, and were already fairly familiar with the nicotine-pouch category and how it ts into a wider tobacco alternatives range. PoS and promotional activity also played a key role in injecting excitement into stores’ pre-existing Nordic Spirit ranges. Nithyanandan attributed the success of the trial partly to the PoS and promotion of new flavours, which drew shoppers towards the range as a whole and helped it stand out.

This indicates the importance of visibility of the category at the counter for customers to make quick decisions.

Clear pricing on the PoS was also a factor that drove valuedriven customers towards the category in Ricky Sharma’s Thrifty’s store in St Helen’s, which saw an 87% increase in Nordic Spirit sales compared with the three months pre-trial.

The ability to put PoS by store entrances drives awareness of the brand as soon as shoppers enter the store and aids purchasing decisions.

As the UK’s number-one nicotine pouch in the independent channel, Nordic Spirit generates £ 4.5m in value sales every month1

HOWEVER, trial participants agree there is more to do around category awareness and education. Despite Sidhu seeing a considerable sales increase, making his shop a destination for tobacco-alternative shoppers, new customers entering the nicotine-pouch category require guidance on proper usage.

While Chris Presland, at Fender Post O ce, successful-

ly transitioned existing pouch users to the new lines, introducing the product to tobacco users presented a unique opportunity for further engagement and education. To address knowledge gaps surrounding nicotine pouches and their distinction from tobacco and other alternatives, Nithyanandan suggests implementing simple educational posters, o ering a readily ac-

cessible resource for shoppers given sta time constraints. This is particularly important given price, flavour and strength are big factors in influencing the direction of the category. The nicotine-pouch category is continuing to grow: Nordic Spirit generates £4.5m in value sales every month1 in convenience and extra-strong pouches are the fastest-growing strength in the category

OVERALL, all participants believe in the success of tobacco alternatives, indicating the potential for growth through a combination of flavour innovation, keen pricing and distinctive branding.

Flavours are going to be particularly important for maintaining interest in the category among more established brands. Currently, mint

flavours represent 83.6% of the UK nicotine-pouch market2, making them the dominant segment. Combined with the growth of extra-strong flavours, this gives retailers a good starting point for a successful nicotine-pouch range.

Distinctive flavours with distinctive packaging are not only easier for customers to spot, but also for retailers to nd

and serve.

The ve participants were united in their view that there needs to be more concerted e orts around education in terms of what pouches do, how to use them and how they can di er in strength. As shoppers look for other alternatives that can be used instead of, or alongside, their traditional tobacco products,

in the UK. As it continues to increase in popularity, retailers need to know which price points and flavours suit their customers.

The visibility of these factors is a key driver behind customer purchase decisions. Sharma says the nicotine-pouch brands whose pricing, flavours and strength are presented most clearly are seeing the most success in his store.

Chris Presland, Fender Post O ce, The Wirral

“WE made sure to talk to regular Nordic Spirit shoppers in my store to encourage them to trial the new SKUs. That’s a great way to get engagement with your customers and really push NPD to ensure it lands brilliantly.”

Avtar Sidhu, St John’s Budgens, Kenilworth, Warwickshire

“WE’VE spent time investing in categories like this, having recognised the direction of travel a few years ago. The results of this trial really justify that work, and show that by making your store a destination, you can really win.”

Neil Godhania, JS Premier Neil’s, Peterborough

“THE two new flavours we got as part of this trial ended up accounting for 20% of our total Nordic Spirit sales over the three months – showing that with promotion and a direct push, shoppers will engage with the category and the new flavours within it.”

Ricky Sharma, Thrifty’s, St Helen’s, Merseyside

“THE market is very di cult at the moment, so growing any brand or category by 87%, like we did, is something we can’t turn down. The PoS that supported the new lines helped ensure shoppers knew the price before asking for the product, which is crucial.”

it is crucial that suppliers support retailers around category education, including what a pouch is, how to use it and which strengths are available, thus assisting customers in their decision-making process and ensuring your stock is aligned to current trends. JTI’s retailer micro-site, JTI 360, has a range of training modules and sales guidance.

Sue Nithyanandan, Costcutter Epsom, Surrey

“NEW, fun flavours are a big driver of sales in my store, and anything that highlights the flavours we sell and the full range is helpful. This trial helped drive a real increase in sales of Nordic Spirit for me, which was great to see.”

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

What do you like most about working in convenience?

I like the fact that you get to meet a wide variety of people from all walks of life. You never know who is going to walk into the store. You also get to know most of them on a deeper level.

Can you tell us your funniest moment while working? There have been numerous funny moments in the past 13 years of working in the store,but one thing I volunteered to do for the team was alcohol testing. Not many people can say they have been encouraged to drink at work.

What has been the most exciting product for you?

For me, it must be the Costa Co ee machine, but our customers love the Post O ce counter, as a lot of the banks are closing in the town. Having the facility close by is a real help to them.

Do you have any big achievements your proud of?

I don’t think I’ve had any big achievements, just numerous small ones over the years. It’s a testament to my ‘work family’ that I still enjoy going in and seeing everyone, even when life has thrown curve balls at me. They help and encourage me to keep going.

What does a typical day look like for you?

No two days are the same. We have our standard routine of stock deliveries, shelf stacking and cleaning, but it’s our customers that make the day diverse. We laugh with them, see their children grow, comfort them through bad times and check in on older customers.

My store has gained a positive reputation

SPRING: How are you preparing your store for the warmer weather?

“WE used to have a seating area outside. We took it away, but I’m thinking of reinstating it. There’s a park opposite, so there are children and walkers. Cyclists also seem to love this area – they always stop, eat their baguettes and move on.”

Alan Mannings, Shop on the Green, Chartham, Kent

“IT is about availability, so I make sure I’m well stocked with ice cream and soft drinks. I also make sure my chillers are in good working order. There is a park opposite my shop, and lots of dog-walkers, so my shop works well in good weather.”

Ferhan Ashiq, Levenhall Village Store, East Lothian

Trial and error is the key to nding out what works

STAFF: How are you giving them more responsibility?

“IT’S challenging at the moment, and it will become more so, when National Insurance rises. I am not replacing staff if they leave, but we are all doing more, including myself. I’m upping hours at peak times and giving staff responsibility on the shop �loor to deter shoplifters.”

Mo Razzaq, Mo’s Premier, Blantyre

“MOST of our staff are trained to be multi-skilled so they can take on responsibility more easily. I’m also holding back on employing younger workers who need the investment of training. I’m sticking with more-experienced team members. I’m also upping my own hours in store.”

I’m sticking with moreexperienced team members

PRODUCTS: What interesting lines have you introduced?

“IN my village, I am in competition with a petrol station and a Co-op. A lot of my elderly customers love to knit, so I sell good-quality wool and knitting equipment. The wool I sell is the King Cole range, which is the best in England, so my store has gained a positive reputation.”

Dilsher Sing, Sanderz Convenience Store, Oxfordshire

“TO offset rising costs, we looked at lines where we could set our own margins, such as greetings cards. Cards, stationery, pens, pencils, envelopes and packaging also �it with the post of�ice, and these have become our point of difference.”

Mike Mitchelson, Mitchelson Newsagents & Post Of�ice, Brampton, Cumbria

It’s

about availability, so

I

make sure I’m stocked

SOCIAL MEDIA: What makes your store stand out?

“I ALWAYS post new product activations and keep my posts lively and positive. If there are freebies that customers can try, Facebook is a great place to shout about them. Trial and error is the key, and you’ll soon work out what works for your store.”

Ken Singh, BB Nevison Superstore, Pontefract, West Yorkshire

“IF we have a giveaway, we can get up to 30,000 views on our Facebook page. New products are the same. Recently, we posted a picture of the new Cadbury bar with Biscoff pieces through it. Our post got 5,000 views, and it tells people we’re the store to come to.”

Nick Farnsworth, Farnsworth News, Isle of Wight

I’VE been having an issue across several of my stores where customers have been asking for refunds for Uber Eats deliveries and then having them approved straight away. We are delivering the food, but Uber Eats has not asked us for evidence. We’ve also not been given a solution on how to prevent this. It’s been happening since May last year and we’re losing about £150 a week

across several sites. The area does make a difference, as we get a higher volume of orders in certain places. Although some claims do go our way, the majority don’t. We initially thought it was an issue with only our drivers. However, we found the instances included orders where drivers are provided by both ourselves and Uber. In one order of £27, the customer asked for £11 back.

When we’ve gone to Uber for support, we’ve been told the refund process is not bulletproof and to keep trying. I’ve gone through a lot of people at Uber because I’ve been passed around. Why don’t they work with us?

Fuzail Patel, Redbeck Group, Rotherham

Uber Eats failed to respond as Retail Express went to print

PEPSICO has partnered with Retail Express to o er ve retailers the chance to win £50-worth of Doritos Dinamita stock. Following a series of spicy launches over the past year, the new rolled tortilla chip is the latest addition to the successful Extra Flamin’ Hot range. Available exclusively to the convenience channel and solely in a 65g price-marked pack (RRP £1.25), it lets you give your heat-loving shoppers the ultimate flavour experience.

Review your store ahead of a tough 12 months

IT’S been a tough 12 months and I think there’s a tough 12 months ahead. Rather than sitting back and taking it on the chin, retailers need to be more proactive than ever and look for ways they can reduce costs and increase e ciencies in store.

Trying to upsell at the moment is very di cult because everyone is looking for value. So, even as we’re knocking down and rebuilding one of my stores, we’re going through it and remerchandising as we go.

Rather than having premium products right in customers’ faces and eye lines, we want to be screaming about value instead. We’ve started adding more and more of an essentials range from Co-op, and making it more prominent for customers to show them we are o ering added value at every opportunity.

You have to look at your customers, understand what they want and look at what’s working in your store. If promotions are working, then put more of them out there, or if budget ranges are selling, then start increasing the amount of value options on your shelves. And then make sure you’re shouting about it to customers so the message really gets across.

As well as looking at how we can increase sales front of house, the other side of the coin is increasing e ciencies behind the scenes.

I’m looking to start working with Chase & Co, which would outsource a lot of my admin tasks to India, e ectively giving my business its own personal assistant. Currently, I’m working out how many hours I spend collating sales, looking at wastage, generating reports and making sales. I reckon I spend about a day and a half doing these tasks when I could be out front of house nding ways to improve my business and drive more sales. Think about what you can do now for your business rather than waiting.

“ANOTHER year has passed and I have another opportunity to run the London Marathon. I am again supporting Marie Curie in the process. My team at the store are backing my corner, as are AF Blakemore. My family think I am mad. The training begins in earnest now as I look to the end of April and trying to shave a few seconds o last year’s pace. I am still working out at Napalm CrossFit in Stoke in between marathon training. Just like last year, I will run in the memory of our great friend and team member Tim Forde, who sadly lost his ght to the Big C last year.”

So drinks remain a cornerstone for retailers.

PRIYA KHAIRA breaks down some of the top trends shaping the category and nds out how retailers can stay ahead of the curve and drive sales

THE soft drinks category remains a strong performer for retailers, fuelled by constant innovation, bold product launches and adventurous global flavour trends.

For those looking to stay ahead, keeping pace with emerging consumer interests is essential.

“Shoppers are seeking more variety from their soft drinks,” says Ash Chadha, sales and marketing director of Mogu Mogu. “They want bigger, bolder flavours and even new textures,” he adds.

Nishi Patel, of Londis Bexley Park in Dartford, Kent, believes that staying on top of trends is key to thriving in the category. He has successfully capitalised on pop-culture moments and social-media-driven crazes – sourcing Squid Game

Energy Drinks at the height of the show’s global popularity and importing a Fresh Pistachio Dubai Chocolate drink following growing customer interest in the confectionery craze.

“We keep a selection of imported brands from Japan and America next to our interna-

tional snacks to build incremental sales. We tend to keep an eye out for them on social media,” he explains. Platforms such as TikTok and Instagram often act as early indicators of what consumers will want next, whether it’s a viral drink challenge or a new international flavour craze. Retailers who monitor these platforms and stay agile with their buying decisions can position themselves at the forefront of these trends.

Beyond pop culture, global flavour trends are also mak-

ing their mark on the UK soft drinks market. Tropical fruit blends, Asian-inspired flavours like lychee and yuzu, and Middle Eastern influences such as rosewater and pistachio are increasingly popular among consumers.

THE health and wellness movement continues to reshape the category, with more consumers prioritising their well-being when choosing drinks.

Natalie Lightfoot, of Londis Solo Convenience in Baillieston, Glasgow, acknowledges the growing demand for sugarfree options. “Demand for sugar-free has risen over the past year,” she says.

This shift is reflected in broader consumer behaviour trends. According to a spokesperson from Red Bull, one in

four shoppers now say that health and well-being is their number-one priority. “Seventy- ve per cent of shoppers consider health when they choose a soft drink.

“O ering more no-sugar options is key to building incrementality for the category,” they added.

Retailers are responding to this shift by diversifying their soft drinks ranges to cater to health-conscious consumers. This includes increasing shelf space for sugar-free and re-

duced-calorie products, as well as highlighting functional bene ts like added vitamins, electrolytes or natural ingredients.

Promoting these products e ectively can signi cantly boost sales. Lightfoot notes that positioning healthier options at eye-level or near the checkout has helped encourage impulse buys from health-conscious customers.

Seasonal promotions and multi-buy o ers on no-sugar options can also help drive trial and repeat purchases.

Functional drinks, such as vitamin-infused waters and natural energy drinks, are also gaining traction. O ering a selection of these alongside traditional soft drinks caters to a wider audience and can help boost overall category sales.

Moreover, retailers should consider using signage and labelling to highlight low-sugar and functional options clearly. With clear in-store communication, customers are more likely to notice and choose healthier alternatives.

Five ways to maximise sales

Promote new releases

Dedicate shelf space to new or trending products and highlight them with clear signage.

Prioritise health-conscious ranges

Dedicate at least 50% of your range to low- or nosugar drinks to meet growing health demands.

Bundle for value

Pair soft drinks with popular snacks or sandwiches for meal deals to encourage larger basket sizes.

Use data wisely

Track your top-selling products by season and adjust inventory accordingly.

Keep it cold

Stock impulse buys in chilled units near the till to drive unplanned purchases.

WHEN it comes to pack sizes, it’s not a one-size- ts-all situation.

Retailers should o er a diverse range of pack sizes to cater to various needs – whether it’s a quick grab-and-go can, a multipack for sharing or a larger take-home bottle.

For some retailers, shoppers are leaning toward smaller, on-the-go formats.

“Promotional activity always helps boost soft drinks sales. We have been shifting our focus to our smaller bottles and canned soft drinks as opposed to larger 2l formats,” explains Enya McAteer, from Mulkerns Spar in County Armagh.

This reflects a growing consumer preference for smaller,

convenient formats – ideal for on-the-go shopper missions.

Additionally, price-marked packs (PMPs) continue to prove their worth.

“We dedicate a lot of space for larger bottled formats on the core brands like Coca-Cola and Sprite, and try to make sure we are o ering PMPs,” says Ken Singh, of BB Nevison Superstore in Pontefract, West Yorkshire. “We make a 40-50% margin on the category,” he notes.

“Multipacks and larger formats are perceived to be better value due to their lower cost per litre. We predict that big bottles will translate to big business in 2025,” adds Mogu Mogu’s Chadha.

Suntory Beverage & Food GB&I

Suntory Beverage & Food GB&I has brought US brand Celsius to the UK market. Available in four varieties – Peach Vibe, Fantasy Vibe, Cosmic Vibe and Sunset Vibe – Celsius is a zero-sugar energy drink and contains vitamins C, B12, B6 and B5. Each variety is available in 355ml plain and £1.79 price-marked cans.

Red Bull

Red Bull has unveiled a Summer Edition White Peach flavour. The latest-limited edition variety has launched this month with an RRP of £1.65 for 250ml plain cans and £1.65 for 250ml PMP cans. The drinks are also available at an RRP of £2.10 for 355ml Sugarfree varieties and £5.40 for a 4x250ml multipack.

Irn-Bru

Irn-Bru has launched a campaign that will give consumers the chance to win one of four solid carat gold girders worth £10,000. There will be thousands of other prizes on o er including gold-plated key rings and charms. Shoppers can enter by scanning the QR codes on the packs. PoS kits are available for retailers via the Irn-Bru website.

Volvic

Volvic has expanded its flavour portfolio with the reintroduction of Cherry to its Sugar Free Touch of Fruit range. The new flavour will be available from April with an RRP of £1.35 for a 1.5l bottle. It comes as cherry-flavoured soft drinks have seen a strong increase in sales over the past year.

Fanta

CCEP has launched three new zero-sugar flavour varieties including Fanta Zero Apple, Fanta Zero Raspberry and limited-edition Fanta Tutti Frutti Zero Sugar. The lines are being supported by a multimillion-pound marketing campaign.

Tango

Tango has launched its latest Editions flavour, Strawberry Smash. It features a blend of strawberry and pineapple flavours, and is one flavour in Tango’s annual rotational flavour series, which has seen considerable success. Previous Editions, including Tango Mango, Paradise Punch and Berry Peachy, have all been crowned number-one new product development in the fruit flavoured carbonates category in their respective launch years. It is available in 330ml cans, 500ml bottles, 2l and multipack formats.

Arctic Co ee

Arctic Co ee has unveiled a Arctic Frappe range, available this month in Caramelised Biscuit and Chocolate Fudge flavours. Both varieties have an RRP of £1.40. The launch aims to target Gen Z consumers who constitute the majority of the category’s demographic.

Monster

Monster has added Monster Juiced Rio Punch to its portfolio, now available in plain and price-marked single 500ml cans and four-can multipacks.

Sugar-free surge

Health-conscious consumers are driving demand for low- and no-sugar options. Brands such as Coca-Cola Zero Sugar and Pepsi Max continue to dominate, while functional beverages with added health bene ts are on the rise.

Function meets flavour

Consumers are looking for more than just refreshment – energy, hydration and wellness are key drivers. Drinks infused with vitamins, electrolytes or adaptogens are rapidly growing in popularity.

Global flavours on the rise

Adventurous consumers are trying international favourites, from Japanese melon sodas to American root beers. Stocking niche global options can help stores stand out from the competition.

Social media sensations

TikTok and Instagram are influencing buying habits more than ever. Limited-editions and viral releases can drive major footfall – especially when backed by influencers.

Beyond the usual suspects

Ready-to-drink co ee and flavoured milk are booming, o ering convenience and health appeal. The flavoured milk category is now worth £726.5m, with growth driven by on-the-go demand.

Sustainability in focus

Eco-friendly packaging and recyclable materials are becoming a bigger priority for consumers. Brands o ering sustainable solutions are likely to gain favour with ethically minded shoppers.

Shop+ is a brand-new free digital magazine for consumers, featuring: Join the Shop+ Club and earn money for your store!

New products in the convenience channel

Recipes using ingredients from your store

Money-saving ideas, well-being advice and lots more!

Join our exclusive Shop+ club and earn money every time one of your shoppers scans the Shop+ QR code. PLUS: The chance to win £500 cash with every issue.

Find out more and get your free in-store and digital point-of-sale at bit.ly/shop-plus25 or by scanning the QR code.

£17.5bn

The total value of the UK soft drinks market 75% of UK shoppers consider health when choosing a soft drink 23%

The growth in the functional drinks category year on year 30% of soft drinks sales are impulse purchases – placement matters 86% of

Crisps and snacks is a key category for independent stores, one which continues to evolve and provide fresh opportunities. SIMON KING reports

THE total salty-snacks category in independent and symbol stores is worth £631.6m and is growing at 18%, showing that snacking remains a huge part of day-to-day UK life.

Within this, the crisps, snacks and nuts category accounts for 94.1% value sales of total savoury snacks, highlighting the importance for retailers to look at their savourysnack ranges.

Nic Storey, PepsiCo’s senior sales director, impulse and eld sales, says: “Shoppers

continue to value brands they know within this category, so we’re seeing shoppers seeking not only familiar brands, but also their favourite flavours.

“It is therefore key that retailers stock strong cores of bestselling products to boost sales. Product launches have an important role to play in driving interest and excitement within the category, but the key to success is supplementing this with a strong core to drive repeat sales.”

Sas Horscroft, head of mar-

keting and innovations at Burts Snacks, says 96% of consumers claim to snack, and that it is a daily occurrence for most. “Additionally, 63% of UK consumers pick snacks up o the shelf as an impulse buy, highlighting the spontaneous nature of snack-buying behaviour,” she says.

“With almost half of consumers purchasing on-the-go food items, stores should ensure they are fully stocked with snack items to avoid missed opportunities.”

Jeet Bansi, owner of Meon Vale Londis in Stratford-uponAvon, Warwickshire, says while it’s important for retailers to have good core ranges, they should also look at current trends. “When it comes to standard bags, grab bags, sharing bags and bigger bags, look at your margins and see what’s more pro table for you,” he says.

ers to have good core ranges,

“Getting rid of standard bags of crisps worked well for us, but don’t stock too many varieties of the same product.”

AVTAR Sidhu, owner of St John’s Budgens in Kenilworth, Warwickshire, says it’s vital to look at linking purchases by positioning snacks near to complementary products.

“We have a crisp basket underneath our sandwich section for a meal deal and we also merchandise premium crisps close to our Cook freezers –

they sell exceedingly well,” Sidhu says.

“We also have a freestanding display unit full of 125g crisps and peanuts from KP Snacks, adjacent to our beers, wines and spirits area.

“If customers are buying Cook products, or if they’re buying alcohol, crisps and snacks, it is an easy sell.”

Ken Singh, owner of BB Nevison Superstore in Pontefract, West Yorkshire, displays his crisps and snacks in the middle aisle, which leads to the till.

“Everybody that walks into the store comes straight to the counter area down the middle aisle, which increases the opportunity for impulse sales,” he says.

Nic Storey, senior sales director, impulse and eld sales, PepsiCo

“WE have seen two shopper trends continue to dominate the savoury-snack category in 2025. PMPs remain crucial for retailers as consumers consistently seek value. Alongside this, shopper demand for spicy snacks across the channel has been undeniable, with the flavour segment up by 8.7% year on year1.

“To help independent retailers tap into these trends, PepsiCo launched Doritos Dinamita exclusively to the impulse channel in February. As the next step in our Extra Flamin’ Hot range, the new product caters to preferences for spicy flavours. Rolling out solely in a £1.25 PMP, retailers can boost their savourysnack sales by o ering the innovation in a format that highlights value.”

Doritos Dinamita to spice up shelves

PepsiCo followed the launch of its Extra Flamin’ Hot range in 2024 with new Doritos Dinamita. The product, which features bold flavours and a hint of lime, is available in £1.25 price-marked packs (PMPs) and is being supported by an impulse shopper campaign across March.

Pringles turns up the heat

Pringles has launched Flame Grilled Steak exclusively in the convenience channel. Flame Grilled Steak, available in PMPs, combines the Pringles crunch and steak flavour.

Limited-edition Extra Flamin’ Hot launch from Walkers

Walkers Extra Flamin’ Hot has joined the Walkers Max, Doritos and Wotsits Crunchy line-up, for a limited time. The launch comes as spicy flavours grew faster than the savoury-snack category average last year. Walkers Extra Flamin’ Hot is available in a 150g sharing pack, 70g PMP at £1.25, and 45g grab bag.

Plantain Chips from Grace Foods

Grace Foods says the launch of its Exotic Chips selection has helped to achieve a double-digit growth with the company’s snacks range and has introduced new customers to the company’s snacking range, Plantain Chips.

THERE is still debate about PMPs, but retailers say they work well in crisps and snacks.

MarkDudden, owner of Albany News in Cardi , sells PMPs in the crisps-andsnacks category because his store has strong competition from national retailers. “With PMPs, I might be charging lower prices, but I’m getting guaranteed margin, and customers don’t feel ripped o ,” he says.

“Stocking PMPs for crisps and snacks works really well. If retailers have strong com-

petition and are looking at their sales, I’d advise them all to go to PMPs, because the margin is there.”

Nishi Patel, owner of Londis Bexley Park in Dartford, Kent, agrees PMPs in this category make sense as they keep things simple for customers in what is predominantly an impulse category. “PMPs are probably the way forward for people,” Patel says.

“Keep your ranging simple. If you’ve only got a small area, keep it to one-size bags, rather than trying to do small, medium and large bags.”

Sponsored by Suntory Beverage & Food GB&I

your store making a positive impact in your local community?

If the answer is YES, enter the Better Retailing Community Hero Award, and gain the recognition you, your store and your team deserve.

Don’t stop at Community Hero. Enter one (or more) of our other categories:

Store Development

Effective Ranging & Availability

Customer Engagement

Responsible Retailing

Team Development

Merchandising & In-store Display

Retail Innovation

TASH Jones, commercial director at Fair elds Farm, says global flavours are continuing to influence the food industry, with imports such as Cheez-Its and Takis widening the snacking category.

“With the rise of social media platforms such as TikTok and YouTube, consumers now have greater access to unique flavour combinations from around the world,” Jones says.

Singh says Takis sold well in his store when they were rst available, but sales have slowed down since that ini-

tial burst. “I don’t stock anything I can’t get from my local wholesaler, unless it’s a TikTok craze, in which case I get hold of it,” he says.

However, to grow sales in more-unusual options, Fiona Malone, from Tenby Post Ofce & Stores in Pembrokeshire, says retailers could consider o ering tastings to customers. “Some people don’t want to spend £1.25 if there’s a risk they’re not going to like the crisps, so retailers could do tastings, especially of new products,” she says.

“Don’t be afraid to sample. If you open a bag, you might get 20 people to have a sample of it. If those 20 people buy 20 bags, you’ve easily covered your costs and made a pro t, and you’ll be reordering them for returning customers.”

Fair elds Farms’ Jones adds that convenience retailers should be o ering diverse product ranges and testing new entrants through oshelf display and promotion to add interest to their store environments.

• Offer Differentiation

• Have a Long Shelf Life

• Provide Great POR‘s

• Add Incremental Sales

•

• Taste Fantastic

• Are Much Loved Across Europe

Sas Horscroft, head of marketing and innovations, Burts Snacks

“FRIDAYS and Saturdays remain key sales days for snacks, as consumers o en stock up for weekend social occasions such as movie nights, sports viewing and family gatherings. These days present a valuable opportunity for retailers to drive sales through promotions and special o ers.

“However, lunch has also become a crucial snack occasion, with the rise of food on the go. According to Kantar data for the 52 weeks ending 1 September 2024, food-on-the-go sales have surged by 13.3% year on year, reaching nearly £38.4bn, with unit sales up by 7.7%.

This growth follows the Covid-19 slump, with a change in working patterns being a key driver.

“Hybrid working is particularly influential, as 28% of people still adopt this pattern, with 13% working solely from home, compared to 5% in 2019. This has led to a 25% increase in eating while working and an 8% rise in grabbing fast snacks.”

ers reported an uplift in their bagged-snack sales, with an average growth of 15.3%.

SIDHU says convenience retailers should work closely with their suppliers to drive more sales in the crisps-andsnacks category.

In 2024, KP Snacks launched its ‘25 to Thrive’ ranging advice to help retailers capitalise on bagged snacks.

Recently, the company worked with independent retailers to put its ‘25 to Thrive’ advice into practice and help drive category sales.

Following the trials, retail-

Sidhu says: “The ‘25 to Thrive’ advice is unbiased and focuses on the core sellers –it’s a great tool to use.

“It makes sure retailers look at secondary and tertiary missions, in addition to their main crisps-and-snacks displays.”

Kenny Chupe, owner of Our Local in Moston, Manchester, achieved a 17% uplift in his

Stuart Graham, head of convenience and impulse, KP Snacks

bagged-snack sales after implementing KP’s ‘25 to Thrive’ ranging advice. “Through the trial, our bagged-snack xture was completely rearranged, maximising the visibility of bagged snacks, which has driven sales,” he says.

“Stocking a wide range of PMPs at di erent prices has led to an uplift in sales in our store. Smaller PMPs appeal to family shoppers looking for lighter, more a ordable snacks.”

“PMP formats have seen signi cant growth in recent years and will stay increasingly relevant as the cost of living remains high.

“PMPs o er consumers great value for money, with clear pricing reassuring shoppers they’re getting good deals. Worth £324m, the PMP format is popular within the crisps and snacks category, with 57% of impulse shoppers buying PMPs.

“KP’s smaller-format PMPs include Space Raiders in a 40p PMP, alongside brands such as Discos, Skips and Wheat Crunchies at 50p, as well as the Hula Hoops core range and Pom Bear at 65p.”

Retailers unveil their VApril strategies to educate consumers about the upcoming disposables ban and the range they have on o er. TAMARA BIRCH reports

EDUCATION has always been the main aspect of VApril, which was originally launched by the UK Vaping Industry Association (UKVIA), and this year is no di erent.

Retailers have a strong opportunity to use this year’s campaign to educate current vapers on the upcoming disposable-vapes ban, which comes into e ect from 1 June.

“The ban itself is very sim-

ple, but because of opinions online and in the media, consumers are confused. We’re explaining it in the most simple ways. We say if it’s a single-use device, it’s banned, so if it’s rechargeable, it’s not banned,” says Michael Burnell, of The Vapourist in Chester eld, Derbyshire. Vince Malone, of Premier Tenby Stores & Post O ce in Pembrokeshire, and his team

tell customers buying a disposable vape about the ban.

“We say there’s a change in legislation and while you can buy them until 1 June, you won’t be able to afterwards, and then we direct them towards alternatives,” he says.

“VApril and this period needs to be about education and we’ve experienced two outcomes when talking to our customers. The rst is custom-

ers either know nothing about the ban or they think all vapes are going.”

It’s likely a lot of customers are already thinking this way, so strike up a conversation and inform customers buying disposables of the ban and when it comes into e ect. Some retailers also explain why the ban is coming, but the key is keeping things simple to avoid overwhelming them.

The government issued guidance in January, setting out the details on the de nition of single-use vapes and penalties

What is a reusable vape?

• Must have a battery you can recharge

• Must be re llable with vape liquid, up to a maximum of 10ml

• If the vape has a coil, it must be one that can be replaced by an average user

What are the nes and penalties?

• Fines of £200 are con rmed for rst-o ence cases of retailers found continuing to sell disposable vapes after 1 June.

• The guidance con rmed trading standards will be able to issue stop notices and compliance notices, as well as seize any non-compliant products found.

• In the case of further notices, retailers may be charged with an unlimited ne, a prison sentence of up to two years, or both. You may also receive an additional cost recovery notice, where you must pay the costs incurred by trading standards while investigating your o ence. This includes investigative, administrative and legal costs.

• In Scotland and Northern Ireland, the ne could escalate to £5,000. A two-year prison sentence is also possible for the worst o enders across England, Scotland and Northern Ireland.

*Puff count is a maximum estimate of 1 second puffs per pod based on lab testing of newly manufactured products. Actual number of puffs may vary depending on individual usage and flavour.

THIS PRODUCT CONTAINS NICOTINE . For existing adult smokers and vapers only. 18+ only. Not a smoking cessation product. © Fontem 2025

START now or use VApril as a way to explore alternatives, which will help maintain both sales and customers.

Popular alternatives right now are big-pu devices. IVG o ers a 2400 device, but another big-pu device stocked in stores is the Avomi Fliq 4-in1 2400 pod kit. Both devices utilise four di erent flavour pods in one device.

“When a customer asks for a big-pu device for the rst time, we tell them as much information as possible,” Malone says. “This includes telling them it’s rechargeable

via USB-C ports, how many pods you can use and that we also sell the pods so they don’t need to buy another device.”

Burnell’s advice is to ensure you stock the full vape kit because it o ers the least waste and is the most cost e ective for consumers.

“Currently, with big-pu devices, it can be a challenge as batteries aren’t designed to be used all day so will run out, and some larger big-pu devices, like the 10,000-pu devices, leak,” he explains.

Some customers, however, will be open to trying other

next-gen products and transitioning away from vapes. Popular products include heated tobacco and nicotine pouches.

“Nicotine pouch users are motivated by flavour more than anything, and with overall traditional sales in decline and with the impact of the ban now a few months away, convenience retailers need to fully embrace all aspects of the next-gen category,” advises

Prianka Jhingan, head of marketing, Scandinavian Tobacco Group UK (STG UK).

There are three nicotine pouch brands to note: Velo

from BAT UK, XQS from STG UK and Nordic Spirit from JTI UK. It’s also worth considering heated tobacco, which is largely dominated by Iqos from Philip Morris Limited (PML).

“Adopting a multi-category product approach is critical if retailers are going to meet di erent consumer tastes and preferences. There’s clearly an opportunity for retailers to switch single-use vapers to an alternative smoke-free option, preventing them from reverting to cigarettes,” says John Rennie, director of commercial operations at PML.

Michael Burnell, The Vapourist, Chester eld, Derbyshire

“THE opinion and feedback we’ve been getting from customers is they’ll keep buying disposables until the ban comes in and some businesses are working with that approach. We recommend buying little and o en if this is your approach to avoid being outpriced by nearby stores. If you stockpile and the price drops, but you have a competitor who buys little and o en, you risk looking more expensive than you are and you’ll have dead stock.”

How to

How to find profitable products

How to buy a convenience store

How to list your business on Google

How to attract customers to your store

How to write a stand-out job advert x

RELY on your teams to help educate your customers, or create VApril champions to help deliver the message of the ban and the campaign.

aware of the core information and then the team puts their own personality into it. Me, Fiona [Malone] and our retail manager are always on the shop floor and we listen to each team member deliver this to customers and provide feedback.

“This could be telling them they’ve done well or explaining that next time they could add an alternative. We also have a WhatsApp group to send reminders and product launches.”

PML expands Terea Pearls range

PML has expanded its Terea Pearls capsule range for Iqos heated tobacco devices with Riviera Pearl and Provence Pearl. Terea Pearls feature new capsule technology, which allows users to switch from a traditional tobacco blend to a unique flavour with a single click. They are only compatible with the Iqos Iluma device.

Elfbar Dual10k pod kit

Elfbar has continued to expand its range of pre lled pod devices with the launch of the Dual10k pod kit. It features two di erent flavours in one rechargeable device with an 850mAh battery. Users can alternate between the two flavours with the flick of a switch, and is available in 20 editions with 40 flavours.

STG UK expands XQS nicotine pouches range

Retailers can now stock two new flavours of STG UK’s XQS nicotine pouches range: Black Cherry and Citrus Cooling. Black Cherry o ers a rich, deep flavour pro le inspired by dark cherries, while Citrus Cooling combines tart citrus notes with a cooling mint e ect. Each pouch contains 8mg of nicotine and has an RRP of £5.50.

Pod Salt 2-in-1 kit

In November, vape supplier Pod Salt launched the Pod Salt x Pyne Pod 2-in-1 pod kit range to help retailers transition their next-gen range from disposable vapes. The pod kit combines two pods in one unit, which the supplier says can deliver up to 1,500 pu s and has a 600mAh rechargeable battery. The range has 10 start editions, each with a device and two pods of two di erent flavours at a £4.99 RRP.

New Riot Labs flavours

E-liquid producer Riot Labs has launched what it calls a “supercharged” collection of new flavours. Available online and in retailers nationwide, the 12-strong range will include Blackcurrant & Passionfruit, Cherry Ice, Strawberry & Melon Chew, Sour Pineapple Razz, Blueberry & Peach Fizz, Orange & Raspberry Ice, Blueberry Sour Strawberry, Morello Cherry & Banana, Grape & Strawberry, Cola Ice, Sweet Mint and Dark Fruits. Nicotine strengths of 5mg, 10mg and 20mg will be available starting from an RRP of £3.99.

As a framework, John Dunne, director general of the UKVIA, says teams can build on VApril’s core principles by educating smokers on how to quit through vaping, but concentrate on reusable devices, and make smokers aware how they can tell the di erence between legal and illegal vapes, and how to report rogue retailers. Dunne recommends keeping your customers informed on how best to responsibly dispose of their used vape devices.

Among this, Malone advises keeping it simple and not overcomplicating messaging. He says: “We’re big on making sure our team is

Take time with your sta to bring them up to speed. As this is a core part of VApril, it doesn’t have to just be about educating your customers, but your teams, too. Explain the ban, how it will impact the store and any business plans you have, such as any display changes.

MORE legislation surrounding the ban is likely to come, so looking ahead, it’s likely the category will continue to be impacted. The biggest change will be the new tax, which comes into e ect from October 2026.

Current information means a £2.20 tax will be implemented per 10ml of e-liquid. Other updates – although not con rmed – that are worrying retailers include possible

flavour and display bans.

Burnell welcomes these changes, however, and says:

“It will prevent the saturation of the market from pop-up shops, or people who are in it for the wrong reasons. We will also see an increase in trading standards, which is long overdue, as they’ve had minimal funding.

“Right now, these seem to be going after distributors, but independents selling

illicit stock are causing a larger impact.”

Malone is concerned that the speed these legislative changes are coming into e ect will push consumers to the black market. “We need to ensure compliant and legal stock is accessible. Currently, the costs keep shoppers in store, but if they increase, we worry they’ll be pushed to an unregulated black market,” he says.

Thornbury Refrigeration, an Arneg Distributor, has advertised in Retail Express for years. The

The RETAIL EXPRESS team nds out how retailers are getting more customers through their doors

Neil Weir, Ollie’s Day-Today, Ballyclare, County Antrim 1

“WE offer parcel collection from Amazon, Yodel and UPS to get people through the doors. We’ve had them for about a year now and our footfall has increased by 100 people a day, easily. Parcels are huge business and it’s a smooth transition. We use our PayPoint tills which have an app on them for it, so it’s just become a part of that rather than a whole extra section. The parcels are located at the checkouts and then transferred to the back of�ice.

“It’s been seamless and it drives people to us. People will come in and post a parcel, and most of them will stop and buy something in the store or at least have a look around. Parcels really do drag people into the shop.

“It helps for Google searches as well. People will search online for the nearest place that offers Yodel rather than our speci�ic shop, and it will bring us up.”

2

Nick Thornton, Sam’s Local Shopper, Pulham Market, Norfolk

Raj Suchak, Coldean Convenience, Brighton, East Sussex 3

“THE �irst thing we do as a shop is make sure people know that our post of�ice hours are the same as our shop hours – seven days a week including bank holidays – which means that people know we’ll be open and will come to us.

“On top of that, I’ve been trying to get lots of extra in-store services. I’ve already got Amazon, Evri and DPD, and I’m looking to get DHL, UPS and more. The aim is to become a postal hub for the area. I would say that 30% of the people who come into the shop to post or collect a parcel buy something.

“Retail is tough at the moment and people don’t have a lot of extra money, so you’ve got to give them a reason to come to your shop. The more services I provide, the more likely they are to come to me. We also offer dry cleaning pick-up and drop-off, and have coffee, fresh bread and cakes every morning for people, which de�initely helps.”

“AT the end of the day, customers want convenience, everything they need under one roof and all at a price that’s competitive with multiples. So, that’s how we run our shop.

“We stock as much as we possibly can source – we’ve got over 12,000 lines, and they’re all priced competitively, especially on those core lines like bread, milk and even tobacco. One of our keys is price-marked packs. It’s a trust-building exercise between you and your customer.

“We’re with Premier, so we try to get hold of its promotions and pass those savings onto our customers rather than chasing higher margins. If we’re withing 20p of the supermarket price, then we’re doing well, and often when we’re on promotion, we’re far more competitive than that. It gives people con�idence and keeps them coming back. We’re also known for always being open from 6am to 10pm, except Christmas Day.”

In the next issue, the Retail Express team nds out what unusual products and categories are driving sales. If you have any problems you’d like us to explore, please email