Connect & Inspire Conference will be held at the ICC Wales and the Celtic Manor Resort. Throughout the day you will get to connect with our members, learn about the future direction of the Caterforce group and be inspired by our fantastic line-up of speakers including a celebrity guest.

will be followed by an evening of celebration with great food, entertainment

awards for the best suppliers in 2022

voted for by our nine wholesalers.

prestigious event is open exclusively

suppliers.

Building profits and increasing success A guide to the most innovative and costeffective methods that guarantee success in the channel

REPORT

With rising energy bills coupled with the costof-living-crisis, the UK looks set for a bleak winter.

Wholesalers, like all businesses, were eagerly waiting to learn how prime minister Liz Truss planned to tackle the crisis.

At time of writing, the overall support scheme could cost up to £150bn, but Truss refused to put a figure on it. However, help for businesses will only be capped for half a year initially, a shorter period

than many wholesalers would have hoped for. The help will be for all companies in England, Scotland and Wales with equivalent assistance for Northern Ireland.

It seems pertinent, then, that this report focuses on cost-effective methods that guarantee success in the channel. This edition features a five-point plan for Truss from the FWD, including a call to re-establish the 12.5% VAT rate, as well as a moratorium on outstanding policies.

Elsewhere in this edition, I interview the co-founder of an online wholesale marketplace pioneering a new way to distribute food and beverage products to independent buyers.

David Gilroy, meanwhile, takes lessons from coaches responsible for recent sporting success and applies them to wholesale. We also look into how the adoption of new ERP technology has improved profitability and efficiency at Reynolds.

Finally, buying groups feature heavily in this issue, with the managing directors of Unitas, NBC and Confex revealing how they can help improve wholesale operations.

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Head of design

Anne-Claire Pickard

Production editor Ryan Cooper

Sub editors Jim Findlay, Robin Jarossi

Designer Jody Cooke

Contributors David Gilroy, Tom Gockelen-Kozlowski, Rob Mannion, Tanya Pepin, Elit Rowland, Charles Smith, Tevin Tobun

Production coordinator

Chris Gardner

Head of commercial Natalie Reeve 020 7689 3372

Senior account director

Charlotte Jesson 020 7689 3389

Account manager

Marie Dickens 020 7689 3366

Senior Account Managers

Barry Lavis 020 7689 3372

Lindsay Hudson 020 7689 3366

Printed by Acorn Web Offset Ltd, Loscoe Close, Normanton Industrial Estate, Normanton, West Yorkshire, WF6 1TW Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT

Newtrade Media Limited, 11 Angel Gate, City Road, London EC1V 2SD Tel 020 7689 0600

P6-7: Viewpoint

Taking wholesale lessons from the world of elite sport

P8-9: Interview

We hear about a unique new way to distribute

P10: Opinion

Going online will drive sales and maximise profits

P11: Insight

An update on the latest developments in Scotland

P12: Insight

A five-point wholesale plan for the new prime minister

P13: Data

A guide to innovative and costeffective wholesale methods

P14: Advice

How Women in Wholesale is continuing to evolve

P15: Insight

Economic and social changes threaten profitability

P16: Opinion

Why wholesalers are missing a trick in dropping D2C

P17: Profile

Analysing the adoption of a new ERP tech at Reynolds

P18-19: Tips and summary

Five ways wholesalers can build profits

CATEGORY ADVICE

P4-5: Working Together

Why promotions lead to huge sales uplift

P20-38: What to Stock

Our annual guide to the bestselling products

P33-45: Suppliers

We hear from four key brands working in the channel

Better Wholesaling Insight's publisher Newtrade Media cares

Better Wholesaling Insight is

by Newtrade Media

which is wholly owned by

which is wholly owned by the

of the National

of Retail

Reproduction or transmission in part or whole of any item

P46-50 Buying groups

Three companies talk through their latest developments

P52-56: Sector review

The latest trends and product news within Christmas, Halloween & Bonfire Night

Promotions have always proven to be important to the exposure of products in the wholesale channel and Suntory Beverage & Food GB&I (SBF GB&I) recently visited Parfetts in Stockport to check out a new promotion its Lucozade Energy brand was running with Xbox.

“It’s really great to work with the likes of Parfetts to discuss the importance of going big on promo options to attract retailer attention and drive sales,” explained Adam Woodmansey, regional account manager at SBF GB&I.

Jamie Ferguson, head of marketing at Parfetts, added: “We always learn a lot from our visits from SBF GB&I, which we’re then able to pass onto our Go Local retailers.”

Now worth £318m, the Lucozade Energy portfolio is already a high performer in the soft drinks category and the addition of an on-pack promotion increases this further, according to Ferguson. “Lucozade drinks are already performing really well here at Parfetts. It’s also great to introduce something like this into the depot to create a buzz around the place and excite both staff and customers,” he said.

Meanwhile, Elliot Sleath, national account manager at SBF GB&I, explained the choice of the gaming industry for this particu lar promotion: “Gaming is absolutely massive right now, with more than two-thirds of people playing in the UK, so targeting gamers is a big opportunity for the Lucozade brand. This partnership will allow

retailers and wholesalers to take advantage of this opportunity as well, with the bottles transformed through limited-edition sleeves that will drive shoppers towards the packs. Every bottle has a guaranteed prize for shoppers to redeem, making it undoubtedly one of our biggest promotions yet.”

Sleath described how promoting partnerships such as this in cash and carries is key, with bespoke front-of-depot displays being proven to lead to sales uplifts of 5%, “while a depot fixture relay can increase sales by a huge 91%. This shows the huge benefit of working together with our wholesale partners and helping them to become more suc cessful in the soft drinks category.”

“It’s been great having SBF GB&I here in Stockport,” said Ferguson. “These types of exciting promotions are ones that our retailers and their customers love. Judging by the initial buzz in depot, I can’t wait to hear how the Lucozade products continue to sell in stores and can’t wait to see what other promotions we’ll be running with them in the future.”

1(All data from SBF GB&I Activation Uplift Report, 2021), 2IRI Total Market 52wk 26.10.20 Litres converted to 500ml bottles, 3Nielsen, GB Total Market, YOY latest 52 weeks to 26.02.22, 4IRI S&I L52w 28.10.20 Sales Value

We’re always more than happy to welcome the SBF GB&I team to Stockport, especially when there’s an exciting promotion taking place. It’s also good to learn about the wider category in general from them, which we’re then able to pass onto our Go Local retailers.

Regional Account Manager, SBF GB&I

Promoting in depot to retailers is hugely important, and massively beneficial to wholesalers. We have data from a recent takeover in one cash and carry which shows that we saw sales uplifts of more than 180% of Lucozade Energy drinks compared to the previous week.

Data from a supplier takeover in one cash and carry

a sales uplift on the brands featured (based on

from the previous week) of 183%

Bespoke front-of-depot display can lead to sales

of 5%, based on data from a similar launch promotion without a front-of-depot display

increases depot sales by 2%

fixture relay can increase sales by

two of the best test teams in the world?

David Gilroy is the founder and managing director of Store Excel

Can England win this?

Chloe Kelly stabs the ball home from close range at the second attempt. Cue her exhilarating shirt-twirling celebration across the Wembley turf. Everyone in the stadium is going wild. England 2-1 Germany, and they are on their way to winning the Euros, with millions of fans across the country in raptures. Who could fail to be swept up in their success? How can a team that seemed to have stalled 18 months ago power through 20 games undefeated to take the title? Three words: coach Sarina Wiegman. A few weeks earlier, at the Headingly Cricket Ground, against all odds, Jonny Bairstow smashed one of the fastestever unbeaten centuries to close out a famous test victory against India to level the series. Remarkably, it is his fourth century run chase of the summer, and England’s fourth consecutive victory. How can a team that previously had only one win in 17 matches and looked totally moribund lift itself up to beat

Three words: coach Brendon McCul lum. Players and experts commenting on Wiegman and McCullum describe their methods in similar words and phrases: clarity of vision, simplicity, consistency, continuity, risk taking, lack of fear, trust in the players, deep understanding of the game, meticulous preparation, calmness under pressure and a whole lot of fun. Are there busi ness parallels and lessons to be learned from sport and are there similar types of leaders to be found?

No-frills airline Ryanair is not uni versally admired by the industry or its peers, but its customers know what to expect and buy tickets in large numbers. Chief executive Michael O’ Leary is straight-talking and doesn’t pull his punches. He has a clear vision of an efficient, low-cost airline operating with maximum passenger loadings, opti mised by a dynamic pricing model.

The entire management team is focused on driving out unnecessary cost, running profitably and planning ahead. The business hedged effectively against the oil price increases, and this is bearing fruit. O’Leary never deviates from the mission and will make tough decisions to keep the business on track.

As The Sunday Times reported recently, when EasyJet cancelled 741 flights in June from UK airports and British Airways cancelled 421, Ryanair scrapped only 25. The biggest cause of airport chaos was staffing, and while its competitors were culling numbers during the pandemic, Ryanair did a deal with the Unite union to save cabin

Parfetts built its business over many years on the premise of honest value, comprehen sive ranges and good service

crew in return for temporary pay cuts. This enabled the company to respond quickly to the increase in demand post-pandemic. Ryanair did everything to keep its pilots flying – if they weren’t on planes, they’d be in simulators.

Fashion retailer Next started life as a skunkworks project at Hepworth’s in 1982. George Davies, the project leader, had other ideas, and 70 Next stores were trading within weeks of launching. His knowledge and eye for design were sec ond to none. He set the vision of ‘great design at affordable prices’.

This remains central to the compa ny’s values statement to this day. The business has become one of the UK’s most consistent top-performing retailers. Under the leadership of Lord (Simon) Wolfson, it has outperformed the FTSE 100 and the retail sector by a wide margin for more than 20 years.

Oliver Shah, in The Sunday Times, writes that Wolfson’s strategy has been defined by consistency, an eye for detail and pragmatism. He has constantly trimmed the property portfolio, getting rid of poorly performing stores and managing down the average lease length. Unlike many of its high-street ri vals, Next has never found itself saddled with excess space. Its trading statements and market guidance are models of clar ity. Next plans forward, subjecting itself to brutal stress tests looking at how its

In partnership with

As a key decision-maker within wholesale, you’re invited to take part in research, in partnership with Ferrero, that will give Better Wholesaling Insight a clearer understanding of how the industry has shifted towards e-commerce.

For a chance of winning £250-worth of Love2Shop vouchers, please answer the five questions found using this QR Code:

Or by going to – betterwholesaling.com/ ecommerce-ferrero-survey

business will fare over the next 15 years including shop sales falling by 10%.

The company had to close stores in the pandemic, but Wolfson used the time to turn it from a fashion retailer to ward being an online platform providing services for third-party brands. Compare and contrast with Marks & Spencer. Next thrives in a turbulent market.

Well established in the US, ware house club Costco entered the UK in the early 1990s. Warehouse clubs are unique in that they charge customers a membership fee before they are allowed to shop. The format is positioned as wholesale and is all about large bulk packs and focused ranges offering outstanding value.

Costs are ruthlessly contained and waste is driven down. Supplier invest ment is invariably channelled directly to the product to ensure the most compet itive selling price at all times. Costco’s target customers are broadly – but not exclusively – business users including retailers and caterers.

The range numbers are tightly con trolled, with around 60% of shelf space devoted to clothing, homeware and elec tricals. This product mix significantly contributes to gross margins. Costco is hugely successful and has opened stores and built sales since launch.

Jeremy Garlick, of FMCG strategy consultancy Insight Traction, highlights

one of Costco’s key strengths – fresh food. While Tesco and Sainsbury’s have closed service counters and cafés, and have given way to an ocean of bland ness, Costco prepares much of its fresh food on site with food-production areas highly visible. The selection of meat, fish, prepared meals, fresh produce and celebration cakes is peerless. Sampling throughout the department with knowl edgeable colleagues advising customers underlines the retail confidence.

This, aligned with the authority of the bulk displays, gives a level of theatre rarely seen in the multiples, and this makes Costco an exciting destination. I have studied Costco in the US and Europe over the years, and it never devi ates from this format. It is clear about its proposition, it executes superbly and colleagues are highly committed. Costco knows exactly where it is and the format delivers continual success.

Family owned Parfetts built its busi ness over many years on the premise of honest value, comprehensive ranges and good service geared to small-store customers. This assured a measured sales trajectory at a manageable pace. Over the past three years, the business has sprouted wings and turbo boosters to outperform the market, but how?

Before stepping back, Steve Parfett determined to set up the company along employee-owned lines similar to John

Lewis Partnership. This has been an undoubted success and seems to have fired up the entire workforce.

The business has stayed true to its primary mission of being brilliant for independent retailers by continually honing its Go Local store formats, and it has mastered the art of operating as a cash and carry and delivery hub within the same premises. This is no mean feat and, as a consequence, productivity and sales per square foot are some of the highest in the industry.

The employee partnership model enables the business to reinvest in services, facilities and its fascia estate, thus continually improving the customer offering and locking in loyalty. Even in these tough times, Parfetts continues to offer free deliveries on a given set of commercial terms. Confidence is high and Parfetts is set to open its eighth de pot in central Birmingham as it looks to expand its Go Local symbol operations.

Operational excellence, talented, mo tivated, committed players and effective succession planning are essential for success. This is the platform. To elevate above this level and into the realms of the stellar, a clarity of purpose, consist ency, simplicity and a true belief in the proposition must be rooted in the core and continually nurtured. This is what characterises the top-performing elite sports and business enterprises. l

we’re facilitating trading activity between seller and buyer, which then creates greater transparency and profit margins. This means our buyers know where they are buying from and sellers know where their products are going to. This doesn’t always happen in traditional wholesale.

PL: We are an online wholesale mar ketplace. We are doing wholesaling, but we’re not doing it the traditional way of buying and selling. Instead,

Before launching at the end of 2019, we started building the framework in 2018. At the same time, we started to create demand and build relationships with customers. We then did a small pivot into the business-to-consumer market during Covid-19, where we went straight to our consumers and also worked with the NHS to supply some of its doctors.

Through our technology, we have al gorithms in place that enable buyers to find the right producers or suppliers to buy from. We use data to algorithmi cally match retailers and outlets with what we like to call the ‘most relevant

proposition’. We base this algorithm on cost, locations, provenance, pack aging requirements and so on, with some of these attributes having differ ent weights of importance within the framework. There is an elaborate data science behind all of this, and it saves a lot of time and effort for everyone in volved. All of the programmes we use are ours, as we own the AI. Despite it sounding complicated in the back end, it is a very simple user experience for our buyers, who are able to select products from across 12 countries.

We make our money by taking a cut from the sales of our sellers. We don’t take any money from the buyer at all – our service is completely free to use and there are no upfront fees for a company to start with us. This makes it a very fair marketplace as buyers and sellers can test it out, unlike traditional wholesalers who will have their terms and agreements in place from the start. We treat it like partnerships where

we look to grow with them and all they have to do is sign up and browse through our producers. They also have the option to request that we list certain brands or product types. I compare it to Airbnb in the way we have opened up the market to more producers like they have done for property owners, and by doing that have demonopolised the market. I have spoken to brands in countries including Italy and Spain that said they couldn’t agree deals with UK wholesalers, but we are now giving them that option.

We don’t work with mainstream brands. Our brands are almost always independent, and are small-to-mediumsized, speciality, challenger brands. Some could be small start-ups, whereas some could be several years old. The brands we work with are not necessari

ly trying to get into the big retailers, but are not posh or niche, either – they’re what I like to call ‘non-mainstream’, and that is 90% of the overall food and drink market.

Good-quality food should not be seen as premium, niche, posh or unat tainable to retailers. We want to make it more affordable and profitable within its margin. ShelfNow aims to make artisan brands more accessible to all. However, the producers on the digital marketplace are, in some instances, unique and premium.

Do you work with convenience stores?

We haven’t worked with traditional convenience stores as much, although we are open to non-symbol-group-affil iated independent stores. We’re hoping to get the message across to them that buying from our types of suppliers will

incur the same – if not better – cost and profit margins as going to big suppliers through traditional wholesalers.

With so many suppliers, how do you measure your sustainability?

We’re working on measuring our CO2 impact in the near future, which we believe will prove our system is more sustainable than traditional wholesal ers. Our products go direct to retailers and don’t have to be stored in a depot, saving on transport and storage.

What is your long-term plan? We already work with thousands of suppliers. The average wholesaler in the UK has around 4,000 products, but we could work with 100,000 if we really wanted to as there’s no limit to it. We also aim to be in the different geographies on the buyer’s side as well as the seller’s in the coming years. l

The twin challenges of the cost-of-living crisis and soaring inflation have been well documented over the past few weeks, with mainstream media highlighting the impact that increased fuel, en ergy and food costs are likely to have on consumers. However, the effect these price rises will have on manufacturers and business owners has largely evaded the discourse.

Soaring costs and inflationary pressures on overheads such as global shipping, store energy prices and increasing staffing costs will be strongly felt by many commercial enterprises.

For wholesalers, there is also the added pressure of balanc ing rising supplier pricing with maintaining low prices for cash-

strapped customers and their con sumers, while keeping demand alive and still making a profit.

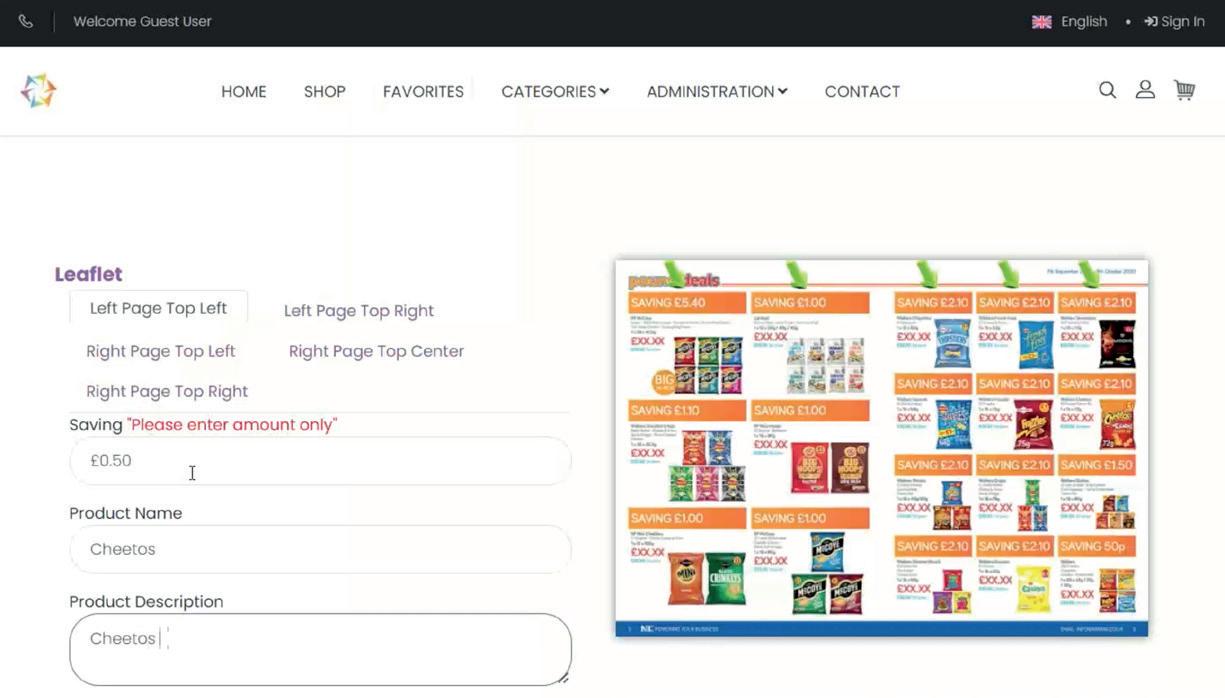

Encouragingly, recent data has shown that digital wholesale is now reporting larger basket sizes than orders placed via traditional channels, not simply redirecting sales from one channel to anoth er. Creating a strong e-commerce presence is, therefore, increasing ly important given the challeng ing economic climate.

Creating an online purchasing environment is quick and straight forward, with fully-branded platforms such as b2b.store able to be created in just a few clicks. Not only do e-commerce platforms make it more conven ient for customers to place orders any time, any place and on any internet-connected device, they can also help alleviate business

costs and provide new communi cations channels that can be used to boost sales and even generate new revenue streams.

For example, customers using b2b.store are now able to process payments through open banking rather than taking credit, debit or company card payments, significantly reducing transaction fees incurred. The service also integrates invoice reconciliation into the process and smooths cashflow as pay ments go directly into wholesal ers’ bank accounts, rather than taking several days to process.

As well as improving commu nications with individual custom ers, using e-commerce platforms also opens up new advertising and marketing opportunities to boost sales.

The recent release of our advertising module on b2b.store allows wholesalers to benefit from sophisticated, in-platform communications capabilities. From simply uploading an advert for immediate display and then deleting it, to more advanced

approaches, such as scheduling adverts or tying SKUs to adverts with a clear call to action that can be tracked through to custom er baskets, digital advertising provides a sophisticated approach that returns clear performance data, allowing campaigns to be honed quickly to deliver maxi mum returns.

Digital campaigns can also be created to replicate in-depot marketing activities, such as end-of-aisle promotions and trade events. Crucially, though, while traditional advertising takes weeks to plan and imple ment, in-platform e-commerce advertising is flexible and reactive, allowing wholesalers to adapt promotions in real time in response to consumer behaviour, trends and even changing prices, supply or stock levels.

E-commerce increasingly pro vides wholesalers with the tools they need to build better profits. The ability to be open 24 hours a day while automating marketing and back-office processes reduces staff costs and increases sales.

For the Scottish Wholesale Association (SWA), recent months have seen increased collaboration with other trade groups and stakehold ers on key areas such as local sourcing and decarbonisation.

Chief executive Colin Smith explains: “Post-pandemic, we’ve really ramped up our levels of engagement with our members in order to focus on areas of their business that are becoming increasingly important.

“While we’ve always taken a collaborative approach, we’re very much at the forefront of driving the sustainability agenda as it affects our members and also local sourcing – both of which are priorities for Ylva Haglund, our recently appointed head of sustainability and engagement.

“It’s a wide-ranging role designed to help members share knowledge and resources to understand and overcome the challenges on the road to net zero, and in doing so create a greener, more sustainable local food-and-drink supply chain.”

Working closely with govern ment, stakeholder groups and colleagues at the Federation of Wholesale Distributors (FWD), Haglund will lead on the whole sale sector’s decarbonisation and net-zero strategy, incorpo rating phase two (buildings and energy use) and phase three (people and travel) of the SWA’s ongoing ‘Decarbonisation of the Wholesale Industry’ project.

Earlier this year, the SWA was

invited to join Scotland’s new Zero Emission Truck Taskforce in recognition of its ongoing work with members as part of the project.

The taskforce comprises industry leaders from the road haulage, logistics, manufactur ing, energy and finance sectors who will work in partnership to identify and co-design creative and practical solutions to max imise opportunities.

It will also tackle any hurdles in relation to technology, charg ing infrastructure, costs, finance, and operator engagement in the transition to zero-emission trucks.

This new collaboration will set out the steps required to enable a swift and just transition to new technologiy, identifying where further development is required and exploring new business models.

Meanwhile, the ‘Delivering

Growth Through Wholesale’ programme facilitated by the SWA, Scotland Food & Drink and Scottish Agricultural Society Scotland is proving highly suc cessful in introducing suppliers to wholesalers to showcase their products and spark new business opportunities.

In March, 200 business meetings took place at the first cross-sector event between Scottish wholesalers and foodand-drink producers to help build stronger relationships between the sectors.

The programme is designed to provide businesses with the tools they need to help them max imise opportunities within the wholesale industry – which is currently worth £1.7bn in gross value added to the Scottish econ omy – and increase the amount of local sourcing among Scottish wholesalers.

Smith adds: “Again, collaboration is definitely the way forward.

“We have developed this programme with our partners to strengthen engagement with wholesalers and local produc ers, and help them access new markets – driving more Scottish products into the 5,000 conveni ence stores and 30,000 hospital ity, tourism and leisure venues that our members supply.

“There are always challenges in the wholesale sector and the past couple of years have been particularly tough,” says Smith. “However, by engaging with our members more closely with regard to these key business opportunities, and providing them with the information and contacts as they plan for the fu ture, we create a stronger sector that collectively has the potential to be more profitable.” l

The wholesale industry has laid out a fivepoint manifesto for new prime minister

Liz Truss, which will support food distribution in the UK and boost the wider economy.

When drafting this prior to her appointment, the FWD told the Conservative Party that its mem bers have been disproportionately affected by the Covid-19 pan demic, labour shortages and the Ukraine war, which have resulted in a huge increase in the costs of doing business.

The FWD Manifesto for Liz Truss:

1) Cut fuel duty by 15p per litre to reduce the cost of doing business and inflation This is one of the most effective tools the new government could use to reduce inflation. The dramatic increase in fuel prices is multiplied and passed on through out the supply chain and onto consumers, driving up prices and inflationary pressures.

A move to cut fuel duty by 15p per litre would bring the UK in line with Germany, France, The Netherlands, Ireland and others across Europe that have responded to spiralling petrol prices.

This would result in a concrete, immediate reduction on the cost of living, and contribute across the economy.

2) Introduce a moratorium on outstanding policies

The introduction of policies to limit harmful eating and envi ronmental practices are welcome and supported by FWD and many within the sector. However, there is a time and place to introduce dramatic policy changes that alter the relationship between the state and business to introduce new compliance burdens, and the time is not now, especially given the costs associated with introducing these policies.

A moratorium should be introduced for invasive policies such as HFSS restrictions and ecotaxes such as the Deposit Return Scheme and Extended Producer Responsibility. This will also provide ample time for government to get the design of the policies and schemes right for the longer term.

FWD welcomes the ambition of the Food Strategy White Paper, and the Government Buying Standards for Food and Catering Services. The vision of healthy, nutritious and British-produced catering for public sector is no less than our members would wel come. However, these ambitions are entirely unrealistic in the face of public-sector food budgets, which have not been accurately adjusted to account for inflation over the course of a decade.

Rather than being able to sup

contain less expensive (and there fore less healthy and nutritious) provisions to be supplied on a more regular basis.

By introducing a greater amount of ringfenced funding for public-sector food, the knock-on effects throughout the agri-food sector and wider economy would be profound.

4) Utilise control over our borders to ensure there is enough labour to support with domestic food production and distribution

The shortages of labour witnessed throughout 2021, most notably resulting in HGV driver shortages, and in 2022, with shortages of pickers and processors, is causing major and unnecessary disruption to the food and drink supply chain.

The UK must think about post-Brexit labour planning in a new way. We should be in control of immigration without having a closed-door policy. Skills vital for our economy should be prioritised, and in this instance, agri-food workers are essential for keeping shelves stocked, and

plates full.

The new government should consider practical changes to end the post-Brexit boom and bust cycles of labour shortages through tweaks to the shortage occupation list, coupled with domestic skills training. This will provide short-, medium- and long-term solutions to labour issues.

5) Re-establish the 12.5% VAT rate for hospitality to alleviate cost of living and encourage participation in the economy to stave off threats of recession Companies are doing everything they can to limit price rises for consumers, but amid rising ingredient, fuel and energy inputs, stopping these price increases is challenging. Reintroducing a 12.5% VAT rate will not only help to lower costs of products in the out-of-home setting, but will spur on demand at a time when consum ers may be inclined to protect their budgets, providing vital support for thousands of small, local, communi ty businesses l

It may not feel like it, but we have had a relatively stable economic climate for many years – at least in terms of inflation remaining low. Economists predict that we may be on the brink of ‘stagflation’ –persistent high inflation, slowing economic growth and high unem ployment. As such, success for wholesalers – and their suppliers – is really about surviving these tough economic times and redis covering the lost art of inflation ary buying and selling.

Given the number of price in creases coming through currently (some brands are already putting through their fifth in 2022), a clear understanding of what stock has been bought at what cost price is imperative. This means taking a forensic approach to understanding the margin/stock/ volume relationship and the impact that any pricing decisions will have.

We are already seeing evidence of wholesalers building up a stock buffer and this is critical – stock is king. As prices rise, potentially on a weekly basis, the most pow erful mitigation is having pur chased stock when it was slightly cheaper. This gives the operator options – to sell at the new market price and recoup some margin or hold the lower price and gain competitive advantage by offering lower prices.

A great deal of administration and data analysis is needed and, therefore, operators with an ef fective data management strategy

– as well as senior team members who have experience of trading through inflation before – will be at an advantage. Operators will be buying the same SKU at different prices, and to survive they will need to track each case – what price it was bought at and the selling price, so there is absolute clarity on margin by day.

Price volatility makes tactics including price-marked packs trickier than ever. Our latest TWC Trends research shows that consumers’ willingness to accept a premium in convenience stores has slipped slightly, which argu ably makes the role of PMPs – to reassure on price – even more critical. However, to be sustain able, price-marked packs must provide sufficient shared margin to cover the needs of both the wholesaler and the retailer.

Getting the product mix right is also imperative. It is advisable to look at listings from two per spectives driven by the consumer: cash-strapped consumers will be looking for affordable treats and, conversely, to trade down. Our latest TWC Trends research confirms that more than half of consumers are having to reduce their spending to pay their bills and they are using many tactics to achieve this across both gro cery and discretionary spend. Wholesalers, and their customers, can optimise sales by positioning range to reflect this.

Premium brands will always have a role, but, using the ‘good, better, best’ analogy – the share of space and sales of ‘best’ is likely to shrink while ‘better’ and ‘good’ expands through consumer choic es at the till. Again, understanding

the profitability of these product segments and shifting their share of space means that the consumer gets a product they can afford while the wholesaler, retailer and caterer can keep moving stock.

Finally, not unconnected to ‘mix’, my parting advice is to be ruthless and cut the tail. For a wholesaler to be well known for the size and breadth of their range inevitably means there will be a long tail of products that are not really earning their keep due to low rates of sale.

Be firm, draw a line across a category and remove products that do not justify the space they are taking up, and then replace them with lines that hit the rateof-sale threshold.

This simple act will increase sales in core lines and reduce operating costs. l

Women in Wholesale (WiW) has launched a virtual workshop to help men in the wholesale industry to become bet ter allies to female team members.

The first sessions took place ealier this month, with a focus on unconscious bias, hosted by Chris Tarquini, senior category manager at Brown Forman, who is also co-lead on its GROW (Growing Remarkable & Outstanding Women) ERG Committee.

“Male allies are people who are willing to advocate and speak up in support of gender equality,” said WiW chairperson Clare Bocking. “They are vital in helping to create a pathway to a more inclusive workforce that helps to attract and retain female employees.”

In a recent WiW survey, 90% of male members said they would be interested in learning how to become better allies, while 67% were motivated by ‘setting a good example’ to other men; 50% said they wanted to ‘help other women on their team progress’ and 43% are motivated by ‘being a better person’.

The guest speaker for our first Male Allies session was executive coach Ayman Nasreldin, who has 22 years of corporate experience in the FMCG industry, where he held many commercial leadership roles, in organisations including Mars, PepsiCo and Nestlé.

On top of this, we have our

upcoming conference with a high-profile line-up of speakers this year including directors from Booker, Costco, Bestway and Unitas plus a raft of foodie entre preneurs and sporting talent.

The event, which is tak ing place on 22 September in London, has attracted a record level of support from senior-level men as well as a loyal following of women across all levels.

Supporting the event for the first time since its 2016 inception, Booker Wholesale says it is com mitted to creating a workforce where everyone is welcome.

Rebecca Mallows, people director at Booker said: “We remain committed to creating a diverse and inclusive workforce that reflects the wide variety of customers, businesses and com

munities we serve.

“Inclusion is about making a real difference to our colleagues in their daily working lives by talking about what matters to them and building an inclusive, supportive and sustainable culture.”

The initiative has gained a record level of senior-level male support, including long-term support from Ian Johnstone, business unit director at AG Barr.

“Supporting WIW over the years has been immensely valuable to me and my senior leadership team who are mostly women,” he said.

“It demonstrates the need for more women in our sector at all levels, giving them a voice in a sector where they, at times, feel unheard. We are crying out for

diversity, and we have some of the best female role models in the industry to help us achieve that.”

The programme is designed to help women progress through discussion, storytelling and networking, while helping senior business leaders create inclusive and diverse cultures. l

Anew survey commissioned by OGL Group has revealed that the Covid-19 pandemic, Brexit, the continued reliance on manual processes and supply-chain issues are the biggest challenges affecting profitability for wholesale and distributor businesses in 2022.

The pandemic and Brexit have hit supply chains and necessi tated many businesses pivoting to online sales. Exacerbated by stock management pressures, companies are citing their priori ties for the next 12-24 months as business performance report ing (41%), linking ERP with e-commerce (40%) and managing inventory (33%).

The five main factors affecting wholesalers’ and distributors’ profitability in 2022 were cited as the Covid-19 pandemic (54%), Brexit (38%), manual processes (33%), stock availability (32%) and employee cost (27%).

Digging deeper into coronavi rus and its effects, respondents’ business priorities were to man age cashflow (81%), have a crisis plan in place (80%) and flexible employees (80%).

Back in 2019, when OGL conducted the same survey, respondents cited Brexit as the main factor at (47%), followed by employee costs (44%) and inaccurate data (38%).

Brexit and manual processes are still in the top five, but un surprisingly, Covid-19 is the top factor affecting wholesalers and

distributors this year.

Inaccurate data (24%) and outdated technology (27%) have been ousted by the pandemic and stock availability.

Still a top-three factor, inse curity around Brexit is affecting company profitability at (38%), but this has gone down from pre-pandemic figures, which saw (47%) of respondents citing it in the top three in 2019.

The pandemic has led to sup ply chain shortages and a threat as some wholesale businesses are stockpiling products and parts to ensure supply to clients. Manual processes are still plaguing businesses, leaving them behind the curve with regards to digital transformation, with 99% still using them and 67% citing them as a problem that slows down

their business efficiency.

Respondents also cited major factors damaging profitability as: ‘access to talent’, ‘variable costs’, ‘warehouse space’ and ‘war’, as well as ‘stock value and liquidity’.

Entering another potentially uncertain economic period with continuing supply-chain issues, the Ukraine-Russia war, cost of living and fuel price rises, whole salers’ efforts to increase profit ability are critical. Technology is at the heart of this, with 86% of respondents agreeing that technology is vital to the efficient running of their business, while 82% agreed that automating business processes helps their companies stay competitive.

A key finding of the research was the wide spread of technolo

gies used and the disparate nature of systems that are not neces sarily “talking to each other” to provide a full view of operations. Wholesale businesses use a range of software systems to function: more than 95% of respondents use one or more software systems to run their business, from warehouse management, inven tory/stock control to accounting software, CRM (customer rela tionship management) and ERP (enterprise resource planning).

Gary Reynolds, operations di rector at OGL Group, said: “This year’s findings reflect the huge impact the pandemic has had across any business that holds stock. Supply-chain uncertainties exacerbated by Brexit and the pandemic have affected compa nies’ profitability. Many smaller businesses don’t have the ability or money to stockpile products to meet pent-up demand, and now with the fuel crisis and war, they are having to take a pragmatic approach to supply customers.

“Positively, there is a greater degree of acceptance of cloud technology and understanding that ERP systems are not just for larger companies. Manual processes are a hindrance, as are disparate systems, both of which lead to inefficiencies. A single view of a business, especially of inventory levels, and integrated technologies will lead to better profitability, increased productivi ty and accurate data for planning. Wholesalers need to streamline their businesses to ensure they efficiently meet demand.”

The foodservice and wholesale sectors have never been afraid of evolution.

The speed and depth of change many organisations have to go through on a daily basis would be the envy of many other industries. If there’s one thing we all know how to do well, it’s adapting to a changing brief.

We’ve done this since the beginning of time, but we really showed the strength of our collec tive innovation during the height of the Covid-enforced lockdowns.

During the pandemic, 52% of wholesalers began selling direct-to-consumer for the first time after they saw their usual customers, such as schools and restaurants, shut by lockdowns.

Nearly a third (29%) saw a significant increase in orders during this time. The lessening need to deliver and provide for commercial establishments meant they had good access to drivers and people to be able to deliver to a new audience.

Commercially, it was a huge success in the context of what was happening elsewhere in the world.

Fast forward to what is seem ingly the post-Covid era. What we are faced with is a cost-of-living crisis where consumers are not only struggling with increased food costs, but sky-rocketing fuel prices. However, few to no wholesalers have continued their direct-to-consumer ser vice post-pandemic, despite the opportunities it offers to reach a

huge customer base looking to save money.

With the cost of fuel and goods increasing at such a pace, it isn’t cost-effective to buy in small quantities anymore. Meanwhile, wholesalers are looking for more hybrid solutions to increase their reach.

During the pandemic, consum ers became even more aware of the benefits of buying produce through wholesale. The past two years demonstrated that consum ers are not only willing to buy in bulk, but eager to do so, particu larly as it saves them money.

The cost-of-living crisis is now the number-one concern for UK households. According to a poll, 88% of UK consumers said they were concerned or very concerned about the economic climate, with 47% choosing not to eat and drink out – leading to more cooking at home.

There is an opportunity here for wholesalers to sell direct to consumers looking to reduce their costs and tackle inflationary pressures, but we need to be more proactive in targeting this market to reap what it can offer. It’s time for wholesalers to go residential and evolve their business models to include this customer base.

We all learned how to pivot our businesses during the pandemic and do things a little differently to ensure we remained relevant. The whole of the foodservice sector took the opportunity to reset and revisit, with many adopting new technologies to drive their busi

ness. Those businesses that con tinue to evolve, innovate, remain agile and tap into new markets will be the ones that survive into the future.

Wholesalers have the product, the storage facilities and the delivery model for this to work, and supporting tech is the missing piece of the infrastructure puzzle to allow them to continue these services in the long-term.

This is where last-mile logistic services come in. This can provide the tech to plan and analyse, as well as a fleet of vehicles to transport products

through congested city streets and narrow country lanes to remote residential locations. And with businesses under pressure to en sure they’re reducing their scope 1, 2 and 3 emissions, last-mile logistics providers can use the latest technology to offer a more sustainable and environmentally aware route management strategy.

By selling direct-to-consumer, wholesalers can tap into a huge new audience who have already demonstrated they’re prepared to buy in bulk, while consumers can save money – it’s a win-win for everyone. l

Tevin Tobun is the chief executive of GV Group, a B2B logistics and tech provider to the foodservice industry

The Reynolds family has been expanding its business for a number of years, and, after four generations, has managed to become one of the leading fresh-produce suppliers to the UK foodservice industry.

With a 200,000sq ft tempera ture-controlled national distribu tion facility near London, and six regional depots, it processes more than 3,200 orders daily, spanning some 62,000 sales-order lines and more than 3,000 different products. This equates to approx imately 12,000 buffet boxes and 50,000 whole cases on average per day, packed in seven-hour shifts and delivered by a fleet of 200 vehicles.

The company's growth has led to a complex organisational net work with a variety of supplychain systems going through its structures. To deal with this and become more efficient and profitable, Reynolds recently be gan working with ERP solution provider Infor M3 to help break down operational silos, stream line processes, and add func tionality around tasks such as

invoicing and inbound delivery management.

Infor M3 is a cloud-based manufacturing and distribution ERP system that is said to be delivering Reynolds the function ality to manage complex food distribution, including the chal lenges associated with the short shelf life of chilled products.

For example, reinspection time and sales time features enable Reynolds to reclassify and adjust shelf lives at item and lot levels, which has reduced the risk of product waste.

Using the most recent version of the programme, Reynolds has embedded Infor M3 at the foun dation of its business develop ment. For the finance department, M3 has delivered a substantial improvement in the speed and detail of reporting, which has led to better credit control and a reduction in debtor days.

The increased detail is also claimed to have improved deci sion-making across the company and led to a reinvention of critical processes—going from a siloed, functional department approach to one with end-to-end processes spanning departments.

One area of increased efficien cy is in the way the company packs cases. Richard Calder, Reynolds’ IT director, explains: “We ship 12,000 individual cases a day, with approximately 10 items per case. If we can improve box fill, we improve efficiency.

“A reduction of around 1,000 cases per night would lead to a six-figure improvement, but there is a trade-off against what can be feasibly done given the changing nature of orders and ensuring produce quality, which is why we need input from across the teams.”

Another example involves the introduction of RFID crate tracking. Reynolds was facing substantial costs for unreturned plastic crates and needed an au tomated system that would match each crate to a given pick list and then show the crate itself as having been checked out and back in again. As the cost of RFID tags has decreased, the technology has become more fea sible for this project. Reynolds’ customers who don’t return crates can now be identified and the situation rectified.

As well as undertaking a project to implement Infor OS to

provide a better user experience, Reynolds has developed an inhouse application called Reyhub, pulling information from Infor M3 to provide customers with near-real-time visibility of product and order availability and status.

Reyhub enables individual res taurants to monitor their orders, alerting customers to changes to order status and any unavailable products, for example, advising them of substitutions in plenty of time, which enables them to change any plans accordingly.

“We’re providing a consumerlevel experience to restaurants, which is something you don’t often see in a B2B environment,” explains Calder. “With Infor M3, we have the right information at the right time to enable us to do this. We’ve also been able to de velop Reyhub Central, which acts as a self-service logistics portal, delivering key supply-chain information relating to multiple restaurants.

“It’s the ideal tool for those at head-office level, with more informed decision-making for our customers when it comes to areas such as inventory, logistics and transportation.” l

1. Find new customers in new market sectors, and develop their business for mutual benefit

Don’t be afraid to branch into new customer areas and list new prod ucts, if you think you can make more money. But remember, certain types of customer and certain product categories are more profitable than others. Turnover is vanity, profit is sanity. Achieve healthy growth through profitable business.

Developing mutually beneficial propositions for customers in new sectors starts with gaining understanding by asking questions. What challenges do they face? What do they think constitutes a great whole saler? Listen intently. Talking to people working at the coal face day in, day out will deliver invaluable light. Remember the human touch. All any customer wants to know is: do I feel I’m being looked after? Displaying an intimate knowledge of their particular challenges, and being honest and transparent, is the key to long-lasting relationships. Demonstrating this level of commitment will naturally attract new customers to your business.

Supply chain and availability issues are a growing challenge for wholesalers and suppliers alike, emphasising the need for joint strat egies, not only over sales and marketing, but operations. Developing deeper working relationships with suppliers is important for short-, medium- and long-term success. Transparency with data and forecast ing, and flexibility over logistics, are crucial.

Start supplier discussions with a transparent co-prosperity theme. Wholesales often think of customers as the people they sell to, but smart operators increasingly think of customers being the folk they sell for, meaning the suppliers. Brand owners’ internal resources vary widely, and savvy wholesalers support them with bespoke solutions. Last year, Pricecheck created a supplier services menu covering every stage of a brand’s journey. This enables marketers with differing needs by sector, customer or country, to save their resources by deploying the wholesaler’s capability on their behalf so they act like a brand owner.

4. Make wholesale businesses more sustainable and reduce operating costs

Wholesalers should think of the first step in making their businesses more sustainable being to treat team members as an important asset and safeguard their well-being and mental health. Next, review teams’ day-to-day environmental impact, from everyday kitchen rub bish, such as plastic bottles, to larger waste, such as the packaging goods are delivered in. Encourage staff to help the environment by cycling to work and car sharing. Wholesalers’ operations are getting greener, and saving money.

Wilds of Oldham has electric forklifts on order, replacing its diesel fleet, and has installed charging points. It is also putting in more energy-efficient warehouse lighting, and making a conscious effort to switch all office machines off overnight.

Wilds has also raised its minimum drop for free delivery to £200, and customers are now ordering bigger amounts, less frequently. This is reducing the number of deliveries the wholesaler is making, and using less diesel.

3. Use merchandising in depots and online, to introduce new products and grow categories

Merchandising new products to best effect in depot involves suppli ers providing print and digital marketing materials and samples, and giving wholesalers’ sales teams category insights and wider appreci ation of the product and brand’s benefits so they feel fully confident selling it. With so many customers now ordering online, it’s im portant for wholesalers to give new products similar prominence in their digital activity. This can include advertising on the home page, boosting the product so it appears at the top of a page, or with a ban ner on top-searched pages. Wholesalers of all sizes are getting bolder about using the available tech, and reaping the rewards. Specialist drinks wholesaler Wilds of Oldham encourages customers to order via its app. For Wilds, it’s about making the ordering experience smooth, easy and reassuring, including acknowledging orders by email, giving customers piece of mind. Twenty per cent of all Wilds’ on-trade orders now come through the app.

5. Grow existing customers’ business with you, by tailoring the customer experience and personalising your marketing

Wholesalers can bring customers closer, using personalisation tools to merchandise elements of their websites, and create a unique customer experience with relevant products, offers and content. Include event spaces to advertise relevant seasonal products. Use the tech to help make purchasing frictionless, and make customers more likely to buy. Marketing tech can also help wholesalers increase customers’ revenue, footfall and margin. Use big data, AI, power BI and social media to ensure customers have the right range of products at the right price-point within their communities, to really accelerate their business. Wholesalers can also re-engage customers and grow sales through memorable live events. Parfetts recently morphed its annual trade show into Parfest 2022, a week-long festival in all seven depots, with deals on more than 600 SKUs, and suppliers activating key lines, showcasing NPD and sampling. Parfest attracted more than 10,000 customers and delivered a record week of sales of more than £14m. l

Simon Hannah, chief executive, JW Filshill

Guy Swindell, joint managing director, Parfetts

Cliff Wishart, senior business development manager, Savona Foodservice

Andrew Wild, managing director, Wilds of Oldham

Coca-Cola Original Taste continues to dominate for both overall sales and profits for wholesale customers in soft drinks. However, Pepsi Max 2l has now entered the top three profit drivers, disrupting Coca-Cola’s dominance of this metric in 2021.

The bigger Coca-Cola bottles also do

well, with the 1.5l and 1.75l bringing £4.94 and £4.58 average weekly profits, respectively. Diet Coke’s top two sizes, 1.75l and 500ml, bring in £4.23 and £4.19 profits, respectively.

Also worth noting are two new entries in the category – Coca-Cola Original Taste 6x330ml and Coca-Cola Original

Taste 10x330ml. These bring in £3.07 and £2.13 profit each. The Pepsi Max 330ml 24-pack brings in £1.96. All of these lines are available in less than 70% of stores, but could point to a new multipack opportunity in soft drinks as more shoppers look for value rather than impulse.

Coca-Cola Original Taste 500ml

Coca-Cola Original Taste 330ml

Coca-Cola Original Taste 1.5l

Coca-Cola Original Taste 1.75l

Pepsi Max 2l

Diet Coke 1.75l

Dr Pepper 500ml

Diet Coke 500ml

Pepsi Max 500ml

Coca-Cola Original Taste 6x330ml

Coca-Cola Original Taste Cherry 500ml

Coca-Cola Original Taste 10x330ml

Pepsi 1.5l

Dr Pepper 2l

Coca-Cola Original Taste Cherry 330ml

Diet Coke 330ml

Schweppes Lemonade 2l

Coke Zero 1.75l

Pepsi Max Cherry 2l

Fanta Fruit Twist 500ml

Pepsi Max Cherry 500ml

Pepsi Max 24x330ml

Fanta Orange Zero 500ml

Pepsi 500ml

Pepsi Max 330ml

£26.94 £21.87 £21.32 £19.72 £17.35 £11.71 £10.85 £10.01 £10.25 £12.75 £9.34 £11.82 £7.55 £6.95 £7.49 £6.36 £6.65 £6.81 £6.69 £5.96 £6.37 £10.71 £5.57 £5.83 £5.88

96.5% 95.6% 91.1% 87.7% 91% 92.5% 93% 95.8% 90.7% 67.1% 82.8% 61.2% 86% 85.9% 79.7% 93.4% 87.8% 84.1% 81.7% 90.2% 83.3% 49% 93.7% 88% 85.5%

Coca-Cola Original Taste 500ml Coca-Cola Original Taste 1.5l

Big changes have occurred in the roll-your-own tobacco market that reveal where the profits are in this crucial wholesale category.

A quick look at our table shows massive changes in the top sellers from last year. Important to note is some of the biggest risers in overall sales are

2-in-1 packs, showing retailer’s custom ers are looking for convenience and value in this category, while one of the biggest fallers, Marlboro Fine Cut Gold 30g, is a single tobacco pack. Gold Leaf JPS 2-in-1 30g further supports this trend, the fourth-best weekly profit driver per wholesale customers’ store

overall at £8.18.

Fifty-gram packs are also bringing in strong profits. For instance, Sterling 2-in-1 has risen from 14th to second in overall sales, and is earning £4.11 average weekly profits per retail store, while the new-entry Gold Leaf 2-in-1 brings in £4.67.

Amber Leaf 2-in-1 30g

Sterling 2-in-1 30g

Amber Leaf 2-in-1 50g

Gold Leaf JPS 2-in-1 30g

Golden Virginia The Original 2-in-1 30g

Sterling 2-in-1 50g

Golden Virginia The Original 2-in-1 50g

Gold Leaf JPS 2-in-1 50g

Cutters Choice Extra Fine 2-in-1 30g

Riverstone Easy Rolling 2-in-1 30g

Golden Virginia Yellow 2-in-1 30g

Cutters Choice Original 2-in-1 30g

Lambert & Butler Original 2-in-1 30g

Sterling 3-in-1 30g

JPS Players Easy Rolling 2-in-1 30g

Marlboro Gold Fine Cut 30g

Golden Virginia Yellow 2-in-1 50g

Amber Leaf 3-in-1 30g

Lambert & Butler Original 2-in-1 50g

Pall Mall Fine Cut 30g

Holborn Yellow 3-in-1 30g

Riverstone Easy Rolling 2-in-1 50g

Cutters Choice Extra Fine 2-in-1 50g

JPS Players 2-in-1 50g

Cutters Choice Original 2-in-1 50g

£201.02 £122.10 £93.86 £81.03 £63.75 £61.33 £49.34 £46.26 £71.95 £38.81 £36.58 £42.55 £37.19 £33.78 £30.05 £37.48 £18.66 £18.67 £20.73 £22.48 £15.42 £14.84 £45.56 £13.42 £25.60

94.9% 89.5% 86.4% 92.1% 92.3% 75.9% 78.7% 79.2% 47.2% 77.5% 78.1% 57.4% 62.6% 67.2% 76% 41.7% 55.9% 52.6% 46.7% 41.9% 59.9% 54.7% 17% 52% 21.5%

Swan Filter Tips Extra Slim 120s kept its place at the top for another year in this established category, with the product bringing in £2.79 more weekly sales for wholesale customers’ stores than Raw Connoisseur Cigarette Papers Slim 32s King Size, and a sizable £11.06 more than the third-

bestselling line.

This clearly shows the market share these two products have within the tobacco sundries category. Wholesalers should keep this in mind when selecting for their tobacco rooms in depot, where space is limited.

Elsewhere on the list, the Rizla brand

makes up 11 of the 25 positions, with Swan also taking up another four. Elements Cigarettes Papers 50 is the biggest new entry this year, at number 20, with Zig Zag Cigarette Papers Green 50s 8pk Regular and Tobacco Accessory Magnetic No 1 1 piece also sneaking in as new entries in the final two places.

Swan Filter Tips Extra Slim 120s

Raw Connoisseur Cigarette Papers Slim 32s King Size

Rizla Cigarette Papers Slim Silver 32s King Size

Rizla Cigarette Papers Green 50s Regular

Raw Cigarette Papers 50s King Size

Rizla Cigarette Papers Green 50s 5pk Regular

Rizla Cigarette Papers Slim Blue 32s King Size

Swan Filter Tips Slim 165s

Raw Classic Cigarette Papers Slim Black 32s King Size

Rizla Flavour Cards Menthol Chill 1pk

Swan Filter Tips Slim 102s

Rizla Filter Tips Extra Slim Polar Blast 60s

Rizla Cigarette Papers Green 32s King Size

Swan Filter Tips Ultra Slim 126s

Rizla Flavour Cards Fresh Mint 1pk

Rizla Cigarette Papers Blue 50s Regular

Raw Filter Tips 100s

Instahit Tobacco Accessory Menthol 2ml

Swan Crushball Filter Tips Extra Slim Fresh Burst 54s

Elements Cigarette Papers 50s

Zig Zag Cigarette Papers Green 50s Regular

Rizla Cigarette Papers Liquorice 50s Regular

Rizla Cigarette Papers Silver 50s Regular

Zig Zag Cigarette Papers Green 50s 8pk Regular

Accessory Magnetic No 1 1 piece

£17.89 £15.10 £6.83 £3.96 £4.42 £4.35 £2.90 £3 £5.72 £2.19 £2.48 £2.31 £1.81 £2.57 £1.36 £1.36 £1.87 £1.61 £1.51 £4.83 £2.17 93p 90p £3.73 £1.55

95.4% 77.1% 88.8% 92.2% 67% 53.4% 78.5% 75.3% 35.1% 87.3% 65.5% 69.2% 75.6% 50.1% 83.3% 83.2% 58.9% 58.3% 49.4% 14.9% 31.7% 71.5% 72% 15.9% 36.8%

Swan Filter Tips

Extra Slim 120s

Raw Connoisseur

Cigarette Papers Slim

32s King Size

Rizla Cigarette Papers

Slim Silver 32s King Size

Moving beyond vapes, other opportuni ties exist in next-gen nicotine, which although not offering the same profits as refills and devices, are nevertheless worth considering as footfall drivers for retailers. The Heets brand of heated tobacco products dominate in terms of overall sales. Amber is at the top with

£9.39 weekly sales for wholesale customers, followed by the Blue and Sienna variants, respectively. All of Heets, however, are available in less than a quarter of convenience stores across the country, so plenty of potential for growth in depots.

In pouches, Nordic Spirit is top, and

its Mint varieties are the most profitable for wholesale customers. 12mg earns 36p a week, 9mg 30p and 6mg 19p. Outside of Mint, Bergamont Wildberry is most profitable: the 9mg box earns 19p a week.

The top Velo line, Freeze 11mg, brings in 27p.

Nordic Spirit

Nordic

Heets

Velo

Nordic

Velo

£5.55 £5.50 £4.90 £5.14 £1.80 £1.51 £3.61 £1.35

26.1% 22.1% 20.5% 24.4% 22.4% 20.4% 17.9% 12.9% 36% 38.9% 14% 29% 39.7% 33.6% 27.7% 33.3% 21.1% 9.3% 3.3% 7.1%

8.5% 3.2%

category is

at

the speed of the

category¹.

Sports and energy drinks remain one of the most lucrative categories in whole sale, so it’s vital to get it right for your customers in depot.

Big brands dominate the category for sales, with Lucozade, Monster and Red Bull filling out the top 10. One thing worth noting is that Lucozade lines,

which tend to have lower average prices, nevertheless bring in solid profits. Lucozade Energy Orange 500ml earns £5.30 per week per retail store on average, pointing to strong rates of sale.

Value multipacks are also worth bearing in mind, with Euro Shopper’s

Reduced Sugar four-pack offering average weekly profits of £6.33. Ultimately, most of these energy drinks meet different customer needs, so it makes sense to offer a selection from the different brands, balancing original and low- and no-sugar options.

Red Bull 250ml

Red Bull 355ml

Monster Energy Original 500ml

Red Bull 473ml

Monster Juiced Mango Loco 500ml

Monster Punch Pipeline Punch 500ml

Lucozade Energy Orange 380ml

Monster Ultra White Sugar Free 500ml

Lucozade Sport Orange 500ml

Monster Juiced Monarch 500ml

Euro Shopper Original Reduced Sugar 250ml

Euro Shopper Original Reduced Sugar 4x250ml

Lucozade Energy Orange 900ml & 1l

Relentless Origin 500ml

Lucozade Energy Original Reduced Sugar 380ml

Monster Punch Pacific Punch 500ml

Lucozade Sport Raspberry 500ml

Red Bull 4x250ml

Euro Shopper Sport Isotonic Hydration Orange 500ml

Red Bull Sugar Free 250ml

Monster Punch Mixxd 500ml

Lucozade Energy Original 900 & 1l

Euro Shopper Sport Isotonic Hydration Tropical Berry 500ml

Euro Shopper Sport Isotonic Hydration Berries 500ml

Euro Shopper Energy Sugar Free 250ml

£41.47 £29.55 £27.15 £30.46 £16.58 £16.70 £12.45 £12.49 £11.64 £12.40 £11.48 £14.80 £9.71 £8.87 £8.29 £8.82 £7.40 £10.06 £8 £7.11 £6.66 £6.04 £5.62 £5.16 £5.58

94.6% 81.4% 90.8% 89.3% 93.4% 90.8% 93.5% 87.6% 84.2% 61.4% 88.8% 87% 92.1% 84.1% 90.8% 63.8% 77.9% 86.4% 85.5% 87.9% 76.7% 77% 70.4%

Red

Red

Undeniably, everyday essentials are where the profits lie in wrapped bakery. Bread dominates sales and drives profits.

Outside of the top three profit drivers, Hovis Soft White Thick 800g is earning wholesale customers’ stores £3.52 average weekly profits, while Kingsmill

Soft White Medium brings in £2.95. When it comes to brown bread, Warburtons Wholemeal Medium 400g is the top profit driver, earning stores an average £1.19 a week. Only available in 36.1% of shops, this is a line worth considering if you’re looking for an additional brown bread option.

Outside of bread, there are other opportunities. Clay Oven naan breads earn stores 89p a week, Mission Tortillas bring in 75p and Baker Street’s Hot Dog Rolls 49p. These all point to the potential profits that can be found in diversifying retailers’ ranges to meet additional meal options.

Hovis Soft White Medium 800g

Warburtons Toastie Thick White 800g

Hovis Soft White Thick 800g

Warburtons Soft White Medium 800g

Kingsmill Soft White Medium 800g

Braces Luxury Medium White 800g

Roberts Thick Soft White 800g

Braces Luxury Thick White 800g

Roberts Medium Soft White 800g

Kingsmill Soft White Thick 800g

Hovis Best of Both Medium 750g

Kingsmill 50/50 Medium 800g

Hovis Tasty Wholemeal Medium 800g

Warburtons Toastie Thick White 400g

Warburtons Crumpets 6x330g

Warburtons Wholemeal Medium 400g

Mission Plain Tortilla Wraps 6x368g

Baker Street White 550g

Warburtons Farmhouse Soft White 800g

Hovis Seed Sensations Seven Seeds 800g

Warburtons Wholemeal Medium 800g

Warburtons Soft White Medium 400g

Warburtons Seeded Batch 800g

Baker Street Pre-Cut Hot Dog Rolls 4x252g

Clay Oven Bakery Garlic & Coriander Giant Naan Bread

£17.58 £22.10 £12.21 £12.85 £9.22 £37.60 £28.40 £29.25 £18.48 £5.45 £3.83 £4.66 £3.22 £5.40 £3.41 £4.14 £2.55 £3.18 £4.33 £3.89 £3.57 £3.50 £4.35 £1.49 £1.95

79.6% 46.4% 72.5% 43.7% 52.8% 10.6% 13.3% 10.7% 13.8% 46.1% 57.3% 45.4% 65.2% 35.6% 56.4% 36.1% 58.6% 45.2% 32.9% 30.9% 33.4% 32.6% 24.7% 71.5% 52.9%

Over the past five years, savoury snacks have de livered consistent value growth of 2.4%1, with crisps and snacks be ing the second-biggest segment, making up 44% of snacking occasions2

Not only is our savoury snack ing portfolio perfectly positioned to help wholesalers maximise this opportunity, we also help whole salers to be knowledge leaders for retailers, offering advice and guidance on what to stock so re tailers can also capitalise on this growth opportunity in store.

Wholesalers should encourage retailers to stock the right formats for the right occasion so that they maximise sales opportunities. The World Cup represents a great opportunity to promote sharing bags and help retailer customers to capitalise on the occasion. Seasonal occasions are also key, and with Diwali around the corner, our Kurkure brand is a must-stock here.

Using front-of-store, end-of-aisle displays and secondary sitings can also help to keep snacking products top of mind. Wholesalers should also block by key missions – for later (multipacks), for tonight (sharing), singles and PMPs. It is important to remember that wholesalers that also sell to endconsumers may be affected by upcoming changes in legislation. To mitigate this, Walkers’ new digital HFSS guide (pictured) includes key dos and don’ts when promoting items for these depots.

Wholesalers can maximise sales by stocking the products that meet the needs and expectations for retailers, and our snacking products have been created with consumers’ needs in mind first and foremost. For example, taste is the number-one driver for consumers when buying crisps and snacks3. Our Hero 25 range of bestselling SKUs has been developed to help wholesalers meet this need for taste and drive their crisps and snacks sales, as retailers look to stock consumer favourites and stay on top of the growth seen in the past five years.

Ahead of the new HFSS legislation coming into effect in England this October, Walkers has issued a new digital HFSS guide to help retailers navigate the implications for the savoury snacks category. If asked about upcoming legislations, wholesalers can direct retailers to the digital guide as a source of support. Our digital guide also highlights the three key strategies retailers can put in place to help them maximise their savoury snacks sales.

• Wholesalers should encourage retailers to prioritise stocking a strong core range, as bestsellers

Mike Chapman, business unit controller at PepsiCo, explains why Walkers is the go-to supplier for wholesalers within the savoury snacks category

Perhaps reflecting the continued popularity of the big night in with shoppers, Pringles is proving a steady profit driver for wholesale customers.

Texas BBQ Sauce is earning retail stores £1.99 per week, Salt & Vinegar is earning 96p and Original 93p. Although they have bigger pack sizes than most of

the other lines here, they meet a differ ent retailer need and are worth having on display in depots.

Happy Shopper Onion Rings 70g show the profitability that can be found in value options. At 52p for a 70g pack, they have the lowest average price of any line here, yet they’re earning stores

£1.85 per week, on average.

Meanwhile, Cheetos Twisted Flamin’ Hot and Walkers Quavers Cheese are other profit earners worth noting, giving stores average weekly profits of £2.40 and £2.26, respectively.

They’re among the best-performing lines for retailers.

Hula Hoops Big Hoops BBQ Beef 70g & 80g

Walkers Cheese & Onion 65g

Cheetos Twisted Flamin’ Hot 65g

Pringles Sour Cream & Onion 165g & 200g

Walkers Quavers Cheese 45g & 54g

Doritos Chilli Heatwave 70g

Doritos Tangy Cheese 70g

Walkers Ready Salted 65g

Nik Naks Nice ’n’ Spicy 75g & 85g

Walkers Sensations Thai Sweet Chilli 65g

Pringles Texas BBQ Sauce 165 & 200g

Walkers Wotsits Really Cheesy 50g & 60g

McCoy’s Flame Grilled Steak 65g

Walkers Monster Munch Pickled Onion 60g & 72g

Skips Prawn Cocktail 40g & 45g

Walkers Monster Munch Roast Beef 60g & 72g

Pringles Salt & Vinegar 165g & 200g

Nik Naks Rib ’n’ Saucy 75g & 85g

Pringles Original 165g & 200g

Doritos Cool Original 70g

Happy Shopper Onion Rings 70g

Hula Hoops Big Hoops Salted 70g & 80g

Walkers Cheese & Onion 32.5g

Space Raiders Beef 70g & 78g

Walkers Monster Munch Flamin Hot 60g

72g

£5.99 £5.69 £5.64 £5.57 £5.28 £5.12 £4.98 £4.77 £4.53 £4.17 £4.35 £3.84 £4.15 £3.84 £3.76 £4.13 £3.65 £3.55 £3.99 £3.79 £3.79 £4.03 £3.27

88.5% 88.6% 88.9% 90.6% 90.9% 91.7% 92% 88.3% 85.9% 86.5% 89.2% 89.5% 80.5% 89.4% 82.1% 87.9% 88.8% 80.7% 90.6% 90.7% 77.7% 80.5% 79.5% 71.1% 84.8%

BBQ

The fact the second- and third-best profit drivers were on promotion at the time of writing shows how quickly this category can change for retailers with certain offers.

Excluding promotional lines, Oasis Citrus Punch and Capri-Sun Orange are the second- and third-best profit drivers,

at £1.66 and £1.59 each, showing citrus flavours are crucial.

Also worth noting is Euro Shopper Summer Fruits 500ml. At 50p, it has the lowest average price here, but that’s not affecting its profitability, earning wholesale customers an average of £1.23 per week, showing the value of

low-cost on-the-go options.

The bigger pack sizes are generally earning stores lower average weekly profits. Here, it seems lower prices are better. The Happy Shopper Apple & Blackcurrant 1l earns stores 91p a week, while Robinsons in the same size and flavour brings in 79p.

Oasis Summer Fruits Reduced Sugar 500ml

Ribena Blackcurrant 500ml

Oasis Citrus Punch Reduced Sugar 500ml

Capri-Sun Orange 330ml

Vimto Mixed Fruit 500ml

Euro Shopper Orange Juice 1l

Euro Shopper Summer Fruits Reduced Sugar 500ml

Oasis Blackcurrant Apple Reduced Sugar 500ml

Robinsons Real Fruit Orange Squash NAS 900ml & 1l

Euro Shopper Apple Juice 1l

Robinsons Real Fruit Apple & Blackcurrant Squash NAS 900ml & 1l

Robinsons Fruit Shoot Apple & Blackcurrant 275ml

Calypso Ocean Blue Lemonade 473ml

Vimto Real Fruit Squash Reduced Sugar 725ml

Ribena Blackcurrant 250ml

Happy Shopper Apple & Blackcurrant Squash NAS 1l

Robinsons Real Fruit Summer Fruits Squash NAS 900ml & 1l

Ribena Light Strawberry 500ml

Ribena Light Blackcurrant 500ml

Robinsons Fruit Shoot Orange 275ml

Tropicana Smooth Orange 850ml & 950ml

Robinsons Fruit Shoot Summer Fruits 275ml

Robinsons Fruit Shoot Apple & Blackcurrant 8x200ml

Euro Shopper Citrus Reduced Sugar 500ml

Happy Shopper Orange Squash NAS 1l

£8.99 £6.16 £4.81 £5.20 £4.61 £3.90 £3.80 £3.12 £2.49 £2.92 £2.38 £2.55 £3.92 £3.06 £2.26 £2.74 £1.83 £1.87 £2.38 £1.73 £3.21 £1.79 £2.66 £1.99 £1.68

91.9% 92.3% 90.2% 78.7% 74.1% 77.8% 63.8% 73.1% 90.2% 76.2% 89.2% 79.4% 51.3% 64.1% 83.8% 67.7% 85.4% 81.3% 63.5% 78.0% 40.1% 71.2% 47% 61.5% 68%

Oasis Summer Fruits

Sugar 500ml

Ribena

Oasis Citrus Punch

Sugar 500ml

BWI: How is SBF GB&I helping wholesalers support retailers on upcoming legislation such as DRS and HFSS?

MG: The introduction of DRS is cer tainly something wholesalers need to be prepared for, and we’re on hand to help. The rollout of such schemes will have a big impact on retailers who will need to find space in store for the return vending machines, which may mean reviewing their range and re laying parts of their store. This means retailers may be more discerning about the products they buy in depot and require support from wholesalers to make these significant changes. We are well placed to advise wholesalers about DRS legislation as a founding member of Circularity Scotland, the body set up to administer deposit returns in Scotland.

We commissioned a white paper re search study, Deposit Return Schemes: What’s in Store?, to help inform retailers on the schemes and their aims ahead of introductions across the UK.

We are also uniquely positioned to help wholesalers and retailers navigate the upcoming high fat, sugar and salt (HFSS) legislation. Every single bottle and can variety of our most popular drinks brands, Lucozade and Ribena, are already non-HFSS, so won’t be subject to promotional, location or advertising restrictions. This means wholesalers can advise retailers that these drinks can continue to be sited and sold anywhere in store.

What challenges has SBF had to overcome in the past year?

Over the past year, the team have been working around the clock as the supply chain continues to be disrupt ed, to maintain deliveries of our drinks to customers. Although broad national and global pressures continue to affect the entire manufacturing industry, we are optimistic that we are beginning to return to improved delivery times, production line outputs and higher general service levels.

Sustainability is a longer-term issue where we have been making strides of progress. As part of our ‘Growing for Good’ vision, we are designing our products for circularity by making sure that we are using more sustaina ble materials, such as rPET.

All our on-the-go 500ml bottles (excluding the cap and label) will be made from 100% recycled poly ethylene tetraphyte (rPET) plastic, including Lucozade Sport, Lucozade Energy, Orangina and Ribena, by the end of the year.

How can wholesalers work effective ly with brands to make a splash in depot and drive their sales?

Under the new HFSS restrictions, from 1 October, the sale of products high in fat, salt and sugar will be sub jected to legally-binding location and promotion rules. Wholesalers should work with HFSS-compliant brands like ours to make a splash in depots and get the message across that no changes are required on such products in terms of the way they are sold.

Wholesalers should also work closely with suppliers to leverage the power of their brands. Creating theatre in depot through high-impact displays and impeccable merchandising is important in making the retailer’s journey through the depot as seamless and exciting as possible. Bespoke front-of-depot displays are proven to lead to sales uplifts of at least 5%1, while a depot fixture relay can nearly double sales. One Lucozade Energy

cash and carry takeover with Parfetts recently generated weekly sales uplifts of 180%.

Are you planning any activity of which wholesalers should be aware?