Buses Trial

46. Second-Hand EV Market 49. Charger Funding for Businesses 50. ORS Program 53. Solar Wholesalers Partnership

Skilled Migration 56. Solid State Batteries

Business Partner Index

Jodi

Welcome to the 2025 edition of Future Auto magazine.

As MTA Chair, and having spent decades navigating the dynamic currents of importing, I’ve seen countless evolutions in our industry. What stands out as we drive deeper into 2025 is that the Motor Trade Association (MTA SA/NT) is not just observing change; we are actively leading and supporting our members through it. The coming years promise to see a significant transformation,

abundant opportunity, and, as always, our collective resilience will shine.

Currently, the landscape of used EVs in Australia is dynamic and somewhat unpredictable. Recent data from the Australian Automotive Dealer Association (AADA) indicates a significant increase of close to 40 per cent in the availability of second-hand electric cars compared to the same point in 2024, a natural consequence of early adopters upgrading and leases expiring. This growing supply,

coupled with factors such as evolving government incentives for new EVs and a degree of uncertainty surrounding battery health and longevity, has led to a noticeable softening in used EV prices.

One of the most significant shifts in the automotive landscape over the past year has been the accelerating adoption of electric vehicles (EVs). Australia is experiencing an unprecedented wave of new EV models, with more than 40

expected to arrive in 2025. These include competitive offerings from emerging Chinese brands such as BYD and Geely, alongside established manufacturers.

From budget-friendly hatchbacks to high-end SUVs, this growing range is key to making EVs accessible to more drivers across the country. The introduction of the New Vehicle Efficiency Standard (NVES) further reinforces Australia’s position as an emerging growth market for affordable EV options.

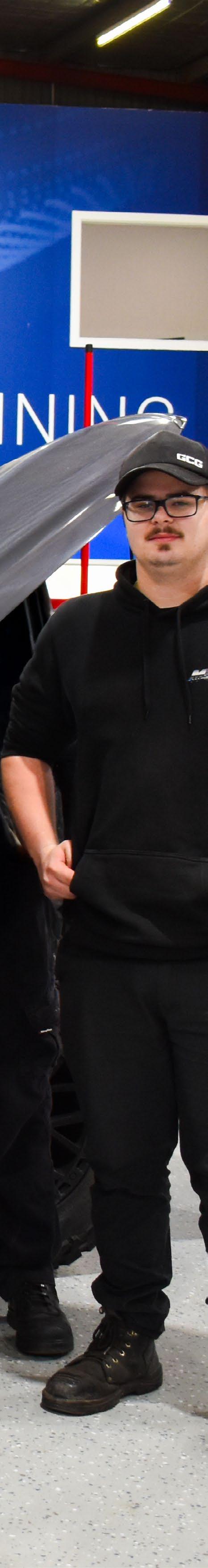

This evolution isn’t just about vehicles, it’s about people. Skilled tradespeople have always been the backbone of the automotive industry, and the rise of EVs brings new opportunities and challenges for technicians. To meet this demand, the MTA SA/NT has introduced Australia’s first automotive dual-trade apprenticeships, blending traditional mechanical training with advanced electrical expertise. This forward-thinking approach ensures the next generation of technicians is prepared for the high-tech vehicles already on our roads whilst also preparing them for the present where internal combustion engines

are the majority. The key is training a workforce in the skills needed for today and the technology of tomorrow.

In addition, the recently launched Occupational Recognition Service (ORS) is helping experienced technicians have their skills formally recognised—whether gained locally or overseas—supporting career progression and helping address the industry’s ongoing skills shortages. These initiatives are shaping an industry that’s ready for the future while valuing the expertise that has driven it for decades.

Currently, there is a lack of standardised and easily accessible methods for assessing battery health in the used car market. Pickle’s Auto EV Battery Assurance Program has released results of the average state of health of batteries in EVs which found EVs four or more years old typically return battery health above 93 per cent. The study also found that EVs with 80,000kms to 120,000kms still retained over 91 per cent. Whilst this study is welcome news for people looking to buy a second-hand EV, the information asymmetry can create

anxiety for buyers, making it difficult to accurately gauge the long-term value proposition of a second-hand EV.

Finally, while the spotlight often falls on cars, we must not overlook other forms of transport. The ongoing trial of hydrogen buses in Adelaide, for instance, underscores the broader exploration of diverse carbon-free public transport solutions in our state. This holistic view of mobility, where efficiency and urban integration are key.

The year 2025 is not just about electric cars; it’s about a comprehensive electric ecosystem. It’s about ensuring the automotive industry is equipped, our workforce is skilled, and our collective approach is forward-thinking. It’s about embracing the opportunities this new era brings, not just for individual business growth, but for a more sustainable and prosperous future for the entire motor trade.

I encourage you to delve into the articles within this magazine, absorb the insights, and join us in driving this exciting transformation.

Apprentices can now double their career prospects in a rapidly evolving automotive industry, following a successful application by the Motor Trade Association (MTA) to the South Australian Skills Commission for three new dual trade apprenticeships.

The new dual trades, the first automotive dual trades in Australia, combine traditional either a Light, Heavy Vehicle or Agricultural Mechanical Technology apprenticeship with an Automotive Electrical apprenticeship.

Minister for Education, Training and Skills, Blair Boyer, praised the MTA for its leadership: “South Australia is leading the way with the first automotive dual trades in Australia.” It’s critical that we ensure apprentices entering the workforce are prepared with the skills they need.”

With industry sources predicting a step change in automotive technology, including more electric and autonomous vehicles, dual trades may have arrived at just the right time.

“Our members and customers were not only telling us that this technology was coming. They were telling us it is already here” said MTA SA/NT CEO Darrell Jacobs.

In South Australia, zero and low emission vehicles including hybrids, plug in hybrids and electric vehicles, currently account for more than 20 per cent of all new cars sold bringing new customers, challenges and opportunities for businesses.

Responding to industry calls, Mr. Jacobs added “as an industry association, trainer and employer of automotive apprentices, the MTA’s job is to make sure that businesses and apprentices are ready for whatever enters the workshop.”

Jenny Seal, People and Safety Manager at Australia’s largest dealer group, Eagers Automotive, agreed: “We are thrilled with the announcement of dual trade apprenticeships and the opportunities this will bring to our SA dealer network.”

First year light vehicle apprentice Paul Ljuldjuraj shared his enthusiasm for the announcement, “working at Adelaide BMW, I get exposed to some of the most high-tech vehicles in the country. I can’t wait to transfer to dual trade.”

South Australian Skills Commissioner Cameron Baker was one of the first to learn of the MTA’s plans to apply for three dual trade apprenticeships.

“The South Australian Skills Commission has worked in partnership with the MTA to formally establish these dual qualifications,” he said.

“It is a great example, of how, in partnership with industry, the skills system can develop and respond to specific workforce needs.”

The MTA has opened expressions of interest for both businesses and apprentices via its website: www.mtasant.com.au.

“South Australia is leading the way with the first automotive dual trades in Australia.”

Darrell Jacobs MTA SA/NT CEO

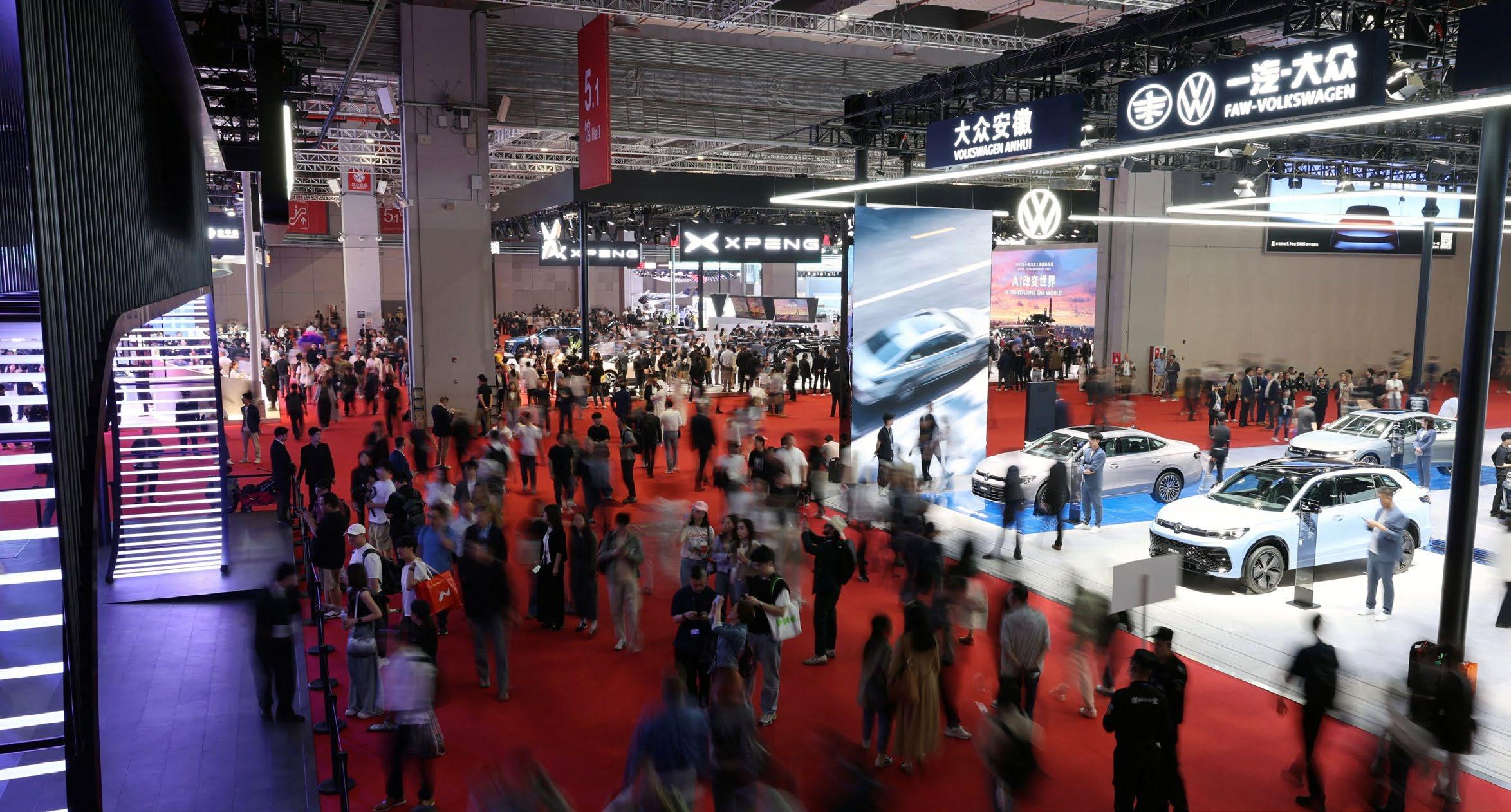

In 2018, I visited Shanghai to watch the Power play the Gold Coast Suns. Port won that day.

An amazing city with a population of near 25 million, roughly the same as Australia, and you sense it is a place where east meets west.

I recall the noise of the city. Cars, buses and scooters everywhere – an assault on all the senses.

Earlier this year, I had the opportunity to return to Shanghai to attend Auto Shanghai 2025 – the biggest automotive show in the world.

The quietness and blue sky of Shanghai left an unforgettable impression. Yes, you read that

correctly. You can hear the beat of the city and see the skyscrapers. The scooters have become electric, the buses too, and my best guess is that half of all vehicles were electric or hybrid, although most did look like Tesla cousins. It was a strange feeling. Recent data from the China Association of Automobile Manufactures shows that new energy vehicles, such as EVs, now make up over 50 per cent of new vehicle sales. In Shanghai, so much has changed in such a short time.

It was in stark contrast to the streets of Adelaide where just 5.4 per cent of new vehicles are fully electric.

Looking further afield, the United Kingdom has 20.4 per cent of the new vehicle sales as fully electric, demonstrating that the rest of the world still has a long road ahead towards full decarbonisation of passenger transport.

Back to the car show. What I experienced was nothing short of mind blowing. The show is housed across eight two story arenas, each the size of the Adelaide Convention Centre. The size and scale of the event was only the beginning.

I noticed lots of young people, teenagers and children experiencing the technology in the cars like in an Apple Store.

Of course, I expected to see electric vehicles and hybrids and there were plenty on show with names I dare not try to pronounce. Xpeng, Ora, BYD, Xiamoi, Zeekr, Aion, Roewe, Voyah, Wuling and many more.

But it wasn’t the fact that these vehicles had the latest battery technology or that they could drive up to 1,500 kms without needing a charge or fuel. It was the integration of artificial intelligence that astounded me.

The dashboard as we know it today will soon be no longer, replaced by screens from the left to the right. Video screens displaying the side mirror view, a driver’s screen, a central screen for all the car connections and a passenger screen for entertainment. The rear vision mirrors replaced with live video from the rear of the car. In the back, personalised controls on the door for each passenger to adjust air conditioning, seat heating or sound levels for your speaker. One car even had a full cinema screen that drops from the roof lining behind the front seats and a projector allowing

passengers everything from video on demand to video conferencing.

Beyond the screens and dozens of cameras placed all over the car, connectivity is new frontier being led by Chinese manufacturers.

Think mobility meets connectivity to provide convenience and ultimately another step towards the internet of things. One car I sat in retailed at $USD35,000 ($AUD55,000) featured all of the aforementioned, but what it really did was connect with your life. Through speech recognition, motorists can order take away on the way home, put on the air conditioner at home before arriving home, ask it where a car park spot is nearby and conduct everyday banking through it.

Then there are these pods on the top of the car, just above the front windscreen. Remember the London Taxi sign? In concert with the dozens of other cameras around the vehicle, we are seeing the start of the next generation of autonomous vehicles.

I returned home from Shanghai trying to imagine what from the motor show

and streets of Shanghai will arrive in Australia. Auto Shanghai is a looking glass into Australia’s automotive future. While some of the technology at Auto Shanghai were prototypes – for display purpose only, a lot will trickle-down into vehicles Australian consumers will purchase in the coming years.

No doubt our design rules and regulations will come into play.

The current uncertainty of global trade courtesy of tariffs imposed by the USA and the European Union to protect their local automotive manufacturing industries will come into play. We don’t build cars here anymore and as takers of technology, Chinese built cars will undoubtedly grow their local presence as the Federal Government chases ambitious targets under the New Vehicle Efficiency Standard. But one thing I do know is that Aussies love technology, and it is only a matter of time before this AI, electric vehicle and connected motoring future arrives at a driveway near you.

At CareSuper, every dollar that’s in your super is invested to help grow your retirement savings. But that’s not all. Our investments can also help grow our communities—they can build businesses, create jobs, and strengthen Australia’s economy.

Investing in Australia’s growth

Super funds contribute over $82 billion a year to Australia’s economy— and that number is set to grow.1 These investments power businesses, fund infrastructure, and drive innovation. CareSuper focuses on long-term growth, aiming to ensure your retirement savings work for you while seeking new investment opportunities across all of Australia that are expected to contribute to achieving our portfolio objectives and be in members’ best financial interests.

impact:

investments across Australia

We invest in real assets across the country, including infrastructure and property.

Supporting key projects such as:

Hobart Airport – a $200 million terminal expansion and runway upgrades to increase domestic and international flights.

GeelongPort - Victoria’s premier bulk port and a major driver of Victoria’s economy managing 12 million tonnes of cargo and $7 billion of trade annually.

And we’re investing in other parts of Australia, too. Our commitment to seeking opportunities in key industries in infrastructure and property fuels our growth nationwide.

A major player in the Australian share market

We’re also an active investor in

Australian listed companies, helping to provide selected businesses with the support they need to expand and thrive. When businesses succeed, they create jobs and drive innovation— and that helps everyone.

Creating jobs and supporting communities

Our investments don’t just aim to grow wealth—they may also create opportunity. Super funds can provide stable, long-term capital to businesses, allowing them to hire, innovate, and expand. Our investment in infrastructure projects like roads, rail, and energy developments can create thousands of jobs, and additionally our investments in venture capital can support start-ups and emerging industries. A strong super system can mean more stable employment and a more resilient economy.

A super system that’s built to last Australia’s super system is globally recognised as one of the best. Recent analysis by the Super Members Council found that it is the fastest growing super system globally, growing at twice the rate of our international peers. The Australian system has the fourth largest pool of pension assets internationally and only sits behind the UK, Canada and the US. We are expected to rise to second in the world by 2031. 2 Even in uncertain times, CareSuper stays focused on long-term growth and stability.

At Super Summit 2025 in Washington, D.C., and New York, industry leaders from Australia and the United States explored investment opportunities in infrastructure, energy, and capital markets. CareSuper Chair, Linda Scott took the opportunity to ask United

States Treasury Secretary, Scott

Bessent what he thought of our super system. His response? Strong praise. He called out its sustainability, steady growth, and reliable inflows as key strengths.

Grow your retirement, strengthen Australia’s economy

At CareSuper, your super is more than just savings for your retirement—it’s an investment in your future and a potential window into Australia’s growth. At CareSuper, we’re committed to delivering strong, longterm returns and, while achieving this, some of our investments may also help build a stronger economy. See how your super is working for you, find out more at caresuper.com.au.

1https://smcaustralia.com/news/securingaustralias-super-powered-future-speech-tothe-committee-for-economic-developmentof-australia/

2 https://smcaustralia.com/news/australianssuper-savings-on-track-to-become-secondlargest-globally-by-the-early-2030s/

CareSuper Pty Ltd (Trustee) (ABN 14 008 650 628, AFSL 238718). CareSuper (Fund) (ABN 74 559 365 913). Any advice is provided by CareSuper Advice Pty Ltd (ABN 78 102 167 877, AFSL 284443). Consider the PDS and TMD at caresuper.com.au/pds. A copy of the Financial services guide for CareSuper is available at caresuper.com.au/fsg/

This is general information only and doesn’t take into account your objectives, financial situation or needs. Before making a decision about CareSuper, you should consider if this information is right for you. You may also wish to consult a licensed financial adviser.

All information, rates and/or fees are current at the time of production and are subject to change. Changes to government legislation and superannuation rules made after this time may affect the accuracy of the information provided. You may wish to obtain professional advice before acting on any of the information contained in this document. Past performance isn’t a reliable indicator of future performance. The value of investments can rise or fall, and investment returns can be positive or negative.

Australia’s electric vehicle (EV) market is navigating a complex global landscape.

Even before the tariff uncertainty that is a hallmark of the Trump Presidency in the United States, the global EV market was being shaped by shifting trade policies, evolving efficiency standards and geopolitical tensions.

Australia’s EV policy landscape reflects the broader global trend of recalibrating ambitions against a backdrop of slowing adoption rates and economic pressures. Some nations are scaling back incentives while others are doubling down on mandates.

Implemented on January 1, 2025, the New Vehicle Efficiency Standard (NVES) sets gradual CO2 reduction

targets for new vehicles, allowing manufacturers to offset highemission sales with efficient models.

While the NVES signals progress, it attracted both praise and criticism.

The Electric Vehicle Council (EVC) called it a “strong, ambitious standard” that pressures global automakers to prioritise Australia, likening it to US and EU frameworks. Others such as the Australian Electric Vehicle Association were critical of concessions to automakers, describing it as “watered down” and noting the standard excludes heavy vehicles and sunsets in 2029.

While it aligns Australia with international efficiency frameworks, there is no denying Europe has much stricter standards.

The EU and UK enforce Zero-Emission Vehicle (ZEV) mandates, requiring automakers to meet binding EV sales quotas - a policy Australia’s NVES lacks.

The term “watered down” could be the theme of 2024 and 2025. Several countries have tempered EV ambitions as consumer adoption lags behind targets.

Germany abruptly ended its AUD$10,400 EV subsidy, contributing to a 37% year-on-year sales drop by July 2024. Peter Mock of the International Council on Clean Transportation warned the move came “too early” for manufacturers to meet emissions targets, risking climate goals. However, early 2025

“Australia’s EV trajectory hinges on leveraging the NVES to close the policy gap with Europe, while navigating tariff-induced market volatility.”

figures are showing signs of a modest rebound.

France cut subsidies in late 2024 and early 2025. Autovista24 cited data that “highlighted that private buyers are turning away from electric cars, with registrations in this channel dropping by 58%.”

Tesla’s sales – and stock price – both suffered alarming falls through 2025 (at EOFY). In contrast, China’s BYD is reporting record levels of sales.

There is little doubt that US President Donald Trump will have a major impact on electrification. This started in the early days of his second presidency when he revoked the order by former President Joe Biden, which set a 50% target for EV sales by 2030.

The Trump administration’s move to relax emissions standards has also lowered battery EV adoption projections to 30% by 2030 (down from 40%).

He has also introduced tariffs, including a 10% tariff on EV powerhouse China. Some have raised concerns that China may now look to flood other markets, such as Australia, while other commentators have forecast that such a move is likely to be negligible.

This is not the case in Europe.

The EU is weighing up tariffs on Chinese EVs to protect domestic industries, potentially spurring Chinese automakers like BYD to build local factories.

EV sales in Australia have slowed growth, up only 7 per cent year on year in contrast to accelerating hybrid and plug-in hybrid sales. BYD has overtaken Tesla for overall EV sales in Australia.

While some have suggested that expanded model availability and NVES

incentives could see EVs achieve as much as 11% of new car sales by yearend (130,000 vehicles).

The consensus view is that Australia’s EV trajectory hinges on leveraging the NVES to close the policy gap with Europe, while navigating tariff-induced market volatility.

While the US retreats from aggressive electrification, and the EU fortifies its defences against Chinese imports, Australia’s moderate approach positions it as a growth market for affordable EVs - provided infrastructure and consumer incentives keep pace.

The challenge lies in sustaining momentum amid geopolitical and economic headwinds.

As Lead Trainer – Future Technologies at MTA Training and Employment in Adelaide, Steve Richardson is a leading expert in zero and low emission vehicles (ZLEVs) and emerging fuel technologies.

As Australia undergoes a transformative period driven by innovation in new fuel and drivetrain technologies, Steve shares his expert insights on the current ZLEV landscape, the innovations on the horizon, and the barriers to greater uptake across the country.

What current technological trends are you seeing with ZLEVs?

The biggest advancement in technology I am seeing is a lot of investment into battery design. Manufacturers are prioritising increasing the longevity of batteries, this means more vehicle range per charge and extending the overall life of the battery.

For hybrids and PHEVs, we have seen vast improvements. Regular hybrids such as the Toyota Camry are very

different cars compared to hybrids of 15 – 20 years ago.

Previously, a hybrid would only be capable of travelling a short distance before engaging the internal combustion engine to work in conjunction with the electric drive train. These days hybrids get a lot more from their electric motors. Likewise, the introduction of plugin hybrids has given motorists the best of both worlds and can go even further purely on the battery supply before reverting to a more conventional hybrid system.

What is the next step in battery technology?

Solid state batteries will continue to develop and be the next big technological breakthrough which will substantially change the abilities of ZLEVs. Compared with current battery technology, solid state batteries will be safer, and the current understanding is they will offer greater range and allow for safer, faster charging. In many cases this would make these vehicles more attractive to owners and operators who travel longer distances.

Which type of technology is the best solution for Australia into the future?

Until very long-range batteries are available, plug-in hybrid electric vehicles are the direction Australia should be looking at over the coming few years. These systems give motorists the best of both worlds and tackles range anxiety whilst reducing emissions and fuel consumption significantly. Given the size of the country, achievable distance from a single charge is a must.

We are seeing this shift already, with sales of electric vehicles slowing, however many people are moving to plug-in hybrids. Until economically viable alternative fuel sources or longrange batteries are developed, PHEVs will be the preferred option.

is needed to support greater uptake of ZLEVs across Australia?

Infrastructure, it’s that simple. We do not have the charging infrastructure to accommodate a sizeable shift to ZLEVs, especially full EVs. This starts with consistent energy delivery from the national grid and flows on to the charging infrastructure. This isn’t just about installing more charging points, but the actual electrical supply network that supports the chargers to accommodate a greater number of vehicles drawing power simultaneously.

Investment in this industry needs to be beyond urban areas as well. Australia is a big country and there needs to be the infrastructure available to charge these vehicles in remote places. Currently any longdistance road trip requires substantial planning of where to charge, and motorists can be caught out with the lack of charging stations.

should potential buyers look for when buying a ZLEV?

The first thing a potential buyer needs to do is work out what they want to do with the vehicle. Are they commuting under 50kms a day? Do they have access to charging infrastructure at home or at work? For city driving, most EVs are very good with public charging points available, and the

vehicle regenerative braking systems come into play, benefitting from stop/ start peak hour driving. ZLEVs also produce a lot less emissions when sitting in congested traffic.

Beyond these considerations, it’s important that a potential buyer looks at the battery warranty, not just the vehicle warranty as these can often be two separate things.

At the end of the day take the vehicle for a drive, get a feel for it and buy what feels comfortable and most importantly suits your lifestyle, be it a pure EV, PHEV or hybrid.

How difficult is it to service an ZLEV? Can you do it at home?

Working on a ZLEV isn’t more difficult than working on an internal combustion engine vehicle, it just requires a different set of skills. Many of the systems are similar, and technically, an EV drivetrain has fewer moving mechanical parts and requires less conventional routine maintenance.

As vehicle service and repair businesses adapt and embrace this new technology there will be more places readily available to get ZLEVs serviced.

I wouldn’t recommend servicing the electrical components of a ZLEV unless you’ve undertaken specialised training to handle the high voltage batteries and their associated electrical systems due to safety concerns.

All modern vehicles have complex electronics in them for example Advanced Driver-Assistance Systems (ADAS) which make it hard to work on at home without specialist equipment and knowledge. We have come a long way from being able to service the family Kingswood or Datsun 180B.

What role does software play in new technology?

Modern ZLEVs have some level of connectivity to the internet. They rely on a lot of different software and can be updated to improve drivetrain control systems or battery efficiency via the internet – like updating the

operating system of your computer or smartphone.

In your opinion, what are the next technological advancements for vehicles?

Further advancements in battery technology will be what we see over the coming years as manufacturers look to provide improved range and improved battery life.

EV integration into the grid will also be another big step forward. We are already starting to see early signs

of this, as people begin using their vehicles to power their homes and help manage fluctuations in electricity supply and demand, especially with the growing integration of renewable energy like solar and wind

Autonomous related features will take big leaps forward in the coming years as vehicles become a lot smarter. These vehicles will technically be online and able to talk with each other and with their surrounding infrastructure exchanging information with each other, improving road

safety, smoothing traffic flow and ultimately leading to more efficient transportation.

Personally, I believe that EVs or plugin hybrid vehicles, depending on the needs of the driver, are the way to go for Australia now, and possibly over the coming decades. However, without the availability of the proper charging infrastructure, motorists won’t be able to get the most out of either of these vehicle design types.

Mas National is proud to support the Motor Trade Association.

Mas National (Mas), proudly part of the IntoWork Group, has been delivering employment and apprenticeship support services to employers, apprentices and trainees across South Australia for over 20 years.

We partner with government, industry, employers, individuals and other stakeholders to facilitate apprenticeship sign-ups, deliver targeted mentoring and to create workforce participation opportunities, across all industries.

Why is Mas South Australia’s leading Apprentice Connect Provider?

Trusted by South Australian employers for over 20 years. We tailor our services to suit your individual or business needs. When you work with Mas, you become a valued partner.

Qualified Allied Health professionals to support apprentices to complete their apprenticeship.

Access to our MasConnects app designed to empower apprentices throughout their apprenticeship journey, from commencement to completion.

Access to additional resources through our IntoWork Group of businesses.

We would like to wish all finalists the very best and congratulations to all apprentices and trainees on their success.

The Australian automotive landscape is undergoing a seismic shift, and at the epicentre of this change is the arrival and rapid ascent of the BYD Shark 6 plug-in hybrid electric vehicle (PHEV) ute.

Launched in early 2025, the new offering from Chinese automotive giant BYD has quickly captured the attention of Australian motorists, challenging established players and highlighting a growing appetite for zero and low emission solutions in a segment traditionally dominated by diesel power.

In the first half of 2025, the BYD Shark 6 sold an impressive 10,424 units in Australia, accounting for a significant 45% of BYD’s total local sales during the same period. This strong performance saw BYD achieve a record 8,156 deliveries in June alone, marking a remarkable 368% year-onyear increase for the brand according to FCAI monthly reporting.

The Shark 6’s contribution was crucial, with 2,993 units sold as of

The BYD Shark 6 plug-in hybrid drivetrain

June, making it the third best-selling 4x4 vehicle in Australia, behind the Ford Ranger and Toyota HiLux. This unprecedented success underscores a clear demand for its unique proposition.

Its key features paint a clear picture of a vehicle designed to meet modern demands while retaining traditional ute capabilities:

PHEV Drivetrain: At its core, the Shark 6 boasts a sophisticated plug-in hybrid system. It combines a 1.5-litre turbocharged petrol engine with dual electric motors, one on each axle, delivering a formidable combined output of 321kW and 650Nm of torque. Critically, BYD claim it offers an EV-only range of approximately 100 kilometres, allowing for emissions-free daily commutes for many users.

BYD Battery Technology: The Shark 6 utilises BYD’s renowned 29.58kWh “Blade” battery system, integrated into the ladder

frame chassis. This battery is known for its safety, durability, and energy density.

Vehicle-to-Load (V2L) Capability: A standout feature for the Australian market, particularly for those who enjoy the outdoors or need portable power for work, is the Shark 6’s 230-volt power outlets in the tray and cabin. With a total combined output of 6600W, this allows users to power various appliances, from camping gear to power tools, directly from the vehicle’s battery.

Off-Road Modes: The Shark 6 offers various terrain modes, including Sand, Mountain, Muddy, and Snow, providing electronic traction control for diverse conditions. While it lacks low-range gearing, its immediate electric torque offers considerable capability in many off-road scenarios.

The burgeoning success of the BYD Shark 6 is symptomatic of a broader trend in the Australian market: a growing pivot towards plug-in hybrid vehicles.

With fluctuating fuel prices, the ability to complete daily commutes on electric power alone provides significant savings. Many PHEV owners can charge their vehicles overnight at home, often leveraging solar power, drastically reducing their reliance on fuel stations.

As environmental consciousness grows, motorists are increasingly seeking ways to lower their carbon footprint. PHEVs offer a tangible step in this direction, especially for urban driving, where they can operate in zero-emission electric mode.

Unlike pure Battery Electric Vehicles (BEVs), PHEVs eliminate range anxiety. The internal combustion engine acts as a reliable backup, ensuring that even on longer journeys or in areas with limited charging infrastructure, drivers are never left stranded. This “best of both worlds” approach is particularly appealing to those who frequently travel outside metropolitan areas or require towing capabilities.

Federal and state government incentives, coupled with the introduction of the New Vehicle Efficiency Standard (NVES), are encouraging the uptake of electrified vehicles. This regulatory push is bringing more PHEV models to market and making them more competitive on price.

BYD Shark 6 boasts competitive off-road capabilities

For Australian families and tradespeople who rely on their vehicles for both daily commutes and weekend adventures or work duties, PHEVs offer unparalleled versatility. The ability to switch between electric power for city driving and hybrid power for heavier loads or longer distances makes them a practical choice.

The BYD Shark 6’s entry into the Australian market is more than just the launch of another new vehicle; it represents a significant turning point for the nation’s automotive industry.

As Australians increasingly embrace electrified solutions, the BYD Shark 6 is proving that powerful, practical, and efficient utes can indeed be part of a sustainable future.

“Printing a solar panel onto the roof or bonnet of a vehicle is not a far-fetched idea. That sort of technology is around today but it’s too expensive at the moment.”

One of South Australia’s leading electronics exporters wants the Australian government to protect local manufacturing industries from the threat of cheap foreign alternatives.

As international markets continue to recalibrate after US President Donald Trump’s hefty tariffs on China, REDARC Electronics CEO Anthony Kittel warned the ramifications for Australia are significant.

“Imagine all those goods that China was selling to the United States that won’t be going there anymore,” Anthony said.

“They’re going to have all this free manufacturing capacity. The last thing we want is for all that capacity to result in a lot of low-cost vehicles or parts being sent into Australia, it will potentially destroy our manufacturing industry. We don’t want to be the dumping ground for low-cost products because they can’t be sold somewhere else.”

And that includes EVs and their components.

REDARC is an Adelaide-based company formed in 1979 with an electronics arm that has pivoted toward developing and manufacturing battery power for electric vehicles including recharging mechanisms such as solar.

The company also has a growing interest in defence as illustrated by its investment in its new Global Centre for Excellence at Lonsdale.

Anthony stopped short of recommending Australia adopt similar

tariffs to those the US has imposed on China but said vigilance is imperative.

“I would certainly be looking at monitoring the market to see what the impacts are. The Unites States are protecting US manufacturers. We need the Australian government to make sure they don’t forget about Australian manufacturers. And if China, India and Vietnam can’t sell their products in the US, Australia is going to be on their radar to sell more and more of that free capacity.”

He doesn’t view Trump’s tariffs on Australian products as a long-term issue.

“I think Australia’s come out of it pretty lightly,” he said.

“There’ll be a little bit of negotiation but I’d be quietly confident that 10 per cent tariff would be removed.”

With a view to expanding REDARC’s business, Anthony attended the RAPID + TCT 2025 event in Detroit in April, the biggest additive manufacturing and industrial 3D printing event in North America. It stretched the boundaries of 3D printing, limited more by imagination than technology.

“It was pretty amazing to see what you can do with printing machines,” he said.

“Being able to scan vehicles and look at X-ray part integrity. It’s really revolutionising not just product development but also methods of manufacturing like sand casting and die casting. Complex shapes can be made very quickly.”

The Motor Trade Association (MTA) Training and Employment has announced a three-year strategic partnership with REDARC Electronics, formalised through a signed memorandum of understanding in May.

This collaboration aims to promote automotive electrical technology as a trade and enhance student awareness of career opportunities within the field. As part of the partnership, REDARC will supply equipment to support automotive apprentice electrical training at the MTA Training and Employment Centre in Royal Park.

MTA SA/NT CEO Darrell Jacobs highlighted that “This partnership highlights how collaboration between training organisations and industry can address skills shortages and strengthen career pathways”.

He also noted the “substantial growth in our dual trade apprenticeships which pair light or heavy vehicle with automotive electrical trades,” with 73 South Australians having commenced these since their 2024 launch and believes “this partnership will further support this growth”.

The MTA SA/NT will also leverage its Schools Pathways Program to “continue to promote automotive electrical as a career choice”.

Anthony Kittel, REDARC Group CEO, emphasized their passion for “investing in the future of automotive technology and its workforce”, stating that “This partnership with the MTA is

a significant step, allowing us to equip apprentices with the latest autoelectrical technology and showcase the value of high-quality Australianmade products”. He added that “It’s about fostering the next generation of skilled professionals who will drive innovation and ensure a robust and capable workforce for years to come” Solar Power

He said technological advancements will ensure solar power becomes a key platform in the development and evolution of battery power in all electric vehicles.

“Printing a solar panel onto the roof or bonnet of a vehicle is not a far-fetched idea,” he said.

“That sort of technology is around today but it’s too expensive at the moment. Elon Musk looks at a vehicle as a power station. You plug it into your home during the evening; during the day you can charge it up at work. So I think the solar panel will be integral.”

He said it will help REDARC meet its goals of creating auxiliary power systems for both business and leisure vehicles.

“Our opportunities are where vehicles are used over and above their initial design conditions such as generating an income for a tradie, or as a council or fleet vehicle. Or for pulling a caravan in the outback without having to take a big generator. You’re still going to add third party equipment to the vehicle and therefore you don’t want to run down your main battery. You want a power solution which incorporates solar, lithium batteries and an energy management control system so you’ve got full visibility of your state of charge, how long you can drive for, how long you can operate your microwaves and induction cooktops, and things like that. That’s the opportunity for us and as electrification grabs more market share, we need to think about how we can let customers use that vehicle to live the life they are accustomed to and without anxiety of running without battery capacity. It’s one

thing to run a vehicle but you also want to be able to run one with all the creature comforts of home. I see that auxiliary power systems provided and developed by REDARC are going to be necessary.”

The tyranny of distance has long led the argument against electric vehicles ever superseding petrol vehicles for market share in Australia.

But Anthony doesn’t subscribe to the theory.

“Say we cast our mind forward 20 years, when every fuel station is gone and in their places are battery charging facilities. Well, it’s no different to today; you can travel to the Flinders Ranges and buy fuel in Leigh Creek or Hawker or Quorn. It will be the same in the future, you’ll be able to pull in and charge your vehicle.”

Concerns about the safety of lithiumion batteries have also hampered a more rapid uptake of the technology but Anthony is adamant those issues will be overcome.

“My view is I don’t have any concern,” he said.

“It’d be like someone saying 30 years ago, ‘Wow, are you going to put all that fuel in your car, that could explode?’ It’s like any technology, as it gets more mature, it gets a lot more robust, more standards are introduced by regulators and things improve with greater usage. Suffice to say we’ve still got some issues but things are getting better and better and battery technology is getting safer and safer. The materials that make up the batteries will change over time so there are no safety issues..Technology will move and create the safety that’s required in the market. As more and more people start to use it, the volume increases, the price comes down and the safety goes up. And the weight of batteries will come down and when weight comes down, longevity or range that can be achieved will go up.”

Anthony said he was delighted REDARC was recognised as SA Exporter of the Year in 2022 and 2023.

But he took even greater pleasure from receiving commendation from a satisfied customer in their target market.

“Personally, there’s no better kudos for me than when I was at Airstream, the RV (recreational vehicle) manufacturer in Ohio. I walked in to meet with the senior engineering team and they all knew REDARC and they said to me, ‘We’ve never had one of your products fail, we love your products’. That’s worth more than any award to have a customer on the other side of the globe talk about you like that. I’m not putting the awards down, they‘re great. But it’s that brand awareness when you walk into meet big customers like that, there’s no better satisfaction.”

Over the coming decade, REDARC will unashamedly target international growth, specifically in the US.

“While we want to be Australian owned and manufacturers, we want to make sure our international markets are actually bigger than our Australian business.”

It will maintain its focus in the RV space while planning to make greater inroads with commercial vehicles, truck and industrial markets.

“There’s a force coming which is the electrification of all vehicles across all platforms,” Anthony said.

“That change is moving, it’s gathering momentum so as an Australian designer, manufacturer and developer of new products, if we want to be successful in the years ahead, we have to consider what opportunities exist in all electric vehicles.”

“There’s a force coming which is the electrification of all vehicles across all platforms.”

The ultimate solution for convenient and safe trailer braking.

New SwayStop Plus delivers one-touch sway control, allowing you to keep both hands on the wheel.

The only 6-axis sensor on the market delivers unmatched control and smooth braking.

Tow-Pro Link delivers installations up to 50% faster than other leading brake controllers.

Two braking modes for on-road towing conditions, and more challenging off-road conditions.

The fledgling electric vehicle market is a car lover’s paradise, with an array of fresh options hitting the Australian market in the second half of 2025.

The full calendar year is slated to see the arrival of more than 40 new EV models, including new-to-Australia Chinese brands like GAC and Geely. New entrants will bring some of the world’s most cutting edge technology and aggressive pricing, from affordable selections like the GAC Aion V and UT to luxury offerings such as the Cadillac Lyriq.

Will this be the year that Australians get swamped with EV utes? Unlikely,

Cadillac is making its official debut in Australia in 2025 as an electric-only brand, with the Lyriq SUV leading the charge. Key features include:

Two variants: Luxury ($117,000 plus on-road costs) and Sport ($119,000 plus on-road costs)

102kWh battery pack

Dual motors delivering 388kW of power and 610Nm of torque

530km driving range

190kW DC fast charging capability, providing 128km of range in 10 minutes

The Lyriq is positioned to compete with luxury electric SUVs like the BMW iX and Audi Q8 e-tron, offering a unique blend of American styling and cutting-edge technology.

but LDV has confirmed that a new electric ute, the eTerron 9, will be arriving soon to succeed the eT60. The eTerron 9 is expected to offer significant improvements over its predecessor, including an improved braked towing capacity of 3.5 tonnes, matching conventional diesel utes.

Given the fact that the eT60 hasn’t enjoyed runaway sales, the new ute is being touted as a “completely different vehicle, inside and out”.

Ford is yet to offer a fully electric ute in Australia but its Ranger Plug-In Hybrid (PHEV) ute is expected to arrive in mid-2025, with the same

GAC Motor is set to enter the Australian market by mid-2025 with the Aion V electric SUV:

Priced at less than $28,000, making it one of the most affordable EVs in Australia

Competes with models like the BYD Atto 3 and Volkswagen ID.4

Spacious interior for both driver and passengers

The Aion V’s extremely competitive pricing could make it a game-changer in the Australian EV market, potentially accelerating the adoption of electric vehicles among budget-conscious consumers.

braked towing capacity as the e-tron 9 mentioned above.

While MG has indicated plans to launch a ute to help reach its sales goals, they have not confirmed any timing or whether it would be an electric model. The Tesla Cybertruck appears to be on a long slow burn for Australia, complicated by local design and safety rules, and the GMC Hummer EV appears to be in a similar class.

Looking at what’s actually happening, as opposed to rumours, the details below were correct at the time of writing but are subject to change.

Kia is pushing ahead in the EV space with a range of new offerings including the EV4, which has:

Driving ranges between 410 km and 630 km, depending on the version

Fast charging, going from 10-80 per cent in approximately 30 minutes

Accelerates from 0 to 100 km/h in 7.4 to 7.7 seconds

The EV 4 introduces an AI Assistant is designed to provide natural conversational interactions as an on-board co-pilot is at hand to control vehicle control functions and infotainment system.

MG is introducing the S5 EV, a replacement for the ZS EV, during the second quarter (April to June) of 2025. This new electric SUV is based on the same platform as the MG 4 and offers a variety of options:

Battery choices: 49kWh and 62kWh lithium iron phosphate (LFP) batteries, as well as a 64kWh nickel manganese cobalt (NCM) battery

Motor options: 125kW electric motor for LFP batteries, 170kW for NCM battery

Two trim levels available for each battery option

Choice of 17- or 18-inch wheels

The S5 EV aims to compete with popular models like the BYD Atto 3, Hyundai Kona Electric, and Chery Omoda E5. Pricing details are yet to be announced, but it’s expected to be competitively positioned in the market.

Deepal, a new Chinese brand in Australia, is introducing the S07 midsized family SUV. Notable features include:

Single specification with a 160kW/320Nm electric motor

80kWh battery delivering 475km of range

Priced from $53,900 (plus onroad costs)

Standard equipment includes a 15.6-inch rotating touchscreen, AR head-up display, wireless charging, panoramic roof, and a 14-speaker Sony sound system

7-year/160,000km vehicle warranty and 8-year/240,000km battery warranty

The Deepal S07 offers an attractive price point for a well-equipped electric SUV, making it a compelling option for budget-conscious buyers looking for premium features.

Geely is re-entering the Australian market with the EX5 electric SUV, offering sharp pricing and attractive features:

Two variants: Complete ($40,990 before on-road costs) and Inspire ($44,990 before on-road costs)

Competitive pricing, undercutting many rivals in the mid-sized electric SUV segment

Limited-time incentives until the end of April 2025, including three years of free servicing, one year of free public charging, free premium paint, and a free home charger

The Geely EX5’s aggressive pricing strategy positions it as a strong contender in the increasingly competitive electric SUV market.

Audi Australia has announced the upcoming release of the 2025 Q6 e-tron and SQ6 e-tron electric SUVs, scheduled to arrive in early 2025. While specific details for the Australian market are yet to be confirmed, these models are expected to offer Audi’s renowned luxury and performance in an all-electric package.

“The e-tron 9 is expected to offer significant improvements over its predecessor, including an improved braked towing capacity of 3.5 tonnes, matching conventional diesel utes.”

As more homes and businesses choose to electrify their buildings and transport, this could result in the distribution network (in South Australia’s case, that’s SA Power Networks), carrying vastly more energy than it does today. This presents both great opportunities and great challenges for a network originally built for a simple one-way flow of energy. Forecasts show that, if left unmanaged, demand on the network could double at peak times, requiring a high level of investment in network upgrades. Fortunately, the network has capacity most of the time.

Demand flexibility and ‘whole of home’ or ‘whole of site’ energy management is the least-cost alternative to integrate Customer Energy Resources (CER) into the system (whether it’s solar, smart appliances, batteries or electric vehicles). This means rewarding households and businesses to shift both load (imported from the network) and generation (exported to the network, be it from solar and battery today, or vehicle-to-grid technologies in the future) to times of day where the network has spare capacity.

At the moment, we’re in the process of trialling this ‘whole of home’ energy optimisation approach through our ARENA-supported* Energy Masters pilot[LR1.1], which will include a high number of households trialling flexible EV charging via a home energy management system (HEMS). In Energy Masters, the HEMS will take in signals from the network and the retailer, as well as the customer’s own usage preferences, to optimise the use of a range of energy-smart devices, including EV chargers. If enough customers take up these kinds of offers at scale, existing infrastructure will be better utilised, putting downward pressure on electricity prices for all.

Flexible Exports [L(2.1]was our first demand flexibility offering. In response to the world’s highest solar uptake, we’ve developed this world first offer that customers are taking up

in droves, because most of the time they can export up to 10kW per phase, and only very rarely do they lower their export limit to support grid balance. With Flexible Exports in place, solar can now be synchronised to the needs of the network. But wholesale electricity prices are still frequently negative in South Australia during sunny periods (about 25% of the time in 2024!) which means that there is more supply than demand in the system at certain times.

Electric vehicles (EVs) provide an exciting opportunity for both customers and the network to benefit from these conditions. We believe that if EV charging can be coordinated around times when the network has more capacity, and away from peak times, customers should be rewarded for the contributions they’re making. That means working closely with industry to ensure that energy retailers reward customers for charging at the right time for the grid, and that customers have access to charge at the right times – while minimising the impact it has on their daily routines. Meanwhile, we’re also working on our offering for commercial and industrial customers, with both upfront and ongoing cost reductions available for those who are willing to be flexible in their energy use.

There are some areas in South Australia where the existing poles and wires cannot support high-speed EV charging today. However, we are in the process of trialling the use of community batteries[L(3.1] paired alongside EV chargers to unlock additional network capacity in these areas.

While vehicle-to-grid (V2G) technologies are not quite ready for widespread adoption, they have the potential to unlock even more opportunities for customers to benefit from their investment in electric vehicles thanks to their bi-directional charging capabilities. These vehicles can not only take power from the grid to charge the EV battery, they can also supply power back to the grid, or power a home (vehicle-to-home) by

using energy from the EV battery. Effectively it enables your electric vehicle to act as a home battery, storing energy that can be used to power your home or sold to the grid. We are supportive of South Australians adopting this technology and are actively advocating for a coordinated approach to adopting bidirectional charging technologies, for example via the Federal Government’s National Roadmap for Bidirectional EV Charging.

As the distribution grid becomes responsible for fuelling more and more transport sectors, we see this as an opportunity to use smart technology to integrate EVs in the most efficient way possible. This means constantly evolving services for EV owners to have reliable and affordable access to charging (at home or in the community), as well as rewarding EV owners for including their vehicles in ‘whole of site’ energy optimisation and demand flexibility initiatives.

If we get this right, EVs can play a key role in optimising the energy use of homes and businesses, which not only helps EV owners reduce their costs but could significantly increase the utilisation of SA Power Networks’ infrastructure, lowering costs for all customers.

You can learn more about how SA Power Networks is supporting the transition to electric vehicles on our website: https://www. sapowernetworks.com.au/your-power/ smarter-energy/electric-vehicles/

*The Energy Masters project has received funding from the Australian Renewable Energy Agency (ARENA) as part of ARENA’s Advancing Renewables Program. The views expressed herein are not necessarily the views of the Australian Government, and the Australian Government does not accept responsibility for any information or advice contained herein.

The South Australian automotive industry’s night of nights did not disappoint as guests celebrated in style, honouring the states leading apprentices, employers, trainers and supporters at the 2025 MTA Graduation and Awards.

More than 550 apprentices, employers, parents and supporters packed the Morphettville’s Wolf Blass Event Centre on Friday 4 April, cementing it as one of Australia’s best apprentice graduation and awards events.

In 2025, close to 200 apprentices graduated from their automotive apprenticeships. The event also

celebrated 49 finalists across 17 award categories.

Taking out top honours, Jacob Comley from Eagers Automotive, Eblen Subaru was crowned MTA Apprentice of the Year 2025. Imparting advice to peers in the audience, Jacob shared his advice about the journey of an apprentice, “There will be times where you will doubt yourself, but just stick with it, because everything will be worth it.”

During his keynote address amidst a busy election campaign, Federal Minister for Training and Skills Andrew Giles paid tribute to the critical role graduating apprentices and award

finalists play “When you all work together, it is our nation that benefits.”

“Skills and training are the key to meeting the current and future challenges in our economy” Minister Giles added.

Joining the Federal Minister, South Australian Minister for Education, Training and Skills Blair Boyer highlighted the importance of events such as the MTA Graduation and Awards, “Events like tonight are essential to showcase apprentices who are truly excellent in their field.” Motor Trade Association SA/NT (MTA) CEO Darrell Jacobs reflected on the

evolution of the automotive industry, “Our industry is rapidly changing thanks to technology. The cars and trucks we drive and the machinery we operate will be different tomorrow.”

“You are the future of our industry, embrace it and you will have a lifelong career full of pride and passion” Mr Jacobs added.

Celebrating its 99th year, CEO Darrell Jacobs touched on achievements of MTA Training and Employment in 2025 including:

1,100 apprentices in training

450 apprentices employed by the MTA and hosted in industry

Close to 100 commenced in Australia’s first automotive dual trade apprenticeships

100 schools visited exposing students to the automotive industry

Closing his remarks, Mr Jacobs asked apprentices in attendance to reflect on their achievements, “You wear the MTA brand just like many who have come before you – make us proud.”

“You wear the MTA brand just like many who have come before you – make us proud.”

APPRENTICE OF THE YEAR AWARD

Jacob Comley, employed by Eagers Automotive Eblen Subaru

Presented by Minister Boyer and award sponsor CareSuper

MOST OUTSTANDING 3RD YEAR APPRENTICE AWARD

Kane Angel,

at Ross Aiston Motors

Presented by Minister Boyer and award sponsor Mas National

OUTSTANDING 1ST YEAR APPRENTICE AWARD

APPRENTICE OF THE YEAR AWARD

Presented by Minister Giles, Minister Boyer and award sponsor Penrite Oil

MTA EMERGING TRAINER OF THE YEAR AWARD

Stephen Gust, Trainer & Assessor - Heavy Vehicle

Presented by Minister Boyer and award sponsor RMB Service Group

CLEVE TRAINING CENTRE APPRENTICE OF THE YEAR AWARD

Ilias Apostolidis, employed by Emmetts

Presented by Minister Boyer and General Manager, Automotive Business, Jason Polgreen on behalf of award sponsor District Council of Cleve

AUTOMOTIVE INDUSTRY EMPLOYER OF THE YEAR AWARD

RMB Service Group

Presented by Minister Boyer and award sponsor SherwinWilliams

BOB GOLDSWORTHY AWARD

Muhammad Ibrar, employed by Rhino Crash Repairs City

Presented by Minister Boyer, Anthony Goldsworthy and award sponsor PPG Industries

ROYAL PARK TRAINING CENTRE APPRENTICE OF THE YEAR AWARD

Sam Pearce, employed by G&J East

Presented by Minister Boyer and award sponsor Capricorn Society

AUTOMOTIVE EMPLOYER COMMITMENT TO SAFETY AWARD

Jarvis Group of Companies

Presented by Minister Boyer and award sponsor myenergi

MTA HOST EMPLOYER OF THE YEAR AWARD

RMB Service Group

Presented by Minister Boyer and General Manager, Automotive Business, Jason Polgreen on behalf of award sponsor ADAS Solutions Australia

MOST OUTSTANDING SCHOOL-BASED APPRENTICE OF THE YEAR AWARD

Sophie Duell, employed by Murraylands Training & Employment Association of SA. Inc

Presented by Minister Boyer and award sponsor St Patricks Technical College

ROAD TO RESILIENCE AWARD

Benjamin Monro, MTA SA Automotive Industry Career Mentor

Presented by Minister Boyer

VET COORDINATOR OF THE YEAR AWARD

Annasofia Hamilton, VET / Career Pathways Coordinator at Urrbrae Agricultural High School

Presented by Minister Boyer and award sponsor

Apprenticeship Support Australia

VET IN SCHOOL STUDENT OF THE YEAR AWARD

Samuel Thomas, attending Underdale High School

Presented by Minister Boyer and award sponsor Government of South Australia, Department for Education

The MTA has apprentices across metro and regional SA available right now.

Why hire an apprentice through the MTA?

Our apprentices are put through a pre-employment job-ready program

We handle all the paperwork including payroll, claims and WorkCover

Uniform, tools and all PPE is supplied

Training programs will be designed to assist with planning your workforce

Apprentices receive a dedicated Employment Officer plus ongoing mentorship from trainers and the MTA's mentor

No strings attached, you have the option to release your apprentice at any time and much more...

"We are very happy with the quality of apprentices that MTA are providing us. They are great young people with bright futures."

Nathan McEachern Car Service Manager - O G Roberts & Co

Australia is the poster child for solar, with combined capacity of 37.8 GW photovoltaic (PV) solar power from over 3.92 million solar PV installations. Compared to the UK 17.2 GW capacity, Australia is a giant. Yet solar EV chargers are rolling out in vast numbers in the UK, with the world’s first solar EV charger invented and built in Britain by disruptive greentech brand, myenergi.

Since 2020, myenergi has been bringing the eco-smart solar EV charger zappi to Australia, building on the lessons learnt from the UK.

Being first to market with zappi provided a first-mover advantage, allowing myenergi to establish a strong brand presence from day one. This early lead helped secure market trust, drive adoption, and position myenergi as a key player in the smart EV charging sector. From a small countryside workshop to a purposebuilt eco facility in Stallingborough, myenergi went from green tech

startup to market disruptor in less than a decade.

However, market shifts can happen rapidly in a new and fast-moving industry. It’s therefore important to have the agility to evolve and adapt, as the industry develops and new technology emerges. A key example is the energy sector and developing capabilities such as vehicle to grid.

That agility is also vital in creating the right products for the right market. It’s essential to align with market needs, as what works in one region may not translate directly to another.

Unlike the UK, Australia doesn’t enforce the same smart regulations on EVCE’s, resulting in a higher number of basic, so-called ‘dumb”, chargers in the market. Additionally, Australia’s larger geography has seen higher demand for longer-range EVs, which means charging capabilities need to meet this demand.

Australia is gradually implementing dynamic export control across home

PV production, requiring adaptability in energy management solutions. Additionally, grid operators are adopting the CSIP protocol, meaning devices must comply with evolving regulations.

Environmental factors also play a role—heat, installation conditions, and the need for higher IP-rated products must be considered to ensure optimal performance in Australian conditions.

The impact of recent US tariffs could also see higher costs across the industry, with a weakened Australian dollar.

So what to expect in the future? The EVCE space is evolving rapidly, with wider adoption of agile tariffs and smarter charger capabilities driven by deeper vehicle and grid integrations. myenergi has an exciting product roadmap, with a major new product launch expected toward the end of the year, signalling further innovation in the sector.

As more fires involving lithium-ion batteries are being attended to by the Country Fire Service (CFS), the volunteer based emergency service organisation is providing additional information to help its volunteers manage incidents safely and efficiently.

Incidents involving lithium-ion batteries are increasing across South Australia due to:

The use of convenient cordless devices.

The uptake of electric vehicles, plug-in hybrid electric vehicles and micromobility devices (e-scooters, bikes and skateboards).

The growth in the installation of home and commercial solar systems.

CFS State Operations Officer, Urban Technical Operations and Alternative Energies, Garth Hogarth said there are a variety of reasons we’re seeing increased lithium-ion fires.

“The increase of these devices, e-transportation, power storage and generation will see more fires involving lithium-ion batteries and CFS volunteers will need ongoing training and equipment to safely

combat these incidents when protecting the community,” Mr Hogarth said.

“As we gain more knowledge around lithium-ion fires, we look forward to sharing this information with our volunteers to help them keep themselves and their community safe,” Mr Hogarth said.

In line with this, the CFS has implemented various measures to grow its understanding of these fires and to protect its volunteers and the community. These measures include:

Two online learning packages are available to educate CFS volunteers about lithium-ion battery incident risks.

Operational Bulletin 92, which provides strategies and tactics for incident management.

An online Thermal Imaging Camera course, a vital tool for understanding battery temperature and potential signs of thermal run away.

HazMat brigades have atmosphere monitoring tools to protect firefighters from toxic and corrosive vapours.

A new lithium-ion battery incident reporting form is also

available on the CFS Volunteer Portal to provide details about incidents.

Monthly reports are being developed into case studies for ongoing learning.

CFS subject matter experts (SMEs) are also available to attend brigade and group meetings to answer questions about lithium-ion fires.

The CFS generates further information to develop policy and procedures in this area through the Australasian Fire and Emergency Service Authorities Council (AFAC) Alternative & Renewable Energise Technologies Technical Group, which has representatives from all fire agencies in Australia and New Zealand.

This group of SMEs provides advice in the development of policies and procedures to fire agencies for the safety of first responders. It also shares how each agency is managing these incidents and the learnings gained from attending these incidents.

Scott Corrie, General Manager of the Port Adelaide Collision Repair Centre (PACRC), is witnessing an irresistible trend in the Australian automotive market.

“When I ask an owner of an EV vehicle if they would ever go back to a petrol vehicle almost 100 per cent say ‘no’,” he said.

The Commercial Road company has become the first accredited MTA EV Ready collision repairer.

The need for qualified repairers and desire to remain versatile is precisely why Scott made the decision to embrace the new technology.

“The EV market is growing with new brands and models becoming

available every year,” he said.

“When the MTA announced an EVready certified course, I jumped at the opportunity.

“We need to be educated and understand how to repair electric vehicles safety and correctly.”

The MTA EV Ready Program was built to empower businesses, attract new customers and showcase their readiness to service and repair hybrid and battery electric vehicles.

It offers MTA accreditation with signage while ensuring workshop readiness with a commitment to safety and an empowered workforce.

It is no secret the collision repair industry struggles with a dearth of readily available and qualified tradespeople for all types of vehicles.

Scott hopes PACRC’s decision to jump the queue will help alleviate that issue in the EV space.

“Understanding new technology is difficult as the EV vehicles are built differently to the normal vehicles we repair.

“In order to repair an EV, you need to power them down.

“However, once they are powered down, moving them through the repair facility is a challenge.

“You can use locking spare wheel hubs and you need to think outside

“When the MTA announced an EV-ready certified course, I jumped at the opportunity. We need to be educated and understand how to repair electric vehicles safety and correctly.”

the normal repair process a bit.”

It all needs to be balanced against a tide of rising costs that have seen average vehicle repair bills climbing steadily.

“Running costs will always rise – you need to manage your supplier costs and repair vehicles as efficiently as you can,” Scott said.

Despite inflationary pressures, PACRC has never been busier.

“We have developed and maintained very strong working relationships with our insurance suppliers over many years,” he said.

“Building mutual trust and respect

means we have been able to retain important contracts.

“Through the quality of our work, we have also built a very large database of repeat customers who return to us as needed.

“We have been a repairer in Port Adelaide since 1991 and have repaired vehicles for the same families since we opened.

“These families have sent us repeat work over many years.”

Scott’s father opened the business that year, after selling Welland Crash Repairs to his partners.

Scott began working there part-time and that soon evolved into a full-time spray painting apprenticeship.

The business now employs 15 staff including an apprentice panel beater and spray painter.

But EV’s remain only a small percentage of their total business.

“We probably repair five EV or hybrid vehicles per week,” Scott said.

And while he expects that number to grow, he doesn’t anticipate they will replace petrol vehicles any time soon.

“EVs are not for everyone but they are definitely a growing option in our market.

“There will always be that option for the consumer if they want to buy an EV, hybrid, petrol or diesel.”

The MTA is here to help your business prepare for the future.

Join the MTA EV Ready Program, designed to assist your business in attracting new customers by signaling your readiness to service and repair hybrid and battery electric vehicles.

Scan the QR code, or visit qrco.de/bekwC8, for more information and eligibility criteria www.mtasant.com.au | mta@mtasant.com.au | 8241 0522

The first full-sized electric vehicle was invented by Scottish inventor Robert Anderson in 1832, powered by nonrechargeable power cells

Some electric vehicles are capable of charging to full capacity in under 30 minutes using ultra-fast chargers

China is the largest EV market globally, accounting for over 40% of EV sales worldwide

Are EVs more likely to catch fire than petrol vehicles?

Evidence of vehicle fires indicates that electric vehicles are no more likely to catch fire than internal combustion vehicles. It is important to remember both have the potential to catch fire. Other than arson or catching fire from an external source, significant intrusion of the battery can cause thermal runaway.

Do EV batteries fail after a set number of charge cycles?

This comes down to how the battery is treated. Under current battery technology, owners are encouraged to work on a 30-80 rule, that is, run the battery down to 30 per cent then charge it to 80 per cent. That will cover normal commuting and meet the requirements of the average

Electric vehicles can be used to power homes through bidirectional charging technology, acting as mobile energy storage units

When electric vehicles slow down, they recharge its battery using regenerative braking systems

motorist, that will cover normal commuting. Like any battery it will lose capacity over time with an average degradation of 1.8 per cent per year.

Why can’t EV batteries be dismantled and individual components replaced?

Batteries can, in many examples, be dismantled and components replaced as needed. These batteries are design as a modular state which means modules can be replaced or repaired rather than the whole battery assembly being made redundant. EV batteries which are no longer suitable for vehicle use due to reduced capacity can also be repurposed for stationary energy storage.

Why is EV technology designed to be unnecessarily complex to prevent DIY repairs when compared to ICE vehicles?

Electronics are complex in modern vehicles of all types; powertrain control modules used in conjunction engine control module controls in internal combustion engines have some advanced electronics control systems as well. Regardless of the vehicle type, the systems are design to ensure best vehicle performance and meet the required emissions standards. With hybrid and battery electric vehicles, the main difference is there is also high voltage componentry which before being handled requires the technician to undertake specific training and have access to correct tooling and equipment before beginning work.

Unleash your vehicle’s potential with Penrite - trusted by the Penrite Racing Supercar team for unparalleled reliability and performance on the track. For technical support, contact our experts at lubetech@penriteoil.com.au or call 1300 736 748

Adelaide Metro hydrogen bus concludes its trial

The future of hydrogen buses on Adelaide streets remains unclear beyond the completion of a two-year trial, which concludes in August.

However, this will not deter the South Australian Government’s determination to deliver a carbon-free public transport network by 2050.

Adelaide bus operator Torrens Transit began the two-year trial of two Foton Mobility hydrogen fuel cell buses in August 2023.

The buses carry hydrogen tanks which react with oxygen in the air to recharge their batteries and power their electric motors.

The completion of a recent battery electric bus trial saw the government order 60 new Scania battery electric buses to be delivered over 12 months beginning in the second half of 2025.

But that doesn’t necessarily mean the end for hydrogen buses in Adelaide.

“While there are currently no plans to purchase hydrogen buses, the Department will continue to review

and evaluate the use of hydrogen in public transport following the completion of the trial,” said Nathan Regter, Senior Media Officer for the Department for Infrastructure and Transport.

“To date, the buses have performed well.

“We have received some positive feedback from passengers and also interest from stakeholders, including local schools who have requested to tour the depot.”

The ultimate decision on the future of hydrogen buses will likely hinge on two factors – cost and performance.

“While battery electric buses offer a more cost-effective solution, hydrogen offers greater driving range which is beneficial for servicing longer bus routes,” Nathan said.

Although he conceded, the procurement of hydrogen buses would require greater investment.

“Overall, the performance of the buses has been pleasing, however

the refuelling of the vehicles has been restrictive due to the current infrastructure in place.

“There is potential that this can be scaled up and improved in the future.”

Infrastructure to charge the new electric buses is underway at the Morphettville depot.

While train operations have returned to state control and trams will follow from July, 2025, the repurchase of privatised bus networks is much more complex and there are currently no plans to follow suit.

Hence the government will rely on private operators to meet their designated requirements.

The Adelaide Metro fleet comprises more than 1,000 buses with a mix of diesel, hybrid, battery electric and natural gas-powered vehicles, as well as the two hydrogen buses on trial.

Purchase of diesel-only buses ceased in September, 2022.

The sight of electric vehicles and plug in hybrids are no longer a novelty on Australian roads. As more zero and low emission vehicles (ZLEVs) enter the new car market, a significant shift is occurring beneath the surface: the rise of the second-hand electric vehicle (EV) market. This expanding market presents both exciting opportunities and unique challenges for Australian consumers and the automotive industry alike.

Currently, the landscape of used EVs in Australia is dynamic and somewhat unpredictable. Recent data indicates a significant increase in the availability of second-hand electric cars, a natural consequence of early adopters upgrading and leases expiring. This

growing supply, combined with factors such as evolving government incentives for new EVs and lingering uncertainty around battery health and longevity, has led to a noticeable softening in used EV prices.

For cost conscious consumers, this presents an unprecedented opportunity. Models that were once premium-priced are now becoming more accessible, potentially lowering the barrier to entry for those looking to embrace electric vehicles without the initial high cost of a new vehicle. Reports suggest a buyer’s market is emerging, with some used EV prices experiencing considerable drops. This trend is particularly evident in earlier generation EVs as newer models

with improved range and technology become available.

The recent debate in South Australian Parliament over proposed vehicle inspection legislation has highlighted a significant gap in consumer protection for those buying used cars privately. The Motor Trade Association of SA/NT (MTA SA/NT) has been a strong advocate for this legislation, emphasising the vulnerability of South Australians given that approximately three out of four cars are sold privately through platforms like Facebook Marketplace, often without the consumer safeguards typically associated with licensed dealers.

While the Malinauskas government has indicated that the specific bill

before parliament will not receive their support, they have acknowledged the legitimate concerns raised by the MTA SA/NT and the merit of addressing these issues to better protect buyers from potentially unroadworthy or misrepresented vehicles. This ongoing discussion underscores the need for regulatory reform to ensure greater transparency and safety in the private used car market.