October2025

October is here, and with it comes new opportunities for Milwaukeearea investors This month’s edition brings you the latest local and national market data to help you stay ahead, plus insights on tax strategies to protect your profits and exclusive discounts just for Milwaukee REIA members.

Staying

How

At Milwaukee REIA, our mission is to give you the tools, knowledge, and community you need to succeed Whether you ’ re just starting out or scaling your portfolio, this newsletter is packed with information and inspiration to help you reach your goals Take advantage of what’s inside the strategies, data, and savings are designed to help you take the next step in your investing journey Together, we ’ re building a stronger, more informed investor community right here in Milwaukee.

Paul Finck, The Maverick, is a high-energy, sought-after speaker, negotiation expert, and business consultant with nearly four decades of experience in entrepreneurship and negotiation mastery With a track record of more than $50 million in coaching sales and over $30 million in real estate transactions, Paul is known for his unconventional, no-nonsense approach to business. His methods are grounded in psychological insight and field-tested strategies that have guided hundreds of entrepreneurs, real estate investors, and business owners to exponential growth and success

Paul’s unique, “maverick” style challenges the status quo, inspiring his audience to step outside their comfort zones, break traditional rules, and adopt winning habits that lead to extraordinary results A mentor to high achievers, Paul has been featured in 18 best-selling books and has delivered more than 2,000 presentations worldwide. His new book, "Negotiation Domination: The Maverick's 50 Unstoppable Strategies to Win Every Deal," equips readers with the power tools they need to win every negotiation and is a must-read for anyone serious about mastering the art of influence

This book is the hard-hitting, psychological artillery used by top closers who play to win. Drawing from decades of experience and over $50 million in negotiated results, Paul delivers the exact strategies that shift power, influence behavior, and close deals fast with confidence and integrity

Plus - the first 100 attendees, get a signed copy of the book!

Master real estate negotiation with Paul Finck - The Maverick - in this high impact session featuring unstoppable strategies from his new book, Negotation Domination

Doors open at 6pm, followed by networking, Haves & Wants, and then the featured presentation!

Graf | 920-203-6087 | dave@gsifoundations com

Graf | 414-395-5478 | jgraf@premierpointrealty.com

Rens | 414-296-6225 | taylor rens@zrlaywers com

Landmark Credit Union is the largest Credit Union in Wisconsin with over 375,000 members, 36 branches, serving 35 counties in Wisconsin and 2 counties in Illinois, over 900 dedicated associates, and over $6 Billion in total assets Landmark is a not-for-profit financial cooperative locally owned by our members and we return profits to our members, who enjoy better rates and lower fees on a full range of straightforward financial options. We strive to enable our members to become financially self-sufficient and successful In addition, we demonstrate the value and convenience of membership in Landmark Credit Union by daily fulfilling our promise, “You’re worth more here.”

Martin

BY: BRAD BECKETT VIA REAL ESATE INVESTING TODAY

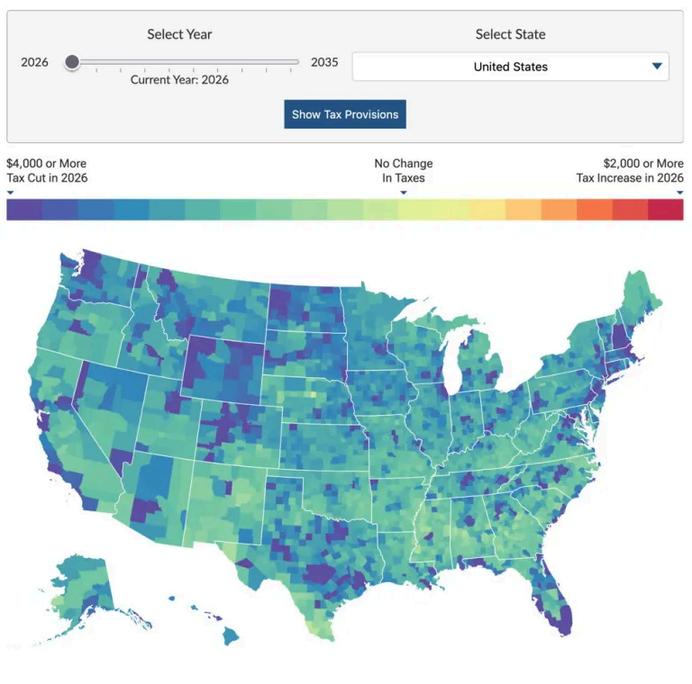

The Tax Foundation says that the One Big Beautiful Bill Act (signed on July 4th) makes the most significant legislative changes to federal tax policy since the 2017 Tax Cuts and Jobs Act (TCJA). They point out how the measure makes permanent the individual tax changes first put in place by the TCJA, avoiding a massive tax hike on an around 62% of tax filers in 2026. In addition, they say the law provides additional tax cuts to individuals and businesses on top of TCJA extensions, including new deductions for tipped and overtime income, an expanded child tax credit and standard deduction, and permanence for 100% bonus depreciation and domestic research and development (R&D) expensing The the interactive map below illustrates the geographic variation in tax benefits from the OBBBA, relative to a scenario in which the TCJA individual tax provisions expire, and business taxes increase as previously scheduled starting in 2026 Taxpayers in Wyoming ($5,375), Washington ($5,372), and Massachusetts ($5,139) will see the largest average tax cuts in 2026, while taxpayers in West Virginia ($2,503) and Mississippi ($2,401) will see the smallest average tax cuts that year. Indeed…

Ready to stop dabbling in real estate and start dominating it?

Join us for an immersive event is your fast track to confidently buying properties in Milwaukeefrom the first seller convo to the final rehab walkthrough. This isn't just a "look at a house and guess the ARV" kind of event. This is a hands-on, real-world investing experience designed to equip you with the tools, scripts and systems to move from seller lead to rehabbed flip or rental

The Bus Tour combines in-depth education with practical experience: Expert Guidance: Learn from a seasoned investor who has mastered the buying and rehab process

Real-World Training: Explore properties, diving deep into the challenges and triumphs of each deal.

Custom Tools: Access exclusive resources to close deals faster and more effectively.

Whether you're a first-time investor or a seasoned pro, this event is packed with insights to help you:

Build confidence in evaluating properties.

Refine your negotiation strategies.

Set yourself up for long-term success in real estate.

BY: DAVID GORENBERG VIA REALESTATEINVESTINGTODAY.COM

For real estate investors and business owners, like-kind exchanges under IRC Section 1031 can offer significant tax deferral opportunities After participating in a 1031 Exchange, taxpayers must complete and submit IRS Form 8824 to remain compliant with the exchange rules.

This article explores the purpose, structure, and filing requirements of Form 8824, providing a basic understanding for anyone involved in qualifying property exchanges

IRS Form 8824, entitled Like-Kind Exchanges (and section 1043 conflict-of-interest sales), is the form used to report a 1031 exchange to the IRS. When a taxpayer exchanges qualifying business or investment property for another qualifying business or investment property following the strict IRS rules, the taxpayer will be eligible to defer their capital gains taxes under Section 1031

This form serves two critical purposes:

1.It documents the details of the exchange, including the properties involved, compliance with the statutory timing requirements, and the parties involved in the transaction

2 It calculates the realized gain or loss, the amount of gain deferred, and the adjusted basis of the replacement property.

A like-kind exchange allows taxpayers to defer recognition of capital gains and related state (if applicable) and federal income tax liability on the exchange of qualifying business or investment property The term “like-kind” is broadly defined for real estate and refers to the nature or character of the property, not its grade or quality Thus, all business or investment property is “like-kind” regardless of asset class.

To qualify for a Section 1031 exchange:

Both the relinquished and replacement properties must be held for productive use in a trade or business, or for investment;

Properties must be exchanged in a properly structured series of transactions (rather than simply a sale followed by a purchase);

Strict timelines must be observed. The replacement property must be identified within 45 days and acquired within 180 days of the transfer of the relinquished property.

Form 8824 is divided into four parts:

Part I: This section describes the properties involved, the timing of the disposition of the relinquished property, the timing of the identification of the replacement property as well as the timing of the actual acquisition of that property. The taxpayer is also asked to acknowledge whether the exchange occurred between related parties.

Part II: This section requires the taxpayer to disclose the identity of the related party disclosed in Part I, their relationship with the taxpayer, their Social Security or Tax Identification Number, and their address It also asks the taxpayer to verify whether either party disposed of their replacement property within the preceding two years, and whether that disposition qualifies for one of three narrow statutory exemptions to the two-year holding period.

Part III: This is where the taxpayer calculates the realized and recognized gain or loss from the exchange, determines the basis of the new, replacement property, and discloses the value of any non-like-kind property involved in the transaction

Part IV: This section does not apply to Section 1031 exchanges, but rather to Section 1043 Conflict-ofInterest sales. The note at the top of this section indicates that this part is used only “by officers or employees of the executive branch of the federal government or judicial officers of the federal government” (and certain related parties) involved transactions involving Section1043.

Accurate reporting is essential to a valid 1031 Exchange Mistakes on Form 8824 can result in audits or unexpected tax liabilities. For this reason, it’s highly recommended that taxpayers participating in Likekind Exchanges consult with a tax advisor who is well-versed in 1031 exchange regulations

Form 8824 must be filed with your federal income tax return (Form 1040, 1120, 1065, etc ) for the tax year in which the exchange took place. It should be submitted by the tax return’s original due date, including extensions if applicable

Form 8824 plays a crucial role in documenting and preserving the tax-deferral benefits of a like-kind exchange. Whether you are an individual investor or a business entity, properly reporting these transactions is essential to documenting compliance with the 1031 rules and regulations and maximizing long-term investment goals Given the complexity of the rules and calculations, partnering with a qualified CPA and/or tax attorney is highly encouraged. The material in this article is presented for informational purposes only The information presented is not investment, legal, tax or compliance advice Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice David Gorenberg is a third-generation real estate investor, an attorney and Certified Exchange Specialist®, and serves as Director of Education for Accruit Members of National REIA can take advantage of special pricing from Accruit Learn more by contacting David directly at 215 770 6354, or by visiting wwwaccruit com

YELLOW LETTER HQ - FAST, AFFORDABLE DIRECT TO SELLER MARKETING

Yellow Letter HQ makes direct mail easy and efficient. With the ability to customize your marketing materials, from postcards to letters, they can get you what you need - fast!

Their pieces start at just $0 509 and the process is so quick and easy! It’s why we have used Yellow Letter in our business for the past 5 years!

Check out their pieces today and see how they can help you up your direct mail game!

SIGN UP TODAY!

LOCAL MARKET MONITOR - SAVE 25% ON ALL PURCHASES

Founded in 1990 by Ingo Winzer, Local Market Monitor began as a quarterly publication before making its way to the Internet. Ingo developed the National Review of Real Estate Markets, which analyzed conditions in 100 US Markets, using such economic data as home values, employment growth, and population growth He developed the concept of Equilibrium Home Prices, which has proved valuable in assessing real estate market risk during the last two economic cycles. www LocalMarketMonitor com

Local Market Monitor continues to evolve in response to the needs of their customers and advances in technology They’ve expanded their market coverage and refined their forecast models to enhance the value of their services

USE PROMO CODE REIA TO SAVE 25%

BY: BRAD BECKETT, REALESTATEINVESTINGTODAY COM

A recent report from Zillow says home values rose in half of the nation’s largest markets over the past year, while falling in the other half. Their latest market report says buyers are gaining leverage across the country and sellers cutting prices at record rates to compete – but they say they’re losing the war on affordability They say it all comes down to where you live:

“Perhaps more than ever, whether it’s a good time to buy depends on where you live…A defining trait of this market is that buyers are gaining leverage that most of them can’t use, because cost barriers are too high Buyers forced to the sidelines means less competition for those who can still afford it Affordability is gradually improving where builders have been able to keep up with demand, showing why continuing to build is so critical It’s not just about giving buyers power, it’s enabling them to use it”