June2025

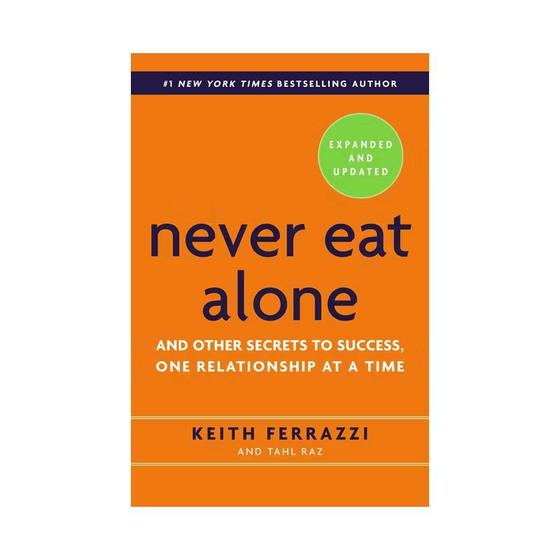

IT’S ALL ABOUT WHO YOU KNOW

A unique networking opportunity to learn new strategies and insights

THE KEY TO BEING A BETTER INVESTOR

How understanding “ROT” can add to your bank account

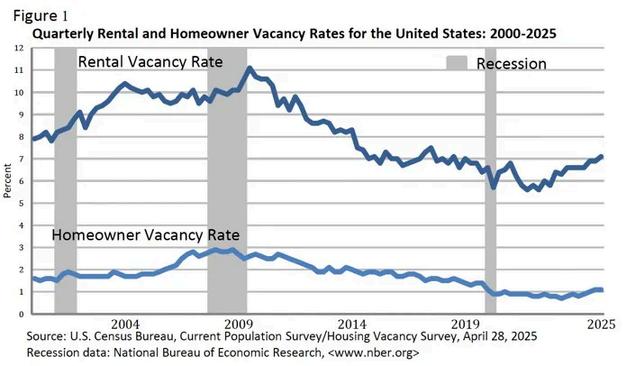

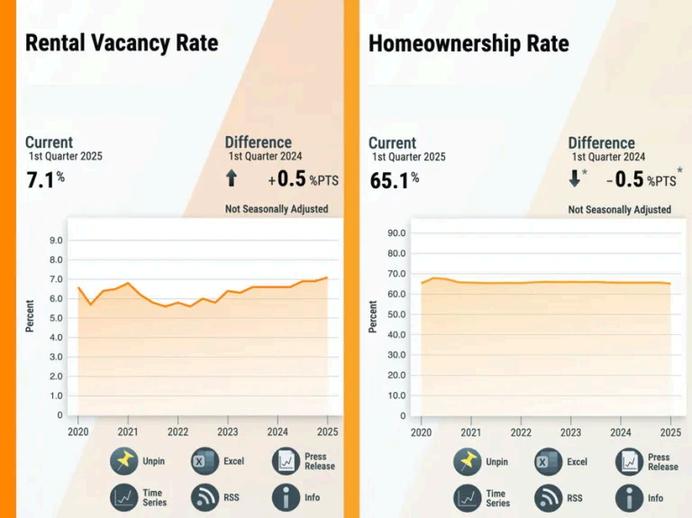

Q1 VACANCY RATES

IT’S ALL ABOUT WHO YOU KNOW

A unique networking opportunity to learn new strategies and insights

THE KEY TO BEING A BETTER INVESTOR

How understanding “ROT” can add to your bank account

Q1 VACANCY RATES

Real insights Local focus Stronger together

Let’s face it, this market is still uncertain, and at times, it feels like we ’ re all trying to make sense of it as we go But you're not alone In this month’s newsletter, we ’ re sharing valuable tips to help you connect more effectively with local investors, updates on what’s happening nationwide, and a closer look at our own Milwaukee market.

At Milwaukee REIA, we ’ re committed to bringing you the information you need right when you need it No fluff, just real insights to help you navigate whatever comes next

Whether you ’ re flipping, buying and holding, or just getting started, staying connected to your community is more important than ever. So grab a coffee, take a moment, and let’s dive into what matters most this month. OFFICIAL

Vacancy rental and homeownership rates in the US

As a real estate investor, staying ahead of the game requires more than just market knowledge and financial acumen. It’s about building relationships, gaining insights from industry veterans, and constantly learning new strategies to adapt to the ever-changing market landscape. That’s why attending the Milwaukee REIA Main Meeting & Roundtable Networking event on June 10, 2025, is an opportunity you cannot afford to miss

Here’s why this event should be a top priority on your calendar:

In real estate, your network is your net worth. This event brings together a diverse group of real estate professionals, from seasoned investors to beginners, offering you a chance to make valuable connections Whether you ’ re looking to partner on deals, find mentors, or simply exchange ideas, the networking opportunities at this event are second to none. You never know who you might meet a future business partner, a mentor with years of experience, or even a buyer for your next property

One of the unique features of this event is the roundtable format. You’ll have the chance to sit down with experts in various aspects of real estate investing These discussions are designed to be interactive, allowing you to ask questions, share your experiences, and gain practical insights that you can apply to your own investments. Whether you ’ re interested in wholesaling, flipping, rental properties, or something else, there’s a table for you

The real estate journey can be challenging, especially when you ’ re navigating it alone. But at the Milwaukee REIA Main Meeting & Roundtable Networking event, you’ll find a community of like-minded individuals who share your passion for real estate This sense of community is not only motivating but also empowering You’ll leave the event feeling inspired, with a renewed sense of purpose and direction.

The Milwaukee REIA Main Meeting & Roundtable Networking event is more than just a meeting; it’s an investment in your future. The connections you make, the knowledge you gain, and the community you build here will have a lasting impact on your real estate journey Don’t let this opportunity pass you by.

BY: BRAD BECKETT

With the help of the Pacific Legal Foundation, a title company in Texas filed a lawsuit in mid-April against the Financial Crimes Enforcement Network (FinCEN), seeking to block a new rule requiring intrusive data collection and reporting for cash real estate purchases.

“Congress cannot shirk its lawmaking responsibilities by granting federal agencies a blank check to write laws FinCEN is now mandating unreasonable collection and reporting of personal information to the federal government; the agency claims a sweeping power to require reporting on conceivably any consumer transaction simply because systematic reporting might prove useful to the government” Said Luke Wake, an attorney at Pacific Legal Foundation.

In 1993, Celia Flowers bought the first of many title companies that she now owns. She and her daughter, Erica Hallmark,own and manage the East Texas Title Companies, based in Tyler, Texas The company facilitates or gathers information for thousands of real estate closings each year and is licensed in more than 80 counties across Texas, where there’s been a surge in “cash purchases,” any transaction in which the buyer does not require a bank loan.

According to the PLF release, in 2024, FinCEN, operating under the supervision of the U.S. Secretary of Treasury, finalized a rule that will force title companies to collect and report detailed information about non-financed real estate transactions, including personal information from everyone involved in the sale, and information about how the payments were made They say breaking the rules (even accidentally) could lead to large fines and even criminal charges. The rule is set to go into effect in December, 2025.

Click here to read the full release at the Pacific Legal Foundation.

Click here to download a copy of the complaint

NINJA: New Investor Networking JUN17 Monthly Meeting: Roundta Networking JUN10

+

NINJA: New Investor Networking

Monthly Meeting: Picnic

Dave Graf | 920-203-6087 | dave@gsifoundations com

Jodi Graf | 414-395-5478 | jgraf@premierpointrealty.com

Taylor Rens | 414-296-6225 | taylor rens@zrlaywers com John Newland | 414-852-0921 jnewland@terranova-realestate.com

| membership@aasew org

Heathcote | 608-234-5734 george heathcote@shepherdfinancialadvisors com

| info@reiahardmoney.com

Kvetkovskiy | 414-946-6022 mark.k@compass.com

Jacked Up LLC lifts sunken concrete slabs to correct drainage, trip hazard, and code violation issues. Our polyjacking equipment and team can lift concrete using small 5/8 drill holes. Our material has fast cure times allowing for use of the slabs within hours of installation

REIA Member Benefits: Mention "Milwaukee REIA member" at time of estimate request and receive priority scheduling of your free estimate. After site visit or received pictures, estimates are in customers hands within 24hrs

dylan@jackedupllc.com

Lexi Konop

Brent Kreutzer

Jeff Kreutzer

Roxanne

BY: SCOT AUBREY VIA REAL ESATE INVESTING TODAY

When you hear the word “rot” in relation to real estate, all sorts of bad visions and horror stories immediately come to mind In fact, that word often translates in our minds to money, as in, how much is it going to cost me to repair whatever is rotting Allow me to introduce a new way of looking at this word in a much better way, one that when done right, can actually add to your bank account rather than being a drain on it.

While every investor is intimately familiar with ROI, return on investment, which carries a great weight when evaluating a property, many may disregard an equally crucial factor, and that is ROT, or return on time. For purposes of this article, we will examine return on time to help you become an even more successful and satisfied investor

If you will, please take the next thirty seconds and stop reading. I want you to think about your portfolio by specific address if you can and think of or say aloud the address of one of your investments. How do you feel when you hear that address? Many of you probably have that “perfect” property that houses great tenants who pay on time and even manage some of the most common maintenance items out of their own pocket This property brings a smile to your face and good feelings, knowing that it is an asset that provides a great return on both your time and your investment Others of you had a physical, maybe even violent reaction when you thought of a property that is less than your ideal. Tenants that pay late consistently, that call you for even the simplest repairs, which cause friction with their neighbors. You know the one because it takes up an inordinate amount of your time and more than once you have considered offloading it, and its attendant problems, out of your portfolio and your life.

While ROT is an often-overlooked metric, it needs to play a critical role in your decision-making, particularly when time is limited After all, time is money and every second you spend managing a property with a low ROT can feel like a total waste because you are sacrificing time that could be spent with family, on a hobby, vacationing or finding your next great property. While there is no universal formula for ROT, you can begin by evaluating the benefits, satisfaction, or personal wealth derived from the time spent on a specific property. Time is finite, and therefore, optimizing how time is spent is just as important as financial investments.

ROT focuses on the time and the intangible returns that come from using time effectively ROT is based on the principle that time, like money, is a limited resource Time cannot be bought back once spent; therefore, ROT considers the opportunity cost of how time is spent Is the time spent working on a project worth the long-term value or the personal satisfaction gained from it? That is the key question in any analysis you perform with ROT in mind.

Decision making focused solely on ROT could result in the neglect of profitable opportunities if that is the only metric considered. Every investment you approach has to include a thorough look at the financial AND time aspects required to create a positive return. For example, let’s say you found an underpriced property in a great neighborhood, but the home needs an extensive remodel to make it appealing to the majority of the market You also found a home in the same neighborhood that is turn-key ready but costs 75% more than the fixer upper ROI and ROT would be evaluated when deciding between these two projects one that offers a higher ROI but requires more time, and another that is less lucrative but can be completed more quickly. Only you can determine how much each factor weighs into your decision-making process, but both must be a major component of your final determination.

While both ROI and ROT are critical for evaluating decision-making in both personal and professional contexts, they serve different purposes. A lot of other factors will influence your investment path as well. Is this a hobby or profession? What is your age and how many years left do you have to grow your portfolio? What kind of financial backing do you have if things go sideways? These questions, and so many others can help you determine how and when to use ROT as a measurement in your present and future investing And if you are still feeling heartburn from the earlier exercise where you thought about your portfolio, be bold enough to cut out the rot and move on to an investment that brings you both joy and financial freedom

Scot Aubrey is Vice-President of Rent Perfect, a private investigator, and fellow landlord who manages short-term rentals Subscribe to the weekly Rent Perfect Podcast (available on YouTube, Spotify, and Apple Podcasts) to stay up to date on the latest industry news and for expert tips on how to manage your properties

Members of National REIA can take advantage of special pricing from RentPerfect; the solution for rental property owners and managers for screening & managing tenants Learn more by clicking here

BATCHLEADS - GET A 7 DAY FREE TRIAL!

Find your next property investment fast. BatchLeads provides the property insights you need to find on and off market deals before the competition.

Features:

250 monthly skip tracing credit

Nationwide listing & property data

140+ customizable lead filters

Built-in marketing tools

Mobile + Virtual Driving for Dollars

Comparables and Comp Calculator

List Stacking & Deduplication

This tool has it all - Reduce your reliance on referrals and oversold lead lists BatchLeads gives you the data, tools, and insights you need to generate targeted leads, connect with property owners, and close more deals!

SIGN UP TODAY!

MILLENNAIL SPECIALY INSURANCE (FORMERLY ARCANA)

Millennial Specialty Insurance offers Milwaukee REIA members multiple insurance products specifically designed for Investors and their tenants. Features include no underwriting or inspections, a 24/7 desktop & smartphone certificate delivery system, outstanding claims management service, and very knowledgeable & courteous staff to handle your insurance needs.

Investment Property Insurance

Tenant Discrimination Program

Landlord Supplemental Protection

Tenant Renters Program

CLICK HERE TO SIGN UP

Every year, the Milwaukee REIA Expo + Tradeshow draws a crowd. It is the place for real estate investors to meet and network with vendors you need to succeed in real estate investing. Whether it’s financing, property management, or renovation services, our vendors have you covered!

But - what makes this year different? And, more importantly, why should you spend Tuesday, July 8th with the Milwaukee REIA?

1.Learn something new at our mini-seminars - We have an exciting lineup with various topics led by industry experts. Our lineup of speakers brings a wealth of experience and knowledge to the table, ensuring that each seminar is packed with valuable insights and actionable takeaways. Whether you're looking to fine-tune your existing approach or explore innovative techniques to enhance your investment portfolio, our seminars provide the perfect opportunity to expand your expertise and stay ahead of the curve in today's dynamic real estate market

2 Network with 40 + vendors in just 2 hours - We are bringing in over 40 industry professionals that are essential to your real estate investing business If you are just starting out and building your team, you will find vendors that can help you get started and success On the flip side, if you already have a team but need a refresh, our vendors are here to help!

3.Enjoy cocktails with the vendors - Cap off your day of exploration and learning with our exclusive post-tradeshow cocktail hour! Unwind in a relaxed atmosphere and mingle with fellow vendors and investors in a laid-back setting. This is your chance to deepen connections, exchange ideas, and forge partnerships in a more intimate environment

4 Network with other real estate investors - Not only do we pack the room with vendors, there will be 150+ like minded real estate investors also in the room This event is perfect to learn what other investors are doing in their business, and how they are working with the vendors in the room to excel in their investing business

5.Win $500 Cash + other raffle items - Every attendee will have the chance to walk away with some amazing prizes provided by the vendors. Some of these prizes include: Hard Money giveaway, Discounts on Real Estate Mentoring, Signed memorabilia, and $500 in cold, hard, CASH!

This event is FREE and open to the public, so bring your friends and business partners This will be an evening of meaningful connections, lessons learned, and hopefully a few prizes in your pocket by the end of the night

Make sure you pre-register to skip the line!

BY: BRAD BECKETT, REALESTATEINVESTINGTODAY COM

The U S government is reporting that the national vacancy rates for Q1 2025 were 7 1% for rental housing and 1 1% for homeowner housing The national homeownership rate for Q1 2025 was 65 1% In addition, approximately 89 5% of the housing units in the United States in Q1 were occupied and 10 5% were vacant Owner-occupied housing units made up 58 2% of total housing units, while renter-occupied units made up 31.2% of the inventory. Vacant year-round units comprised 8.1% of total housing units, while 2.4% were vacant for seasonal use.