May2025

SMART STRATEGIES FOR A SHIFTING MARKET

CREATIVE DEALMAKING

Unlock the secrets behind today’s most powerful creative deals

GENERATIONAL TRENDS

See how buyer and seller trends have changed over the years

CREATING A BACKUP PLAN

How creating a plan can minimize your risk NEWS

The market is shifting - and fast At Milwaukee REIA, we ’ re committed to helping you navigate these uncertain times with confidence This month, we ’ re diving into strategies to protect yourself in today’s volatile market, how to use creative financing to uncover better deals, and why having a solid backup plan is more important than ever.

Now is the time to sharpen your skills, expand your toolbox and stay connected to a community that has your back Whether you ’ re just starting or looking to pivot in a new direction, you’ll find tools, resources and support to help you move forward with clarity and confidence We’ve weathered market changes before - and together, we’ll thrive through this one too.

Bill and Kim are a husband-and-wife real estate investing team Bill creatively constructed his first deal in 1990 in Shreveport, Louisiana. He and Kim have been teaching other investors to do the same since 1997. They became full-time real estate investors in 1998.

Their core belief is that real estate investing is not about buying, selling, or renting houses It’s about helping people solve their real estate problems!

Their investment portfolio consists of single-family rental homes, mobile homes, and a small mobile home park. In addition, they own notes, options, stocks, precious metals, and crypto currency.

With more than 32-years of face-to-face dealmaking experience, Bill is one of the most imaginative advanced creative deal structurers in the country Whether you need to know how to creatively construct, or creatively fund, or creatively hold, or creatively sell a property, Bill is the person many experienced real estate investors call for help

When it comes to advanced creative deal structuring, Bill’s focus is on Structure Stacking. With Structure Stacking, multiple creative deal structuring tools are used to make a single real estate investing transaction succeed. By using Structure Stacking, an investor can make impossible deals possible. Structure Stacking allows you to leave your competition, such that it is, in the dust.

In addition, Bill is one of a handful of real estate investors who has the know-how, skill, and experience to work with Pure Options Less than 1% of the real estate investing world has ever heard of a Pure Option, even though it’s one of the most effective deal structuring tools in the business. For over 20 years, Bill has used Pure Options to generate cash flow, profit and to protect his and Kim’s assets.

Discover proven, creative strategies to get face-to-face with sellers, make better offers, and close more deals. Don’t miss this chance to gain insider knowledge and level up your real estate investing.

This is your chance to gain insider knowledge from seasoned experts and walk away with a clearer understanding of creative deal structuring.

PLUS - bring your contractors for our bi-annual Contractor Corner!

BY: BRAD BECKETT

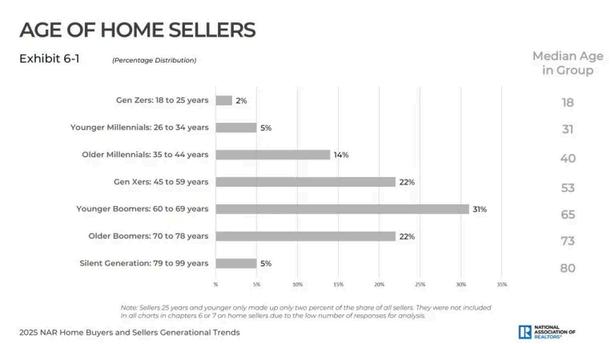

For over a decade, the National Association of Realtors has produced their Home Buyers & Sellers Generational Trends Report. The report provides insights into differences and similarities across generations of home buyers & sellers The data is taken from their annual Profile of Home Buyers and Sellers report. There is a lot of good data in here to unpack.

JOIN IN WITH SOME LOCAL EVENTS!

MAY3

Bus Tour: Renovation Edition

Monthly Meeting: Deal Structuring with Bill Cook MAY13

NINJA: New Investor Networking MAY20

MAY29

W.I.N.G.S. Luncheon

JUN4 Commercial Corner

JUN10

JUN17

NINJA: New Investor Networking

Dave Graf | 920-203-6087 | dave@gsifoundations com

Jodi Graf | 414-395-5478 | jgraf@premierpointrealty.com

Taylor Rens | 414-296-6225 | taylor rens@zrlaywers com

George Heathcote | 608-234-5734 george heathcote@shepherdfinancialadvisors com Dan Farsht | 262-208-4708 | info@reiahardmoney.com 414-276-7378 | membership@aasew org

John Newland | 414-852-0921 jnewland@terranova-realestate.com

Monthly Meeting: Roundtable Networking Mark Kvetkovskiy | 414-946-6022 mark.k@compass.com

Carpet Plus is an independent carpet and vinyl firm.

They strive for the best pricing in the industry due to low overhead

Please call for an appointment to receive a free estimate on your flooring needs!

Specializing in roofing, siding, gutters, fascia and soffits, they are your one stop shop for exterior work! With detailed reports on all inspection and maintenance programs you can rest easy knowing they are ready to meet all your needs.

REIA Member Discount: Waived inspection fees, free estimates, extended workmanship warranties!

Joshua Averbeck

Dominic Bauer

Lisa Carolan

Fakebba Ceesay

Nikolas Chapman

Dan Taylor 414-573-0105

Michelle Eckes

Kyle Flaherty

Lee Goodman

Lora Haines

Dalton Keeney

Isiah King

Mike Kopac

Aji Njie

Marvin Nunez

Mark Perniciaro

Dirk Rigsby

Sofia Rodriguez

Brett Sexton

Jen Sexton

Alex Tappe

Allen Tessmann

Alvin Veasley II

George Warner

Mark Witherspoon

BY: JANE GARVEY VIA REAL ESATE JOURNAL

Uncertain times can allow for extraordinary returns, but they also come with more risk Investors need to find ways to mitigate the risk so that they can capitalize on opportunities The strategies we will be discussing here are important in any market but are critical in shifting markets or uncertain times

The ability to adjust your strategy is key to turning a loser into a winner. There are times in our business that everything is going up-up-up Some investors put their heads down and go to work They can make great money doing this, at least while the market holds The question is, can they recognize a shift and adjust when they need do?

When you are buying a property to rent, you should never pay more than you would if you needed to resell it tomorrow. Will it pencil out the same as a flip if you need to sell it?

When you are buying a property to flip, make sure it will have positive cash flower if you need to keep it. Part of this strategy shift may involve different financing. Make sure that you have a plan for this if need be A private lender or partner that would be able to pay off the short-term financing may be the answer Or a conventional lender that agrees upfront to refinance it on the back end of the rehab work

If you are buying apartments, can they be converted to condo units to resell them individually? If you have single-family homes that you have just rehabbed and they aren’t selling, would they work as a short-term or mid-term rentals? If you have short-term rentals, can they be sold as regular housing if need be?

Make sure that you have the flexibility to shift between strategies as your life circumstances and the market dictate

I recently heard a speaker saying that we should never do a deal with financing that has a balloon. “If you can’t find fully amortizing financing, or pay cash, don’t do it.” I used to say, “balloons are for clowns,” but over the years I have come to realize that they have their place. Balloons are a tool that requires special handling.

A balloon is a one-time payment at the end of the term of a loan that is not fully amortizing So a loan with a 30-year amortization and a 10-year term would have you make payments as if they loan was going to last 30 years, but at the 10-year mark the lender expects you to pay the balance This sort of financing is common in commercial real estate lending and is also common in seller financing. In commercial lending, the balloon payment is often at the 3-, 5- or 7-year point.

What happens when you reach the end of the term of the loan? The most common answer is you extend the loan, When all is good in the market this works. Your rate and payment may adjust, but all is good

Surprise - things are not always good in the market When interest rates climb, the property may not qualify for the new rates and most lenders will be reluctant to extend the loan If property values drop, the collateral may no longer be adequate for the loan

there are occasions where lenders need to prune their portfolio of loans - so even if you are making all payments on time and your property is great, the lender may not want to renew. If your circumstances have changed - let’s say you no longer have a “real job” - it may be tough to get a new lender to decide to make a replacement loan.

If you are not prepared with cash, alternate financing, alternate collateral, financial friends, or the ability to shift strategy, you may be the a clown if you use a balloon In the right circumstances and with the right preparedness, they can allow you to get rates and terms that would not otherwise be available

Like balloons, adjustable-rate notes need to be used with caution They used to be more common than they are today As interest rates have climbed, we are seeing this return to the lending market Sellers buy down the rate for the first year or two on a loan The buyer can more easily afford the payments and will pay more for the property This works great, until it doesn’t At the end of the buy-down period, the payments go up. The choices are then to refinance, sell, or make the higher payments. Refinancing might work to get lower payments, if the borrower has been paying extra toward their note every month, or if rates have dropped. Selling might work if the market is moving up, and they are willing to move. Making the higher payments might work, if the borrower can afford it.

If you decide to use adjustable-rate loans, make sure that the property would cash flow with the higher rate If it is your residence, try to make payments at the higher rate so that your budget is used to the expense This will make it easier to refinance if necessary

When you have an issue with one property, and you have others, you may have extra flexibility If you have come to choke point, it may be time to prune your portfolio To do this, you should look at the financials for all your properties (something you should do regularly), and see which properties are performing well and which are struggling

Selling a struggling property may allow you to clear up a problem with one you want to keep. Don’t put all your properties in danger by cross-collateralizing them. This could have you starting over if you get into a situation you can’t unravel.

As a side note - when you can get it, non-recourse financing is the best! The property stands on its own. The lender is not looking to you for other income to qualify or to pay for this loan. And, if things go wrong, the only thing they will come after is the property that was provided as collateral. Typically, a large down-payment will be needed, and these will be more common on larger properties or when sellers are providing the financing.

Asset protection techniques are important no matter what the market is like. Isolating problems is a very important part of any strategy. Like the rotten lemon in the bag of lemons, it is important to make sure that you remove weak properties before they infect the whole portfolio.

If you ’ ve ever flipped a house or bought & sold property you have undoubtedly run into a “stink” along the way that you struggled to get rid of. Whether it was from a long-gone mystery pet or maybe an unplugged freezer, it seems everyone has a story.

That’s where OdorXit steps in. You name the odor; and they have a product that can safely eliminate it. Their products are not just a cover up but eliminate the odor at the source. They are safe to use around people, pets and the planet as well as being easy on your bottom-line. In other words, you’ll replace a whole lot less flooring, concrete tile and grout in your properties which keeps your rehab costs much lower.

REIA Member get 25% off when you use discount code NREIA25. You work too hard to give up your profits to odors! Get OdorXit Products at a discount and get full price for your listings and rentals!

SAVE 25% WITH CODE NREIA25

Real Estate at your fingertips Unlock your full potential and build wealth with the platform that gives you the power of real estate Driving for dollars is a real estate investment technique where investors drive through neighborhoods, looking for properties that appear to be vacant, distressed, or in need of repair By focusing on these types of properties, investors can potentially find good deals and maximize their investment returns.

DealMachine automatically logs your location every time you hit the road, so you can easily view your past routes on a map and avoid driving the same route twice. Plus - you can even plan your route ahead of time-based on customized criteria and receive step-by-step navigation to every nearby property that matches your search.

BY: BRAD BECKETT VIA REALESTATEINVESTINGTODAY.COM

Recent data crunched by the NAHB’s Eye on Housing shows that property tax revenue collected by state & local governments reached a new high in 2024 and continued to make up a bulk of tax revenue. In 2024, total tax revenue was $2 095 trillion – up 4 6% from $2 004 trillion in 2023 Indeed

In today's real estate market, buyers are increasingly prioritizing move-in ready homes over fixeruppers With limited inventory and higher mortgage rates, many prospective homeowners are looking for properties that require little to no additional investment in repairs or renovations. For real estate investors, this shift presents both challenges and opportunities particularly for those involved in fix-and-flip projects.

For many investors, real estate is an attractive asset class due to its ability to generate consistent income and long-term appreciation However, direct property ownership comes with challenges maintenance, tenant management, and market fluctuations. This is where real estate funds provide a powerful alternative, allowing investors to earn passive income without the operational burdens of direct ownership

If you don’t think that real estate investing is a relationship business, you haven’t been paying attention It’s your connections with other investors that bring you the local knowledge, the referrals to the right professionals, the money, the partnerships, and the deals that let you prosper now, and for years to come.

BY: BRAD BECKETT, REALESTATEINVESTINGTODAY COM

Using data from the Federal Reserve, today’s graphic from the venerable Visual Capitalist breaks down America’s wealth (total net worth of all U S households) by wealth percentile, and lists the number of households in each percentile