August2025

THE LIQUIDITY TRAP

Why investors are rethinking capital in 2025

FORECLOSURE ACTIVITY

Increases slightly in Q1 and Q2 of 2025

SAVING MONEY

Join the upcoming Bus Tour at a discount!

THE LIQUIDITY TRAP

Why investors are rethinking capital in 2025

FORECLOSURE ACTIVITY

Increases slightly in Q1 and Q2 of 2025

SAVING MONEY

Join the upcoming Bus Tour at a discount!

Smart moves for your money, deals, and network

We’re glad you ’ re here - because staying connected and informed is what keeps you one step ahead in this ever-changing market This month, we ’ re diving deep into how today’s investors are rethinking how they put their capital to work, and what smart moves you can make right now to protect and grow your wealth.

We’re also breaking down the latest foreclosure trends, where the opportunities are, what to watch for, and how to navigate the process with confidence And since relationships are everything in real estate, we’ll share practical ways to expand your network and leverage connections that open doors you didn’t even know existed Whether you ’ re closing your first deal or adding another zero to your portfolio, your REIA is here to help you learn, connect, and thrive

Let’s make this month count and as always, don’t hesitate to reach out, show up, and get involved.

Here’s to your success!

BY: JASON K POWERS VIA REALESTATEINVESTINGTODAY.COM

Many real estate investors today find themselves sitting on great opportunities undervalued properties, up-and-coming neighborhoods, even distressed assets ripe for repositioning but they’re stuck. Not because the deals aren’t there, but because the liquidity isn’t. The financing environment has tightened, and the rules of the game have shifted

The Federal Reserve’s decision in May 2025 to hold rates steady for the sixth consecutive meeting underscores a deeper concern: inflationary pressures persist, and policymakers are showing little interest in loosening monetary policy anytime soon While this may be aimed at stabilizing the economy, it’s having a real impact on real estate activity at the ground level.

Traditional financing channels have not only become more expensive; they’ve become slower and more restrictive. Banks are requiring higher down payments, scrutinizing debt-to-income ratios more aggressively, and pulling back on commercial real estate loans altogether in some markets For investors accustomed to easy capital, it feels like the rug has been pulled out from under them

At the same time, opportunities are accelerating in certain sectors. Urban revitalization projects, such as the redevelopment of downtown Phoenix or the momentum behind Las Vegas’ stadiumadjacent growth corridors, are creating real chances for those who can act quickly. The problem is, many can’t

Speed matters in real estate. If an investor hesitates while waiting for a bank to sign off on a loan, that property may be gone Someone else with ready capital will get the deal It’s no longer just about finding the opportunity. It’s about being able to execute.

And this is where the conversation starts to shift More and more investors are looking inward literally and asking themselves: how can I become my own best source of capital?

That question is leading some to revisit or discover the Infinite Banking Concept. At its core, Infinite Banking is a method of using a specially designed whole life insurance policy to build a pool of capital that can be accessed at any time, without relying on traditional lenders It’s not a gimmick or a get-rich-quick play. It’s a long-term financial strategy that offers control, liquidity, and reliability.

Through a properly structured policy, the investor builds cash value over time. That cash value can then be borrowed against to fund deals, cover expenses, or provide a temporary cushion during market turbulence And while that loan is outstanding, the cash value continues to grow as if it had never been touched. For the investor, it’s a form of uninterrupted compounding a financial engine that can keep working quietly in the background.

The appeal in today’s market is obvious. With banks growing more conservative, policy loans don’t require credit checks, debt ratios, or waiting periods The investor is in control of how and when the money is used and just as importantly, how and when it’s paid back. That flexibility is hard to come by in a market where lenders are driving the timeline.

This isn’t about replacing traditional financing entirely. It’s about supplementing it. Think of it as having your own line of credit that grows stronger every year. Investors using IBC aren’t just financing one deal They’re building a personal system they can return to over and over again

It also encourages a deeper mindset shift: the move from being a borrower to being a banker Instead of waiting on approval, the investor becomes the one making the decisions. That shift can be profound, especially in a climate where control over capital can make or break an investment strategy

Of course, Infinite Banking isn’t a silver bullet. It takes time to build. It requires discipline. And like any financial tool, it works best when integrated into a larger strategy But for investors thinking about the long game and many in 2025 are this approach offers more than just a place to park cash It offers a plan

In a market where liquidity is king, and banks are less willing to lend, having a system that generates its own accessible capital is becoming a serious competitive advantage As the lending environment continues to evolve, so too must the investor’s approach to funding.

In the past, access to capital was something you got from someone else

In 2025 and beyond, the smart investor may need to become the source themselves

It’s not about abandoning traditional financing, but about complementing it with a strategy that puts more control into the hands of the investor Those who take the time to build systems that prioritize liquidity and autonomy will find themselves in a much stronger position not just for the next deal, but for the next decade of opportunity

Because in a world where flexibility, speed, and control matter more than ever, the real edge isn’t just in the property you buy it’s in how you fund it

To learn more about how Infinite Banking is being used by real estate investors around the country, visit 1024wealth com/nreia and download a free copy of “A Real Estate Investor’s Guide to Infinite Banking.”

Jason K Powers is a Multi-Business Owner, Real Estate Investor and an Authorized IBC Practitioner In an exclusive partnership with the National Real Estate Investor Association, Jason is the go-to expert for all aspects of Infinite Banking and Life Insurance Jason works with clients across the country showing them how to achieve their financial goals by taking control of the banking function in their life and creating financial velocity that can last for generations Connect with Jason today to explore how the Infinite Banking Concept can empower you to reach your financial goals For more information, click here

NINJA: New Investor Networking AUG19 Monthly Meeting: Picnic *Members Only! AUG12

Dave Graf | 920-203-6087 | dave@gsifoundations com

Jodi Graf | 414-395-5478 | jgraf@premierpointrealty.com

Taylor Rens | 414-296-6225 | taylor rens@zrlaywers com John Newland | 414-852-0921 jnewland@terranova-realestate.com

| membership@aasew org

|

Install Carpet LLC is a residential and commercial general contractor for both renovations and new construction We are a Milwaukee based company and fully insured serving MKE and the surrounding areas

Need Carpet? Flooring? Give us a call today to set up a free in home estimate!

WaterStone Bank can lend on both owneroccupied and investment real estate - industrial, retail, office, warehouse, mixed use, specialty use, 1-4 family residential, 4+ family residential, scattered site, multiple collateral with one loan, bundle loan aka blanket loan aka crosscollateralized – we love real estate and can be creative in how we structure the deal!

Joe Bass 414-526-3613

Big Mike Danielson 414-467-4048

Jerry Berg

George Berka

Michele Cherney

Kesler DeRuyter

Darrin Dunn

Zachary Earhart

Isabelle Earhart

Brittany Ellenz

Melinda Gayle

Avery Goodrich

Mohammed Hamdan

DaMarcus Harris

Shannon Jefferson

Chris Kantak

Shatara King

Georgia Konstantakis

Danielle Mazza

Danielle McClain

Corey Paszkiewicz

Justin Price

Dan Raphael

Howie Riemann

Jason Sellnow

Jasmine Smith

Isaac Stefanski

Stephanie Wagner

BY: BRAD BECKETT VIA REAL ESATE INVESTING TODAY

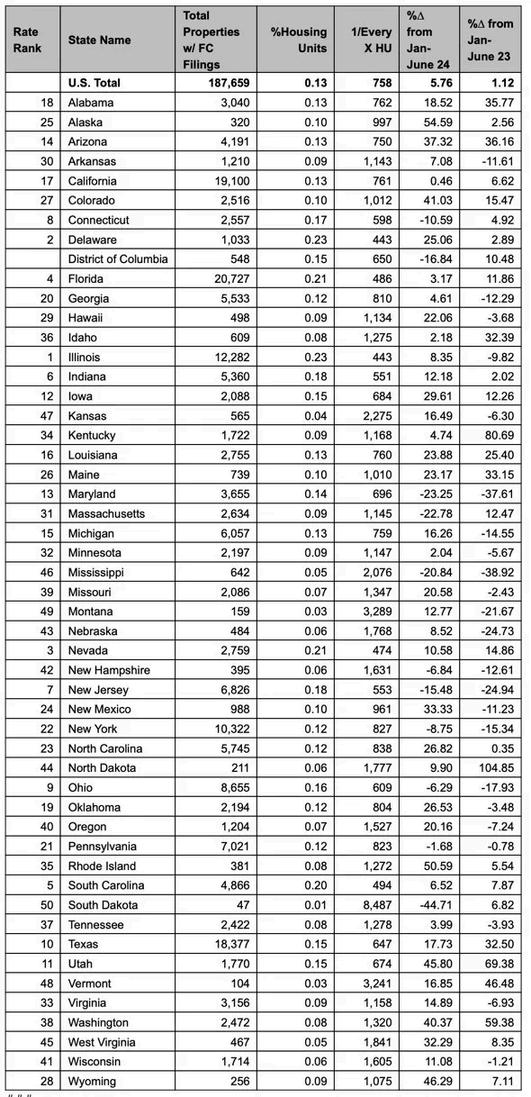

According to ATTOM’s Mid-Year 2025 U.S. Foreclosure Market Report, there were a total of 187,659 U.S. properties with foreclosure filings (default notices, scheduled auctions or bank repossessions) in the first six months of 2025 That figure is up 5 8% from one year ago and up 1 1% from the same time period two years ago States with the greatest increases in foreclosure activity included Alaska (up 55%); Rhode Island (up 51%); Wyoming (up 46%); Utah (up 46%); and Colorado (up 41%)

“Foreclosure activity continued its upward trend in the first half of 2025, with increases in both starts and completed foreclosures compared to last year While the overall numbers remain below pre-pandemic levels, the persistent rise suggests that some homeowners are still facing financial challenges amid today’s housing and economic landscape” Said Rob Barber, CEO of ATTOM

Unlock the full potential of your real estate investments with Skip Force's superior skip tracing solutions. Offering the most accurate Tier 1 data at wholesale prices, Skip Force ensures you access top-quality leads without breaking the bank.

Most Accurate Data: Get up-to-date phone numbers and optimal call times.

Efficient Workflow: Batch processing to save time and resources

Real-Time Results: Immediate access to processed data.

High-Quality Leads: Accurate contact information for better outreach

Prime Number Generator: Graded numbers for better call success.

SIGN UP TODAY!

HAMMERZEN - SAVE $2 OFF THE APP + FREE 30 DAY TRIAL

Very few people in real estate investing can say they enjoy manually entering all of their company ’ s purchase data into an Excel spreadsheet. That's where HammerZen steps in to save the day. The HammerZen app automates the data import process from The Home Depot right into QuickBooks Typically, you needed to review your receipts and then type in each tiny detail, digit-by-digit. When you use HammerZen, you can automatically upload hundreds of statements in a matter of minutes! It's like stress-free accounting. HammerZen eliminates the potential for any errors, significantly increasing the accuracy of your data so that you can produce accurate reports and estimates. Approved by Intuit, HammerZen is one of the most valuable tools you can have at your disposal.

SIGN UP TODAY FOR A FREE TRIAL!

seller lead to rehabbed flip or rental

The Bus Tour combines in-depth education with practical experience: Expert Guidance: Learn from a seasoned investor who has mastered the buying and rehab process

Real-World Training: Explore properties, diving deep into the challenges and triumphs of each deal.

Custom Tools: Access exclusive resources to close deals faster and more effectively.

Whether you're a first-time investor or a seasoned pro, this event is packed with insights to help you:

Build confidence in evaluating properties.

Refine your negotiation strategies.

Set yourself up for long-term success in real estate.

EARLY-EARLY BIRD SPECIAL - SAVE $100 AND BRING A GUEST FOR $1

Members: $49

Non-Members: $99

BY: BRAD BECKETT, REALESTATEINVESTINGTODAY.COM

FHFA Director William J. Pulte recently issued an order directing Fannie Mae and Freddie Mac to consider crypto currency as an asset for single-family loans. According to Pulte’s directive, cryptocurrency is an emerging asset class that may offer an opportunity to build wealth outside of the stock & bond markets In addition, prior to implementing any changes, each enterprise must submit their plans to the FHFA (after their respective boards approval) for review

“After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage” Said FHFA Director William J Pulte on X