Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt Lake Realtor Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and

not come from parks or wilderness areas. In addition, a portion

from

paper.

President

Perry

First Vice President

Century

Second Vice President

Dawn Stevens

Presidio

Morelza Boratzuk

RealtyPath

Hannah Cutler

Coldwell Banker

Laura Fidler

Summit Sotheby’s

Amy Gibbons

Keller Williams

Estate

Treasurer

Claire Larson

Woodside Homes

Past President

Matt Ulrich

Ulrich Realtors

Curtis Bullock

Jenni Barber

Hathaway

Advertising

Jennifer Gilchrist

Utah Key Real Estate

Tony Ketterling

Equity Real Estate

John Lucky

Berkshire Hathaway

Jodie Osofsky

Signature Real Estate Utah

Janice Smith

Coldwell Banker

Carlye Webb

Summit Sotheby’s

Total active listings on UtahRealEstate.com increased to 10,001 in the first week of October, an increase of 144% from 4,100 active listings a year ago. Active listings are now at similar levels from before the pandemic, giving home buyers more choices.

Homes across Utah took a median of 22 days to sell in August, up from seven days a year ago. Statewide, there is a 4.2-month supply of housing inventory based on sales trends over the past six months. A five-to-sixmonth supply of housing inventory is considered a balanced market. Multiple offers are still being made on homes priced right, but instead of 20 or 30 offers, there are two or three.

Home buyers are no longer waiving due diligence or offering nonrefundable earnest money upon acceptance. Instead, buyers are negotiating home repairs and asking for home warranties. It is much easier for buyers to find a home and get it under contract.

Managing Editor

Anderton

Publishing,

President

Miller

Director

Medina

Magleby

Witmer

Administrator

Bell Snow

Salt

Staff

Bell

Nicholas

It is not uncommon for sellers or builders to buy down interest rates to attract buyers. Short-term buy downs are popular. For example, a 2-1 buy down shaves off two percentage points of interest in the first year of the loan and one percentage point of interest in the second year.

While no one knows the future of mortgage interest rates, one thing is certain: Utah will continue to see its population swell. According to The Salt Lake Tribune, “Utah will jump from 3.3 million residents today to 5.5 million in 2060 … Demographers foresee the state surpassing the 4 million mark a little more than 10 years from now, between 2032 and 2033, then topping 5 million sometime after 2050.”

Higher interest rates don’t stop new households from being formed or babies from being born. Thankfully, as a state, we are issuing more residential building permits now than at any other point in our history, helping to erase the current 31,000-plus housing unit deficit.

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color,

The

Permission

Views and

“Inventory will remain tight in the coming months and even for the next couple of years,” said Lawrence Yun, chief economist for the National Association of Realtors®. “Some homeowners are unwilling to trade up or trade down after locking in historically-low mortgage rates in recent years, increasing the need for more new-home construction to boost supply.”

The current market correction will pass. Let’s look forward and move ahead!

Total active listings on UtahRealEstate.com increased to 10,001 properties on Oct. 4, a 144% increase from 4,100 active listings the same day a year ago. Active listings are now at similar levels before the pandemic, giving home buyers more choices. Homes across Utah in August took a median of 22 days to sell, up from seven days a year ago. Statewide, there is a 4.2-month supply of housing inventory based on sales trends over the past six months. A five-to-six month supply of housing inventory is considered a balanced market.

National Association of Realtors® President Leslie Rouda Smith participated in a White House meeting with a diverse group of housing industry leaders in September to discuss viable solutions to the nation’s housing supply and affordability crisis.

The discussion covered legislative, administrative, private sector, and state and local actions to address housing supply and affordability challenges across the country.

Joining from the Administration were National Economic Council Director Brian Deese, Domestic Policy Council Director Ambassador Susan Rice, Housing and Urban Development Secretary Marcia Fudge, and Federal Housing Finance Agency Director Sandra Thompson.

“This was a candid discussion of ideas about how to fill the historic 5.5 million housing unit gap in the United States,” said Rouda Smith.

“Housing supply is the number one issue for millions of consumers who are locked out of the market. I conveyed to the Administration and my colleagues our support for a comprehensive plan that includes investment in new construction, zoning reforms, expansion of financing, and tax incentives to spur investment in housing and convert unused commercial space to residential.”

Permit-authorized dwelling units decreased by 6.5% to 18,575 through the second quarter after a record 2021, according to the Ivory-Boyer Construction Report. Single-family permitted units led the decrease – the 7,928 permitted units is a 21.3% drop over the first six months of 2021. Condos, townhomes, and duplexes set a record with 4,177 units permitted, an increase of 4.5% over last year. Apartment activity is up 15.2% from last year, with a record 6,350 units permitted. During the first six months of 2022, total permitted construction value reached $7.23 billion, a 1.8% decrease over the same time period from 2021. However, when controlling for inflation, the construction value decreased 6.0%. This is the first decrease in inflation-adjusted construction value activity since 2012. The decline was led by a drop in residential activity and additions, alterations, and repairs.

The White House invited leaders from a diverse group of housing industry organizations, including the Mortgage Bankers Association, National Association of Home Builders, National Housing Conference, National Multi-Housing Council, National Low Income Housing Coalition, National Fair Housing Alliance, Bipartisan Policy Center, and Affordable Housing Tax Credit Coalition.

“Discussions like this are critical to raising awareness about housing affordability. Middle-income, first-time, and first-generation homebuyers feel the most impact of this supply shortage as they face greater obstacles in the current economic climate. We look forward to continuing discussions with the Administration, policymakers, and our industry partners to advance viable reforms that have a lasting impact on the housing market,” Rouda Smith continued.

Nationally, the best day to buy fall on Nov. 28th with the lowest premium of 1.1% for homebuyers, followed by Jan. 9th seeing a 1.3% premium.

By ATTOMATTOM, a real estate data provider, released its annual analysis of the best time of the year to buy a home, which shows that the month of October, as well as the winter months, offer homebuyers the best deals –fetching lower premiums than other months of the year.

According to the analysis, buyers who close in October will get the best deal compared to the spring buying season. While the premium is still above market value, homebuyers are only dealing with a 3.3% premium, as

opposed to the month of May, when homebuyers are experiencing an 10.5% premium. This analysis of more than 39 million single family home and condo sales over the past nine years is evidence of the continuation of a hot sellers’ market (see full methodology below).

The analysis also looked at the best days to buy at the national level and best months to buy at the state level.

“Apparently the old adage ‘Spring forward and Fall back’

Month

Number of Sales Median Sales Price Median AVM

October 3,515,328 $222,004 $215,000 3.3%

November 3,028,121 $225,000 $217,000 3.7%

December 3,206,084 $225,000 $217,000 3.7%

January 2,440,874 $198,157 $190,362 4.1%

September 3,505,874 $225,000 $214,000 5.1%

August 3,891,711 $226,500 $215,000 5.3%

February 2,366,350 $200,000 $189,000 5.8%

March 3,123,442 $210,000 $196,342 7.0%

July 3,896,532 $229,000 $213,182 7.4%

June 3,932,078 $227,500 $211,000 7.8%

April 3,261,709 $215,000 $198,600 8.3%

May 3,560,639 $219,900 $199,000 10.5%

applies not only to setting your clocks, but to home prices as well,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “Seasonality has always had an impact on home prices, which tend to weaken in the Fall and Winter months when there’s less buying activity. Savvy homebuyers can take advantage of those lower prices and less competition from other buyers once the leaves start to turn.”

Nationally, the best day to buy fall on November 28th with the lowest premium of 1.1% for homebuyers, followed by January 9th seeing a 1.3% premium. Then December days take the lead with December 5th a 1.5% premium, December 26th a 1.5% premium, December 19th a 1.9% premium, December 12th a 2.0% premium, and December 24th a 2.0% premium. A far cry from the month of May, where May 23rd, 20th and 27th offer over a 15% premium.

According to the study, the states realizing the biggest discounts below full market value were New Jersey (-3.9% in February); Maryland (-3.5% in January); Michigan (-3.3% in October); Illinois (-2.7% in October); and Connecticut (-2.4% in December).

For this analysis ATTOM looked at any calendar day in the last nine years (2013 to 2021) with at least 10,000 single family home and condo sales. There were 362 days (including leap year data) that matched these criteria, with the four exceptions being Jan. 1, July 4, Nov. 11, and Dec. 25. To calculate the premium or discount paid on a given day, ATTOM compared the median sales price for homes with a purchase closing on that day with the median automated valuation model (AVM) for those same homes at the time of sale.

House-price declines are likely, but the stability of the market overall is on solid ground.

By Dejan Eskic Chief Economist of the Salt Lake Board of Realtors®

By Dejan Eskic Chief Economist of the Salt Lake Board of Realtors®

The summer of wild mortgage rate surges has brought demand to a standstill across the country. The daily 50-plus basis point swings in mortgage rates make it difficult for buyers and sellers to transact in a stable environment. While this is concerning, inventory is still moving, albeit at a slower pace than we’ve experienced the last two years.

The next 12 to 18 months of housing market activity will be at the mercy of the Federal Reserve and the Treasury markets. In his most recent public statement, Federal Reserve Chair Jerome Powell brought some clarity to

what he means by a “housing reset.” He explained that supply and demand need to be better aligned and that ... “we need to go through a correcting to get back to that place.” With “that place” being an environment where people can afford houses again.

So what does this mean for our housing market? There are a few points that are important to highlight.

First, I believe we are likely to see negative year-overyear prices in late winter/early spring of 2023. Our median sales price peaked in May of 2022, and through August, the median sold price across the Wasatch

Front decreased by 5%. The extent of the decline will be rate driven. It is this rate environment that is thwarting buyers and sellers and as a result made today’s market unaffordable for approximately 76% of Utah households. The median mortgage payment has jumped nearly $1,400 over the last 12 months! We need prices to go down to get the market transacting again. Second, the stability of the market overall is on solid ground. What do I mean by that? Approximately 80% of current active residential mortgages in the state of Utah have an interest rate that is 4% or lower. And 34% are locked into a 3% or lower rate! There are also are 80% of mortgage holders that have 40% or more equity. On top of that, delinquencies and foreclosure are at historic lows. All of these variables are signaling a strong cushion to absorb any significant price declines. Really,

listings in September is showing an even greater slowing of 16.2% in new listings. Further indicating that sellers are not motivated to move because of the high mortgage rate environment.

To my final point then: what is selling? Properties that are priced correctly of course! Transaction data from August and first two weeks of Septembers shows that it is pricing that moves inventory (who would have thought!). For example, properties that sold in one week or less had no price cuts from the original listing price. On average, properties that sold in two weeks had an average price cut of 1.5%, three weeks showed an average of 5.4% in price cuts. Properties that took eight weeks to sell had an average price cut of 7.4%. You get the point.

Rates are expected to stay

New home buyers are becoming more cautious. Rising mortgage rates and declining home sales have signaled the end of a hot housing market that has plagued buyers for over a year. According to the Census Bureau, home sales are down almost 18% since January 2022. However, some areas have cooled more than others.

To uncover where housing markets are cooling off most, SmartAsset analyzed the 100 largest metro areas, 92 of which had complete data. The study compared places across a total of eight metrics, split into two categories: price reduction and decreased demand.

California metro areas are cooling off the most. Three California metro areas rank in the top 10 for the study.

In these areas, homes are staying on the market longer relative to a year ago – nearly double the amount of time. Moreover, all three areas have seen over a 33% decrease in the number of houses sold monthly from August 2021 to August 2022.

The share of listings with price cuts is up 10% from a year ago. Nationally, about 16% of home listings had a price cut in August 2021. Comparatively, that figure is now almost 26%.

California metro areas ranked near the top of the list. Salt Lake City was No. 6.

Homes are on the market for less than 10 days in 36 metro areas. Last year, 67 metro areas fell into that category. Nationally, the average time on the market for a home listing currently stands at 13 days.

The study considered eight metrics across two categories, scored on a scale of 0 to 100 (higher scores indicate a cooler market).

The housing market in Boise, Idaho is cooling off the most relative to all other metro areas in our study. Boise has the sixth-lowest ratio of number of sold houses to new listings (0.49), meaning that almost twice as many houses are being listed relative to ones that are sold. The median days a house sits on the market is 20,

and this figure is almost 186% higher than one year previously.

2. Austin-Round Rock-Georgetown, TX

The fourth-largest metro area in Texas has experienced a chill in its housing market with the fourth-largest decrease in demand and the 13th-largest price reductions. Across specific metrics, Austin-Round RockGeorgetown has the second-highest median days on the market for home lists (27 days) and the fourth-worst ratio of houses sold to new listings (0.49).

3. Phoenix-Mesa-Chandler, AZ

Phoenix-Mesa-Chandler, Arizona ranks No. 3 overall. The metro area has the fifth-highest percentage of house listings with a price cut (39.61%), which 25% point higher than a year ago. Additionally, the number of houses sold in a month has declined by more than 41% between August 2021 and August 2022.

4. San Jose-Sunnyvale-Santa Clara, CA

San Jose-Sunnyvale-Santa Clara, California ranks in the top 10 for both larger price reductions and lower demand. Houses are on the market for roughly 19 days (eighth-highest), which is a 90% increase since exactly one-year ago (18th-highest). There has also been a 43.17% decrease in the number of houses sold and 26.81% of current listings have a price cut.

5. Las Vegas-Henderson-Paradise, NV

Across all 92 metro areas we considered, Las VegasHenderson-Paradise, Nevada ranks worst for our

decreased demand category. Over the past year, the number of houses sold monthly has fallen by about 44%. And as a result, Las Vegas-Henderson-Paradise has the third-lowest ratio of number of sold houses to new listings (0.48), meaning that almost twice as many houses are being listed relative to ones that are sold.

point difference between the share of listings with a price cut over a one-year period (17.78%).

Price reductions on homes in Provo-Orem, Utah have been widespread. The metro area has the secondhighest share of listings with a price cut (45.58%) and the largest increase in this figure relative to one year prior (26.26%). In terms of demand, there was a 57.38% decrease in houses sold in the area from August 2021 to August 2022 and there were nearly double the new listings compared to houses sold in August 2022.

6. Salt Lake City, UT

Salt Lake City, Utah has the eighth-largest decrease in demand and 16th-largest price reductions. Specifically, this area takes spots in the top 10 across five metrics including the percentage of listings with a price cut (41.89%) and the one-year change in the number of houses sold monthly (down 41.88%).

7. North Port-Sarasota-Bradenton, FL

Home prices in North Port-Sarasota-Bradenton, Florida are experiencing significant reductions. As of August 2022, over 31% of house listings have a price cut and the average price cut as a percentage of the home value is almost 6%. Relative to one year previously, this is a 17% increase in the percentage of homes with a price cut.

Rounding out the top 10 is Stockton, California, which eighth-longer average number of days on the market for home listings (19 days) and the 10th-highest oneyear change in the percentage of listings with a price cut (33.85%). As of August 2022, over a third of home listings in the area experience a price cut.

Consider all the costs before you sign the papers.

Don’t shy away from finding your forever home. Mortgage rates hit a new average of 6.7% - the highest since 2007 – and typically, buyers shy away from making a home purchase in these conditions. However, this might be a great time to buy a home.

Work with a financial expert. Buying a house – whether for your own personal use or as an investment can impact your finances all around. Talk to a financial advisor to help you manage your assets before and after this major purchase.

To uncover which housing markets are cooling off most, SmartAsset compared data for the 100 largest metro areas, 92 of which had complete data. We compared these areas across two categories and a total of eight metrics:

Percentage of listings with a price cut

One-year change in the percentage of listings with a price cut

Average price cut relative to average home value

One-year change in average price cuts

of houses sold to new listings

change in number of houses sold

Median days on the market

The San Diego-Chula Vista-Carlsbad, California metro area takes a top 15 spot across three metrics: the oneyear change in houses sold (35.53% decrease), the oneyear change in the median amount of time that a house is on the market (two times higher) and the percentage

One-year change in median days on the market

The study ranked each metro area in every metric and found an average ranking and score for each category. The study found a final score, averaging the two category scores. The metro area with the highest cumulative score ranked at the top of the list.

Location is the most important factor in the purchasing decision for second home owners (67%) and aspiring homeowners (70%) when buying a second home.

By Chrissy BrucheySales of luxury second homes increased nearly 25% year-over-year during the second quarter of 2022 and approximately 235% compared to Q1 2020, prior to the pandemic intensifying in the U.S.*

What’s motivating these second home buyers and more is captured in the 2022 Second Home Attitude Report — a quantitative survey-driven report conducted by Pacaso and Savanta, a trusted research firm. The report identifies trends around second homeowners and aspiring second homeowners’ preferences and gauges

the factors considered when deciding to buy a second home.

This report uses data from a July 2022 survey conducted online among more than 1,000 current and aspiring second homeowners with household incomes equivalent to or above $150,000 in the United States, United Kingdom and Canada. The findings shared in this report are specific to the U.S.

“The newfound flexibility many Americans are afforded

has made demand for second homeownership stronger than ever as people look to put quality of life frontand-center in their lifestyle,” said Pacaso CEO and CoFounder Austin Allison. “When you buy a second home, you’re unlocking a new chapter in life, becoming a part of the fabric of the community, and above all else, finding a special place to spend time with friends and family.”

“Existing second homeowners have experienced firsthand the life enriching possibilities of second

homeownership and thus we expect to have more realistic responses as they have a peak under the hood of how often they use their home as opposed to dreamers who haven’t yet seen their preferred usage,” said Allison. “Our data shows that only 29% of people plan to visit their second home, more than 7x per year. This stat further cements co-ownership as a more efficient and sustainable option, as buyers have the power to own only what they will use. Owning 100% of a home you barely use is wasteful and antiquated.”

For both existing second homeowners and aspiring second homeowners, location (67% vs. 70%), price (49% vs. 66%) and home size (44% vs. 48%) are the top three most important considerations in purchasing decisions for their families when buying a second home.

Location, location, location! As the desire to own a second home grows, the role of location in the buying decision does as well with 67% of current second homeowners and 70% of aspiring second homeowners choosing location as their number one consideration when thinking about purchasing a second home. However, existing second homeowners (45%) tend to value the appeal of the neighborhood more than nonowners (30%).

An inability to afford the second home they want is holding non-second homeowners (66%). Of the people who desire to own a second home but don’t already, four in ten (42%) show concern about the associated costs and more than one-third (35%) are hesitant about the effort to maintain a second home.

Nearly half of all current (44%) and non-second homeowners (48%) consider the size of the property

when buying their second home. Both value travel time and amenities as other important considerations.

“Maintaining a home at a luxury level with contemporary design, high-end furnishings and decor, top-notch amenities and appliances, regular cleaning and maintenance, comes at high cost and a large time commitment as to care for the home properly,” said Allison. “These buyers are still in the process of considering their lifestyle and how they plan to use their home, how often, and who will take care of it when they’re not there. There are options outside of traditional second homeownership, like co-ownership, that mitigate some ownership issues and provide better value.”

Second home dreamers and owners aren’t crazy about catching a plane to head to their second home but love a road trip.

Nearly two-thirds of people (64%) commute or expect to commute to their second home in four hours or less and the majority (87%) want to drive. One exception is that current second homeowners are slightly more likely to have longer commutes than those intending to own a second home would expect, as 43% of existing

second homeowners commute more than four hours to their second home, while only 31% of intenders expect to travel more than four hours.

Without major differences between owners versus non-owners, people overwhelmingly expect to drive to their second home (approaching nine in ten) than those who expect to fly (three in ten) or commute by train (one in ten).

The permanent shift toward work-from-home has forever changed the way people work and is giving second home buyers more flexibility to spend time away from their primary home and office.

“Both existing second homeowners and aspiring owners prefer domestic second homes because they are more accessible, allowing them to visit more often. These owners and aspiring owners are attracted to a second home to share with their family and friends so they can live life to the fullest,” said Savanta Director Research, Insights and Consulting, Amit Sahni.

When asked about their desired location type for purchasing a second home, 61% of non-second homeowners want to be near the water. Non-second homeowners ranked a beach house (42%) at the top of their list, followed by lake (19%) and mountain (14%).

91% of existing second homeowners own domestically and 15% own internationally, which is in alignment with the desires of non-second homeowners.

Second home owners visit their homes less frequently but stay for longer

Non-owners and existing owners feel nearly the same about the number of trips they make and expect to make to their second home each year with only 29% of people planning to visit their second home more than six times per year. More than half (59%) of existing and intending owners visit and expect to visit their homes more than four times per year, with nearly a third (29%) visiting more than six times per year.

Existing second homeowners (61%) are generally more likely to spend two or three plus weeks on vacation, while people who desire to own a second home are more likely to spend one week or less on vacation (58%). 65% of owners and buyers spend or expect to spend two or fewer weeks per stay.

“People who intend to own a second home are daydreaming of a perfect place to run to for a quick escape or for occasional weekend getaways throughout the year,” said Allison. “Whereas people who are already second homeowners may be a bit more comfortable with working from their second home or going for two or more weeks at a time, but just less frequently.”

Pacaso commissioned market research firm Savanta on a quantitative online study aimed at understanding the sec ond home attitudes and usage preferences of existing and non-second homeowners. The research was conducted in July 2022 amongst households with incomes equivalent to $150,000 or greater per year across the United States, United Kingdom and Canada. Data shared in this report reflects the analysis of median and average results exclud ing outliers. This report focuses on United States results.

“Sixty-one percent of non-second homeowners want to be near the water. Non-second homeowners ranked a beach house (42%) at the top of their list, followed by lake (19%) and mountain (14%).”

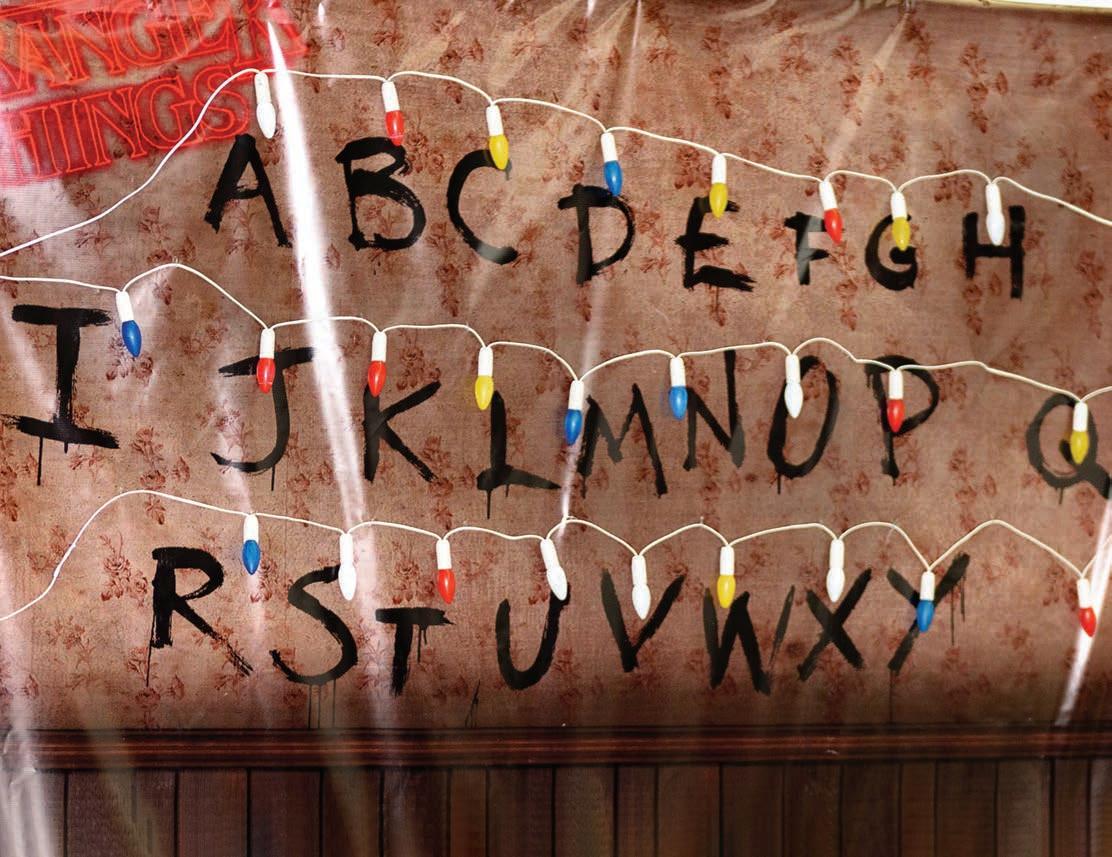

The Upside Down was ever present as real-estate agent played up ties between show and this three-bedroom, 1,850-square-foot home in Fayetteville, Ga.

By Joseph PisaniA three-bedroom house seen in Netflix Inc.’s “Stranger Things” was up for sale. The price: $300,000. The location: Fayetteville, Ga. Not included: Demogorgons, even though the show’s monster makes an appearance in one of the listing photos.

Michael Smith, the real-estate agent who listed the home in September, said he wanted to attract investors who would turn the nearly 1,850-square-foot home into an Airbnb for “Stranger Things” fans.

He featured the show heavily in the listing, even asking a photographer to add a reddish-hue so it looks like it

is in the Upside Down, the scary alternate dimension in the show. A Demogorgon was photoshopped into the living room. For another photo, Mr. Smith hung Christmas lights and painted the alphabet in black paint on the wall, re-creating a critical scene where the character Joyce Byers, played by actress Winona Ryder, communicates with her missing son who is stuck in the Upside Down.

A day after the listing went up, gossip site TMZ wrote about it. “My phone just started blowing up,” Mr. Smith said, with requests to see the property. Multiple offers

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

came in, he said, and one was accepted this week. It is expected to close in October.

The house, built more than 120 years ago, has been passed down through one family for a century, Mr. Smith said. It is currently owned by seven siblings who didn’t want to speak to the media or be named, the agent said. The owners are distantly related to Mr. Smith’s wife, he said.

“Stranger Things” producers first approached the home’s owners in 2015 about using the building’s exterior as a setting in the show.

“They said they were looking for a house that looked like it was in ‘The Goonies’ but with aliens,” Mr. Smith said.

Netflix didn’t respond to a request for comment.

The wood-paneled walls and dated wallpaper won them over, Mr. Smith said, giving them the 1970s and 1980s vibe they were looking for. The show, which takes place in the 1980s, is set in the fictional town of Hawkins, Ind., and the house serves as the residence of the main characters, the Byers family. It is featured heavily in the first season. Producers filmed outside and at sets in Georgia, Mr. Smith said.

“Stranger Things,” which premiered in 2016, was a breakout hit for Netflix and has led to numerous merchandise tie-ins, including Nike Inc. sneakers and limited-edition cans of Coca-Cola Co.

Fans frequently visit the house, Mr. Smith said.

“Some people even were trying to open the door because they didn’t realize people live there,” he said.

The driveway had to be blocked, and a no trespassing sign was put outside.

Mr. Smith, a real-estate agent with eXp Realty and longtime fan of “Stranger Things,” knows of other famous homes rented to fans, including the whitecolumned house from the 1990s sitcom “The Fresh Prince of Bel-Air” and a home from the “Twilight” vampire film series. Another “Stranger Things” house, which the Byers moved into in later seasons, typically rents for $400 a night on Airbnb.

Ryan Asher, the owner of that house in Albuquerque, N.M., said he didn’t know it was a “Stranger Things” house when he first saw it last year, but it was disclosed to him after he expressed interest in buying it. He bought the five-bedroom house for more than $500,000 in December and hasn’t moved in. It is booked until November on Airbnb, Mr. Asher said, and then booked

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

throughout the holidays—which more than pays for the monthly mortgage.

Fans who rent the house like to recreate scenes from “Stranger Things” to post on TikTok, Mr. Asher said. A renter once wore a Demogorgon mask and sat by a window, he said, startling fans who were visiting the home.

He thinks he will move into the house eventually—if the excitement around the show dies down.

“I would be thrilled if it never ended,” he said.

Producers have said the next season will be the show’s last.

going to fall through the floor.”

The winning bidder plans to renovate it and make the interiors look more like it did on the show, said Katie Siplon, a real-estate agent who represented the buyers. Ms. Siplon declined to name the buyers, but said they are married real-estate investors from Portland, Ore. She showed them the house on a video call.

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

Mr. Asher said he made few changes to the house, except he tried to match curtains and decorations seen in the show.

The house in Fayetteville, however, was listed as a fixer-upper and needs renovations, Mr. Smith said.

“It’s just old,” he said. But, he added, someone could potentially just move in if they wanted to. “You’re not

The house will be up on Airbnb before the end of the year, said Ms. Siplon, who works for TriCounty Real Estate in Savannah, Ga.

There were 25 other offers for the house, she said. The winning bid? About $600,000, or nearly double the asking price, Ms. Siplon said.

“It was a very tough fight for this one,” she said.

Reprinted by permission of The Wall Street Journal, Copyright © 2022 Dow Jones & Company, Inc. All Rights Reserved Worldwide. License number 5403211028611.

Soaring mortgage interest rates are slowing home sales in Utah and across the country. The 30-year, fixed-rate mortgage averaged 6.7% in the last week of September, the highest average rate since 2007, according to Freddie Mac.

Higher rates are disqualifying home buyers from financing. Home sales of all housing types in August fell to 1,204 units in Salt Lake County, down 27% from sales in August 2021.

The positive side is that active listings on UtahRealEstate.com in August topped 10,000 homes, a 150% increase over the 4,000 active listings a year earlier. The number of homes for sale has reached a balanced level, eliminating bidding wars and offers above asking price.

“The Federal Reserve’s aggressive rate hikes seem to be having little effect on inflation, but are slowing the housing market,” said Steve Perry, president of the Salt Lake Board of Realtors®. “We are selling about 400 fewer homes a month than the 10-year average.”

The single-family median home price in August was $601,000, up 10% from $545,000 in August 2021. Single-family home prices in Salt Lake County peaked at $650,000 in May, but are down 8% as of August. The median price of all housing types (single-family, condominiums, town homes, twin homes) was $525,000 in August, up 11% from $475,000 in August 2021.

Single-family home prices have increased 63% since the start of the pandemic to the peak, March 2020 to May 2022, when prices climbed from $400,000 to more than $650,000 in Salt Lake County.

In August, the median number of days a home was on the market was 28, more than double the time a year ago. Nationally, year-over-year sales faded by 20% in August, according to the National Association of Realtors®.

“The housing sector is the most sensitive to and experiences the most immediate impacts from the Federal Reserve’s interest rate policy changes,” said NAR Chief Economist Lawrence Yun. “The softness in home sales reflects this year’s escalating mortgage rates. Nonetheless, homeowners are doing well with near nonexistent distressed property sales and home prices still higher than a year ago.”

First-time buyers were responsible for 29% of sales in August, consistent with July 2022 and August 2021. NAR’s 2021 Profile of Home Buyers and Sellers – released in late 20214 – reported that the annual share of first-time buyers was 34%.

In the U.S., all-cash sales accounted for 24% of transactions in August, the same share as in July, but up from 22% in August 2021.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in August, up from 14% in July and 15% in August 2021.

Distressed sales – foreclosures and short sales – represented approximately 1% of sales in August, essentially unchanged from July 2022 and August 2021.

Buyer’s remorse is kicking in as home prices and borrowing costs soar, with more purchasers bailing on their sales contracts after their offer is accepted. Sixteen percent of signed deals fell through in July, the highest share since the onset of the COVID-19 pandemic in March and April 2020, according to Redfin. That’s irking sellers who thought they had their homes sold only to find themselves having to relist weeks—or even days— before closing.

Some areas of the country are seeing a larger uptick in canceled contracts than others, including these cities, which saw a cancelation rate of 25% or more over the summer: Jacksonville, Fla.; Las Vegas; Lakeland, Fla.; New Orleans; and San Antonio.

When home buyers back out of the transaction at the last minute, sellers may worry about the stigma that could put on their property. And as contingencies reemerge in a slowing housing market, canceled sales are increasingly likely, said Liz Perez Barletta, an attorney at Boston-based Ligris, a real estate law firm. She adds that she’s seen an uptick in inquiries about canceled contracts from home buyers and their agents.

“Because of the last two or three years of [market] craziness, home sellers may feel like this is new,” Perez Barletta said about the wave of canceled contracts. “But the ability to get an offer accepted with contingencies is typically pretty standard in a balanced market.” When buyers have a contingency around, say, a home inspection, they have justification to back out of the deal if something goes wrong.

Barletta suggests that sellers maintain tight closing timelines in their sales contracts to help keep the transaction on track or avoid a long lapse in case a buyer cancels the sale.

While millennials are the strongest homebuying force in the market right now, more than half say they’ve backed out of a sale contract this year—the highest of any other age group, according to a recent study from Cinch Home Services. They mostly cite unfavorable home inspection results and difficulty securing financing as their reasons for canceling a sale, according to the survey.

When the buyer wants to cancel the sale contract, what do you and your seller do next?

is your clients' raison d'être. Whether it's fostering a musical talent,

solos on the virtual guitar

planning the perfect flex space, at D.R. Horton, we get it.

we can help build those dreams.