THE PROPERTY CHRONICLE

TOWN&COUNTRY

Whenyouknow,youknow.™ APRIL2024

TNBPropetyServicesLimited(LicencedREAA2008)

Reports, Surveys & Commentaries

• REINZ Property Report – 16 April 24 Link – (March Data)

o Press Release

o March Snapshot

o Annual Median Price Changes

• REINZ House Price Index Report (HPI) 14 March 24 (March Data)

• CoreLogic

Finance & Lending

Our People

• Venita Attrill

• Lina Roban

• Brent Worthington

• Debbie Harrison

• Johnny Bright (Apollo Auctions)

• Robert Tulp (Apollo Auctions) •

Town & Country CONTENTS Page LJ Hooker Newsletter and Blogs • Letter from Principal (Brent Worthington) – Update o Hot tips to prepare your property for Autumn Sale • Property Management (Rent Exchange) o Guide to Renting Real Estate o Recently Leased 3 4 8 10

o Slow start for New Zealand housing marketing in March (Interactive Link) • TradeMe o Property prices continue to rise o State of the Nation report 12 13 14 15 16 30 34 37

• Tony’s View Alexander o Weak indicators relevant tomonetary policy. o Property developers – Cash woes fear of collapse (OneRoof) 41 46 Properties - LJ Hooker Town & Country • Properties Listed 50 • Properties Recently Sold 64

Keith Jones (Loan Market) 66 67 68 69 70 71 72 SuperGold - Welcome Here 73

29 April 2024

Despite home mortgage rates still hovering around 7%, the current 'flattening off' of property sales values and the Government announcing it will reform financial services in a bid to make it easier to get home loans and other lending reaffirms it's a buyer's market and now is an ideal time to be purchasing. This said, it's also an extremely positive environment for sellers, as long as they're prepared to meet the market.

If you're looking to sell and upsize, downsize or move to another part of the country, as long as this all occurs during the same market conditions, the price gap between what you sell and purchase for remains the same. However, we're finding there are currently too many vendors who are placing their properties on the market with the expectation they'll achieve the same prices they would have 3 years ago and as a result these properties aren't selling. Those who are meeting the market are getting sold.

So, if you're considering selling, before you engage a real estate professional, give serious consideration to whether you wish to be 'ON THE MARKET or IN THE MARKET'. If your decision is to be 'ON THE MARKET' it's highly likely you won't be selling any time soon. Why? Current market conditions are unlikely to change because interest rate cuts aren't predicted to fall significantly in the foreseeable future, fuel prices are unlikely to reduce, inflation is still well above the Reserve Bank of New Zealand's target range of 1 to 3% , Council rates continue to rise and the cost of living isn't changing.

If your decision is to be IN THE MARKET you'll be selling. Give serious consideration to selling your property by auction and make sure you invest in an excellent marketing campaign. The first Open Home buyers attend these days is online, so the quality of your marketing and photography is paramount for you to attract buyers to your property ahead of your competition. Remember, presentation and first impressions are everything.

As always I hope you enjoy this publication.

Kind regards Brent

Brent Worthington Principal and Licensee Agent

LJ Hooker Town & Country & Property Management

1/233 Great South road, Drury

0292 965 362

Town & Country

Hi

Hot Tips to PrepYour Property for an Autumn Sale

Autumnis a great timetosell.Buyers have welland trulysettled into the year,most peopleare backat work, kids are intheirschool routine and those who have madea newyear’sresolution tobuy a newhome, are eagerand readytohomehunt. But astheweatherstarts toshift, how do you makethemost of your property?

Here are 7 jobs to ensure your home is ready for sale in rain, hail or shine.

1. Create autumn curb appeal

Thisstep isimportant nomatterwhat timeofyearyou are selling. Why? Becausepotentialbuyers oftendo a ‘drive past’ ofa propertybefore they comeinfor aninspection – theyare seeing ifthepropertylooks good and worth theirtime. Thismeans that first impressions are critical,and this startsat the curb.

Here are somesimplejobs tohelp enhance your curb appeal:

• Waterblast thepathout the front of thepropertyand along the entryway

• Tidyup thefront garden – keep it neat and trim,weed yourgarden beds,remove dead plants,keep the lawnmown – and yeseven thestrip out thefront of your home,if youhave one,should be mowed.

• Remove fallenleaves– If have anexcessive amount offallen leavesare in yourfront garden,rake theseup, asleaving big piles canmakethehomefeel unloved.

• Just becausethe leavesare starting tochangecolour and falling off thetrees, it doesn't meanyour gardenneedstobevoid of colour. Head to yourlocalflower market and pickup some seasonal flowering plantsand eitheradd them toyour front entrance area inpots orif youfeel reallyinspired plant them around yourgardenbeds.

2. Check gutters and drainage

Ifyou are surrounded bydeciduous treesyou would know that this timeof yearyour guttersstart tofill up with dead leaves. Buyers donot want to seea roof lineoverflowing asit gives theimpressionthe homeisunloved.

It is a good idea toget a professional tohelp you here to cleanthegutters and makesure there are no drainageissues. As autumncanbring heavy rain,you do not want to have todealwith damp ormould issues during open homes.

3. Check your roof

It is probablybest toget anexpert tohelp you withthis job as it canbe dangerous. But getting up and checking that thetileson theroof are allin good condition and not damaged isanimportant job todobefore you open yourhomefor inspections. Inmost cases, serious buyers will organize fora propertyinspection tobecarried out and if thereport highlights issues with theroof it mayturnbuyers off.

Ifyou have any broken tilesget them fixed byanexpert asleaving them canresult inmore extensive damagetoyourpropertyespeciallyifwater getsin. Also ask theroofer tochecktheseals around ventsand chimneys are not wornout and if theyare sealthem up.

4. Tidy up the garden

Waterthelawneachdayor everysecond dayleading up to the inspections (just makesure you complywithwaterrestrictionlaws), remove anydead ordying plants and replacewithfresh flowering autumn plants. Rakeup any leavesand trim largerbushesand shrubs.

5. Check heating systems

Makesure your homefeelswarm and inviting when buyers are inspecting it,you want buyers tosee that it standsup tothecold but not steaming hot. Put your heating ona timersoit switches onan hour before they arrive. Ifit is cold and you have a fireplace ora gasfire, ensure theseare lit just before theagent arrives. Theflickering ofa fire cantotally change the atmosphere of a room.

Someadditionalways toensure your homefeelswarm is toensure there are no cracksaround doors and windows and fillin anycracks.Watchout for anyolderwindows as theseare the worst offenders for letting indrafts. So spend an hour orso checking and fixing these before the first open home.

6. Lighting

Asthe daysget shorter and thesun drops downto a lowerangle,you will need to relyonyour internallights tocreatethefeeling of light and space.

Pull backalltheblinds,open theshutters and ensure allcurtains are open. Turn oneverylight in thehouse, including tablelampsand ifyou have a darkroom consideradding spotlights behind furniture.

7. Bring the seasonindoors

Autumnis a favouriteseason for many,so embracetheseason and add subtleremindersof autumnaround your hometomakeit seem more inviting. Ifyour homehas a fireplace,have a lowburning fire during the open homecanhelp tocreateaninviting autumn atmosphere. Potential buyers willlove to envisagethemselveslounging bythefire aftera long day.

Pleasedon'thesitatetocontact ourteamwhocanablyassist youwithanyproperty managementmattersyoumay haveorifyouhaveany questionsaboutanythinginthe newsletterorproperty managementingeneral.

Whenyouknow,youknow.™ APRIL2024

COUNTRY

TOWN&

TNBPropetyServicesLimited(LicencedREAA2008)

Guide to Renting Real Estate

Information a tenant should receive before moving in

• Information pack relating to renting with LJ Hooker

• Copy of the tenancy agreement and relevant contact numbers

• Emailed copy of the condition report - to be checked and returned with amendments (if there was anything missing), then completed and signed, then returned to the office in the required time frame

• Photocopy of all keys and remote controls (if any)

• Local utilities services details

Your LJ Hooker property manager will be able to offer you additional information that is applicable to your particular circumstances.

Routine inspection checklist

Your property manager will carry out a periodic inspection of the property to ensure it is being well cared for and to identify any maintenance that may be needed. This inspection may include the following:

• The property is being maintained in a clean and tidy condition.

• The grounds are being maintained in a clean and tidy condition.

• The property is not being damaged in any way.

• There are no more than the number of people specified on the tenancy agreement are living at the property.

• No pets are housed at the property, unless otherwise agreed to.

• Any maintenance issues identified can be attended to (it's important urgent maintenance is report to your property manager straight away).

Whenyouknow,youknow.™ APRIL2024

TOWN&COUNTRY REPORTS, SURVEYS& COMMENTARIES TNBPropetyServicesLimited(LicencedREAA2008)

CLICK HERE TO VIEW FULL REPORT Published 16 April 2024 NEW ZEALAND PROPERTY REPORT This report includes REINZ residential property statistics from March 2024.

Momentum in multiple market measures

The Real Estate Institute of New Zealand (REINZ), released their March 2024 data today, showing a significant increase in listings and stock levels, creating more options for buyers.

REINZ Chief Executive Jen Baird says the market is clearly more active compared to a year ago, with high listing numbers, increased stock levels, higher sales counts, and higher median sale prices.

“ Listings increased substantially, up by 23.9% nationally compared with March 2023, reinforcing a trend we have seen since the beginning of 2024 with more property coming to market. New Zealand’s stock levels also saw a year-on-year increase, which means more available properties for sale and more choices for buyers. Agents are seeing activity among a range of buyer groups, with first-home buyers and owner occupiers being the most active. ” says Baird.

Listings nationally increased by 23.9% year-on-year from 9,242 to 11,455; compared with February 2024, national listings decreased 2.8% from 11,788 to 11,455. Five regions, all in the North Island, saw large year-on-year increases, with Wellington up 215 listings (+32.4%), Auckland up 986 listings (+31.4%), Manawatu-Whanganui up 112 (+30.4%), Bay of Plenty up 172 listings (+28.8%), and Hawke’s Bay up 72 listings (+26.8%). Only Nelson (-2.7%) and West Coast (-1.4%) recorded decreases in listings compared with March 2023. This is the second consecutive month where North Island regions have recorded the highest year-on-year increases in listings.

New Zealand’s inventory levels have increased by 13.5% from 29,284 to 33,245 properties year-on-year – the highest level since 2015.

“Sales activity was higher in 13 of 16 regions compared to March 2023. Seven of those regions’ sales counts increased by over 10%; Gisborne led the way with the highest yearon-year increase in sales (+27.8%), reflecting a more usual level of demand, bouncing back from the low levels post the devastation of cyclones Hale and Gabrielle in early 2023.”

The total number of properties sold for New Zealand increased in March (+7.4%) compared to February 2024, from 6,073 to 6,521, and up 8.0% year-on-year, from 6,040 to 6,521. Only Northland (-1.9%) and Otago (-6.3%) recorded decreased sales activity compared with March 2023.

The national median sale price has increased by 2.7% from $779,000 to $800,000 year-on-year; it also increased by 1.1% from February 2024, from $791,500 to $800,000. For New Zealand, excluding Auckland, the median price also increased –

Jen Baird CEO, REINZ

it was up by 2.3% year-on-year from $695,000 to $711,000, and up by 0.1% month-on-month from $710,000 to $711,000.

“This is the second consecutive month recording a year-onyear increase in the median sale price nationally. This, along with the increased year-on-year levels of sales and listings, suggests that we are past the lowest point of this market cycle.”

Median days to sell decreased by 6 days compared to a year ago, from 44 to 38 days, both nationally and for NZ excluding Auckland. In 12 of 16 regions, median days to sell were lower compared with March 2023, with the biggest decreases in Marlborough (down 26 days), Hawke’s Bay (down 25 days), and Tasman (down 20 days).

The HPI for New Zealand stood at 3,655 in March 2024, down by 1.2% compared to the previous month and up by 2.6% for the same period last year. The average annual growth in the New Zealand HPI over the past five years has been 5.7% per annum, and it is currently 14.5% below the peak of the market reached in 2021.

Overall, the data paints a picture of the New Zealand housing market being more active, characterised by increasing listings, solid sales activity, expanding stock levels, and lifts in property prices.

“This summer has seen a return to a more normal level of real estate market activity after a relatively slow and subdued 2023. Reasons for this will vary, for example some vendors may prefer not to wait any longer and are willing to ‘meet the market’ with their price expectations. Some buyers may want to act now ahead of potential further lifts in sale prices or potential increased competition for properties, as upcoming changes to bring the bright line test back to two years, and the reintroduction of interest deductibility on investment properties, are expected to draw some investors back to the market in the next few months.

“The current economic environment with higher interest rates and some uncertainty in the jobs market will mean some buyers remain cautious, with prices still off their peaks from a couple of years ago, however growing numbers of buyers are acting now. Most agents are cautiously optimistic that market activity will continue to pick up as we move into the cooler months,” adds Baird.

The Real Estate Institute of New Zealand (REINZ) has the latest and most accurate real estate data in New Zealand.

For more information and data on national and regional activity visit the REINZ’s website.

Media contact:

Laura Wilmot Head of Communications

and Engagement, REINZ Mobile: 021 953 308 communications@reinz.co.nz

3 | REINZ Monthly Property Report

REINZ Monthly Property Report | 3

Market Snapshot – March 2024

4 | REINZ Monthly Property Report 39 38 38

$ $ MEDIAN HOUSE PRICE YEAR-ON-YEAR REINZ HOUSE PRICE INDEX YEAR-ON-YEAR SALES COUNT YEAR-ON-YEAR SEASONALLY ADJUSTED SALES COUNT MONTH-ON-MONTH MEDIAN HOUSE PRICE MONTH-ON-MONTH SALES COUNT MONTH-ON-MONTH

to sell nationally

National$800,0002.7% p NZ excl Akl$711,0002.3% p Auckland$1,050,0005.0% p National6,5218.0% p NZ excl Akl4,5218.9% p Auckland2,0005.8% p National$800,0001.1% p NZ excl Akl$711,0000.1% p Auckland$1,050,0002.9% p National6,5217.4% p NZ excl Akl4,5216.3% p Auckland2,00010.0% p National3,6552.6% p NZ excl Akl3,8262.9% p Auckland3,4132.2% q National-0.5% p NZ excl Akl5.0% q Auckland-11.8% days year-on-year -6 NZ excl Akl days -6 Auckland days -6

Days

p

ANNUAL MEDIAN PRICE CHANGES

MARCH 2024

5 | REINZ Monthly Property Report © Mapbox © OpenStreetMap

Hawkes Bay

Manawatu-Whanganui

Bay of Plenty $710,000 Northland Auckland Wellington Waikato Taranaki Nelson Tasman West Coast Southland Marlborough Canterbury Otago National Median Price Median Days to Sell Compared to March 2023 R Record Median Prices Increase Decrease Stable 0.0% u $1,050,000 5.0% p $785,000 -4.3% q $625,000 -0.8% q $715,000 8.2% p $545,000 3.8% p $820,000 9.3% p $760,000 2.8% p $600,000 0.0% u $715,000 7.5% p $840,000 0.0% u $370,000 4.2% p $648,000

q $693,000

p $705,000

p $445,000

Gisborne

-1.8%

1.9%

5.2%

-1.1% q

38 2.7% $800,000

16 April 2024

NEW ZEALAND HOUSE PRICE INDEX REPORT

©REINZ-RealEstateInstituteofNewZealandInc.

Published

REINZ House Price Index (HPI)

As one of the country’s foremost authorities on real estate data, we are proud to bring you the REINZ HPI (House Price Index). It provides a level of detail and understanding of the true movements of housing values over time to a higher standard than before. The REINZ HPI was developed in partnership with the Reserve Bank of New Zealand and provides a more complete picture of the New Zealand housing market.

BENEFITS OF THE REINZ HPI

Data on median and average house prices is open to being skewed by market composition changes. This means observed changes in these values could be almost entirely due to the changed nature in the underlying sample (e.g. an unusually large representation of high end housing sales) rather than changes in the true market value. The REINZ HPI takes many aspects of market composition into account resulting in greater accuracy.

ABOUT REINZ HPI

The REINZ HPI is based on the SPAR methodology and has been proven to be the most comprehensive tool to understand the housing market for four main reasons:

• Timeliness - This is the number one advantage of REINZ HPI. REINZ data is based on sales as they occur (unconditional) so is the most up to date data source in NZ.

• Accuracy - REINZ data is supplied by the actual sales prices supplied by its members so has a high level of accuracy.

• Stability - REINZ has the most data available to it so can provide the most stable and complete one month indices.

• Disaggregation - Indices can be disaggregated to a lower level than before. Disaggregation means you can focus on a smaller data set, allowing comparison of building typology and suburbs, i.e. Three bedroom houses in Manukau.

The number one advantage between REINZ data and other housing data on the market is that REINZ has access to sales data from the time the price is locked in (unconditional data) as opposed to when the house changes hands (settlement date) which can often be weeks/months later. Therefore, the REINZ HPI is the best and most timely measure of recent housing market activity.

EXPERT INDUSTRY FEEDBACK

“I have had the opportunity to utilise the REINZ HPI website, and have been involved in advising on the HPI’s preparation. The new index fills a gap in providing reliable up to date information on house price developments across all of New Zealand’s local authorities. It’s wonderful to see REINZ providing this level of detailed data for wider public use. I am already planning to use this data in my own research.”

Dr Arthur Grimes Senior Fellow, Motu Research; and Adjunct Professor, Victoria University of Wellington

“Accuracy and timeliness of information on house price movements is vital for home buyers, sellers, agents, and analysts such as myself. The data from REINZ meets both requirements and gives New Zealand a collection of house price series comparable with the best overseas.”

Tony Alexander Independent Economist and Speaker

“The Real Estate Institute of New Zealand’s Market Intelligence portal opens up to users the ability to interactively compare price trends amongst a wide range of local council regions. Users can pick and choose regions of interest and use the chart tools to instantly compare price performances. For those wanting to look at house prices in more depth there is the capability to download the data in spreadsheet format all the way back to 1992 when the Institute started recording sales price information.”

Nick Tuffley Chief Economist, ASB

2 | REINZ Monthly House Price Index Report

For more information visit: reinz.co.nz/reinz-hpi

REINZ HOUSE PRICE INDEX

MARCH 2024 RESULTS

Looking at the REINZ HPI for March 2024, the ‘gold standard’ for New Zealand house price analysis, Jen Baird, Chief Executive at REINZ, says:

The REINZ House Price Index was developed in partnership with the Reserve Bank of New Zealand.

Already being used by the Reserve Bank’s forecasting and macro financial teams, plus the major banks, the REINZ HPI provides a level of detail and understanding of the true movements of housing values over time. It does this by analysing how prices in a market are influenced by a range of attributes such as land area, floor area, number of bedrooms etc. to create a single, more accurate measure of housing market activity and trends over time. Using the Reserve Bank’s preferred Sale Price to Appraisal Ratio (SPAR) methodology, the REINZ HPI uses unconditional sales data (when the price is agreed) rather than at settlement, which can often be weeks later. It is therefore more accurate and timely.

Year-on-year, the HPI indicates that housing market value nationwide has risen 2.6%, up in Auckland by 2.2% and increasing outside Auckland by 2.9%.

“The REINZ HPI takes many aspects of market composition into account and thus provides more accurate results. When applied to the March data, the HPI indicates that the housing market value nationwide has risen 2.6% year-on-year. In Auckland, the value increased by 2.2% and increased by 2.9% outside of Auckland. Otago retains the top spot for HPI percentage changes over the 12 months ending March 2024. Wellington and Canterbury came second and third, respectively, for annual percentage movement.

“The importance of the HPI is evident in the Southland region this month, where the median sale price tells a different story to the HPI.

“The median sale price in the region decreased 1.1% over the past year, the third worst return of all the regions. This suggests a market where performance is poor in the long term compared to other regions.

“However, the Southland region had the fourth strongest annual performance of all regions in HPI over the past year with an increase of 4.3%. Sample composition changes — such as the size of properties or the underlying value of properties sold — can change statistics, such as median, that are purely based on price. However, because the underlying value of each property sold is considered by the HPI, such sample changes have little effect on HPI results. In summary, long-term property value growth in Southland is increasing at a faster rate than many other regions, a fact that would have remained hidden from those monitoring statistics without access to the HPI.”

3 | REINZ Monthly House Price Index Report

NEW ZEALAND

4 | REINZ Monthly House Price Index Report

National House Price Index Figures 3000 3500 4000 HPI 2020 2021 2022 2023 2024 New Zealand NZ Excl. Auckland

HOUSE PRICE INDICIES

UPPER NORTH ISLAND

LOWER

ISLAND

5 | REINZ Monthly House Price Index Report

REGIONAL HOUSE PRICE INDICIES

Regional House Price Index Figures 3000 3500 4000 4500 HPI 2020 2021 2022 2023 2024 Auckland Bay of Plenty Northland Waikato 2500 3000 3500 4000 4500 5000 5500 HPI 2020 2021 2022 2023 2024

NORTH

REGIONAL HOUSE PRICE INDICIES

Gisborne/Hawke's Bay Manawatu-Whanganui Taranaki Wellington

SOUTH ISLAND REGIONAL HOUSE PRICE INDICIES

South Island

4,4400.8%4.7%5.3%9.7%

Source: REINZ *=Compound Growth Rate

6 | REINZ Monthly House Price Index Report

2000 2500 3000 3500 4000 4500 5000 HPI 2020 2021 2022 2023 2024 Canterbury Otago Southland Tasman/Nelson/Marlborough/West Coast Regional House Price Index Figures House Price Index Index level One Month Three Months One Year Five Years* House Price Index Index level One Month Three Months One Year Five Years* New Zealand 3,655-1.2%0.2%2.6%5.7% NZ excl. Auckland 3,826-0.8%0.4%2.9%7.0% Auckland 3,413-1.9%-0.3%2.2%3.8% Rodney District 3,586-3.1%-0.6%-0.5%5.1% North Shore City 3,470-1.8%-2.0%4.0%3.8% Waitakere City 3,615-2.8%-1.6%-1.4%3.5% Auckland City 3,171-2.3%1.7%2.8%3.4% Manukau City 3,623-0.8%-2.1%2.4%4.1% Papakura District 3,973-0.1%0.1%3.1%5.3% Franklin District 4,0101.8%2.3%0.1%4.8% Other North Island Whangarei District

SUMMARY OF MOVEMENTS

3,847-1.4%-0.4%-1.1%5.3%

Hamilton City 3,926-0.5%0.1%0.4%5.9% Tauranga City 3,6570.1%0.7%2.2%6.3%

Hastings District 4,1160.2%2.4%3.1%8.9% Napier City 3,5100.3%-2.4%-0.5%6.2% New Plymouth District 4,348-0.8%-0.1%1.2%8.5% Palmerston North City 3,809-0.9%-0.7%2.0%7.4% Wellington 3,410-1.0%-1.2%4.7%4.6% Porirua City 3,5151.2%-1.9%4.4%5.8% Upper Hutt City 4,042-1.2%-0.8%4.6%5.5% Lower Hutt City 3,711-2.0%-0.2%4.7%5.1% Wellington City 2,958-2.2%-3.0%4.7%3.2%

Rotorua District 4,217-2.6%-3.3%1.4%5.6%

Nelson City

Christchurch City

2,8541.0%0.0%-2.4%4.3%

3,596-0.7%1.7%5.1%8.6%

Dunedin City

City

Queenstown-Lakes District 3,979-1.3%0.1%12.2%8.7%

4,245-1.0%2.6%4.0%6.7% Invercargill

UPPER NORTH ISLAND (EX-AUCKLAND)

7 | REINZ Monthly House Price Index Report 3000 3500 4000 4500 HPI 2020 2021 2022 2023 2024 Auckland City Manukau North Shore Rodney Waitakere 2500 3000 3500 4000 4500 5000 5500 HPI 2020 2021 2022 2023 2024

AUCKLAND

PRICE INDICIES

Hamilton Rotorua Tauranga Whangarei

COUNCILS HOUSE

Monthly Calculated House Price Index Figures For Councils

COUNCIL HOUSE PRICE INDICIES

LOWER NORTH ISLAND COUNCILS

8 | REINZ Monthly House Price Index Report

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES Monthly Calculated House Price Index Figures For Councils 2000 2500 3000 3500 4000 4500 5000 5500 HPI 2020 2021 2022 2023 2024 Hastings Lower Hutt Napier New Plymouth Palmerston North Wellington City 2000 2500 3000 3500 4000 4500 5000 HPI 2020 2021 2022 2023 2024 Christchurch City Dunedin

HOUSE PRICE INDICIES

UPPER NORTH ISLAND (EX-AUCKLAND) COUNCILS

MID NORTH ISLAND COUNCIL HOUSE PRICE INDICIES

HOUSE PRICE INDICIES

9 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils 2500 3000 3500 4000 4500 5000 5500 6000 HPI 2020 2021 2022 2023 2024

2000 3000 4000 5000 6000 HPI 2020 2021 2022 2023 2024

Far

North Matamata-Piako Thames-Coromandel Waikato District

Taupo Waipa Western Bay of Plenty

LOWER NORTH ISLAND COUNCILS

INDICIES

SOUTH

COUNCIL HOUSE PRICE INDICIES 10 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils 3000 4000 5000 6000 7000 HPI 2020 2021 2022 2023 2024

HOUSE PRICE

UPPER

ISLAND

4500 5000 5500 6000 6500 7000 7500 HPI 2020 2021 2022 2023 2024

Horowhenua Kapiti Coast Masterton Porirua Upper Hutt Whanganui

Marlborough Nelson Tasman

LOWER SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

11 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils 2500 3000 3500 4000 4500 HPI 2020 2021 2022 2023 2024

Queenstown-Lakes Selwyn Timaru Waimakariri

NORTH ISLAND COUNCILS HOUSE PRICE

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES 12 | REINZ Monthly House Price Index Report Three Month Rolling Calculated House Price Index Figures For Councils 2000 3000 4000 5000 6000 7000 8000 9000 HPI 2020 2021 2022 2023 2024 Kaipara Manawatu South Taranaki South Waikato Whakatane 2000 2500 3000 3500 4000 4500 5000 HPI 2020 2021 2022 2023 2024 Ashburton Central Otago Southland District Waitaki

INDICIES

NORTH ISLAND COUNCILS HOUSE PRICE

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES 13 | REINZ Monthly House Price Index Report Six Month Rolling Calculated House Price Index Figures For Councils 3000 4000 5000 6000 7000 HPI 2020 2021 2022 2023 2024

INDICIES

3000 3500 4000 4500 5000 5500 6000 HPI 2020 2021 2022 2023 2024

Central Hawke's Bay Hauraki Rangitikei Ruapehu South Wairarapa Tararua

Clutha Gore

TERRITORIAL AUTHORITY HPI VALUES

Council CalculatedHPI

Ashburton District 3 month rolling3,920

Auckland City Actual Month3,171

Buller District 6 month rolling4,417

Carterton District 6 month rolling4,451

Central Hawke’s Bay District 6 month rolling5,238

Central Otago District 3 month rolling4,386

Christchurch City Actual Month3,596

Clutha District 6 month rolling5,380

Dunedin City Actual Month4,245

Far North District 2 month rolling3,920

Franklin District 2 month rolling3,990

Gisborne District 2 month rolling5,066

Gore District 6 month rolling5,669

Grey District 6 month rolling4,354

Hamilton City Actual Month3,926

Hastings District Actual Month4,116

Hauraki District 6 month rolling4,989

Horowhenua District 2 month rolling4,779

Hurunui District 6 month rolling4,619

Invercargill City Actual Month4,440

Kaikoura District 3 month rolling3,505

Kaipara District 2 month rolling4,554

Kapiti Coast District Actual Month4,132

Kawerau District 3 month rolling6,598

Lower Hutt City Actual Month3,711

Mackenzie District 6 month rolling7,564

Manawatu District 3 month rolling4,822

Manukau City Actual Month3,623

Marlborough District 2 month rolling3,433

Masterton District 2 month rolling3,976

Matamata-Piako District 2 month rolling4,716

Napier City Actual Month3,510

Nelson City 2 month rolling2,887

New Plymouth District Actual Month4,348

North Shore City Actual Month 3,470

Opotiki District 6 month rolling4,704 Council

Otorohanga District 6 month rolling4,936

Palmerston North City Actual Month3,809

Papakura District 2 month rolling3,988

Porirua City 2 month rolling3,520

Queenstown-Lakes District 2 month rolling4,068

Rangitikei District 6 month rolling6,239

Rodney District Actual Month3,586

Rotorua District Actual Month4,217

Ruapehu District 6 month rolling5,724

Selwyn District 2 month rolling4,048

South Taranaki District 3 month rolling4,999

South Waikato District 3 month rolling6,825

South Wairarapa District 6 month rolling5,187

Southland District 3 month rolling4,620

Stratford District 6 month rolling6,239

Tararua District 6 month rolling5,180

Tasman District 2 month rolling3,065

Taupo District 2 month rolling3,595

Tauranga City Actual Month3,657

Thames-Coromandel District 2 month rolling4,093

Timaru District 2 month rolling4,692

Upper Hutt City 2 month rolling 4,070

Waikato District 2 month rolling4,902

Waimakariri District 2 month rolling3,777

Waimate District 6 month rolling6,172

Waipa District 2 month rolling4,781

Wairoa District 6 month rolling4,972

Waitakere City Actual Month3,615

Waitaki District 3 month rolling4,381

Waitomo District 6 month rolling5,244

Wellington City Actual Month2,958

Western Bay of Plenty District 2 month rolling4,050

Westland District 6 month rolling4,979

Whakatane District 3 month rolling4,132

Whanganui District 2 month rolling5,596

Whangarei District Actual Month3,847

This report is intended for general information purposes only. This report and the information contained herein is under no circumstances intended to be used or considered as legal, financial or investment advice. The material in this report is obtained from various sources (including third parties) and REINZ does not warrant the accuracy, reliability or completeness of the information provided in this report and does not accept liability for any omissions, inaccuracies or losses incurred, either directly or indirectly, by any person arising from or in connection with the supply, use or misuse of the whole or any part of this report. Any and all third party data or analysis in this report does not necessarily represent the views of REINZ. When referring to this report or any information contained herein, you must cite REINZ as the source of the information. REINZ reserves the right to request that you immediately withdraw from publication any document that fails to cite REINZ as the source.

14 | REINZ Monthly House Price Index Report

DISCLAIMER

CalculatedHPI

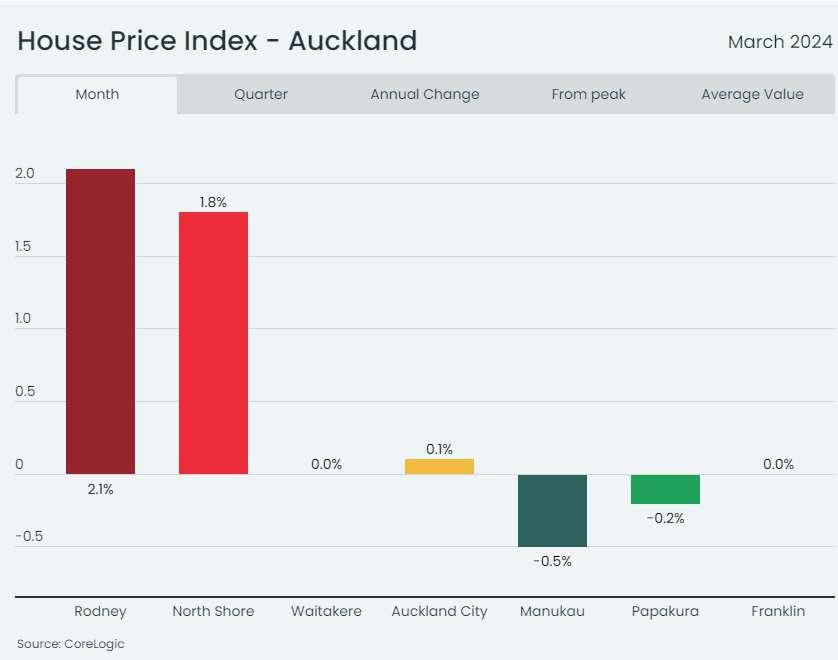

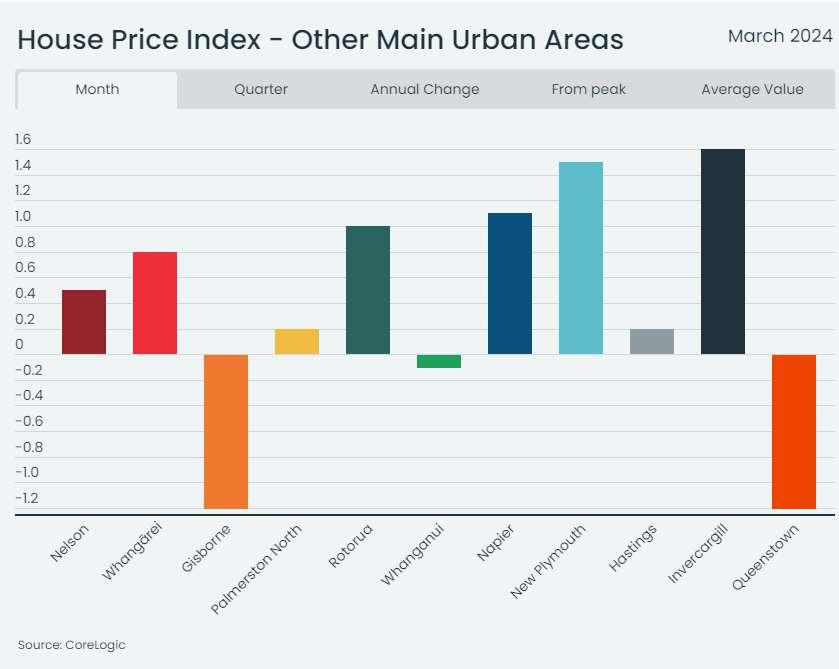

CoreLogic's House Price Index rose 0.5% in March, similar to January and February's muted gains, taking values 1.1% higher over the first quarter of 2024.

The average property value across NZ now stands at $934,806, up 3.2% ($29,361) from September's trough, but still 10.4% (-$108,455) below the recent peak.

The inconsistent nature of the upturn so far was evident again through March, with Wellington rising strongly (0.9%), and Christchurch, Dunedin and Auckland also showing gains (0.4-0.6%), but both Tauranga and Hamilton edging down 0.2%.

CoreLogic NZ Chief Property Economist, Kelvin Davidson, said the run of three softer results in a row at the national level was expected given stretched housing affordability.

"NZ's housing market can probably be described as 'not too hot, not too cold'," Mr Davidson said.

CLICK HERE TO USE THE INTERACTIVE REPORT

"High mortgage rates remain a big challenge at the forefront of all borrowers’ minds, whether they’re taking out a new loan or repricing an existing mortgage. While the new tax year and 80% mortgage interest deductions will help cashflow for property investors, it's unlikely to be enough to trump high interest rates.

“In addition, while the first official cash rate cut in the next cycle is getting closer, it’s certainly not here yet. Indeed, if the Reserve Bank’s current projections prove to be correct, the cash rate may not start to fall until next year, highlighting that shorterterm fixed mortgage rates may not drop much for at least another six to nine months.

“We’ve also seen a turnaround for listings activity in the first few months of 2024, with a good flow of fresh properties hitting the market, raising the choice for buyers and taking a bit of heat out of property prices. There’s no set definition, but the general sense is that the so-called sellers’ market of late 2023 has now switched back in favour of credit-approved purchasers,” Mr Davidson added.

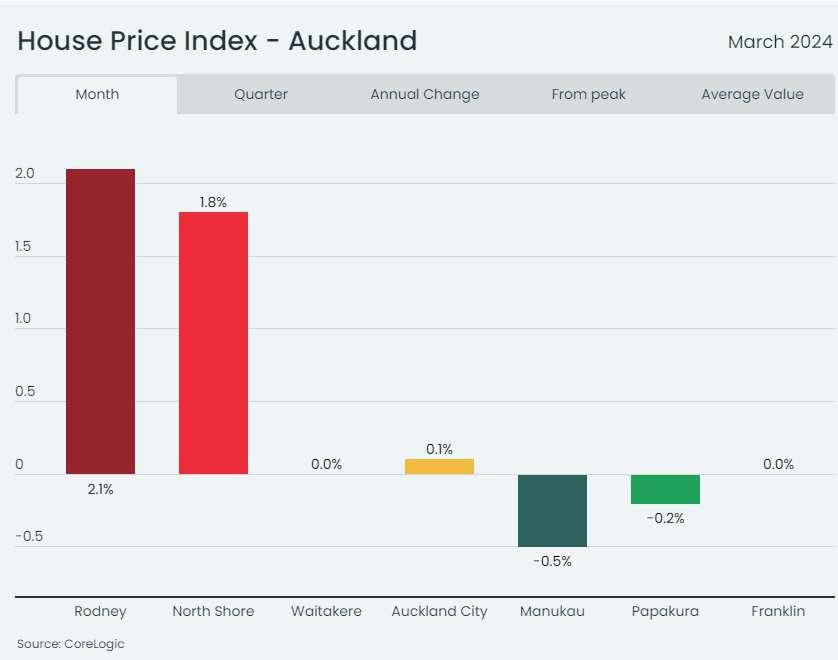

Market performance was pretty variable across Auckland in March, with Rodney and North Shore both up by around 2%, but then a large gap back to broad stability in Auckland City, Waitakere, and Franklin, while values in Papakura and Manukau declined over the month.

There's also been inconsistent growth over the March quarter, with Rodney up more than 2%, but areas such as Waitakere only up very slightly (0.2%) and Papakura fractionally lower (-0.1%).

“Auckland's market is often seen as a bellwether for national trends, and although I'm a little sceptical of the degree to which patterns in our largest city genuinely 'filter out' to the regions, there's no doubt Auckland is currently demonstrating what's being seen elsewhere – an 'up and down' recovery," Mr Davidson said.

Indeed, digging beneath the surface in Wellington too, there's also clear evidence of variable performance. Upper Hutt, for example, spiked 2.3% in March, with Kapiti Coast and Wellington City also posting solid growth. However Lower Hutt and Porirua both saw values slide backwards.

"It's interesting to note the falls from the peak remain pretty large in Wellington, even after recent growth. Take Lower and Upper Hutt as examples, where values are still down from the peak by around 20% in both areas. That decline probably isn't doing much for the moods of homeowners who purchased at the tail-end of the boom, but on the flipside, it may present a good opportunity for prospective new buyers," Mr Davidson said.

Regional House Price Index results

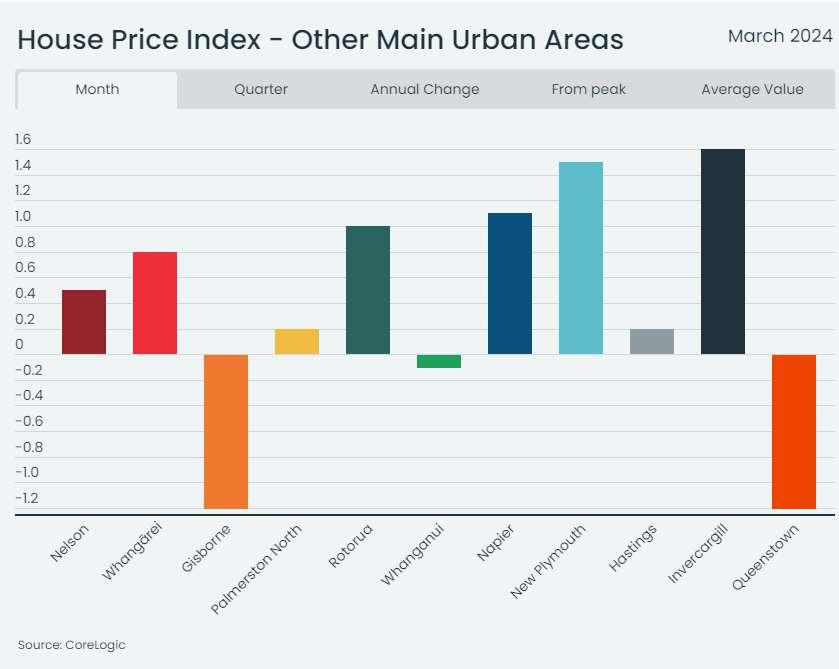

Outside the main centres, March's data was also a mixed bag, with Invercargill, New Plymouth, Napier, and Rotorua all rising by at least 1%, but Gisborne and Queenstown dropping 1.2% apiece.

Given the broad (albeit slow) upturn has now been in progress for around six months, a number of regional markets have seen their annual house price growth rates turn positive. Hastings, Invercargill, and Queenstown have seen annual gains

of around 3% or more, however Gisborne, Whangarei, and Nelson are still around 2% (or more) below the levels from a year ago.

Mr Davidson said there's always local variation in house price trends, even when the wider market nationally is booming.

"It's no surprise that some regions are rising more strongly than others in this current 'testing' market, while some are still actually falling. The general trend should remain upwards in the coming months, but it's unlikely to be a straight line everywhere."

Property market outlook

Looking ahead, Mr Davidson said there are certainly still challenges in play for the housing market.

"March’s subdued property value data is a timely reminder that this upturn may well be inconsistent from month to month, and across regions,” he said.

“Certainly, although house sales volumes are now trending higher, they’re coming off a very low base, and activity remains well below normal. In that environment, it’s no surprise that value patterns are also a bit patchy.

"First home buyers continue to target the market, and have been a great success story in the past 12-18 months, using KiwiSaver for at least part of the deposit, and making full use of the low deposit lending allowances at the banks. But other buyer groups, such as mortgaged investors, remain more subdued.

“Sales volumes remain on track to rise by about 10% this calendar year and property values by perhaps 5% nationally – decent figures, but slow by past standards," Mr Davidson concluded.

Property prices continue to rise

March Property Price Index

New Zealand’s property prices have recorded an increase for the second month in a row according to Trade Me's Property Price Index for March.

The national average asking price for a property was recorded at $885,100, up 2.2 per cent compared to the same time last year.

"It’s too early to tell if the prices will return to the highs we saw a few years ago, but consecutive months of increases is another positive sign for the property market," said Trade Me spokesperson Casey Wylde.

“We know from our State of the Nation report that 23 per cent of respondents that own a home have intent to sell within the next year and with inflation at its lowest point in almost three years this may also help more Kiwi consider buying a home, if we see interest rates start to come down - so overall this is welcome news for both buyers and sellers,” Wylde added.

TRADE ME ARTICLE 223 March 202434

Most of South Island records price rise

The increase in the average asking price was led by the South Island, where most regions experienced a hike in prices with the West Coast seeing the biggest increase again, up 10.2 per cent to $481,550.

Otago saw the next biggest increase up 7.9 per cent to $855,959 followed by Southland which recorded an increase of 3.8 per cent to $525,400.

When looking at the North Island, prices in the smaller regions such as Taranaki (3.3%), Waikato (3%), Bay of Plenty (1%) and the Hawkes Bay (0.4%) recorded minor increases while the other areas saw a drop in the average asking price.

“We are still seeing prices come down in the main areas of the North Island, for example in the extended Auckland region, there was a decline of 1 per cent, bringing the average asking price to $1,083,650. Meanwhile, the Wellington region saw a decrease of 1.3 per cent, with the asking price now at $853,350,” Wylde said.

Record high for 3-4 bedroom properties in Christchurch City

When looking at the major urban cities, property prices in Christchurch city are continuing to climb. The average asking price was recorded at $711,450, up 4 per cent year on year.

Properties with 3-4 bedrooms have reached a new record high of $778,100 which is a 5 per cent increase compared to the same time last year. Other sized homes also recorded an increase in the garden city. Properties with over five bedrooms increased by 5 per cent to $1,170,200 and smaller homes with 1-2 bedrooms rose by 1.6 per cent.

All property sizes in Wellington city witnessed a decline, with homes that have over five bedrooms dropping significantly by 9.2 per cent and 3-4 bedroom sized dwellings down by 5.5 per cent.

“Despite this buyers can still expect to pay over a million dollars for a larger property in Pōneke, the average asking price for a 3-4 bedroom house is $1,019,500 and that jumps to $1,371,250 when looking at places that have five or more bedrooms,” said Wylde.

"In Tāmaki Makaurau, buyers will be paying double than those in Wellington for over five bedrooms with the average asking price jumping by 3.6 per cent to $2,775,150,” said Wylde.

“However it could be a good time for those looking to downsize or purchasing a smaller size dwelling, after 1-2 bedroom homes experienced the biggest decline of

all the house sizes across the city centres, with the average price now sitting at $857,700 after dropping by 10.7 per cent," highlighted Casey Wilde.

Supply and demand shows signs of narrowing

Interest in properties on the market rose year on year, showing a 7 per cent increase in February compared to the same time last year. This demand has spiked in regional areas such as Gisborne (26%), Northland (20%) and the Hawkes Bay (19%).

The nation’s housing supply has also gone up by eight per cent year on year, helping to balance out the demand for properties on the market. Northland recorded the biggest jump in the amount of properties available compared to March 2023.

“With supply and demand almost at an even point - it’s a really good time for those who are thinking of buying to start seriously looking at securing a property. We know from our recent survey that 27.6 per cent of respondents intend on purchasing a property this year, so it’s better to act sooner rather than later before the market becomes flooded with buyers,” said Wylde.

STATE OF THE NATION 2024

Inside the hearts and minds of Kiwi buyers and sellers, and the future of property in NZ.

FOREWORD: INSIGHTS TO GUIDE YOU IN THE YEAR AHEAD

Hello and welcome to Trade Me Property’s Annual State of the Nation.

Over the last few years, in a post-Covid landscape, the nation has seen some big shifts.

In 2024, it’s great to see that, despite intense pressure from the rising cost of living, Kiwi are feeling so much more confident in the property market.

In January last year only 14.9% of people we surveyed thought that housing prices would increase in the next 12 months. Today that number is 64.8%.

People are willing to compromise in order to buy

Trade Me Property’s Head of Classifieds Alan Clark reviews this year’s key findings

Buyers are eager to purchase houses - and they are willing to compromise on the property’s size and quality in order to secure a home.

A huge 89.1% of respondents were flexible in multiple aspects including size and condition.

Trust

is

what will set up sellers and agents for success

After a tumultuous year in the property market, and with families feeling the squeeze of the cost of living, trust is the key driver when a seller is choosing an agent. Our surveyants told us that information and insights often play a key role in driving their confidence and trust.

Bridging the gap

As agents know all too well, whether someone is a well-versed veteran or fresh to the scene, the property market can feel like a minefield. Trends can change quickly in a region, and it takes a while for the public to identify trends.

From our Trade Me search data, we can see that property search prices tend to follow property prices in terms of trends. However, they lag behind them by a month or two - this lapse is representative of the time it takes for people to hear about and respond to changes in the market. This is just one example of many that show the importance of having and sharing relevant data and one thing is clear:

Property

agents and their insights are

KEY FOR HELPING BRIDGE THIS GAP.

The nation has a renewed confidence in the real estate industry, and we want to help you make the most of that.

State of the Nation Report 2024 2

CONTENTS

*State of the Nation survey methodology: This survey was conducted during January 2024 and collates answers from 2,557 individual New Zealand-based respondents. Respondents were a sample of Trade Me members who had been active on either Trade Me Property, Trade Me Motors, or Trade Me Jobs in the previous 12 months. CLICK HERE TO VIEW FULL REPORT

TNBPropetyServicesLimited(LicencedREAA2008)

TOWN&COUNTRY FINANCE & LENDING

Whenyouknow,youknow.™ APRIL2024

Input to your Strategy for Adapting to Challenges

Feel free topass on to friendsand clients wantingindependenteconomic commentary

ISSN: 2703-2825 www.tonyalexander.nz

4 April 2024

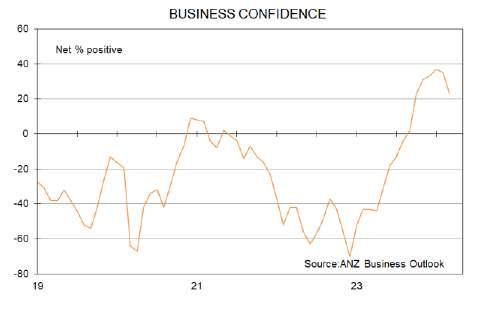

Weak indicators relevant to monetary policy

The case for a quick series of interest rate cuts to occur and to commence before the end of this year was strengthened right at the end of last week with a couple of data releases.

First, we had the ANZ Roy Morgan Consumer Confidence Index. The average reading for this measure over the past decade has been 112 and just before the pandemic started early in 2020 the index stood just above 122. It weakened to 85 briefly then soared to 114 as we went on a spending binge fuelled by excessively loose monetary and fiscal policies and inability to travel offshore.

The measure then fell to a record low of 74 at the very end of 2022 as people felt the strain from the credit crunch, falling house prices, and still rising interest rates. There wasalso the November 2022 warning from the Reserve Bank (accurate as it turns out) that the economy was headed for recession. It actually was already in it when they made that comment.

Over the second half of last year as house prices edged higher the index recovered to 95 in February. But this was still a relatively depressed level which helped encourage us economists to maintain a fairly downbeat outlook for consumer spending through all of 2024.

That outlook has now got worse because with confirmation of the economy being back in recession again the index has fallen back to just 86. Consumers have a very negative outlook for the economy and the ANZ index move confirms the deterioration already revealed earlier in March by my own monthly Spending Plans measure. It fell in March to a net 24% of respondents

1

expecting to cut their spending over the next 3-6 months from -18% in February where the average reading has been -2%.

This graph shows the two measures together.

Unfortunately the fresh decline in sentiment has not been accompanied by a falling away of household inflation expectations. After rising from 3.9% to 4.5% in February they held that level in March. This tells us that no policy easing from the Reserve Bank is imminent. They need to see solidity of inflation heading to 2% and not just economic weakness.

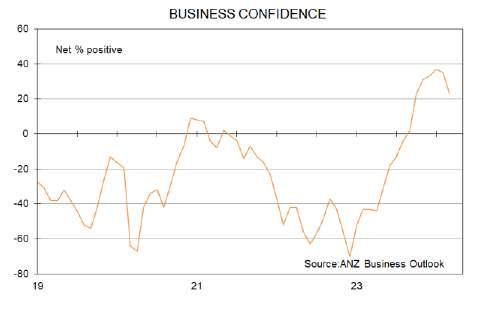

Which brings us to the second dataset released just before Easter. It also came from ANZ, and it also moved in line with what my monthly Business Survey with Mint Design had already shown. The net proportion of businesses feeling confident about the NZ economy over the coming year has retreated to a still well above zero average of 23% from 35% in February.

Page | 2

Confidence of retailers still sits unusually high at a net 30% optimistic from 32% in February where the long-term average is 2%. Given the terrible numbers coming out for retail spending over the past two years, the deterioration in consumer confidence, and announced closures of retailers, it seems reasonable to conclude that this result is politically driven.

That is, the change in government in October has been greeted so positively by many businesses that they are ignoring much of the business reality around them and expressing excess optimism. Even farmers at a net 8% positivity sit well above average which for these perennially dour people is a net 22% feeling pessimistic about the economy.

What really matters is business intentions with regard to hiring people and undertaking investment. In both cases things are weaker than average.

A net 4% of businesses say that they plan boosting payrolls in the coming 12 months. This is about where this measure has sat since August and below the 7% long-term average. Frankly it still looks a bit strong considering the layoffs occurring throughout the economy this year.

A net 4% of businesses plan raising their levels of capital expenditure in the next 12 months. This is down from 12% in February and well below the 11% average. This is bad news for productivity growth in the economy which in turn is bad news for growth in incomes and inflation.

Page | 3

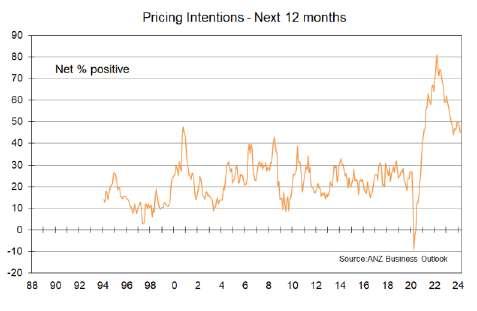

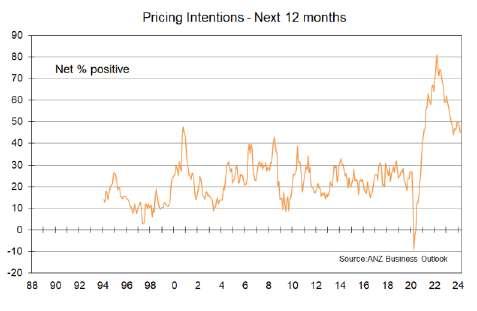

A key area of interest we all have in this monthly survey is the set of indicators relating to inflation. In this latest edition a net 45% of respondents have reported that they plan raising their selling prices over the coming year.

This is a good change but only takes this measure to the bottom of its range of movement over the past year. We cannot consider this to be a decisive shift down and neither will the Reserve Bank be jumping for joy. At 45% this measure still sits well above the 25% average achieved during the period when inflation has average just over 2% in New Zealand since 1992.

The other prices-relevant measure is year ahead inflation expectations held by businesses. There

was a decent fall this month to 3.8% from 4.03% in February. The average is 3%. Things are heading in the right direction but again the Reserve Bank will not consider this to be a signal that everything is sweet, and they can start whispering about policy easing soon.

All up, the two sets of survey results from ANZ show a poor outlook for the economy and highlight the way positive business feelings about the government have swamped perceptions of the reality businesses are really facing – especially retailers.

One more thing, a net 7% of builders have a positive outlook for their residential construction. This is up from a net 63% feeling negative a year ago. The truly depressed activity expectations of a year ago may have been overblown, but the latest positive reading which is almost equaltothe 9%long-termaveragedoesnot gel with the reality being faced by home builders – especially multi-unit developers. More liquidations loom.

In case you missed it

Nothing new this week.

Page | 4

If I were a borrower, what would I do?

Wholesale interest rates haven’t changed much this week. The chancesare next week willbe the same even though the Reserve Bank will review its5.5%official cash rateon Wednesday 10th Although thereare many signs of continuing and potentially deepening weakness in our recessionaryeconomy, wedon’t have solid measures in hand showing this weakness greatly affecting inflation.

The current inflation rate is4.7%and that is still too high for the Reserve Bank to take the riskof sendingan easingsignal. Doingso would give business pricesetters the green light to pull back fromtrimming expenses and drivingefficiencies and instead revert tosimply raisingselling prices.

The return of the cost-plus mentality made so comfortable for businesses by high inflation has to be avoided and only when our central bank is confident that businesses have altered their behaviour will they firmly signal falling interest rates.

So, as wehead into winter expect to see more pain in the economy, multi-unit property developers fallingover, retailers closing, more redundancies, and general doom and gloom like we have not seen

outside of ashock period for quite some time. For those who have been around a while andseen suchperiods before, who restrained themselves on the way up,and who have sparecapital, investingand purchasingopportunities willabound.

Expect to see more Kiwis headingoffshore yet plenty of foreigners frompoor countries continuing to flock in to populate our services sector – cafes etc. They have at least two challenges.Learning that toast means browning the bread and not just warmingit, and thatwe like our coffee strong. What’s goingto happen when the new government’sdevelopingefforts to get people off benefits leads some to seeking hospitality employment and they are placed alongside people with a work ethic magnitudes higher? I hope the Kiwis can rise to the challenge.

If I were borrowingat the moment I would take a mixof 6 and 12 month fixed rates and expect to make a similar decision in 6-12 months time.

Nothing I write here or anywhere else in this publication is intended to be personal advice. You should discuss your financing options with a professional.

This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation, or omission, whether negligent or otherwise, contained in this publication. No material in this publication was produced by AI.

Page | 5

TonyAlexander:Propertydevelopers‘are staggering’ -cashwoes raisefearsof a collapse

We’reina buyer’smarketnowandthatspellstroubleforthosebuilding multi-units.

Tony Alexander 03Apr2024

Theliftin thenumber ofhomes for saleand therecent hikes in interest rates haveput thesqueezeon developers.Photo / NZME

ANALYSIS:

Prospects forpropertydevelopers in the multi-unitsectorcontinue to look negative, with someextradeterioration potentiallyunderway. Thisis because of the now 21% rise in the numberofproperties listedforsale comparedwith the lowreached in Julylastyear. The total is the highestsince late-2015 andbuyers have plentyofchoices in mostparts ofthe country.

One wayto measure stock availabilityis to compare the latesttotal with the long-term average. Forthe countryoverall, the numberofproperties which buyers can peruse is 14% below average. ButAucklandstock levels are 15% above average while the rest ofthe countryis 25% below.

In Aucklandthe outcome ofthe UnitaryPlan has been to greatlyspur densification andbuyers have plentyofpurchasingoptions – iftheycan raise the necessaryfinance. This raisingoffinance is where things are troublesome forthe multi-unitdevelopers.

Readmore:

- How muchhas yourhome madeinthelast year?

- Whysomebank economists arescrubbing their2024 housepriceforecasts

- Young familybuys derelict Wellingtonhousewithtreegrowing throughit

Theyare sittingon landwhich mayhave been purchasedwhen house price growth was stronganddemandfornew builds was soaring. They’dlike to build units andsell them as quicklyas possible because the interestcostofholding the land is much higherthan average as aresultoftightmonetarypolicy.

In fact, the main banks have plentyofgrey-hairedpeople who have been aroundthrough manycredit cycles, andtheywould have advisedcaution in lendingto the manydevelopers who grew stronglyduringthe pandemic. This means manydevelopers have hadto relyon second-tierfinanciers to provide fundingfortheirland purchases andthese lenders typicallycharge higher interestrates than the banks.

To covertheirdebt-servicingcash outflows the developers need to sell what they’ve alreadybuilt, are part-waythrough building, orwouldlike to build. But buyers are waryfollowingstories ofcostescalations andcancelledcontracts. Theyalso have problems gettingfinance because ofhigh interestrates and the previous government’s changes to the CreditContracts andConsumerFinance Actin 2021. Plus, as notedabove, theyhave plentyofalreadybuiltproperties which theycan view andmaybe purchase.

Developers are respondingbyofferingvarious deals to tryandgetbuyers to purchase off-the-plan orbuyaunitnearcompletion. Butfigures releasedby ANZ andRoyMorgan lastweek show thatconsumersentimenthas justfallen sharply. Affectedno doubtbyconfirmation thatoureconomyhas gone back into recessionandreports oflayoffs in thepublicandprivate sectors,people are sayingthey’ve goingto puttheirwallets even furtheroutofreach.

Forretailers this means poorsales andbigcontinuation decisions forsome. For developers itmeans the clock is tickingon the time theirfinanciers will allow them to tryand generate cash to meettheirdebtservicingobligations. Or, as a bankerputit recently– “the rhino is staggering”. This means the effects ofthe cash inflow shortage are beingfeltandfallingto the groundmaybe imminent.

I have no ideawhich developers are mostatrisk. Butthe factthatfive have contactedme recentlyto enquire aboutme makingpresentations forthem, acceptingtheir advertising, andwritingmaterial forthem when none everhave before,I takeas myown anecdotal evidence thattheirproblems are deepening.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz

TOWN&COUNTRY

PROPERTIES

Whenyouknow,youknow.™ APRIL2024

TNBPropetyServicesLimited(LicencedREAA2008)

LJHooker

Town & Country

Current Listings

114 Harbourside Drive, Karaka NZ

§- b-�-

RIPE FOR DEVELOPMENTin KARAKA

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land ho...

5 Coronation Road, Papatoetoe NZ

PRIME COMMERCIAL BLOCK.

Set in the heart ofOld Papatoetoe's commercial hub, the opportunity to acquire blocks ofthis size

For Sale $4,000,000 Plus GST (ifany) View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

80 & 150 Sutton Road, Drury NZ

§2 bl �1

REVEALED - Buy OneOr Both

A Rare and UniqueOpportunity! Zoned Future Urban - BUY ONE OR BOTH

80 Sutton Road, Drury NZ

§2 bl �-

RARE OPPORTUNITY - Zoned Future Urban

80 Sutton Road

* 8.4731 ha (more or less)

*8 Bay Milking Shed -130sqm approx

150 Sutton Road, Drury NZ

§2 bl �-

A rareopportunity- Zoned Future Urban

150 Sutton Road

* 11.9382ha (more or less)

*2 Bedroom Cottage - 124sqm approx

2/11 Beach Road, Pahurehure NZ

§3 bl �1

More Than meets the eye

Nestledin the heart ofconvenience,this 193m2 residenceis more than just a house, its anembodime...

For Sale Price onApplication View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale Price onApplication View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $3,400,000 (plus GST ifany) View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $4,800,000 (plus GST ifany) View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale Fixed Price $799,000 View ByAppointment

VenitaAttrill 021 286 7792 venita.attrill@ljhooker.co.nz

09 294 7500 https://drury.ljhooker.co.nz/

29th, Apr2024

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

Town & Country

Current Listings

Lotsto

ORDEVELOP

and

Auction InRooms: 1/233GreatSouthRoad,Drury Wednesday15thMay6.30pm (Unlesssoldprior) 3 1 2 17FairdaleAvenue

RENOVATE

-

do;

lotsonoffer -635m2mixed-housingsuburbanzoned -3doublebedrooms;openplanliving -Doublegarageplusutilityroom -Massivepotentialforrealrewards

All information contained herein is gathered from sources we consider to be reliable. However, we cannot guarantee or give any warranty about the information provided. Interested parties must solely rely on their own enquiries. TNB Property Services Ltd Licenced REAA(2008) SteveReilly 021930352 View Sat/SunOpenHomesorByAppointment BrentWorthington 0292965362 ClickherefortheLinktotheproperty

-Clearinstructions–SELL

Brandnewandpricedtosell

Introducingabrand-new4-bedroomhaventhat seamlesslycombinesstyle,functionality,andcomfort. Thismodernresidence,adornedwithalowmaintenancebrickandtileexterior,invitesyouto experiencecontemporarylivingatitsfinest.

Agorgeouskitchenfeaturingamplebenchspace, perfectforcreatingculinarydelightsandhosting gatherings.

thispropertyoffersaharmoniousblendofeasycare livingandaccessibilitysodon'tmisstheopportunityto makethisyournewhome.

ForSale Pricedat $999,000 View ByAppointmentor OpenHomeasadvertised 4 2 2 20BReidlyPlace Pukekohe

TNBPropertyServicesLtdLicencedREAA(2008)

0212867792 ClickherefortheLinktotheproperty

VenitaAttrill

MoreThanMeetsTheEye

This193m2residenceembodieseasycareliving near thetowncenter,trainstationanddesiredschool.

Theheartofthehomeisthekitcheninvitingcreativity andconnection.threewellappointedbedrooms offeringtheperfectbalanceofspace,comfortand privacy.

Internalgaragingtakesthehassleoutofdailylife, providingsecureshelterandseamlesstransitionfrom theoutsideworldtoyourhome,nomattertheweather.

Yourdreamhomeiswaiting,sostartyourjourney,call metodayformoreinformation.

ForSale Pricedat $799,000 View ByAppointmentor OpenHomeasadvertised 3 1 1 2/11BeachRoad Papakura

TNBPropertyServicesLtdLicencedREAA(2008) VenitaAttrill 0212867792 ClickherefortheLinktotheproperty

Please contact Brent directly for more information andfor a copy of the Comprehensive Property Reportor click here to view on website.

•8.4731 ha (more or less)

•8 Bay Milking shed -130sqm (Approx)

•Chicken shed – 200 sqm (Approx)

•Haybarn - Machinery storage

2nd Chicken Shed – 680sqm (Approx)

•Water Bore

Also available is the neighbouring property at 150 Sutton Road.

(2008)

brent.worthington@ljhooker.co.nz

Drury

NOW

View

Contact

PRICED!!

By Appointment only

Town & Country

150SuttonRoad

Drury

PRIMEDEVELOPMENT

Zoned Future Urban!

NOWPRICED!1 View By Appointment only Contact 3 1 1 brent.worthington@ljhooker.co.nz (2008) •11.9382 ha

or less) •2 Bedroom Cottage- 124sqm

•Single Garage

Shed - 36sqm

available is the neighbouring property at 80 Sutton Road.

(more

(Approx)

&

(Approx) Also

Town & Country

for more information

copy of the Comprehensive Property Report

here to go to website.

Please contact Brent directly

andfor a

or click

*Increasingly more difficult to find blocks of this size and zoning around in the heart of Papatoetoe

*Site is held in two Records of Title located adjacent to the corner of Coronation and Shirley Roads..

*Under the Auckland Council Auckland Unitary Plan (AUP)statesthat:

"The zone provides for a wide range of activities including commercial, leisure, residential, tourist, cultural, community and civic services, providing a focus for commercial activities and growth."

*Land 3662m² (m.o.)

*The six existing tenants currently return $138,581.00 per annum plus GST and outgoings.

(2008)

View Contact Please contact Brent directly for more information and for a copy of the Comprehensive Property Report or click here to view on website.

5CoronationRoad PAPATOETOE PRIMECOMMERCIALBLOCK.

KARAKA

RIPE FOR DEVELOPMENT in KARAKA

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land holding of this size and zoning is unlikely.

Currently consented for a 7 Lot residential subdivision, the property is also subject to Auckland Council's Plan Change 78Intensification proposed 18/08/2022. Possibly greater development opportunities!

TNB Property Services Ltd Licensed REAA(2008)

114HarboursideDrive

NNOW PRICED AT $4,000,000 + GST (if any) Contact Brent Worthington 0292 965 362 Click here to view on website

LJHooker

Town&Country

A Sample of Various Town Houses & Apartments.

For more options contact Brent on 0292 296 5362

8/10 Fathom Place, Te Atatu Peninsula NZ

§1 bl �-

SMART TOWNHOUSE - Stunning complex

Located on Fathom Place in TeAtatu Peninsula, this Townhouse is in an area spoilt for choice of Res...

29th, Apr2024

For Sale $635,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

216 Rosebank Road, Avondale South NZ

§1 bl �-

TOWNHOUSES - Modern & Affordable

Located on Rosebank Road, these Townhouses are within walking distance to Eastdale Reserve, Rosebank...

C 26-51/49 Te Kanawa Crescent, Henderson NZ §2 bl �-

ATTRACTIVE ELEGANT TOWNHOUSE

This Townhouse is one of 28 homes in a complex or two or three storey brand new quality, crafted, s...

For Sale $675,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Unit C/23Awaroa Road, Sunnyvale NZ §2 bl �1

Stunning Functional Townhouse

Perfectly positioned for access to trains, buses and motorway connections this Townhouse, at an affo...

For Sale $815,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $740,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Unit 1/200 Carrington Road, Mount Albert NZ §3 b2 �-

ultra Modern Living in MountAlbert

In the Premium suburb of Mount Albert this development features two and three bedroom townhouses.

Unit 7/200 Carrington Road, Mt Albert NZ §2 b2 �1

Welcome to Convenient Living

In the Premium suburb of Mount Albert this development features two and three bedroom townhouses.

For Sale $1,050,000 View ByAppointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $1,290,000 View ByAppointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Avondale,

• • r:f: l · tlf1 1 ,., s ,p, . f. I •1• ' I ., l II ...L..-: -. �--\' ' ,. :,ii ' �-"'-09 294 7500 ' https://drury.ljhooker.co.nz/

216 Rosebank Road

Auckland

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

LJHooker

Town & Country

A Sample of Various Town Houses & Apartments. For more options contact Brent on 0292 296 5362

Unit D/200 Carrington Road, Mt Albert NZ

§2 b2 �-

Modern Living in Premium Suburb In the Premium suburb of MountAlbert this development features two and three bedroom townhouses.

For Sale $945,000 View ByAppointment

29th, Apr2024 Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

09 294 7500 https://drury.ljhooker.co.nz/

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

TOWNHOUSES

- Modern & Affordable 1 1

Located on Rosebank Road, these Townhouses are within walking distance to Eastdale Reserve, Rosebank School, Avondale College, and the famous Avondale Sunday Market.

In terms of transport, there is a bus stop just outside or it is a short drive to access the Motorway

•On the Ground Floor, the kitchen, dining, and living areas are open plan.

•There is a Washer/Dryer Combination conveniently located within the kitchen.

•Upstairs on the first floor is a full size bedroom, which includes a wardrobe and high storage space

•Also on this floor is a full size bathroom

•Outside is a low maintenance private courtyard, which includes a power supply. For units A, D-M, a clothesline is included

These move-in-ready homes feature top-of-the-line appliances, catering to both first-time homebuyers and savvy investors looking for a hassle-free experience. Imagine the convenience of having all your appliances seamlessly integrated, allowing you to focus on what truly matters

Constructed with superior materials, these homes are built to last and impress. The commitment to quality extends beyond aesthetics, as these residences are designed to be low-maintenance, giving you more time to live, work, and play in this dynamic city.

For full details please contact Brent Worthington on 0292 965 362

Brent Worthington Mob: 0292 965 362 E: brent.worthington@ljhooker.co.nz LJ Hooker Town & Country TNB Property Services Ltd Licenced REAA 2008

Welcome to 216 Rosebank Road

Wecometo anexc· ·ngnewdevelopment·n Auckland -aworld-classer lh tcontinues othrive ncl beckon residents hitsvrbrant lifestyle.

IIIiamsCorporation proudlypresents13 b nci-new 1-bedroom homes,thoughtfullydesigned toembody modernlivingwhileremainingaffordable

e5e move-in-readyhomei.featuretop-o- e-line appli'lnces,carennglOboth ,rst-trme homebuyers anL wyinvestorsloo ing forah ssle-free e;iperience. Im ginetheconvenienceofh ·ngan yourappliancesse mlesslyintegrated,allowingyou tofocuson whattrulymatters.

Constructedwith superiormaterial5,ourhomesare bui tolast and impress. hecommitmenttoquality e ends beyond es e ics,astheseresidencesare des· nedto below-maintenance, glv,ngyou more metolive,work,andp yinthisdynamiccity. 216 Rosebank Road consist o

216 Rosebank Road

thistownhouse can offeryou.

On theGround Floor,the I<" chen,dining, and livin areasareopen plan.There is aWasher/Dryer co 1bination convenientlylocated wi inthe kite en.

Upstairsonthefirstfloorisa fullsizebedroom, whichincludesawardrobeand high storage space Alsoonthisfloor is fullsize bathroom

Outsideis alow maintenance privatecourtyard, whichincludesapovversupply. ForunitsA, D-M a clo esllne Is included

E) 2

1 1 0

Bedrooms Bathrooms Carpark 0 Internal 57-586m2 Site 61-l07m2 Garage 0

What

GAOV�OFLOOlt

LJHooker

Town & Country

91 Beatty Road, Pukekohe NZ

§8 b7 �

uNuM1TED POTENTIAL

On the market for the first time in 43 years. The 630m2 dwelling is set on a 2,379m2 site (more or I...

SOLD PROPERTIES

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

35 Briody Terrace, Stonefields NZ

§4 bl �4

STAND ALONE IN STONEFIELDS

Set on a 372m2 site (more or less) this 243m2 Fletcher designed and built dwelling will definitely i...

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

102Mountain Road,Mangere Bridge NZ

§2 bl �1

LOCATION - LOCATION - LOCATION CONJUNCTIONALS ARE WELCOME.

On the market for the first time ever, this offering is p...

3 Paparata Road, Bombay NZ §4 b2 �8

MOTIVATED VENDOR MOVING SOUTH

*4 Double bedrooms.

* Master with ensuite.

* Impeccably cared for and presented. < ...

151 Barrack Road,Mount Wellington NZ §4 bl �6

UNIQUE INVESTMENT with HUGE POTENTIAL

Located in the geographical centre of metropolitan Auckland, this property is all about potential. D...

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Sold Price onApplication Lina Roban 021 022 88521 lina.rob@ljhooker.co.nz

09 294 7500 https://drury.ljhooker.co.nz/

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

OUR PEOPLE TNBPropetyServicesLimited(LicencedREAA2008) Whenyouknow,youknow.™ APRIL2024

TOWN&COUNTRY

Town&Country

VENITAATTRILL

VenitaAttrill SalesConsultant

0212867792

venita.attrill@ljhooker.co.nz

MeetVenita-YourTrustedRealEstateExpertSince1996!

With an impressive career spanning over two decades, Venita began her journey in Real Estate sales in 1996 with the esteemed LJ Hooker/Harveys Group. Throughout her tenure, Venita has been recognized with numerous national awards, a testament to her unwavering dedication to her clients. In fact, approximately 90% of Venita's sales are derived from her past clients and client referrals, showcasing the exceptional level of trustandsatisfactionsheconsistentlydelivers.

Selecting the right agent is crucial, and there is no better way to make that decision than by evaluating their success and the manner in which they achieve it. Venita's vast clientele, who repeatedly seek her services, skill, and advice, stand as a true testamenttoherabilitytoexceedexpectations.

While Venita boasts extensive experience and a track record of success, she remains driven and committed to going above and beyond to achieve a premium outcome for every client. Her dedication to continuous improvement ensures that she remainsat theforefrontoftheindustry,offeringyouunparalleledserviceandexpertise.

When you choose Venita as your agent, you can rest assured that you have a trusted partner by your side, who will tirelessly work to secure the best possible results for you. With Venita, your real estate journey is in safe hands, backed by a legacy of excellenceandarelentlesspursuitofsuccess.

Contact Venita today and experience firsthand the difference a seasoned and determinedprofessionalcanmakeinyourrealestateendeavours.

Whenyouknow,youknow. ™ TNBPropertyServicesLimited,LicensedREAA(2008)

LINAROBAN

LinaRoban LicenseeSalesperson

02102288521

lina.roban@ljhooker.co.nz

Prior to entering the world of real estate, driven by her love of meeting and helping people, Lina had an impressive 20 year career in sales and marketing roles in the telecommunications and corporate marketing industries where her expertise in communication and negotiation always resulted in the delivery of superior customer service to her clients.

Originally from Fiji, Lina epitomises energy, passion integrity and hard work in everything she turns her hand to.

When not delivering superior service to her clients, Lina loves spending time with her family and is a passionate cyclist, owning both road and mountain bikes. With her three children all having "flown the coop", Lina and her husband also have plenty of time to enjoy their love of travel and some of their more memorable adventures include extensive journeys throughout South East Asia, the USA and the South Pacific.

TNB Property Services Limited, Licensed REAA (2008 drury@ljhooker.co.nz https: //drury.ljhooker.co.nz) When you know, you know. ™

BRENTWORTHINGTON

There’s not much Brent doesn’t know when it comes to selling real estate. This town and country agent has had a successful career in the property market and is now the proud owner of his own business. Definitely a quality over quantity man, when you bring Brent on board, you’ll find that accumulating listings is far less important to him than making each one as good as it can get. He prides himself on telling it like it isknowing you’ll be able to make better decisions with a person and information you can trust.

Complementing Brent’s practical and credible approach is a background full to the brim of industry knowledge and business expertise from 30 years working within the construction industry. His capabilities have been well proven as a highly successful business owner.

A family man, with a proven track record of success, Brent has earned an excellent reputation and the trust of his local community and business colleagues.

He places huge emphasis on customer satisfaction, attention to detail and conducting his business with a genuine duty of care. Brent has gained many awards as a business leader during his 12-year tenure in Real Estate.

His entrepreneurial style ensures he reaches out and connects people with like minds. He imparts his wisdom in a warm and friendly manner and helps people to make wise and right decisions before investing in the property market, Auckland wide.

If you are considering a lifestyle change, investing for your future or simply wanting to know the worth of your property in this fluctuating market, feel welcome to call or email Brent to receive the latest updates on the trends and statistics in your area.

Worthington LicensedAgent&Principal 0292965362

Brent

Brent.worthington@ljhooker.co.nz

Whenyouknow,youknow. ™ TNB Property Services Limited, Licensed REAA (2008)

DEBBIEHARRISON

Debbie Harrison PropertyManager

021302864

debbie.harrison@ljhooker.co.nz

With a passion and a commitment to providing exceptional service, Debbie has a fantastic attitude of getting things done and ensuring that the clients are happy and well cared for. She takes great pride in her work and goes above and beyond to ensure the satisfaction of both property owners and tenants.

Debbie’s attention to detail and organizational abilities are exceptional, enabling her to efficiently handle all aspects of property management, from tenancy agreements, rent collection to property inspections and maintenance coordination.

Debbie understands that property management requires a compassionate and empathetic approach, and she always strives to create a positive and harmonious living environment for tenants while protecting the interests of property owners.

Whether you are a property owner seeking professional management services or a tenant searching for a well-maintained rental property, Debbie is committed to delivering exceptional results and ensuring a smooth and rewarding experience for all parties involved.

With her excellent communication skills, strong work ethic and dedication to excellence, Debbie Harrison is a true asset to LJ Hooker, Drury.

Whenyouknow,youknow. ™ TNB Property Services Limited, Licensed REAA (2008)

JohnnyBright

AUCTIONEER