The Property Chronicle

LJHookerNewsletterandBlogs

LetterFromPrincipal(BrentWorthington)-Update

SellingahomewithaMortgage-Whatyouneedtoknow. WinaTritonPromotion

ChangingFamilyHomeinNewZealand

WelcometoRentExchange

PropertyManagement NewsLetterMay25

5BenefitsofUsingaQualifiedTradespersonforYourRentalProperty

DebbieHarrisonProfile

Surveys&Commentaries

RespiteforKiwisaspropertypricesremainstable

5Thingsyouneedtoknowaboutthehousingmarketthisweek Finance TonyAlexander-Tony’sview Retailingoutlookstillpoor

Hi

May 2025

Whilethemarketisstillsittingaround16%belowitsJanuary2022peak,thesustainedgrowthpointsto renewedbuyerconfidenceandfirmermarketconditions.We’renotseeingadramaticrebound,butamore stable,confidence-ledrecovery.Aftertheturbulenceofthepastcoupleofyears,theseincrementalgains areawelcomesignforbothbuyersandsellers We’realsostartingtoseethebenefitsoflowermortgage ratesripplethroughthemarketgivingmorebuyerstheability—andcrucially,theconfidence tomaketheir move

InAuckland,thebulkoflocalmarketspostedmodestgainsinApril.NorthShore,Rodney,Waitakere, AucklandCity,andFranklinallrecordedliftsof+0.3%to+0.4%,whileManukauheldsteadyandPapakura dippedslightly(-0.1%).

LookingatthebroadertrendsinceJanuary,keypartsofAucklandhavemadeaclearrecovery.“North Shore,FranklinandAucklandCityareallupbyatleast1%overthepastthreemonths That’sadecent turnaround,especiallyinacityasdiverseasAuckland,wheretherecoverycanbepatchyfromsuburbto suburb.

TheCotalityindexalsotracksperformancebypropertytypeandrecentdatasuggeststherecoveryis spreadingacrossmoresegments SinceJanuarystandalonehouseshaveincreasedby+1.0%, flats/townhousesareup+0.9%andlifestylepropertieshaveliftedslightlyby+0.2%.Thisbroaderbaseof recoveryisakeymarkerofmarkethealth Whenyoustartseeingallmajorpropertytypesinchingupwards, itsuggeststhisisn’tjustashort-livedbounce it’samarketbeginningtofinditsfeetagain

Lookingahead,theforecastremainscautiouslyoptimisticwithCotality’sChiefEconomistKelvinDavidson suggestingnationalvaluesareontracktorisebyaround5%across2025.asentimentDunoonsupports It’ s amodestoutlookbyhistoricalstandards,butitreflectsthemoredisciplinedlendingenvironmentwe’rein now DebttoIncome(DTI)restrictionsandtighterserviceabilitytestsareinfluencingwhatbuyerscan borrow andthathelpskeeppricesincheck

Themoderatepaceofgrowthpresentsanopportunityforbothfirsthomebuyersandlong-terminvestors whereaslower,steadiermarketisactuallyagoodthing Itgivesthembreathingroomtosave,planandact strategically.

Ifyou 'relookingtosell,giveusacalltogetafreepropertyappraisaltofindouthowmuchyourpropertyis worth Yourfreeappraisalwillcontainadetailedbreakdownwithanupdateonmarketconditions,howyour propertycomparestosimilarpropertiesbasedonlocalsalesandlistingsandmuchmore

Asalwayswehopeyouenjoythispublication.

Kindregards

Brent

BrentWorthington PrincipalandLicenseeAgent

0292965362

brent.worthington@ljhooker.co.nz

LJHookerTown&Country RentExchangePropertyManagement 1/233GreatSouthRoad,Drury

Selling a House with a Mortgage: What You Need to Know

Selling your home while you still have a mortgage? It’s more common than you might think. Many Kiwi homeowners make the move before their home loan is fully repaid. While it’s entirely possible to sell with a mortgage, there are a few steps you’ll need to follow to ensure a smooth process. Whether you’re upsizing, relocating, or making a lifestyle change, here’s how to manage the sale of a mortgaged home.

Can you sell a property if you still have a home loan?

Yes — in fact, most people do. Having a mortgage on your home doesn’t prevent you from selling it. However, your lender will need to be paid the outstanding balance from the proceeds of the sale before the transaction can be finalised. It’s essential to understand how your loan works and what it means for the sale. The earlier you speak to your bank or lender, the more time you’ll have to plan accordingly. What happens to the mortgage when you sell? Your lender holds a legal interest in the property — known as a registered mortgage. When you sell, they must be repaid in full before the title can be transferred to the buyer.

Here’s how it usually works:

1. Notify your lender as soon as you decide to sell. This allows them to prepare for the discharge of the mortgage.

2. Complete a discharge of mortgage form, available from your bank's website or in branch.

3. Allow up to three weeks for the discharge to be processed.

4. Your lawyer or conveyancer will ensure that, on settlement day, the outstanding loan balance is paid directly from the sale proceeds.

5. Once the mortgage is repaid, your lender will remove their interest from the property via Land Information New Zealand (LINZ). Discharge fees vary by lender but are usually in the range of $150 to $400. Five key steps to selling with a mortgage

1. Review your loan terms and conditions

Before you put your property on the market, check in with your bank or mortgage broker to understand your current loan situation. Some important questions to ask include:

• • How much do I still owe? (Your current loan balance) Are there break fees? (Applies to fixed-term loans. In NZ, early repayment charges can apply if you repay a fixed-rate mortgage before the term ends.) Can I transfer my loan to another property? (Known as loan portability – some lenders allow you to move your existing loan to a new property, saving on fees.)

• Understanding this will help you determine what you need to sell for and how much equity you’re working with.

2. Know your home equity

Your equity is the difference between your home’s current market value and your outstanding mortgage. If your home is worth more than your mortgage, you’ll likely have a surplus you can use for your next purchase or other expenses. Example: If your home is appraised at $850,000 and your remaining loan is $600,000, your equity is $250,000 (excluding selling costs). However, if your property sells for less than what you owe, you may need to cover the shortfall. This is known as negative equity, and while rare in New Zealand's housing market, it can occur, especially in slower markets or after borrowing heavily.

3. Organise a property appraisal

Getting a clear understanding of your home’s market value is a crucial first step — and it’s something your local LJ Hooker office can help with.

An appraisal will give you a realistic idea of what your home might sell for, based on recent comparable sales and market conditions in your suburb or region

Our agents across New Zealand are local experts and can guide you through pricing, timing, and preparing your property for sale.

4. Prepare and list your property

Once you’ve got your finances lined up and your appraisal completed, it’s time to list your home. You’ll work with your LJ Hooker agent to:

•

•

• Decide on the sales method (auction, tender, or private treaty)

Set a timeline for marketing and open homes

Launch your marketing campaign – which may include Trade Me, realestate.co.nz and OneRoof listings, professional photography, social media, signage, and print advertising

Your agent will also help you navigate any negotiations and ensure buyers are well-informed throughout the process.

5. Accept an offer and settle the sale

Once you’ve accepted an offer, your solicitor and your lender will work together to discharge the mortgage and finalise the sale.

Make sure the settlement date aligns with your loan discharge timeline. On the day, the mortgage will be repaid from the buyer’s funds, and any remaining profit will be transferred to you.

What if your sale price doesn’t cover the mortgage?

If your home sells for less than your remaining mortgage balance, you’ll need to make up the difference — usually from your own funds. For example, if you owe $700,000 but your home sells for $680,000, you must pay the $20,000 shortfall before the transaction can complete. In extreme cases where repayment isn’t possible, lenders may pursue recovery through mortgage insurance or legal proceedings, so it’s crucial to seek financial advice early if you’re in this position. Don’t forget the additional costs

When selling with a mortgage, keep these other costs in mind:

• • • Legal fees: Typically range between $1,000 and $2,000.

Agent commission: May be a fixed fee or a percentage-based commission. LJ Hooker agents will explain your options clearly before signing.

Marketing costs: Vary depending on your location and property type but may include professional photography, online ads, drone footage, brochures, and more.

Budgeting for these expenses helps avoid surprises down the track.

Selling with confidence

While it may seem complex, selling a property with a mortgage is a straightforward process with the right guidance. LJ Hooker’s local teams are here to support you at every step — from property appraisal to settlement day.

If you’re ready to take the next step or have questions about how your home loan will affect your sale, get in touch with your local LJ Hooker office. We’ll help you understand your options and guide you through a smooth and successful sale.

Thedifferencebetween choosinganagentandchoosing onewhocouldhandyouthe keystoanextgenTriton.

ChangingFamilyHomeinNewZealand

YoungerKiwisvalueformallivinganddiningspacesmorethan oldergenerations,with70%ofGenZconsideringthemrelevant comparedto43%ofBabyBoomers.

Aquiet,peacefulatmosphereisthemostimportantfactorin choosingacommunity,with43%ofrespondentsprioritising tranquillityoverproximitytoamenitiesandschools.

These

WelcometoRentExchange

YourProfessionalPropertyManagementPartner

At Rent Exchange, we provide comprehensive property management services tailored to your needs Beyond our full-service professional management, we offer a variety of additional services to ensure all your property requirements are met:

Flexible Pay-As-You-Go Options

Inspections Only

Commercial Leasing / Management

Air BnB Casual / Short Stay Letting

Consider Rent Exchange as your on-demand property management consultants. Here to help you manage all aspects of your portfolio!

BrentWorthington

Principal/Licensee Agent

0292 965 362

brent worthington@ljhooker co nz

DebbieHarrison

Property Management 021 303 864

debbie harrison@ljhooker co nz

May Newsletter 2025

5BenefitsofUsinga QualifiedTradespersonfor YourRentalProperty

WhileDIYcanbesatisfyingandseemcost-effective, whenitcomestoyourinvestmentproperty,callingina qualifiedprofessionalisalmostalwaysthebetteroption. Whetherit’saminorrepairoramajorjob,usinga trustedtradiecansaveyoumoney,timeandstress— andhelpkeepyourtenantshappytoo.

Herearefivekeybenefitsofusingaqualified tradesperson:

Somejobssimplyaren’tsafetodoyourself.Electrical, plumbing,andstructuralworkallcomewithseriousrisks ifnothandledproperly—andinmanycases,it’sillegalto dothisworkunlessyou’relicensed.Qualified tradespeoplearetrainedtomeetNewZealand’s buildingcodesandhealthandsafetyrequirements, ensuringyourrentalremainssafeandcompliant.This notonlyprotectsyourtenantsbutalsosafeguardsyou fromlegalliabilityandpotentialinsuranceissuesdown thetrack.

Whenaprofessionalhandlesthejob,youcantrustthat it’sdonetoahighstandard.Fromneatfinishestolonglastingresults,qualifiedtradespeoplebringexperience, skill,andattentiontodetail.Theirworkcanenhancethe appealandvalueofyourproperty,andhelpprevent recurringissuescausedbyquickfixesorsubstandard repairs.They’realsomorelikelytospotunderlying problemsearly—avoidingbiggerheadacheslateron.

Itmightseemlikeagoodideatosaveafewdollarswith DIYorthecheapestoption,butitcanquicklybecome costlyifsomethinggoeswrong.Poorworkmanshipcan resultindamagethat’smoreexpensivetofix,oreven putyourtenantsatrisk.Aqualifiedtradiemaycost moreupfront,butthey’lldothejobrightthefirsttime —helpingyouavoidrepeatcallouts,lostrentfrom extendeddowntime,orcostlyrepairsduetoshortcuts.

Arentalthat’swelllookedafterhelpsbuildtrust betweenlandlordandtenant.Whenrepairsare handledpromptlyandprofessionally,tenantsfeel respectedandmorecomfortableintheirhome.This canleadtofewercomplaints,bettercommunication, andlongertenancies—whichreducesvacancyperiods andkeepsyourinvestmentworkingforyou.Tenants arealsomorelikelytotakecareofapropertythat’s clearlycaredforbythelandlord.

Qualifiedtradespeopletypicallyprovidedetailed documentationoftheworkcarriedout,including itemisedinvoicesandjobreports.Thisisimportantfor keepingarecordofmaintenance,makinginsurance claims,ormeetingyourHealthyHomescompliance obligations.Ifanythinggoeswrong,you’llhaveaclear papertrail—andmostprofessionalswillreturnto resolveanyissuesaspartoftheirserviceguarantee, givingyouextrapeaceofmind.

Needareliabletradie?TalktoyourlocalLJHooker propertymanager–they’vegotthecontactsand experiencetogetthejobdoneright.

AGuidetoChoosingthe RightLandlordInsurance

Eventhemostreliabletenantscanaccidentally damageyourrentalproperty,whichcouldimpactyour income.Andthentherearerisksoutsideanyone’s control–thinkflooding,earthquakesorstrongwinds. Whilelandlordinsuranceisn’tlegallyrequiredinNew Zealand,manypropertyownersconsideritessential.It cancovernotjustthehomeitself,butalsolossofrent, legalcosts,anddamagefromunexpectedevents.

Choosingtherightpolicyisasmartmovethatcanhelp protectyourinvestmentlong-term.It’simportantto understandwhatyou’recoveredforandtoreviewyour policyregularlytomakesureitstillfitsyourneeds. Herearethekeyfactorstokeepinmindwhen selectinglandlordinsurance.

UnderstandYourNeeds

Startbyconsideringthetypeofpropertyyouown–whetherit’sanapartment,townhouse,orstandalone home–andwhereit’slocated.Forinstance, propertiesinflood-proneareasornearthecoastmay needdifferentcoverthananinner-cityapartment. Thinkaboutyourfinancialsituationandwhatlevelof protectionyou’dneedifsomethingwentwrong.

ComprehensiveCoverage

Lookforapolicythatoffersbroadcoverage.Thismay include:

Accidentalormaliciousdamagecausedbytenants

Lossofrentalincome

Legalliabilityifsomeoneisinjuredonyour property

Legalexpenses,suchascostsrelatedtotenancy disputes

Acomprehensivepolicygivesyoumorepeaceofmind iftheunexpectedhappens.

ConsiderthePropertyType

Furnishedrentalsmayneedcontentscoverforthings likefurniture,appliancesandwhiteware.Ifyourentout amulti-unitproperty,makesureyourpolicyaccounts fortheextrarisksthatcomewithhousingmultiple tenants.

LossofRentalIncome

Naturaldisasterslikefloods,storms,andearthquakes arearealityinmanypartsofNewZealand.Ifyour propertybecomesuninhabitable,lossofincomecover canhelpreplaceyourrentwhilerepairsarebeing carriedout.

LiabilityProtection

Thiscoversyouifatenantorvisitorisinjuredonyour propertyandholdsyouresponsible.Liability protectionisanimportantsafeguardagainstpotential legalandfinancialconsequences.

LegalExpensesCover

Disputeswithtenantsorsituationswhereyouneedto takelegalaction–suchaspursuingunpaidrentor handlinganeviction–canbecostly.Somepolicies coverlegalexpenses,whichcanbeabighelpifissues arise.

ChecktheExclusions

Alwaysreadthefineprinttounderstandwhat’snot included.Manypoliciesexcludegeneralwearand tear,gradualdamage(likeleaksovertime),or deliberatedamagebytenants.Somemayalsolimit coverforspecificnaturaldisastersunlessyoupay extra.

UnderstandtheExcess(Deductibles)

Theexcessistheamountyou’llneedtopayifyou makeaclaim.Choosingahigherexcesscanlower yourpremiums,butitalsomeansmoreout-ofpocketcostsifyouneedtoclaim.Weighupthe trade-offtofindwhatworksbestforyourbudgetand riskcomfort.

CompareProviders

Shoparoundbeforecommitting.Getquotesfrom differentinsurers,comparewhat’scovered,and checktheirreputation–especiallyhowtheyhandle claims.Onlinereviewsortalkingtootherproperty ownerscanhelp.

SeekExpertAdvice

Ifyou’reunsurewhatpolicyisrightforyou,talktoan insurancebrokerorfinancialadvisor.Theycanhelp younavigatetheoptionsbasedonyourpropertytype andriskprofile,soyoucanmakeaconfident, informeddecision.

Choosinglandlordinsuranceisn’tjustabouttickinga box–it’saboutprotectingyourpropertyandincome againstlife’scurveballs.Withtherightcoverinplace, youcanfeelmoreconfidentthatyourinvestmentis secure,nomatterwhatcomesyourway.

Pleasedon’thesitatetocontact ourteamwhocanablyassistyou withanypropertymanagement mattersyoumayhaveorifyou haveanyquestionsabout anythinginthenewsletteror propertymanagementingeneral.

We Property Management

Meet: DebbieHarrison

Withapassionandacommitmenttoprovidingexceptionalservice, Debbiehasafantasticattitudeofgettingthingsdoneandensuring thattheclientsarehappyandwellcaredfor. Shetakesgreatpridein herworkandgoesaboveandbeyondtoensurethesatisfactionof bothpropertyownersandtenants.

Debbie’sattentiontodetailandorganizationalabilitiesare exceptional,enablinghertoefficientlyhandleallaspectsofproperty management,fromtenancyagreementsandrentcollectionto propertyinspectionsandmaintenancecoordination.

Debbieunderstandsthatpropertymanagementrequiresa compassionateandempatheticapproach,andshealwaysstrivesto createapositiveandharmoniouslivingenvironmentfortenantswhile protectingtheinterestsofpropertyowners.

Whetheryouareapropertyownerseekingprofessionalmanagement servicesoratenantsearchingforawell-maintainedrentalproperty, Debbieiscommittedtodeliveringexceptionalresultsandensuringa smoothandrewardingexperienceforallpartiesinvolved.

Withherexcellentcommunicationskills,strongworkethicand dedicationtoexcellence,DebbieHarrisonisatrueassettoLJHooker, RentExchange.

DebbieHarrison

Property Management 021 303 864

debbie.harrison@ljhooker.co.nz

Reports, Surveys& Commentaries

Autumn Chill Hits Property Market

Press Release

Published 15 May 2025

The Real Estate Institute of New Zealand (REINZ) has released figures for April, revealing a slightly slower and more subdued market as the cooler months arrive. Although sales have increased compared to April 2024, the national median price has declined. Additionally, new listings entering the market have also reported a drop.

“This April, there were many factors that influenced the property market, such as school holidays, ANZAC Day, and Easter. Some salespeople mentioned that there were fewer attendees at open homes and fewer successful auctions,” says Acting Chief Executive Rowan Dixon.

New Zealand’s median price declined by 1.1% year-on-year to $781,000. In New Zealand, excluding Auckland, the median price remained unchanged year-on-year, at $700,000. Auckland’s median price declined by 4.0% year-on-year, at $1,000,000.

Seven out of the sixteen regions reported an increase in median prices compared to April 2024. Tasman recorded the highest yearly increase of 8.4%, to $875,000 from $807,550. Southland followed with an increase of 6.6% compared to April 2024, reaching $485,000, up from $455,000.

The number of properties sold in New Zealand in April 2025 increased by 9.5% compared to April 2024, rising from 5,871 to 6,427 sales. Excluding Auckland, sales increased 11.1% year-on-year from 4,023 to 4,470. At a regional level, the highest year-on-year increase was achieved by Southland, up 28.7% from 115 to 148 sales. Other regions that experienced notable increases were Manawatu/Whanganui (+19.0%), Waikato (+17.3 %), and Gisborne (+15.9%).

“There has been a notable increase in sales across the country. However, despite this upward trend, property prices continue to decline due to a significant number of properties still available on the market. Real estate professionals report that buyers are seeking properties at lower price points, and they are willing to explore alternative options if they view prices as being excessively high,” says Dixon.

Fewer properties were listed for sale this April compared to both the previous month and the same period last year. New Zealand experienced an 11.6% decline in listings from April 2024, totalling 8,518 listings. Excluding Auckland, a 5.7% decline was reported in listings, bringing the total to 5,739. Inventory levels for New Zealand increased by 6.2% year-on-year to 35,924 properties for sale.

Nationally, there were 912 auction sales reported. Excluding Auckland, there were 424 auction sales. There was no change year-on-year for the average days to sell in New Zealand, sitting at 42 days.

Sales often decline in winter or over the holidays, so month-to-month changes may reflect seasonal behaviour rather than true market shifts. Seasonally adjusted (SA) data eliminates these seasonal effects and shows the actual trend.

"Looking at sales activity across New Zealand, the raw data shows a 17.6% drop in activity from March to April 2025," notes Dixon. "However, when seasonally adjusted, this substantial decline becomes just a 0.5% decrease. This reveals that while transaction numbers have fallen as expected for this time of year, the actual market activity remains stable when seasonal patterns are taken into account."

This month, market sentiment is largely influenced by easing interest rates and concerns about job security. As interest rates decrease, we can expect an increase in market activity. However, vendors should be aware that prices haven't yet aligned with these changes and should be ready to adapt to evolving market dynamics, Dixon advises.

The House Price Index (HPI) for New Zealand is currently at 3,621, showing a year-on-year and month-on-month decrease of 0.3%. Over the past five years, the average annual growth rate of New Zealand’s HPI has been 4.0%. Southland remains the highest-ranked region for HPI movement, taking the top place for 10 consecutive months.

(1 May 2025)

Written by Hannah Franklin

RespiteforKiwisaspropertypricesremainstable

KeyTakeaways:

Written by Hannah Franklin

Average asking prices remain stable.

Stock up, buyer choice strong, but no sales boom. Is it a buyer ’ s market or a seller’ s market? Both

KeyFigures:

National average asking price dips 1.7% year-on-year to $852,364.

Stock reaches 35,924 homes for sale across New Zealand.

New listings in April down 11.6% year-on-year to 8,518.

Published 03/03/2025

Is there ever a right time to buy or sell property? Yes – and it’s now! The latest data from realestate.co.nz shows stock levels are high, and prices are stable, giving buyers and sellers theadvantageoftime.

SarahWood,CEOofrealestate.co.nz,saysthatwhileglobaluncertaintypersists,New Zealand’spropertymarketremainsremarkablysteady,givingbuyersandsellersarare advantageinanotherwiseuncertainenvironment:

“We’reinsomethingofaholdingpenatpresent.Withglobaleconomicturmoil,UStariffs,and employmentuncertainty,NewZealandisabitstuckaswewaittoseehowthesepressuresplay out.”

“Butthere’sasilverlining:today’swell-stockedandstablepropertymarketoffersbuyersand sellerstime,choice,andflexibility.Afastmarketisstressfulforbuyersandsellers;aslower, stablemarketbringsrealpositives.Ifyouwanttohavecertaintyaroundyourbuyingandselling price,now’sagreattimetomakeyourmove.”

RespiteforKiwisaspricesremainstable

Whilethefinancialmarketsarevolatile,thenationalaverageaskingpricehasheldsteady.In April2025,thenationalaverageaskingpricedipped1.7%year-on-yearto$852,364—stillwell withinthenarrowrangeofroughly$850,000to$890,000thathasdefinedthepasttwoyears. “It’sbeenmorethantwoyearssincethenationalaverageaskingpricewasabove$900,000. Overthattime,priceshavefluctuatedbylessthan6.0%withinatight$50,000band.Wearein aperiodofrarestability,”saysWood.

"

Despitethestability,pocketsofthecountryreportedyear-on-yearaverageaskingpricegrowth duringApril.MostsignificantwereGisborne(up17%to$724,168),CentralNorthIsland(up 12.6%to$779,099),Wairarapa(up8.5%to$733,735),andHawke’sBay(up8.1%to$778,039).

“Highstocklevelsgivebuyersmorechoice

National stock was up 6.2% year-on-year in April 2025, continuing a trend of elevated listings across the country.

“There’ s plenty of stock available, but we ’ re not seeing a boom in sales activity to move it through yet,” says Wood

Sales data from the Real Estate Institute of New Zealand (REINZ) shows steady movement but not at peak historical levels Across the first quarter of 2025, residential sales increased monthon-month, from 3,774 in January, to 6,287 in February, and 7,640 in March.

Vendorscooltheirjetsastheweatherturns

hechangeinseasonsandthearrivalofshorterdayssawnewlistingsfall,down29.2% from12,029inMarchto8,518inApril.Woodsaysit’stypicaltoseeaseasonaldipinnew listingsatthistimeofyearbutnotesthatnewlistingswerealsolowercomparedtoApril 2024.

“Newlistingsweredown11.6%comparedtolastyear,butthereisstillstronginterest acrossthemarket.We’reseeingthehighestlevelofenquiriesfrombuyersinthreeyears. That’sapositivesign.”

Someofthebiggestyear-on-yearliftsinstockwereseeninGisborne(up75.0%—though actuallistingnumbersremainsmall,risingfromjust82to144properties),CentralOtago/ LakesDistrict(up28.2%),WestCoast(up28.0%),Otago(up22.4%),CentralNorthIsland (up19.6%),Canterbury(up14.5%),Marlborough(up11.0%),Wellington(up10.8%),and Coromandel(up10.3%).

So,isitabuyer’soraseller'smarket?

In today’s slower but stable market, both buyers and sellers have real opportunities

For buyers, the current climate offers time to act carefully rather than under pressure Wood encourages buyers to take full advantage of this breathing room.

“My advice? Visit 50 properties before you buy. You need to know the market, know what' s selling, and know what buyers are paying — and right now, you have the time to do exactly that,” she says

“This market also allows buyers to negotiate terms, like longer settlement periods, and complete thorough due diligence before making decisions.”

Wood adds that buyers today have access to more data than ever before: “Our insights page gives real-time suburb trends and recent sales information, which simply wasn ’t available five years ago.”

Sellers, too, can benefit from stability. Well-priced properties are still moving, and many vendors will soon become buyers themselves.

"If you accept a slightly lower sale price than your original expectations, you ’ re also better positioned to negotiate sharply when you purchase your next property. It’ s a two-sided opportunity,” says Wood

Written by Hannah Franklin

01 Mayr 2025

Thefivethingsyouneedtoknowaboutthe housingmarketthisweek.

Themediangrossprofitforhomesresoldinthefirstthreemonthsofthisyearwas$280,000.

1.First-homebuyersarehanginginthere

FollowingaslightlyquieterperiodoverJanuarytoMarch,theCotalityBuyerClassificationfiguresforAprilshoweda bounce-backbyfirst-homebuyers,withtheirshareofpropertypurchasesrisingfrom25%inQ1tonearly27%inApril. TappingintotheirKiwiSaverfundsforatleastpartofthedepositremainsakeysupportforfirst-homebuyers,asdoes accesstothelow-deposit(orhighLVR)lendingallowancesatthebanks.Justoverathirdoffirst-homebuyersare gettingafootontheladderwithadepositoflessthan20%.

Atthesametime,mortgagedmultiplepropertyowners(includinginvestors)remainonthecomebacktrailtoo,risingto 24%ofactivityinApril.That’sstillatouchbelowtheirlong-termaverageofaround25%,butneverthelessthehighest figuresincelate2021.Interestdeductibilityisnowbackto100%,whichnodoubthelpsthesumslookbetterforwould-be mortgagedinvestors.Butthebiggestfactorissurelythefallinmortgagerates,whichsignificantlyreducesthecashflow top-upsfromotherincomesourcesthataregenerallyrequiredonastandardinvestmentpurchase.

Meanwhile,movers(i.e.relocatingowner-occupiers)arestillabitquieterthannormalintermsoftheirshareof purchases.Butasoverallsalesactivitycontinuestoincreaseacrossthemarketthisyear,it’slikelythatallbuyergroups willdoahighernumberofdeals,evenifnotallgroups’marketsharescanriseatthesametime(giventhesemustalways addupto100%).

2.Astablelevelofpain(andgain)

Theshareofpropertyresalesmadeforagrossprofit(i.e.salepriceabovewhattheowneroriginallypaid)–orgain–was broadlystableat91%inthefirstthreemonthsoftheyear,meaninggrosslosses(orpain)werealsoflatatroughly9%. Whereaprofitwasmade,themedianfigurewas$280,000,downfromthemorethan$400,000gainduringthepostCovidboom,butstillasubstantialsum.

I’djustmakeacoupleofpointsaboutthis,however.Forowner-occupiers,that’snotgenerallyacashwindfall;newequity issimplyrequiredtogostraightbackintothenextpurchase.Andsecond,holdperiodisvital.Shortownershipperiodsof 2-3yearsarefarmorelikelytoseelosses,whereasatypicalholdperiodof8-9yearsalmostinevitablyresultsingains.

3.Subduednetmigrationiskeepingalidonpropertydemand

Lastweek’sfiguresfromStatsNZshowedthattheannualrollingtotalfornetmigrationisnowbackdowntoaround 26,350–wellbelowthepeakofmorethan135,000inOctober2023andthelong-termaverageofabout32,000.It’s hardtoknowwhenthismigrationdown-cyclemightbottomout(andatwhatlevel),buteitherway,thesubduedresults furtheraddtotheexpectationofasofteconomyandhousingmarketoverthecomingmonths.

4.Probablynothingmuchproperty-relatedintheBudget

Budget2025willbedeliveredat2pmonThursdayanditpromisestobeatightaffairintermsoffiscalspendingplans,atleastbased ontheGovernment’spre-announcementstodate.I’veseennothingtosuggestthatpropertywillfeaturedirectly,althoughI supposewe’vealwaysjustgottobeaweebitalertforanypossiblechangestotheforeignbuyerbanatsomestage.

5.Hopingforgoodeconomicnews

Otherwisethisweek,we’llalsogetthelatestNZActivityIndexfromStatsNZ,aswellastheperformanceofservices(BNZBusinessNZ)andretailsales.Recenteconomicdatahasbeenabitpatchy,soit’dbegreattoseemoregrowthinthisweek’s figures.

-KelvinDavidsonischiefeconomistatpropertyinsightsfirmCotality

Photo/FionaGoodall

Finance & Lending

InputtoyourStrategyforAdaptingtoChallenges

Feel free to pass on to friends and clients wanting independent economic commentary ISSN: 2703-2825

Published15May2025

Sign up for free at www.tonyalexander.nz

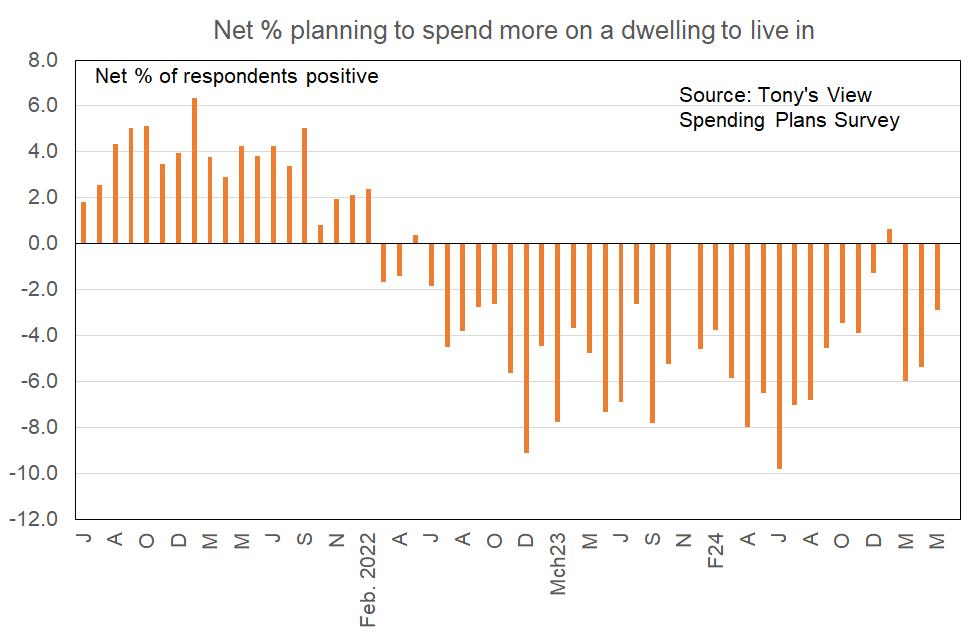

Retailingoutlookstillpoor

ThisweekIranmymonthlySpendingPlansSurvey whichgivesretailersinsightintowhattheirtrading conditionsmightlooklikeoverthenext3-6months. Theresultsshowthatthingsarenotgettinganyworse overallthantheywereinApril,buttheoutlook remainspoorfortheWinter-Springperiod. Whenaskedwhethertheyplanspendingmoreorless onstuffgenerallyinthenext3-6monthsanet18%of thenear700respondentssaidtheywouldspendless. Thislooksstatisticallythesameasthe-19%resultfor Apriland-15%forMarch.

Themostrecentpositiveresultcameearlyin Decemberwhenanet10%ofpeoplesaidthatthey wouldspendmore Thiswasthepeakforoptimism followingthelowofJunelastyearwhenahighnet 42%ofpeoplesaidtheyplannedcuttingbackon theirspending ThatresultcamebeforetheReserve Bankhintedthatitwouldsooncutinterestrates, andthe+10%numberreflectedmisplacedoptimism regardingwhattheimpactwouldbeofremoving tightmonetaryconditions.

Thelatest-18%resulttellsusthatretailersshould bewaryoftheirsalesprojectionsandinventory levels Cashflowswillneedverytightmonitoring anddon’tbesurprisedifone’sbankerswantextra, morefrequentinformationontradingflows.Before theyearisoutanotherbatchofretailersislikelyto gointoliquidation

As I pointed out back in August, there is more to the economy than just the level of interest rates Things like job security matter and I can see from my survey of real estate agents discussed last week that a still high 47% of agents say that people are worried about their employment The five year average is 21%, the mid-2024 result was a record high of 56%, and we started last year with just 14%.

Looking at the Spending Plans Survey we can see that one reason for the continuing high restraint on spending intentions is worries about the future –expressed by a net 22% of respondents as shown in the following graph

Thisnextgraphshowstheproportionsofpeople citingthefactorsshownasreasonforspendingless.

Theproportioncitinganeedtohaveenoughmoneyto buygroceriesis11%.Theinitialshockofhighergrocery priceshaspassed,butconcernsarestillthereIonly startedaskingaboutthisfactorinJuly2022.

Lookingatindividualareasofspendingplanswe canseestrongestplansareheldforspendingon groceriesandinternationaltravel.Welovetotravel outofourowncountry–justlikemostofthe winnersonTheChasewhenaskedwhattheyplan doingwiththeirwinnings.Noteveryonewantsto blowitallonahandbagornewchickenrun.

Plans for offshore travel are holding up, but for viewing our own country there is no increase underway.

There has been a small recovery in plans for spending on home renovations. This area of spending has held up quite well in recent times and that might reflect expectations of better availability of tradespeople along with plenty of people not being affected by the rise in the unemployment rate to 5.1%.

There is no reason for dealers in motor vehicles in aggregate to be expecting better sales in the near Future

Thesamegoesforretailersoffurnitureand appliances

Forthosewhosellstuffforourgardensthepicture remainspoorasweheadintothetraditionallyquiet timeofWinter.

Retailers of sports equipment look like still doing it tough

And there seems little reason for optimism on the part of the average operator in the hospitality sector The net proportion of people planning to cut their spending on eating out fell to only 9% at the end of this year from a horrid 44% in May 2024. But the reading now is back at about 26%.

Given the way butter prices are rising it looks like the cost of getting a tasty something to eat at a café will go higher again. Increasingly, eating outside the home in locations other than one of the fast food chains is becoming something reserved for special occasions – like Mother’ s Dat

Looking now at our two measures for the housing market we see divergent movements over the past month. A net 2.9% of respondents have reported that they are not looking at buying a property to live in over the next 3-6 months. This is better than the net 5.4% of a month ago but still not a strong signal for real estate activity and house prices. The optimism of January disappeared in a flash.

Whenaskedaboutpurchasinganinvestment propertyanet12.8%ofpeoplehavesaidtheyhave noplans.Thisisadeteriorationfrom-9.3%amonth agoandaboutthesameasthe-13%oftwomonths back.Notethecomparisonwith2021.

Finally,takingintoaccounttherecenthighvolatility insharepricesassociatedwiththeUS-initiated tradewaritisnotsurprisingthatmorepeopleplan sellingsharesthanbuyingtheminthenext3-6 months.However,at-2.3%theresultthismonthis betterthan-3.5%onemonthagoand-3.2%two monthsback.Volatilitytendstomakepeoplehold backoninvestmentdecisionsjustincasethething theywanttobuygetscheaper.Ofcoursewhen lookingatthelong-termhorisonthisdoesn’tmatter allthatmuch.

Overall, Kiwis remain worried about the future and plan keeping their spending levels in check even though for the one-third of households with mortgages debt-servicing costs are declining The other two-thirds rent or have paid off their mortgage

Netmigrationeases

With help from a revision downward of 5,000 to the previous annual total the 12 month sum of the net flow of migrants in and out of NZ fell to 26,300 in March from 27,600 in February and 100,400 a year earlier.

Although the total is at its lowest since December 2022 there still looks to be a broad flattening of the numbers just below 30,000. But it pays to remember that it is impossible to accurately forecast net migration flows for New Zealand.

This is because we have one of the most churning populations on the planet with a gross inflow each year of around 2.7% of our population and outflow of 2.0%. It does not take too much of a change in outflows in one direction and inflows the other for the net result to whip around tremendously.

Themainimplicationofthebelowtenyear50,000 averagenetinflowof26,300peopleisslower growthinconsumerspendingandslowergrowthin demandforhousingandrentalaccommodation perhapsinparticular.

Atatimewhenthereisanover-supplyofrental propertiesthisimpliesitisreasonabletoexpect belowaveragedemandforpropertyfrominvestors andthereforelessthanusualupwardmovementin prices–whichiswhatwearecurrentlyseeing.

RetailSpendingConstrained I

I think this graph well sums up the way I am seeing a lot of things in the economy at the moment including general GDP momentum In seasonally adjusted terms over the three months to April spending using debit and credit cards fell 0.4% from the three months to January.

FThis was a slowdown from growth of 1.5% in the three months to January and 0.7% in the three months to October

The surge in consumer spending in response to the surge in sentiment over the second half of 2024 following the easing of monetary policy commencing has faded away.

wereaborrower, what wouldIdo?

Wholesale borrowing costs facing NZ banks have increased this week, largely in response to the easing of trade tensions between China and the United States. Analysts in the US still see the trade war as being detrimental to US and world growth, but not by as much as they were thinking a few days ago

This means that predictions for easing of monetary policy by the Federal Reserve Board have been reined in and that accounts for some of the rise in US interest rates The US ten year Treasury bond yield for instance has jumped to 4.53% from 4.26% last week This is the highest yield since mid-February.

The three year swap rate at which NZ banks borrow in order to lend at a fixed rate for three years has risen to a six week high of 3.31% from 3.19% last week

The following three graphs show rough margins between bank fixed lending and wholesale fixed borrowing costs for the one, three and five year terms No great scope exists for fixed mortgage rates to be cut at the moment and given backroom processing delays no cuts seem likely.

Nonetheless, if I were borrowing currently, I’d still be looking for a 4.99% three year or longer rate given my belief that wholesale interest rates for terms of three years and beyond and maybe two years have already bottomed out this cycle

These three graphs show mortgage rates since 1997 excluding the period of deflation worries (2019)andthepandemic

This graph shows how current rates compare with averages from 2009-19

Nothing I write here or anywhere else in this publication is intended to be personal advice You should discuss your financing options with a professional.

Properties

Unit 22/200 Carrington Road, Mt Albert

Beyond the stylish facade, indulge in the convenience of the Mount Albert location. Explore nearby p. ..

2C WaiariR oad, Papakura

Conifer Grove; Entry Level Buying

Freehold Title & Priced to SELL.

First home buyers, families, professional couples or. ..

Lot 13/717-719S andringham Road Extension, Sandringham

Must Sell, Call Today To View. Welcome to a unique opportunity to own a stunning home in nearly completed multi-unit development th ...

48AS inclairRoad, Ararimu

A Luxury haven in a magical setting

Discover the ultimate sanctuary for your family in this expansive, luxury home designed to cater to ...

430 TwilightR oad, Brookby

Secluded Elegance

Nestled in a sunny spot amongst the trees, is this wonderful private residence. If you are looking f...

For Sale $1,050,900 View By Appointment

Anu Jay 022 3577 554 anu.jay@ljhooker.co.nz

llB School Road,Tuakau

Start your property journey here!

This newly renovated 2-bedroom gem is the perfect step onto the property ladder. Enjoy modern neutra. ..

For Sale $759,000 View Sunday 25 May at 12:00PM12:45PM

SteveR eilly 021930352 steve.reilly@ljhooker.co.nz

For Sale Enquiries over $889,000 View By Appointment

KJ Klavenes 027 5566 194 knut.klavenes@ljhooker.co.nz

For Sale $2,600,000 View By Appointment

Venita Attrill 021 286 7792 venita.attrill@ljhooker.co.nz

For Sale 1,759,000 View By Appointment

Venita Attrill 021 286 7792 venita.attrill@ljhooker.co.nz

For Sale $535,000 View By Appointment

Venita Attrill 021 286 7792 venita.attrill@ljhooker.co.nz

51 Normanby Road, Karaka

Newto Market

BANKTHELAND-LIVETHELIFESTYLE

This offering is position perfect and delivers the astute buyer a unique opportunity to acquire a rock-solid investment property situated on 1.0110 hectares (more or less) of valuable land, currently zoned Residential-Mixed Housing Suburban Zone.

If development' s your idea, depending on Auckland Council approval to your scheme, the site can be further developed for a 19 to 22 Lot subdivision and you can enjoy the seven-bedroom, three-bathroom, 3 car garage, 450m2 dwelling currently on the property while you work through your development process

FORSALE

Pricebynegotiation

View Byappointmentonly

AGENCY

LJHookerTown&Country 092947500

Click here to view the full details on our website

Sales&MarketingConsultant

M:0212867792

E:venita.attrill@ljhooker.co.nz

Sales&MarketingConsultant M:0274816422

E:johnny.cleven@ljhooker.co.nz

Sales&MarketingConsultant M:0223577554

E:anu.jay@ljhooker.co.nz

BrentWorthington

Principal/LicenseeAgent

M:0292965362

E:brent.worthington@ljhooker.co.nz

Sales&MarketingConsultant M:021396977

E:paula.cox@ljhooker.co.nz

Sales&MarketingConsultant M:0212721912

E:atesh.narayan@ljhooker.co.nz

OfficeAdministrator Ph:092947500

Sales&MarketingConsultant

M:021930352

E:steve.reilly@ljhooker.co.nz

Sales&MarketingConsultant M:0275566194

E:knut.klavenes@ljhooker.co.nz

DebbieHarrison

PropertyManager

M:021303864

E:megan.vanwinden@ljhooker.co.nz

E:debbie.harrison@ljhooker.co.nz

“Wheretheonlyresultthat matterisyours!”

VenitaAttrill

PaulaCox

SteveReilly

JohnnyCleven AteshNarayan

KJKlavenes Megan

VENITAATTRILL

VenitaAttrill Residential&LifestyleSalesConsultant

0212867792

venita.attrill@ljhooker.co.nz

MeetVenita-YourTrustedRealEstateExpertSince1996!

Withanimpressivecareerspanningoverthreedecades,Venitabeganherjourney inRealEstatesalesin1996withtheesteemedLJHooker/HarveysGroup.Throughout hertenure,Venitahasbeenrecognizedwithnumerousnationalawards,atestamentto herunwaveringdedicationtoherclients.Infact,approximately90%ofVenita'ssales arederivedfromherpastclientsandclientreferrals,showcasingtheexceptional leveloftrustandsatisfactionsheconsistentlydelivers.

Selectingtherightagentiscrucial,andthereisnobetterwaytomakethatdecision thanbyevaluatingtheirsuccessandthemannerinwhichtheyachieveit.Venita'svast clientele,whorepeatedlyseekherservices,skill,andadvice,standasatruetestament toherabilitytoexceedexpectations.

WhileVenitaboastsextensiveexperienceandatrackrecordofsuccess,sheremains drivenandcommittedtogoingaboveandbeyondtoachieveapremiumoutcomefor everyclient.Herdedicationtocontinuousimprovementensuresthatsheremainsat theforefrontoftheindustry,offeringyouunparalleledserviceandexpertise.

WhenyouchooseVenitaasyouragent,youcanrestassuredthatyouhaveatrusted partnerbyyourside,whowilltirelesslyworktosecurethebestpossibleresultsforyou. WithVenita,yourrealestatejourneyisinsafehands,backedbyalegacyofexcellence andarelentlesspursuitofsuccess.

ContactVenitatodayandexperiencefirsthandthedifferenceaseasonedand determinedprofessionalcanmakeinyourrealestateendeavours

Johnnycombineshisauctioneering expertisewithapersonableandengaging styletodelivertop-tierauctionexperiences. He’scommittedtoeverypropertyhe represents,regardlessofitscircumstances, andisknownformotivatingbuyersand guidingclientstowardthebestresults.With abackgroundinactingandadegreein PerformingandScreenArts,Johnnyhas appearedinTVcommercials,films— includingNetflix’sFallingInnLove—andhas workedwiththeAucklandTheatre Company.

WinnerREINZNationalAuctionCompetition

2023 - Open Division

FinalistREINZNationalAuctionCompetition

2022 - Open Division

WinnerREINZAuctionChampionships

2024 (Premier Division)

WinnerLVDAuctionInvitational

2019

WinnerofApolloAuctionInvitational

2017 & 2019

WinnerHarcourtsNewZealandAuctioneeroftheYear 2010, 2014 & 2017

Runner-upAustralasianAuctionCompetition

2022

Runner-upREINZNationalAuctionCompetition

2010, 2019, 2020 & 2022

WinneroftheAustralasianCompetition

2011 & 2015

FinalistLVDAuctionInvitational

2021 & 2022

FinalistApolloAuctionInvitational

2018 & 2022

FinalistHarcourtsNewZealandAuctioneeroftheYear 2011, 2018 & 2019

FinalistREINZNationalAuctionCompetition

2010, 2011, 2012, 2013, 2016, 2018

FinalistAustralasianAuctionCompetition

2010

Local Updates

SH1PapakuratoDruryConstructionupdate

MAY2025

Construction update | He pānui

We are now starting our winter works programme on the project. Winter weatherpresents additionalchallengesthatcancausedelays.

The team has made good progress over the last month, particularly near thesouthern end of Victoria Street. Works have included identifying undergroundservices, installing temporary barriers, carrying out earthworks and layingstormwater pipes which will enable us to realign theendoftheroad.

Great South Road / SH22 is a busy, tight site with work underway on both sides of the road. To make things safer for our workers on the road and for everyone travelling through this busy area, temporary steel barriers have been installed one Each side of the road. Read on for more about these. Much the current work is being carried out at night, including directional drilling under the full width of the road – which removes the need to open trench across this busy, arterial route.

We have also started work in the middle section (the central median) of th motorway. To make this work area safe and accessible, a key focus last month was shifting the SH1 northbound lanes across to the west after southbound lanes were shifted eastwards earlier in the year. This change in traffic layout has created the space we need in the median for road construction. Continue reading for more details.

Block laying and backfilling works on the large retaining wall on Flanagan Road has been completed to the point where backfilled material must now settle for a period to become compacted. This wall has been built to enable the realignment of Flanagan Road and will also house a section of the Waikato 1 watermain – which needs to be moved because it currently lies where new motorway lanes will be built. Installing new pipes for the Waikato 1 watermain is already underway and, following a 'cutover' from the old alignment to the ns , the new section of this watermain is expected to become operational in December this year.

The temporary steel truss bridge being built on Bremner Road over Ngaakooroa Stream is also progressing well. It is planned to have traffic shifted onto it in the third quarter of this year, following which the existing bridge over the stream will be demolished and replaced with a higher bridge.

Further north at Slippery Creek / Otuuwairoa Stream, earthworks on the eastern side of the motorway are clearly visible on both sides of the stream. Our current works have centred on clearing and establishing a site access and undertaking the enabling works required to bring in large cranes. These cranes will be used to drive in ground improvement piles that will significantly strengthen the ground under the new alignment for the motorway and its new higher and wider bridge across the stream.

An aerial view of the central median, looking south from the BP motorway service centre

Centralmedianworks| Ngā mahi kei waenga i tehuarahi matua

Good progress was made on the Southern Motorway last month, which saw the northbound motorway lanes shifted over to the west and the creation of a protected work area in the central median to allow the building of new pavement. Site access points into the median are now under construction to provide safe passage for construction crews and equipment going in and out of this central site.

Earthworks in the median will commence later this month, which is the first stage ofbuilding new pavement. These earthworks will prepare the ground to build the solidfoundation needed for the new motorway lanes. Initially, our focus will be on thesection of median between the BP motorway service centre and Slippery Creek /Otuuwairoa Stream.

In contrast to Stage 1A already completed, Stage 1B central median works will bedelivered in a series of smaller work areas. This approach is necessary because thereare new bridges to build over Slippery Creek / Otuuwairoa Stream, over themotorway at Bremner Road and over Great South Road at Drury Interchange.Building smaller sections of new pavement in the central median allows us toconstruct the foundations and structures of these bridges safely as we progressdown the motorway.

Our construction activities in the median will include earthworks, installing underground utility services and drainage pipes, laying the base layers, and then building the final road surface for the new lanes.

TemporarySteelBarriers|

Ngā mea haumaru

Keeping both motorists and our crews safe is always our number one priority and a key method to achieve this is by using temporary steel barriers. These barriers ar eessential for creating sufficient, safe spaces for our crews working next to live traffic without needing to close the motorway.

You'll see these temporary steel barriers when you're driving through our sites on the motorway and on SH22. Their main purpose is simple and vital – they physically separate the road from our construction sites.

Wherever a row of temporary steel barriers begins, there is a special crash cushion installed at the start. These cushions are designed to absorb energy and provide a buffer zone in case a vehicle accidentally hits the start of the barrier, helping to reduce the severity of any impact on those in the vehicle.

For the temporary steel barriers to work safely, a 'deflection zone' is required. This zone is the distance the barrier is expected to move or bend sideways if it gets hit by a vehicle. The width of the deflection zone is critical because it determines the exclusion zone behind the barriers where our crews cannot work or store materials and plant. If any construction work needs to be carried out within the deflection zone, then we must close either one or both adjacent traffic lanes while carrying out the work at night. The steel barriers also protect motorists from hitting construction equipment and driving on uneven surfaces or potentially into an excavation or trench.

We can only close lanes or roads on the state highway network at night. This is because there is significantly less traffic during night hours, which helps to minimise delays and disruption for most travellers. If part of the motorway is closed, our crews are out there working, even if you can’t see exactly where because you’ve been diverted onto a detour route. The section of the Southern Motorway we are widening between Papakura and Drury now carries around 85,000 vehicles each day.

Latest photos from site | Ngā pikitia

We are investigating underground services, carrying out earthworks, paving andpiling across the project extent – safe from live traffic with temporary steel barriersin.

During the coming months, our project works include: Looking ahead | E haere ake nei

During the coming months, our project works include:

Wheretheonlyresultthatmattersisyours!

SubhTown & Countryeading

“Where

drury@ljhooker.co.nz

TNB Property Services Limited (Licensed REAA 2008) 1/233 Great South Road, Drury Auckland 2113 https://drury.ljhooker co nz/