E P O R T

EXPERT GUIDANCE

Gain the knowledge needed to confidently make informed real estate decisions in this year’s market with confidence

INDUSTRY INSIGHT

Professional perspective on market movements and investment opportunities from advisory President & Broker of Record, Nicole Kobrinsky

Copyright June © 2025

TRENDS

An exploration of the latest market shifts, buyer behaviors, and investment patterns shaping the Phoenix real estate landscape.

Overall Insights

1 A concise and insightful breakdown of the Phoenix Metro real estate market

3-4 A deep dive into detailed market data, analyzing past and present trends for a comprehensive perspective Highlights

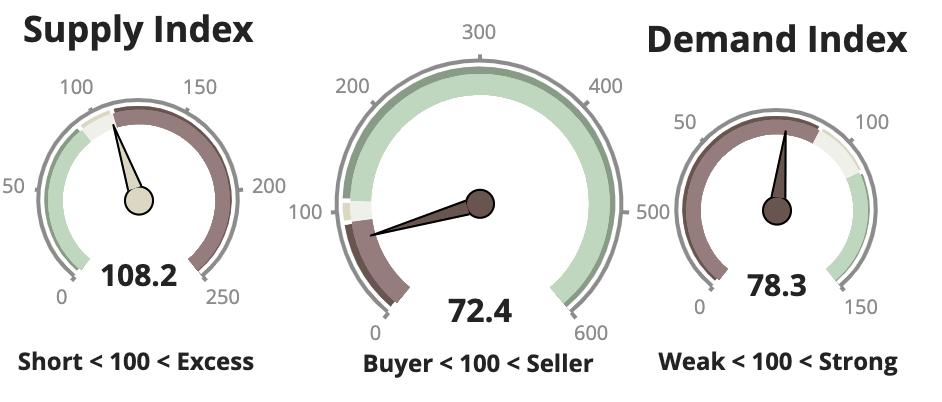

2 Leveraging The Cromford Index™ to assess supply and demand dynamics through critical market metrics

OVERALL INSIGHTS

There’s mixed news this month Supply is stabilizing as new listings drop off, but demand continues to weaken. Listings under contract fell 12% from last month and are down 5% yearover-year

Closings dropped 6 6%, but that’s actually not bad considering May 2025 had fewer business days than May 2024. Agents and lenders are still closing deals efficiently on a per-day basis.

Prices rebounded slightly after April’s dip, but don’t read too much into it The luxury market had a stronger month, skewing averages up 0.8%. The median sale price also rose to $450,000, though it briefly touched $455,000.

Mortgage rates remain stuck around 7%. Buyers seeking relief are turning to builders offering rate buy-downs often to 4 99% to meet quarterly sales goals

The Cromford® Market Index dropped to 73, signaling a weak market but not a crash. Supply and demand remain out of balance, a challenge across much of Arizona, Florida, and Texas However, sellers still have the upper hand in the Northeast.

June's outlook hinges on new listings. If they stay low, they may help balance soft demand. If they rise, sellers could face more difficulty

The luxury market, driven by wealth trends and second-home purchases, rebounded in May after a slow April. Homes over $3M saw declining supply due to strong demand.

As of June 15:

Average sales price per square foot: $300.58 (up 2% from May 15)

Median sale price: $450,000 (up slightly from $446,990)

Pending listings average $/SF: $319 39 (down 1 4%)

Active listings average $/SF: down 2 2% over the past month

Forecast for July: average sales $/SF expected to drop to ~$295.49

In short, while there’s been a short-term price bounce, indicators suggest a likely decline in pricing over the next few weeks. The market remains soft, especially under $3M, with luxury holding firmer due to unique demand factors.

Nicole Kobrinsky PRESIDENT & BROKER OF RECORD

TRENDS

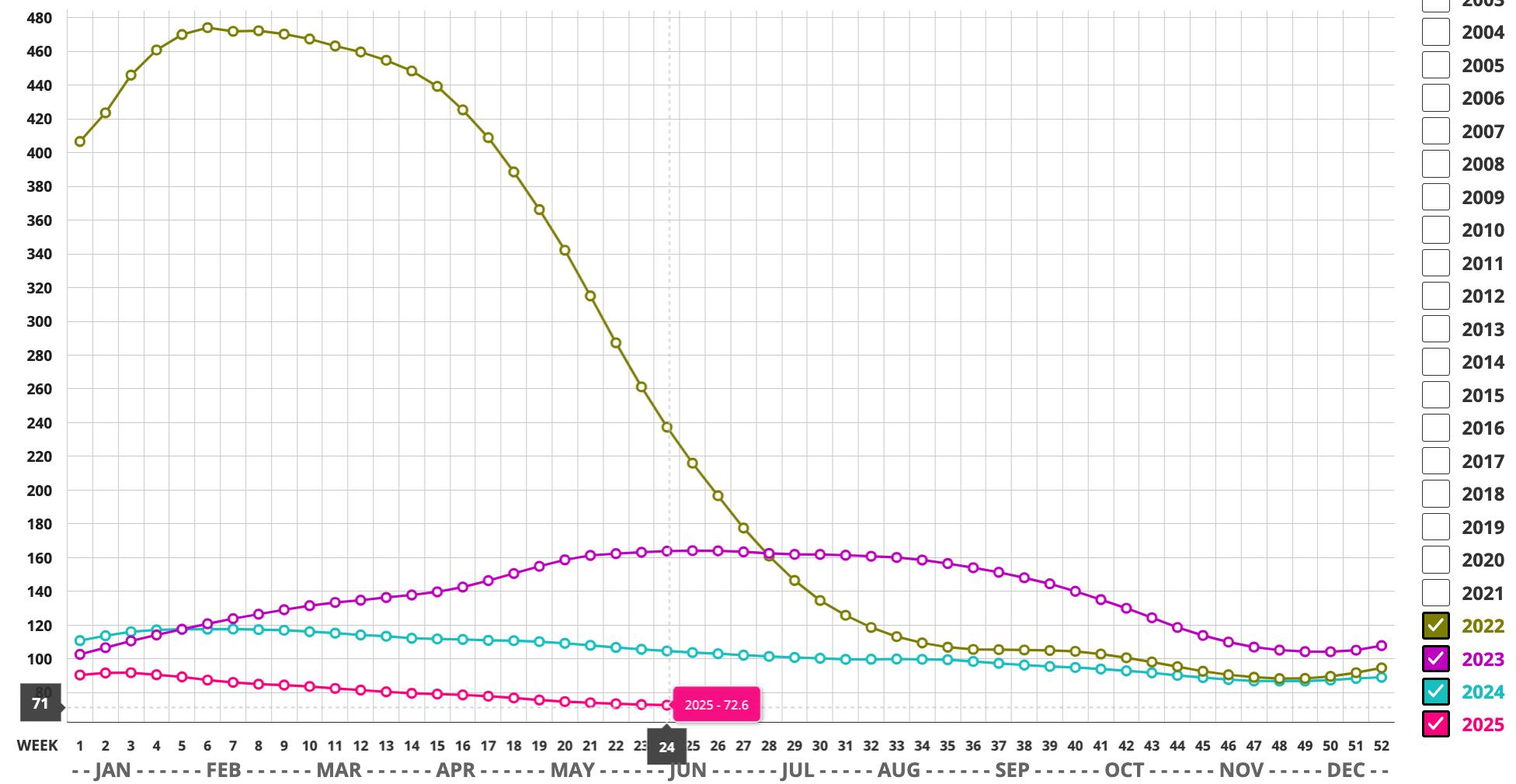

CROMFORD MARKET INDEX

MARKET HIGH

The Market Index was 514 at the height of the market in May 2021.

EXPECTATIONS

The Cromford® Market Index is down to 73 and we consider this unusually low. Yes, we saw much lower values in the CMI during the crash of 2006-2009 but we are not in a crash situation.

MARKET LOW

In the late Spring of 2022, the market decelerated quickly. A Market Index of 88.3 was seen in December 2022

PRICING

The monthly median sales price increased by 2.2%. The monthly average price per square foot trends up 0.8% YOY.

INVENTORY

Active listings (excluding UBC) are up 47% YOY and months of inventory is up 41.9% from 3.1 to 4.4 months YOY.

VOLUME

Overall volume of residential sales for the year is up 1.7% compared to June 2024.

Questions or Comments? Email Report author: Nicole Kobrinsky at nicole@housegallery com

6901 East 1st St Suite 103 Scottsdale, Arizona 85251 480 808 1223 | housegallery com

© 2025 HOUSE GALLERY COLLECTIVE. ALL WORLDWIDE RIGHTS RESERVED. ALL MATERIAL PRESENTED HEREIN IS INTENDED FOR INFORMATION PURPOSES ONLY WHILE, THIS INFORMATION IS BELIEVED TO BE CORRECT, IT IS REPRESENTED SUBJECT TO ERRORS, OMISSIONS, CHANGES OR WITHDRAWAL WITHOUT NOTICE THIS INFORMATION IS BASED ON DATA FROM ARIZONA REGIONAL MULTIPLE LISTING SERVICE, INC (ARMLS), CROMFORD ASSOCIATES LLC , REALTORS PROPERTY RESOURCE®, LLC AND INTERPRETED BY HOUSE GALLERY COLLECTIVE, LLC DATA HAS BEEN LIMITED TO SALES REPORTED WITHIN THE COUNTY OF MARICOPA BOUNDARIES

IF YOUR PROPERTY IS CURRENTLY LISTED WITH ANOTHER REAL ESTATE BROKER, OR YOUR ARE UNDER A BUYER REPRESENTATION CONTRACT WITH ANOTHER REAL ESTATE BROKER, PLEASE DISREGARD THIS OFFER IT IS NOT OUR INTENTION TO SOLICIT THE OFFERINGS OF OTHER REAL ESTATE BROKERS