6 minute read

Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

AvaTrade is a globally regulated Forex and CFD broker offering multiple trading platforms, tight spreads, and advanced tools — making it a strong choice for both beginners and experienced traders.

The world of online trading is evolving at a rapid pace, and choosing the right broker is now more crucial than ever. One name that consistently appears in discussions among serious traders is AvaTrade. Whether you're a seasoned investor or just entering the world of forex and CFD trading, understanding the full scope of what AvaTrade offers can empower you to make smarter decisions.

In this Avatrade Broker Review 2025, we’ll break down everything you need to know: its pros, cons, trading features, platforms, support, and more. By the end of this in-depth guide, you'll know whether AvaTrade is the right partner for your trading journey.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. What is AvaTrade?

AvaTrade is a globally recognized CFD and forex broker established in 2006. With over a million users worldwide and offices in Europe, Asia, the Middle East, and Africa, AvaTrade has carved a reputation for trust, transparency, and trading technology.

It offers a wide range of instruments such as forex, stocks, indices, commodities, cryptocurrencies, and more. With its broad regulatory oversight and user-friendly platforms, AvaTrade appeals to both novice and professional traders.

2. AvaTrade Broker Overview

Founded: 2006Headquarters: Dublin, IrelandRegulated by: Central Bank of Ireland, ASIC (Australia), FSCA (South Africa), FSA (Japan), and othersSupported Instruments: Forex, CFDs on stocks, indices, commodities, ETFs, cryptoTrading Platforms: MetaTrader 4, MetaTrader 5, AvaTradeGO, WebTrader

3. Trading Platforms Offered by AvaTrade

One of AvaTrade’s strong suits is its range of robust and intuitive trading platforms.

MetaTrader 4 (MT4) – Highly popular, excellent for automated trading.

MetaTrader 5 (MT5) – Offers more timeframes, order types, and economic calendar integration.

AvaTradeGO App – A mobile-first experience with exclusive market trends and advanced risk management tools.

WebTrader – No downloads needed, trade directly from your browser.

Whether you prefer desktop or mobile, AvaTrade delivers flexibility and reliability.

4. ✅ Key Advantages of AvaTrade

Highly Regulated: Licensed in multiple jurisdictions, providing strong legal safeguards.

Commission-Free Trading: No hidden fees on standard accounts.

Beginner-Friendly: AvaTradeGO is intuitive and designed for ease.

Multiple Trading Assets: Forex, crypto, stocks, indices, and more.

Islamic Accounts Available: Sharia-compliant accounts upon request.

Excellent Education Center: Learn-to-trade courses, webinars, tutorials.

Negative Balance Protection: Protects you from losing more than your deposit.

Social Trading: Copy successful traders via DupliTrade or ZuluTrade.

5. ❌ Limitations to Consider

High Inactivity Fees: Charged after 3 months of dormancy.

Fixed Spreads: Not suitable for scalpers who prefer tight spreads.

No US Clients: AvaTrade does not accept residents of the United States.

Limited Advanced Features: Not ideal for algorithmic traders needing full customization.

See more:

6. Account Types & Minimum Deposits

AvaTrade offers several account options:

Standard Account – $100 minimum deposit.

Professional Account – For experienced traders who qualify under specific criteria.

Avatrade Islamic Account – No swap or interest, suitable for Muslim traders.

Avatrade Demo Account – Unlimited practice environment.

With low entry points, trading with AvaTrade is accessible to most traders.

7. Spread, Fees, and Commissions

No Commissions: AvaTrade earns via spreads.

Forex Spreads: Typically start from 0.9 pips.

No Deposit/Withdrawal Fees: Most payment methods are free.

Inactivity Fee: $50 per quarter after 3 months of inactivity.

Administration Fee: $100 annually if dormant for 12 months.

Spreads are fixed, which can be a ✅ for stability but ❌ for scalping strategies.

8. Regulation and Security

AvaTrade is licensed by multiple global regulators, offering a secure trading environment:

Central Bank of Ireland (CBI)

ASIC (Australia)

FSA (Japan)

FSCA (South Africa)

ADGM (UAE)

Client funds are held in segregated accounts and all platforms are encrypted.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

9. AvaTrade for Beginners vs. Advanced Traders

✅ Beginners will love the intuitive AvaTradeGO app and comprehensive education portal. ❌ Advanced traders may find fixed spreads and lack of customization limiting.

However, platforms like MT4 and MT5 do allow expert advisors (EAs) and other tools suitable for technical and automated trading.

10. AvaTrade Mobile Trading Experience

The AvaTradeGO app is a mobile trader’s dream:

Sleek interface and real-time news updates

Built-in risk management

Market sentiment indicators

One-click trading

It provides a seamless experience for traders on the go.

11. AvaTrade Deposit & Withdrawal Methods

Credit/Debit Cards

Wire Transfers

E-wallets (Skrill, Neteller, WebMoney)

Processing time: 24–48 hours

✅ No fees from AvaTrade’s side for deposits/withdrawals.

12. AvaTrade Customer Support

Support is available in multiple languages via:

Live Chat

Phone Support

Email

The service is fast and reliable, operating 24/5.

13. AvaTrade Educational Resources

Education is a key pillar of AvaTrade’s value:

Trading for Beginners course

Forex eBooks and PDFs

Live Webinars

Platform Tutorials

Perfect for those who want to level up their trading skills.

14. Is AvaTrade Good for Forex Trading?

✅ Yes, especially for those who value regulation, simplicity, and a broad range of instruments. However, high-frequency traders or scalpers might prefer platforms with variable spreads and no inactivity fees.

15. AvaTrade in 2025: What’s New?

Enhanced AvaProtect features

Improved mobile trading app UI

Expanded crypto asset list

Enhanced AI-based trading tools (coming soon)

AvaTrade continues to evolve with market trends, offering tools that cater to modern traders.

16. Final Verdict: Should You Trade with AvaTrade?

If you're a trader looking for stability, regulation, and simplicity, AvaTrade is an excellent choice. While it's not tailored for scalping or ultra-professional customization, it excels in offering a secure and intuitive trading environment for the majority of retail traders.

Want to start trading with AvaTrade? ✅ Don’t wait—open your account today and experience the difference!

17. ✅ FAQs – AvaTrade Broker Review

1. Is AvaTrade regulated?Yes, AvaTrade is licensed by multiple regulatory bodies including the Central Bank of Ireland, ASIC, and FSCA.

2. What is the minimum deposit at AvaTrade?The minimum deposit is $100 for standard accounts.

3. Does AvaTrade offer MetaTrader?Yes, AvaTrade supports both MetaTrader 4 and MetaTrader 5.

4. Can I use AvaTrade in the USA?No, AvaTrade does not accept clients from the United States.

5. Is AvaTrade good for beginners?Absolutely. It offers a beginner-friendly platform, educational content, and responsive customer support.

6. Does AvaTrade charge withdrawal fees?No, AvaTrade does not charge withdrawal fees, though your bank or payment provider might.

7. Is AvaTrade safe?Yes, client funds are kept in segregated accounts, and the broker is regulated by top-tier authorities.

8. What instruments can I trade on AvaTrade?Forex, cryptocurrencies, indices, commodities, stocks, and ETFs.

9. Does AvaTrade allow scalping?Not ideal due to fixed spreads.

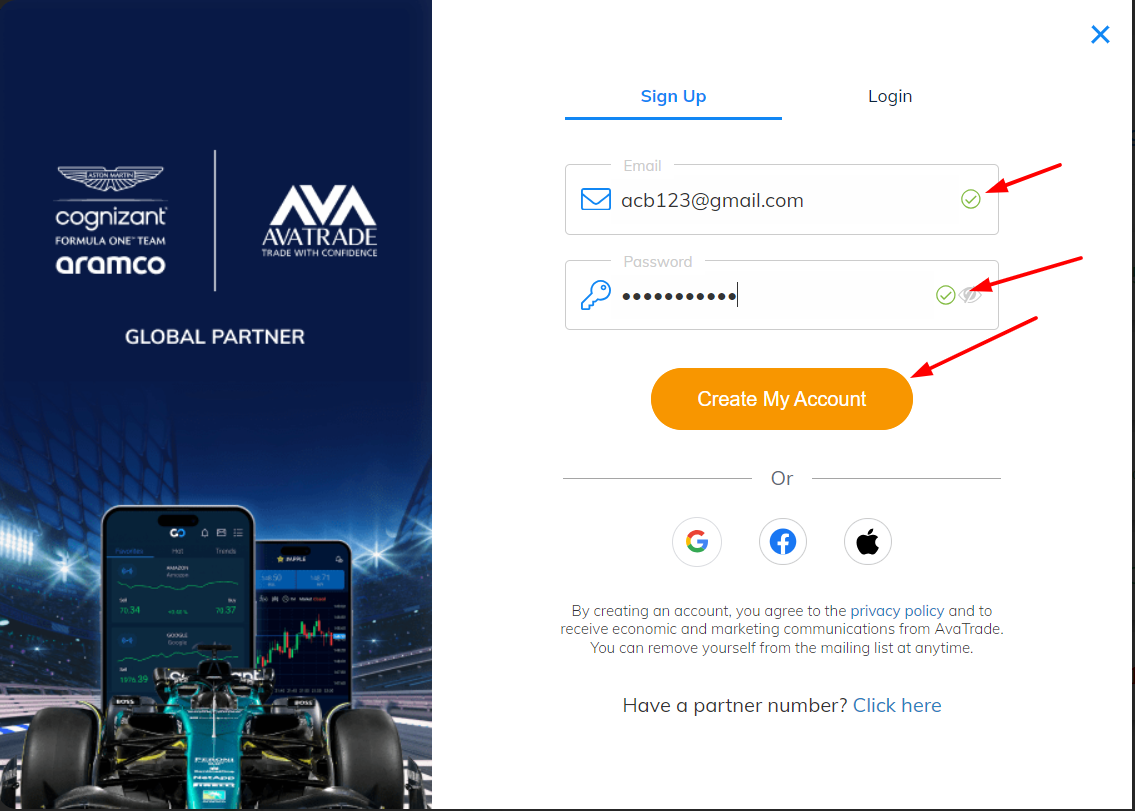

10. How can I open an account with AvaTrade?You can register online in minutes. Submit your documents, verify your identity, deposit funds, and start trading.

Start your trading journey with confidence. AvaTrade delivers the tools, support, and regulation that serious traders demand.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

See more: