5 minute read

Avatrade Review India 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

Avatrade Review India 2025: Pros & Cons A Comprehensive Review

Welcome to this in-depth AvaTrade Review India 2025, a fully updated breakdown crafted specifically for Indian traders. Whether you're a beginner exploring Forex for the first time or an experienced trader considering a switch, this article will guide you through every crucial detail about AvaTrade's offerings, regulatory standing, trading conditions, and more.

💡 Tip for Traders in India: Choosing a broker isn't just about spreads or leverage—security, support, and platform compatibility matter just as much!

👉 Explore the latest trends and updates on our Forex Markets page – your go-to source for trading insights.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Introduction to AvaTrade

Founded in 2006, AvaTrade is a globally recognized Forex and CFD broker. It serves over 400,000 registered clients worldwide, offering a range of instruments across Forex, commodities, indices, cryptocurrencies, stocks, and options.

AvaTrade is known for its strong regulatory compliance, offering a secure environment for trading. For Indian traders, it is one of the few international brokers that accept INR-based deposits and provide dedicated account managers.

Is AvaTrade Legal and Safe for Indian Traders?

✅ Yes, AvaTrade is considered safe.

AvaTrade is regulated by top-tier authorities including:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

FSA (Japan)

ADGM (Abu Dhabi Global Market)

Even though AvaTrade is not SEBI-regulated, it operates legally for Indian residents under international regulations.

Key Security Features:Negative balance protectionSegregated client accountsSSL encryption for transactions

Account Types Available

AvaTrade offers multiple account options to cater to different trading levels:

Standard Account: No commission, fixed spreads

Islamic Account: Swap-free, Sharia-compliant

Professional Account: For high-volume traders

Demo Account: Unlimited practice without risk

Each account provides access to all available platforms and trading tools.

AvaTrade Trading Platforms

AvaTrade supports a wide range of platforms:

MetaTrader 4 & 5 (MT4/MT5) ✅

AvaTradeGO App – Mobile-first experience with social trading features

WebTrader – Browser-based, no installation needed

AvaOptions – Focused on options trading

DupliTrade/ZuluTrade – Automated & social trading ❌ (Only for eligible users)

Deposit & Withdrawal Options in India

AvaTrade makes it easy for Indian users to fund accounts:

Deposit Methods:

UPI / Net Banking ✅

Credit/Debit Cards

E-Wallets (Skrill, Neteller)

Wire Transfers

Withdrawal Methods:

Processed within 24–48 hours ✅

Minimum withdrawal: $100 (or INR equivalent)

AvaTrade does not charge any internal fees for deposits/withdrawals.

AvaTrade India – Pros ✅ and Cons ❌

✅ Pros:

Regulated by multiple top-tier authorities

INR deposit options via UPI & NetBanking

Fixed spreads offer consistency

Multiple platforms including MT5

Free demo & Islamic accounts

❌ Cons:

No ECN/raw spread account

No SEBI regulation

No crypto wallet integration

Limited leverage for crypto

Inactivity fees after 3 months

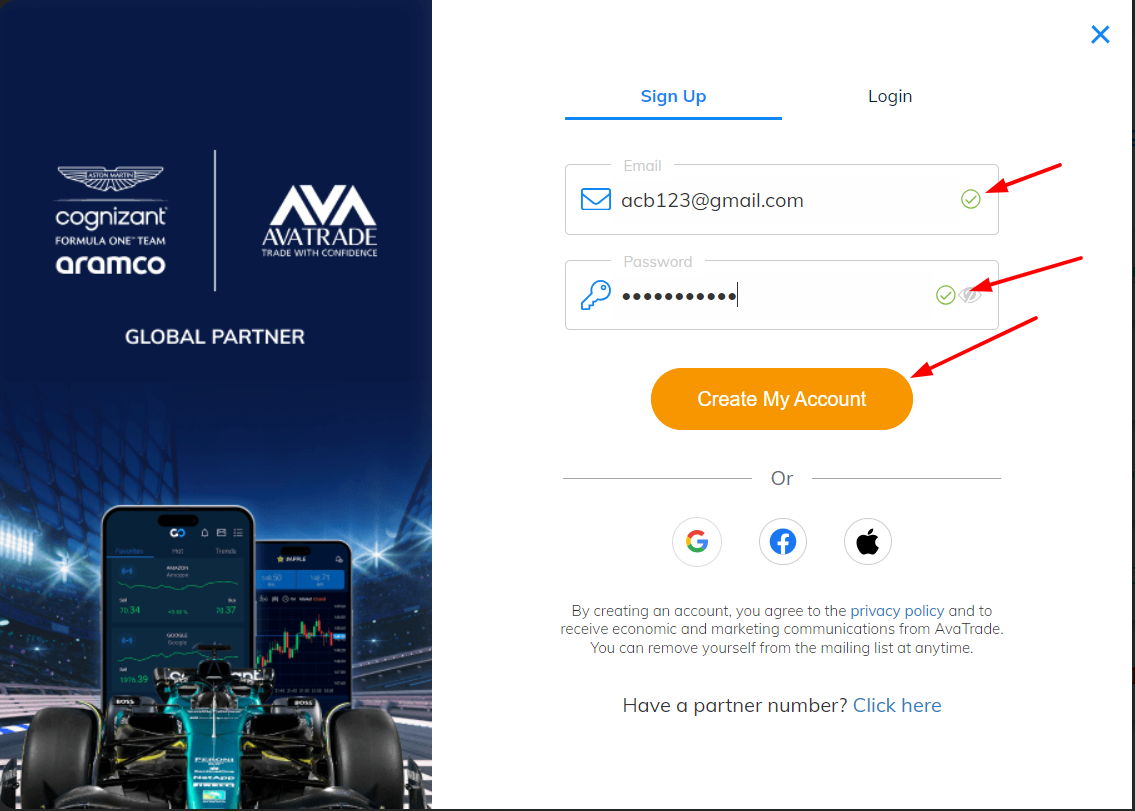

Step-by-Step: How to Open an AvaTrade Account in India

Click on "Register" and fill out the form

Choose account type (Standard or Islamic)

Submit PAN card and address proof (Aadhaar/Utility bill)

Fund your account (UPI recommended ✅)

Start trading on MT4/MT5 or AvaTradeGO

💼 Pro Tip: Ask for a dedicated account manager to help set up your first trade.

AvaTrade vs Other Top Brokers in India

Here’s how AvaTrade compares with other brokers popular among Indian traders:

AvaTrade: Not SEBI-regulated, but accepts INR deposits via UPI/NetBanking. Offers fixed spreads and supports MT4/MT5, AvaTradeGO, and crypto trading.

Exness: Also not SEBI-regulated. Supports INR deposits, variable spreads, MT4/MT5 platforms, and crypto trading. - If you choose Exness, 👉 Click here to open an account

XM: Not SEBI-regulated. Allows INR deposits and variable spreads. Supports MT4/MT5, but crypto offerings are limited.

Zerodha: SEBI-regulated broker catering to Indian equity markets. Supports INR deposits and uses its proprietary Kite platform. Does not offer crypto or Forex.

Is AvaTrade Good for Beginners in India?

✅ Absolutely. AvaTrade offers:

A free unlimited demo account

Educational webinars and tutorials

User-friendly interface on AvaTradeGO

Fixed spreads = easier to calculate risk

Localized support and UPI payments

Beginners find confidence with AvaTrade thanks to its simplified setup, security, and educational tools.

Marketing Highlight: Why Choose AvaTrade in 2025?

🔥 AvaTrade 2025 is tailor-made for Indian traders!

INR support means no conversion hassle

Fast withdrawals via local banking ✅

1000+ instruments including Nifty50, USD/INR, and Gold

Advanced platforms with AI-powered trade insights

💰 Don’t miss out! Thousands of Indians are opening accounts daily. You can too!

>> Ready to trade? Open your AvaTrade account now and start your Forex journey with confidence!

FAQs – AvaTrade India

1. Is AvaTrade legal in India?Yes, while not SEBI-regulated, it's legally accessible to Indian residents under international law.

2. Can I deposit in INR?✅ Yes, through UPI and Net Banking.

3. What is the minimum deposit?The minimum deposit is $100 or INR equivalent.

4. Does AvaTrade offer a demo account?✅ Yes, with no expiry.

5. Is AvaTrade good for crypto trading?Yes, but leverage is lower compared to Forex.

6. What platforms are available?MT4, MT5, AvaTradeGO, AvaOptions, WebTrader.

7. Are there any commissions?No, AvaTrade uses commission-free fixed spreads.

8. How fast are withdrawals processed?✅ Typically within 24–48 hours.

9. Is customer support available in India?Yes, localized support is available via chat and email.

10. Does AvaTrade offer any bonuses?Occasionally, but check your account dashboard for the latest offers.

Final Thoughts

If you're a trader in India looking for fixed spreads, easy deposits, secure regulation, and powerful trading platforms, AvaTrade is a solid option in 2025.

✅ Start now. Trade smart. Trade safe.

💥💥💥 Read more:

Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review

Avatrade Review Singapore 2025: Pros & Cons A Comprehensive Review