6 minute read

Avatrade Canada Review 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

Avatrade Canada Review 2025: Pros & Cons A Comprehensive Review

Forex trading is growing rapidly in Canada, and traders are constantly on the lookout for a trustworthy, secure, and profitable broker. One name that frequently appears on top lists is AvaTrade. But is it the right broker for you in 2025? In this comprehensive review, we'll break down everything you need to know about AvaTrade Canada: from its features and pros & cons, to real-world usage, account types, and much more. Whether you're a beginner or an experienced trader, this guide is crafted to help you make the most informed decision possible.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Introduction to AvaTrade Canada in 2025

Founded in 2006, AvaTrade is a globally recognized forex and CFD broker, known for its regulatory compliance and trader-friendly platforms. In 2025, AvaTrade continues to be a top choice for Canadian forex traders due to its regulated status, diverse trading options, and comprehensive educational resources.

Canada's tight financial regulations make it critical for brokers to maintain transparency. ✅ AvaTrade meets these expectations, offering peace of mind for traders who want to avoid unreliable brokers.

💡 Learn how the global currency market moves—check out our Forex Markets page now!

Is AvaTrade Legal in Canada?

Yes. ✅ AvaTrade operates legally in Canada through its subsidiary, Ava Trade EU Ltd, which complies with IIROC guidelines via partnerships with regulatory entities. While AvaTrade itself isn’t headquartered in Canada, its global recognition and partnerships enable it to serve Canadian clients under full compliance.

However, Canadian traders should note:

AvaTrade is not a direct member of IIROC, but complies with international standards.

You must verify your identity to comply with KYC and AML laws in Canada.

Bottom line: If you're looking for a safe and legal broker, AvaTrade checks the boxes.

AvaTrade Account Types for Canadian Traders

AvaTrade offers several types of accounts designed to fit various trading styles and experience levels:

1. Standard Retail Account

Ideal for new traders ✅

Minimum deposit: $100

Access to all platforms & assets

2. Professional Account

Requires higher trading volume

Better leverage ratios (up to 400:1)

Lower spreads

3. Islamic Account

Swap-free ❌ (no interest)

Fully Sharia-compliant

4. Demo Account

Practice without risk

Virtual $100,000 balance

These account options allow flexibility for beginners, professionals, and religiously observant traders alike.

"Your trading success starts with the right broker. 🔍 Explore our expert Forex broker reviews now!"

Trading Platforms AvaTrade Offers in Canada

AvaTrade offers multiple platforms that are user-friendly, powerful, and compatible with various trading strategies:

MetaTrader 4 (MT4) – Still the most popular choice ✅

MetaTrader 5 (MT5) – Advanced features for experienced users

AvaTradeGO – Mobile-first experience for on-the-go trading

WebTrader – No download required

DupliTrade/ZuluTrade – Copy trading and social strategies

Whether you're a manual trader or prefer automation, AvaTrade provides the tools you need to succeed.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Spreads, Fees & Leverage

Understanding the cost structure is vital. AvaTrade offers competitive spreads and transparent fees.

Spreads

EUR/USD: From 0.9 pips ✅

Gold: From 0.34

Indices: From 0.5

Fees

No commission ❌

Inactivity fee after 3 months: $50

Overnight swap rates apply

Leverage

Retail traders: Up to 30:1 (per Canadian regulations)

Pro traders: Up to 400:1 (eligibility needed)

Key takeaway: AvaTrade offers tight spreads and low fees, though the inactivity fee is worth noting.

Deposit & Withdrawal Methods in Canada

Canadian traders can fund their accounts using multiple secure options:

Credit/Debit Cards ✅

Bank Wire Transfers ✅

E-wallets: Skrill, Neteller

Withdrawals are processed within 1–3 business days. AvaTrade follows strict anti-money laundering (AML) guidelines.

Minimum deposit: $100 only — an affordable entry for beginners.

Customer Support & Local Language Availability

Support is available 24/5 with:

Live chat ✅

Email support

Phone assistance (including toll-free numbers)

While AvaTrade does not offer French support for Quebec currently ❌, it is expected to expand in 2025.

Support is available in English and many other global languages, and AvaTrade’s website has an intuitive design that even non-native speakers can navigate easily.

Pros & Cons of Using AvaTrade in Canada

Let’s break it down:

✅ Pros:

Regulated internationally

Low spreads

Multiple platforms (MT4, MT5, AvaTradeGO)

$100 minimum deposit

Comprehensive educational tools

❌ Cons:

Inactivity fee

Not IIROC-licensed directly

Limited local language support

AvaTrade vs Other Brokers in Canada

Minimum Deposit:

AvaTrade: $100 ✅

Questrade: $1,000 ❌

FXCM Canada: $300 ❌

OANDA Canada: $0 ✅

Trading Platforms:

AvaTrade: MT4, MT5, AvaTradeGO ✅

Questrade: IQ Edge ❌

FXCM Canada: Trading Station

OANDA Canada: fxTrade

Social/Copy Trading:

AvaTrade: Yes ✅

Questrade: No ❌

FXCM Canada: No ❌

OANDA Canada: Limited ❌

Regulation:

AvaTrade: Global ✅

Questrade: IIROC ✅

FXCM Canada: IIROC ✅

OANDA Canada: IIROC ✅

Leverage:

AvaTrade: Up to 400:1 ✅ (for eligible traders)

Questrade: Up to 50:1

FXCM Canada: Up to 50:1

OANDA Canada: Up to 50:1

AvaTrade clearly offers more global leverage and platform versatility, though it falls short on direct Canadian registration.

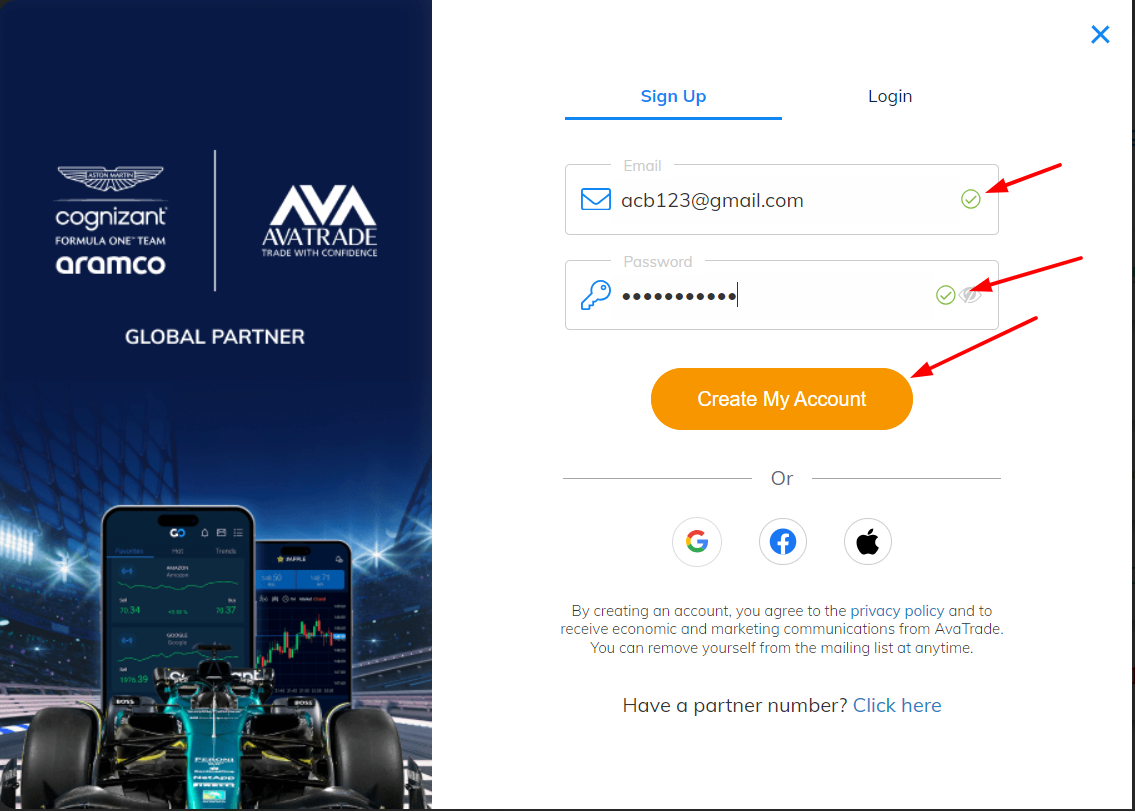

How to Open a Real Account with AvaTrade Canada

Opening a real AvaTrade account in Canada is fast and simple:

Click Start Trading

Fill out the registration form

Upload KYC documents (ID + Proof of Address)

Make your first $100+ deposit

Start trading ✅

The entire process takes less than 10 minutes. AvaTrade’s user interface is beginner-friendly and their support can help you every step of the way.

⚡ Want to start Forex trading in Canada? Don’t wait. AvaTrade offers all the tools you need to win in 2025.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Top Tips for New Canadian Forex Traders

Start with a Demo Account – Practice makes perfect.

Understand Leverage – Don’t overexpose your capital.

Use Stop Loss – Risk management is key.

Keep Learning – AvaTrade offers webinars and tutorials ✅

Trade What You Know – Focus on currency pairs or markets you understand.

AvaTrade’s free education center is a goldmine for new traders in Canada.

FAQs - AvaTrade Canada

1. Is AvaTrade regulated in Canada?

Not directly, but it operates under global regulations and accepts Canadian clients.

2. What is the minimum deposit for AvaTrade in Canada?

Only $100, making it one of the most accessible brokers.

3. Can I open an Islamic account?

Yes, AvaTrade offers swap-free Islamic accounts.

4. What platforms can I use?

You can trade using MT4, MT5, AvaTradeGO, and WebTrader.

5. Does AvaTrade offer a demo account?

Yes, you get a free $100,000 virtual balance to practice.

6. How long does it take to withdraw funds?

Withdrawals typically process within 1–3 business days.

7. Is AvaTrade beginner-friendly?

Absolutely ✅, especially with its educational tools and low deposit requirement.

8. Can I trade crypto with AvaTrade in Canada?

Yes, crypto CFDs are available, though with adjusted leverage.

9. What are the main cons of AvaTrade Canada?

Inactivity fee and lack of French language support.

10. Why should I choose AvaTrade over other brokers?

Because it offers a balanced mix of low costs, great tools, strong support, and beginner access — making it ideal for both new and experienced Canadian traders.

Ready to experience powerful trading in 2025?

👉 Open your AvaTrade Canada account today and step into the world of modern forex trading with confidence.

👉 Open An Account or 👉 Go to broker

AvaTrade: Trade with Trust, Trade with Technology.

💥 Read more: