7 minute read

Is Avatrade a Market maker

from Avatrade Review

by ForexMakets

Is Avatrade a Market maker? -> Yes, AvaTrade operates primarily as a market maker broker. This means it may act as the counterparty to traders’ positions, offering fixed spreads and fast order execution. Market makers provide liquidity, but traders should understand how this model impacts spreads, slippage, and trading conditions.

In the world of Forex trading, understanding the role of brokers is crucial for success. One common term that often comes up when discussing Forex brokers is "Market Maker." Avatrade, a popular online trading platform, has been a subject of debate among traders regarding whether it functions as a Market Maker. In this article, we will delve deep into the question: Is Avatrade a Market Maker? and explore how its business model works. Additionally, we’ll analyze the advantages and disadvantages of using a Market Maker broker in Forex trading.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

What is a Market Maker in Forex?

In the Forex market, brokers can either be Market Makers or ECN (Electronic Communication Network) brokers. Market Makers are brokers who create a market for their clients by providing both the buy and sell price for a currency pair. This means they take the opposite side of a trader’s position. For example, if a trader buys a currency pair, the Market Maker will sell that pair to them.

Market Makers are also known for offering fixed spreads and guaranteeing liquidity. They often make money through the spread (the difference between the buying and selling price) and by taking the other side of their clients' trades. ❌

How Does Avatrade Work?

Avatrade is a global online brokerage that offers trading in a variety of financial instruments, including Forex, stocks, commodities, and cryptocurrencies. Established in 2006, it is regulated in multiple jurisdictions, offering a high level of trustworthiness.

Avatrade provides clients with several platforms, such as MetaTrader 4, MetaTrader 5, and their proprietary AvaTradeGo app, which are accessible for both beginners and advanced traders. It also offers the option of using leverage and trading on CFDs (Contracts for Difference), which adds flexibility to a trader’s portfolio. ✅

The platform has gained a strong reputation due to its educational resources and customer support. But one of the most important things to understand about Avatrade is how it executes orders and whether it acts as a Market Maker or follows another model.

Is Avatrade a Market Maker or ECN?

So, is Avatrade a Market Maker? The answer lies in understanding its order execution model.

Market Maker Model

Avatrade does operate as a Market Maker in certain circumstances. When a trader places an order on the platform, Avatrade may act as the counterparty to that trade. This means that the broker might hold the other side of the trade rather than matching orders with other clients or liquidity providers. The key here is that Avatrade may be the one to provide liquidity and take the opposite side of trades.

ECN Model

However, Avatrade is not solely a Market Maker. It also provides ECN execution for some assets, allowing trades to be routed to multiple liquidity providers. This results in lower spreads and greater transparency. Thus, Avatrade offers both Market Maker and ECN execution methods depending on the type of trading account you open. ✅

Advantages of Using a Market Maker Broker like Avatrade

1. Fixed Spreads

One of the main advantages of using a Market Maker like Avatrade is the fixed spreads. Unlike ECN brokers, who often offer variable spreads based on market conditions, Market Makers offer predictable costs for traders. This makes it easier to plan and manage trades without worrying about sudden fluctuations in spreads.

2. Guaranteed Liquidity

Market Makers ensure liquidity at all times, even during times of high volatility. This means that traders can enter and exit trades when they need to, without delays or slippage, which is a common issue with ECN brokers.

3. No Commission Fees

Most Market Maker brokers do not charge commission fees on trades. Instead, they make their profit from the spread. This can be beneficial for traders who want to avoid additional costs, particularly those who are trading on a frequent basis.

4. Simple Execution

With Market Makers, execution is often more straightforward since there is less reliance on third parties and external liquidity sources. This results in faster trade execution for traders.

Disadvantages of Market Maker Brokers

1. Conflict of Interest

One potential disadvantage of using a Market Maker like Avatrade is the potential conflict of interest. Since the broker is taking the opposite side of your trades, there’s a possibility that they might profit when you lose. However, Avatrade has regulatory oversight and employs fair practices to mitigate this issue.

2. Limited Market Depth

Market Makers provide liquidity from their own capital, which means they might not offer the same level of market depth as ECN brokers. This can result in slippage during times of extreme market volatility.

3. Wider Spreads During Volatility

While Market Makers typically offer fixed spreads, these spreads may widen during times of market volatility, making it more expensive for traders to enter or exit positions.

How Avatrade Differs from ECN Brokers

1. Execution Model

As mentioned earlier, Avatrade offers both Market Maker and ECN execution, whereas ECN brokers offer direct access to liquidity providers and typically feature variable spreads. Traders using Avatrade’s ECN account can benefit from the direct interaction with a wider range of liquidity providers.

2. Cost Structure

Market Makers like Avatrade generally make their money through the spread, while ECN brokers tend to charge a commission on trades. Traders should evaluate which cost structure is more beneficial to their trading style.

3. Liquidity Access

ECN brokers provide access to true market liquidity, meaning orders are matched with other traders or liquidity providers. Avatrade’s Market Maker model, on the other hand, ensures liquidity but might not offer the same market depth and pricing transparency.

How to Get Started with Avatrade?

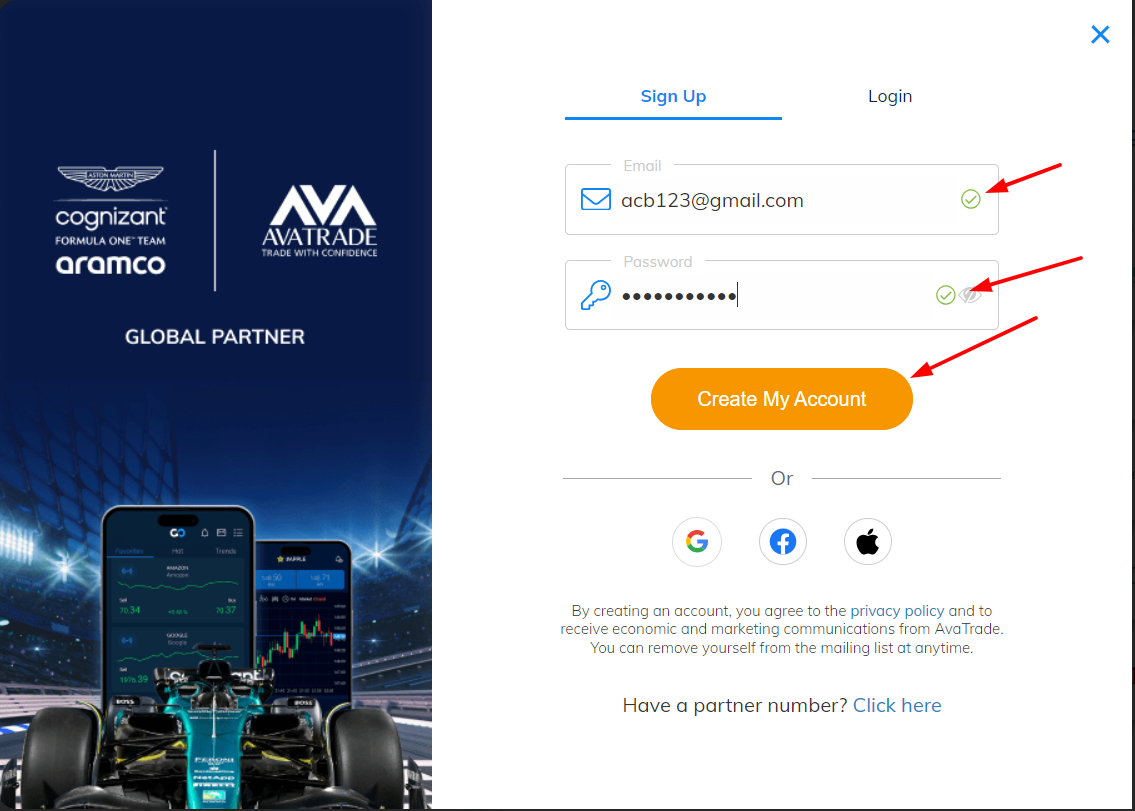

Starting with Avatrade is simple, and the platform is beginner-friendly. To open an account:

Visit the Avatrade Website – Go to their official site and click the “Register” button.

Fill Out the Registration Form – Provide your personal details, including name, email, and phone number.

Choose Your Account Type – Decide whether you want to open a Market Maker or ECN account.

Deposit Funds – Avatrade offers several payment methods, including bank transfers and credit cards.

Start Trading – Once your account is set up, you can begin trading on the MetaTrader 4/5 platforms or the AvaTradeGo app.

See more:

Frequently Asked Questions (FAQ)

Q1: Is Avatrade regulated?A1: Yes, Avatrade is regulated in multiple jurisdictions, including Europe, Australia, and Japan.

Q2: Does Avatrade charge commissions?A2: Avatrade typically does not charge commissions on Market Maker accounts but may charge them on ECN accounts.

Q3: Can I trade CFDs with Avatrade?A3: Yes, Avatrade offers trading on a wide range of CFDs, including Forex, stocks, commodities, and cryptocurrencies.

Q4: What is the minimum deposit for opening an Avatrade account?A4: The minimum deposit for an Avatrade account is typically $100, depending on the account type.

Q5: Does Avatrade offer leverage?A5: Yes, Avatrade offers leverage to its traders, though the amount of leverage varies by region and regulatory requirements.

Q6: Is Avatrade a good choice for beginners?A6: Yes, Avatrade is known for its user-friendly platforms and educational resources, making it suitable for beginners.

Q7: Can I trade with Avatrade on mobile?A7: Yes, Avatrade offers mobile apps such as AvaTradeGo for trading on the go.

Q8: What are the spreads like on Avatrade?A8: Spreads on Avatrade are competitive, especially on Market Maker accounts, where they are fixed.

Q9: Does Avatrade offer demo accounts?A9: Yes, Avatrade offers demo accounts for beginners to practice without risking real money.

Q10: How do I withdraw funds from Avatrade?A10: You can withdraw funds via the same method used for deposits, such as bank transfers or credit cards.

Conclusion

Avatrade is indeed a Market Maker in certain aspects of its operations, though it also offers ECN accounts for those looking for direct market access. Whether you're a beginner or an experienced trader, Avatrade provides an accessible and reliable platform for trading various financial instruments. By understanding how Market Maker brokers work, you can make more informed decisions about whether this model aligns with your trading style.

If you’re ready to start trading with Avatrade, click below to register and open your account today! ✅

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

See more: