7 minute read

Avatrade South Africa Review 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

Avatrade South Africa Review 2025: Pros & Cons A Comprehensive Review

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Introduction

AvaTrade is a prominent global forex and CFD broker that has been operational since 2006. In South Africa, AvaTrade is regulated by the Financial Sector Conduct Authority (FSCA), ensuring compliance with local financial regulations. This review delves into AvaTrade's offerings for South African traders in 2025, examining its pros, cons, and overall suitability for various trading needs.

💡 Learn how the global currency market moves—check out our Forex Markets page now!

Regulation and Security

AvaTrade operates under multiple regulatory bodies, including the FSCA in South Africa, the Central Bank of Ireland (CBI), the Australian Securities and Investments Commission (ASIC), and the Financial Services Agency (FSA) in Japan. This multi-tiered regulation provides a robust framework ensuring transparency, client fund protection, and adherence to industry standards.

The broker offers negative balance protection, ensuring that traders cannot lose more than their deposited funds. Additionally, client funds are kept in segregated accounts, enhancing security.

Trading Platforms and Tools

AvaTrade provides a diverse range of trading platforms to cater to different trader preferences:

MetaTrader 4 (MT4) & MetaTrader 5 (MT5): Widely recognized platforms offering advanced charting tools, automated trading capabilities, and a user-friendly interface.

AvaTradeGO: A proprietary mobile app designed for on-the-go trading, featuring real-time market updates and intuitive navigation.

AvaOptions: A platform tailored for forex options trading, providing advanced risk management tools.

WebTrader: A browser-based platform allowing traders to access their accounts without the need for software installation.

These platforms are compatible with various devices, including Windows, macOS, iOS, and Android, ensuring accessibility for traders across different operating systems.

Account Types and Fees

AvaTrade offers several account types to accommodate both novice and experienced traders:

Retail Accounts: Designed for individual traders, offering competitive spreads and leverage up to 1:400.

Professional Accounts: For qualified traders seeking higher leverage and additional features.

Demo Accounts: Allow traders to practice strategies without financial risk.

Fees:

Spreads: Competitive spreads starting from 0.9 pips on major currency pairs like EUR/USD.

Commissions: AvaTrade operates on a commission-free model, earning revenue through spreads.

Inactivity Fees: A fee of $50 is charged if an account remains inactive for three months.

Overnight Financing: Swap rates apply for positions held overnight, varying based on the instrument and market conditions.

Market Instruments and Asset Classes

AvaTrade provides access to a broad spectrum of financial instruments:

Forex: Over 55 currency pairs, including major, minor, and exotic pairs.

Stocks: Shares from over 700 global companies, including Apple, Amazon, and Facebook.

Cryptocurrencies: Trading on popular digital currencies like Bitcoin, Ethereum, and Litecoin.

Commodities: Instruments like gold, silver, and crude oil.

Indices: Major indices such as the S&P 500, FTSE 100, and DAX 30.

This diverse range allows traders to build a well-rounded portfolio and capitalize on various market opportunities.

Not sure which broker is trustworthy? Read Review Forex Broker from Real Users here!

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Education and Research

AvaTrade places a strong emphasis on trader education:

AvaAcademy: Offers comprehensive courses covering topics from basic trading principles to advanced strategies.

Video Tutorials: A library of videos explaining platform features, trading techniques, and market analysis.

Webinars: Regularly scheduled sessions hosted by experienced traders and analysts.

Market Analysis: Access to research from third-party providers like Trading Central, along with market commentary and news updates.

These resources are designed to enhance traders' skills and knowledge, catering to both beginners and seasoned professionals.

Customer Support

AvaTrade offers robust customer support to assist traders:

Availability: 24/7 support to address queries and issues promptly.

Contact Methods: Support is accessible via phone, email, live chat, and WhatsApp.

Languages: Assistance is provided in multiple languages, including English, ensuring clear communication.

This comprehensive support structure ensures that traders receive timely assistance whenever needed.

Deposits and Withdrawals

AvaTrade facilitates convenient financial transactions:

Local Bank Transfers: South African traders can deposit and withdraw funds using local bank transfers, minimizing currency conversion fees.

Payment Methods: Supports various methods, including credit/debit cards and a-wallets

Fees: No deposit or withdrawal fees are charged. Processing Times: While deposits are processed promptly, withdrawals may take longer depending on the method used.

These options provide flexibility and ease for traders managing their funds.

Pros and Cons

Pros:

✅ Regulated by FSCA, ensuring local legal compliance and fund safety.

✅ Wide range of tradable instruments, including forex, stocks, crypto, commodities, and indices.

✅ Multiple trading platforms like MT4, MT5, AvaTradeGO, and AvaOptions—suited for all experience levels.

✅ Zero commission model, with competitive spreads starting from 0.9 pips.

✅ Educational support through AvaAcademy, webinars, and market research.

✅ 24/7 multilingual customer support, including live chat and WhatsApp.

✅ User-friendly mobile trading, ideal for South African traders on-the-go.

✅ Fast and flexible funding options, including local bank transfers.

✅ Negative balance protection and segregated client funds.

Cons:

❌ No ZAR-based trading account, which may involve conversion fees for South African users.

❌ Inactivity fee of $50 after 3 months without trading.

❌ Lack of direct MetaTrader plugin for South African bank accounts.

❌ Limited availability of advanced analytics tools within their native platforms.

❌ Withdrawals can be delayed depending on bank processing times.

Conclusion

AvaTrade South Africa has proven to be a trusted and robust broker for traders of all experience levels in 2025. With strong regulatory backing, competitive pricing, and a wide array of trading platforms and instruments, it offers a compelling environment for both beginners and advanced traders.

If you're a South African trader seeking a safe, regulated, and feature-rich forex broker — AvaTrade is a top-tier choice.

👉 Ready to start trading? Don’t miss your opportunity — open an AvaTrade account today and claim your welcome bonus!

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

FAQs

1. Is AvaTrade legal and safe to use in South Africa?✅ Yes, AvaTrade is fully licensed by the Financial Sector Conduct Authority (FSCA), ensuring its operations are legal and secure.

2. What is the minimum deposit to start trading on AvaTrade?You can start trading with as little as $100, though a higher deposit is recommended for better risk management.

3. Does AvaTrade support trading in cryptocurrencies?Yes, AvaTrade offers a wide range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

4. Can I use ZAR to fund my AvaTrade account?While ZAR deposits are supported via local bank transfer, the trading account base currency is typically in USD or EUR, so conversions may apply.

5. How fast are withdrawals processed by AvaTrade?Withdrawals typically take 1–3 business days depending on your payment method.

6. Does AvaTrade offer copy trading?Yes, AvaTrade supports copy trading via platforms like DupliTrade and ZuluTrade.

7. Can I practice trading before risking real money?Absolutely. AvaTrade offers a free demo account with virtual funds.

8. Is there a mobile app available for South African users?Yes, the AvaTradeGO mobile app is available on both Android and iOS for South African users.

9. Are there any hidden fees with AvaTrade?No hidden fees, but be aware of inactivity and overnight swap charges.

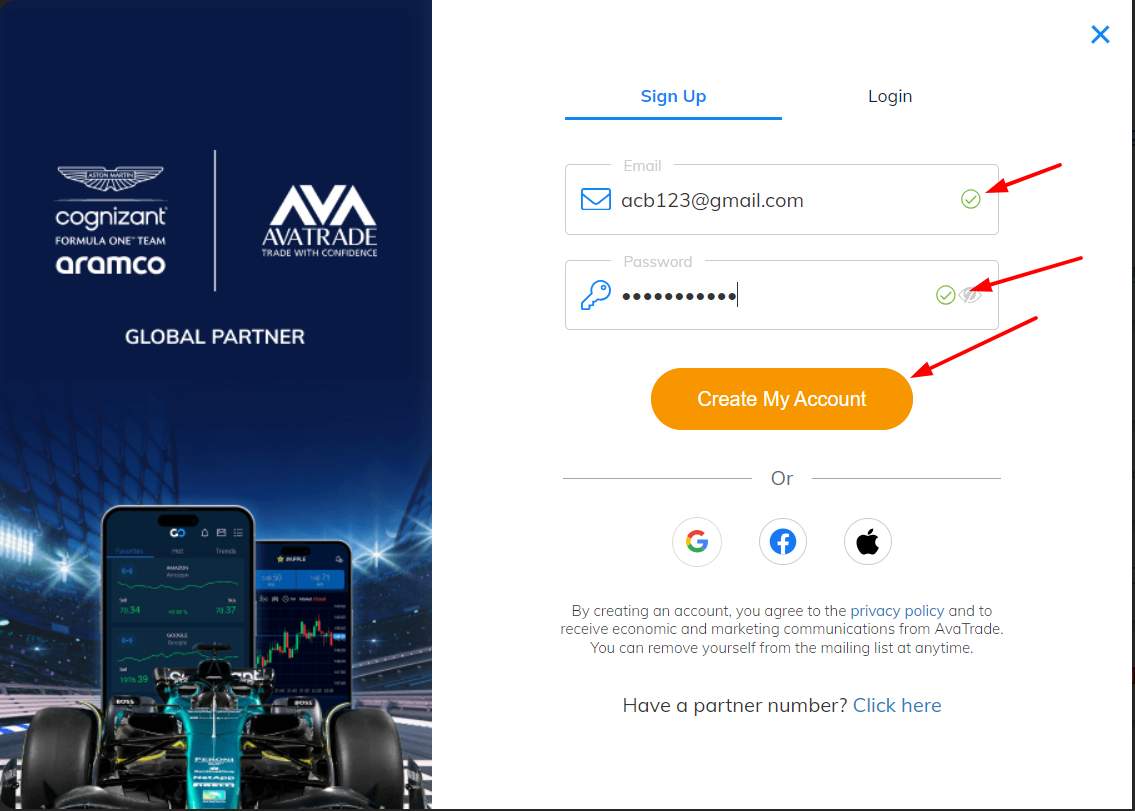

10. How can I open an AvaTrade account?Simply visit AvaTrade’s official website, click "Register", complete your verification, and make your first deposit.

💥💥💥 Click here to register: 👉 Open An Account or 👉 Go to broker

💡 Tip for Traders: Don't just trade — trade smart. With AvaTrade’s tools, regulation, and global access, you’re backed by a broker that empowers your strategy.

💥 Read more: