8 minute read

Is Avatrade an ECN Broker

from Avatrade Review

by ForexMakets

Is Avatrade an ECN Broker -> No, AvaTrade is not classified as a pure ECN broker. It primarily operates as a market maker, offering stable spreads and internal order execution. While this model benefits many retail traders with predictable pricing, it differs from true ECN environments that route orders directly to liquidity providers.

In the world of online trading, brokers play a vital role in the financial success of traders. Whether you are a seasoned expert or a beginner, choosing the right broker can make all the difference in achieving your trading goals. One question that often arises in the trading community is whether Avatrade is an ECN broker. In this comprehensive guide, we’ll explore the intricate details of Avatrade’s trading platform, its ECN capabilities, and what it means for you as a trader.

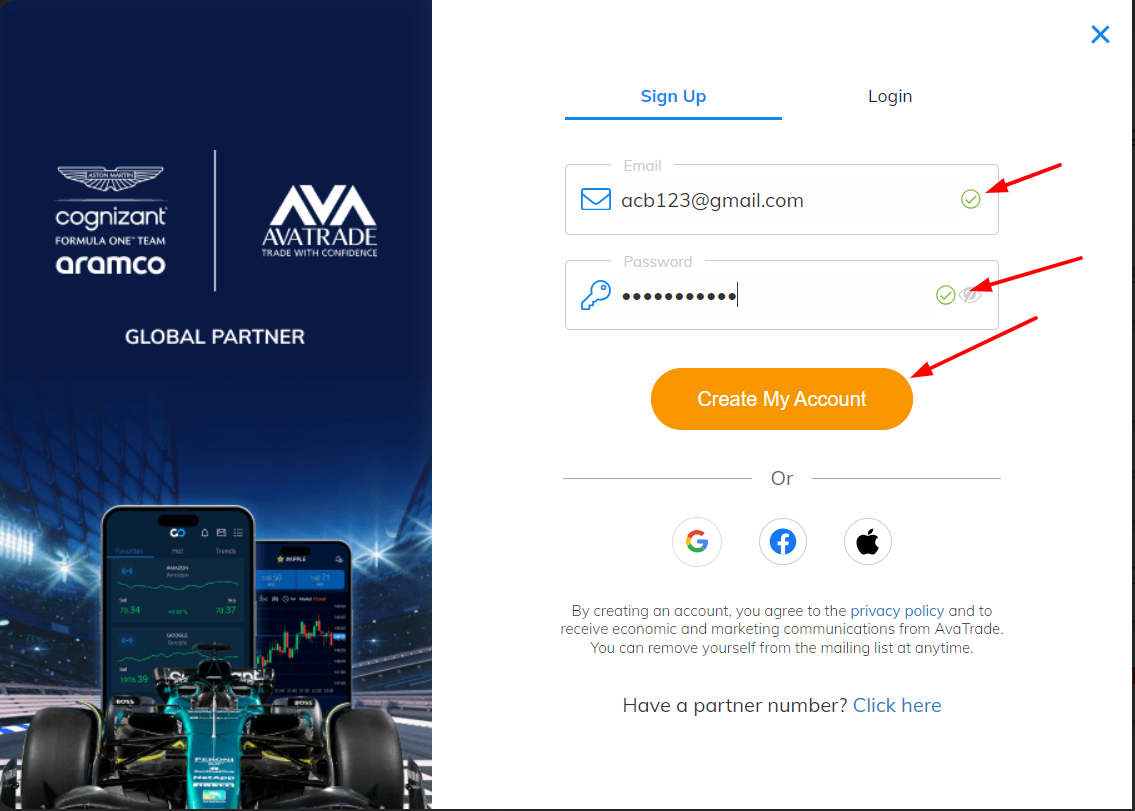

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

But before diving into the depths of this analysis, let’s get a brief understanding of ECN brokers. ECN, or Electronic Communication Network, refers to a trading system that provides a direct connection between buyers and sellers, bypassing traditional dealing desks. As a result, ECN brokers typically offer lower spreads, faster execution, and more transparent pricing.

1. What is an ECN Broker?

An ECN broker is a type of forex broker that facilitates direct access to a network of liquidity providers, such as banks, financial institutions, and other traders. The primary advantage of an ECN broker is that they allow traders to execute trades without the interference of a dealing desk, offering true market prices and faster execution. This creates an environment where trades are executed quickly with minimal delays, which is crucial for high-frequency and algorithmic traders.

Key features of ECN brokers include:

Tighter spreads: Since ECN brokers aggregate quotes from multiple liquidity providers, the spreads tend to be much narrower than those found with standard brokers.

No dealing desk intervention: ECN brokers don’t intervene in the execution process, meaning there’s no potential conflict of interest, and orders are filled at the best available market price.

Transparency: With an ECN broker, you have direct access to market prices and liquidity, which adds a layer of transparency to the trading process.

2. Does Avatrade Offer ECN Trading?

The short answer is Yes, Avatrade does offer ECN trading. However, it’s important to note that Avatrade operates under a slightly different model than traditional ECN brokers. Avatrade’s ECN offerings are available under specific conditions and on certain account types. Their ECN-like system is designed to provide fast execution speeds, direct access to liquidity providers, and competitive spreads.

Although Avatrade is not purely a no-dealing desk broker, they offer a hybrid model that incorporates features of ECN trading. Traders who choose Avatrade will benefit from lower spreads and direct execution on most currency pairs, similar to what you would find with traditional ECN brokers.

3. Advantages of Trading with Avatrade ECN Broker

There are several advantages to using Avatrade as your ECN broker. Let’s break down some of the key benefits:

✅ Lower Spreads

One of the most significant benefits of trading with an ECN broker like Avatrade is the lower spreads. This is because there are no intermediaries; instead, you are dealing directly with the liquidity providers. Lower spreads mean that traders pay less to enter and exit trades, thus improving their overall profitability.

✅ Faster Execution

With ECN execution, you get access to instant order execution, which is essential in volatile market conditions. This is particularly beneficial for day traders and scalpers who need to execute orders in fractions of a second.

✅ No Dealing Desk Interference

ECN brokers are known for no dealing desk intervention. This means there is no conflict of interest between the broker and the trader, and you will always get the best available price on your trades.

✅ Access to Global Liquidity

Avatrade’s ECN system allows traders to access global liquidity from a variety of sources, including banks, financial institutions, and other traders. This provides deeper liquidity, reducing the chances of slippage and allowing for more efficient trades.

✅ Transparency

ECN brokers are known for their transparency. Avatrade offers you a direct connection to the market with real-time pricing and the ability to view the full order book. This transparency gives traders more control over their trades.

See more:

4. How Avatrade’s ECN System Works

Avatrade’s ECN system works by aggregating liquidity from multiple providers, including top-tier financial institutions and banks. This results in tighter spreads and better trade execution. Traders can access this liquidity pool and execute trades directly through Avatrade’s platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

In terms of how it benefits traders:

Order Matching: When you place an order, it is matched with the best possible bid or ask from the available liquidity providers.

No Dealing Desk: There is no middleman between the trader and the market. This ensures that there is no manipulation or conflict of interest, which is common in dealing desk brokers.

Market Transparency: Traders can see real-time market prices and execute trades at the most favorable rates available at the time.

5. Account Types at Avatrade

Avatrade offers several account types that cater to various types of traders, including those looking to trade with ECN conditions. The main accounts available are:

Standard Account: Ideal for beginners, this account offers lower minimum deposits and access to the basic features of the platform.

Professional Account: Aimed at experienced traders, this account comes with advanced features and allows access to ECN-like conditions.

Demo Account: Perfect for newcomers who wish to test the platform before committing real money.

Traders interested in ECN trading can opt for accounts that provide direct access to liquidity providers and superior execution speeds.

6. Is Avatrade Suitable for Beginner Traders?

Yes, Avatrade is highly suitable for beginner traders. The platform provides a user-friendly interface, educational resources, and demo accounts to help new traders get started. Additionally, Avatrade’s customer support is available 24/5, making it easy for beginners to get assistance when needed.

For beginners who are looking to trade with ECN-like conditions but without the steep learning curve, Avatrade offers a seamless experience with a variety of educational tools to help them get up to speed.

7. The Trading Experience with Avatrade

Avatrade is known for offering a smooth and efficient trading experience. Execution speeds are fast, and traders have access to a range of tools designed to enhance their trading strategies, including:

Advanced charting tools

Technical analysis indicators

Automated trading systems (for advanced traders)

The mobile trading apps provided by Avatrade are also highly rated, allowing traders to trade on the go with the same level of efficiency as on desktop platforms.

8. Avatrade’s Regulatory Standing

When it comes to regulatory standing, Avatrade is fully regulated in several jurisdictions, including the European Union, Australia, and South Africa. This offers a sense of security and trust to traders, as it ensures that Avatrade complies with the financial laws and standards of these regions.

Traders can rest assured that Avatrade operates transparently and ethically, providing a safe environment for trading.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

9. Trading Fees and Costs with Avatrade

Avatrade’s fee structure is competitive. While it offers low spreads, there may be commissions on certain ECN account types. The fee structure is transparent, and traders can easily view the costs associated with their trades in real-time.

10. Customer Support and Education at Avatrade

Avatrade offers excellent customer support and a wealth of educational resources. Traders can access tutorials, webinars, and articles to enhance their trading knowledge. The customer support team is available via live chat, email, or phone.

11. Pros and Cons of Avatrade

Pros:

✅ Low spreads and fast execution

✅ Regulated in multiple jurisdictions

✅ User-friendly platform for beginners

✅ Comprehensive educational resources

✅ Demo accounts for practice

Cons:

❌ Commissions on certain account types

❌ Limited range of cryptocurrencies

12. 10 Commonly Asked Questions About Avatrade

Is Avatrade a regulated broker?

Yes, Avatrade is regulated in multiple regions.

Does Avatrade offer ECN trading?

Yes, Avatrade offers ECN-like trading conditions on certain account types.

What are the spreads like with Avatrade?

Spreads with Avatrade are competitive, especially on their ECN accounts.

Can I use automated trading with Avatrade?

Yes, Avatrade supports automated trading systems.

Does Avatrade charge commissions on trades?

Yes, there are commissions on specific ECN accounts.

Is Avatrade suitable for beginners?

Yes, Avatrade is beginner-friendly with educational resources and demo accounts.

What is the minimum deposit at Avatrade?

The minimum deposit varies depending on the account type but is generally low.

Can I trade on mobile with Avatrade?

Yes, Avatrade offers a mobile trading app.

Does Avatrade offer a demo account?

Yes, Avatrade provides demo accounts for practice.

Is Avatrade a good broker for forex trading?

Yes, Avatrade is a strong choice for forex trading with ECN-like conditions.

Conclusion

In summary, Avatrade ECN Broker provides traders with competitive spreads, fast execution, and a user-friendly platform, making it a great choice for both beginners and experienced traders. Whether you’re looking for a broker with ECN-style trading conditions or a regulated, reliable platform, Avatrade stands out as a solid option in the forex market.

If you’re ready to take your trading to the next level, sign up with Avatrade today and open an account with competitive spreads, robust tools, and exceptional customer support. Happy trading!

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

See more: