7 minute read

Avatrade Review Singapore 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

Avatrade Review Singapore 2025: Pros & Cons A Comprehensive Review

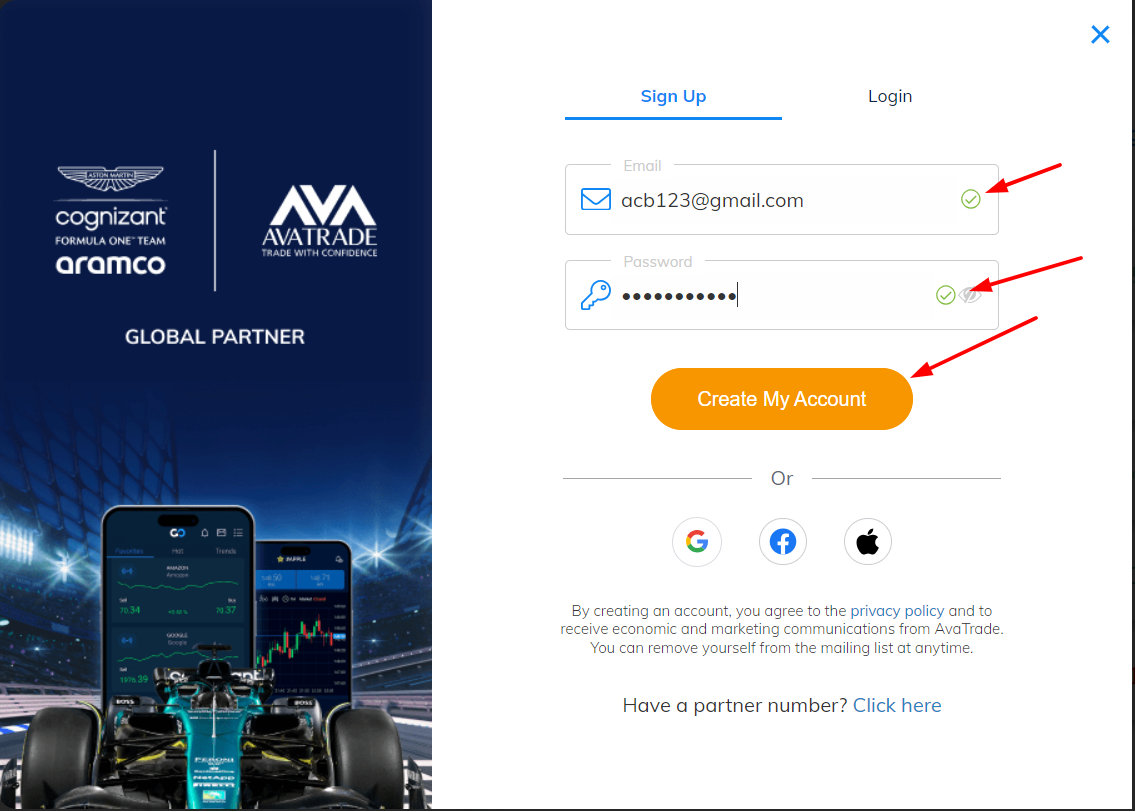

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Introduction

In the dynamic world of forex trading, selecting a reliable broker is paramount. AvaTrade, established in 2006, has emerged as a prominent player in the industry, offering a range of trading platforms and tools to cater to both novice and experienced traders. This comprehensive review delves into the pros and cons of AvaTrade, providing insights to help you determine if it's the right fit for your trading needs.

📌 Navigate the world of forex with confidence—start with our expert content on the Forex Markets!

1. Overview of AvaTrade

AvaTrade is an online forex and CFD broker that offers trading services across various asset classes, including forex, stocks, commodities, indices, and cryptocurrencies. The broker provides access to multiple trading platforms, catering to different trading styles and preferences

2. Regulation and Trustworthiness

AvaTrade is regulated in several jurisdictions, ensuring a level of trust and security for its clients. The broker holds licenses from reputable regulatory bodies, including:

Central Bank of Ireland

Australian Securities and Investments Commission (ASIC)

Financial Services Commission (FSC) of the British Virgin Islands

These regulatory affiliations contribute to AvaTrade's credibility in the global trading community.

3. Account Types and Minimum Deposit

AvaTrade offers various account types to cater to different trader profiles:

Standard Account: Suitable for most traders, offering competitive spreads and access to all available markets.

Professional Account: Designed for experienced traders, offering higher leverage and tighter spreads.

Demo Account: Allows traders to practice strategies without risking real capital.

The minimum deposit requirement is $100, making it accessible for new traders to start their trading journey.

4. Trading Platforms Offered

AvaTrade provides access to several trading platforms, each catering to different trading needs:

MetaTrader 4 (MT4): A widely used platform known for its user-friendly interface and robust charting tools.

MetaTrader 5 (MT5): An upgraded version of MT4, offering additional features like more timeframes and order types.

AvaTradeGO: A proprietary mobile app designed for trading on the go.

AvaOptions: A platform tailored for options trading, providing advanced risk management tools.

WebTrader: A browser-based platform offering flexibility and ease of access.

These platforms are compatible with both desktop and mobile devices, ensuring traders can access their accounts anytime, anywhere.

5. Financial Instruments Available

AvaTrade offers a diverse range of financial instruments, allowing traders to diversify their portfolios:

Forex: Access to over 60 currency pairs, including major, minor, and exotic pairs.

Stocks and Indices: Trade CFDs on global stocks and major indices like the S&P 500 and NASDAQ.

Commodities: Includes popular commodities such as gold, oil, and agricultural products.

Cryptocurrencies: Trade CFDs on cryptocurrencies like Bitcoin and Ethereum.

ETFs and Bonds: Access to a variety of ETFs and bonds for diversified trading.

This extensive selection provides traders with numerous opportunities to capitalize on market movements.

📌 Choosing a Forex broker is crucial. Don’t miss our honest and updated Review Forex Broker to help you decide wisely.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

6. Spreads, Fees, and Commissions

AvaTrade operates on a spread-only fee model, meaning traders are charged through the difference between the buy and sell prices. This structure ensures transparency and simplicity in cost calculation.

Key points to note:

Spreads: Competitive spreads starting from 0.9 pips on major currency pairs.

Commissions: No additional commissions on trades.

Inactivity Fee: A fee is charged if the account remains inactive for a specified period.

Deposit and Withdrawal Fees: No fees for deposits or withdrawals, though third-party charges may apply.

These cost structures make AvaTrade an attractive option for traders seeking cost-effective trading solutions.

7. Educational Resources and Support

AvaTrade places a strong emphasis on trader education, offering a wealth of resources:

AvaAcademy: A comprehensive learning platform with courses ranging from beginner to advanced levels.

Webinars and Tutorials: Regularly scheduled sessions covering various trading topics.

E-books and Articles: A library of written materials for self-paced learning.

Demo Account: Allows traders to practice strategies without financial risk.

These resources are designed to help traders enhance their skills and make informed trading decisions.

8. Customer Support Services

AvaTrade offers robust customer support to assist traders:

Availability: 24/5 support through live chat, email, and phone.

Languages: Support available in multiple languages, including English, Spanish, French, and more.

Help Center: A self-service portal with FAQs, platform guides, and troubleshooting steps.

Dedicated Account Managers: For premium users or those trading at higher volumes, AvaTrade assigns personal account managers to assist in strategy and execution. ✅

User Experience Rating: Most traders report positive experiences, particularly highlighting AvaTrade's fast response times and multilingual accessibility.

9. Pros and Cons Summary

Below is a detailed comparison of AvaTrade’s strengths and potential drawbacks for traders in Singapore in 2025.

✅ Pros

Regulated by multiple tier-1 authorities

Wide range of tradable assets, including forex, crypto, and commodities

User-friendly platforms, including MT4, MT5, and AvaTradeGO

No commissions on trades

Robust educational resources for all levels

Excellent mobile trading experience

Responsive multilingual customer support

Low minimum deposit ($100)

❌ Cons

Inactivity fees apply after 3 months

No direct ECN/STP access — may not appeal to some scalpers or HFTs

Fixed spread model may be less appealing during volatile market conditions

Limited weekend trading options

Cryptocurrency leverage is lower due to regulatory constraints

10. Marketing Angle: Why You Should Open an AvaTrade Account Today

Are you looking for a broker that blends advanced tools, regulation, education, and support?

👉 Whether you're new to trading or an experienced trader searching for deeper liquidity and global exposure, AvaTrade offers everything you need to get started — and to grow your trading journey.

🔥 Limited-Time Offer for Singapore Traders in 2025:

Sign up today and receive a welcome bonus up to $1000 on your first deposit (terms apply).

Get exclusive access to one-on-one coaching, trade signals, and premium webinars.

👉 Don’t just trade—trade smart.👉 Don’t just open an account—open opportunities.

✅ Ready to start? Register now and take your first step towards financial independence with AvaTrade!

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

11. Frequently Asked Questions (FAQs)

1. Is AvaTrade legal in Singapore?

Yes, AvaTrade is accessible to Singapore residents and complies with international regulatory standards. However, always ensure you meet MAS guidelines for retail trading.

2. What is the minimum deposit for AvaTrade in Singapore?

The minimum deposit is $100, making it accessible to beginners and part-time traders.

3. Does AvaTrade offer Islamic accounts?

Yes, AvaTrade offers Sharia-compliant Islamic accounts, also known as swap-free accounts.

4. Can I trade crypto with AvaTrade?

Absolutely. You can trade crypto CFDs such as Bitcoin, Ethereum, Ripple, and others, 24/7.

5. How can I withdraw funds from AvaTrade?

Withdrawals can be processed via bank transfer, credit/debit cards, and e-wallets. Processing typically takes 1–3 business days.

6. Does AvaTrade charge commission?

No. AvaTrade uses a spread-only pricing model, so there are no additional commissions on trades.

7. Is AvaTrade suitable for beginners?

Yes. With educational resources, a demo account, and simple user interfaces, it is well-suited for novice traders.

8. What leverage is available on AvaTrade?

Leverage varies by asset class and region. For forex, it can go up to 1:400 for professional accounts.

9. Can I use automated trading or EAs on AvaTrade?

Yes. MT4 and MT5 platforms fully support Expert Advisors (EAs) for automated trading strategies.

10. Is there any bonus for new users?

Yes, new traders may be eligible for a deposit bonus or free educational tools, depending on promotions available at the time of registration.

Final Thoughts

AvaTrade in Singapore (2025) stands out as a solid and secure broker, especially for traders seeking versatile platforms, tight spreads, and a strong support structure. Whether you are testing the waters or scaling up your trading game, AvaTrade offers the infrastructure and tools to help you succeed.

✅ Still thinking about it?👉 Take control of your financial future—open an AvaTrade account today.

💥 Read more:

Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review

Avatrade App Review 2025: Pros & Cons A Comprehensive Review

Avatrade Demo Account Review 2025: Pros & Cons A Comprehensive Review