10 minute read

Avatrade Islamic Account Review 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

The AvaTrade Islamic Account is a Sharia-compliant trading option that offers swap-free trading on Forex and CFDs, making it suitable for Muslim traders who want to trade ethically.

In the ever-evolving landscape of Forex trading, choosing a broker that aligns with your values, trading goals, and religious beliefs is more important than ever. For Muslim traders seeking a halal trading environment, the Avatrade Islamic Account offers a compelling solution. But is it really the best choice in 2025? ✅

This comprehensive review will provide an in-depth analysis of the Avatrade Islamic Account, examining its advantages, disadvantages, trading conditions, and unique features. Whether you're new to Forex or a seasoned trader, this guide will help you decide whether Avatrade's swap-free option is right for you.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. What is an Islamic Forex Account?

An Islamic Forex account, also known as a swap-free account, is designed for Muslim traders who want to trade in accordance with Sharia law. In Islam, riba (interest) is strictly prohibited, and conventional Forex accounts typically involve overnight interest (swap fees), which conflicts with Islamic financial principles.

Here’s how an Islamic Forex account works:

No overnight interest is charged or paid ✅

Transactions are processed quickly to avoid interest accumulation

Trading practices align with halal guidelines

The Avatrade Islamic Account is one such solution that claims to support Islamic values while offering a modern trading experience. But how well does it deliver on this promise?

See more: Broker Avatrade Review 2025

2. Overview of Avatrade

Avatrade is a globally recognized Forex and CFD broker, operating since 2006, and regulated across multiple jurisdictions, including:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

ADGM (UAE)

With a solid reputation and diverse product offering, Avatrade caters to over 300,000 traders globally. Their inclusion of an Islamic trading account positions them as one of the few mainstream brokers aiming to meet the demands of the Muslim trading community.

See more:

3. Key Features of Avatrade Islamic Account

The Avatrade Islamic Account comes packed with features that cater to both beginners and advanced traders:

✅ Swap-free trading: No interest charged on overnight positions

✅ Sharia-compliant structure: Designed to avoid riba

✅ No hidden fees: Transparent pricing policy

✅ Access to all instruments: Trade Forex, commodities, indices, and more

✅ MetaTrader 4 & 5 supported: Industry-leading platforms

✅ Multilingual support: Arabic-speaking customer service available

✅ Negative balance protection: Additional risk management

Important Note: While the account is swap-free, Avatrade may apply an administration fee after a certain period to cover operational costs. This is not considered interest, but rather a fixed service fee, which aligns with Islamic finance guidelines.

4. How the Islamic Account Differs from Standard Accounts

Here’s a breakdown of how the Avatrade Islamic Account differs from regular trading accounts (listed, not in table form as per your request):

No overnight interest charges ✅

Fees structured to remain compliant with Sharia law

Different account approval process (must request Islamic status manually)

Fixed spreads in some markets for more stable pricing

Slightly different rollover rules for open positions

Restricted access to certain high-interest instruments to avoid potential non-halal trades

These distinctions are crucial for Muslim traders seeking a halal path in a traditionally interest-heavy market.

5. Pros of Using Avatrade Islamic Account ✅

Choosing the Avatrade Islamic Account offers several advantages that go beyond just Sharia compliance:

Global Regulation: Safety and trust backed by multiple top-tier licenses

True Swap-Free Trading: No interest, ever, on overnight positions

Wide Asset Selection: Over 1,250 financial instruments including Forex, crypto, and indices

Robust Platforms: MetaTrader 4, MetaTrader 5, WebTrader, and mobile apps

Risk Management Tools: AvaProtect™, stop loss, and negative balance protection

Strong Educational Content: Webinars, courses, and daily market analysis

Excellent Customer Support: Available in Arabic and several languages

Easy Deposit and Withdrawal: Multiple local options with fast processing

Multilingual Platforms: Ideal for traders from the Middle East and Asia

High Leverage (varies by region): Up to 1:400 for certain instruments

6. Cons of Using Avatrade Islamic Account ❌

While the account has strong advantages, there are also some drawbacks worth considering:

❌ Not Activated by Default: You must manually request Islamic status after account registration

❌ Admin Fees: After a few days, fixed admin charges may apply (non-interest)

❌ Unavailable in Some Jurisdictions: Depending on regulations, not all regions support Islamic accounts

❌ Limited Scalping Options: Some restrictions apply on high-frequency trading

❌ No ECN Access: Market-making model may not suit all advanced traders

While these issues aren’t deal-breakers for most retail traders, advanced users should be aware.

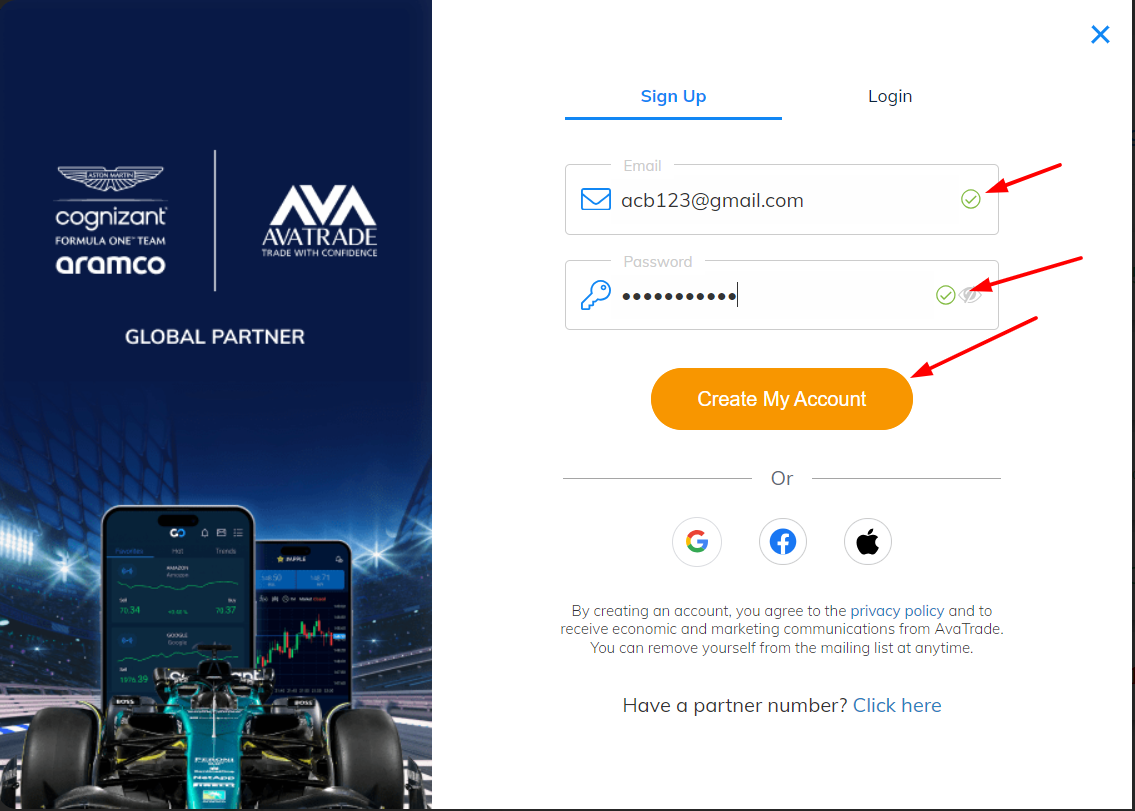

7. Account Opening Process

Opening an Avatrade Islamic Account is a simple process:

Click “Register” and complete the sign-up form

Submit identification documents (KYC)

Verify your email and identity

Fund your account with a minimum deposit (usually $100)

Contact support or account manager to request Islamic account status

Wait for confirmation (usually within 1-2 business days)

✅ Once approved, you’ll be trading without interest fees on a fully halal platform.

8. Trading Conditions and Supported Assets

With the Avatrade Islamic Account, traders can access:

Forex: Major, minor, and exotic currency pairs

Commodities: Gold, silver, oil, natural gas

Indices: S&P 500, NASDAQ, FTSE, DAX, and more

Cryptocurrencies: Bitcoin, Ethereum, Ripple (with swap-free conditions)

Stocks & ETFs: Global companies and diversified funds

Spreads are competitive, especially on major Forex pairs, and execution is fast with minimal slippage. You can also trade with fixed or variable spreads, depending on market conditions and platform preference.

9. Platforms and Tools Available

The Avatrade Islamic Account gives traders access to some of the most powerful and widely used trading platforms:

✦ MetaTrader 4 (MT4)

One of the most popular platforms globally

Advanced charting tools and indicators

Expert Advisors (EAs) supported

Real-time market execution

✦ MetaTrader 5 (MT5)

Enhanced version of MT4

More technical indicators

Depth of Market (DOM) analysis

Ideal for multi-asset trading

✦ AvaTrade WebTrader

No download required

Accessible via browser on any device

User-friendly interface

✦ AvaTradeGO (Mobile App)

Trade on the go

Integrated risk management tools

Arabic interface available ✅

✦ AvaOptions

Specialized in options trading

Designed for advanced hedging strategies

Bonus Tools:

AvaProtect™: Insurance-like tool that protects trades against loss

DupliTrade™: Social trading feature for copying expert strategies

Trading Central: Market insights and signals

These platforms, when combined with the Islamic account structure, provide a full-fledged halal trading experience suitable for every skill level.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

10. Fees and Commissions

The Avatrade Islamic Account stands out for its transparent fee model.

No Swap Fees ✅

Unlike conventional accounts, no interest is charged or credited for overnight positions.

Admin Fees (Where Applicable)

After a certain number of days (typically 3-7), Avatrade may apply a fixed administrative fee to open trades. This is not riba, but rather a service fee allowed under Islamic finance principles.

Spreads

Forex majors: From 0.9 pips

Gold/Silver: Competitive spreads

Cryptos: Higher spreads due to volatility

Other Fees

❌ No deposit or withdrawal fees (depending on payment method)

❌ No commission on trades

❌ No inactivity fee for Islamic accounts

This structure ensures that traders stay Sharia-compliant without sacrificing competitive pricing.

11. Is Avatrade Truly Sharia-Compliant?

This is the most important question for any Muslim trader: Can I trade with Avatrade and still follow my faith?

The answer is: Yes, but with clarity.

✅ Avatrade removes all swap and rollover interest, which aligns with Islamic finance

✅ The admin fees are fixed and do not depend on interest rates or borrowed capital

✅ All trading activities follow ethical practices — no speculative or gambling instruments

✅ Customer support provides transparency regarding how halal standards are maintained

Still, traders should do their own due diligence and consult a religious advisor if unsure.

12. Risk Management Tools for Islamic Traders

Halal trading doesn’t mean risky trading. Avatrade ensures Muslim traders have access to tools to protect their capital:

Negative Balance Protection ✅

AvaProtect™: Protect trades against loss for a fixed cost

Stop Loss / Take Profit

Trailing Stops

Volatility Alerts

Margin Call Notifications

Using these tools wisely allows traders to trade ethically and responsibly — two key pillars of Islamic finance.

13. Tips for Successful Halal Trading

For traders seeking consistent returns while staying within Islamic rules, here are essential tips:

Avoid High-Leverage Gambling: Stick to logical, well-analyzed trades

Do Not Trade Just for Volatility: Follow macro trends and technical setups

Always Confirm Islamic Account Activation: Before funding or trading

Use Stop Losses Religiously: To prevent account wipeouts

Avoid Non-Halal Instruments: Such as certain CFDs that mimic gambling

Stay Educated: Learn about both Sharia finance and technical analysis

Keep Your Intentions Pure: Trading should be for wealth preservation and growth, not gambling

Reinvest Ethically: Use profits in halal investments or charity

14. Comparison with Other Brokers Offering Islamic Accounts

While we won't use tables, here’s how Avatrade Islamic Account stacks up via listing:

More Regulated than most Islamic brokers ✅

Better Platforms: Full suite including mobile, MT4/5, AvaOptions

Faster Account Approval than some competitors

Greater Variety of Assets including crypto (many exclude this)

Strong Educational Portal for new Muslim traders

Higher Trust Score based on global reviews

Some other brokers might offer lower spreads or ECN access, but few combine halal compliance with Avatrade's global reach.

15. User Reviews and Real-World Feedback

Most Muslim traders report high satisfaction with Avatrade’s Islamic offering:

“Finally, a broker I can trust with both my money and my faith.”

“The account was approved in less than 24 hours. Zero swaps, and the admin fee is fair.”

“I asked my imam to review it. He confirmed it is halal.”

Of course, some users mention that the admin fees can add up if you keep positions open for too long — but this is expected in swap-free accounts and is clearly disclosed upfront ✅.

16. FAQs: 10 Questions & Answers

Q1: Is the Avatrade Islamic Account 100% halal?A1: Yes. It removes interest-based elements and uses admin fees in compliance with Sharia.

Q2: Can I trade cryptocurrencies with the Islamic Account?A2: Yes. Avatrade allows swap-free crypto trading.

Q3: Do I need to prove I’m Muslim to open the account?A3: No formal proof is required, but the broker expects good faith declaration.

Q4: How long does it take to approve the Islamic status?A4: Usually 24–48 hours after KYC.

Q5: Are there hidden charges?A5: No. Admin fees are disclosed clearly.

Q6: Can I use automated trading (EAs)?A6: Yes, especially on MT4/MT5 platforms.

Q7: Is AvaProtect available for Islamic Accounts?A7: Yes. You can protect trades against losses for a fixed cost.

Q8: What’s the minimum deposit?A8: Typically $100, but may vary by region.

Q9: Is customer service available in Arabic?A9: Yes, Avatrade supports Arabic-speaking customers ✅

Q10: Can I convert a standard account into Islamic later?A10: Yes, just contact support and request the conversion.

17. Final Verdict: Is Avatrade Islamic Account Worth It?

The Avatrade Islamic Account is one of the most trustworthy, accessible, and halal-compliant options for Muslim traders in 2025. With solid regulation, robust tools, a broad asset selection, and transparent fees, it’s hard to find a better all-in-one solution.

✅ Pros outweigh the cons✅ No interest, no hidden fees✅ Tailored for ethical investing

Whether you're a beginner or a seasoned trader looking for Sharia-compliant opportunities, Avatrade offers the right tools, security, and ethical grounding to help you succeed.

18. Call to Action: Start Trading with a Halal Edge Today

If you're ready to take your Forex journey seriously — without compromising your faith — now is the time to act.

👉 Open your Avatrade Islamic Account today and start trading in a 100% interest-free, Sharia-compliant environment.✅ Join over 300,000 traders worldwide✅ Access to 1,250+ instruments✅ Start with as little as $100

Your faith. Your future. Your trading — halal and professional.

See more: