5 minute read

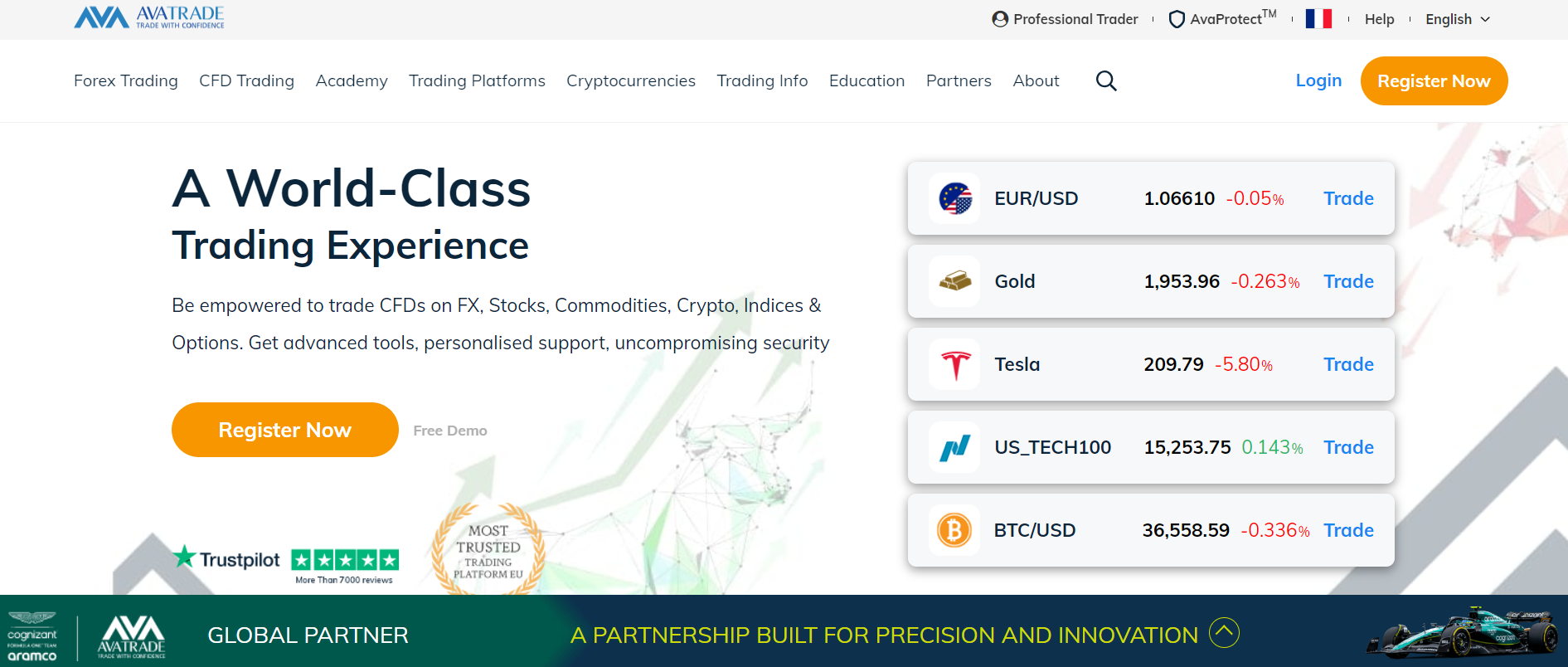

Avatrade Vs Fxpro 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Fxpro 2025: Compared - which is better broker?

In the ever-evolving world of forex trading, selecting the right broker can be the defining factor between consistent success and devastating losses. With dozens of options out there, two names often stand out in traders' discussions: Avatrade vs Fxpro. As we step into 2025, it’s time to deeply analyze, compare, and evaluate these two major players based on the latest market performance, user satisfaction, trading tools, regulation, spreads, platforms, and more.

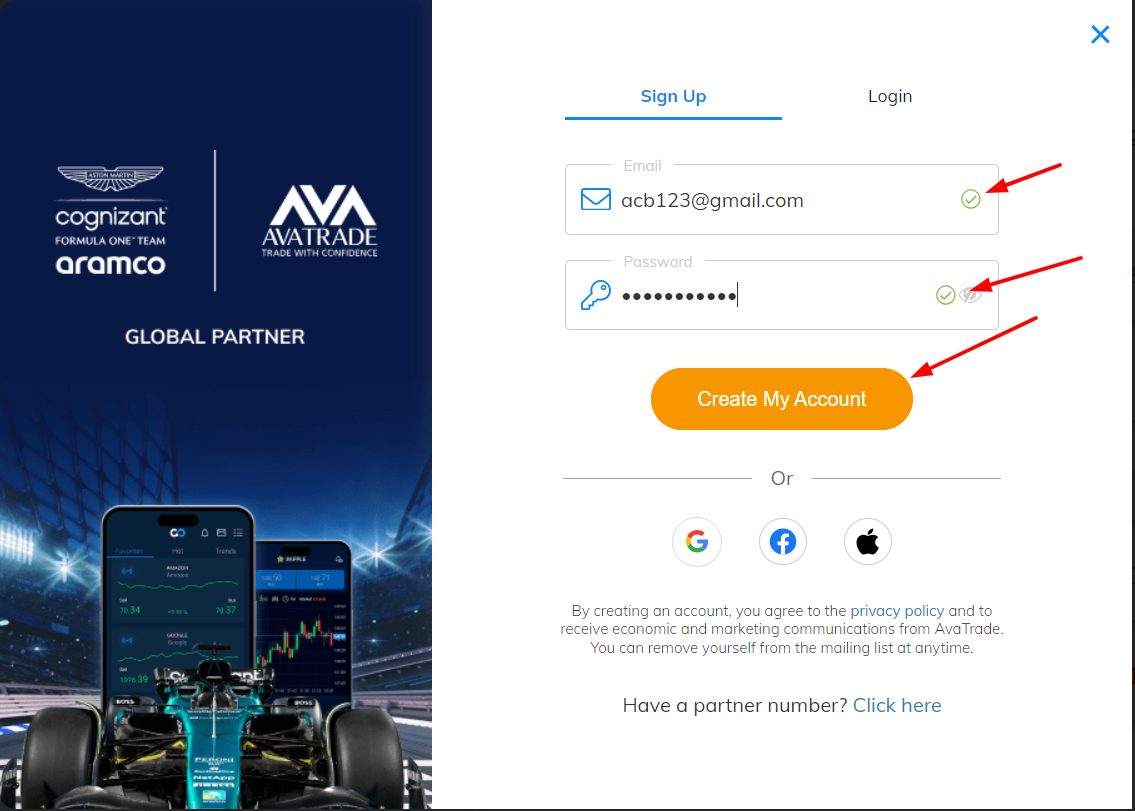

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

✅ If you're a beginner or even a seasoned trader looking for the most optimal trading experience in 2025, this guide is tailored for you.

Understanding the Forex Broker Landscape in 2025

The year 2025 has brought about massive shifts in the forex trading industry. With regulatory updates, increased transparency, advanced technology, and tighter spreads, traders now demand more than just basic features from their brokers. They seek:

Strong regulatory backing

Ultra-low latency executions

Powerful trading platforms

Transparent fee structures

Educational support

Multi-asset access

So how do Avatrade and Fxpro stack up in these areas?

Let’s break it down.

1. Regulation & Safety: Who Can You Trust More?

Avatrade ✅:

Regulated by 6 major financial authorities, including ASIC, FSCA, FSA Japan, and the Central Bank of Ireland

Offers segregated client funds and negative balance protection

Over 16 years in operation with zero security scandals

Fxpro ❌:

Regulated by FCA, CySEC, and FSCA

Does not offer guaranteed stop losses on all account types

Limited presence in Asia-Pacific regions

➡️ Verdict: Avatrade wins in terms of broader global regulation, giving traders better peace of mind.

2. Trading Platforms & Tools

Avatrade ✅:

Supports MetaTrader 4, MetaTrader 5, AvaTradeGO, and WebTrader

Built-in tools: Trading Central, DupliTrade, Guardian Angel (risk management assistant)

Fast execution and minimal slippage

Fxpro ❌:

Offers MT4, MT5, cTrader, FxPro Edge

Limited third-party plugins compared to Avatrade

Slightly slower execution times during high-volatility periods

➡️ Verdict: Avatrade provides a more beginner-friendly and feature-rich environment, with smart tools designed to support both technical and fundamental traders.

3. Account Types and Flexibility

Avatrade ✅:

Offers Standard, Islamic, and Professional accounts

Minimum deposit: $100

Demo account with unlimited access

Zero commission on most accounts

Fxpro ❌:

Several accounts depending on the platform (can confuse beginners)

Minimum deposit: $1000 (MT4 market account)

Charges commissions on cTrader and Raw Spread accounts

➡️ Verdict: For simplicity and affordability, Avatrade clearly outperforms Fxpro.

4. Spreads and Fees

This is where many brokers lose their charm. But not Avatrade.

Avatrade ✅:

Fixed and variable spreads available

EUR/USD spread from 0.9 pips

No hidden fees or commissions

Fxpro ❌:

Variable spreads only

EUR/USD spread from 1.5 pips on average

Commissions apply on certain account types

➡️ Verdict: Lower spreads + commission-free trades = Avatrade gives more value to traders.

5. Customer Support & User Experience

Avatrade ✅:

24/5 multilingual support via live chat, email, phone

Extensive FAQ section and educational blog

Dedicated account managers

Fxpro ❌:

Limited support hours

No personal account managers for standard users

Fewer local-language support options

➡️ Verdict: Traders feel more supported on Avatrade, especially beginners who need extra guidance.

6. Trading Education & Resources

Avatrade ✅:

Rich video tutorials, webinars, daily analysis

Ava Academy for structured learning

Real-time market alerts and insights

Fxpro ❌:

Educational content exists but lacks structure

No dedicated academy or progressive learning

➡️ Verdict: For newcomers and evolving traders, Avatrade offers a superior learning environment.

7. Deposit & Withdrawal Options

Avatrade ✅:

Supports credit/debit cards, bank wire, eWallets (Skrill, Neteller, etc.)

Zero deposit fees

Fast withdrawal times (1–2 days)

Fxpro ❌:

Bank withdrawals may incur fees

Slower processing times, especially during peak hours

➡️ Verdict: If speed and zero-cost are important to you, choose Avatrade.

8. Trading Instruments Available

Avatrade ✅:

Forex, stocks, commodities, indices, crypto, bonds, ETFs

Over 1200 instruments

Copy trading and automated strategies supported

Fxpro ❌:

Fewer than 400 instruments

Limited exposure to crypto and bonds

➡️ Verdict: Avatrade leads in asset diversity, making it suitable for portfolio builders.

👉 Open your AvaTrade account today

9. Mobile Trading Experience

Avatrade ✅:

AvaTradeGO is intuitive and loaded with features

One-click trading, market sentiment, and risk management tools built-in

High ratings on both iOS and Android

Fxpro ❌:

FxPro App has basic features

Some users report bugs during fast execution trades

➡️ Verdict: Mobile-first traders will find Avatrade’s mobile app far more powerful and user-friendly.

10. User Feedback and Online Reputation

Avatrade ✅:

Rated 4.7/5 on major platforms

Known for reliability and honesty in executions

Fxpro ❌:

Ratings around 3.9/5

Mixed reviews regarding slippage and withdrawal delays

➡️ Verdict: Avatrade has the edge in community trust and reliability.

❓ Frequently Asked Questions (FAQs)

1. Is Avatrade safer than Fxpro in 2025?✅ Yes. Avatrade has broader regulation and stronger fund security policies.

2. Can beginners start with Avatrade easily?Absolutely. Avatrade offers an intuitive platform and tons of educational content for starters.

3. Is the spread better on Avatrade?Yes. Fixed and lower spreads give Avatrade an advantage over Fxpro.

4. What’s the minimum deposit for each broker?Avatrade: $100 ✅ | Fxpro: $1000 ❌

5. Which has faster withdrawals?Avatrade processes most withdrawals within 1–2 days.

6. Does Avatrade allow crypto trading?Yes, and with competitive spreads on major coins.

7. Is Fxpro suitable for day traders?Only if using the cTrader platform, but commissions apply.

8. What support languages does Avatrade offer?Over 20 languages supported in live chat and email.

9. Do both offer demo accounts?Yes, but Avatrade’s demo account has no expiry ✅

10. Which is better overall for 2025?✅ Avatrade is the clear winner in terms of features, pricing, and trader support.

Final Verdict: Why Avatrade Is the Better Choice in 2025

When comparing Avatrade vs Fxpro, it’s clear that Avatrade offers more value, better tools, and stronger security — all packed into a user-friendly ecosystem. Whether you're a beginner looking for a smooth entry, or a pro needing cutting-edge tools, Avatrade delivers on all fronts.

Don’t waste time on second-tier experiences. Make the smart move today.

🎯 Ready to Trade Like a Pro? Open Your Account with Avatrade Now – Experience Excellence!

💥 Read more:

Avatrade Vs Exness 2025: Compared - which is better broker?

Avatrade Vs Plus500 2025: Compared - which is better broker?

Avatrade Vs iBKR 2025: Compared - which is better broker?