5 minute read

Avatrade Vs Fxcm 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Fxcm 2025: Compared - which is better broker?

Choosing the right broker is one of the most critical decisions any trader can make. In 2025, two names that consistently spark debate among forex enthusiasts are Avatrade vs Fxcm. But which one truly stands out? Whether you're new to trading or a seasoned investor, this deep-dive analysis will provide you with the clear edge needed to make an informed decision.

Introduction: The Battlefield of Brokers

The forex trading world is fiercely competitive, and in this battlefield, brokers play the role of gatekeepers. With so many platforms available, it's easy to get overwhelmed. However, two platforms have gained notable attention: Avatrade and Fxcm. This guide provides an exhaustive breakdown of these two giants to help you understand their key differences, strengths, and where each stands out.

1. Company Background and Trust Factor

Avatrade:

Established in 2006

Regulated in multiple jurisdictions including Ireland, Australia, Japan, UAE, and South Africa

Offers robust client protection policies and segregated accounts

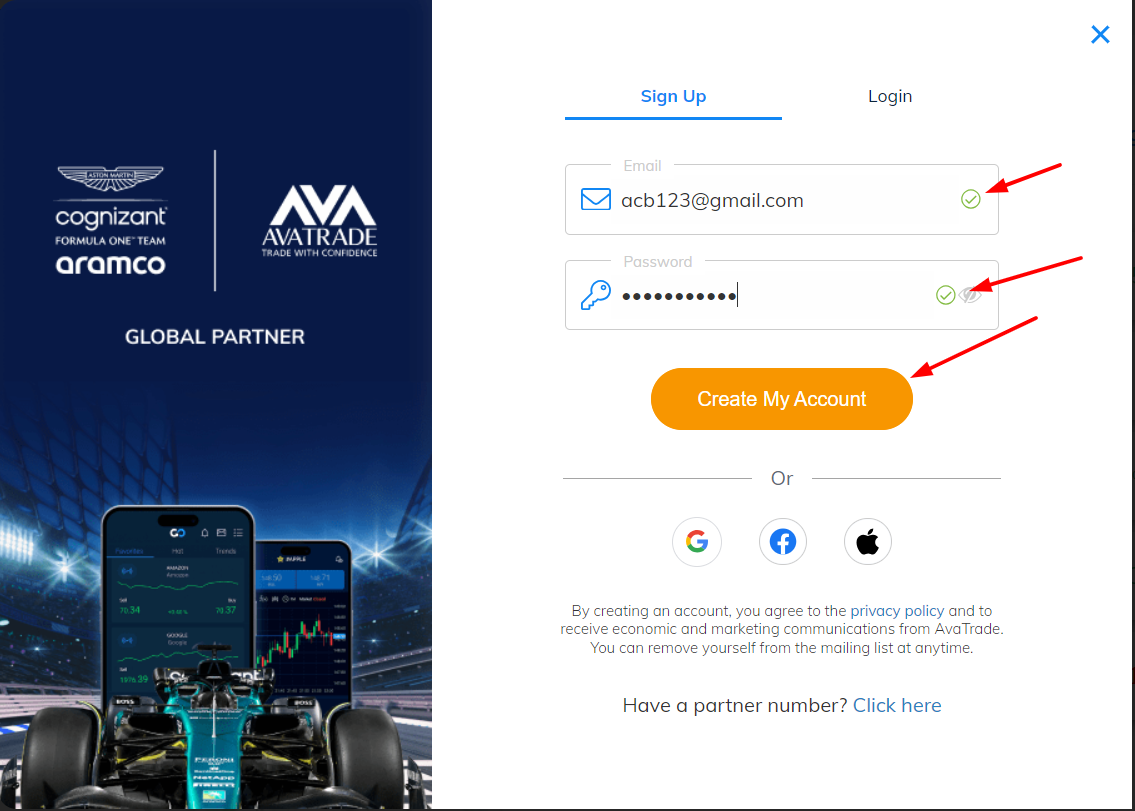

High trust rating ✅ 👉 Join Avatrade Now

Fxcm:

Founded in 1999

Regulated by UK’s FCA, and other global entities

Previously penalized by US regulators (settled in 2017)

Medium trust rating ❌

When comparing Avatrade vs Fxcm, Avatrade edges ahead in terms of regulatory reputation and client fund safety protocols.

2. Trading Platforms and Tools

Avatrade:

MT4, MT5, AvaOptions, AvaTradeGo

Proprietary risk management tool AvaProtect

Social trading via DupliTrade

User-friendly interface, fast execution ✅

Fxcm:

MT4, Trading Station, NinjaTrader, ZuluTrade

Focuses on algorithmic trading

Moderate custom tools, but lacks innovation

Platform performance occasionally lags ❌

Avatrade delivers superior tools with greater ease-of-use, making it ideal for traders seeking simplicity and power. 👉 Join Avatrade Now

3. Asset Offerings: What Can You Trade?

Avatrade:

1,250+ instruments

Forex, crypto, stocks, commodities, indices, ETFs, options

Innovative asset classes such as bonds & vanilla options ✅

Fxcm:

~300 instruments

Mainly forex, indices, and some crypto

Limited exotic pairs and no options trading ❌

In the battle of Avatrade vs Fxcm, it's clear Avatrade offers significantly wider diversification.

4. Spreads, Fees, and Commissions

Avatrade:

Fixed and variable spreads

No commissions on standard accounts ✅

Competitive pricing for retail traders

Fxcm:

Variable spreads only

Commissions on some accounts

Higher overnight fees ❌

Budget-conscious traders will find Avatrade to be the more economical choice.

5. Regulation and Licensing

Avatrade:

Regulated by 6 major financial bodies globally

Strong international presence ✅

Fxcm:

FCA regulated, others include ASIC and FSCA

Past issues may concern conservative investors ❌

When regulation equals peace of mind, Avatrade takes the lead.

6. Customer Support and Education

Avatrade:

24/5 multilingual support

Dedicated account managers

Extensive educational library with videos, webinars, eBooks ✅

Fxcm:

24/5 live chat

Limited learning content

No structured beginner pathway ❌

New traders need guidance, and Avatrade excels in nurturing them.

7. Mobile Trading Experience

Avatrade:

AvaTradeGo is clean, fast, intuitive ✅

Built-in risk tools and market sentiment

Fxcm:

App is serviceable but outdated interface

Limited customization ❌

Mobile trading in 2025 demands performance and reliability, where Avatrade clearly wins.

8. Social Trading and Automation

Avatrade:

DupliTrade integration

ZuluTrade and MT5 signals ✅

Fxcm:

ZuluTrade available

Basic API for algorithmic trading ❌

Avatrade supports automated trading while keeping it accessible to average traders.

9. Account Types and Minimum Deposit

Avatrade:

Standard, Professional, Islamic accounts ✅

Minimum deposit: $100

Fxcm:

Standard and Active Trader

Minimum deposit: $50

While Fxcm has a lower barrier to entry, Avatrade offers more account variety and better value for long-term growth.

10. Marketing Insight: Why Traders Choose Avatrade

✅ Exceptional educational support

✅ Transparent pricing

✅ Regulated across 6 continents

✅ Tools like AvaProtect are game-changers

Traders today don’t just want a broker. They want a partner. Avatrade has positioned itself as the go-to broker for beginners and pros alike.

👉 Ready to elevate your trading journey? Sign up with Avatrade today and take control of your financial future!

FAQs: Avatrade Vs Fxcm 2025

1. Which broker is safer in 2025?Avatrade. It has a cleaner regulatory track record and multiple licenses ✅

2. Which broker has more trading assets?Avatrade offers over 1,250 assets, compared to Fxcm’s 300+.

3. Which is better for beginner traders?Avatrade due to superior educational content and customer support.

4. Do both offer demo accounts?Yes, both do, but Avatrade’s demo platform is more user-friendly.

5. Who has better spreads in 2025?Avatrade offers lower and more consistent spreads ✅

6. Is Fxcm still a good broker?Yes, but it lacks in areas like customer education and asset range ❌

7. Which platform has better mobile experience?Avatrade’s AvaTradeGo app is cleaner and faster.

8. Can I automate my trading?Yes. Both support automation, but Avatrade offers more accessible tools ✅

9. Does Avatrade offer Islamic accounts?Yes. Fxcm does not.

10. What makes Avatrade stand out most?Its combination of safety, tools, education, and innovation.

Final Verdict: Avatrade Vs Fxcm 2025

After an in-depth comparison of Avatrade vs Fxcm, the verdict is crystal clear. While Fxcm has legacy appeal, Avatrade has evolved into a modern, trustworthy, and feature-rich broker.

✅ Higher trust ratings✅ More asset choices✅ Better educational support✅ Superior technology and mobile experience

If you're serious about growing as a trader in 2025, don't settle.Sign up with Avatrade today and experience the difference.

💥 Read more:

Avatrade Vs Eightcap 2025: Compared - which is better broker?

Avatrade Vs Tickmill 2025: Compared - which is better broker?

Avatrade Vs Trading 212 2025: Compared - which is better broker?