6 minute read

Avatrade Vs Fusion Markets 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Fusion Markets 2025: Compared - which is better broker?

In the dynamic world of forex trading, selecting the right broker is paramount to your success. Two prominent names in the industry are Avatrade and Fusion Markets. This comprehensive analysis delves deep into their offerings, comparing their features, fees, platforms, and more, to help you make an informed decision.

🧭 Broker Overview

Avatrade

Established in 2006, Avatrade is a globally recognized broker regulated in multiple jurisdictions, including the Central Bank of Ireland, ASIC, and FSCA. With over 300,000 active traders, Avatrade offers a wide array of financial instruments and robust trading platforms.

Fusion Markets

Founded in 2017 and headquartered in Melbourne, Australia, Fusion Markets has quickly gained traction among traders for its low-cost trading environment. Regulated by ASIC and VFSC, Fusion Markets provides a range of platforms and competitive pricing structures.

💰 Trading Costs & Fees

Spreads & Commissions

Avatrade: Offers spreads starting from 0.9 pips on major currency pairs like EUR/USD. For most trades, there are no commissions, making it an attractive option for traders seeking simplicity.

Fusion Markets: Known for its ultra-low spreads, starting from 0.0 pips on certain accounts. The Zero account charges a commission of $2.25 per side, translating to $4.50 round-turn. This structure benefits high-frequency traders aiming to minimize costs.

Deposit & Withdrawal

Avatrade: Requires a minimum deposit of $100. Withdrawals are processed within 1-3 business days, with no fees on most payment methods, though some charges may apply depending on the method used.

Fusion Markets: Boasts a $0 minimum deposit requirement, allowing traders to start with any amount. They offer multiple deposit and withdrawal methods, including Visa/MasterCard, PayPal, Skrill, Neteller, Bank transfers, and even cryptocurrency transactions.

📊 Trading Platforms

Avatrade

Avatrade offers a diverse range of platforms:

MetaTrader 4 (MT4) & MetaTrader 5 (MT5): Industry-standard platforms known for their reliability and extensive toolsets.

AvaTradeGO: A proprietary mobile app designed for on-the-go trading.

AvaOptions: A platform tailored for options trading.

WebTrader: A browser-based platform for quick access.

Trading Central & Autochartist: Integrated tools for technical analysis and market insights.

Fusion Markets

Fusion Markets provides four primary platforms:

MetaTrader 4 (MT4) & MetaTrader 5 (MT5): Popular platforms offering advanced charting and automated trading capabilities.

cTrader: Known for its intuitive interface and advanced charting tools.

TradingView: Recently added, this platform offers social trading features and a vast library of custom indicators and scripts.

📈 Leverage & Account Types

Avatrade

Leverage: Offers leverage up to 1:400, depending on the jurisdiction.

Account Types: Provides various account types, including standard and professional accounts. Swap-free accounts are available for Islamic traders.

Fusion Markets

Leverage: Offers leverage up to 1:500, providing greater flexibility for experienced traders.

Account Types: Offers multiple account types, including Zero, Classic, and Fusion Pro accounts, catering to different trading styles and preferences.

📞 Customer Support

Avatrade

Avatrade provides 24/5 customer support through various channels, including live chat, email, and phone. They also offer educational resources through AvaAcademy, webinars, and market analysis.

Fusion Markets

Fusion Markets offers 24/7 customer support via live chat, email, and phone. Each live account holder is assigned a dedicated trading specialist, ensuring personalized assistance.

🔍 Regulation & Security

Avatrade

Avatrade is regulated in multiple jurisdictions, including:

Central Bank of Ireland (CBI)

Australian Securities and Investments Commission (ASIC)

Financial Sector Conduct Authority (FSCA)

Financial Services Agency (FSA) Japan

Abu Dhabi Global Markets (ADGM)

Financial Services Regulatory Authority (FSRA)

This extensive regulatory coverage provides traders with a high level of security and trust.

Fusion Markets

Fusion Markets is regulated by:

Australian Securities and Investments Commission (ASIC)

Vanuatu Financial Services Commission (VFSC)

While Fusion Markets has robust regulation in Australia, its global regulatory coverage is more limited compared to Avatrade.

✅ Why Choose Avatrade?

Global Regulation: Avatrade's extensive regulatory coverage ensures a high level of security for traders.

Diverse Platforms: With a wide range of platforms, traders can choose the one that best suits their needs.

Educational Resources: AvaAcademy and other resources help traders enhance their skills.

Swap-Free Accounts: Available for Islamic traders, accommodating diverse client needs.

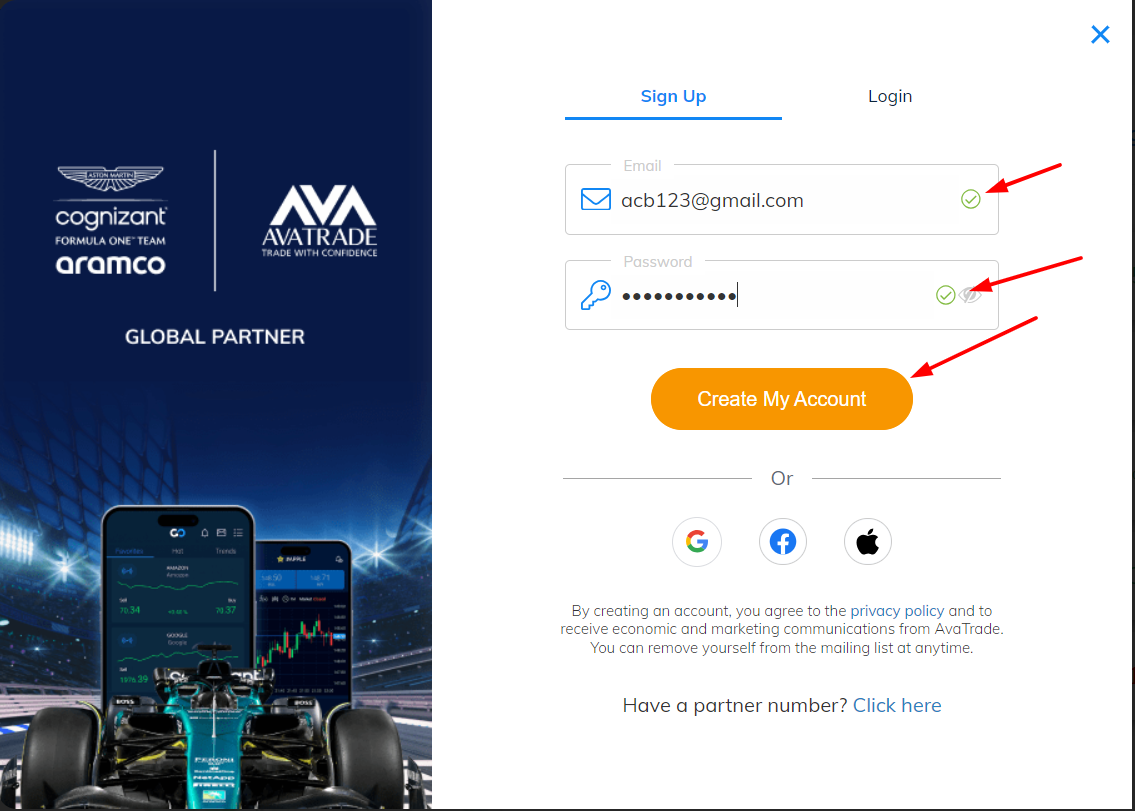

👌 If you choose Avatrade, 👉 Click here to open an account

❌ Why Choose Fusion Markets?

Lower Trading Costs: Fusion Markets offers some of the lowest spreads and commissions in the industry.

High Leverage: With leverage up to 1:500, experienced traders have greater flexibility.

Multiple Platforms: Access to MT4, MT5, cTrader, and TradingView caters to various trading preferences.

No Minimum Deposit: Allows traders to start with any amount, making it accessible for beginners.

🧭 Final Verdict

Both Avatrade and Fusion Markets offer compelling features for traders. If you prioritize global regulation, diverse platforms, and educational resources, Avatrade may be the better choice. However, if you're looking for low trading costs, high leverage, and flexible account options, Fusion Markets stands out.

❓ Frequently Asked Questions (FAQs)

What is the minimum deposit required for Avatrade?

The minimum deposit for Avatrade is $100.

Does Fusion Markets charge any inactivity fees?

No, Fusion Markets does not charge inactivity fees.

Which platforms does Avatrade offer?

Avatrade offers MT4, MT5, AvaTradeGO, AvaOptions, and WebTrader.

Can I trade cryptocurrencies with Fusion Markets?

Yes, Fusion Markets offers cryptocurrency trading.

What leverage does Avatrade offer?

Avatrade offers leverage up to 1:400, depending on the jurisdiction.

Is Fusion Markets regulated?

Yes, Fusion Markets is regulated by ASIC and VFSC.

Does Avatrade offer swap-free accounts?

Yes, Avatrade offers swap-free accounts for Islamic traders.

What is the average spread on EUR/USD with Fusion Markets?

The average spread on EUR/USD with Fusion Markets is 0.0 pips.

Does Avatrade offer copy trading?- ✅ Yes, Avatrade provides access to copy trading via third-party platforms like DupliTrade and ZuluTrade, enabling less experienced traders to mirror the strategies of seasoned professionals.

Which broker is better for beginners: Avatrade or Fusion Markets?

For beginners, Avatrade tends to be the more user-friendly option thanks to its comprehensive educational resources, intuitive mobile app (AvaTradeGO), and strong regulatory oversight. ❗Fusion Markets may appeal to cost-conscious traders, but it lacks the deep educational ecosystem found at Avatrade.

🧲 Strong Marketing Hook: Why You Should Start Trading With Avatrade Now

Choosing a forex broker is not just about spreads and commissions — it’s about safety, education, support, and the power to grow with your broker.

Here’s why opening a trading account with Avatrade is a smart move in 2025:

✅ Regulated on 6 continents – You trade with peace of mind, knowing your broker meets global compliance standards.✅ Award-winning platforms – From desktop to mobile, trade your way, wherever you are.✅ No hidden costs – Transparent pricing, no commissions on most accounts.✅ 24/5 multilingual support – We speak your language.✅ 1000+ financial instruments – Forex, crypto, stocks, indices, options, and more.✅ Social and copy trading tools – Ideal for beginners to follow proven strategies.✅ Exclusive educational hub (AvaAcademy) – Learn, grow, and master trading with the best-in-class materials.

💥 Read more:

Avatrade Vs Exness 2025: Compared - which is better broker?

Avatrade Vs Pepperstone 2025: Compared - which is better broker?

Avatrade Vs Interactive brokers 2025: Compared - which is better broker?

Avatrade Vs eToro 2025: Compared - which is better broker?

Avatrade Vs Octafx 2025: Compared - which is better broker?