9 minute read

Avatrade Vs Exness 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Exness 2025: Compared - which is better broker?

Introduction

In the ever-evolving world of Forex trading, choosing the right broker can be the deciding factor between consistent profits and unexpected losses. With so many platforms flooding the market, traders—especially those just getting started—often find themselves torn between top-tier names. Two of the most prominent brokers in 2025 are Avatrade and Exness. But when it comes to Avatrade Vs Exness, which one truly gives you the upper hand?

This detailed comparison dives deep into every essential aspect: from spreads, regulations, trading platforms, and execution speed, to customer support, and trader-focused features. ✅ Whether you're a beginner or an advanced trader, by the end of this guide, you'll be equipped with everything you need to confidently decide where to open your next Forex account.

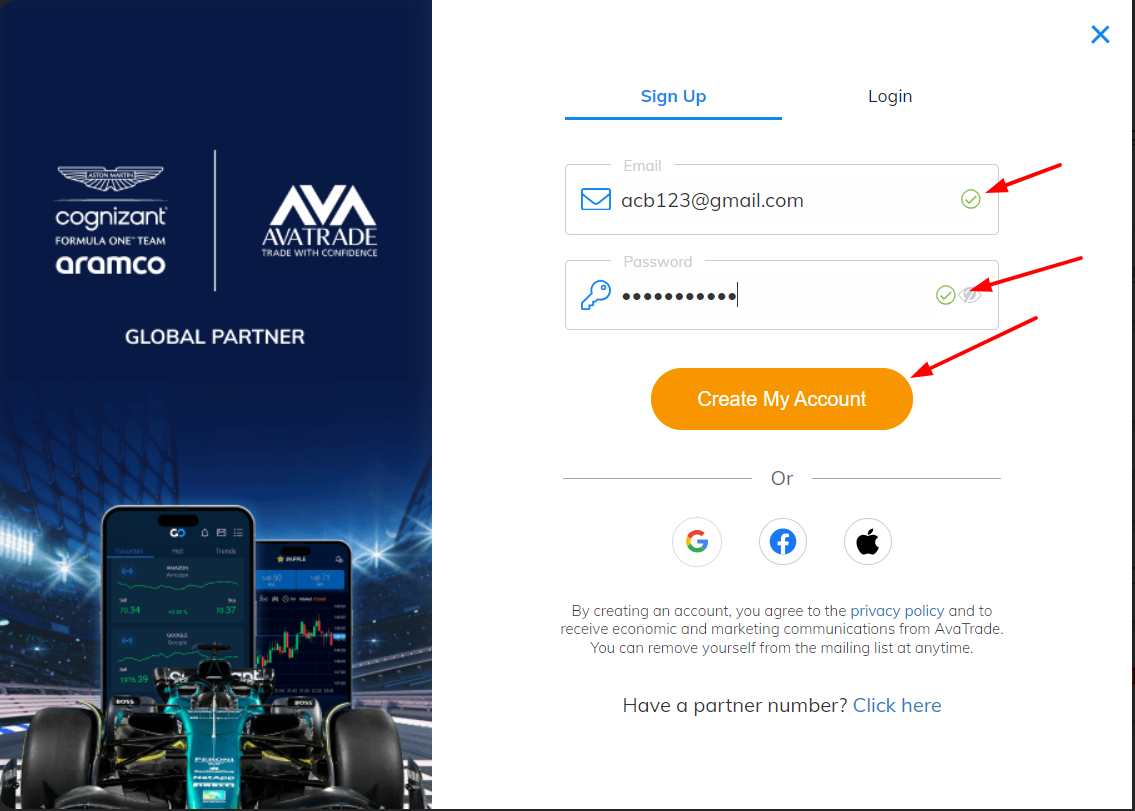

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Overview of Avatrade and Exness

When it comes to Forex and CFD trading, Avatrade and Exness have long been regarded as industry leaders. But how do they really stack up against each other in 2025?

✅ Avatrade

Founded in 2006, Avatrade is a global broker that offers Forex, stocks, indices, commodities, cryptocurrencies, and more. Headquartered in Dublin, Ireland, the company serves clients from over 150 countries. With a strong regulatory framework and a wide array of platforms including MetaTrader 4, MetaTrader 5, and AvaTradeGO, it appeals to both beginners and advanced traders.

✅ Exness

Launched in 2008, Exness has rapidly gained popularity due to its ultra-low spreads, flexible leverage, and fast execution. The broker is known for its transparent trading environment and support for automated strategies, making it a favorite among algorithmic traders. Its focus on local payment solutions and multilingual support gives it a global edge.

💥 Want to learn about Exness’s trading features, spreads, and reliability? Read our full Exness Broker Reviews now!

2. Regulation & Trust Factor

In a landscape filled with scams and unregulated entities, regulation is the backbone of trust in Forex trading. ❌ Choosing an unregulated broker could lead to irreversible financial loss.

✅ Avatrade Regulations:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

FSA (Japan)

ADGM (UAE)

BVI (British Virgin Islands)

✅ Exness Regulations:

FCA (UK)

CySEC (Cyprus)

FSCA (South Africa)

FSA (Seychelles)

Both brokers are well-regulated, but Avatrade's broader regulatory presence gives it an edge in global compliance and security.

3. Trading Platforms & Technology

Traders demand fast, stable, and customizable platforms. Here's how Avatrade Vs Exness compete in terms of technology.

✅ Avatrade Offers:

MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

AvaTradeGO – user-friendly mobile app

AvaOptions – for advanced options trading

WebTrader – accessible from any browser

Social trading via DupliTrade & ZuluTrade

✅ Exness Offers:

MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

Exness Terminal – custom in-house platform

Mobile apps for Android/iOS

VPS service for algo traders

Both brokers support MT4/MT5, but Exness shines for algorithmic traders, while Avatrade caters better to beginners and mobile-focused users.

4. Account Types & Minimum Deposits

✅ Avatrade:

Retail Account (Standard)

Professional Account (EU-qualified)

Islamic (Swap-Free) Account

Minimum Deposit: $100

✅ Exness:

Standard Account

Raw Spread Account

Zero Account

Pro Account

Islamic Account available

Minimum Deposit: $10

Verdict: Exness takes the win for ultra-low deposit requirements, making it ideal for new traders. ✅

5. Spreads, Fees, and Commissions

Cost of trading is a crucial metric. It affects profitability in every trade.

✅ Avatrade:

Commission-free on most accounts

Spreads start from 0.9 pips for major pairs

No deposit/withdrawal fees

✅ Exness:

Raw Spread accounts with 0.0 pips + $3.5 commission

Standard accounts with 1.0+ pips, no commissions

No deposit/withdrawal fees

For high-frequency traders, Exness offers lower spreads and more flexible pricing. ✅For casual traders, Avatrade is more straightforward. ❌

👌 If you choose Exness, 👉 Click here to open an account

6. Leverage Options & Risk Management Tools

Leverage is a double-edged sword. Use it wisely.

✅ Avatrade:

Retail clients: up to 1:30 (EU), 1:400 (non-EU)

Negative balance protection

AvaProtect: unique tool to insure trades

✅ Exness:

Dynamic leverage up to 1:Unlimited

Negative balance protection

Risk settings for margin call, stop-out levels

Exness offers unmatched leverage, suitable for experienced traders. ✅Avatrade counters with innovative risk tools like AvaProtect – perfect for cautious traders. ✅

7. Deposit & Withdrawal Speed

Nothing is more frustrating than delayed access to your funds.

✅ Avatrade:

Bank transfer, credit card, e-wallets

Withdrawal processing time: 24–48 hours

✅ Exness:

Instant deposits/withdrawals with no manual approval

Supports local payment methods

Crypto options available

Exness is a leader in fast transactions, often within minutes. ✅

8. Execution Speed and Slippage

In volatile markets, every millisecond counts.

✅ Avatrade:

Average execution speed: 0.09s

Rare slippage during normal conditions

✅ Exness:

Average execution speed: <0.05s

Optimized for scalpers and EA users

For scalpers and bots, Exness provides superior conditions. ✅

9. Educational Resources & Tools for Traders

Learning never stops in trading.

✅ Avatrade:

Free courses, webinars, eBooks

AvaTrade Academy

Advanced analysis tools

✅ Exness:

Economic calendar, news feeds

Market sentiment tools

Less structured educational content

Avatrade clearly caters better to new learners. ✅Exness is more suitable for those who already have basic knowledge.

10. Customer Support Experience

Reliable support makes a big difference during market chaos.

✅ Avatrade:

24/5 support via live chat, phone, email

Multilingual team

✅ Exness:

24/7 support – a rare advantage

Fast, localized service

✅ Exness wins for its round-the-clock support, essential for global traders.

11. Bonus Programs & Promotions

Incentives often influence a trader’s choice—especially when brokers provide real value.

✅ Avatrade:

Occasional welcome bonuses in non-EU regions

Refer-a-friend program

Cashback and loyalty programs (in specific jurisdictions)

✅ Exness:

No traditional bonus structures

Focuses on tight spreads and execution instead of promotions

Avatrade provides more marketing-driven perks, making it ideal for users seeking extra value from registration. ✅Exness, on the other hand, chooses to focus purely on performance and transparency ❌ – an approach some pro traders actually prefer.

12. Avatrade vs Exness: Which Broker Suits You Best?

When comparing Avatrade Vs Exness, the choice depends heavily on your trading style, experience, and goals.

Choose Avatrade if:

You are a beginner or intermediate trader

You value user-friendly tools and educational content

You prefer regulated environments and risk-reduction tools

You enjoy having trading insurance via AvaProtect ✅

Choose Exness if:

You are a scalper, algo trader, or high-frequency trader

You prefer ultra-tight spreads and rapid execution

You need unlimited leverage and instant transactions

You want 24/7 multilingual support ✅

👌 If you choose Exness, 👉 Click here to open an account

13. Common Mistakes Traders Make When Choosing Brokers

Avoid these critical errors when comparing Avatrade Vs Exness or any brokers in 2025:

❌ Ignoring Regulation: Always check licenses before depositing.

❌ Overlooking Fee Structures: Tiny spreads can hide high commissions.

❌ Focusing Only on Bonuses: Sustainable trading is more than free credit.

❌ Not Testing the Platform First: Use demo accounts to explore features.

❌ Ignoring Customer Support Quality: This matters more than you think when issues arise.

✅ Not Matching Your Strategy to the Broker: Day traders need speed. Swing traders need tools. Choose accordingly.

14. Why Choosing the Right Broker Matters in 2025

The Forex market in 2025 is more competitive than ever. With tighter regulations, advanced automation, and volatile global events, the broker you choose directly impacts:

Your profitability

Your trading speed

Your safety

Your growth as a trader

✅ A solid broker offers more than just a platform – it offers a long-term trading environment where your skills can thrive.

15. 🔥 Strong Marketing Push: Why You Should Open an Account Now

If you’re reading this, you're clearly serious about improving your trading game. But let’s be honest—analysis without action means nothing.

👉 Whether you want to trade with high leverage, get access to instant withdrawals, or benefit from low spreads, the time to act is NOW.

✅ Open your Forex account today with either Avatrade or Exness – both are solid choices, but the right one depends on YOU.

⏳ Don't wait for the market to move without you. Every minute you delay is a missed opportunity to grow your capital.

16. ✅ Final Verdict: Avatrade Vs Exness – Our Top Pick

So, when all is said and done: Avatrade Vs Exness, who wins?

🎯 Exness is the winner for experienced, high-volume, and algorithmic traders who want:

✅ Unmatched leverage

✅ Lightning-fast withdrawals

✅ Tightest possible spreads

👌 If you choose Exness, 👉 Click here to open an account

🎯 Avatrade wins for beginners and intermediate traders who prioritize:

✅ Easy-to-use platforms

✅ Educational support

✅ Innovative risk-protection features

💥If you choose Avareade, Open Avatrade account now

Ultimately, both are top-tier brokers. The real question is: Which broker matches your personality and strategy?

Choose wisely. Trade confidently. Profit consistently.

📌 Choosing a Forex broker is crucial. Don’t miss our honest and updated Review Forex Broker to help you decide wisely.

17. Frequently Asked Questions (Q&A)

Q1: Which broker is safer, Avatrade or Exness?

A: Both are highly regulated. However, Avatrade is licensed across more jurisdictions, making it slightly more versatile in terms of global safety standards. ✅

Q2: Can beginners use Exness easily?

A: While Exness is beginner-friendly in terms of deposit, its advanced tools and interface may overwhelm absolute newcomers. Avatrade may be more intuitive for first-timers. ✅

Q3: Is leverage really unlimited on Exness?

A: Yes, but only under certain conditions. Unlimited leverage is available only after meeting specific volume and risk requirements.

Q4: Does Avatrade offer crypto trading?

A: Yes, Avatrade offers a wide variety of crypto CFDs including BTC, ETH, and more.

Q5: What’s the best platform for mobile traders?

A: AvatradeGO is tailored for mobile-first users and provides seamless access with strong UX. ✅

Q6: Which broker processes withdrawals faster?

A: Exness offers near-instant withdrawals for most methods. ✅

Q7: Does Avatrade charge commission?

A: No, most accounts are commission-free. Fees are built into the spread.

Q8: Can I open an Islamic account with either broker?

A: Yes, both Avatrade and Exness offer swap-free Islamic accounts.

Q9: Which is better for scalping and EAs?

A: Exness is preferred for scalping and expert advisors due to fast execution and low latency. ✅

Q10: Is it easy to switch brokers if I’m not happy?

A: Yes, both brokers allow easy account closure and fund transfers. However, it's always best to test with a demo or small deposit first.

💥 Read more:

Avatrade Vs Plus500 2025: Compared - which is better broker?

Avatrade Vs iBKR 2025: Compared - which is better broker?

Avatrade Vs Fxcm 2025: Compared - which is better broker?