6 minute read

Avatrade Vs iBKR 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs iBKR 2025: Compared - which is better broker?

In the world of Forex and CFD trading, selecting the right broker can mean the difference between consistent growth and frustrating setbacks. With dozens of brokers competing for your attention, two names often rise to the top: Avatrade and iBKR (Interactive Brokers). But which one truly delivers for traders in 2025?

This expert comparison dives deep into the differences between Avatrade vs iBKR, exploring every essential factor traders care about — from trading platforms to fees, regulation, support, and marketing edge. Our goal? To help you decide which broker best suits your trading style and goals.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

✅ Regulation and Trustworthiness

When choosing a broker, regulatory compliance is non-negotiable. Here's how these two compare:

Avatrade is regulated by multiple reputable bodies: ASIC (Australia), Central Bank of Ireland, FSA (Japan), FSCA (South Africa), and others. This wide regulatory network ensures that Avatrade adheres to strict financial standards. ✅

👉 Read more: Avatrade Review

iBKR, headquartered in the U.S., is regulated by top-tier entities including the SEC, CFTC, and FINRA. While this is highly trustworthy, it also comes with certain limitations for non-U.S. clients. ❌

Verdict: Both brokers are trustworthy, but Avatrade's global regulation makes it more accessible for international traders.

Trading Platforms & Tools

Avatrade offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary AvaTradeGO app. These platforms are perfect for both beginners and advanced traders.

iBKR uses its proprietary Trader Workstation (TWS). While powerful, it has a steep learning curve, making it less beginner-friendly.

Verdict: Avatrade excels with multiple intuitive platforms. ✅

Account Types and Minimum Deposits

Avatrade requires only a $100 minimum deposit, making it highly accessible to beginners and small investors.

iBKR traditionally caters to professional traders, with higher capital requirements depending on region and account type. ❌

Verdict: Avatrade wins with its low entry barrier. ✅

Asset Variety

iBKR offers access to thousands of instruments across global markets — stocks, options, futures, ETFs, and more. Great for institutional traders.

Avatrade, while not as broad, focuses on Forex, CFDs, crypto, indices, and commodities. For most retail traders, this range is more than enough.

Verdict: iBKR wins on asset variety for professionals, but Avatrade provides focused, accessible instruments.

Spreads and Fees

Avatrade has fixed and floating spreads, with no commission on Forex and CFDs. That makes cost structures predictable. ✅

iBKR has complex, commission-based pricing, often unclear for new traders. This may reduce profit margins. ❌

Verdict: Avatrade offers simpler, cost-effective trading. ✅

Leverage and Margin

Avatrade offers leverage up to 1:400 for Forex trading (based on your region). This allows for aggressive strategies.

iBKR offers leverage but under stricter regulatory caps, especially for U.S. clients (often 1:50 or lower).

Verdict: Avatrade offers higher flexibility for leveraged trading. ✅

👉 Open your AvaTrade account today

Education and Support

Avatrade features an extensive Education Hub, with articles, video tutorials, webinars, and trading strategies tailored for all levels.

iBKR has solid educational material, but it’s more institutional and technical, not tailored to retail traders.

Verdict: Avatrade provides clearer, more actionable education. ✅

Customer Support

Avatrade provides 24/5 multilingual support via live chat, phone, and email.

iBKR’s support is less responsive and known for its complex interface, frustrating many retail clients. ❌

Verdict: Avatrade clearly leads in user support. ✅

Mobile Experience

Avatrade’s AvaTradeGO app is modern, fast, and designed with the user in mind.

iBKR’s mobile app is powerful, but again, not ideal for beginners.

Verdict: Avatrade offers a better, more intuitive mobile experience. ✅

Bonuses and Promotions

Avatrade offers deposit bonuses, referral programs, and frequent promos to attract and retain traders. ✅

iBKR does not typically offer trading bonuses. ❌

Verdict: Avatrade leads in user acquisition and retention offers. ✅

Final Thoughts: Avatrade Vs iBKR — Which Should You Choose?

Choosing the right broker is about matching your trading goals to the platform's strengths. Here's the bottom line:

If you are a retail trader, beginner, or intermediate-level investor looking for strong support, simplicity, and flexibility — Avatrade is the clear winner.

If you are an institutional trader or require access to global equities and advanced tools — iBKR might serve you better.

However, in 2025, more and more traders are choosing Avatrade for its:

✅ Easy onboarding

✅ Commission-free trading

✅ Superior mobile app

✅ Rich education and support

Don’t miss the opportunity to trade smarter. Join thousands of traders moving to Avatrade — experience the broker designed to help you win.

👌 If you choose Avatrade, 👉 Click here to open an account

Frequently Asked Questions (FAQ)

1. Is Avatrade better than iBKR for beginners? Yes. Avatrade offers user-friendly platforms, low deposit requirements, and excellent support — ideal for new traders.

2. Does iBKR offer Forex trading? Yes, but it's part of a larger multi-asset system designed for professional use. The interface can be overwhelming for casual traders.

3. Which broker has lower trading fees? Avatrade, with zero commissions on Forex/CFDs and fixed spreads, provides a more transparent cost structure.

4. Is Avatrade regulated? Absolutely. Avatrade is regulated in multiple jurisdictions worldwide, including Australia, Ireland, and South Africa.

5. Can I use MetaTrader on both platforms? No. Only Avatrade supports MT4 and MT5. iBKR uses its own Trader Workstation.

6. Which broker is safer? Both are highly secure and regulated, but Avatrade's global presence gives it more flexibility for traders outside the U.S.

7. What’s the minimum deposit for each broker? Avatrade requires $100. iBKR may require more depending on your region.

8. Is Avatrade good for crypto trading? Yes. Avatrade supports major crypto CFDs with solid trading conditions.

9. Can I get a bonus with iBKR? Typically no. iBKR rarely offers promotions.

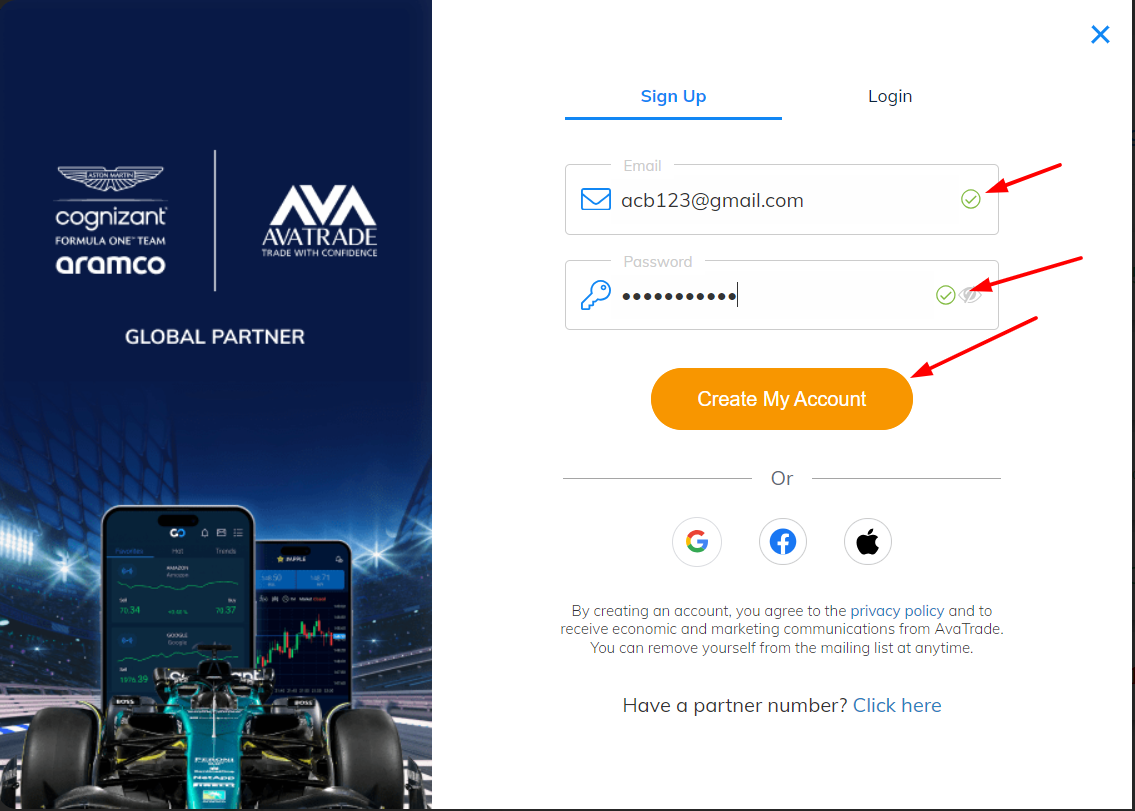

10. How do I open an account with Avatrade? It's easy! Just sign up, verify your identity, deposit as little as $100, and start trading. 👉 Join Avatrade Nowand elevate your trading game. ✅

Avatrade vs iBKR in 2025 is a battle of priorities. For real-world traders who want access, education, and growth, the choice is simple: Go with Avatrade.

Your trading future deserves a platform that grows with you — choose Avatrade, and start trading smart today.

💥 Read more:

How long Does it Take to Withdraw Money From Avatrade

Avatrade App Review 2025: Pros & Cons A Comprehensive Review