5 minute read

Avatrade Vs Plus500 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Plus500 2025: Compared - which is better broker?

In the ever-evolving world of forex and CFD trading, choosing the right broker is not just a preference—it’s a strategic decision. Among the most talked-about platforms in 2025 are Avatrade and Plus500. Both have strong reputations and serve a wide range of trader types, but they differ significantly in tools, features, and trading philosophies.

This article offers a deep, comprehensive, and trader-friendly analysis of Avatrade Vs Plus500. We’ll explore all key aspects: regulation, trading platforms, spreads, education, tools, support, and more. By the end, you’ll understand which platform better aligns with your goals—and why Avatrade is the smarter choice for most traders in 2025.

✅ Broker Overview: Avatrade Vs Plus500

Avatrade

Founded in 2006

Headquartered in Dublin, Ireland

Regulated by major global authorities: ASIC, FSCA, FSA, Central Bank of Ireland, ADGM

Platforms: MetaTrader 4 & 5, AvaTradeGO, AvaOptions, DupliTrade, ZuluTrade

Offers both manual and copy trading

Minimum deposit: $250

Leverage: Up to 400:1 (depending on region)

👉 Read more: Avatrade Review

Plus500

Founded in 2008

Headquartered in Israel

Regulated by FCA, ASIC, CySEC

Platform: Proprietary web-based and mobile app

Minimum deposit: $100

Leverage: Up to 30:1 for retail clients

📊 Trading Platforms: Depth vs Simplicity

Avatrade

✅ Offers industry-leading platforms:

MetaTrader 4 & 5 – perfect for professional traders

AvaTradeGO – highly rated mobile app

AvaOptions – for trading vanilla options

ZuluTrade & DupliTrade – for automated copy trading

Highly customizable, compatible with indicators, scripts, bots, and external tools.

Plus500

❌ Proprietary platform designed for ease of use

Suitable for beginners

No MetaTrader support

Limited charting features

Basic technical indicators only

➡️ If you're seeking versatility and professional tools, Avatrade is the clear winner.

💸 Fees, Spreads & Commission

Spreads

Avatrade: Fixed and variable spreads from 0.9 pips (EUR/USD)

Plus500: Spreads start from 0.6 pips (EUR/USD), variable only

Commission

Both platforms are commission-free, earning revenue from spreads.

Inactivity Fees

Avatrade: $50 after 3 months of inactivity ✅

Plus500: $10 per month after 3 months ❌

While spreads may be slightly tighter with Plus500, Avatrade’s fixed options offer more transparency during volatile markets.

📱 Mobile Trading: Which App Dominates?

Mobile trading in 2025 is essential for every trader. You need speed, reliability, and features on the go.

AvatradeGO

✅ Sleek, powerful, fast

Integrated with MT4/MT5 accounts

Real-time data, advanced charts, risk management tools

Easy switch between demo and live

Plus500 App

❌ Simpler interface

Good for beginners

Lacks advanced tools

Not suitable for strategy testing or scalping

➡️ For serious traders, Avatrade’s mobile app delivers unmatched performance.

🔒 Security & Regulation: Trustworthy and Transparent?

Avatrade

✅ Globally regulated:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

FSA (Japan)

Abu Dhabi Global Market (UAE)

✅ Segregated client accounts✅ Negative balance protection

Plus500

Regulated by FCA, CySEC, ASIC

Offers negative balance protection

Both are safe brokers, but Avatrade’s broader global reach and regulation give it the edge.

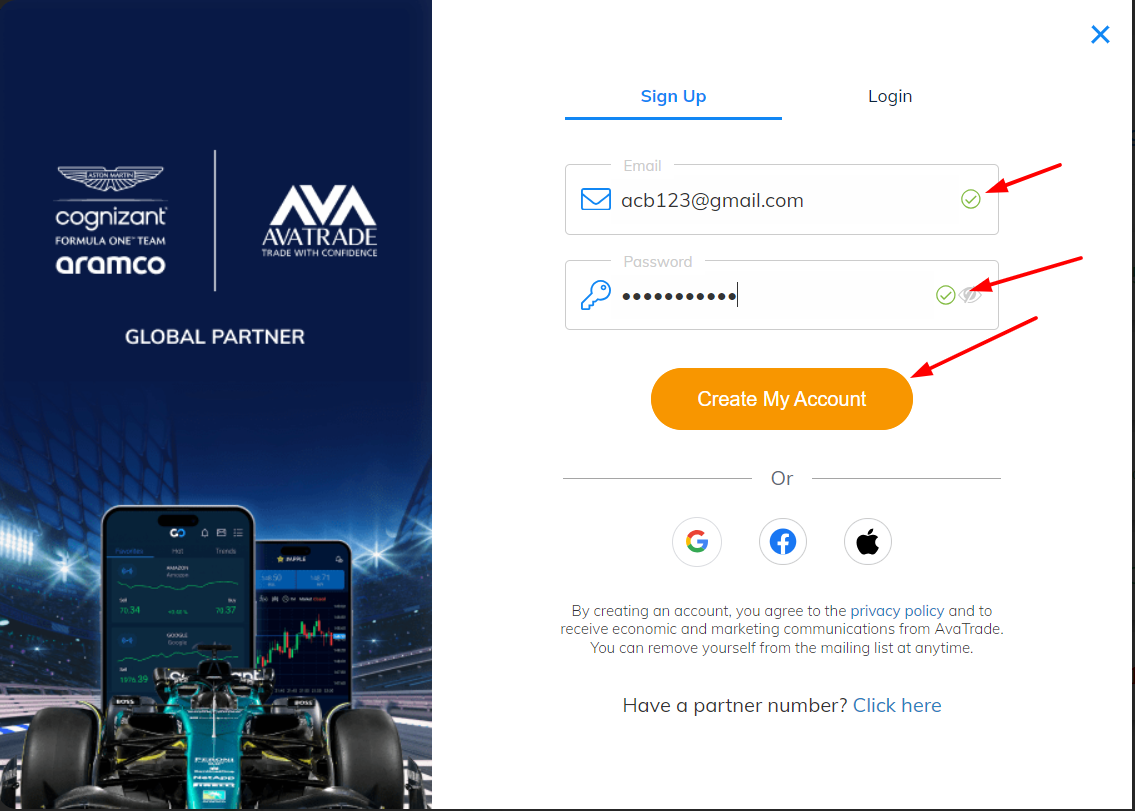

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

🎓 Education & Research: Learn While You Earn

Avatrade

✅ Rich educational suite:

Video tutorials

eBooks

Strategy guides

Webinars with expert traders

Daily market analysis

Perfect for both beginner and advanced traders looking to master their craft.

Plus500

❌ Limited educational resources

No interactive courses

No mentorship or advanced webinars

➡️ If you value knowledge and skill development, Avatrade leads by a mile.

🔧 Trading Tools & Strategy Integration

Avatrade

✅ Access to:

Autochartist

Trading Central

APIs for algorithmic trading

Social trading tools (ZuluTrade)

Advanced risk management tools

Plus500

❌ No third-party integration❌ Limited charting❌ Not suitable for automated strategies

➡️ Avatrade caters to both retail and professional traders with high-level tools.

🌍 Market Variety & Instruments

Avatrade

✅ Offers:

Forex: 50+ pairs

Cryptocurrencies

Indices

Commodities

Bonds

Stocks

ETFs

Vanilla options

Plus500

Forex: 70+ pairs

Cryptos

Indices

Stocks

Commodities

❌ No options or ETFs

➡️ Avatrade wins with broader and more strategic asset coverage, perfect for portfolio diversification.

📞 Customer Support

Avatrade

✅ Multilingual support via:

Phone

Email

Live Chat

Available 24/5

Plus500

❌ Only live chat and email

No phone support

Slower response times during peak hours

➡️ Traders who need direct human support will prefer Avatrade.

✅ Final Verdict: Why Avatrade Is the Smarter Choice

When comparing Avatrade Vs Plus500, both brokers offer decent service, but Avatrade offers more in every meaningful category:

More trading platforms (MT4, MT5, AvaOptions)

More regulation across continents

More asset variety including options and ETFs

Better mobile and desktop experience

Superior educational content

Advanced tools and integrations

Better support structure

Plus500 might suit absolute beginners due to its simple layout, but it lacks the depth, flexibility, and power that modern traders demand in 2025.

🔥 Open an Avatrade Account Today

📈 Join hundreds of thousands of traders who trust Avatrade every day to handle their forex and CFD trading with reliability and speed.

✅ Up to $10,000 welcome bonus (terms apply)✅ 0% commission trading✅ Trade 1250+ instruments✅ Regulated on 5 continents✅ Instant deposits & fast withdrawals

Ready to take your trading to the next level? Choose Avatrade and trade smarter.

👌 If you choose Avatrade, 👉 Click here to open an account

❓ FAQs – Avatrade Vs Plus500

Which broker is better for beginners?

Plus500 is simpler, but Avatrade provides more educational support.

Does Avatrade offer social trading?

Yes, through ZuluTrade and DupliTrade.

Which broker offers higher leverage?

Avatrade, with leverage up to 400:1.

Is MetaTrader available on Plus500?

No, Plus500 uses its own proprietary platform.

Are both brokers regulated?

Yes, but Avatrade is regulated in more jurisdictions.

Which broker has more trading tools?

Avatrade provides far more tools and integrations.

Can I trade options with Avatrade?

Yes, including vanilla options on FX.

Is there a demo account on both platforms?

Yes, both offer demo accounts.

How long do withdrawals take?

Avatrade: 1–2 business days. Plus500: up to 5 days.

Which broker is better for long-term traders?

Avatrade, due to its education, regulation, and platform options.

💥 Read more:

Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review

Avatrade Vs Exness 2025: Compared - which is better broker?