5 minute read

Avatrade Vs CMC Markets 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

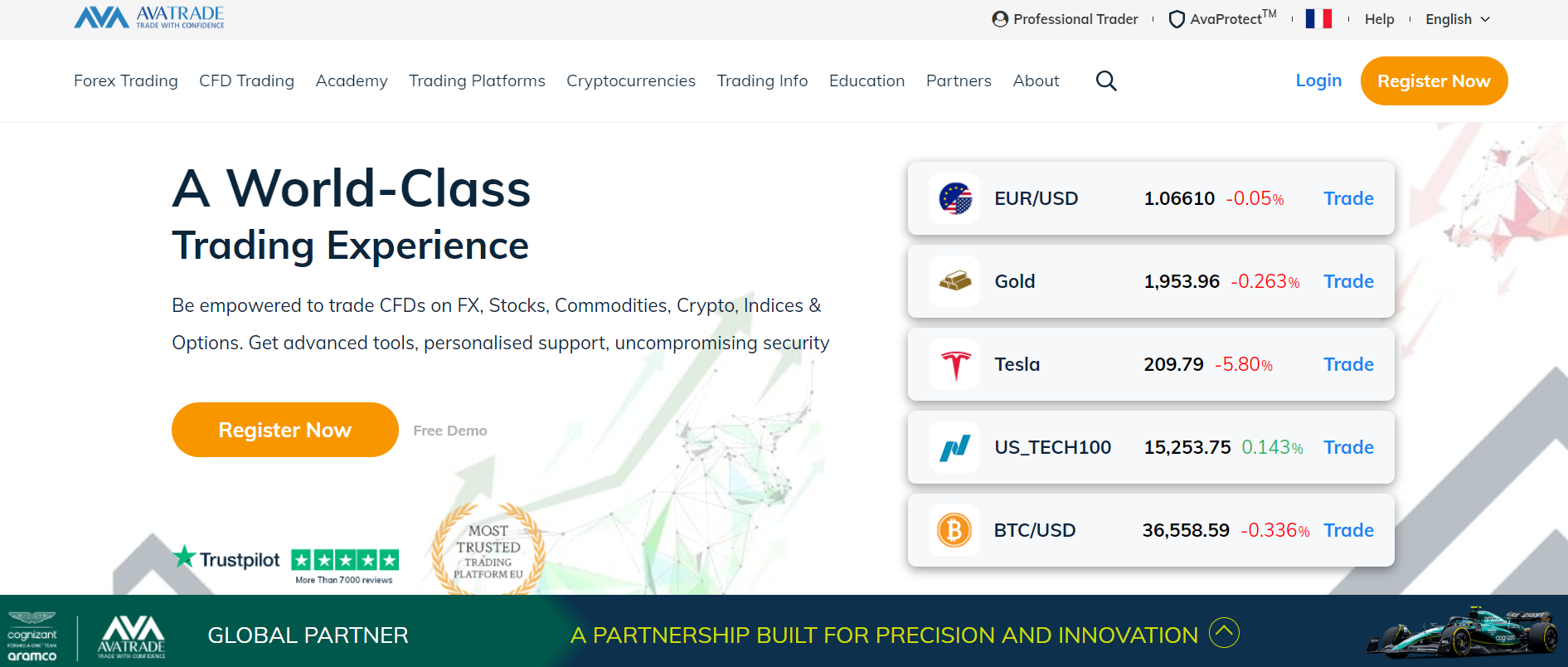

The world of forex and CFD trading is fiercely competitive, and Avatrade vs CMC Markets has emerged as one of the most debated comparisons among modern traders in 2025. Whether you are a seasoned investor or a beginner stepping into the global trading arena, understanding the differences, advantages, and practical performance of each broker is critical. This guide provides an in-depth comparison of Avatrade and CMC Markets, highlighting their strengths, weaknesses, and unique offerings. ✅

Let’s break it down clearly so every trader—regardless of experience—can make a smart and confident choice.

What Makes a Broker Truly Worthy in 2025?

Before we dive into the Avatrade vs CMC Markets debate, it’s important to recognize what defines a top-tier forex broker in 2025:

Ultra-low spreads and fast execution

Robust trading platforms

Responsive and reliable customer service

Seamless deposits and withdrawals

Regulatory strength and fund security

Educational tools and market analysis for traders

Marketing offers like bonuses or promotions

These criteria form the basis for evaluating both brokers in this detailed comparison.

1. Regulation & Trustworthiness

Avatrade

Avatrade is regulated in multiple jurisdictions globally:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

FSA (Japan)

ADGM (Abu Dhabi)

BVI FSC

✅ Trust Score: Extremely High

CMC Markets

CMC Markets is also heavily regulated:

FCA (UK)

ASIC (Australia)

MAS (Singapore)

✅ Trust Score: Very High

Verdict: While both brokers are well-regulated, Avatrade’s broader global presence offers more flexibility for international traders. ✅

2. Trading Platforms & Tools

Avatrade

MetaTrader 4 & 5

AvaTradeGO (Mobile Trading App)

WebTrader

DupliTrade for copy trading

AvaOptions for options trading

CMC Markets

Next Generation platform (proprietary)

MetaTrader 4 (limited)

Verdict: Avatrade offers more variety, especially with tools like DupliTrade and AvaOptions. CMC's proprietary platform is powerful, but Avatrade is more flexible and trader-friendly. ✅

3. Account Types & Spreads

Avatrade

Fixed and floating spreads

Commission-free trading

Islamic account option

CMC Markets

Floating spreads only

Commission on shares CFDs

No Islamic accounts

Verdict: Avatrade wins here for its flexibility in spreads and broader account type support. ✅

4. Leverage & Margin Requirements

Avatrade

Leverage up to 1:400 (depending on regulation)

Lower margin requirements for major forex pairs

CMC Markets

Leverage up to 1:30 (FCA/ASIC regulated)

Verdict: Traders seeking higher leverage and margin efficiency will prefer Avatrade. ✅

5. Asset Offering

Avatrade

Forex, commodities, indices, crypto, stocks, ETFs, bonds, options

Over 1,250 instruments

CMC Markets

12,000+ instruments (including treasuries, ETFs, FX, shares)

Verdict: CMC Markets has a broader selection overall. ❌ However, most traders don’t utilize more than 100 instruments. Avatrade’s offering is more than sufficient for practical purposes. ✅

6. Trading Costs & Commissions

Avatrade

0% commission trading

Tight spreads

CMC Markets

Variable spreads

Commission on share CFDs

Verdict: Avatrade’s no-commission model is more transparent and ideal for cost-conscious traders. ✅

7. Customer Support

Avatrade

24/5 multilingual support

Phone, email, live chat

Dedicated account managers

CMC Markets

24/5 support

Live chat and email

Verdict: Both offer excellent support, but Avatrade goes the extra mile with multilingual options and account managers. ✅

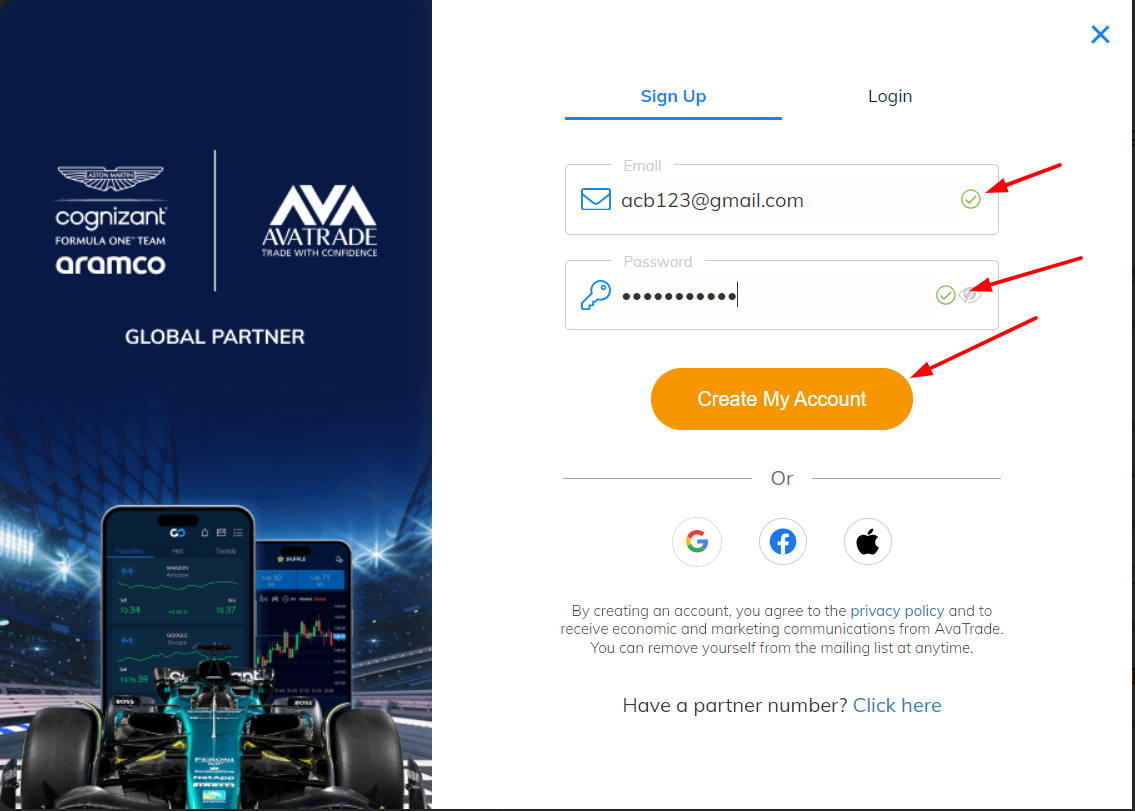

👌 If you choose Avatrade, 👉 Click here to open an account

8. Education & Market Research

Avatrade

Free trading courses

Webinars and eBooks

Daily market analysis

CMC Markets

Webinars

Platform-focused guides

Verdict: Avatrade’s content is broader and more beginner-friendly. ✅

9. Deposit & Withdrawal

Avatrade

No deposit or withdrawal fees

Credit card, wire, e-wallets

Fast processing

CMC Markets

Limited funding methods

Fees may apply depending on method

Verdict: Avatrade makes money movement easy and cost-efficient. ✅

10. User Experience & Interface

Avatrade

Simple, user-friendly platforms

One-click trading

Clear dashboard for managing assets

CMC Markets

Advanced features, but steeper learning curve

Verdict: Avatrade is more approachable, especially for new or intermediate traders. ✅

Final Verdict: Why Avatrade is the Smart Choice in 2025 ✅

While CMC Markets has a wider instrument range and powerful proprietary platform, Avatrade beats it in almost every area that matters to active traders:

Better leverage options

More trading platforms

Transparent pricing (0% commission)

Richer educational content

Easier funding and withdrawals

Flexible spread models

Broader regulatory presence

If you’re serious about trading forex and CFDs in 2025, Avatrade provides a smarter, easier, and more profitable experience.

🔥 Ready to start your trading journey? Open an account with Avatrade today and experience the edge real traders deserve.

FAQs about Avatrade Vs CMC Markets

1. Which broker is better for beginners: Avatrade or CMC Markets?Avatrade is more beginner-friendly due to its intuitive platform and extensive educational resources. ✅

2. Does Avatrade offer MetaTrader 5?Yes, Avatrade supports both MT4 and MT5, unlike CMC which only supports MT4 partially.

3. Are spreads lower on Avatrade?Generally, yes. Avatrade offers both fixed and floating spreads with no commissions.

4. Can I trade cryptocurrencies on Avatrade?Absolutely. Avatrade offers a wide range of crypto CFDs.

5. Does Avatrade charge any withdrawal fees?No. Withdrawals on Avatrade are completely fee-free. ✅

6. Which broker offers better mobile trading?Avatrade's AvaTradeGO app is highly rated and beginner-friendly.

7. Is copy trading available on Avatrade?Yes. Avatrade offers DupliTrade and ZuluTrade for social and copy trading. ✅

8. Who regulates Avatrade?Multiple top-tier bodies including Central Bank of Ireland, ASIC, FSCA, FSA Japan, and more.

9. Is Avatrade safe for high-volume trading?Yes. It is regulated globally and supports high leverage and fast execution.

10. How fast can I open an account with Avatrade?Account setup takes only a few minutes, and verification is quick—often under 24 hours. ✅

Avatrade vs CMC Markets is a close race, but if you're looking for a broker that offers greater flexibility, transparent pricing, and a smoother experience, the answer is clear:

⭐ Choose Avatrade and elevate your trading to the next level in 2025! 👌 If you choose Avatrade, 👉 Click here to open an account

💥 Read more:

Avatrade Vs IC Markets 2025: Compared - which is better broker?

Avatrade Vs Tickmill 2025: Compared - which is better broker?

Avatrade Vs Trading 212 2025: Compared - which is better broker?

Avatrade Vs Deriv 2025: Compared - which is better broker?

Avatrade Vs Degiro 2025: Compared - which is better broker?