5 minute read

Avatrade Vs HFM 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

In the ever-evolving world of online trading, choosing the right broker is not just a preference—it’s a necessity. Whether you're a beginner or a seasoned trader, selecting the right partner can make a significant difference in your trading journey. Among the most talked-about brokers in 2025 are Avatrade Vs HFM. This comprehensive comparison will break down their features, performance, support, and value, and ultimately guide you towards the better choice for your trading goals.

Introduction to Forex Trading in 2025

Forex trading has rapidly evolved with technology, regulation, and increased competition. More traders are now looking for brokers that not only offer low spreads but also provide robust educational tools, excellent customer support, and top-tier trading platforms. In this climate, Avatrade and HFM (HotForex) emerge as two strong contenders—but which one truly delivers more?

Before diving into the nitty-gritty comparison, it’s essential to understand what traders value most in 2025:

Regulation and safety

Platform variety and usability

Educational content and trading tools

Spread, commissions, and account types

Deposit/withdrawal ease

Marketing bonuses and promotions

Customer service and support quality

Let’s take a deep dive into each of these areas to reveal the winner in the Avatrade Vs HFM showdown.

1. Regulation and Security

In 2025, safety is paramount. Traders want to ensure their funds are protected by strong regulatory frameworks.

Avatrade ✅:

Regulated by six global authorities including the Central Bank of Ireland, ASIC (Australia), FSCA (South Africa), and FSA (Japan).

Offers segregated accounts, negative balance protection, and strict compliance protocols.

HFM ✅:

Also well-regulated, notably by CySEC, FCA, FSCA, and DFSA.

Provides similar safety features but slightly less global regulatory reach than Avatrade.

Verdict: While both brokers are safe, Avatrade offers broader international regulation coverage.

2. Trading Platforms and Tools

Your trading experience is largely influenced by the platform you use.

Avatrade ✅:

Offers MT4, MT5, AvatradeGO, and WebTrader.

Integrated with Trading Central, DupliTrade, and ZuluTrade for social and automated trading.

Unique access to options trading and AVAProtect for risk management.

HFM ✅:

Also provides MT4 and MT5.

Strong charting tools and VPS support.

Lacks the innovative features and proprietary platforms that Avatrade brings.

Verdict: Avatrade leads with richer tools and unique platform features.

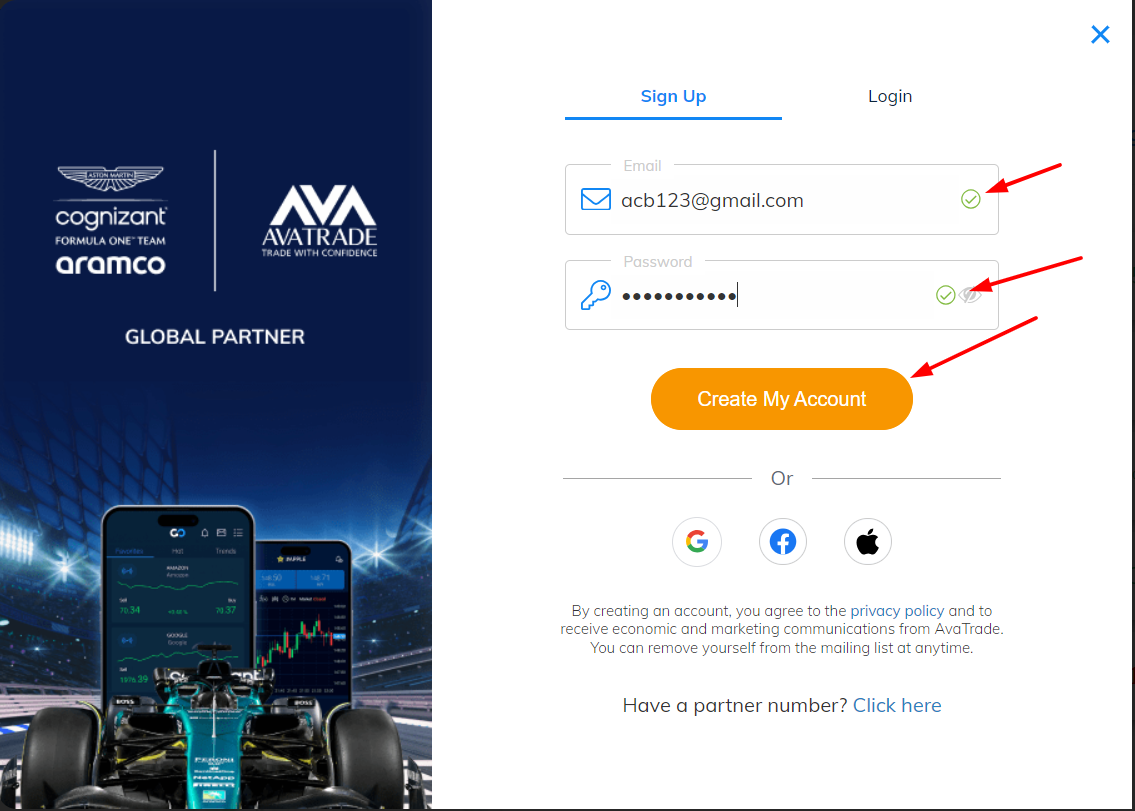

👌 If you choose Avatrade, 👉 Click here to open an account

3. Spreads, Fees, and Account Types

Low fees and versatile accounts are key for maximizing profits.

Avatrade ✅:

Offers fixed and variable spreads starting from 0.9 pips.

No commissions on standard accounts.

Multiple account types including Islamic, Demo, and Professional accounts.

HFM ❌:

Variable spreads starting from 1.0 pips.

Commission accounts available, but fees can be higher on some asset classes.

Offers more variety but can be confusing for new users.

Verdict: Avatrade wins on transparent, trader-friendly fee structures.

4. Deposit and Withdrawal Process

Fast and hassle-free transactions matter more than ever.

Avatrade ✅:

Wide array of methods: credit/debit cards, bank transfers, e-wallets.

Withdrawals processed within 24-48 hours.

HFM ❌:

Also supports various payment methods.

Withdrawal delays and more verification steps reported by users.

Verdict: Avatrade provides a smoother, quicker transaction experience.

5. Education and Market Analysis

Knowledge is power. Brokers that empower traders with educational content build loyalty.

Avatrade ✅:

Massive library of videos, webinars, eBooks, and trading guides.

Integrated tools like Autochartist and Trading Central.

HFM ✅:

Solid educational section with live webinars and analysis.

Slightly less structured and less comprehensive than Avatrade.

Verdict: Avatrade offers more structured and rich educational tools.

6. Bonus and Promotions

Let’s talk marketing incentives.

Avatrade ✅:

Offers welcome bonuses, referral rewards, and loyalty programs (varies by region).

Clear terms, no hidden traps.

HFM ✅:

Known for high-value no-deposit bonuses and contests.

But often subject to high trading volume requirements.

Verdict: Avatrade offers more transparent and user-friendly promotions.

7. Customer Support

When issues arise, support quality makes a real difference.

Avatrade ✅:

Multilingual support 24/5 via live chat, phone, and email.

Fast response and in-depth knowledge.

HFM ✅:

Also provides multilingual support.

Some users report longer wait times during peak hours.

Verdict: Avatrade takes the edge for quicker and more efficient service.

8. Asset Diversity

Avatrade ✅:

Over 1250+ instruments: Forex, commodities, indices, stocks, crypto, and options.

Unique access to Vanilla Options trading.

HFM ✅:

Around 1200 instruments, slightly less.

Strong in forex pairs but less depth in crypto and options.

Verdict: Avatrade offers broader market access.

Final Verdict: Why Avatrade is Better ✅

After a deep comparison, the clear winner of Avatrade Vs HFM in 2025 is Avatrade. With:

Superior global regulation

More advanced tools

Better educational support

Competitive spreads

Smooth transaction processes

Innovative features like AVAProtect

Avatrade is the better broker for both beginners and experienced traders.

FAQs – Avatrade Vs HFM 2025

1. Which broker is more beginner-friendly?✅ Avatrade, thanks to its structured education and easy-to-use platforms.

2. Who offers better trading tools?✅ Avatrade, due to its proprietary apps and integrated tools like ZuluTrade.

3. Is HFM safe to trade with?✅ Yes, HFM is well-regulated, but Avatrade offers broader global compliance.

4. Which has better spreads?✅ Avatrade, with spreads starting at 0.9 pips.

5. Can I trade crypto with both?✅ Yes, but Avatrade offers more crypto pairs.

6. Are there welcome bonuses?✅ Yes, both offer them, but Avatrade has clearer terms.

7. Which broker has better mobile trading?✅ Avatrade, with its award-winning AvatradeGO app.

8. How fast are withdrawals?✅ Avatrade processes within 24-48 hours.

9. Do both support automated trading?✅ Yes, but Avatrade excels with more integration options.

10. Why choose Avatrade over HFM?✅ Avatrade provides more value, more features, and more support, making it the top choice in 2025.

Start your trading journey with a trusted global broker.Open your Avatrade account today and experience the difference! ✅

💥 Read more:

Avatrade Vs Interactive brokers 2025: Compared - which is better broker?

Avatrade Vs eToro 2025: Compared - which is better broker?

Avatrade Vs Octafx 2025: Compared - which is better broker?

Avatrade Vs Oanda 2025: Compared - which is better broker?

Avatrade Vs Admiral Markets 2025: Compared - which is better broker?

Avatrade Vs Saxo 2025: Compared - which is better broker?