6 minute read

Avatrade Vs IC Markets 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs IC Markets 2025: Compared - which is better broker?

In the ever-evolving world of Forex trading, the importance of choosing the right broker cannot be overstated. As we move into 2025, traders are becoming more discerning, seeking brokers that not only offer competitive spreads and lightning-fast execution but also provide strong regulatory oversight, superior technology, and top-notch customer service. Two brokers that frequently emerge in these discussions are AvaTrade and IC Markets. But when it comes to Avatrade Vs IC Markets, which broker truly stands out in 2025?

This comprehensive comparison will dig deep into every aspect of these brokers – from trading conditions to platform features, from regulatory strength to user experience – to help you decide which one aligns better with your trading goals.

📌 Choosing a Forex broker is crucial. Don’t miss our honest and updated Review Forex Broker to help you decide wisely.

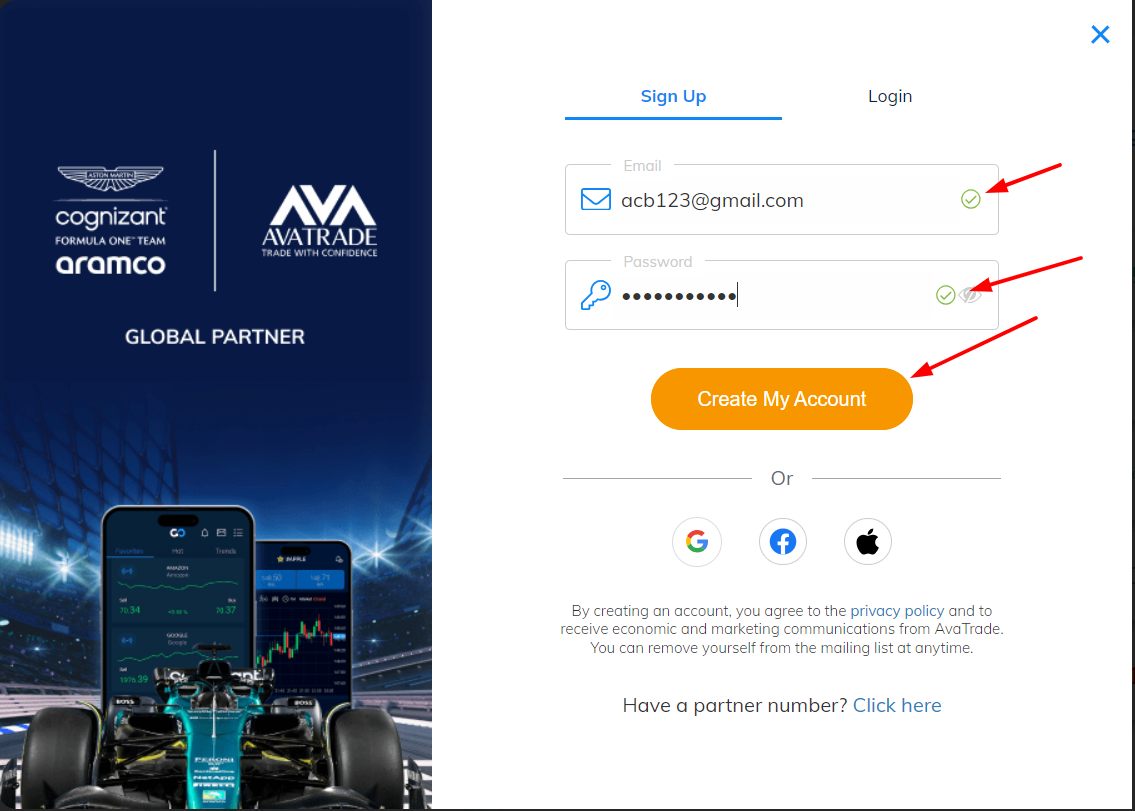

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Introduction to AvaTrade and IC Markets

Both AvaTrade and IC Markets have solidified their reputations in the trading world. While they cater to slightly different types of traders, their core services appeal to a wide audience of Forex enthusiasts.

AvaTrade, founded in 2006, is a globally recognized broker known for its wide range of assets and strong regulation. Its appeal lies in its simplicity and accessibility, especially for beginner and intermediate traders.

IC Markets, on the other hand, is often hailed as a go-to broker for scalpers and high-frequency traders, thanks to its ultra-tight spreads and ECN-style execution.

So, Avatrade Vs IC Markets – how do they really compare when the details are laid bare?

2. Regulation and Trustworthiness

A crucial factor in choosing a broker is its regulatory backing. Here's how both perform:

✅ AvaTrade is regulated by:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

ADGM (Abu Dhabi)

FSA (Japan)

✅ IC Markets holds regulation from:

ASIC (Australia)

CySEC (Cyprus)

FSA (Seychelles)

Both brokers are trustworthy, but AvaTrade’s global reach and regulatory presence in more diverse regions give it a slight edge in terms of international investor protection.

3. Trading Platforms and Tools

When comparing Avatrade Vs IC Markets, platforms and trading tools are key battlegrounds.

AvaTrade offers:

MetaTrader 4 & 5

AvaTradeGO (mobile app)

WebTrader

AvaOptions (for options trading)

ZuluTrade and DupliTrade for copy trading

IC Markets offers:

MetaTrader 4 & 5

cTrader (a favorite among professionals)

Copy trading via Myfxbook & AutoTrade

✅ IC Markets stands out for providing cTrader, a platform with advanced charting tools, depth of market (DOM) data, and superior order control.

However, AvaTrade’s proprietary platforms and social trading features make it more appealing to beginner and intermediate traders.

4. Account Types and Minimum Deposit

Let’s break down the accounts:

AvaTrade:

Standard Account (no commission)

Islamic Account (swap-free)

Professional Account (higher leverage)

Minimum deposit: $100

IC Markets:

Standard Account (no commission, higher spreads)

Raw Spread Account (commission + ultra-low spreads)

Islamic Account

Minimum deposit: $200

✅ AvaTrade offers a lower entry point, ideal for traders starting small.

❌ IC Markets, although slightly more expensive upfront, provides tighter spreads that may benefit high-volume traders.

5. Spreads, Fees, and Commissions

This is where IC Markets truly shines:

✅ IC Markets:

Raw Spread Account: spreads from 0.0 pips, $3.5 per side commission

Standard Account: spreads from 0.6 pips, no commission

AvaTrade:

Fixed spreads starting from 0.9 pips

No commissions on any account

If you're a scalper or EA user, IC Markets’ ECN model is hard to beat. But for traders who prefer fixed costs and simpler fee structures, AvaTrade holds its own.

6. Execution Speed and Order Types

Execution is a critical element, especially for short-term traders.

✅ IC Markets offers:

Lightning-fast execution via Equinix servers

Low latency for HFT strategies

True ECN infrastructure

AvaTrade:

Market execution

Decent speed, but not optimized for HFT

❌ In terms of raw speed, IC Markets takes the crown.

7. Deposit & Withdrawal Options

Both brokers provide multiple options for deposits and withdrawals:

AvaTrade:

Credit/Debit cards

Wire transfer

E-wallets (Skrill, Neteller, etc.)

Fast processing time (within 24-48 hours)

IC Markets:

Credit/Debit cards

PayPal

Wire transfer

E-wallets (Skrill, Neteller)

✅ IC Markets has an edge by offering PayPal, which is a preferred method for many users globally.

8. Educational Resources and Customer Support

AvaTrade:

Extensive tutorials, ebooks, webinars

24/5 multilingual support

Dedicated personal account manager

IC Markets:

Decent educational hub

24/7 customer support via live chat, phone, and email

✅ AvaTrade goes the extra mile in educating its clients – a big plus for new traders.

9. Trader Sentiment in 2025

As of 2025, user sentiment reflects the following:

✅ AvaTrade is popular for its user-friendliness, fixed spreads, and low entry barrier.

✅ IC Markets remains the top pick for professionals and algorithmic traders due to its unmatched trading conditions.

10. Mobile Trading Experience

Mobile platforms are essential in today’s fast-paced trading world.

AvaTradeGO offers:

Simple, intuitive interface

Market trends and social trading insights

Advanced risk management tools

IC Markets Mobile:

Native MT4/MT5 and cTrader apps

Deep market access

Full trading functionality

✅ Both offer excellent mobile experiences, but AvaTradeGO is more tailored for beginners.

11. Which Broker is Better for Beginners?

✅ AvaTrade stands out here, thanks to:

Lower minimum deposit

Fixed spreads

Educational resources

Intuitive mobile and desktop platforms

12. Which is Better for Pro Traders?

✅ IC Markets wins due to:

ECN pricing

Raw spreads

Fast execution

Scalping and algo-friendly platforms

13. Real User Reviews

AvaTrade users say:

"Perfect for learning. The webinars and ebooks helped me get started."

"Withdrawals are smooth. Never had issues."

IC Markets users say:

"Lowest spreads I’ve ever seen. I love it for scalping."

"Execution is unmatched. My EAs work flawlessly."

14. Final Verdict: Avatrade Vs IC Markets

So, Avatrade Vs IC Markets in 2025 – who wins?

✅ Choose AvaTrade if you’re:

A beginner or intermediate trader

Looking for fixed spreads

Interested in copy or social trading

Starting with a small capital

👌 If you choose Avatrade, 👉 Click here to open an account

✅ Choose IC Markets if you’re:

A professional or scalper

Running automated strategies

Needing institutional-level trading conditions

Both brokers are industry leaders. Your choice depends on your trading style, experience, and goals.

❓ FAQs - Avatrade Vs IC Markets 2025

1. Which broker is more beginner-friendly? AvaTrade is more beginner-friendly due to its intuitive platform, fixed spreads, and educational tools.

2. Which has lower spreads, AvaTrade or IC Markets? IC Markets has lower spreads, especially with its Raw Spread account.

3. Can I use automated trading strategies on both? Yes, both support EAs. However, IC Markets is better optimized for automation.

4. Is AvaTrade regulated in more regions than IC Markets? Yes, AvaTrade has broader global regulation.

5. Which broker processes withdrawals faster? Both are fast, but AvaTrade has slightly faster average processing times.

6. Is copy trading available on both? Yes. AvaTrade uses ZuluTrade and DupliTrade; IC Markets uses Myfxbook and AutoTrade.

7. Can I trade crypto on AvaTrade and IC Markets? Yes, both offer crypto trading.

8. What’s the minimum deposit required? AvaTrade requires $100; IC Markets requires $200.

9. Is PayPal supported by both brokers? Only IC Markets supports PayPal.

10. Which broker is better for mobile trading? AvaTrade is better for beginners; IC Markets suits advanced users.

Ready to take the leap into Forex trading?

✅ Open an account with the broker that matches your trading style and strategy. Whether it's the simplicity of AvaTrade or the professional edge of IC Markets, 2025 is your year to start trading smarter.

Don't just trade – trade with the best.

💥 Read more:

Avatrade UK Review 2025: Pros & Cons A Comprehensive Review

Avatrade South Africa Review 2025: Pros & Cons A Comprehensive Review